Ask a question from expert

Chapter 4 Systems Design: Process Costing

53 Pages9865 Words196 Views

Added on 2021-09-02

Chapter 4 Systems Design: Process Costing

Added on 2021-09-02

BookmarkShareRelated Documents

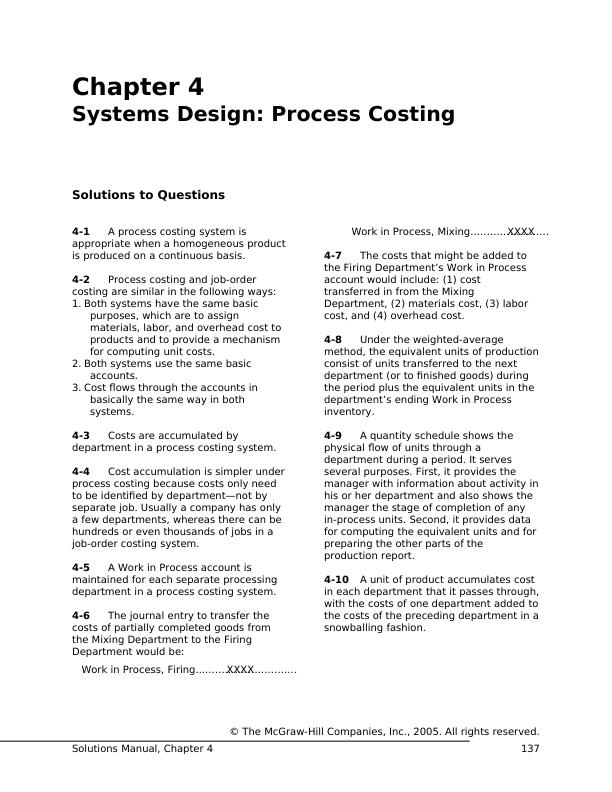

Chapter 4

Systems Design: Process Costing

Solutions to Questions

4-1 A process costing system is

appropriate when a homogeneous product

is produced on a continuous basis.

4-2 Process costing and job-order

costing are similar in the following ways:

1. Both systems have the same basic

purposes, which are to assign

materials, labor, and overhead cost to

products and to provide a mechanism

for computing unit costs.

2. Both systems use the same basic

accounts.

3. Cost flows through the accounts in

basically the same way in both

systems.

4-3 Costs are accumulated by

department in a process costing system.

4-4 Cost accumulation is simpler under

process costing because costs only need

to be identified by department—not by

separate job. Usually a company has only

a few departments, whereas there can be

hundreds or even thousands of jobs in a

job-order costing system.

4-5 A Work in Process account is

maintained for each separate processing

department in a process costing system.

4-6 The journal entry to transfer the

costs of partially completed goods from

the Mixing Department to the Firing

Department would be:

Work in Process, Firing...............................XXXX

Work in Process, Mixing........................XXXX

4-7 The costs that might be added to

the Firing Department’s Work in Process

account would include: (1) cost

transferred in from the Mixing

Department, (2) materials cost, (3) labor

cost, and (4) overhead cost.

4-8Under the weighted-average

method, the equivalent units of production

consist of units transferred to the next

department (or to finished goods) during

the period plus the equivalent units in the

department’s ending Work in Process

inventory.

4-9 A quantity schedule shows the

physical flow of units through a

department during a period. It serves

several purposes. First, it provides the

manager with information about activity in

his or her department and also shows the

manager the stage of completion of any

in-process units. Second, it provides data

for computing the equivalent units and for

preparing the other parts of the

production report.

4-10 A unit of product accumulates cost

in each department that it passes through,

with the costs of one department added to

the costs of the preceding department in a

snowballing fashion.

© The McGraw-Hill Companies, Inc., 2005. All rights reserved.

Solutions Manual, Chapter 4 137

Systems Design: Process Costing

Solutions to Questions

4-1 A process costing system is

appropriate when a homogeneous product

is produced on a continuous basis.

4-2 Process costing and job-order

costing are similar in the following ways:

1. Both systems have the same basic

purposes, which are to assign

materials, labor, and overhead cost to

products and to provide a mechanism

for computing unit costs.

2. Both systems use the same basic

accounts.

3. Cost flows through the accounts in

basically the same way in both

systems.

4-3 Costs are accumulated by

department in a process costing system.

4-4 Cost accumulation is simpler under

process costing because costs only need

to be identified by department—not by

separate job. Usually a company has only

a few departments, whereas there can be

hundreds or even thousands of jobs in a

job-order costing system.

4-5 A Work in Process account is

maintained for each separate processing

department in a process costing system.

4-6 The journal entry to transfer the

costs of partially completed goods from

the Mixing Department to the Firing

Department would be:

Work in Process, Firing...............................XXXX

Work in Process, Mixing........................XXXX

4-7 The costs that might be added to

the Firing Department’s Work in Process

account would include: (1) cost

transferred in from the Mixing

Department, (2) materials cost, (3) labor

cost, and (4) overhead cost.

4-8Under the weighted-average

method, the equivalent units of production

consist of units transferred to the next

department (or to finished goods) during

the period plus the equivalent units in the

department’s ending Work in Process

inventory.

4-9 A quantity schedule shows the

physical flow of units through a

department during a period. It serves

several purposes. First, it provides the

manager with information about activity in

his or her department and also shows the

manager the stage of completion of any

in-process units. Second, it provides data

for computing the equivalent units and for

preparing the other parts of the

production report.

4-10 A unit of product accumulates cost

in each department that it passes through,

with the costs of one department added to

the costs of the preceding department in a

snowballing fashion.

© The McGraw-Hill Companies, Inc., 2005. All rights reserved.

Solutions Manual, Chapter 4 137

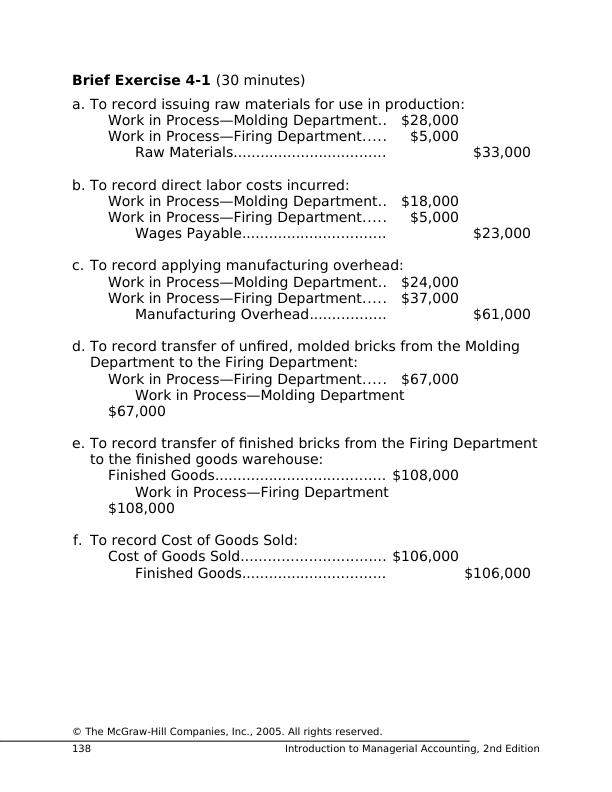

Brief Exercise 4-1 (30 minutes)

a. To record issuing raw materials for use in production:

Work in Process—Molding Department.. $28,000

Work in Process—Firing Department..... $5,000

Raw Materials.................................. $33,000

b. To record direct labor costs incurred:

Work in Process—Molding Department.. $18,000

Work in Process—Firing Department..... $5,000

Wages Payable................................ $23,000

c. To record applying manufacturing overhead:

Work in Process—Molding Department.. $24,000

Work in Process—Firing Department..... $37,000

Manufacturing Overhead................. $61,000

d. To record transfer of unfired, molded bricks from the Molding

Department to the Firing Department:

Work in Process—Firing Department..... $67,000

Work in Process—Molding Department

$67,000

e. To record transfer of finished bricks from the Firing Department

to the finished goods warehouse:

Finished Goods...................................... $108,000

Work in Process—Firing Department

$108,000

f. To record Cost of Goods Sold:

Cost of Goods Sold................................ $106,000

Finished Goods................................ $106,000

© The McGraw-Hill Companies, Inc., 2005. All rights reserved.

138 Introduction to Managerial Accounting, 2nd Edition

a. To record issuing raw materials for use in production:

Work in Process—Molding Department.. $28,000

Work in Process—Firing Department..... $5,000

Raw Materials.................................. $33,000

b. To record direct labor costs incurred:

Work in Process—Molding Department.. $18,000

Work in Process—Firing Department..... $5,000

Wages Payable................................ $23,000

c. To record applying manufacturing overhead:

Work in Process—Molding Department.. $24,000

Work in Process—Firing Department..... $37,000

Manufacturing Overhead................. $61,000

d. To record transfer of unfired, molded bricks from the Molding

Department to the Firing Department:

Work in Process—Firing Department..... $67,000

Work in Process—Molding Department

$67,000

e. To record transfer of finished bricks from the Firing Department

to the finished goods warehouse:

Finished Goods...................................... $108,000

Work in Process—Firing Department

$108,000

f. To record Cost of Goods Sold:

Cost of Goods Sold................................ $106,000

Finished Goods................................ $106,000

© The McGraw-Hill Companies, Inc., 2005. All rights reserved.

138 Introduction to Managerial Accounting, 2nd Edition

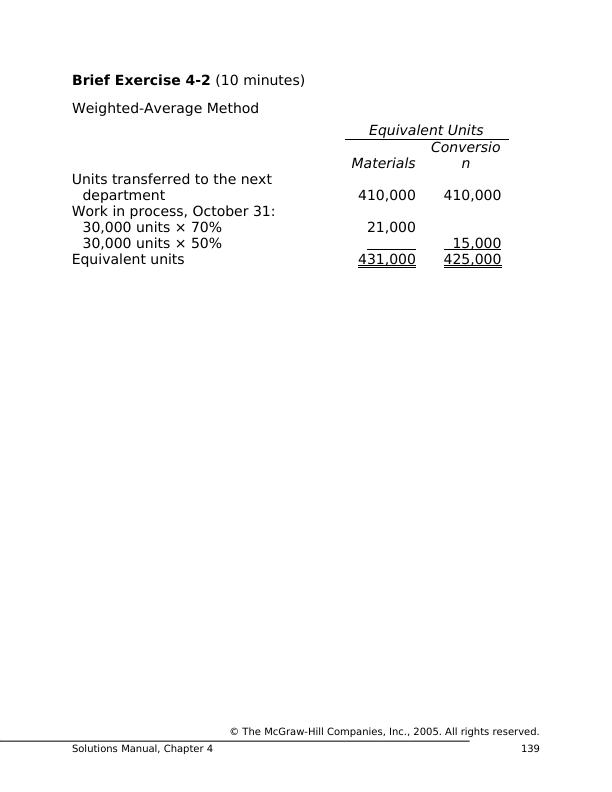

Brief Exercise 4-2 (10 minutes)

Weighted-Average Method

Equivalent Units

Materials

Conversio

n

Units transferred to the next

department 410,000 410,000

Work in process, October 31:

30,000 units × 70% 21,000

30,000 units × 50% 15,000

Equivalent units 431,000 425,000

© The McGraw-Hill Companies, Inc., 2005. All rights reserved.

Solutions Manual, Chapter 4 139

Weighted-Average Method

Equivalent Units

Materials

Conversio

n

Units transferred to the next

department 410,000 410,000

Work in process, October 31:

30,000 units × 70% 21,000

30,000 units × 50% 15,000

Equivalent units 431,000 425,000

© The McGraw-Hill Companies, Inc., 2005. All rights reserved.

Solutions Manual, Chapter 4 139

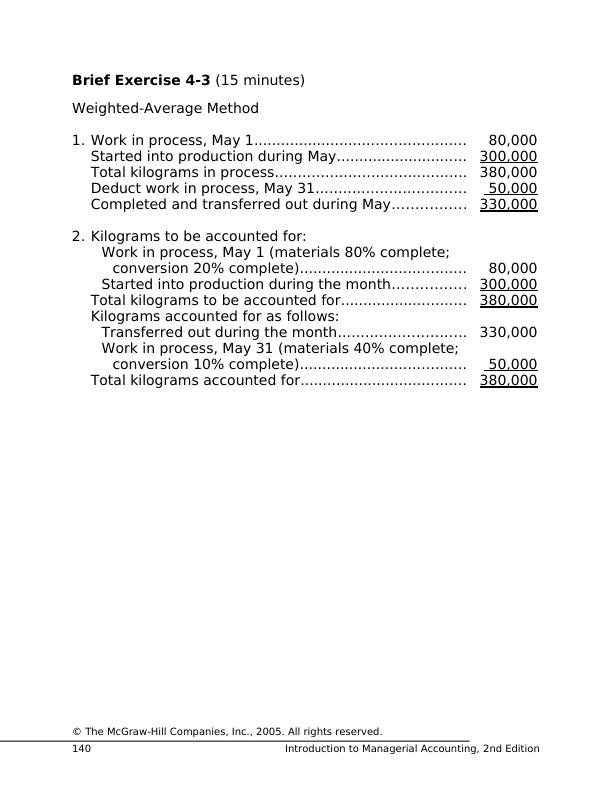

Brief Exercise 4-3 (15 minutes)

Weighted-Average Method

1. Work in process, May 1............................................... 80,000

Started into production during May............................. 300,000

Total kilograms in process.......................................... 380,000

Deduct work in process, May 31................................. 50,000

Completed and transferred out during May................ 330,000

2. Kilograms to be accounted for:

Work in process, May 1 (materials 80% complete;

conversion 20% complete)..................................... 80,000

Started into production during the month................ 300,000

Total kilograms to be accounted for............................ 380,000

Kilograms accounted for as follows:

Transferred out during the month............................ 330,000

Work in process, May 31 (materials 40% complete;

conversion 10% complete)..................................... 50,000

Total kilograms accounted for..................................... 380,000

© The McGraw-Hill Companies, Inc., 2005. All rights reserved.

140 Introduction to Managerial Accounting, 2nd Edition

Weighted-Average Method

1. Work in process, May 1............................................... 80,000

Started into production during May............................. 300,000

Total kilograms in process.......................................... 380,000

Deduct work in process, May 31................................. 50,000

Completed and transferred out during May................ 330,000

2. Kilograms to be accounted for:

Work in process, May 1 (materials 80% complete;

conversion 20% complete)..................................... 80,000

Started into production during the month................ 300,000

Total kilograms to be accounted for............................ 380,000

Kilograms accounted for as follows:

Transferred out during the month............................ 330,000

Work in process, May 31 (materials 40% complete;

conversion 10% complete)..................................... 50,000

Total kilograms accounted for..................................... 380,000

© The McGraw-Hill Companies, Inc., 2005. All rights reserved.

140 Introduction to Managerial Accounting, 2nd Edition

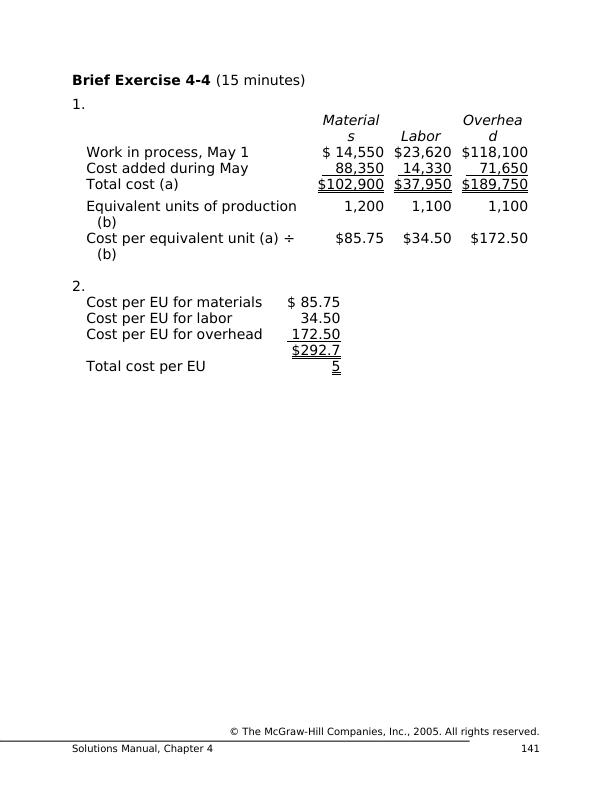

Brief Exercise 4-4 (15 minutes)

1.

Material

s Labor

Overhea

d

Work in process, May 1 $ 14,550 $23,620 $118,100

Cost added during May 88,350 14,330 71,650

Total cost (a) $102,900 $37,950 $189,750

Equivalent units of production

(b)

1,200 1,100 1,100

Cost per equivalent unit (a) ÷

(b)

$85.75 $34.50 $172.50

2.

Cost per EU for materials $ 85.75

Cost per EU for labor 34.50

Cost per EU for overhead 172.50

Total cost per EU

$292.7

5

© The McGraw-Hill Companies, Inc., 2005. All rights reserved.

Solutions Manual, Chapter 4 141

1.

Material

s Labor

Overhea

d

Work in process, May 1 $ 14,550 $23,620 $118,100

Cost added during May 88,350 14,330 71,650

Total cost (a) $102,900 $37,950 $189,750

Equivalent units of production

(b)

1,200 1,100 1,100

Cost per equivalent unit (a) ÷

(b)

$85.75 $34.50 $172.50

2.

Cost per EU for materials $ 85.75

Cost per EU for labor 34.50

Cost per EU for overhead 172.50

Total cost per EU

$292.7

5

© The McGraw-Hill Companies, Inc., 2005. All rights reserved.

Solutions Manual, Chapter 4 141

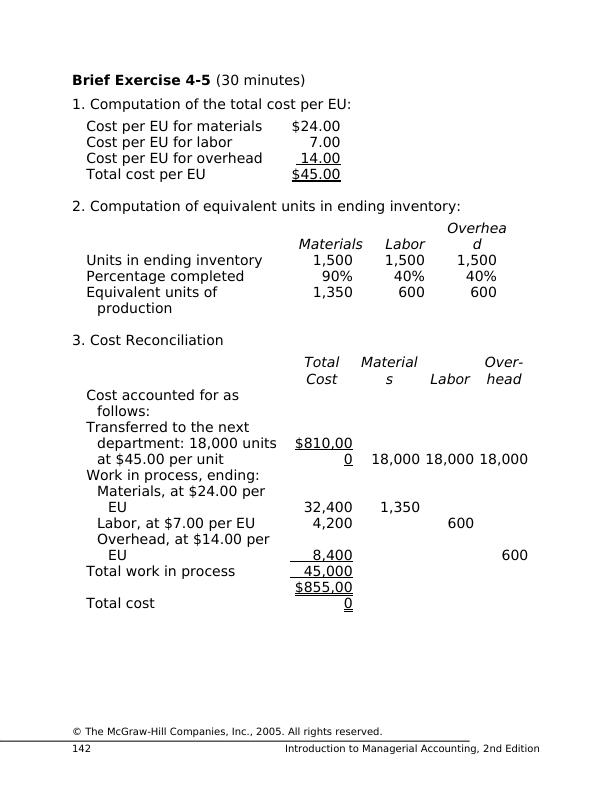

Brief Exercise 4-5 (30 minutes)

1. Computation of the total cost per EU:

Cost per EU for materials $24.00

Cost per EU for labor 7.00

Cost per EU for overhead 14.00

Total cost per EU $45.00

2. Computation of equivalent units in ending inventory:

Materials Labor

Overhea

d

Units in ending inventory 1,500 1,500 1,500

Percentage completed 90% 40% 40%

Equivalent units of

production

1,350 600 600

3. Cost Reconciliation

Total

Cost

Material

s Labor

Over-

head

Cost accounted for as

follows:

Transferred to the next

department: 18,000 units

at $45.00 per unit

$810,00

0 18,000 18,000 18,000

Work in process, ending:

Materials, at $24.00 per

EU 32,400 1,350

Labor, at $7.00 per EU 4,200 600

Overhead, at $14.00 per

EU 8,400 600

Total work in process 45,000

Total cost

$855,00

0

© The McGraw-Hill Companies, Inc., 2005. All rights reserved.

142Introduction to Managerial Accounting, 2nd Edition

1. Computation of the total cost per EU:

Cost per EU for materials $24.00

Cost per EU for labor 7.00

Cost per EU for overhead 14.00

Total cost per EU $45.00

2. Computation of equivalent units in ending inventory:

Materials Labor

Overhea

d

Units in ending inventory 1,500 1,500 1,500

Percentage completed 90% 40% 40%

Equivalent units of

production

1,350 600 600

3. Cost Reconciliation

Total

Cost

Material

s Labor

Over-

head

Cost accounted for as

follows:

Transferred to the next

department: 18,000 units

at $45.00 per unit

$810,00

0 18,000 18,000 18,000

Work in process, ending:

Materials, at $24.00 per

EU 32,400 1,350

Labor, at $7.00 per EU 4,200 600

Overhead, at $14.00 per

EU 8,400 600

Total work in process 45,000

Total cost

$855,00

0

© The McGraw-Hill Companies, Inc., 2005. All rights reserved.

142Introduction to Managerial Accounting, 2nd Edition

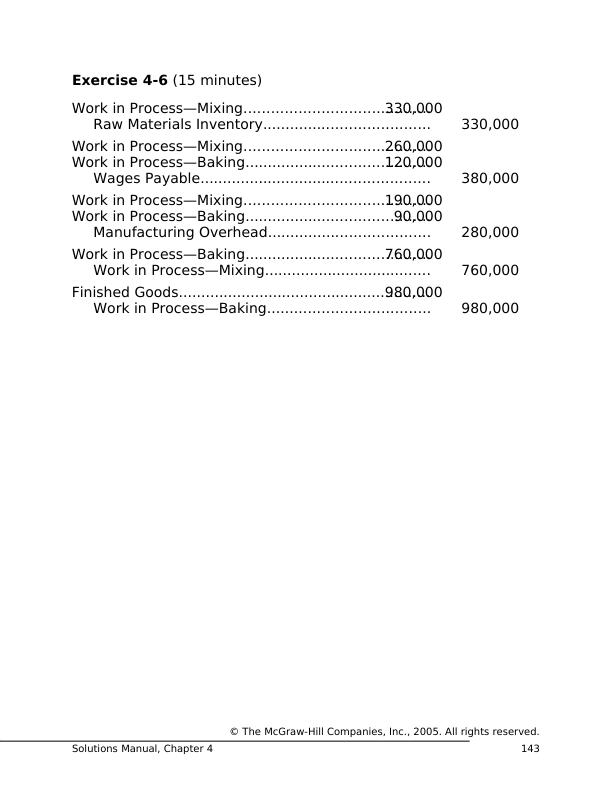

Exercise 4-6 (15 minutes)

Work in Process—Mixing.........................................330,000

Raw Materials Inventory..................................... 330,000

Work in Process—Mixing.........................................260,000

Work in Process—Baking.........................................120,000

Wages Payable................................................... 380,000

Work in Process—Mixing.........................................190,000

Work in Process—Baking.........................................90,000

Manufacturing Overhead.................................... 280,000

Work in Process—Baking.........................................760,000

Work in Process—Mixing..................................... 760,000

Finished Goods........................................................980,000

Work in Process—Baking.................................... 980,000

© The McGraw-Hill Companies, Inc., 2005. All rights reserved.

Solutions Manual, Chapter 4 143

Work in Process—Mixing.........................................330,000

Raw Materials Inventory..................................... 330,000

Work in Process—Mixing.........................................260,000

Work in Process—Baking.........................................120,000

Wages Payable................................................... 380,000

Work in Process—Mixing.........................................190,000

Work in Process—Baking.........................................90,000

Manufacturing Overhead.................................... 280,000

Work in Process—Baking.........................................760,000

Work in Process—Mixing..................................... 760,000

Finished Goods........................................................980,000

Work in Process—Baking.................................... 980,000

© The McGraw-Hill Companies, Inc., 2005. All rights reserved.

Solutions Manual, Chapter 4 143

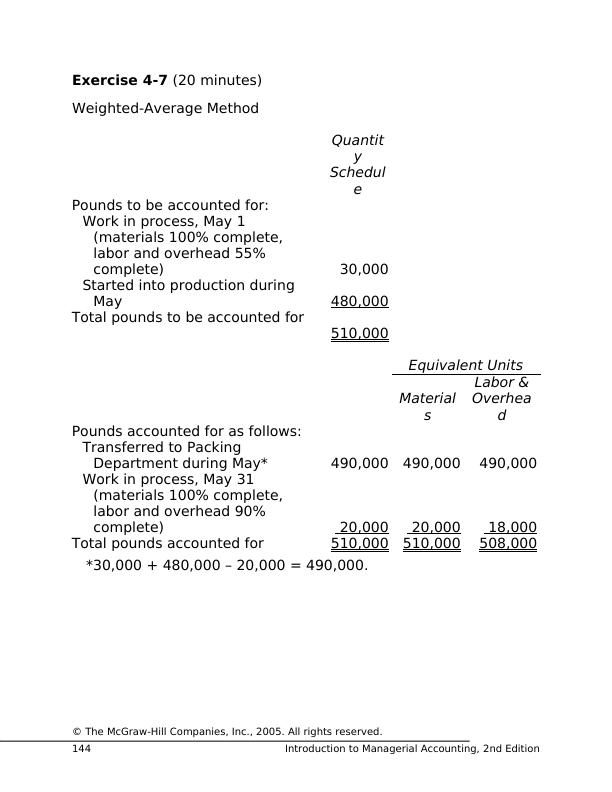

Exercise 4-7 (20 minutes)

Weighted-Average Method

Quantit

y

Schedul

e

Pounds to be accounted for:

Work in process, May 1

(materials 100% complete,

labor and overhead 55%

complete) 30,000

Started into production during

May 480,000

Total pounds to be accounted for

510,000

Equivalent Units

Material

s

Labor &

Overhea

d

Pounds accounted for as follows:

Transferred to Packing

Department during May* 490,000 490,000 490,000

Work in process, May 31

(materials 100% complete,

labor and overhead 90%

complete) 20,000 20,000 18,000

Total pounds accounted for 510,000 510,000 508,000

*30,000 + 480,000 – 20,000 = 490,000.

© The McGraw-Hill Companies, Inc., 2005. All rights reserved.

144 Introduction to Managerial Accounting, 2nd Edition

Weighted-Average Method

Quantit

y

Schedul

e

Pounds to be accounted for:

Work in process, May 1

(materials 100% complete,

labor and overhead 55%

complete) 30,000

Started into production during

May 480,000

Total pounds to be accounted for

510,000

Equivalent Units

Material

s

Labor &

Overhea

d

Pounds accounted for as follows:

Transferred to Packing

Department during May* 490,000 490,000 490,000

Work in process, May 31

(materials 100% complete,

labor and overhead 90%

complete) 20,000 20,000 18,000

Total pounds accounted for 510,000 510,000 508,000

*30,000 + 480,000 – 20,000 = 490,000.

© The McGraw-Hill Companies, Inc., 2005. All rights reserved.

144 Introduction to Managerial Accounting, 2nd Edition

End of preview

Want to access all the pages? Upload your documents or become a member.

Related Documents

Benefits of Replacing Activity Based Costing (ABC)lg...

|11

|2518

|65

ACC200: Job Costing System Projectlg...

|9

|2463

|188

Management Accounting: Solved Assignments and Essays - Deskliblg...

|19

|3305

|132

Costing System Management Accounting Report 2022lg...

|12

|2181

|19

Management Accountinglg...

|5

|696

|121

Managerial Accountinglg...

|12

|2739

|237