Finance Assignment: Cost of Capital and IPO Analysis (AES & Netscape)

VerifiedAdded on 2022/12/27

|22

|6645

|47

Case Study

AI Summary

This assignment analyzes two case studies in international finance: AES and Netscape. The AES case examines risk factors in developing markets (currency devaluation, regulatory changes, and commodity price declines), capital budgeting techniques, WACC calculation (including sovereign and unsystematic risk adjustments), and the consequences of inaccurate cost of capital methodologies. The Netscape case explores the rationale behind its high valuation during its IPO, the advantages and disadvantages of going public, the IPO process, the features of preferred and common stocks, and the implications of increasing the offer price. The assignment provides calculations and explanations based on the case data and addresses key concepts in international finance, risk management, and valuation.

CASES IN FINANCE ASSIGNMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance

Executive Summary

International finance has assumed a place of special importance because a company needs to

undergo many concepts in the normal course of business. When it comes to the performance

of the company various parameters is taken into consideration. In this report, two case studies

relating to international finance is being discussed. The first case sheds light on the concept

of cost of capital. The report initiates with the risk factors that are undertaken by AES. It is

then followed by the different mechanism of capital budgeting and the WACC of the

company is computed. Further, systematic and unsystematic risk is being discussed together.

Lastly, it comes to the forefront that AES has foreign expansions and therefore, the hurdle

rate matters a lot. If the wrong rate is computed or mechanism is wrong then it will affect the

financial structure and will generate a wrong result for the business. The second case study is

about Netscape and the planning for IPO to raise more funds. The report initiates with the

reason of why a loss of making the new company is hitting a high valuation scene and the

result is owing to the fundamentals of the company. further, matters relating to the pros and

cons of IPO and the general process of IPO is being described. Lastly, the risk and reward of

increasing the offer price if being discussed in the light of Netscape. Ideally, the report

balances two parts that are the cost of capital and IPO in the domain of international business.

2

Executive Summary

International finance has assumed a place of special importance because a company needs to

undergo many concepts in the normal course of business. When it comes to the performance

of the company various parameters is taken into consideration. In this report, two case studies

relating to international finance is being discussed. The first case sheds light on the concept

of cost of capital. The report initiates with the risk factors that are undertaken by AES. It is

then followed by the different mechanism of capital budgeting and the WACC of the

company is computed. Further, systematic and unsystematic risk is being discussed together.

Lastly, it comes to the forefront that AES has foreign expansions and therefore, the hurdle

rate matters a lot. If the wrong rate is computed or mechanism is wrong then it will affect the

financial structure and will generate a wrong result for the business. The second case study is

about Netscape and the planning for IPO to raise more funds. The report initiates with the

reason of why a loss of making the new company is hitting a high valuation scene and the

result is owing to the fundamentals of the company. further, matters relating to the pros and

cons of IPO and the general process of IPO is being described. Lastly, the risk and reward of

increasing the offer price if being discussed in the light of Netscape. Ideally, the report

balances two parts that are the cost of capital and IPO in the domain of international business.

2

Finance

Contents

Introduction...........................................................................................................................................4

Part A - Case: Globalizing the Cost of Capital and Capital Budgeting at AES......................................4

1. Risk factors that AES had come across in developing markets and factors that influence the

company................................................................................................................................................4

2. Utilization of different capital budgeting techniques......................................................................5

3. Computation of WACC.....................................................................................................................6

4. Systematic and unsystematic risks.....................................................................................................9

5. Consequences of the wrong methodology of computing cost of capital on AES.............................10

Part B - Case: Netscape’s Initial Public Offering................................................................................11

1. Reason for higher valuation of Netscape.....................................................................................11

2. Advantage & disadvantage of going public..................................................................................12

3. Describe the general IPO process giving examples from Netscape’s IPO....................................13

4. Features and characteristics of preferred stocks and common stocks............................................14

5. Increment of the offer price for Netscape from $14 to $28 as suggested by the underwriters.......16

Conclusion...........................................................................................................................................18

References...........................................................................................................................................19

3

Contents

Introduction...........................................................................................................................................4

Part A - Case: Globalizing the Cost of Capital and Capital Budgeting at AES......................................4

1. Risk factors that AES had come across in developing markets and factors that influence the

company................................................................................................................................................4

2. Utilization of different capital budgeting techniques......................................................................5

3. Computation of WACC.....................................................................................................................6

4. Systematic and unsystematic risks.....................................................................................................9

5. Consequences of the wrong methodology of computing cost of capital on AES.............................10

Part B - Case: Netscape’s Initial Public Offering................................................................................11

1. Reason for higher valuation of Netscape.....................................................................................11

2. Advantage & disadvantage of going public..................................................................................12

3. Describe the general IPO process giving examples from Netscape’s IPO....................................13

4. Features and characteristics of preferred stocks and common stocks............................................14

5. Increment of the offer price for Netscape from $14 to $28 as suggested by the underwriters.......16

Conclusion...........................................................................................................................................18

References...........................................................................................................................................19

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Finance

Introduction

Companies, as well as investment funds, are riding on a huge sum of money and before it is

invested various factors is taken into consideration. The most important consideration is that

each company comprises its own cost of capital. In the report, the case study of AES will be

discussed in light of the cost of capital and capital budgeting. Secondly, IPO is a lucrative

option that provides a huge boost to the company because once listed the company attains

paramount goodwill and comes in the notice of the investors. In the second case, the case

study of Netscape is dealt with. The public issues and the related matter is vividly discussed

in the report. Hence, both the case studies shed light the concept of international finance such

as adverse regulatory changes and currency devaluation.

Part A - Case: Globalizing the Cost of Capital and Capital Budgeting at AES

1. Risk factors that AES had come across in developing markets and factors that

influence the company

Currency Devaluation

It was observed that Argentina was facing a political and economic crisis in the year 2001

because of which degradation of the South American currencies was observed against the US

dollar. Also, it was observed in December that the newly elected government abandoned the

markets fixed the dollar to Argentina-peso exchange rate and further also changed all the

loans taken in the form of US dollar into pesos. It was observed on the very first day of

trading that pesos lost 40% of its value against the US dollar acting as a floating currency. By

the end of the year, it was observed that the trading rate of the peso was 3.32 against the US

dollar. Earlier this rate has been as high as 3.9 pesos (Desai, 2006). The currencies in Brazil

and Venezuela very important for the Australian stock exchange market because they were

depreciating with the rate of 50% approximately against the US dollar in the same period.

Also, a loss in the foreign currency transactions worth 456 million dollars was observed in

the year 2002. Many subsidiaries in South America were observed to default their debt

obligations and also were forced to restructure so that they are not anymore connected to the

parent corporation. It was observed that the parent company suffered from shortfalls in cash

flow and also received dividend which was less than the actual budget. The degradation in the

value of the foreign currencies made the foreign businesses to pay the debt obligations in US

dollars (Desai, 2006).

4

Introduction

Companies, as well as investment funds, are riding on a huge sum of money and before it is

invested various factors is taken into consideration. The most important consideration is that

each company comprises its own cost of capital. In the report, the case study of AES will be

discussed in light of the cost of capital and capital budgeting. Secondly, IPO is a lucrative

option that provides a huge boost to the company because once listed the company attains

paramount goodwill and comes in the notice of the investors. In the second case, the case

study of Netscape is dealt with. The public issues and the related matter is vividly discussed

in the report. Hence, both the case studies shed light the concept of international finance such

as adverse regulatory changes and currency devaluation.

Part A - Case: Globalizing the Cost of Capital and Capital Budgeting at AES

1. Risk factors that AES had come across in developing markets and factors that

influence the company

Currency Devaluation

It was observed that Argentina was facing a political and economic crisis in the year 2001

because of which degradation of the South American currencies was observed against the US

dollar. Also, it was observed in December that the newly elected government abandoned the

markets fixed the dollar to Argentina-peso exchange rate and further also changed all the

loans taken in the form of US dollar into pesos. It was observed on the very first day of

trading that pesos lost 40% of its value against the US dollar acting as a floating currency. By

the end of the year, it was observed that the trading rate of the peso was 3.32 against the US

dollar. Earlier this rate has been as high as 3.9 pesos (Desai, 2006). The currencies in Brazil

and Venezuela very important for the Australian stock exchange market because they were

depreciating with the rate of 50% approximately against the US dollar in the same period.

Also, a loss in the foreign currency transactions worth 456 million dollars was observed in

the year 2002. Many subsidiaries in South America were observed to default their debt

obligations and also were forced to restructure so that they are not anymore connected to the

parent corporation. It was observed that the parent company suffered from shortfalls in cash

flow and also received dividend which was less than the actual budget. The degradation in the

value of the foreign currencies made the foreign businesses to pay the debt obligations in US

dollars (Desai, 2006).

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance

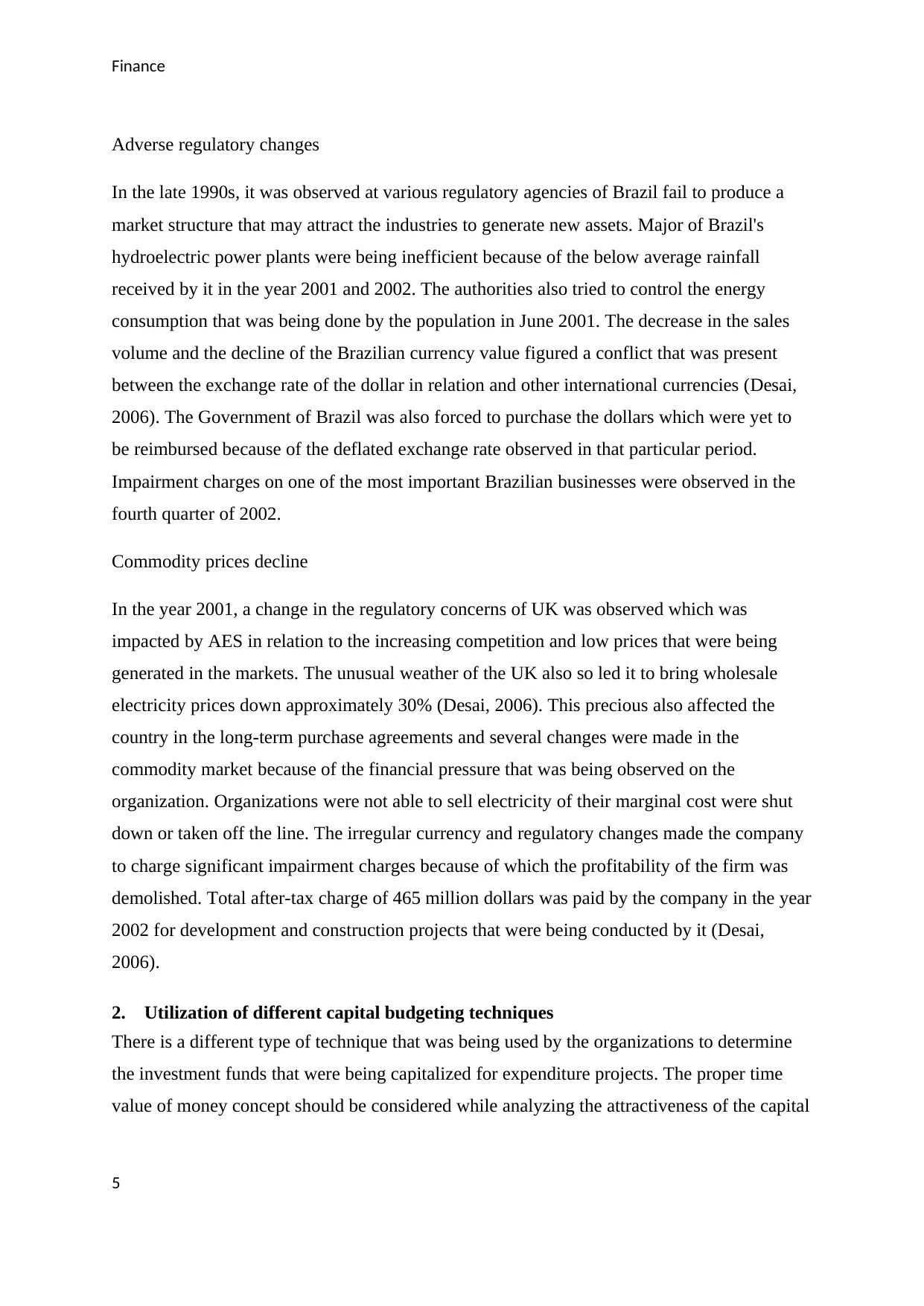

Adverse regulatory changes

In the late 1990s, it was observed at various regulatory agencies of Brazil fail to produce a

market structure that may attract the industries to generate new assets. Major of Brazil's

hydroelectric power plants were being inefficient because of the below average rainfall

received by it in the year 2001 and 2002. The authorities also tried to control the energy

consumption that was being done by the population in June 2001. The decrease in the sales

volume and the decline of the Brazilian currency value figured a conflict that was present

between the exchange rate of the dollar in relation and other international currencies (Desai,

2006). The Government of Brazil was also forced to purchase the dollars which were yet to

be reimbursed because of the deflated exchange rate observed in that particular period.

Impairment charges on one of the most important Brazilian businesses were observed in the

fourth quarter of 2002.

Commodity prices decline

In the year 2001, a change in the regulatory concerns of UK was observed which was

impacted by AES in relation to the increasing competition and low prices that were being

generated in the markets. The unusual weather of the UK also so led it to bring wholesale

electricity prices down approximately 30% (Desai, 2006). This precious also affected the

country in the long-term purchase agreements and several changes were made in the

commodity market because of the financial pressure that was being observed on the

organization. Organizations were not able to sell electricity of their marginal cost were shut

down or taken off the line. The irregular currency and regulatory changes made the company

to charge significant impairment charges because of which the profitability of the firm was

demolished. Total after-tax charge of 465 million dollars was paid by the company in the year

2002 for development and construction projects that were being conducted by it (Desai,

2006).

2. Utilization of different capital budgeting techniques

There is a different type of technique that was being used by the organizations to determine

the investment funds that were being capitalized for expenditure projects. The proper time

value of money concept should be considered while analyzing the attractiveness of the capital

5

Adverse regulatory changes

In the late 1990s, it was observed at various regulatory agencies of Brazil fail to produce a

market structure that may attract the industries to generate new assets. Major of Brazil's

hydroelectric power plants were being inefficient because of the below average rainfall

received by it in the year 2001 and 2002. The authorities also tried to control the energy

consumption that was being done by the population in June 2001. The decrease in the sales

volume and the decline of the Brazilian currency value figured a conflict that was present

between the exchange rate of the dollar in relation and other international currencies (Desai,

2006). The Government of Brazil was also forced to purchase the dollars which were yet to

be reimbursed because of the deflated exchange rate observed in that particular period.

Impairment charges on one of the most important Brazilian businesses were observed in the

fourth quarter of 2002.

Commodity prices decline

In the year 2001, a change in the regulatory concerns of UK was observed which was

impacted by AES in relation to the increasing competition and low prices that were being

generated in the markets. The unusual weather of the UK also so led it to bring wholesale

electricity prices down approximately 30% (Desai, 2006). This precious also affected the

country in the long-term purchase agreements and several changes were made in the

commodity market because of the financial pressure that was being observed on the

organization. Organizations were not able to sell electricity of their marginal cost were shut

down or taken off the line. The irregular currency and regulatory changes made the company

to charge significant impairment charges because of which the profitability of the firm was

demolished. Total after-tax charge of 465 million dollars was paid by the company in the year

2002 for development and construction projects that were being conducted by it (Desai,

2006).

2. Utilization of different capital budgeting techniques

There is a different type of technique that was being used by the organizations to determine

the investment funds that were being capitalized for expenditure projects. The proper time

value of money concept should be considered while analyzing the attractiveness of the capital

5

Finance

investment so as to determine the uncertainty of the cash flows and the performance that are

present in the particular project (Bailey, Kumar & Nag, 2011).

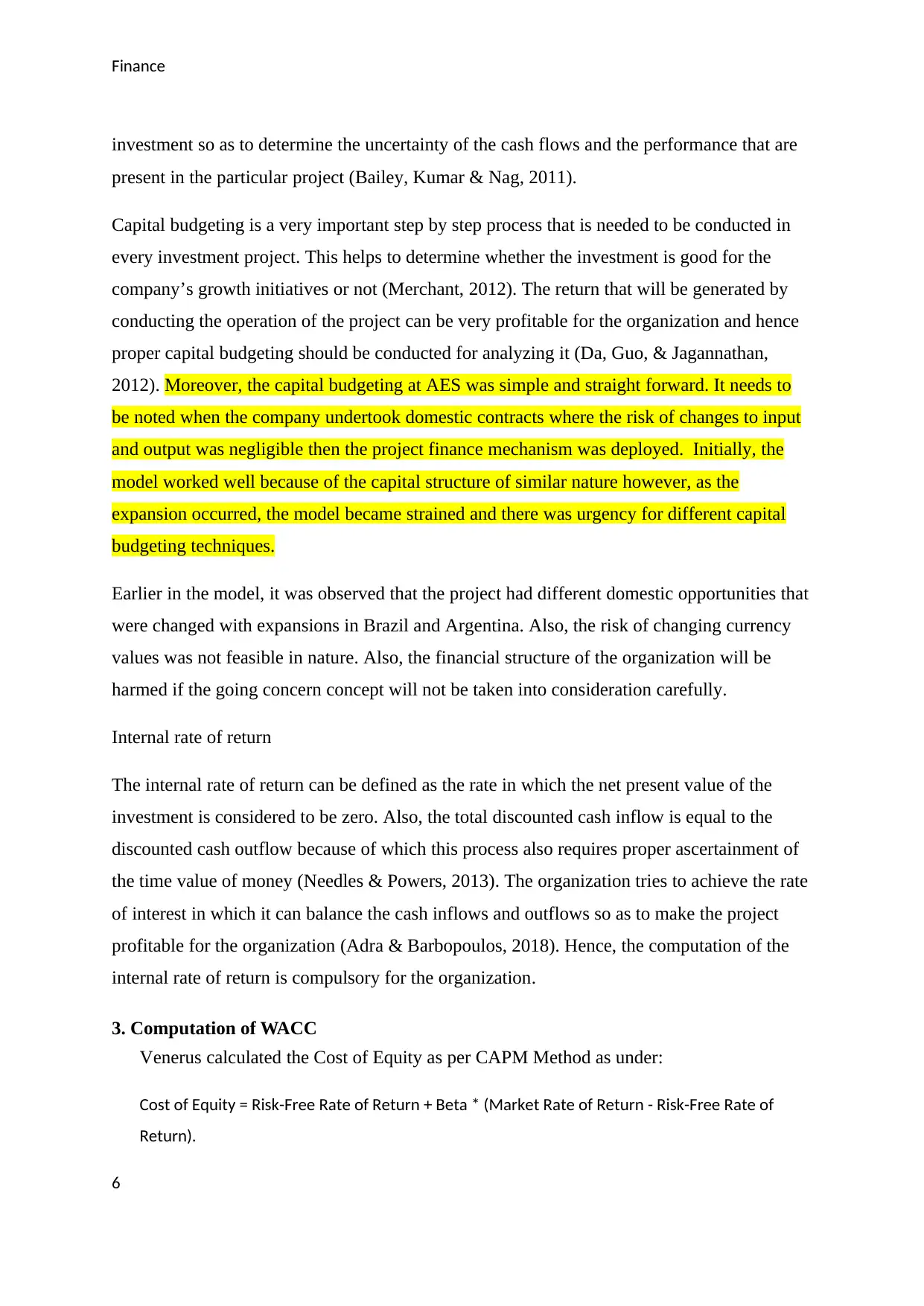

Capital budgeting is a very important step by step process that is needed to be conducted in

every investment project. This helps to determine whether the investment is good for the

company’s growth initiatives or not (Merchant, 2012). The return that will be generated by

conducting the operation of the project can be very profitable for the organization and hence

proper capital budgeting should be conducted for analyzing it (Da, Guo, & Jagannathan,

2012). Moreover, the capital budgeting at AES was simple and straight forward. It needs to

be noted when the company undertook domestic contracts where the risk of changes to input

and output was negligible then the project finance mechanism was deployed. Initially, the

model worked well because of the capital structure of similar nature however, as the

expansion occurred, the model became strained and there was urgency for different capital

budgeting techniques.

Earlier in the model, it was observed that the project had different domestic opportunities that

were changed with expansions in Brazil and Argentina. Also, the risk of changing currency

values was not feasible in nature. Also, the financial structure of the organization will be

harmed if the going concern concept will not be taken into consideration carefully.

Internal rate of return

The internal rate of return can be defined as the rate in which the net present value of the

investment is considered to be zero. Also, the total discounted cash inflow is equal to the

discounted cash outflow because of which this process also requires proper ascertainment of

the time value of money (Needles & Powers, 2013). The organization tries to achieve the rate

of interest in which it can balance the cash inflows and outflows so as to make the project

profitable for the organization (Adra & Barbopoulos, 2018). Hence, the computation of the

internal rate of return is compulsory for the organization.

3. Computation of WACC

Venerus calculated the Cost of Equity as per CAPM Method as under:

Cost of Equity = Risk-Free Rate of Return + Beta * (Market Rate of Return - Risk-Free Rate of

Return).

6

investment so as to determine the uncertainty of the cash flows and the performance that are

present in the particular project (Bailey, Kumar & Nag, 2011).

Capital budgeting is a very important step by step process that is needed to be conducted in

every investment project. This helps to determine whether the investment is good for the

company’s growth initiatives or not (Merchant, 2012). The return that will be generated by

conducting the operation of the project can be very profitable for the organization and hence

proper capital budgeting should be conducted for analyzing it (Da, Guo, & Jagannathan,

2012). Moreover, the capital budgeting at AES was simple and straight forward. It needs to

be noted when the company undertook domestic contracts where the risk of changes to input

and output was negligible then the project finance mechanism was deployed. Initially, the

model worked well because of the capital structure of similar nature however, as the

expansion occurred, the model became strained and there was urgency for different capital

budgeting techniques.

Earlier in the model, it was observed that the project had different domestic opportunities that

were changed with expansions in Brazil and Argentina. Also, the risk of changing currency

values was not feasible in nature. Also, the financial structure of the organization will be

harmed if the going concern concept will not be taken into consideration carefully.

Internal rate of return

The internal rate of return can be defined as the rate in which the net present value of the

investment is considered to be zero. Also, the total discounted cash inflow is equal to the

discounted cash outflow because of which this process also requires proper ascertainment of

the time value of money (Needles & Powers, 2013). The organization tries to achieve the rate

of interest in which it can balance the cash inflows and outflows so as to make the project

profitable for the organization (Adra & Barbopoulos, 2018). Hence, the computation of the

internal rate of return is compulsory for the organization.

3. Computation of WACC

Venerus calculated the Cost of Equity as per CAPM Method as under:

Cost of Equity = Risk-Free Rate of Return + Beta * (Market Rate of Return - Risk-Free Rate of

Return).

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Finance

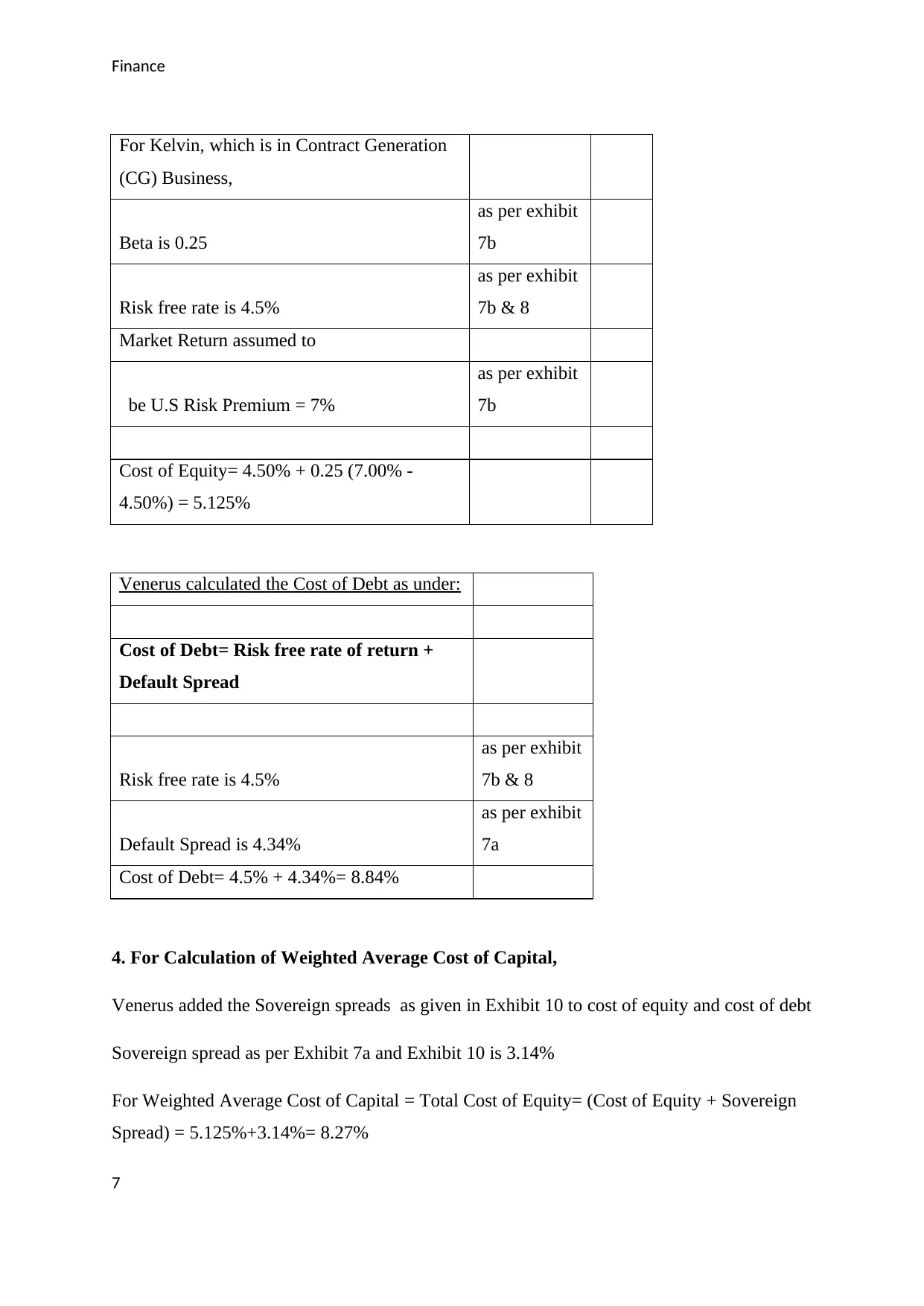

For Kelvin, which is in Contract Generation

(CG) Business,

Beta is 0.25

as per exhibit

7b

Risk free rate is 4.5%

as per exhibit

7b & 8

Market Return assumed to

be U.S Risk Premium = 7%

as per exhibit

7b

Cost of Equity= 4.50% + 0.25 (7.00% -

4.50%) = 5.125%

Venerus calculated the Cost of Debt as under:

Cost of Debt= Risk free rate of return +

Default Spread

Risk free rate is 4.5%

as per exhibit

7b & 8

Default Spread is 4.34%

as per exhibit

7a

Cost of Debt= 4.5% + 4.34%= 8.84%

4. For Calculation of Weighted Average Cost of Capital,

Venerus added the Sovereign spreads as given in Exhibit 10 to cost of equity and cost of debt

Sovereign spread as per Exhibit 7a and Exhibit 10 is 3.14%

For Weighted Average Cost of Capital = Total Cost of Equity= (Cost of Equity + Sovereign

Spread) = 5.125%+3.14%= 8.27%

7

For Kelvin, which is in Contract Generation

(CG) Business,

Beta is 0.25

as per exhibit

7b

Risk free rate is 4.5%

as per exhibit

7b & 8

Market Return assumed to

be U.S Risk Premium = 7%

as per exhibit

7b

Cost of Equity= 4.50% + 0.25 (7.00% -

4.50%) = 5.125%

Venerus calculated the Cost of Debt as under:

Cost of Debt= Risk free rate of return +

Default Spread

Risk free rate is 4.5%

as per exhibit

7b & 8

Default Spread is 4.34%

as per exhibit

7a

Cost of Debt= 4.5% + 4.34%= 8.84%

4. For Calculation of Weighted Average Cost of Capital,

Venerus added the Sovereign spreads as given in Exhibit 10 to cost of equity and cost of debt

Sovereign spread as per Exhibit 7a and Exhibit 10 is 3.14%

For Weighted Average Cost of Capital = Total Cost of Equity= (Cost of Equity + Sovereign

Spread) = 5.125%+3.14%= 8.27%

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance

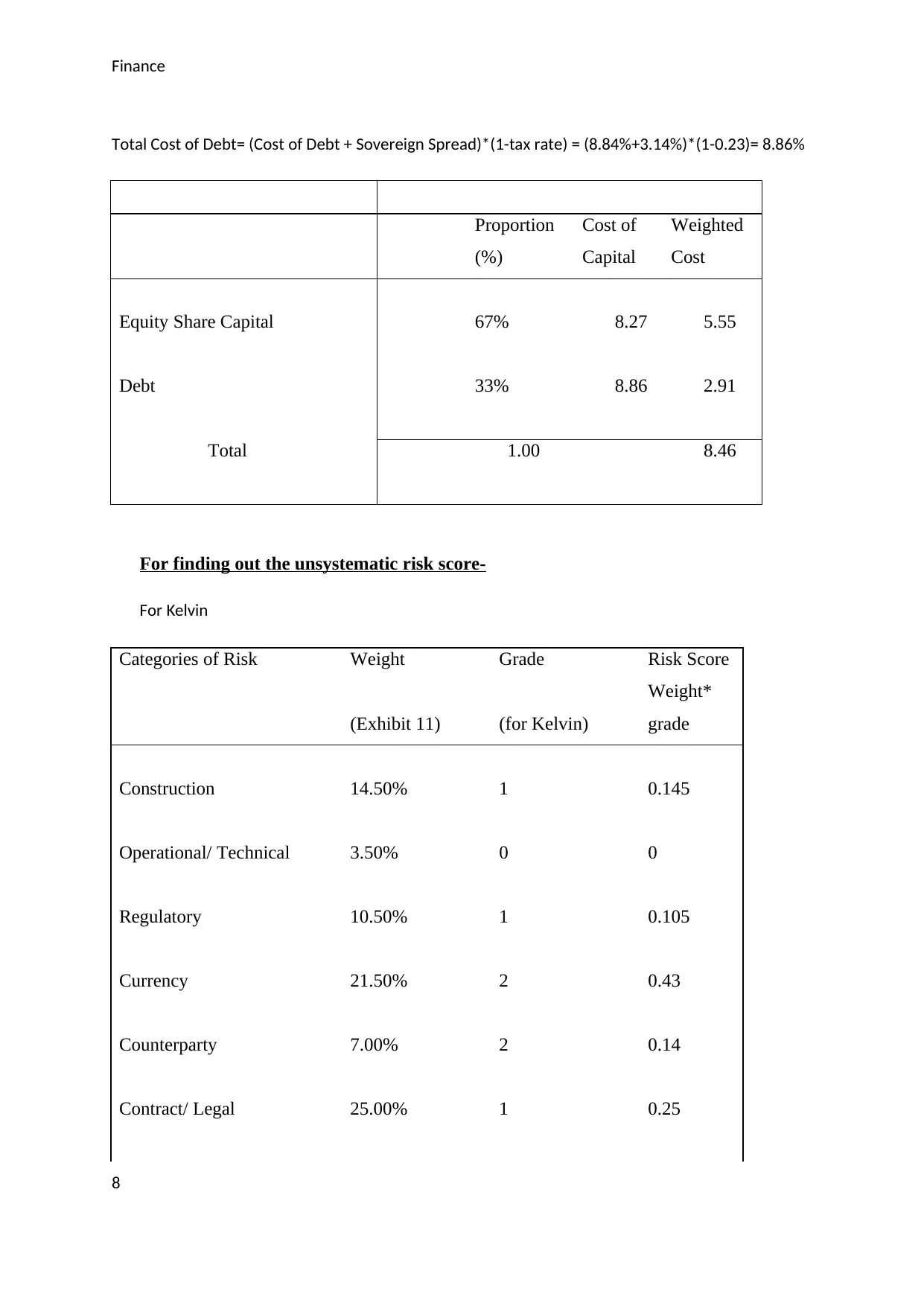

Total Cost of Debt= (Cost of Debt + Sovereign Spread)*(1-tax rate) = (8.84%+3.14%)*(1-0.23)= 8.86%

Proportion Cost of Weighted

(%) Capital Cost

Equity Share Capital 67% 8.27 5.55

Debt 33% 8.86 2.91

Total 1.00 8.46

For finding out the unsystematic risk score-

For Kelvin

Categories of Risk Weight Grade Risk Score

(Exhibit 11) (for Kelvin)

Weight*

grade

Construction 14.50% 1 0.145

Operational/ Technical 3.50% 0 0

Regulatory 10.50% 1 0.105

Currency 21.50% 2 0.43

Counterparty 7.00% 2 0.14

Contract/ Legal 25.00% 1 0.25

8

Total Cost of Debt= (Cost of Debt + Sovereign Spread)*(1-tax rate) = (8.84%+3.14%)*(1-0.23)= 8.86%

Proportion Cost of Weighted

(%) Capital Cost

Equity Share Capital 67% 8.27 5.55

Debt 33% 8.86 2.91

Total 1.00 8.46

For finding out the unsystematic risk score-

For Kelvin

Categories of Risk Weight Grade Risk Score

(Exhibit 11) (for Kelvin)

Weight*

grade

Construction 14.50% 1 0.145

Operational/ Technical 3.50% 0 0

Regulatory 10.50% 1 0.105

Currency 21.50% 2 0.43

Counterparty 7.00% 2 0.14

Contract/ Legal 25.00% 1 0.25

8

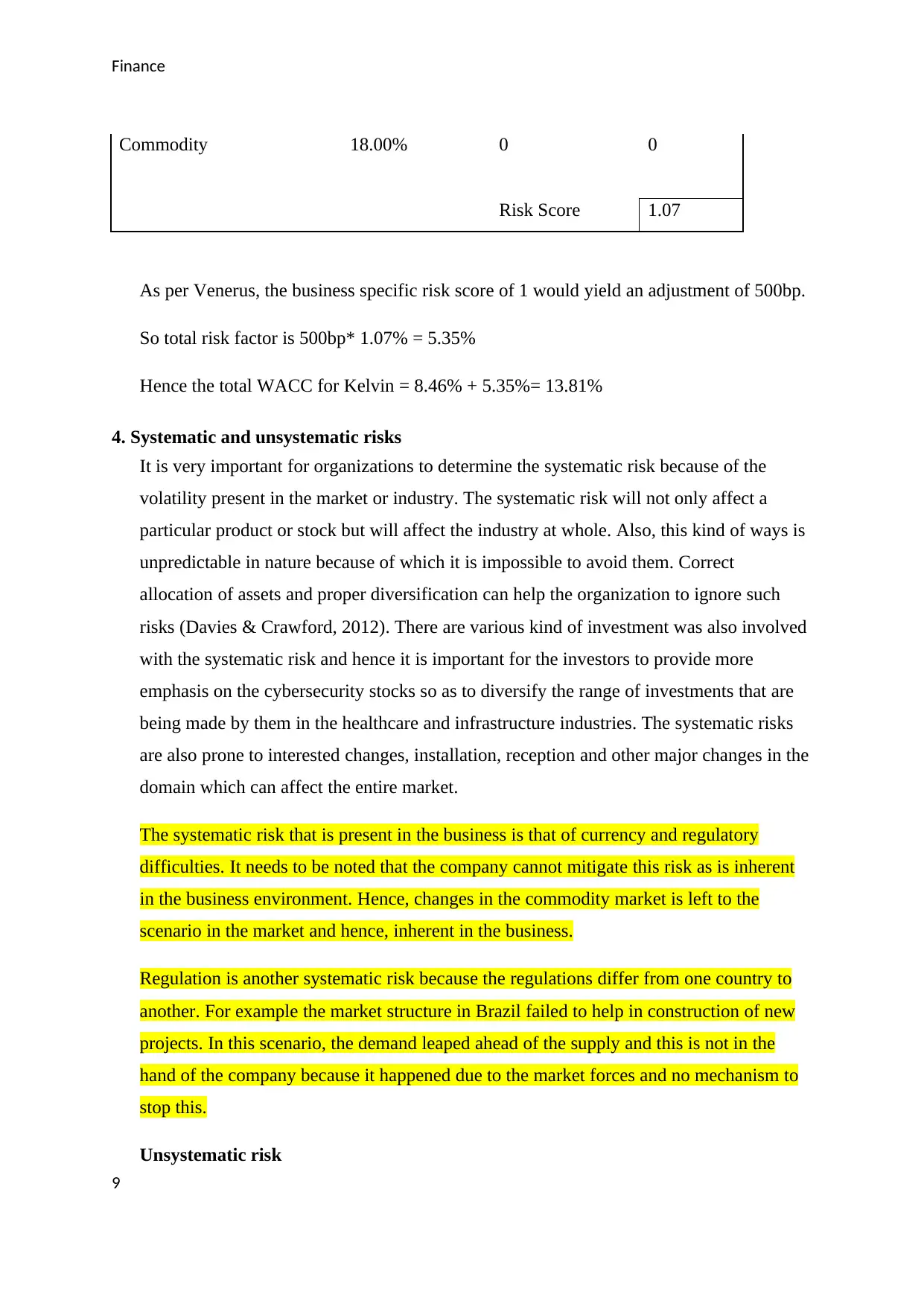

Finance

Commodity 18.00% 0 0

Risk Score 1.07

As per Venerus, the business specific risk score of 1 would yield an adjustment of 500bp.

So total risk factor is 500bp* 1.07% = 5.35%

Hence the total WACC for Kelvin = 8.46% + 5.35%= 13.81%

4. Systematic and unsystematic risks

It is very important for organizations to determine the systematic risk because of the

volatility present in the market or industry. The systematic risk will not only affect a

particular product or stock but will affect the industry at whole. Also, this kind of ways is

unpredictable in nature because of which it is impossible to avoid them. Correct

allocation of assets and proper diversification can help the organization to ignore such

risks (Davies & Crawford, 2012). There are various kind of investment was also involved

with the systematic risk and hence it is important for the investors to provide more

emphasis on the cybersecurity stocks so as to diversify the range of investments that are

being made by them in the healthcare and infrastructure industries. The systematic risks

are also prone to interested changes, installation, reception and other major changes in the

domain which can affect the entire market.

The systematic risk that is present in the business is that of currency and regulatory

difficulties. It needs to be noted that the company cannot mitigate this risk as is inherent

in the business environment. Hence, changes in the commodity market is left to the

scenario in the market and hence, inherent in the business.

Regulation is another systematic risk because the regulations differ from one country to

another. For example the market structure in Brazil failed to help in construction of new

projects. In this scenario, the demand leaped ahead of the supply and this is not in the

hand of the company because it happened due to the market forces and no mechanism to

stop this.

Unsystematic risk

9

Commodity 18.00% 0 0

Risk Score 1.07

As per Venerus, the business specific risk score of 1 would yield an adjustment of 500bp.

So total risk factor is 500bp* 1.07% = 5.35%

Hence the total WACC for Kelvin = 8.46% + 5.35%= 13.81%

4. Systematic and unsystematic risks

It is very important for organizations to determine the systematic risk because of the

volatility present in the market or industry. The systematic risk will not only affect a

particular product or stock but will affect the industry at whole. Also, this kind of ways is

unpredictable in nature because of which it is impossible to avoid them. Correct

allocation of assets and proper diversification can help the organization to ignore such

risks (Davies & Crawford, 2012). There are various kind of investment was also involved

with the systematic risk and hence it is important for the investors to provide more

emphasis on the cybersecurity stocks so as to diversify the range of investments that are

being made by them in the healthcare and infrastructure industries. The systematic risks

are also prone to interested changes, installation, reception and other major changes in the

domain which can affect the entire market.

The systematic risk that is present in the business is that of currency and regulatory

difficulties. It needs to be noted that the company cannot mitigate this risk as is inherent

in the business environment. Hence, changes in the commodity market is left to the

scenario in the market and hence, inherent in the business.

Regulation is another systematic risk because the regulations differ from one country to

another. For example the market structure in Brazil failed to help in construction of new

projects. In this scenario, the demand leaped ahead of the supply and this is not in the

hand of the company because it happened due to the market forces and no mechanism to

stop this.

Unsystematic risk

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Finance

This kind of risk is very unique in nature because of which it can affect the business of

the organization and also the investment portfolio. In order to remove such risks,

diversification should be present in the portfolio that has been accepted by the

organization.

This kind of risks can also be described as uncertainties that are present in the investment

strategies of the organization. This kind of unsystematic risk includes various types of

competitors in the market place because of which the organizational profits are affected at

large and regulatory changes can be observed in the management structure of the

organization (Parrino,Kidwell & Bates, 2012). Some of the systematic risks can be

anticipated but not all of them.

The operational or the technical area is another important aspect that comes under the

ambit of unsystematic risk. It is well observed that any deficiency in the area of operation

or technical can lead to major issues and halting the progress however, it can be mitigated

through proper managerial tools and effective planning.

5. Consequences of the wrong methodology of computing cost of capital on AES

The cost of capital should be computed with the accurate methodology because if the

inaccurate method is followed then it will project a market condition that does not exist.

Cost of capital helps in defining the hurdle rate of the company. It is the minimum rate of

return needed by the company to attain the value (Bernard, 2011). Hence, if inaccurate

methodology exists then a wrong projection will be observed that will ultimately reflect a

wrong momentum. This will distract the company from reaching its goal. Further, the

wrong mechanism will bring the issue of financing in terms of international operations. It

is important for the company to know the exact hurdle rate otherwise the financing

planning is severely disturbed (Bloomberg, 2018). In this scenario, it is observed that the

company AES has foreign expansions and therefore, the hurdle rate matters a lot. If the

wrong rate is computed or mechanism is wrong then it will affect the financial structure

and will generate a wrong result for the business.

Cost of capital is an important aspect because it is a variable that is crucial and helps in

ascertaining the capital structure. Further, it is even the discount rate when it comes to the

free cash flow in the model of DCF analysis. Therefore, any wrong computation will

10

This kind of risk is very unique in nature because of which it can affect the business of

the organization and also the investment portfolio. In order to remove such risks,

diversification should be present in the portfolio that has been accepted by the

organization.

This kind of risks can also be described as uncertainties that are present in the investment

strategies of the organization. This kind of unsystematic risk includes various types of

competitors in the market place because of which the organizational profits are affected at

large and regulatory changes can be observed in the management structure of the

organization (Parrino,Kidwell & Bates, 2012). Some of the systematic risks can be

anticipated but not all of them.

The operational or the technical area is another important aspect that comes under the

ambit of unsystematic risk. It is well observed that any deficiency in the area of operation

or technical can lead to major issues and halting the progress however, it can be mitigated

through proper managerial tools and effective planning.

5. Consequences of the wrong methodology of computing cost of capital on AES

The cost of capital should be computed with the accurate methodology because if the

inaccurate method is followed then it will project a market condition that does not exist.

Cost of capital helps in defining the hurdle rate of the company. It is the minimum rate of

return needed by the company to attain the value (Bernard, 2011). Hence, if inaccurate

methodology exists then a wrong projection will be observed that will ultimately reflect a

wrong momentum. This will distract the company from reaching its goal. Further, the

wrong mechanism will bring the issue of financing in terms of international operations. It

is important for the company to know the exact hurdle rate otherwise the financing

planning is severely disturbed (Bloomberg, 2018). In this scenario, it is observed that the

company AES has foreign expansions and therefore, the hurdle rate matters a lot. If the

wrong rate is computed or mechanism is wrong then it will affect the financial structure

and will generate a wrong result for the business.

Cost of capital is an important aspect because it is a variable that is crucial and helps in

ascertaining the capital structure. Further, it is even the discount rate when it comes to the

free cash flow in the model of DCF analysis. Therefore, any wrong computation will

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance

project a wrong capital structure. Capital structure is essential for various purposes and

plays an important role in the company’s functioning. Hence, when the capital structure is

wrongly computed, it will lead to wrong calculations and chances of wrong decision are

likely to happen.

11

project a wrong capital structure. Capital structure is essential for various purposes and

plays an important role in the company’s functioning. Hence, when the capital structure is

wrongly computed, it will lead to wrong calculations and chances of wrong decision are

likely to happen.

11

Finance

Part B - Case: Netscape’s Initial Public Offering

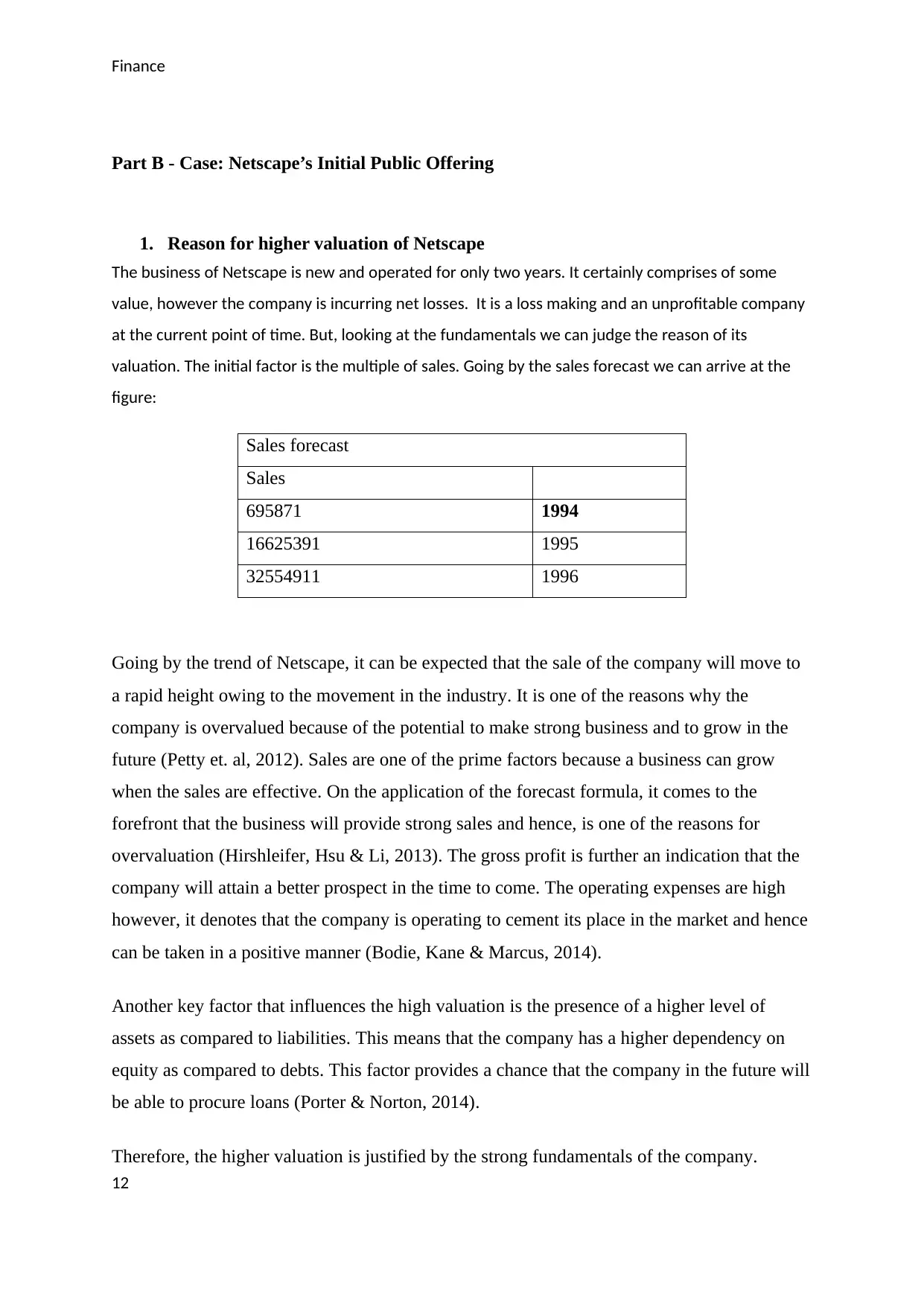

1. Reason for higher valuation of Netscape

The business of Netscape is new and operated for only two years. It certainly comprises of some

value, however the company is incurring net losses. It is a loss making and an unprofitable company

at the current point of time. But, looking at the fundamentals we can judge the reason of its

valuation. The initial factor is the multiple of sales. Going by the sales forecast we can arrive at the

figure:

Sales forecast

Sales

695871 1994

16625391 1995

32554911 1996

Going by the trend of Netscape, it can be expected that the sale of the company will move to

a rapid height owing to the movement in the industry. It is one of the reasons why the

company is overvalued because of the potential to make strong business and to grow in the

future (Petty et. al, 2012). Sales are one of the prime factors because a business can grow

when the sales are effective. On the application of the forecast formula, it comes to the

forefront that the business will provide strong sales and hence, is one of the reasons for

overvaluation (Hirshleifer, Hsu & Li, 2013). The gross profit is further an indication that the

company will attain a better prospect in the time to come. The operating expenses are high

however, it denotes that the company is operating to cement its place in the market and hence

can be taken in a positive manner (Bodie, Kane & Marcus, 2014).

Another key factor that influences the high valuation is the presence of a higher level of

assets as compared to liabilities. This means that the company has a higher dependency on

equity as compared to debts. This factor provides a chance that the company in the future will

be able to procure loans (Porter & Norton, 2014).

Therefore, the higher valuation is justified by the strong fundamentals of the company.

12

Part B - Case: Netscape’s Initial Public Offering

1. Reason for higher valuation of Netscape

The business of Netscape is new and operated for only two years. It certainly comprises of some

value, however the company is incurring net losses. It is a loss making and an unprofitable company

at the current point of time. But, looking at the fundamentals we can judge the reason of its

valuation. The initial factor is the multiple of sales. Going by the sales forecast we can arrive at the

figure:

Sales forecast

Sales

695871 1994

16625391 1995

32554911 1996

Going by the trend of Netscape, it can be expected that the sale of the company will move to

a rapid height owing to the movement in the industry. It is one of the reasons why the

company is overvalued because of the potential to make strong business and to grow in the

future (Petty et. al, 2012). Sales are one of the prime factors because a business can grow

when the sales are effective. On the application of the forecast formula, it comes to the

forefront that the business will provide strong sales and hence, is one of the reasons for

overvaluation (Hirshleifer, Hsu & Li, 2013). The gross profit is further an indication that the

company will attain a better prospect in the time to come. The operating expenses are high

however, it denotes that the company is operating to cement its place in the market and hence

can be taken in a positive manner (Bodie, Kane & Marcus, 2014).

Another key factor that influences the high valuation is the presence of a higher level of

assets as compared to liabilities. This means that the company has a higher dependency on

equity as compared to debts. This factor provides a chance that the company in the future will

be able to procure loans (Porter & Norton, 2014).

Therefore, the higher valuation is justified by the strong fundamentals of the company.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.