Managerial Accounting Report: Costing Methods Analysis

VerifiedAdded on 2023/04/23

|16

|2574

|281

Report

AI Summary

This report provides a comprehensive analysis of managerial accounting, focusing on two primary costing methods: traditional costing and activity-based costing (ABC). It begins with an introduction to both methods, highlighting their differences in accuracy and complexity, with the traditional method being simpler but less accurate. The report then details the calculation of cost per unit using both methods, presenting the results in tabular form and comparing the outcomes. It includes profit and loss statements under both costing systems and explores the reasons behind the overseas buyer's preference for the advanced model. The report also examines the concepts of over and under absorption costs, including the ways these costs are treated in accounting. The report concludes with a discussion on the merits of accurate product pricing and the importance of selecting appropriate costing methods for informed decision-making. The report is based on an assignment brief from ACC200 and addresses the specific challenges faced by Fantori Ltd, a sewing machine manufacturer, in its costing practices and buyer interactions.

MANAGERIAL ACCOUNTING 1

MANAGERIAL

ACCOUNTING

MANAGERIAL

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGERIAL ACCOUNTING 2

Contents

Introduction:...............................................................................................................................3

Calculation per unit using Traditional costing method:.............................................................3

Calculation per unit using ABC costing method:......................................................................4

Profit and Loss statement under Traditional costing method:...................................................6

Profit and Loss statement under ABC costing method:.............................................................6

Over and under absorption costs:...............................................................................................8

Ways of treating the over or under absorption:..........................................................................8

Treatment of over or under applied overheads:.........................................................................9

Conclusion:...............................................................................................................................9

References:...............................................................................................................................11

Contents

Introduction:...............................................................................................................................3

Calculation per unit using Traditional costing method:.............................................................3

Calculation per unit using ABC costing method:......................................................................4

Profit and Loss statement under Traditional costing method:...................................................6

Profit and Loss statement under ABC costing method:.............................................................6

Over and under absorption costs:...............................................................................................8

Ways of treating the over or under absorption:..........................................................................8

Treatment of over or under applied overheads:.........................................................................9

Conclusion:...............................................................................................................................9

References:...............................................................................................................................11

MANAGERIAL ACCOUNTING 3

Introduction:

In the field of accounting, there are mainly 2 methods of calculating the costs, the traditional

costing method being the first and the activity based costing method being the second. These

are the methods of the allocation of the indirect costs.

Both of these methods are used for the purposes of estimation of the overhead costs which are

related with production and then these are the costs that are assigned to the products using

some rate of the cost driver. The difference between these 2 methods is the accuracy and the

complexity which is employed when employing these methods. The traditional method of

costing is the method which is way simpler and is also considered to be less accurate when

compared with the activity based costing method. This is the method which assigns in these

costs of the overheads to the products and is based upon the arbitrary average rate. The

method of ABC is more complex and is also more accurate when compared with the

traditional method of costing. The first method is the one which assigns all of the indirect

costs to the various different activities and then goes on to assign in the costs to the products

which is based upon the usage of the various different activities of each one of the product.

The traditional costing method is the system wherein all of the indirect costs are applied to

the products which is based upon a pre-determined overhead rate. The method of ABC and

the traditional costing system helps in treating the overhead costs in one single pool of

indirect costs. The traditional costing method acts accurately when the indirect costs are

much low when compared with the direct costs. The following are the steps that are applied

when it comes to the allocation of the costs under the traditional costing method:

1. Identification of all of the indirect costs

2. Estimation of all of the indirect costs suing some appropriate period, usually a year,

quarter or a month

Introduction:

In the field of accounting, there are mainly 2 methods of calculating the costs, the traditional

costing method being the first and the activity based costing method being the second. These

are the methods of the allocation of the indirect costs.

Both of these methods are used for the purposes of estimation of the overhead costs which are

related with production and then these are the costs that are assigned to the products using

some rate of the cost driver. The difference between these 2 methods is the accuracy and the

complexity which is employed when employing these methods. The traditional method of

costing is the method which is way simpler and is also considered to be less accurate when

compared with the activity based costing method. This is the method which assigns in these

costs of the overheads to the products and is based upon the arbitrary average rate. The

method of ABC is more complex and is also more accurate when compared with the

traditional method of costing. The first method is the one which assigns all of the indirect

costs to the various different activities and then goes on to assign in the costs to the products

which is based upon the usage of the various different activities of each one of the product.

The traditional costing method is the system wherein all of the indirect costs are applied to

the products which is based upon a pre-determined overhead rate. The method of ABC and

the traditional costing system helps in treating the overhead costs in one single pool of

indirect costs. The traditional costing method acts accurately when the indirect costs are

much low when compared with the direct costs. The following are the steps that are applied

when it comes to the allocation of the costs under the traditional costing method:

1. Identification of all of the indirect costs

2. Estimation of all of the indirect costs suing some appropriate period, usually a year,

quarter or a month

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MANAGERIAL ACCOUNTING 4

3. Selecting the cost driver with one casual link to the cost such as the labour or the

machine hours

4. Estimation of the different amounts of the cost drivers for an appropriate period using

the labour hours for each quarter

5. Computation of the overhead rate

6. Application of these overheads to the products using a predetermined overhead rate.

The activity based costing system is much more accurate when compared with the traditional

costing system. This is due to the fact that this method provides a more precise breakdown of

all of the indirect costs. The activity based costing system is also complex and more costly

when it comes to implementation. The change from the traditional costing method to the

activity based costing method is very difficult (Wilkinson, 2019).

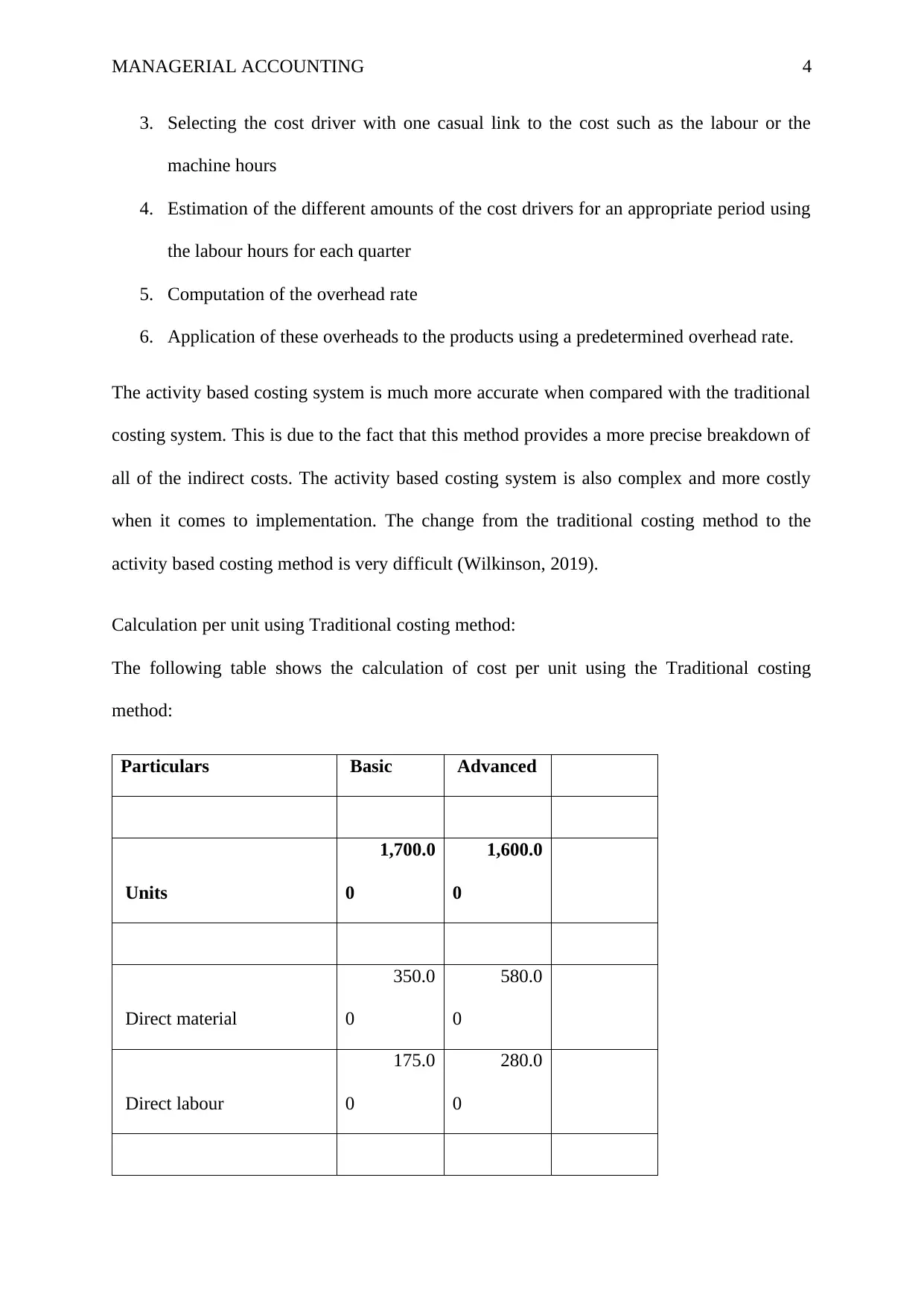

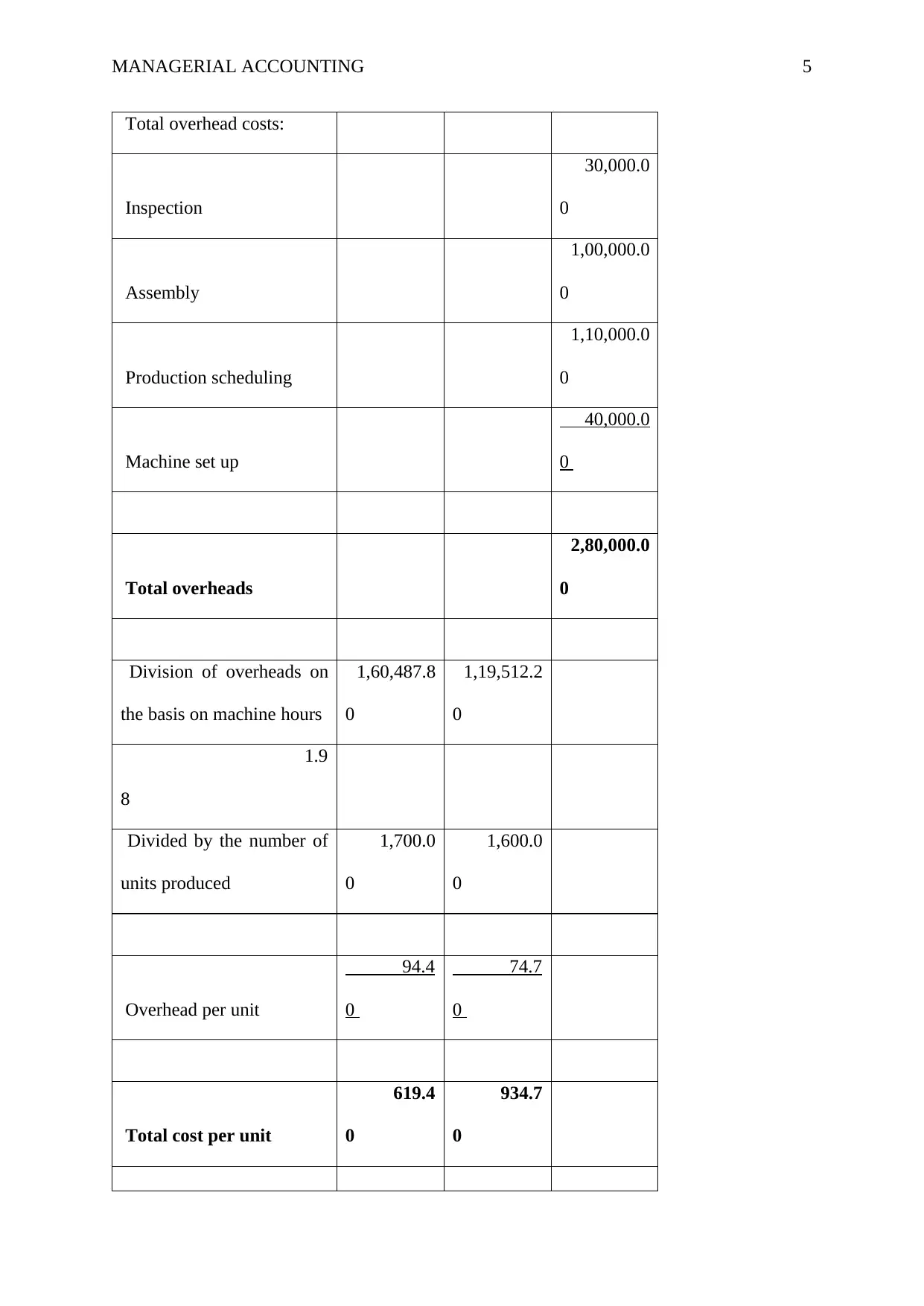

Calculation per unit using Traditional costing method:

The following table shows the calculation of cost per unit using the Traditional costing

method:

Particulars Basic Advanced

Units

1,700.0

0

1,600.0

0

Direct material

350.0

0

580.0

0

Direct labour

175.0

0

280.0

0

3. Selecting the cost driver with one casual link to the cost such as the labour or the

machine hours

4. Estimation of the different amounts of the cost drivers for an appropriate period using

the labour hours for each quarter

5. Computation of the overhead rate

6. Application of these overheads to the products using a predetermined overhead rate.

The activity based costing system is much more accurate when compared with the traditional

costing system. This is due to the fact that this method provides a more precise breakdown of

all of the indirect costs. The activity based costing system is also complex and more costly

when it comes to implementation. The change from the traditional costing method to the

activity based costing method is very difficult (Wilkinson, 2019).

Calculation per unit using Traditional costing method:

The following table shows the calculation of cost per unit using the Traditional costing

method:

Particulars Basic Advanced

Units

1,700.0

0

1,600.0

0

Direct material

350.0

0

580.0

0

Direct labour

175.0

0

280.0

0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGERIAL ACCOUNTING 5

Total overhead costs:

Inspection

30,000.0

0

Assembly

1,00,000.0

0

Production scheduling

1,10,000.0

0

Machine set up

40,000.0

0

Total overheads

2,80,000.0

0

Division of overheads on

the basis on machine hours

1,60,487.8

0

1,19,512.2

0

1.9

8

Divided by the number of

units produced

1,700.0

0

1,600.0

0

Overhead per unit

94.4

0

74.7

0

Total cost per unit

619.4

0

934.7

0

Total overhead costs:

Inspection

30,000.0

0

Assembly

1,00,000.0

0

Production scheduling

1,10,000.0

0

Machine set up

40,000.0

0

Total overheads

2,80,000.0

0

Division of overheads on

the basis on machine hours

1,60,487.8

0

1,19,512.2

0

1.9

8

Divided by the number of

units produced

1,700.0

0

1,600.0

0

Overhead per unit

94.4

0

74.7

0

Total cost per unit

619.4

0

934.7

0

MANAGERIAL ACCOUNTING 6

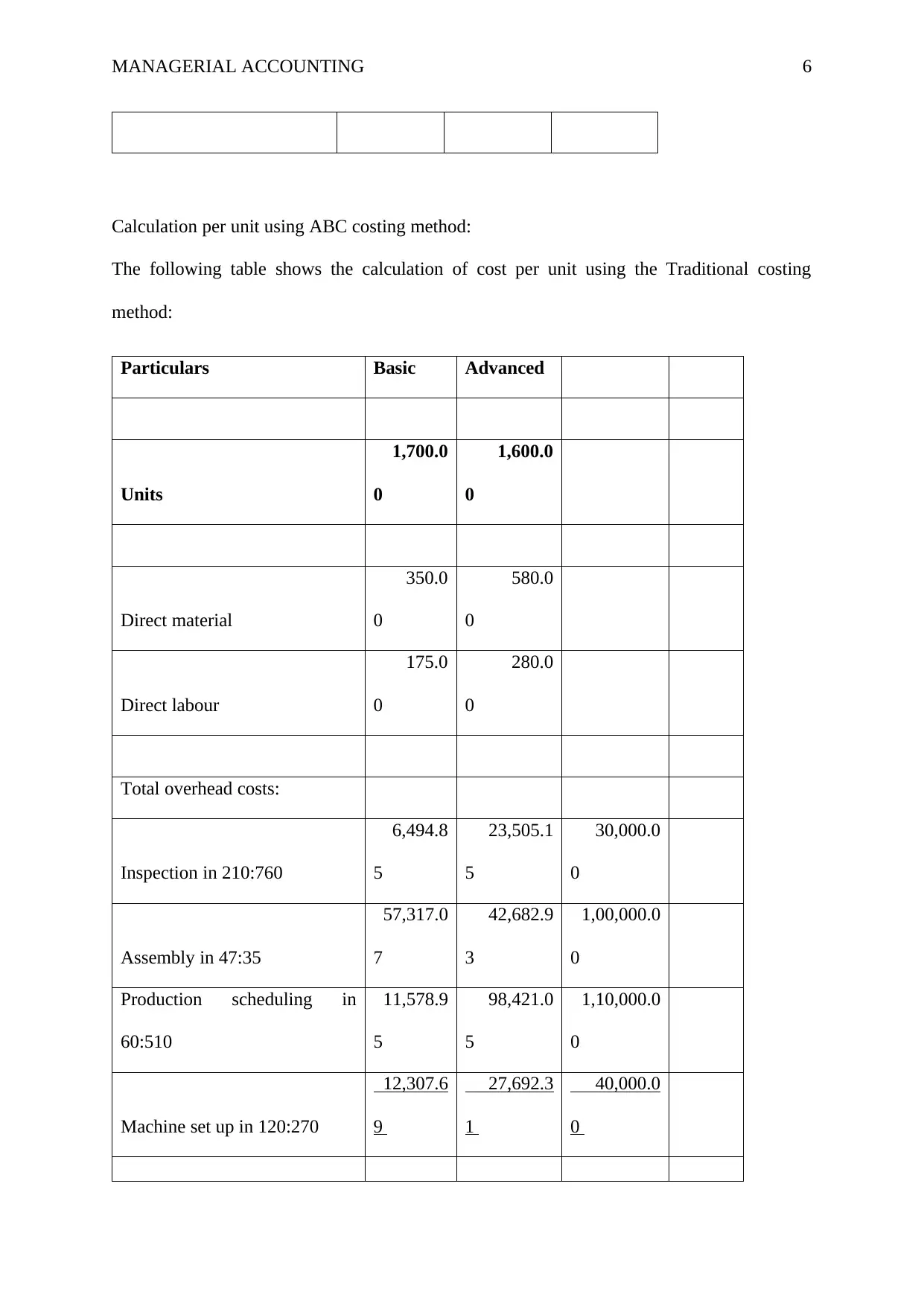

Calculation per unit using ABC costing method:

The following table shows the calculation of cost per unit using the Traditional costing

method:

Particulars Basic Advanced

Units

1,700.0

0

1,600.0

0

Direct material

350.0

0

580.0

0

Direct labour

175.0

0

280.0

0

Total overhead costs:

Inspection in 210:760

6,494.8

5

23,505.1

5

30,000.0

0

Assembly in 47:35

57,317.0

7

42,682.9

3

1,00,000.0

0

Production scheduling in

60:510

11,578.9

5

98,421.0

5

1,10,000.0

0

Machine set up in 120:270

12,307.6

9

27,692.3

1

40,000.0

0

Calculation per unit using ABC costing method:

The following table shows the calculation of cost per unit using the Traditional costing

method:

Particulars Basic Advanced

Units

1,700.0

0

1,600.0

0

Direct material

350.0

0

580.0

0

Direct labour

175.0

0

280.0

0

Total overhead costs:

Inspection in 210:760

6,494.8

5

23,505.1

5

30,000.0

0

Assembly in 47:35

57,317.0

7

42,682.9

3

1,00,000.0

0

Production scheduling in

60:510

11,578.9

5

98,421.0

5

1,10,000.0

0

Machine set up in 120:270

12,307.6

9

27,692.3

1

40,000.0

0

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MANAGERIAL ACCOUNTING 7

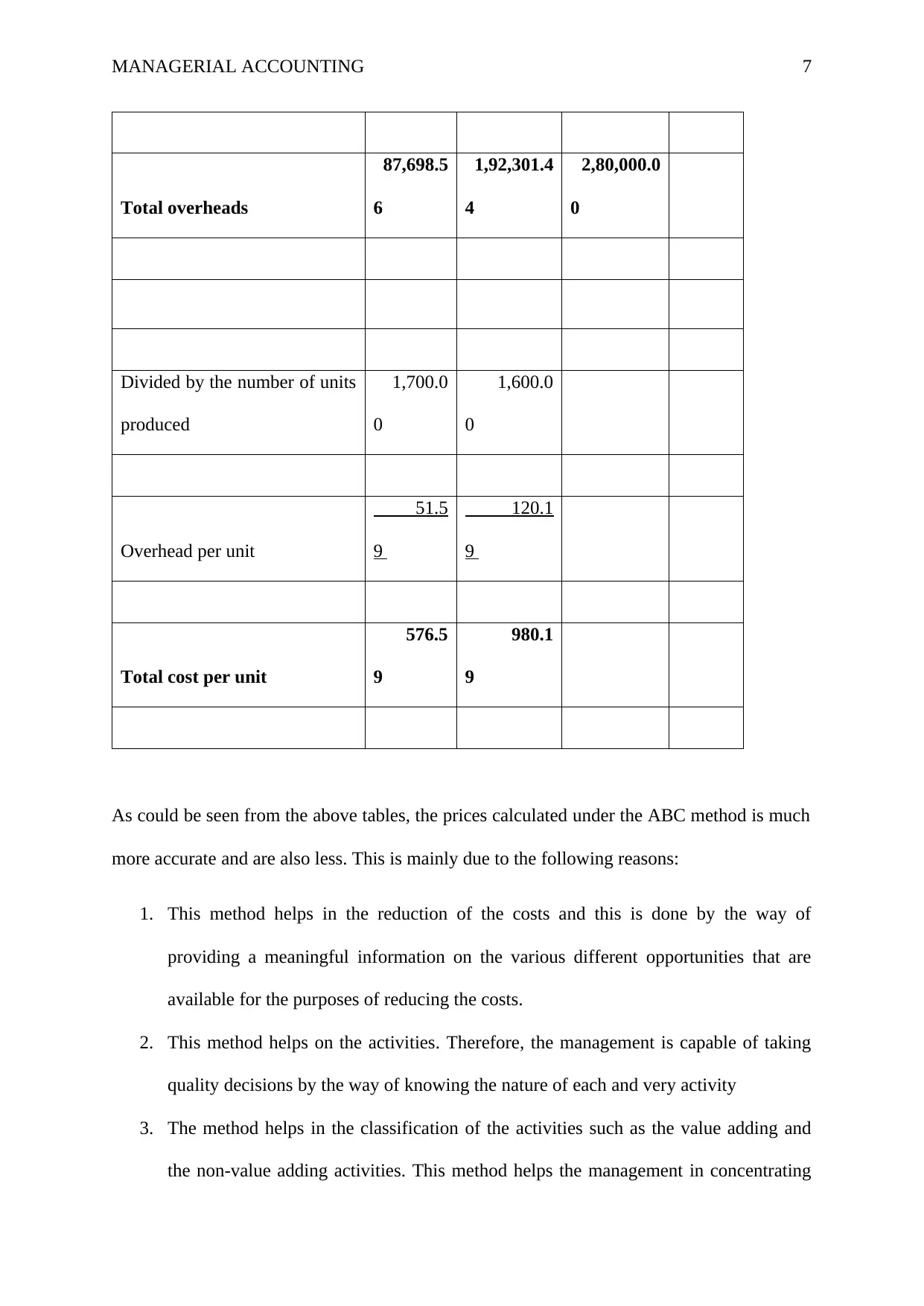

Total overheads

87,698.5

6

1,92,301.4

4

2,80,000.0

0

Divided by the number of units

produced

1,700.0

0

1,600.0

0

Overhead per unit

51.5

9

120.1

9

Total cost per unit

576.5

9

980.1

9

As could be seen from the above tables, the prices calculated under the ABC method is much

more accurate and are also less. This is mainly due to the following reasons:

1. This method helps in the reduction of the costs and this is done by the way of

providing a meaningful information on the various different opportunities that are

available for the purposes of reducing the costs.

2. This method helps on the activities. Therefore, the management is capable of taking

quality decisions by the way of knowing the nature of each and very activity

3. The method helps in the classification of the activities such as the value adding and

the non-value adding activities. This method helps the management in concentrating

Total overheads

87,698.5

6

1,92,301.4

4

2,80,000.0

0

Divided by the number of units

produced

1,700.0

0

1,600.0

0

Overhead per unit

51.5

9

120.1

9

Total cost per unit

576.5

9

980.1

9

As could be seen from the above tables, the prices calculated under the ABC method is much

more accurate and are also less. This is mainly due to the following reasons:

1. This method helps in the reduction of the costs and this is done by the way of

providing a meaningful information on the various different opportunities that are

available for the purposes of reducing the costs.

2. This method helps on the activities. Therefore, the management is capable of taking

quality decisions by the way of knowing the nature of each and very activity

3. The method helps in the classification of the activities such as the value adding and

the non-value adding activities. This method helps the management in concentrating

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGERIAL ACCOUNTING 8

on the forces of the value added activities along with elimination of the non-value

added activities.

4. There are some of the costs which are the non-manufacturing costs which comprise of

a major component of the total cost of each product.

5. When the costing of the product is done accurately, then it leads to a proper adoption

of the pricing policy.

6. The statement of profit and loss is compared on the basis of each activity and it helps

in the comparing of the costs of each activity with one another.

7. When the costing information has been predicted with accuracy, then it helps the

management in the adoption of the productivity improvement approaches such as the

total quality management etc.

8. By using this costing technique, the management is able to take the decisions of make

or buy.

9. In case, the resources which are available are not capable of being used, then the same

can be used even after the sub-contracting of the manufacture of the products and then

the management can decide to manufacture the product within the company.

10. If any product is transferred from one department to another, then the transfer price of

the same can be fixed (Account learning, 2019).

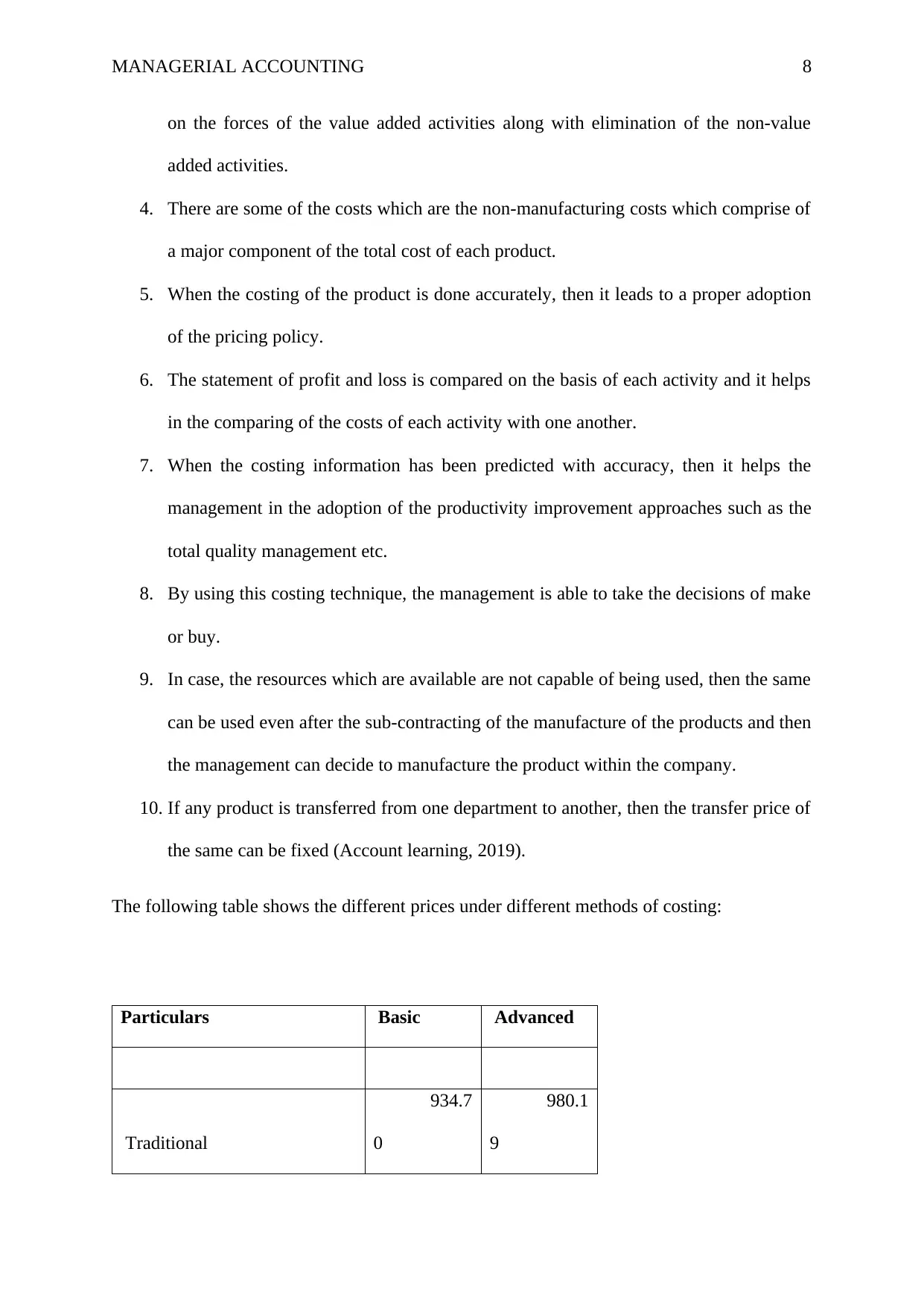

The following table shows the different prices under different methods of costing:

Particulars Basic Advanced

Traditional

934.7

0

980.1

9

on the forces of the value added activities along with elimination of the non-value

added activities.

4. There are some of the costs which are the non-manufacturing costs which comprise of

a major component of the total cost of each product.

5. When the costing of the product is done accurately, then it leads to a proper adoption

of the pricing policy.

6. The statement of profit and loss is compared on the basis of each activity and it helps

in the comparing of the costs of each activity with one another.

7. When the costing information has been predicted with accuracy, then it helps the

management in the adoption of the productivity improvement approaches such as the

total quality management etc.

8. By using this costing technique, the management is able to take the decisions of make

or buy.

9. In case, the resources which are available are not capable of being used, then the same

can be used even after the sub-contracting of the manufacture of the products and then

the management can decide to manufacture the product within the company.

10. If any product is transferred from one department to another, then the transfer price of

the same can be fixed (Account learning, 2019).

The following table shows the different prices under different methods of costing:

Particulars Basic Advanced

Traditional

934.7

0

980.1

9

MANAGERIAL ACCOUNTING 9

ABC

619.4

0

576.5

9

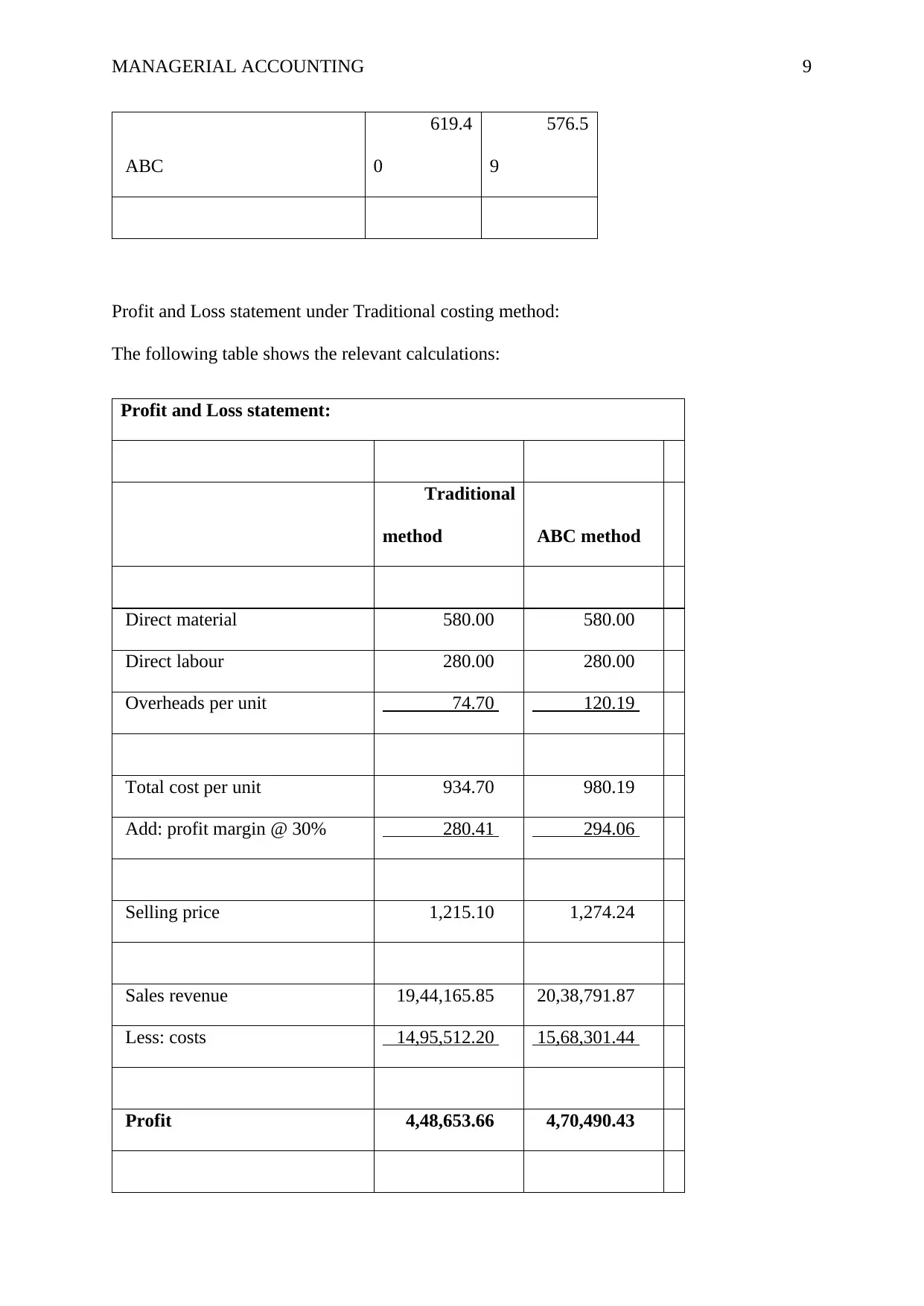

Profit and Loss statement under Traditional costing method:

The following table shows the relevant calculations:

Profit and Loss statement:

Traditional

method ABC method

Direct material 580.00 580.00

Direct labour 280.00 280.00

Overheads per unit 74.70 120.19

Total cost per unit 934.70 980.19

Add: profit margin @ 30% 280.41 294.06

Selling price 1,215.10 1,274.24

Sales revenue 19,44,165.85 20,38,791.87

Less: costs 14,95,512.20 15,68,301.44

Profit 4,48,653.66 4,70,490.43

ABC

619.4

0

576.5

9

Profit and Loss statement under Traditional costing method:

The following table shows the relevant calculations:

Profit and Loss statement:

Traditional

method ABC method

Direct material 580.00 580.00

Direct labour 280.00 280.00

Overheads per unit 74.70 120.19

Total cost per unit 934.70 980.19

Add: profit margin @ 30% 280.41 294.06

Selling price 1,215.10 1,274.24

Sales revenue 19,44,165.85 20,38,791.87

Less: costs 14,95,512.20 15,68,301.44

Profit 4,48,653.66 4,70,490.43

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MANAGERIAL ACCOUNTING 10

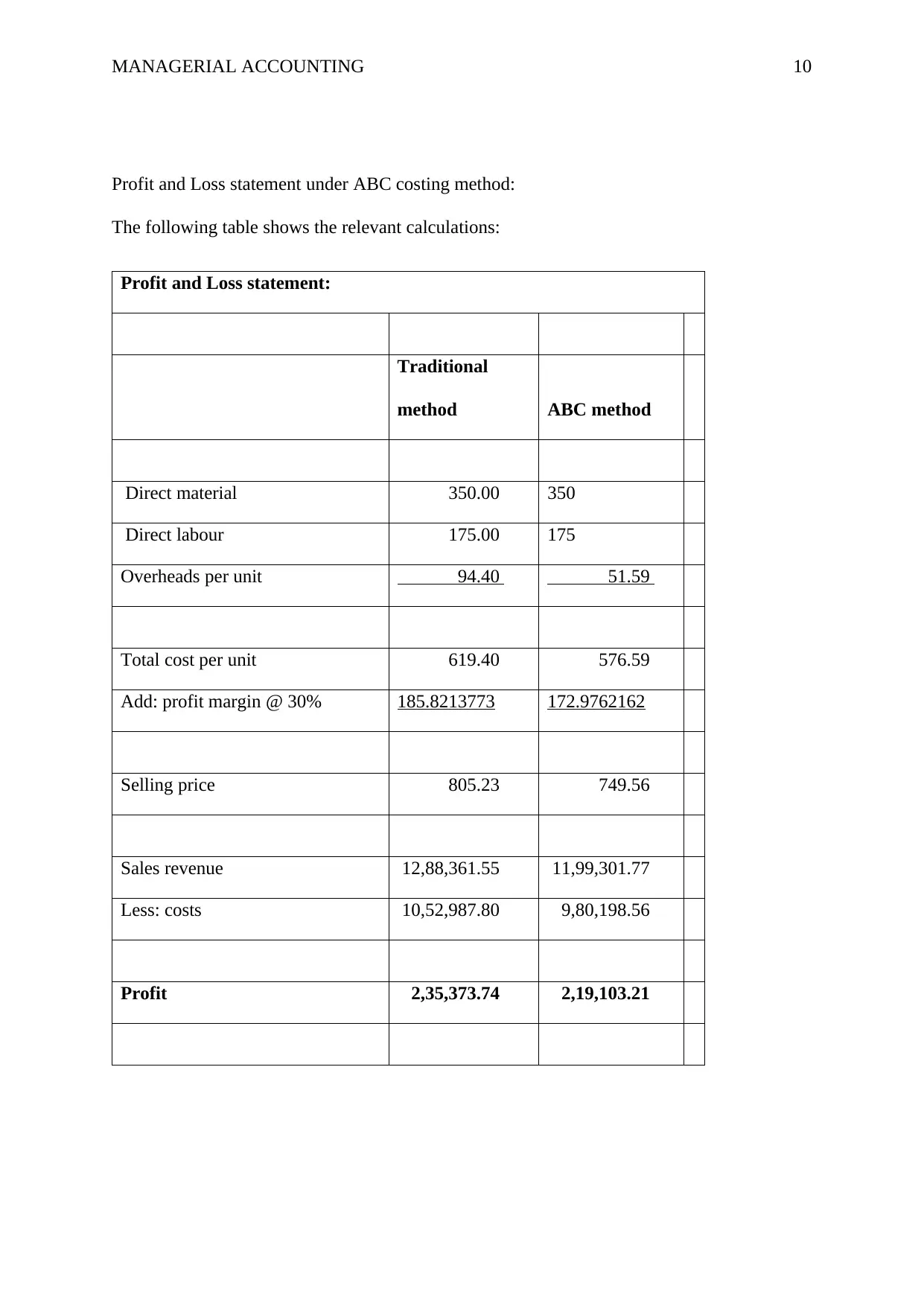

Profit and Loss statement under ABC costing method:

The following table shows the relevant calculations:

Profit and Loss statement:

Traditional

method ABC method

Direct material 350.00 350

Direct labour 175.00 175

Overheads per unit 94.40 51.59

Total cost per unit 619.40 576.59

Add: profit margin @ 30% 185.8213773 172.9762162

Selling price 805.23 749.56

Sales revenue 12,88,361.55 11,99,301.77

Less: costs 10,52,987.80 9,80,198.56

Profit 2,35,373.74 2,19,103.21

Profit and Loss statement under ABC costing method:

The following table shows the relevant calculations:

Profit and Loss statement:

Traditional

method ABC method

Direct material 350.00 350

Direct labour 175.00 175

Overheads per unit 94.40 51.59

Total cost per unit 619.40 576.59

Add: profit margin @ 30% 185.8213773 172.9762162

Selling price 805.23 749.56

Sales revenue 12,88,361.55 11,99,301.77

Less: costs 10,52,987.80 9,80,198.56

Profit 2,35,373.74 2,19,103.21

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGERIAL ACCOUNTING 11

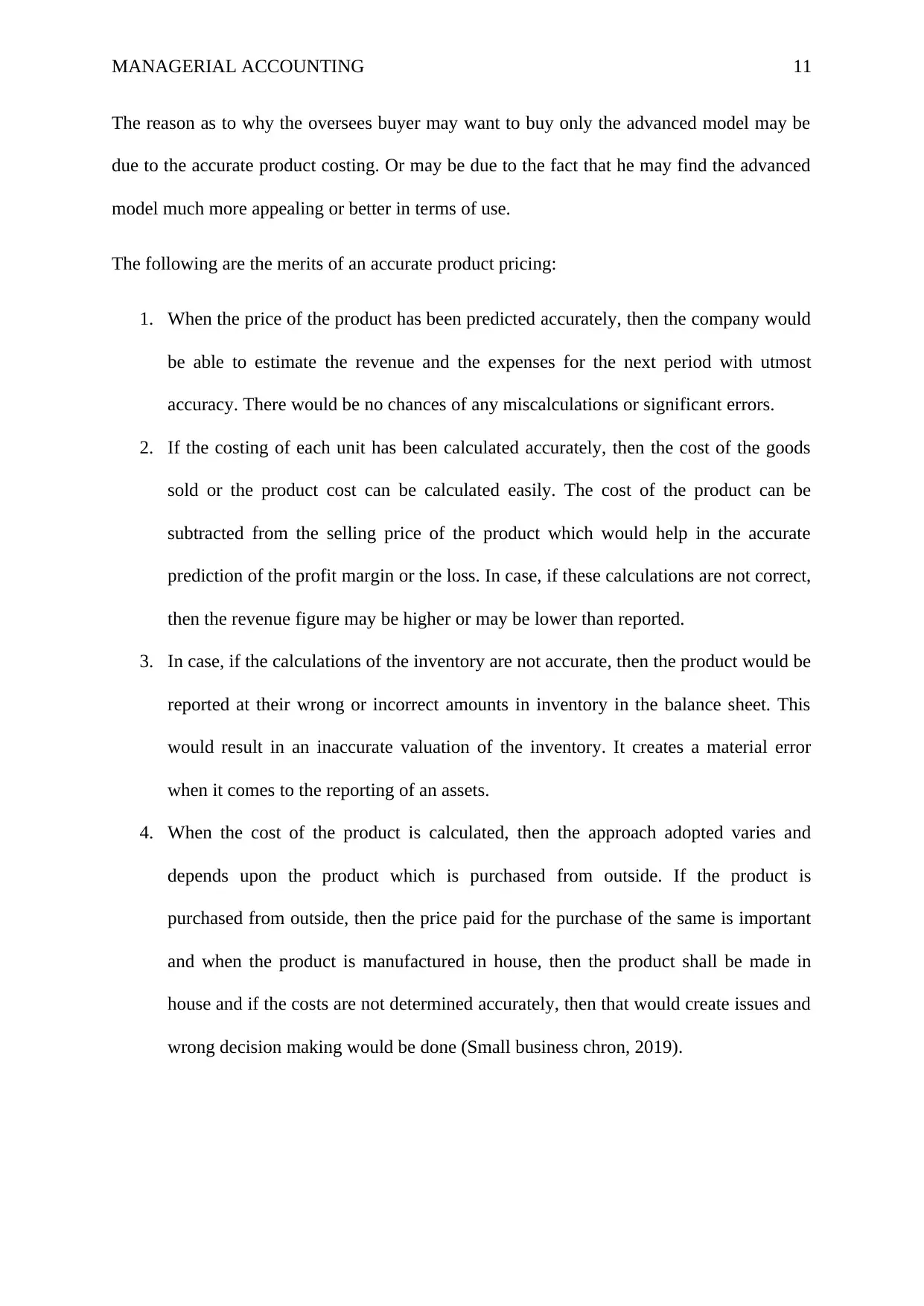

The reason as to why the oversees buyer may want to buy only the advanced model may be

due to the accurate product costing. Or may be due to the fact that he may find the advanced

model much more appealing or better in terms of use.

The following are the merits of an accurate product pricing:

1. When the price of the product has been predicted accurately, then the company would

be able to estimate the revenue and the expenses for the next period with utmost

accuracy. There would be no chances of any miscalculations or significant errors.

2. If the costing of each unit has been calculated accurately, then the cost of the goods

sold or the product cost can be calculated easily. The cost of the product can be

subtracted from the selling price of the product which would help in the accurate

prediction of the profit margin or the loss. In case, if these calculations are not correct,

then the revenue figure may be higher or may be lower than reported.

3. In case, if the calculations of the inventory are not accurate, then the product would be

reported at their wrong or incorrect amounts in inventory in the balance sheet. This

would result in an inaccurate valuation of the inventory. It creates a material error

when it comes to the reporting of an assets.

4. When the cost of the product is calculated, then the approach adopted varies and

depends upon the product which is purchased from outside. If the product is

purchased from outside, then the price paid for the purchase of the same is important

and when the product is manufactured in house, then the product shall be made in

house and if the costs are not determined accurately, then that would create issues and

wrong decision making would be done (Small business chron, 2019).

The reason as to why the oversees buyer may want to buy only the advanced model may be

due to the accurate product costing. Or may be due to the fact that he may find the advanced

model much more appealing or better in terms of use.

The following are the merits of an accurate product pricing:

1. When the price of the product has been predicted accurately, then the company would

be able to estimate the revenue and the expenses for the next period with utmost

accuracy. There would be no chances of any miscalculations or significant errors.

2. If the costing of each unit has been calculated accurately, then the cost of the goods

sold or the product cost can be calculated easily. The cost of the product can be

subtracted from the selling price of the product which would help in the accurate

prediction of the profit margin or the loss. In case, if these calculations are not correct,

then the revenue figure may be higher or may be lower than reported.

3. In case, if the calculations of the inventory are not accurate, then the product would be

reported at their wrong or incorrect amounts in inventory in the balance sheet. This

would result in an inaccurate valuation of the inventory. It creates a material error

when it comes to the reporting of an assets.

4. When the cost of the product is calculated, then the approach adopted varies and

depends upon the product which is purchased from outside. If the product is

purchased from outside, then the price paid for the purchase of the same is important

and when the product is manufactured in house, then the product shall be made in

house and if the costs are not determined accurately, then that would create issues and

wrong decision making would be done (Small business chron, 2019).

MANAGERIAL ACCOUNTING 12

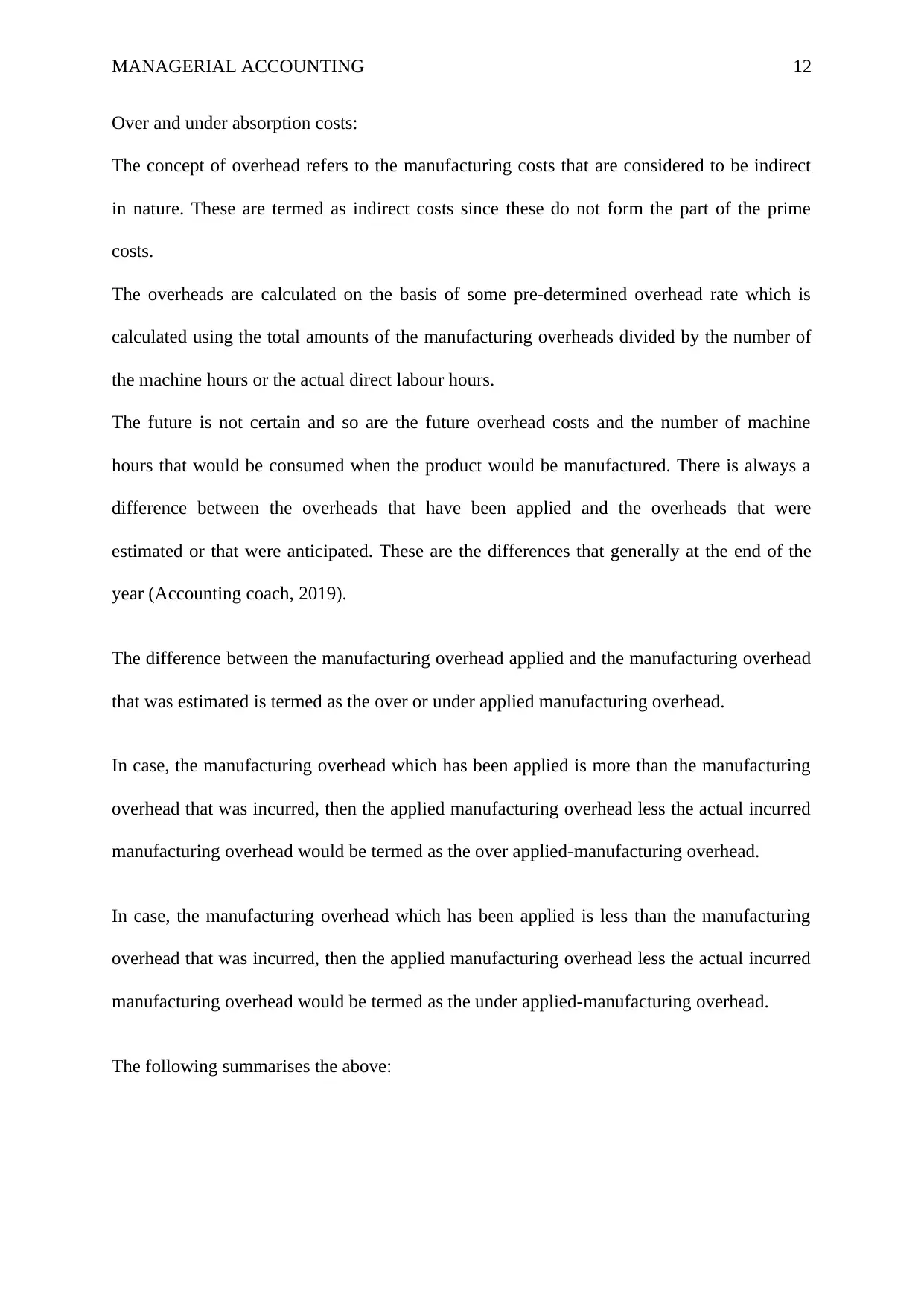

Over and under absorption costs:

The concept of overhead refers to the manufacturing costs that are considered to be indirect

in nature. These are termed as indirect costs since these do not form the part of the prime

costs.

The overheads are calculated on the basis of some pre-determined overhead rate which is

calculated using the total amounts of the manufacturing overheads divided by the number of

the machine hours or the actual direct labour hours.

The future is not certain and so are the future overhead costs and the number of machine

hours that would be consumed when the product would be manufactured. There is always a

difference between the overheads that have been applied and the overheads that were

estimated or that were anticipated. These are the differences that generally at the end of the

year (Accounting coach, 2019).

The difference between the manufacturing overhead applied and the manufacturing overhead

that was estimated is termed as the over or under applied manufacturing overhead.

In case, the manufacturing overhead which has been applied is more than the manufacturing

overhead that was incurred, then the applied manufacturing overhead less the actual incurred

manufacturing overhead would be termed as the over applied-manufacturing overhead.

In case, the manufacturing overhead which has been applied is less than the manufacturing

overhead that was incurred, then the applied manufacturing overhead less the actual incurred

manufacturing overhead would be termed as the under applied-manufacturing overhead.

The following summarises the above:

Over and under absorption costs:

The concept of overhead refers to the manufacturing costs that are considered to be indirect

in nature. These are termed as indirect costs since these do not form the part of the prime

costs.

The overheads are calculated on the basis of some pre-determined overhead rate which is

calculated using the total amounts of the manufacturing overheads divided by the number of

the machine hours or the actual direct labour hours.

The future is not certain and so are the future overhead costs and the number of machine

hours that would be consumed when the product would be manufactured. There is always a

difference between the overheads that have been applied and the overheads that were

estimated or that were anticipated. These are the differences that generally at the end of the

year (Accounting coach, 2019).

The difference between the manufacturing overhead applied and the manufacturing overhead

that was estimated is termed as the over or under applied manufacturing overhead.

In case, the manufacturing overhead which has been applied is more than the manufacturing

overhead that was incurred, then the applied manufacturing overhead less the actual incurred

manufacturing overhead would be termed as the over applied-manufacturing overhead.

In case, the manufacturing overhead which has been applied is less than the manufacturing

overhead that was incurred, then the applied manufacturing overhead less the actual incurred

manufacturing overhead would be termed as the under applied-manufacturing overhead.

The following summarises the above:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.