Accounting Financial Analysis Report for Caffyns plc

VerifiedAdded on 2023/06/13

|33

|8388

|156

AI Summary

This report provides a detailed analysis of Caffyns plc, a motor vehicle retailer company in England. The report includes a strategic and operating analysis, accounting quality analysis, and financial analysis. The financial analysis includes trend analysis, ratio analysis, and investor analysis. The report concludes with a recommendation and conclusion for potential investors.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: Accounting financial analysis report

1

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Accounting financial analysis report 2

Contents

Section A: Equity investment report.................................................................................3

Introduction...................................................................................................................3

Caffyns plc....................................................................................................................3

Strategic and operating analysis...................................................................................3

Accounting quality analysis..........................................................................................8

Financial analysis:........................................................................................................9

Investor analysis.........................................................................................................10

Recommendation and conclusion...............................................................................11

Section B: Capital budgeting analysis............................................................................12

Introduction.................................................................................................................12

Analysis......................................................................................................................12

Recommendation and conclusion...............................................................................14

References.......................................................................................................................15

Appendix.........................................................................................................................17

Contents

Section A: Equity investment report.................................................................................3

Introduction...................................................................................................................3

Caffyns plc....................................................................................................................3

Strategic and operating analysis...................................................................................3

Accounting quality analysis..........................................................................................8

Financial analysis:........................................................................................................9

Investor analysis.........................................................................................................10

Recommendation and conclusion...............................................................................11

Section B: Capital budgeting analysis............................................................................12

Introduction.................................................................................................................12

Analysis......................................................................................................................12

Recommendation and conclusion...............................................................................14

References.......................................................................................................................15

Appendix.........................................................................................................................17

Accounting financial analysis report 3

Section A: Equity investment report

Introduction:

Equity investment reports are prepared to evaluate the financial and non financial

position of an organization so that a decision could be made about the investment and equity

position of the company. The report takes the concern of industry evaluation, company

evaluation, external environments, internal environments, accounting quality, competitor’s

analysis, financial analysis etc (Grinblatt and Titman, 2016). It makes it easy for the investors

of the company to make a better decision about the divestment into the company.

The report has been prepared to brief you about the Caffyn plc and its performance.

For evaluating the investment opportunity in the company, financial and non financial factors

of the company has been evaluated and it has been recognized that how the company is

performing in context with the industry and the competitor of the company, Pendragon plc.

The financial position of the company has been compared with last year and the competitor to

evaluate the better opportunity of investment.

Caffyns plc:

Caffyns plc is a motor vehicle retailer company in England. The company has been

awarded as one of the largest car retailing company is Southeast, England. The main

operations of the company are to sell the new and used car and car parts. The main products

of the company are mobility van, car, oil, parts, tyres, accessories etc. (History,, 2018).The

company also offers the repairing services to the cars. The company explains about a

portfolio of 6 franchises which are Audi, SEAT, Vauxhall, Volvo, Volkswagen and Skoda.

The company has been founded in 1865. Headquarter of the company is in Eastbourne, UK.

The main competitor of the company is Pendragon plc which is also operating its business in

England (Bloomberg, 2018).

The financial performance and non financial performance of the company indicates

about numerous changes in recent years. The performance of the company has been enhanced

and the company has also managed the non financial factors to enhance the performance of

the company (Reuters, 2018). The financial and non financial performance of Caffyns plc is

below.

Strategic and operating analysis:

Section A: Equity investment report

Introduction:

Equity investment reports are prepared to evaluate the financial and non financial

position of an organization so that a decision could be made about the investment and equity

position of the company. The report takes the concern of industry evaluation, company

evaluation, external environments, internal environments, accounting quality, competitor’s

analysis, financial analysis etc (Grinblatt and Titman, 2016). It makes it easy for the investors

of the company to make a better decision about the divestment into the company.

The report has been prepared to brief you about the Caffyn plc and its performance.

For evaluating the investment opportunity in the company, financial and non financial factors

of the company has been evaluated and it has been recognized that how the company is

performing in context with the industry and the competitor of the company, Pendragon plc.

The financial position of the company has been compared with last year and the competitor to

evaluate the better opportunity of investment.

Caffyns plc:

Caffyns plc is a motor vehicle retailer company in England. The company has been

awarded as one of the largest car retailing company is Southeast, England. The main

operations of the company are to sell the new and used car and car parts. The main products

of the company are mobility van, car, oil, parts, tyres, accessories etc. (History,, 2018).The

company also offers the repairing services to the cars. The company explains about a

portfolio of 6 franchises which are Audi, SEAT, Vauxhall, Volvo, Volkswagen and Skoda.

The company has been founded in 1865. Headquarter of the company is in Eastbourne, UK.

The main competitor of the company is Pendragon plc which is also operating its business in

England (Bloomberg, 2018).

The financial performance and non financial performance of the company indicates

about numerous changes in recent years. The performance of the company has been enhanced

and the company has also managed the non financial factors to enhance the performance of

the company (Reuters, 2018). The financial and non financial performance of Caffyns plc is

below.

Strategic and operating analysis:

Accounting financial analysis report 4

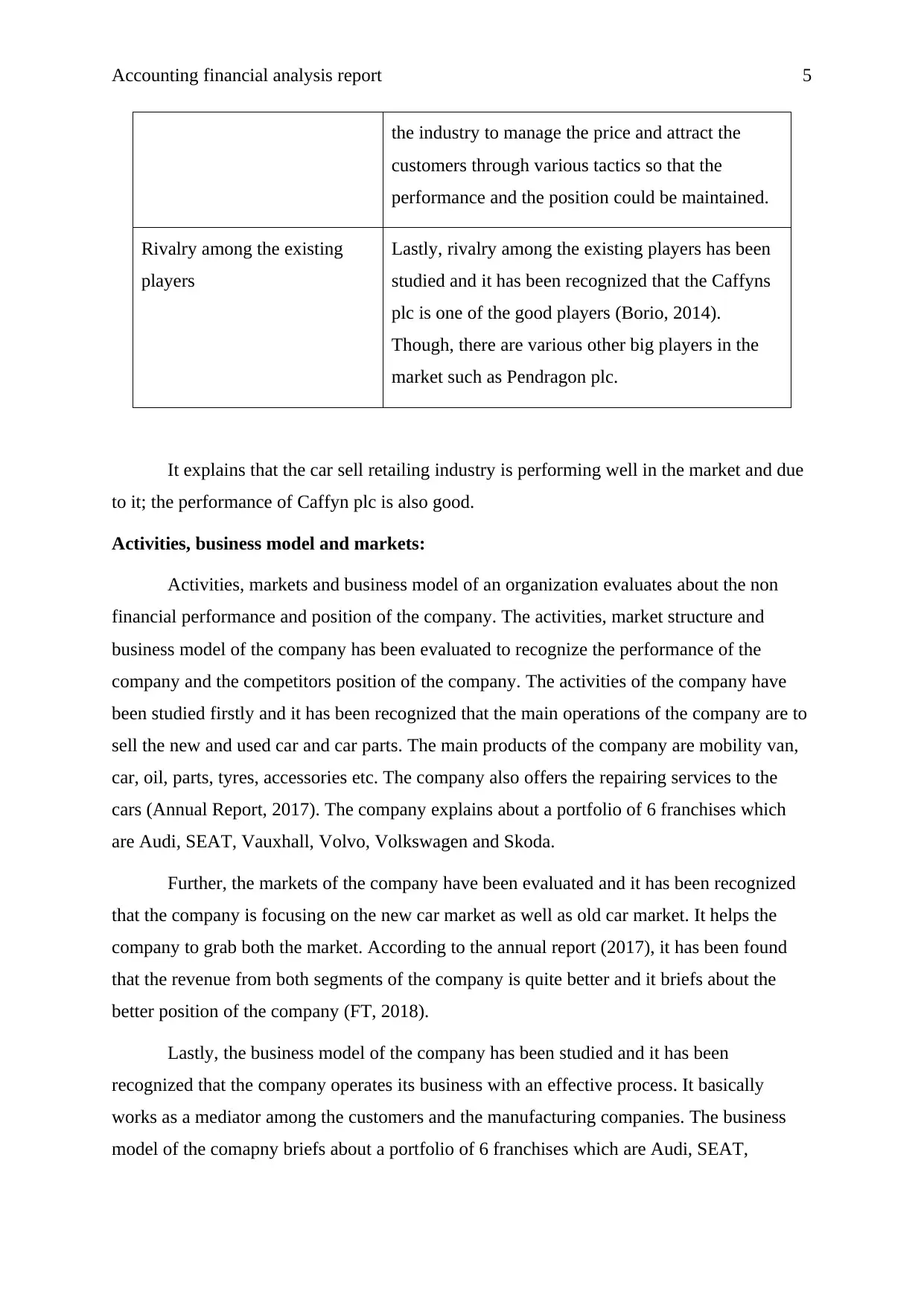

Strategic and operating policy of an organization express about the current policies

and rules which are followed by the comapny to achieve the goal and objective of the

company (Gitman and Zutter, 2012). The strategies of the company, its competitors and the

industry are as follows:

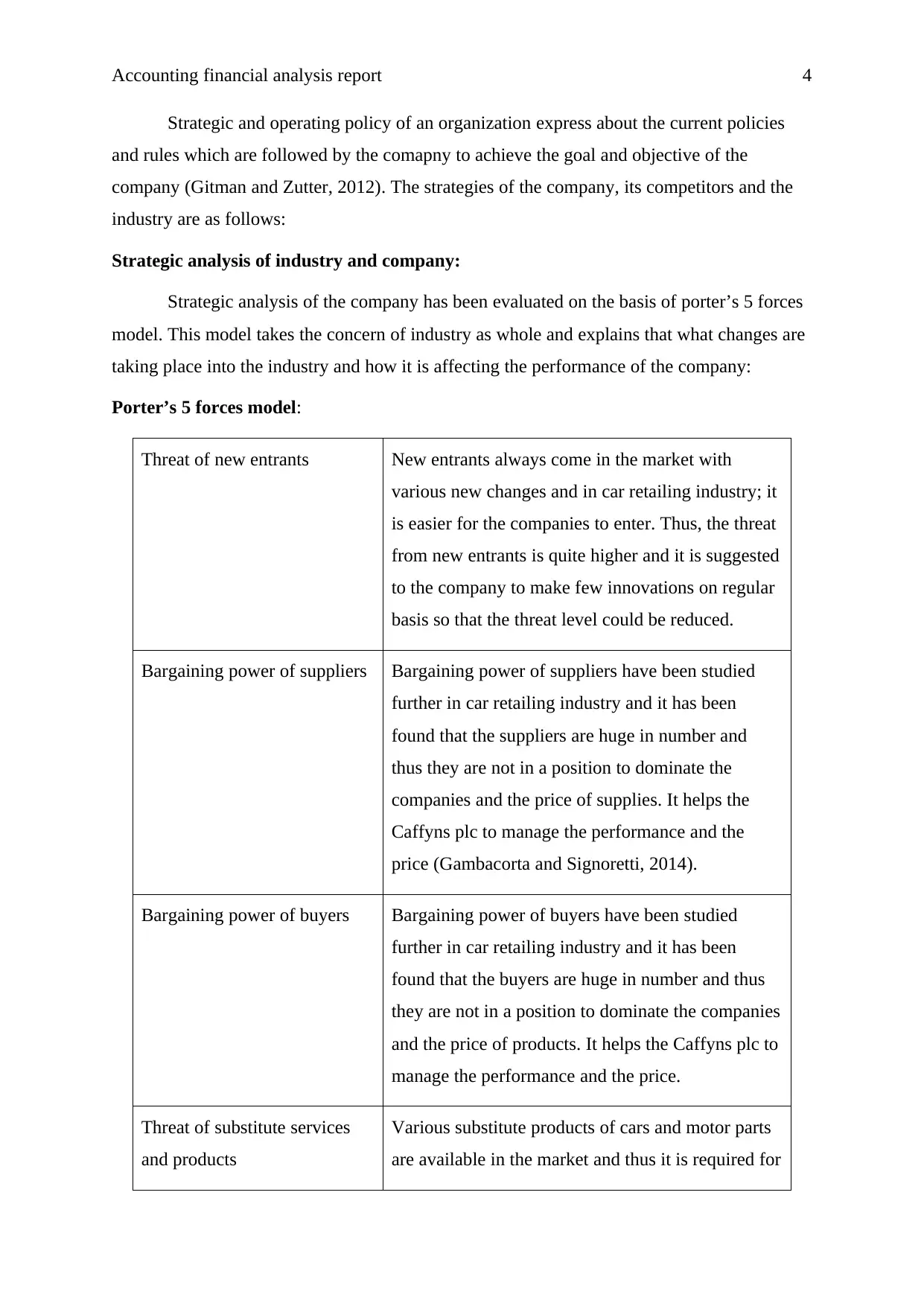

Strategic analysis of industry and company:

Strategic analysis of the company has been evaluated on the basis of porter’s 5 forces

model. This model takes the concern of industry as whole and explains that what changes are

taking place into the industry and how it is affecting the performance of the company:

Porter’s 5 forces model:

Threat of new entrants New entrants always come in the market with

various new changes and in car retailing industry; it

is easier for the companies to enter. Thus, the threat

from new entrants is quite higher and it is suggested

to the company to make few innovations on regular

basis so that the threat level could be reduced.

Bargaining power of suppliers Bargaining power of suppliers have been studied

further in car retailing industry and it has been

found that the suppliers are huge in number and

thus they are not in a position to dominate the

companies and the price of supplies. It helps the

Caffyns plc to manage the performance and the

price (Gambacorta and Signoretti, 2014).

Bargaining power of buyers Bargaining power of buyers have been studied

further in car retailing industry and it has been

found that the buyers are huge in number and thus

they are not in a position to dominate the companies

and the price of products. It helps the Caffyns plc to

manage the performance and the price.

Threat of substitute services

and products

Various substitute products of cars and motor parts

are available in the market and thus it is required for

Strategic and operating policy of an organization express about the current policies

and rules which are followed by the comapny to achieve the goal and objective of the

company (Gitman and Zutter, 2012). The strategies of the company, its competitors and the

industry are as follows:

Strategic analysis of industry and company:

Strategic analysis of the company has been evaluated on the basis of porter’s 5 forces

model. This model takes the concern of industry as whole and explains that what changes are

taking place into the industry and how it is affecting the performance of the company:

Porter’s 5 forces model:

Threat of new entrants New entrants always come in the market with

various new changes and in car retailing industry; it

is easier for the companies to enter. Thus, the threat

from new entrants is quite higher and it is suggested

to the company to make few innovations on regular

basis so that the threat level could be reduced.

Bargaining power of suppliers Bargaining power of suppliers have been studied

further in car retailing industry and it has been

found that the suppliers are huge in number and

thus they are not in a position to dominate the

companies and the price of supplies. It helps the

Caffyns plc to manage the performance and the

price (Gambacorta and Signoretti, 2014).

Bargaining power of buyers Bargaining power of buyers have been studied

further in car retailing industry and it has been

found that the buyers are huge in number and thus

they are not in a position to dominate the companies

and the price of products. It helps the Caffyns plc to

manage the performance and the price.

Threat of substitute services

and products

Various substitute products of cars and motor parts

are available in the market and thus it is required for

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Accounting financial analysis report 5

the industry to manage the price and attract the

customers through various tactics so that the

performance and the position could be maintained.

Rivalry among the existing

players

Lastly, rivalry among the existing players has been

studied and it has been recognized that the Caffyns

plc is one of the good players (Borio, 2014).

Though, there are various other big players in the

market such as Pendragon plc.

It explains that the car sell retailing industry is performing well in the market and due

to it; the performance of Caffyn plc is also good.

Activities, business model and markets:

Activities, markets and business model of an organization evaluates about the non

financial performance and position of the company. The activities, market structure and

business model of the company has been evaluated to recognize the performance of the

company and the competitors position of the company. The activities of the company have

been studied firstly and it has been recognized that the main operations of the company are to

sell the new and used car and car parts. The main products of the company are mobility van,

car, oil, parts, tyres, accessories etc. The company also offers the repairing services to the

cars (Annual Report, 2017). The company explains about a portfolio of 6 franchises which

are Audi, SEAT, Vauxhall, Volvo, Volkswagen and Skoda.

Further, the markets of the company have been evaluated and it has been recognized

that the company is focusing on the new car market as well as old car market. It helps the

company to grab both the market. According to the annual report (2017), it has been found

that the revenue from both segments of the company is quite better and it briefs about the

better position of the company (FT, 2018).

Lastly, the business model of the company has been studied and it has been

recognized that the company operates its business with an effective process. It basically

works as a mediator among the customers and the manufacturing companies. The business

model of the comapny briefs about a portfolio of 6 franchises which are Audi, SEAT,

the industry to manage the price and attract the

customers through various tactics so that the

performance and the position could be maintained.

Rivalry among the existing

players

Lastly, rivalry among the existing players has been

studied and it has been recognized that the Caffyns

plc is one of the good players (Borio, 2014).

Though, there are various other big players in the

market such as Pendragon plc.

It explains that the car sell retailing industry is performing well in the market and due

to it; the performance of Caffyn plc is also good.

Activities, business model and markets:

Activities, markets and business model of an organization evaluates about the non

financial performance and position of the company. The activities, market structure and

business model of the company has been evaluated to recognize the performance of the

company and the competitors position of the company. The activities of the company have

been studied firstly and it has been recognized that the main operations of the company are to

sell the new and used car and car parts. The main products of the company are mobility van,

car, oil, parts, tyres, accessories etc. The company also offers the repairing services to the

cars (Annual Report, 2017). The company explains about a portfolio of 6 franchises which

are Audi, SEAT, Vauxhall, Volvo, Volkswagen and Skoda.

Further, the markets of the company have been evaluated and it has been recognized

that the company is focusing on the new car market as well as old car market. It helps the

company to grab both the market. According to the annual report (2017), it has been found

that the revenue from both segments of the company is quite better and it briefs about the

better position of the company (FT, 2018).

Lastly, the business model of the company has been studied and it has been

recognized that the company operates its business with an effective process. It basically

works as a mediator among the customers and the manufacturing companies. The business

model of the comapny briefs about a portfolio of 6 franchises which are Audi, SEAT,

Accounting financial analysis report 6

Vauxhall, Volvo, Volkswagen and Skoda. Caffyns plc sells the cars of these brands to the

customers of UK (Galí, 2015).

Objectives and policies:

Objectives and policies of an organization brief about the man target which has been

set by the management of the company and the entire organizations works as a team to reach

and meet the target. The main objectives of Caffyns plc are to analyze the new market for the

company and grab that market. Currently, the company is focusing on diversifying so that the

new market could be grabbed and the turnover of the company could be enhanced. The

company has prepared various new policies of human resources and financial management to

meet the objectives (annual report, 2017).

The objectives of the company have been prepared in such a manner that society

could not be harmed as well as the position and the performance of the company is enhanced.

The company wants to be leader in the market but various competitors are available in the

market to defeat the company (Simply Wall, 2018).

KPIs:

Key performance indicators of the company have been studied further to recognize the

changes into the performance of the company in context with the last year and the competitor

of the company. The key performance indicators of the company such as net profit, Earnings

per share, gearing ratio of the company etc explains that the performance of the company has

been better from the last year (Annaul Report, 2017). On the other hand, the Pendragon plc’s

key performance indicators explains that the performance of the company has been lowered

in financial year 2017 in context with the financial year 2016. It explains that the Caffyns plc

is a good option for the purpose of investment.

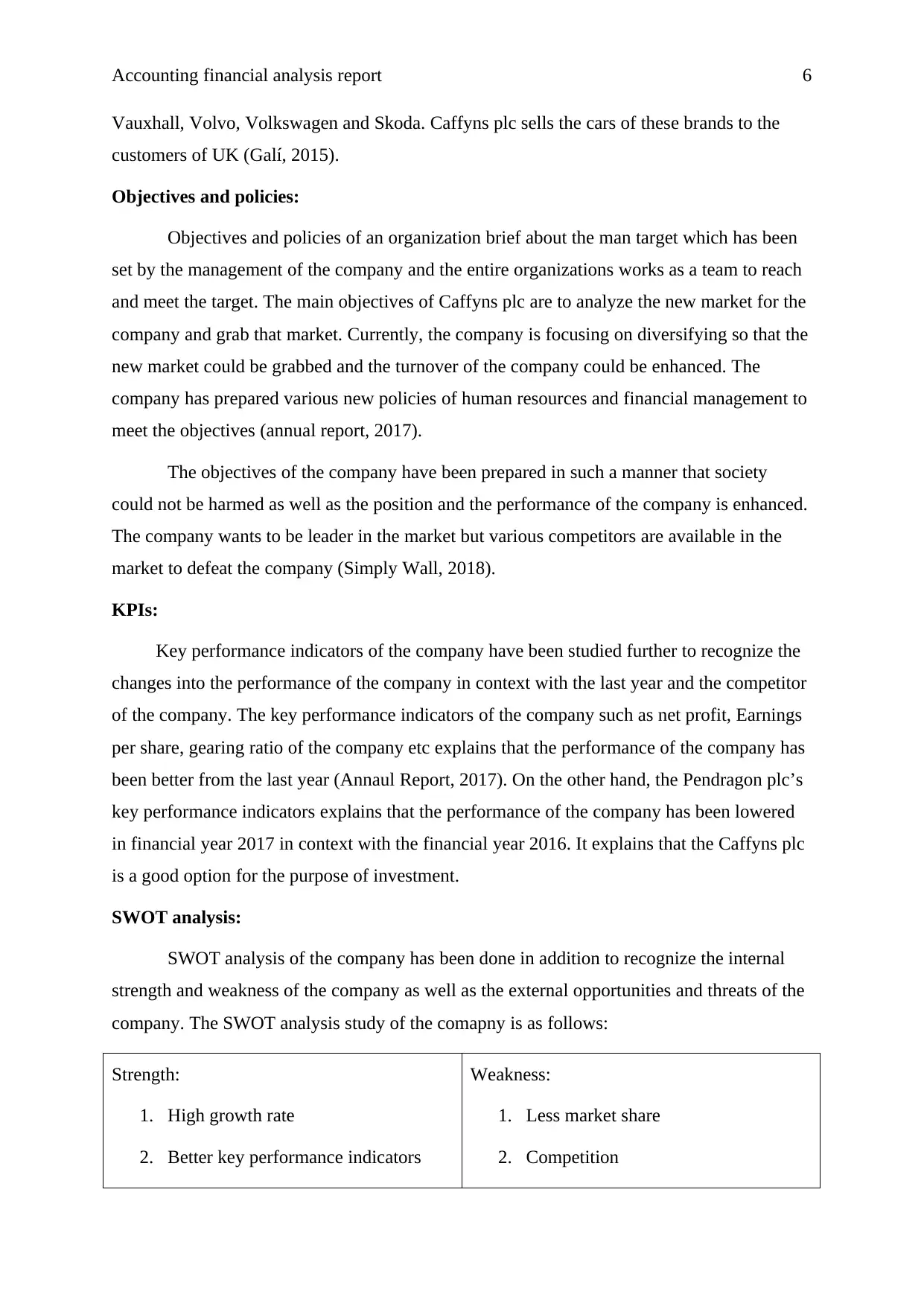

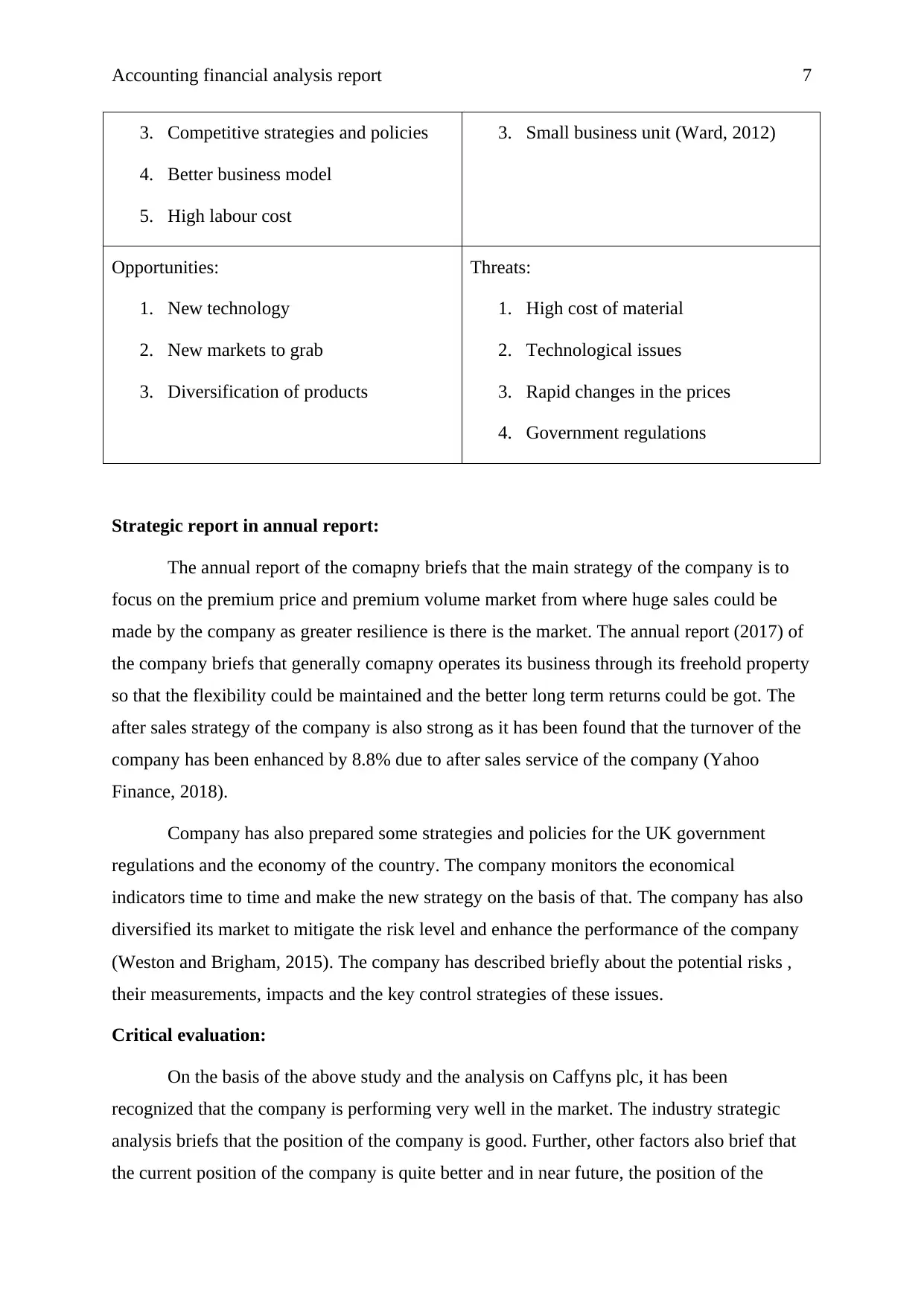

SWOT analysis:

SWOT analysis of the company has been done in addition to recognize the internal

strength and weakness of the company as well as the external opportunities and threats of the

company. The SWOT analysis study of the comapny is as follows:

Strength:

1. High growth rate

2. Better key performance indicators

Weakness:

1. Less market share

2. Competition

Vauxhall, Volvo, Volkswagen and Skoda. Caffyns plc sells the cars of these brands to the

customers of UK (Galí, 2015).

Objectives and policies:

Objectives and policies of an organization brief about the man target which has been

set by the management of the company and the entire organizations works as a team to reach

and meet the target. The main objectives of Caffyns plc are to analyze the new market for the

company and grab that market. Currently, the company is focusing on diversifying so that the

new market could be grabbed and the turnover of the company could be enhanced. The

company has prepared various new policies of human resources and financial management to

meet the objectives (annual report, 2017).

The objectives of the company have been prepared in such a manner that society

could not be harmed as well as the position and the performance of the company is enhanced.

The company wants to be leader in the market but various competitors are available in the

market to defeat the company (Simply Wall, 2018).

KPIs:

Key performance indicators of the company have been studied further to recognize the

changes into the performance of the company in context with the last year and the competitor

of the company. The key performance indicators of the company such as net profit, Earnings

per share, gearing ratio of the company etc explains that the performance of the company has

been better from the last year (Annaul Report, 2017). On the other hand, the Pendragon plc’s

key performance indicators explains that the performance of the company has been lowered

in financial year 2017 in context with the financial year 2016. It explains that the Caffyns plc

is a good option for the purpose of investment.

SWOT analysis:

SWOT analysis of the company has been done in addition to recognize the internal

strength and weakness of the company as well as the external opportunities and threats of the

company. The SWOT analysis study of the comapny is as follows:

Strength:

1. High growth rate

2. Better key performance indicators

Weakness:

1. Less market share

2. Competition

Accounting financial analysis report 7

3. Competitive strategies and policies

4. Better business model

5. High labour cost

3. Small business unit (Ward, 2012)

Opportunities:

1. New technology

2. New markets to grab

3. Diversification of products

Threats:

1. High cost of material

2. Technological issues

3. Rapid changes in the prices

4. Government regulations

Strategic report in annual report:

The annual report of the comapny briefs that the main strategy of the company is to

focus on the premium price and premium volume market from where huge sales could be

made by the company as greater resilience is there is the market. The annual report (2017) of

the company briefs that generally comapny operates its business through its freehold property

so that the flexibility could be maintained and the better long term returns could be got. The

after sales strategy of the company is also strong as it has been found that the turnover of the

company has been enhanced by 8.8% due to after sales service of the company (Yahoo

Finance, 2018).

Company has also prepared some strategies and policies for the UK government

regulations and the economy of the country. The company monitors the economical

indicators time to time and make the new strategy on the basis of that. The company has also

diversified its market to mitigate the risk level and enhance the performance of the company

(Weston and Brigham, 2015). The company has described briefly about the potential risks ,

their measurements, impacts and the key control strategies of these issues.

Critical evaluation:

On the basis of the above study and the analysis on Caffyns plc, it has been

recognized that the company is performing very well in the market. The industry strategic

analysis briefs that the position of the company is good. Further, other factors also brief that

the current position of the company is quite better and in near future, the position of the

3. Competitive strategies and policies

4. Better business model

5. High labour cost

3. Small business unit (Ward, 2012)

Opportunities:

1. New technology

2. New markets to grab

3. Diversification of products

Threats:

1. High cost of material

2. Technological issues

3. Rapid changes in the prices

4. Government regulations

Strategic report in annual report:

The annual report of the comapny briefs that the main strategy of the company is to

focus on the premium price and premium volume market from where huge sales could be

made by the company as greater resilience is there is the market. The annual report (2017) of

the company briefs that generally comapny operates its business through its freehold property

so that the flexibility could be maintained and the better long term returns could be got. The

after sales strategy of the company is also strong as it has been found that the turnover of the

company has been enhanced by 8.8% due to after sales service of the company (Yahoo

Finance, 2018).

Company has also prepared some strategies and policies for the UK government

regulations and the economy of the country. The company monitors the economical

indicators time to time and make the new strategy on the basis of that. The company has also

diversified its market to mitigate the risk level and enhance the performance of the company

(Weston and Brigham, 2015). The company has described briefly about the potential risks ,

their measurements, impacts and the key control strategies of these issues.

Critical evaluation:

On the basis of the above study and the analysis on Caffyns plc, it has been

recognized that the company is performing very well in the market. The industry strategic

analysis briefs that the position of the company is good. Further, other factors also brief that

the current position of the company is quite better and in near future, the position of the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting financial analysis report 8

company would be much better. It evaluates that the company is a good option for the

purpose of investment.

Accounting quality analysis:

Accounting quality is an extent which evaluates the accounting standards, accounting

reports and accounting position of the company and it briefs that whether the comapny is

disclosing all the activities and figures to the company or not. Auditors of an organization are

required to evaluate the accounting reports of the company so that the accounting qualities

could be measures and evaluated.

Accounting quality:

Accounting quality of Caffyns plc has been evaluated on the basis of annual report

(2017). On the basis of annual report of the company, it has been found that the company has

measured and recorded all the financial figures such as depreciation, tax amount, goodwill

amount, provisions etc on the basis of accounting standards and the international accounting

regulations which explains that the accounting quality of the company is quite better and the

company is following all the main accounting connects to run the business properly such as

going concern concept (Weaver, Weston and Weaver, 2001).

Company disclosure policies and estimates:

Annual report (2017) of Caffyns plc describes that the company is disclosing all the

relevant and main figures of accounting in a proper way. The final accounts of the company

have been prepared and notes have also been attached with them which contain all the

relevant information. The annual report of Caffyns plc has been compared with Pendragon

plc’ annual report (2017) and it has been recognized that the performance and the disclosing

policies of both the reports are same which explains that Caffyns plc estimates, records and

disclose all the figures on the basis of accounting standards.

Auditors focus:

Auditor report has also been studied further to evaluate that whether the company is

involved in any fraudulent activities or any figure or transaction has been disclosed by the

company. On the basis of the evaluation, it has been recognized that the company’s

accounting quality is quite good and no issues are involved in the company.

Red Flags:

company would be much better. It evaluates that the company is a good option for the

purpose of investment.

Accounting quality analysis:

Accounting quality is an extent which evaluates the accounting standards, accounting

reports and accounting position of the company and it briefs that whether the comapny is

disclosing all the activities and figures to the company or not. Auditors of an organization are

required to evaluate the accounting reports of the company so that the accounting qualities

could be measures and evaluated.

Accounting quality:

Accounting quality of Caffyns plc has been evaluated on the basis of annual report

(2017). On the basis of annual report of the company, it has been found that the company has

measured and recorded all the financial figures such as depreciation, tax amount, goodwill

amount, provisions etc on the basis of accounting standards and the international accounting

regulations which explains that the accounting quality of the company is quite better and the

company is following all the main accounting connects to run the business properly such as

going concern concept (Weaver, Weston and Weaver, 2001).

Company disclosure policies and estimates:

Annual report (2017) of Caffyns plc describes that the company is disclosing all the

relevant and main figures of accounting in a proper way. The final accounts of the company

have been prepared and notes have also been attached with them which contain all the

relevant information. The annual report of Caffyns plc has been compared with Pendragon

plc’ annual report (2017) and it has been recognized that the performance and the disclosing

policies of both the reports are same which explains that Caffyns plc estimates, records and

disclose all the figures on the basis of accounting standards.

Auditors focus:

Auditor report has also been studied further to evaluate that whether the company is

involved in any fraudulent activities or any figure or transaction has been disclosed by the

company. On the basis of the evaluation, it has been recognized that the company’s

accounting quality is quite good and no issues are involved in the company.

Red Flags:

Accounting financial analysis report 9

There are no red flags in the accounting policies and standards of the company. It

briefs that the financial position of the company is is quite good and no issues are involved in

the company. The annual report of Caffyns plc has been compared with Pendragon plc’

annual report (2017) and it has been recognized that the performance and the disclosing

policies of both the reports are same.

Financial analysis:

Financial analysis study has been done further to analyze the performance of the

company in context with the last year performance and the competitors of the company. the

financial analysis study of the company is as follows:

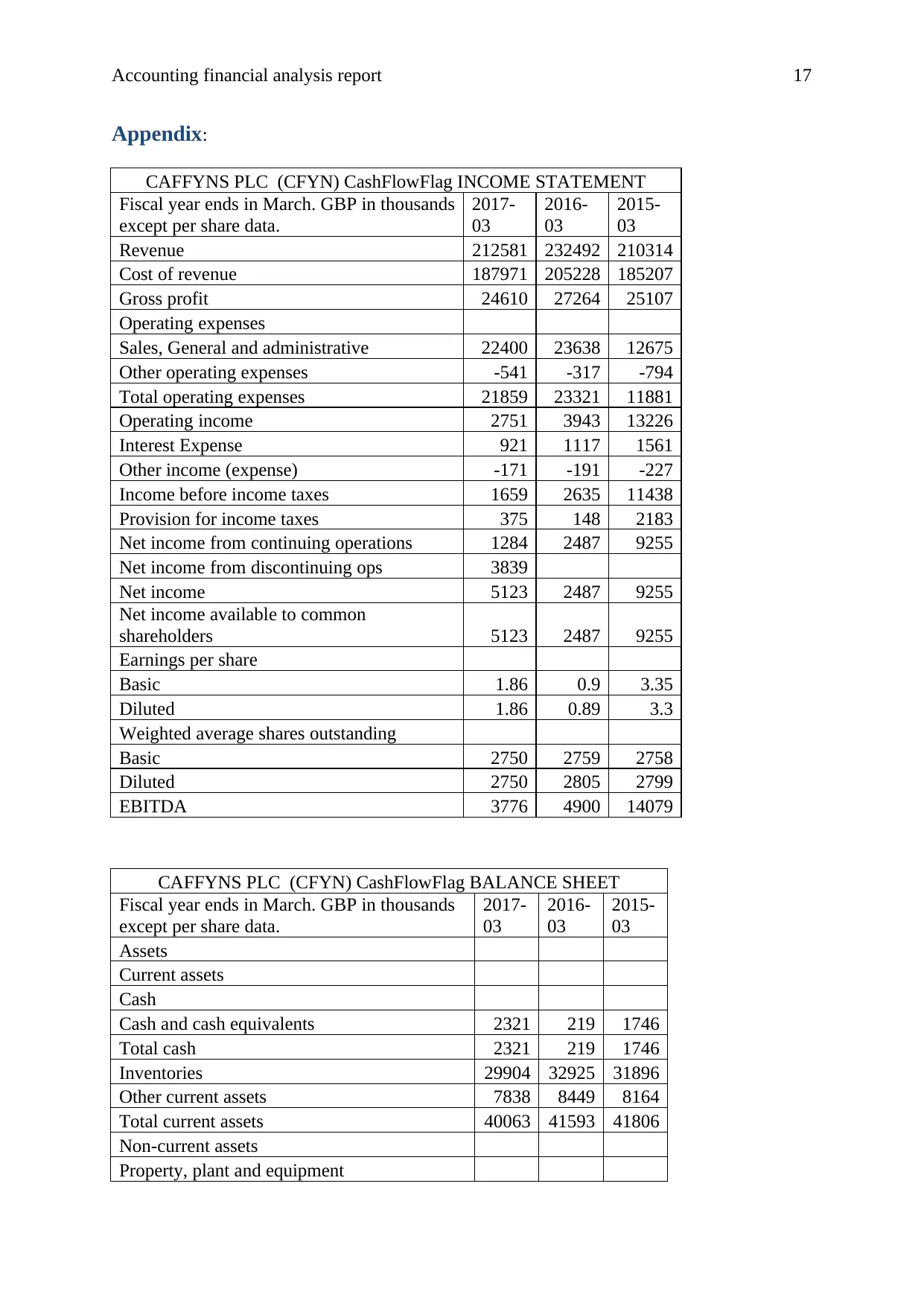

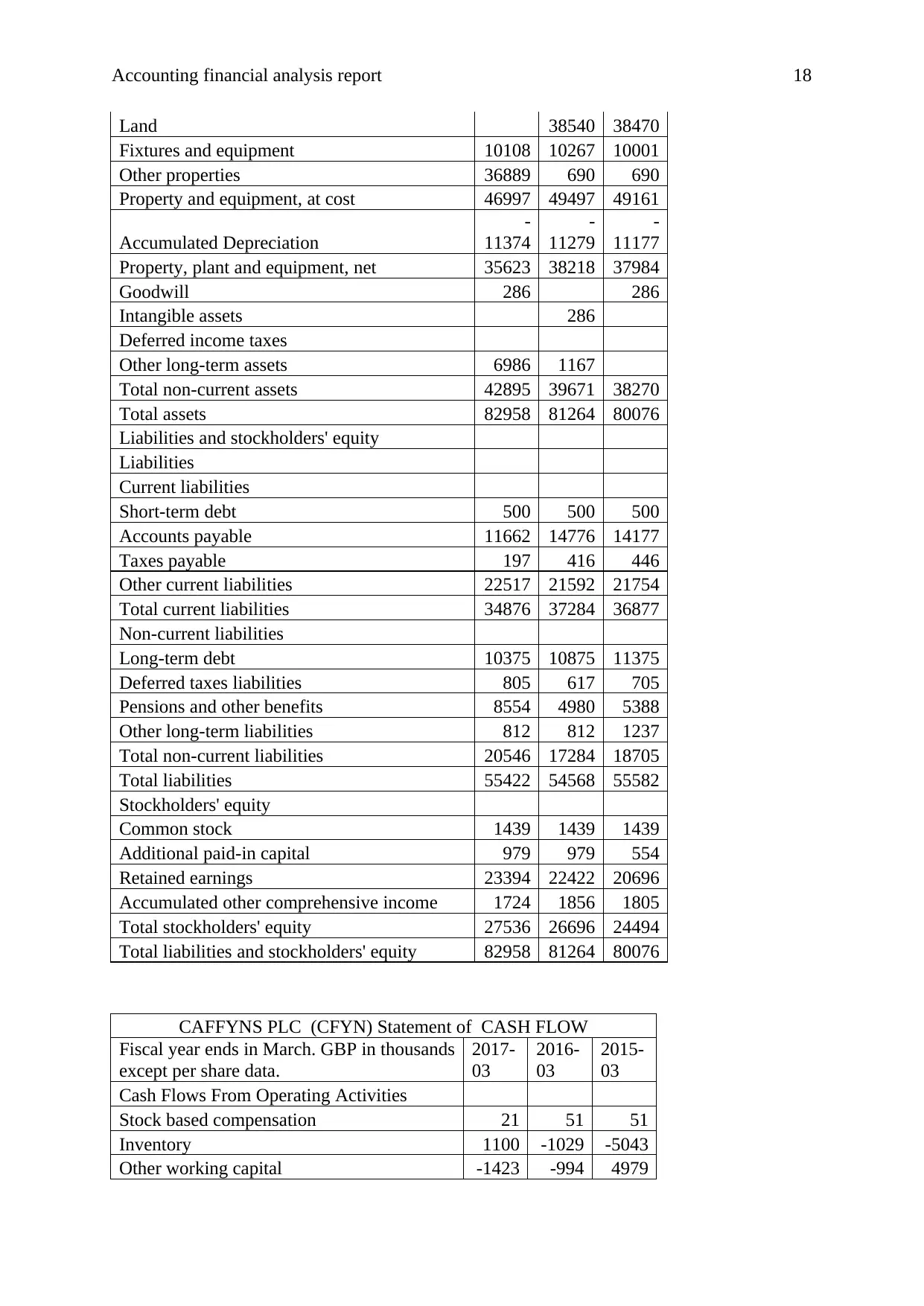

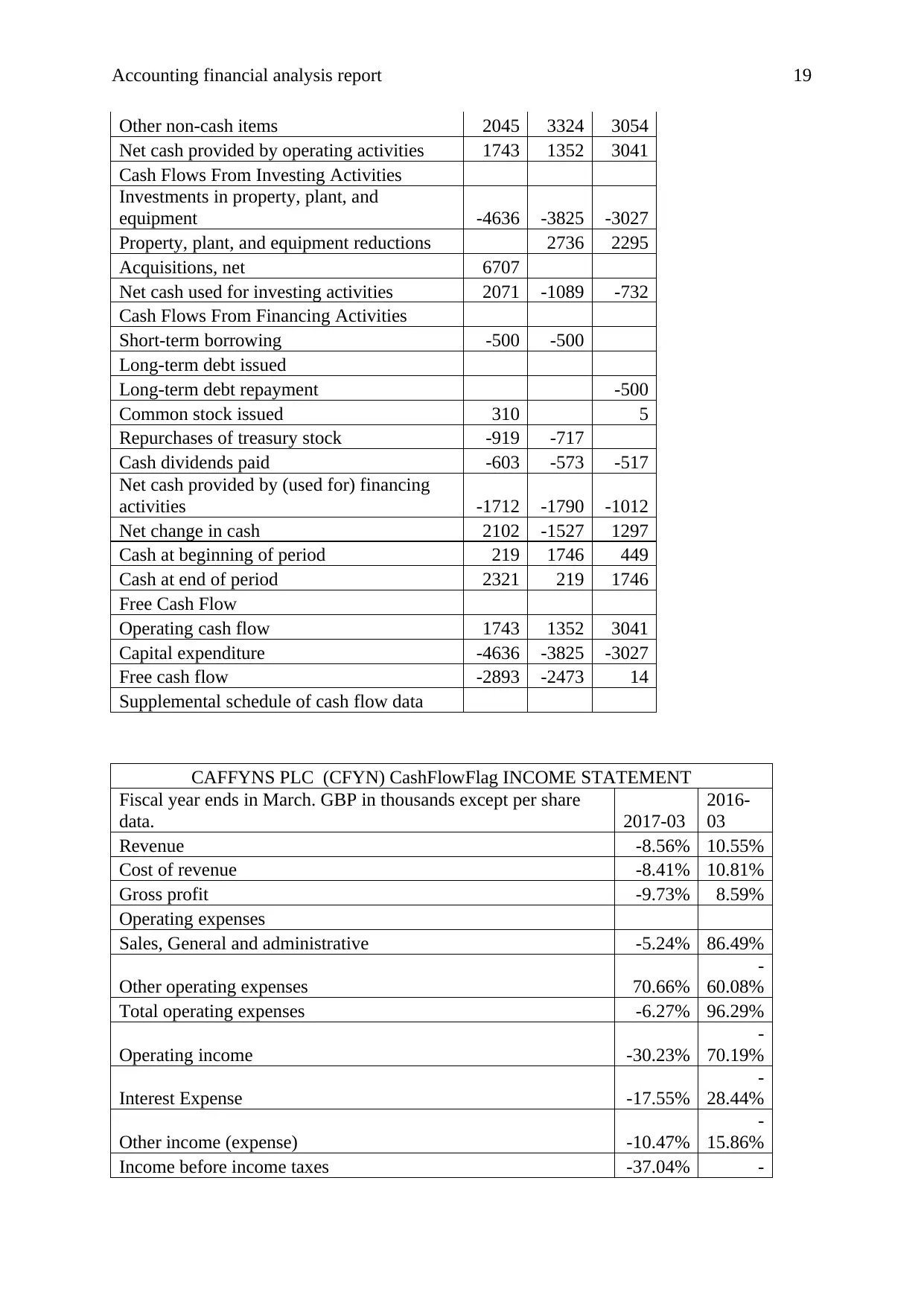

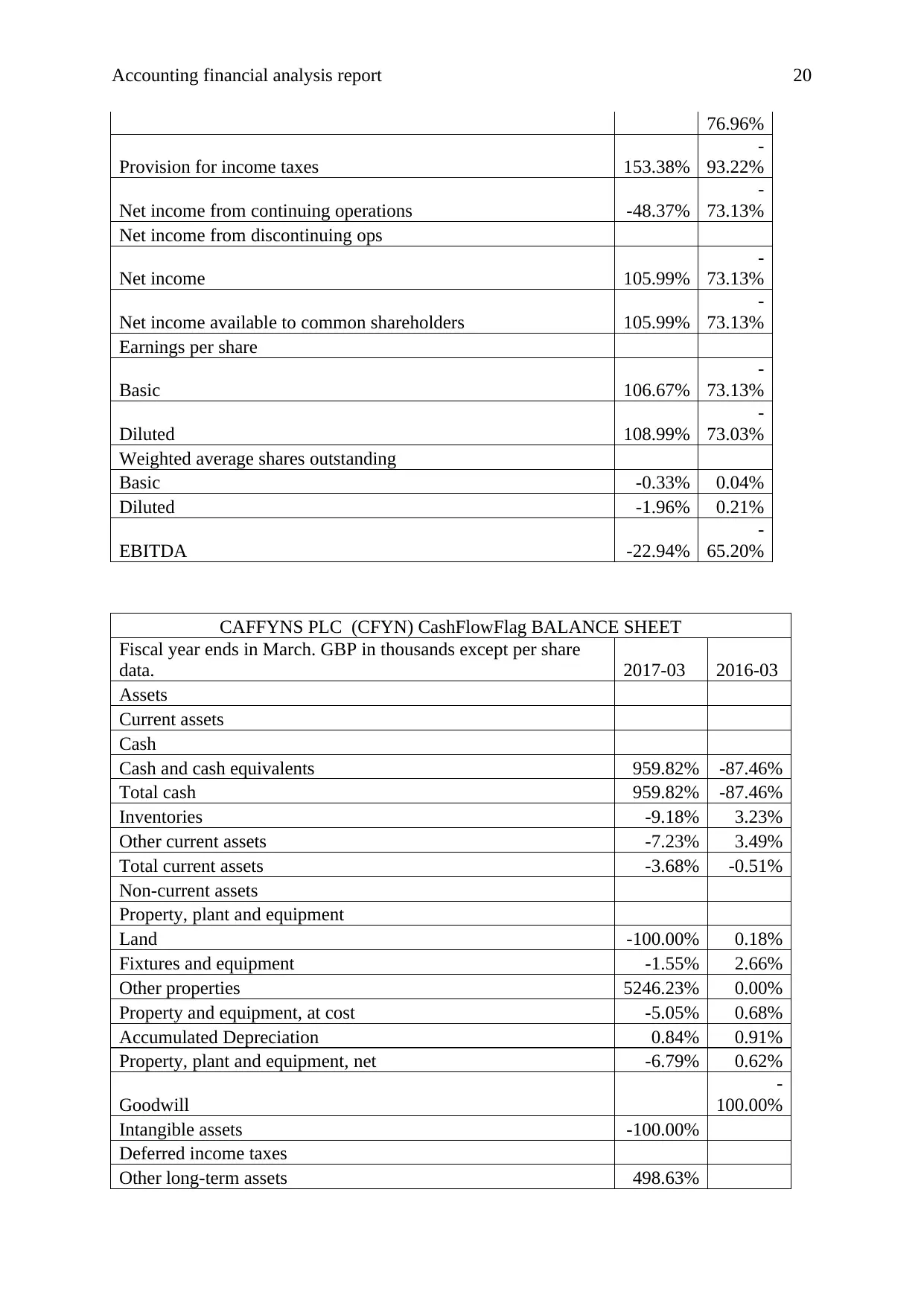

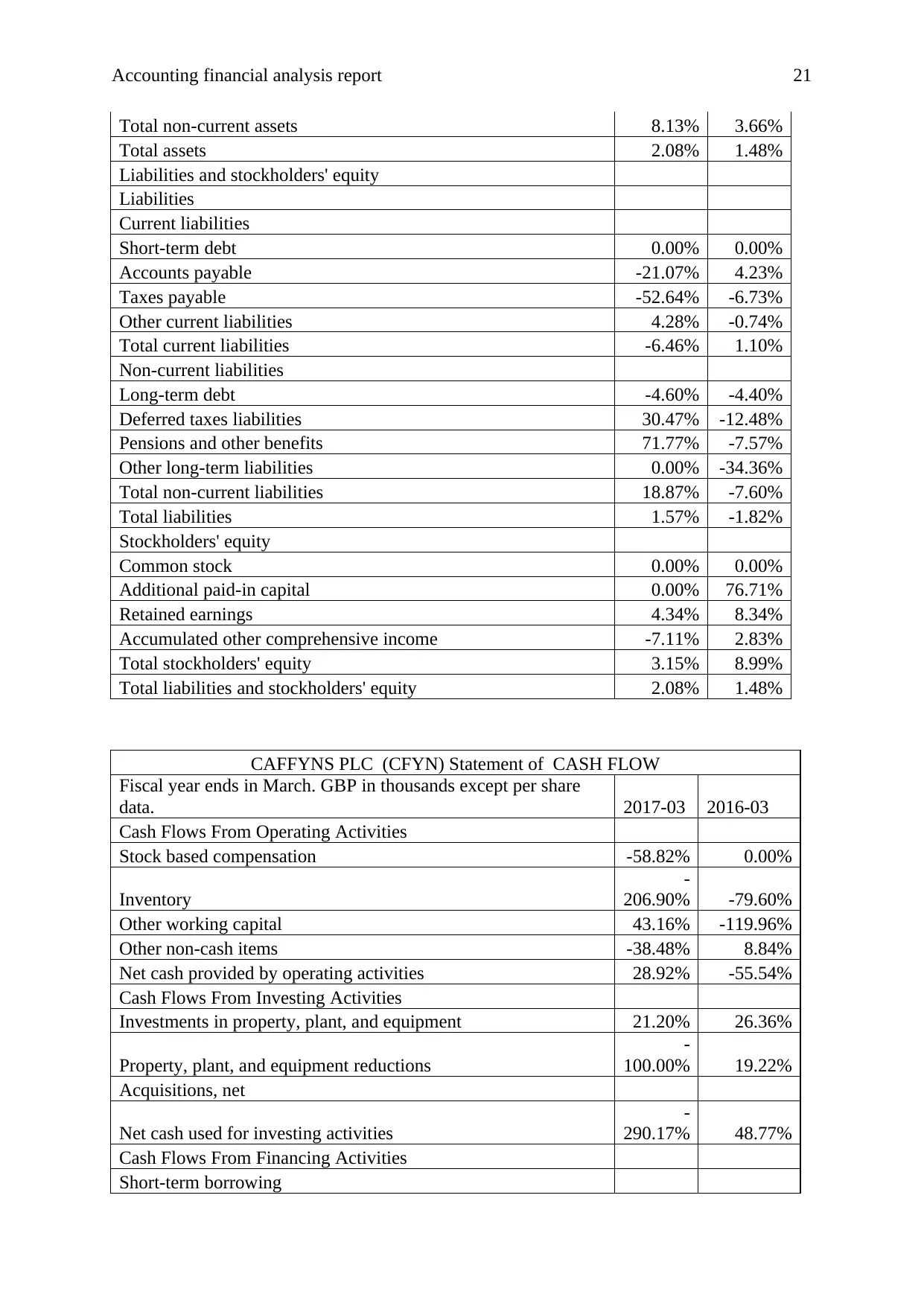

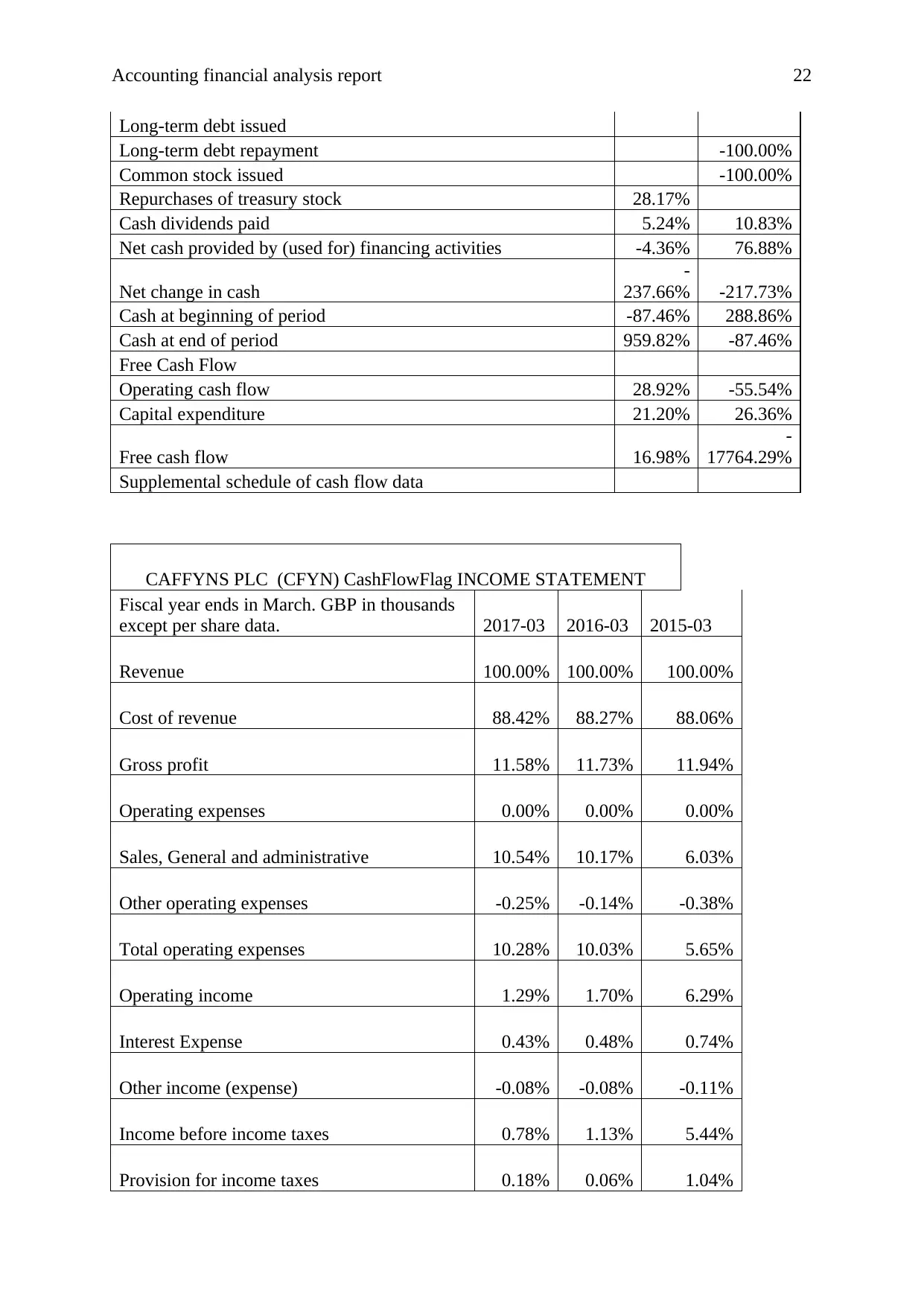

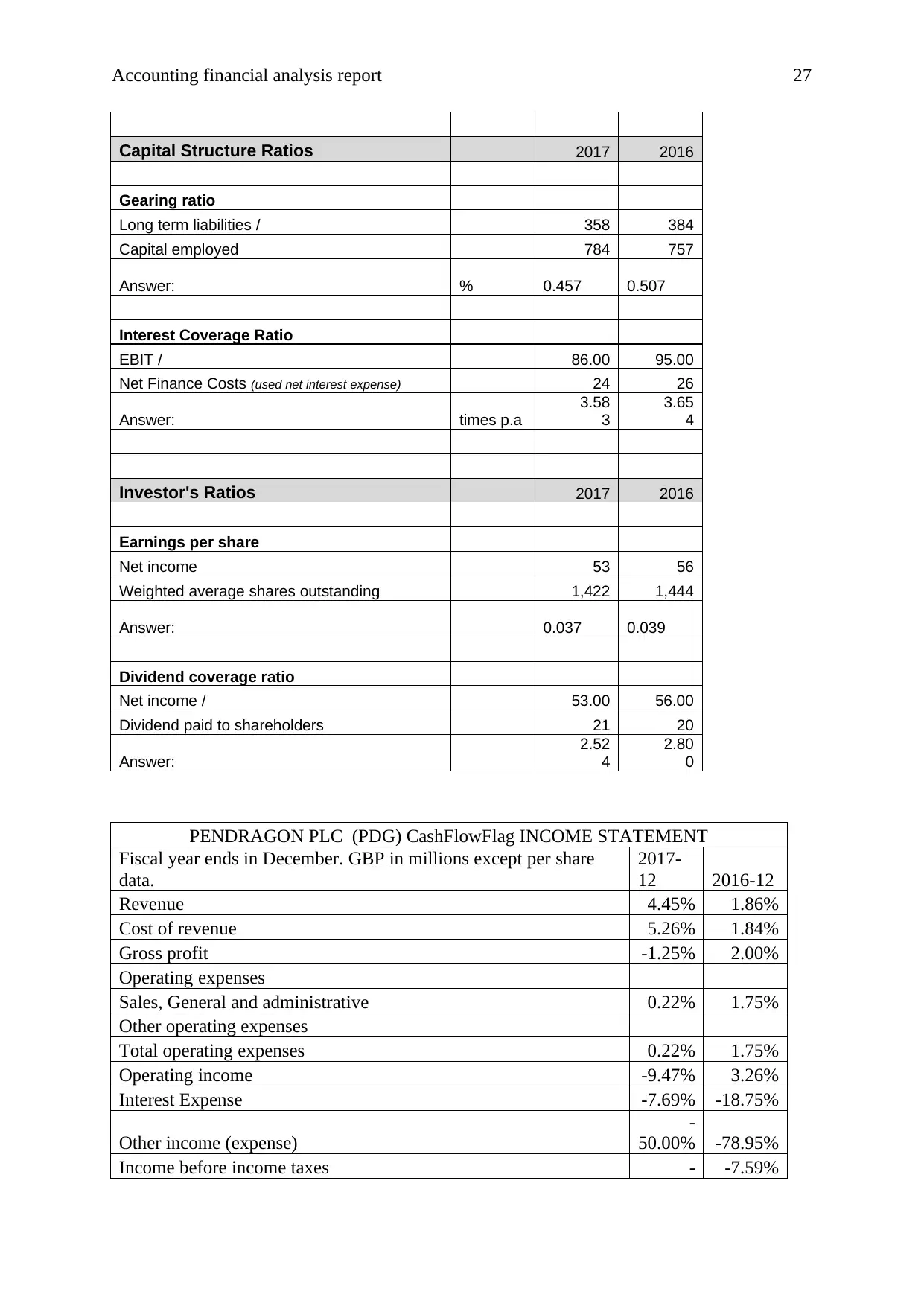

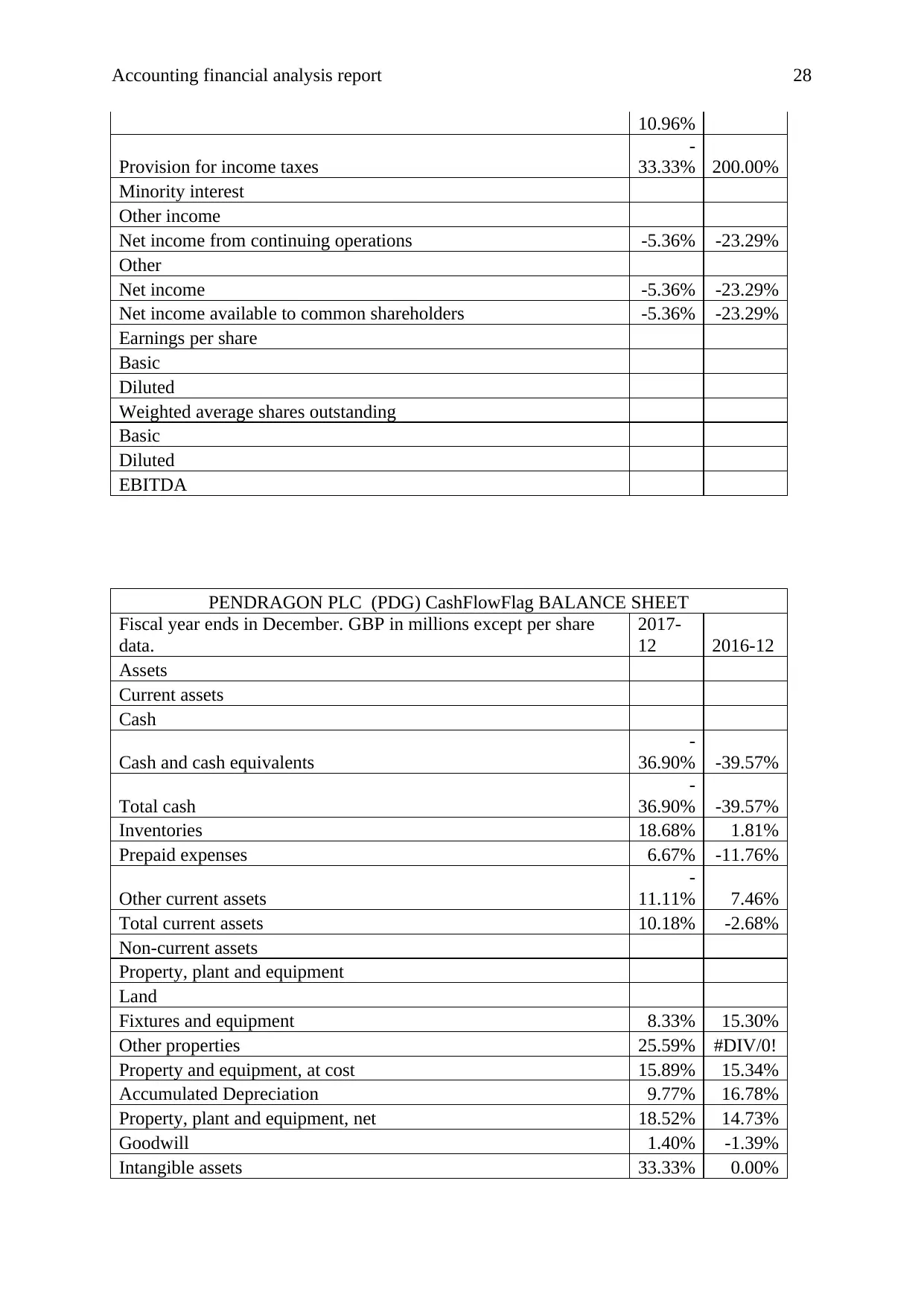

Trend analysis:

Trend analysis stands for changes into the financial figures if income statement and

balance sheet on the basis of sales revenue, total assets and total stockholder’s equity and

liabilities. The trend analysis of the company briefs that the gross profit position of the

company has been lowered from last year and the same has been impacted on the net income

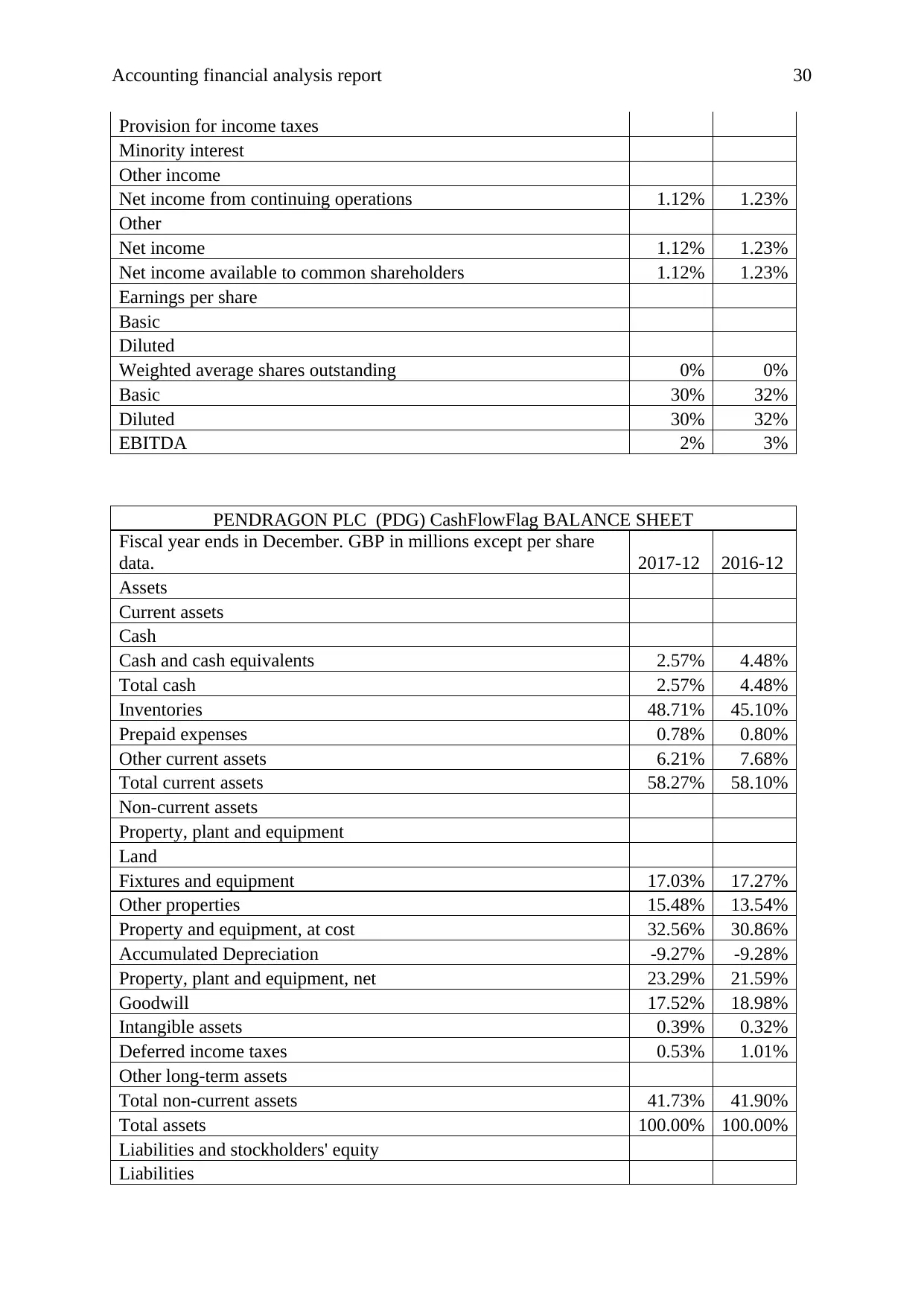

of the company (Appendix). The evaluation of trend analysis on Pendragon plc briefs that the

gross profit and income of Competitor Company has also been lowered. These changes have

been occurred into the company due to some industrial issues and it explains that the

performance of the company is quite good (Du and Girma, 2009).

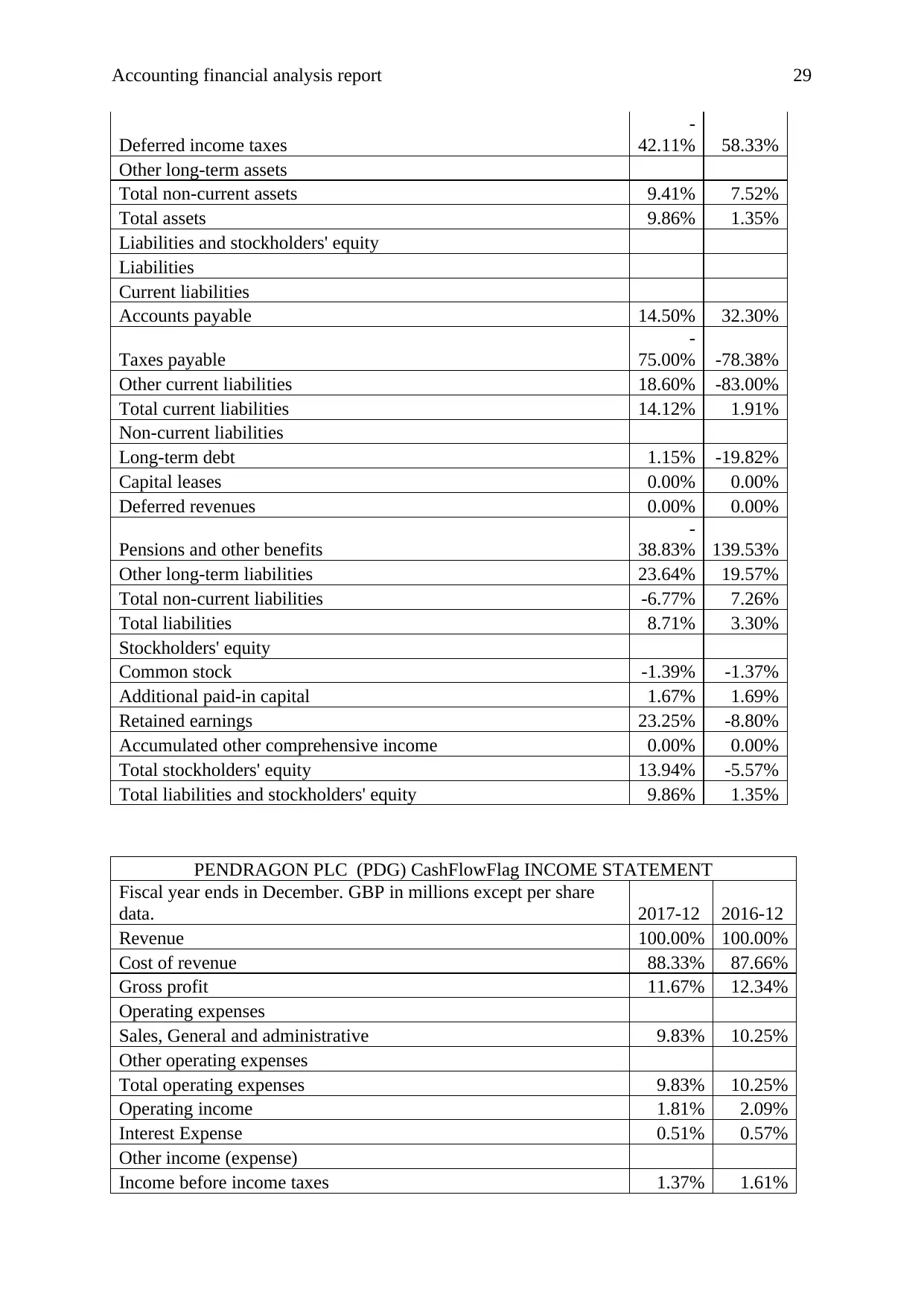

The balance sheet of the company has also been studied and it has been recognized

that the capital structure has been changed by the company to maintain the optimal capitals

structure as well as the liquidity position has also been maintained by the comapny through

managing the level of current assets (Morningstar, 2018). The evaluation brief that the

company is maintain a good competitive position.

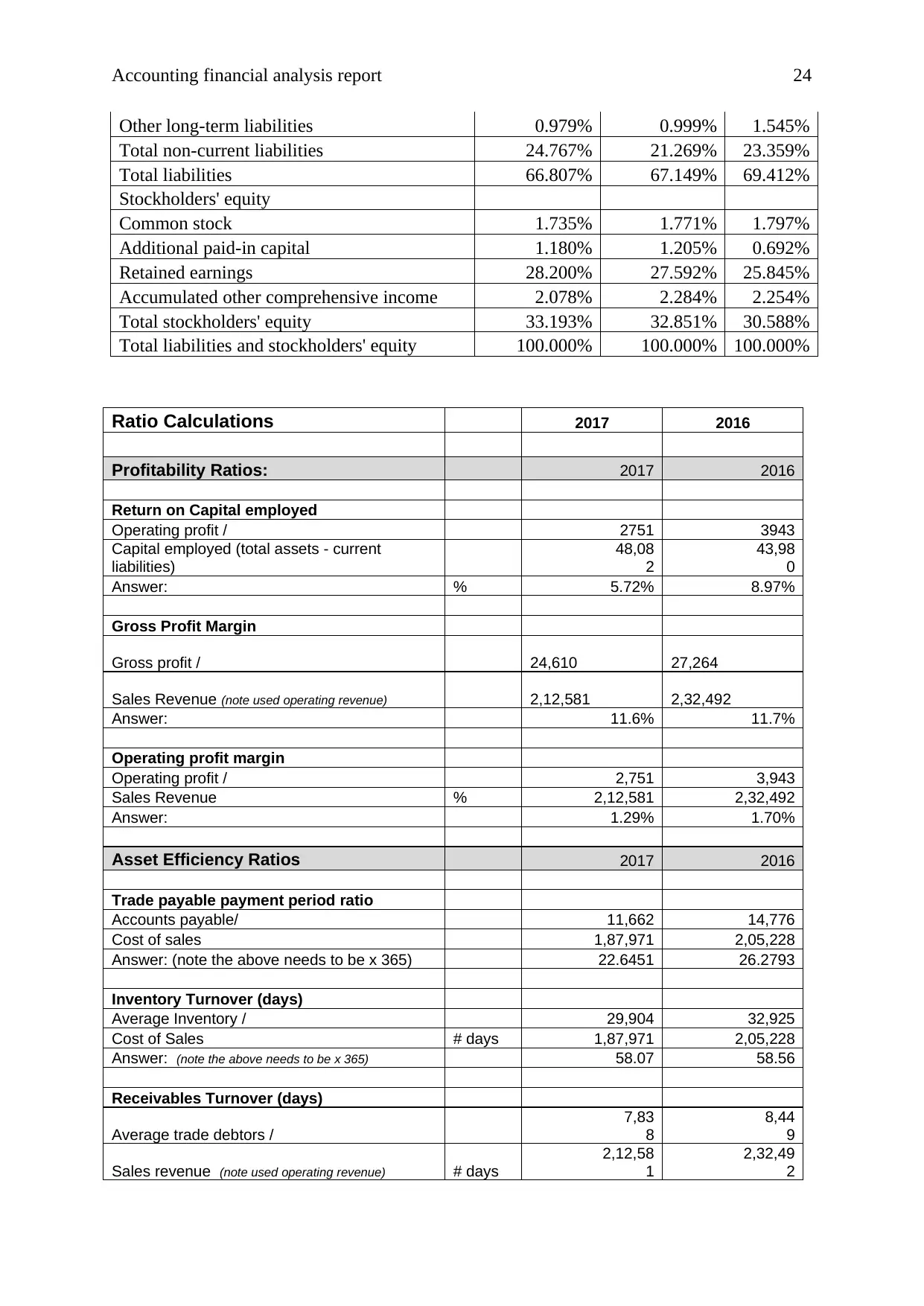

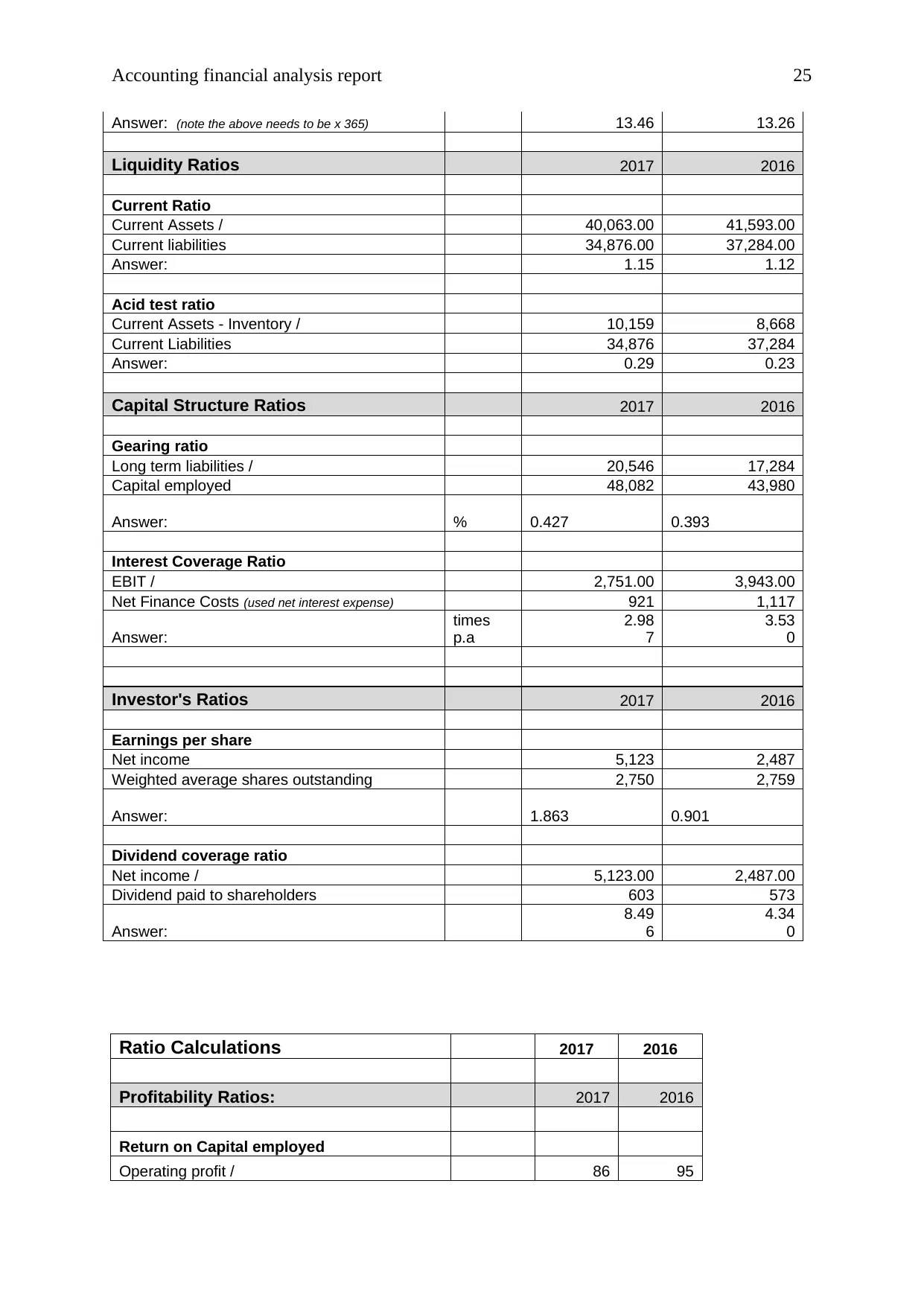

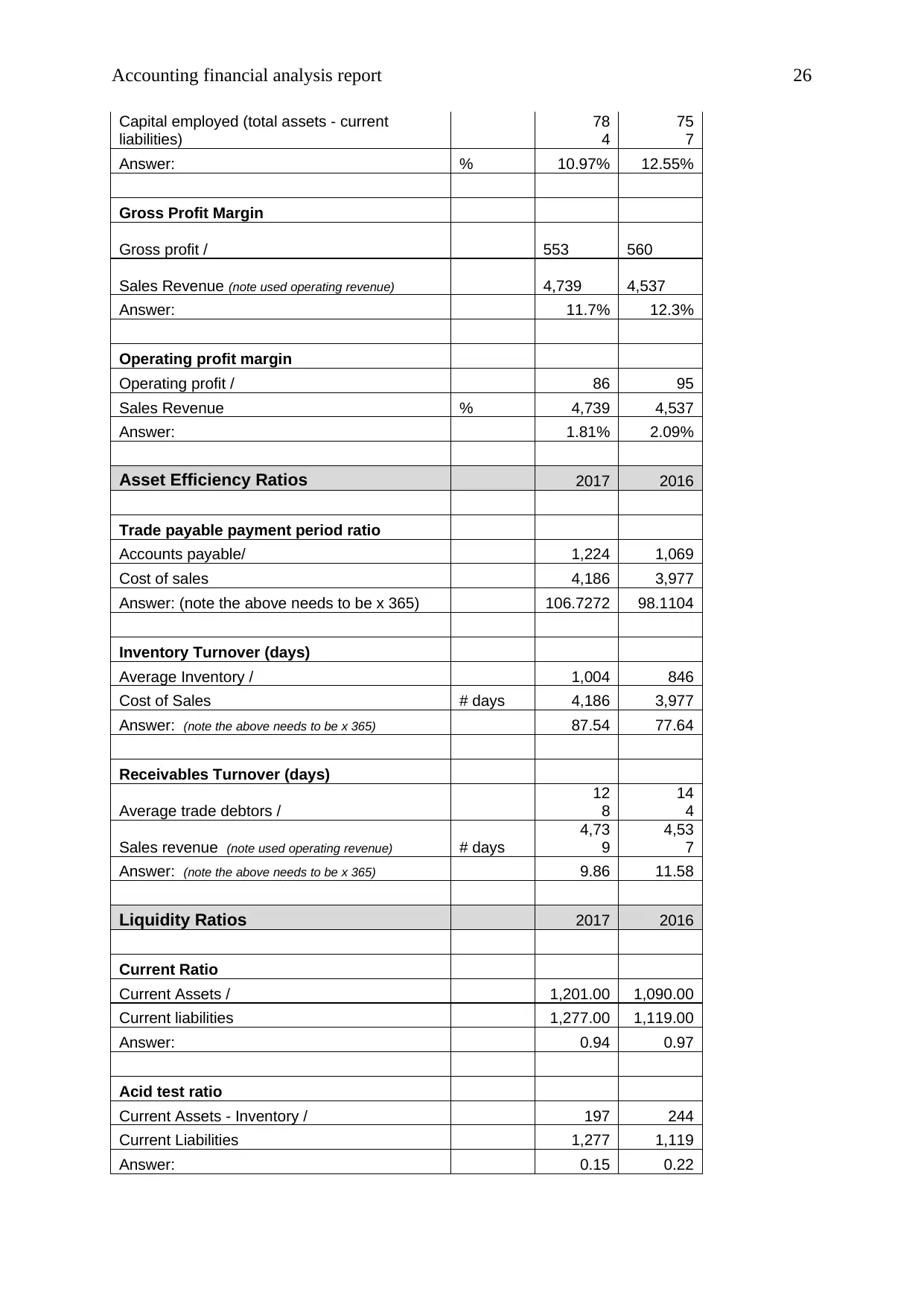

Ratio analysis:

Ratio analysis study has been done to evaluate the profitability, liquidity, asset

management etc position of the company. firstly, the profitability ratio of the company has

been evaluated and it has been recognized that the profitability generation capability of the

company has been lower on the other hand, competitors position also brief about decrement.

Further, the liquidity position briefs that reduction in the company as well as

competitor comapny and briefs that the current position of the company is quite better

(Appendix). Company is utilizing the resources at their fullest. Asset management ratios of

There are no red flags in the accounting policies and standards of the company. It

briefs that the financial position of the company is is quite good and no issues are involved in

the company. The annual report of Caffyns plc has been compared with Pendragon plc’

annual report (2017) and it has been recognized that the performance and the disclosing

policies of both the reports are same.

Financial analysis:

Financial analysis study has been done further to analyze the performance of the

company in context with the last year performance and the competitors of the company. the

financial analysis study of the company is as follows:

Trend analysis:

Trend analysis stands for changes into the financial figures if income statement and

balance sheet on the basis of sales revenue, total assets and total stockholder’s equity and

liabilities. The trend analysis of the company briefs that the gross profit position of the

company has been lowered from last year and the same has been impacted on the net income

of the company (Appendix). The evaluation of trend analysis on Pendragon plc briefs that the

gross profit and income of Competitor Company has also been lowered. These changes have

been occurred into the company due to some industrial issues and it explains that the

performance of the company is quite good (Du and Girma, 2009).

The balance sheet of the company has also been studied and it has been recognized

that the capital structure has been changed by the company to maintain the optimal capitals

structure as well as the liquidity position has also been maintained by the comapny through

managing the level of current assets (Morningstar, 2018). The evaluation brief that the

company is maintain a good competitive position.

Ratio analysis:

Ratio analysis study has been done to evaluate the profitability, liquidity, asset

management etc position of the company. firstly, the profitability ratio of the company has

been evaluated and it has been recognized that the profitability generation capability of the

company has been lower on the other hand, competitors position also brief about decrement.

Further, the liquidity position briefs that reduction in the company as well as

competitor comapny and briefs that the current position of the company is quite better

(Appendix). Company is utilizing the resources at their fullest. Asset management ratios of

Accounting financial analysis report 10

the company briefs that the cash conversion cycle of the company is higher than competitive

company and thus the company should reduce the level.

Lastly, capital structure ratio of the company explains that the company should

maintain the optimal capital structure to manage the risk and cost of the company.

Horizontal analysis:

Horizontal analysis stands for changes into the financial figures of income statement

and balance sheet on the basis of last year data. The horizontal analysis of the company briefs

that the sales position and gross profit position of the company has been lowered from last

year though, the net income of the company has been better (Appendix). The evaluation of

horizontal analysis on Pendragon plc briefs that the income of Competitor Company has also

been enhanced but net income has been lowered. These changes explain about the better

performance of the company.

The balance sheet of the company has also been studied and it has been recognized

that the company has made few changes into its financial performance to make the position

more competitive. The evaluation brief that the company is maintain a good competitive

position.

Critical evaluation:

It evaluates that the financial performance of the company is quite better. Few

changes are required to be done in the company though; it hardly matters to the inventors.

The investing position of the company is quite better.

Investor analysis:

Investor’s analysis has been done further to analyze the performance of the company.

Dividend position:

Dividend position of the company explains that the dividend amount has been

enhanced by the company by 3.4% which explains that the divided payout ratio of the

company is quite better (Yahoo Finance, 2018).

Market price:

The market stock price of the company explains about the increment into the stock

price of the company. the current stock price of the company is GBP 429 which is quite better

in context of the competitors of the company (Business Insider, 2018).

the company briefs that the cash conversion cycle of the company is higher than competitive

company and thus the company should reduce the level.

Lastly, capital structure ratio of the company explains that the company should

maintain the optimal capital structure to manage the risk and cost of the company.

Horizontal analysis:

Horizontal analysis stands for changes into the financial figures of income statement

and balance sheet on the basis of last year data. The horizontal analysis of the company briefs

that the sales position and gross profit position of the company has been lowered from last

year though, the net income of the company has been better (Appendix). The evaluation of

horizontal analysis on Pendragon plc briefs that the income of Competitor Company has also

been enhanced but net income has been lowered. These changes explain about the better

performance of the company.

The balance sheet of the company has also been studied and it has been recognized

that the company has made few changes into its financial performance to make the position

more competitive. The evaluation brief that the company is maintain a good competitive

position.

Critical evaluation:

It evaluates that the financial performance of the company is quite better. Few

changes are required to be done in the company though; it hardly matters to the inventors.

The investing position of the company is quite better.

Investor analysis:

Investor’s analysis has been done further to analyze the performance of the company.

Dividend position:

Dividend position of the company explains that the dividend amount has been

enhanced by the company by 3.4% which explains that the divided payout ratio of the

company is quite better (Yahoo Finance, 2018).

Market price:

The market stock price of the company explains about the increment into the stock

price of the company. the current stock price of the company is GBP 429 which is quite better

in context of the competitors of the company (Business Insider, 2018).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Accounting financial analysis report 11

Company news and Analysts view:

the news and the analysts report brief that the company is a good opportunity for the

purpose of investment. The market performance of the company is quite better as well as the

dividend payout ratio of the company is also good (Morningstar, 2018).

Critical evaluation:

It evaluates that the investment position of the company is quite better. The investing

position of the company is quite better in context with the competitors. It briefs that the

investors should invest more in the company for better returns.

Recommendation and conclusion:

The above study recommends the investors to hold the stock for some time for better

returns. Though, the current position of the company is also string but the evaluation study

brief that in future the position of the company would be enhanced more. The non financial

performance of the company briefs the position of the company is quite strong in the market

as well as the strategies and future policies of the company are also strong.

On the other hand, financial figures of the comapny briefs that the investment position

and financial position of the company has been better and it is also better from the

competitors. The investment report and the analyst report also briefs that the company is a

good option for the purpose of investment and thus the investor should hold the stock.

Company news and Analysts view:

the news and the analysts report brief that the company is a good opportunity for the

purpose of investment. The market performance of the company is quite better as well as the

dividend payout ratio of the company is also good (Morningstar, 2018).

Critical evaluation:

It evaluates that the investment position of the company is quite better. The investing

position of the company is quite better in context with the competitors. It briefs that the

investors should invest more in the company for better returns.

Recommendation and conclusion:

The above study recommends the investors to hold the stock for some time for better

returns. Though, the current position of the company is also string but the evaluation study

brief that in future the position of the company would be enhanced more. The non financial

performance of the company briefs the position of the company is quite strong in the market

as well as the strategies and future policies of the company are also strong.

On the other hand, financial figures of the comapny briefs that the investment position

and financial position of the company has been better and it is also better from the

competitors. The investment report and the analyst report also briefs that the company is a

good option for the purpose of investment and thus the investor should hold the stock.

Accounting financial analysis report 12

Section B: Capital budgeting analysis

Introduction:

Hammond electronics is manufacturing computer peripheral devices and that wants to

invest into a new product “Super Zip”. This report has been prepared to evaluate that whether

the project is beneficial for the company or not. For evaluating the performance of the project

discounted cash flow, internal rate of return and payback period of the project has been

evaluated and on the basis of that a conclusion has been made about the investment.

Discounted cash flow, internal rate of return and payback period are some techniques of

capital budgeting which evaluates the project and analyze that whether the project would be

beneficial for the company or not. It analyzes the project on various bases such as total time

period, cash flow etc.

Analysis:

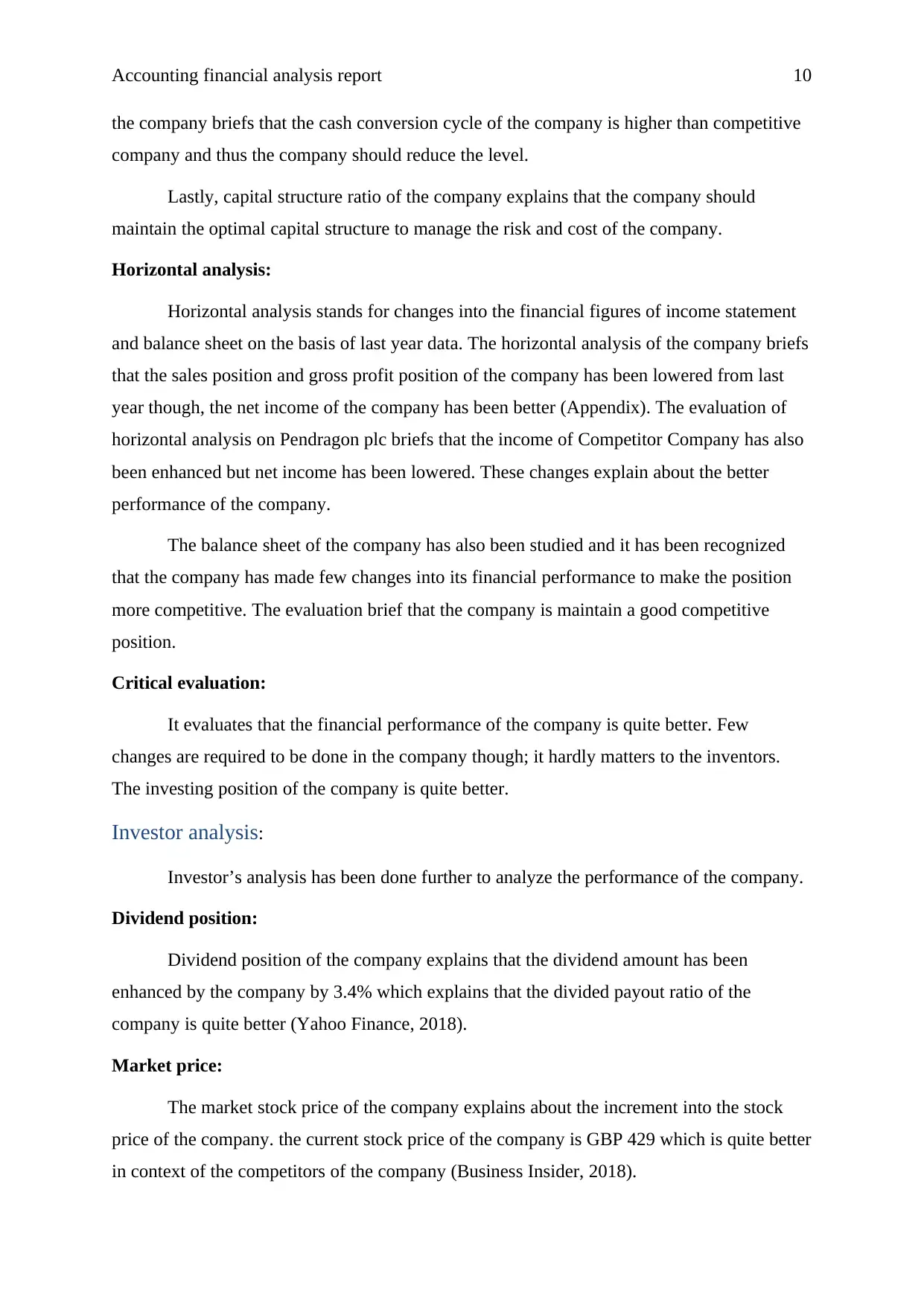

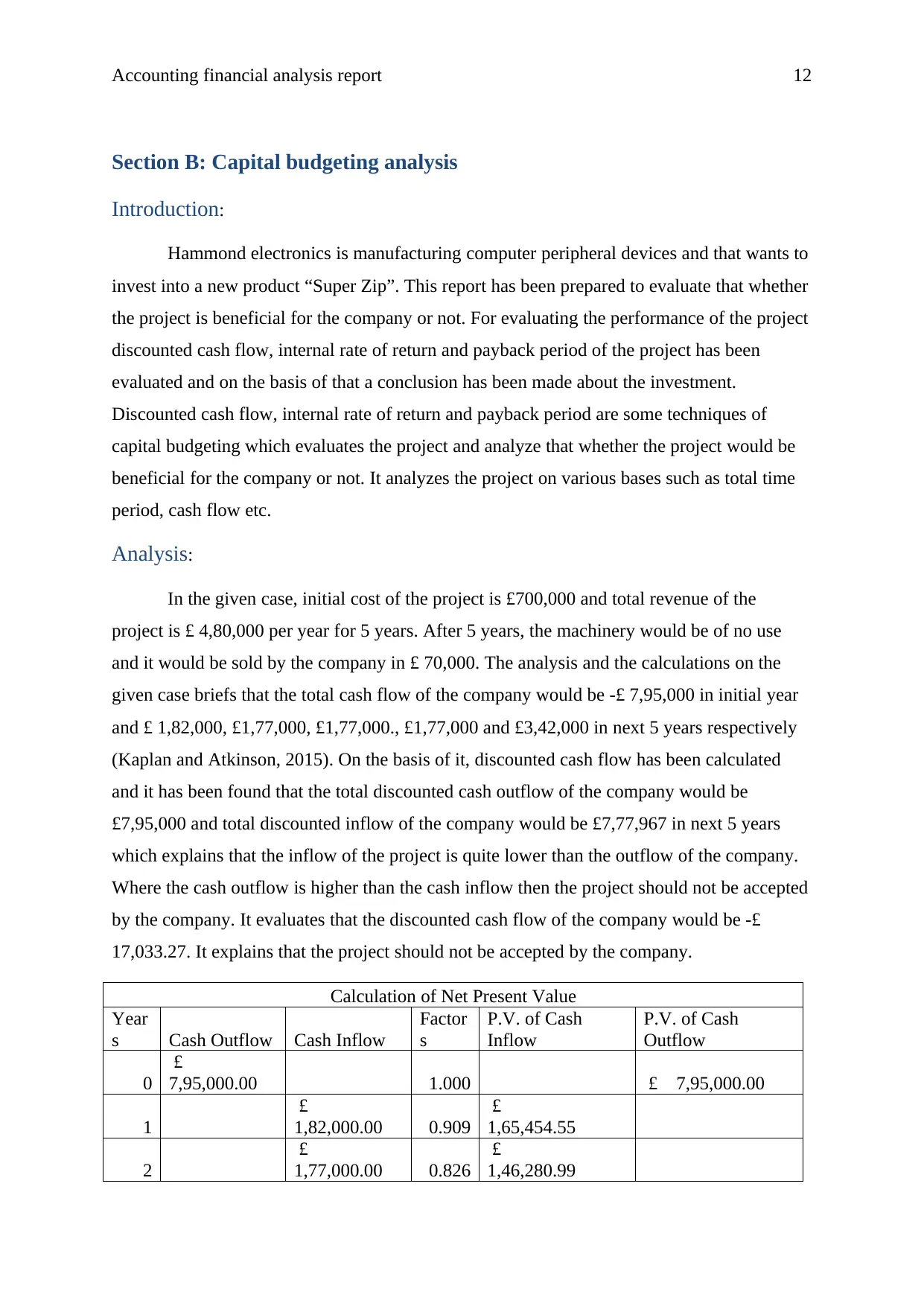

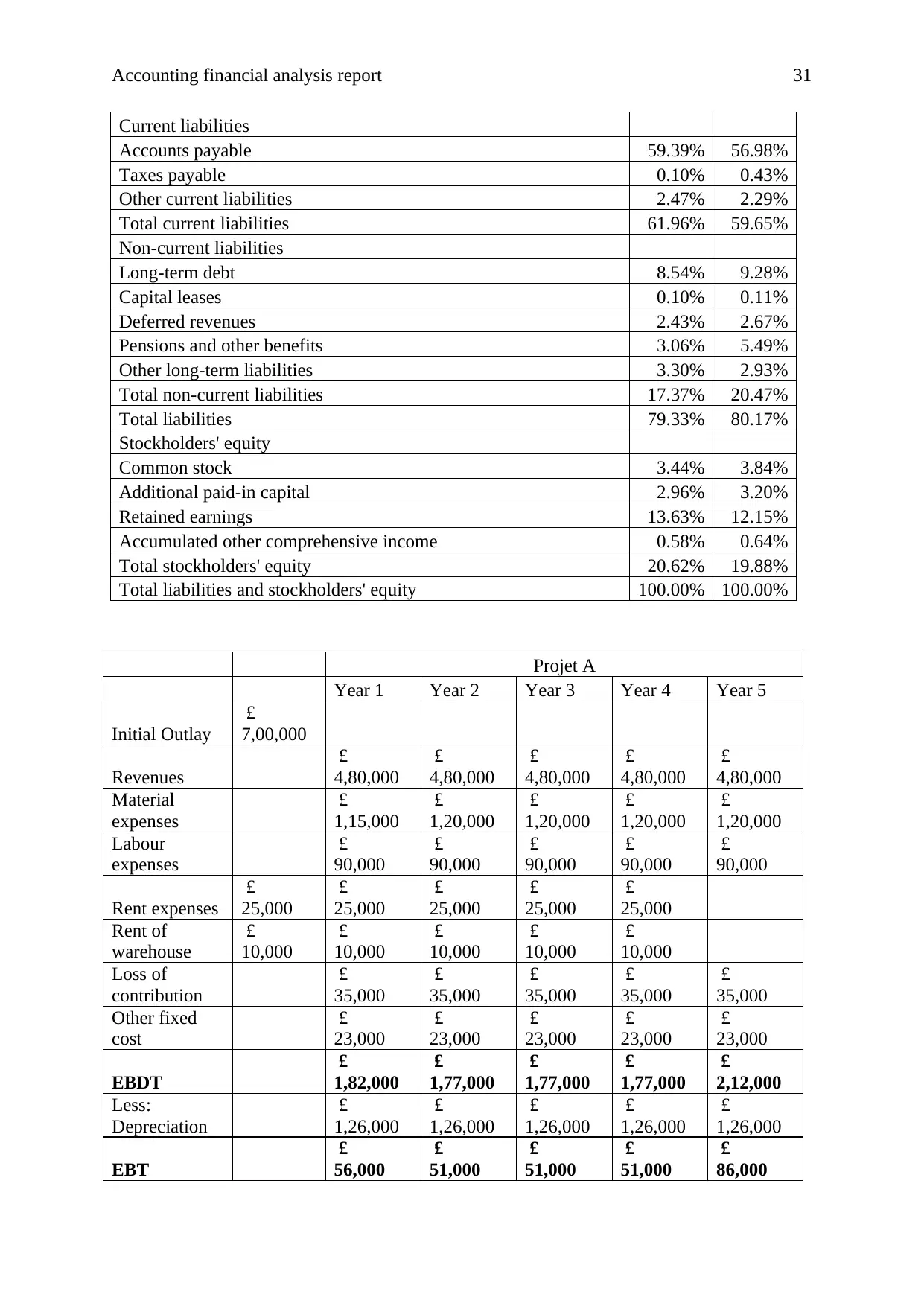

In the given case, initial cost of the project is £700,000 and total revenue of the

project is £ 4,80,000 per year for 5 years. After 5 years, the machinery would be of no use

and it would be sold by the company in £ 70,000. The analysis and the calculations on the

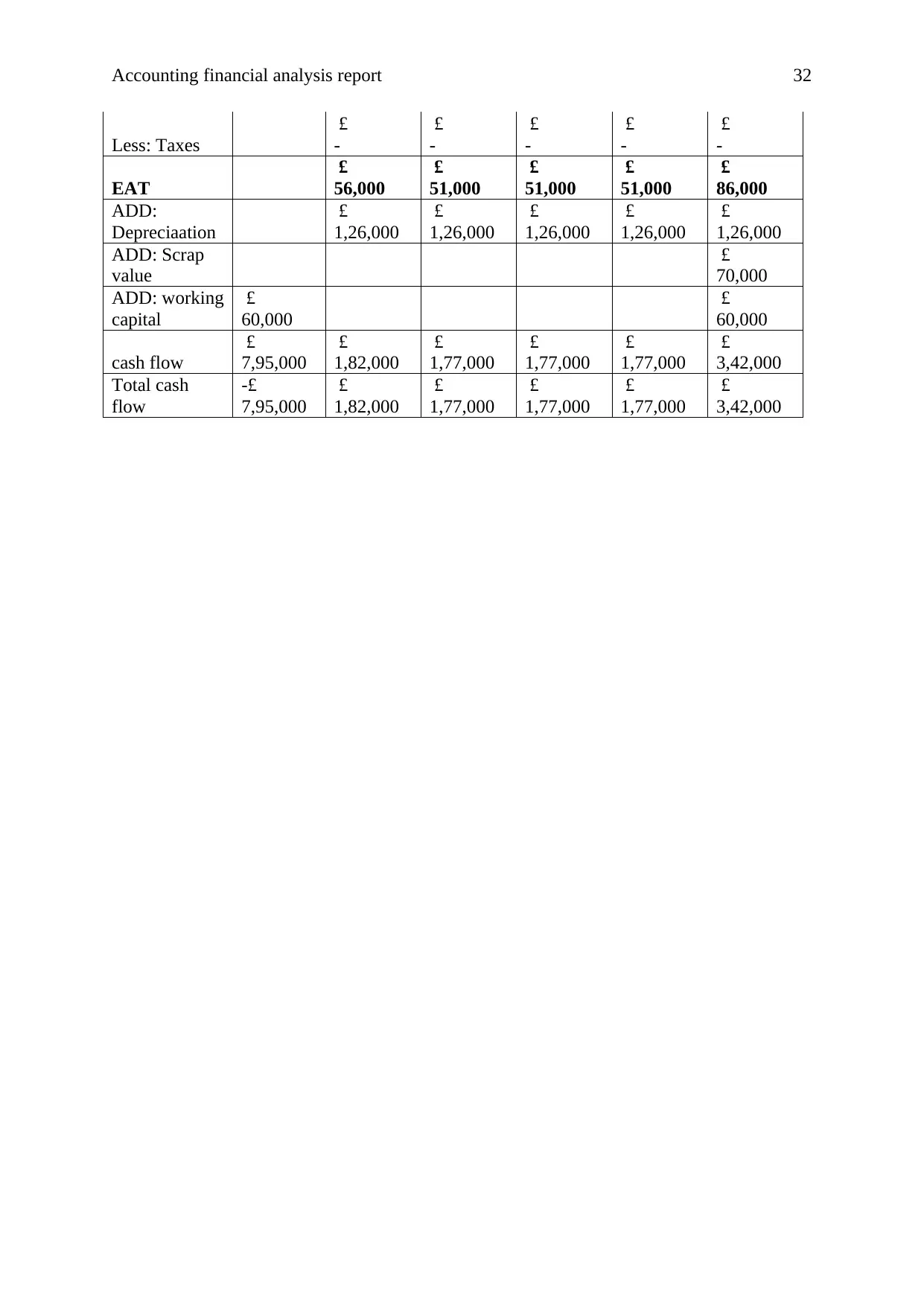

given case briefs that the total cash flow of the company would be -£ 7,95,000 in initial year

and £ 1,82,000, £1,77,000, £1,77,000., £1,77,000 and £3,42,000 in next 5 years respectively

(Kaplan and Atkinson, 2015). On the basis of it, discounted cash flow has been calculated

and it has been found that the total discounted cash outflow of the company would be

£7,95,000 and total discounted inflow of the company would be £7,77,967 in next 5 years

which explains that the inflow of the project is quite lower than the outflow of the company.

Where the cash outflow is higher than the cash inflow then the project should not be accepted

by the company. It evaluates that the discounted cash flow of the company would be -£

17,033.27. It explains that the project should not be accepted by the company.

Calculation of Net Present Value

Year

s Cash Outflow Cash Inflow

Factor

s

P.V. of Cash

Inflow

P.V. of Cash

Outflow

0

£

7,95,000.00 1.000 £ 7,95,000.00

1

£

1,82,000.00 0.909

£

1,65,454.55

2

£

1,77,000.00 0.826

£

1,46,280.99

Section B: Capital budgeting analysis

Introduction:

Hammond electronics is manufacturing computer peripheral devices and that wants to

invest into a new product “Super Zip”. This report has been prepared to evaluate that whether

the project is beneficial for the company or not. For evaluating the performance of the project

discounted cash flow, internal rate of return and payback period of the project has been

evaluated and on the basis of that a conclusion has been made about the investment.

Discounted cash flow, internal rate of return and payback period are some techniques of

capital budgeting which evaluates the project and analyze that whether the project would be

beneficial for the company or not. It analyzes the project on various bases such as total time

period, cash flow etc.

Analysis:

In the given case, initial cost of the project is £700,000 and total revenue of the

project is £ 4,80,000 per year for 5 years. After 5 years, the machinery would be of no use

and it would be sold by the company in £ 70,000. The analysis and the calculations on the

given case briefs that the total cash flow of the company would be -£ 7,95,000 in initial year

and £ 1,82,000, £1,77,000, £1,77,000., £1,77,000 and £3,42,000 in next 5 years respectively

(Kaplan and Atkinson, 2015). On the basis of it, discounted cash flow has been calculated

and it has been found that the total discounted cash outflow of the company would be

£7,95,000 and total discounted inflow of the company would be £7,77,967 in next 5 years

which explains that the inflow of the project is quite lower than the outflow of the company.

Where the cash outflow is higher than the cash inflow then the project should not be accepted

by the company. It evaluates that the discounted cash flow of the company would be -£

17,033.27. It explains that the project should not be accepted by the company.

Calculation of Net Present Value

Year

s Cash Outflow Cash Inflow

Factor

s

P.V. of Cash

Inflow

P.V. of Cash

Outflow

0

£

7,95,000.00 1.000 £ 7,95,000.00

1

£

1,82,000.00 0.909

£

1,65,454.55

2

£

1,77,000.00 0.826

£

1,46,280.99

Accounting financial analysis report 13

3

£

1,77,000.00 0.751

£

1,32,982.72

4

£

1,77,000.00 0.683

£

1,20,893.38

5

£

3,42,000.00 0.621

£

2,12,355.09

Total

£

7,77,966.73 £ 7,95,000.00

NPV= Total Cash Inflow-Total cash outflow

-£

17,033.27

(Davies and Crawford, 2011)

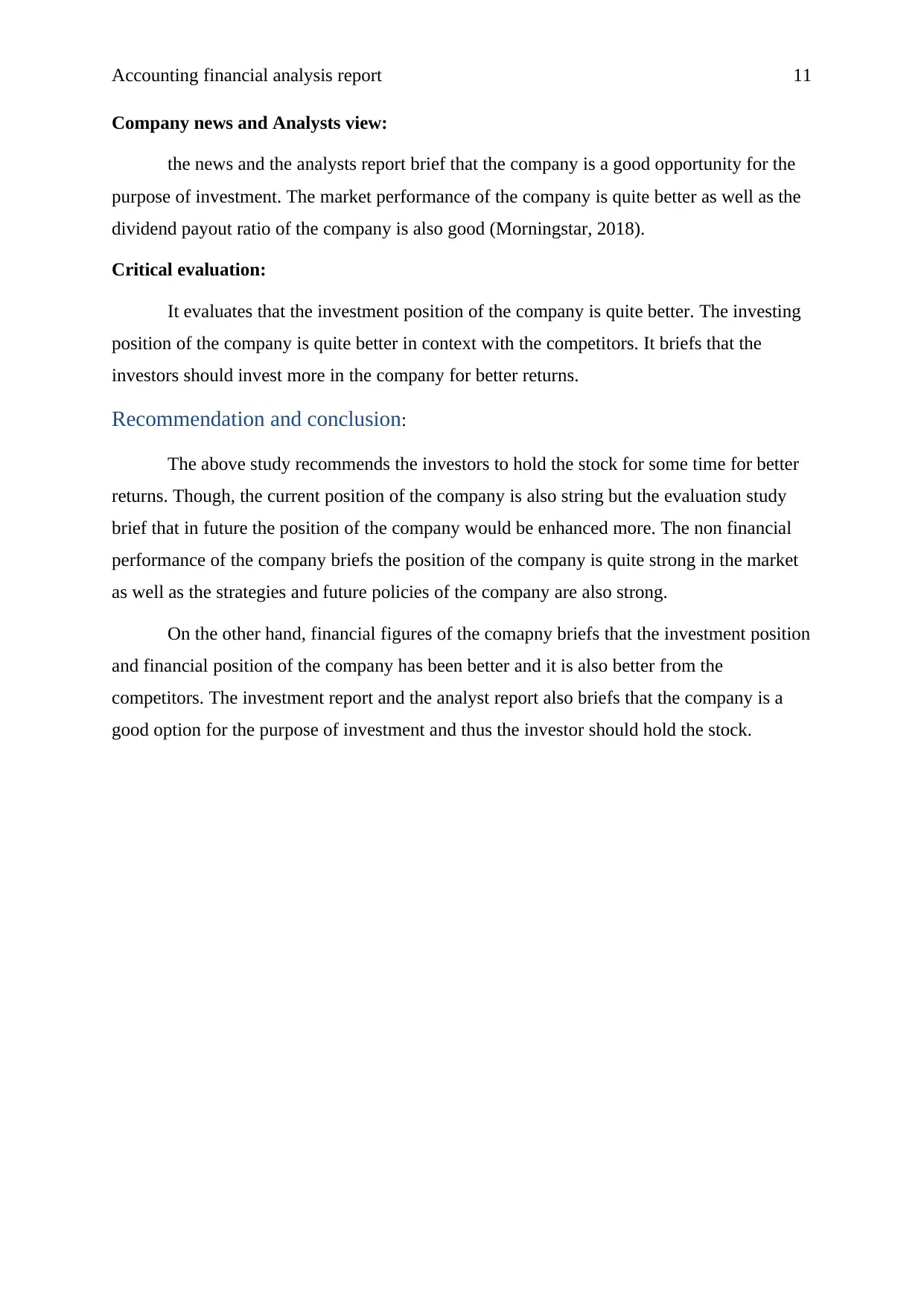

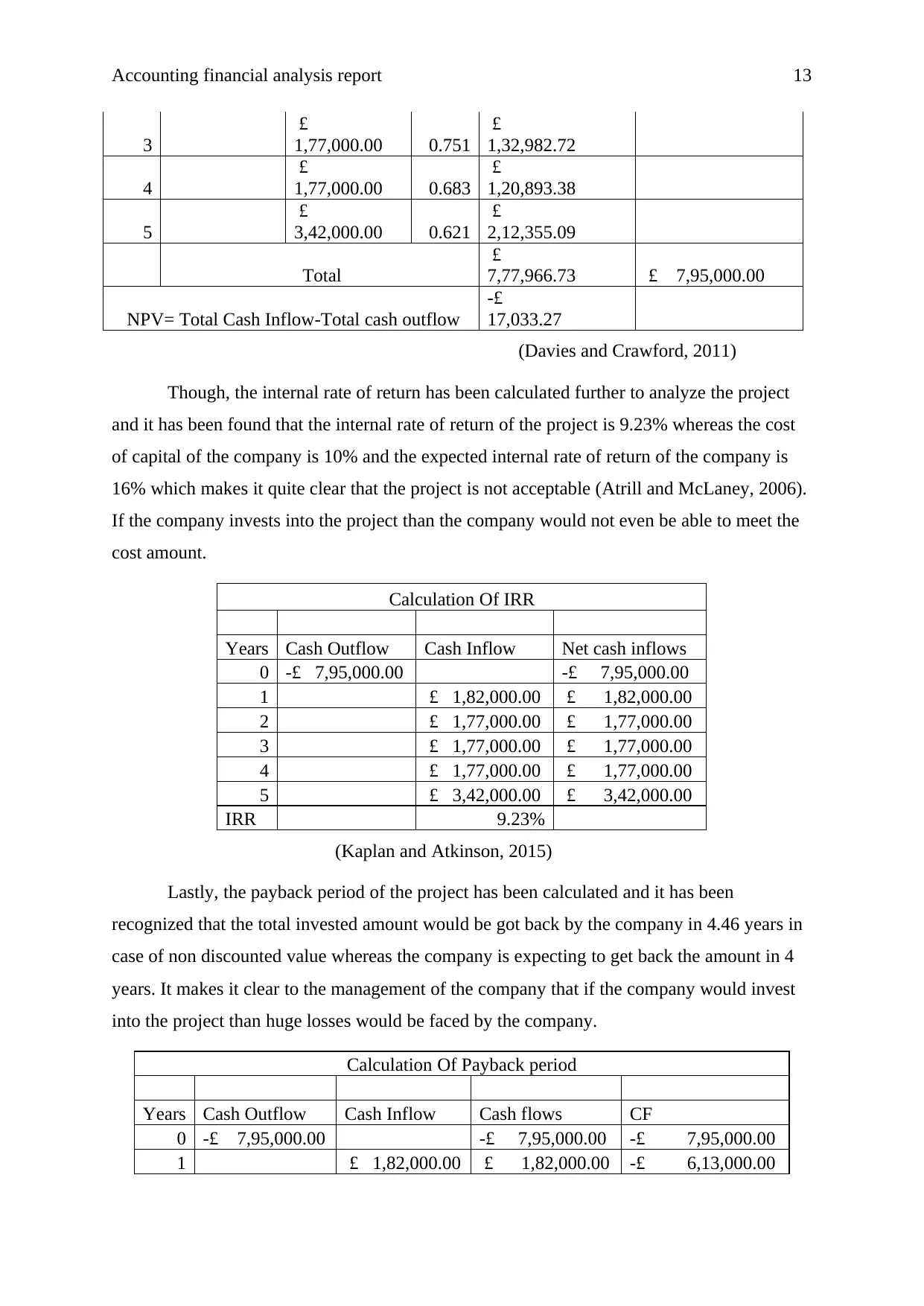

Though, the internal rate of return has been calculated further to analyze the project

and it has been found that the internal rate of return of the project is 9.23% whereas the cost

of capital of the company is 10% and the expected internal rate of return of the company is

16% which makes it quite clear that the project is not acceptable (Atrill and McLaney, 2006).

If the company invests into the project than the company would not even be able to meet the

cost amount.

Calculation Of IRR

Years Cash Outflow Cash Inflow Net cash inflows

0 -£ 7,95,000.00 -£ 7,95,000.00

1 £ 1,82,000.00 £ 1,82,000.00

2 £ 1,77,000.00 £ 1,77,000.00

3 £ 1,77,000.00 £ 1,77,000.00

4 £ 1,77,000.00 £ 1,77,000.00

5 £ 3,42,000.00 £ 3,42,000.00

IRR 9.23%

(Kaplan and Atkinson, 2015)

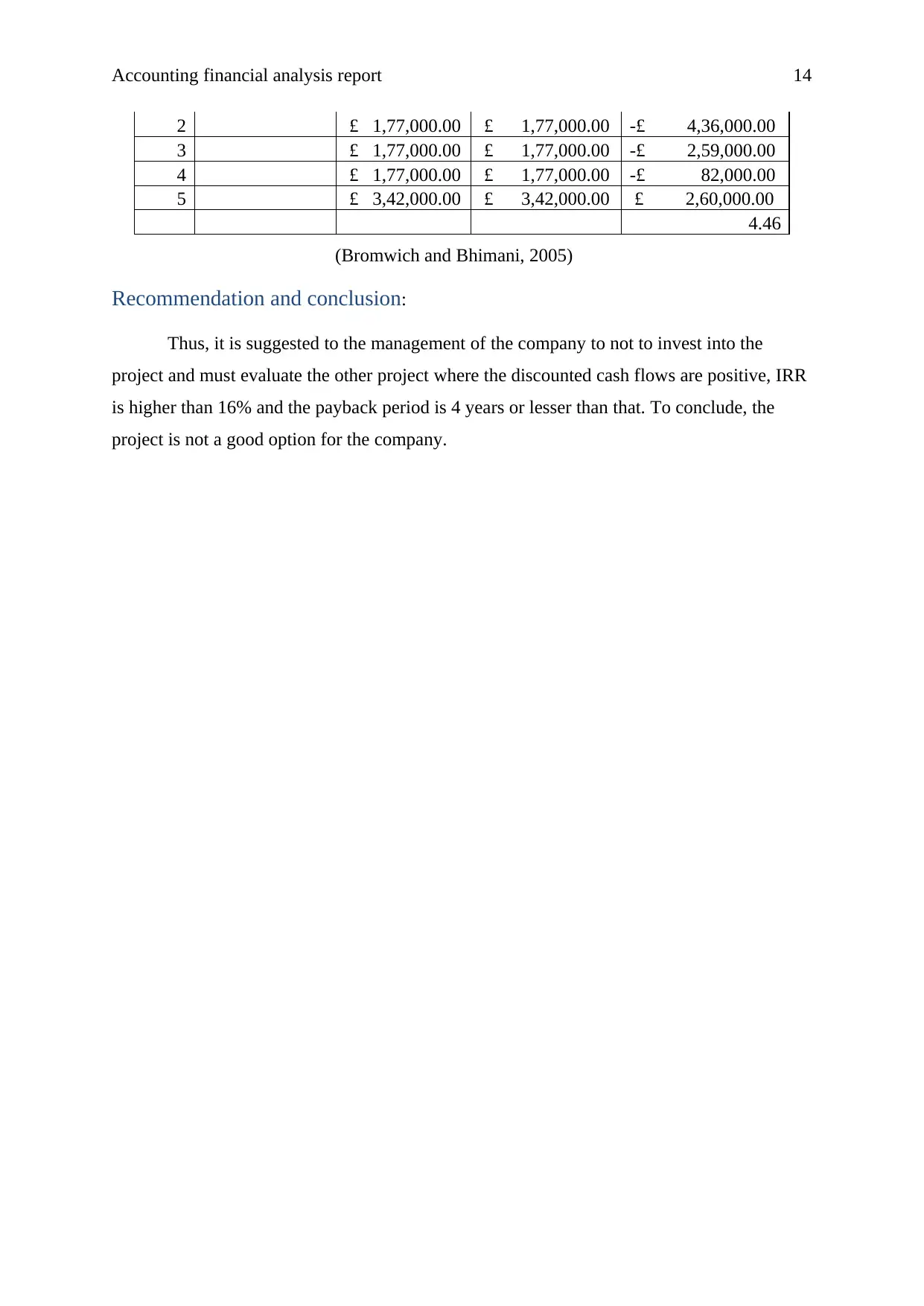

Lastly, the payback period of the project has been calculated and it has been

recognized that the total invested amount would be got back by the company in 4.46 years in

case of non discounted value whereas the company is expecting to get back the amount in 4

years. It makes it clear to the management of the company that if the company would invest

into the project than huge losses would be faced by the company.

Calculation Of Payback period

Years Cash Outflow Cash Inflow Cash flows CF

0 -£ 7,95,000.00 -£ 7,95,000.00 -£ 7,95,000.00

1 £ 1,82,000.00 £ 1,82,000.00 -£ 6,13,000.00

3

£

1,77,000.00 0.751

£

1,32,982.72

4

£

1,77,000.00 0.683

£

1,20,893.38

5

£

3,42,000.00 0.621

£

2,12,355.09

Total

£

7,77,966.73 £ 7,95,000.00

NPV= Total Cash Inflow-Total cash outflow

-£

17,033.27

(Davies and Crawford, 2011)

Though, the internal rate of return has been calculated further to analyze the project

and it has been found that the internal rate of return of the project is 9.23% whereas the cost

of capital of the company is 10% and the expected internal rate of return of the company is

16% which makes it quite clear that the project is not acceptable (Atrill and McLaney, 2006).

If the company invests into the project than the company would not even be able to meet the

cost amount.

Calculation Of IRR

Years Cash Outflow Cash Inflow Net cash inflows

0 -£ 7,95,000.00 -£ 7,95,000.00

1 £ 1,82,000.00 £ 1,82,000.00

2 £ 1,77,000.00 £ 1,77,000.00

3 £ 1,77,000.00 £ 1,77,000.00

4 £ 1,77,000.00 £ 1,77,000.00

5 £ 3,42,000.00 £ 3,42,000.00

IRR 9.23%

(Kaplan and Atkinson, 2015)

Lastly, the payback period of the project has been calculated and it has been

recognized that the total invested amount would be got back by the company in 4.46 years in

case of non discounted value whereas the company is expecting to get back the amount in 4

years. It makes it clear to the management of the company that if the company would invest

into the project than huge losses would be faced by the company.

Calculation Of Payback period

Years Cash Outflow Cash Inflow Cash flows CF

0 -£ 7,95,000.00 -£ 7,95,000.00 -£ 7,95,000.00

1 £ 1,82,000.00 £ 1,82,000.00 -£ 6,13,000.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting financial analysis report 14

2 £ 1,77,000.00 £ 1,77,000.00 -£ 4,36,000.00

3 £ 1,77,000.00 £ 1,77,000.00 -£ 2,59,000.00

4 £ 1,77,000.00 £ 1,77,000.00 -£ 82,000.00

5 £ 3,42,000.00 £ 3,42,000.00 £ 2,60,000.00

4.46

(Bromwich and Bhimani, 2005)

Recommendation and conclusion:

Thus, it is suggested to the management of the company to not to invest into the

project and must evaluate the other project where the discounted cash flows are positive, IRR

is higher than 16% and the payback period is 4 years or lesser than that. To conclude, the

project is not a good option for the company.

2 £ 1,77,000.00 £ 1,77,000.00 -£ 4,36,000.00

3 £ 1,77,000.00 £ 1,77,000.00 -£ 2,59,000.00

4 £ 1,77,000.00 £ 1,77,000.00 -£ 82,000.00

5 £ 3,42,000.00 £ 3,42,000.00 £ 2,60,000.00

4.46

(Bromwich and Bhimani, 2005)

Recommendation and conclusion:

Thus, it is suggested to the management of the company to not to invest into the

project and must evaluate the other project where the discounted cash flows are positive, IRR

is higher than 16% and the payback period is 4 years or lesser than that. To conclude, the

project is not a good option for the company.

Accounting financial analysis report 15

References:

Annual report. 2017. Caffyns plc. [Online]. Available at:

http://www.caffynsplc.co.uk/pdfs/annual_report_2017.pdf (Accessed as on 15th April 2018).

Annual Report. 2017. Penadragon plc. [Online]. Available at:

http://www.pendragonplc.com/documents/2017/pendragon-plc-annual-report-2017.pdf

(Accessed as on 15th April 2018).

Atrill, P. and McLaney, E.J., 2006. Accounting and Finance for Non-specialists. Pearson

Education.

Bloomberg. 2018. Caffyns plc. [Online]. Available at:

https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=876234

(Accessed as on 15th April 2018).

Borio, C., 2014. The financial cycle and macroeconomics: What have we learnt?. Journal of

Banking & Finance, 45, pp.182-198.

Bromwich, M. and Bhimani, A., 2005. Management accounting: Pathways to progress. Cima

publishing.

Business Insider. 2018. Caffyns plc. [Online]. Available at:

http://markets.businessinsider.com/analyst/caffyns_2 (Accessed as on 15th April 2018).

Davies, T. and Crawford, I., 2011. Business accounting and finance. Pearson.

Du, J. and Girma, S., 2009. Source of finance, growth and firm size: evidence from

China (No. 2009.03). Research paper/UNU-WIDER.

FT. 2018. Caffyns plc. [Online]. Available at:

https://markets.ft.com/data/equities/tearsheet/summary?s=CFYN:LSE (Accessed as on 15th

April 2018).

Galí, J., 2015. Monetary policy, inflation, and the business cycle: an introduction to the new

Keynesian framework and its applications. Princeton University Press.

Gambacorta, L. and Signoretti, F.M., 2014. Should monetary policy lean against the wind?:

An analysis based on a DSGE model with banking. Journal of Economic Dynamics and

Control, 43, pp.146-174.

References:

Annual report. 2017. Caffyns plc. [Online]. Available at:

http://www.caffynsplc.co.uk/pdfs/annual_report_2017.pdf (Accessed as on 15th April 2018).

Annual Report. 2017. Penadragon plc. [Online]. Available at:

http://www.pendragonplc.com/documents/2017/pendragon-plc-annual-report-2017.pdf

(Accessed as on 15th April 2018).

Atrill, P. and McLaney, E.J., 2006. Accounting and Finance for Non-specialists. Pearson

Education.

Bloomberg. 2018. Caffyns plc. [Online]. Available at:

https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=876234

(Accessed as on 15th April 2018).

Borio, C., 2014. The financial cycle and macroeconomics: What have we learnt?. Journal of

Banking & Finance, 45, pp.182-198.

Bromwich, M. and Bhimani, A., 2005. Management accounting: Pathways to progress. Cima

publishing.

Business Insider. 2018. Caffyns plc. [Online]. Available at:

http://markets.businessinsider.com/analyst/caffyns_2 (Accessed as on 15th April 2018).

Davies, T. and Crawford, I., 2011. Business accounting and finance. Pearson.

Du, J. and Girma, S., 2009. Source of finance, growth and firm size: evidence from

China (No. 2009.03). Research paper/UNU-WIDER.

FT. 2018. Caffyns plc. [Online]. Available at:

https://markets.ft.com/data/equities/tearsheet/summary?s=CFYN:LSE (Accessed as on 15th

April 2018).

Galí, J., 2015. Monetary policy, inflation, and the business cycle: an introduction to the new

Keynesian framework and its applications. Princeton University Press.

Gambacorta, L. and Signoretti, F.M., 2014. Should monetary policy lean against the wind?:

An analysis based on a DSGE model with banking. Journal of Economic Dynamics and

Control, 43, pp.146-174.

Accounting financial analysis report 16

Gitman, L.J. and Zutter, C.J., 2012. Principles of managerial finance. Prentice Hall.

Grinblatt, M. and Titman, S., 2016. Financial markets & corporate strategy. Prentice Hall.

History. 2018. Caffyns plc. [Online]. Available at:

https://www.caffyns.co.uk/about-us/caffyns-history/ (Accessed as on 15th April 2018).

Kaplan, R.S. and Atkinson, A.A., 2015. Advanced management accounting. PHI Learning.

Morningstar. 2018. Caffyns plc. [Online]. Available at:

http://financials.morningstar.com/cash-flow/cf.html?t=CFYN®ion=gbr&culture=en-US

(Accessed as on 15th April 2018).

Morningstar. 2018. Penadragon plc. [Online]. Available at:

http://financials.morningstar.com/ratios/r.html?t=PDGNF(Accessed as on 15th April 2018).

Reuters. 2018. Caffyns plc. [Online]. Available at:

https://in.reuters.com/finance/stocks/overview/CFYN.L (Accessed as on 15th April 2018).

Reuters. 2018. Caffyns plc. [Online]. Available at:

https://www.reuters.com/finance/stocks/analyst-research/CFYN.L (Accessed as on 15th April

2018).

Simply wall. 2018. Caffyns plc. [Online]. Available at:

https://simplywall.st/stocks/gb/retail/lse-cfyn/caffyns-shares/news/caffyns-plc-loncfyn-time-

for-a-financial-health-check/ (Accessed as on 15th April 2018).

Ward, K., 2012. Strategic management accounting. Routledge.

Weaver, S.C., Weston, J.F. and Weaver, S., 2001. Finance and accounting for nonfinancial

managers. New York: McGraw-Hill.

Weston, J.F. and Brigham, E.F., 2015. Managerial finance. Hinsdale, IL: Dryden Press.

Yahoo Finance. 2018. Caffyns plc. [Online]. Available at:

https://finance.yahoo.com/quote/79GL.L/analysis?p=79GL.L (Accessed as on 15th April

2018).

Gitman, L.J. and Zutter, C.J., 2012. Principles of managerial finance. Prentice Hall.

Grinblatt, M. and Titman, S., 2016. Financial markets & corporate strategy. Prentice Hall.

History. 2018. Caffyns plc. [Online]. Available at:

https://www.caffyns.co.uk/about-us/caffyns-history/ (Accessed as on 15th April 2018).

Kaplan, R.S. and Atkinson, A.A., 2015. Advanced management accounting. PHI Learning.

Morningstar. 2018. Caffyns plc. [Online]. Available at:

http://financials.morningstar.com/cash-flow/cf.html?t=CFYN®ion=gbr&culture=en-US

(Accessed as on 15th April 2018).

Morningstar. 2018. Penadragon plc. [Online]. Available at:

http://financials.morningstar.com/ratios/r.html?t=PDGNF(Accessed as on 15th April 2018).

Reuters. 2018. Caffyns plc. [Online]. Available at:

https://in.reuters.com/finance/stocks/overview/CFYN.L (Accessed as on 15th April 2018).

Reuters. 2018. Caffyns plc. [Online]. Available at:

https://www.reuters.com/finance/stocks/analyst-research/CFYN.L (Accessed as on 15th April

2018).

Simply wall. 2018. Caffyns plc. [Online]. Available at:

https://simplywall.st/stocks/gb/retail/lse-cfyn/caffyns-shares/news/caffyns-plc-loncfyn-time-

for-a-financial-health-check/ (Accessed as on 15th April 2018).

Ward, K., 2012. Strategic management accounting. Routledge.

Weaver, S.C., Weston, J.F. and Weaver, S., 2001. Finance and accounting for nonfinancial

managers. New York: McGraw-Hill.

Weston, J.F. and Brigham, E.F., 2015. Managerial finance. Hinsdale, IL: Dryden Press.

Yahoo Finance. 2018. Caffyns plc. [Online]. Available at:

https://finance.yahoo.com/quote/79GL.L/analysis?p=79GL.L (Accessed as on 15th April

2018).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Accounting financial analysis report 17

Appendix:

CAFFYNS PLC (CFYN) CashFlowFlag INCOME STATEMENT

Fiscal year ends in March. GBP in thousands

except per share data.

2017-

03

2016-

03

2015-

03

Revenue 212581 232492 210314

Cost of revenue 187971 205228 185207

Gross profit 24610 27264 25107

Operating expenses

Sales, General and administrative 22400 23638 12675

Other operating expenses -541 -317 -794

Total operating expenses 21859 23321 11881

Operating income 2751 3943 13226

Interest Expense 921 1117 1561

Other income (expense) -171 -191 -227

Income before income taxes 1659 2635 11438

Provision for income taxes 375 148 2183

Net income from continuing operations 1284 2487 9255

Net income from discontinuing ops 3839

Net income 5123 2487 9255

Net income available to common

shareholders 5123 2487 9255

Earnings per share

Basic 1.86 0.9 3.35

Diluted 1.86 0.89 3.3

Weighted average shares outstanding

Basic 2750 2759 2758

Diluted 2750 2805 2799

EBITDA 3776 4900 14079

CAFFYNS PLC (CFYN) CashFlowFlag BALANCE SHEET

Fiscal year ends in March. GBP in thousands

except per share data.

2017-

03

2016-

03

2015-

03

Assets

Current assets

Cash

Cash and cash equivalents 2321 219 1746

Total cash 2321 219 1746

Inventories 29904 32925 31896

Other current assets 7838 8449 8164

Total current assets 40063 41593 41806

Non-current assets

Property, plant and equipment

Appendix:

CAFFYNS PLC (CFYN) CashFlowFlag INCOME STATEMENT

Fiscal year ends in March. GBP in thousands

except per share data.

2017-

03

2016-

03

2015-

03

Revenue 212581 232492 210314

Cost of revenue 187971 205228 185207

Gross profit 24610 27264 25107

Operating expenses

Sales, General and administrative 22400 23638 12675

Other operating expenses -541 -317 -794

Total operating expenses 21859 23321 11881

Operating income 2751 3943 13226

Interest Expense 921 1117 1561

Other income (expense) -171 -191 -227

Income before income taxes 1659 2635 11438

Provision for income taxes 375 148 2183

Net income from continuing operations 1284 2487 9255

Net income from discontinuing ops 3839

Net income 5123 2487 9255

Net income available to common

shareholders 5123 2487 9255

Earnings per share

Basic 1.86 0.9 3.35

Diluted 1.86 0.89 3.3

Weighted average shares outstanding

Basic 2750 2759 2758

Diluted 2750 2805 2799

EBITDA 3776 4900 14079

CAFFYNS PLC (CFYN) CashFlowFlag BALANCE SHEET

Fiscal year ends in March. GBP in thousands

except per share data.

2017-

03

2016-

03

2015-

03

Assets

Current assets

Cash

Cash and cash equivalents 2321 219 1746

Total cash 2321 219 1746

Inventories 29904 32925 31896

Other current assets 7838 8449 8164

Total current assets 40063 41593 41806

Non-current assets

Property, plant and equipment

Accounting financial analysis report 18

Land 38540 38470

Fixtures and equipment 10108 10267 10001

Other properties 36889 690 690

Property and equipment, at cost 46997 49497 49161

Accumulated Depreciation

-

11374

-

11279

-

11177

Property, plant and equipment, net 35623 38218 37984

Goodwill 286 286

Intangible assets 286

Deferred income taxes

Other long-term assets 6986 1167

Total non-current assets 42895 39671 38270

Total assets 82958 81264 80076

Liabilities and stockholders' equity

Liabilities

Current liabilities

Short-term debt 500 500 500

Accounts payable 11662 14776 14177

Taxes payable 197 416 446

Other current liabilities 22517 21592 21754

Total current liabilities 34876 37284 36877

Non-current liabilities

Long-term debt 10375 10875 11375

Deferred taxes liabilities 805 617 705

Pensions and other benefits 8554 4980 5388

Other long-term liabilities 812 812 1237

Total non-current liabilities 20546 17284 18705

Total liabilities 55422 54568 55582

Stockholders' equity

Common stock 1439 1439 1439

Additional paid-in capital 979 979 554

Retained earnings 23394 22422 20696

Accumulated other comprehensive income 1724 1856 1805

Total stockholders' equity 27536 26696 24494

Total liabilities and stockholders' equity 82958 81264 80076

CAFFYNS PLC (CFYN) Statement of CASH FLOW

Fiscal year ends in March. GBP in thousands

except per share data.

2017-

03

2016-

03

2015-

03

Cash Flows From Operating Activities

Stock based compensation 21 51 51

Inventory 1100 -1029 -5043

Other working capital -1423 -994 4979

Land 38540 38470

Fixtures and equipment 10108 10267 10001

Other properties 36889 690 690

Property and equipment, at cost 46997 49497 49161

Accumulated Depreciation

-

11374

-

11279

-

11177

Property, plant and equipment, net 35623 38218 37984

Goodwill 286 286

Intangible assets 286

Deferred income taxes

Other long-term assets 6986 1167

Total non-current assets 42895 39671 38270

Total assets 82958 81264 80076

Liabilities and stockholders' equity

Liabilities

Current liabilities

Short-term debt 500 500 500

Accounts payable 11662 14776 14177

Taxes payable 197 416 446

Other current liabilities 22517 21592 21754

Total current liabilities 34876 37284 36877

Non-current liabilities

Long-term debt 10375 10875 11375

Deferred taxes liabilities 805 617 705

Pensions and other benefits 8554 4980 5388

Other long-term liabilities 812 812 1237

Total non-current liabilities 20546 17284 18705

Total liabilities 55422 54568 55582

Stockholders' equity

Common stock 1439 1439 1439

Additional paid-in capital 979 979 554

Retained earnings 23394 22422 20696

Accumulated other comprehensive income 1724 1856 1805

Total stockholders' equity 27536 26696 24494

Total liabilities and stockholders' equity 82958 81264 80076

CAFFYNS PLC (CFYN) Statement of CASH FLOW

Fiscal year ends in March. GBP in thousands

except per share data.

2017-

03

2016-

03

2015-

03

Cash Flows From Operating Activities

Stock based compensation 21 51 51

Inventory 1100 -1029 -5043

Other working capital -1423 -994 4979

Accounting financial analysis report 19

Other non-cash items 2045 3324 3054

Net cash provided by operating activities 1743 1352 3041

Cash Flows From Investing Activities

Investments in property, plant, and

equipment -4636 -3825 -3027

Property, plant, and equipment reductions 2736 2295

Acquisitions, net 6707

Net cash used for investing activities 2071 -1089 -732

Cash Flows From Financing Activities

Short-term borrowing -500 -500

Long-term debt issued

Long-term debt repayment -500

Common stock issued 310 5

Repurchases of treasury stock -919 -717

Cash dividends paid -603 -573 -517

Net cash provided by (used for) financing

activities -1712 -1790 -1012

Net change in cash 2102 -1527 1297

Cash at beginning of period 219 1746 449

Cash at end of period 2321 219 1746

Free Cash Flow

Operating cash flow 1743 1352 3041

Capital expenditure -4636 -3825 -3027

Free cash flow -2893 -2473 14

Supplemental schedule of cash flow data

CAFFYNS PLC (CFYN) CashFlowFlag INCOME STATEMENT

Fiscal year ends in March. GBP in thousands except per share

data. 2017-03

2016-

03

Revenue -8.56% 10.55%

Cost of revenue -8.41% 10.81%

Gross profit -9.73% 8.59%

Operating expenses

Sales, General and administrative -5.24% 86.49%

Other operating expenses 70.66%

-

60.08%

Total operating expenses -6.27% 96.29%

Operating income -30.23%

-

70.19%

Interest Expense -17.55%

-

28.44%

Other income (expense) -10.47%

-

15.86%

Income before income taxes -37.04% -

Other non-cash items 2045 3324 3054

Net cash provided by operating activities 1743 1352 3041

Cash Flows From Investing Activities

Investments in property, plant, and

equipment -4636 -3825 -3027

Property, plant, and equipment reductions 2736 2295

Acquisitions, net 6707

Net cash used for investing activities 2071 -1089 -732

Cash Flows From Financing Activities

Short-term borrowing -500 -500

Long-term debt issued

Long-term debt repayment -500

Common stock issued 310 5

Repurchases of treasury stock -919 -717

Cash dividends paid -603 -573 -517

Net cash provided by (used for) financing

activities -1712 -1790 -1012

Net change in cash 2102 -1527 1297

Cash at beginning of period 219 1746 449

Cash at end of period 2321 219 1746

Free Cash Flow

Operating cash flow 1743 1352 3041

Capital expenditure -4636 -3825 -3027

Free cash flow -2893 -2473 14

Supplemental schedule of cash flow data

CAFFYNS PLC (CFYN) CashFlowFlag INCOME STATEMENT

Fiscal year ends in March. GBP in thousands except per share

data. 2017-03

2016-

03

Revenue -8.56% 10.55%

Cost of revenue -8.41% 10.81%

Gross profit -9.73% 8.59%

Operating expenses

Sales, General and administrative -5.24% 86.49%

Other operating expenses 70.66%

-

60.08%

Total operating expenses -6.27% 96.29%

Operating income -30.23%

-

70.19%

Interest Expense -17.55%

-

28.44%

Other income (expense) -10.47%

-

15.86%

Income before income taxes -37.04% -

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting financial analysis report 20

76.96%

Provision for income taxes 153.38%

-

93.22%

Net income from continuing operations -48.37%

-

73.13%

Net income from discontinuing ops

Net income 105.99%

-

73.13%

Net income available to common shareholders 105.99%

-

73.13%

Earnings per share

Basic 106.67%

-

73.13%

Diluted 108.99%

-

73.03%

Weighted average shares outstanding

Basic -0.33% 0.04%

Diluted -1.96% 0.21%

EBITDA -22.94%

-

65.20%

CAFFYNS PLC (CFYN) CashFlowFlag BALANCE SHEET

Fiscal year ends in March. GBP in thousands except per share

data. 2017-03 2016-03

Assets

Current assets

Cash

Cash and cash equivalents 959.82% -87.46%

Total cash 959.82% -87.46%

Inventories -9.18% 3.23%

Other current assets -7.23% 3.49%

Total current assets -3.68% -0.51%

Non-current assets

Property, plant and equipment

Land -100.00% 0.18%

Fixtures and equipment -1.55% 2.66%

Other properties 5246.23% 0.00%

Property and equipment, at cost -5.05% 0.68%

Accumulated Depreciation 0.84% 0.91%

Property, plant and equipment, net -6.79% 0.62%

Goodwill

-

100.00%

Intangible assets -100.00%

Deferred income taxes

Other long-term assets 498.63%

76.96%

Provision for income taxes 153.38%

-

93.22%

Net income from continuing operations -48.37%

-

73.13%

Net income from discontinuing ops

Net income 105.99%

-

73.13%

Net income available to common shareholders 105.99%

-

73.13%

Earnings per share

Basic 106.67%

-

73.13%

Diluted 108.99%

-

73.03%

Weighted average shares outstanding

Basic -0.33% 0.04%

Diluted -1.96% 0.21%

EBITDA -22.94%

-

65.20%

CAFFYNS PLC (CFYN) CashFlowFlag BALANCE SHEET

Fiscal year ends in March. GBP in thousands except per share

data. 2017-03 2016-03

Assets

Current assets

Cash

Cash and cash equivalents 959.82% -87.46%

Total cash 959.82% -87.46%

Inventories -9.18% 3.23%

Other current assets -7.23% 3.49%

Total current assets -3.68% -0.51%

Non-current assets

Property, plant and equipment

Land -100.00% 0.18%

Fixtures and equipment -1.55% 2.66%

Other properties 5246.23% 0.00%

Property and equipment, at cost -5.05% 0.68%

Accumulated Depreciation 0.84% 0.91%

Property, plant and equipment, net -6.79% 0.62%

Goodwill

-

100.00%

Intangible assets -100.00%

Deferred income taxes

Other long-term assets 498.63%

Accounting financial analysis report 21

Total non-current assets 8.13% 3.66%

Total assets 2.08% 1.48%

Liabilities and stockholders' equity

Liabilities

Current liabilities

Short-term debt 0.00% 0.00%

Accounts payable -21.07% 4.23%

Taxes payable -52.64% -6.73%

Other current liabilities 4.28% -0.74%

Total current liabilities -6.46% 1.10%

Non-current liabilities

Long-term debt -4.60% -4.40%

Deferred taxes liabilities 30.47% -12.48%

Pensions and other benefits 71.77% -7.57%

Other long-term liabilities 0.00% -34.36%

Total non-current liabilities 18.87% -7.60%

Total liabilities 1.57% -1.82%

Stockholders' equity

Common stock 0.00% 0.00%

Additional paid-in capital 0.00% 76.71%

Retained earnings 4.34% 8.34%

Accumulated other comprehensive income -7.11% 2.83%

Total stockholders' equity 3.15% 8.99%

Total liabilities and stockholders' equity 2.08% 1.48%

CAFFYNS PLC (CFYN) Statement of CASH FLOW

Fiscal year ends in March. GBP in thousands except per share

data. 2017-03 2016-03

Cash Flows From Operating Activities

Stock based compensation -58.82% 0.00%

Inventory

-

206.90% -79.60%

Other working capital 43.16% -119.96%

Other non-cash items -38.48% 8.84%

Net cash provided by operating activities 28.92% -55.54%

Cash Flows From Investing Activities

Investments in property, plant, and equipment 21.20% 26.36%

Property, plant, and equipment reductions

-

100.00% 19.22%

Acquisitions, net

Net cash used for investing activities

-

290.17% 48.77%

Cash Flows From Financing Activities

Short-term borrowing

Total non-current assets 8.13% 3.66%

Total assets 2.08% 1.48%

Liabilities and stockholders' equity

Liabilities

Current liabilities

Short-term debt 0.00% 0.00%

Accounts payable -21.07% 4.23%

Taxes payable -52.64% -6.73%

Other current liabilities 4.28% -0.74%

Total current liabilities -6.46% 1.10%

Non-current liabilities

Long-term debt -4.60% -4.40%

Deferred taxes liabilities 30.47% -12.48%

Pensions and other benefits 71.77% -7.57%

Other long-term liabilities 0.00% -34.36%

Total non-current liabilities 18.87% -7.60%

Total liabilities 1.57% -1.82%

Stockholders' equity

Common stock 0.00% 0.00%

Additional paid-in capital 0.00% 76.71%

Retained earnings 4.34% 8.34%

Accumulated other comprehensive income -7.11% 2.83%

Total stockholders' equity 3.15% 8.99%

Total liabilities and stockholders' equity 2.08% 1.48%

CAFFYNS PLC (CFYN) Statement of CASH FLOW

Fiscal year ends in March. GBP in thousands except per share

data. 2017-03 2016-03

Cash Flows From Operating Activities

Stock based compensation -58.82% 0.00%

Inventory

-

206.90% -79.60%

Other working capital 43.16% -119.96%

Other non-cash items -38.48% 8.84%

Net cash provided by operating activities 28.92% -55.54%

Cash Flows From Investing Activities

Investments in property, plant, and equipment 21.20% 26.36%

Property, plant, and equipment reductions

-

100.00% 19.22%

Acquisitions, net

Net cash used for investing activities

-

290.17% 48.77%

Cash Flows From Financing Activities

Short-term borrowing

Accounting financial analysis report 22

Long-term debt issued

Long-term debt repayment -100.00%

Common stock issued -100.00%

Repurchases of treasury stock 28.17%

Cash dividends paid 5.24% 10.83%

Net cash provided by (used for) financing activities -4.36% 76.88%

Net change in cash

-

237.66% -217.73%

Cash at beginning of period -87.46% 288.86%

Cash at end of period 959.82% -87.46%

Free Cash Flow

Operating cash flow 28.92% -55.54%

Capital expenditure 21.20% 26.36%

Free cash flow 16.98%

-

17764.29%

Supplemental schedule of cash flow data

CAFFYNS PLC (CFYN) CashFlowFlag INCOME STATEMENT

Fiscal year ends in March. GBP in thousands

except per share data. 2017-03 2016-03 2015-03

Revenue 100.00% 100.00% 100.00%