ACFI 7009 Corporate Finance Concepts

VerifiedAdded on 2023/06/15

|16

|4514

|257

AI Summary

This report discusses the impact of capital structure on investment decisions and shareholder value. It includes a critical literature review, calculation of weighted average cost of capital, capital gearing ratio, and interest cover of Shabanie Plc. It also determines the net present value of three projects offered to the company. The report concludes with an evaluation of the proposed investments and financing and their impact on shareholders. ACFI 7009 Corporate Finance Concepts

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

ACFI 7009 Corporate

Finance Concepts

Finance Concepts

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION ..........................................................................................................................3

MAIN BODY...................................................................................................................................3

Prepare a critical literature review on capital structure and its impact on investment decisions

and shareholder value.............................................................................................................3

Calculate the weighted average cost of capital, capital gearing ratio and interest cover of

Shabanie Plc...........................................................................................................................5

Determine the net present value of each of all the three projects...........................................8

Incorporate your conclusions by evaluating the proposed investments and financing along

with discussing its impact on shareholders. ........................................................................12

CONCLUSION .............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION ..........................................................................................................................3

MAIN BODY...................................................................................................................................3

Prepare a critical literature review on capital structure and its impact on investment decisions

and shareholder value.............................................................................................................3

Calculate the weighted average cost of capital, capital gearing ratio and interest cover of

Shabanie Plc...........................................................................................................................5

Determine the net present value of each of all the three projects...........................................8

Incorporate your conclusions by evaluating the proposed investments and financing along

with discussing its impact on shareholders. ........................................................................12

CONCLUSION .............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

Corporate finance refers to section which deals in acquisition of capital, its structuring

and the actions that are taken by managers for increasing the value of company of its

shareholders. This also makes use of tools for analysing the operations and allocation of

resources. Its main target is to raise the wealth of shareholders. It has mainly two disciplines.

One is Capital budgeting and other is management of working capital. They both helps in the

growth of business. They also assists the firm in deciding in which project, the investment should

be made (Huang, Hu and Zhu, 2018). The company chosen in this report is Shabanie Plc. It has

been listed on stack exchange for the last 20 years and has a hold over diverged shareholders and

none of them is acquiring more than 5% stakes. Also, for further investment it is preferring debt

over shares. The report is based on reviewing the capital structure and all its possible affects on

the value of shareholders and investment decisions. It further calculates the weighted average

cost of capital, capital gearing ratio and interest cover. It also calculates the net present value of

all the projects offered to the company and choose the most suitable one. Their is also analysis of

the the decision affects the shareholders of the company.

MAIN BODY

Prepare a critical literature review on capital structure and its impact on investment decisions and

shareholder value.

According to Gerestenberg, Capital structure refers to a composition of money that

includes all the long term resources such as reserves, loans, shares, bonds and debts. A properly

structured capital helps in creating a balance between the funds and their sources in proper

manner. In this division more shares means that the company is sharing its ownership with

shareholders at large level and high debts than shares says that the firm tries to keep its

ownership rights with itself only. A choice about the proportion in which they both would be

held by firm represents its capital structure decision (Your article library, 2021).

As per P. Chandra, it is related to the manner in which the firm takes the decision of

diving its cash flows in different parts – fixed and the residual one. Fixed capital is used for

meeting the obligation of debt capital and residual relates to equity shareholders. This refers to

the arrangement in which the funds are raised by a firm from different sources. This amount is

Corporate finance refers to section which deals in acquisition of capital, its structuring

and the actions that are taken by managers for increasing the value of company of its

shareholders. This also makes use of tools for analysing the operations and allocation of

resources. Its main target is to raise the wealth of shareholders. It has mainly two disciplines.

One is Capital budgeting and other is management of working capital. They both helps in the

growth of business. They also assists the firm in deciding in which project, the investment should

be made (Huang, Hu and Zhu, 2018). The company chosen in this report is Shabanie Plc. It has

been listed on stack exchange for the last 20 years and has a hold over diverged shareholders and

none of them is acquiring more than 5% stakes. Also, for further investment it is preferring debt

over shares. The report is based on reviewing the capital structure and all its possible affects on

the value of shareholders and investment decisions. It further calculates the weighted average

cost of capital, capital gearing ratio and interest cover. It also calculates the net present value of

all the projects offered to the company and choose the most suitable one. Their is also analysis of

the the decision affects the shareholders of the company.

MAIN BODY

Prepare a critical literature review on capital structure and its impact on investment decisions and

shareholder value.

According to Gerestenberg, Capital structure refers to a composition of money that

includes all the long term resources such as reserves, loans, shares, bonds and debts. A properly

structured capital helps in creating a balance between the funds and their sources in proper

manner. In this division more shares means that the company is sharing its ownership with

shareholders at large level and high debts than shares says that the firm tries to keep its

ownership rights with itself only. A choice about the proportion in which they both would be

held by firm represents its capital structure decision (Your article library, 2021).

As per P. Chandra, it is related to the manner in which the firm takes the decision of

diving its cash flows in different parts – fixed and the residual one. Fixed capital is used for

meeting the obligation of debt capital and residual relates to equity shareholders. This refers to

the arrangement in which the funds are raised by a firm from different sources. This amount is

received from debt and shares and is hold by firm for a long period of time. It is concerned with

the numeric or quantitative aspect.

As stated by David Durand, Any type of change occurring in financial leverage results in

the change in its capital costs. It means that if the a firm decides to accept more debt rather than

arranging its funds from equity then it will lead to an increase in its capital structure. This will

further result in decrease in the weighted average cost of capital and raise in the value of the

firm. This is because with rise in debt value, the profits of business decreases. This results in

decrease in the value of tax obligation for firm which raises the value of firm.

According to the theorem provided by Modigliani and Miller, the approach of capital

structuring does not matters for the companies that operates in perfect market as their market

value is determined by the earning made by it and risk related to assets hold by it. As per their

theorem, the value of firm in these markets is independent form the method they choose for

financing their business (Invetopedia, 2021). Shabanie Plc is currently having a share capital

which is diverse among its holders in various proportion but all of them have the sharing of less

than 5% only. This simply means that the firm keeps all the rights of decision taking with itself.

For all the other requirements of arranging capital, it is opting to arrange it from debt. This

means that the firm is not choosing to provide the rights of the firm to any other authority. This

will helps the firm in maintaining and even rising its value in association.

On the other hand, it is also found that Shabanie Plc cannot increase its debt by £ 500m.

This means that of they increase their debt more than this then, the value of firm will decrease.

This can impact the investing decision of parties and shareholder value.

According to Saees, Gull and Rasheed (2013), the capital structure of firm directly affects

its performance. It changes the return earned on assets and equity and also effects the earnings

per share of the company. These are the bases on which the investors decide that whether they

should invest in a particular firm or not. Long and short term debt to capital ratio is used to

analyse the capital structure of firm. They finds a positive relation among the equity an debt

structure and the performance analysis of it.

As stated by Nawaz, Ali and Naseem, (2011) these ratios are the true indicators of the

performance of the company and they holds the capacity to influence the decision of the

shareholders. But at the same time, it also have been analysed that these two variants are

negatively related to each other.

the numeric or quantitative aspect.

As stated by David Durand, Any type of change occurring in financial leverage results in

the change in its capital costs. It means that if the a firm decides to accept more debt rather than

arranging its funds from equity then it will lead to an increase in its capital structure. This will

further result in decrease in the weighted average cost of capital and raise in the value of the

firm. This is because with rise in debt value, the profits of business decreases. This results in

decrease in the value of tax obligation for firm which raises the value of firm.

According to the theorem provided by Modigliani and Miller, the approach of capital

structuring does not matters for the companies that operates in perfect market as their market

value is determined by the earning made by it and risk related to assets hold by it. As per their

theorem, the value of firm in these markets is independent form the method they choose for

financing their business (Invetopedia, 2021). Shabanie Plc is currently having a share capital

which is diverse among its holders in various proportion but all of them have the sharing of less

than 5% only. This simply means that the firm keeps all the rights of decision taking with itself.

For all the other requirements of arranging capital, it is opting to arrange it from debt. This

means that the firm is not choosing to provide the rights of the firm to any other authority. This

will helps the firm in maintaining and even rising its value in association.

On the other hand, it is also found that Shabanie Plc cannot increase its debt by £ 500m.

This means that of they increase their debt more than this then, the value of firm will decrease.

This can impact the investing decision of parties and shareholder value.

According to Saees, Gull and Rasheed (2013), the capital structure of firm directly affects

its performance. It changes the return earned on assets and equity and also effects the earnings

per share of the company. These are the bases on which the investors decide that whether they

should invest in a particular firm or not. Long and short term debt to capital ratio is used to

analyse the capital structure of firm. They finds a positive relation among the equity an debt

structure and the performance analysis of it.

As stated by Nawaz, Ali and Naseem, (2011) these ratios are the true indicators of the

performance of the company and they holds the capacity to influence the decision of the

shareholders. But at the same time, it also have been analysed that these two variants are

negatively related to each other.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

As per Torman, Kihc and Reis (2013), they did not find any relation among the debt to

equity ratio and returns due to capital structure. They used various models of statistics for

analysing the relation among these constraints.

So, there are various situation where the capital structure of firm affects the decision

taken by the investors. But this do affect the value Of the shareholders. An optimally structured

capital of the firm reduces its weighted cost of capital which result in raising the value for the

shareholders. Thus, this is always challenging for a business to adopt such a capital structure that

can hold the capacity of maintaining the weighted cost of capital to be suitable for business and

the stakeholder as well. The lower value of cost of capital means that the firm has higher cash

flows with lower discounting value. This increase in the future cash flow of business will help in

raising the net present value of investment and will also help in managing the value shareholders.

According to Pandey (2004), the capital structure of company influences the risk and

return for shareholders. The value of these shares is usually affected by the capital structure

decision of the firm. So, it should be the main focus of organisations to maximise their value by

anticipating the required and correct financial structure by sighting at the impact of this

arrangement on the value of firm (Does capital structure impact firm performance, 2021).

Shabanie Plc should again review its decision of arranging further funds through debts

and restraining all the control of business in its own hands. This will help the firm in maintaining

a balance in its financial leverage. Though availing funds from debts increase the vale for

shareholders and positively affects the decision making of the investors. But excess of funds over

share capital can even lead to decrease in their market value . As more payment of interest means

lowering the profit earning capabilities of firm. This will directly impact its value in market .

Calculate the weighted average cost of capital, capital gearing ratio and interest cover of

Shabanie Plc.

Weighted cost of capital = cost of equity * weight of equity + cost of debt * Weight of debt

Cost of equity = Risk free rate + Beta ( Risk premium )

= 2.3 + 1.23 * 3%

= 2.3378

Cost of debt = Rate of interest * ( 1 – Tax rate )

= 5% * ( 1 – 20% )

= 5% (0.8 )

equity ratio and returns due to capital structure. They used various models of statistics for

analysing the relation among these constraints.

So, there are various situation where the capital structure of firm affects the decision

taken by the investors. But this do affect the value Of the shareholders. An optimally structured

capital of the firm reduces its weighted cost of capital which result in raising the value for the

shareholders. Thus, this is always challenging for a business to adopt such a capital structure that

can hold the capacity of maintaining the weighted cost of capital to be suitable for business and

the stakeholder as well. The lower value of cost of capital means that the firm has higher cash

flows with lower discounting value. This increase in the future cash flow of business will help in

raising the net present value of investment and will also help in managing the value shareholders.

According to Pandey (2004), the capital structure of company influences the risk and

return for shareholders. The value of these shares is usually affected by the capital structure

decision of the firm. So, it should be the main focus of organisations to maximise their value by

anticipating the required and correct financial structure by sighting at the impact of this

arrangement on the value of firm (Does capital structure impact firm performance, 2021).

Shabanie Plc should again review its decision of arranging further funds through debts

and restraining all the control of business in its own hands. This will help the firm in maintaining

a balance in its financial leverage. Though availing funds from debts increase the vale for

shareholders and positively affects the decision making of the investors. But excess of funds over

share capital can even lead to decrease in their market value . As more payment of interest means

lowering the profit earning capabilities of firm. This will directly impact its value in market .

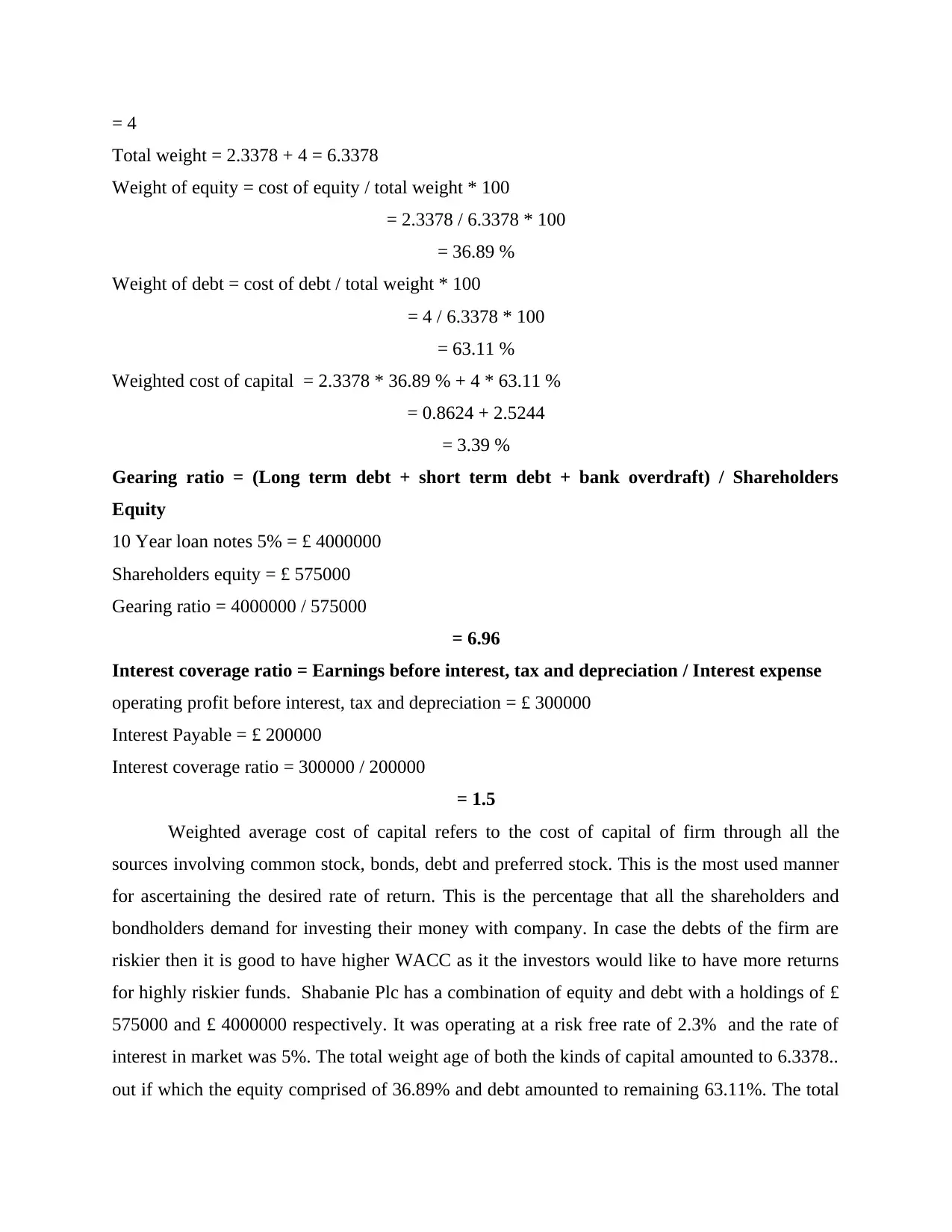

Calculate the weighted average cost of capital, capital gearing ratio and interest cover of

Shabanie Plc.

Weighted cost of capital = cost of equity * weight of equity + cost of debt * Weight of debt

Cost of equity = Risk free rate + Beta ( Risk premium )

= 2.3 + 1.23 * 3%

= 2.3378

Cost of debt = Rate of interest * ( 1 – Tax rate )

= 5% * ( 1 – 20% )

= 5% (0.8 )

= 4

Total weight = 2.3378 + 4 = 6.3378

Weight of equity = cost of equity / total weight * 100

= 2.3378 / 6.3378 * 100

= 36.89 %

Weight of debt = cost of debt / total weight * 100

= 4 / 6.3378 * 100

= 63.11 %

Weighted cost of capital = 2.3378 * 36.89 % + 4 * 63.11 %

= 0.8624 + 2.5244

= 3.39 %

Gearing ratio = (Long term debt + short term debt + bank overdraft) / Shareholders

Equity

10 Year loan notes 5% = £ 4000000

Shareholders equity = £ 575000

Gearing ratio = 4000000 / 575000

= 6.96

Interest coverage ratio = Earnings before interest, tax and depreciation / Interest expense

operating profit before interest, tax and depreciation = £ 300000

Interest Payable = £ 200000

Interest coverage ratio = 300000 / 200000

= 1.5

Weighted average cost of capital refers to the cost of capital of firm through all the

sources involving common stock, bonds, debt and preferred stock. This is the most used manner

for ascertaining the desired rate of return. This is the percentage that all the shareholders and

bondholders demand for investing their money with company. In case the debts of the firm are

riskier then it is good to have higher WACC as it the investors would like to have more returns

for highly riskier funds. Shabanie Plc has a combination of equity and debt with a holdings of £

575000 and £ 4000000 respectively. It was operating at a risk free rate of 2.3% and the rate of

interest in market was 5%. The total weight age of both the kinds of capital amounted to 6.3378..

out if which the equity comprised of 36.89% and debt amounted to remaining 63.11%. The total

Total weight = 2.3378 + 4 = 6.3378

Weight of equity = cost of equity / total weight * 100

= 2.3378 / 6.3378 * 100

= 36.89 %

Weight of debt = cost of debt / total weight * 100

= 4 / 6.3378 * 100

= 63.11 %

Weighted cost of capital = 2.3378 * 36.89 % + 4 * 63.11 %

= 0.8624 + 2.5244

= 3.39 %

Gearing ratio = (Long term debt + short term debt + bank overdraft) / Shareholders

Equity

10 Year loan notes 5% = £ 4000000

Shareholders equity = £ 575000

Gearing ratio = 4000000 / 575000

= 6.96

Interest coverage ratio = Earnings before interest, tax and depreciation / Interest expense

operating profit before interest, tax and depreciation = £ 300000

Interest Payable = £ 200000

Interest coverage ratio = 300000 / 200000

= 1.5

Weighted average cost of capital refers to the cost of capital of firm through all the

sources involving common stock, bonds, debt and preferred stock. This is the most used manner

for ascertaining the desired rate of return. This is the percentage that all the shareholders and

bondholders demand for investing their money with company. In case the debts of the firm are

riskier then it is good to have higher WACC as it the investors would like to have more returns

for highly riskier funds. Shabanie Plc has a combination of equity and debt with a holdings of £

575000 and £ 4000000 respectively. It was operating at a risk free rate of 2.3% and the rate of

interest in market was 5%. The total weight age of both the kinds of capital amounted to 6.3378..

out if which the equity comprised of 36.89% and debt amounted to remaining 63.11%. The total

weighted cost of capital comes out to be 3.39%. This simply means that the equity shareholders

of firm expects a return of around 3.39% form the firm. Also, at this situation, firm is opting to

increase its further debt through the debt rather then arranging it from shares. This will on one

hand will help the business in keeping all the rights of taking decision in its own hands and also

increase the value of firm. This rate is fine for the business. Though the higher rate of return

would have attracted more investors towards it.

Gearing ratio refers to a comparison among the equity of the owner and its debt or

amount borrowed by it. It calculates the ratio in which the operations of firm are funded through

equity over the debts. The relevance of this ratio is more meaningful when it is compared to the

value of other firms. The gearing ratio of Shabanie Plc came out to be 6.96 when taking into

account its equity of shareholders and debts of loan. This means that the firm is holding almost 7

times off its debts over the shares. This is a good sign as though more holdings over debt means

that the firm is playing more riskier. But this also shows that company holds the capacity to

perform with high risk environment. Shabanie Plc also keeps itself safe by providing low control

of outsiders over its operations which puts it at a low risk of default.

Interest coverage ratio simply means that how much a firm is capable of satisfying its

debt from itgs profits. In this case, higher coverage is always better. This shows that the

company is well off in paying its interest charges and can earn good amount of profit after its

payment. The firms having more debts should have huge interest coverage rate so that investors

can trust the firm for investing in it. Shabanie Plc prefers to avail its investment through debt ad

this means its interest coverage ratio should be good. Also, even know it is having high gearing

ratio which shows that already the loans of business are more than the shareholdings of it. At

present, the interest coverage ratio of Shabanie Plc is just 1.5 times which shows that the firm is

able to satisfy its interest charges only one and half times. This ratio is not good for it. At this

time, the company is thinking about making more investment which would be funded though

debt only. If the company performs in same manner in future, then it will have to make payment

for more interest which either could not be satisfied from the current earnings or if satisfied then

it will not let it earn income. This is important for firm to increase its earning and decrease its

expenses.

of firm expects a return of around 3.39% form the firm. Also, at this situation, firm is opting to

increase its further debt through the debt rather then arranging it from shares. This will on one

hand will help the business in keeping all the rights of taking decision in its own hands and also

increase the value of firm. This rate is fine for the business. Though the higher rate of return

would have attracted more investors towards it.

Gearing ratio refers to a comparison among the equity of the owner and its debt or

amount borrowed by it. It calculates the ratio in which the operations of firm are funded through

equity over the debts. The relevance of this ratio is more meaningful when it is compared to the

value of other firms. The gearing ratio of Shabanie Plc came out to be 6.96 when taking into

account its equity of shareholders and debts of loan. This means that the firm is holding almost 7

times off its debts over the shares. This is a good sign as though more holdings over debt means

that the firm is playing more riskier. But this also shows that company holds the capacity to

perform with high risk environment. Shabanie Plc also keeps itself safe by providing low control

of outsiders over its operations which puts it at a low risk of default.

Interest coverage ratio simply means that how much a firm is capable of satisfying its

debt from itgs profits. In this case, higher coverage is always better. This shows that the

company is well off in paying its interest charges and can earn good amount of profit after its

payment. The firms having more debts should have huge interest coverage rate so that investors

can trust the firm for investing in it. Shabanie Plc prefers to avail its investment through debt ad

this means its interest coverage ratio should be good. Also, even know it is having high gearing

ratio which shows that already the loans of business are more than the shareholdings of it. At

present, the interest coverage ratio of Shabanie Plc is just 1.5 times which shows that the firm is

able to satisfy its interest charges only one and half times. This ratio is not good for it. At this

time, the company is thinking about making more investment which would be funded though

debt only. If the company performs in same manner in future, then it will have to make payment

for more interest which either could not be satisfied from the current earnings or if satisfied then

it will not let it earn income. This is important for firm to increase its earning and decrease its

expenses.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

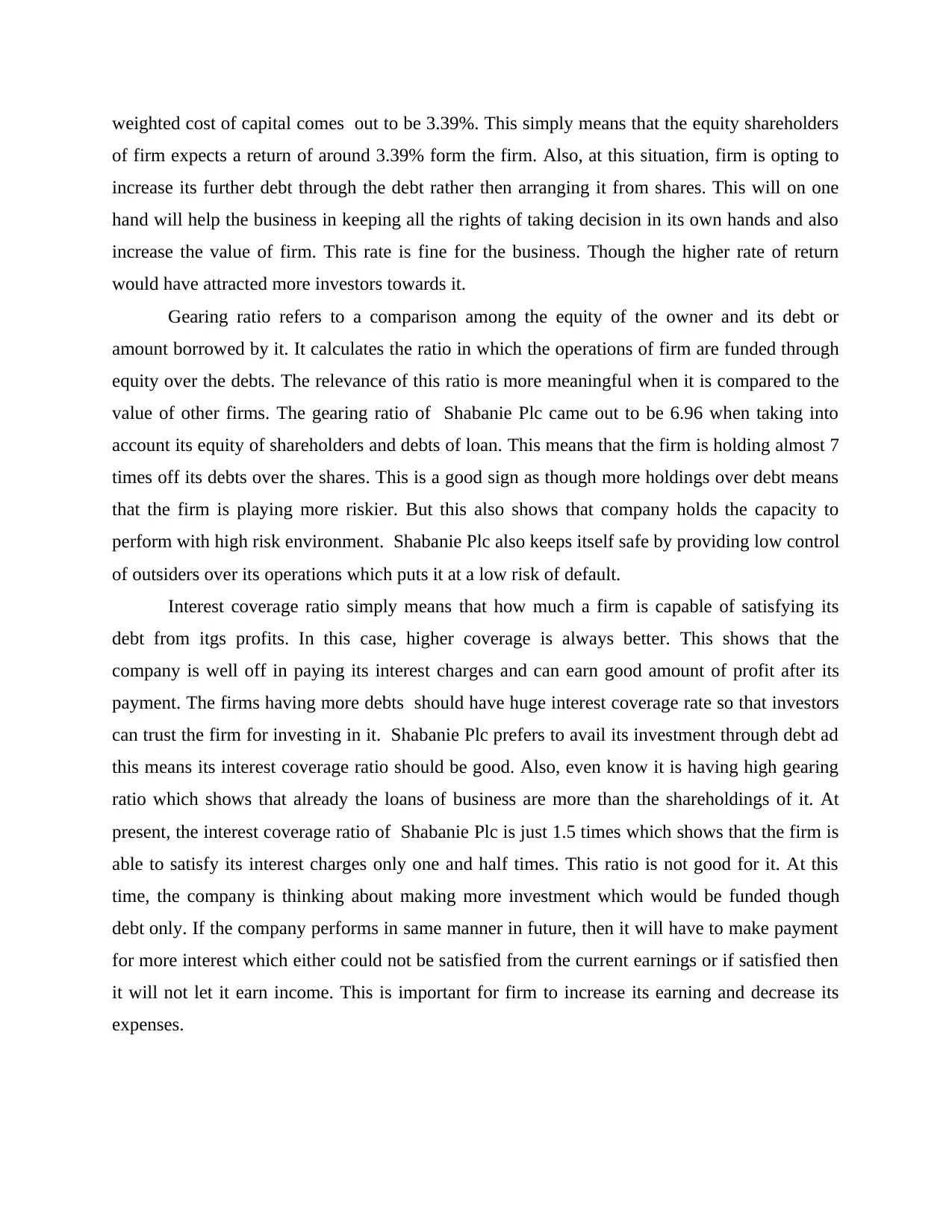

Determine the net present value of each of all the three projects.

NPV (Net Present value) can be defined as a techniques of calculating the value of cash

flows by applying discounting factor on it. Its value depends on the time interval that lies in

between the year in which the investment has been made and the completion of project. It is

important to apply this factor on the flow of money because the value of money changes with

time and it does not remains the same it is at present. It helps in ascertaining the actual results

that a firm will get after the completion of the deal. On the basis of this value, a business can

decide that whether it should take the offer or not. The result of NPV should be positive for

accepting it. If the result is negative, then the chances of accepting the project becomes zero.

Project A

Cash flows in five years

Particulars Year 1 Year 2 Year 3 Year 4 Year 5

Revenue 500000 500000 500000 500000 500000

Less: cash

outflows

Cost of sales

(55% of

revenue)

275000 275000 275000 275000 275000

Additional

working

capital

60000

Depreciation

of capital

expenditure

64000 64000 64000 64000 64000

Annual fixed

cost

125000 125000 125000 125000 125000

Cash flow -24000 36000 36000 36000 36000

Tax @ 20% 7200 7200 7200 7200

NPV (Net Present value) can be defined as a techniques of calculating the value of cash

flows by applying discounting factor on it. Its value depends on the time interval that lies in

between the year in which the investment has been made and the completion of project. It is

important to apply this factor on the flow of money because the value of money changes with

time and it does not remains the same it is at present. It helps in ascertaining the actual results

that a firm will get after the completion of the deal. On the basis of this value, a business can

decide that whether it should take the offer or not. The result of NPV should be positive for

accepting it. If the result is negative, then the chances of accepting the project becomes zero.

Project A

Cash flows in five years

Particulars Year 1 Year 2 Year 3 Year 4 Year 5

Revenue 500000 500000 500000 500000 500000

Less: cash

outflows

Cost of sales

(55% of

revenue)

275000 275000 275000 275000 275000

Additional

working

capital

60000

Depreciation

of capital

expenditure

64000 64000 64000 64000 64000

Annual fixed

cost

125000 125000 125000 125000 125000

Cash flow -24000 36000 36000 36000 36000

Tax @ 20% 7200 7200 7200 7200

Net cash flows -24000 28800 28800 28800 28800

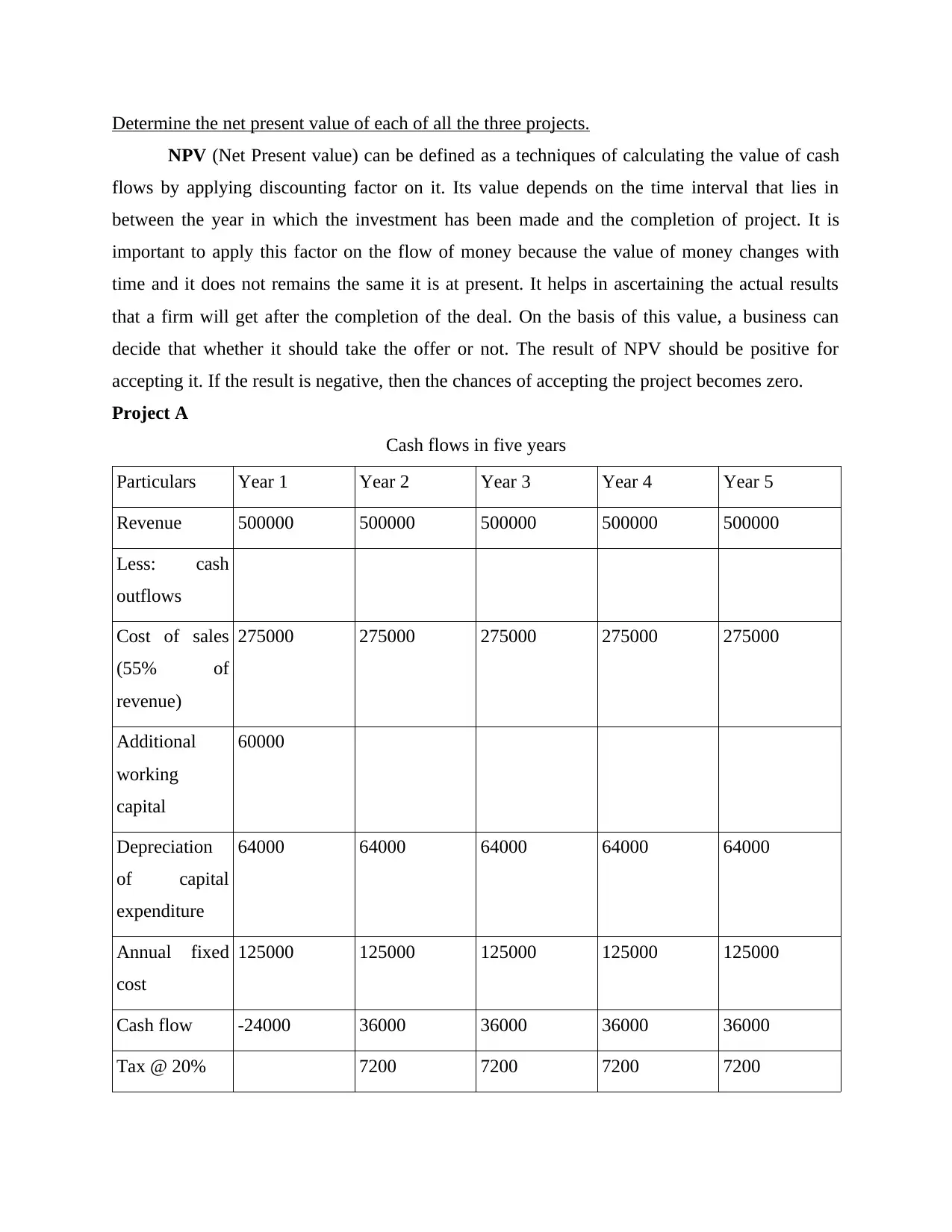

Project B

Cash flows in five years

Particulars Year 1 Year 2 Year 3 Year 4 Year 5

Revenue 425000 425000 425000 425000 425000

Less: cash

outflows

Cost of sales

(58% of

revenue)

246500 246500 246500 246500 246500

Additional

working

capital

55000

Depreciation

of capital

expenditure

80000 80000 80000 80000 80000

Annual fixed

cost

100000 100000 100000 100000 100000

Cash flow -56500 -1500 -1500 -1500 -1500

Tax @ 20%

Add Residual

value

200000

Net cash flows -56500 -1500 -1500 -1500 198500

Project C

Cash flows in five years

Particulars Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

Project B

Cash flows in five years

Particulars Year 1 Year 2 Year 3 Year 4 Year 5

Revenue 425000 425000 425000 425000 425000

Less: cash

outflows

Cost of sales

(58% of

revenue)

246500 246500 246500 246500 246500

Additional

working

capital

55000

Depreciation

of capital

expenditure

80000 80000 80000 80000 80000

Annual fixed

cost

100000 100000 100000 100000 100000

Cash flow -56500 -1500 -1500 -1500 -1500

Tax @ 20%

Add Residual

value

200000

Net cash flows -56500 -1500 -1500 -1500 198500

Project C

Cash flows in five years

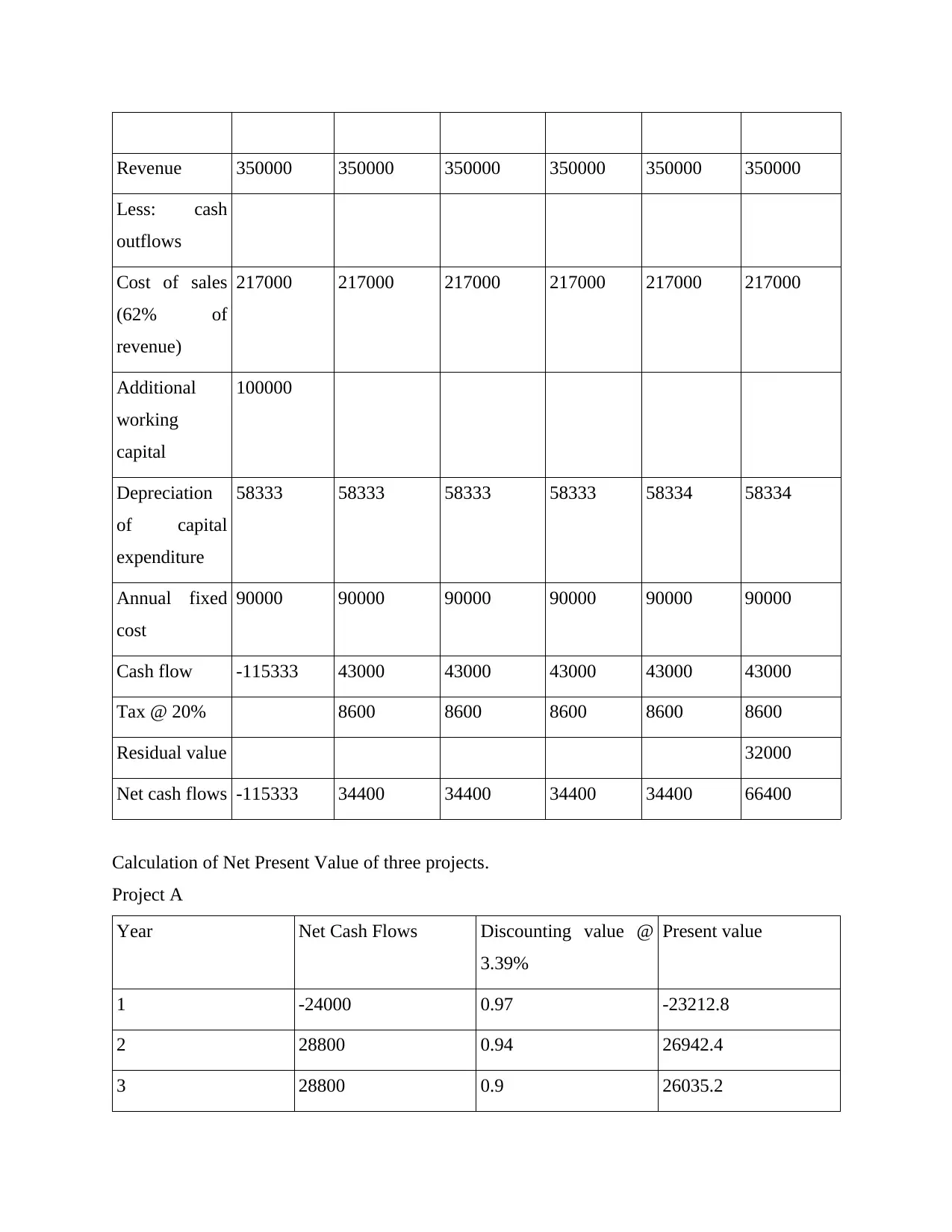

Particulars Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

Revenue 350000 350000 350000 350000 350000 350000

Less: cash

outflows

Cost of sales

(62% of

revenue)

217000 217000 217000 217000 217000 217000

Additional

working

capital

100000

Depreciation

of capital

expenditure

58333 58333 58333 58333 58334 58334

Annual fixed

cost

90000 90000 90000 90000 90000 90000

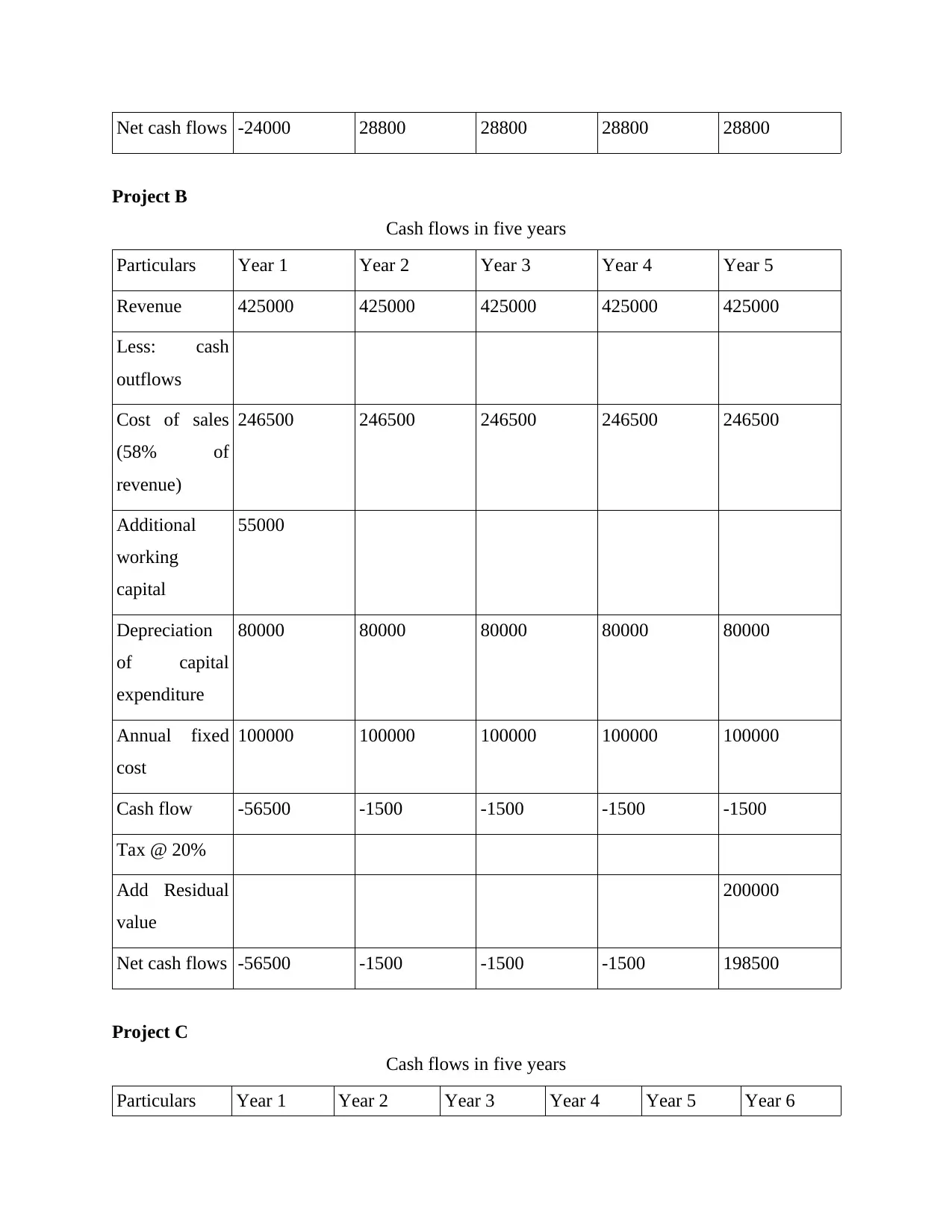

Cash flow -115333 43000 43000 43000 43000 43000

Tax @ 20% 8600 8600 8600 8600 8600

Residual value 32000

Net cash flows -115333 34400 34400 34400 34400 66400

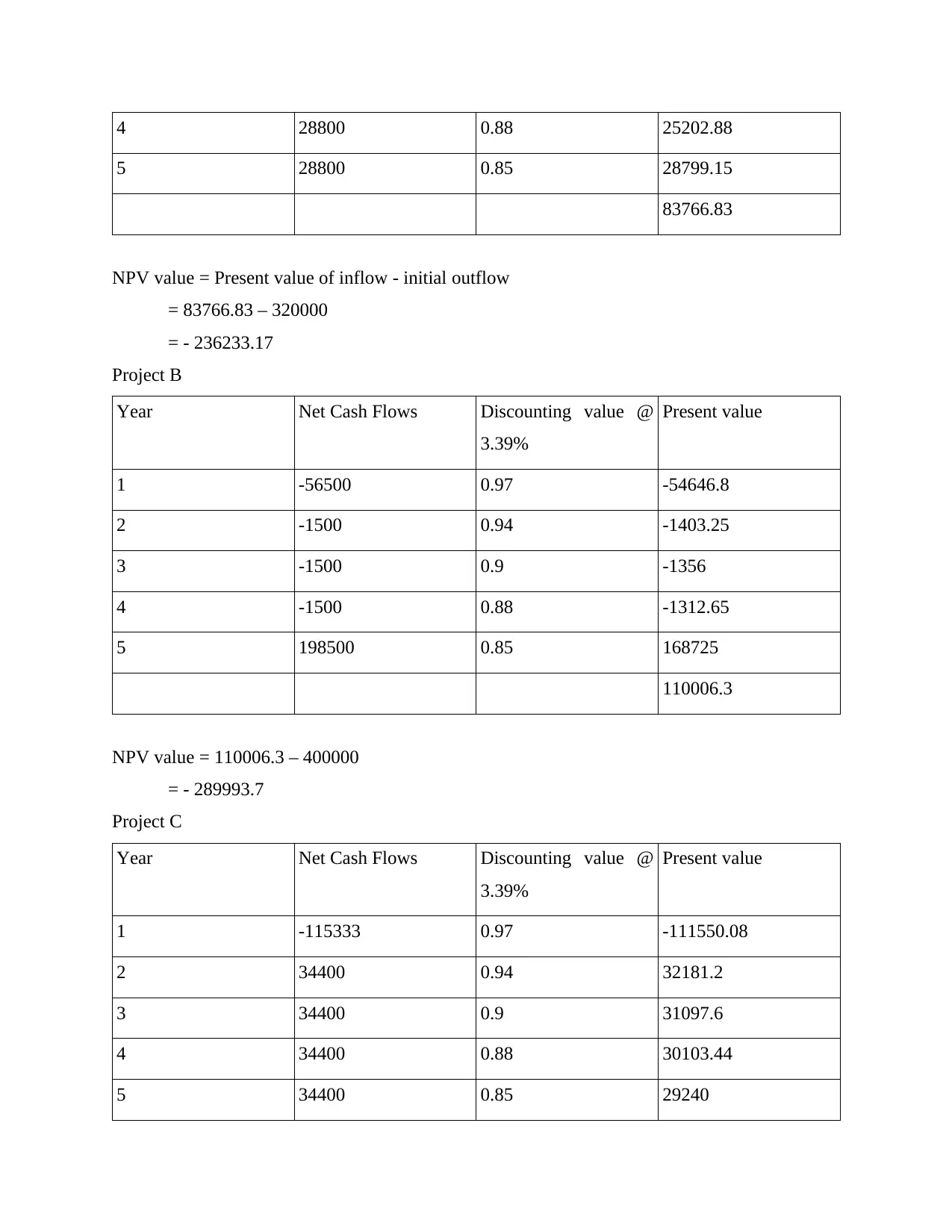

Calculation of Net Present Value of three projects.

Project A

Year Net Cash Flows Discounting value @

3.39%

Present value

1 -24000 0.97 -23212.8

2 28800 0.94 26942.4

3 28800 0.9 26035.2

Less: cash

outflows

Cost of sales

(62% of

revenue)

217000 217000 217000 217000 217000 217000

Additional

working

capital

100000

Depreciation

of capital

expenditure

58333 58333 58333 58333 58334 58334

Annual fixed

cost

90000 90000 90000 90000 90000 90000

Cash flow -115333 43000 43000 43000 43000 43000

Tax @ 20% 8600 8600 8600 8600 8600

Residual value 32000

Net cash flows -115333 34400 34400 34400 34400 66400

Calculation of Net Present Value of three projects.

Project A

Year Net Cash Flows Discounting value @

3.39%

Present value

1 -24000 0.97 -23212.8

2 28800 0.94 26942.4

3 28800 0.9 26035.2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4 28800 0.88 25202.88

5 28800 0.85 28799.15

83766.83

NPV value = Present value of inflow - initial outflow

= 83766.83 – 320000

= - 236233.17

Project B

Year Net Cash Flows Discounting value @

3.39%

Present value

1 -56500 0.97 -54646.8

2 -1500 0.94 -1403.25

3 -1500 0.9 -1356

4 -1500 0.88 -1312.65

5 198500 0.85 168725

110006.3

NPV value = 110006.3 – 400000

= - 289993.7

Project C

Year Net Cash Flows Discounting value @

3.39%

Present value

1 -115333 0.97 -111550.08

2 34400 0.94 32181.2

3 34400 0.9 31097.6

4 34400 0.88 30103.44

5 34400 0.85 29240

5 28800 0.85 28799.15

83766.83

NPV value = Present value of inflow - initial outflow

= 83766.83 – 320000

= - 236233.17

Project B

Year Net Cash Flows Discounting value @

3.39%

Present value

1 -56500 0.97 -54646.8

2 -1500 0.94 -1403.25

3 -1500 0.9 -1356

4 -1500 0.88 -1312.65

5 198500 0.85 168725

110006.3

NPV value = 110006.3 – 400000

= - 289993.7

Project C

Year Net Cash Flows Discounting value @

3.39%

Present value

1 -115333 0.97 -111550.08

2 34400 0.94 32181.2

3 34400 0.9 31097.6

4 34400 0.88 30103.44

5 34400 0.85 29240

6 66400 0.82 54448

65520.16

NPV value = 65520.16 – 350000

= - 284479.84

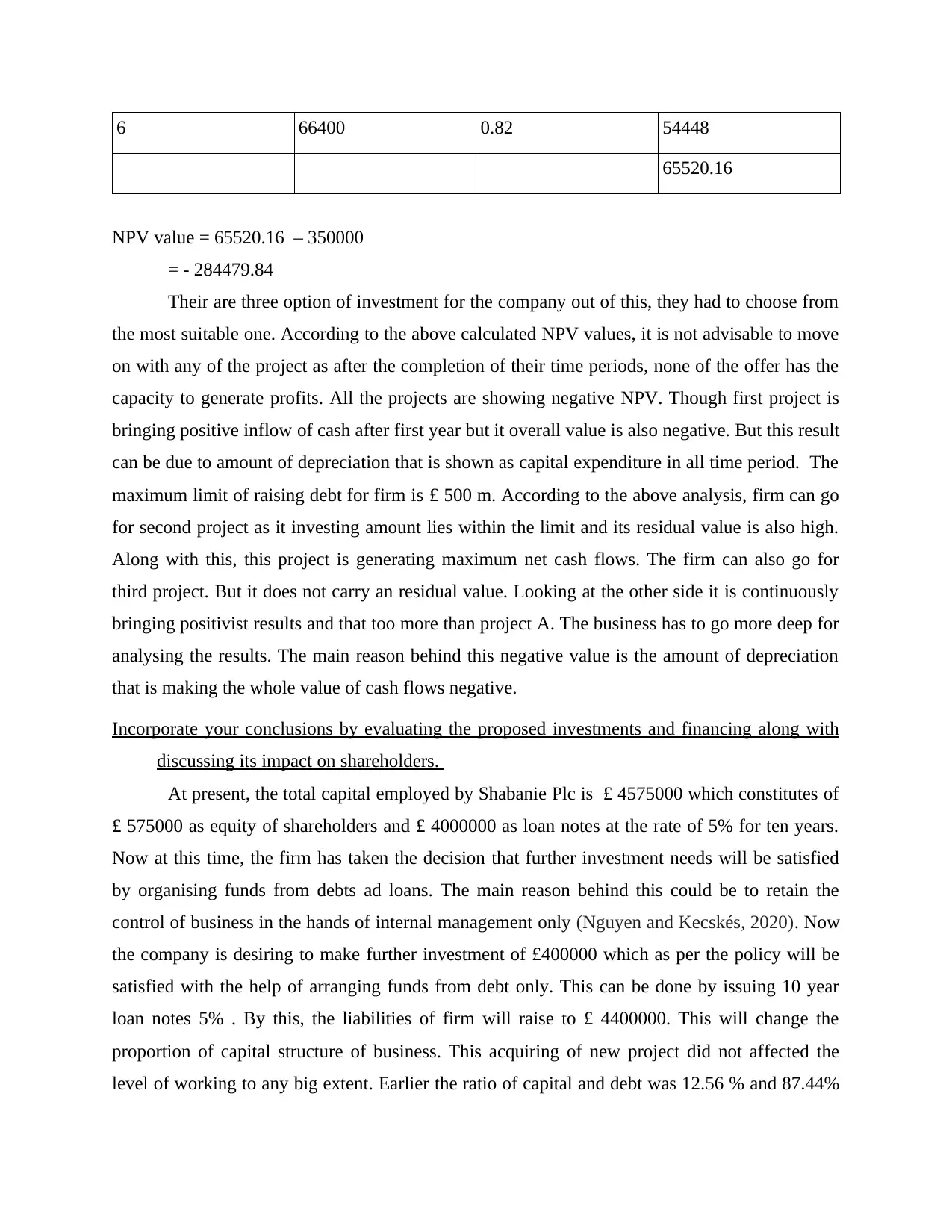

Their are three option of investment for the company out of this, they had to choose from

the most suitable one. According to the above calculated NPV values, it is not advisable to move

on with any of the project as after the completion of their time periods, none of the offer has the

capacity to generate profits. All the projects are showing negative NPV. Though first project is

bringing positive inflow of cash after first year but it overall value is also negative. But this result

can be due to amount of depreciation that is shown as capital expenditure in all time period. The

maximum limit of raising debt for firm is £ 500 m. According to the above analysis, firm can go

for second project as it investing amount lies within the limit and its residual value is also high.

Along with this, this project is generating maximum net cash flows. The firm can also go for

third project. But it does not carry an residual value. Looking at the other side it is continuously

bringing positivist results and that too more than project A. The business has to go more deep for

analysing the results. The main reason behind this negative value is the amount of depreciation

that is making the whole value of cash flows negative.

Incorporate your conclusions by evaluating the proposed investments and financing along with

discussing its impact on shareholders.

At present, the total capital employed by Shabanie Plc is £ 4575000 which constitutes of

£ 575000 as equity of shareholders and £ 4000000 as loan notes at the rate of 5% for ten years.

Now at this time, the firm has taken the decision that further investment needs will be satisfied

by organising funds from debts ad loans. The main reason behind this could be to retain the

control of business in the hands of internal management only (Nguyen and Kecskés, 2020). Now

the company is desiring to make further investment of £400000 which as per the policy will be

satisfied with the help of arranging funds from debt only. This can be done by issuing 10 year

loan notes 5% . By this, the liabilities of firm will raise to £ 4400000. This will change the

proportion of capital structure of business. This acquiring of new project did not affected the

level of working to any big extent. Earlier the ratio of capital and debt was 12.56 % and 87.44%

65520.16

NPV value = 65520.16 – 350000

= - 284479.84

Their are three option of investment for the company out of this, they had to choose from

the most suitable one. According to the above calculated NPV values, it is not advisable to move

on with any of the project as after the completion of their time periods, none of the offer has the

capacity to generate profits. All the projects are showing negative NPV. Though first project is

bringing positive inflow of cash after first year but it overall value is also negative. But this result

can be due to amount of depreciation that is shown as capital expenditure in all time period. The

maximum limit of raising debt for firm is £ 500 m. According to the above analysis, firm can go

for second project as it investing amount lies within the limit and its residual value is also high.

Along with this, this project is generating maximum net cash flows. The firm can also go for

third project. But it does not carry an residual value. Looking at the other side it is continuously

bringing positivist results and that too more than project A. The business has to go more deep for

analysing the results. The main reason behind this negative value is the amount of depreciation

that is making the whole value of cash flows negative.

Incorporate your conclusions by evaluating the proposed investments and financing along with

discussing its impact on shareholders.

At present, the total capital employed by Shabanie Plc is £ 4575000 which constitutes of

£ 575000 as equity of shareholders and £ 4000000 as loan notes at the rate of 5% for ten years.

Now at this time, the firm has taken the decision that further investment needs will be satisfied

by organising funds from debts ad loans. The main reason behind this could be to retain the

control of business in the hands of internal management only (Nguyen and Kecskés, 2020). Now

the company is desiring to make further investment of £400000 which as per the policy will be

satisfied with the help of arranging funds from debt only. This can be done by issuing 10 year

loan notes 5% . By this, the liabilities of firm will raise to £ 4400000. This will change the

proportion of capital structure of business. This acquiring of new project did not affected the

level of working to any big extent. Earlier the ratio of capital and debt was 12.56 % and 87.44%

respectively and after acquisition of project, it became 11.56 % and 88.44 % respectively. Their

was a change of only 1 % in both the values. Arranging funds through debt will be riskier for the

organisation but still it is a cheaper option because it helps in availing a deduction on the

payment of tax while on the other side, the dividend paid on equity is not allowed to be shown as

expense in profit calculation of tax (Díez-Esteban And et. al., 2017). Also, this amount of debt

can be returned after the completion of its time period or unfolding of project. This will become

less risky year by year.

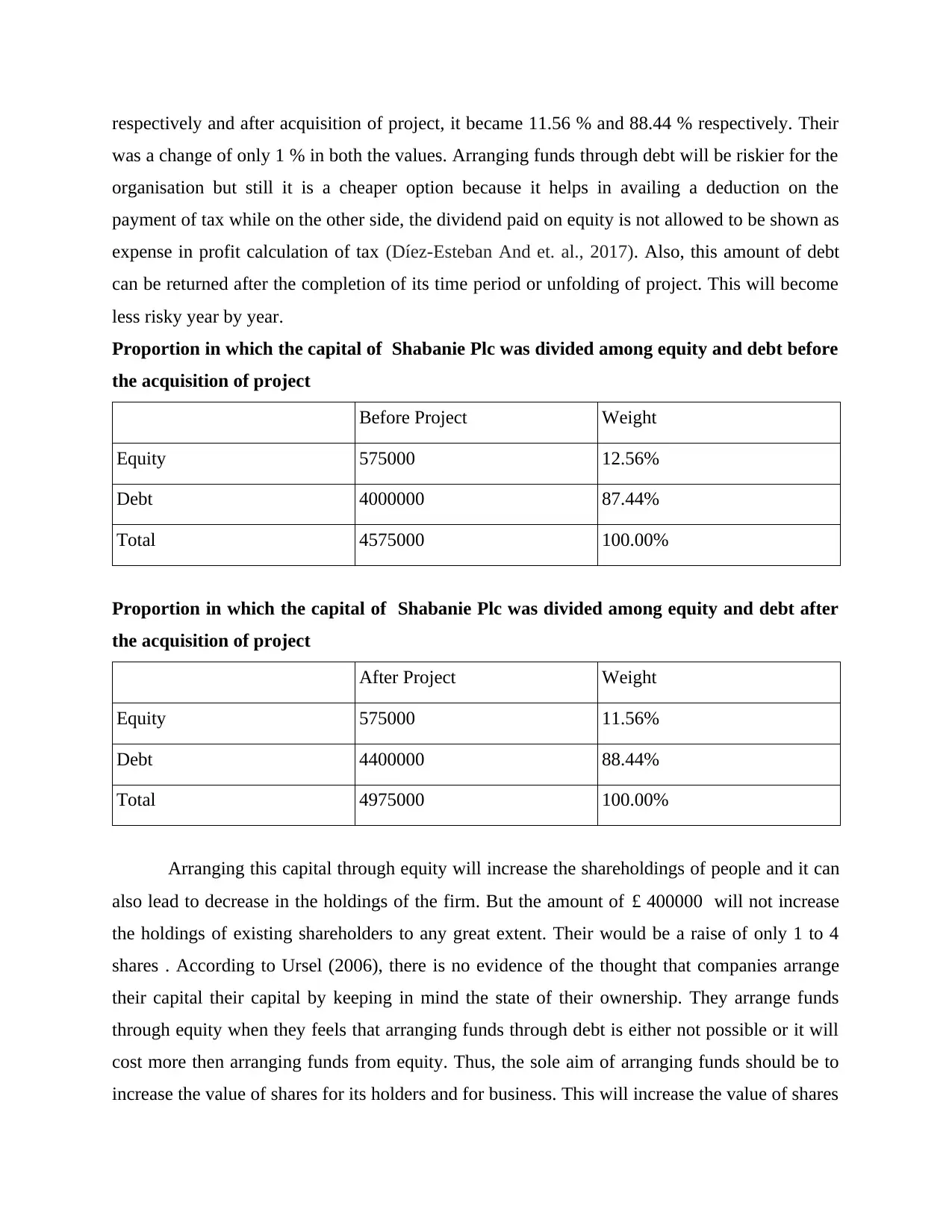

Proportion in which the capital of Shabanie Plc was divided among equity and debt before

the acquisition of project

Before Project Weight

Equity 575000 12.56%

Debt 4000000 87.44%

Total 4575000 100.00%

Proportion in which the capital of Shabanie Plc was divided among equity and debt after

the acquisition of project

After Project Weight

Equity 575000 11.56%

Debt 4400000 88.44%

Total 4975000 100.00%

Arranging this capital through equity will increase the shareholdings of people and it can

also lead to decrease in the holdings of the firm. But the amount of £ 400000 will not increase

the holdings of existing shareholders to any great extent. Their would be a raise of only 1 to 4

shares . According to Ursel (2006), there is no evidence of the thought that companies arrange

their capital their capital by keeping in mind the state of their ownership. They arrange funds

through equity when they feels that arranging funds through debt is either not possible or it will

cost more then arranging funds from equity. Thus, the sole aim of arranging funds should be to

increase the value of shares for its holders and for business. This will increase the value of shares

was a change of only 1 % in both the values. Arranging funds through debt will be riskier for the

organisation but still it is a cheaper option because it helps in availing a deduction on the

payment of tax while on the other side, the dividend paid on equity is not allowed to be shown as

expense in profit calculation of tax (Díez-Esteban And et. al., 2017). Also, this amount of debt

can be returned after the completion of its time period or unfolding of project. This will become

less risky year by year.

Proportion in which the capital of Shabanie Plc was divided among equity and debt before

the acquisition of project

Before Project Weight

Equity 575000 12.56%

Debt 4000000 87.44%

Total 4575000 100.00%

Proportion in which the capital of Shabanie Plc was divided among equity and debt after

the acquisition of project

After Project Weight

Equity 575000 11.56%

Debt 4400000 88.44%

Total 4975000 100.00%

Arranging this capital through equity will increase the shareholdings of people and it can

also lead to decrease in the holdings of the firm. But the amount of £ 400000 will not increase

the holdings of existing shareholders to any great extent. Their would be a raise of only 1 to 4

shares . According to Ursel (2006), there is no evidence of the thought that companies arrange

their capital their capital by keeping in mind the state of their ownership. They arrange funds

through equity when they feels that arranging funds through debt is either not possible or it will

cost more then arranging funds from equity. Thus, the sole aim of arranging funds should be to

increase the value of shares for its holders and for business. This will increase the value of shares

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

for their holders and will also help them in gaining confidence on firm (Schultz, Tan and Walsh,

2017).

Method of valuation explains the way in which shareholders earn their return and to what

level of extent. The profits of the firm are anticipated for future in presence of uncertainties and

this estimation is made with the help of stakeholders. They are directly or indirectly involved in

the projects and takes interest in maximising their own wealth. Their is a positive relation among

the capital structure and the value of the firm. An optimal financial leverage helps in reducing

the cost of capital that can also help in managing its profits and payment of tax (Dong, Liao and

Zhang, 2018).

The NPV value of all the three projects came out to be negative but it does not mean that

all three offers are bad. The resulting negative value was due to depreciation of amount invested

in capital expenditure. Many a times, a positive value of NPV can be proved to be wrong. This is

because of lack of application of stakeholder theory. This theory includes the information about

all the stakeholders. When the decision is made according to the paper work only and investors

are neglected then this results in bad decisions. As per Crilly (2012), while estimating the value

of project, it is equally important to review the point of stakeholders and impact of decision on

them. They can help in reducing the risk factor of the project by showcasing their own

expectations and anticipations (Tseng, Su and Tsai, 2017).

From the decisions made above, it is very much clear that the firm is looking forward to

expand its market by arranging debt . This will not only effect Shabanie Plc but also its

employees, suppliers and other concerned parties. So, a firm should before making any decision

of arranging funds should analyse its impact on both the shareholders as well as stakeholders.

CONCLUSION

From the above report, it can be analysed that capital structuring of firm makes a direct

impact on the decision taken by firm and value of shareholders. The companies are normally

aware and are vigilant about maximising the value of shares. Decrease in the cost of capital of

business increases it profits which leads to rise in the shareholder value. The interest coverage

ratio of the firm should also be high as it put positive impact on the investors and stakeholders.

The decision of firm to arrange its capital through debt will also increase the value of shares held

by them. This also helps the firm in retaining its control with itself. This mode of expanding the

market will also opens the door of repayment of the holdings after completion of project. But at

2017).

Method of valuation explains the way in which shareholders earn their return and to what

level of extent. The profits of the firm are anticipated for future in presence of uncertainties and

this estimation is made with the help of stakeholders. They are directly or indirectly involved in

the projects and takes interest in maximising their own wealth. Their is a positive relation among

the capital structure and the value of the firm. An optimal financial leverage helps in reducing

the cost of capital that can also help in managing its profits and payment of tax (Dong, Liao and

Zhang, 2018).

The NPV value of all the three projects came out to be negative but it does not mean that

all three offers are bad. The resulting negative value was due to depreciation of amount invested

in capital expenditure. Many a times, a positive value of NPV can be proved to be wrong. This is

because of lack of application of stakeholder theory. This theory includes the information about

all the stakeholders. When the decision is made according to the paper work only and investors

are neglected then this results in bad decisions. As per Crilly (2012), while estimating the value

of project, it is equally important to review the point of stakeholders and impact of decision on

them. They can help in reducing the risk factor of the project by showcasing their own

expectations and anticipations (Tseng, Su and Tsai, 2017).

From the decisions made above, it is very much clear that the firm is looking forward to

expand its market by arranging debt . This will not only effect Shabanie Plc but also its

employees, suppliers and other concerned parties. So, a firm should before making any decision

of arranging funds should analyse its impact on both the shareholders as well as stakeholders.

CONCLUSION

From the above report, it can be analysed that capital structuring of firm makes a direct

impact on the decision taken by firm and value of shareholders. The companies are normally

aware and are vigilant about maximising the value of shares. Decrease in the cost of capital of

business increases it profits which leads to rise in the shareholder value. The interest coverage

ratio of the firm should also be high as it put positive impact on the investors and stakeholders.

The decision of firm to arrange its capital through debt will also increase the value of shares held

by them. This also helps the firm in retaining its control with itself. This mode of expanding the

market will also opens the door of repayment of the holdings after completion of project. But at

the time of making decision of its capital structure, it should keep in mind their impact on the

various stakeholders by keeping it in mind. By considering them in the decision, the firm can

open up new perspectives through which more efficient decisions can be made.

various stakeholders by keeping it in mind. By considering them in the decision, the firm can

open up new perspectives through which more efficient decisions can be made.

REFERENCES

Books and Journals

Huang, J., Hu, W. and Zhu, G., 2018. The effect of corporate social responsibility on cost of

corporate bond: Evidence from China. Emerging Markets Finance and Trade. 54(2).

pp.255-268.

Nguyen, P.A. and Kecskés, A., 2020. Do technology spillovers affect the corporate information

environment?. Journal of Corporate Finance. 62. p.101581.

Díez-Esteban, J.M. And et. al., 2017. Corporate risk-taking, returns and the nature of major

shareholders: Evidence from prospect theory. Research in International Business and

Finance. 42. pp.900-911.

Schultz, E.L., Tan, D.T. and Walsh, K.D., 2017. Corporate governance and the probability of

default. Accounting & Finance. 57. pp.235-253.

Dong, W., Liao, S. and Zhang, Z., 2018. Leveraging financial social media data for corporate

fraud detection. Journal of Management Information Systems. 35(2). pp.461-487.

Tseng, P.H., Su, X.Q. and Tsai, H.J., 2017. Managerial education and the wealth effect of

corporate capital investment in Taiwan. Managerial Finance.

Invetopedia, 2021 Available through [Online]

<https://www.investopedia.com/ask/answers/031915/what-capital-structure-theory.asp>

Your article library, 2021 Available through [Online]

<https://www.yourarticlelibrary.com/financial-management/capital-structure/capital-

structure-concept-definition-and-importance/44063>

Does capital structure impact firm performance, 2021 Available through

[Online]<http://digitalcommons.www.nabusinesspress.com/JAF/ColeC_Web15_6_.pdf

>

Books and Journals

Huang, J., Hu, W. and Zhu, G., 2018. The effect of corporate social responsibility on cost of

corporate bond: Evidence from China. Emerging Markets Finance and Trade. 54(2).

pp.255-268.

Nguyen, P.A. and Kecskés, A., 2020. Do technology spillovers affect the corporate information

environment?. Journal of Corporate Finance. 62. p.101581.

Díez-Esteban, J.M. And et. al., 2017. Corporate risk-taking, returns and the nature of major

shareholders: Evidence from prospect theory. Research in International Business and

Finance. 42. pp.900-911.

Schultz, E.L., Tan, D.T. and Walsh, K.D., 2017. Corporate governance and the probability of

default. Accounting & Finance. 57. pp.235-253.

Dong, W., Liao, S. and Zhang, Z., 2018. Leveraging financial social media data for corporate

fraud detection. Journal of Management Information Systems. 35(2). pp.461-487.

Tseng, P.H., Su, X.Q. and Tsai, H.J., 2017. Managerial education and the wealth effect of

corporate capital investment in Taiwan. Managerial Finance.

Invetopedia, 2021 Available through [Online]

<https://www.investopedia.com/ask/answers/031915/what-capital-structure-theory.asp>

Your article library, 2021 Available through [Online]

<https://www.yourarticlelibrary.com/financial-management/capital-structure/capital-

structure-concept-definition-and-importance/44063>

Does capital structure impact firm performance, 2021 Available through

[Online]<http://digitalcommons.www.nabusinesspress.com/JAF/ColeC_Web15_6_.pdf

>

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.