International Finance: Capital Structure, WACC & Kings Bars Analysis

VerifiedAdded on 2023/05/30

|14

|3192

|289

Homework Assignment

AI Summary

This assignment delves into the intricacies of capital structure theories, cost of equity calculations, and the weighted average cost of capital (WACC) within the context of international finance. It covers various approaches to capital structure, including the Net Income (NI), Net Operating Income (NOI), and Modigliani-Miller (MM) approaches, while outlining key assumptions underlying these theories. The assignment further calculates the cost of equity using both the Capital Asset Pricing Model (CAPM) and the Dividend Growth Model, and it computes the WACC using both book value and market value. It discusses the implications of using book value versus market value in WACC calculations and evaluates the suitability of CAPM for specialized portfolios. Furthermore, the document explores the concept of hurdle rates in capital investment appraisal and analyzes the impact of buybacks versus dividend payments on shareholder value. The practical application of these concepts is illustrated through the analysis of Kings Bars' capital structure and financing decisions.

International Finance and Decision Making

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1.

Answer.

Capital refer to the permanent finance that is invested in the business. Long term funds that are

invested in business can be categorized into two types i.e. Debt or Equity. Debt is the funds that

business borrows from outside sources like bonds, commercial papers, loans, debentures etc. Debts

funds have a fixed interest rate bearing on the lender. Whereas, equity refers to the funds that the

owner of the business invests like shares, retained earnings etc. Equity funds do not have any fixed

interest bearings on the business. All profits and loss are to be borne by the equity owners. The basic

point that is to be noted for determining capital structure is the proportion of borrowed capital or

owned funds invested in the business. Issue of debentures, shares, long term borrowing, and loans are

the sources through which long term funds can be raised. The main difference between the two types of

funds is the fixed rate of interest to be paid in case of debt whether there is profit or not, which is not

the case in equity which, requires dividends to be paid but only in case of availability of sufficient profits.

Returns which are available for shareholders are affected by the capital structure decisions.

There are four types of Capital structure theories:

1. NI (Net Income) Approach

2. NOI (Net Operating Income) Approach

3. Modigliani Miller (MM) Approach

4. Traditional Approach

Following are the assumptions for capital structure theories:

1. No corporate taxes will be there.

2. Debt and Equity are the only two sources of finance for the firms.

3. Dividend pay-out (DP) ratio is 100% i.e firm distributes all its income to its shareholders as

dividend and retained earnings is 0.

4. Total assets will be given and will not change, investment decisions which are given will be

constant.

5. There is perpetual life for the firm.

6. Earnings before interest and tax of a firm will not grow.

7. Total financing of the firm remains the same. Firm’s leverage will be altered only by selling

shares.

8. Business risk is not dependent upon capital structure and will remain constant.

9. Deferred tax is ignored as accounting only.

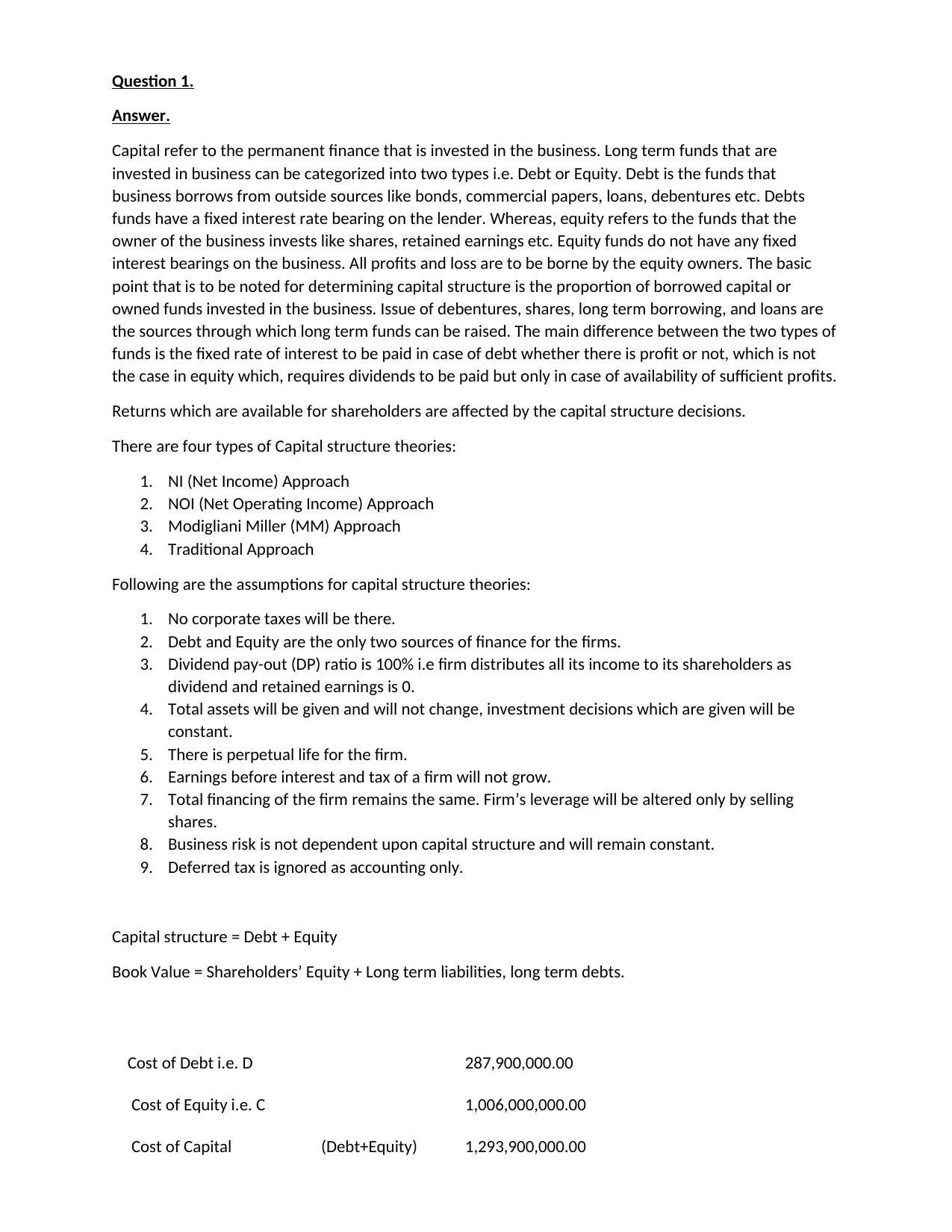

Capital structure = Debt + Equity

Book Value = Shareholders’ Equity + Long term liabilities, long term debts.

Cost of Debt i.e. D 287,900,000.00

Cost of Equity i.e. C 1,006,000,000.00

Cost of Capital (Debt+Equity) 1,293,900,000.00

Answer.

Capital refer to the permanent finance that is invested in the business. Long term funds that are

invested in business can be categorized into two types i.e. Debt or Equity. Debt is the funds that

business borrows from outside sources like bonds, commercial papers, loans, debentures etc. Debts

funds have a fixed interest rate bearing on the lender. Whereas, equity refers to the funds that the

owner of the business invests like shares, retained earnings etc. Equity funds do not have any fixed

interest bearings on the business. All profits and loss are to be borne by the equity owners. The basic

point that is to be noted for determining capital structure is the proportion of borrowed capital or

owned funds invested in the business. Issue of debentures, shares, long term borrowing, and loans are

the sources through which long term funds can be raised. The main difference between the two types of

funds is the fixed rate of interest to be paid in case of debt whether there is profit or not, which is not

the case in equity which, requires dividends to be paid but only in case of availability of sufficient profits.

Returns which are available for shareholders are affected by the capital structure decisions.

There are four types of Capital structure theories:

1. NI (Net Income) Approach

2. NOI (Net Operating Income) Approach

3. Modigliani Miller (MM) Approach

4. Traditional Approach

Following are the assumptions for capital structure theories:

1. No corporate taxes will be there.

2. Debt and Equity are the only two sources of finance for the firms.

3. Dividend pay-out (DP) ratio is 100% i.e firm distributes all its income to its shareholders as

dividend and retained earnings is 0.

4. Total assets will be given and will not change, investment decisions which are given will be

constant.

5. There is perpetual life for the firm.

6. Earnings before interest and tax of a firm will not grow.

7. Total financing of the firm remains the same. Firm’s leverage will be altered only by selling

shares.

8. Business risk is not dependent upon capital structure and will remain constant.

9. Deferred tax is ignored as accounting only.

Capital structure = Debt + Equity

Book Value = Shareholders’ Equity + Long term liabilities, long term debts.

Cost of Debt i.e. D 287,900,000.00

Cost of Equity i.e. C 1,006,000,000.00

Cost of Capital (Debt+Equity) 1,293,900,000.00

Market Value = No. of shares x Share price + No. of bonds x Bond price.

Market Value

(Bond Price*Number of Bonds)

Cost of Debt i.e. D

Short Term Debt 54,900,000.00

Bonds 22,135,000,000.00 22,189,900,000.00

Cost of Equity i.e. C 3,060,000,000.00

Cost of Capital 25,249,900,000.00

Market Value

(Bond Price*Number of Bonds)

Cost of Debt i.e. D

Short Term Debt 54,900,000.00

Bonds 22,135,000,000.00 22,189,900,000.00

Cost of Equity i.e. C 3,060,000,000.00

Cost of Capital 25,249,900,000.00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Question 2.

Answer.

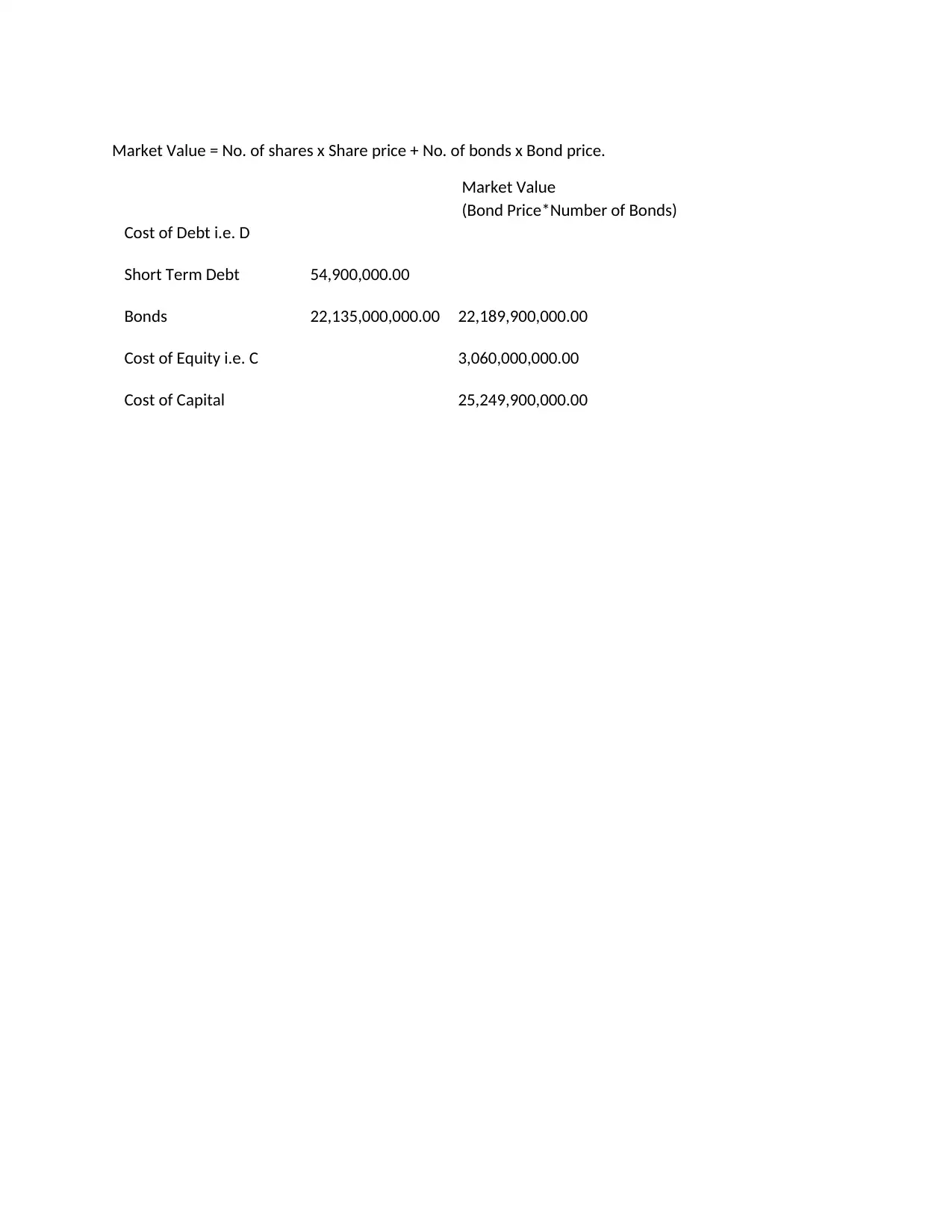

Calculation of Cost of Equity:

(i) Using CAPM.

Risk Free Rate of Return i.e. Rf 4

Market Rate of Return i.e. Rm 12

Beta

1.

1

Per Capital Asset Pricing Model, Cost of Equity

= Rf+ (Rm-Rf)Beta 12.8%

Debt

28

8

Equity

100

6

First we will ungear the Beta usinf formula

BEquity = BAsset + {(1-t) D/E}*BAsset

(ii) Using Dividend Growth Model.

Re = D1/P0 + g

Equity Value

1006

million

Shares Outstanding (75+10-5) 80 million

Face Value 12.575

Dividend (%) 11.67%

Dividend ($) 1.4675025

Price (P0) 36

Growth(g) 12.50%

Re 16.58%

Cost of Debt

Interest

Rate Debt

Weighted Average Cost

of Debt

Sinking Fund

Debenture

First Issue 6.99 133,000,000.00

Second Issue 7.46 100,000,000.00

233,000,000.00

Yield to maturity compounded on semi-annual basis

Effective annual yield- APR Formula

(1+r/m)m-1

where m=2

Answer.

Calculation of Cost of Equity:

(i) Using CAPM.

Risk Free Rate of Return i.e. Rf 4

Market Rate of Return i.e. Rm 12

Beta

1.

1

Per Capital Asset Pricing Model, Cost of Equity

= Rf+ (Rm-Rf)Beta 12.8%

Debt

28

8

Equity

100

6

First we will ungear the Beta usinf formula

BEquity = BAsset + {(1-t) D/E}*BAsset

(ii) Using Dividend Growth Model.

Re = D1/P0 + g

Equity Value

1006

million

Shares Outstanding (75+10-5) 80 million

Face Value 12.575

Dividend (%) 11.67%

Dividend ($) 1.4675025

Price (P0) 36

Growth(g) 12.50%

Re 16.58%

Cost of Debt

Interest

Rate Debt

Weighted Average Cost

of Debt

Sinking Fund

Debenture

First Issue 6.99 133,000,000.00

Second Issue 7.46 100,000,000.00

233,000,000.00

Yield to maturity compounded on semi-annual basis

Effective annual yield- APR Formula

(1+r/m)m-1

where m=2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

r=6.87

(1+6.87/2)2-1 6.99

Question 3

Answer-

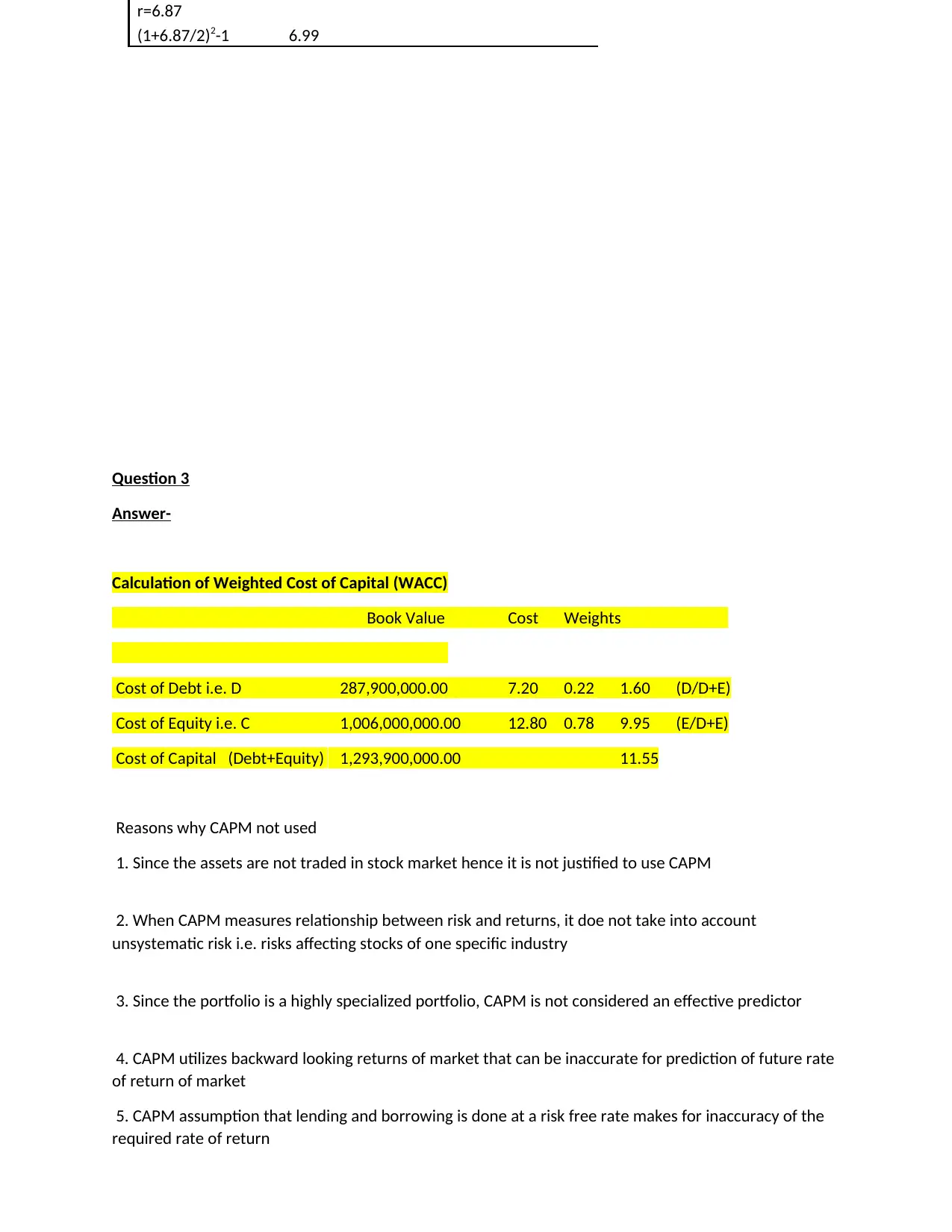

Calculation of Weighted Cost of Capital (WACC)

Book Value Cost Weights

Cost of Debt i.e. D 287,900,000.00 7.20 0.22 1.60 (D/D+E)

Cost of Equity i.e. C 1,006,000,000.00 12.80 0.78 9.95 (E/D+E)

Cost of Capital (Debt+Equity) 1,293,900,000.00 11.55

Reasons why CAPM not used

1. Since the assets are not traded in stock market hence it is not justified to use CAPM

2. When CAPM measures relationship between risk and returns, it doe not take into account

unsystematic risk i.e. risks affecting stocks of one specific industry

3. Since the portfolio is a highly specialized portfolio, CAPM is not considered an effective predictor

4. CAPM utilizes backward looking returns of market that can be inaccurate for prediction of future rate

of return of market

5. CAPM assumption that lending and borrowing is done at a risk free rate makes for inaccuracy of the

required rate of return

(1+6.87/2)2-1 6.99

Question 3

Answer-

Calculation of Weighted Cost of Capital (WACC)

Book Value Cost Weights

Cost of Debt i.e. D 287,900,000.00 7.20 0.22 1.60 (D/D+E)

Cost of Equity i.e. C 1,006,000,000.00 12.80 0.78 9.95 (E/D+E)

Cost of Capital (Debt+Equity) 1,293,900,000.00 11.55

Reasons why CAPM not used

1. Since the assets are not traded in stock market hence it is not justified to use CAPM

2. When CAPM measures relationship between risk and returns, it doe not take into account

unsystematic risk i.e. risks affecting stocks of one specific industry

3. Since the portfolio is a highly specialized portfolio, CAPM is not considered an effective predictor

4. CAPM utilizes backward looking returns of market that can be inaccurate for prediction of future rate

of return of market

5. CAPM assumption that lending and borrowing is done at a risk free rate makes for inaccuracy of the

required rate of return

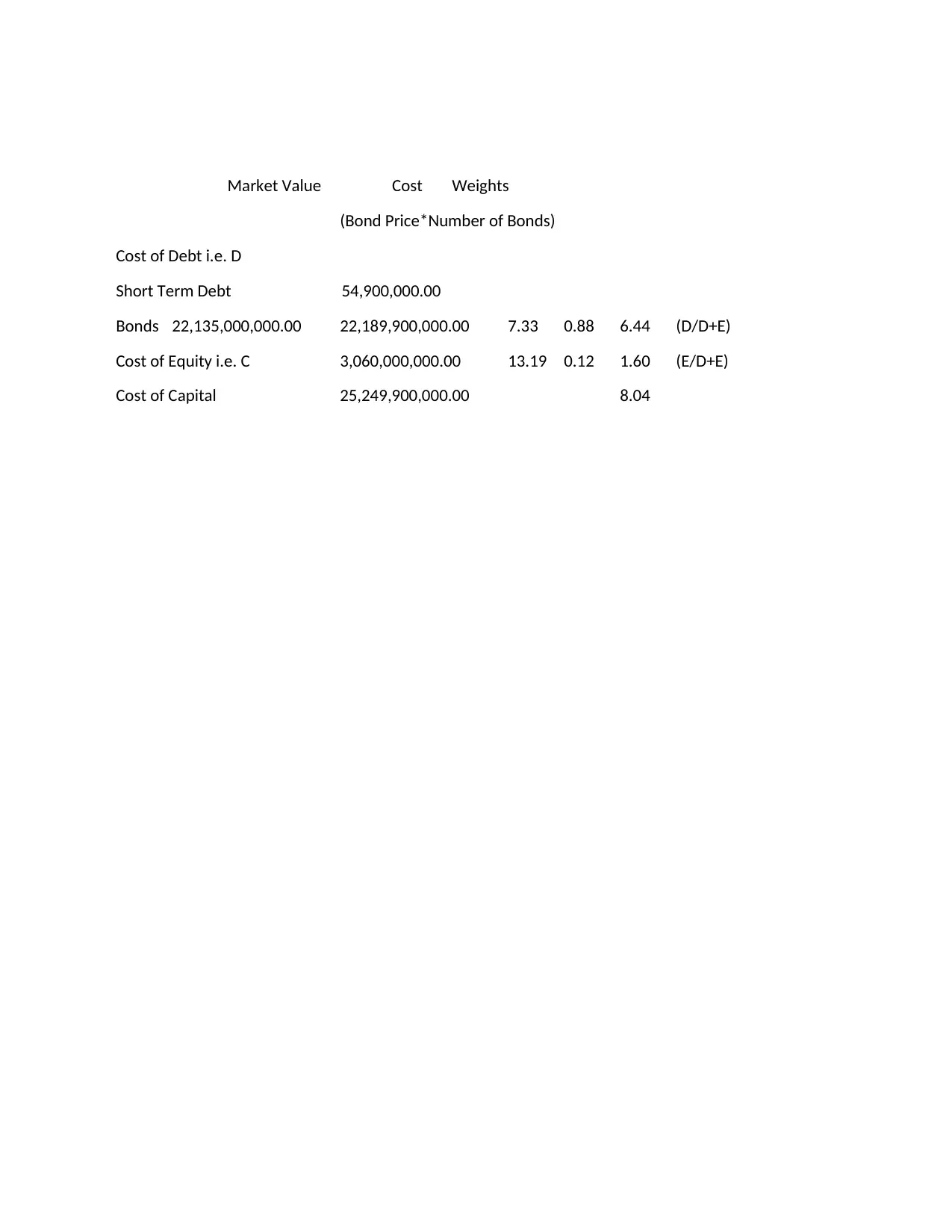

Market Value Cost Weights

(Bond Price*Number of Bonds)

Cost of Debt i.e. D

Short Term Debt 54,900,000.00

Bonds 22,135,000,000.00 22,189,900,000.00 7.33 0.88 6.44 (D/D+E)

Cost of Equity i.e. C 3,060,000,000.00 13.19 0.12 1.60 (E/D+E)

Cost of Capital 25,249,900,000.00 8.04

(Bond Price*Number of Bonds)

Cost of Debt i.e. D

Short Term Debt 54,900,000.00

Bonds 22,135,000,000.00 22,189,900,000.00 7.33 0.88 6.44 (D/D+E)

Cost of Equity i.e. C 3,060,000,000.00 13.19 0.12 1.60 (E/D+E)

Cost of Capital 25,249,900,000.00 8.04

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Question 4

Answer-

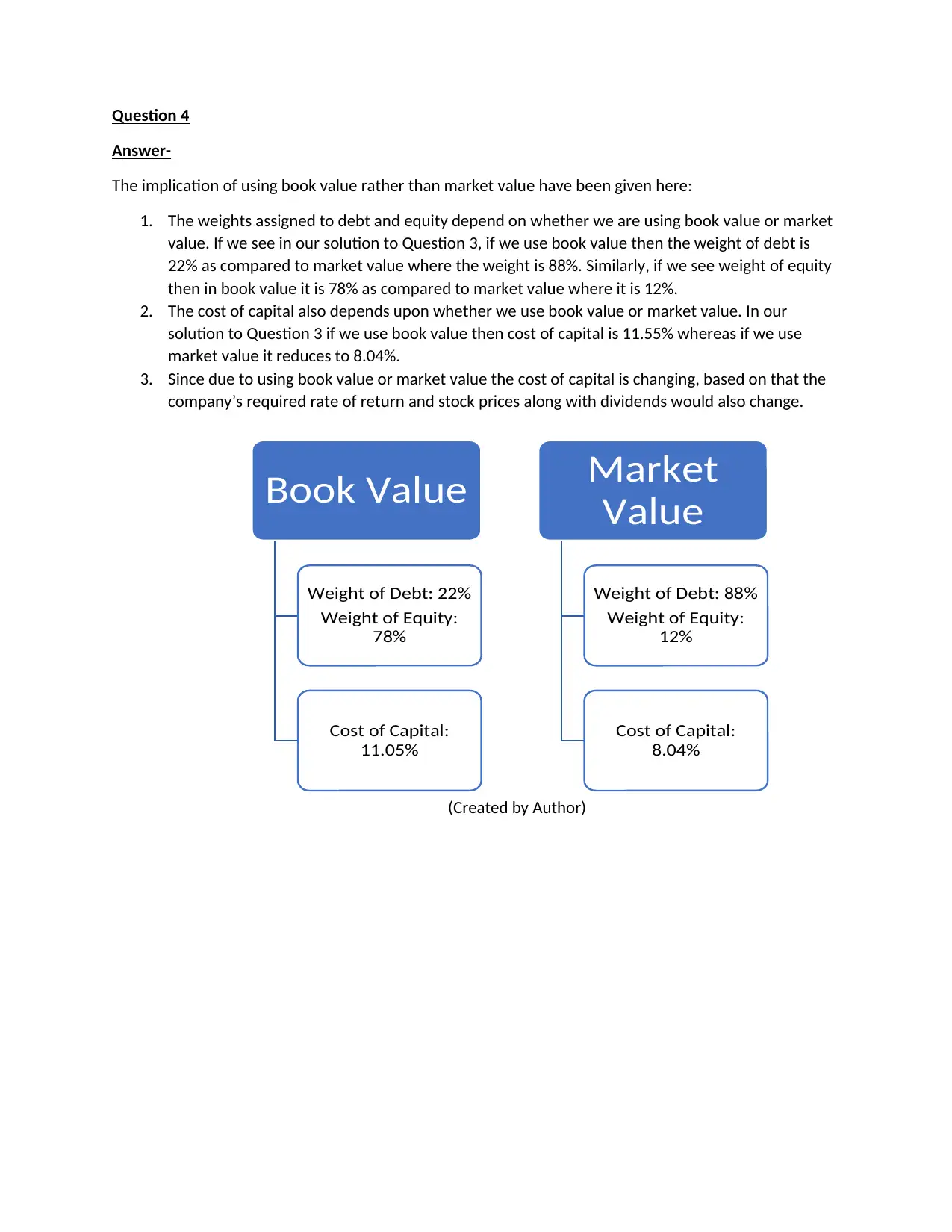

The implication of using book value rather than market value have been given here:

1. The weights assigned to debt and equity depend on whether we are using book value or market

value. If we see in our solution to Question 3, if we use book value then the weight of debt is

22% as compared to market value where the weight is 88%. Similarly, if we see weight of equity

then in book value it is 78% as compared to market value where it is 12%.

2. The cost of capital also depends upon whether we use book value or market value. In our

solution to Question 3 if we use book value then cost of capital is 11.55% whereas if we use

market value it reduces to 8.04%.

3. Since due to using book value or market value the cost of capital is changing, based on that the

company’s required rate of return and stock prices along with dividends would also change.

(Created by Author)

Book Value

Weight of Debt: 22%

Weight of Equity:

78%

Cost of Capital:

11.05%

Market

Value

Weight of Debt: 88%

Weight of Equity:

12%

Cost of Capital:

8.04%

Answer-

The implication of using book value rather than market value have been given here:

1. The weights assigned to debt and equity depend on whether we are using book value or market

value. If we see in our solution to Question 3, if we use book value then the weight of debt is

22% as compared to market value where the weight is 88%. Similarly, if we see weight of equity

then in book value it is 78% as compared to market value where it is 12%.

2. The cost of capital also depends upon whether we use book value or market value. In our

solution to Question 3 if we use book value then cost of capital is 11.55% whereas if we use

market value it reduces to 8.04%.

3. Since due to using book value or market value the cost of capital is changing, based on that the

company’s required rate of return and stock prices along with dividends would also change.

(Created by Author)

Book Value

Weight of Debt: 22%

Weight of Equity:

78%

Cost of Capital:

11.05%

Market

Value

Weight of Debt: 88%

Weight of Equity:

12%

Cost of Capital:

8.04%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 5 :

Answer-

Investors can use many metrics/methods to determine the value of a company's stock. Book value and

market value are the two most common methods used by the investors. Using these methods we can

identify whether the stock is fairly valued or under/overvalued.

Book Value is the amount that is to be paid to a shareholder after paying off the liabilities when the

company gets liquidated.

[Book Value = Net Worth = Assets – Liabilities].

Market value of a share that is traded on a financial market is calculated by investors on a fixed date.

Market Value is calculated as follows:

[Market price of asset X No. of outstanding shares of the company].

Market value is never same, it needs to be calculated on daily basis, as the market price of share is

different for each day. It is calculated more frequently than the book value, which is calculated at

regular intervals. Market value can be greater or lower as compared to the book value. If the market

value is more than book value, then it means that the share is trading at a premium and vice versa.

(Waingankar, 2018)

Weakness of using Book Value.

1. Book Value does not show the correct market value at which any asset can be traded in the market as it

is only accounting value. It does not reflect a correct picture for the investors.

2. Book value is generally considered as a secondary method to evaluate businesses. As, it is not adequate

to value small businesses which do not hold much assets. It can be used to evaluate companies that

have significant number of assets or companies having lower profits. (EduPristine, 2018)

Pros of Market Value Approach.

1. Unlike Book Value, Market Value provides investors with a better picture and more accurate value of the

asset. Market Value is determined by supply and demand for the asset.

2. It’s a measurement of true income since, there are less chances of manipulating the data.

3. Market Value approach is the most widely and commonly used approach of valuation. As, book value is

not always the approach after a longer period but, market value keeps a track of all assets from

buildings to even land.

4. It is a survival method in an economy. At the time of inflation and depression the prices of assets and

liabilities goes up and down, market value takes that into consideration unlike the book value approach.

(BrandonGaille.com, 2018)

Answer-

Investors can use many metrics/methods to determine the value of a company's stock. Book value and

market value are the two most common methods used by the investors. Using these methods we can

identify whether the stock is fairly valued or under/overvalued.

Book Value is the amount that is to be paid to a shareholder after paying off the liabilities when the

company gets liquidated.

[Book Value = Net Worth = Assets – Liabilities].

Market value of a share that is traded on a financial market is calculated by investors on a fixed date.

Market Value is calculated as follows:

[Market price of asset X No. of outstanding shares of the company].

Market value is never same, it needs to be calculated on daily basis, as the market price of share is

different for each day. It is calculated more frequently than the book value, which is calculated at

regular intervals. Market value can be greater or lower as compared to the book value. If the market

value is more than book value, then it means that the share is trading at a premium and vice versa.

(Waingankar, 2018)

Weakness of using Book Value.

1. Book Value does not show the correct market value at which any asset can be traded in the market as it

is only accounting value. It does not reflect a correct picture for the investors.

2. Book value is generally considered as a secondary method to evaluate businesses. As, it is not adequate

to value small businesses which do not hold much assets. It can be used to evaluate companies that

have significant number of assets or companies having lower profits. (EduPristine, 2018)

Pros of Market Value Approach.

1. Unlike Book Value, Market Value provides investors with a better picture and more accurate value of the

asset. Market Value is determined by supply and demand for the asset.

2. It’s a measurement of true income since, there are less chances of manipulating the data.

3. Market Value approach is the most widely and commonly used approach of valuation. As, book value is

not always the approach after a longer period but, market value keeps a track of all assets from

buildings to even land.

4. It is a survival method in an economy. At the time of inflation and depression the prices of assets and

liabilities goes up and down, market value takes that into consideration unlike the book value approach.

(BrandonGaille.com, 2018)

Question 6

Answer-

Hurdle rate is the minimum required rate of return on an investment or project that an investor or

manager would like to achieve. It functions as parameter for comparing whether a project is worth

when compared to the risk associated with it (McLaney, E., Pointon, J., Thomas, M., and Tucker, J.,

2004). The cost of capital implied by company’s mix of financing would be a good point to start to arrive

at hurdle rate for the capital investment appraisal. The company decides to make certain adjustments to

this cost of capital depending upon the project’s associated specific risk. Moreover, the companies

attach a risk premium to the cost of capital to determine the hurdle rate. But the question is how to

adjust the risk, that again depends upon project size, whether the project will be overseas or home, new

or existing project and so on. It is practical to pursue CAPM based cost of capital that is weighted

average and make consistent and sensible risk adjustments to same for determining project hurdle

rates. All the components of capital structure should be at market values and costs must be forward

looking (Bierman Jr. and Smidt, 2006).

The beta for Kings bar is 0.95 whereas the Beta for Bartini foods is 1.1.

It is assumed that the securities having Beta more than 1 are volatile and are expected for having

greater risk premium than that of market (Theseus.fi, 2018). When the acquiring firm has a lower

Beta as compare to the target firm the risk of option for entering takeover deal is lower to the risk of its

underlying assets (hbr.org, 2018). With the takeover becoming more likely value of option of merging

increases with its Beta. Therefore, the firm should observe a run down in bidding firm’s beta prior to

takeover when acquiring firm has a lower beta than target (Hackbarth and Morellec‡, 2006).

Answer-

Hurdle rate is the minimum required rate of return on an investment or project that an investor or

manager would like to achieve. It functions as parameter for comparing whether a project is worth

when compared to the risk associated with it (McLaney, E., Pointon, J., Thomas, M., and Tucker, J.,

2004). The cost of capital implied by company’s mix of financing would be a good point to start to arrive

at hurdle rate for the capital investment appraisal. The company decides to make certain adjustments to

this cost of capital depending upon the project’s associated specific risk. Moreover, the companies

attach a risk premium to the cost of capital to determine the hurdle rate. But the question is how to

adjust the risk, that again depends upon project size, whether the project will be overseas or home, new

or existing project and so on. It is practical to pursue CAPM based cost of capital that is weighted

average and make consistent and sensible risk adjustments to same for determining project hurdle

rates. All the components of capital structure should be at market values and costs must be forward

looking (Bierman Jr. and Smidt, 2006).

The beta for Kings bar is 0.95 whereas the Beta for Bartini foods is 1.1.

It is assumed that the securities having Beta more than 1 are volatile and are expected for having

greater risk premium than that of market (Theseus.fi, 2018). When the acquiring firm has a lower

Beta as compare to the target firm the risk of option for entering takeover deal is lower to the risk of its

underlying assets (hbr.org, 2018). With the takeover becoming more likely value of option of merging

increases with its Beta. Therefore, the firm should observe a run down in bidding firm’s beta prior to

takeover when acquiring firm has a lower beta than target (Hackbarth and Morellec‡, 2006).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

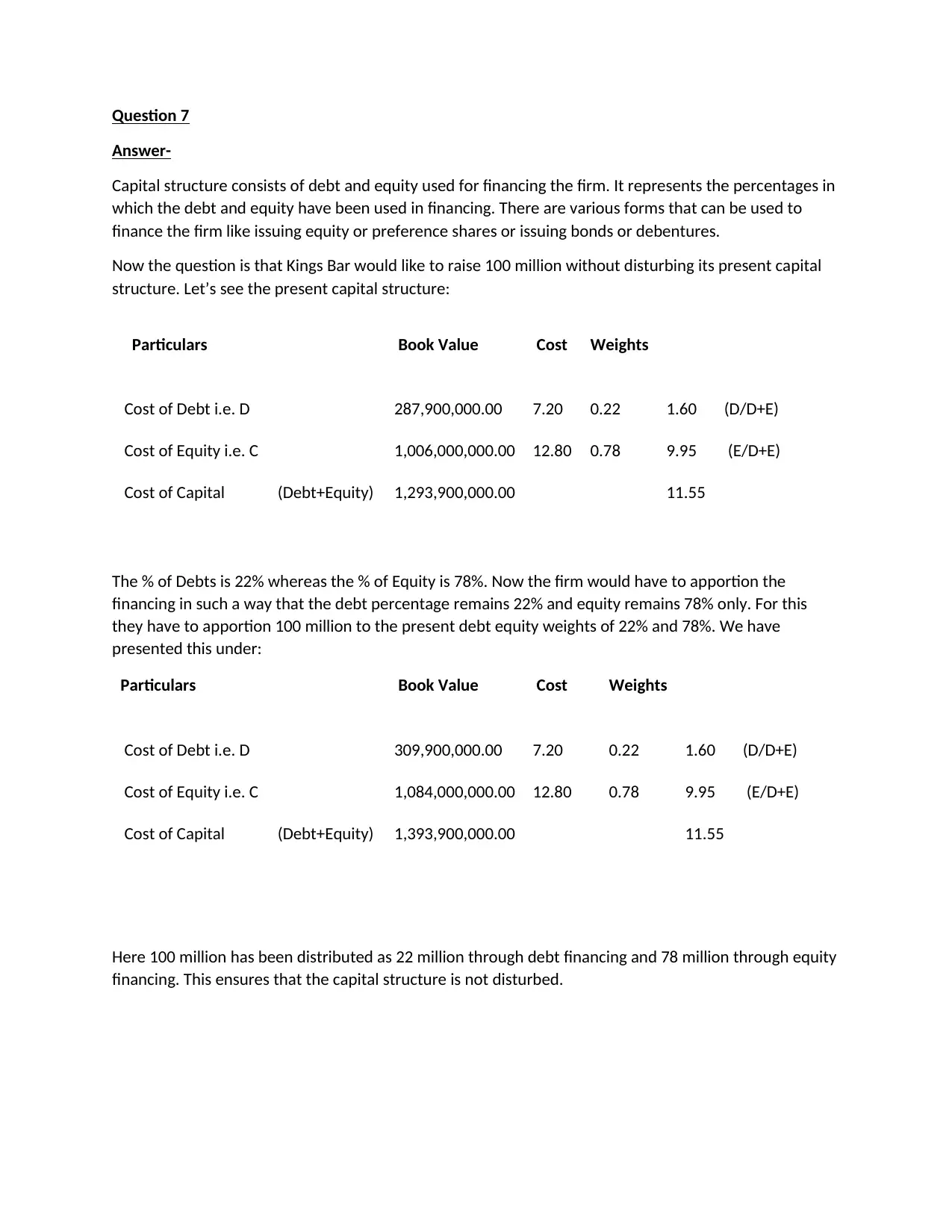

Question 7

Answer-

Capital structure consists of debt and equity used for financing the firm. It represents the percentages in

which the debt and equity have been used in financing. There are various forms that can be used to

finance the firm like issuing equity or preference shares or issuing bonds or debentures.

Now the question is that Kings Bar would like to raise 100 million without disturbing its present capital

structure. Let’s see the present capital structure:

Particulars Book Value Cost Weights

Cost of Debt i.e. D 287,900,000.00 7.20 0.22 1.60 (D/D+E)

Cost of Equity i.e. C 1,006,000,000.00 12.80 0.78 9.95 (E/D+E)

Cost of Capital (Debt+Equity) 1,293,900,000.00 11.55

The % of Debts is 22% whereas the % of Equity is 78%. Now the firm would have to apportion the

financing in such a way that the debt percentage remains 22% and equity remains 78% only. For this

they have to apportion 100 million to the present debt equity weights of 22% and 78%. We have

presented this under:

Particulars Book Value Cost Weights

Cost of Debt i.e. D 309,900,000.00 7.20 0.22 1.60 (D/D+E)

Cost of Equity i.e. C 1,084,000,000.00 12.80 0.78 9.95 (E/D+E)

Cost of Capital (Debt+Equity) 1,393,900,000.00 11.55

Here 100 million has been distributed as 22 million through debt financing and 78 million through equity

financing. This ensures that the capital structure is not disturbed.

Answer-

Capital structure consists of debt and equity used for financing the firm. It represents the percentages in

which the debt and equity have been used in financing. There are various forms that can be used to

finance the firm like issuing equity or preference shares or issuing bonds or debentures.

Now the question is that Kings Bar would like to raise 100 million without disturbing its present capital

structure. Let’s see the present capital structure:

Particulars Book Value Cost Weights

Cost of Debt i.e. D 287,900,000.00 7.20 0.22 1.60 (D/D+E)

Cost of Equity i.e. C 1,006,000,000.00 12.80 0.78 9.95 (E/D+E)

Cost of Capital (Debt+Equity) 1,293,900,000.00 11.55

The % of Debts is 22% whereas the % of Equity is 78%. Now the firm would have to apportion the

financing in such a way that the debt percentage remains 22% and equity remains 78% only. For this

they have to apportion 100 million to the present debt equity weights of 22% and 78%. We have

presented this under:

Particulars Book Value Cost Weights

Cost of Debt i.e. D 309,900,000.00 7.20 0.22 1.60 (D/D+E)

Cost of Equity i.e. C 1,084,000,000.00 12.80 0.78 9.95 (E/D+E)

Cost of Capital (Debt+Equity) 1,393,900,000.00 11.55

Here 100 million has been distributed as 22 million through debt financing and 78 million through equity

financing. This ensures that the capital structure is not disturbed.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 8

Answer-

Buyback and Dividend payment are both ways of distributing profit to shareholders, dividend

involves paying in cash whereas Buyback involves purchasing own shares. If the world is devoid

of transaction costs or taxes, then the shareholder would be indifferent of getting dividends or

earning capital gain as result of buyback (Pe, 2018).

Advantages of Buyback

1. It reduces outstanding shares of the corporation, increases the EPS and its price of share.

2. There are considerable taxes on dividends whereas on buyback the taxes are comparatively less

3. It prevents the value of stock from declining by reducing the stock’s supply

4. Through buyback, improves measures of performance like return of equity which drive price of

share over time resulting in capital gain to shareholders in long run (Timothy P. Connolly et

al., 2018)

5. It allows company to transfer the cash that is surplus sitting on the balance sheet to its

shareholders

6. Buyback prices are generally offered as premium price in comparison to market price to

shareholders which gives them an incentive to invest in the same (hl.co.uk, 2018)

Disadvantages of buyback

1. It sends signals to the market that the corporation does not have any profit earning

opportunities for investing which turns off the long term investors

2. There is negative signal sent that the company lacks confidence in their self which instigates

promoters for selling their stake

3. The process is time consuming requiring approval from regulatory bodies and disclosure to stock

exchange. It involves hiring investment bankers thereby becoming expensive affair to

corporation.

4. The size of paying out dividend is smaller compared to buyback and allows company to maintain

structure of conservative capitalization rather than holding huge piles of cash (Ro.uow.edu.au,

2018)

5. It is also not for those investors who largely depend on their share investments paying tehm

regularly for meeting their expenses of living

Answer-

Buyback and Dividend payment are both ways of distributing profit to shareholders, dividend

involves paying in cash whereas Buyback involves purchasing own shares. If the world is devoid

of transaction costs or taxes, then the shareholder would be indifferent of getting dividends or

earning capital gain as result of buyback (Pe, 2018).

Advantages of Buyback

1. It reduces outstanding shares of the corporation, increases the EPS and its price of share.

2. There are considerable taxes on dividends whereas on buyback the taxes are comparatively less

3. It prevents the value of stock from declining by reducing the stock’s supply

4. Through buyback, improves measures of performance like return of equity which drive price of

share over time resulting in capital gain to shareholders in long run (Timothy P. Connolly et

al., 2018)

5. It allows company to transfer the cash that is surplus sitting on the balance sheet to its

shareholders

6. Buyback prices are generally offered as premium price in comparison to market price to

shareholders which gives them an incentive to invest in the same (hl.co.uk, 2018)

Disadvantages of buyback

1. It sends signals to the market that the corporation does not have any profit earning

opportunities for investing which turns off the long term investors

2. There is negative signal sent that the company lacks confidence in their self which instigates

promoters for selling their stake

3. The process is time consuming requiring approval from regulatory bodies and disclosure to stock

exchange. It involves hiring investment bankers thereby becoming expensive affair to

corporation.

4. The size of paying out dividend is smaller compared to buyback and allows company to maintain

structure of conservative capitalization rather than holding huge piles of cash (Ro.uow.edu.au,

2018)

5. It is also not for those investors who largely depend on their share investments paying tehm

regularly for meeting their expenses of living

References

Bierman Jr., H. and Smidt, S. (2006). The Capital Budgeting Decision: Economic Analysis of Investment Projects, 1st

Edition (Paperback) - Routledge. [online] Routledge.com. Available at: https://www.routledge.com/The-Capital-

Budgeting-Decision-Economic-Analysis-of-Investment-Projects/Bierman-Jr-Smidt/p/book/9780415400046

[Accessed 8 Dec. 2018].

Brainmass.com. (2018). [online] Available at: https://brainmass.com/business/capital-asset-pricing-model/capm-

constant-dividend-growth-model-611079 [Accessed 8 Dec. 2018].

BrandonGaille.com. (2018). 8 Fair Value Accounting Pros and Cons - BrandonGaille.com. [online] Available at:

https://brandongaille.com/8-fair-value-accounting-pros-and-cons/ [Accessed 8 Dec. 2018].

EduPristine. (2018). Capital Budgeting: Features, Process, Factors affecting & Decisions. [online] Available at:

https://www.edupristine.com/blog/capital-budgeting [Accessed 8 Dec. 2018].

Hackbarth, D. and Morellec‡, E. (2006). [online] Faculty.fuqua.duke.edu. Available at:

https://faculty.fuqua.duke.edu/corpfinance/papers/merger-sept-7.pdf [Accessed 8 Dec. 2018].

hbr.org (2018). Strategic Analysis for More Profitable Acquisitions. [online] Harvard Business Review. Available at:

https://hbr.org/1979/07/strategic-analysis-for-more-profitable-acquisitions [Accessed 8 Dec. 2018].

hl.co.uk (2018). Dividends vs. share buybacks. [online] Hargreaves Lansdown. Available at:

https://www.hl.co.uk/news/articles/dividends-vs.-share-buybacks [Accessed 8 Dec. 2018].

Investopedia. (2018). Market Value Of Equity. [online] Available at:

https://www.investopedia.com/terms/m/market-value-of-equity.asp [Accessed 8 Dec. 2018].

McLaney, E., Pointon, J., Thomas, M., and Tucker, J., 2004, “Practitioners’ Perspectives on the Cost of Capital”,

European Journal of Finance, 10, 123-138, April.

Pe, M. (2018). Are stock buybacks better for investors than dividends?. [online] MoneySense. Available at:

https://www.moneysense.ca/save/investing/stocks/are-stock-buybacks-better-for-investors-than-dividends/

[Accessed 8 Dec. 2018].

Ro.uow.edu.au (2018). [online] Ro.uow.edu.au. Available at: https://ro.uow.edu.au/cgi/viewcontent.cgi?

referer=https://www.google.co.in/&httpsredir=1&article=1859&context=aabfj [Accessed 8 Dec. 2018].

Study.com. (2018). Geometric Mean: Definition and Formula - Video & Lesson Transcript | Study.com. [online]

Available at: https://study.com/academy/lesson/geometric-mean-definition-and-formula.html [Accessed 9 Dec.

2018].

Timothy P. Connolly, C., Timothy P. Connolly, C., More posts Timothy P. Connolly, C., A. Michael Lipper, C., Ted

Seides, C. and Hamlin Lovell, C. (2018). Are Dividends Better Than Buybacks?. [online] CFA Institute Inside Investing.

Available at: https://blogs.cfainstitute.org/insideinvesting/2012/07/31/are-dividends-better-than-buybacks/

[Accessed 8 Dec. 2018].

Theseus.fi (2018). [online] Theseus.fi. Available at:

https://www.theseus.fi/bitstream/handle/10024/95645/Nguyen_Tuan_Viet.pdf?sequence=2 [Accessed 8 Dec.

2018].

Waingankar, R. (2018). Book Value Vs Market Value | Top 5 Best Differences. [online] Learn Investment Banking:

Financial Modeling Training Courses Online. Available at: https://www.wallstreetmojo.com/book-value-vs-market-

value/ [Accessed 8 Dec. 2018].

Bierman Jr., H. and Smidt, S. (2006). The Capital Budgeting Decision: Economic Analysis of Investment Projects, 1st

Edition (Paperback) - Routledge. [online] Routledge.com. Available at: https://www.routledge.com/The-Capital-

Budgeting-Decision-Economic-Analysis-of-Investment-Projects/Bierman-Jr-Smidt/p/book/9780415400046

[Accessed 8 Dec. 2018].

Brainmass.com. (2018). [online] Available at: https://brainmass.com/business/capital-asset-pricing-model/capm-

constant-dividend-growth-model-611079 [Accessed 8 Dec. 2018].

BrandonGaille.com. (2018). 8 Fair Value Accounting Pros and Cons - BrandonGaille.com. [online] Available at:

https://brandongaille.com/8-fair-value-accounting-pros-and-cons/ [Accessed 8 Dec. 2018].

EduPristine. (2018). Capital Budgeting: Features, Process, Factors affecting & Decisions. [online] Available at:

https://www.edupristine.com/blog/capital-budgeting [Accessed 8 Dec. 2018].

Hackbarth, D. and Morellec‡, E. (2006). [online] Faculty.fuqua.duke.edu. Available at:

https://faculty.fuqua.duke.edu/corpfinance/papers/merger-sept-7.pdf [Accessed 8 Dec. 2018].

hbr.org (2018). Strategic Analysis for More Profitable Acquisitions. [online] Harvard Business Review. Available at:

https://hbr.org/1979/07/strategic-analysis-for-more-profitable-acquisitions [Accessed 8 Dec. 2018].

hl.co.uk (2018). Dividends vs. share buybacks. [online] Hargreaves Lansdown. Available at:

https://www.hl.co.uk/news/articles/dividends-vs.-share-buybacks [Accessed 8 Dec. 2018].

Investopedia. (2018). Market Value Of Equity. [online] Available at:

https://www.investopedia.com/terms/m/market-value-of-equity.asp [Accessed 8 Dec. 2018].

McLaney, E., Pointon, J., Thomas, M., and Tucker, J., 2004, “Practitioners’ Perspectives on the Cost of Capital”,

European Journal of Finance, 10, 123-138, April.

Pe, M. (2018). Are stock buybacks better for investors than dividends?. [online] MoneySense. Available at:

https://www.moneysense.ca/save/investing/stocks/are-stock-buybacks-better-for-investors-than-dividends/

[Accessed 8 Dec. 2018].

Ro.uow.edu.au (2018). [online] Ro.uow.edu.au. Available at: https://ro.uow.edu.au/cgi/viewcontent.cgi?

referer=https://www.google.co.in/&httpsredir=1&article=1859&context=aabfj [Accessed 8 Dec. 2018].

Study.com. (2018). Geometric Mean: Definition and Formula - Video & Lesson Transcript | Study.com. [online]

Available at: https://study.com/academy/lesson/geometric-mean-definition-and-formula.html [Accessed 9 Dec.

2018].

Timothy P. Connolly, C., Timothy P. Connolly, C., More posts Timothy P. Connolly, C., A. Michael Lipper, C., Ted

Seides, C. and Hamlin Lovell, C. (2018). Are Dividends Better Than Buybacks?. [online] CFA Institute Inside Investing.

Available at: https://blogs.cfainstitute.org/insideinvesting/2012/07/31/are-dividends-better-than-buybacks/

[Accessed 8 Dec. 2018].

Theseus.fi (2018). [online] Theseus.fi. Available at:

https://www.theseus.fi/bitstream/handle/10024/95645/Nguyen_Tuan_Viet.pdf?sequence=2 [Accessed 8 Dec.

2018].

Waingankar, R. (2018). Book Value Vs Market Value | Top 5 Best Differences. [online] Learn Investment Banking:

Financial Modeling Training Courses Online. Available at: https://www.wallstreetmojo.com/book-value-vs-market-

value/ [Accessed 8 Dec. 2018].

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.