Carsales.com Limited – Company Analysis

VerifiedAdded on 2023/06/03

|23

|6887

|318

AI Summary

This article provides an analysis of Carsales.com, the biggest online dealer of automobiles, motorcycles and marine described businesses in Australia. It covers the company's vision, structure, subsidiaries and divisions, recent corporate activities, business activities, sectorial performance, corporate finances, stock market, competitive performance, industry overview, SWOT analysis, and future of the company.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Carsales.com Limited – Company Analysis

Name

Submitted By

Date

Lecturer’s Name

Name

Submitted By

Date

Lecturer’s Name

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Content

About the Company...............................................................................................................................4

Vision of the Company......................................................................................................................4

Structure............................................................................................................................................4

Subsidiaries and Divisions:............................................................................................................5

Recent Corporate Activities...................................................................................................................7

Business Activities................................................................................................................................8

Carsales.com..............................................................................................................................8

Bikesales.com............................................................................................................................8

Boatsales.com............................................................................................................................8

Redbook.com.............................................................................................................................8

Datamotive.com.........................................................................................................................9

Carfacts.com..............................................................................................................................9

Ryvusiq.com..............................................................................................................................9

Strattonfinance.com...................................................................................................................9

Encar.com..................................................................................................................................9

Businesses Classification...................................................................................................................9

Quick Sales............................................................................................................................9

Data Motive.........................................................................................................................10

Click4Finance......................................................................................................................10

E-Carsales.com.au...............................................................................................................10

Company Operations...........................................................................................................................10

Sectorial Performance......................................................................................................................11

Corporate Finances..............................................................................................................................12

Horizontal Analysis of Balance Sheet..............................................................................................12

Horizontal Analysis of Profit and Loss Statement...........................................................................13

Ratio Analysis.................................................................................................................................13

Stock Market.......................................................................................................................................14

Competitive Performance....................................................................................................................15

About the Company...............................................................................................................................4

Vision of the Company......................................................................................................................4

Structure............................................................................................................................................4

Subsidiaries and Divisions:............................................................................................................5

Recent Corporate Activities...................................................................................................................7

Business Activities................................................................................................................................8

Carsales.com..............................................................................................................................8

Bikesales.com............................................................................................................................8

Boatsales.com............................................................................................................................8

Redbook.com.............................................................................................................................8

Datamotive.com.........................................................................................................................9

Carfacts.com..............................................................................................................................9

Ryvusiq.com..............................................................................................................................9

Strattonfinance.com...................................................................................................................9

Encar.com..................................................................................................................................9

Businesses Classification...................................................................................................................9

Quick Sales............................................................................................................................9

Data Motive.........................................................................................................................10

Click4Finance......................................................................................................................10

E-Carsales.com.au...............................................................................................................10

Company Operations...........................................................................................................................10

Sectorial Performance......................................................................................................................11

Corporate Finances..............................................................................................................................12

Horizontal Analysis of Balance Sheet..............................................................................................12

Horizontal Analysis of Profit and Loss Statement...........................................................................13

Ratio Analysis.................................................................................................................................13

Stock Market.......................................................................................................................................14

Competitive Performance....................................................................................................................15

Industry Overview...........................................................................................................................15

Carsales.com SWOT Analysis:........................................................................................................15

Strengths..............................................................................................................................16

Weaknesses..........................................................................................................................16

Opportunities.......................................................................................................................16

Threats.................................................................................................................................16

Future of the Company........................................................................................................................17

References...........................................................................................................................................18

Appendix.............................................................................................................................................21

1. Profit and Loss Statement of Carsales.com for Period FY 2014-18.........................................21

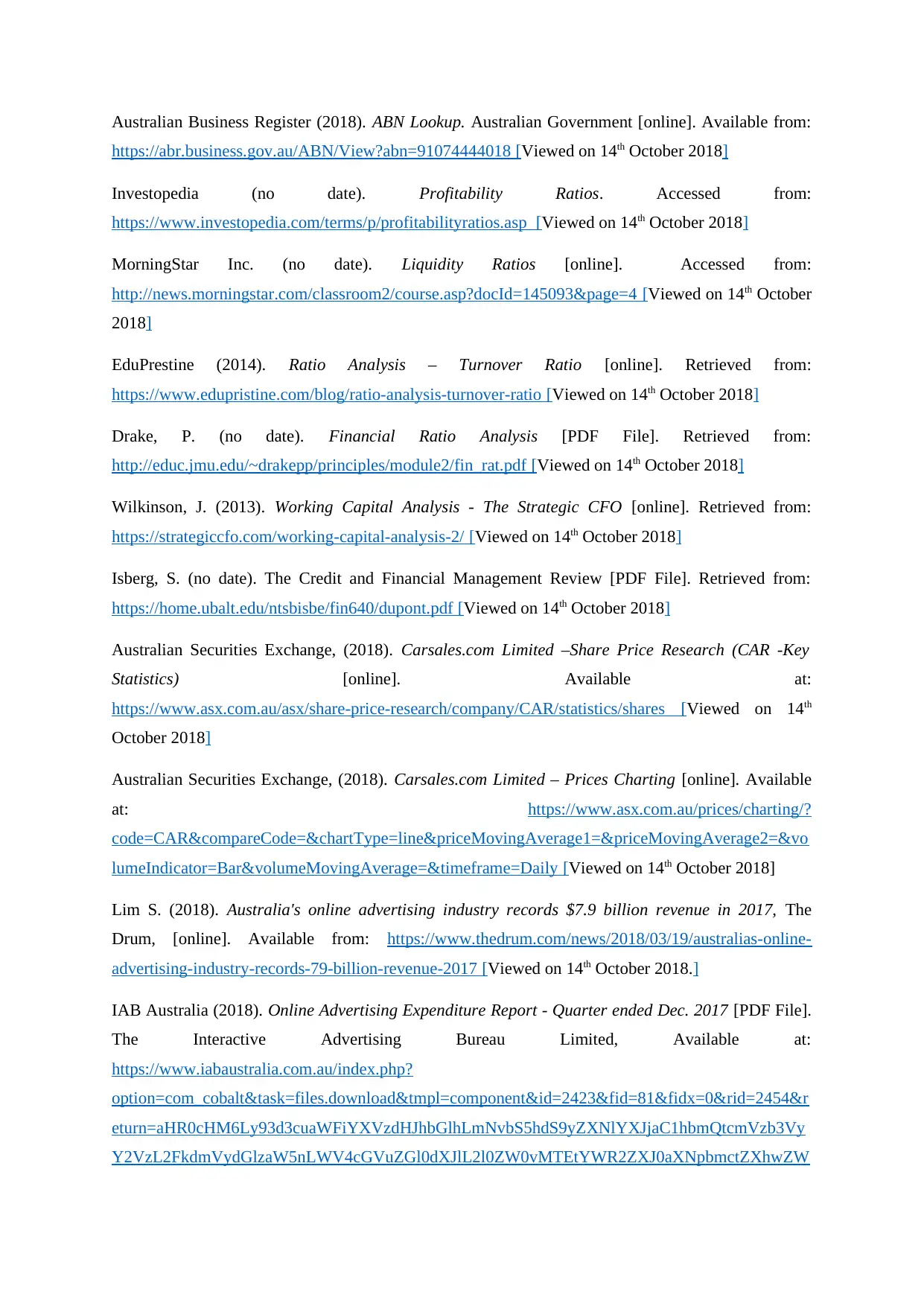

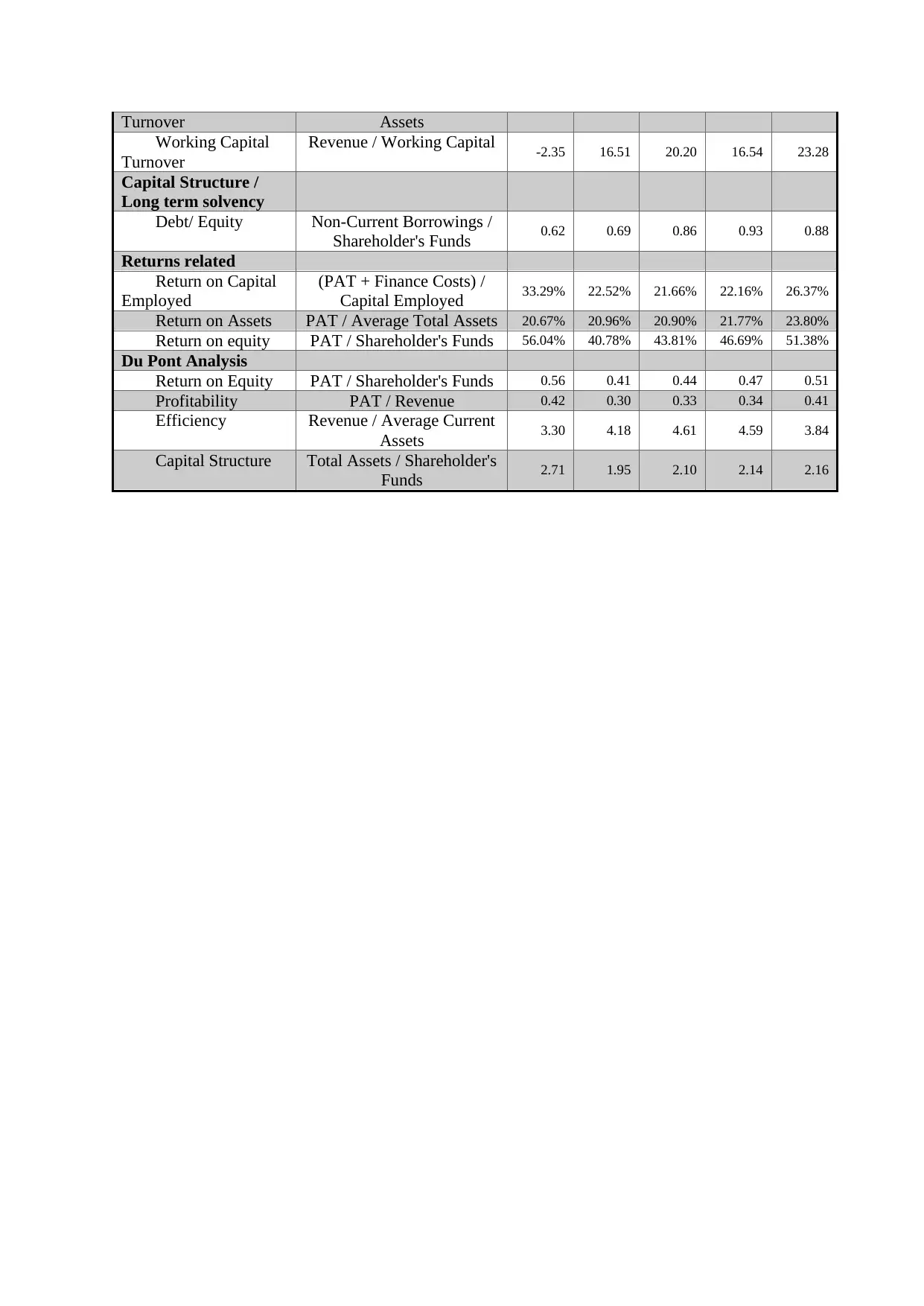

2. Segment wise revenues of Carsales.com for Period FY 2014-18.............................................22

3. Horizontal Analysis of Balance Sheet......................................................................................22

4. Horizontal Analysis of Profit and Loss Statement...................................................................23

5. Ratio Calculations....................................................................................................................24

Carsales.com SWOT Analysis:........................................................................................................15

Strengths..............................................................................................................................16

Weaknesses..........................................................................................................................16

Opportunities.......................................................................................................................16

Threats.................................................................................................................................16

Future of the Company........................................................................................................................17

References...........................................................................................................................................18

Appendix.............................................................................................................................................21

1. Profit and Loss Statement of Carsales.com for Period FY 2014-18.........................................21

2. Segment wise revenues of Carsales.com for Period FY 2014-18.............................................22

3. Horizontal Analysis of Balance Sheet......................................................................................22

4. Horizontal Analysis of Profit and Loss Statement...................................................................23

5. Ratio Calculations....................................................................................................................24

About the Company

Carsales.com is a public non-listed company under ASX: CAR, it is the biggest online dealer of

automobiles, motorcycles and marine described businesses in Australia. The company caters to

individuals with a demand for buying an automobile (cars, trucks, caravans etc), motorcycles, boat or

even a harvester through its distinct and targeted group subsidiaries. Carsales.com has a global

footprint which currently caters to Australia, South Korea, Brazil, Malaysia, Indonesia, Thailand and

Mexico (Carsales.com Ltd. 2018).

Employing more than 600 individuals, the company has been able to mark its presence in major

developing and developed markets across the globe with service like advertising solutions and its core

competency of buying and selling automobiles, motorcycles and marine classifications.

Vision of the Company

The company wants to create a platform to cater to individuals for a streamlined and a hassle-free car

buying or selling experience. In the process, Carsales.com creates an equal opportunity for all the

vertically integrated segments in the buying and selling process, i.e. the manufacturers, the dealers

and the ultimate consumers.

Carsales.com has build its brand equity in Australia and consistent efforts towards the same, the

company has been able to make technological advancements which has led to current situation in

which the company has marked its global footprint.

The brand equity of carsales can be understood by their belief of providing each and every customer

with same level of technology if he/she is buying or selling a car, a motorcycle, a caravan, a truck, a

boat or even a combine harvester for that matters (Carsales.com Ltd. 2018).

Structure

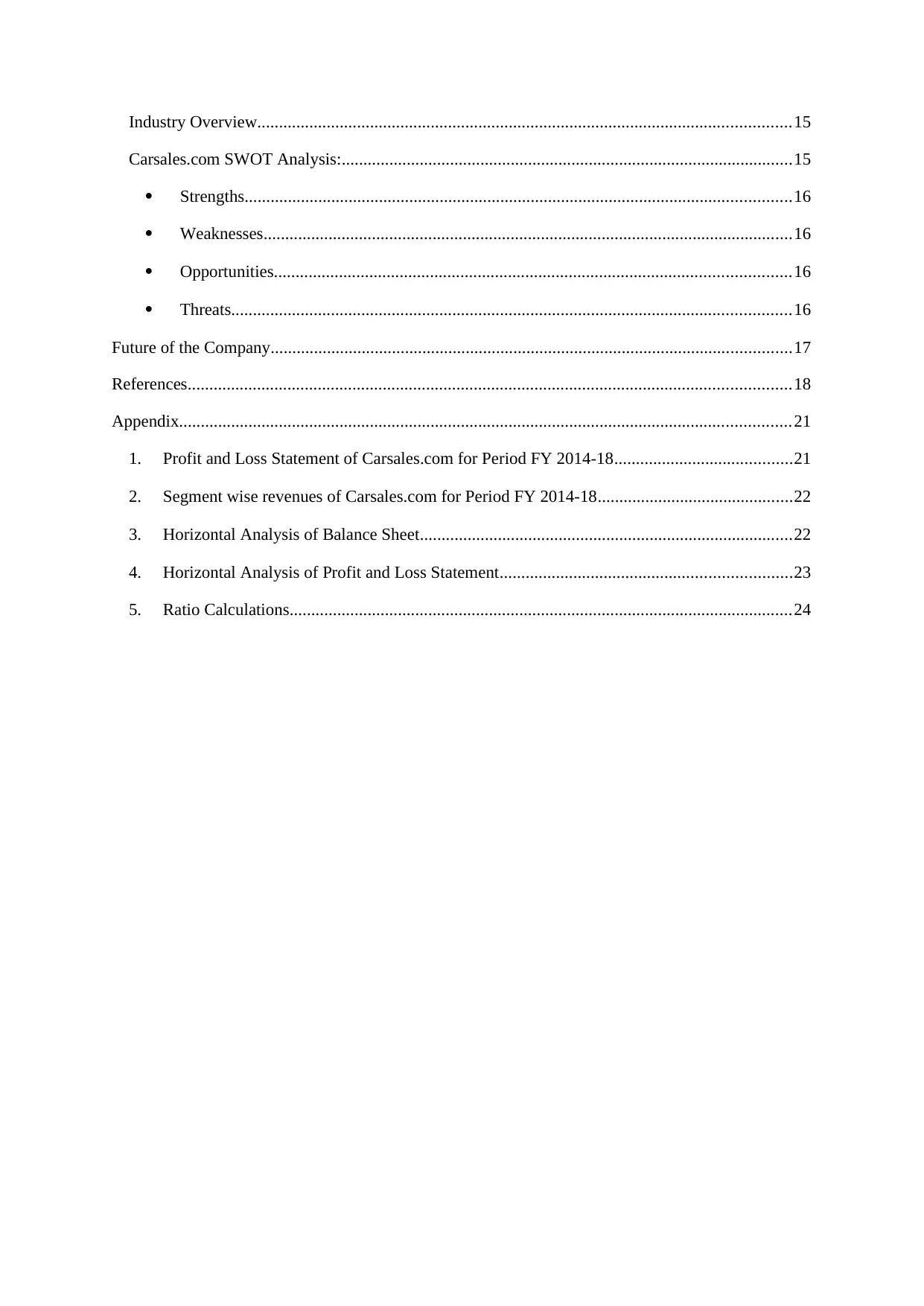

After its beginnings in 1997, Carsales.com became a non-public listed company in 2000 and is

currently traded under the symbol “CAR” in the ASX (Australian Securities Exchange) (Carsales.com

Ltd 2018). By the end of FY 2018, the holding company i.e. Carsales.com Ltd. had a total contributed

equity of AUD ~119 Mn (Carsales.com Ltd, 2018).

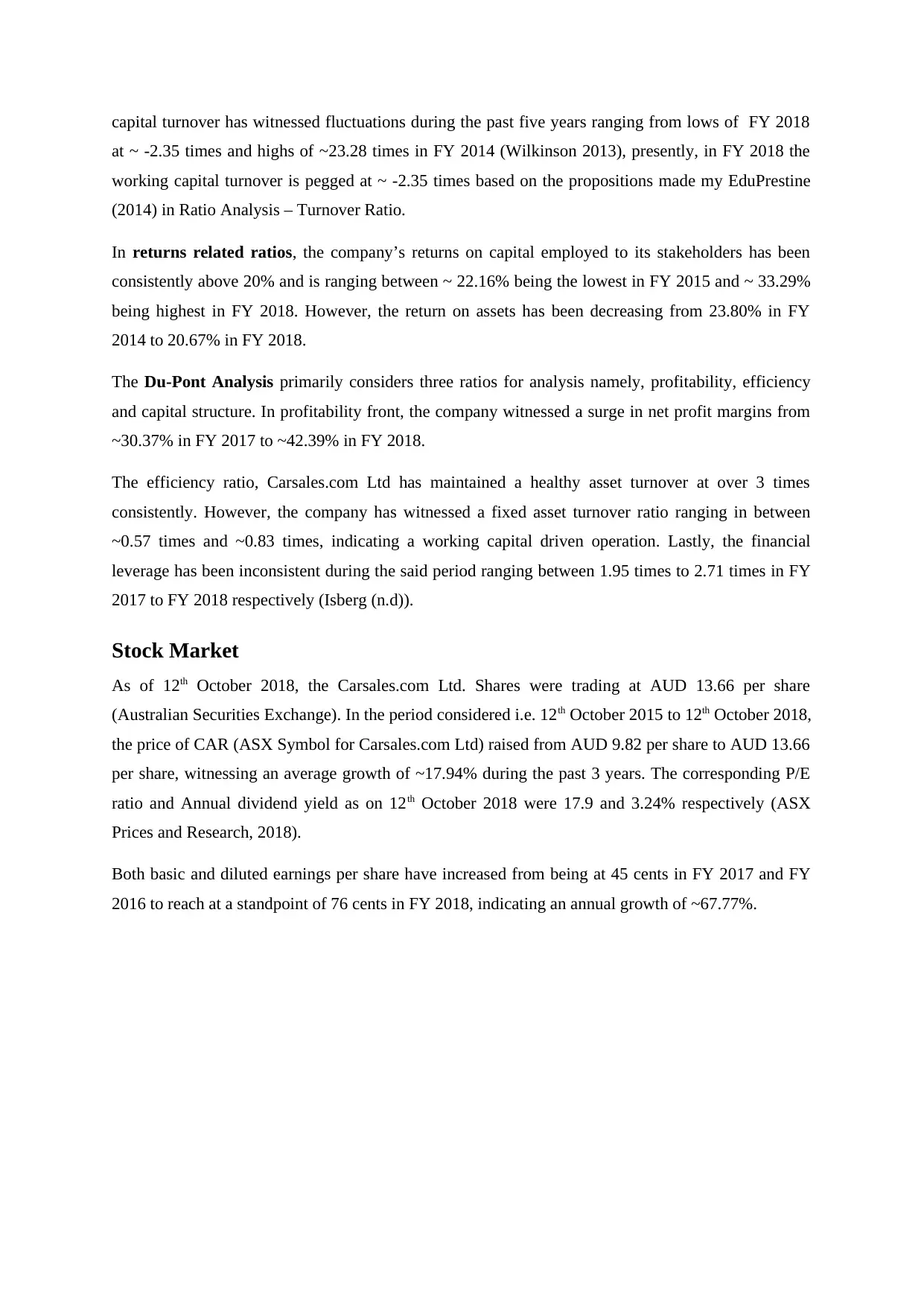

During the period FY 2014-18, the contributed equity has increased in line with the increase in total

equity. In the period mentioned, the contributed equity and the total equity have grown by CAGR of

~11.41% and ~15.70% respectively. Furthermore, annual year on year (Y-o-Y) increase has been

relatively higher as compared with the average growth for past five financial years at ~ 12.92% and

~21.17% respectively.

Carsales.com is a public non-listed company under ASX: CAR, it is the biggest online dealer of

automobiles, motorcycles and marine described businesses in Australia. The company caters to

individuals with a demand for buying an automobile (cars, trucks, caravans etc), motorcycles, boat or

even a harvester through its distinct and targeted group subsidiaries. Carsales.com has a global

footprint which currently caters to Australia, South Korea, Brazil, Malaysia, Indonesia, Thailand and

Mexico (Carsales.com Ltd. 2018).

Employing more than 600 individuals, the company has been able to mark its presence in major

developing and developed markets across the globe with service like advertising solutions and its core

competency of buying and selling automobiles, motorcycles and marine classifications.

Vision of the Company

The company wants to create a platform to cater to individuals for a streamlined and a hassle-free car

buying or selling experience. In the process, Carsales.com creates an equal opportunity for all the

vertically integrated segments in the buying and selling process, i.e. the manufacturers, the dealers

and the ultimate consumers.

Carsales.com has build its brand equity in Australia and consistent efforts towards the same, the

company has been able to make technological advancements which has led to current situation in

which the company has marked its global footprint.

The brand equity of carsales can be understood by their belief of providing each and every customer

with same level of technology if he/she is buying or selling a car, a motorcycle, a caravan, a truck, a

boat or even a combine harvester for that matters (Carsales.com Ltd. 2018).

Structure

After its beginnings in 1997, Carsales.com became a non-public listed company in 2000 and is

currently traded under the symbol “CAR” in the ASX (Australian Securities Exchange) (Carsales.com

Ltd 2018). By the end of FY 2018, the holding company i.e. Carsales.com Ltd. had a total contributed

equity of AUD ~119 Mn (Carsales.com Ltd, 2018).

During the period FY 2014-18, the contributed equity has increased in line with the increase in total

equity. In the period mentioned, the contributed equity and the total equity have grown by CAGR of

~11.41% and ~15.70% respectively. Furthermore, annual year on year (Y-o-Y) increase has been

relatively higher as compared with the average growth for past five financial years at ~ 12.92% and

~21.17% respectively.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

FY 2018 FY 2017 FY 2016 FY 2015 FY 2014

-

20,000

40,000

60,000

80,000

100,000

120,000

140,000

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

119,541

105,861 99,026 91,905

77,603

335,821

277,160 260,370

229,513

187,376

Contributed Equity vs Total Equity

(In AUD '000)

Contributed equity Total equity

Source: Contributed Equity vs Total Equity (Carsales.com Ltd AR, 2014-18)

Subsidiaries and Divisions:

Carsales.com’s businesses have been broadly classified into five types of business verticals namely:

Online Advertising Services:

These can further be classified in two sub-segments namely: Classified Advertisements and Display

Advertising.

Classified Advertising refers to the platform which allows both dealers and consumers to advertise

their buying or selling proposition of automotive or non-automotive goods and services with the help

to diversified Carsales.com network.

Display Advertising on the other hand, acts as an add-on benefit for Carsales.com as it refers to the

services in which customers like OEMs or Insurance companies etc. can display their advertisements

to leverage on the footfall generated by Carsales.com network.

*Online Advertisement Services also include Tyresales.com which allows customers to buy or sell tyres.

Data, research and services:

This segment enables the company to provide its stakeholders (including OEMs, dealers, external

bodies, insurance companies etc) with its product offerings namely software, analysis, research

reports, valuations, website and hosting services.

Since inception of FY 2018, Carsales.com has increased its investments in this segment. A recent

update in this regard, the ‘2017 Auto Buying Journey Study’ which is a quarterly published market

paper has found its grounds amongst the stakeholders.

-

20,000

40,000

60,000

80,000

100,000

120,000

140,000

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

119,541

105,861 99,026 91,905

77,603

335,821

277,160 260,370

229,513

187,376

Contributed Equity vs Total Equity

(In AUD '000)

Contributed equity Total equity

Source: Contributed Equity vs Total Equity (Carsales.com Ltd AR, 2014-18)

Subsidiaries and Divisions:

Carsales.com’s businesses have been broadly classified into five types of business verticals namely:

Online Advertising Services:

These can further be classified in two sub-segments namely: Classified Advertisements and Display

Advertising.

Classified Advertising refers to the platform which allows both dealers and consumers to advertise

their buying or selling proposition of automotive or non-automotive goods and services with the help

to diversified Carsales.com network.

Display Advertising on the other hand, acts as an add-on benefit for Carsales.com as it refers to the

services in which customers like OEMs or Insurance companies etc. can display their advertisements

to leverage on the footfall generated by Carsales.com network.

*Online Advertisement Services also include Tyresales.com which allows customers to buy or sell tyres.

Data, research and services:

This segment enables the company to provide its stakeholders (including OEMs, dealers, external

bodies, insurance companies etc) with its product offerings namely software, analysis, research

reports, valuations, website and hosting services.

Since inception of FY 2018, Carsales.com has increased its investments in this segment. A recent

update in this regard, the ‘2017 Auto Buying Journey Study’ which is a quarterly published market

paper has found its grounds amongst the stakeholders.

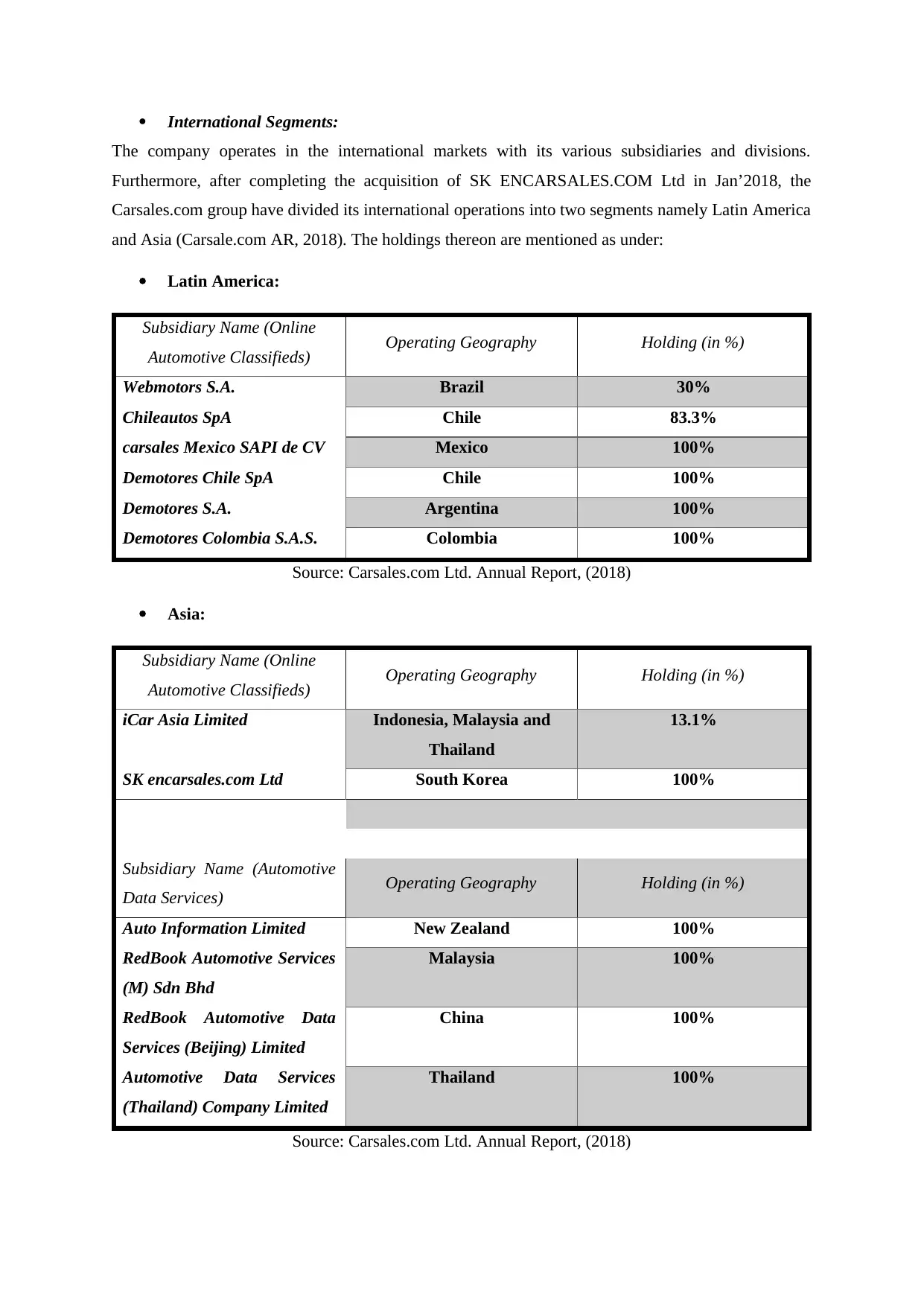

International Segments:

The company operates in the international markets with its various subsidiaries and divisions.

Furthermore, after completing the acquisition of SK ENCARSALES.COM Ltd in Jan’2018, the

Carsales.com group have divided its international operations into two segments namely Latin America

and Asia (Carsale.com AR, 2018). The holdings thereon are mentioned as under:

Latin America:

Subsidiary Name (Online

Automotive Classifieds) Operating Geography Holding (in %)

Webmotors S.A. Brazil 30%

Chileautos SpA Chile 83.3%

carsales Mexico SAPI de CV Mexico 100%

Demotores Chile SpA Chile 100%

Demotores S.A. Argentina 100%

Demotores Colombia S.A.S. Colombia 100%

Source: Carsales.com Ltd. Annual Report, (2018)

Asia:

Subsidiary Name (Online

Automotive Classifieds) Operating Geography Holding (in %)

iCar Asia Limited Indonesia, Malaysia and

Thailand

13.1%

SK encarsales.com Ltd South Korea 100%

Subsidiary Name (Automotive

Data Services) Operating Geography Holding (in %)

Auto Information Limited New Zealand 100%

RedBook Automotive Services

(M) Sdn Bhd

Malaysia 100%

RedBook Automotive Data

Services (Beijing) Limited

China 100%

Automotive Data Services

(Thailand) Company Limited

Thailand 100%

Source: Carsales.com Ltd. Annual Report, (2018)

The company operates in the international markets with its various subsidiaries and divisions.

Furthermore, after completing the acquisition of SK ENCARSALES.COM Ltd in Jan’2018, the

Carsales.com group have divided its international operations into two segments namely Latin America

and Asia (Carsale.com AR, 2018). The holdings thereon are mentioned as under:

Latin America:

Subsidiary Name (Online

Automotive Classifieds) Operating Geography Holding (in %)

Webmotors S.A. Brazil 30%

Chileautos SpA Chile 83.3%

carsales Mexico SAPI de CV Mexico 100%

Demotores Chile SpA Chile 100%

Demotores S.A. Argentina 100%

Demotores Colombia S.A.S. Colombia 100%

Source: Carsales.com Ltd. Annual Report, (2018)

Asia:

Subsidiary Name (Online

Automotive Classifieds) Operating Geography Holding (in %)

iCar Asia Limited Indonesia, Malaysia and

Thailand

13.1%

SK encarsales.com Ltd South Korea 100%

Subsidiary Name (Automotive

Data Services) Operating Geography Holding (in %)

Auto Information Limited New Zealand 100%

RedBook Automotive Services

(M) Sdn Bhd

Malaysia 100%

RedBook Automotive Data

Services (Beijing) Limited

China 100%

Automotive Data Services

(Thailand) Company Limited

Thailand 100%

Source: Carsales.com Ltd. Annual Report, (2018)

Finance and Related services:

This segment is responsible to generate revenues to innovative mechanisms to provide the customers

with vehicular finance for procurement or related services. The primal revenue model for the segment

is commissions arising from financing and related service providers. Carsales.com Ltd as of FY 2018,

have holdings in:

i. Stratton Finance Pty Ltd

ii. RateSetter Australia Pty Ltd

iii. PromisePay Pte Ltd

With former being direct subsidiary with a holding of 50.1% and the latter two being equity accounted

associates with a holding of 18.6% and 7.1% respectively (Carsale.com AR, 2018).

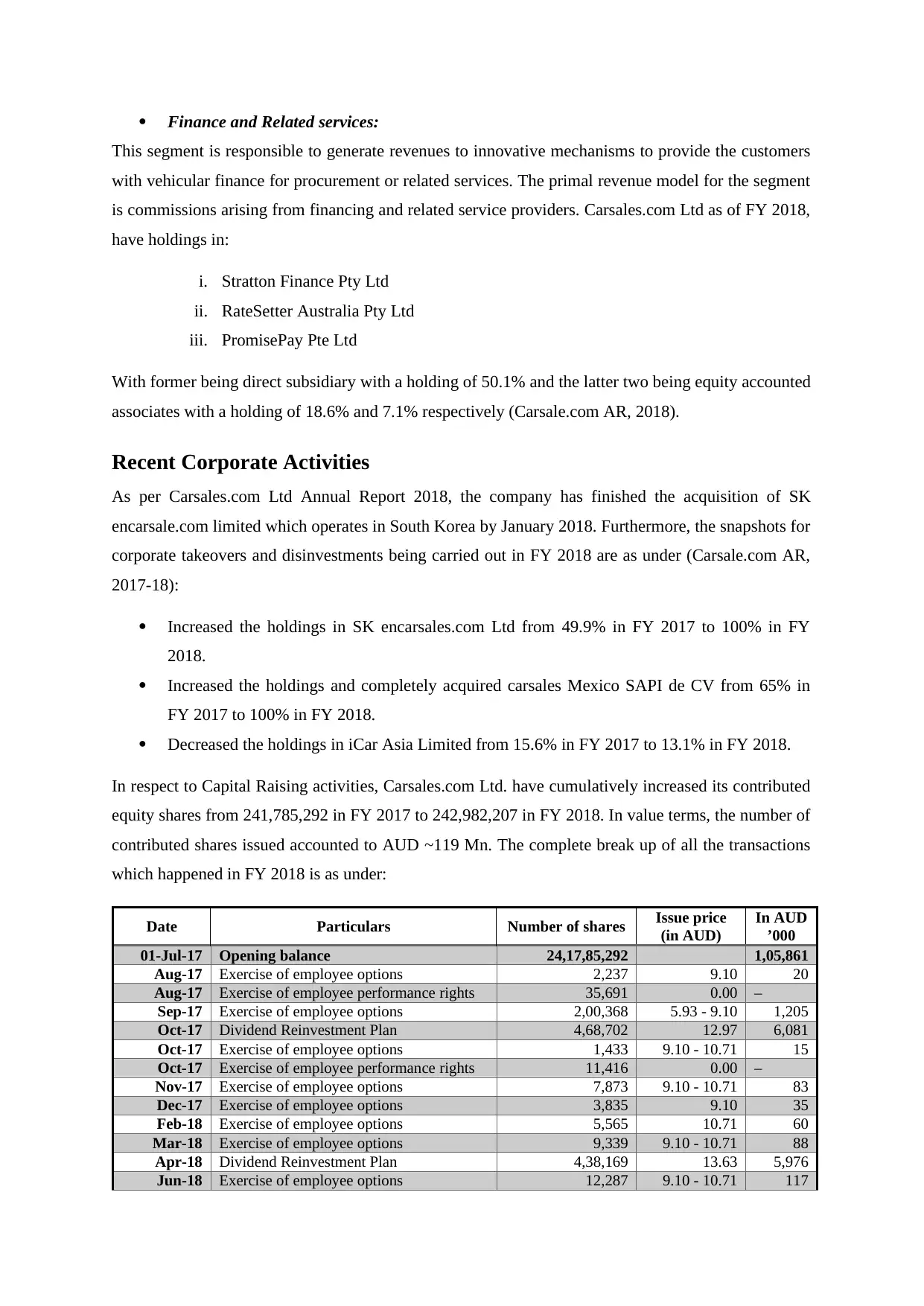

Recent Corporate Activities

As per Carsales.com Ltd Annual Report 2018, the company has finished the acquisition of SK

encarsale.com limited which operates in South Korea by January 2018. Furthermore, the snapshots for

corporate takeovers and disinvestments being carried out in FY 2018 are as under (Carsale.com AR,

2017-18):

Increased the holdings in SK encarsales.com Ltd from 49.9% in FY 2017 to 100% in FY

2018.

Increased the holdings and completely acquired carsales Mexico SAPI de CV from 65% in

FY 2017 to 100% in FY 2018.

Decreased the holdings in iCar Asia Limited from 15.6% in FY 2017 to 13.1% in FY 2018.

In respect to Capital Raising activities, Carsales.com Ltd. have cumulatively increased its contributed

equity shares from 241,785,292 in FY 2017 to 242,982,207 in FY 2018. In value terms, the number of

contributed shares issued accounted to AUD ~119 Mn. The complete break up of all the transactions

which happened in FY 2018 is as under:

Date Particulars Number of shares Issue price

(in AUD)

In AUD

’000

01-Jul-17 Opening balance 24,17,85,292 1,05,861

Aug-17 Exercise of employee options 2,237 9.10 20

Aug-17 Exercise of employee performance rights 35,691 0.00 –

Sep-17 Exercise of employee options 2,00,368 5.93 - 9.10 1,205

Oct-17 Dividend Reinvestment Plan 4,68,702 12.97 6,081

Oct-17 Exercise of employee options 1,433 9.10 - 10.71 15

Oct-17 Exercise of employee performance rights 11,416 0.00 –

Nov-17 Exercise of employee options 7,873 9.10 - 10.71 83

Dec-17 Exercise of employee options 3,835 9.10 35

Feb-18 Exercise of employee options 5,565 10.71 60

Mar-18 Exercise of employee options 9,339 9.10 - 10.71 88

Apr-18 Dividend Reinvestment Plan 4,38,169 13.63 5,976

Jun-18 Exercise of employee options 12,287 9.10 - 10.71 117

This segment is responsible to generate revenues to innovative mechanisms to provide the customers

with vehicular finance for procurement or related services. The primal revenue model for the segment

is commissions arising from financing and related service providers. Carsales.com Ltd as of FY 2018,

have holdings in:

i. Stratton Finance Pty Ltd

ii. RateSetter Australia Pty Ltd

iii. PromisePay Pte Ltd

With former being direct subsidiary with a holding of 50.1% and the latter two being equity accounted

associates with a holding of 18.6% and 7.1% respectively (Carsale.com AR, 2018).

Recent Corporate Activities

As per Carsales.com Ltd Annual Report 2018, the company has finished the acquisition of SK

encarsale.com limited which operates in South Korea by January 2018. Furthermore, the snapshots for

corporate takeovers and disinvestments being carried out in FY 2018 are as under (Carsale.com AR,

2017-18):

Increased the holdings in SK encarsales.com Ltd from 49.9% in FY 2017 to 100% in FY

2018.

Increased the holdings and completely acquired carsales Mexico SAPI de CV from 65% in

FY 2017 to 100% in FY 2018.

Decreased the holdings in iCar Asia Limited from 15.6% in FY 2017 to 13.1% in FY 2018.

In respect to Capital Raising activities, Carsales.com Ltd. have cumulatively increased its contributed

equity shares from 241,785,292 in FY 2017 to 242,982,207 in FY 2018. In value terms, the number of

contributed shares issued accounted to AUD ~119 Mn. The complete break up of all the transactions

which happened in FY 2018 is as under:

Date Particulars Number of shares Issue price

(in AUD)

In AUD

’000

01-Jul-17 Opening balance 24,17,85,292 1,05,861

Aug-17 Exercise of employee options 2,237 9.10 20

Aug-17 Exercise of employee performance rights 35,691 0.00 –

Sep-17 Exercise of employee options 2,00,368 5.93 - 9.10 1,205

Oct-17 Dividend Reinvestment Plan 4,68,702 12.97 6,081

Oct-17 Exercise of employee options 1,433 9.10 - 10.71 15

Oct-17 Exercise of employee performance rights 11,416 0.00 –

Nov-17 Exercise of employee options 7,873 9.10 - 10.71 83

Dec-17 Exercise of employee options 3,835 9.10 35

Feb-18 Exercise of employee options 5,565 10.71 60

Mar-18 Exercise of employee options 9,339 9.10 - 10.71 88

Apr-18 Dividend Reinvestment Plan 4,38,169 13.63 5,976

Jun-18 Exercise of employee options 12,287 9.10 - 10.71 117

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

30-Jun-18 Balance 24,29,82,207 1,19,541

Source: Carsales.com Ltd. Annual Report, (2018). pp. 113

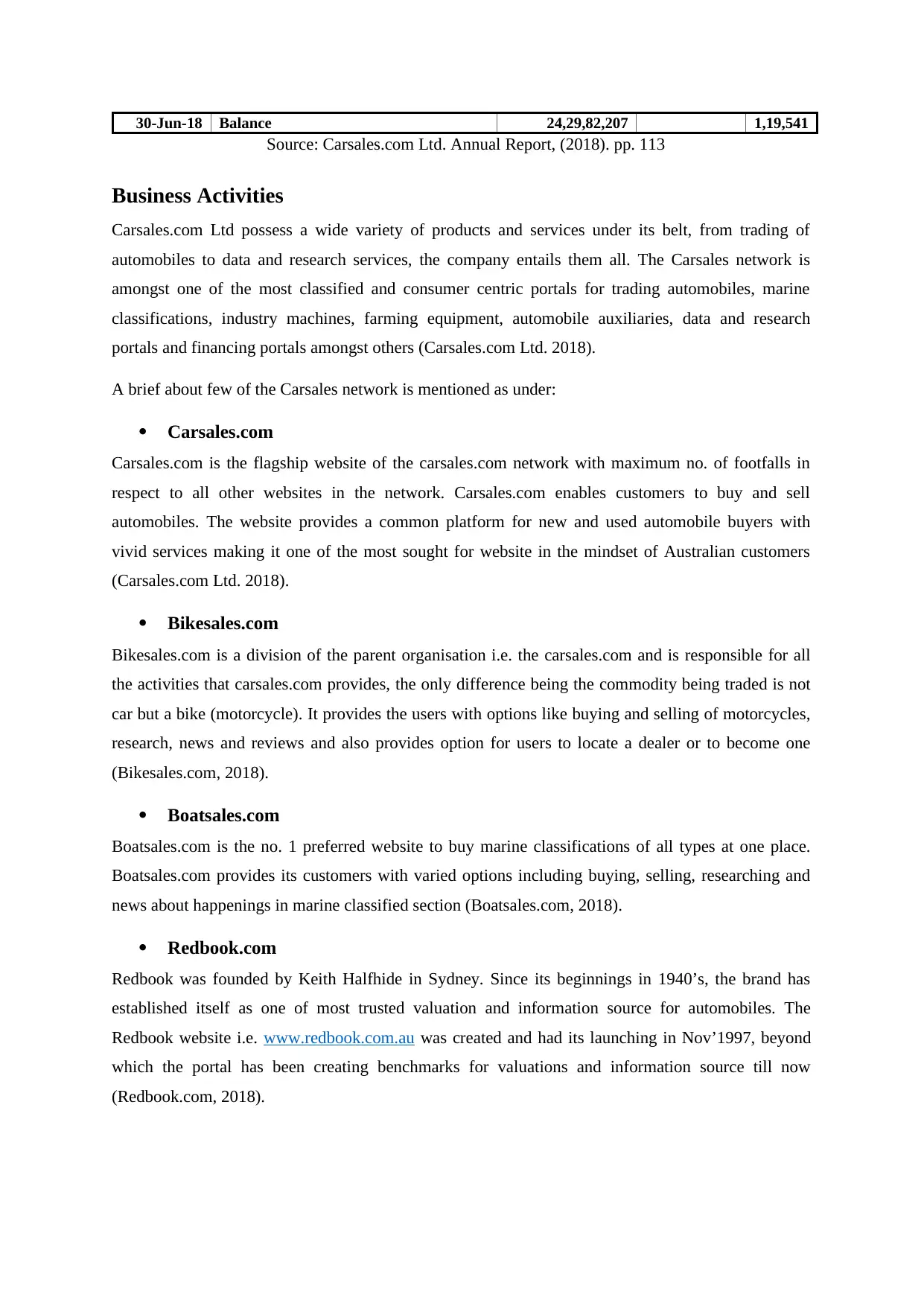

Business Activities

Carsales.com Ltd possess a wide variety of products and services under its belt, from trading of

automobiles to data and research services, the company entails them all. The Carsales network is

amongst one of the most classified and consumer centric portals for trading automobiles, marine

classifications, industry machines, farming equipment, automobile auxiliaries, data and research

portals and financing portals amongst others (Carsales.com Ltd. 2018).

A brief about few of the Carsales network is mentioned as under:

Carsales.com

Carsales.com is the flagship website of the carsales.com network with maximum no. of footfalls in

respect to all other websites in the network. Carsales.com enables customers to buy and sell

automobiles. The website provides a common platform for new and used automobile buyers with

vivid services making it one of the most sought for website in the mindset of Australian customers

(Carsales.com Ltd. 2018).

Bikesales.com

Bikesales.com is a division of the parent organisation i.e. the carsales.com and is responsible for all

the activities that carsales.com provides, the only difference being the commodity being traded is not

car but a bike (motorcycle). It provides the users with options like buying and selling of motorcycles,

research, news and reviews and also provides option for users to locate a dealer or to become one

(Bikesales.com, 2018).

Boatsales.com

Boatsales.com is the no. 1 preferred website to buy marine classifications of all types at one place.

Boatsales.com provides its customers with varied options including buying, selling, researching and

news about happenings in marine classified section (Boatsales.com, 2018).

Redbook.com

Redbook was founded by Keith Halfhide in Sydney. Since its beginnings in 1940’s, the brand has

established itself as one of most trusted valuation and information source for automobiles. The

Redbook website i.e. www.redbook.com.au was created and had its launching in Nov’1997, beyond

which the portal has been creating benchmarks for valuations and information source till now

(Redbook.com, 2018).

Source: Carsales.com Ltd. Annual Report, (2018). pp. 113

Business Activities

Carsales.com Ltd possess a wide variety of products and services under its belt, from trading of

automobiles to data and research services, the company entails them all. The Carsales network is

amongst one of the most classified and consumer centric portals for trading automobiles, marine

classifications, industry machines, farming equipment, automobile auxiliaries, data and research

portals and financing portals amongst others (Carsales.com Ltd. 2018).

A brief about few of the Carsales network is mentioned as under:

Carsales.com

Carsales.com is the flagship website of the carsales.com network with maximum no. of footfalls in

respect to all other websites in the network. Carsales.com enables customers to buy and sell

automobiles. The website provides a common platform for new and used automobile buyers with

vivid services making it one of the most sought for website in the mindset of Australian customers

(Carsales.com Ltd. 2018).

Bikesales.com

Bikesales.com is a division of the parent organisation i.e. the carsales.com and is responsible for all

the activities that carsales.com provides, the only difference being the commodity being traded is not

car but a bike (motorcycle). It provides the users with options like buying and selling of motorcycles,

research, news and reviews and also provides option for users to locate a dealer or to become one

(Bikesales.com, 2018).

Boatsales.com

Boatsales.com is the no. 1 preferred website to buy marine classifications of all types at one place.

Boatsales.com provides its customers with varied options including buying, selling, researching and

news about happenings in marine classified section (Boatsales.com, 2018).

Redbook.com

Redbook was founded by Keith Halfhide in Sydney. Since its beginnings in 1940’s, the brand has

established itself as one of most trusted valuation and information source for automobiles. The

Redbook website i.e. www.redbook.com.au was created and had its launching in Nov’1997, beyond

which the portal has been creating benchmarks for valuations and information source till now

(Redbook.com, 2018).

Redbook’s data is trusted upon to the level that even industry and general public uses it alike along

with other users including industry players, financing and insurance industry and the government

(Redbook.com, 2018).

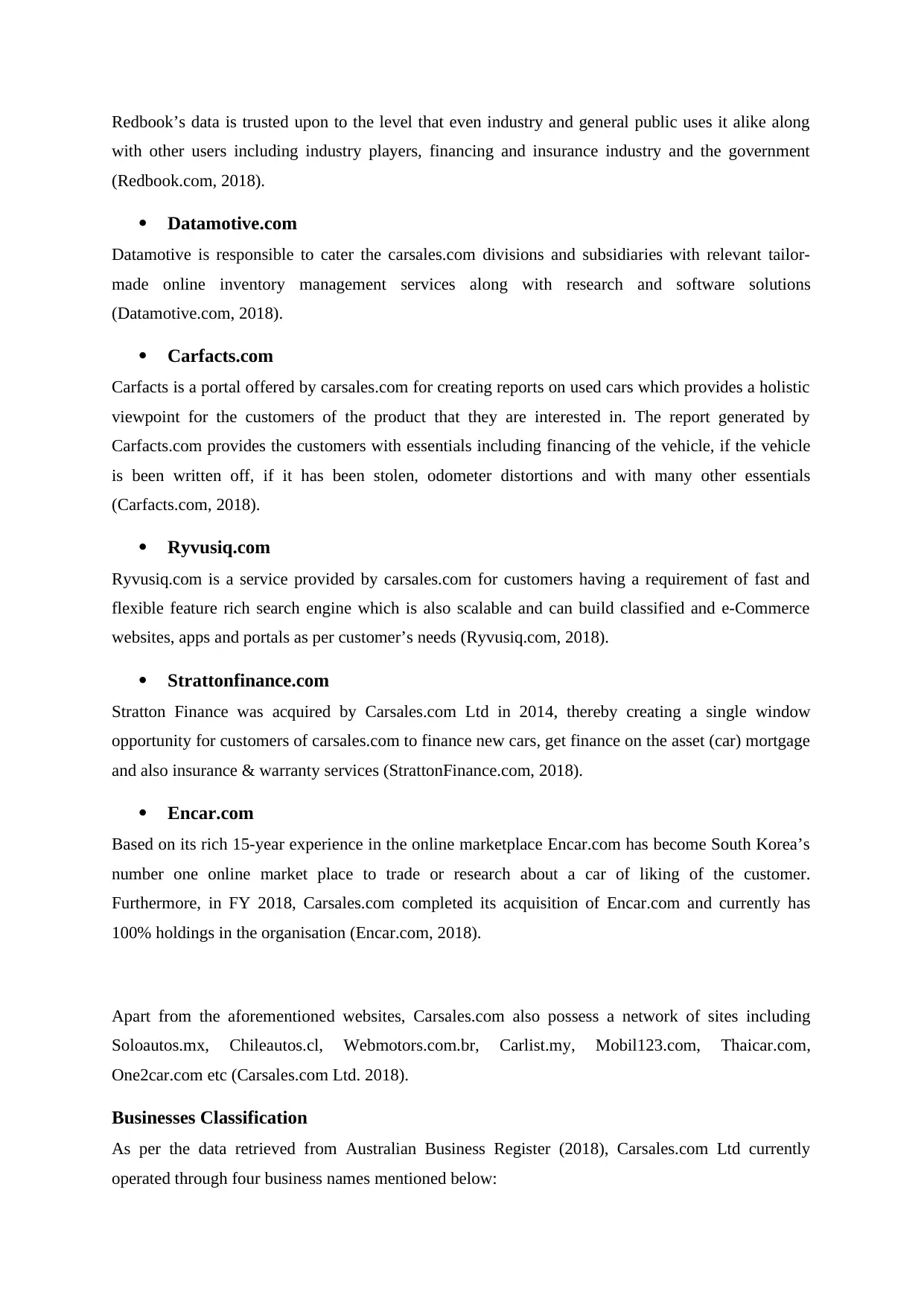

Datamotive.com

Datamotive is responsible to cater the carsales.com divisions and subsidiaries with relevant tailor-

made online inventory management services along with research and software solutions

(Datamotive.com, 2018).

Carfacts.com

Carfacts is a portal offered by carsales.com for creating reports on used cars which provides a holistic

viewpoint for the customers of the product that they are interested in. The report generated by

Carfacts.com provides the customers with essentials including financing of the vehicle, if the vehicle

is been written off, if it has been stolen, odometer distortions and with many other essentials

(Carfacts.com, 2018).

Ryvusiq.com

Ryvusiq.com is a service provided by carsales.com for customers having a requirement of fast and

flexible feature rich search engine which is also scalable and can build classified and e-Commerce

websites, apps and portals as per customer’s needs (Ryvusiq.com, 2018).

Strattonfinance.com

Stratton Finance was acquired by Carsales.com Ltd in 2014, thereby creating a single window

opportunity for customers of carsales.com to finance new cars, get finance on the asset (car) mortgage

and also insurance & warranty services (StrattonFinance.com, 2018).

Encar.com

Based on its rich 15-year experience in the online marketplace Encar.com has become South Korea’s

number one online market place to trade or research about a car of liking of the customer.

Furthermore, in FY 2018, Carsales.com completed its acquisition of Encar.com and currently has

100% holdings in the organisation (Encar.com, 2018).

Apart from the aforementioned websites, Carsales.com also possess a network of sites including

Soloautos.mx, Chileautos.cl, Webmotors.com.br, Carlist.my, Mobil123.com, Thaicar.com,

One2car.com etc (Carsales.com Ltd. 2018).

Businesses Classification

As per the data retrieved from Australian Business Register (2018), Carsales.com Ltd currently

operated through four business names mentioned below:

with other users including industry players, financing and insurance industry and the government

(Redbook.com, 2018).

Datamotive.com

Datamotive is responsible to cater the carsales.com divisions and subsidiaries with relevant tailor-

made online inventory management services along with research and software solutions

(Datamotive.com, 2018).

Carfacts.com

Carfacts is a portal offered by carsales.com for creating reports on used cars which provides a holistic

viewpoint for the customers of the product that they are interested in. The report generated by

Carfacts.com provides the customers with essentials including financing of the vehicle, if the vehicle

is been written off, if it has been stolen, odometer distortions and with many other essentials

(Carfacts.com, 2018).

Ryvusiq.com

Ryvusiq.com is a service provided by carsales.com for customers having a requirement of fast and

flexible feature rich search engine which is also scalable and can build classified and e-Commerce

websites, apps and portals as per customer’s needs (Ryvusiq.com, 2018).

Strattonfinance.com

Stratton Finance was acquired by Carsales.com Ltd in 2014, thereby creating a single window

opportunity for customers of carsales.com to finance new cars, get finance on the asset (car) mortgage

and also insurance & warranty services (StrattonFinance.com, 2018).

Encar.com

Based on its rich 15-year experience in the online marketplace Encar.com has become South Korea’s

number one online market place to trade or research about a car of liking of the customer.

Furthermore, in FY 2018, Carsales.com completed its acquisition of Encar.com and currently has

100% holdings in the organisation (Encar.com, 2018).

Apart from the aforementioned websites, Carsales.com also possess a network of sites including

Soloautos.mx, Chileautos.cl, Webmotors.com.br, Carlist.my, Mobil123.com, Thaicar.com,

One2car.com etc (Carsales.com Ltd. 2018).

Businesses Classification

As per the data retrieved from Australian Business Register (2018), Carsales.com Ltd currently

operated through four business names mentioned below:

Quick Sales

Quick Sales was registered on 28th Feb 2011 and is currently active

Data Motive

Data Motive was registered on 22nd Feb 2010 and is currently active

Click4Finance

Click4Finance was registered on 5th May 2008 and is currently active

E-Carsales.com.au

The Primal E-Carsales.com.au was registered with ASIC on 22nd Oct 2001 and is also currently active

Company Operations

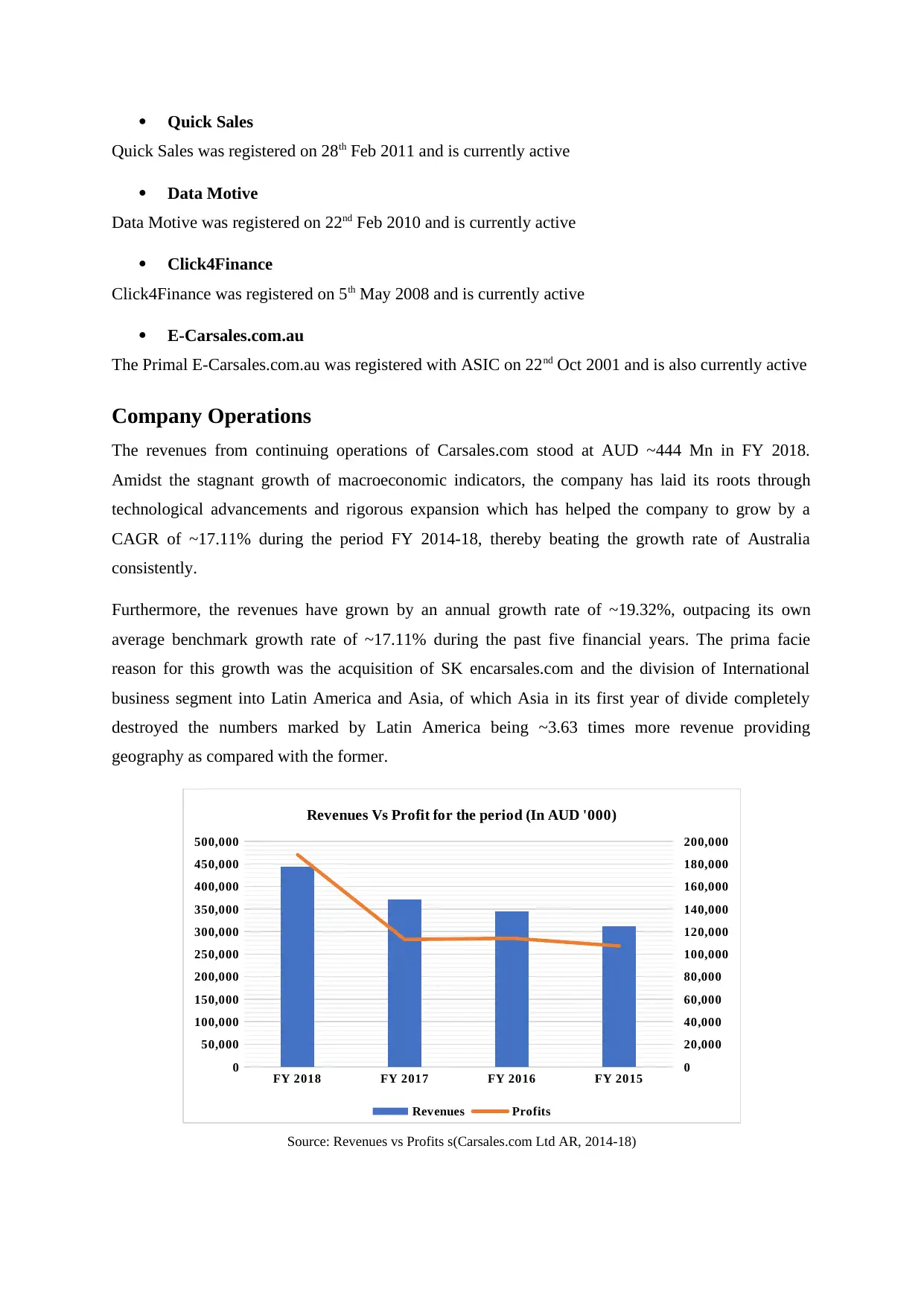

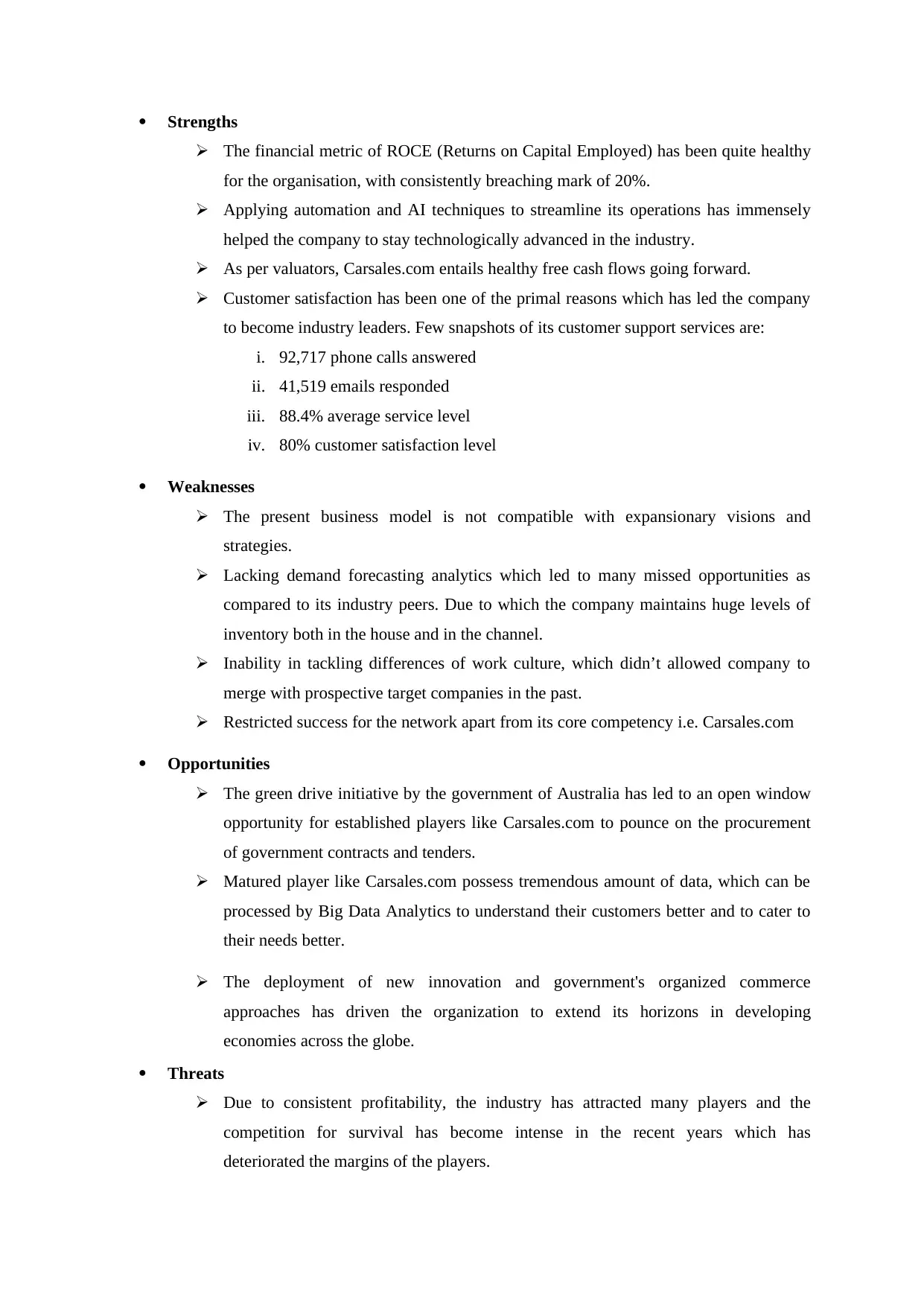

The revenues from continuing operations of Carsales.com stood at AUD ~444 Mn in FY 2018.

Amidst the stagnant growth of macroeconomic indicators, the company has laid its roots through

technological advancements and rigorous expansion which has helped the company to grow by a

CAGR of ~17.11% during the period FY 2014-18, thereby beating the growth rate of Australia

consistently.

Furthermore, the revenues have grown by an annual growth rate of ~19.32%, outpacing its own

average benchmark growth rate of ~17.11% during the past five financial years. The prima facie

reason for this growth was the acquisition of SK encarsales.com and the division of International

business segment into Latin America and Asia, of which Asia in its first year of divide completely

destroyed the numbers marked by Latin America being ~3.63 times more revenue providing

geography as compared with the former.

FY 2018 FY 2017 FY 2016 FY 2015

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

450,000

500,000

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

180,000

200,000

Revenues Vs Profit for the period (In AUD '000)

Revenues Profits

Source: Revenues vs Profits s(Carsales.com Ltd AR, 2014-18)

Quick Sales was registered on 28th Feb 2011 and is currently active

Data Motive

Data Motive was registered on 22nd Feb 2010 and is currently active

Click4Finance

Click4Finance was registered on 5th May 2008 and is currently active

E-Carsales.com.au

The Primal E-Carsales.com.au was registered with ASIC on 22nd Oct 2001 and is also currently active

Company Operations

The revenues from continuing operations of Carsales.com stood at AUD ~444 Mn in FY 2018.

Amidst the stagnant growth of macroeconomic indicators, the company has laid its roots through

technological advancements and rigorous expansion which has helped the company to grow by a

CAGR of ~17.11% during the period FY 2014-18, thereby beating the growth rate of Australia

consistently.

Furthermore, the revenues have grown by an annual growth rate of ~19.32%, outpacing its own

average benchmark growth rate of ~17.11% during the past five financial years. The prima facie

reason for this growth was the acquisition of SK encarsales.com and the division of International

business segment into Latin America and Asia, of which Asia in its first year of divide completely

destroyed the numbers marked by Latin America being ~3.63 times more revenue providing

geography as compared with the former.

FY 2018 FY 2017 FY 2016 FY 2015

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

450,000

500,000

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

180,000

200,000

Revenues Vs Profit for the period (In AUD '000)

Revenues Profits

Source: Revenues vs Profits s(Carsales.com Ltd AR, 2014-18)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

On the Profit front, the company portrayed an even better performance as the profits increased by a

CAGR of ~18.25%, beating its average growth rate of revenues as mentioned above, which leads to

conclusive statement that Carsales.com have also optimised their operations amidst their expanding

operations. In absolute terms, the Profits from continuing operations have increased from AUD

~96.27 Mn in FY 2014 to AUD ~188.21 Mn in FY 2018.

However, the major chunk of this surge can be accredited to only a Y-o-Y increase being experienced

in FY 2018. In percentage terms, the profits grew ~66.53% on an annual basis in FY 2018, mainly

because of an abnormal gain on step acquisition of associate which amounted to AUD ~57.02 Mn.

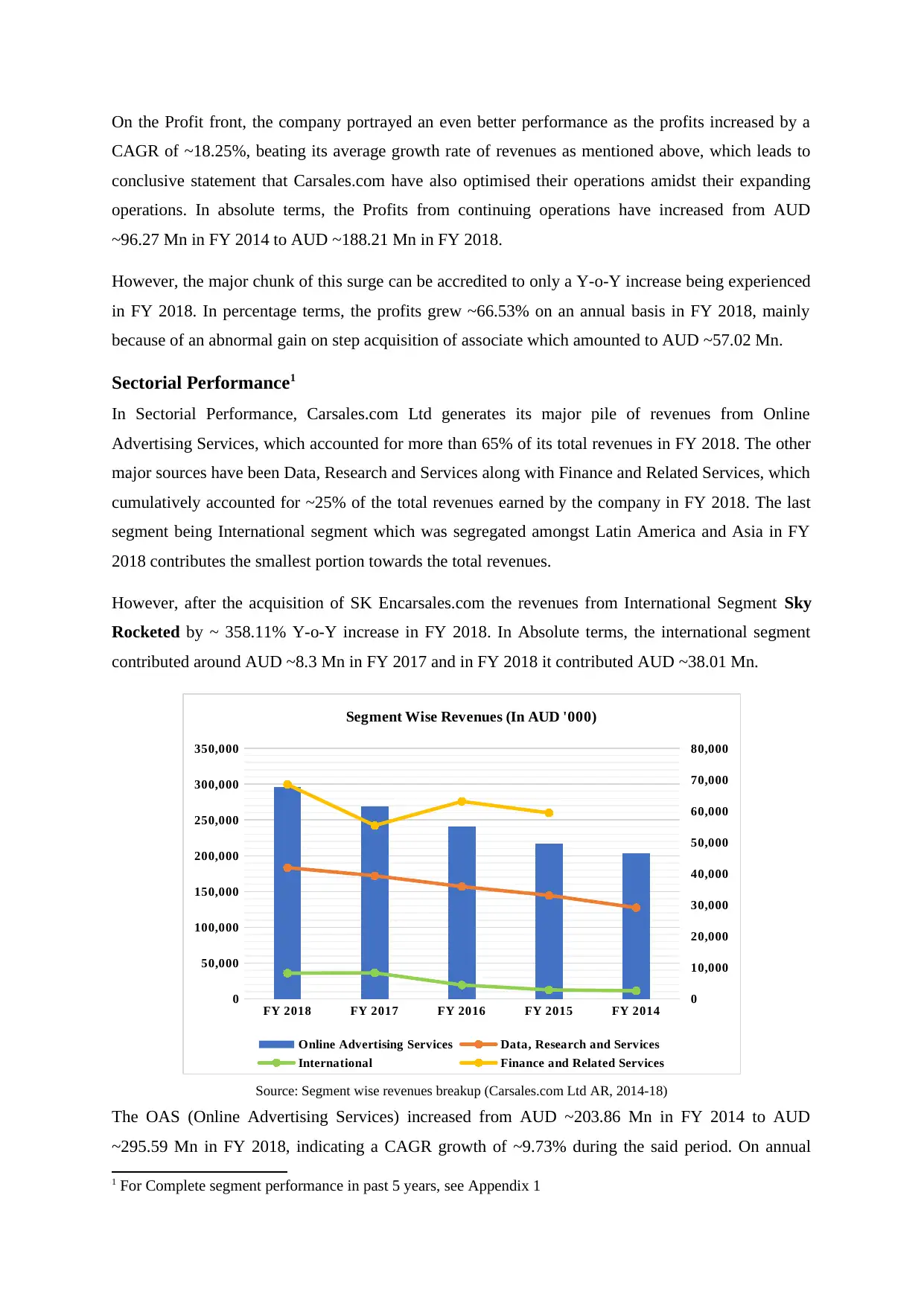

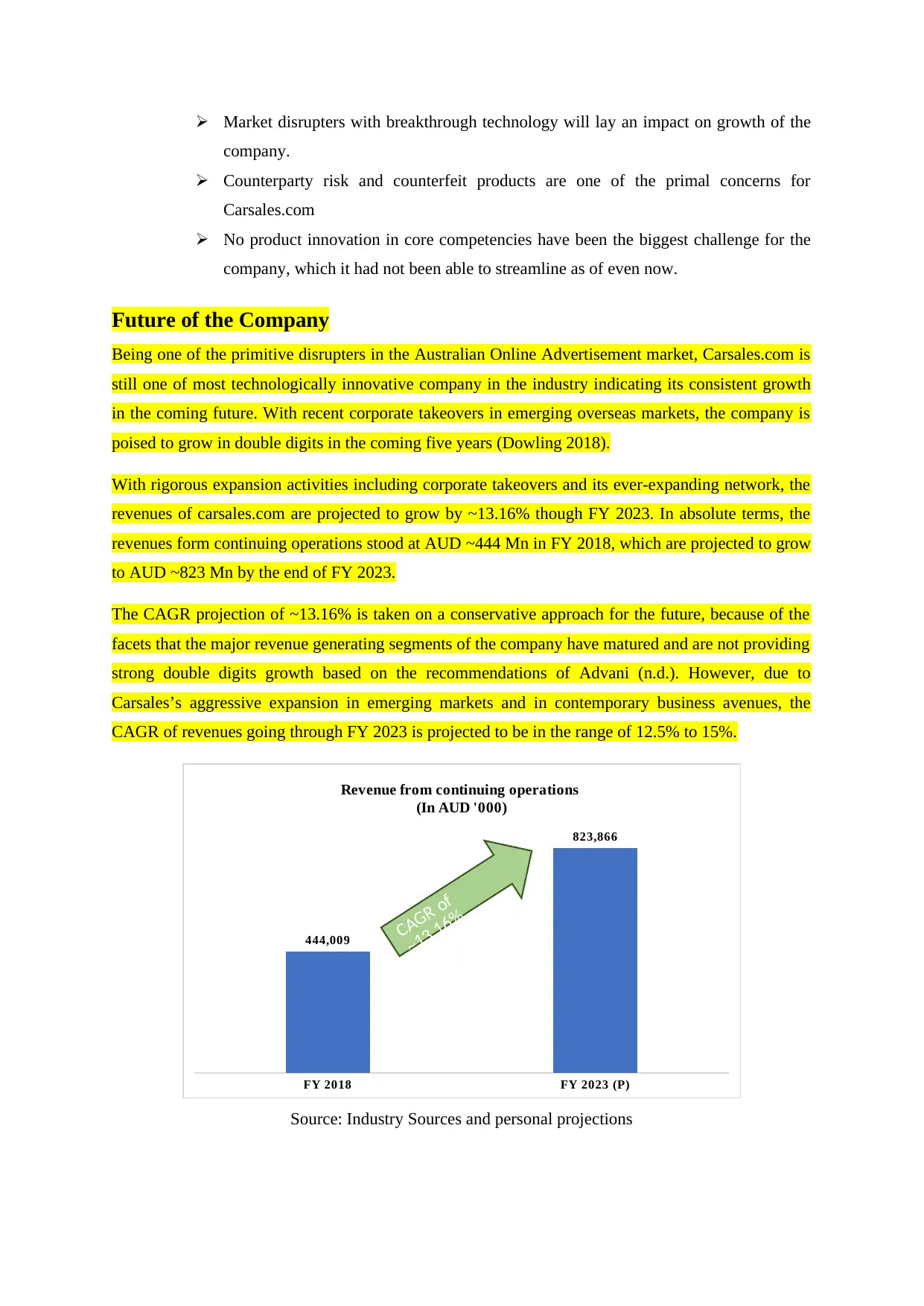

Sectorial Performance1

In Sectorial Performance, Carsales.com Ltd generates its major pile of revenues from Online

Advertising Services, which accounted for more than 65% of its total revenues in FY 2018. The other

major sources have been Data, Research and Services along with Finance and Related Services, which

cumulatively accounted for ~25% of the total revenues earned by the company in FY 2018. The last

segment being International segment which was segregated amongst Latin America and Asia in FY

2018 contributes the smallest portion towards the total revenues.

However, after the acquisition of SK Encarsales.com the revenues from International Segment Sky

Rocketed by ~ 358.11% Y-o-Y increase in FY 2018. In Absolute terms, the international segment

contributed around AUD ~8.3 Mn in FY 2017 and in FY 2018 it contributed AUD ~38.01 Mn.

FY 2018 FY 2017 FY 2016 FY 2015 FY 2014

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

Segment Wise Revenues (In AUD '000)

Online Advertising Services Data, Research and Services

International Finance and Related Services

Source: Segment wise revenues breakup (Carsales.com Ltd AR, 2014-18)

The OAS (Online Advertising Services) increased from AUD ~203.86 Mn in FY 2014 to AUD

~295.59 Mn in FY 2018, indicating a CAGR growth of ~9.73% during the said period. On annual

1 For Complete segment performance in past 5 years, see Appendix 1

CAGR of ~18.25%, beating its average growth rate of revenues as mentioned above, which leads to

conclusive statement that Carsales.com have also optimised their operations amidst their expanding

operations. In absolute terms, the Profits from continuing operations have increased from AUD

~96.27 Mn in FY 2014 to AUD ~188.21 Mn in FY 2018.

However, the major chunk of this surge can be accredited to only a Y-o-Y increase being experienced

in FY 2018. In percentage terms, the profits grew ~66.53% on an annual basis in FY 2018, mainly

because of an abnormal gain on step acquisition of associate which amounted to AUD ~57.02 Mn.

Sectorial Performance1

In Sectorial Performance, Carsales.com Ltd generates its major pile of revenues from Online

Advertising Services, which accounted for more than 65% of its total revenues in FY 2018. The other

major sources have been Data, Research and Services along with Finance and Related Services, which

cumulatively accounted for ~25% of the total revenues earned by the company in FY 2018. The last

segment being International segment which was segregated amongst Latin America and Asia in FY

2018 contributes the smallest portion towards the total revenues.

However, after the acquisition of SK Encarsales.com the revenues from International Segment Sky

Rocketed by ~ 358.11% Y-o-Y increase in FY 2018. In Absolute terms, the international segment

contributed around AUD ~8.3 Mn in FY 2017 and in FY 2018 it contributed AUD ~38.01 Mn.

FY 2018 FY 2017 FY 2016 FY 2015 FY 2014

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

Segment Wise Revenues (In AUD '000)

Online Advertising Services Data, Research and Services

International Finance and Related Services

Source: Segment wise revenues breakup (Carsales.com Ltd AR, 2014-18)

The OAS (Online Advertising Services) increased from AUD ~203.86 Mn in FY 2014 to AUD

~295.59 Mn in FY 2018, indicating a CAGR growth of ~9.73% during the said period. On annual

1 For Complete segment performance in past 5 years, see Appendix 1

basis, the growth was in in-line with the average growth, only a marginal increase was experienced at

~9.83%. The aforementioned Y-o-Y growth indicates that the segment has matured and is currently

acting as a cash cow for the company, therefore the company should look for alternative investments

the this point on.

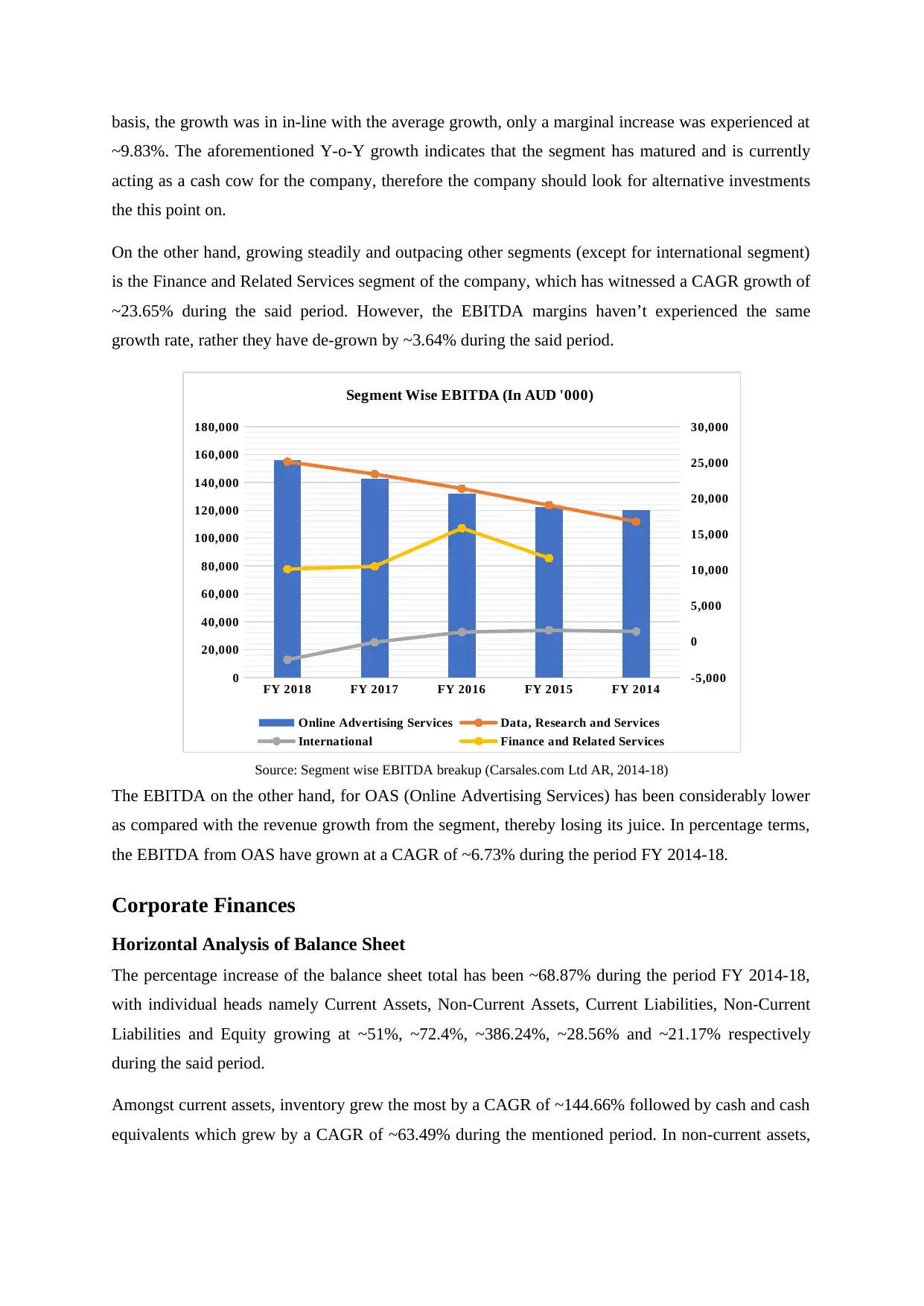

On the other hand, growing steadily and outpacing other segments (except for international segment)

is the Finance and Related Services segment of the company, which has witnessed a CAGR growth of

~23.65% during the said period. However, the EBITDA margins haven’t experienced the same

growth rate, rather they have de-grown by ~3.64% during the said period.

FY 2018 FY 2017 FY 2016 FY 2015 FY 2014

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

180,000

-5,000

0

5,000

10,000

15,000

20,000

25,000

30,000

Segment Wise EBITDA (In AUD '000)

Online Advertising Services Data, Research and Services

International Finance and Related Services

Source: Segment wise EBITDA breakup (Carsales.com Ltd AR, 2014-18)

The EBITDA on the other hand, for OAS (Online Advertising Services) has been considerably lower

as compared with the revenue growth from the segment, thereby losing its juice. In percentage terms,

the EBITDA from OAS have grown at a CAGR of ~6.73% during the period FY 2014-18.

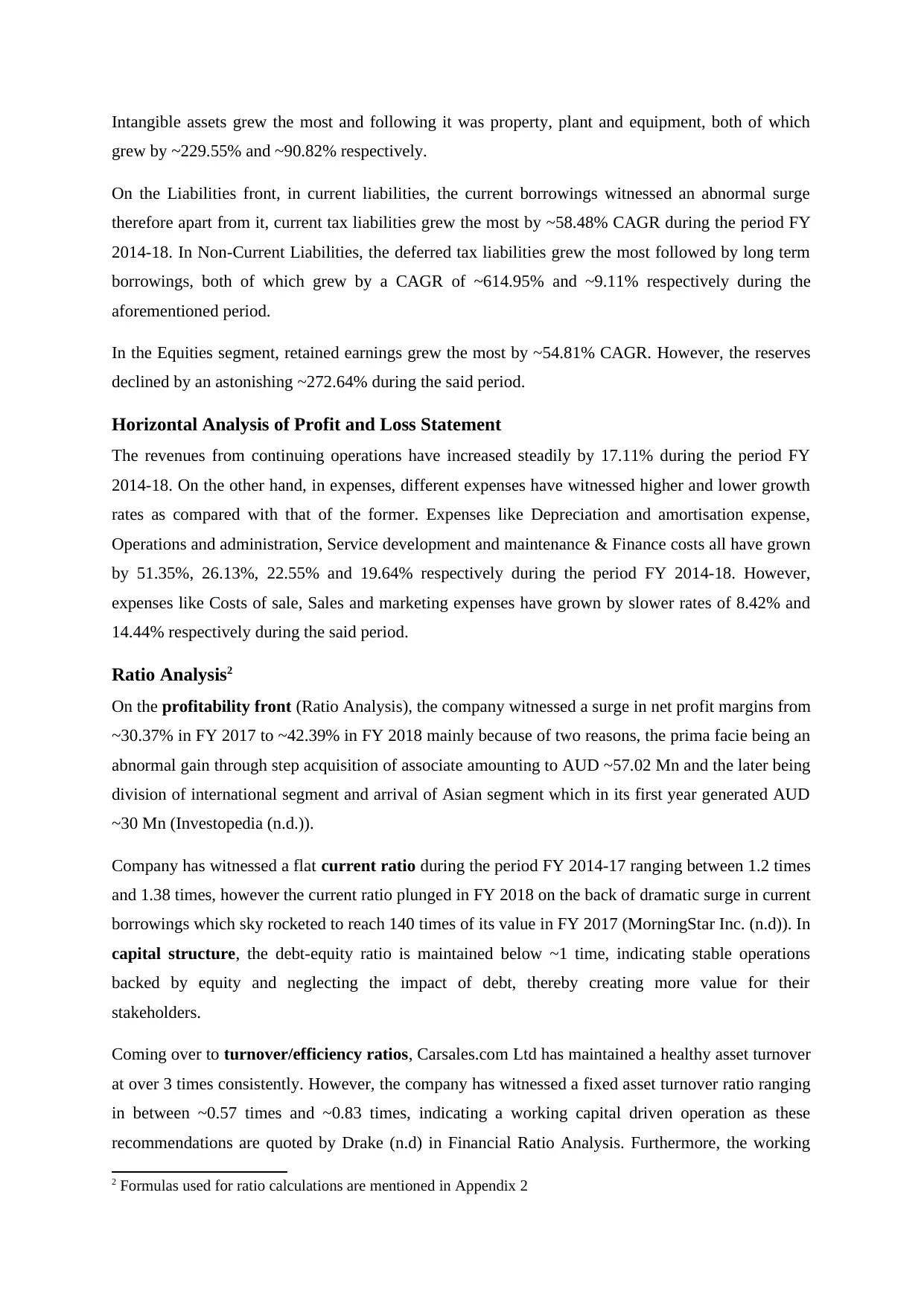

Corporate Finances

Horizontal Analysis of Balance Sheet

The percentage increase of the balance sheet total has been ~68.87% during the period FY 2014-18,

with individual heads namely Current Assets, Non-Current Assets, Current Liabilities, Non-Current

Liabilities and Equity growing at ~51%, ~72.4%, ~386.24%, ~28.56% and ~21.17% respectively

during the said period.

Amongst current assets, inventory grew the most by a CAGR of ~144.66% followed by cash and cash

equivalents which grew by a CAGR of ~63.49% during the mentioned period. In non-current assets,

~9.83%. The aforementioned Y-o-Y growth indicates that the segment has matured and is currently

acting as a cash cow for the company, therefore the company should look for alternative investments

the this point on.

On the other hand, growing steadily and outpacing other segments (except for international segment)

is the Finance and Related Services segment of the company, which has witnessed a CAGR growth of

~23.65% during the said period. However, the EBITDA margins haven’t experienced the same

growth rate, rather they have de-grown by ~3.64% during the said period.

FY 2018 FY 2017 FY 2016 FY 2015 FY 2014

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

180,000

-5,000

0

5,000

10,000

15,000

20,000

25,000

30,000

Segment Wise EBITDA (In AUD '000)

Online Advertising Services Data, Research and Services

International Finance and Related Services

Source: Segment wise EBITDA breakup (Carsales.com Ltd AR, 2014-18)

The EBITDA on the other hand, for OAS (Online Advertising Services) has been considerably lower

as compared with the revenue growth from the segment, thereby losing its juice. In percentage terms,

the EBITDA from OAS have grown at a CAGR of ~6.73% during the period FY 2014-18.

Corporate Finances

Horizontal Analysis of Balance Sheet

The percentage increase of the balance sheet total has been ~68.87% during the period FY 2014-18,

with individual heads namely Current Assets, Non-Current Assets, Current Liabilities, Non-Current

Liabilities and Equity growing at ~51%, ~72.4%, ~386.24%, ~28.56% and ~21.17% respectively

during the said period.

Amongst current assets, inventory grew the most by a CAGR of ~144.66% followed by cash and cash

equivalents which grew by a CAGR of ~63.49% during the mentioned period. In non-current assets,

Intangible assets grew the most and following it was property, plant and equipment, both of which

grew by ~229.55% and ~90.82% respectively.

On the Liabilities front, in current liabilities, the current borrowings witnessed an abnormal surge

therefore apart from it, current tax liabilities grew the most by ~58.48% CAGR during the period FY

2014-18. In Non-Current Liabilities, the deferred tax liabilities grew the most followed by long term

borrowings, both of which grew by a CAGR of ~614.95% and ~9.11% respectively during the

aforementioned period.

In the Equities segment, retained earnings grew the most by ~54.81% CAGR. However, the reserves

declined by an astonishing ~272.64% during the said period.

Horizontal Analysis of Profit and Loss Statement

The revenues from continuing operations have increased steadily by 17.11% during the period FY

2014-18. On the other hand, in expenses, different expenses have witnessed higher and lower growth

rates as compared with that of the former. Expenses like Depreciation and amortisation expense,

Operations and administration, Service development and maintenance & Finance costs all have grown

by 51.35%, 26.13%, 22.55% and 19.64% respectively during the period FY 2014-18. However,

expenses like Costs of sale, Sales and marketing expenses have grown by slower rates of 8.42% and

14.44% respectively during the said period.

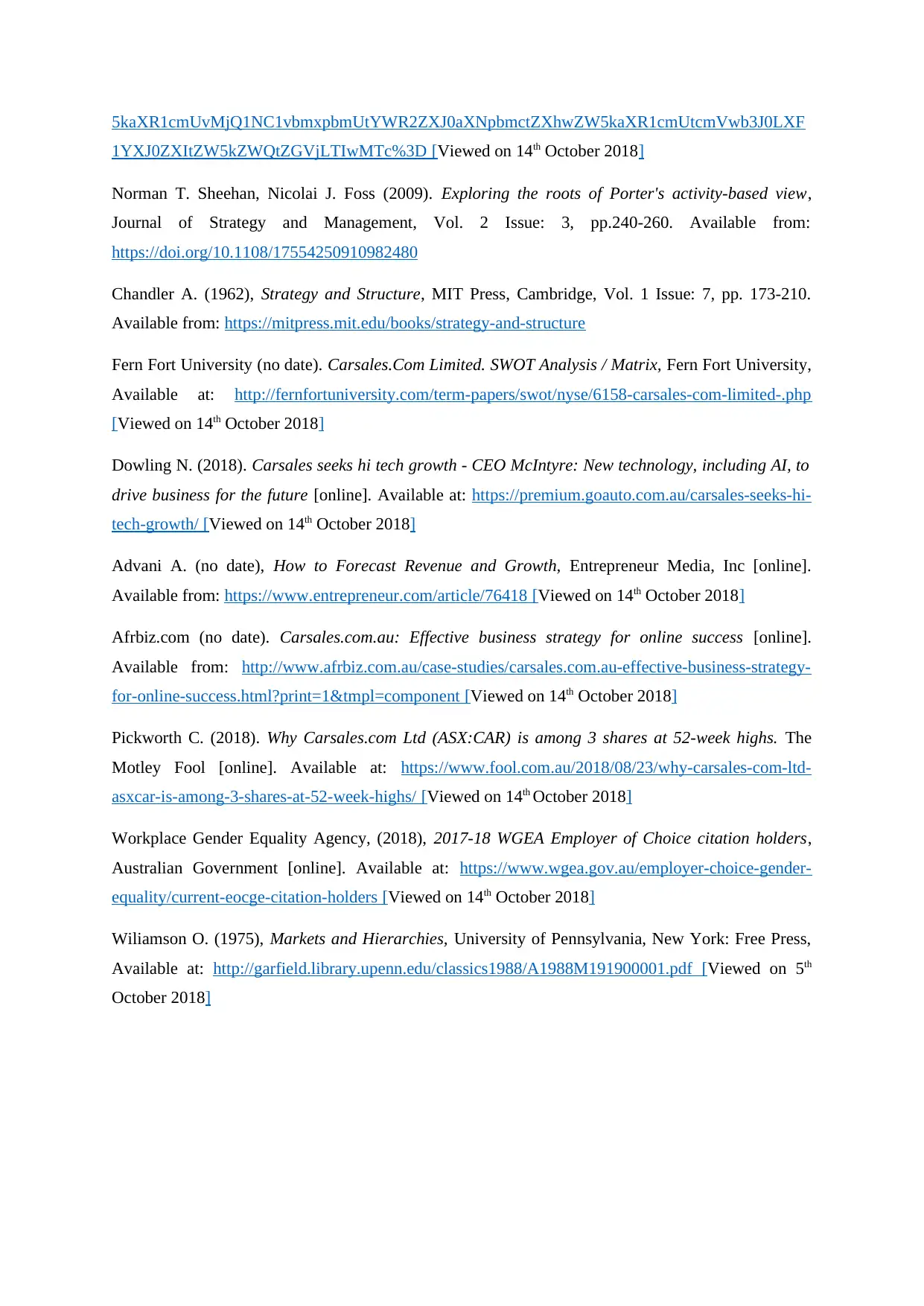

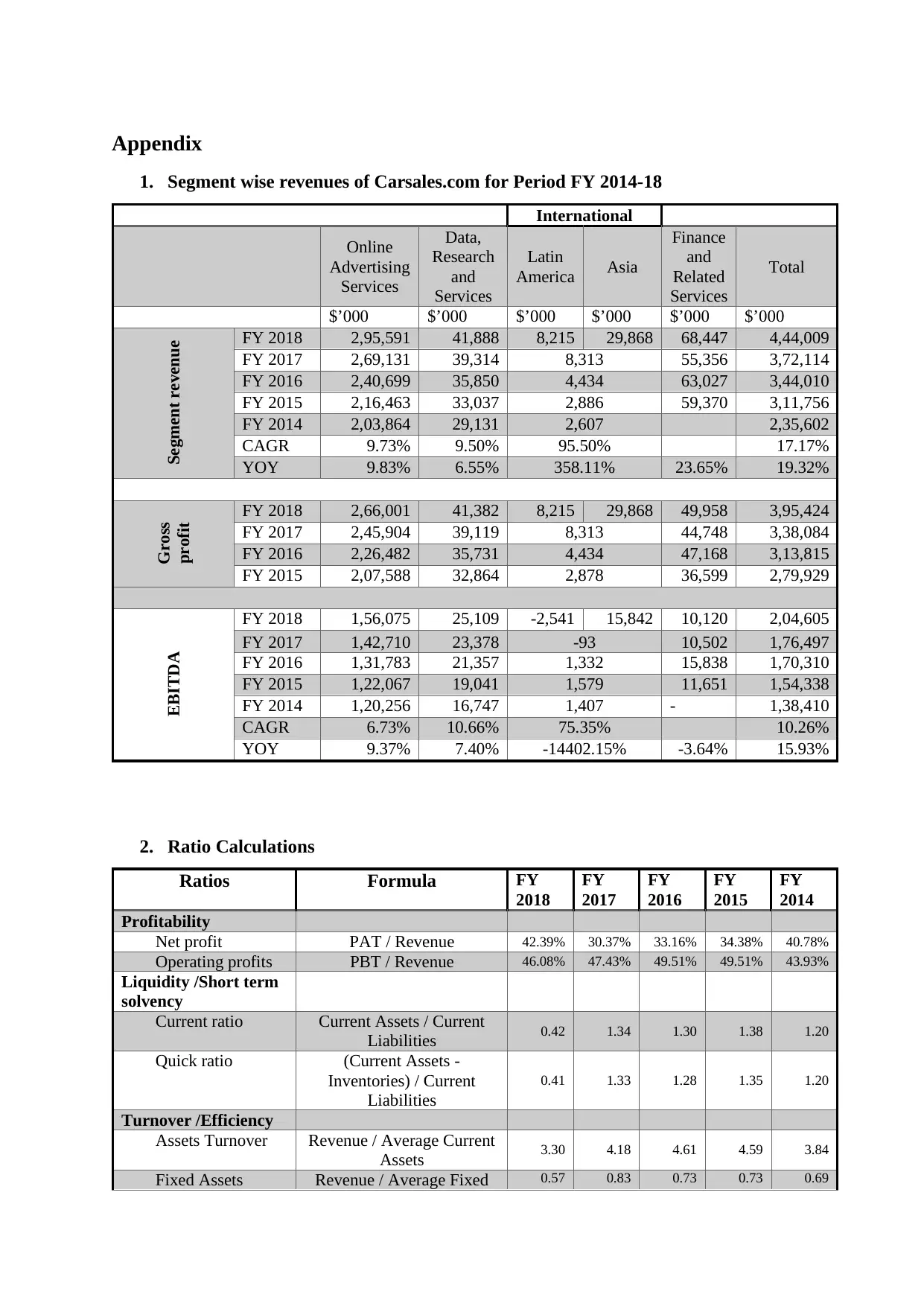

Ratio Analysis2

On the profitability front (Ratio Analysis), the company witnessed a surge in net profit margins from

~30.37% in FY 2017 to ~42.39% in FY 2018 mainly because of two reasons, the prima facie being an

abnormal gain through step acquisition of associate amounting to AUD ~57.02 Mn and the later being

division of international segment and arrival of Asian segment which in its first year generated AUD

~30 Mn (Investopedia (n.d.)).

Company has witnessed a flat current ratio during the period FY 2014-17 ranging between 1.2 times

and 1.38 times, however the current ratio plunged in FY 2018 on the back of dramatic surge in current

borrowings which sky rocketed to reach 140 times of its value in FY 2017 (MorningStar Inc. (n.d)). In

capital structure, the debt-equity ratio is maintained below ~1 time, indicating stable operations

backed by equity and neglecting the impact of debt, thereby creating more value for their

stakeholders.

Coming over to turnover/efficiency ratios, Carsales.com Ltd has maintained a healthy asset turnover

at over 3 times consistently. However, the company has witnessed a fixed asset turnover ratio ranging

in between ~0.57 times and ~0.83 times, indicating a working capital driven operation as these

recommendations are quoted by Drake (n.d) in Financial Ratio Analysis. Furthermore, the working

2 Formulas used for ratio calculations are mentioned in Appendix 2

grew by ~229.55% and ~90.82% respectively.

On the Liabilities front, in current liabilities, the current borrowings witnessed an abnormal surge

therefore apart from it, current tax liabilities grew the most by ~58.48% CAGR during the period FY

2014-18. In Non-Current Liabilities, the deferred tax liabilities grew the most followed by long term

borrowings, both of which grew by a CAGR of ~614.95% and ~9.11% respectively during the

aforementioned period.

In the Equities segment, retained earnings grew the most by ~54.81% CAGR. However, the reserves

declined by an astonishing ~272.64% during the said period.

Horizontal Analysis of Profit and Loss Statement

The revenues from continuing operations have increased steadily by 17.11% during the period FY

2014-18. On the other hand, in expenses, different expenses have witnessed higher and lower growth

rates as compared with that of the former. Expenses like Depreciation and amortisation expense,

Operations and administration, Service development and maintenance & Finance costs all have grown

by 51.35%, 26.13%, 22.55% and 19.64% respectively during the period FY 2014-18. However,

expenses like Costs of sale, Sales and marketing expenses have grown by slower rates of 8.42% and

14.44% respectively during the said period.

Ratio Analysis2

On the profitability front (Ratio Analysis), the company witnessed a surge in net profit margins from

~30.37% in FY 2017 to ~42.39% in FY 2018 mainly because of two reasons, the prima facie being an

abnormal gain through step acquisition of associate amounting to AUD ~57.02 Mn and the later being

division of international segment and arrival of Asian segment which in its first year generated AUD

~30 Mn (Investopedia (n.d.)).

Company has witnessed a flat current ratio during the period FY 2014-17 ranging between 1.2 times

and 1.38 times, however the current ratio plunged in FY 2018 on the back of dramatic surge in current

borrowings which sky rocketed to reach 140 times of its value in FY 2017 (MorningStar Inc. (n.d)). In

capital structure, the debt-equity ratio is maintained below ~1 time, indicating stable operations

backed by equity and neglecting the impact of debt, thereby creating more value for their

stakeholders.

Coming over to turnover/efficiency ratios, Carsales.com Ltd has maintained a healthy asset turnover

at over 3 times consistently. However, the company has witnessed a fixed asset turnover ratio ranging

in between ~0.57 times and ~0.83 times, indicating a working capital driven operation as these

recommendations are quoted by Drake (n.d) in Financial Ratio Analysis. Furthermore, the working

2 Formulas used for ratio calculations are mentioned in Appendix 2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

capital turnover has witnessed fluctuations during the past five years ranging from lows of FY 2018

at ~ -2.35 times and highs of ~23.28 times in FY 2014 (Wilkinson 2013), presently, in FY 2018 the

working capital turnover is pegged at ~ -2.35 times based on the propositions made my EduPrestine

(2014) in Ratio Analysis – Turnover Ratio.

In returns related ratios, the company’s returns on capital employed to its stakeholders has been

consistently above 20% and is ranging between ~ 22.16% being the lowest in FY 2015 and ~ 33.29%

being highest in FY 2018. However, the return on assets has been decreasing from 23.80% in FY

2014 to 20.67% in FY 2018.

The Du-Pont Analysis primarily considers three ratios for analysis namely, profitability, efficiency

and capital structure. In profitability front, the company witnessed a surge in net profit margins from

~30.37% in FY 2017 to ~42.39% in FY 2018.

The efficiency ratio, Carsales.com Ltd has maintained a healthy asset turnover at over 3 times

consistently. However, the company has witnessed a fixed asset turnover ratio ranging in between

~0.57 times and ~0.83 times, indicating a working capital driven operation. Lastly, the financial

leverage has been inconsistent during the said period ranging between 1.95 times to 2.71 times in FY

2017 to FY 2018 respectively (Isberg (n.d)).

Stock Market

As of 12th October 2018, the Carsales.com Ltd. Shares were trading at AUD 13.66 per share

(Australian Securities Exchange). In the period considered i.e. 12th October 2015 to 12th October 2018,

the price of CAR (ASX Symbol for Carsales.com Ltd) raised from AUD 9.82 per share to AUD 13.66

per share, witnessing an average growth of ~17.94% during the past 3 years. The corresponding P/E

ratio and Annual dividend yield as on 12th October 2018 were 17.9 and 3.24% respectively (ASX

Prices and Research, 2018).

Both basic and diluted earnings per share have increased from being at 45 cents in FY 2017 and FY

2016 to reach at a standpoint of 76 cents in FY 2018, indicating an annual growth of ~67.77%.

at ~ -2.35 times and highs of ~23.28 times in FY 2014 (Wilkinson 2013), presently, in FY 2018 the

working capital turnover is pegged at ~ -2.35 times based on the propositions made my EduPrestine

(2014) in Ratio Analysis – Turnover Ratio.

In returns related ratios, the company’s returns on capital employed to its stakeholders has been

consistently above 20% and is ranging between ~ 22.16% being the lowest in FY 2015 and ~ 33.29%

being highest in FY 2018. However, the return on assets has been decreasing from 23.80% in FY

2014 to 20.67% in FY 2018.

The Du-Pont Analysis primarily considers three ratios for analysis namely, profitability, efficiency

and capital structure. In profitability front, the company witnessed a surge in net profit margins from

~30.37% in FY 2017 to ~42.39% in FY 2018.

The efficiency ratio, Carsales.com Ltd has maintained a healthy asset turnover at over 3 times

consistently. However, the company has witnessed a fixed asset turnover ratio ranging in between

~0.57 times and ~0.83 times, indicating a working capital driven operation. Lastly, the financial

leverage has been inconsistent during the said period ranging between 1.95 times to 2.71 times in FY

2017 to FY 2018 respectively (Isberg (n.d)).

Stock Market

As of 12th October 2018, the Carsales.com Ltd. Shares were trading at AUD 13.66 per share

(Australian Securities Exchange). In the period considered i.e. 12th October 2015 to 12th October 2018,

the price of CAR (ASX Symbol for Carsales.com Ltd) raised from AUD 9.82 per share to AUD 13.66

per share, witnessing an average growth of ~17.94% during the past 3 years. The corresponding P/E

ratio and Annual dividend yield as on 12th October 2018 were 17.9 and 3.24% respectively (ASX

Prices and Research, 2018).

Both basic and diluted earnings per share have increased from being at 45 cents in FY 2017 and FY

2016 to reach at a standpoint of 76 cents in FY 2018, indicating an annual growth of ~67.77%.

Source: Stock Price Performance of CAR for past 3 YTD (ASX Charting, 2018)

Competitive Performance

Industry Overview

The Australian online advertisement industry is pegged at AUD ~7.9 Bn by the end of CY 2017,

increasing by ~7% on a Y-o-Y basis. In absolute terms, the total size of online advertisement industry

grew from AUD ~7.39 Bn in CY 2016 to AUD ~7.9 Bn in CY 2017 (Lim S., 2018).

The total market can be segregated into three segments namely, Search and Directories, Classifieds

and General Display. Out of three, Classified grew the most by ~15.2% followed by General Display

and Search & Directories which grew by ~6% and ~4.7% on Y-o-Y basis in CY 2017 respectively

(IAB Australia, 2018).

Amongst the top advertisers by industry for display, Auto industry stood first followed by real estate

and retail industry which bagged second and third position respectively.

Carsales.com was amongst to top players to drive growth of classified advertising (Lim S., 2018).

Carsales.com SWOT Analysis:

SWOT analysis is a strategic analysis tool which analyses an entity’s Strengths (Porter 1980),

Weaknesses (Chandler 1962), Opportunities and Threats. It enables top management to devise

strategic goals and to take tactical approaches towards the same (Wiliamson 1975). The SWOT

analysis for Carsales.com is discussed as under (Fern Fort University (n.d.)):

Competitive Performance

Industry Overview

The Australian online advertisement industry is pegged at AUD ~7.9 Bn by the end of CY 2017,

increasing by ~7% on a Y-o-Y basis. In absolute terms, the total size of online advertisement industry

grew from AUD ~7.39 Bn in CY 2016 to AUD ~7.9 Bn in CY 2017 (Lim S., 2018).

The total market can be segregated into three segments namely, Search and Directories, Classifieds

and General Display. Out of three, Classified grew the most by ~15.2% followed by General Display

and Search & Directories which grew by ~6% and ~4.7% on Y-o-Y basis in CY 2017 respectively

(IAB Australia, 2018).

Amongst the top advertisers by industry for display, Auto industry stood first followed by real estate

and retail industry which bagged second and third position respectively.

Carsales.com was amongst to top players to drive growth of classified advertising (Lim S., 2018).

Carsales.com SWOT Analysis:

SWOT analysis is a strategic analysis tool which analyses an entity’s Strengths (Porter 1980),

Weaknesses (Chandler 1962), Opportunities and Threats. It enables top management to devise

strategic goals and to take tactical approaches towards the same (Wiliamson 1975). The SWOT

analysis for Carsales.com is discussed as under (Fern Fort University (n.d.)):

Strengths

The financial metric of ROCE (Returns on Capital Employed) has been quite healthy

for the organisation, with consistently breaching mark of 20%.

Applying automation and AI techniques to streamline its operations has immensely

helped the company to stay technologically advanced in the industry.

As per valuators, Carsales.com entails healthy free cash flows going forward.

Customer satisfaction has been one of the primal reasons which has led the company

to become industry leaders. Few snapshots of its customer support services are:

i. 92,717 phone calls answered

ii. 41,519 emails responded

iii. 88.4% average service level

iv. 80% customer satisfaction level

Weaknesses

The present business model is not compatible with expansionary visions and

strategies.

Lacking demand forecasting analytics which led to many missed opportunities as

compared to its industry peers. Due to which the company maintains huge levels of

inventory both in the house and in the channel.

Inability in tackling differences of work culture, which didn’t allowed company to

merge with prospective target companies in the past.

Restricted success for the network apart from its core competency i.e. Carsales.com

Opportunities

The green drive initiative by the government of Australia has led to an open window

opportunity for established players like Carsales.com to pounce on the procurement

of government contracts and tenders.

Matured player like Carsales.com possess tremendous amount of data, which can be

processed by Big Data Analytics to understand their customers better and to cater to

their needs better.

The deployment of new innovation and government's organized commerce

approaches has driven the organization to extend its horizons in developing

economies across the globe.

Threats

Due to consistent profitability, the industry has attracted many players and the

competition for survival has become intense in the recent years which has

deteriorated the margins of the players.

The financial metric of ROCE (Returns on Capital Employed) has been quite healthy

for the organisation, with consistently breaching mark of 20%.

Applying automation and AI techniques to streamline its operations has immensely

helped the company to stay technologically advanced in the industry.

As per valuators, Carsales.com entails healthy free cash flows going forward.

Customer satisfaction has been one of the primal reasons which has led the company

to become industry leaders. Few snapshots of its customer support services are:

i. 92,717 phone calls answered

ii. 41,519 emails responded

iii. 88.4% average service level

iv. 80% customer satisfaction level

Weaknesses

The present business model is not compatible with expansionary visions and

strategies.

Lacking demand forecasting analytics which led to many missed opportunities as

compared to its industry peers. Due to which the company maintains huge levels of

inventory both in the house and in the channel.

Inability in tackling differences of work culture, which didn’t allowed company to

merge with prospective target companies in the past.

Restricted success for the network apart from its core competency i.e. Carsales.com

Opportunities

The green drive initiative by the government of Australia has led to an open window

opportunity for established players like Carsales.com to pounce on the procurement

of government contracts and tenders.

Matured player like Carsales.com possess tremendous amount of data, which can be

processed by Big Data Analytics to understand their customers better and to cater to

their needs better.

The deployment of new innovation and government's organized commerce

approaches has driven the organization to extend its horizons in developing

economies across the globe.

Threats

Due to consistent profitability, the industry has attracted many players and the

competition for survival has become intense in the recent years which has

deteriorated the margins of the players.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Market disrupters with breakthrough technology will lay an impact on growth of the

company.

Counterparty risk and counterfeit products are one of the primal concerns for

Carsales.com

No product innovation in core competencies have been the biggest challenge for the

company, which it had not been able to streamline as of even now.

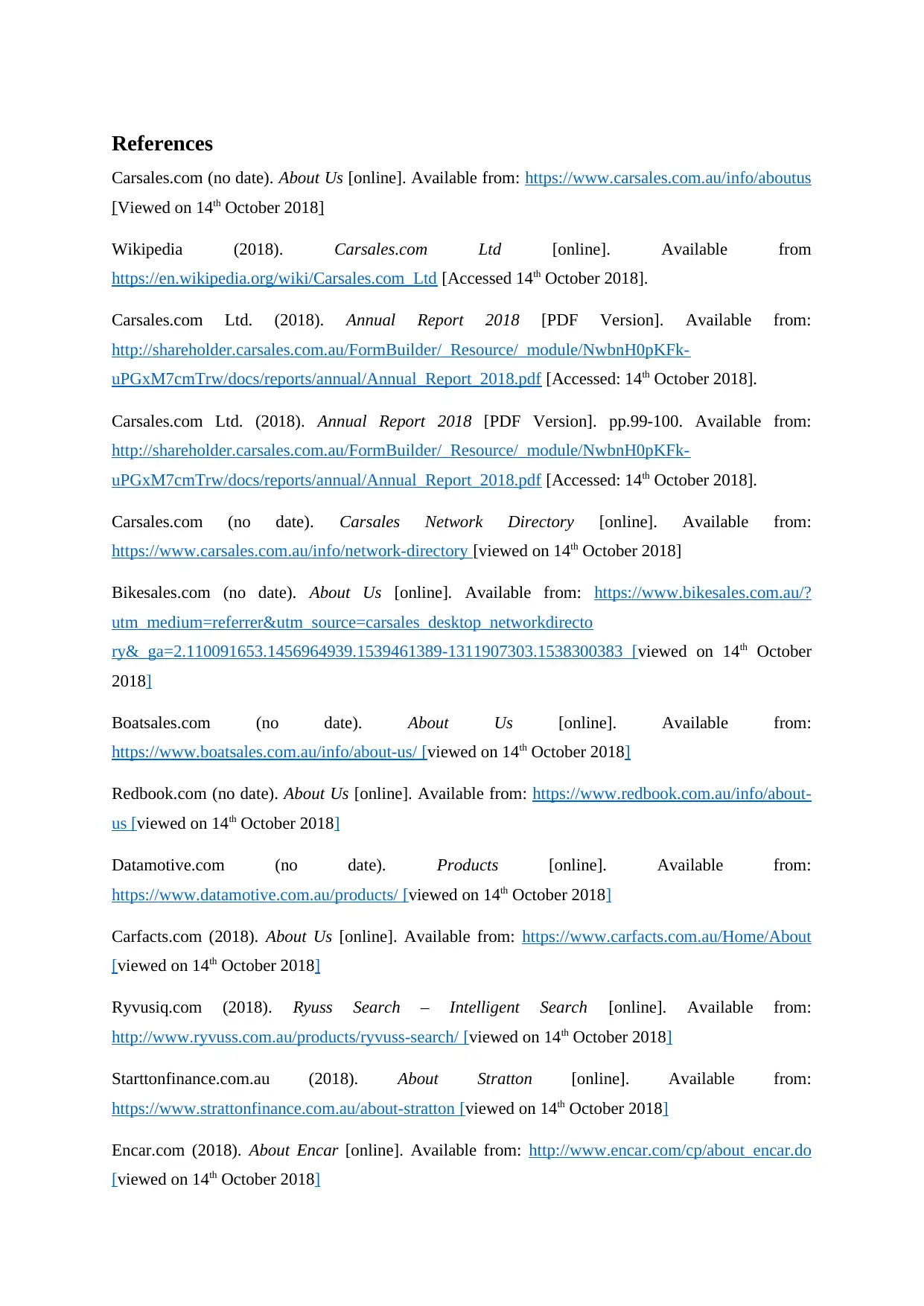

Future of the Company

Being one of the primitive disrupters in the Australian Online Advertisement market, Carsales.com is

still one of most technologically innovative company in the industry indicating its consistent growth

in the coming future. With recent corporate takeovers in emerging overseas markets, the company is

poised to grow in double digits in the coming five years (Dowling 2018).

With rigorous expansion activities including corporate takeovers and its ever-expanding network, the

revenues of carsales.com are projected to grow by ~13.16% though FY 2023. In absolute terms, the

revenues form continuing operations stood at AUD ~444 Mn in FY 2018, which are projected to grow

to AUD ~823 Mn by the end of FY 2023.

The CAGR projection of ~13.16% is taken on a conservative approach for the future, because of the

facets that the major revenue generating segments of the company have matured and are not providing

strong double digits growth based on the recommendations of Advani (n.d.). However, due to

Carsales’s aggressive expansion in emerging markets and in contemporary business avenues, the

CAGR of revenues going through FY 2023 is projected to be in the range of 12.5% to 15%.

FY 2023 (P)FY 2018

823,866

444,009

Revenue from continuing operations

(In AUD '000)

CAGR of

~13.16%

Source: Industry Sources and personal projections

company.

Counterparty risk and counterfeit products are one of the primal concerns for

Carsales.com

No product innovation in core competencies have been the biggest challenge for the

company, which it had not been able to streamline as of even now.

Future of the Company

Being one of the primitive disrupters in the Australian Online Advertisement market, Carsales.com is

still one of most technologically innovative company in the industry indicating its consistent growth

in the coming future. With recent corporate takeovers in emerging overseas markets, the company is

poised to grow in double digits in the coming five years (Dowling 2018).

With rigorous expansion activities including corporate takeovers and its ever-expanding network, the

revenues of carsales.com are projected to grow by ~13.16% though FY 2023. In absolute terms, the

revenues form continuing operations stood at AUD ~444 Mn in FY 2018, which are projected to grow

to AUD ~823 Mn by the end of FY 2023.

The CAGR projection of ~13.16% is taken on a conservative approach for the future, because of the

facets that the major revenue generating segments of the company have matured and are not providing

strong double digits growth based on the recommendations of Advani (n.d.). However, due to

Carsales’s aggressive expansion in emerging markets and in contemporary business avenues, the

CAGR of revenues going through FY 2023 is projected to be in the range of 12.5% to 15%.

FY 2023 (P)FY 2018

823,866

444,009

Revenue from continuing operations

(In AUD '000)

CAGR of

~13.16%

Source: Industry Sources and personal projections

Business Community Perceptions

Since its very inception till now, Carsales.com has consistently maintained its image of a dynamic and

rapidly growing organisation (Afrbiz (n.d)). Recently in Aug’ 2018, Carsales.com’s stocks were

amongst the top 3 shares which were at 52-weeks high, the primal reason being announcement of a

jump of key financial metrics in its FY 2018 released profits for the period which witnessed an almost

70% surge on a Y-o-Y basis (Pickworth, 2018).

On the other hand, the company has been doing wonders in its people’s operations in FY 2018, with

the brand grabbing several awards and recognitions. In FY 2018, carsales came up with technology

learning programs in order to bring the technology to the community namely, Kids Coding Camp

and Go4Tech. Furthermore, in order to create a level playing field for men and women alike, Carsales

have consistently maintained gender equality and has been reiterating on the notion, which resulted in

Carsales being recognised as the “Employer of Choice” by Workforce Gender Equality Agency

(WGEA) consistently since 2015 (WGEA 2018).

Since its very inception till now, Carsales.com has consistently maintained its image of a dynamic and

rapidly growing organisation (Afrbiz (n.d)). Recently in Aug’ 2018, Carsales.com’s stocks were

amongst the top 3 shares which were at 52-weeks high, the primal reason being announcement of a

jump of key financial metrics in its FY 2018 released profits for the period which witnessed an almost

70% surge on a Y-o-Y basis (Pickworth, 2018).

On the other hand, the company has been doing wonders in its people’s operations in FY 2018, with

the brand grabbing several awards and recognitions. In FY 2018, carsales came up with technology

learning programs in order to bring the technology to the community namely, Kids Coding Camp

and Go4Tech. Furthermore, in order to create a level playing field for men and women alike, Carsales

have consistently maintained gender equality and has been reiterating on the notion, which resulted in

Carsales being recognised as the “Employer of Choice” by Workforce Gender Equality Agency

(WGEA) consistently since 2015 (WGEA 2018).

References

Carsales.com (no date). About Us [online]. Available from: https://www.carsales.com.au/info/aboutus

[Viewed on 14th October 2018]

Wikipedia (2018). Carsales.com Ltd [online]. Available from

https://en.wikipedia.org/wiki/Carsales.com_Ltd [Accessed 14th October 2018].

Carsales.com Ltd. (2018). Annual Report 2018 [PDF Version]. Available from:

http://shareholder.carsales.com.au/FormBuilder/_Resource/_module/NwbnH0pKFk-

uPGxM7cmTrw/docs/reports/annual/Annual_Report_2018.pdf [Accessed: 14th October 2018].

Carsales.com Ltd. (2018). Annual Report 2018 [PDF Version]. pp.99-100. Available from:

http://shareholder.carsales.com.au/FormBuilder/_Resource/_module/NwbnH0pKFk-

uPGxM7cmTrw/docs/reports/annual/Annual_Report_2018.pdf [Accessed: 14th October 2018].

Carsales.com (no date). Carsales Network Directory [online]. Available from:

https://www.carsales.com.au/info/network-directory [viewed on 14th October 2018]

Bikesales.com (no date). About Us [online]. Available from: https://www.bikesales.com.au/?

utm_medium=referrer&utm_source=carsales_desktop_networkdirecto

ry&_ga=2.110091653.1456964939.1539461389-1311907303.1538300383 [viewed on 14th October

2018]

Boatsales.com (no date). About Us [online]. Available from:

https://www.boatsales.com.au/info/about-us/ [viewed on 14th October 2018]

Redbook.com (no date). About Us [online]. Available from: https://www.redbook.com.au/info/about-

us [viewed on 14th October 2018]

Datamotive.com (no date). Products [online]. Available from:

https://www.datamotive.com.au/products/ [viewed on 14th October 2018]

Carfacts.com (2018). About Us [online]. Available from: https://www.carfacts.com.au/Home/About

[viewed on 14th October 2018]

Ryvusiq.com (2018). Ryuss Search – Intelligent Search [online]. Available from:

http://www.ryvuss.com.au/products/ryvuss-search/ [viewed on 14th October 2018]

Starttonfinance.com.au (2018). About Stratton [online]. Available from:

https://www.strattonfinance.com.au/about-stratton [viewed on 14th October 2018]

Encar.com (2018). About Encar [online]. Available from: http://www.encar.com/cp/about_encar.do

[viewed on 14th October 2018]

Carsales.com (no date). About Us [online]. Available from: https://www.carsales.com.au/info/aboutus

[Viewed on 14th October 2018]

Wikipedia (2018). Carsales.com Ltd [online]. Available from

https://en.wikipedia.org/wiki/Carsales.com_Ltd [Accessed 14th October 2018].

Carsales.com Ltd. (2018). Annual Report 2018 [PDF Version]. Available from:

http://shareholder.carsales.com.au/FormBuilder/_Resource/_module/NwbnH0pKFk-

uPGxM7cmTrw/docs/reports/annual/Annual_Report_2018.pdf [Accessed: 14th October 2018].

Carsales.com Ltd. (2018). Annual Report 2018 [PDF Version]. pp.99-100. Available from:

http://shareholder.carsales.com.au/FormBuilder/_Resource/_module/NwbnH0pKFk-

uPGxM7cmTrw/docs/reports/annual/Annual_Report_2018.pdf [Accessed: 14th October 2018].

Carsales.com (no date). Carsales Network Directory [online]. Available from:

https://www.carsales.com.au/info/network-directory [viewed on 14th October 2018]

Bikesales.com (no date). About Us [online]. Available from: https://www.bikesales.com.au/?

utm_medium=referrer&utm_source=carsales_desktop_networkdirecto