Corporate Finance: Evaluating Exchange Rate Risk and Hedging Options

VerifiedAdded on 2023/05/30

|4

|1014

|276

Case Study

AI Summary

This case study delves into the concerns of Cain regarding the high fluctuation rate of the Canadian dollar and its impact on a U.S. purchase. It identifies the potential risks associated with waiting for the exchange rate to stabilize, including the possibility of price decrement. The study explores alternative solutions such as call options, put options, and hedging strategies to mitigate these risks. It further analyzes the impact of two hedging strategies versus an un-hedged position, concluding that a hedging strategy is the best choice to increase the stock return of the company and manage potential financial constraints. The analysis includes tables illustrating the potential outcomes of different strategies, providing a comprehensive evaluation of the financial implications.

1Running head: CASE STUDY 3433

Case Study 3433

Author’s Name

Institutional Affiliation

Case Study 3433

Author’s Name

Institutional Affiliation

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2CASE STUDY 3433

Case Study 3433

1. Current Exchange Rate Fluctuation

Based on the case scenario, it can be identified that the Cain is concerned regarding

the high fluctuation rate of the Canadian dollar. It has been observed that the CAD$ has

increased by 7% last month. Hence, the chance of increment exists in this scenario. For any

reason, this rate of stock increment price can be decreased. However, the rate will stabilize

again after a period of time. Based on the above information about US$ fluctuations, Cain at

least waits for a month. Hence, the risk of price decrement can be considered as a major issue

for Cain. Her position is for the long period of time, as it can help in generating the expected

profit from the U.S purchase. A chance of price increment also arises, wherein she has to be

more conscious about put and call option so that return can ensure the organizational cost of

US$7.5 million.

2. Alternative Solutions to the Problem

With intention of resolving the aforementioned issue, Cain may adopt call, put,

hedging strategies, and the un-hedged position strategies (Evans, 2011; Broll, Welzel, &

Wong, 2008): Based on the situation mentioned in the case, Cain must implement the call

option so that cost of the organization can be paid (Dejanovski, 2014). It has been observed

that the value of CAD$ has been increased and US$ has decreased. Hence, a high volume of

stock can be purchased at a low price and sell it at a higher price in January. With respect to

determine alternative solutions, Cain can further implement the strategy of a call option for

US$7.5 million so that the organization can pay off reasonably. Besides, Cain can also adopt

hedging strategies or the un-hedged position, which can also help in increasing her

company’s sales.

3. Impact of the Two Hedging Strategies

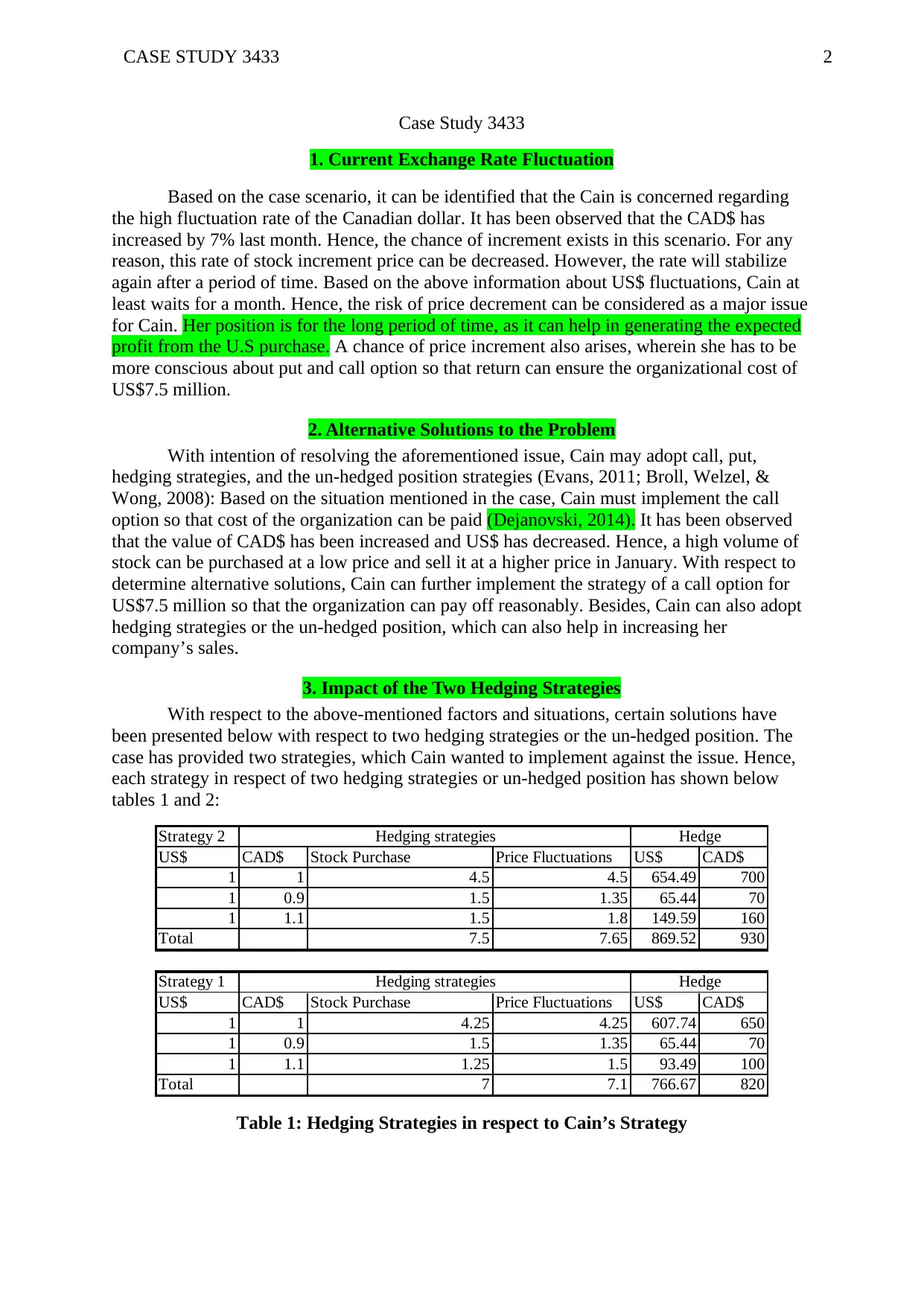

With respect to the above-mentioned factors and situations, certain solutions have

been presented below with respect to two hedging strategies or the un-hedged position. The

case has provided two strategies, which Cain wanted to implement against the issue. Hence,

each strategy in respect of two hedging strategies or un-hedged position has shown below

tables 1 and 2:

Strategy 2

US$ CAD$ Stock Purchase Price Fluctuations US$ CAD$

1 1 4.5 4.5 654.49 700

1 0.9 1.5 1.35 65.44 70

1 1.1 1.5 1.8 149.59 160

Total 7.5 7.65 869.52 930

Strategy 1

US$ CAD$ Stock Purchase Price Fluctuations US$ CAD$

1 1 4.25 4.25 607.74 650

1 0.9 1.5 1.35 65.44 70

1 1.1 1.25 1.5 93.49 100

Total 7 7.1 766.67 820

HedgeHedging strategies

Hedging strategies Hedge

Table 1: Hedging Strategies in respect to Cain’s Strategy

Case Study 3433

1. Current Exchange Rate Fluctuation

Based on the case scenario, it can be identified that the Cain is concerned regarding

the high fluctuation rate of the Canadian dollar. It has been observed that the CAD$ has

increased by 7% last month. Hence, the chance of increment exists in this scenario. For any

reason, this rate of stock increment price can be decreased. However, the rate will stabilize

again after a period of time. Based on the above information about US$ fluctuations, Cain at

least waits for a month. Hence, the risk of price decrement can be considered as a major issue

for Cain. Her position is for the long period of time, as it can help in generating the expected

profit from the U.S purchase. A chance of price increment also arises, wherein she has to be

more conscious about put and call option so that return can ensure the organizational cost of

US$7.5 million.

2. Alternative Solutions to the Problem

With intention of resolving the aforementioned issue, Cain may adopt call, put,

hedging strategies, and the un-hedged position strategies (Evans, 2011; Broll, Welzel, &

Wong, 2008): Based on the situation mentioned in the case, Cain must implement the call

option so that cost of the organization can be paid (Dejanovski, 2014). It has been observed

that the value of CAD$ has been increased and US$ has decreased. Hence, a high volume of

stock can be purchased at a low price and sell it at a higher price in January. With respect to

determine alternative solutions, Cain can further implement the strategy of a call option for

US$7.5 million so that the organization can pay off reasonably. Besides, Cain can also adopt

hedging strategies or the un-hedged position, which can also help in increasing her

company’s sales.

3. Impact of the Two Hedging Strategies

With respect to the above-mentioned factors and situations, certain solutions have

been presented below with respect to two hedging strategies or the un-hedged position. The

case has provided two strategies, which Cain wanted to implement against the issue. Hence,

each strategy in respect of two hedging strategies or un-hedged position has shown below

tables 1 and 2:

Strategy 2

US$ CAD$ Stock Purchase Price Fluctuations US$ CAD$

1 1 4.5 4.5 654.49 700

1 0.9 1.5 1.35 65.44 70

1 1.1 1.5 1.8 149.59 160

Total 7.5 7.65 869.52 930

Strategy 1

US$ CAD$ Stock Purchase Price Fluctuations US$ CAD$

1 1 4.25 4.25 607.74 650

1 0.9 1.5 1.35 65.44 70

1 1.1 1.25 1.5 93.49 100

Total 7 7.1 766.67 820

HedgeHedging strategies

Hedging strategies Hedge

Table 1: Hedging Strategies in respect to Cain’s Strategy

3CASE STUDY 3433

Based on the above table 1, it has been identified that strategy two can be considered

to be more reasonable, as it provides more revenue as compared to the strategy 1. At the same

time, a rational hedge value can assist in preventing market risk.

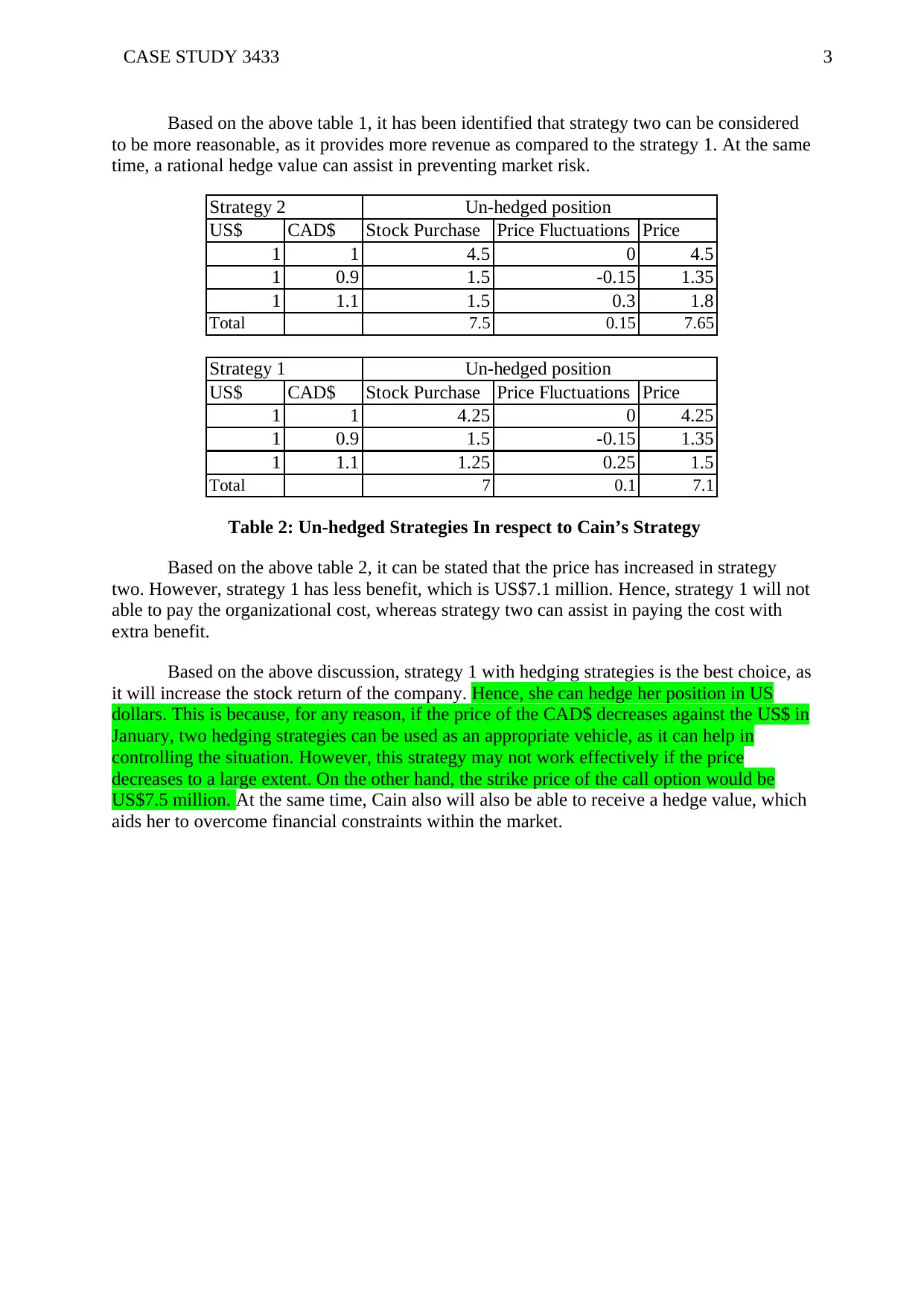

Strategy 2

US$ CAD$ Stock Purchase Price Fluctuations Price

1 1 4.5 0 4.5

1 0.9 1.5 -0.15 1.35

1 1.1 1.5 0.3 1.8

Total 7.5 0.15 7.65

Strategy 1

US$ CAD$ Stock Purchase Price Fluctuations Price

1 1 4.25 0 4.25

1 0.9 1.5 -0.15 1.35

1 1.1 1.25 0.25 1.5

Total 7 0.1 7.1

Un-hedged position

Un-hedged position

Table 2: Un-hedged Strategies In respect to Cain’s Strategy

Based on the above table 2, it can be stated that the price has increased in strategy

two. However, strategy 1 has less benefit, which is US$7.1 million. Hence, strategy 1 will not

able to pay the organizational cost, whereas strategy two can assist in paying the cost with

extra benefit.

Based on the above discussion, strategy 1 with hedging strategies is the best choice, as

it will increase the stock return of the company. Hence, she can hedge her position in US

dollars. This is because, for any reason, if the price of the CAD$ decreases against the US$ in

January, two hedging strategies can be used as an appropriate vehicle, as it can help in

controlling the situation. However, this strategy may not work effectively if the price

decreases to a large extent. On the other hand, the strike price of the call option would be

US$7.5 million. At the same time, Cain also will also be able to receive a hedge value, which

aids her to overcome financial constraints within the market.

Based on the above table 1, it has been identified that strategy two can be considered

to be more reasonable, as it provides more revenue as compared to the strategy 1. At the same

time, a rational hedge value can assist in preventing market risk.

Strategy 2

US$ CAD$ Stock Purchase Price Fluctuations Price

1 1 4.5 0 4.5

1 0.9 1.5 -0.15 1.35

1 1.1 1.5 0.3 1.8

Total 7.5 0.15 7.65

Strategy 1

US$ CAD$ Stock Purchase Price Fluctuations Price

1 1 4.25 0 4.25

1 0.9 1.5 -0.15 1.35

1 1.1 1.25 0.25 1.5

Total 7 0.1 7.1

Un-hedged position

Un-hedged position

Table 2: Un-hedged Strategies In respect to Cain’s Strategy

Based on the above table 2, it can be stated that the price has increased in strategy

two. However, strategy 1 has less benefit, which is US$7.1 million. Hence, strategy 1 will not

able to pay the organizational cost, whereas strategy two can assist in paying the cost with

extra benefit.

Based on the above discussion, strategy 1 with hedging strategies is the best choice, as

it will increase the stock return of the company. Hence, she can hedge her position in US

dollars. This is because, for any reason, if the price of the CAD$ decreases against the US$ in

January, two hedging strategies can be used as an appropriate vehicle, as it can help in

controlling the situation. However, this strategy may not work effectively if the price

decreases to a large extent. On the other hand, the strike price of the call option would be

US$7.5 million. At the same time, Cain also will also be able to receive a hedge value, which

aids her to overcome financial constraints within the market.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4CASE STUDY 3433

References

Bhuyan, R. & Chaudhury, M. (2005). Trading on the information content of open interest:

Evidence from the US equity options market. Derivative. USA, Trading & Rogulo, 11

(2), 16-36.

Broll, U., Welzel, P. & Wong, K.P. (2008). Export and strategic currency hedging. Retrieved

November 24, 2018, from http://citeseerx.ist.psu.edu/viewdoc/download?

doi=10.1.1.532.6837&rep=rep1&type=pdf

Dejanovski, A. (2014). The role and importance of the options as a unstandardized financial

derivatives. TEM Journal, 3(1), 81-87.

Evans, G.R. (2011). Put and call options. Retrieved November 24, 2018, from

http://pages.hmc.edu/evans/ch7options.pdf

References

Bhuyan, R. & Chaudhury, M. (2005). Trading on the information content of open interest:

Evidence from the US equity options market. Derivative. USA, Trading & Rogulo, 11

(2), 16-36.

Broll, U., Welzel, P. & Wong, K.P. (2008). Export and strategic currency hedging. Retrieved

November 24, 2018, from http://citeseerx.ist.psu.edu/viewdoc/download?

doi=10.1.1.532.6837&rep=rep1&type=pdf

Dejanovski, A. (2014). The role and importance of the options as a unstandardized financial

derivatives. TEM Journal, 3(1), 81-87.

Evans, G.R. (2011). Put and call options. Retrieved November 24, 2018, from

http://pages.hmc.edu/evans/ch7options.pdf

1 out of 4

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.