Project Report: Business Valuation and Analysis of JB HI FI

VerifiedAdded on 2023/01/04

|22

|5156

|57

Project

AI Summary

This project report presents a comprehensive business valuation and analysis of JB HI FI, a company operating in the Australian consumer goods market. The analysis encompasses various financial modeling techniques, including Dividend Discount Model (DDM), Residual Income Model (RIM), Residual Operating Income Model (ROIM), and Free Cash Flow Model (FCFM), to estimate the intrinsic value of JB HI FI's stock. The report incorporates forecasting methods to predict future sales growth, asset turnover, profit margins, and free cash flows, considering factors such as inflation, GDP, and industry trends. Sensitivity analysis is conducted to assess the impact of changes in key variables like sales growth and cost of capital on the valuation outcomes. The study also evaluates the cost of debt and equity, along with the Weighted Average Cost of Capital (WACC), and provides management consulting recommendations. The project concludes with an assessment of opportunities and challenges, offering insights into the company's financial performance and investment potential. The report also compares the estimated stock prices with the actual market prices to determine if the stock is undervalued or overvalued.

Running Head: Business valuation and analysis

1

Project Report: Business valuation and analysis

1

Project Report: Business valuation and analysis

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business valuation and analysis 2

Contents

Introduction:.....................................................................................................................3

Forecasting:.......................................................................................................................3

Sales growth:................................................................................................................4

Asset turnover ratio forecast (ATO forecast):..............................................................5

Profit Margin:...............................................................................................................6

Free cash flow and Net dividend payout ratio forecasting:..........................................7

Cost of debt:..................................................................................................................8

Cost of equity:...............................................................................................................8

Valuation:.........................................................................................................................9

Dividend discount model:...........................................................................................10

Residual income model:.............................................................................................11

Residual operating income model:.............................................................................12

Free cash flow model:.................................................................................................13

Sensitivity analysis:........................................................................................................14

Sales growth:..............................................................................................................14

ATO:...........................................................................................................................15

PM:.............................................................................................................................15

Net dividend payout ratio:..........................................................................................16

Cost of debt:................................................................................................................16

Cost of equity and WACC:.........................................................................................16

Management consulting decisions:.................................................................................17

Opportunities..............................................................................................................17

Contents

Introduction:.....................................................................................................................3

Forecasting:.......................................................................................................................3

Sales growth:................................................................................................................4

Asset turnover ratio forecast (ATO forecast):..............................................................5

Profit Margin:...............................................................................................................6

Free cash flow and Net dividend payout ratio forecasting:..........................................7

Cost of debt:..................................................................................................................8

Cost of equity:...............................................................................................................8

Valuation:.........................................................................................................................9

Dividend discount model:...........................................................................................10

Residual income model:.............................................................................................11

Residual operating income model:.............................................................................12

Free cash flow model:.................................................................................................13

Sensitivity analysis:........................................................................................................14

Sales growth:..............................................................................................................14

ATO:...........................................................................................................................15

PM:.............................................................................................................................15

Net dividend payout ratio:..........................................................................................16

Cost of debt:................................................................................................................16

Cost of equity and WACC:.........................................................................................16

Management consulting decisions:.................................................................................17

Opportunities..............................................................................................................17

Business valuation and analysis 3

Challenges...................................................................................................................18

Conclusion:.....................................................................................................................18

References:.....................................................................................................................20

Appendix.........................................................................................................................21

Challenges...................................................................................................................18

Conclusion:.....................................................................................................................18

References:.....................................................................................................................20

Appendix.........................................................................................................................21

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Business valuation and analysis 4

Introduction:

Evaluation over the stock and financial position of an organization is one of the

mandatory and important steps which must be taken by the investors and financial analyst to

make decision about investment into organization. The main concept of business valuation

and analysis is to gather the financial data of past few years and measure them on the basis of

various methods and ways to identify the changes faced by the company in previous few

years. This method helps the organization to evaluate the current and future performance of

the company so that the total return which could be got from the company is forecasted and a

decision could be made accordingly. Business valuation and analysis study has been

conducted over JB HI FI limited.

In order to measure and estimate the future values of stock of JB HI FI, various

financial methods have been applied over the business such as valuation model i.e. DDM

model, growth discount model etc, forecasting models such as changes in sales level,

profitability level etc, sensitivity analysis such as changes in few independent factors and

management consulting advise. All of these methods assist the shareholders and other

internal & external stakeholders of the business to measure the level of business and make a

better investment decision accordingly.

JB HI FI is running its business in Australian market. It has further expanded its

business into overseas market. Consumer goods are mainly provided by the company in its

running market. Main subsidiary company of JB HI FI is “The good guys”. Most of the

business and operations of the business are run by its subsidiary company. JB HI FI is

running its operations since 1974 in Australian market. Further, the company has diversified

its market in different industry. The changes and financial and non financial performance

study depicts that company has improved a lot in the market since last few years. The report

focuses over the overall changes and future prediction about worth of the business for the

internal and external users of the business.

Forecasting:

Forecasting is a process of identifying the future changes in an organization on the

basis of various independent and dependent factors such as changes in sales revenue, changes

in profitability level, demand fluctuations, economical changes, change in industry factors

Introduction:

Evaluation over the stock and financial position of an organization is one of the

mandatory and important steps which must be taken by the investors and financial analyst to

make decision about investment into organization. The main concept of business valuation

and analysis is to gather the financial data of past few years and measure them on the basis of

various methods and ways to identify the changes faced by the company in previous few

years. This method helps the organization to evaluate the current and future performance of

the company so that the total return which could be got from the company is forecasted and a

decision could be made accordingly. Business valuation and analysis study has been

conducted over JB HI FI limited.

In order to measure and estimate the future values of stock of JB HI FI, various

financial methods have been applied over the business such as valuation model i.e. DDM

model, growth discount model etc, forecasting models such as changes in sales level,

profitability level etc, sensitivity analysis such as changes in few independent factors and

management consulting advise. All of these methods assist the shareholders and other

internal & external stakeholders of the business to measure the level of business and make a

better investment decision accordingly.

JB HI FI is running its business in Australian market. It has further expanded its

business into overseas market. Consumer goods are mainly provided by the company in its

running market. Main subsidiary company of JB HI FI is “The good guys”. Most of the

business and operations of the business are run by its subsidiary company. JB HI FI is

running its operations since 1974 in Australian market. Further, the company has diversified

its market in different industry. The changes and financial and non financial performance

study depicts that company has improved a lot in the market since last few years. The report

focuses over the overall changes and future prediction about worth of the business for the

internal and external users of the business.

Forecasting:

Forecasting is a process of identifying the future changes in an organization on the

basis of various independent and dependent factors such as changes in sales revenue, changes

in profitability level, demand fluctuations, economical changes, change in industry factors

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business valuation and analysis 5

etc. Forecasting process makes it easier for the management of the company to consider the

previous changes and make compatible strategy for the business accordingly (Lord, 2017).

Also, this process helps the financial analyst to evaluate about investment level in the

business. In case of JB HI FI, forecasting study has been done over the company to recognize

overall performance of the company. Below is the evaluation over JB HI FI:

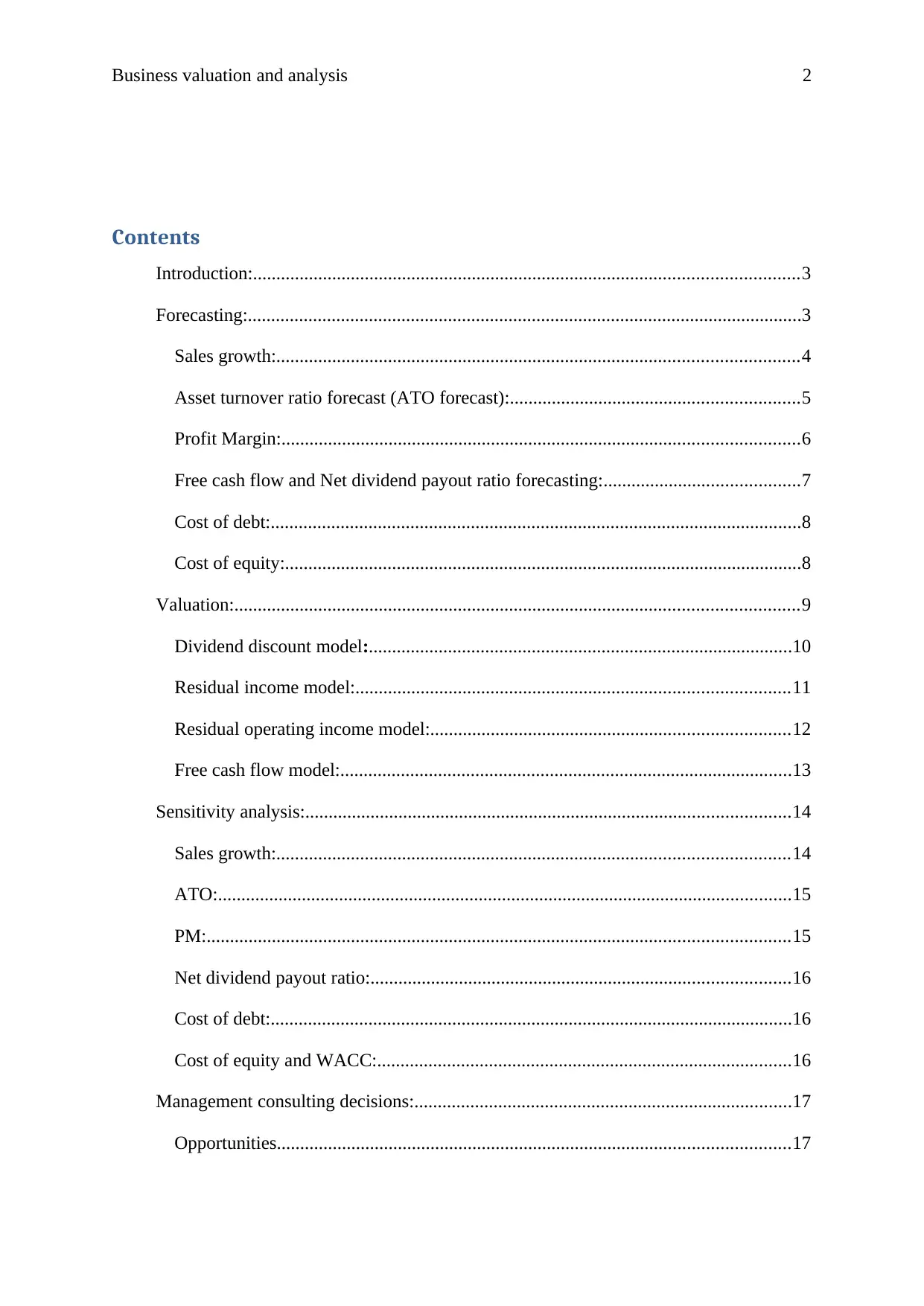

Sales growth:

The study over JB HI FI last 5 years data, it has been found that few changes have

occurred into previous years which would also impact in upcoming years of the company.

The study explains that initially the sales growth would be lower because of the new projects

of the business. But along with the time, sales growth level of the business would be better

and it would help the business to make better decision.

Figure 1: Sales Growth

(Appendix)

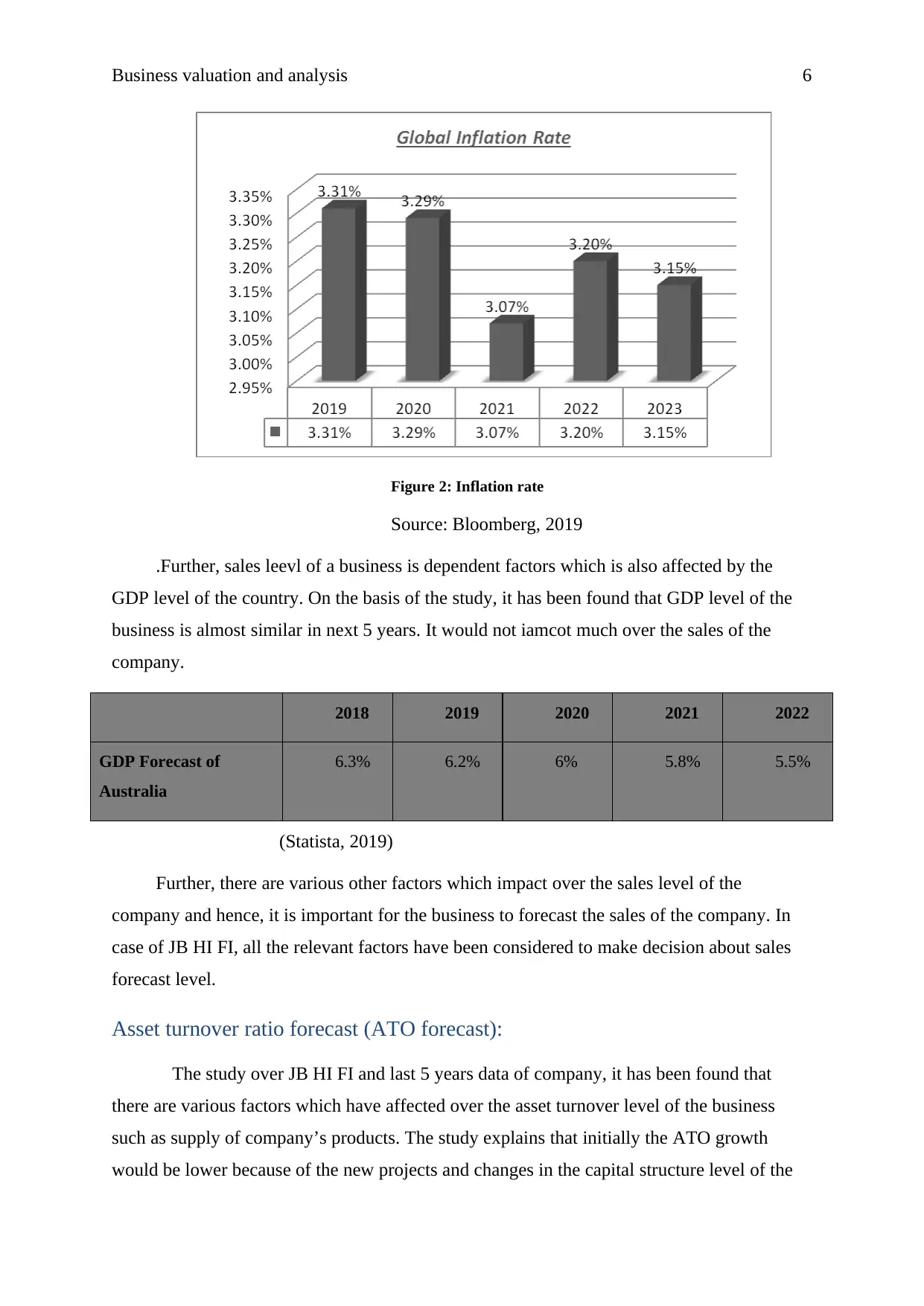

Along with the new projects, the sales growth level of the business has also affected

because of the inflation rate of Australia. The below graph explains that inflation rate of the

business would be higher at initial years which would affect the sales growth of the company

negatively. But in next year’s, it would be reduced and would impact negatively on the sale

growth of the business.

etc. Forecasting process makes it easier for the management of the company to consider the

previous changes and make compatible strategy for the business accordingly (Lord, 2017).

Also, this process helps the financial analyst to evaluate about investment level in the

business. In case of JB HI FI, forecasting study has been done over the company to recognize

overall performance of the company. Below is the evaluation over JB HI FI:

Sales growth:

The study over JB HI FI last 5 years data, it has been found that few changes have

occurred into previous years which would also impact in upcoming years of the company.

The study explains that initially the sales growth would be lower because of the new projects

of the business. But along with the time, sales growth level of the business would be better

and it would help the business to make better decision.

Figure 1: Sales Growth

(Appendix)

Along with the new projects, the sales growth level of the business has also affected

because of the inflation rate of Australia. The below graph explains that inflation rate of the

business would be higher at initial years which would affect the sales growth of the company

negatively. But in next year’s, it would be reduced and would impact negatively on the sale

growth of the business.

Business valuation and analysis 6

Figure 2: Inflation rate

Source: Bloomberg, 2019

.Further, sales leevl of a business is dependent factors which is also affected by the

GDP level of the country. On the basis of the study, it has been found that GDP level of the

business is almost similar in next 5 years. It would not iamcot much over the sales of the

company.

2018 2019 2020 2021 2022

GDP Forecast of

Australia

6.3% 6.2% 6% 5.8% 5.5%

(Statista, 2019)

Further, there are various other factors which impact over the sales level of the

company and hence, it is important for the business to forecast the sales of the company. In

case of JB HI FI, all the relevant factors have been considered to make decision about sales

forecast level.

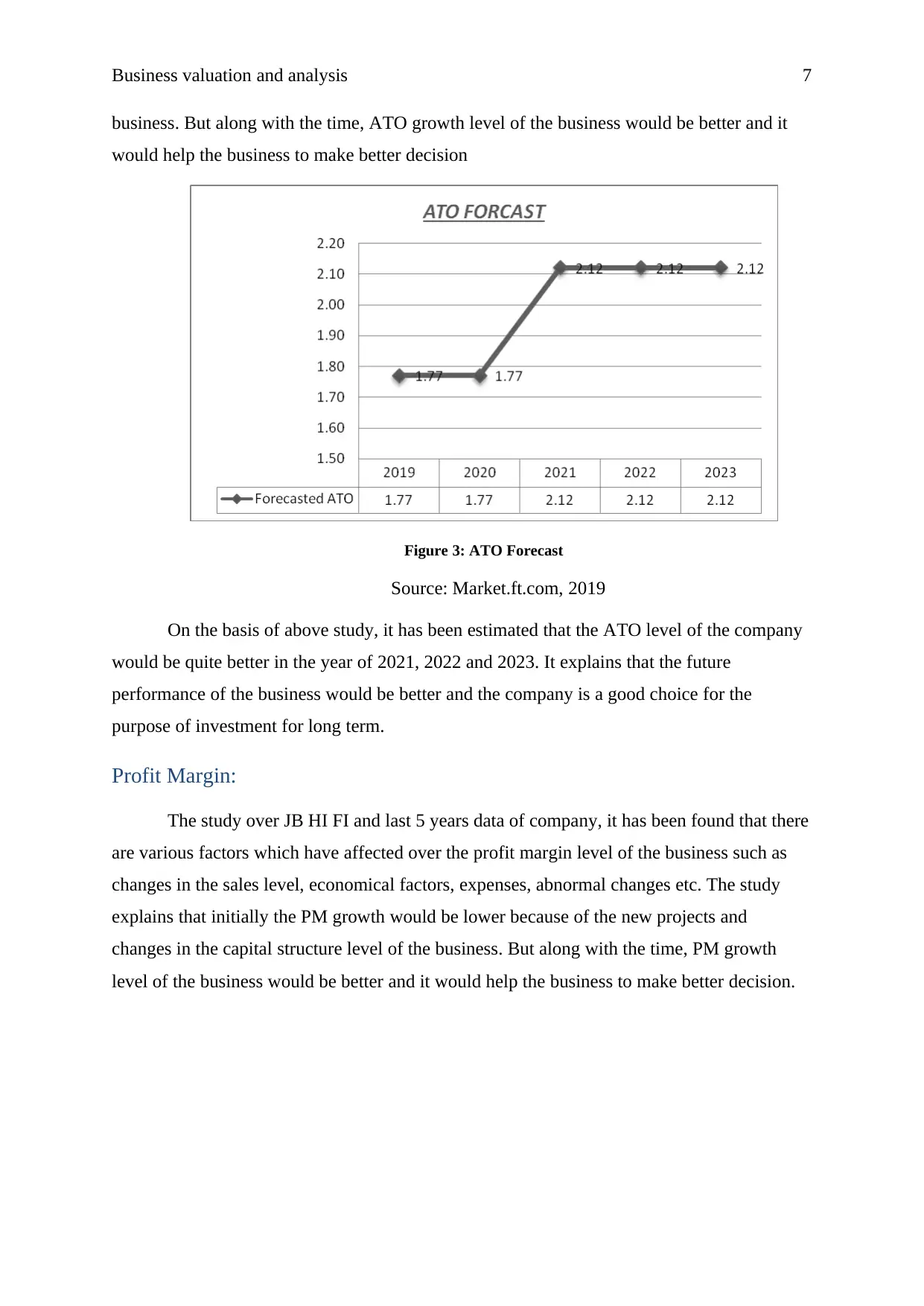

Asset turnover ratio forecast (ATO forecast):

The study over JB HI FI and last 5 years data of company, it has been found that

there are various factors which have affected over the asset turnover level of the business

such as supply of company’s products. The study explains that initially the ATO growth

would be lower because of the new projects and changes in the capital structure level of the

Figure 2: Inflation rate

Source: Bloomberg, 2019

.Further, sales leevl of a business is dependent factors which is also affected by the

GDP level of the country. On the basis of the study, it has been found that GDP level of the

business is almost similar in next 5 years. It would not iamcot much over the sales of the

company.

2018 2019 2020 2021 2022

GDP Forecast of

Australia

6.3% 6.2% 6% 5.8% 5.5%

(Statista, 2019)

Further, there are various other factors which impact over the sales level of the

company and hence, it is important for the business to forecast the sales of the company. In

case of JB HI FI, all the relevant factors have been considered to make decision about sales

forecast level.

Asset turnover ratio forecast (ATO forecast):

The study over JB HI FI and last 5 years data of company, it has been found that

there are various factors which have affected over the asset turnover level of the business

such as supply of company’s products. The study explains that initially the ATO growth

would be lower because of the new projects and changes in the capital structure level of the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Business valuation and analysis 7

business. But along with the time, ATO growth level of the business would be better and it

would help the business to make better decision

Figure 3: ATO Forecast

Source: Market.ft.com, 2019

On the basis of above study, it has been estimated that the ATO level of the company

would be quite better in the year of 2021, 2022 and 2023. It explains that the future

performance of the business would be better and the company is a good choice for the

purpose of investment for long term.

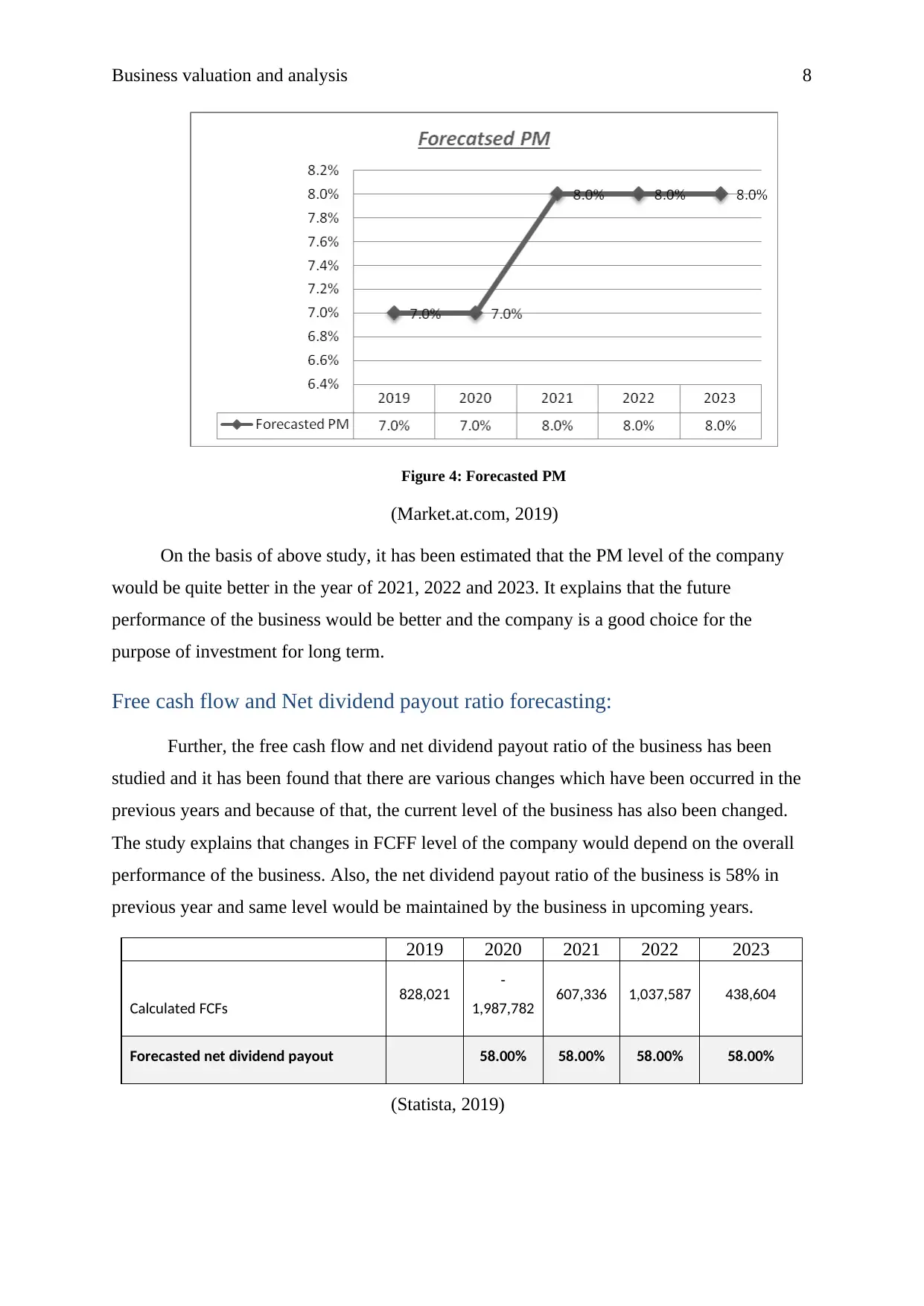

Profit Margin:

The study over JB HI FI and last 5 years data of company, it has been found that there

are various factors which have affected over the profit margin level of the business such as

changes in the sales level, economical factors, expenses, abnormal changes etc. The study

explains that initially the PM growth would be lower because of the new projects and

changes in the capital structure level of the business. But along with the time, PM growth

level of the business would be better and it would help the business to make better decision.

business. But along with the time, ATO growth level of the business would be better and it

would help the business to make better decision

Figure 3: ATO Forecast

Source: Market.ft.com, 2019

On the basis of above study, it has been estimated that the ATO level of the company

would be quite better in the year of 2021, 2022 and 2023. It explains that the future

performance of the business would be better and the company is a good choice for the

purpose of investment for long term.

Profit Margin:

The study over JB HI FI and last 5 years data of company, it has been found that there

are various factors which have affected over the profit margin level of the business such as

changes in the sales level, economical factors, expenses, abnormal changes etc. The study

explains that initially the PM growth would be lower because of the new projects and

changes in the capital structure level of the business. But along with the time, PM growth

level of the business would be better and it would help the business to make better decision.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business valuation and analysis 8

Figure 4: Forecasted PM

(Market.at.com, 2019)

On the basis of above study, it has been estimated that the PM level of the company

would be quite better in the year of 2021, 2022 and 2023. It explains that the future

performance of the business would be better and the company is a good choice for the

purpose of investment for long term.

Free cash flow and Net dividend payout ratio forecasting:

Further, the free cash flow and net dividend payout ratio of the business has been

studied and it has been found that there are various changes which have been occurred in the

previous years and because of that, the current level of the business has also been changed.

The study explains that changes in FCFF level of the company would depend on the overall

performance of the business. Also, the net dividend payout ratio of the business is 58% in

previous year and same level would be maintained by the business in upcoming years.

2019 2020 2021 2022 2023

Calculated FCFs 828,021 -

1,987,782 607,336 1,037,587 438,604

Forecasted net dividend payout 58.00% 58.00% 58.00% 58.00%

(Statista, 2019)

Figure 4: Forecasted PM

(Market.at.com, 2019)

On the basis of above study, it has been estimated that the PM level of the company

would be quite better in the year of 2021, 2022 and 2023. It explains that the future

performance of the business would be better and the company is a good choice for the

purpose of investment for long term.

Free cash flow and Net dividend payout ratio forecasting:

Further, the free cash flow and net dividend payout ratio of the business has been

studied and it has been found that there are various changes which have been occurred in the

previous years and because of that, the current level of the business has also been changed.

The study explains that changes in FCFF level of the company would depend on the overall

performance of the business. Also, the net dividend payout ratio of the business is 58% in

previous year and same level would be maintained by the business in upcoming years.

2019 2020 2021 2022 2023

Calculated FCFs 828,021 -

1,987,782 607,336 1,037,587 438,604

Forecasted net dividend payout 58.00% 58.00% 58.00% 58.00%

(Statista, 2019)

Business valuation and analysis 9

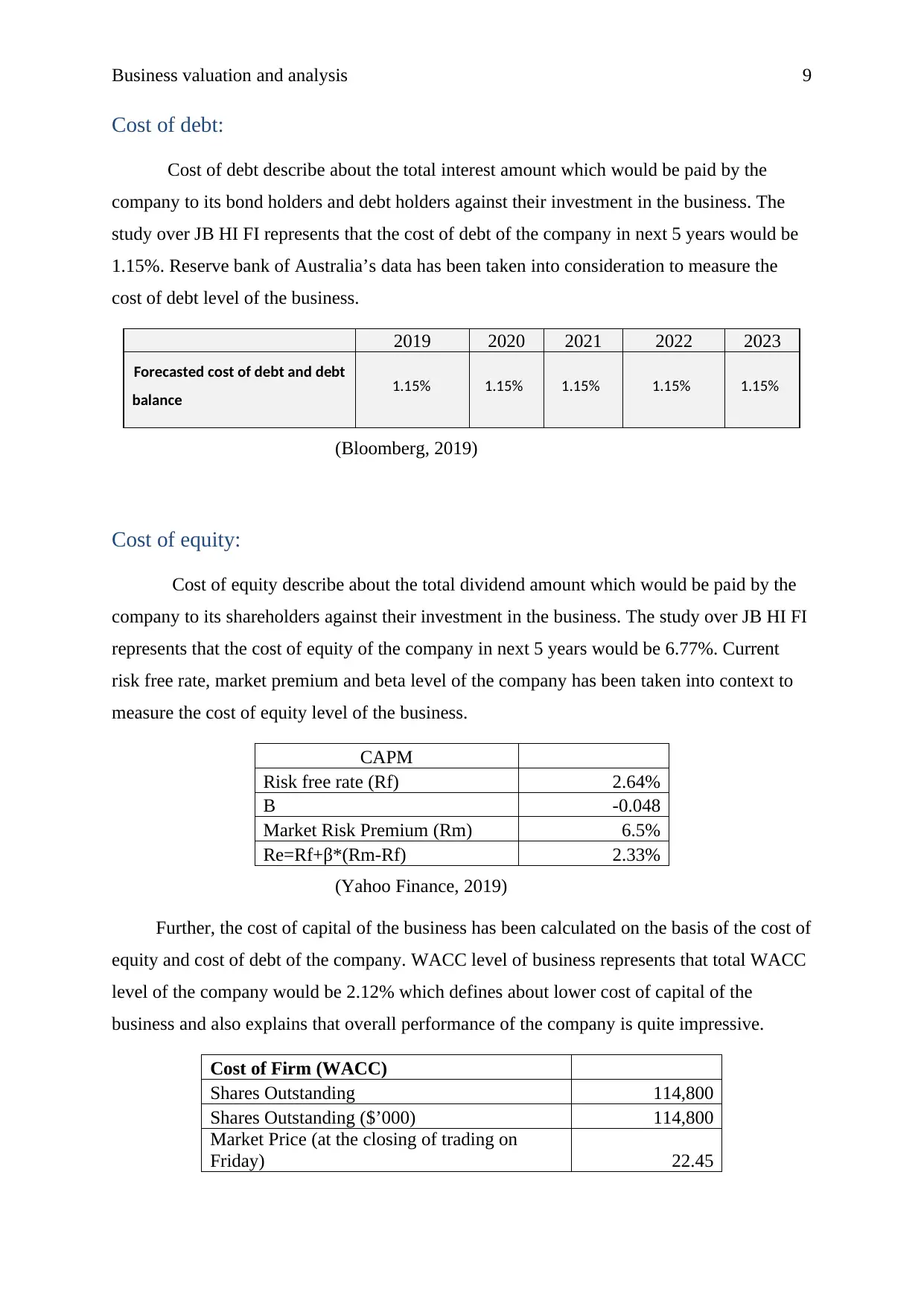

Cost of debt:

Cost of debt describe about the total interest amount which would be paid by the

company to its bond holders and debt holders against their investment in the business. The

study over JB HI FI represents that the cost of debt of the company in next 5 years would be

1.15%. Reserve bank of Australia’s data has been taken into consideration to measure the

cost of debt level of the business.

2019 2020 2021 2022 2023

Forecasted cost of debt and debt

balance 1.15% 1.15% 1.15% 1.15% 1.15%

(Bloomberg, 2019)

Cost of equity:

Cost of equity describe about the total dividend amount which would be paid by the

company to its shareholders against their investment in the business. The study over JB HI FI

represents that the cost of equity of the company in next 5 years would be 6.77%. Current

risk free rate, market premium and beta level of the company has been taken into context to

measure the cost of equity level of the business.

CAPM

Risk free rate (Rf) 2.64%

Β -0.048

Market Risk Premium (Rm) 6.5%

Re=Rf+β*(Rm-Rf) 2.33%

(Yahoo Finance, 2019)

Further, the cost of capital of the business has been calculated on the basis of the cost of

equity and cost of debt of the company. WACC level of business represents that total WACC

level of the company would be 2.12% which defines about lower cost of capital of the

business and also explains that overall performance of the company is quite impressive.

Cost of Firm (WACC)

Shares Outstanding 114,800

Shares Outstanding ($’000) 114,800

Market Price (at the closing of trading on

Friday) 22.45

Cost of debt:

Cost of debt describe about the total interest amount which would be paid by the

company to its bond holders and debt holders against their investment in the business. The

study over JB HI FI represents that the cost of debt of the company in next 5 years would be

1.15%. Reserve bank of Australia’s data has been taken into consideration to measure the

cost of debt level of the business.

2019 2020 2021 2022 2023

Forecasted cost of debt and debt

balance 1.15% 1.15% 1.15% 1.15% 1.15%

(Bloomberg, 2019)

Cost of equity:

Cost of equity describe about the total dividend amount which would be paid by the

company to its shareholders against their investment in the business. The study over JB HI FI

represents that the cost of equity of the company in next 5 years would be 6.77%. Current

risk free rate, market premium and beta level of the company has been taken into context to

measure the cost of equity level of the business.

CAPM

Risk free rate (Rf) 2.64%

Β -0.048

Market Risk Premium (Rm) 6.5%

Re=Rf+β*(Rm-Rf) 2.33%

(Yahoo Finance, 2019)

Further, the cost of capital of the business has been calculated on the basis of the cost of

equity and cost of debt of the company. WACC level of business represents that total WACC

level of the company would be 2.12% which defines about lower cost of capital of the

business and also explains that overall performance of the company is quite impressive.

Cost of Firm (WACC)

Shares Outstanding 114,800

Shares Outstanding ($’000) 114,800

Market Price (at the closing of trading on

Friday) 22.45

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Business valuation and analysis 10

Market Value of Equity 2,577,260

Market Value of Equity ($’000) 2,577,260

NFO 566,100

Rd 1.15%

MV 2,577,260

Re 2.33%

NFO+MV 3,143,360

WACC 2.12%

(Bloomberg, 2019)

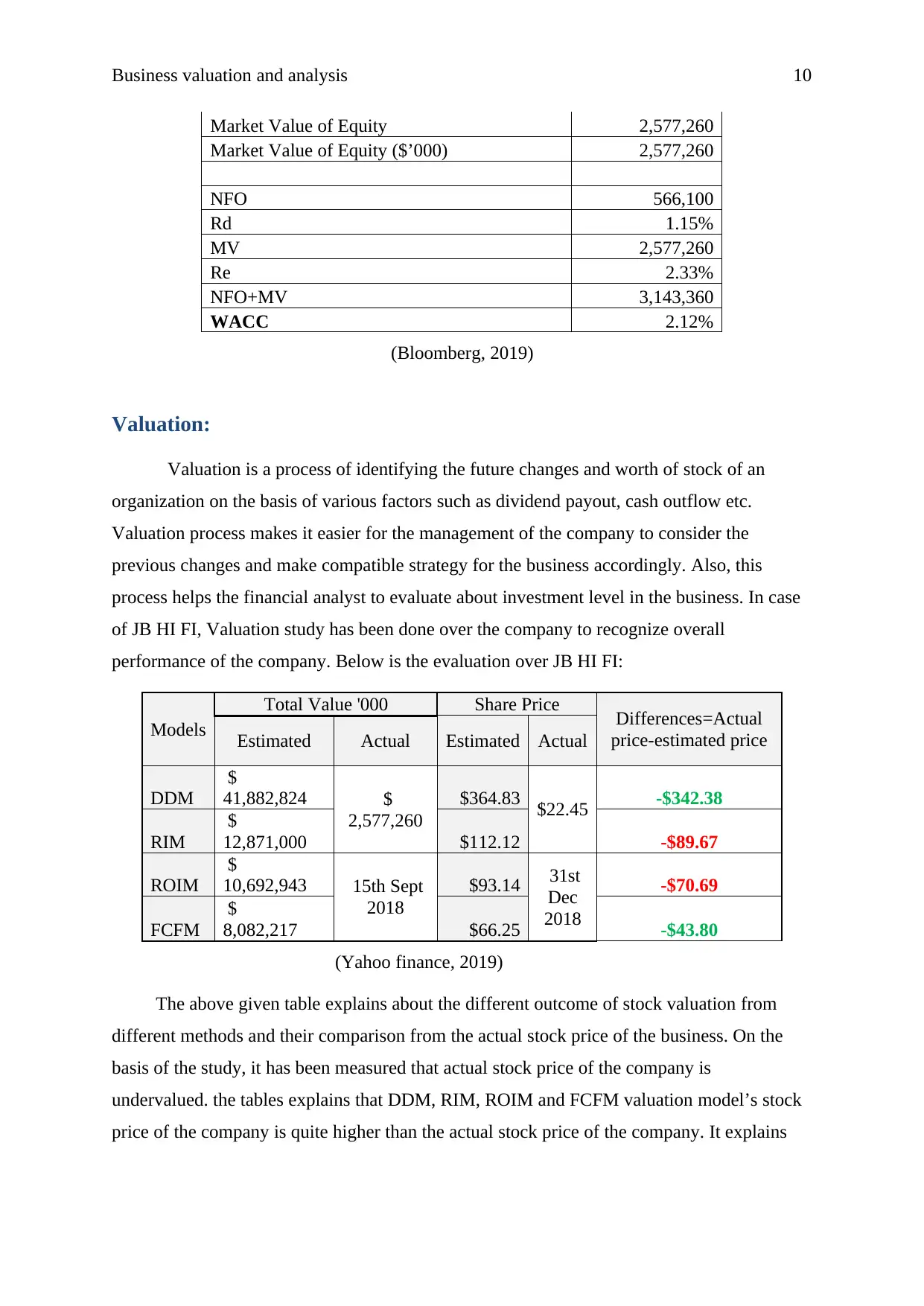

Valuation:

Valuation is a process of identifying the future changes and worth of stock of an

organization on the basis of various factors such as dividend payout, cash outflow etc.

Valuation process makes it easier for the management of the company to consider the

previous changes and make compatible strategy for the business accordingly. Also, this

process helps the financial analyst to evaluate about investment level in the business. In case

of JB HI FI, Valuation study has been done over the company to recognize overall

performance of the company. Below is the evaluation over JB HI FI:

Models

Total Value '000 Share Price Differences=Actual

price-estimated priceEstimated Actual Estimated Actual

DDM

$

41,882,824 $

2,577,260

$364.83 $22.45 -$342.38

RIM

$

12,871,000 $112.12 -$89.67

ROIM

$

10,692,943 15th Sept

2018

$93.14 31st

Dec

2018

-$70.69

FCFM

$

8,082,217 $66.25 -$43.80

(Yahoo finance, 2019)

The above given table explains about the different outcome of stock valuation from

different methods and their comparison from the actual stock price of the business. On the

basis of the study, it has been measured that actual stock price of the company is

undervalued. the tables explains that DDM, RIM, ROIM and FCFM valuation model’s stock

price of the company is quite higher than the actual stock price of the company. It explains

Market Value of Equity 2,577,260

Market Value of Equity ($’000) 2,577,260

NFO 566,100

Rd 1.15%

MV 2,577,260

Re 2.33%

NFO+MV 3,143,360

WACC 2.12%

(Bloomberg, 2019)

Valuation:

Valuation is a process of identifying the future changes and worth of stock of an

organization on the basis of various factors such as dividend payout, cash outflow etc.

Valuation process makes it easier for the management of the company to consider the

previous changes and make compatible strategy for the business accordingly. Also, this

process helps the financial analyst to evaluate about investment level in the business. In case

of JB HI FI, Valuation study has been done over the company to recognize overall

performance of the company. Below is the evaluation over JB HI FI:

Models

Total Value '000 Share Price Differences=Actual

price-estimated priceEstimated Actual Estimated Actual

DDM

$

41,882,824 $

2,577,260

$364.83 $22.45 -$342.38

RIM

$

12,871,000 $112.12 -$89.67

ROIM

$

10,692,943 15th Sept

2018

$93.14 31st

Dec

2018

-$70.69

FCFM

$

8,082,217 $66.25 -$43.80

(Yahoo finance, 2019)

The above given table explains about the different outcome of stock valuation from

different methods and their comparison from the actual stock price of the business. On the

basis of the study, it has been measured that actual stock price of the company is

undervalued. the tables explains that DDM, RIM, ROIM and FCFM valuation model’s stock

price of the company is quite higher than the actual stock price of the company. It explains

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business valuation and analysis 11

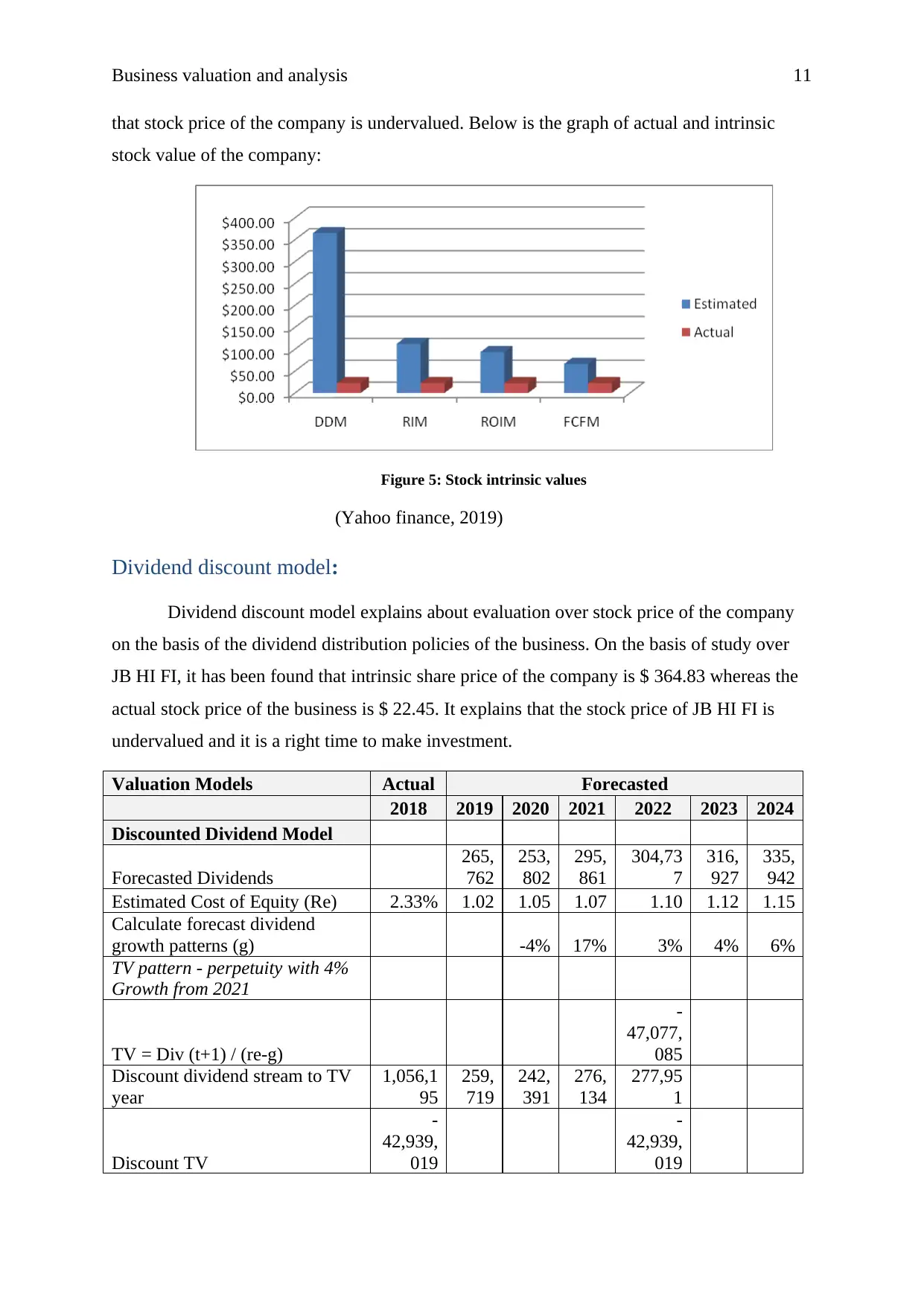

that stock price of the company is undervalued. Below is the graph of actual and intrinsic

stock value of the company:

Figure 5: Stock intrinsic values

(Yahoo finance, 2019)

Dividend discount model:

Dividend discount model explains about evaluation over stock price of the company

on the basis of the dividend distribution policies of the business. On the basis of study over

JB HI FI, it has been found that intrinsic share price of the company is $ 364.83 whereas the

actual stock price of the business is $ 22.45. It explains that the stock price of JB HI FI is

undervalued and it is a right time to make investment.

Valuation Models Actual Forecasted

2018 2019 2020 2021 2022 2023 2024

Discounted Dividend Model

Forecasted Dividends

265,

762

253,

802

295,

861

304,73

7

316,

927

335,

942

Estimated Cost of Equity (Re) 2.33% 1.02 1.05 1.07 1.10 1.12 1.15

Calculate forecast dividend

growth patterns (g) -4% 17% 3% 4% 6%

TV pattern - perpetuity with 4%

Growth from 2021

TV = Div (t+1) / (re-g)

-

47,077,

085

Discount dividend stream to TV

year

1,056,1

95

259,

719

242,

391

276,

134

277,95

1

Discount TV

-

42,939,

019

-

42,939,

019

that stock price of the company is undervalued. Below is the graph of actual and intrinsic

stock value of the company:

Figure 5: Stock intrinsic values

(Yahoo finance, 2019)

Dividend discount model:

Dividend discount model explains about evaluation over stock price of the company

on the basis of the dividend distribution policies of the business. On the basis of study over

JB HI FI, it has been found that intrinsic share price of the company is $ 364.83 whereas the

actual stock price of the business is $ 22.45. It explains that the stock price of JB HI FI is

undervalued and it is a right time to make investment.

Valuation Models Actual Forecasted

2018 2019 2020 2021 2022 2023 2024

Discounted Dividend Model

Forecasted Dividends

265,

762

253,

802

295,

861

304,73

7

316,

927

335,

942

Estimated Cost of Equity (Re) 2.33% 1.02 1.05 1.07 1.10 1.12 1.15

Calculate forecast dividend

growth patterns (g) -4% 17% 3% 4% 6%

TV pattern - perpetuity with 4%

Growth from 2021

TV = Div (t+1) / (re-g)

-

47,077,

085

Discount dividend stream to TV

year

1,056,1

95

259,

719

242,

391

276,

134

277,95

1

Discount TV

-

42,939,

019

-

42,939,

019

Business valuation and analysis 12

Equity value

41,882,

824

Share outstanding

114,80

0

Share Price=Equity Value/No. of

Shares 364.83

Actual share price as at (Apr 30,

2019) 22.45

Difference -342.38

(Annual report, 2018)

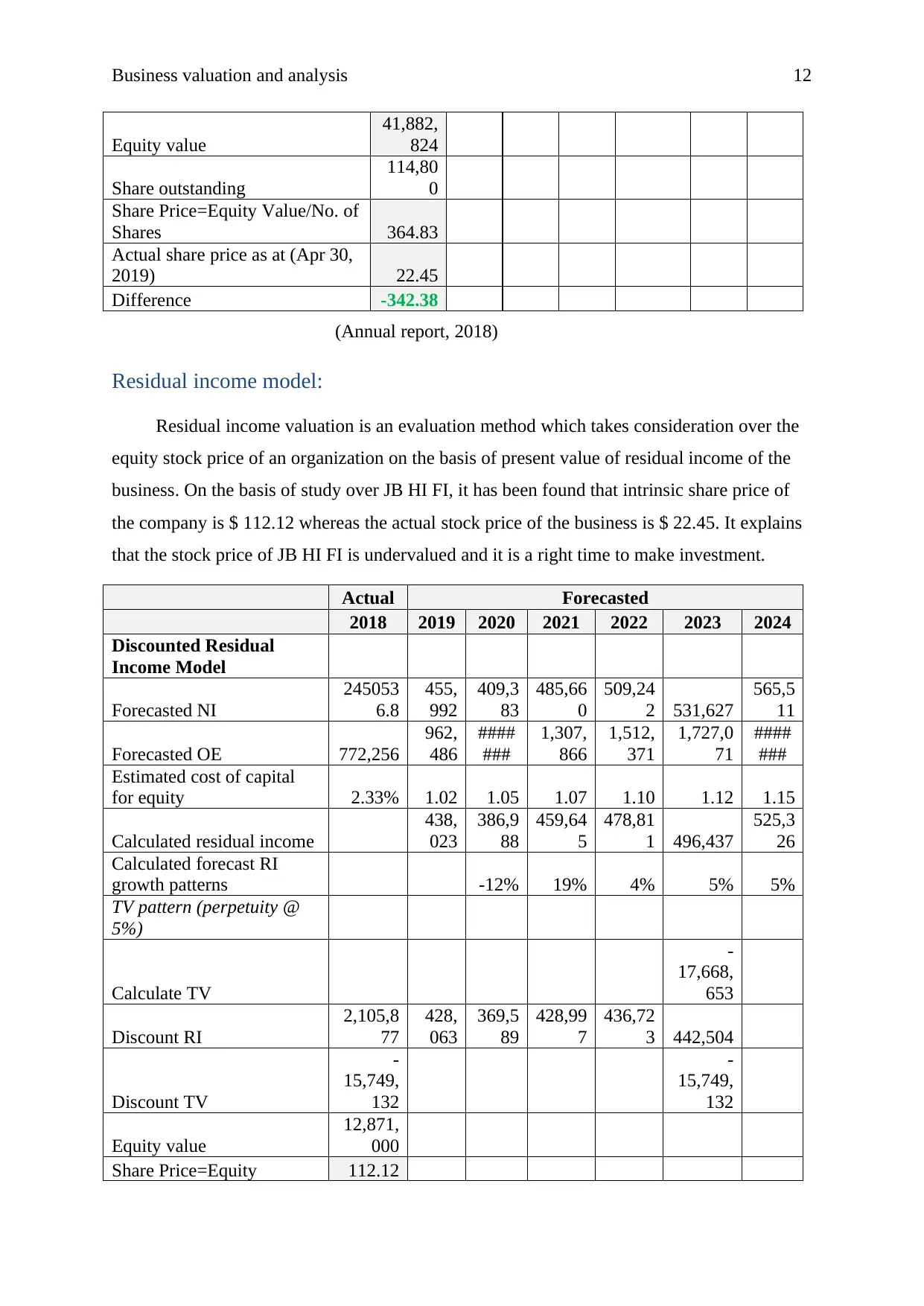

Residual income model:

Residual income valuation is an evaluation method which takes consideration over the

equity stock price of an organization on the basis of present value of residual income of the

business. On the basis of study over JB HI FI, it has been found that intrinsic share price of

the company is $ 112.12 whereas the actual stock price of the business is $ 22.45. It explains

that the stock price of JB HI FI is undervalued and it is a right time to make investment.

Actual Forecasted

2018 2019 2020 2021 2022 2023 2024

Discounted Residual

Income Model

Forecasted NI

245053

6.8

455,

992

409,3

83

485,66

0

509,24

2 531,627

565,5

11

Forecasted OE 772,256

962,

486

####

###

1,307,

866

1,512,

371

1,727,0

71

####

###

Estimated cost of capital

for equity 2.33% 1.02 1.05 1.07 1.10 1.12 1.15

Calculated residual income

438,

023

386,9

88

459,64

5

478,81

1 496,437

525,3

26

Calculated forecast RI

growth patterns -12% 19% 4% 5% 5%

TV pattern (perpetuity @

5%)

Calculate TV

-

17,668,

653

Discount RI

2,105,8

77

428,

063

369,5

89

428,99

7

436,72

3 442,504

Discount TV

-

15,749,

132

-

15,749,

132

Equity value

12,871,

000

Share Price=Equity 112.12

Equity value

41,882,

824

Share outstanding

114,80

0

Share Price=Equity Value/No. of

Shares 364.83

Actual share price as at (Apr 30,

2019) 22.45

Difference -342.38

(Annual report, 2018)

Residual income model:

Residual income valuation is an evaluation method which takes consideration over the

equity stock price of an organization on the basis of present value of residual income of the

business. On the basis of study over JB HI FI, it has been found that intrinsic share price of

the company is $ 112.12 whereas the actual stock price of the business is $ 22.45. It explains

that the stock price of JB HI FI is undervalued and it is a right time to make investment.

Actual Forecasted

2018 2019 2020 2021 2022 2023 2024

Discounted Residual

Income Model

Forecasted NI

245053

6.8

455,

992

409,3

83

485,66

0

509,24

2 531,627

565,5

11

Forecasted OE 772,256

962,

486

####

###

1,307,

866

1,512,

371

1,727,0

71

####

###

Estimated cost of capital

for equity 2.33% 1.02 1.05 1.07 1.10 1.12 1.15

Calculated residual income

438,

023

386,9

88

459,64

5

478,81

1 496,437

525,3

26

Calculated forecast RI

growth patterns -12% 19% 4% 5% 5%

TV pattern (perpetuity @

5%)

Calculate TV

-

17,668,

653

Discount RI

2,105,8

77

428,

063

369,5

89

428,99

7

436,72

3 442,504

Discount TV

-

15,749,

132

-

15,749,

132

Equity value

12,871,

000

Share Price=Equity 112.12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.