Comprehensive Report on Financial Analysis and Investment Decisions

VerifiedAdded on 2023/06/18

|16

|4048

|134

Report

AI Summary

This business report focuses on capital appraising techniques for S Plc, a computer games company, evaluating investment proposals through cash flow analysis, payback period calculation, and net present value determination. It contrasts bank loans with equity issues for long-term finance, calcul...

Business Report

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

TASK...............................................................................................................................................3

A.......................................................................................................................................................3

1. Explaining the importance of capital appraising process........................................................3

2. Calculating cash-flow analysis statement...............................................................................3

3. Calculating Payback period.....................................................................................................4

4. Determining Net Present Value for new investment...............................................................5

5. Explaining logic behind Net present value and relationship to cost of capital.......................5

6. Computing Internal Rate of Return and its impact on investment..........................................6

7. Discussing the superiority of NPV than IRR..........................................................................6

B.......................................................................................................................................................7

Critically contrasting bank loan with equity issue in long-term finance....................................7

C.......................................................................................................................................................8

1. Calculating break even sales revenue.....................................................................................8

2. Calculating the changes in BEP if prices changes..................................................................8

3. Discussing the assumption of Cost-volume-profit analysis....................................................9

D.....................................................................................................................................................10

1. Explaining the difference between three categories of suppliers..........................................10

2. Comparing the advantages of single-sourcing and multiple sourcing..................................11

3. Describing Cross-sourcing with example and benefits.........................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................3

TASK...............................................................................................................................................3

A.......................................................................................................................................................3

1. Explaining the importance of capital appraising process........................................................3

2. Calculating cash-flow analysis statement...............................................................................3

3. Calculating Payback period.....................................................................................................4

4. Determining Net Present Value for new investment...............................................................5

5. Explaining logic behind Net present value and relationship to cost of capital.......................5

6. Computing Internal Rate of Return and its impact on investment..........................................6

7. Discussing the superiority of NPV than IRR..........................................................................6

B.......................................................................................................................................................7

Critically contrasting bank loan with equity issue in long-term finance....................................7

C.......................................................................................................................................................8

1. Calculating break even sales revenue.....................................................................................8

2. Calculating the changes in BEP if prices changes..................................................................8

3. Discussing the assumption of Cost-volume-profit analysis....................................................9

D.....................................................................................................................................................10

1. Explaining the difference between three categories of suppliers..........................................10

2. Comparing the advantages of single-sourcing and multiple sourcing..................................11

3. Describing Cross-sourcing with example and benefits.........................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION

Capital investments require lot of funds by company so that it can enhance its business

operations and can achieve higher goals and objectives. It can be done through various sources

such as raising a loan or equity shares, utilizing company's retained earnings, etc. The present

report is based on S Plc which deals in computer games and wants to broaden its product line.

The study will outline various techniques of capital budgeting which can be used by organization

to analyse profitability of proposal.

Further, the report will highlight the contrasting views on equity issue and bank loans. It

will also calculate break even sales revenue and will provide useful insight about cost-volume

profit analysis. In addition to this, report will also distinguish between different categories of

suppliers and will compare single source and multiple sources of procurement. Lastly, study will

explain cross-sourcing along with example and its benefits to buyers.

TASK

A

1. Explaining the importance of capital appraising process

Evaluating the capital investment with different techniques helps company identifying the

optimum proposal that will give company maximum output with minimum input and

risks.

Large amount of money is invested in capital resources that makes it necessary for S Plc

to analyse investment proposals in depth (Alles and et.al., 2021).

Investment decisions are linked to S Plc's strategic business decisions that have direct

impact on shareholders' wealth. Therefore, to maximize shareholders' wealth capital

decisions are important if taken with the help of different techniques.

S plc is involved with no. of long term investment proposals which leads to greater risks

than return. In such case, cash flows may be affected badly. Hence, capital appraisal is

beneficial for business entity.

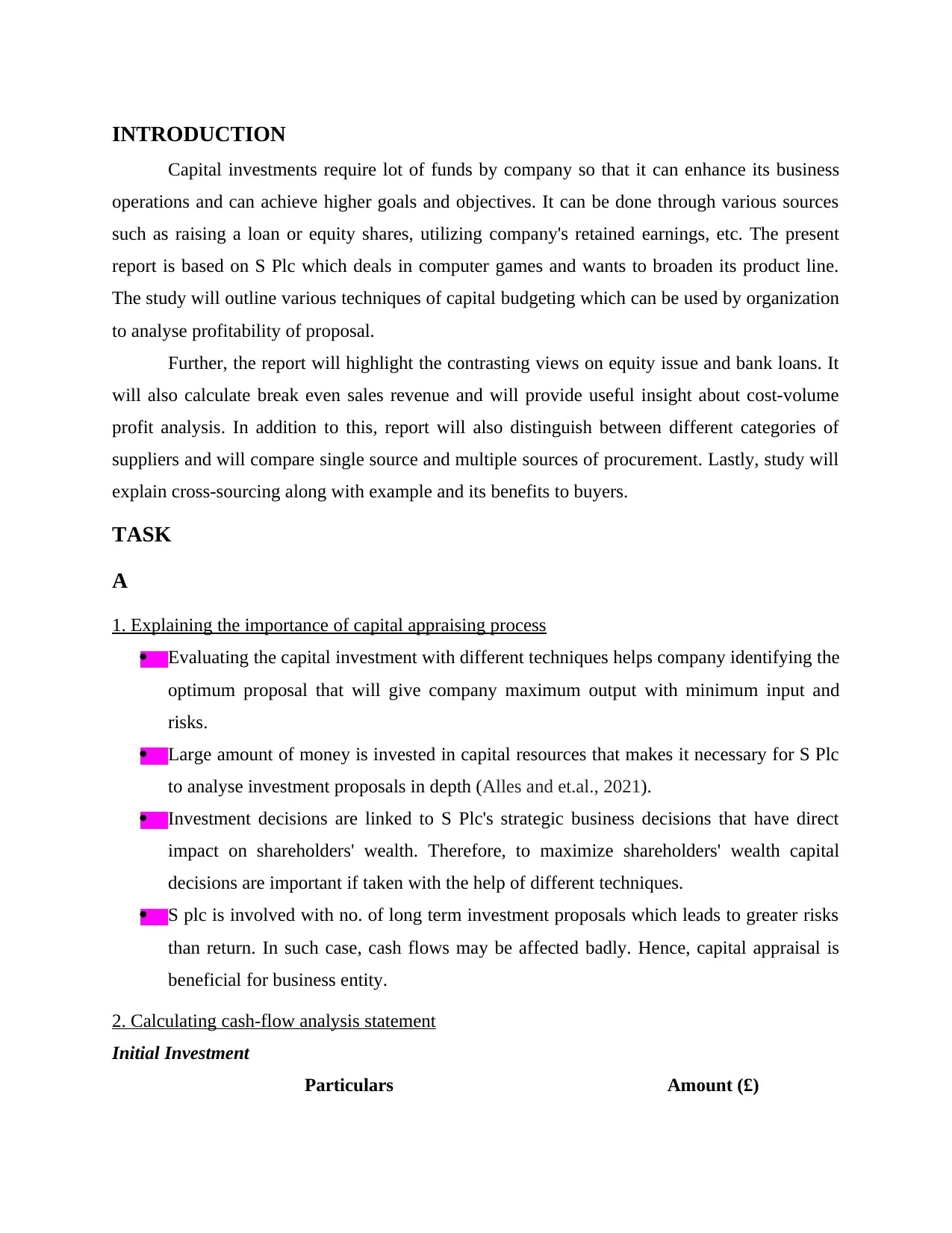

2. Calculating cash-flow analysis statement

Initial Investment

Particulars Amount (£)

Capital investments require lot of funds by company so that it can enhance its business

operations and can achieve higher goals and objectives. It can be done through various sources

such as raising a loan or equity shares, utilizing company's retained earnings, etc. The present

report is based on S Plc which deals in computer games and wants to broaden its product line.

The study will outline various techniques of capital budgeting which can be used by organization

to analyse profitability of proposal.

Further, the report will highlight the contrasting views on equity issue and bank loans. It

will also calculate break even sales revenue and will provide useful insight about cost-volume

profit analysis. In addition to this, report will also distinguish between different categories of

suppliers and will compare single source and multiple sources of procurement. Lastly, study will

explain cross-sourcing along with example and its benefits to buyers.

TASK

A

1. Explaining the importance of capital appraising process

Evaluating the capital investment with different techniques helps company identifying the

optimum proposal that will give company maximum output with minimum input and

risks.

Large amount of money is invested in capital resources that makes it necessary for S Plc

to analyse investment proposals in depth (Alles and et.al., 2021).

Investment decisions are linked to S Plc's strategic business decisions that have direct

impact on shareholders' wealth. Therefore, to maximize shareholders' wealth capital

decisions are important if taken with the help of different techniques.

S plc is involved with no. of long term investment proposals which leads to greater risks

than return. In such case, cash flows may be affected badly. Hence, capital appraisal is

beneficial for business entity.

2. Calculating cash-flow analysis statement

Initial Investment

Particulars Amount (£)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Production equipment 1000000

Staff training provision 100000

Advertising & promotion costs 20000

Incremental working capital 180000

Total 1300000

Cash Inflow

Year Amount (£)

1 600000

2 1000000

3 1200000

4 1000000

5 800000

total 4600000

Cash Outflow

Particulars Year 1 Year 2 Year 3 Year 4 Year 5

Cost of sales 180000 300000 360000 300000 240000

Operation costs 100000 100000 100000 100000 100000

Depreciation 260000 260000 260000 260000 260000

Total 540000 660000 720000 660000 600000

Cash-flow statement

Year Cash inflow Cash outflow Net Cash flow

1 600000 540000 60000

2 1000000 660000 340000

3 1200000 720000 480000

4 1000000 660000 340000

5 800000 600000 200000

Staff training provision 100000

Advertising & promotion costs 20000

Incremental working capital 180000

Total 1300000

Cash Inflow

Year Amount (£)

1 600000

2 1000000

3 1200000

4 1000000

5 800000

total 4600000

Cash Outflow

Particulars Year 1 Year 2 Year 3 Year 4 Year 5

Cost of sales 180000 300000 360000 300000 240000

Operation costs 100000 100000 100000 100000 100000

Depreciation 260000 260000 260000 260000 260000

Total 540000 660000 720000 660000 600000

Cash-flow statement

Year Cash inflow Cash outflow Net Cash flow

1 600000 540000 60000

2 1000000 660000 340000

3 1200000 720000 480000

4 1000000 660000 340000

5 800000 600000 200000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

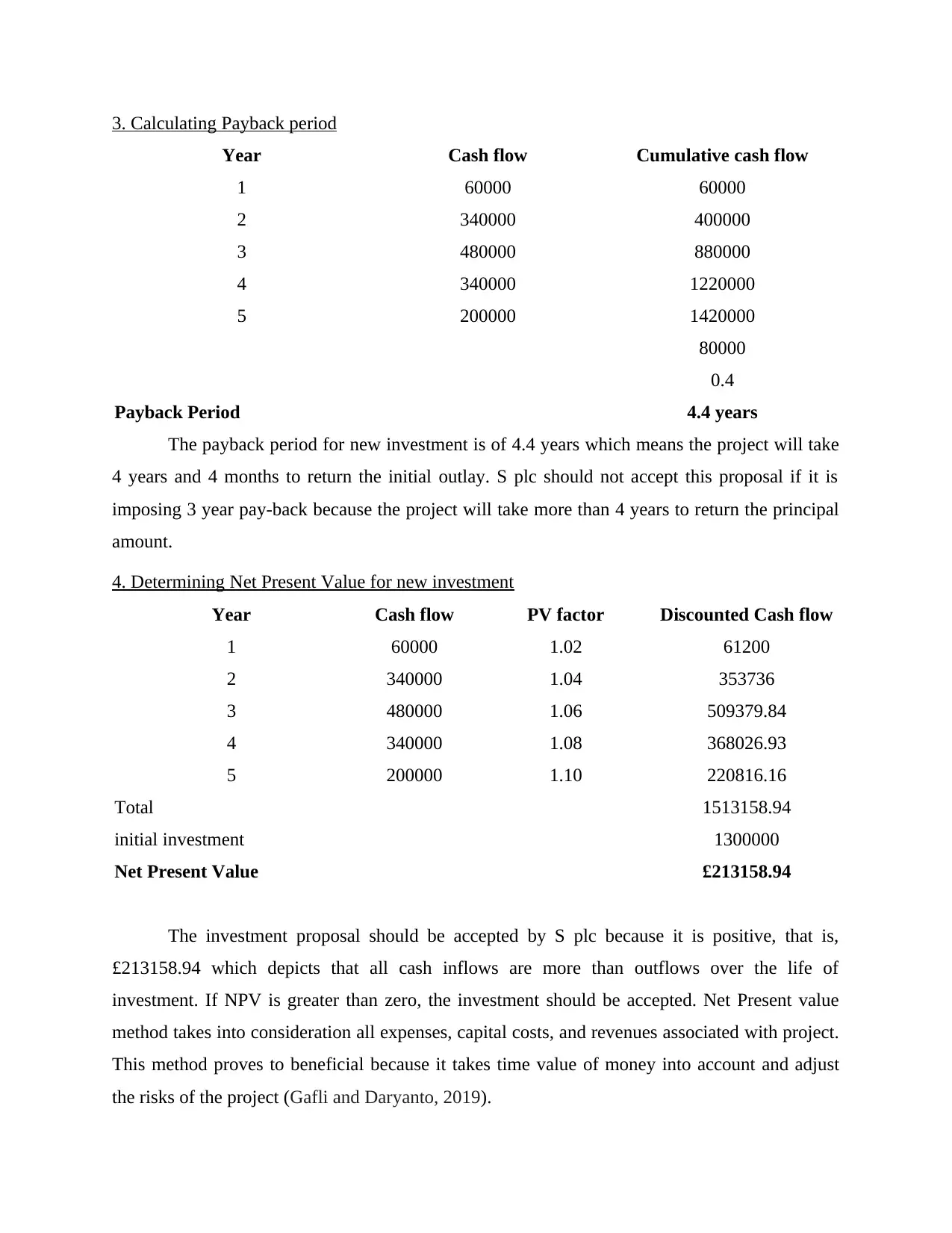

3. Calculating Payback period

Year Cash flow Cumulative cash flow

1 60000 60000

2 340000 400000

3 480000 880000

4 340000 1220000

5 200000 1420000

80000

0.4

Payback Period 4.4 years

The payback period for new investment is of 4.4 years which means the project will take

4 years and 4 months to return the initial outlay. S plc should not accept this proposal if it is

imposing 3 year pay-back because the project will take more than 4 years to return the principal

amount.

4. Determining Net Present Value for new investment

Year Cash flow PV factor Discounted Cash flow

1 60000 1.02 61200

2 340000 1.04 353736

3 480000 1.06 509379.84

4 340000 1.08 368026.93

5 200000 1.10 220816.16

Total 1513158.94

initial investment 1300000

Net Present Value £213158.94

The investment proposal should be accepted by S plc because it is positive, that is,

£213158.94 which depicts that all cash inflows are more than outflows over the life of

investment. If NPV is greater than zero, the investment should be accepted. Net Present value

method takes into consideration all expenses, capital costs, and revenues associated with project.

This method proves to beneficial because it takes time value of money into account and adjust

the risks of the project (Gafli and Daryanto, 2019).

Year Cash flow Cumulative cash flow

1 60000 60000

2 340000 400000

3 480000 880000

4 340000 1220000

5 200000 1420000

80000

0.4

Payback Period 4.4 years

The payback period for new investment is of 4.4 years which means the project will take

4 years and 4 months to return the initial outlay. S plc should not accept this proposal if it is

imposing 3 year pay-back because the project will take more than 4 years to return the principal

amount.

4. Determining Net Present Value for new investment

Year Cash flow PV factor Discounted Cash flow

1 60000 1.02 61200

2 340000 1.04 353736

3 480000 1.06 509379.84

4 340000 1.08 368026.93

5 200000 1.10 220816.16

Total 1513158.94

initial investment 1300000

Net Present Value £213158.94

The investment proposal should be accepted by S plc because it is positive, that is,

£213158.94 which depicts that all cash inflows are more than outflows over the life of

investment. If NPV is greater than zero, the investment should be accepted. Net Present value

method takes into consideration all expenses, capital costs, and revenues associated with project.

This method proves to beneficial because it takes time value of money into account and adjust

the risks of the project (Gafli and Daryanto, 2019).

5. Explaining logic behind Net present value and relationship to cost of capital

Net present value technique measures the efficiency and profitability level of investment

and evaluates whether organization should invest in the project or not. NPV makes use of

discounted cash flows in the evaluation which precisely considers risk and time component.

Project should be independent which means it should not be affected by cash flows of other

projects and it should produce positive NPV for acceptance of proposal (Chrysafis and

Papadopoulos, 2021).

Cost of capital is the least desired rate of return which is a weighted average cost of

equity and debt. If the expected cash outflow are more than cash inflows, then NPV is negative

i.e. less than zero. In the case, project proposal is rejected by company. On the other hand, if

expected outflows are less than inflows, then Net present value is greater than Zero which means

it is positive. Investment proposal is accepted because it is giving positive cash flows.

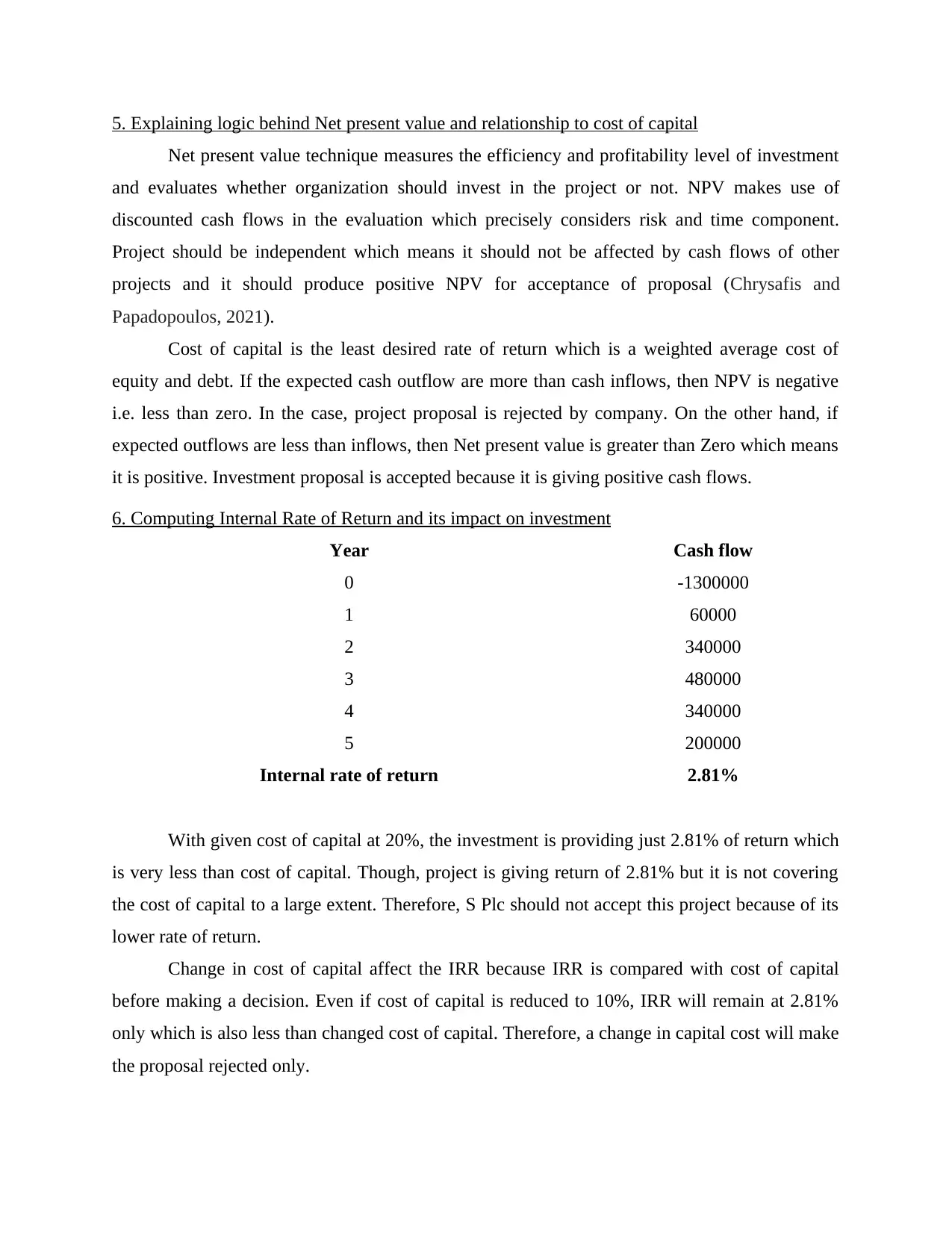

6. Computing Internal Rate of Return and its impact on investment

Year Cash flow

0 -1300000

1 60000

2 340000

3 480000

4 340000

5 200000

Internal rate of return 2.81%

With given cost of capital at 20%, the investment is providing just 2.81% of return which

is very less than cost of capital. Though, project is giving return of 2.81% but it is not covering

the cost of capital to a large extent. Therefore, S Plc should not accept this project because of its

lower rate of return.

Change in cost of capital affect the IRR because IRR is compared with cost of capital

before making a decision. Even if cost of capital is reduced to 10%, IRR will remain at 2.81%

only which is also less than changed cost of capital. Therefore, a change in capital cost will make

the proposal rejected only.

Net present value technique measures the efficiency and profitability level of investment

and evaluates whether organization should invest in the project or not. NPV makes use of

discounted cash flows in the evaluation which precisely considers risk and time component.

Project should be independent which means it should not be affected by cash flows of other

projects and it should produce positive NPV for acceptance of proposal (Chrysafis and

Papadopoulos, 2021).

Cost of capital is the least desired rate of return which is a weighted average cost of

equity and debt. If the expected cash outflow are more than cash inflows, then NPV is negative

i.e. less than zero. In the case, project proposal is rejected by company. On the other hand, if

expected outflows are less than inflows, then Net present value is greater than Zero which means

it is positive. Investment proposal is accepted because it is giving positive cash flows.

6. Computing Internal Rate of Return and its impact on investment

Year Cash flow

0 -1300000

1 60000

2 340000

3 480000

4 340000

5 200000

Internal rate of return 2.81%

With given cost of capital at 20%, the investment is providing just 2.81% of return which

is very less than cost of capital. Though, project is giving return of 2.81% but it is not covering

the cost of capital to a large extent. Therefore, S Plc should not accept this project because of its

lower rate of return.

Change in cost of capital affect the IRR because IRR is compared with cost of capital

before making a decision. Even if cost of capital is reduced to 10%, IRR will remain at 2.81%

only which is also less than changed cost of capital. Therefore, a change in capital cost will make

the proposal rejected only.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7. Discussing the superiority of NPV than IRR

There are various situations that causes problems for IRR, one of which is it does not

consider changing discount rates which is not suitable to evaluate long term profitability of

venture. The discount rate does not remain constant and keep on changing substantially over

time. The benefit of using NPV is that it take into account multiple discount rates without any

issues. Cash flows can be discounted every year separately without any problem (Difference

Between NPV and IRR, 2021).

Another problem with IRR is that it is ineffective when there are many positive and

negative cash flows due to market conditions. Therefore, long-term ventures with changing cash-

flows will lead to multiple and distinct IRR. On the other hand, NPV can be used to analyse long

term projects or merger and acquisitions that will be favourable for company.

In addition to this, decision taken in case of IRR is based on percentage basis and it does

not clearly states how much return will generated to business whereas NPV shows outcome in

dollar or pound which serves to be better to take final investment decision (Basu, 2019).

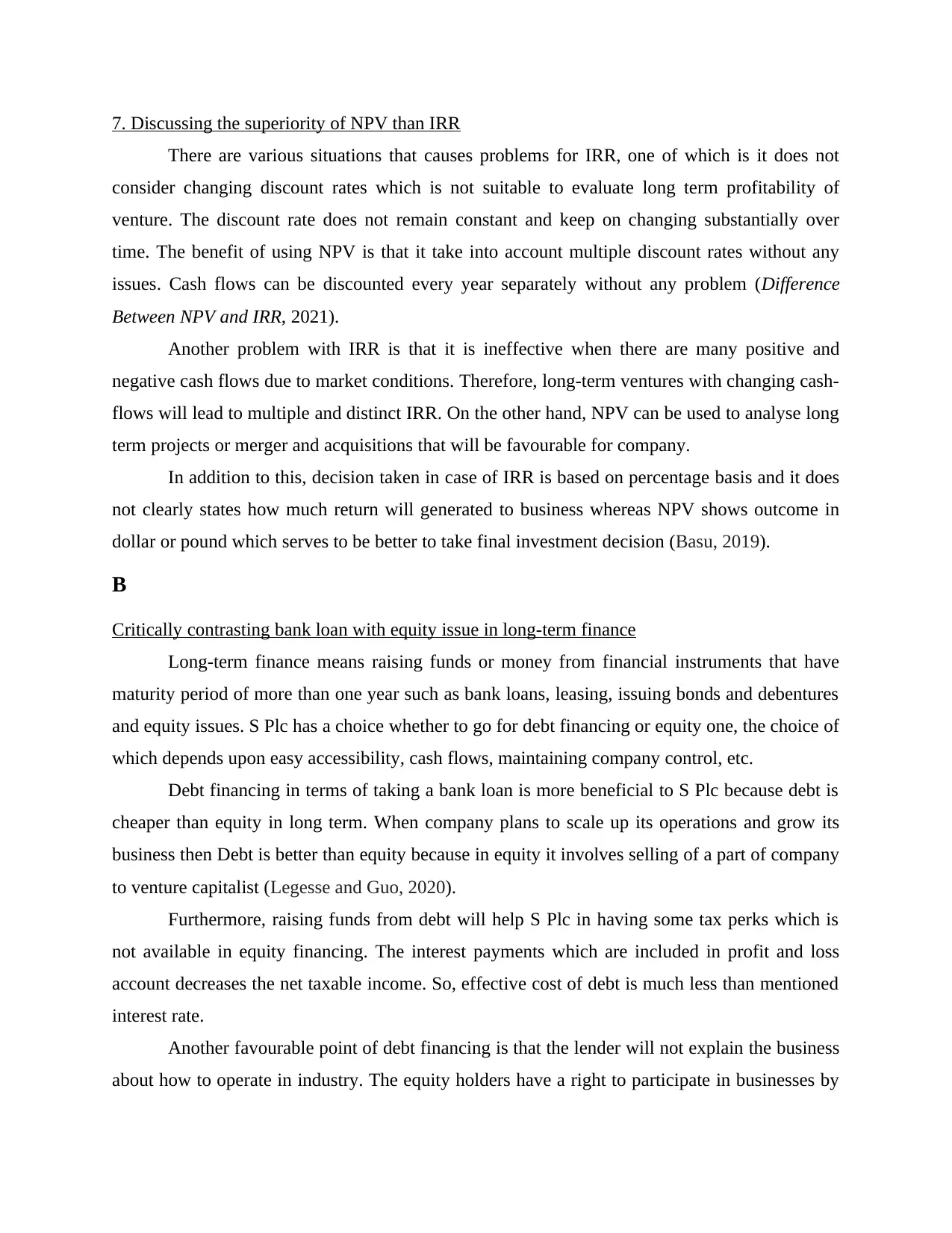

B

Critically contrasting bank loan with equity issue in long-term finance

Long-term finance means raising funds or money from financial instruments that have

maturity period of more than one year such as bank loans, leasing, issuing bonds and debentures

and equity issues. S Plc has a choice whether to go for debt financing or equity one, the choice of

which depends upon easy accessibility, cash flows, maintaining company control, etc.

Debt financing in terms of taking a bank loan is more beneficial to S Plc because debt is

cheaper than equity in long term. When company plans to scale up its operations and grow its

business then Debt is better than equity because in equity it involves selling of a part of company

to venture capitalist (Legesse and Guo, 2020).

Furthermore, raising funds from debt will help S Plc in having some tax perks which is

not available in equity financing. The interest payments which are included in profit and loss

account decreases the net taxable income. So, effective cost of debt is much less than mentioned

interest rate.

Another favourable point of debt financing is that the lender will not explain the business

about how to operate in industry. The equity holders have a right to participate in businesses by

There are various situations that causes problems for IRR, one of which is it does not

consider changing discount rates which is not suitable to evaluate long term profitability of

venture. The discount rate does not remain constant and keep on changing substantially over

time. The benefit of using NPV is that it take into account multiple discount rates without any

issues. Cash flows can be discounted every year separately without any problem (Difference

Between NPV and IRR, 2021).

Another problem with IRR is that it is ineffective when there are many positive and

negative cash flows due to market conditions. Therefore, long-term ventures with changing cash-

flows will lead to multiple and distinct IRR. On the other hand, NPV can be used to analyse long

term projects or merger and acquisitions that will be favourable for company.

In addition to this, decision taken in case of IRR is based on percentage basis and it does

not clearly states how much return will generated to business whereas NPV shows outcome in

dollar or pound which serves to be better to take final investment decision (Basu, 2019).

B

Critically contrasting bank loan with equity issue in long-term finance

Long-term finance means raising funds or money from financial instruments that have

maturity period of more than one year such as bank loans, leasing, issuing bonds and debentures

and equity issues. S Plc has a choice whether to go for debt financing or equity one, the choice of

which depends upon easy accessibility, cash flows, maintaining company control, etc.

Debt financing in terms of taking a bank loan is more beneficial to S Plc because debt is

cheaper than equity in long term. When company plans to scale up its operations and grow its

business then Debt is better than equity because in equity it involves selling of a part of company

to venture capitalist (Legesse and Guo, 2020).

Furthermore, raising funds from debt will help S Plc in having some tax perks which is

not available in equity financing. The interest payments which are included in profit and loss

account decreases the net taxable income. So, effective cost of debt is much less than mentioned

interest rate.

Another favourable point of debt financing is that the lender will not explain the business

about how to operate in industry. The equity holders have a right to participate in businesses by

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

giving them seats on board. Money lender to business does not bother how S Plc is working, they

just want their interest payments on time.

In addition to this, debt financing can be useful if company is having continuous revenue

streams which means a small part of loan will enhance cash flows and extra cash in hand will

allow to company to make fresh recruitment. The new hires will come up with effective sales

programs and schemes which will further enhance the ROI (Debt vs Equity Financing, 2021).

Along with this, raising funds through equity is a lengthy and time-consuming process

which involves long meeting with venture capitalists, drawing up legal documents and

paperworks, etc. On the other hand, raising loans generally takes lesser time, say a month and

does not involve several meetings (Vaznyte and Andries, 2019).

Moreover, debt financing comes with definite term and conditions with little alteration in

coming years. The interest payment amount remain constant every month with no fluctuations as

compared to dividends payments which changes every year with change in profits.

C

1. Calculating break even sales revenue

Break-even sales revenue

Particulars Amount per unit (£)

Selling price per unit 100

Variable cost per unit 60

Contribution margin 40

Break even point 7500

BREAK EVEN SALES 750000

Sales revenue to achieve a target profit of £120,000

Desired profit 120000

Contribution per unit 40

Break even units 7500

No. of units to produce desired profit 10500

Sales revenue £1050000

just want their interest payments on time.

In addition to this, debt financing can be useful if company is having continuous revenue

streams which means a small part of loan will enhance cash flows and extra cash in hand will

allow to company to make fresh recruitment. The new hires will come up with effective sales

programs and schemes which will further enhance the ROI (Debt vs Equity Financing, 2021).

Along with this, raising funds through equity is a lengthy and time-consuming process

which involves long meeting with venture capitalists, drawing up legal documents and

paperworks, etc. On the other hand, raising loans generally takes lesser time, say a month and

does not involve several meetings (Vaznyte and Andries, 2019).

Moreover, debt financing comes with definite term and conditions with little alteration in

coming years. The interest payment amount remain constant every month with no fluctuations as

compared to dividends payments which changes every year with change in profits.

C

1. Calculating break even sales revenue

Break-even sales revenue

Particulars Amount per unit (£)

Selling price per unit 100

Variable cost per unit 60

Contribution margin 40

Break even point 7500

BREAK EVEN SALES 750000

Sales revenue to achieve a target profit of £120,000

Desired profit 120000

Contribution per unit 40

Break even units 7500

No. of units to produce desired profit 10500

Sales revenue £1050000

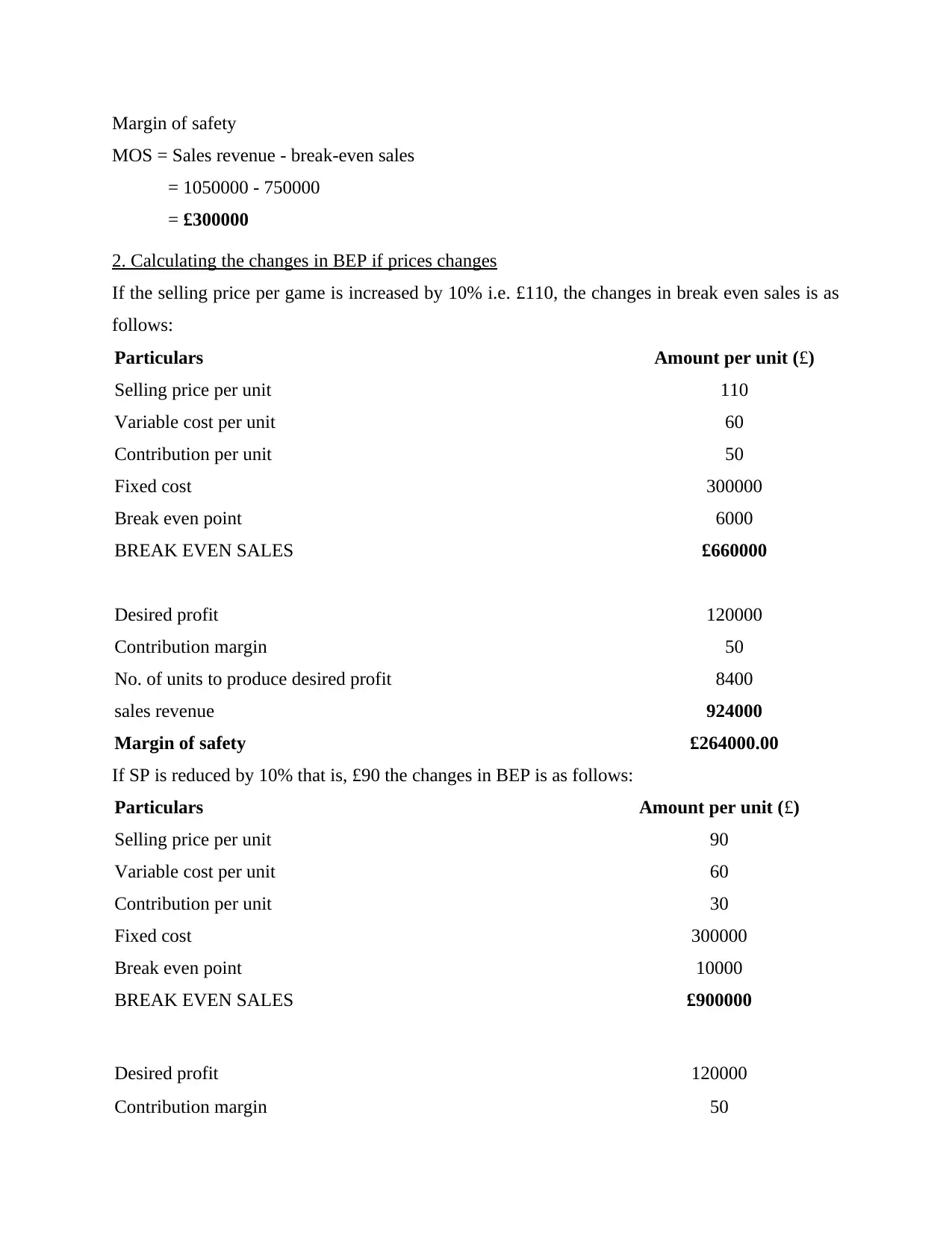

Margin of safety

MOS = Sales revenue - break-even sales

= 1050000 - 750000

= £300000

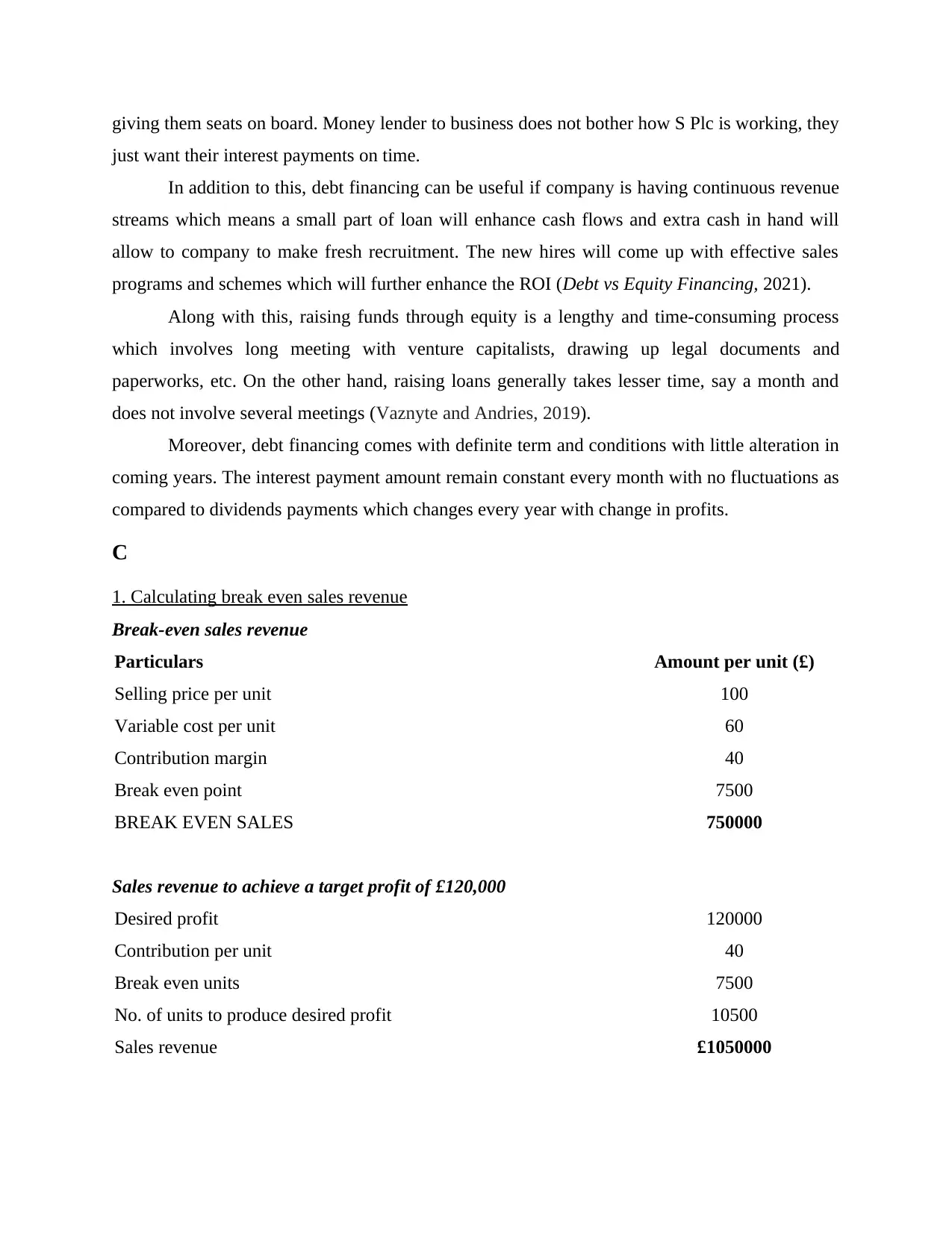

2. Calculating the changes in BEP if prices changes

If the selling price per game is increased by 10% i.e. £110, the changes in break even sales is as

follows:

Particulars Amount per unit (£)

Selling price per unit 110

Variable cost per unit 60

Contribution per unit 50

Fixed cost 300000

Break even point 6000

BREAK EVEN SALES £660000

Desired profit 120000

Contribution margin 50

No. of units to produce desired profit 8400

sales revenue 924000

Margin of safety £264000.00

If SP is reduced by 10% that is, £90 the changes in BEP is as follows:

Particulars Amount per unit (£)

Selling price per unit 90

Variable cost per unit 60

Contribution per unit 30

Fixed cost 300000

Break even point 10000

BREAK EVEN SALES £900000

Desired profit 120000

Contribution margin 50

MOS = Sales revenue - break-even sales

= 1050000 - 750000

= £300000

2. Calculating the changes in BEP if prices changes

If the selling price per game is increased by 10% i.e. £110, the changes in break even sales is as

follows:

Particulars Amount per unit (£)

Selling price per unit 110

Variable cost per unit 60

Contribution per unit 50

Fixed cost 300000

Break even point 6000

BREAK EVEN SALES £660000

Desired profit 120000

Contribution margin 50

No. of units to produce desired profit 8400

sales revenue 924000

Margin of safety £264000.00

If SP is reduced by 10% that is, £90 the changes in BEP is as follows:

Particulars Amount per unit (£)

Selling price per unit 90

Variable cost per unit 60

Contribution per unit 30

Fixed cost 300000

Break even point 10000

BREAK EVEN SALES £900000

Desired profit 120000

Contribution margin 50

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

No. of units to produce desired profit 8400

Sales revenue 924000

Margin of safety £264000.00

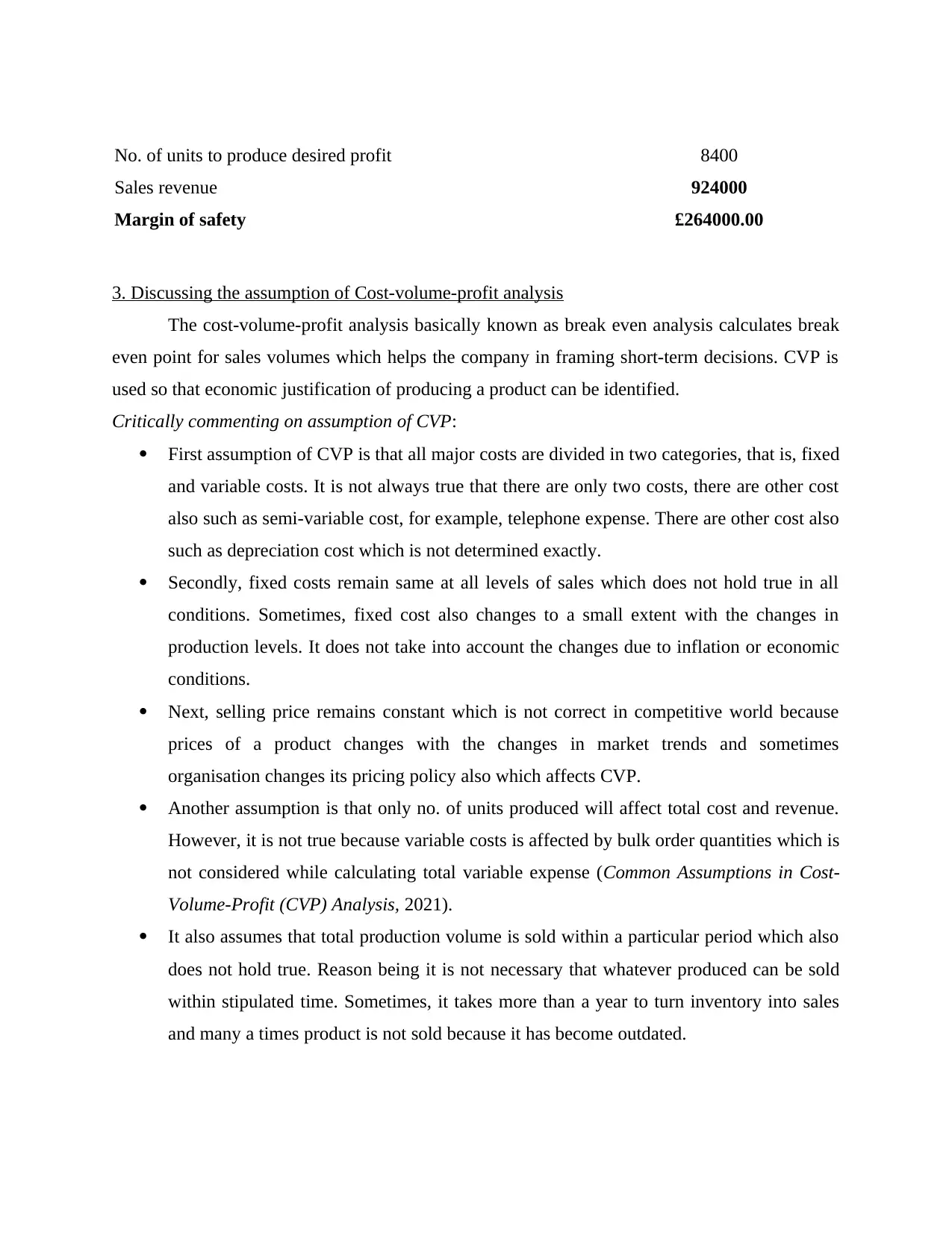

3. Discussing the assumption of Cost-volume-profit analysis

The cost-volume-profit analysis basically known as break even analysis calculates break

even point for sales volumes which helps the company in framing short-term decisions. CVP is

used so that economic justification of producing a product can be identified.

Critically commenting on assumption of CVP:

First assumption of CVP is that all major costs are divided in two categories, that is, fixed

and variable costs. It is not always true that there are only two costs, there are other cost

also such as semi-variable cost, for example, telephone expense. There are other cost also

such as depreciation cost which is not determined exactly.

Secondly, fixed costs remain same at all levels of sales which does not hold true in all

conditions. Sometimes, fixed cost also changes to a small extent with the changes in

production levels. It does not take into account the changes due to inflation or economic

conditions.

Next, selling price remains constant which is not correct in competitive world because

prices of a product changes with the changes in market trends and sometimes

organisation changes its pricing policy also which affects CVP.

Another assumption is that only no. of units produced will affect total cost and revenue.

However, it is not true because variable costs is affected by bulk order quantities which is

not considered while calculating total variable expense (Common Assumptions in Cost-

Volume-Profit (CVP) Analysis, 2021).

It also assumes that total production volume is sold within a particular period which also

does not hold true. Reason being it is not necessary that whatever produced can be sold

within stipulated time. Sometimes, it takes more than a year to turn inventory into sales

and many a times product is not sold because it has become outdated.

Sales revenue 924000

Margin of safety £264000.00

3. Discussing the assumption of Cost-volume-profit analysis

The cost-volume-profit analysis basically known as break even analysis calculates break

even point for sales volumes which helps the company in framing short-term decisions. CVP is

used so that economic justification of producing a product can be identified.

Critically commenting on assumption of CVP:

First assumption of CVP is that all major costs are divided in two categories, that is, fixed

and variable costs. It is not always true that there are only two costs, there are other cost

also such as semi-variable cost, for example, telephone expense. There are other cost also

such as depreciation cost which is not determined exactly.

Secondly, fixed costs remain same at all levels of sales which does not hold true in all

conditions. Sometimes, fixed cost also changes to a small extent with the changes in

production levels. It does not take into account the changes due to inflation or economic

conditions.

Next, selling price remains constant which is not correct in competitive world because

prices of a product changes with the changes in market trends and sometimes

organisation changes its pricing policy also which affects CVP.

Another assumption is that only no. of units produced will affect total cost and revenue.

However, it is not true because variable costs is affected by bulk order quantities which is

not considered while calculating total variable expense (Common Assumptions in Cost-

Volume-Profit (CVP) Analysis, 2021).

It also assumes that total production volume is sold within a particular period which also

does not hold true. Reason being it is not necessary that whatever produced can be sold

within stipulated time. Sometimes, it takes more than a year to turn inventory into sales

and many a times product is not sold because it has become outdated.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

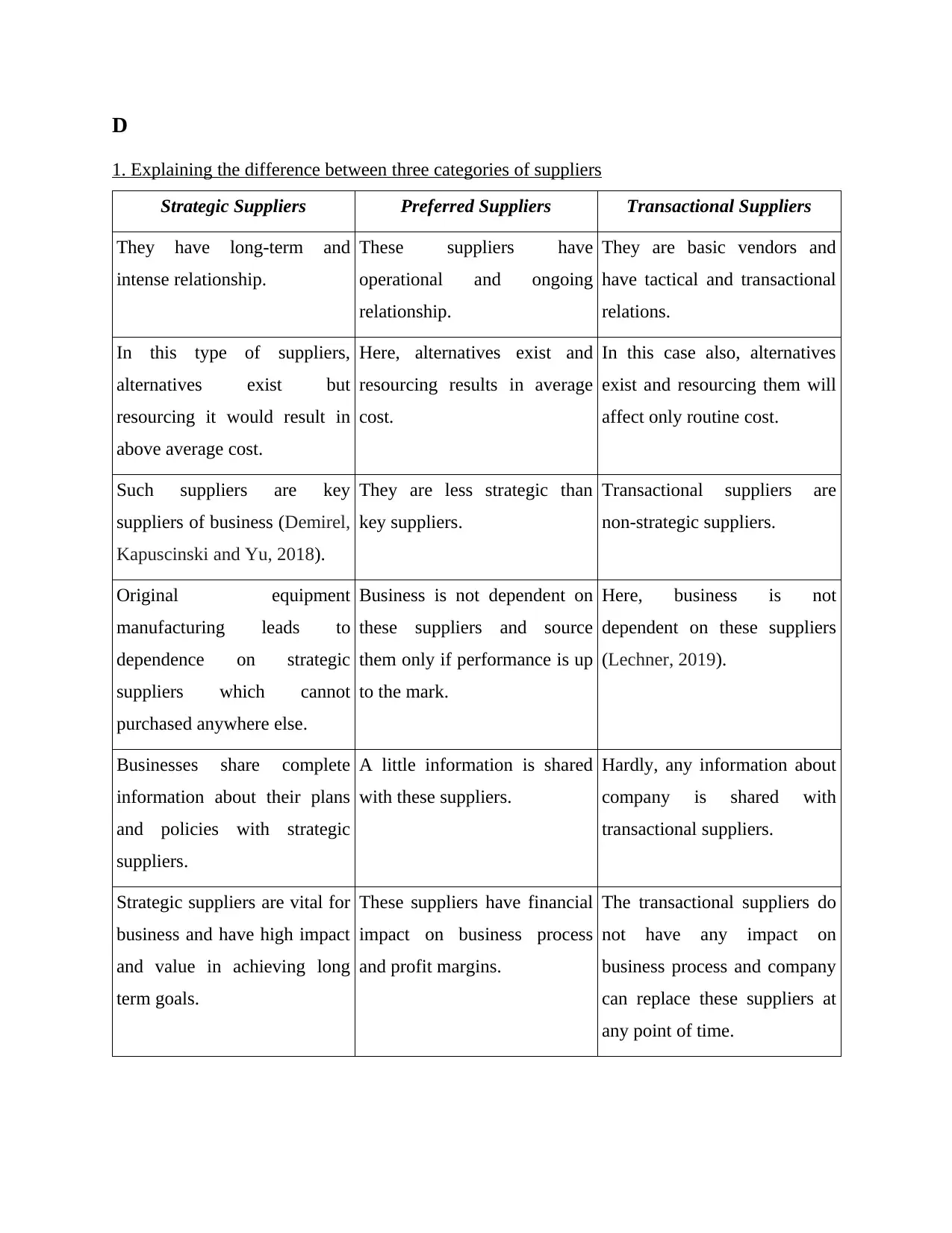

D

1. Explaining the difference between three categories of suppliers

Strategic Suppliers Preferred Suppliers Transactional Suppliers

They have long-term and

intense relationship.

These suppliers have

operational and ongoing

relationship.

They are basic vendors and

have tactical and transactional

relations.

In this type of suppliers,

alternatives exist but

resourcing it would result in

above average cost.

Here, alternatives exist and

resourcing results in average

cost.

In this case also, alternatives

exist and resourcing them will

affect only routine cost.

Such suppliers are key

suppliers of business (Demirel,

Kapuscinski and Yu, 2018).

They are less strategic than

key suppliers.

Transactional suppliers are

non-strategic suppliers.

Original equipment

manufacturing leads to

dependence on strategic

suppliers which cannot

purchased anywhere else.

Business is not dependent on

these suppliers and source

them only if performance is up

to the mark.

Here, business is not

dependent on these suppliers

(Lechner, 2019).

Businesses share complete

information about their plans

and policies with strategic

suppliers.

A little information is shared

with these suppliers.

Hardly, any information about

company is shared with

transactional suppliers.

Strategic suppliers are vital for

business and have high impact

and value in achieving long

term goals.

These suppliers have financial

impact on business process

and profit margins.

The transactional suppliers do

not have any impact on

business process and company

can replace these suppliers at

any point of time.

1. Explaining the difference between three categories of suppliers

Strategic Suppliers Preferred Suppliers Transactional Suppliers

They have long-term and

intense relationship.

These suppliers have

operational and ongoing

relationship.

They are basic vendors and

have tactical and transactional

relations.

In this type of suppliers,

alternatives exist but

resourcing it would result in

above average cost.

Here, alternatives exist and

resourcing results in average

cost.

In this case also, alternatives

exist and resourcing them will

affect only routine cost.

Such suppliers are key

suppliers of business (Demirel,

Kapuscinski and Yu, 2018).

They are less strategic than

key suppliers.

Transactional suppliers are

non-strategic suppliers.

Original equipment

manufacturing leads to

dependence on strategic

suppliers which cannot

purchased anywhere else.

Business is not dependent on

these suppliers and source

them only if performance is up

to the mark.

Here, business is not

dependent on these suppliers

(Lechner, 2019).

Businesses share complete

information about their plans

and policies with strategic

suppliers.

A little information is shared

with these suppliers.

Hardly, any information about

company is shared with

transactional suppliers.

Strategic suppliers are vital for

business and have high impact

and value in achieving long

term goals.

These suppliers have financial

impact on business process

and profit margins.

The transactional suppliers do

not have any impact on

business process and company

can replace these suppliers at

any point of time.

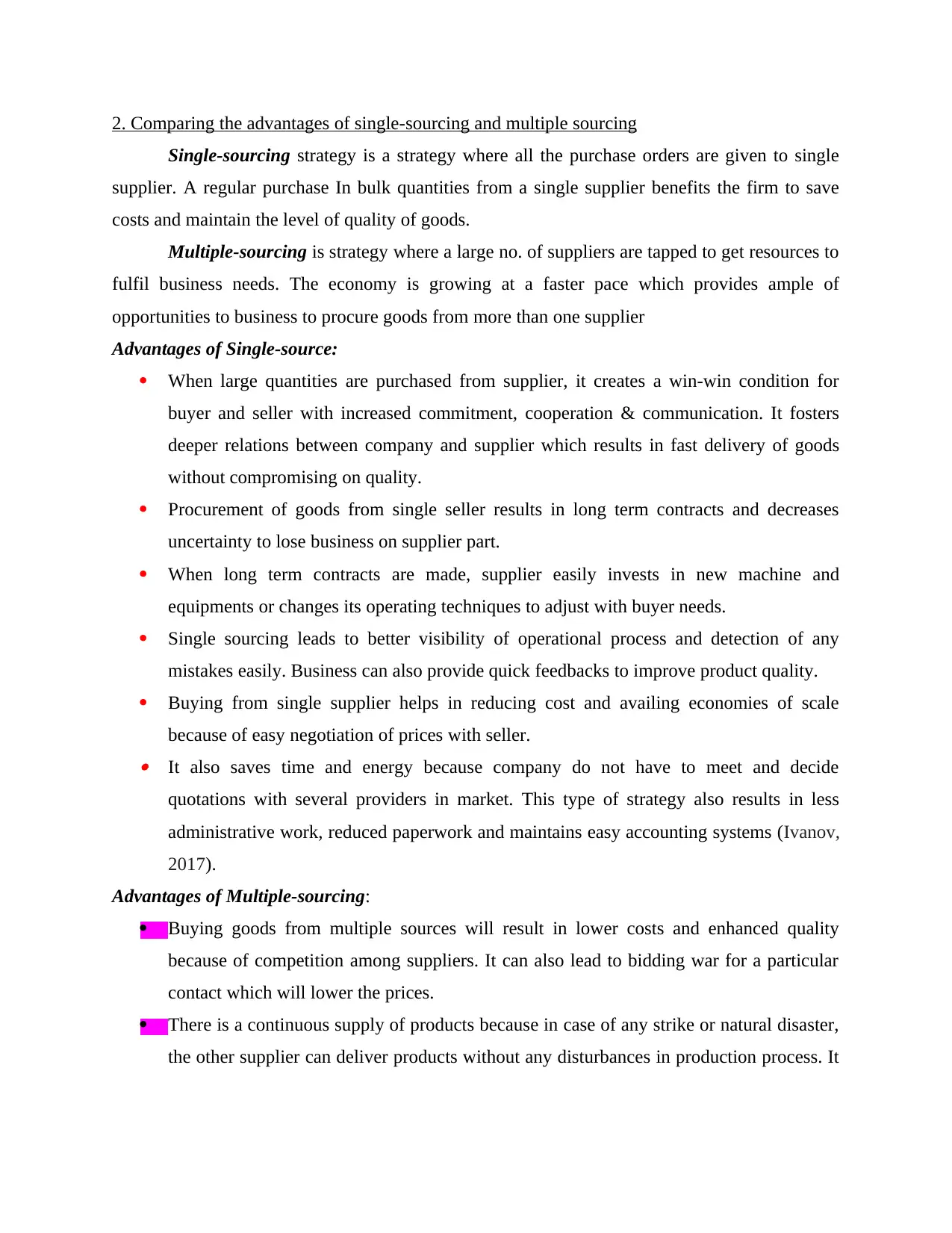

2. Comparing the advantages of single-sourcing and multiple sourcing

Single-sourcing strategy is a strategy where all the purchase orders are given to single

supplier. A regular purchase In bulk quantities from a single supplier benefits the firm to save

costs and maintain the level of quality of goods.

Multiple-sourcing is strategy where a large no. of suppliers are tapped to get resources to

fulfil business needs. The economy is growing at a faster pace which provides ample of

opportunities to business to procure goods from more than one supplier

Advantages of Single-source:

When large quantities are purchased from supplier, it creates a win-win condition for

buyer and seller with increased commitment, cooperation & communication. It fosters

deeper relations between company and supplier which results in fast delivery of goods

without compromising on quality.

Procurement of goods from single seller results in long term contracts and decreases

uncertainty to lose business on supplier part.

When long term contracts are made, supplier easily invests in new machine and

equipments or changes its operating techniques to adjust with buyer needs.

Single sourcing leads to better visibility of operational process and detection of any

mistakes easily. Business can also provide quick feedbacks to improve product quality.

Buying from single supplier helps in reducing cost and availing economies of scale

because of easy negotiation of prices with seller. It also saves time and energy because company do not have to meet and decide

quotations with several providers in market. This type of strategy also results in less

administrative work, reduced paperwork and maintains easy accounting systems (Ivanov,

2017).

Advantages of Multiple-sourcing:

Buying goods from multiple sources will result in lower costs and enhanced quality

because of competition among suppliers. It can also lead to bidding war for a particular

contact which will lower the prices.

There is a continuous supply of products because in case of any strike or natural disaster,

the other supplier can deliver products without any disturbances in production process. It

Single-sourcing strategy is a strategy where all the purchase orders are given to single

supplier. A regular purchase In bulk quantities from a single supplier benefits the firm to save

costs and maintain the level of quality of goods.

Multiple-sourcing is strategy where a large no. of suppliers are tapped to get resources to

fulfil business needs. The economy is growing at a faster pace which provides ample of

opportunities to business to procure goods from more than one supplier

Advantages of Single-source:

When large quantities are purchased from supplier, it creates a win-win condition for

buyer and seller with increased commitment, cooperation & communication. It fosters

deeper relations between company and supplier which results in fast delivery of goods

without compromising on quality.

Procurement of goods from single seller results in long term contracts and decreases

uncertainty to lose business on supplier part.

When long term contracts are made, supplier easily invests in new machine and

equipments or changes its operating techniques to adjust with buyer needs.

Single sourcing leads to better visibility of operational process and detection of any

mistakes easily. Business can also provide quick feedbacks to improve product quality.

Buying from single supplier helps in reducing cost and availing economies of scale

because of easy negotiation of prices with seller. It also saves time and energy because company do not have to meet and decide

quotations with several providers in market. This type of strategy also results in less

administrative work, reduced paperwork and maintains easy accounting systems (Ivanov,

2017).

Advantages of Multiple-sourcing:

Buying goods from multiple sources will result in lower costs and enhanced quality

because of competition among suppliers. It can also lead to bidding war for a particular

contact which will lower the prices.

There is a continuous supply of products because in case of any strike or natural disaster,

the other supplier can deliver products without any disturbances in production process. It

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

means there is no dependence on one supplier to supply goods which enhances the

freedom of company (Rashidi and Cullinane, 2019).

Multiple sourcing is advantageous in case of high demand of products. Maintaining

relations with several vendors will result in continuous supply without interruptions to

meet increasing customer demand and satisfy consumer needs.

It is very to easy to replace any supplier because of presence of several vendors without

affecting the contracts and business of organization. If one supplier increases its prices,

organization can easily shift to another vendor with lower quotations.

3. Describing Cross-sourcing with example and benefits

Cross-sourcing:

A sourcing strategy used by businesses where a single provider supplies on part or

administration and other provider provides alternate part with same capacities. It is a hybrid

approach of single sourcing and multiple sourcing because organization can procure products

from single or multiple vendors (He and et.al., 2018).

For example, there are 2 suppliers, Supplier X and Supplier Y. Both suppliers can

produce parts a, b, c, d and e with same capacities. Now, company can make use of cross-

sourcing and can benefit from it. Suppose Supplier X produces all parts of a, c and e while

supplier Y manufactures all of b and d. if anything happens bad like strikes or disasters to

supplier X, then supplier Y can continue with production because it has the capacity to produce

a, c & e as well.

Benefits:

Cross-sourcing helps in procuring product easily without any disruptions in production

cycle in case of any natural disaster.

Any supplier who is not meeting the company expectations, providing goods at poor

quality and high prices can be changed easily without any issues.

It reduces the risk of non-availability of goods because if one supplier fails to supply

products, other suppliers can be approached for supplying goods.

CONCLUSION

From the above report, it can be summarized that capital budgeting techniques are

important to evaluate the efficiency of investments. It helps in selecting that project which has

freedom of company (Rashidi and Cullinane, 2019).

Multiple sourcing is advantageous in case of high demand of products. Maintaining

relations with several vendors will result in continuous supply without interruptions to

meet increasing customer demand and satisfy consumer needs.

It is very to easy to replace any supplier because of presence of several vendors without

affecting the contracts and business of organization. If one supplier increases its prices,

organization can easily shift to another vendor with lower quotations.

3. Describing Cross-sourcing with example and benefits

Cross-sourcing:

A sourcing strategy used by businesses where a single provider supplies on part or

administration and other provider provides alternate part with same capacities. It is a hybrid

approach of single sourcing and multiple sourcing because organization can procure products

from single or multiple vendors (He and et.al., 2018).

For example, there are 2 suppliers, Supplier X and Supplier Y. Both suppliers can

produce parts a, b, c, d and e with same capacities. Now, company can make use of cross-

sourcing and can benefit from it. Suppose Supplier X produces all parts of a, c and e while

supplier Y manufactures all of b and d. if anything happens bad like strikes or disasters to

supplier X, then supplier Y can continue with production because it has the capacity to produce

a, c & e as well.

Benefits:

Cross-sourcing helps in procuring product easily without any disruptions in production

cycle in case of any natural disaster.

Any supplier who is not meeting the company expectations, providing goods at poor

quality and high prices can be changed easily without any issues.

It reduces the risk of non-availability of goods because if one supplier fails to supply

products, other suppliers can be approached for supplying goods.

CONCLUSION

From the above report, it can be summarized that capital budgeting techniques are

important to evaluate the efficiency of investments. It helps in selecting that project which has

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

maximum benefit with the least risk. It can also be concluded that NPV is a better method for S

plc to evaluate the profitability of new investment than others because it considers discounted

factor and time value of money that other methods ignore it. Another conclusive point is that

NPV is better than IRR because IRR provides the result in percentage format which becomes an

obstacle to correctly estimate the profitability of venture.

Furthermore, it can be analysed that debt financing is better than equity in long term

because loans and advances comes with definite terms and conditions with little alterations as

compared to equity. The study has also shed light on different types of suppliers along with their

relations with company. Report also described the advantages of single-sourcing and multiple

sourcing. Single sourcing leads to improved supervision over performance because only one

vendor is considered here as compared to multiple suppliers.

plc to evaluate the profitability of new investment than others because it considers discounted

factor and time value of money that other methods ignore it. Another conclusive point is that

NPV is better than IRR because IRR provides the result in percentage format which becomes an

obstacle to correctly estimate the profitability of venture.

Furthermore, it can be analysed that debt financing is better than equity in long term

because loans and advances comes with definite terms and conditions with little alterations as

compared to equity. The study has also shed light on different types of suppliers along with their

relations with company. Report also described the advantages of single-sourcing and multiple

sourcing. Single sourcing leads to improved supervision over performance because only one

vendor is considered here as compared to multiple suppliers.

REFERENCES

Books and Journals

Alles, L. and et.al., 2021. An investigation of the usage of capital budgeting techniques by small

and medium enterprises. Quality & Quantity. 55(3). pp.993-1006.

Basu, U. K., 2019. CAPITAL BUDGETING TECHNIQUE FOR BORROWING

PROJECTS. Hyperion International Journal of Econophysics & New Economy. 12(2).

Chrysafis, K. A. and Papadopoulos, B. K., 2021. Decision making for project appraisal in

uncertain environments: A fuzzy-possibilistic approach of the expanded NPV

method. Symmetry. 13(1). p.27.

Demirel, S., Kapuscinski, R. and Yu, M., 2018. Strategic behavior of suppliers in the face of

production disruptions. Management Science. 64(2). pp.533-551.

Gafli, G. F. M. and Daryanto, W. M., 2019. Decision making on project feasibility using capital

budgeting model and sensitivity analysis. case study: Development solar PV power plant

project. International Journal of Business, Economics and Law. 19(1). pp.50-58.

He, Y. and et.al., 2018. An in-depth analysis of contingent sourcing strategy for handling supply

disruptions. IEEE Transactions on Engineering Management. 67(1). pp.201-219.

Ivanov, D., 2017. Simulation-based single vs. dual sourcing analysis in the supply chain with

consideration of capacity disruptions, big data and demand patterns. International Journal

of Integrated Supply Management. 11(1). pp.24-43.

Lechner, G., 2019. Supplier Relationship Management: Small, Non-Replaceable Suppliers and

Close Customer-Supplier Relationships. Open Journal of Business and Management.

7(03). p.1451.

Legesse, T. S. and Guo, H., 2020. Does firm efficiency matter for debt financing decisions?

Evidence from the biggest manufacturing countries. Journal of Applied Economics. 23(1).

pp.106-128.

Rashidi, K. and Cullinane, K., 2019. A comparison of fuzzy DEA and fuzzy TOPSIS in

sustainable supplier selection: Implications for sourcing strategy. Expert Systems with

Applications. 121. pp.266-281.

Vaznyte, E. and Andries, P., 2019. Entrepreneurial orientation and start-ups' external

financing. Journal of business venturing. 34(3). pp.439-458.

Online

Common Assumptions in Cost-Volume-Profit (CVP) Analysis. 2021. [Online]. Available through:

<https://www.assignmentpoint.com/business/accounting/common-assumptions-in-cost-

volume-profit-cvp-analysis.html>

Debt vs Equity Financing. 2021. [Online]. Available through:

<https://corporatefinanceinstitute.com/resources/knowledge/finance/debt-vs-equity/>

Books and Journals

Alles, L. and et.al., 2021. An investigation of the usage of capital budgeting techniques by small

and medium enterprises. Quality & Quantity. 55(3). pp.993-1006.

Basu, U. K., 2019. CAPITAL BUDGETING TECHNIQUE FOR BORROWING

PROJECTS. Hyperion International Journal of Econophysics & New Economy. 12(2).

Chrysafis, K. A. and Papadopoulos, B. K., 2021. Decision making for project appraisal in

uncertain environments: A fuzzy-possibilistic approach of the expanded NPV

method. Symmetry. 13(1). p.27.

Demirel, S., Kapuscinski, R. and Yu, M., 2018. Strategic behavior of suppliers in the face of

production disruptions. Management Science. 64(2). pp.533-551.

Gafli, G. F. M. and Daryanto, W. M., 2019. Decision making on project feasibility using capital

budgeting model and sensitivity analysis. case study: Development solar PV power plant

project. International Journal of Business, Economics and Law. 19(1). pp.50-58.

He, Y. and et.al., 2018. An in-depth analysis of contingent sourcing strategy for handling supply

disruptions. IEEE Transactions on Engineering Management. 67(1). pp.201-219.

Ivanov, D., 2017. Simulation-based single vs. dual sourcing analysis in the supply chain with

consideration of capacity disruptions, big data and demand patterns. International Journal

of Integrated Supply Management. 11(1). pp.24-43.

Lechner, G., 2019. Supplier Relationship Management: Small, Non-Replaceable Suppliers and

Close Customer-Supplier Relationships. Open Journal of Business and Management.

7(03). p.1451.

Legesse, T. S. and Guo, H., 2020. Does firm efficiency matter for debt financing decisions?

Evidence from the biggest manufacturing countries. Journal of Applied Economics. 23(1).

pp.106-128.

Rashidi, K. and Cullinane, K., 2019. A comparison of fuzzy DEA and fuzzy TOPSIS in

sustainable supplier selection: Implications for sourcing strategy. Expert Systems with

Applications. 121. pp.266-281.

Vaznyte, E. and Andries, P., 2019. Entrepreneurial orientation and start-ups' external

financing. Journal of business venturing. 34(3). pp.439-458.

Online

Common Assumptions in Cost-Volume-Profit (CVP) Analysis. 2021. [Online]. Available through:

<https://www.assignmentpoint.com/business/accounting/common-assumptions-in-cost-

volume-profit-cvp-analysis.html>

Debt vs Equity Financing. 2021. [Online]. Available through:

<https://corporatefinanceinstitute.com/resources/knowledge/finance/debt-vs-equity/>

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Difference Between NPV and IRR. 2021. Common Assumptions in Cost-Volume-Profit (CVP)

Analysis.[Online]. Available through: <https://www.wallstreetmojo.com/npv-vs-irr/>

Analysis.[Online]. Available through: <https://www.wallstreetmojo.com/npv-vs-irr/>

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.