Capital Budgeting Analysis and Investment Decisions for Delaware Pipe

VerifiedAdded on 2020/06/04

|19

|4338

|30

Homework Assignment

AI Summary

This assignment provides a comprehensive capital budgeting analysis for Delaware Pipe, evaluating the financial viability of a project to produce 10-in and 12-in pipes. It utilizes various capital budgeting tools, including Net Present Value (NPV), Internal Rate of Return (IRR), and Profitability Index (PI), to compare the MAKE and BUY options. The analysis includes an incremental cash flow table, sensitivity analysis, and break-even cash flow calculations. The study makes assumptions about sales growth, labor costs, and depreciation, and provides recommendations based on the calculated financial metrics. The assignment suggests that the BUY option is more profitable for Delaware Pipe, offering higher NPV, IRR, and PI values. The analysis also explores the impact of different scenarios (worst, most likely, best) on the NPV, providing a robust evaluation of the investment decisions. The document also provides a detailed overview of the cost and revenue structure for the project.

CAPITAL BUDGETING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

QUESTION 1...................................................................................................................................1

Comment on items listed in Exhibit 1.........................................................................................1

QUESTION 2...................................................................................................................................2

Incremental cash flow table........................................................................................................2

QUESTION 3...................................................................................................................................5

Capital budgeting tools for MAKE option..................................................................................5

Capital budgeting tools for BUY option.....................................................................................6

Suggestions for undertaking project on the basis of above investment evaluation tools............8

QUESTION 4...................................................................................................................................9

Sensitivity analysis of NPV for MAKE option...........................................................................9

Sensitivity analysis of NPV for BUY option............................................................................10

QUESTION 5.................................................................................................................................12

For MAKE option.....................................................................................................................12

For BUY option........................................................................................................................12

QUESTION 6.................................................................................................................................13

Break even cash flow for MAKE option...................................................................................13

Break even cash flow for BUY option......................................................................................14

QUESTION 7.................................................................................................................................15

QUESTION 8.................................................................................................................................16

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION...........................................................................................................................1

QUESTION 1...................................................................................................................................1

Comment on items listed in Exhibit 1.........................................................................................1

QUESTION 2...................................................................................................................................2

Incremental cash flow table........................................................................................................2

QUESTION 3...................................................................................................................................5

Capital budgeting tools for MAKE option..................................................................................5

Capital budgeting tools for BUY option.....................................................................................6

Suggestions for undertaking project on the basis of above investment evaluation tools............8

QUESTION 4...................................................................................................................................9

Sensitivity analysis of NPV for MAKE option...........................................................................9

Sensitivity analysis of NPV for BUY option............................................................................10

QUESTION 5.................................................................................................................................12

For MAKE option.....................................................................................................................12

For BUY option........................................................................................................................12

QUESTION 6.................................................................................................................................13

Break even cash flow for MAKE option...................................................................................13

Break even cash flow for BUY option......................................................................................14

QUESTION 7.................................................................................................................................15

QUESTION 8.................................................................................................................................16

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION

Capital budgeting is one of the important and widely considered tool by the project

managers in order to make effectual business decisions. The reason is that, it helps to compare

and take decisions that which one project will be the most profitable for the working

environment. The study is based on Delaware Pipe which owner is Philip Walker and going to

undertake new project. In this, owner going to produce 10-in and 12-in pipes on the basis of

interest of various distributors. When he will produce such both kinds of pipes then profitable in

two ways like preventing expenses and assisting problems of staff. The present project shows

about the calculation of various capital budgeting tools and methods for net cash flows estimated

in the incremental cash flow table. Apart from this, in order to make effective decisions for

undertaking the project in Delaware Pipe company, base of NPV, IRR and PI calculations is

taken into account.

QUESTION 1

Comment on items listed in Exhibit 1

In the present case scenario basically three conditions are provided which are like worst,

most likely as well as the best. In this, accountant of Delaware Pipe company used situation of

the most likely where annual sales is worth of 1.65 million. This figure of revenue is considered

at the higher value which can affect to the decision making in order to undertake the project.

Further, all the items are providing information about the expenses only to the accountant which

are adequate. Apart from expenses data related to the incomes are also required in order to assess

viability of the project. However, given data and information in the Exhibit 3 are not considering

to the probability which also plays a major role. The reason is that, on the basis of probabilities

future scenario of conditions of the project can be easily and clearly assumed (Chow and

Teicher, 2012). Henceforth, the provided data is not sufficient which lead to create impact of

effective decision making. As the probabilities level are not undertaken in the project then

transpire to cash flows as well as net present value in a negative direction. Moreover, it can be

said that information provided in the Exhibit 3 are sufficient up to the certain level. Therefore,

the accountant should work upon it and consider effective strategies for estimating data in order

to perform calculation of Net Present Value (NPV).

Capital budgeting is one of the important and widely considered tool by the project

managers in order to make effectual business decisions. The reason is that, it helps to compare

and take decisions that which one project will be the most profitable for the working

environment. The study is based on Delaware Pipe which owner is Philip Walker and going to

undertake new project. In this, owner going to produce 10-in and 12-in pipes on the basis of

interest of various distributors. When he will produce such both kinds of pipes then profitable in

two ways like preventing expenses and assisting problems of staff. The present project shows

about the calculation of various capital budgeting tools and methods for net cash flows estimated

in the incremental cash flow table. Apart from this, in order to make effective decisions for

undertaking the project in Delaware Pipe company, base of NPV, IRR and PI calculations is

taken into account.

QUESTION 1

Comment on items listed in Exhibit 1

In the present case scenario basically three conditions are provided which are like worst,

most likely as well as the best. In this, accountant of Delaware Pipe company used situation of

the most likely where annual sales is worth of 1.65 million. This figure of revenue is considered

at the higher value which can affect to the decision making in order to undertake the project.

Further, all the items are providing information about the expenses only to the accountant which

are adequate. Apart from expenses data related to the incomes are also required in order to assess

viability of the project. However, given data and information in the Exhibit 3 are not considering

to the probability which also plays a major role. The reason is that, on the basis of probabilities

future scenario of conditions of the project can be easily and clearly assumed (Chow and

Teicher, 2012). Henceforth, the provided data is not sufficient which lead to create impact of

effective decision making. As the probabilities level are not undertaken in the project then

transpire to cash flows as well as net present value in a negative direction. Moreover, it can be

said that information provided in the Exhibit 3 are sufficient up to the certain level. Therefore,

the accountant should work upon it and consider effective strategies for estimating data in order

to perform calculation of Net Present Value (NPV).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

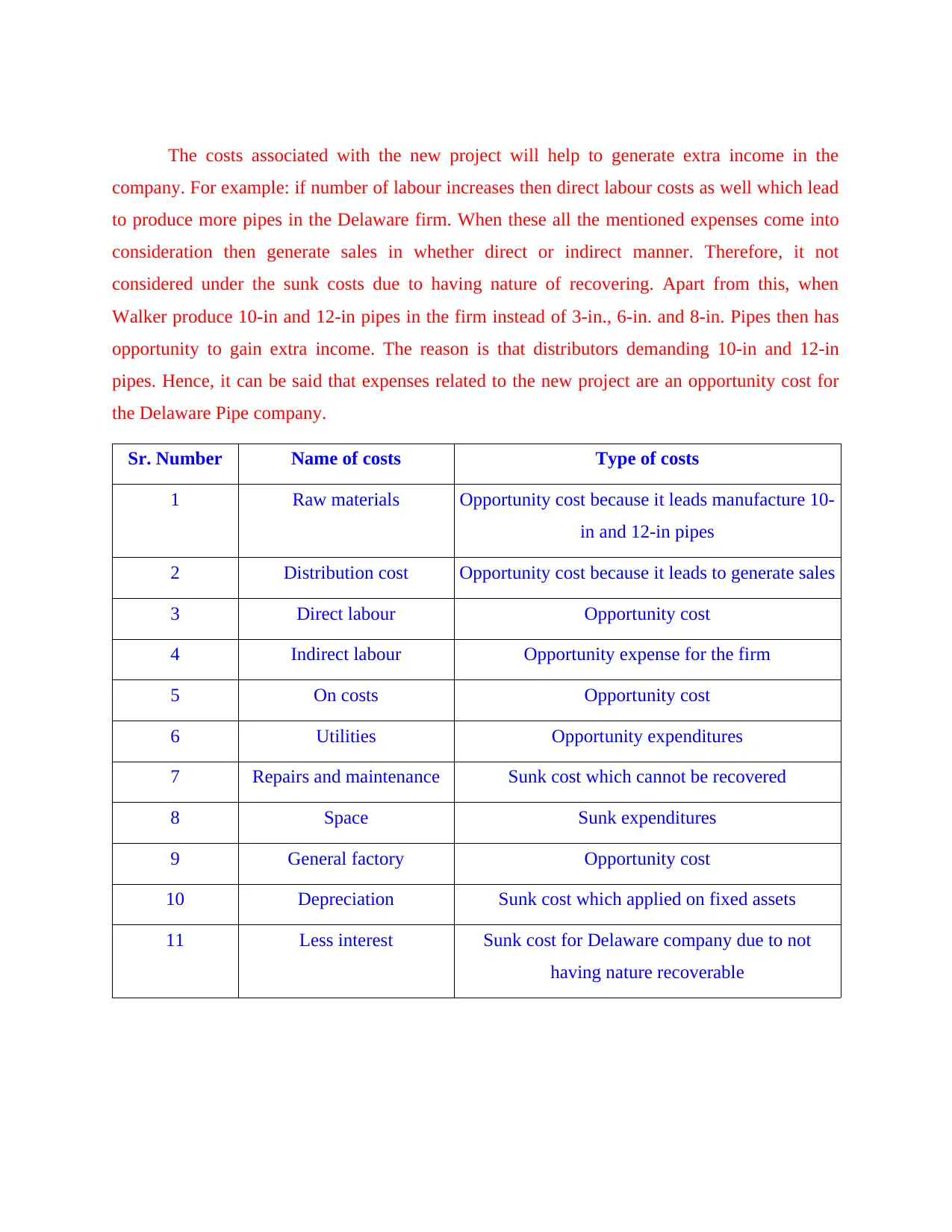

The costs associated with the new project will help to generate extra income in the

company. For example: if number of labour increases then direct labour costs as well which lead

to produce more pipes in the Delaware firm. When these all the mentioned expenses come into

consideration then generate sales in whether direct or indirect manner. Therefore, it not

considered under the sunk costs due to having nature of recovering. Apart from this, when

Walker produce 10-in and 12-in pipes in the firm instead of 3-in., 6-in. and 8-in. Pipes then has

opportunity to gain extra income. The reason is that distributors demanding 10-in and 12-in

pipes. Hence, it can be said that expenses related to the new project are an opportunity cost for

the Delaware Pipe company.

Sr. Number Name of costs Type of costs

1 Raw materials Opportunity cost because it leads manufacture 10-

in and 12-in pipes

2 Distribution cost Opportunity cost because it leads to generate sales

3 Direct labour Opportunity cost

4 Indirect labour Opportunity expense for the firm

5 On costs Opportunity cost

6 Utilities Opportunity expenditures

7 Repairs and maintenance Sunk cost which cannot be recovered

8 Space Sunk expenditures

9 General factory Opportunity cost

10 Depreciation Sunk cost which applied on fixed assets

11 Less interest Sunk cost for Delaware company due to not

having nature recoverable

company. For example: if number of labour increases then direct labour costs as well which lead

to produce more pipes in the Delaware firm. When these all the mentioned expenses come into

consideration then generate sales in whether direct or indirect manner. Therefore, it not

considered under the sunk costs due to having nature of recovering. Apart from this, when

Walker produce 10-in and 12-in pipes in the firm instead of 3-in., 6-in. and 8-in. Pipes then has

opportunity to gain extra income. The reason is that distributors demanding 10-in and 12-in

pipes. Hence, it can be said that expenses related to the new project are an opportunity cost for

the Delaware Pipe company.

Sr. Number Name of costs Type of costs

1 Raw materials Opportunity cost because it leads manufacture 10-

in and 12-in pipes

2 Distribution cost Opportunity cost because it leads to generate sales

3 Direct labour Opportunity cost

4 Indirect labour Opportunity expense for the firm

5 On costs Opportunity cost

6 Utilities Opportunity expenditures

7 Repairs and maintenance Sunk cost which cannot be recovered

8 Space Sunk expenditures

9 General factory Opportunity cost

10 Depreciation Sunk cost which applied on fixed assets

11 Less interest Sunk cost for Delaware company due to not

having nature recoverable

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

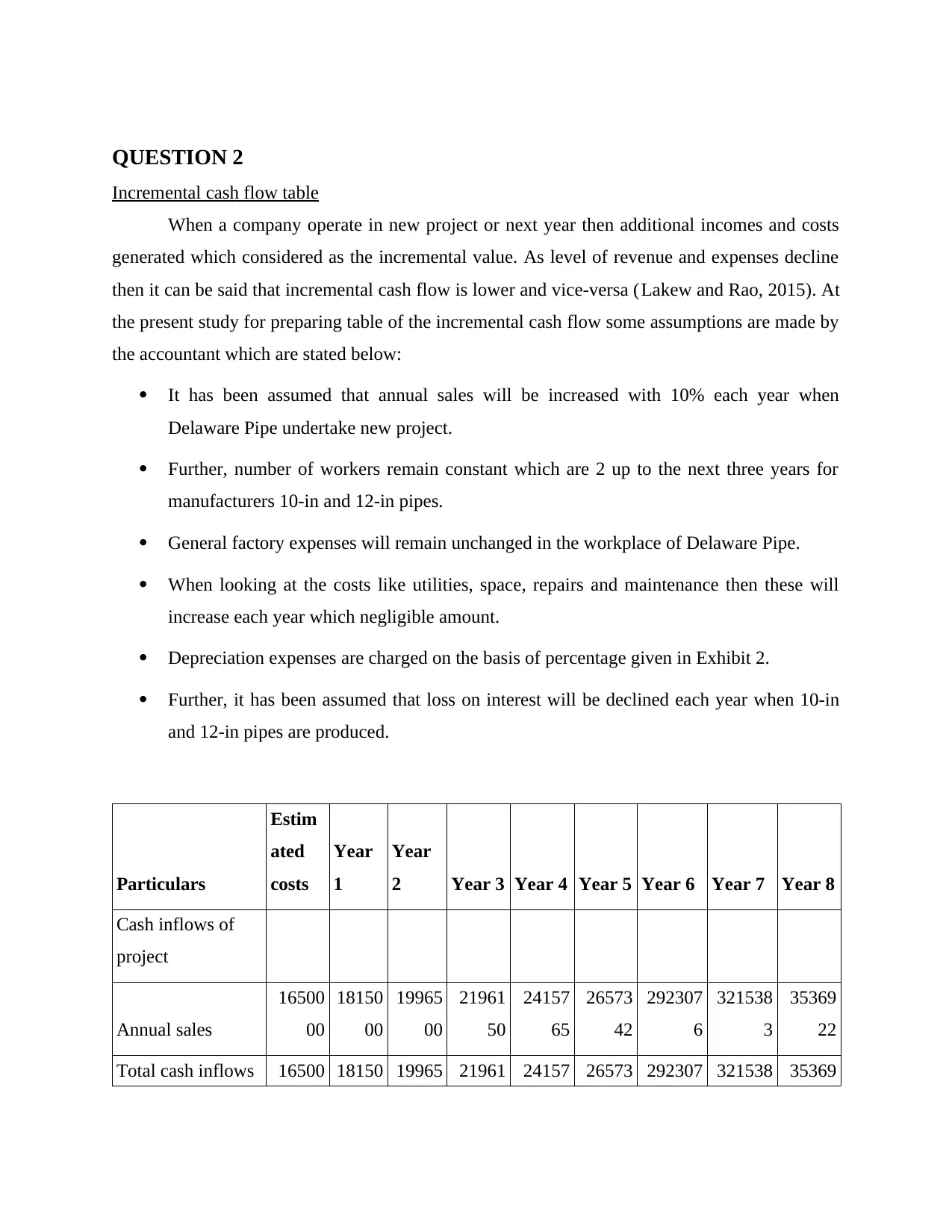

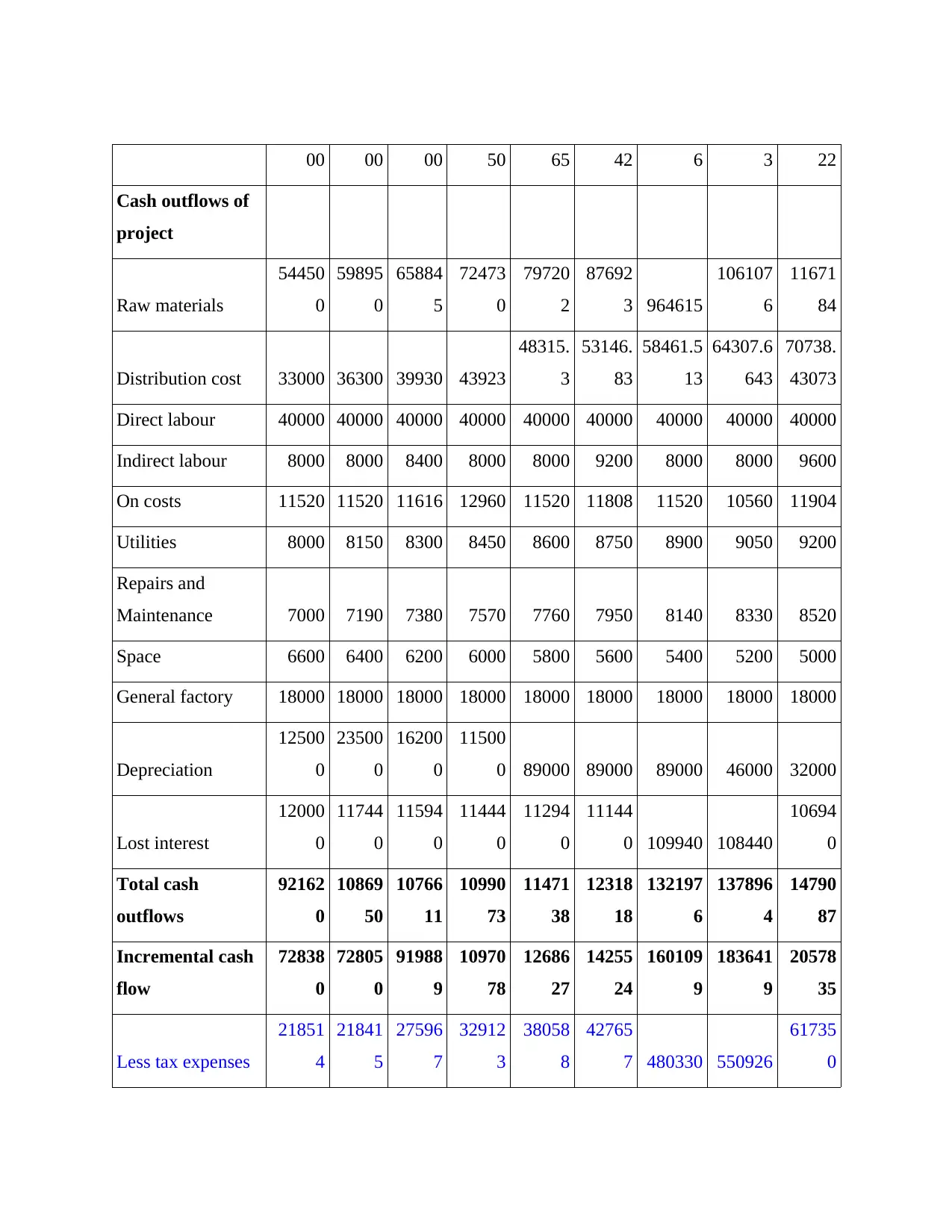

QUESTION 2

Incremental cash flow table

When a company operate in new project or next year then additional incomes and costs

generated which considered as the incremental value. As level of revenue and expenses decline

then it can be said that incremental cash flow is lower and vice-versa (Lakew and Rao, 2015). At

the present study for preparing table of the incremental cash flow some assumptions are made by

the accountant which are stated below:

It has been assumed that annual sales will be increased with 10% each year when

Delaware Pipe undertake new project.

Further, number of workers remain constant which are 2 up to the next three years for

manufacturers 10-in and 12-in pipes.

General factory expenses will remain unchanged in the workplace of Delaware Pipe.

When looking at the costs like utilities, space, repairs and maintenance then these will

increase each year which negligible amount.

Depreciation expenses are charged on the basis of percentage given in Exhibit 2.

Further, it has been assumed that loss on interest will be declined each year when 10-in

and 12-in pipes are produced.

Particulars

Estim

ated

costs

Year

1

Year

2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8

Cash inflows of

project

Annual sales

16500

00

18150

00

19965

00

21961

50

24157

65

26573

42

292307

6

321538

3

35369

22

Total cash inflows 16500 18150 19965 21961 24157 26573 292307 321538 35369

Incremental cash flow table

When a company operate in new project or next year then additional incomes and costs

generated which considered as the incremental value. As level of revenue and expenses decline

then it can be said that incremental cash flow is lower and vice-versa (Lakew and Rao, 2015). At

the present study for preparing table of the incremental cash flow some assumptions are made by

the accountant which are stated below:

It has been assumed that annual sales will be increased with 10% each year when

Delaware Pipe undertake new project.

Further, number of workers remain constant which are 2 up to the next three years for

manufacturers 10-in and 12-in pipes.

General factory expenses will remain unchanged in the workplace of Delaware Pipe.

When looking at the costs like utilities, space, repairs and maintenance then these will

increase each year which negligible amount.

Depreciation expenses are charged on the basis of percentage given in Exhibit 2.

Further, it has been assumed that loss on interest will be declined each year when 10-in

and 12-in pipes are produced.

Particulars

Estim

ated

costs

Year

1

Year

2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8

Cash inflows of

project

Annual sales

16500

00

18150

00

19965

00

21961

50

24157

65

26573

42

292307

6

321538

3

35369

22

Total cash inflows 16500 18150 19965 21961 24157 26573 292307 321538 35369

00 00 00 50 65 42 6 3 22

Cash outflows of

project

Raw materials

54450

0

59895

0

65884

5

72473

0

79720

2

87692

3 964615

106107

6

11671

84

Distribution cost 33000 36300 39930 43923

48315.

3

53146.

83

58461.5

13

64307.6

643

70738.

43073

Direct labour 40000 40000 40000 40000 40000 40000 40000 40000 40000

Indirect labour 8000 8000 8400 8000 8000 9200 8000 8000 9600

On costs 11520 11520 11616 12960 11520 11808 11520 10560 11904

Utilities 8000 8150 8300 8450 8600 8750 8900 9050 9200

Repairs and

Maintenance 7000 7190 7380 7570 7760 7950 8140 8330 8520

Space 6600 6400 6200 6000 5800 5600 5400 5200 5000

General factory 18000 18000 18000 18000 18000 18000 18000 18000 18000

Depreciation

12500

0

23500

0

16200

0

11500

0 89000 89000 89000 46000 32000

Lost interest

12000

0

11744

0

11594

0

11444

0

11294

0

11144

0 109940 108440

10694

0

Total cash

outflows

92162

0

10869

50

10766

11

10990

73

11471

38

12318

18

132197

6

137896

4

14790

87

Incremental cash

flow

72838

0

72805

0

91988

9

10970

78

12686

27

14255

24

160109

9

183641

9

20578

35

Less tax expenses

21851

4

21841

5

27596

7

32912

3

38058

8

42765

7 480330 550926

61735

0

Cash outflows of

project

Raw materials

54450

0

59895

0

65884

5

72473

0

79720

2

87692

3 964615

106107

6

11671

84

Distribution cost 33000 36300 39930 43923

48315.

3

53146.

83

58461.5

13

64307.6

643

70738.

43073

Direct labour 40000 40000 40000 40000 40000 40000 40000 40000 40000

Indirect labour 8000 8000 8400 8000 8000 9200 8000 8000 9600

On costs 11520 11520 11616 12960 11520 11808 11520 10560 11904

Utilities 8000 8150 8300 8450 8600 8750 8900 9050 9200

Repairs and

Maintenance 7000 7190 7380 7570 7760 7950 8140 8330 8520

Space 6600 6400 6200 6000 5800 5600 5400 5200 5000

General factory 18000 18000 18000 18000 18000 18000 18000 18000 18000

Depreciation

12500

0

23500

0

16200

0

11500

0 89000 89000 89000 46000 32000

Lost interest

12000

0

11744

0

11594

0

11444

0

11294

0

11144

0 109940 108440

10694

0

Total cash

outflows

92162

0

10869

50

10766

11

10990

73

11471

38

12318

18

132197

6

137896

4

14790

87

Incremental cash

flow

72838

0

72805

0

91988

9

10970

78

12686

27

14255

24

160109

9

183641

9

20578

35

Less tax expenses

21851

4

21841

5

27596

7

32912

3

38058

8

42765

7 480330 550926

61735

0

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Net incremental

cash flow after

tax

50986

6

50963

5

64392

2

76795

4

88803

9

99786

7

112076

9

128549

3

14404

84

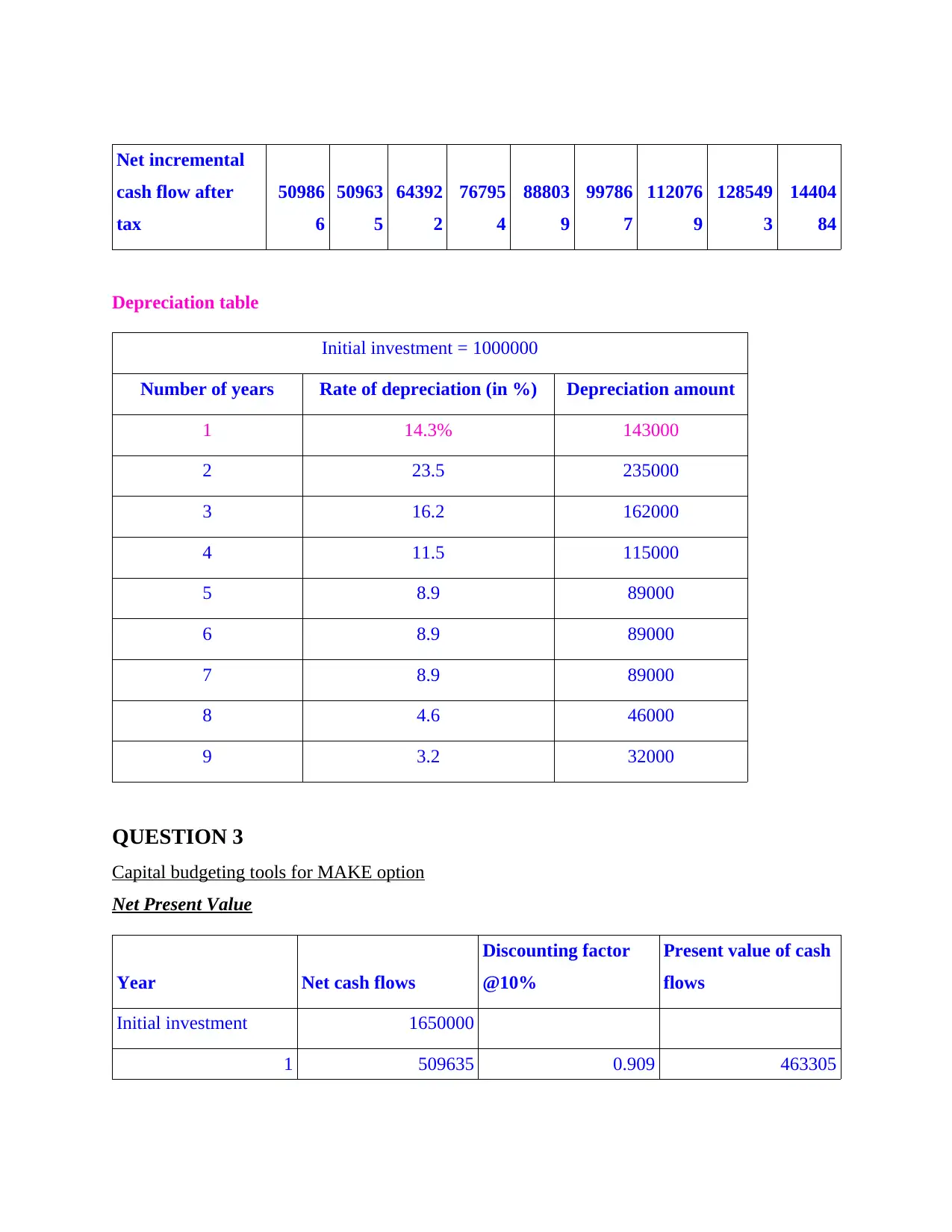

Depreciation table

Initial investment = 1000000

Number of years Rate of depreciation (in %) Depreciation amount

1 14.3% 143000

2 23.5 235000

3 16.2 162000

4 11.5 115000

5 8.9 89000

6 8.9 89000

7 8.9 89000

8 4.6 46000

9 3.2 32000

QUESTION 3

Capital budgeting tools for MAKE option

Net Present Value

Year Net cash flows

Discounting factor

@10%

Present value of cash

flows

Initial investment 1650000

1 509635 0.909 463305

cash flow after

tax

50986

6

50963

5

64392

2

76795

4

88803

9

99786

7

112076

9

128549

3

14404

84

Depreciation table

Initial investment = 1000000

Number of years Rate of depreciation (in %) Depreciation amount

1 14.3% 143000

2 23.5 235000

3 16.2 162000

4 11.5 115000

5 8.9 89000

6 8.9 89000

7 8.9 89000

8 4.6 46000

9 3.2 32000

QUESTION 3

Capital budgeting tools for MAKE option

Net Present Value

Year Net cash flows

Discounting factor

@10%

Present value of cash

flows

Initial investment 1650000

1 509635 0.909 463305

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

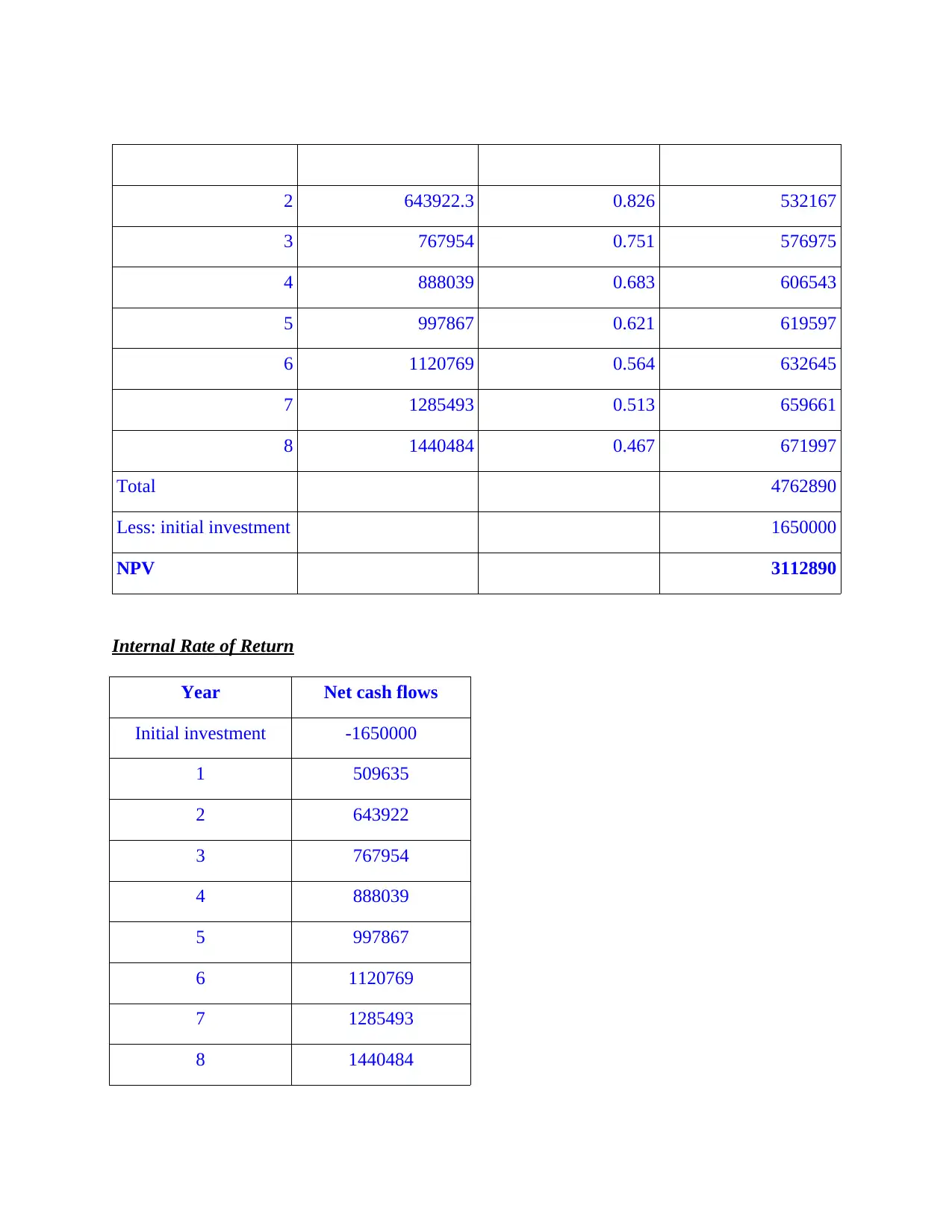

2 643922.3 0.826 532167

3 767954 0.751 576975

4 888039 0.683 606543

5 997867 0.621 619597

6 1120769 0.564 632645

7 1285493 0.513 659661

8 1440484 0.467 671997

Total 4762890

Less: initial investment 1650000

NPV 3112890

Internal Rate of Return

Year Net cash flows

Initial investment -1650000

1 509635

2 643922

3 767954

4 888039

5 997867

6 1120769

7 1285493

8 1440484

3 767954 0.751 576975

4 888039 0.683 606543

5 997867 0.621 619597

6 1120769 0.564 632645

7 1285493 0.513 659661

8 1440484 0.467 671997

Total 4762890

Less: initial investment 1650000

NPV 3112890

Internal Rate of Return

Year Net cash flows

Initial investment -1650000

1 509635

2 643922

3 767954

4 888039

5 997867

6 1120769

7 1285493

8 1440484

IRR 42.54%

Profitability Index

Year Net cash flows

Discounting factor

@10%

Present value of cash

flows

Initial investment 1650000

1 509635 0.909 463305

2 643922 0.826 532167

3 767954 0.751 576975

4 888039 0.683 606543

5 997867 0.621 619597

6 1120769 0.564 632645

7 1285493 0.513 659661

8 1440484 0.467 671997

Total 4762890

Less: initial investment 1650000

NPV 3112890

Profitability index 1.89

Capital budgeting tools for BUY option

NPV

Year Net cash flows

Discounting factor

@10%

Present value of cash

flows

Profitability Index

Year Net cash flows

Discounting factor

@10%

Present value of cash

flows

Initial investment 1650000

1 509635 0.909 463305

2 643922 0.826 532167

3 767954 0.751 576975

4 888039 0.683 606543

5 997867 0.621 619597

6 1120769 0.564 632645

7 1285493 0.513 659661

8 1440484 0.467 671997

Total 4762890

Less: initial investment 1650000

NPV 3112890

Profitability index 1.89

Capital budgeting tools for BUY option

NPV

Year Net cash flows

Discounting factor

@10%

Present value of cash

flows

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

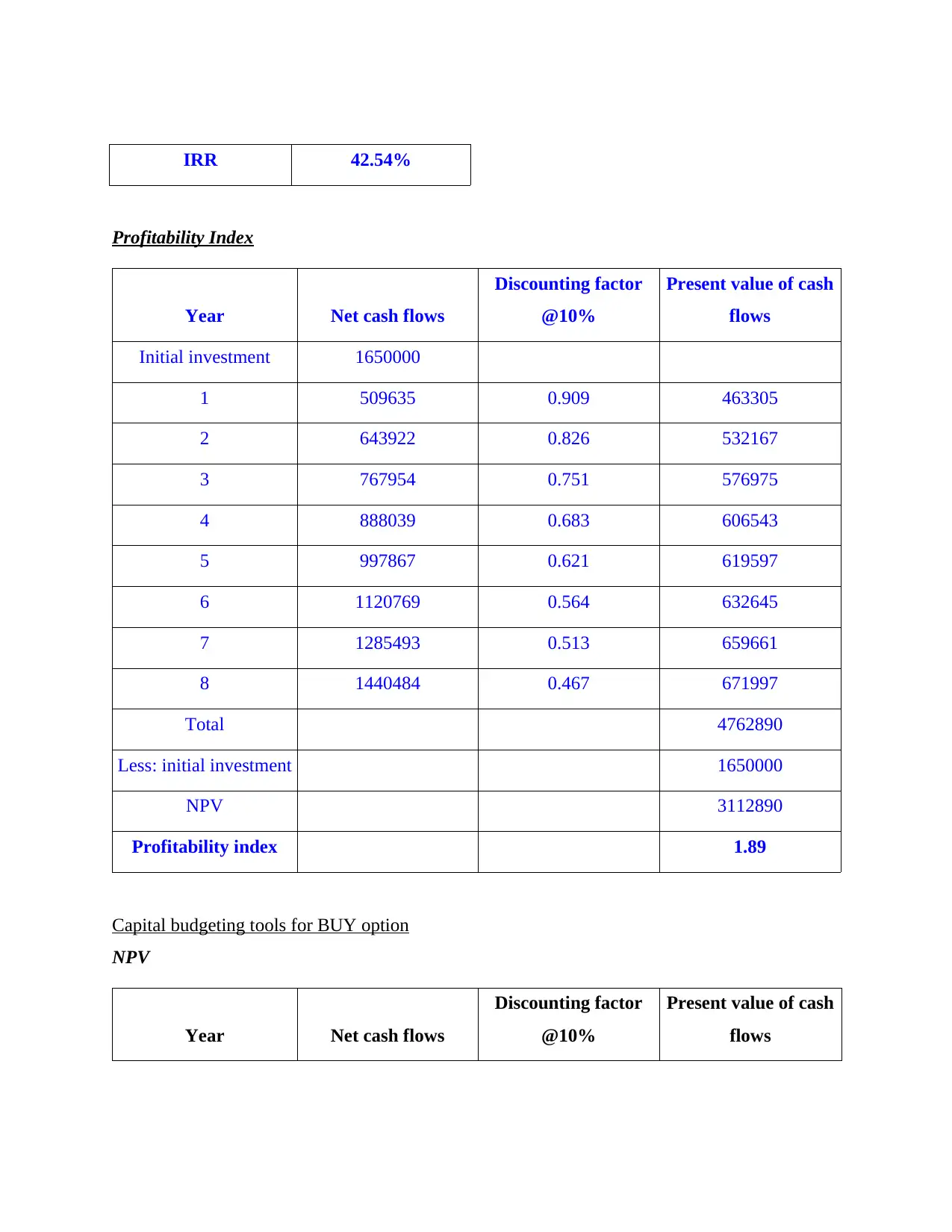

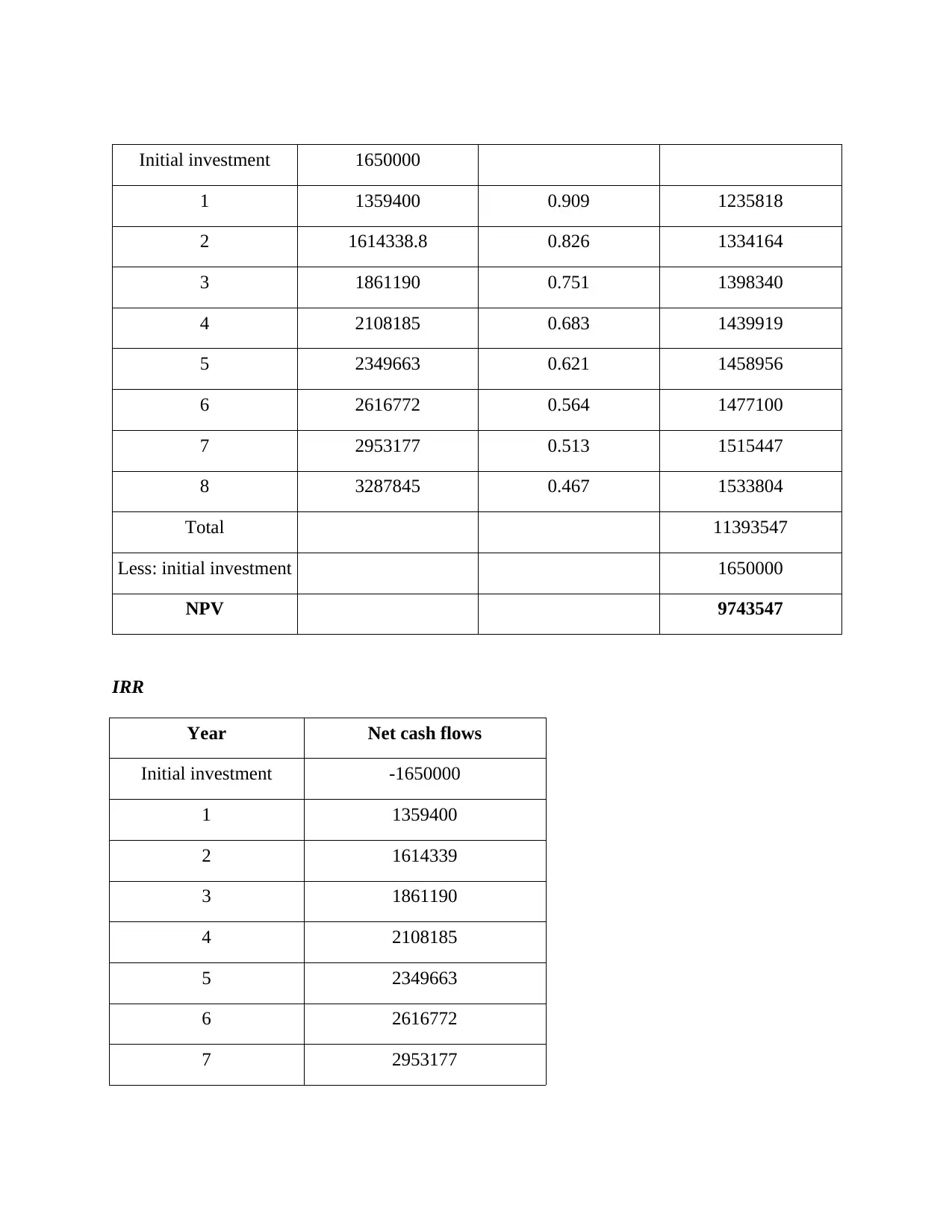

Initial investment 1650000

1 1359400 0.909 1235818

2 1614338.8 0.826 1334164

3 1861190 0.751 1398340

4 2108185 0.683 1439919

5 2349663 0.621 1458956

6 2616772 0.564 1477100

7 2953177 0.513 1515447

8 3287845 0.467 1533804

Total 11393547

Less: initial investment 1650000

NPV 9743547

IRR

Year Net cash flows

Initial investment -1650000

1 1359400

2 1614339

3 1861190

4 2108185

5 2349663

6 2616772

7 2953177

1 1359400 0.909 1235818

2 1614338.8 0.826 1334164

3 1861190 0.751 1398340

4 2108185 0.683 1439919

5 2349663 0.621 1458956

6 2616772 0.564 1477100

7 2953177 0.513 1515447

8 3287845 0.467 1533804

Total 11393547

Less: initial investment 1650000

NPV 9743547

IRR

Year Net cash flows

Initial investment -1650000

1 1359400

2 1614339

3 1861190

4 2108185

5 2349663

6 2616772

7 2953177

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

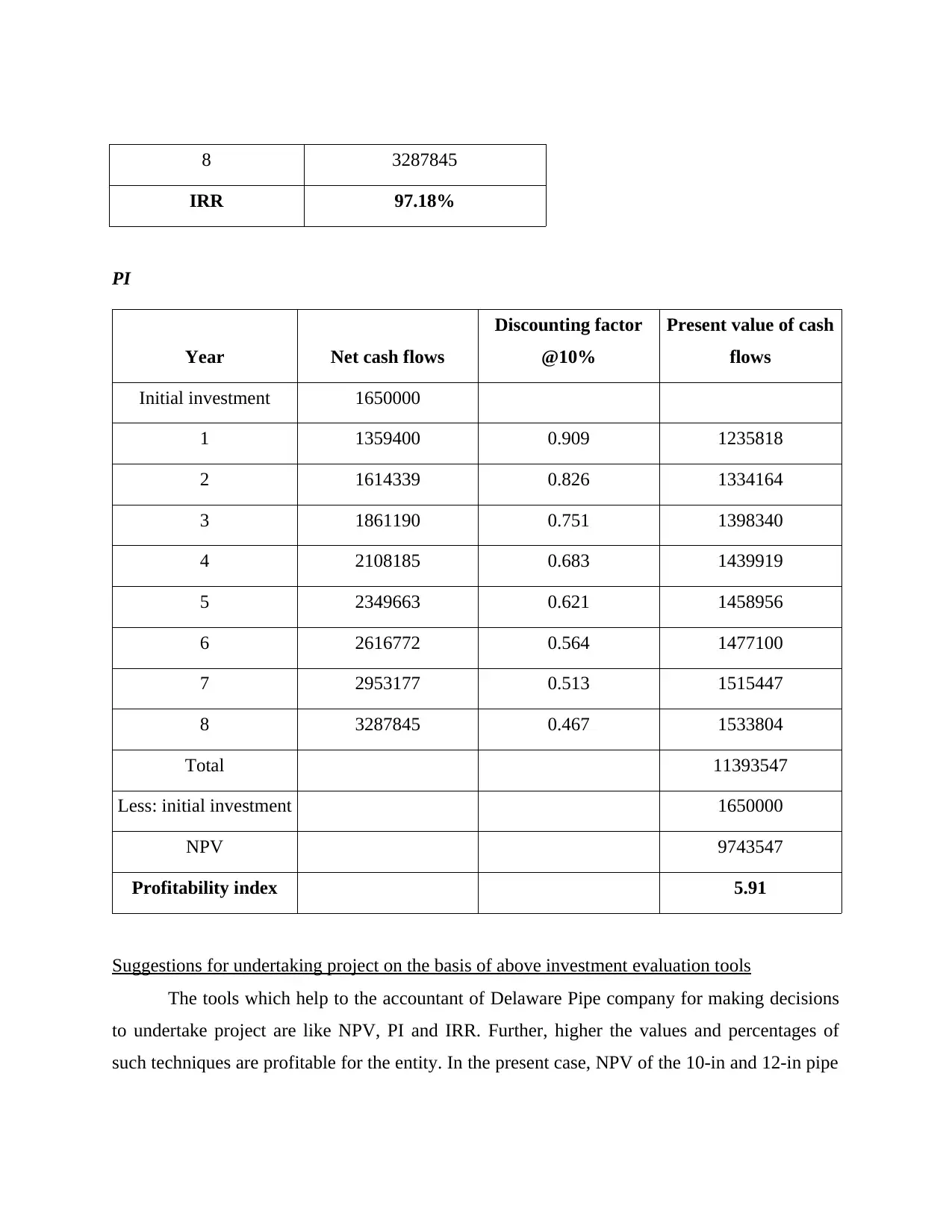

8 3287845

IRR 97.18%

PI

Year Net cash flows

Discounting factor

@10%

Present value of cash

flows

Initial investment 1650000

1 1359400 0.909 1235818

2 1614339 0.826 1334164

3 1861190 0.751 1398340

4 2108185 0.683 1439919

5 2349663 0.621 1458956

6 2616772 0.564 1477100

7 2953177 0.513 1515447

8 3287845 0.467 1533804

Total 11393547

Less: initial investment 1650000

NPV 9743547

Profitability index 5.91

Suggestions for undertaking project on the basis of above investment evaluation tools

The tools which help to the accountant of Delaware Pipe company for making decisions

to undertake project are like NPV, PI and IRR. Further, higher the values and percentages of

such techniques are profitable for the entity. In the present case, NPV of the 10-in and 12-in pipe

IRR 97.18%

PI

Year Net cash flows

Discounting factor

@10%

Present value of cash

flows

Initial investment 1650000

1 1359400 0.909 1235818

2 1614339 0.826 1334164

3 1861190 0.751 1398340

4 2108185 0.683 1439919

5 2349663 0.621 1458956

6 2616772 0.564 1477100

7 2953177 0.513 1515447

8 3287845 0.467 1533804

Total 11393547

Less: initial investment 1650000

NPV 9743547

Profitability index 5.91

Suggestions for undertaking project on the basis of above investment evaluation tools

The tools which help to the accountant of Delaware Pipe company for making decisions

to undertake project are like NPV, PI and IRR. Further, higher the values and percentages of

such techniques are profitable for the entity. In the present case, NPV of the 10-in and 12-in pipe

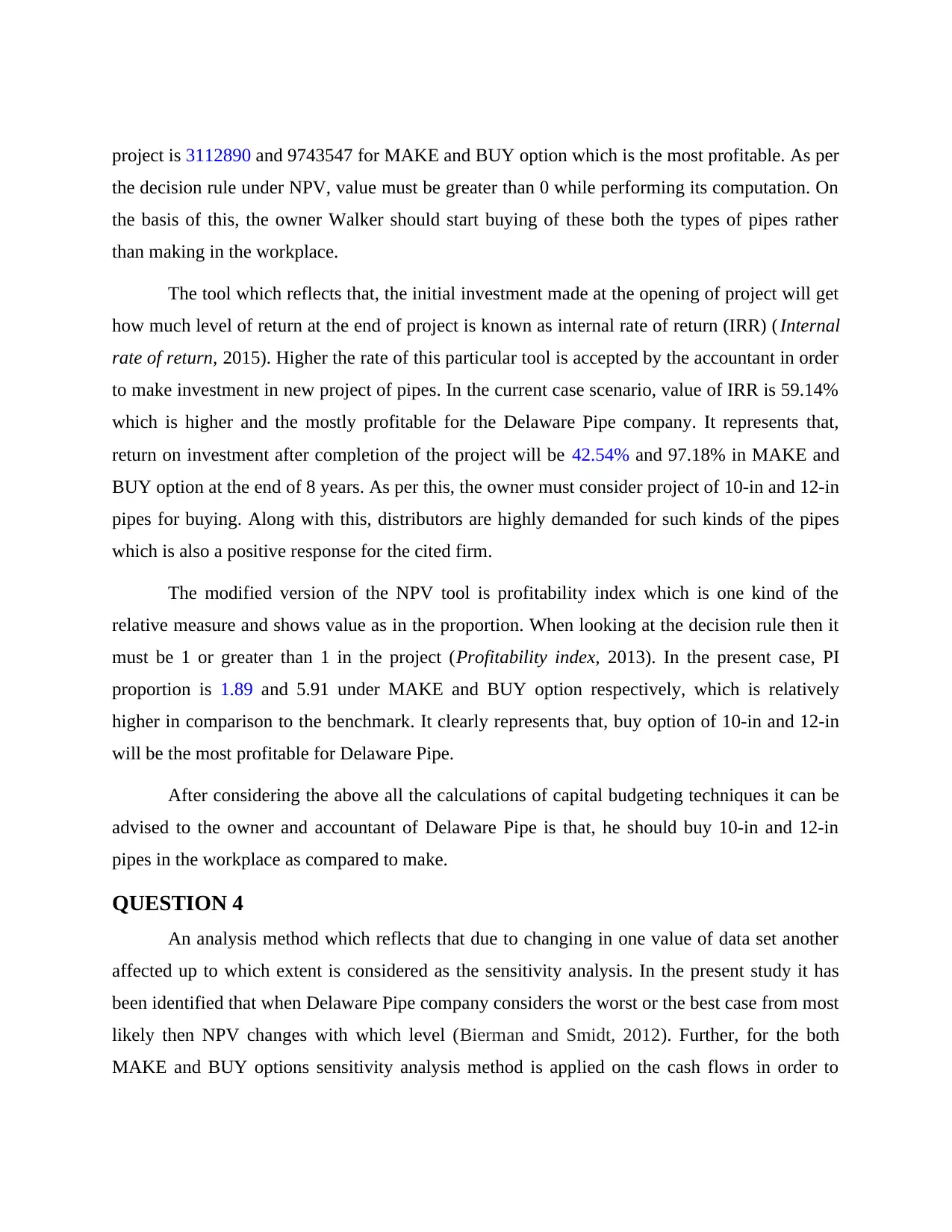

project is 3112890 and 9743547 for MAKE and BUY option which is the most profitable. As per

the decision rule under NPV, value must be greater than 0 while performing its computation. On

the basis of this, the owner Walker should start buying of these both the types of pipes rather

than making in the workplace.

The tool which reflects that, the initial investment made at the opening of project will get

how much level of return at the end of project is known as internal rate of return (IRR) ( Internal

rate of return, 2015). Higher the rate of this particular tool is accepted by the accountant in order

to make investment in new project of pipes. In the current case scenario, value of IRR is 59.14%

which is higher and the mostly profitable for the Delaware Pipe company. It represents that,

return on investment after completion of the project will be 42.54% and 97.18% in MAKE and

BUY option at the end of 8 years. As per this, the owner must consider project of 10-in and 12-in

pipes for buying. Along with this, distributors are highly demanded for such kinds of the pipes

which is also a positive response for the cited firm.

The modified version of the NPV tool is profitability index which is one kind of the

relative measure and shows value as in the proportion. When looking at the decision rule then it

must be 1 or greater than 1 in the project (Profitability index, 2013). In the present case, PI

proportion is 1.89 and 5.91 under MAKE and BUY option respectively, which is relatively

higher in comparison to the benchmark. It clearly represents that, buy option of 10-in and 12-in

will be the most profitable for Delaware Pipe.

After considering the above all the calculations of capital budgeting techniques it can be

advised to the owner and accountant of Delaware Pipe is that, he should buy 10-in and 12-in

pipes in the workplace as compared to make.

QUESTION 4

An analysis method which reflects that due to changing in one value of data set another

affected up to which extent is considered as the sensitivity analysis. In the present study it has

been identified that when Delaware Pipe company considers the worst or the best case from most

likely then NPV changes with which level (Bierman and Smidt, 2012). Further, for the both

MAKE and BUY options sensitivity analysis method is applied on the cash flows in order to

the decision rule under NPV, value must be greater than 0 while performing its computation. On

the basis of this, the owner Walker should start buying of these both the types of pipes rather

than making in the workplace.

The tool which reflects that, the initial investment made at the opening of project will get

how much level of return at the end of project is known as internal rate of return (IRR) ( Internal

rate of return, 2015). Higher the rate of this particular tool is accepted by the accountant in order

to make investment in new project of pipes. In the current case scenario, value of IRR is 59.14%

which is higher and the mostly profitable for the Delaware Pipe company. It represents that,

return on investment after completion of the project will be 42.54% and 97.18% in MAKE and

BUY option at the end of 8 years. As per this, the owner must consider project of 10-in and 12-in

pipes for buying. Along with this, distributors are highly demanded for such kinds of the pipes

which is also a positive response for the cited firm.

The modified version of the NPV tool is profitability index which is one kind of the

relative measure and shows value as in the proportion. When looking at the decision rule then it

must be 1 or greater than 1 in the project (Profitability index, 2013). In the present case, PI

proportion is 1.89 and 5.91 under MAKE and BUY option respectively, which is relatively

higher in comparison to the benchmark. It clearly represents that, buy option of 10-in and 12-in

will be the most profitable for Delaware Pipe.

After considering the above all the calculations of capital budgeting techniques it can be

advised to the owner and accountant of Delaware Pipe is that, he should buy 10-in and 12-in

pipes in the workplace as compared to make.

QUESTION 4

An analysis method which reflects that due to changing in one value of data set another

affected up to which extent is considered as the sensitivity analysis. In the present study it has

been identified that when Delaware Pipe company considers the worst or the best case from most

likely then NPV changes with which level (Bierman and Smidt, 2012). Further, for the both

MAKE and BUY options sensitivity analysis method is applied on the cash flows in order to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.