SingTel and StarHub: A Detailed Financial Analysis and WACC Report

VerifiedAdded on 2023/04/23

|17

|2725

|478

Report

AI Summary

This report provides a financial analysis of Singapore Telecommunications Limited (Singtel) and StarHub, focusing on the calculation and comparison of their Weighted Average Cost of Capital (WACC) over three years. It details the methodology used to calculate WACC, including the cost of equity ...

1

Financial Report

Financial Report

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Contents

Introduction......................................................................................................................................3

Calculation of Weighted Average cost of capital............................................................................3

Brief Analysis of WACC and Judgments made to calculate the WACC........................................7

Gearing Ratios of SingTel and StarHub..........................................................................................7

Recommendation and Conclusion...................................................................................................9

Reflection.........................................................................................................................................9

References......................................................................................................................................11

Appendix........................................................................................................................................12

Contents

Introduction......................................................................................................................................3

Calculation of Weighted Average cost of capital............................................................................3

Brief Analysis of WACC and Judgments made to calculate the WACC........................................7

Gearing Ratios of SingTel and StarHub..........................................................................................7

Recommendation and Conclusion...................................................................................................9

Reflection.........................................................................................................................................9

References......................................................................................................................................11

Appendix........................................................................................................................................12

3

Introduction

Weighted average cost of capital refers to the rate at which the firm cost of capital has

been financed. There is generally three type capital used by company to finance their capital and

these are equity capital, debt capital and preference share capital. Weighted average cost of

capital calculates cost of each capital and each category of capital is proportionately weighted.

The purpose of this report is calculate the weighted average cost of capital of Singapore

Telecommunication Limited (Singtel) through providing detailed judgment and calculations in

arriving the answer. In order to make comparison for having better understanding of WACC, it

has been decided to compare value of WACC of Singtel with Star Hub. In addition to WACC,

gearing ratios of both companies are also calculated to provide the brief overview of capital

structure of the Singtel. Recommendations have been given to the board of directors of Singtel to

improve their capital structure. It is followed by the reflection of overall work processed in this

report.

Singtel is the famous telecommunication based in Singapore and it has largest mobile

network operator in Singapore. Some of the important services of telecommunication provided

by Singtel are ISP (SingNet), mobile phone network known as Singtel Mobile and IPTV known

as Singtel TV. As per the information Singtel also owns market share outside its home country

through investing in the second largest Australia telecommunication company Optus and many

other telecommunication company. In Singapore, Singtel owned maximum market share as

compare any other telecommunication in Singapore (About US, 2019).

Starhub Limited is one of the three major telecommunication companies that are based in

Singapore. Starhub has received the license to operate in Singapore in year 1998 and it has

gained significant market in Singapore after its establishment. This company provides mobile

services, IPTV services, internet services and fixed landline services (StarHub: About Us, 2019).

This report is processed to calculate the WACC of SingNet and StarHub for last three

years so that comparison can be made. In addition to this gearing ratios of both the companies

have been calculated to review the capital structure of the company through analyzing it with

capital structure theory.

Calculation of Weighted Average cost of capital

In this section of this report weighted average of cost of capital has been calculated of

SingTel and StarHub for last three years. WACC is the rate of return or cost of total capital

employed by the company during the year. Companies mainly use three types of capitals to

finance their business. While making the calculation of weighted average cost capital all three

capital employed by the company are weighted proportionally and cost of each capital multiplied

by the weight of each capital to arrive at the weighted average cost of capital. Some of the major

sources of capital are common stock (equity capital), bonds, debentures, preference capital and

Introduction

Weighted average cost of capital refers to the rate at which the firm cost of capital has

been financed. There is generally three type capital used by company to finance their capital and

these are equity capital, debt capital and preference share capital. Weighted average cost of

capital calculates cost of each capital and each category of capital is proportionately weighted.

The purpose of this report is calculate the weighted average cost of capital of Singapore

Telecommunication Limited (Singtel) through providing detailed judgment and calculations in

arriving the answer. In order to make comparison for having better understanding of WACC, it

has been decided to compare value of WACC of Singtel with Star Hub. In addition to WACC,

gearing ratios of both companies are also calculated to provide the brief overview of capital

structure of the Singtel. Recommendations have been given to the board of directors of Singtel to

improve their capital structure. It is followed by the reflection of overall work processed in this

report.

Singtel is the famous telecommunication based in Singapore and it has largest mobile

network operator in Singapore. Some of the important services of telecommunication provided

by Singtel are ISP (SingNet), mobile phone network known as Singtel Mobile and IPTV known

as Singtel TV. As per the information Singtel also owns market share outside its home country

through investing in the second largest Australia telecommunication company Optus and many

other telecommunication company. In Singapore, Singtel owned maximum market share as

compare any other telecommunication in Singapore (About US, 2019).

Starhub Limited is one of the three major telecommunication companies that are based in

Singapore. Starhub has received the license to operate in Singapore in year 1998 and it has

gained significant market in Singapore after its establishment. This company provides mobile

services, IPTV services, internet services and fixed landline services (StarHub: About Us, 2019).

This report is processed to calculate the WACC of SingNet and StarHub for last three

years so that comparison can be made. In addition to this gearing ratios of both the companies

have been calculated to review the capital structure of the company through analyzing it with

capital structure theory.

Calculation of Weighted Average cost of capital

In this section of this report weighted average of cost of capital has been calculated of

SingTel and StarHub for last three years. WACC is the rate of return or cost of total capital

employed by the company during the year. Companies mainly use three types of capitals to

finance their business. While making the calculation of weighted average cost capital all three

capital employed by the company are weighted proportionally and cost of each capital multiplied

by the weight of each capital to arrive at the weighted average cost of capital. Some of the major

sources of capital are common stock (equity capital), bonds, debentures, preference capital and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

other long term debt. Weighted average cost of capital critically depends upon number of factors

such as risk free rate, market return, beta, interest rate tec. The WACC of the company increases

as the beta and required rate of return on equity capital increases. The increases in WACC

reflects increases overall risk and decrease in valuation of capital.

Formula of Weighted Cost of capital:

WACC = E

V * Re + D

V * Rd * (1-Tc) (Brigham & Michael, 2013)

Where:

E: Value of Equity capital (Market Value)

D: Market value or book value of debt capital

V: (E+D) Sum of equity and debt capital employed by the company in the respective year

E/V: Proportion of equity capital in the capital structure of company

D/V: Proportion of Debt capital in the capital structure of the company

Re: Rate of cost of Equity capital

Rd: Rate of cost of Debt capital

Tc: Tax rate

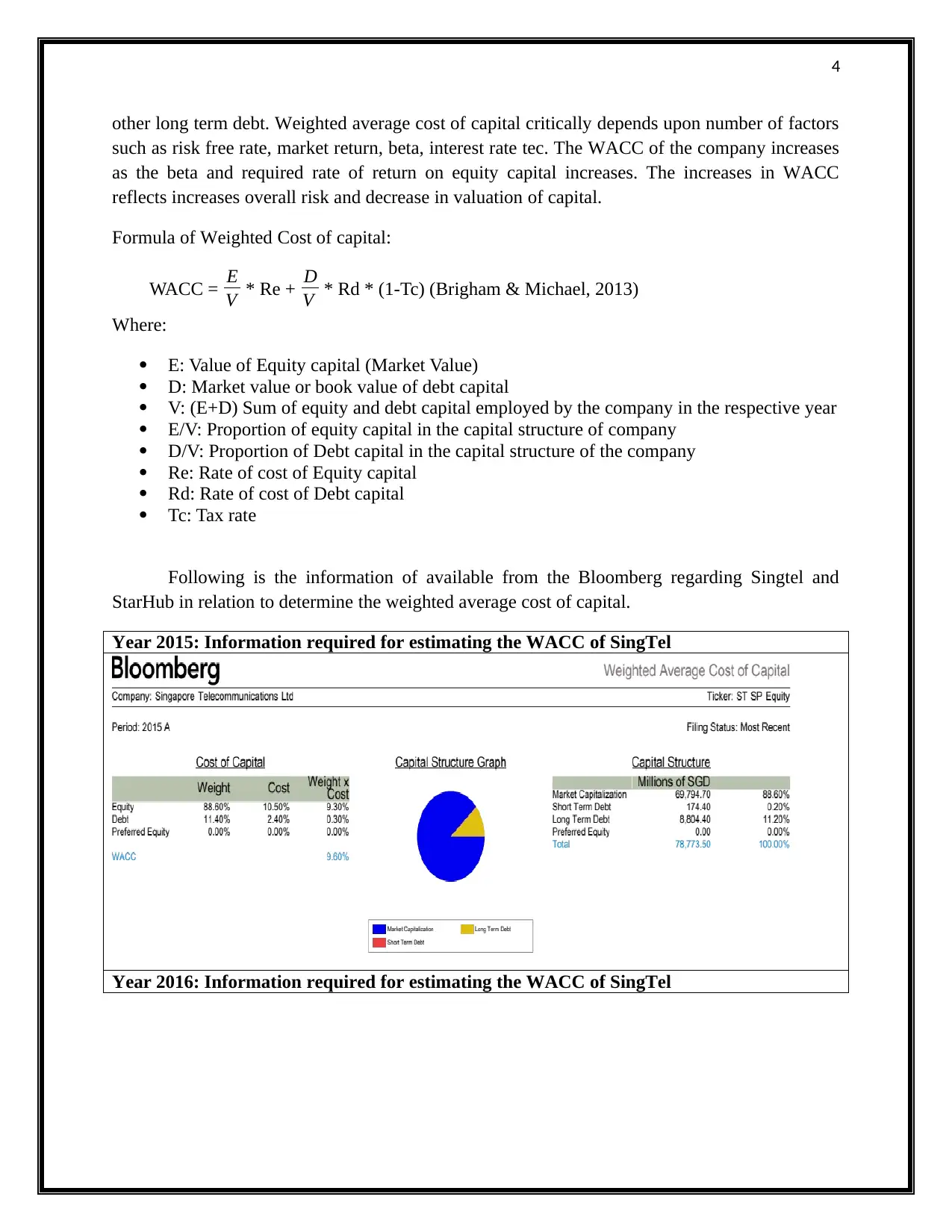

Following is the information of available from the Bloomberg regarding Singtel and

StarHub in relation to determine the weighted average cost of capital.

Year 2015: Information required for estimating the WACC of SingTel

Year 2016: Information required for estimating the WACC of SingTel

other long term debt. Weighted average cost of capital critically depends upon number of factors

such as risk free rate, market return, beta, interest rate tec. The WACC of the company increases

as the beta and required rate of return on equity capital increases. The increases in WACC

reflects increases overall risk and decrease in valuation of capital.

Formula of Weighted Cost of capital:

WACC = E

V * Re + D

V * Rd * (1-Tc) (Brigham & Michael, 2013)

Where:

E: Value of Equity capital (Market Value)

D: Market value or book value of debt capital

V: (E+D) Sum of equity and debt capital employed by the company in the respective year

E/V: Proportion of equity capital in the capital structure of company

D/V: Proportion of Debt capital in the capital structure of the company

Re: Rate of cost of Equity capital

Rd: Rate of cost of Debt capital

Tc: Tax rate

Following is the information of available from the Bloomberg regarding Singtel and

StarHub in relation to determine the weighted average cost of capital.

Year 2015: Information required for estimating the WACC of SingTel

Year 2016: Information required for estimating the WACC of SingTel

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

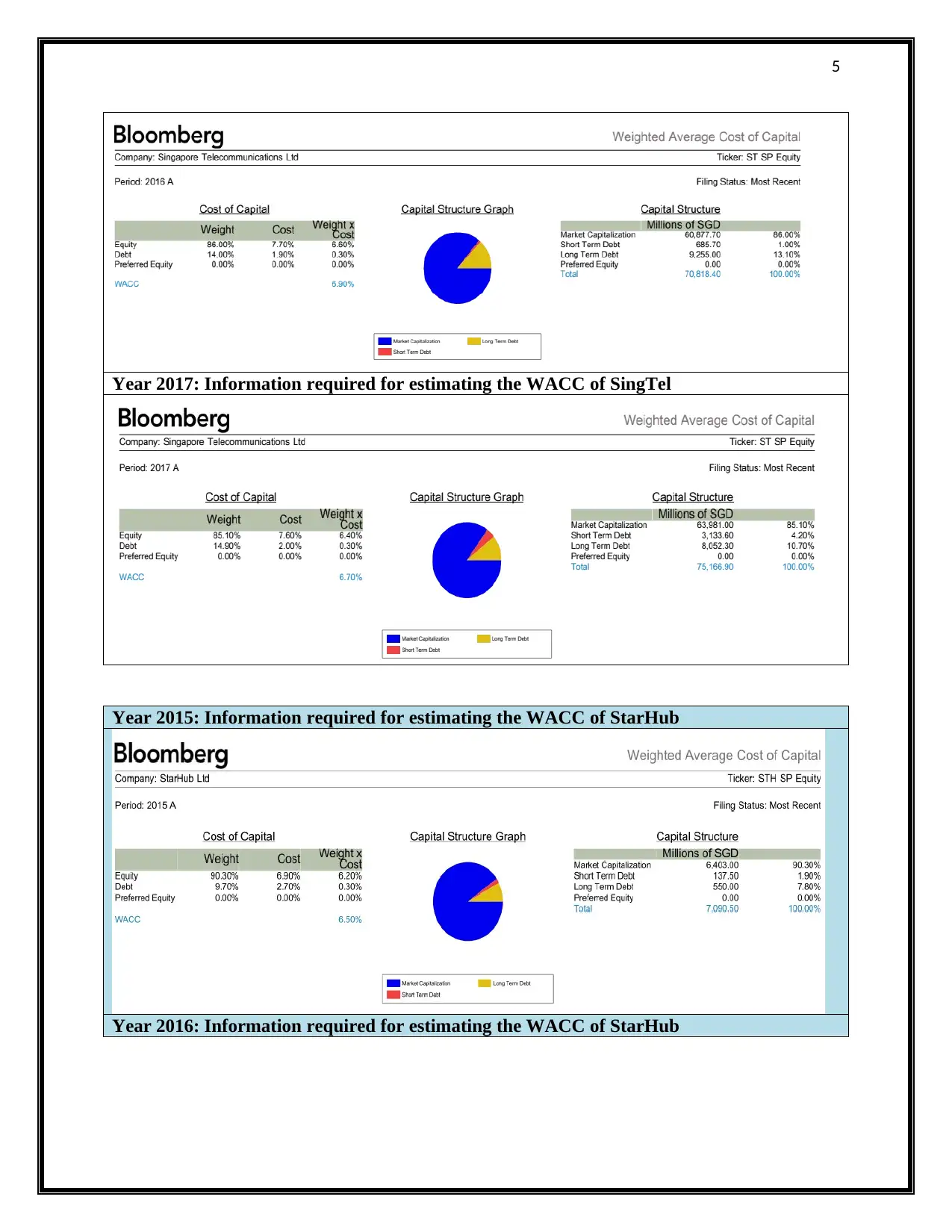

Year 2017: Information required for estimating the WACC of SingTel

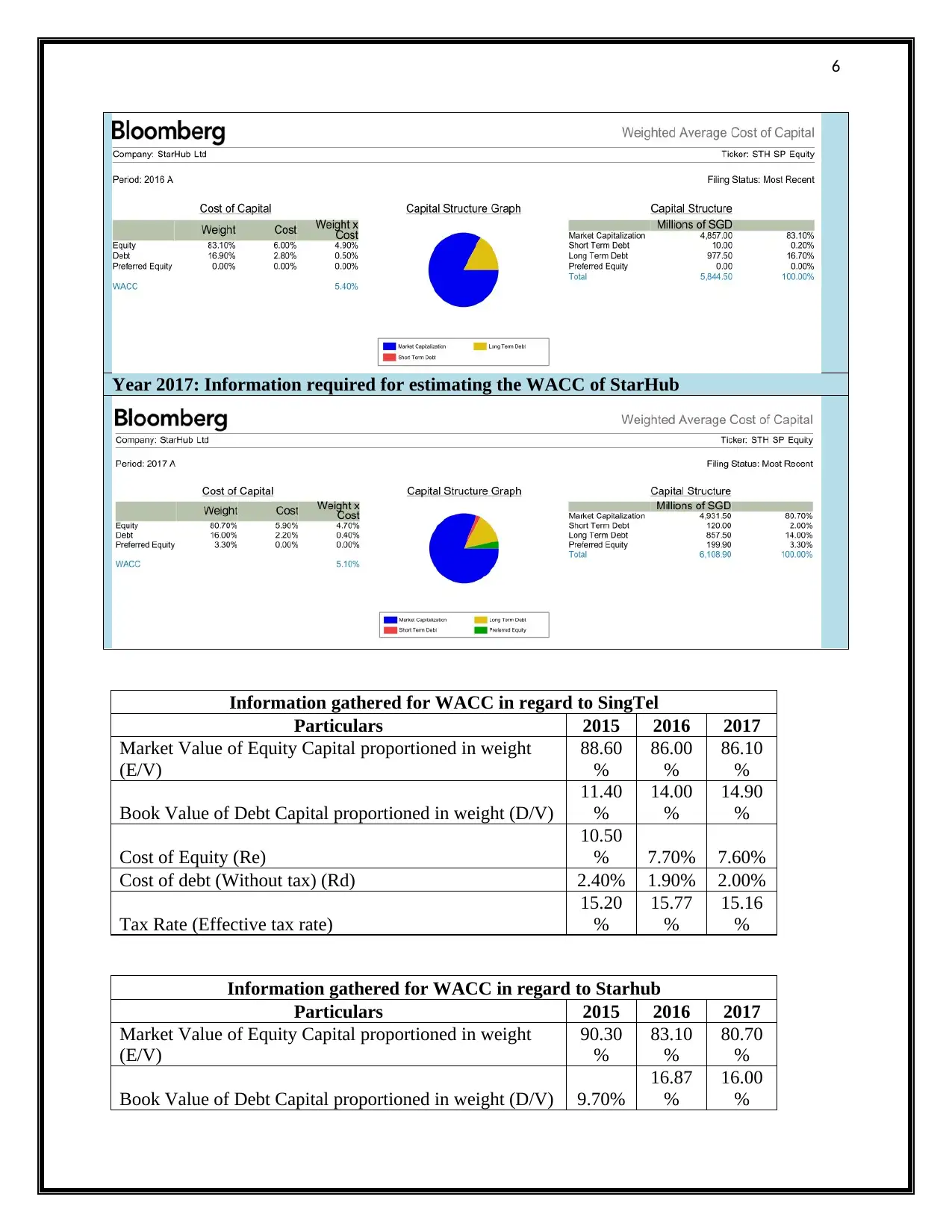

Year 2015: Information required for estimating the WACC of StarHub

Year 2016: Information required for estimating the WACC of StarHub

Year 2017: Information required for estimating the WACC of SingTel

Year 2015: Information required for estimating the WACC of StarHub

Year 2016: Information required for estimating the WACC of StarHub

6

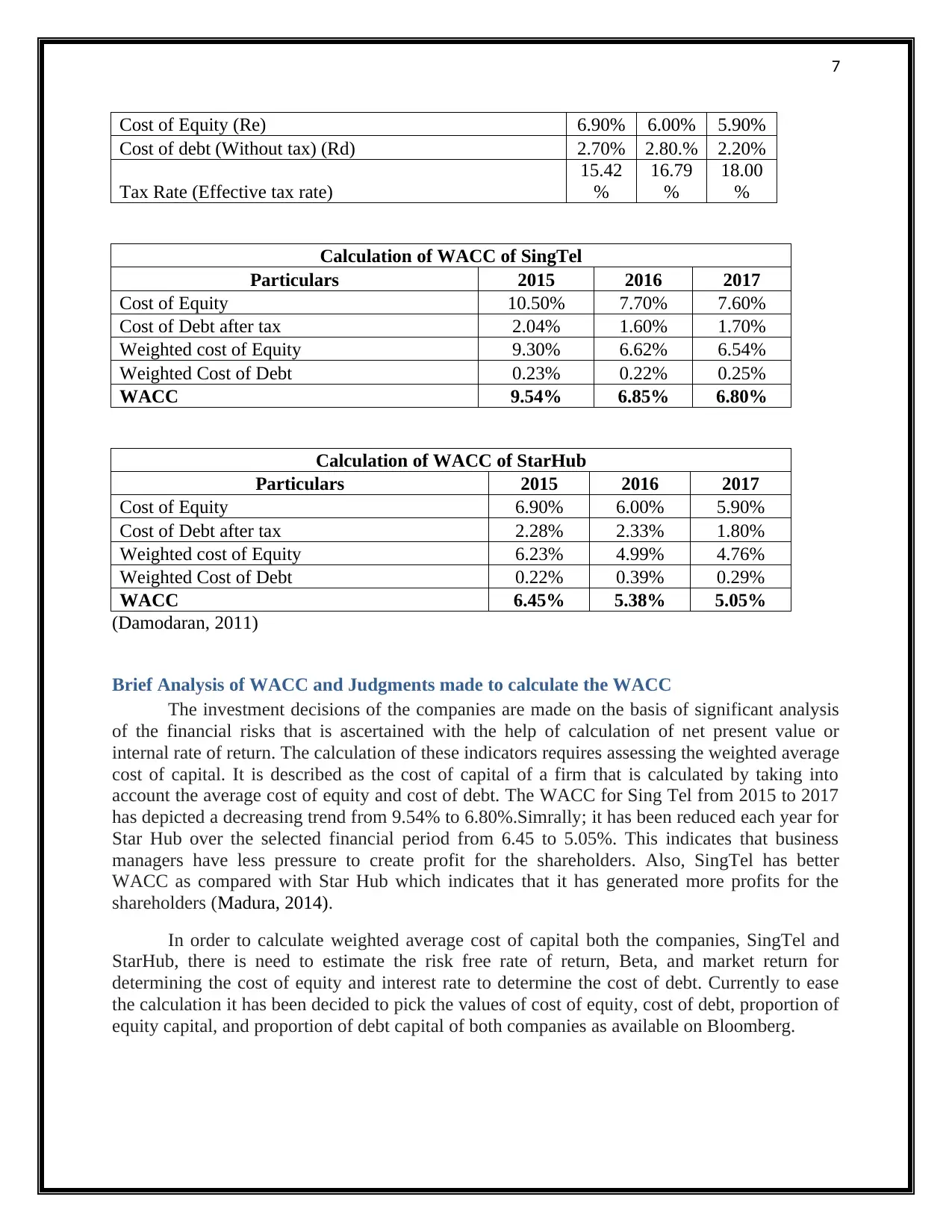

Year 2017: Information required for estimating the WACC of StarHub

Information gathered for WACC in regard to SingTel

Particulars 2015 2016 2017

Market Value of Equity Capital proportioned in weight

(E/V)

88.60

%

86.00

%

86.10

%

Book Value of Debt Capital proportioned in weight (D/V)

11.40

%

14.00

%

14.90

%

Cost of Equity (Re)

10.50

% 7.70% 7.60%

Cost of debt (Without tax) (Rd) 2.40% 1.90% 2.00%

Tax Rate (Effective tax rate)

15.20

%

15.77

%

15.16

%

Information gathered for WACC in regard to Starhub

Particulars 2015 2016 2017

Market Value of Equity Capital proportioned in weight

(E/V)

90.30

%

83.10

%

80.70

%

Book Value of Debt Capital proportioned in weight (D/V) 9.70%

16.87

%

16.00

%

Year 2017: Information required for estimating the WACC of StarHub

Information gathered for WACC in regard to SingTel

Particulars 2015 2016 2017

Market Value of Equity Capital proportioned in weight

(E/V)

88.60

%

86.00

%

86.10

%

Book Value of Debt Capital proportioned in weight (D/V)

11.40

%

14.00

%

14.90

%

Cost of Equity (Re)

10.50

% 7.70% 7.60%

Cost of debt (Without tax) (Rd) 2.40% 1.90% 2.00%

Tax Rate (Effective tax rate)

15.20

%

15.77

%

15.16

%

Information gathered for WACC in regard to Starhub

Particulars 2015 2016 2017

Market Value of Equity Capital proportioned in weight

(E/V)

90.30

%

83.10

%

80.70

%

Book Value of Debt Capital proportioned in weight (D/V) 9.70%

16.87

%

16.00

%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

Cost of Equity (Re) 6.90% 6.00% 5.90%

Cost of debt (Without tax) (Rd) 2.70% 2.80.% 2.20%

Tax Rate (Effective tax rate)

15.42

%

16.79

%

18.00

%

Calculation of WACC of SingTel

Particulars 2015 2016 2017

Cost of Equity 10.50% 7.70% 7.60%

Cost of Debt after tax 2.04% 1.60% 1.70%

Weighted cost of Equity 9.30% 6.62% 6.54%

Weighted Cost of Debt 0.23% 0.22% 0.25%

WACC 9.54% 6.85% 6.80%

Calculation of WACC of StarHub

Particulars 2015 2016 2017

Cost of Equity 6.90% 6.00% 5.90%

Cost of Debt after tax 2.28% 2.33% 1.80%

Weighted cost of Equity 6.23% 4.99% 4.76%

Weighted Cost of Debt 0.22% 0.39% 0.29%

WACC 6.45% 5.38% 5.05%

(Damodaran, 2011)

Brief Analysis of WACC and Judgments made to calculate the WACC

The investment decisions of the companies are made on the basis of significant analysis

of the financial risks that is ascertained with the help of calculation of net present value or

internal rate of return. The calculation of these indicators requires assessing the weighted average

cost of capital. It is described as the cost of capital of a firm that is calculated by taking into

account the average cost of equity and cost of debt. The WACC for Sing Tel from 2015 to 2017

has depicted a decreasing trend from 9.54% to 6.80%.Simrally; it has been reduced each year for

Star Hub over the selected financial period from 6.45 to 5.05%. This indicates that business

managers have less pressure to create profit for the shareholders. Also, SingTel has better

WACC as compared with Star Hub which indicates that it has generated more profits for the

shareholders (Madura, 2014).

In order to calculate weighted average cost of capital both the companies, SingTel and

StarHub, there is need to estimate the risk free rate of return, Beta, and market return for

determining the cost of equity and interest rate to determine the cost of debt. Currently to ease

the calculation it has been decided to pick the values of cost of equity, cost of debt, proportion of

equity capital, and proportion of debt capital of both companies as available on Bloomberg.

Cost of Equity (Re) 6.90% 6.00% 5.90%

Cost of debt (Without tax) (Rd) 2.70% 2.80.% 2.20%

Tax Rate (Effective tax rate)

15.42

%

16.79

%

18.00

%

Calculation of WACC of SingTel

Particulars 2015 2016 2017

Cost of Equity 10.50% 7.70% 7.60%

Cost of Debt after tax 2.04% 1.60% 1.70%

Weighted cost of Equity 9.30% 6.62% 6.54%

Weighted Cost of Debt 0.23% 0.22% 0.25%

WACC 9.54% 6.85% 6.80%

Calculation of WACC of StarHub

Particulars 2015 2016 2017

Cost of Equity 6.90% 6.00% 5.90%

Cost of Debt after tax 2.28% 2.33% 1.80%

Weighted cost of Equity 6.23% 4.99% 4.76%

Weighted Cost of Debt 0.22% 0.39% 0.29%

WACC 6.45% 5.38% 5.05%

(Damodaran, 2011)

Brief Analysis of WACC and Judgments made to calculate the WACC

The investment decisions of the companies are made on the basis of significant analysis

of the financial risks that is ascertained with the help of calculation of net present value or

internal rate of return. The calculation of these indicators requires assessing the weighted average

cost of capital. It is described as the cost of capital of a firm that is calculated by taking into

account the average cost of equity and cost of debt. The WACC for Sing Tel from 2015 to 2017

has depicted a decreasing trend from 9.54% to 6.80%.Simrally; it has been reduced each year for

Star Hub over the selected financial period from 6.45 to 5.05%. This indicates that business

managers have less pressure to create profit for the shareholders. Also, SingTel has better

WACC as compared with Star Hub which indicates that it has generated more profits for the

shareholders (Madura, 2014).

In order to calculate weighted average cost of capital both the companies, SingTel and

StarHub, there is need to estimate the risk free rate of return, Beta, and market return for

determining the cost of equity and interest rate to determine the cost of debt. Currently to ease

the calculation it has been decided to pick the values of cost of equity, cost of debt, proportion of

equity capital, and proportion of debt capital of both companies as available on Bloomberg.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

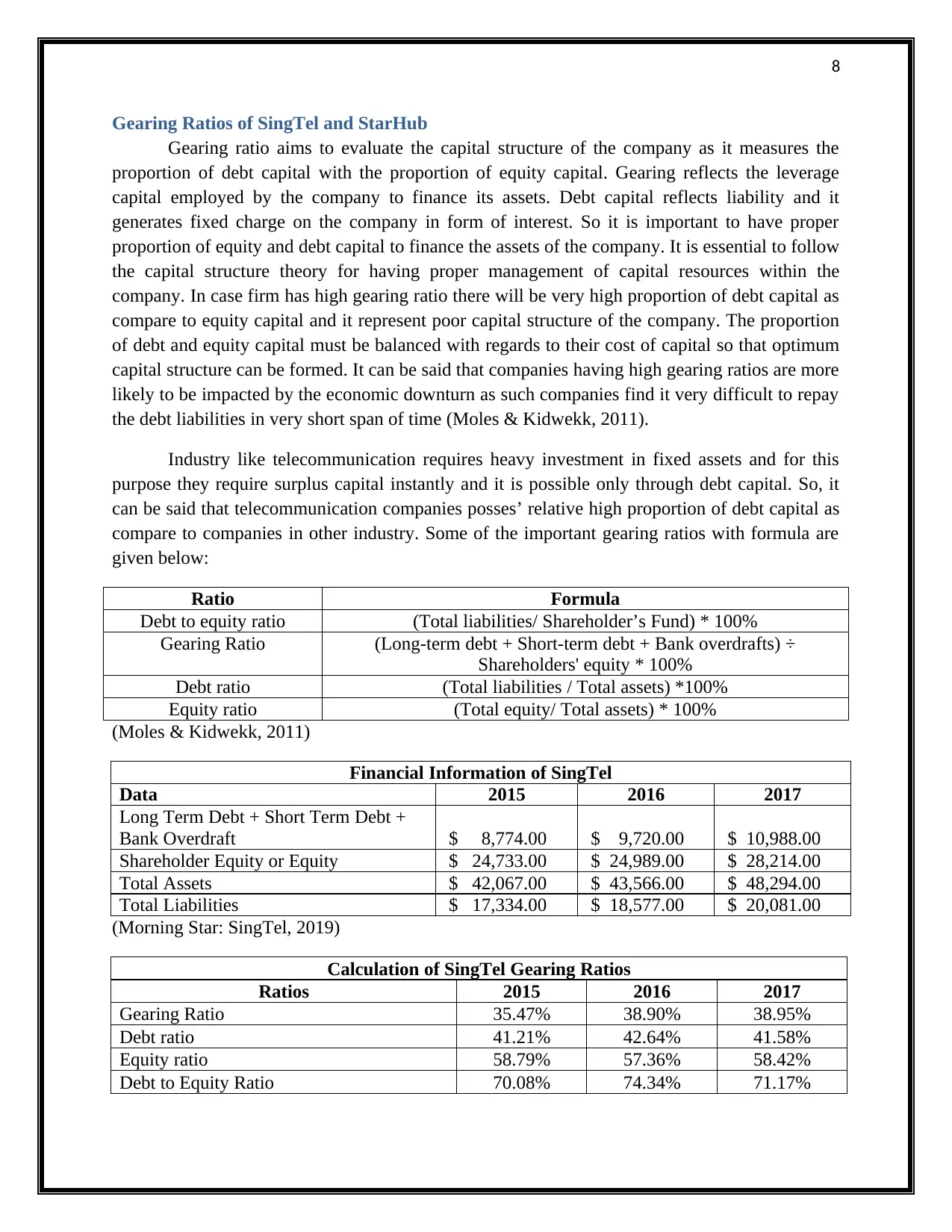

Gearing Ratios of SingTel and StarHub

Gearing ratio aims to evaluate the capital structure of the company as it measures the

proportion of debt capital with the proportion of equity capital. Gearing reflects the leverage

capital employed by the company to finance its assets. Debt capital reflects liability and it

generates fixed charge on the company in form of interest. So it is important to have proper

proportion of equity and debt capital to finance the assets of the company. It is essential to follow

the capital structure theory for having proper management of capital resources within the

company. In case firm has high gearing ratio there will be very high proportion of debt capital as

compare to equity capital and it represent poor capital structure of the company. The proportion

of debt and equity capital must be balanced with regards to their cost of capital so that optimum

capital structure can be formed. It can be said that companies having high gearing ratios are more

likely to be impacted by the economic downturn as such companies find it very difficult to repay

the debt liabilities in very short span of time (Moles & Kidwekk, 2011).

Industry like telecommunication requires heavy investment in fixed assets and for this

purpose they require surplus capital instantly and it is possible only through debt capital. So, it

can be said that telecommunication companies posses’ relative high proportion of debt capital as

compare to companies in other industry. Some of the important gearing ratios with formula are

given below:

Ratio Formula

Debt to equity ratio (Total liabilities/ Shareholder’s Fund) * 100%

Gearing Ratio (Long-term debt + Short-term debt + Bank overdrafts) ÷

Shareholders' equity * 100%

Debt ratio (Total liabilities / Total assets) *100%

Equity ratio (Total equity/ Total assets) * 100%

(Moles & Kidwekk, 2011)

Financial Information of SingTel

Data 2015 2016 2017

Long Term Debt + Short Term Debt +

Bank Overdraft $ 8,774.00 $ 9,720.00 $ 10,988.00

Shareholder Equity or Equity $ 24,733.00 $ 24,989.00 $ 28,214.00

Total Assets $ 42,067.00 $ 43,566.00 $ 48,294.00

Total Liabilities $ 17,334.00 $ 18,577.00 $ 20,081.00

(Morning Star: SingTel, 2019)

Calculation of SingTel Gearing Ratios

Ratios 2015 2016 2017

Gearing Ratio 35.47% 38.90% 38.95%

Debt ratio 41.21% 42.64% 41.58%

Equity ratio 58.79% 57.36% 58.42%

Debt to Equity Ratio 70.08% 74.34% 71.17%

Gearing Ratios of SingTel and StarHub

Gearing ratio aims to evaluate the capital structure of the company as it measures the

proportion of debt capital with the proportion of equity capital. Gearing reflects the leverage

capital employed by the company to finance its assets. Debt capital reflects liability and it

generates fixed charge on the company in form of interest. So it is important to have proper

proportion of equity and debt capital to finance the assets of the company. It is essential to follow

the capital structure theory for having proper management of capital resources within the

company. In case firm has high gearing ratio there will be very high proportion of debt capital as

compare to equity capital and it represent poor capital structure of the company. The proportion

of debt and equity capital must be balanced with regards to their cost of capital so that optimum

capital structure can be formed. It can be said that companies having high gearing ratios are more

likely to be impacted by the economic downturn as such companies find it very difficult to repay

the debt liabilities in very short span of time (Moles & Kidwekk, 2011).

Industry like telecommunication requires heavy investment in fixed assets and for this

purpose they require surplus capital instantly and it is possible only through debt capital. So, it

can be said that telecommunication companies posses’ relative high proportion of debt capital as

compare to companies in other industry. Some of the important gearing ratios with formula are

given below:

Ratio Formula

Debt to equity ratio (Total liabilities/ Shareholder’s Fund) * 100%

Gearing Ratio (Long-term debt + Short-term debt + Bank overdrafts) ÷

Shareholders' equity * 100%

Debt ratio (Total liabilities / Total assets) *100%

Equity ratio (Total equity/ Total assets) * 100%

(Moles & Kidwekk, 2011)

Financial Information of SingTel

Data 2015 2016 2017

Long Term Debt + Short Term Debt +

Bank Overdraft $ 8,774.00 $ 9,720.00 $ 10,988.00

Shareholder Equity or Equity $ 24,733.00 $ 24,989.00 $ 28,214.00

Total Assets $ 42,067.00 $ 43,566.00 $ 48,294.00

Total Liabilities $ 17,334.00 $ 18,577.00 $ 20,081.00

(Morning Star: SingTel, 2019)

Calculation of SingTel Gearing Ratios

Ratios 2015 2016 2017

Gearing Ratio 35.47% 38.90% 38.95%

Debt ratio 41.21% 42.64% 41.58%

Equity ratio 58.79% 57.36% 58.42%

Debt to Equity Ratio 70.08% 74.34% 71.17%

9

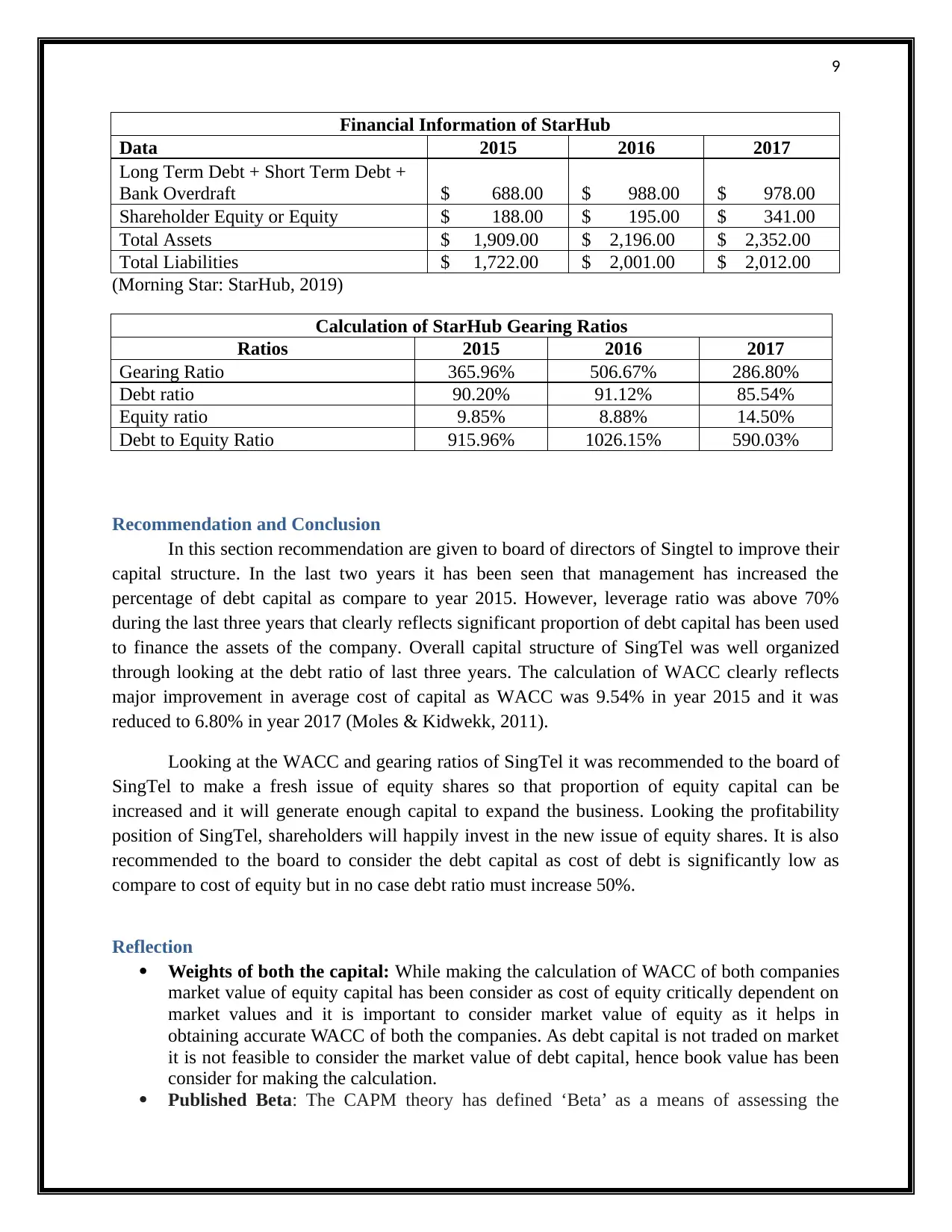

Financial Information of StarHub

Data 2015 2016 2017

Long Term Debt + Short Term Debt +

Bank Overdraft $ 688.00 $ 988.00 $ 978.00

Shareholder Equity or Equity $ 188.00 $ 195.00 $ 341.00

Total Assets $ 1,909.00 $ 2,196.00 $ 2,352.00

Total Liabilities $ 1,722.00 $ 2,001.00 $ 2,012.00

(Morning Star: StarHub, 2019)

Calculation of StarHub Gearing Ratios

Ratios 2015 2016 2017

Gearing Ratio 365.96% 506.67% 286.80%

Debt ratio 90.20% 91.12% 85.54%

Equity ratio 9.85% 8.88% 14.50%

Debt to Equity Ratio 915.96% 1026.15% 590.03%

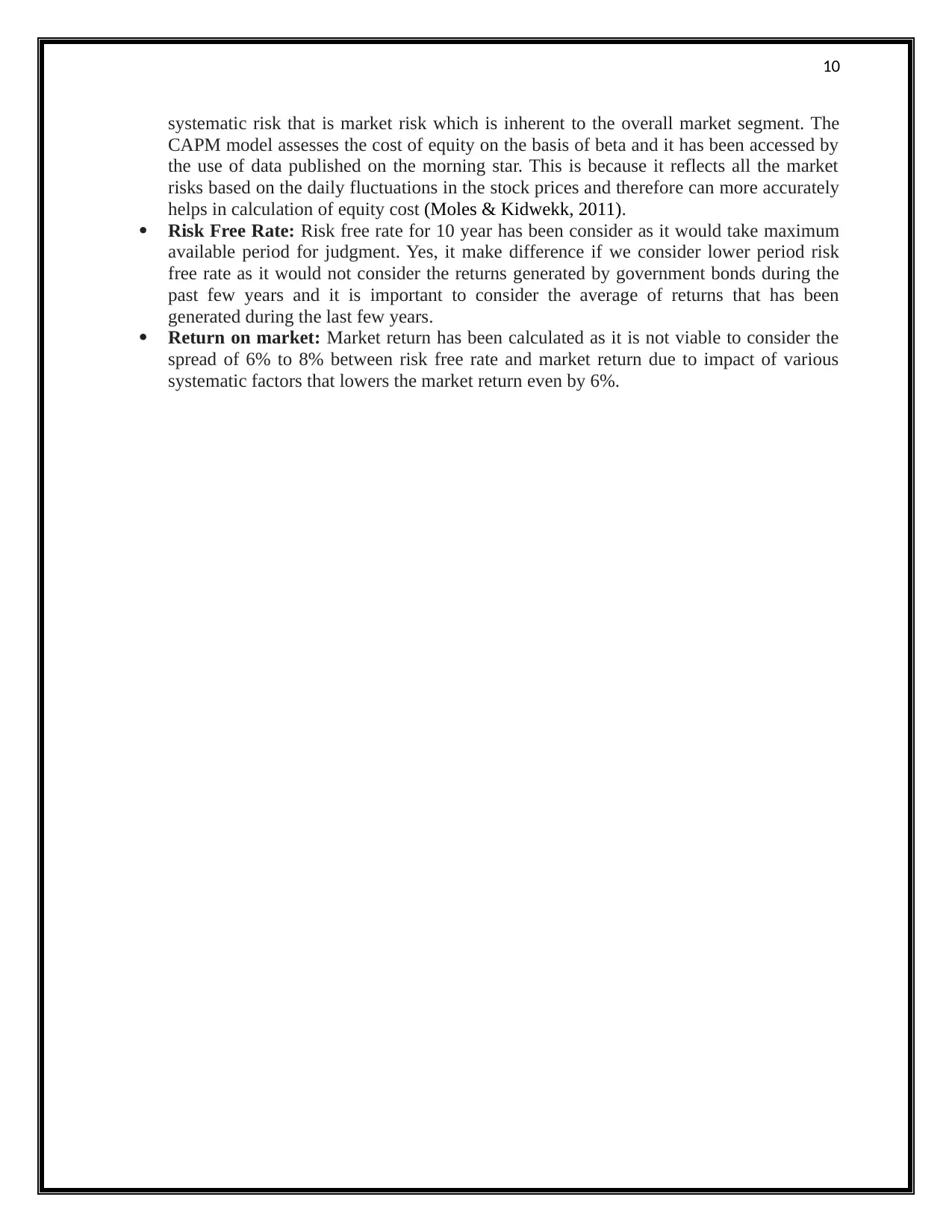

Recommendation and Conclusion

In this section recommendation are given to board of directors of Singtel to improve their

capital structure. In the last two years it has been seen that management has increased the

percentage of debt capital as compare to year 2015. However, leverage ratio was above 70%

during the last three years that clearly reflects significant proportion of debt capital has been used

to finance the assets of the company. Overall capital structure of SingTel was well organized

through looking at the debt ratio of last three years. The calculation of WACC clearly reflects

major improvement in average cost of capital as WACC was 9.54% in year 2015 and it was

reduced to 6.80% in year 2017 (Moles & Kidwekk, 2011).

Looking at the WACC and gearing ratios of SingTel it was recommended to the board of

SingTel to make a fresh issue of equity shares so that proportion of equity capital can be

increased and it will generate enough capital to expand the business. Looking the profitability

position of SingTel, shareholders will happily invest in the new issue of equity shares. It is also

recommended to the board to consider the debt capital as cost of debt is significantly low as

compare to cost of equity but in no case debt ratio must increase 50%.

Reflection

Weights of both the capital: While making the calculation of WACC of both companies

market value of equity capital has been consider as cost of equity critically dependent on

market values and it is important to consider market value of equity as it helps in

obtaining accurate WACC of both the companies. As debt capital is not traded on market

it is not feasible to consider the market value of debt capital, hence book value has been

consider for making the calculation.

Published Beta: The CAPM theory has defined ‘Beta’ as a means of assessing the

Financial Information of StarHub

Data 2015 2016 2017

Long Term Debt + Short Term Debt +

Bank Overdraft $ 688.00 $ 988.00 $ 978.00

Shareholder Equity or Equity $ 188.00 $ 195.00 $ 341.00

Total Assets $ 1,909.00 $ 2,196.00 $ 2,352.00

Total Liabilities $ 1,722.00 $ 2,001.00 $ 2,012.00

(Morning Star: StarHub, 2019)

Calculation of StarHub Gearing Ratios

Ratios 2015 2016 2017

Gearing Ratio 365.96% 506.67% 286.80%

Debt ratio 90.20% 91.12% 85.54%

Equity ratio 9.85% 8.88% 14.50%

Debt to Equity Ratio 915.96% 1026.15% 590.03%

Recommendation and Conclusion

In this section recommendation are given to board of directors of Singtel to improve their

capital structure. In the last two years it has been seen that management has increased the

percentage of debt capital as compare to year 2015. However, leverage ratio was above 70%

during the last three years that clearly reflects significant proportion of debt capital has been used

to finance the assets of the company. Overall capital structure of SingTel was well organized

through looking at the debt ratio of last three years. The calculation of WACC clearly reflects

major improvement in average cost of capital as WACC was 9.54% in year 2015 and it was

reduced to 6.80% in year 2017 (Moles & Kidwekk, 2011).

Looking at the WACC and gearing ratios of SingTel it was recommended to the board of

SingTel to make a fresh issue of equity shares so that proportion of equity capital can be

increased and it will generate enough capital to expand the business. Looking the profitability

position of SingTel, shareholders will happily invest in the new issue of equity shares. It is also

recommended to the board to consider the debt capital as cost of debt is significantly low as

compare to cost of equity but in no case debt ratio must increase 50%.

Reflection

Weights of both the capital: While making the calculation of WACC of both companies

market value of equity capital has been consider as cost of equity critically dependent on

market values and it is important to consider market value of equity as it helps in

obtaining accurate WACC of both the companies. As debt capital is not traded on market

it is not feasible to consider the market value of debt capital, hence book value has been

consider for making the calculation.

Published Beta: The CAPM theory has defined ‘Beta’ as a means of assessing the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

systematic risk that is market risk which is inherent to the overall market segment. The

CAPM model assesses the cost of equity on the basis of beta and it has been accessed by

the use of data published on the morning star. This is because it reflects all the market

risks based on the daily fluctuations in the stock prices and therefore can more accurately

helps in calculation of equity cost (Moles & Kidwekk, 2011).

Risk Free Rate: Risk free rate for 10 year has been consider as it would take maximum

available period for judgment. Yes, it make difference if we consider lower period risk

free rate as it would not consider the returns generated by government bonds during the

past few years and it is important to consider the average of returns that has been

generated during the last few years.

Return on market: Market return has been calculated as it is not viable to consider the

spread of 6% to 8% between risk free rate and market return due to impact of various

systematic factors that lowers the market return even by 6%.

systematic risk that is market risk which is inherent to the overall market segment. The

CAPM model assesses the cost of equity on the basis of beta and it has been accessed by

the use of data published on the morning star. This is because it reflects all the market

risks based on the daily fluctuations in the stock prices and therefore can more accurately

helps in calculation of equity cost (Moles & Kidwekk, 2011).

Risk Free Rate: Risk free rate for 10 year has been consider as it would take maximum

available period for judgment. Yes, it make difference if we consider lower period risk

free rate as it would not consider the returns generated by government bonds during the

past few years and it is important to consider the average of returns that has been

generated during the last few years.

Return on market: Market return has been calculated as it is not viable to consider the

spread of 6% to 8% between risk free rate and market return due to impact of various

systematic factors that lowers the market return even by 6%.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

References

About US. 2019. SingTel. Retrieved on January 19, 2019, from https://www.singtel.com/about-

us

Brigham, F., & Michael C. 2013. Financial management: Theory & practice. Cengage Learning.

Damodaran, A, 2011. Applied corporate finance. John Wiley & sons.

Madura, J. 2014. Financial Markets and Institutions. Cengage Learning.

Moles, P. & Kidwekk, D. 2011. Corporate finance. John Wiley &sons.

Morning Star: SingTel. 2019. StarHub Ltd CC3. Retrieved on January 19, 2019, from

http://financials.morningstar.com/balance-sheet/bs.html?t=Z74®ion=sgp&culture=en-

US

Morning Star: StarHub. 2019. StarHub Ltd CC3. Retrieved on January 19, 2019, from

http://financials.morningstar.com/balance-sheet/bs.html?

t=CC3®ion=sgp&culture=en-US

StarHub: About Us. 2019. About StarHub. Retrieved on January 19, 2019, from

http://www.starhub.com/about-us.html

References

About US. 2019. SingTel. Retrieved on January 19, 2019, from https://www.singtel.com/about-

us

Brigham, F., & Michael C. 2013. Financial management: Theory & practice. Cengage Learning.

Damodaran, A, 2011. Applied corporate finance. John Wiley & sons.

Madura, J. 2014. Financial Markets and Institutions. Cengage Learning.

Moles, P. & Kidwekk, D. 2011. Corporate finance. John Wiley &sons.

Morning Star: SingTel. 2019. StarHub Ltd CC3. Retrieved on January 19, 2019, from

http://financials.morningstar.com/balance-sheet/bs.html?t=Z74®ion=sgp&culture=en-

US

Morning Star: StarHub. 2019. StarHub Ltd CC3. Retrieved on January 19, 2019, from

http://financials.morningstar.com/balance-sheet/bs.html?

t=CC3®ion=sgp&culture=en-US

StarHub: About Us. 2019. About StarHub. Retrieved on January 19, 2019, from

http://www.starhub.com/about-us.html

12

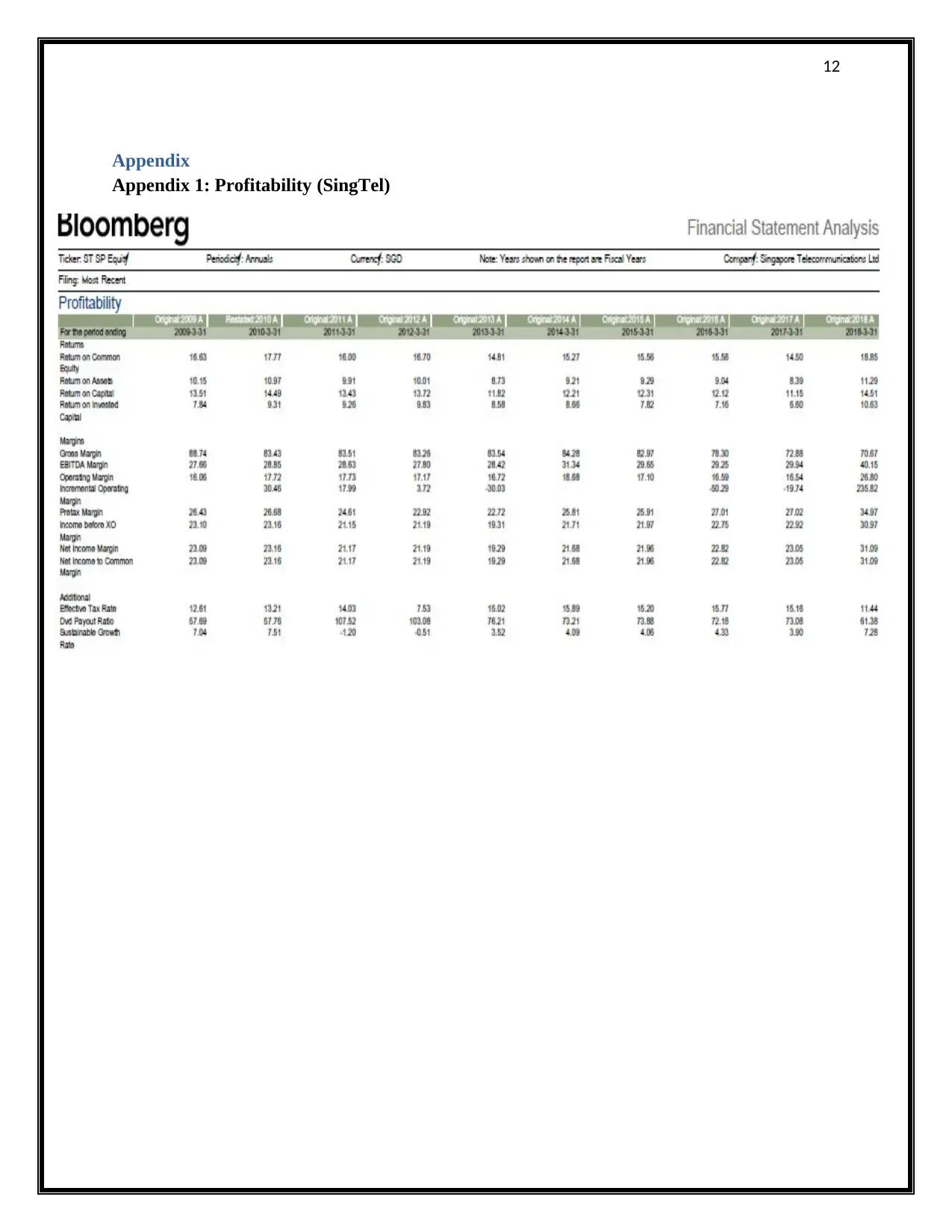

Appendix

Appendix 1: Profitability (SingTel)

Appendix

Appendix 1: Profitability (SingTel)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

13

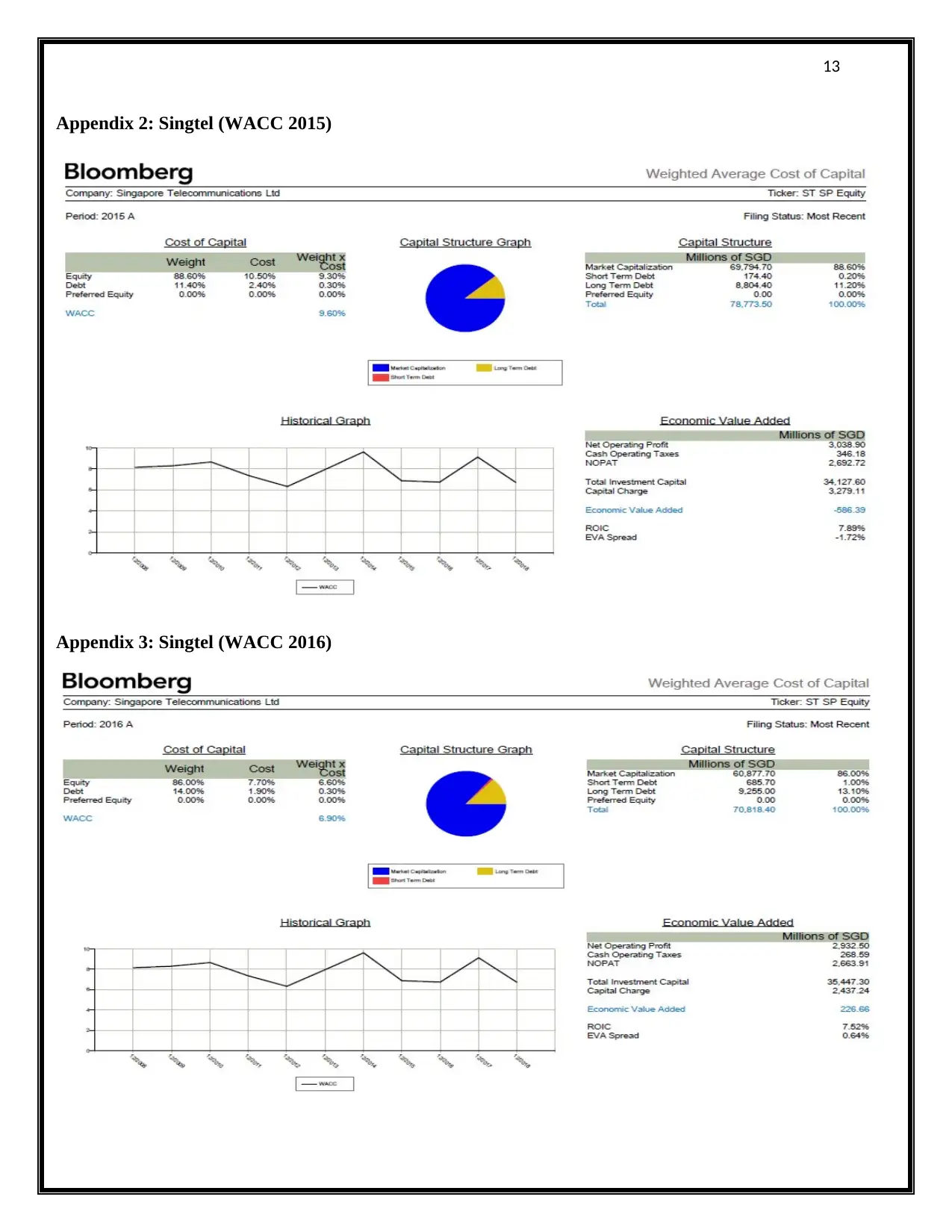

Appendix 2: Singtel (WACC 2015)

Appendix 3: Singtel (WACC 2016)

Appendix 2: Singtel (WACC 2015)

Appendix 3: Singtel (WACC 2016)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

14

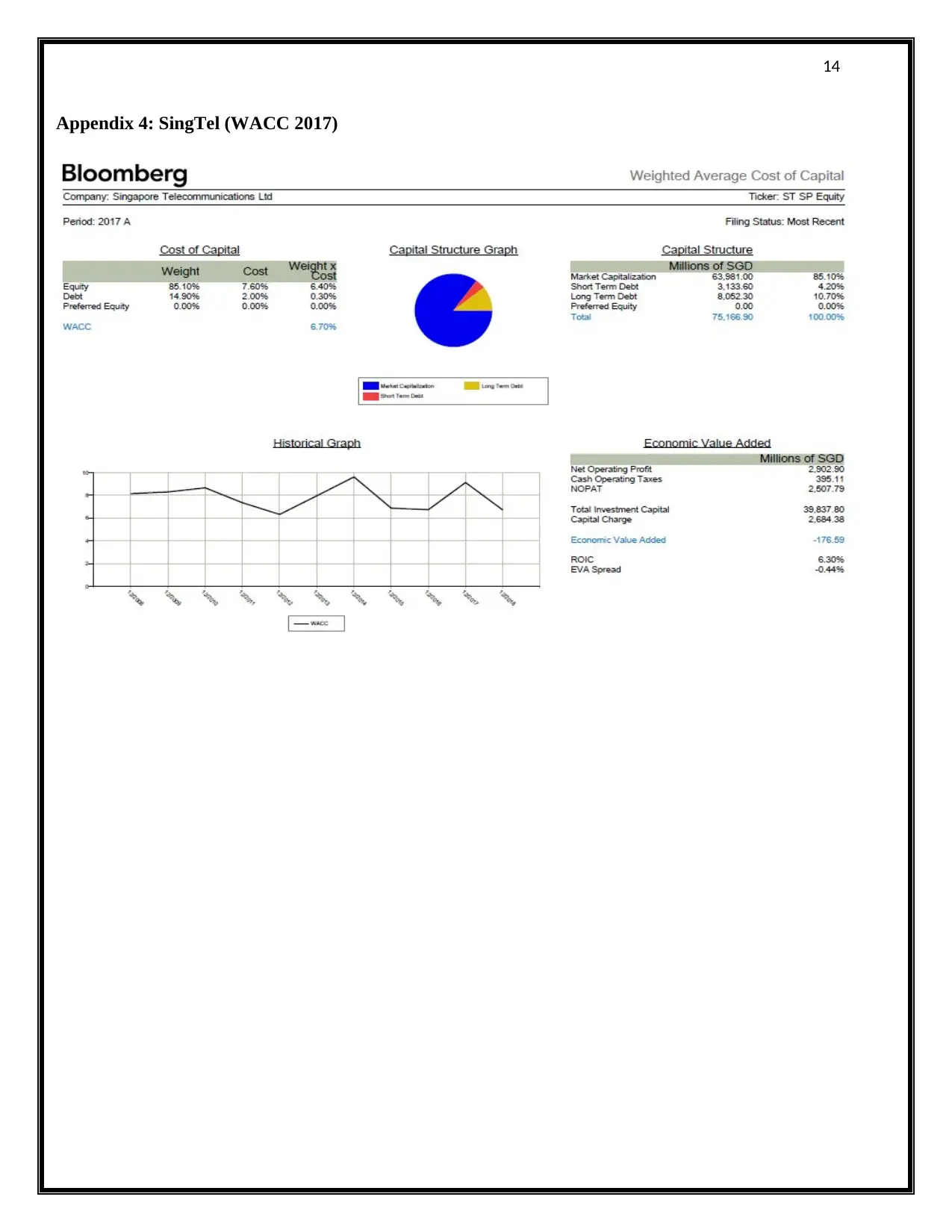

Appendix 4: SingTel (WACC 2017)

Appendix 4: SingTel (WACC 2017)

15

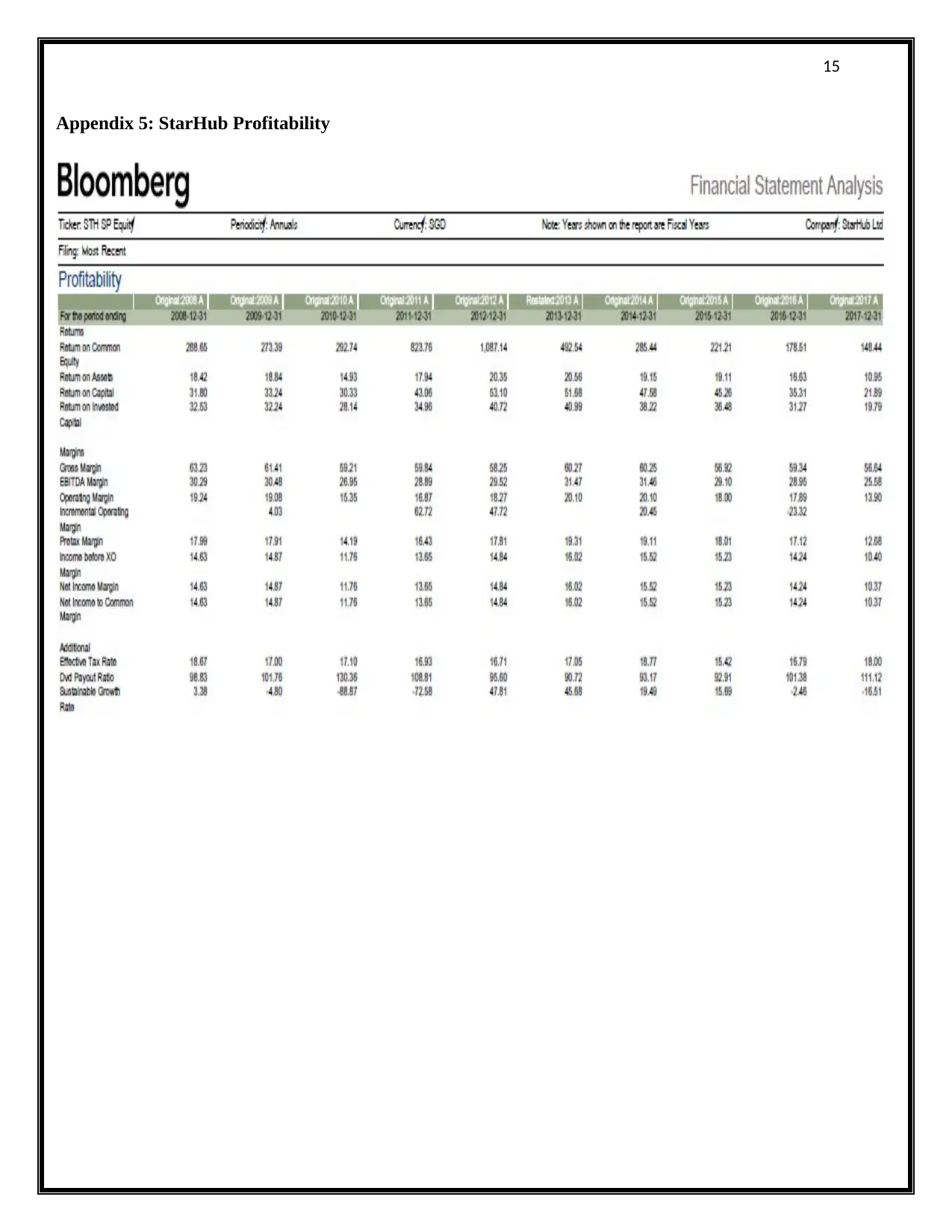

Appendix 5: StarHub Profitability

Appendix 5: StarHub Profitability

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

16

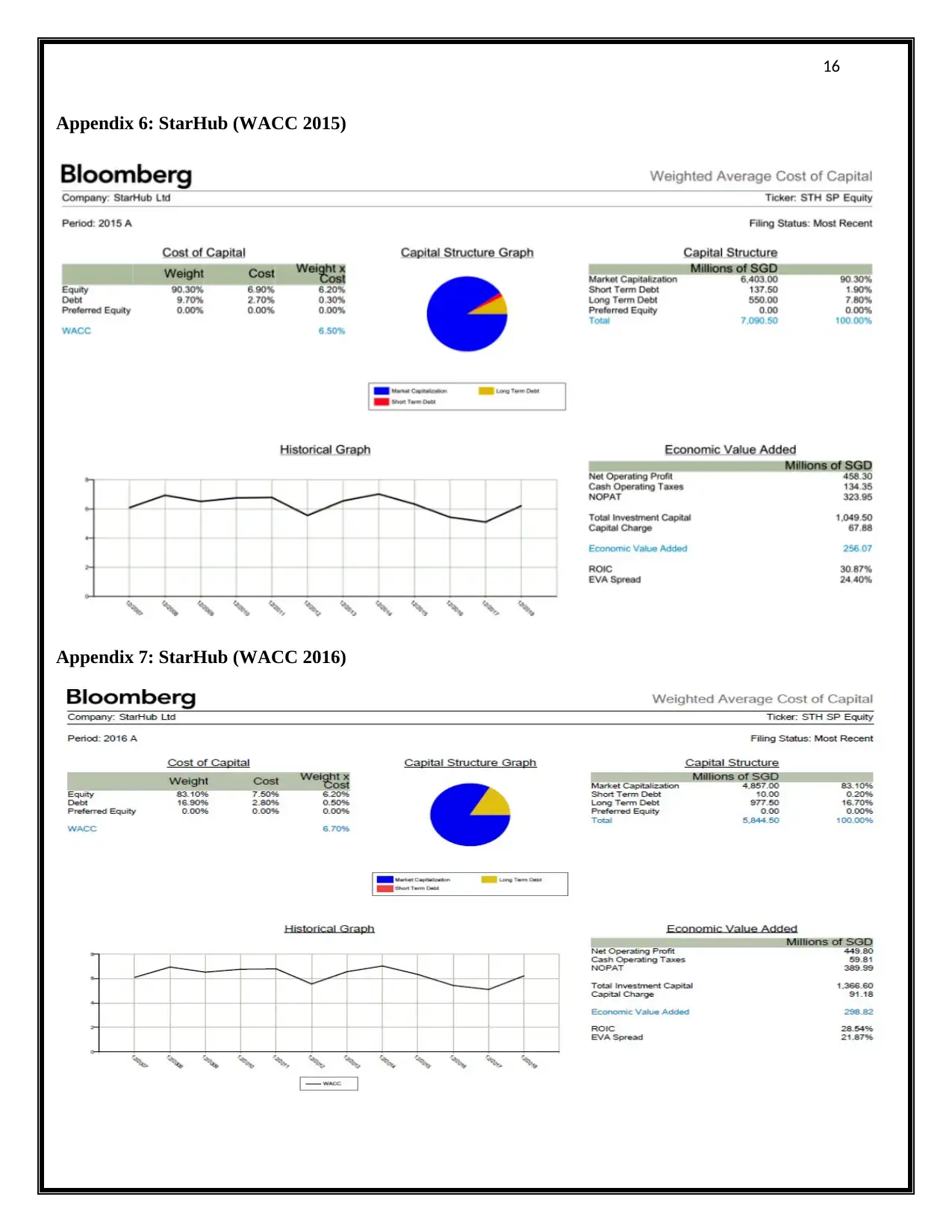

Appendix 6: StarHub (WACC 2015)

Appendix 7: StarHub (WACC 2016)

Appendix 6: StarHub (WACC 2015)

Appendix 7: StarHub (WACC 2016)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

17

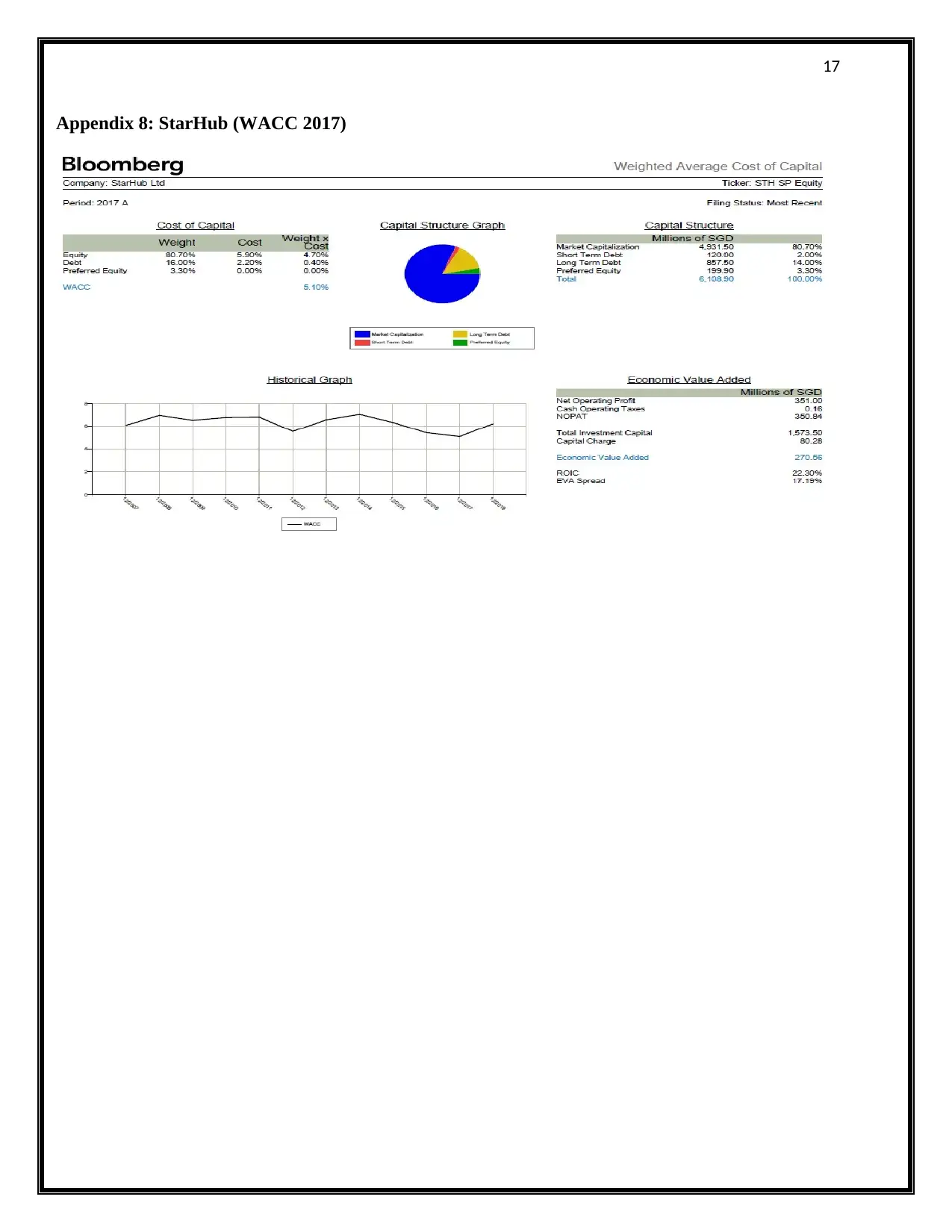

Appendix 8: StarHub (WACC 2017)

Appendix 8: StarHub (WACC 2017)

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.