Taxation Analysis: Capital Gains, Fringe Benefits, and Property

VerifiedAdded on 2020/03/23

|9

|2029

|30

Report

AI Summary

This report presents a comprehensive analysis of several taxation scenarios. It begins with a case study on capital gains tax, calculating the tax implications of buying and selling various assets like an antique vase, shares, and an antique chair. The report then delves into fringe benefits tax, analyzing a case where an executive receives a loan from a banking institution with a special interest rate. It calculates the taxable amount of the loan fringe benefit. The report further examines rental property taxation, addressing a situation where a couple jointly owns a rental property and incurs a loss, discussing the treatment of this loss for tax purposes. The report also explores the concept of tax avoidance, referencing the Duke of Westminster case. Lastly, it analyzes the tax implications of timber sales, considering scenarios where a landowner sells standing timber and timber rights. The report provides relevant legal provisions and concludes with the taxability of each scenario, referencing relevant sections and rulings.

Taxation

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Answer 1....................................................................................................................................3

Answer 2....................................................................................................................................4

Answer 3....................................................................................................................................5

Answer 4....................................................................................................................................6

Answer 5....................................................................................................................................7

REFERENCES...........................................................................................................................9

Answer 1....................................................................................................................................3

Answer 2....................................................................................................................................4

Answer 3....................................................................................................................................5

Answer 4....................................................................................................................................6

Answer 5....................................................................................................................................7

REFERENCES...........................................................................................................................9

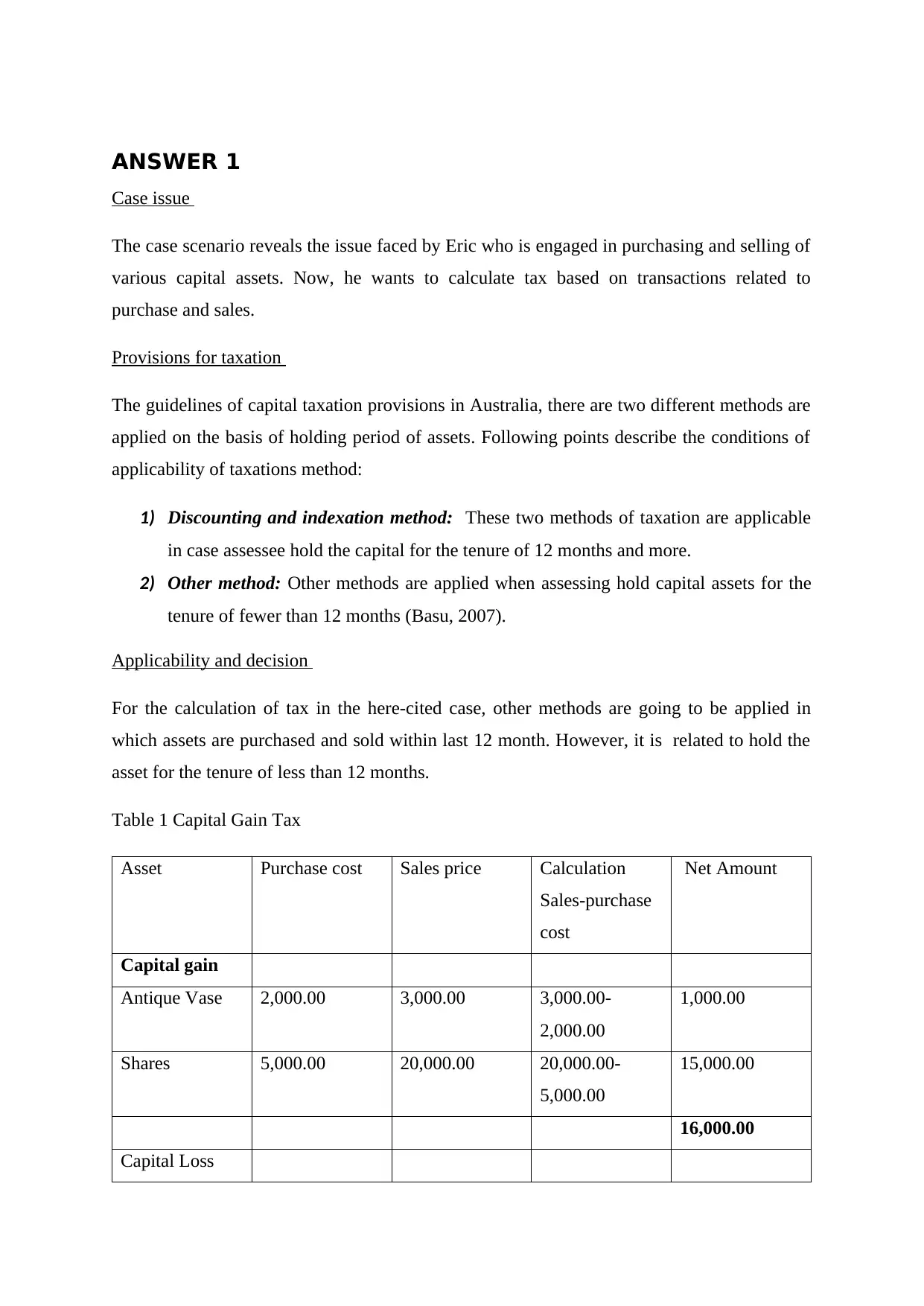

ANSWER 1

Case issue

The case scenario reveals the issue faced by Eric who is engaged in purchasing and selling of

various capital assets. Now, he wants to calculate tax based on transactions related to

purchase and sales.

Provisions for taxation

The guidelines of capital taxation provisions in Australia, there are two different methods are

applied on the basis of holding period of assets. Following points describe the conditions of

applicability of taxations method:

1) Discounting and indexation method: These two methods of taxation are applicable

in case assessee hold the capital for the tenure of 12 months and more.

2) Other method: Other methods are applied when assessing hold capital assets for the

tenure of fewer than 12 months (Basu, 2007).

Applicability and decision

For the calculation of tax in the here-cited case, other methods are going to be applied in

which assets are purchased and sold within last 12 month. However, it is related to hold the

asset for the tenure of less than 12 months.

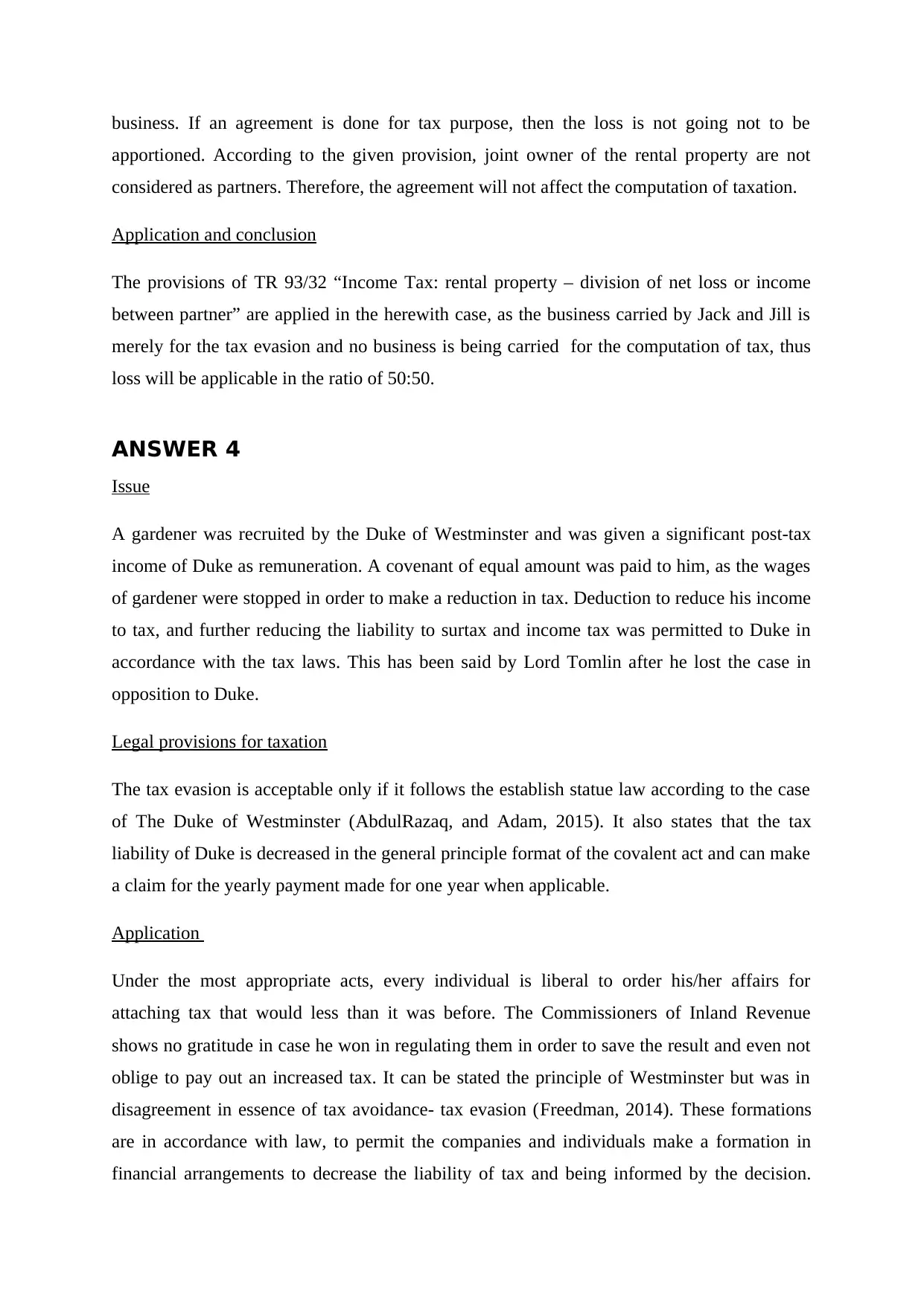

Table 1 Capital Gain Tax

Asset Purchase cost Sales price Calculation

Sales-purchase

cost

Net Amount

Capital gain

Antique Vase 2,000.00 3,000.00 3,000.00-

2,000.00

1,000.00

Shares 5,000.00 20,000.00 20,000.00-

5,000.00

15,000.00

16,000.00

Capital Loss

Case issue

The case scenario reveals the issue faced by Eric who is engaged in purchasing and selling of

various capital assets. Now, he wants to calculate tax based on transactions related to

purchase and sales.

Provisions for taxation

The guidelines of capital taxation provisions in Australia, there are two different methods are

applied on the basis of holding period of assets. Following points describe the conditions of

applicability of taxations method:

1) Discounting and indexation method: These two methods of taxation are applicable

in case assessee hold the capital for the tenure of 12 months and more.

2) Other method: Other methods are applied when assessing hold capital assets for the

tenure of fewer than 12 months (Basu, 2007).

Applicability and decision

For the calculation of tax in the here-cited case, other methods are going to be applied in

which assets are purchased and sold within last 12 month. However, it is related to hold the

asset for the tenure of less than 12 months.

Table 1 Capital Gain Tax

Asset Purchase cost Sales price Calculation

Sales-purchase

cost

Net Amount

Capital gain

Antique Vase 2,000.00 3,000.00 3,000.00-

2,000.00

1,000.00

Shares 5,000.00 20,000.00 20,000.00-

5,000.00

15,000.00

16,000.00

Capital Loss

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Antique chair 3,000.00 1,000.00 1,000.00-

3,000.00

-2,000.00

Painting 9,000.00 1,000.00 1,000.00-

9,000.00

-8,000.00

Sound system 12,000.00 11,000.00 11,000.00-

12,000.00

-1,000.00

-11,000.00

Net Capital

gain

Total Capital gain - Total Capital loss

16,000.00--11,000.00

5,000.00

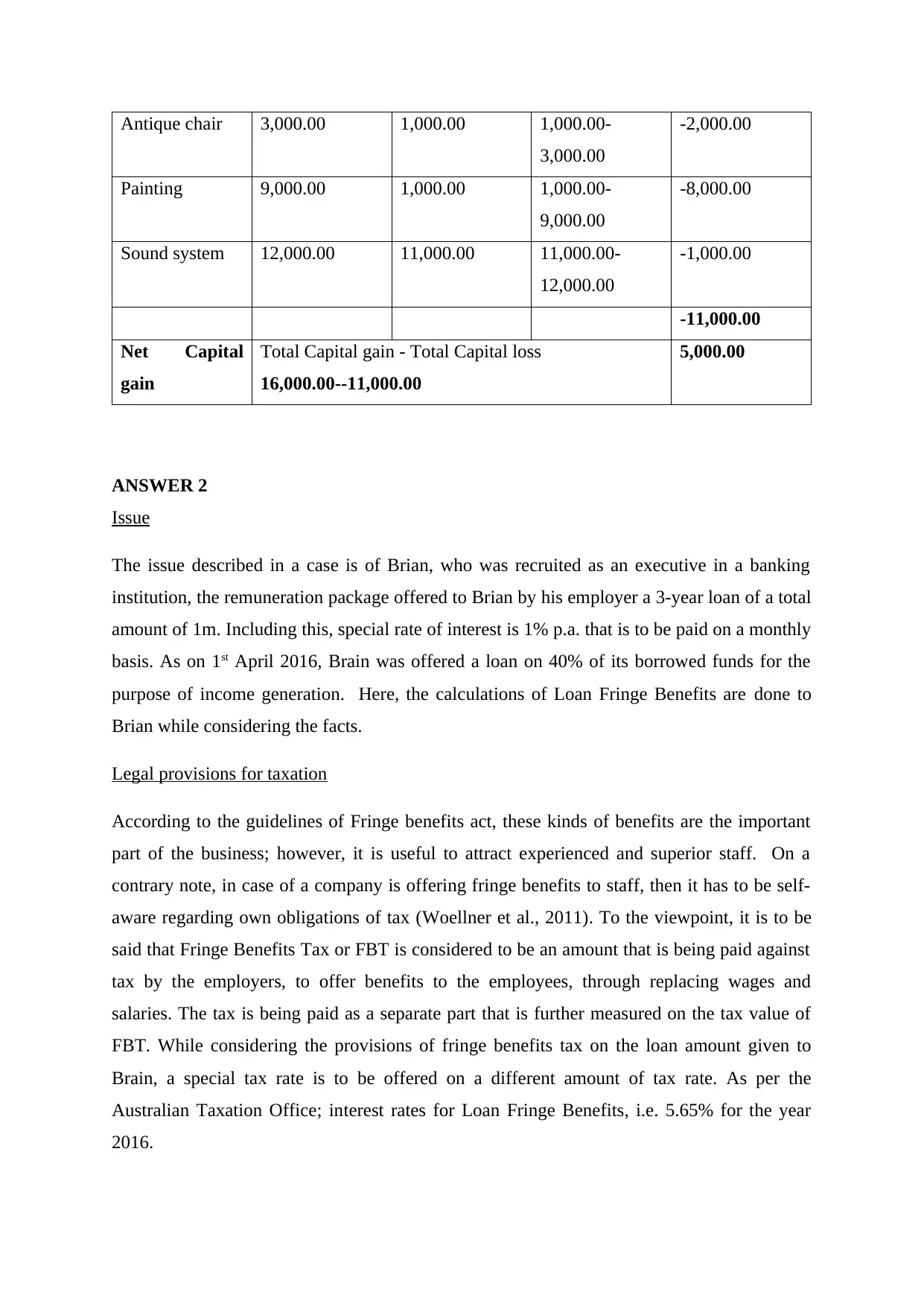

ANSWER 2

Issue

The issue described in a case is of Brian, who was recruited as an executive in a banking

institution, the remuneration package offered to Brian by his employer a 3-year loan of a total

amount of 1m. Including this, special rate of interest is 1% p.a. that is to be paid on a monthly

basis. As on 1st April 2016, Brain was offered a loan on 40% of its borrowed funds for the

purpose of income generation. Here, the calculations of Loan Fringe Benefits are done to

Brian while considering the facts.

Legal provisions for taxation

According to the guidelines of Fringe benefits act, these kinds of benefits are the important

part of the business; however, it is useful to attract experienced and superior staff. On a

contrary note, in case of a company is offering fringe benefits to staff, then it has to be self-

aware regarding own obligations of tax (Woellner et al., 2011). To the viewpoint, it is to be

said that Fringe Benefits Tax or FBT is considered to be an amount that is being paid against

tax by the employers, to offer benefits to the employees, through replacing wages and

salaries. The tax is being paid as a separate part that is further measured on the tax value of

FBT. While considering the provisions of fringe benefits tax on the loan amount given to

Brain, a special tax rate is to be offered on a different amount of tax rate. As per the

Australian Taxation Office; interest rates for Loan Fringe Benefits, i.e. 5.65% for the year

2016.

3,000.00

-2,000.00

Painting 9,000.00 1,000.00 1,000.00-

9,000.00

-8,000.00

Sound system 12,000.00 11,000.00 11,000.00-

12,000.00

-1,000.00

-11,000.00

Net Capital

gain

Total Capital gain - Total Capital loss

16,000.00--11,000.00

5,000.00

ANSWER 2

Issue

The issue described in a case is of Brian, who was recruited as an executive in a banking

institution, the remuneration package offered to Brian by his employer a 3-year loan of a total

amount of 1m. Including this, special rate of interest is 1% p.a. that is to be paid on a monthly

basis. As on 1st April 2016, Brain was offered a loan on 40% of its borrowed funds for the

purpose of income generation. Here, the calculations of Loan Fringe Benefits are done to

Brian while considering the facts.

Legal provisions for taxation

According to the guidelines of Fringe benefits act, these kinds of benefits are the important

part of the business; however, it is useful to attract experienced and superior staff. On a

contrary note, in case of a company is offering fringe benefits to staff, then it has to be self-

aware regarding own obligations of tax (Woellner et al., 2011). To the viewpoint, it is to be

said that Fringe Benefits Tax or FBT is considered to be an amount that is being paid against

tax by the employers, to offer benefits to the employees, through replacing wages and

salaries. The tax is being paid as a separate part that is further measured on the tax value of

FBT. While considering the provisions of fringe benefits tax on the loan amount given to

Brain, a special tax rate is to be offered on a different amount of tax rate. As per the

Australian Taxation Office; interest rates for Loan Fringe Benefits, i.e. 5.65% for the year

2016.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Application and conclusion

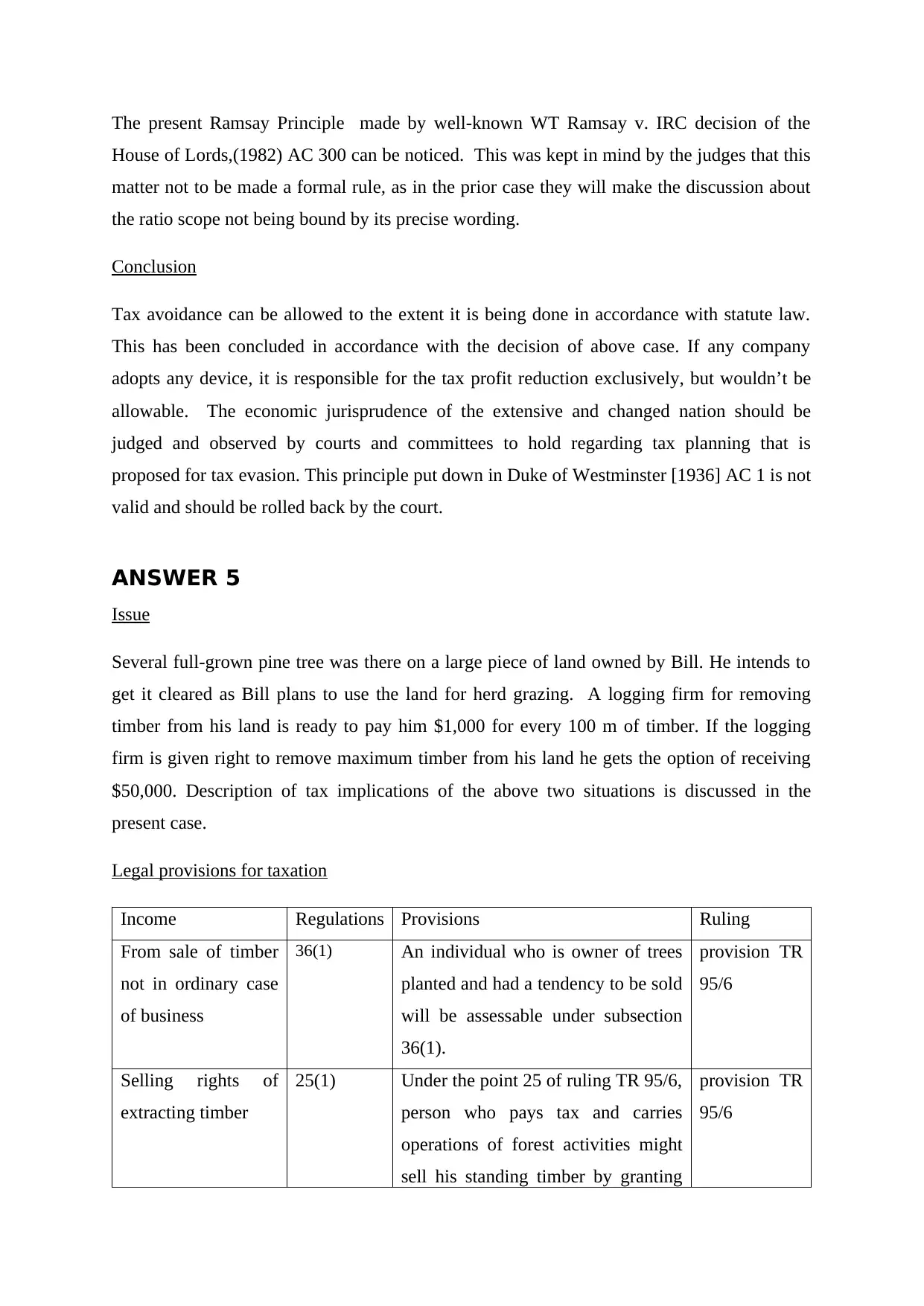

Table 2 Calculation of taxable amount for Brian for Loan Fringe Benefits

Particulars Calculation Amount ($)

Interest payable by Brain

as per Loan Fringe

Benefits

1,000,000.00*1% 10,000.00

Interest payable by Brain

as per statutory interest

rate

1,000,000.00*5.65% 56,500.00

Taxable amount of loan

fringe benefit

56,500.00-10,000.00 46,500.00

The calculation reflected that $ 46,500.00 and taxable amount are not going to be

affected if only 40% is used in respect to income generation.

Taxability is not going to be affected even in case interest payment is made

The total taxable amount will be $56,500.00 if Brian is exempted from paying

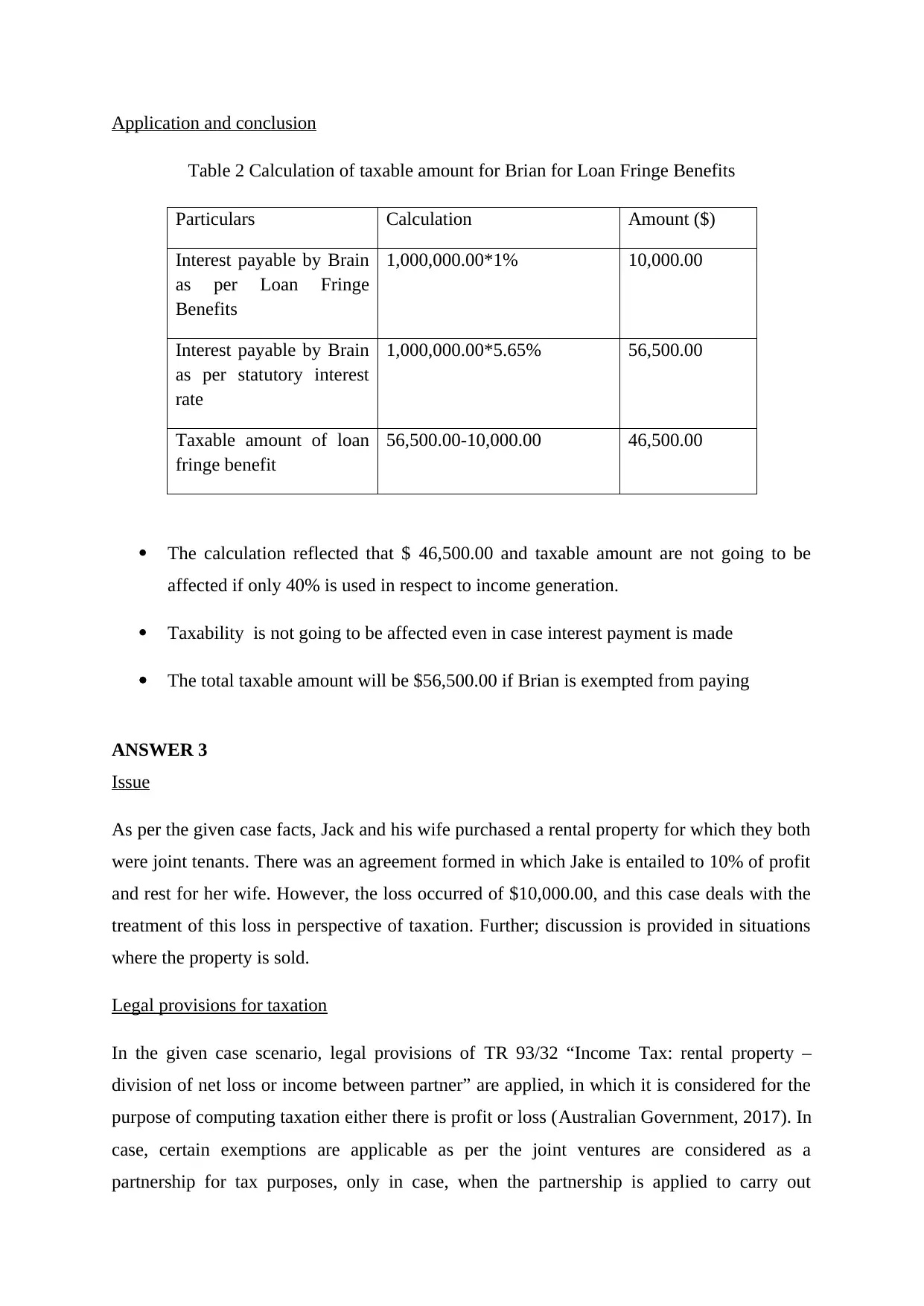

ANSWER 3

Issue

As per the given case facts, Jack and his wife purchased a rental property for which they both

were joint tenants. There was an agreement formed in which Jake is entailed to 10% of profit

and rest for her wife. However, the loss occurred of $10,000.00, and this case deals with the

treatment of this loss in perspective of taxation. Further; discussion is provided in situations

where the property is sold.

Legal provisions for taxation

In the given case scenario, legal provisions of TR 93/32 “Income Tax: rental property –

division of net loss or income between partner” are applied, in which it is considered for the

purpose of computing taxation either there is profit or loss (Australian Government, 2017). In

case, certain exemptions are applicable as per the joint ventures are considered as a

partnership for tax purposes, only in case, when the partnership is applied to carry out

Table 2 Calculation of taxable amount for Brian for Loan Fringe Benefits

Particulars Calculation Amount ($)

Interest payable by Brain

as per Loan Fringe

Benefits

1,000,000.00*1% 10,000.00

Interest payable by Brain

as per statutory interest

rate

1,000,000.00*5.65% 56,500.00

Taxable amount of loan

fringe benefit

56,500.00-10,000.00 46,500.00

The calculation reflected that $ 46,500.00 and taxable amount are not going to be

affected if only 40% is used in respect to income generation.

Taxability is not going to be affected even in case interest payment is made

The total taxable amount will be $56,500.00 if Brian is exempted from paying

ANSWER 3

Issue

As per the given case facts, Jack and his wife purchased a rental property for which they both

were joint tenants. There was an agreement formed in which Jake is entailed to 10% of profit

and rest for her wife. However, the loss occurred of $10,000.00, and this case deals with the

treatment of this loss in perspective of taxation. Further; discussion is provided in situations

where the property is sold.

Legal provisions for taxation

In the given case scenario, legal provisions of TR 93/32 “Income Tax: rental property –

division of net loss or income between partner” are applied, in which it is considered for the

purpose of computing taxation either there is profit or loss (Australian Government, 2017). In

case, certain exemptions are applicable as per the joint ventures are considered as a

partnership for tax purposes, only in case, when the partnership is applied to carry out

business. If an agreement is done for tax purpose, then the loss is not going not to be

apportioned. According to the given provision, joint owner of the rental property are not

considered as partners. Therefore, the agreement will not affect the computation of taxation.

Application and conclusion

The provisions of TR 93/32 “Income Tax: rental property – division of net loss or income

between partner” are applied in the herewith case, as the business carried by Jack and Jill is

merely for the tax evasion and no business is being carried for the computation of tax, thus

loss will be applicable in the ratio of 50:50.

ANSWER 4

Issue

A gardener was recruited by the Duke of Westminster and was given a significant post-tax

income of Duke as remuneration. A covenant of equal amount was paid to him, as the wages

of gardener were stopped in order to make a reduction in tax. Deduction to reduce his income

to tax, and further reducing the liability to surtax and income tax was permitted to Duke in

accordance with the tax laws. This has been said by Lord Tomlin after he lost the case in

opposition to Duke.

Legal provisions for taxation

The tax evasion is acceptable only if it follows the establish statue law according to the case

of The Duke of Westminster (AbdulRazaq, and Adam, 2015). It also states that the tax

liability of Duke is decreased in the general principle format of the covalent act and can make

a claim for the yearly payment made for one year when applicable.

Application

Under the most appropriate acts, every individual is liberal to order his/her affairs for

attaching tax that would less than it was before. The Commissioners of Inland Revenue

shows no gratitude in case he won in regulating them in order to save the result and even not

oblige to pay out an increased tax. It can be stated the principle of Westminster but was in

disagreement in essence of tax avoidance- tax evasion (Freedman, 2014). These formations

are in accordance with law, to permit the companies and individuals make a formation in

financial arrangements to decrease the liability of tax and being informed by the decision.

apportioned. According to the given provision, joint owner of the rental property are not

considered as partners. Therefore, the agreement will not affect the computation of taxation.

Application and conclusion

The provisions of TR 93/32 “Income Tax: rental property – division of net loss or income

between partner” are applied in the herewith case, as the business carried by Jack and Jill is

merely for the tax evasion and no business is being carried for the computation of tax, thus

loss will be applicable in the ratio of 50:50.

ANSWER 4

Issue

A gardener was recruited by the Duke of Westminster and was given a significant post-tax

income of Duke as remuneration. A covenant of equal amount was paid to him, as the wages

of gardener were stopped in order to make a reduction in tax. Deduction to reduce his income

to tax, and further reducing the liability to surtax and income tax was permitted to Duke in

accordance with the tax laws. This has been said by Lord Tomlin after he lost the case in

opposition to Duke.

Legal provisions for taxation

The tax evasion is acceptable only if it follows the establish statue law according to the case

of The Duke of Westminster (AbdulRazaq, and Adam, 2015). It also states that the tax

liability of Duke is decreased in the general principle format of the covalent act and can make

a claim for the yearly payment made for one year when applicable.

Application

Under the most appropriate acts, every individual is liberal to order his/her affairs for

attaching tax that would less than it was before. The Commissioners of Inland Revenue

shows no gratitude in case he won in regulating them in order to save the result and even not

oblige to pay out an increased tax. It can be stated the principle of Westminster but was in

disagreement in essence of tax avoidance- tax evasion (Freedman, 2014). These formations

are in accordance with law, to permit the companies and individuals make a formation in

financial arrangements to decrease the liability of tax and being informed by the decision.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The present Ramsay Principle made by well-known WT Ramsay v. IRC decision of the

House of Lords,(1982) AC 300 can be noticed. This was kept in mind by the judges that this

matter not to be made a formal rule, as in the prior case they will make the discussion about

the ratio scope not being bound by its precise wording.

Conclusion

Tax avoidance can be allowed to the extent it is being done in accordance with statute law.

This has been concluded in accordance with the decision of above case. If any company

adopts any device, it is responsible for the tax profit reduction exclusively, but wouldn’t be

allowable. The economic jurisprudence of the extensive and changed nation should be

judged and observed by courts and committees to hold regarding tax planning that is

proposed for tax evasion. This principle put down in Duke of Westminster [1936] AC 1 is not

valid and should be rolled back by the court.

ANSWER 5

Issue

Several full-grown pine tree was there on a large piece of land owned by Bill. He intends to

get it cleared as Bill plans to use the land for herd grazing. A logging firm for removing

timber from his land is ready to pay him $1,000 for every 100 m of timber. If the logging

firm is given right to remove maximum timber from his land he gets the option of receiving

$50,000. Description of tax implications of the above two situations is discussed in the

present case.

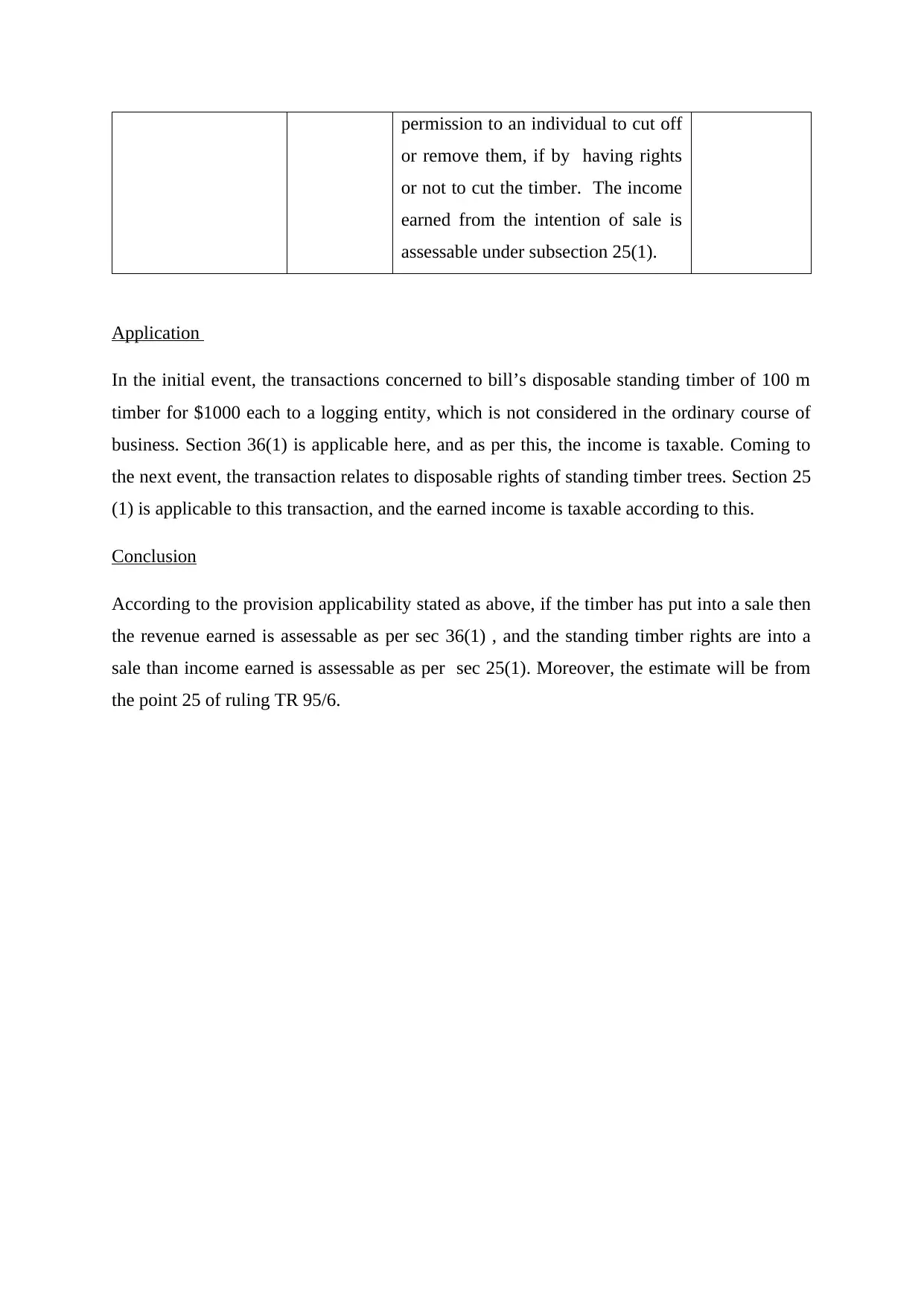

Legal provisions for taxation

Income Regulations Provisions Ruling

From sale of timber

not in ordinary case

of business

36(1) An individual who is owner of trees

planted and had a tendency to be sold

will be assessable under subsection

36(1).

provision TR

95/6

Selling rights of

extracting timber

25(1) Under the point 25 of ruling TR 95/6,

person who pays tax and carries

operations of forest activities might

sell his standing timber by granting

provision TR

95/6

House of Lords,(1982) AC 300 can be noticed. This was kept in mind by the judges that this

matter not to be made a formal rule, as in the prior case they will make the discussion about

the ratio scope not being bound by its precise wording.

Conclusion

Tax avoidance can be allowed to the extent it is being done in accordance with statute law.

This has been concluded in accordance with the decision of above case. If any company

adopts any device, it is responsible for the tax profit reduction exclusively, but wouldn’t be

allowable. The economic jurisprudence of the extensive and changed nation should be

judged and observed by courts and committees to hold regarding tax planning that is

proposed for tax evasion. This principle put down in Duke of Westminster [1936] AC 1 is not

valid and should be rolled back by the court.

ANSWER 5

Issue

Several full-grown pine tree was there on a large piece of land owned by Bill. He intends to

get it cleared as Bill plans to use the land for herd grazing. A logging firm for removing

timber from his land is ready to pay him $1,000 for every 100 m of timber. If the logging

firm is given right to remove maximum timber from his land he gets the option of receiving

$50,000. Description of tax implications of the above two situations is discussed in the

present case.

Legal provisions for taxation

Income Regulations Provisions Ruling

From sale of timber

not in ordinary case

of business

36(1) An individual who is owner of trees

planted and had a tendency to be sold

will be assessable under subsection

36(1).

provision TR

95/6

Selling rights of

extracting timber

25(1) Under the point 25 of ruling TR 95/6,

person who pays tax and carries

operations of forest activities might

sell his standing timber by granting

provision TR

95/6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

permission to an individual to cut off

or remove them, if by having rights

or not to cut the timber. The income

earned from the intention of sale is

assessable under subsection 25(1).

Application

In the initial event, the transactions concerned to bill’s disposable standing timber of 100 m

timber for $1000 each to a logging entity, which is not considered in the ordinary course of

business. Section 36(1) is applicable here, and as per this, the income is taxable. Coming to

the next event, the transaction relates to disposable rights of standing timber trees. Section 25

(1) is applicable to this transaction, and the earned income is taxable according to this.

Conclusion

According to the provision applicability stated as above, if the timber has put into a sale then

the revenue earned is assessable as per sec 36(1) , and the standing timber rights are into a

sale than income earned is assessable as per sec 25(1). Moreover, the estimate will be from

the point 25 of ruling TR 95/6.

or remove them, if by having rights

or not to cut the timber. The income

earned from the intention of sale is

assessable under subsection 25(1).

Application

In the initial event, the transactions concerned to bill’s disposable standing timber of 100 m

timber for $1000 each to a logging entity, which is not considered in the ordinary course of

business. Section 36(1) is applicable here, and as per this, the income is taxable. Coming to

the next event, the transaction relates to disposable rights of standing timber trees. Section 25

(1) is applicable to this transaction, and the earned income is taxable according to this.

Conclusion

According to the provision applicability stated as above, if the timber has put into a sale then

the revenue earned is assessable as per sec 36(1) , and the standing timber rights are into a

sale than income earned is assessable as per sec 25(1). Moreover, the estimate will be from

the point 25 of ruling TR 95/6.

REFERENCES

AbdulRazaq, M.T. and Adam, K.I., 2015. Anti-Avoidance Legislations: Issues & Doubts in

the Application of Tax Rules in Nigeria. AGORA Int'l J. Jurid. Sci., p.1.

Australian Government, 2017. Taxation Ruling/TR 93/32. [Online]. Available at <

https://www.ato.gov.au/law/view/document?docid=TXR/TR9332/NAT/ATO/00001

>[Accessed on 22nd September 2017 ]

Basu, S., 2007. Global perspectives on e-commerce taxation law. Ashgate Publishing, Ltd.

Freedman, J., 2014. Designing a general anti-abuse rule: Striking a balance.

Rohadi, D., Herawati, T., Padoch, C. and Race, D., 2015. Making timber plantations an

attractive business for smallholders (Vol. 114). CIFOR.

Smith, H.F., Ling, S. and Boer, K., 2017. Teak plantation smallholders in Lao PDR: what

influences compliance with plantation regulations?. Australian Forestry, 80(3), pp.178-187.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C. and Pinto, D., 2011. Australian Taxation

Law Select: legislation and commentary. CCH Australia.

AbdulRazaq, M.T. and Adam, K.I., 2015. Anti-Avoidance Legislations: Issues & Doubts in

the Application of Tax Rules in Nigeria. AGORA Int'l J. Jurid. Sci., p.1.

Australian Government, 2017. Taxation Ruling/TR 93/32. [Online]. Available at <

https://www.ato.gov.au/law/view/document?docid=TXR/TR9332/NAT/ATO/00001

>[Accessed on 22nd September 2017 ]

Basu, S., 2007. Global perspectives on e-commerce taxation law. Ashgate Publishing, Ltd.

Freedman, J., 2014. Designing a general anti-abuse rule: Striking a balance.

Rohadi, D., Herawati, T., Padoch, C. and Race, D., 2015. Making timber plantations an

attractive business for smallholders (Vol. 114). CIFOR.

Smith, H.F., Ling, S. and Boer, K., 2017. Teak plantation smallholders in Lao PDR: what

influences compliance with plantation regulations?. Australian Forestry, 80(3), pp.178-187.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C. and Pinto, D., 2011. Australian Taxation

Law Select: legislation and commentary. CCH Australia.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.