Taxation Law: Comprehensive Analysis of CGT and Fringe Benefit Tax

VerifiedAdded on 2023/06/06

|13

|2945

|467

Report

AI Summary

This report provides a detailed analysis of Capital Gains Tax (CGT) and Fringe Benefit Tax (FBT) consequences based on a provided case study. It examines the sale of vacant land, antique beds, paintings, shares, and violins to determine net capital gains or losses for the year ended June 2018. The report also covers fringe benefit tax outcomes, addressing issues related to car fringe benefits, expense payment fringe benefits, and loan fringe benefits under the Fringe Benefits Tax Assessment Act 1986 (FBTAA 1986). The analysis includes relevant sections of the Income Tax Assessment Act 1997 (ITAA 1997) and case law to support the conclusions. The report calculates the net capital gains for the year and discusses the employer's liability for FBT concerning the provided benefits to employees.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Table of Contents

Introduction:...............................................................................................................................2

Question 1:.................................................................................................................................2

Answer to question 2..................................................................................................................7

Answer to A:..............................................................................................................................7

Conclusion:................................................................................................................................9

Answer to 2 B:.........................................................................................................................10

References:...............................................................................................................................11

Table of Contents

Introduction:...............................................................................................................................2

Question 1:.................................................................................................................................2

Answer to question 2..................................................................................................................7

Answer to A:..............................................................................................................................7

Conclusion:................................................................................................................................9

Answer to 2 B:.........................................................................................................................10

References:...............................................................................................................................11

2TAXATION LAW

Introduction:

The existing study will take into the account the CGT and fringe benefit tax

consequences relating to the events occurred in the case study. The study will be considering

the net capital gains or capital loss for the current year ended 30 June. In the later parts the

report would cover the fringe benefit tax outcomes that arises out of the information

furnished in the report for the current income tax year ended 2018.

The wider concept of capital gains tax comprises of the comparison between the

capital proceeds and the cost base of the asset (Barkoczy, 2018). Capital gains or capital loss

is ascertained by subtracting the relevant cost base associated with the asset or other events

from the capital proceeds or the disposal of assets.

Question 1:

Selling of Vacant Land:

According to the Australian taxation office purchasing the vacant land by a taxpayer

for the personal use or for investment purpose, the vacant block of land is treated as capital

asset which will be considered for taxation upon the sale of land. The contract of sale of

vacant land was entered into by the taxpayer (Grange et al., 2014). The land was purchased

for $100,000 with additional $20,000 for land and water tax when the land was under the

ownership of the taxpayer.

The vacant land in the current case will be treated as capital asset which will attract

capital gains tax similar to other assets. The taxpayer under this situation should maintain the

records relating to the date of purchase of land and cost that were incurred in purchasing the

land (James, 2014). The taxpayer cannot claim an allowable deduction for council water,

rates or land tax but these cost will be added up in the property case base. On disposal the

Introduction:

The existing study will take into the account the CGT and fringe benefit tax

consequences relating to the events occurred in the case study. The study will be considering

the net capital gains or capital loss for the current year ended 30 June. In the later parts the

report would cover the fringe benefit tax outcomes that arises out of the information

furnished in the report for the current income tax year ended 2018.

The wider concept of capital gains tax comprises of the comparison between the

capital proceeds and the cost base of the asset (Barkoczy, 2018). Capital gains or capital loss

is ascertained by subtracting the relevant cost base associated with the asset or other events

from the capital proceeds or the disposal of assets.

Question 1:

Selling of Vacant Land:

According to the Australian taxation office purchasing the vacant land by a taxpayer

for the personal use or for investment purpose, the vacant block of land is treated as capital

asset which will be considered for taxation upon the sale of land. The contract of sale of

vacant land was entered into by the taxpayer (Grange et al., 2014). The land was purchased

for $100,000 with additional $20,000 for land and water tax when the land was under the

ownership of the taxpayer.

The vacant land in the current case will be treated as capital asset which will attract

capital gains tax similar to other assets. The taxpayer under this situation should maintain the

records relating to the date of purchase of land and cost that were incurred in purchasing the

land (James, 2014). The taxpayer cannot claim an allowable deduction for council water,

rates or land tax but these cost will be added up in the property case base. On disposal the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

cost base of the asset will be subtracted to determine the net value of capital gains made from

such disposal.

Antique Bed:

As defined in “S-108 (1), ITAA 1997” collectables usually comprise of any rare folio,

manuscript, artwork, jewellery or any antique object or any interest or debts originating from

the above stated items (Jover-Ledesma, 2014). A taxpayer is required to disregard any capital

gains for asset that has the purchase value of $500 or less and hence it is exempted from the

CGT provisions of “S-118-10(1), ITAA 1997”.

In the current case, the evidences gained suggest that the antique bed that was held by

the taxpayer was stolen from the taxpayer’s residence. The taxpayer later learned that antique

bed did not formed the part of specified items in the insurance policy.

As per “S-104-20(1), ITAA 1997” a CGT event C1 happens to a taxpayer when an

asset is destroyed or damaged. It is noteworthy to denote that the timing of the CGT event is

essential in ascertaining the capital loss or capital gains (Kenny et al., 2018). The antique bed

in the current case was stolen from the residence of the taxpayer and the same was not in the

list of specified items. Therefore, the compensation that is received for the lost antique bed

resulted in CGT event C1.

Painting:

“Subdivision 108-C” deals with the personal use assets. A private use asset is

generally treated as non-collectable asset, kept by the taxpayer for their private enjoyment.

These assets are boats, furniture, electrical goods and the household items (McCouat, 2018).

cost base of the asset will be subtracted to determine the net value of capital gains made from

such disposal.

Antique Bed:

As defined in “S-108 (1), ITAA 1997” collectables usually comprise of any rare folio,

manuscript, artwork, jewellery or any antique object or any interest or debts originating from

the above stated items (Jover-Ledesma, 2014). A taxpayer is required to disregard any capital

gains for asset that has the purchase value of $500 or less and hence it is exempted from the

CGT provisions of “S-118-10(1), ITAA 1997”.

In the current case, the evidences gained suggest that the antique bed that was held by

the taxpayer was stolen from the taxpayer’s residence. The taxpayer later learned that antique

bed did not formed the part of specified items in the insurance policy.

As per “S-104-20(1), ITAA 1997” a CGT event C1 happens to a taxpayer when an

asset is destroyed or damaged. It is noteworthy to denote that the timing of the CGT event is

essential in ascertaining the capital loss or capital gains (Kenny et al., 2018). The antique bed

in the current case was stolen from the residence of the taxpayer and the same was not in the

list of specified items. Therefore, the compensation that is received for the lost antique bed

resulted in CGT event C1.

Painting:

“Subdivision 108-C” deals with the personal use assets. A private use asset is

generally treated as non-collectable asset, kept by the taxpayer for their private enjoyment.

These assets are boats, furniture, electrical goods and the household items (McCouat, 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

“S-108-20(2), ITAA 1997” explains that the personal use asset includes the option or the

right to obtain the asset that are mainly used for the taxpayer own purpose.

“S-118-10(3)” held that a taxpayer is required to disregard the capital gains when the

private use where the private use asset that was purchased stands $10,000 or less than that

(Sadiq, 2018). This represents that the taxpayer is under the obligation of keeping the details

of purchase of personal use assets if they are purchased for $10,000 or greater than that.

In the current case the taxpayer has provided an information by stating that the

painting was purchased for $2,000 and was bought on 2nd May 1985. CGT is only applied

when the CGT is acquired on or after 20/9/1985 (Sadiq et al., 2018). Assets which is

purchased before CGT was introduced will be treated as the exempted asset. The gains made

by the taxpayer from the sale of painting will be disregarded because the painting is the pre-

CGT asset and will be treated as exempted asset.

Shares:

As per the Australian taxation office, a taxpayer that holds shares in company or units

in the unit trust will be treated for CGT purpose similar to other assets. An investor that

makes capital gains from the sale of shares when there is a CGT event, especially when the

shares are sold. Profits made from the disposal of shares are considered as income under

ordinary concepts (Taylor et al., 2018). Likewise, the taxpayer presently reported the capital

gains from the sale of shares held in Common Ltd, PHB Ltd and Build Ltd shares. The

taxpayer also reported loss from sale of young kids learning shares. An offset can be claimed

by taxpayer from the gains made on sale of shares.

Violin:

“Subdivision 108-C” deals with the personal use assets. A personal use asset is

generally considered as non-collectable asset, kept by the taxpayer for their private

“S-108-20(2), ITAA 1997” explains that the personal use asset includes the option or the

right to obtain the asset that are mainly used for the taxpayer own purpose.

“S-118-10(3)” held that a taxpayer is required to disregard the capital gains when the

private use where the private use asset that was purchased stands $10,000 or less than that

(Sadiq, 2018). This represents that the taxpayer is under the obligation of keeping the details

of purchase of personal use assets if they are purchased for $10,000 or greater than that.

In the current case the taxpayer has provided an information by stating that the

painting was purchased for $2,000 and was bought on 2nd May 1985. CGT is only applied

when the CGT is acquired on or after 20/9/1985 (Sadiq et al., 2018). Assets which is

purchased before CGT was introduced will be treated as the exempted asset. The gains made

by the taxpayer from the sale of painting will be disregarded because the painting is the pre-

CGT asset and will be treated as exempted asset.

Shares:

As per the Australian taxation office, a taxpayer that holds shares in company or units

in the unit trust will be treated for CGT purpose similar to other assets. An investor that

makes capital gains from the sale of shares when there is a CGT event, especially when the

shares are sold. Profits made from the disposal of shares are considered as income under

ordinary concepts (Taylor et al., 2018). Likewise, the taxpayer presently reported the capital

gains from the sale of shares held in Common Ltd, PHB Ltd and Build Ltd shares. The

taxpayer also reported loss from sale of young kids learning shares. An offset can be claimed

by taxpayer from the gains made on sale of shares.

Violin:

“Subdivision 108-C” deals with the personal use assets. A personal use asset is

generally considered as non-collectable asset, kept by the taxpayer for their private

5TAXATION LAW

satisfaction (Woellner et al., 2018). These assets are boats, furniture, electrical components

and the household objects. “S-118-10(3)” held that a taxpayer is required to disregard the

capital gains when the private use where the private use asset that was purchased stands

$10,000 or less than that.

In the current case it is noticed that the taxpayer brought a violin that costed $5,000.

The taxpayer used the violin for their private use. Since the cost base of asset is less than

$10,000 the capital gains derived by the taxpayer is not included for CGT purpose. The net

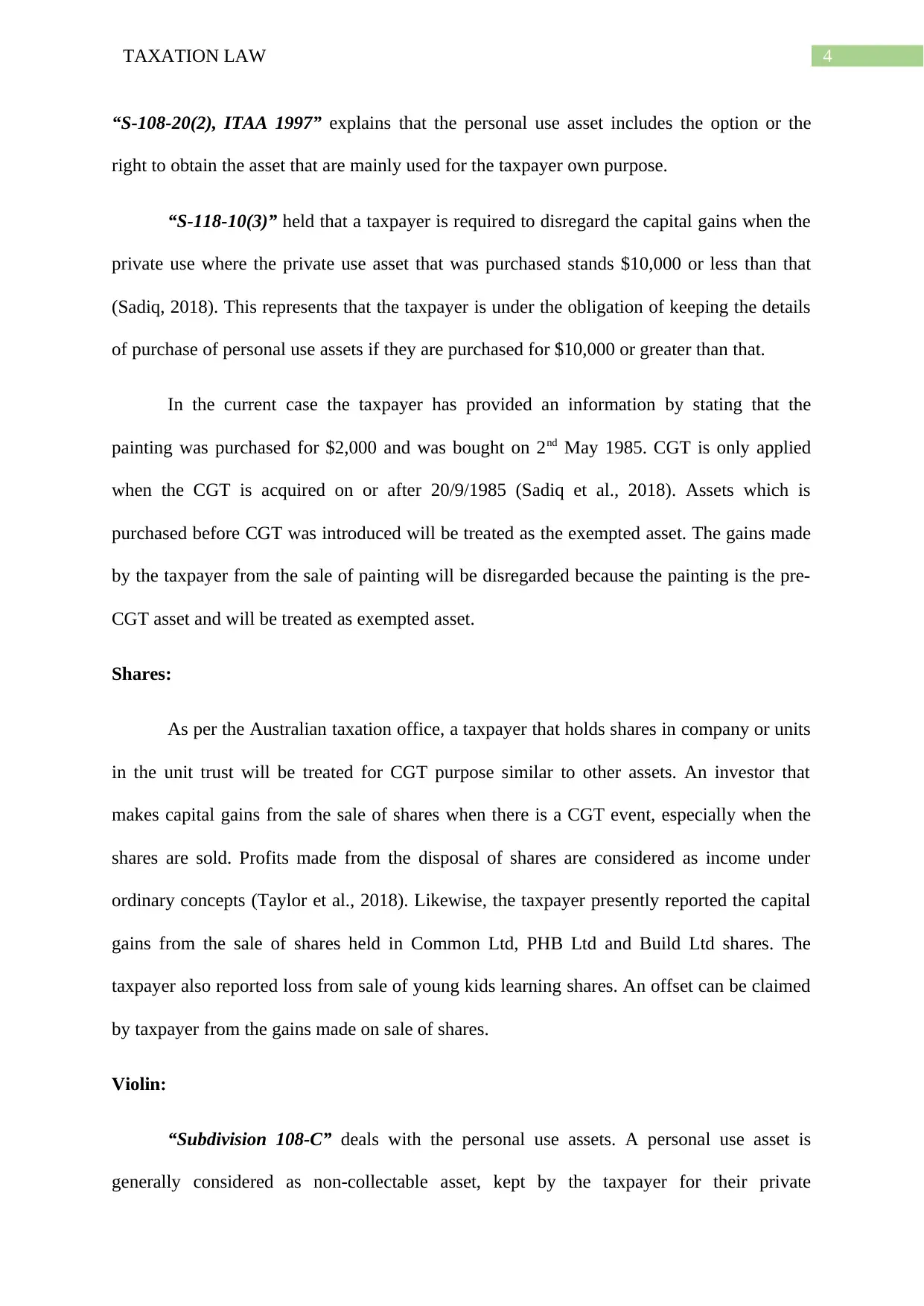

value of capital gains derived from the explanation made is given below;

satisfaction (Woellner et al., 2018). These assets are boats, furniture, electrical components

and the household objects. “S-118-10(3)” held that a taxpayer is required to disregard the

capital gains when the private use where the private use asset that was purchased stands

$10,000 or less than that.

In the current case it is noticed that the taxpayer brought a violin that costed $5,000.

The taxpayer used the violin for their private use. Since the cost base of asset is less than

$10,000 the capital gains derived by the taxpayer is not included for CGT purpose. The net

value of capital gains derived from the explanation made is given below;

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

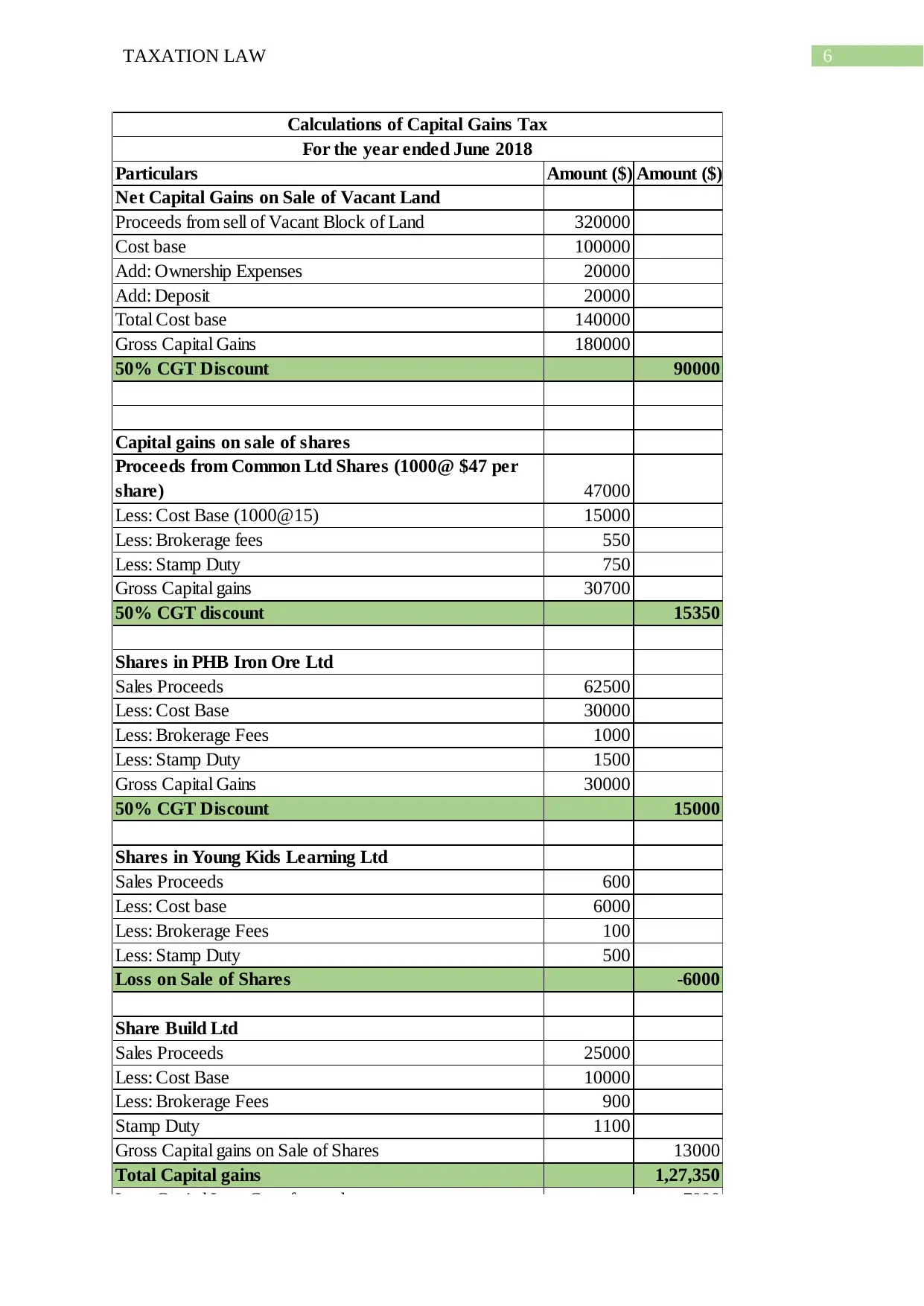

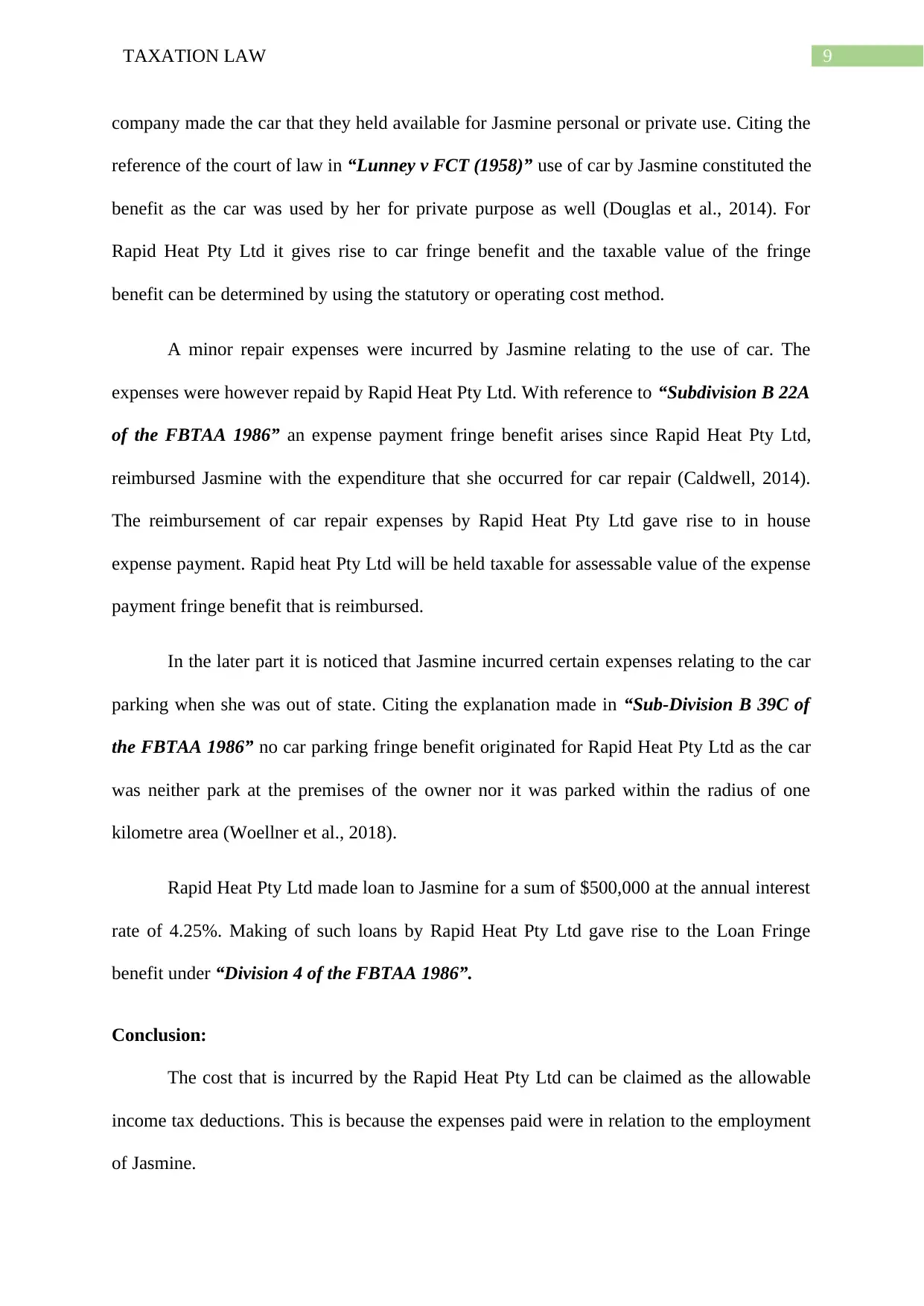

Particulars Amount ($) Amount ($)

Net Capital Gains on Sale of Vacant Land

Proceeds from sell of Vacant Block of Land 320000

Cost base 100000

Add: Ownership Expenses 20000

Add: Deposit 20000

Total Cost base 140000

Gross Capital Gains 180000

50% CGT Discount 90000

Capital gains on sale of shares

Proceeds from Common Ltd Shares (1000@ $47 per

share) 47000

Less: Cost Base (1000@15) 15000

Less: Brokerage fees 550

Less: Stamp Duty 750

Gross Capital gains 30700

50% CGT discount 15350

Shares in PHB Iron Ore Ltd

Sales Proceeds 62500

Less: Cost Base 30000

Less: Brokerage Fees 1000

Less: Stamp Duty 1500

Gross Capital Gains 30000

50% CGT Discount 15000

Shares in Young Kids Learning Ltd

Sales Proceeds 600

Less: Cost base 6000

Less: Brokerage Fees 100

Less: Stamp Duty 500

Loss on Sale of Shares -6000

Share Build Ltd

Sales Proceeds 25000

Less: Cost Base 10000

Less: Brokerage Fees 900

Stamp Duty 1100

Gross Capital gains on Sale of Shares 13000

Total Capital gains 1,27,350

Less: Capital Loss Carryforward 7000

Total Net Capital Gains 1,20,350

Calculations of Capital Gains Tax

For the year ended June 2018

Particulars Amount ($) Amount ($)

Net Capital Gains on Sale of Vacant Land

Proceeds from sell of Vacant Block of Land 320000

Cost base 100000

Add: Ownership Expenses 20000

Add: Deposit 20000

Total Cost base 140000

Gross Capital Gains 180000

50% CGT Discount 90000

Capital gains on sale of shares

Proceeds from Common Ltd Shares (1000@ $47 per

share) 47000

Less: Cost Base (1000@15) 15000

Less: Brokerage fees 550

Less: Stamp Duty 750

Gross Capital gains 30700

50% CGT discount 15350

Shares in PHB Iron Ore Ltd

Sales Proceeds 62500

Less: Cost Base 30000

Less: Brokerage Fees 1000

Less: Stamp Duty 1500

Gross Capital Gains 30000

50% CGT Discount 15000

Shares in Young Kids Learning Ltd

Sales Proceeds 600

Less: Cost base 6000

Less: Brokerage Fees 100

Less: Stamp Duty 500

Loss on Sale of Shares -6000

Share Build Ltd

Sales Proceeds 25000

Less: Cost Base 10000

Less: Brokerage Fees 900

Stamp Duty 1100

Gross Capital gains on Sale of Shares 13000

Total Capital gains 1,27,350

Less: Capital Loss Carryforward 7000

Total Net Capital Gains 1,20,350

Calculations of Capital Gains Tax

For the year ended June 2018

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

Answer to question 2

Answer to A:

Issues:

The issue here revolves around the consequences originating from the FBT event in

relation to “FBTAA 1986”. Will the taxpayer be held liable for the car fringe benefit under

“S-7, FBTAA 1986” originating from the car that is provided to employee? Whether the

taxpayer be held liable for the expense payment fringe benefit under “section 39 A, FBTAA

1986”? Will the taxpayer be accountable under “sub-div A of FBTAA, 1986” for the loan

fringe benefit during the FBT year?

Rule:

A fringe benefit can be defined as the payment that is made to the employee however

the benefit it that is provided is different from the salaries and wages. This effectively means

that the benefit which is provided to someone because the person is an employee. The

employee can be either former or the future employee. Fringe benefit tax is generally paid by

the employer (Woellner et al., 2018). As the employer, they are liable for pay the FBT

notwithstanding of whether the employer is the sole trader, partners or government authority.

An employer may claim the allowable deductions for majority of the cost that is incurred in

providing the fringe benefit.

As per the “S-7, FBTAA 1986” a car fringe benefit in most of the situation arises

where the employer makes the car that they hold available for employees personal or private

use (Caldwell, 2014). An employer usually makes the car available for the private use of the

employee during any day when the car is actually held for the personal purpose of the

employee. As the general rule, the court of law in “Lunney v FCT (1958)” held that travel to

and from the work place is treated as the personal use of the vehicle (Douglas et al., 2014).

Answer to question 2

Answer to A:

Issues:

The issue here revolves around the consequences originating from the FBT event in

relation to “FBTAA 1986”. Will the taxpayer be held liable for the car fringe benefit under

“S-7, FBTAA 1986” originating from the car that is provided to employee? Whether the

taxpayer be held liable for the expense payment fringe benefit under “section 39 A, FBTAA

1986”? Will the taxpayer be accountable under “sub-div A of FBTAA, 1986” for the loan

fringe benefit during the FBT year?

Rule:

A fringe benefit can be defined as the payment that is made to the employee however

the benefit it that is provided is different from the salaries and wages. This effectively means

that the benefit which is provided to someone because the person is an employee. The

employee can be either former or the future employee. Fringe benefit tax is generally paid by

the employer (Woellner et al., 2018). As the employer, they are liable for pay the FBT

notwithstanding of whether the employer is the sole trader, partners or government authority.

An employer may claim the allowable deductions for majority of the cost that is incurred in

providing the fringe benefit.

As per the “S-7, FBTAA 1986” a car fringe benefit in most of the situation arises

where the employer makes the car that they hold available for employees personal or private

use (Caldwell, 2014). An employer usually makes the car available for the private use of the

employee during any day when the car is actually held for the personal purpose of the

employee. As the general rule, the court of law in “Lunney v FCT (1958)” held that travel to

and from the work place is treated as the personal use of the vehicle (Douglas et al., 2014).

8TAXATION LAW

An expense payment fringe benefit arises under “Subdivision B 22A of the FBTAA

1986” when the employer reimburses the employee with the expenditure that they occur. The

expenditure can be either business expenditure or the private expenditure (Kenny, 2014). For

an employer the taxable value of the fringe benefit represents the amount that is reimbursed

or paid. An in house fringe benefit expense payment arises when the expenditure is

reimbursed by the employer or paid relating to the expenses that is incurred by the employee.

As per the “Sub-Division B 39C of the FBTAA 1986” the car parking fringe benefit

might happen for each of the day when the employer provides the employee with the car

parking space for their use (Morgan et al., 2015). A car parking fringe benefit happens only

when;

a. The car is parked at the premises which is owned or leased under the control of the

car provider.

b. The car is parked within the radius of one kilometre of the employer premises

c. The car is provided in respect of the employment

d. Car is used by the employee to travel for home and work place

As per the “Division 4 of the FBTAA 1986” loan fringe benefit happens the employer

provides the employee with the loan. Providing such loan by the employer to employee is

regarded as the benefit for the recipient (Taylor et al., 2018). The lower rate of interest

represents the one which is less than the statutory interest rate.

Application:

In the current case Rapid Heat Pty Ltd provided its employee Jasmine with the car as

she does majority of the work by travelling. The use of car provided by Rapid Heat Pty Ltd to

Jasmine was not limited to work purpose as she uses the car for her private use as well. Citing

“S-7, FBTAA 1986” a car fringe benefit has originated for Rapid Heat Pty Ltd since the

An expense payment fringe benefit arises under “Subdivision B 22A of the FBTAA

1986” when the employer reimburses the employee with the expenditure that they occur. The

expenditure can be either business expenditure or the private expenditure (Kenny, 2014). For

an employer the taxable value of the fringe benefit represents the amount that is reimbursed

or paid. An in house fringe benefit expense payment arises when the expenditure is

reimbursed by the employer or paid relating to the expenses that is incurred by the employee.

As per the “Sub-Division B 39C of the FBTAA 1986” the car parking fringe benefit

might happen for each of the day when the employer provides the employee with the car

parking space for their use (Morgan et al., 2015). A car parking fringe benefit happens only

when;

a. The car is parked at the premises which is owned or leased under the control of the

car provider.

b. The car is parked within the radius of one kilometre of the employer premises

c. The car is provided in respect of the employment

d. Car is used by the employee to travel for home and work place

As per the “Division 4 of the FBTAA 1986” loan fringe benefit happens the employer

provides the employee with the loan. Providing such loan by the employer to employee is

regarded as the benefit for the recipient (Taylor et al., 2018). The lower rate of interest

represents the one which is less than the statutory interest rate.

Application:

In the current case Rapid Heat Pty Ltd provided its employee Jasmine with the car as

she does majority of the work by travelling. The use of car provided by Rapid Heat Pty Ltd to

Jasmine was not limited to work purpose as she uses the car for her private use as well. Citing

“S-7, FBTAA 1986” a car fringe benefit has originated for Rapid Heat Pty Ltd since the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION LAW

company made the car that they held available for Jasmine personal or private use. Citing the

reference of the court of law in “Lunney v FCT (1958)” use of car by Jasmine constituted the

benefit as the car was used by her for private purpose as well (Douglas et al., 2014). For

Rapid Heat Pty Ltd it gives rise to car fringe benefit and the taxable value of the fringe

benefit can be determined by using the statutory or operating cost method.

A minor repair expenses were incurred by Jasmine relating to the use of car. The

expenses were however repaid by Rapid Heat Pty Ltd. With reference to “Subdivision B 22A

of the FBTAA 1986” an expense payment fringe benefit arises since Rapid Heat Pty Ltd,

reimbursed Jasmine with the expenditure that she occurred for car repair (Caldwell, 2014).

The reimbursement of car repair expenses by Rapid Heat Pty Ltd gave rise to in house

expense payment. Rapid heat Pty Ltd will be held taxable for assessable value of the expense

payment fringe benefit that is reimbursed.

In the later part it is noticed that Jasmine incurred certain expenses relating to the car

parking when she was out of state. Citing the explanation made in “Sub-Division B 39C of

the FBTAA 1986” no car parking fringe benefit originated for Rapid Heat Pty Ltd as the car

was neither park at the premises of the owner nor it was parked within the radius of one

kilometre area (Woellner et al., 2018).

Rapid Heat Pty Ltd made loan to Jasmine for a sum of $500,000 at the annual interest

rate of 4.25%. Making of such loans by Rapid Heat Pty Ltd gave rise to the Loan Fringe

benefit under “Division 4 of the FBTAA 1986”.

Conclusion:

The cost that is incurred by the Rapid Heat Pty Ltd can be claimed as the allowable

income tax deductions. This is because the expenses paid were in relation to the employment

of Jasmine.

company made the car that they held available for Jasmine personal or private use. Citing the

reference of the court of law in “Lunney v FCT (1958)” use of car by Jasmine constituted the

benefit as the car was used by her for private purpose as well (Douglas et al., 2014). For

Rapid Heat Pty Ltd it gives rise to car fringe benefit and the taxable value of the fringe

benefit can be determined by using the statutory or operating cost method.

A minor repair expenses were incurred by Jasmine relating to the use of car. The

expenses were however repaid by Rapid Heat Pty Ltd. With reference to “Subdivision B 22A

of the FBTAA 1986” an expense payment fringe benefit arises since Rapid Heat Pty Ltd,

reimbursed Jasmine with the expenditure that she occurred for car repair (Caldwell, 2014).

The reimbursement of car repair expenses by Rapid Heat Pty Ltd gave rise to in house

expense payment. Rapid heat Pty Ltd will be held taxable for assessable value of the expense

payment fringe benefit that is reimbursed.

In the later part it is noticed that Jasmine incurred certain expenses relating to the car

parking when she was out of state. Citing the explanation made in “Sub-Division B 39C of

the FBTAA 1986” no car parking fringe benefit originated for Rapid Heat Pty Ltd as the car

was neither park at the premises of the owner nor it was parked within the radius of one

kilometre area (Woellner et al., 2018).

Rapid Heat Pty Ltd made loan to Jasmine for a sum of $500,000 at the annual interest

rate of 4.25%. Making of such loans by Rapid Heat Pty Ltd gave rise to the Loan Fringe

benefit under “Division 4 of the FBTAA 1986”.

Conclusion:

The cost that is incurred by the Rapid Heat Pty Ltd can be claimed as the allowable

income tax deductions. This is because the expenses paid were in relation to the employment

of Jasmine.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION LAW

Answer to 2 B:

In the alternate situation if the left over portion of the loan was used for acquiring the

shares by Jasmine herself instead of lending the amount to her husband, Jasmine would have

been entitled to claim an allowable deduction under the positive limbs of “section 8-1, ITAA

1997” (Woellner et al., 2018). Nevertheless, the leftover part of the loan was used by Jasmine

husband for acquiring shares. Therefore, Jasmine will not be entitled to any allowable

deductions under the general provision of “S-8-1, ITAA 1997”.

Answer to 2 B:

In the alternate situation if the left over portion of the loan was used for acquiring the

shares by Jasmine herself instead of lending the amount to her husband, Jasmine would have

been entitled to claim an allowable deduction under the positive limbs of “section 8-1, ITAA

1997” (Woellner et al., 2018). Nevertheless, the leftover part of the loan was used by Jasmine

husband for acquiring shares. Therefore, Jasmine will not be entitled to any allowable

deductions under the general provision of “S-8-1, ITAA 1997”.

11TAXATION LAW

References:

Barkoczy, S. (2018). Australian Tax Casebook (2018). 14e ebook. Melbourne: OUPANZ.

Caldwell, R. (2014) Taxation for Australian businesses.

Douglas, H., Bartlett, F., Luker, T., & Hunter, R. (2014) Australian Taxation Judgments.

Grange, J., Jover-Ledesma, G., & Maydew, G. (2014) principles of business taxation.

James, S. (2014) The economics of taxation.

Jover-Ledesma, G. (2014). Principles of business taxation 2015. [Place of publication not

identified]: Cch Incorporated.

Kenny, P. (2014) Australian tax.

Kenny, P., Blissenden, M., & Villios, S. (2018) Australian Tax.

McCouat, P. (2018) Australian master GST guide.

Morgan, A., Mortimer, C., & Pinto, D. (2015) A practical introduction to Australian taxation

law.

Pinto, D. (2013). State taxes. In Australian Taxation Law (pp. 1763-1762). CCH Australia

Limited.

Sadiq, K. (2018). Australian taxation law cases 2018. Pyrmont, NSW: Thomson Reuters.

Sadiq, K., Coleman, C., Hanegbi, R., Jogarajan, S., Krever, R., & Obst, W. et al. (2018)

Principles of taxation law.

Taylor, C., Walpole, M., Burton, M., Ciro, T., & Murray, I. (2018) Understanding taxation

law.

References:

Barkoczy, S. (2018). Australian Tax Casebook (2018). 14e ebook. Melbourne: OUPANZ.

Caldwell, R. (2014) Taxation for Australian businesses.

Douglas, H., Bartlett, F., Luker, T., & Hunter, R. (2014) Australian Taxation Judgments.

Grange, J., Jover-Ledesma, G., & Maydew, G. (2014) principles of business taxation.

James, S. (2014) The economics of taxation.

Jover-Ledesma, G. (2014). Principles of business taxation 2015. [Place of publication not

identified]: Cch Incorporated.

Kenny, P. (2014) Australian tax.

Kenny, P., Blissenden, M., & Villios, S. (2018) Australian Tax.

McCouat, P. (2018) Australian master GST guide.

Morgan, A., Mortimer, C., & Pinto, D. (2015) A practical introduction to Australian taxation

law.

Pinto, D. (2013). State taxes. In Australian Taxation Law (pp. 1763-1762). CCH Australia

Limited.

Sadiq, K. (2018). Australian taxation law cases 2018. Pyrmont, NSW: Thomson Reuters.

Sadiq, K., Coleman, C., Hanegbi, R., Jogarajan, S., Krever, R., & Obst, W. et al. (2018)

Principles of taxation law.

Taylor, C., Walpole, M., Burton, M., Ciro, T., & Murray, I. (2018) Understanding taxation

law.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

12TAXATION LAW

Woellner, R., Barkoczy, S., & Murphy, S. (2018). Australian Taxation Law 2018 ebook 28e.

Melbourne: OUPANZ.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C., & Pinto, D. Australian taxation law 2018.

Woellner, R., Barkoczy, S., & Murphy, S. (2018). Australian Taxation Law 2018 ebook 28e.

Melbourne: OUPANZ.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C., & Pinto, D. Australian taxation law 2018.

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.