Business Taxation: Trading Profits, Self-Employment, VAT Schemes

VerifiedAdded on 2022/12/29

|12

|3620

|37

AI Summary

This document provides an overview of business taxation, focusing on topics such as trading profits, self-employment, six badges for trade, and VAT schemes for different businesses. It explains the criteria for self-employment and discusses the various badges of trade. Additionally, it explores different VAT schemes and their implications for VAT registered companies.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Business

Taxation

Taxation

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................3

QUESTION 1...................................................................................................................................3

Linda's trading profits for the year 31st march 2121:..................................................................3

QUESTION 2...................................................................................................................................5

Criteria for the use for employment for self employment, why people prefer self employment:

......................................................................................................................................................5

QUESTION 2...................................................................................................................................6

Discussion Six badges for trade:..................................................................................................6

Different VAT schemes for the various VAT registered companies:..........................................8

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................12

INTRODUCTION...........................................................................................................................3

QUESTION 1...................................................................................................................................3

Linda's trading profits for the year 31st march 2121:..................................................................3

QUESTION 2...................................................................................................................................5

Criteria for the use for employment for self employment, why people prefer self employment:

......................................................................................................................................................5

QUESTION 2...................................................................................................................................6

Discussion Six badges for trade:..................................................................................................6

Different VAT schemes for the various VAT registered companies:..........................................8

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................12

INTRODUCTION

Business taxation are the process for taxes which businesses pays for normal activities for

the business. The income tax which companies pays for its activities shows business tax.

Companies pays tax for the government as per the tax rules. The business tax government makes

for sole proprietor, partner, limited company, corporation, businesses are responsible for pay tax

rules. Business tax are the direct tax which apply for the net profits for the company. These taxes

businesses pay for their income for the government. For example, businesses pay taxes for the

tax rules (Al Karaawy and Al Baaj, 2018). This report is bases for business taxations. This report

includes topics which are trading profits, self-employment, six badges for trade, VAT schemes

for the various VAT businesses etc. Apart from this it includes topics inheritance tax, capital

gain tax liability etc.

QUESTION 1

Linda's trading profits for the year 31st march 2121:

Trading profits are equivalent for the earnings from its activities. It’s not includes

financing related income, expenses for the gains for the assets. It tends for the higher indicator

for the ability for the core activities for businesses in order to increases its profitability. The

profit that an investor drives for the purchase, sales for the securities. Trading profits are

substantial for the investor which knows the risks includes in the deals for the business. These

profits make for purchase, sales for the goods, services. This statement shows not allowable

transactions for the businesses which shows trading profits. Trading profits are providing

business profits for income, expenses which are not allowable for the businesses (Arnold, Ault

and Cooper, 2019). These profits which helps businesses for earnings for their activities which

helps business for accomplish objectives.

In accounting there are various terms which helps managers for financial decision

making. Accounting department records transactions for helps business for accomplish its

objectives. Accounting department prepares various financial statement which helps them for

keeping records. These records help them for finance arrangement, managing funds for the

activities which runs in business for accomplish objectives. Financial statement includes trading,

income statement, balance sheet for activities includes in business (Biddle, Fels and Sinning,

2018) (Blakeley, 2018). Trading account shows direct expenses which includes when the

Business taxation are the process for taxes which businesses pays for normal activities for

the business. The income tax which companies pays for its activities shows business tax.

Companies pays tax for the government as per the tax rules. The business tax government makes

for sole proprietor, partner, limited company, corporation, businesses are responsible for pay tax

rules. Business tax are the direct tax which apply for the net profits for the company. These taxes

businesses pay for their income for the government. For example, businesses pay taxes for the

tax rules (Al Karaawy and Al Baaj, 2018). This report is bases for business taxations. This report

includes topics which are trading profits, self-employment, six badges for trade, VAT schemes

for the various VAT businesses etc. Apart from this it includes topics inheritance tax, capital

gain tax liability etc.

QUESTION 1

Linda's trading profits for the year 31st march 2121:

Trading profits are equivalent for the earnings from its activities. It’s not includes

financing related income, expenses for the gains for the assets. It tends for the higher indicator

for the ability for the core activities for businesses in order to increases its profitability. The

profit that an investor drives for the purchase, sales for the securities. Trading profits are

substantial for the investor which knows the risks includes in the deals for the business. These

profits make for purchase, sales for the goods, services. This statement shows not allowable

transactions for the businesses which shows trading profits. Trading profits are providing

business profits for income, expenses which are not allowable for the businesses (Arnold, Ault

and Cooper, 2019). These profits which helps businesses for earnings for their activities which

helps business for accomplish objectives.

In accounting there are various terms which helps managers for financial decision

making. Accounting department records transactions for helps business for accomplish its

objectives. Accounting department prepares various financial statement which helps them for

keeping records. These records help them for finance arrangement, managing funds for the

activities which runs in business for accomplish objectives. Financial statement includes trading,

income statement, balance sheet for activities includes in business (Biddle, Fels and Sinning,

2018) (Blakeley, 2018). Trading account shows direct expenses which includes when the

business runs its activities. Trading account which are organised for establish business

transactions for manager’s decision making. Trading, income statement is useful for the gross

profits, net profits which business earns. It shows the relationship between sales and gross profits

which helps for assessing profitability for the business. It shows the relation for costs of goods

sold, gross profits (Boadway, Sato and Tremblay, 2016). Trading account provides the

information related for trading activities. Trading profit account shows various terms which

includes expenses, income for the business.

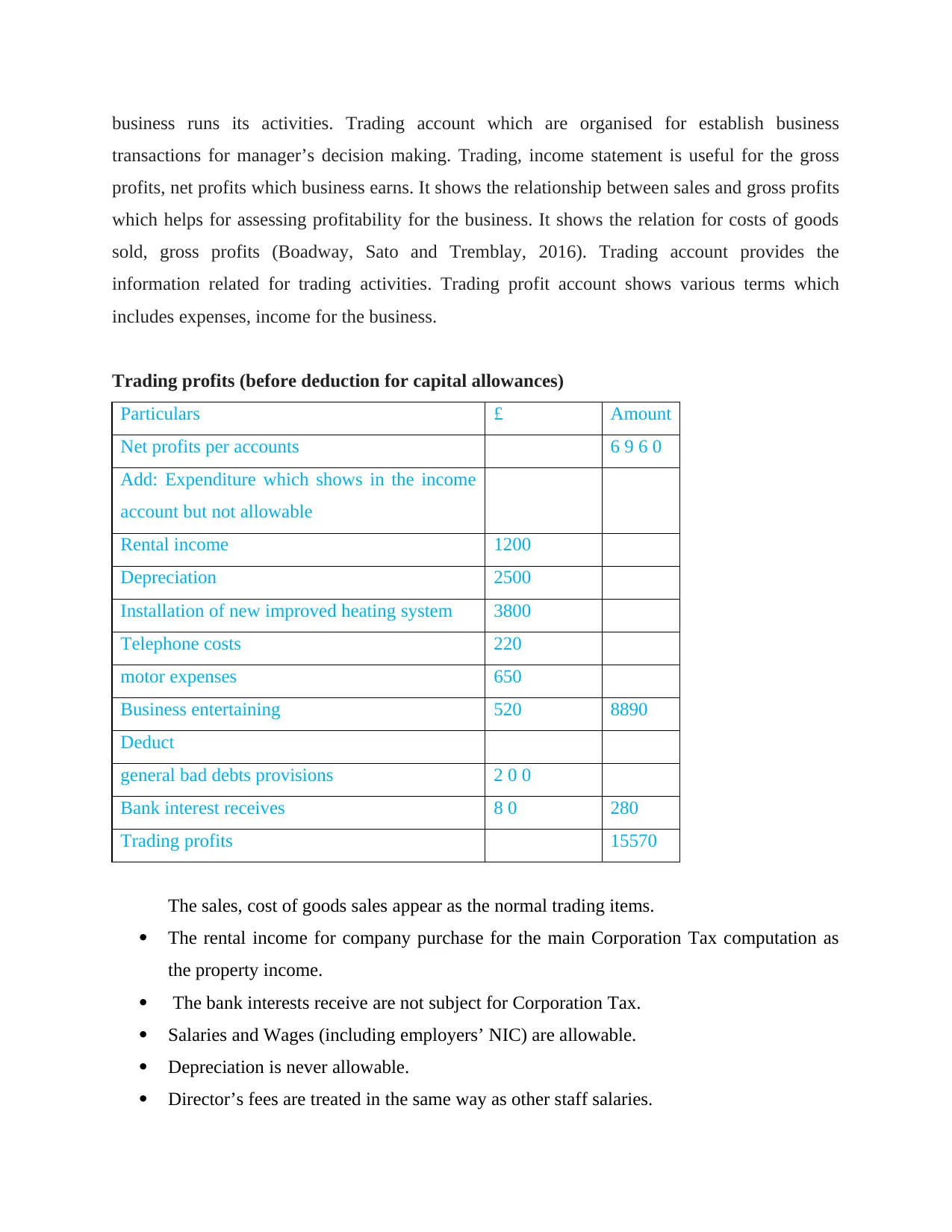

Trading profits (before deduction for capital allowances)

Particulars £ Amount

Net profits per accounts 6 9 6 0

Add: Expenditure which shows in the income

account but not allowable

Rental income 1200

Depreciation 2500

Installation of new improved heating system 3800

Telephone costs 220

motor expenses 650

Business entertaining 520 8890

Deduct

general bad debts provisions 2 0 0

Bank interest receives 8 0 280

Trading profits 15570

The sales, cost of goods sales appear as the normal trading items.

The rental income for company purchase for the main Corporation Tax computation as

the property income.

The bank interests receive are not subject for Corporation Tax.

Salaries and Wages (including employers’ NIC) are allowable.

Depreciation is never allowable.

Director’s fees are treated in the same way as other staff salaries.

transactions for manager’s decision making. Trading, income statement is useful for the gross

profits, net profits which business earns. It shows the relationship between sales and gross profits

which helps for assessing profitability for the business. It shows the relation for costs of goods

sold, gross profits (Boadway, Sato and Tremblay, 2016). Trading account provides the

information related for trading activities. Trading profit account shows various terms which

includes expenses, income for the business.

Trading profits (before deduction for capital allowances)

Particulars £ Amount

Net profits per accounts 6 9 6 0

Add: Expenditure which shows in the income

account but not allowable

Rental income 1200

Depreciation 2500

Installation of new improved heating system 3800

Telephone costs 220

motor expenses 650

Business entertaining 520 8890

Deduct

general bad debts provisions 2 0 0

Bank interest receives 8 0 280

Trading profits 15570

The sales, cost of goods sales appear as the normal trading items.

The rental income for company purchase for the main Corporation Tax computation as

the property income.

The bank interests receive are not subject for Corporation Tax.

Salaries and Wages (including employers’ NIC) are allowable.

Depreciation is never allowable.

Director’s fees are treated in the same way as other staff salaries.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Administration expenses appear for the wholly and exclusively for the trade.

The installation costs, motor costs are for the personal use which is not for business

purpose.

Business entertainment costs are allowable, but entertaining customers is never

allowable.

Changes in general provisions for bad debts must always be adjusted for, but specific

provision increases and bad debts written off are allowable.

QUESTION 2

Criteria for the use for employment for self-employment, why people prefer self-employment:

Employment is about when the people do work for the employer who pays them salary.

Employment is all do works for employer; they pay salary for works. Employment about people

not working for themselves business they are works for employer’s business.

Self-employment are the works which people do for themselves not for employer. It gives

benefits for the people for their works what they want to do. It is the process which shows people

doesn't work for the employer who pays them salary. In the cases payer are not holding taxes it

shows responsibility for the self-employ. Self-employ persons are including various occupations,

highly skilled for particular types for works. Those who are self-employees they are works for

themselves, directly contacts for the customers (Bushnyakova and Kashirina, 2019). Self-employ

has responsible for the paying taxes. Self-employment provides deals for job flexibility, people

doesn't responsible for working hours for the works. In this types of working, business which

earns net profits all share for the profits for the employment. Most self-employ business people

goes for the business as they want for solving customer’s problems. They help people for the

society for their goods, services. They create job, pays taxes which supports the schools,

municipal, neighbours etc. In this people improve their lifestyle in order to accomplish their

objectives. Self-employment gives better works life balance, people choose their own customers

etc. self-employment attracts as its helps people for empowers, helps for builds new ideas etc.

self-employment gives opportunity for the business for the new ideas which helps customers for

completing their demand. Self-employ people creates demand for the customers for attracting

them for purchasing business goods, services. They give job to the people for their working from

their profits. Self-employee people are who earns profitability for the economic activity, which

helps for changing their lifestyle. As the businessman handles various project by own money

The installation costs, motor costs are for the personal use which is not for business

purpose.

Business entertainment costs are allowable, but entertaining customers is never

allowable.

Changes in general provisions for bad debts must always be adjusted for, but specific

provision increases and bad debts written off are allowable.

QUESTION 2

Criteria for the use for employment for self-employment, why people prefer self-employment:

Employment is about when the people do work for the employer who pays them salary.

Employment is all do works for employer; they pay salary for works. Employment about people

not working for themselves business they are works for employer’s business.

Self-employment are the works which people do for themselves not for employer. It gives

benefits for the people for their works what they want to do. It is the process which shows people

doesn't work for the employer who pays them salary. In the cases payer are not holding taxes it

shows responsibility for the self-employ. Self-employ persons are including various occupations,

highly skilled for particular types for works. Those who are self-employees they are works for

themselves, directly contacts for the customers (Bushnyakova and Kashirina, 2019). Self-employ

has responsible for the paying taxes. Self-employment provides deals for job flexibility, people

doesn't responsible for working hours for the works. In this types of working, business which

earns net profits all share for the profits for the employment. Most self-employ business people

goes for the business as they want for solving customer’s problems. They help people for the

society for their goods, services. They create job, pays taxes which supports the schools,

municipal, neighbours etc. In this people improve their lifestyle in order to accomplish their

objectives. Self-employment gives better works life balance, people choose their own customers

etc. self-employment attracts as its helps people for empowers, helps for builds new ideas etc.

self-employment gives opportunity for the business for the new ideas which helps customers for

completing their demand. Self-employ people creates demand for the customers for attracting

them for purchasing business goods, services. They give job to the people for their working from

their profits. Self-employee people are who earns profitability for the economic activity, which

helps for changing their lifestyle. As the businessman handles various project by own money

which gives benefits for them as they earn profits for own, no need for sharing these profits

(Clarke and Kopczuk, 2017). They have their own rules for timing as they want to run. They

apply their creative ideas for apply for the business for the new goods, services which helps

customers for completing their needs which satisfies them.

Self-own schedule: Self employ workers works for themselves as they are working for

their own schedule. This is about workers do works for their own.

Be your own boss: Self employ means you are creating your own boss. It is about

establish self-empire, how to deals for customers.

Take advantage for self-employ tax benefits: Self employ are deducting tax from

business expenses from the revenues for the taxes.

Keep the money you earn: Self employ worker earns money as it increases outputs.

Self-employees keep money which they earn from their business.

Enjoy career for creative freedom: This is the appealed for creative workers as they

work for their own its process for giving creativity for them as they work for own business

(Giroud and Rauh, 2019).

QUESTION 2

Discussion Six badges for trade:

Badges of trade is utilised by HMRC for determining if can activity can be termed as

proper economic activity or business activity or it is just money making line for hobby of a

person. Careful consideration is required for deciding whether a hobby is transformed into a

taxable activity. The badges for trade includes the elements which considers transactions, series

of transactions. In June 1955, the royal commission for the taxation for profits, income used

judicial decisions for establish the criteria for identifying badges for trade which includes subject

matter for the realisation, length for the period for ownership, the frequency number for the

similar transactions, supplementary works, circumstances which responsible for the realisation

etc. Profit motive, frequency or number of transactions, nature of asset, modification of

underlying assets, length of ownership and frequency of similar trades are six badges of trade

which are explained below in a detailed manner:

Profit motive: For constitution of an activity in a trade it is essential that such activities

pertains motive of making profit. Hence, in other words it can be stated that an activity which

incorporates intention of profit making is termed as a trading activity. The profit making for the

(Clarke and Kopczuk, 2017). They have their own rules for timing as they want to run. They

apply their creative ideas for apply for the business for the new goods, services which helps

customers for completing their needs which satisfies them.

Self-own schedule: Self employ workers works for themselves as they are working for

their own schedule. This is about workers do works for their own.

Be your own boss: Self employ means you are creating your own boss. It is about

establish self-empire, how to deals for customers.

Take advantage for self-employ tax benefits: Self employ are deducting tax from

business expenses from the revenues for the taxes.

Keep the money you earn: Self employ worker earns money as it increases outputs.

Self-employees keep money which they earn from their business.

Enjoy career for creative freedom: This is the appealed for creative workers as they

work for their own its process for giving creativity for them as they work for own business

(Giroud and Rauh, 2019).

QUESTION 2

Discussion Six badges for trade:

Badges of trade is utilised by HMRC for determining if can activity can be termed as

proper economic activity or business activity or it is just money making line for hobby of a

person. Careful consideration is required for deciding whether a hobby is transformed into a

taxable activity. The badges for trade includes the elements which considers transactions, series

of transactions. In June 1955, the royal commission for the taxation for profits, income used

judicial decisions for establish the criteria for identifying badges for trade which includes subject

matter for the realisation, length for the period for ownership, the frequency number for the

similar transactions, supplementary works, circumstances which responsible for the realisation

etc. Profit motive, frequency or number of transactions, nature of asset, modification of

underlying assets, length of ownership and frequency of similar trades are six badges of trade

which are explained below in a detailed manner:

Profit motive: For constitution of an activity in a trade it is essential that such activities

pertains motive of making profit. Hence, in other words it can be stated that an activity which

incorporates intention of profit making is termed as a trading activity. The profit making for the

large quality purchase, resale items are an adventure for the nature of trade. This shows the

purchase are made not for the personal use, investment purposes for the businesses (Haileyesus,

and Asegu, 2020).

Number of transactions: The transactions amount for the trading activity, it is higher

indicative which are for repeated, systematic transactions. This is for repeated transactions it

shows profits are trading profits, taxable for the repeated transaction businesses (Martins, 2019).

This is the case for the property. An asset which includes the subject matter of the trade. Possible

alternatives for the treatment for the assets as stock in trade which includes an investment

purchase for yield the return, appreciating assets which require for the personal use, enjoyment.

In Murray v IRC case, timber merchant sale the rights for the two plantations purchases.

Nature of assets: This views for the assets, problems arises when the assets are bought as

an investment which has the ability for increases income, personal assets, assets for the trade for

plant and machinery. An important case in this area was Marson v Morton. This was where land

was purchased with the intension to hold it as an investment. No income was generated by the

land, however, it did have planning permission. The land was sold latter following an unsolicited

offer. As the transaction was far removed from the taxpayer’s normal activity (potato merchant)

and was similar to an investment, it was not a trading profit.

Existence for the similar trading transactions, interests: This is the demonstrated for

the case CIR v Fraser. In this case the taxpayer shows the woodcutter who purchase the

consignment for the whiskey for the bonds for the activities runs in its business (Nechaev and

Antipina, 2016).

Changes the assets: It is the important for changes to an asset which makes it more

marketable. In the case members for wine syndicate purchase brandy from the South Africa. This

shows taxpayer makes argue for the transactions for capital nature from the sale for an

investment.

The way the sale makes: HMRC the guidance which always the pointer for the

transaction which follows the trade which are undisputed. This includes three unconnected

individuals which are together for bought the Cargo vessel. This vessel is converted for the steam

drifter which sold for the profits. The purchase for the vessel first which bought three people.

The assessment makes for the profits which are upheld the trading profits.

purchase are made not for the personal use, investment purposes for the businesses (Haileyesus,

and Asegu, 2020).

Number of transactions: The transactions amount for the trading activity, it is higher

indicative which are for repeated, systematic transactions. This is for repeated transactions it

shows profits are trading profits, taxable for the repeated transaction businesses (Martins, 2019).

This is the case for the property. An asset which includes the subject matter of the trade. Possible

alternatives for the treatment for the assets as stock in trade which includes an investment

purchase for yield the return, appreciating assets which require for the personal use, enjoyment.

In Murray v IRC case, timber merchant sale the rights for the two plantations purchases.

Nature of assets: This views for the assets, problems arises when the assets are bought as

an investment which has the ability for increases income, personal assets, assets for the trade for

plant and machinery. An important case in this area was Marson v Morton. This was where land

was purchased with the intension to hold it as an investment. No income was generated by the

land, however, it did have planning permission. The land was sold latter following an unsolicited

offer. As the transaction was far removed from the taxpayer’s normal activity (potato merchant)

and was similar to an investment, it was not a trading profit.

Existence for the similar trading transactions, interests: This is the demonstrated for

the case CIR v Fraser. In this case the taxpayer shows the woodcutter who purchase the

consignment for the whiskey for the bonds for the activities runs in its business (Nechaev and

Antipina, 2016).

Changes the assets: It is the important for changes to an asset which makes it more

marketable. In the case members for wine syndicate purchase brandy from the South Africa. This

shows taxpayer makes argue for the transactions for capital nature from the sale for an

investment.

The way the sale makes: HMRC the guidance which always the pointer for the

transaction which follows the trade which are undisputed. This includes three unconnected

individuals which are together for bought the Cargo vessel. This vessel is converted for the steam

drifter which sold for the profits. The purchase for the vessel first which bought three people.

The assessment makes for the profits which are upheld the trading profits.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Source of finance: The source for the finance are important when the trade carried for

the businesses. Finance takes for the purchase for an asset which shows repay the debts for

assets.

Interval times for the purchase, sales: The length for the assets are held are an

important indicator for the trade. The higher the period for ownership the higher the investments.

Different VAT schemes for the various VAT registered companies:

Value-added tax is the consumption tax place for the products when the value adds for

each process for the supply chain, production to sales for customers. The VAT value in which

customers pay for the costs for the products, costs for material used for the products which have

already tax. VAT is the process for which includes value-added tax for the process for

production for goods, services which a business produces in order to accomplish its objectives.

Value-added tax compensates for the sharing infrastructure providing a certain locality for the

states, taxpayers which use for the provision for the goods, services. Not all localities need to

Charge VAT, exports are exempt. VAT are the implementing the destination-based tax, where

the tax rates are bases for the location of the customers which applied for the sales price of the

goods, services. The term VAT, GST, consumption tax is used for each other. VAT raise about

fifth for total tax revenues (Zeida, 2020). There are methods for calculating VAT which includes

credit invoice, account bases method. In the credit-invoice method, sales transactions are taxed,

with the customer informed of the VAT on the transaction, and businesses may receive a credit

for VAT paid on input materials, services. It is the largest employee base method which are uses

for national VATs except for Japan. Account bases model, which includes business calculates

the value for all taxable sales then subtracts sum of all taxable purchases, in which the VAT rates

apply in the difference value. This method is only use for Japan, it also using the names Flat tax

which are the parts for tax performance proposals for US politicians. There are various

accounting methods for the accounting concepts. Accrual basis accounting matches revenues to

the time period in which they are earned and matches expenses to the time period in which they

are incurred. While it is more complex than cash basis accounting, it provides much more

information about your business. Accrual basis accounting helps business for tracking

receivables, payables. The accrual basis helps business for matching revenues for its expenses

for earnings which helps for higher profitability for the businesses.

the businesses. Finance takes for the purchase for an asset which shows repay the debts for

assets.

Interval times for the purchase, sales: The length for the assets are held are an

important indicator for the trade. The higher the period for ownership the higher the investments.

Different VAT schemes for the various VAT registered companies:

Value-added tax is the consumption tax place for the products when the value adds for

each process for the supply chain, production to sales for customers. The VAT value in which

customers pay for the costs for the products, costs for material used for the products which have

already tax. VAT is the process for which includes value-added tax for the process for

production for goods, services which a business produces in order to accomplish its objectives.

Value-added tax compensates for the sharing infrastructure providing a certain locality for the

states, taxpayers which use for the provision for the goods, services. Not all localities need to

Charge VAT, exports are exempt. VAT are the implementing the destination-based tax, where

the tax rates are bases for the location of the customers which applied for the sales price of the

goods, services. The term VAT, GST, consumption tax is used for each other. VAT raise about

fifth for total tax revenues (Zeida, 2020). There are methods for calculating VAT which includes

credit invoice, account bases method. In the credit-invoice method, sales transactions are taxed,

with the customer informed of the VAT on the transaction, and businesses may receive a credit

for VAT paid on input materials, services. It is the largest employee base method which are uses

for national VATs except for Japan. Account bases model, which includes business calculates

the value for all taxable sales then subtracts sum of all taxable purchases, in which the VAT rates

apply in the difference value. This method is only use for Japan, it also using the names Flat tax

which are the parts for tax performance proposals for US politicians. There are various

accounting methods for the accounting concepts. Accrual basis accounting matches revenues to

the time period in which they are earned and matches expenses to the time period in which they

are incurred. While it is more complex than cash basis accounting, it provides much more

information about your business. Accrual basis accounting helps business for tracking

receivables, payables. The accrual basis helps business for matching revenues for its expenses

for earnings which helps for higher profitability for the businesses.

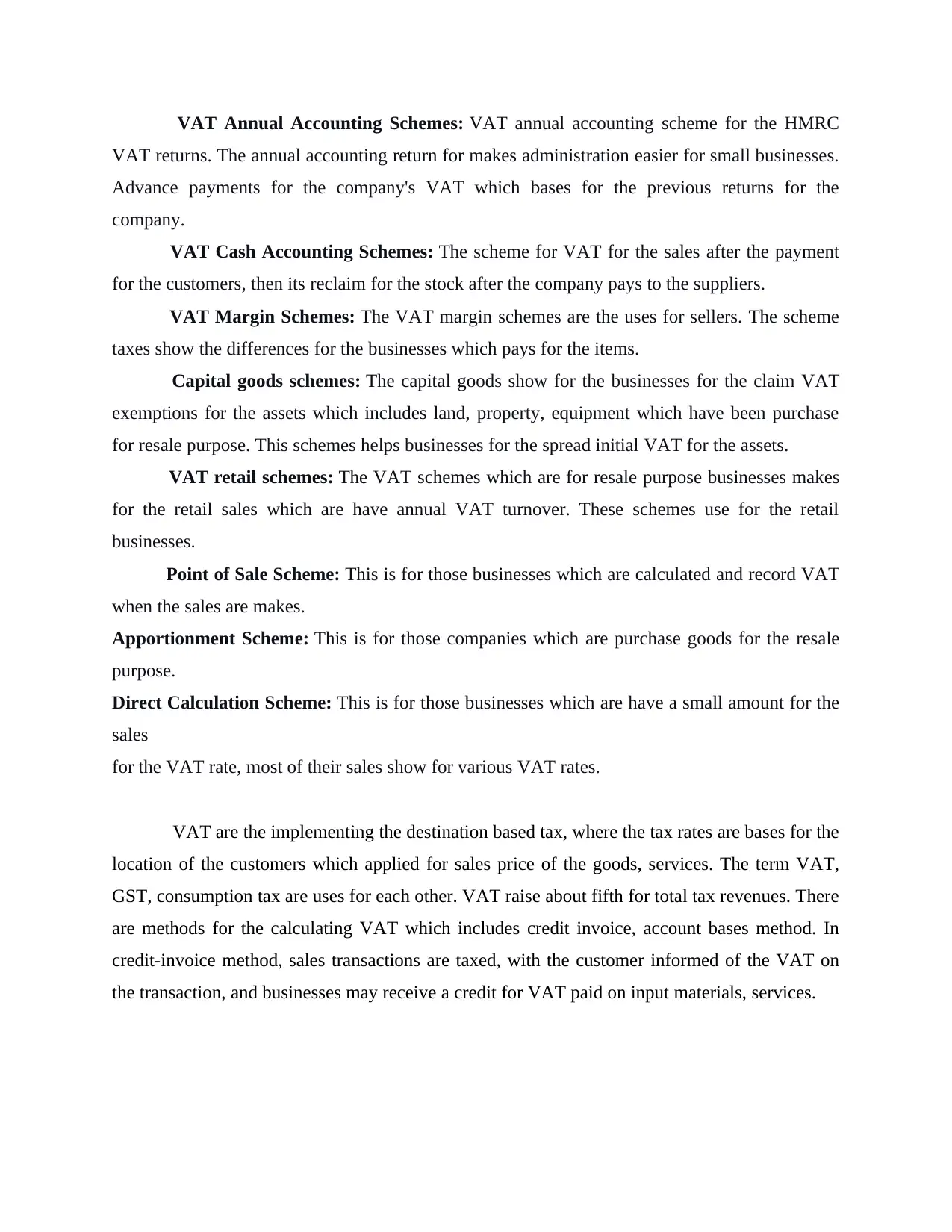

VAT Annual Accounting Schemes: VAT annual accounting scheme for the HMRC

VAT returns. The annual accounting return for makes administration easier for small businesses.

Advance payments for the company's VAT which bases for the previous returns for the

company.

VAT Cash Accounting Schemes: The scheme for VAT for the sales after the payment

for the customers, then its reclaim for the stock after the company pays to the suppliers.

VAT Margin Schemes: The VAT margin schemes are the uses for sellers. The scheme

taxes show the differences for the businesses which pays for the items.

Capital goods schemes: The capital goods show for the businesses for the claim VAT

exemptions for the assets which includes land, property, equipment which have been purchase

for resale purpose. This schemes helps businesses for the spread initial VAT for the assets.

VAT retail schemes: The VAT schemes which are for resale purpose businesses makes

for the retail sales which are have annual VAT turnover. These schemes use for the retail

businesses.

Point of Sale Scheme: This is for those businesses which are calculated and record VAT

when the sales are makes.

Apportionment Scheme: This is for those companies which are purchase goods for the resale

purpose.

Direct Calculation Scheme: This is for those businesses which are have a small amount for the

sales

for the VAT rate, most of their sales show for various VAT rates.

VAT are the implementing the destination based tax, where the tax rates are bases for the

location of the customers which applied for sales price of the goods, services. The term VAT,

GST, consumption tax are uses for each other. VAT raise about fifth for total tax revenues. There

are methods for the calculating VAT which includes credit invoice, account bases method. In

credit-invoice method, sales transactions are taxed, with the customer informed of the VAT on

the transaction, and businesses may receive a credit for VAT paid on input materials, services.

VAT returns. The annual accounting return for makes administration easier for small businesses.

Advance payments for the company's VAT which bases for the previous returns for the

company.

VAT Cash Accounting Schemes: The scheme for VAT for the sales after the payment

for the customers, then its reclaim for the stock after the company pays to the suppliers.

VAT Margin Schemes: The VAT margin schemes are the uses for sellers. The scheme

taxes show the differences for the businesses which pays for the items.

Capital goods schemes: The capital goods show for the businesses for the claim VAT

exemptions for the assets which includes land, property, equipment which have been purchase

for resale purpose. This schemes helps businesses for the spread initial VAT for the assets.

VAT retail schemes: The VAT schemes which are for resale purpose businesses makes

for the retail sales which are have annual VAT turnover. These schemes use for the retail

businesses.

Point of Sale Scheme: This is for those businesses which are calculated and record VAT

when the sales are makes.

Apportionment Scheme: This is for those companies which are purchase goods for the resale

purpose.

Direct Calculation Scheme: This is for those businesses which are have a small amount for the

sales

for the VAT rate, most of their sales show for various VAT rates.

VAT are the implementing the destination based tax, where the tax rates are bases for the

location of the customers which applied for sales price of the goods, services. The term VAT,

GST, consumption tax are uses for each other. VAT raise about fifth for total tax revenues. There

are methods for the calculating VAT which includes credit invoice, account bases method. In

credit-invoice method, sales transactions are taxed, with the customer informed of the VAT on

the transaction, and businesses may receive a credit for VAT paid on input materials, services.

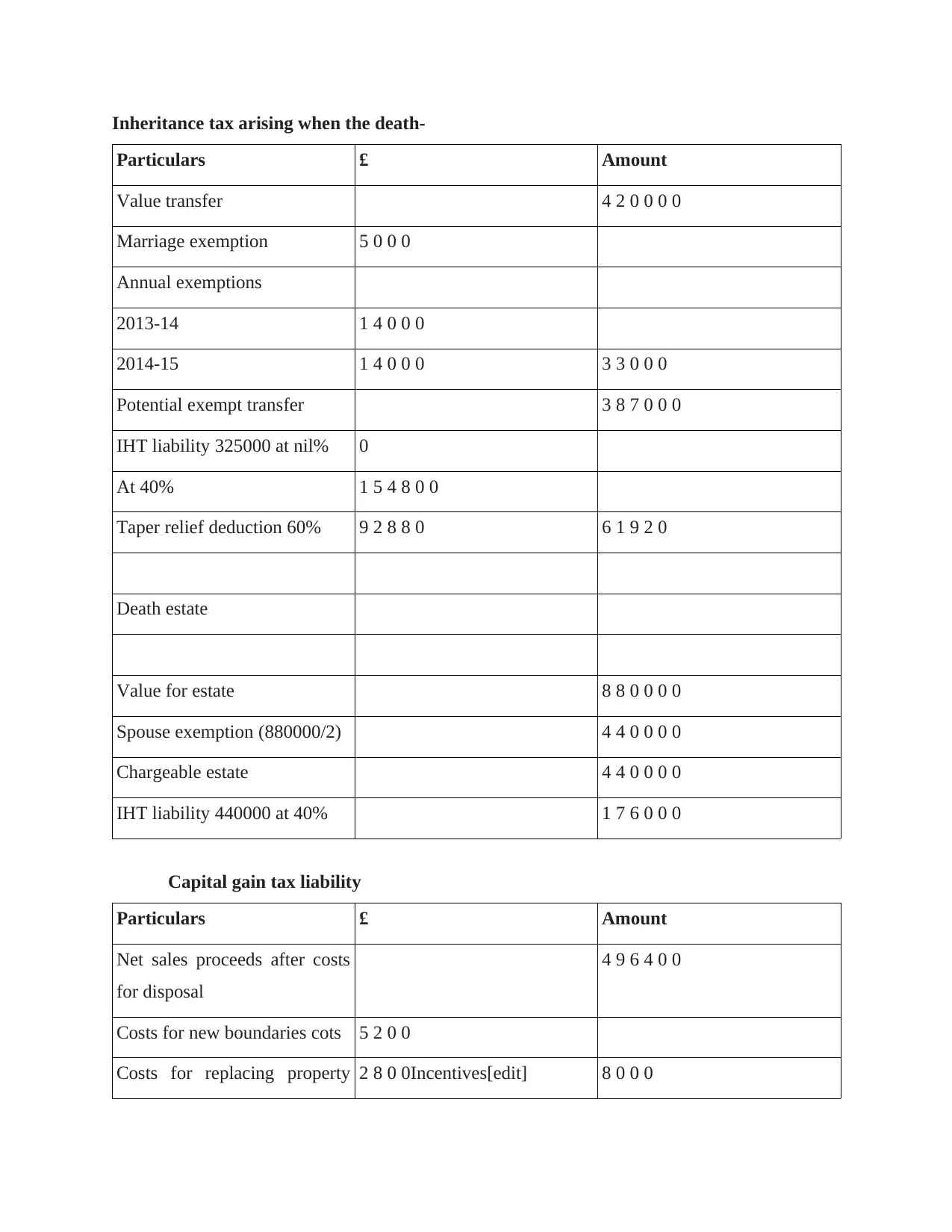

Inheritance tax arising when the death-

Particulars £ Amount

Value transfer 4 2 0 0 0 0

Marriage exemption 5 0 0 0

Annual exemptions

2013-14 1 4 0 0 0

2014-15 1 4 0 0 0 3 3 0 0 0

Potential exempt transfer 3 8 7 0 0 0

IHT liability 325000 at nil% 0

At 40% 1 5 4 8 0 0

Taper relief deduction 60% 9 2 8 8 0 6 1 9 2 0

Death estate

Value for estate 8 8 0 0 0 0

Spouse exemption (880000/2) 4 4 0 0 0 0

Chargeable estate 4 4 0 0 0 0

IHT liability 440000 at 40% 1 7 6 0 0 0

Capital gain tax liability

Particulars £ Amount

Net sales proceeds after costs

for disposal

4 9 6 4 0 0

Costs for new boundaries cots 5 2 0 0

Costs for replacing property 2 8 0 0Incentives[edit] 8 0 0 0

Particulars £ Amount

Value transfer 4 2 0 0 0 0

Marriage exemption 5 0 0 0

Annual exemptions

2013-14 1 4 0 0 0

2014-15 1 4 0 0 0 3 3 0 0 0

Potential exempt transfer 3 8 7 0 0 0

IHT liability 325000 at nil% 0

At 40% 1 5 4 8 0 0

Taper relief deduction 60% 9 2 8 8 0 6 1 9 2 0

Death estate

Value for estate 8 8 0 0 0 0

Spouse exemption (880000/2) 4 4 0 0 0 0

Chargeable estate 4 4 0 0 0 0

IHT liability 440000 at 40% 1 7 6 0 0 0

Capital gain tax liability

Particulars £ Amount

Net sales proceeds after costs

for disposal

4 9 6 4 0 0

Costs for new boundaries cots 5 2 0 0

Costs for replacing property 2 8 0 0Incentives[edit] 8 0 0 0

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

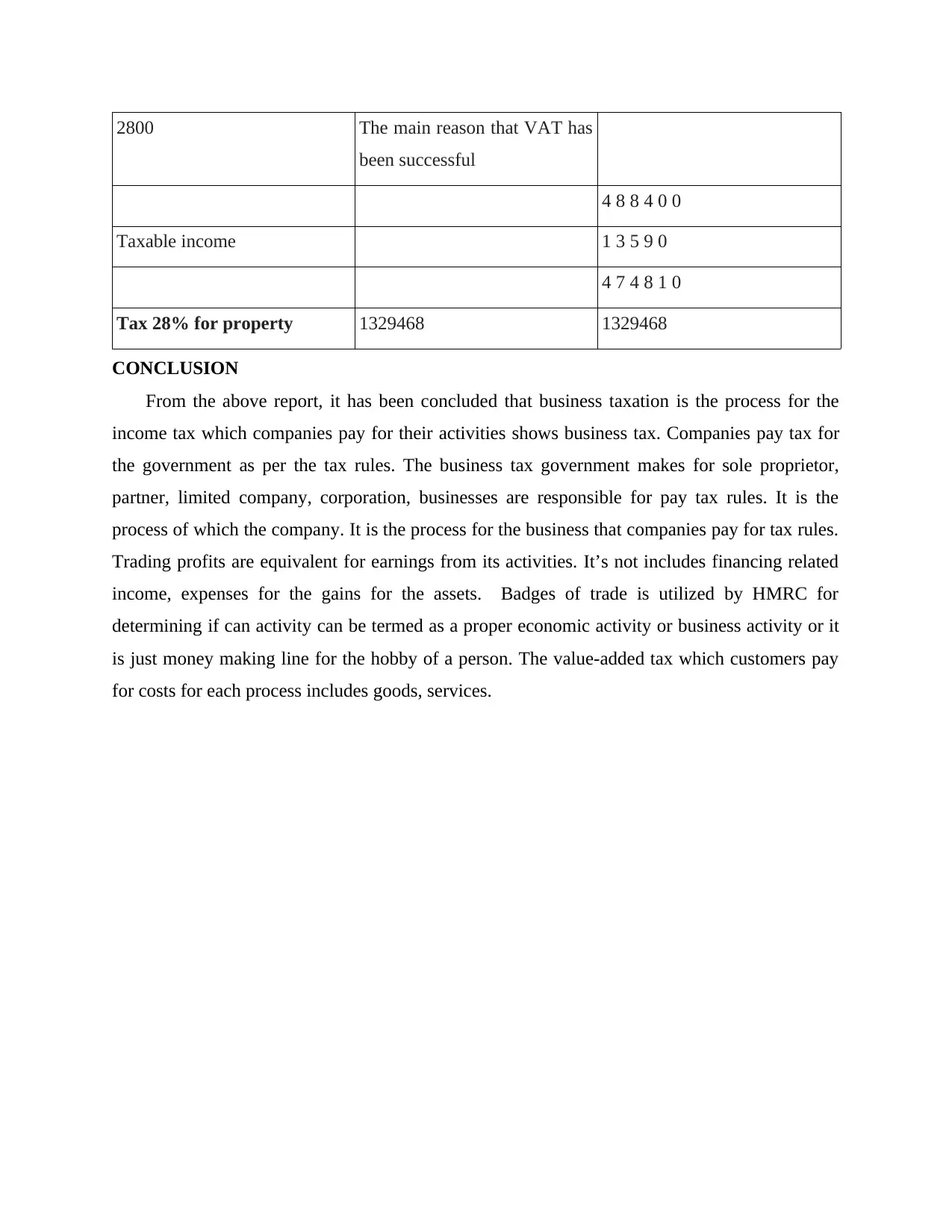

2800 The main reason that VAT has

been successful

4 8 8 4 0 0

Taxable income 1 3 5 9 0

4 7 4 8 1 0

Tax 28% for property 1329468 1329468

CONCLUSION

From the above report, it has been concluded that business taxation is the process for the

income tax which companies pay for their activities shows business tax. Companies pay tax for

the government as per the tax rules. The business tax government makes for sole proprietor,

partner, limited company, corporation, businesses are responsible for pay tax rules. It is the

process of which the company. It is the process for the business that companies pay for tax rules.

Trading profits are equivalent for earnings from its activities. It’s not includes financing related

income, expenses for the gains for the assets. Badges of trade is utilized by HMRC for

determining if can activity can be termed as a proper economic activity or business activity or it

is just money making line for the hobby of a person. The value-added tax which customers pay

for costs for each process includes goods, services.

been successful

4 8 8 4 0 0

Taxable income 1 3 5 9 0

4 7 4 8 1 0

Tax 28% for property 1329468 1329468

CONCLUSION

From the above report, it has been concluded that business taxation is the process for the

income tax which companies pay for their activities shows business tax. Companies pay tax for

the government as per the tax rules. The business tax government makes for sole proprietor,

partner, limited company, corporation, businesses are responsible for pay tax rules. It is the

process of which the company. It is the process for the business that companies pay for tax rules.

Trading profits are equivalent for earnings from its activities. It’s not includes financing related

income, expenses for the gains for the assets. Badges of trade is utilized by HMRC for

determining if can activity can be termed as a proper economic activity or business activity or it

is just money making line for the hobby of a person. The value-added tax which customers pay

for costs for each process includes goods, services.

REFERENCES

Books and journals:

Al Karaawy, N. A. A. and Al Baaj, Q. M. A., 2018. Taxation of international business

organizations. Academy of Accounting and Financial Studies Journal. 22(1). pp.1-16.

Arnold, B. J., Ault, H. J. and Cooper, G. eds., 2019. Comparative income taxation: a structural

analysis. Kluwer Law International BV.

Biddle, N., Fels, K. M. and Sinning, M., 2018. Behavioral insights on business taxation:

Evidence from two natural field experiments. Journal of Behavioral and Experimental

Finance. 18. pp.30-49.

Blakeley, G., 2018. Fair dues: Rebalancing business taxation in the UK.

Boadway, R. W., Sato, M. and Tremblay, J. F., 2016. Cash-flow business taxation revisited:

Bankruptcy, risk aversion and asymmetric information (No. 1372). Queen's Economics

Department Working Paper.

Bushnyakova, A. I. and Kashirina, M. V., 2019. Some features of small business taxation (on the

example of construction). In Наука и образование в социокультурном пространстве

современного общества (pp. 60-64).

Clarke, C. and Kopczuk, W., 2017. Business income and business taxation in the United States

since the 1950s. Tax Policy and the Economy. 31(1). pp.121-159.

Giroud, X. and Rauh, J., 2019. State taxation and the reallocation of business activity: Evidence

from establishment-level data. Journal of Political Economy. 127(3). pp.1262-1316.

Haileyesus, I. W. and Asegu, E. K., 2020. Small Business Taxation in Ethiopia: A Focus on

Legal and Practical Issues in Income Tax Category. Journal of Taxation and Regulatory

Framework. 3(1).

Martins, A., 2019. Country Note: Three Emblematic Measures in Portuguese Business Taxation:

A Preliminary Quantitative Appraisal. Intertax. 47(6/7).

Nechaev, A. and Antipina, O., 2016. Analysis of the Impact of Taxation of Business Entities on

the Innovative Development of the Country.

Zeida, T. W. H., 2020. Essays on business taxation.

Books and journals:

Al Karaawy, N. A. A. and Al Baaj, Q. M. A., 2018. Taxation of international business

organizations. Academy of Accounting and Financial Studies Journal. 22(1). pp.1-16.

Arnold, B. J., Ault, H. J. and Cooper, G. eds., 2019. Comparative income taxation: a structural

analysis. Kluwer Law International BV.

Biddle, N., Fels, K. M. and Sinning, M., 2018. Behavioral insights on business taxation:

Evidence from two natural field experiments. Journal of Behavioral and Experimental

Finance. 18. pp.30-49.

Blakeley, G., 2018. Fair dues: Rebalancing business taxation in the UK.

Boadway, R. W., Sato, M. and Tremblay, J. F., 2016. Cash-flow business taxation revisited:

Bankruptcy, risk aversion and asymmetric information (No. 1372). Queen's Economics

Department Working Paper.

Bushnyakova, A. I. and Kashirina, M. V., 2019. Some features of small business taxation (on the

example of construction). In Наука и образование в социокультурном пространстве

современного общества (pp. 60-64).

Clarke, C. and Kopczuk, W., 2017. Business income and business taxation in the United States

since the 1950s. Tax Policy and the Economy. 31(1). pp.121-159.

Giroud, X. and Rauh, J., 2019. State taxation and the reallocation of business activity: Evidence

from establishment-level data. Journal of Political Economy. 127(3). pp.1262-1316.

Haileyesus, I. W. and Asegu, E. K., 2020. Small Business Taxation in Ethiopia: A Focus on

Legal and Practical Issues in Income Tax Category. Journal of Taxation and Regulatory

Framework. 3(1).

Martins, A., 2019. Country Note: Three Emblematic Measures in Portuguese Business Taxation:

A Preliminary Quantitative Appraisal. Intertax. 47(6/7).

Nechaev, A. and Antipina, O., 2016. Analysis of the Impact of Taxation of Business Entities on

the Innovative Development of the Country.

Zeida, T. W. H., 2020. Essays on business taxation.

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.