MN3365 Strategic Finance: Evaluating the Capital Asset Pricing Model

VerifiedAdded on 2023/06/04

|15

|3839

|346

Essay

AI Summary

This essay provides a comprehensive analysis of the Capital Asset Pricing Model (CAPM), a widely used tool in the finance industry for determining the return value of a stock. It explores the principles, methods, and theories underlying the CAPM, including the Security Market Line (SML) theory, Arbitrag...

Essay: Strategic Finance 1

STRATEGIC FINANCE

STRATEGIC FINANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Essay: Strategic Finance 2

Introduction

The main purpose of this essay is to demonstrate the Capital Asset Pricing Model (CAPM)

which is being used by the industry in order to determine the return value for the stock of

business. In the recent development area of business, CAPM has also become an important part

of the corporate to assess the value of business. The CAPM is assessed in order to identify the

required rate of return in order to make the decision for business portfolio. Along with this,

principles, methods and theories with respect to the capital asset pricing model are described for

demonstrating the ideas and concept accurately. On the other hand, the in-depth knowledge

about the CAPM is carried out for calculations along with the breaking down the CAPM theory

and model including the examples related to the determination of rate of return.

Introduction

The main purpose of this essay is to demonstrate the Capital Asset Pricing Model (CAPM)

which is being used by the industry in order to determine the return value for the stock of

business. In the recent development area of business, CAPM has also become an important part

of the corporate to assess the value of business. The CAPM is assessed in order to identify the

required rate of return in order to make the decision for business portfolio. Along with this,

principles, methods and theories with respect to the capital asset pricing model are described for

demonstrating the ideas and concept accurately. On the other hand, the in-depth knowledge

about the CAPM is carried out for calculations along with the breaking down the CAPM theory

and model including the examples related to the determination of rate of return.

Essay: Strategic Finance 3

Analysis of CAPM with reference to rate of return

Definition and background information about CAPM

The capital asset pricing model is a method which entails about the determination of relationship

in between the expected return for an asset and systematic risk (KUEHN, et. al, 2017). It is

basically used for the identification of rate of return on particular asset for instance as stock. In

recent years, the usability of CAPM method has evolved as major concept which plays important

role in recognition of risk with a particular stock. It is also applicable in order to establish the

investment portfolio about an asset (Corporatefinanceinstitute, 2018). It can also be defined as

the approach which denotes the expected return on a stock is equal to the return over risk free

plus a risk premium. At the same time, the modern age of financial investment market, CAPM

occupies a crucial position with relation to the investment purpose.

Principles of Capital Asset Pricing Model

CAPM is applied as the economic model in order to assess the value of security, stocks,

derivatives and the assets which are risky in its return aspect (Fama and French, 2017). In

context to the concept and idea of capital asset pricing model, it is assessed that the investors

expect the additional return in the situation of accepting the additional risk. It is also used for

pleasing predictions in order to measuring the risk and return relationship with attribution of a

specific asset. It is developed over the portfolio choice in which the mean and variance about the

risk and return is chosen (He, et. al, 2017).

Assumptions of Capital Asset Pricing Model

CAPM basically envisages the return and risk on an individual risky security. This model of

asset valuation over its risk is based on the assumptions about providing the suitable and

Analysis of CAPM with reference to rate of return

Definition and background information about CAPM

The capital asset pricing model is a method which entails about the determination of relationship

in between the expected return for an asset and systematic risk (KUEHN, et. al, 2017). It is

basically used for the identification of rate of return on particular asset for instance as stock. In

recent years, the usability of CAPM method has evolved as major concept which plays important

role in recognition of risk with a particular stock. It is also applicable in order to establish the

investment portfolio about an asset (Corporatefinanceinstitute, 2018). It can also be defined as

the approach which denotes the expected return on a stock is equal to the return over risk free

plus a risk premium. At the same time, the modern age of financial investment market, CAPM

occupies a crucial position with relation to the investment purpose.

Principles of Capital Asset Pricing Model

CAPM is applied as the economic model in order to assess the value of security, stocks,

derivatives and the assets which are risky in its return aspect (Fama and French, 2017). In

context to the concept and idea of capital asset pricing model, it is assessed that the investors

expect the additional return in the situation of accepting the additional risk. It is also used for

pleasing predictions in order to measuring the risk and return relationship with attribution of a

specific asset. It is developed over the portfolio choice in which the mean and variance about the

risk and return is chosen (He, et. al, 2017).

Assumptions of Capital Asset Pricing Model

CAPM basically envisages the return and risk on an individual risky security. This model of

asset valuation over its risk is based on the assumptions about providing the suitable and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Essay: Strategic Finance 4

appropriate decisions about the security. The major assumptions of capital asset pricing model

are as follows

Market efficiency: In relation to the investment portfolio, it is assumed that the market

efficiency shows the reflection over the share price of the stock (Herskovic, 2018). The related

information to the security influenced from the market efficiency that exists in the perspective

market. On the other hand, the investors might not be able to influence the security prices (Fama

and French, 2015). In relation to this, it seems that there are many investors who have small

amount of capital.

Risk aversion and mean variance optimization: It is denoted that the investors are risk averse

and the investors do not want to take the higher risk for its investment because of losing their

money in the fluctuation market (Constantinides, 2017). The investors assess the risk and return

in relation to the variance or standards deviation of the asset value. Along with this, the investors

are interested in having higher return on the purchased security. It shows that the investors

optimize the mean variance in the efficient portfolio of asset management (Barinov et. al, 2018).

Homogeneous expectations: It is also assumed that the investors are having the similar

expectations about the risk of stock and expected return (Putra et. al, 2017).

Single time period: The decisions of investors are treated over a single time period duration as

the security fluctuation varieties at the same time duration as the Singaporean index changes in a

second and there is no stock for which the valuation of stock is changed after that time period

(Gruber, et. al, 2017).

Risk free rate: It is assumed that the investors are able to borrow and lend at the risk free rate of

interest. On the other hand, they engaged into the security for instance as

appropriate decisions about the security. The major assumptions of capital asset pricing model

are as follows

Market efficiency: In relation to the investment portfolio, it is assumed that the market

efficiency shows the reflection over the share price of the stock (Herskovic, 2018). The related

information to the security influenced from the market efficiency that exists in the perspective

market. On the other hand, the investors might not be able to influence the security prices (Fama

and French, 2015). In relation to this, it seems that there are many investors who have small

amount of capital.

Risk aversion and mean variance optimization: It is denoted that the investors are risk averse

and the investors do not want to take the higher risk for its investment because of losing their

money in the fluctuation market (Constantinides, 2017). The investors assess the risk and return

in relation to the variance or standards deviation of the asset value. Along with this, the investors

are interested in having higher return on the purchased security. It shows that the investors

optimize the mean variance in the efficient portfolio of asset management (Barinov et. al, 2018).

Homogeneous expectations: It is also assumed that the investors are having the similar

expectations about the risk of stock and expected return (Putra et. al, 2017).

Single time period: The decisions of investors are treated over a single time period duration as

the security fluctuation varieties at the same time duration as the Singaporean index changes in a

second and there is no stock for which the valuation of stock is changed after that time period

(Gruber, et. al, 2017).

Risk free rate: It is assumed that the investors are able to borrow and lend at the risk free rate of

interest. On the other hand, they engaged into the security for instance as

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Essay: Strategic Finance 5

Break down the CAPM theory

Methods and theories in relevancy of CAPM

The capital assets pricing method is used for identifying the risk and return aspect for a security.

For the implications of CAPM, several models and theories have been determined which are as

follows

SML theory

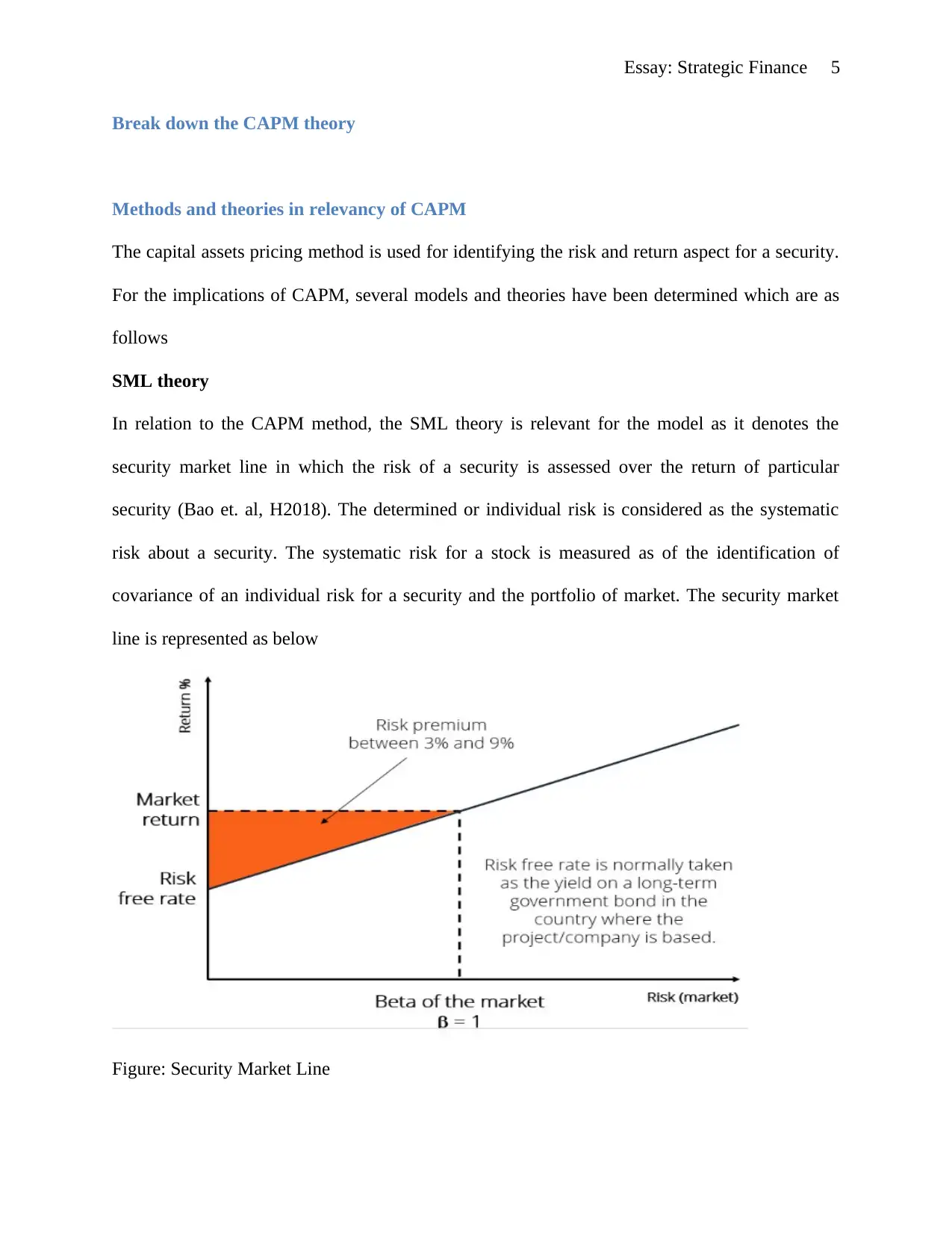

In relation to the CAPM method, the SML theory is relevant for the model as it denotes the

security market line in which the risk of a security is assessed over the return of particular

security (Bao et. al, H2018). The determined or individual risk is considered as the systematic

risk about a security. The systematic risk for a stock is measured as of the identification of

covariance of an individual risk for a security and the portfolio of market. The security market

line is represented as below

Figure: Security Market Line

Break down the CAPM theory

Methods and theories in relevancy of CAPM

The capital assets pricing method is used for identifying the risk and return aspect for a security.

For the implications of CAPM, several models and theories have been determined which are as

follows

SML theory

In relation to the CAPM method, the SML theory is relevant for the model as it denotes the

security market line in which the risk of a security is assessed over the return of particular

security (Bao et. al, H2018). The determined or individual risk is considered as the systematic

risk about a security. The systematic risk for a stock is measured as of the identification of

covariance of an individual risk for a security and the portfolio of market. The security market

line is represented as below

Figure: Security Market Line

Essay: Strategic Finance 6

(Source: Levy, 2011)

As per the depicted security market line figure in the chart is denoted as the line which measures

the relationship in between the covariance and the market portfolio of a particular security

(Valencia-Herrera and López-Herrera, 2018). The covariance is also called the security beta and

the market portfolio is denoting the fluctuation in the individual security. Along with this, the

unsystematic risk is zero then the systematic risk of a security is measured for the dimension of

security. When the beta is zero than it denotes that the security is riskless (Karp and van Vuuren,

2017). With respect to this, the securities below the straight line for value of before zero value of

beta than theses securities called defensive security but on the other hand, security after the beta

value on the X axis, the securities called the aggressive security and these are also higher risk but

the expected return might also be higher in the perspective market (Gruber et. al, 2017).

Calculation of return

Formula of CAPM = Ra = Rrf + [Ba × (Rm – Rrf)] (Adesokan et. al, 2017)

Ra is denoted as expected as the return on the security and Ba is depicted as Beta of the security.

Along with this, Rrf is measured as the risk – free rate and Rm expected return on market. The

risk premium is calculated as the expected return is deducted from risk free rate of the security.

For instance, the Beta is given as 1.5%%, risk free rate = 2.8%

Market risk premium = 9%

= Rrf + [Ba × (Rm – Rrf)] (Bajpai and Sharma, 2017)

= 2.8% + (1.5 × 9%)

= 16.3%

Expected return = Risk – Free Rate + (Beta × Market Risk Premium) (Lund and Nymoen, 2018)

APT theory

(Source: Levy, 2011)

As per the depicted security market line figure in the chart is denoted as the line which measures

the relationship in between the covariance and the market portfolio of a particular security

(Valencia-Herrera and López-Herrera, 2018). The covariance is also called the security beta and

the market portfolio is denoting the fluctuation in the individual security. Along with this, the

unsystematic risk is zero then the systematic risk of a security is measured for the dimension of

security. When the beta is zero than it denotes that the security is riskless (Karp and van Vuuren,

2017). With respect to this, the securities below the straight line for value of before zero value of

beta than theses securities called defensive security but on the other hand, security after the beta

value on the X axis, the securities called the aggressive security and these are also higher risk but

the expected return might also be higher in the perspective market (Gruber et. al, 2017).

Calculation of return

Formula of CAPM = Ra = Rrf + [Ba × (Rm – Rrf)] (Adesokan et. al, 2017)

Ra is denoted as expected as the return on the security and Ba is depicted as Beta of the security.

Along with this, Rrf is measured as the risk – free rate and Rm expected return on market. The

risk premium is calculated as the expected return is deducted from risk free rate of the security.

For instance, the Beta is given as 1.5%%, risk free rate = 2.8%

Market risk premium = 9%

= Rrf + [Ba × (Rm – Rrf)] (Bajpai and Sharma, 2017)

= 2.8% + (1.5 × 9%)

= 16.3%

Expected return = Risk – Free Rate + (Beta × Market Risk Premium) (Lund and Nymoen, 2018)

APT theory

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Essay: Strategic Finance 7

The APT theory is determined as the arbitrage pricing theory which seeks about to take the

benefits from the different in between the two or more markets and this action is referred as the

arbitrage about a security (Karp et. al, 2017). In this method, the mispriced assess is brought into

the expected price. On the other hand, the mispriced asset is termed as the asset where there is

difference in between the current price of the security and the price which is measured by the

model implications.

Apart from this, the CAPM might not be able to assess the risk through beta measurement

always; this has lead towards the new way for introducing the alternative approach which is

called the arbitrage – pricing theory (YAN et. al, 2017). The APT theory does not assess that the

investors do not assume the mean- variance. Under the concept of return under the arbitrage

pricing method is measured in two ways such as predictable and unpredictable, in this situation,

the return will be as

E(Rj) = Rf + UR (Kou et. al, 2017)

In this equation, the Rf is denominated as the predictable risk or the risk – free return and the UR

is denoted as unpredictable return on a security. The risk under the APT approach is devised as

the unsystematic risk for a security and the market risk is basically take place due to the

sensitivity of return for an asset.

Five factor of CAPM

The five factor theory of CAPM is consisting with the aspects such as value, profitability, size

and pattern of investment in order to performing for average return on an asset. As per the

comparison of three factors and five factor model, the five factor model is denoted as the higher

performer (Kroencke, 2017). On the other hand, the five factor model is limited in relation to the

The APT theory is determined as the arbitrage pricing theory which seeks about to take the

benefits from the different in between the two or more markets and this action is referred as the

arbitrage about a security (Karp et. al, 2017). In this method, the mispriced assess is brought into

the expected price. On the other hand, the mispriced asset is termed as the asset where there is

difference in between the current price of the security and the price which is measured by the

model implications.

Apart from this, the CAPM might not be able to assess the risk through beta measurement

always; this has lead towards the new way for introducing the alternative approach which is

called the arbitrage – pricing theory (YAN et. al, 2017). The APT theory does not assess that the

investors do not assume the mean- variance. Under the concept of return under the arbitrage

pricing method is measured in two ways such as predictable and unpredictable, in this situation,

the return will be as

E(Rj) = Rf + UR (Kou et. al, 2017)

In this equation, the Rf is denominated as the predictable risk or the risk – free return and the UR

is denoted as unpredictable return on a security. The risk under the APT approach is devised as

the unsystematic risk for a security and the market risk is basically take place due to the

sensitivity of return for an asset.

Five factor of CAPM

The five factor theory of CAPM is consisting with the aspects such as value, profitability, size

and pattern of investment in order to performing for average return on an asset. As per the

comparison of three factors and five factor model, the five factor model is denoted as the higher

performer (Kroencke, 2017). On the other hand, the five factor model is limited in relation to the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Essay: Strategic Finance 8

lower average return about the small securities in the market. The three factor model is focused

in the market capitalization, outstanding shares and the price times.

The three factor model can be assessed in the center of time series as

Rit–RFt = ai+bi (RMt–RFt) + siSMBt + hiHMLt + eit (Poornima and Swathiga, 2017) Here, Rit

is return on security, i denotes the time period, RMt is return as value weight.

Characteristic line

The characteristics line is determined with the risks which are related to the risks with related to

the security. This line denotes the risks as systematic risks and unsystematic risks. The

systematic risk might not be reduced from the security and the unsystematic risk can be reduced

through diversification (Martin, 2017). For instance, the market portfolio is resulted as with the

security value of ABC Company as the market conditions are rising and the rerun is denoted as

25%, but the return on the ABC company share the expected return is calculated as

= 0.5 * 25 + 0.5 * 20 = 22.5%

lower average return about the small securities in the market. The three factor model is focused

in the market capitalization, outstanding shares and the price times.

The three factor model can be assessed in the center of time series as

Rit–RFt = ai+bi (RMt–RFt) + siSMBt + hiHMLt + eit (Poornima and Swathiga, 2017) Here, Rit

is return on security, i denotes the time period, RMt is return as value weight.

Characteristic line

The characteristics line is determined with the risks which are related to the risks with related to

the security. This line denotes the risks as systematic risks and unsystematic risks. The

systematic risk might not be reduced from the security and the unsystematic risk can be reduced

through diversification (Martin, 2017). For instance, the market portfolio is resulted as with the

security value of ABC Company as the market conditions are rising and the rerun is denoted as

25%, but the return on the ABC company share the expected return is calculated as

= 0.5 * 25 + 0.5 * 20 = 22.5%

Essay: Strategic Finance 9

Implications of CAPM

The capital asset pricing model has the below discussed implications such as

The investors engaged into the combining the risk – free assets with the concerned

portfolio of market with relation to the risky assets. The investors capitalize the fund in

risky assets with the higher proportion of market value (Ross, 2017).

The market investor are seek to compensate for the security which risks cannot be

diversified.

The investors engaged into the expectations about the return with the proportion of risk

that denotes the relationship in between the beta value and expected return (Kozak et. al,

2018).

Limitations of CAPM

The CAPM approach is assumed as a tool for determining the value of rate of return and risk

with respect to the particular security. On the other hand, the CAPM is also limited over its

assumptions; the major limitations of CAPM are as follows

Unrealistic assumptions: The capital asset pricing model is based on the several assumptions but

the derived assumptions are far from the real world situations (•Berrada et. al, 2018). For

instance, as investor want to have the risk free security but it is too difficult while finding the

risk- free security in the market. On the other hand, the assumptions as lending and the rate of

borrowing are also not correct as the theory detains (Tsuji, 2017). Over the different

circumstances, the capital asset pricing model might not be able to accurately determine the

behavior of investment and the CAPM might not assess the BETA as risk of investment might

not be measured in real manner.

Implications of CAPM

The capital asset pricing model has the below discussed implications such as

The investors engaged into the combining the risk – free assets with the concerned

portfolio of market with relation to the risky assets. The investors capitalize the fund in

risky assets with the higher proportion of market value (Ross, 2017).

The market investor are seek to compensate for the security which risks cannot be

diversified.

The investors engaged into the expectations about the return with the proportion of risk

that denotes the relationship in between the beta value and expected return (Kozak et. al,

2018).

Limitations of CAPM

The CAPM approach is assumed as a tool for determining the value of rate of return and risk

with respect to the particular security. On the other hand, the CAPM is also limited over its

assumptions; the major limitations of CAPM are as follows

Unrealistic assumptions: The capital asset pricing model is based on the several assumptions but

the derived assumptions are far from the real world situations (•Berrada et. al, 2018). For

instance, as investor want to have the risk free security but it is too difficult while finding the

risk- free security in the market. On the other hand, the assumptions as lending and the rate of

borrowing are also not correct as the theory detains (Tsuji, 2017). Over the different

circumstances, the capital asset pricing model might not be able to accurately determine the

behavior of investment and the CAPM might not assess the BETA as risk of investment might

not be measured in real manner.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Essay: Strategic Finance 10

Testing of CAPM: In relation to this, the validity of CAPM might also not realistic as it is

measured or rested in practical validity aspect. As of the empirical study of CAPM, it is noted

down that the beta denotes the relationship in between the risk and return over the security in a

particular market (Bromiley et. al, 2017). On the other hand of relevancy of CAPM, it was also

not determined the strong relationship in between the return and respective risk for a security.

The return over the security is concerned to the risk but here it is not sure about the relationship

so it is not seems that the CAPM is valid in practical manner (Aggarwal, 2017). In the far

research, there is no existence of relationship in between the return and Beta. In contrast to this,

the size, book value and market value are also found important factor with relation to the return

of a security. The empirical study state the CAPM is determined as the ex-ante method in which

the data are assessed in expected price for testing the CAPM but the researcher detains the

practical implications over past data but the future is also uncertain so the future value of Beta is

not certain.

Stability of beta: The Beta is used in the security market for the purpose of measuring the future

risk about a stock (Furman et. al, 2018). But on the other hand, it is not possible for the investors

to have the future data as they have past data about share price and portfolio of market. In this

circumstances, the historical beta can be used by the investors if it remain stable over a time

period but the stock value of security are not stable for a particular time duration (Squartini et. al,

2017). In relation to this, it can be stated that the historical or past beta are not feasible and poor

indicator for the identification of risk about a security (Binsbergen, et. al, 2017).

Testing of CAPM: In relation to this, the validity of CAPM might also not realistic as it is

measured or rested in practical validity aspect. As of the empirical study of CAPM, it is noted

down that the beta denotes the relationship in between the risk and return over the security in a

particular market (Bromiley et. al, 2017). On the other hand of relevancy of CAPM, it was also

not determined the strong relationship in between the return and respective risk for a security.

The return over the security is concerned to the risk but here it is not sure about the relationship

so it is not seems that the CAPM is valid in practical manner (Aggarwal, 2017). In the far

research, there is no existence of relationship in between the return and Beta. In contrast to this,

the size, book value and market value are also found important factor with relation to the return

of a security. The empirical study state the CAPM is determined as the ex-ante method in which

the data are assessed in expected price for testing the CAPM but the researcher detains the

practical implications over past data but the future is also uncertain so the future value of Beta is

not certain.

Stability of beta: The Beta is used in the security market for the purpose of measuring the future

risk about a stock (Furman et. al, 2018). But on the other hand, it is not possible for the investors

to have the future data as they have past data about share price and portfolio of market. In this

circumstances, the historical beta can be used by the investors if it remain stable over a time

period but the stock value of security are not stable for a particular time duration (Squartini et. al,

2017). In relation to this, it can be stated that the historical or past beta are not feasible and poor

indicator for the identification of risk about a security (Binsbergen, et. al, 2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Essay: Strategic Finance 11

Conclusion

On the basis of above analysis, it can be concluded that the CAPM is really a useful method for

determination of risks and expected return with some limitations about its assumptions. It can

also be concluded that the assumptions with relation to CAPM approach might not be validated

in practical manner. The major theories and models of CAPM are efficient to identify the risk

and return in better manner as SML, APT, Five factors and three factors model.

Conclusion

On the basis of above analysis, it can be concluded that the CAPM is really a useful method for

determination of risks and expected return with some limitations about its assumptions. It can

also be concluded that the assumptions with relation to CAPM approach might not be validated

in practical manner. The major theories and models of CAPM are efficient to identify the risk

and return in better manner as SML, APT, Five factors and three factors model.

Essay: Strategic Finance 12

References

Adesokan, I., Ngare, P. and Kilishi, A., (2017) Analyzing Expected Returns of a Stock Using

The Markov Chain Model and the Capital Asset Pricing Model. Applied Mathematical Sciences,

11(56), pp.2777-2788.

Agarwal, V., Green, T.C. and Ren, H., (2018) Alpha or beta in the eye of the beholder: What

drives hedge fund flows?. Journal of Financial Economics, 127(3), pp.417-434.

Bajpai, S. and Sharma, A.K., (2017) Capital asset pricing model and subprime crisis: evidence

from Indian equity market. International Journal of Indian Culture and Business Management,

14(1), pp.65-93.

Bao, T., Diks, C. and Li, H., (2018) A generalized CAPM model with asymmetric power

distributed errors with an application to portfolio construction. Economic Modelling, 68, pp.611-

621.

Fama, E. and French, K. (2015) A five-factorassetpricingmodel. Journal of

FinancialEconomics,116, pp. 1-22.

Barinov, A., Pottier, S.W. and Xu, J., (2018) Estimating the Cost of Equity Capital for Insurance

Firms with Multi-period Asset Pricing Models. Finance Study, pp. 1-38.

Berrada, T., Detemple, J. and Rindisbacher, M., (2018) Asset pricing with beliefs-dependent risk

aversion and learning. Journal of Financial Economics, 128(3), pp.504-534.

Bromiley, P., Rau, D. and Zhang, Y., (2017) Is R & D risky?. Strategic Management Journal,

38(4), pp.876-891.

Constantinides, G.M., (2017) Asset Pricing: Models and Empirical Evidence. Journal of

Political Economy, 125(6), pp.1782-1790.

References

Adesokan, I., Ngare, P. and Kilishi, A., (2017) Analyzing Expected Returns of a Stock Using

The Markov Chain Model and the Capital Asset Pricing Model. Applied Mathematical Sciences,

11(56), pp.2777-2788.

Agarwal, V., Green, T.C. and Ren, H., (2018) Alpha or beta in the eye of the beholder: What

drives hedge fund flows?. Journal of Financial Economics, 127(3), pp.417-434.

Bajpai, S. and Sharma, A.K., (2017) Capital asset pricing model and subprime crisis: evidence

from Indian equity market. International Journal of Indian Culture and Business Management,

14(1), pp.65-93.

Bao, T., Diks, C. and Li, H., (2018) A generalized CAPM model with asymmetric power

distributed errors with an application to portfolio construction. Economic Modelling, 68, pp.611-

621.

Fama, E. and French, K. (2015) A five-factorassetpricingmodel. Journal of

FinancialEconomics,116, pp. 1-22.

Barinov, A., Pottier, S.W. and Xu, J., (2018) Estimating the Cost of Equity Capital for Insurance

Firms with Multi-period Asset Pricing Models. Finance Study, pp. 1-38.

Berrada, T., Detemple, J. and Rindisbacher, M., (2018) Asset pricing with beliefs-dependent risk

aversion and learning. Journal of Financial Economics, 128(3), pp.504-534.

Bromiley, P., Rau, D. and Zhang, Y., (2017) Is R & D risky?. Strategic Management Journal,

38(4), pp.876-891.

Constantinides, G.M., (2017) Asset Pricing: Models and Empirical Evidence. Journal of

Political Economy, 125(6), pp.1782-1790.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Essay: Strategic Finance 13

Fama, E.F. and French, K.R., (2017) International tests of a five-factor asset pricing model.

Journal of financial Economics, 123(3), pp.441-463.

Furman, E., Kuznetsov, A. and Zitikis, R., (2018) Weighted risk capital allocations in the

presence of systematic risk. Insurance: Mathematics and Economics, 79, pp.75-81.

Gruber, M., Kavan, S. and Stockert, P., (2017) What drives Austrian banking subsidiaries’ return

on equity in CESEE and how does it compare to their cost of equity?. Financial Stability Report,

(33), pp.78-87.

He, Z., Kelly, B. and Manela, A., (2017) Intermediary asset pricing: New evidence from many

asset classes. Journal of Financial Economics, 126(1), pp.1-35.

Herskovic, B., (2018) Networks in production: Asset pricing implications. The Journal of

Finance, 73(4), pp.1785-1818.

Karp, A. and van Vuuren, G., (2017) The Capital Asset Pricing Model and Fama-French three

factor model in an emerging market environment. The International Business & Economics

Research Journal, 16(4), p.231.

Kou, S., Peng, X. and Zhong, H., (2017) Asset pricing with spatial interaction. Management

Science, 64(5), pp.2083-2101.

Kozak, S., Nagel, S. and Santosh, S., )2018) Interpreting factor models. The Journal of Finance,

73(3), pp.1183-1223.

Kroencke, T.A., (2017) Asset pricing without garbage. The Journal of Finance, 72(1), pp.47-98.

KUEHN, L.A., Simutin, M. and Wang, J.J., (2017) A labor capital asset pricing model. The

Journal of Finance, 72(5), pp.2131-2178.

Levy, H. (2011) The Capital Asset Pricing Model in the 21st Century: Analytical, Empirical, and

Behavioral Perspectives. UK: Cambridge University Press.

Fama, E.F. and French, K.R., (2017) International tests of a five-factor asset pricing model.

Journal of financial Economics, 123(3), pp.441-463.

Furman, E., Kuznetsov, A. and Zitikis, R., (2018) Weighted risk capital allocations in the

presence of systematic risk. Insurance: Mathematics and Economics, 79, pp.75-81.

Gruber, M., Kavan, S. and Stockert, P., (2017) What drives Austrian banking subsidiaries’ return

on equity in CESEE and how does it compare to their cost of equity?. Financial Stability Report,

(33), pp.78-87.

He, Z., Kelly, B. and Manela, A., (2017) Intermediary asset pricing: New evidence from many

asset classes. Journal of Financial Economics, 126(1), pp.1-35.

Herskovic, B., (2018) Networks in production: Asset pricing implications. The Journal of

Finance, 73(4), pp.1785-1818.

Karp, A. and van Vuuren, G., (2017) The Capital Asset Pricing Model and Fama-French three

factor model in an emerging market environment. The International Business & Economics

Research Journal, 16(4), p.231.

Kou, S., Peng, X. and Zhong, H., (2017) Asset pricing with spatial interaction. Management

Science, 64(5), pp.2083-2101.

Kozak, S., Nagel, S. and Santosh, S., )2018) Interpreting factor models. The Journal of Finance,

73(3), pp.1183-1223.

Kroencke, T.A., (2017) Asset pricing without garbage. The Journal of Finance, 72(1), pp.47-98.

KUEHN, L.A., Simutin, M. and Wang, J.J., (2017) A labor capital asset pricing model. The

Journal of Finance, 72(5), pp.2131-2178.

Levy, H. (2011) The Capital Asset Pricing Model in the 21st Century: Analytical, Empirical, and

Behavioral Perspectives. UK: Cambridge University Press.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Essay: Strategic Finance 14

Lund, D. and Nymoen, R., (2018) Comparative statics for real options on oil: What stylized

facts?. The Engineering Economist, 63(1), pp.54-65.

Martin, I., (2017) What is the Expected Return on the Market?. The Quarterly Journal of

Economics, 132(1), pp.367-433.

Poornima, S. and Swathiga, P., (2017) A study on relationship between risk and return analysis

of selected stocks on NSE using capital asset pricing model. International Journal of Applied

Research, 3(7), pp.375-378.

Putra, A., Rizkiant, E. and Chalid, D. (2017) The Analysis of Herding Behavior in Indonesia and

Ross, S.A., (2017) Factors—theory, statistics, and practice. Journal of Portfolio Management,

43(5), pp.1-5.

Singapore Stock Market. Advances in Economics, Business and Management Research, 36, pp.

1-10.

Squartini, T., Almog, A., Caldarelli, G., Van Lelyveld, I., Garlaschelli, D. and Cimini, G., (2017)

Enhanced capital-asset pricing model for the reconstruction of bipartite financial networks.

Physical Review. Pp. 1-14.

Tsuji, C., (2017) An exploration of the time-varying beta of the international capital asset pricing

model: The case of the Japanese and the other Asia-Pacific stock markets. Accounting and

Finance Research, 6(2), pp.86.

Valencia-Herrera, H. and López-Herrera, F., (2018) Markov Switching International Capital

Asset Pricing Model, an Emerging Market Case: Mexico. Journal of Emerging Market Finance,

17(1), pp.96-129.

Lund, D. and Nymoen, R., (2018) Comparative statics for real options on oil: What stylized

facts?. The Engineering Economist, 63(1), pp.54-65.

Martin, I., (2017) What is the Expected Return on the Market?. The Quarterly Journal of

Economics, 132(1), pp.367-433.

Poornima, S. and Swathiga, P., (2017) A study on relationship between risk and return analysis

of selected stocks on NSE using capital asset pricing model. International Journal of Applied

Research, 3(7), pp.375-378.

Putra, A., Rizkiant, E. and Chalid, D. (2017) The Analysis of Herding Behavior in Indonesia and

Ross, S.A., (2017) Factors—theory, statistics, and practice. Journal of Portfolio Management,

43(5), pp.1-5.

Singapore Stock Market. Advances in Economics, Business and Management Research, 36, pp.

1-10.

Squartini, T., Almog, A., Caldarelli, G., Van Lelyveld, I., Garlaschelli, D. and Cimini, G., (2017)

Enhanced capital-asset pricing model for the reconstruction of bipartite financial networks.

Physical Review. Pp. 1-14.

Tsuji, C., (2017) An exploration of the time-varying beta of the international capital asset pricing

model: The case of the Japanese and the other Asia-Pacific stock markets. Accounting and

Finance Research, 6(2), pp.86.

Valencia-Herrera, H. and López-Herrera, F., (2018) Markov Switching International Capital

Asset Pricing Model, an Emerging Market Case: Mexico. Journal of Emerging Market Finance,

17(1), pp.96-129.

Essay: Strategic Finance 15

Valencia-Herrera, H. and López-Herrera, F., (2018) Markov Switching International Capital

Asset Pricing Model, an Emerging Market Case: Mexico. Journal of Emerging Market Finance,

17(1), pp.96-129.

Van Binsbergen, J.H. and Koijen, R.S., (2017) The term structure of returns: Facts and theory.

Journal of Financial Economics, 124(1), pp.1-21.

YAN, Jing-ning, and Qing-wen LIU (2017) "Concession Price Modeling and Simulation of the

Reservoir PPP Project Based on the CAPM Model." Journal of Nanchang Hangkong University,

pp. 1-27.

Valencia-Herrera, H. and López-Herrera, F., (2018) Markov Switching International Capital

Asset Pricing Model, an Emerging Market Case: Mexico. Journal of Emerging Market Finance,

17(1), pp.96-129.

Van Binsbergen, J.H. and Koijen, R.S., (2017) The term structure of returns: Facts and theory.

Journal of Financial Economics, 124(1), pp.1-21.

YAN, Jing-ning, and Qing-wen LIU (2017) "Concession Price Modeling and Simulation of the

Reservoir PPP Project Based on the CAPM Model." Journal of Nanchang Hangkong University,

pp. 1-27.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.