Capital Budgeting and Replacement Analysis for Saturn Petcare Report

VerifiedAdded on 2023/06/04

|7

|1308

|310

Report

AI Summary

This report provides a detailed financial analysis of Saturn Petcare's proposed new manufacturing unit, focusing on capital budgeting techniques. The analysis includes a comprehensive assessment of the initial investment, operational cash flows, and various financial metrics such as Net Present Value (NPV), payback period, and Profitability Index. The report evaluates the project's financial viability under normal production conditions and considers sensitivity analyses by examining scenarios with 5% higher and lower sales volumes. Additionally, the report assesses a replacement option, comparing two alternatives using a risk-adjusted rate and calculating the Net Present Value for each option to determine the most profitable choice for the business. The conclusion emphasizes the importance of cost control for the project's success and recommends the best replacement option based on NPV.

Running head: ACCOUNTING AND FINANCE

Accounting and Finance

Name of the Student:

Name of the University:

Author’s Note:

Accounting and Finance

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING AND FINANCE

ACCOUNTING AND FINANCE

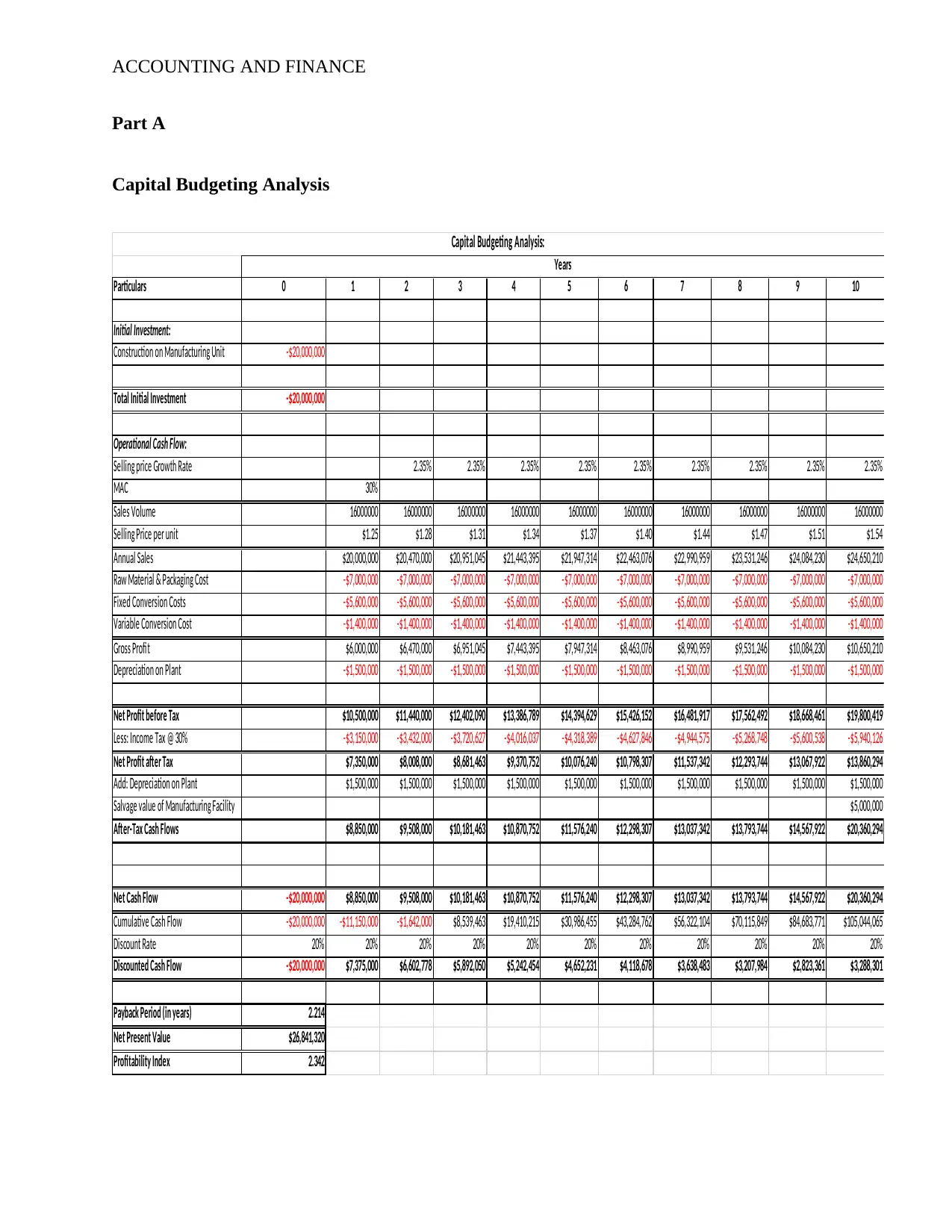

Part A

Capital Budgeting Analysis

Particulars 0 1 2 3 4 5 6 7 8 9 10

Initial Investment:

Construction on Manufacturing Unit -$20,000,000

Total Initial Investment -$20,000,000

Operational Cash Flow:

Selling price Growth Rate 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35%

MAC 30%

Sales Volume 16000000 16000000 16000000 16000000 16000000 16000000 16000000 16000000 16000000 16000000

Selling Price per unit $1.25 $1.28 $1.31 $1.34 $1.37 $1.40 $1.44 $1.47 $1.51 $1.54

Annual Sales $20,000,000 $20,470,000 $20,951,045 $21,443,395 $21,947,314 $22,463,076 $22,990,959 $23,531,246 $24,084,230 $24,650,210

Raw Material & Packaging Cost -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000

Fixed Conversion Costs -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000

Variable Conversion Cost -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000

Gross Profit $6,000,000 $6,470,000 $6,951,045 $7,443,395 $7,947,314 $8,463,076 $8,990,959 $9,531,246 $10,084,230 $10,650,210

Depreciation on Plant -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000

Net Profit before Tax $10,500,000 $11,440,000 $12,402,090 $13,386,789 $14,394,629 $15,426,152 $16,481,917 $17,562,492 $18,668,461 $19,800,419

Less: Income Tax @ 30% -$3,150,000 -$3,432,000 -$3,720,627 -$4,016,037 -$4,318,389 -$4,627,846 -$4,944,575 -$5,268,748 -$5,600,538 -$5,940,126

Net Profit after Tax $7,350,000 $8,008,000 $8,681,463 $9,370,752 $10,076,240 $10,798,307 $11,537,342 $12,293,744 $13,067,922 $13,860,294

Add: Depreciation on Plant $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000

Salvage value of Manufacturing Facility $5,000,000

After-Tax Cash Flows $8,850,000 $9,508,000 $10,181,463 $10,870,752 $11,576,240 $12,298,307 $13,037,342 $13,793,744 $14,567,922 $20,360,294

Net Cash Flow -$20,000,000 $8,850,000 $9,508,000 $10,181,463 $10,870,752 $11,576,240 $12,298,307 $13,037,342 $13,793,744 $14,567,922 $20,360,294

Cumulative Cash Flow -$20,000,000 -$11,150,000 -$1,642,000 $8,539,463 $19,410,215 $30,986,455 $43,284,762 $56,322,104 $70,115,849 $84,683,771 $105,044,065

Discount Rate 20% 20% 20% 20% 20% 20% 20% 20% 20% 20% 20%

Discounted Cash Flow -$20,000,000 $7,375,000 $6,602,778 $5,892,050 $5,242,454 $4,652,231 $4,118,678 $3,638,483 $3,207,984 $2,823,361 $3,288,301

Payback Period (in years) 2.214

Net Present Value $26,841,320

Profitability Index 2.342

Years

Capital Budgeting Analysis:

Part A

Capital Budgeting Analysis

Particulars 0 1 2 3 4 5 6 7 8 9 10

Initial Investment:

Construction on Manufacturing Unit -$20,000,000

Total Initial Investment -$20,000,000

Operational Cash Flow:

Selling price Growth Rate 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35% 2.35%

MAC 30%

Sales Volume 16000000 16000000 16000000 16000000 16000000 16000000 16000000 16000000 16000000 16000000

Selling Price per unit $1.25 $1.28 $1.31 $1.34 $1.37 $1.40 $1.44 $1.47 $1.51 $1.54

Annual Sales $20,000,000 $20,470,000 $20,951,045 $21,443,395 $21,947,314 $22,463,076 $22,990,959 $23,531,246 $24,084,230 $24,650,210

Raw Material & Packaging Cost -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000 -$7,000,000

Fixed Conversion Costs -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000 -$5,600,000

Variable Conversion Cost -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000 -$1,400,000

Gross Profit $6,000,000 $6,470,000 $6,951,045 $7,443,395 $7,947,314 $8,463,076 $8,990,959 $9,531,246 $10,084,230 $10,650,210

Depreciation on Plant -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000 -$1,500,000

Net Profit before Tax $10,500,000 $11,440,000 $12,402,090 $13,386,789 $14,394,629 $15,426,152 $16,481,917 $17,562,492 $18,668,461 $19,800,419

Less: Income Tax @ 30% -$3,150,000 -$3,432,000 -$3,720,627 -$4,016,037 -$4,318,389 -$4,627,846 -$4,944,575 -$5,268,748 -$5,600,538 -$5,940,126

Net Profit after Tax $7,350,000 $8,008,000 $8,681,463 $9,370,752 $10,076,240 $10,798,307 $11,537,342 $12,293,744 $13,067,922 $13,860,294

Add: Depreciation on Plant $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000 $1,500,000

Salvage value of Manufacturing Facility $5,000,000

After-Tax Cash Flows $8,850,000 $9,508,000 $10,181,463 $10,870,752 $11,576,240 $12,298,307 $13,037,342 $13,793,744 $14,567,922 $20,360,294

Net Cash Flow -$20,000,000 $8,850,000 $9,508,000 $10,181,463 $10,870,752 $11,576,240 $12,298,307 $13,037,342 $13,793,744 $14,567,922 $20,360,294

Cumulative Cash Flow -$20,000,000 -$11,150,000 -$1,642,000 $8,539,463 $19,410,215 $30,986,455 $43,284,762 $56,322,104 $70,115,849 $84,683,771 $105,044,065

Discount Rate 20% 20% 20% 20% 20% 20% 20% 20% 20% 20% 20%

Discounted Cash Flow -$20,000,000 $7,375,000 $6,602,778 $5,892,050 $5,242,454 $4,652,231 $4,118,678 $3,638,483 $3,207,984 $2,823,361 $3,288,301

Payback Period (in years) 2.214

Net Present Value $26,841,320

Profitability Index 2.342

Years

Capital Budgeting Analysis:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING AND FINANCE

Scenario Summary

Current Values: 5% Higher Sales 5% Lower Sales

Changing Cells:

Sales Volume 16000000 16800000 15200000

Fixed Conversion Cost -5600000 -5600000 -5600000

Result Cells:

Payback Period 2.214 2.131 2.306

Net Present Value $26,841,320 $29,048,679 $24,633,961

Profitability Index 2.342 2.452 2.232

The management of Saturn Petcare ltd plans to implement a policy whereby the

management can improve the sales of the business and thereby increase the revenue of the

business. The management wants to introduce a new manufacturing unit which will be producing

new dog wet food products.

The sales volume which the management anticipates to produce on a yearly basis is

around 16,000,000 cans for which the NPV, Payback period and Profitability Index of the

project. The decision of the management is to be analyzed considering the investment appraisal

techniques which are used by the business (Bianchini et al., 2016). The management will also be

considering the what if situation wherein if the product is over produced by 5% or where the

product is under produced by 5%. The total investment of the project is shown to be $

20,000,000 and the net present value of the project under normal production conditions is $

26,841,320 which is favorable and so is the profitability index and payback period analysis

(Brewer & Stout, 2014). The NPV of the project under 5% less production capacity is shown to

be $ 23,317,179 which is also shown to be favorable for the business during the period. The

surplus production of the business in case of 5% more production is shown to be $ 30,365,462.

Scenario Summary

Current Values: 5% Higher Sales 5% Lower Sales

Changing Cells:

Sales Volume 16000000 16800000 15200000

Fixed Conversion Cost -5600000 -5600000 -5600000

Result Cells:

Payback Period 2.214 2.131 2.306

Net Present Value $26,841,320 $29,048,679 $24,633,961

Profitability Index 2.342 2.452 2.232

The management of Saturn Petcare ltd plans to implement a policy whereby the

management can improve the sales of the business and thereby increase the revenue of the

business. The management wants to introduce a new manufacturing unit which will be producing

new dog wet food products.

The sales volume which the management anticipates to produce on a yearly basis is

around 16,000,000 cans for which the NPV, Payback period and Profitability Index of the

project. The decision of the management is to be analyzed considering the investment appraisal

techniques which are used by the business (Bianchini et al., 2016). The management will also be

considering the what if situation wherein if the product is over produced by 5% or where the

product is under produced by 5%. The total investment of the project is shown to be $

20,000,000 and the net present value of the project under normal production conditions is $

26,841,320 which is favorable and so is the profitability index and payback period analysis

(Brewer & Stout, 2014). The NPV of the project under 5% less production capacity is shown to

be $ 23,317,179 which is also shown to be favorable for the business during the period. The

surplus production of the business in case of 5% more production is shown to be $ 30,365,462.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING AND FINANCE

The only concern for the business is the costs factor which is to be considered for the

project and the same needs to be controlled by the management of the business during the period.

Replacement Option

Year Option A Option B

0 -$475,000 -$475,000

1 $100,000 $80,000

2 $100,000 $80,000

3 $100,000 $80,000

4 $100,000 $80,000

5 $100,000 $80,000

6 $100,000 $80,000

7 $80,000

8 $80,000

9 $80,000

Risk Adjusted Rate 6% 6%

Net Present Value $ 15,785.31 $ 65,222.06

The only concern for the business is the costs factor which is to be considered for the

project and the same needs to be controlled by the management of the business during the period.

Replacement Option

Year Option A Option B

0 -$475,000 -$475,000

1 $100,000 $80,000

2 $100,000 $80,000

3 $100,000 $80,000

4 $100,000 $80,000

5 $100,000 $80,000

6 $100,000 $80,000

7 $80,000

8 $80,000

9 $80,000

Risk Adjusted Rate 6% 6%

Net Present Value $ 15,785.31 $ 65,222.06

ACCOUNTING AND FINANCE

Year Cash Outflow Cash Inflow Net Cash Flow Cash Outflow Cash Inflow Net Cash Flow

0 -$475,000 -$475,000 -$475,000 -$475,000

1 $100,000 $100,000 $80,000 $80,000

2 $100,000 $100,000 $80,000 $80,000

3 $100,000 $100,000 $80,000 $80,000

4 $100,000 $100,000 $80,000 $80,000

5 $100,000 $100,000 $80,000 $80,000

6 -$475,000 $100,000 -$375,000 $80,000 $80,000

7 $100,000 $100,000 $80,000 $80,000

8 $100,000 $100,000 $80,000 $80,000

9 $100,000 $100,000 -$475,000 $80,000 -$395,000

10 $100,000 $100,000 $80,000 $80,000

11 $100,000 $100,000 $80,000 $80,000

12 -$475,000 $100,000 -$375,000 $80,000 $80,000

13 $100,000 $100,000 $80,000 $80,000

14 $100,000 $100,000 $80,000 $80,000

15 $100,000 $100,000 $80,000 $80,000

16 $100,000 $100,000 $80,000 $80,000

17 $100,000 $100,000 $80,000 $80,000

18 $100,000 $100,000 $80,000 $80,000

Risk Adjusted Rate 6% 6%

Adjusted Net Present Value $ 34,758.15 $ 103,826.89

Option A Option A

The management of the business needs to select Option B for the purpose of replacement

as the same option provides the business with maximum NPV which also signifies that Option B

will be more profitable for the business.

Year Cash Outflow Cash Inflow Net Cash Flow Cash Outflow Cash Inflow Net Cash Flow

0 -$475,000 -$475,000 -$475,000 -$475,000

1 $100,000 $100,000 $80,000 $80,000

2 $100,000 $100,000 $80,000 $80,000

3 $100,000 $100,000 $80,000 $80,000

4 $100,000 $100,000 $80,000 $80,000

5 $100,000 $100,000 $80,000 $80,000

6 -$475,000 $100,000 -$375,000 $80,000 $80,000

7 $100,000 $100,000 $80,000 $80,000

8 $100,000 $100,000 $80,000 $80,000

9 $100,000 $100,000 -$475,000 $80,000 -$395,000

10 $100,000 $100,000 $80,000 $80,000

11 $100,000 $100,000 $80,000 $80,000

12 -$475,000 $100,000 -$375,000 $80,000 $80,000

13 $100,000 $100,000 $80,000 $80,000

14 $100,000 $100,000 $80,000 $80,000

15 $100,000 $100,000 $80,000 $80,000

16 $100,000 $100,000 $80,000 $80,000

17 $100,000 $100,000 $80,000 $80,000

18 $100,000 $100,000 $80,000 $80,000

Risk Adjusted Rate 6% 6%

Adjusted Net Present Value $ 34,758.15 $ 103,826.89

Option A Option A

The management of the business needs to select Option B for the purpose of replacement

as the same option provides the business with maximum NPV which also signifies that Option B

will be more profitable for the business.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING AND FINANCE

Reference

Bianchini, A., Gambuti, M., Pellegrini, M., & Saccani, C. (2016). Performance analysis and

economic assessment of different photovoltaic technologies based on experimental

measurements. Renewable Energy, 85, 1-11.

Brewer, P. C., & Stout, D. E. (2014). The future of accounting education: Addressing the

competency crisis. Strategic Finance, 96(2), 29.

Reference

Bianchini, A., Gambuti, M., Pellegrini, M., & Saccani, C. (2016). Performance analysis and

economic assessment of different photovoltaic technologies based on experimental

measurements. Renewable Energy, 85, 1-11.

Brewer, P. C., & Stout, D. E. (2014). The future of accounting education: Addressing the

competency crisis. Strategic Finance, 96(2), 29.

1 out of 7