Cloud-Based Accounting System Analysis Assignment - Finance Module

VerifiedAdded on 2023/03/17

|13

|2562

|45

Homework Assignment

AI Summary

This assignment delves into the realm of cloud-based accounting systems, exploring various aspects of financial management. It begins with a memo explaining inventory management methods like periodic and perpetual systems, FIFO, and weighted average costing. The assignment then presents a report analyzing cloud-based accounting systems, specifically focusing on Xero, its features, advantages, and implementation. Further, it addresses the importance of internal controls and employee fraud prevention through a letter to a company's directors. The assignment also includes practical exercises involving rectification entries and the preparation of a depreciation schedule. These elements combine to offer a holistic understanding of cloud-based accounting and its practical applications in a business context.

Running head: CLOUD-BASED ACCOUNTING SYSTEM

CLOUD-BASED ACCOUNTING SYSTEM

Name of the Student:

Name of the University:

Author Note

CLOUD-BASED ACCOUNTING SYSTEM

Name of the Student:

Name of the University:

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CLOUD-BASED ACCOUNTING SYSTEM

Table of Contents

Answer to Question 1:-..............................................................................................................2

Answer to Question 2:-..............................................................................................................3

Answer to Question 3:-..............................................................................................................6

Answer to Question 4:-..............................................................................................................7

Answer to Question 5:-............................................................................................................10

References and Bibliography...................................................................................................12

Table of Contents

Answer to Question 1:-..............................................................................................................2

Answer to Question 2:-..............................................................................................................3

Answer to Question 3:-..............................................................................................................6

Answer to Question 4:-..............................................................................................................7

Answer to Question 5:-............................................................................................................10

References and Bibliography...................................................................................................12

2CLOUD-BASED ACCOUNTING SYSTEM

Answer to Question 1:-

MEMO

To: - Mr and Mrs Spot

From: - [Your Name]

Subject: - Inventory Management System

Date: - 14th May 2019

This memo is prepared to explain the different concept and method of the inventory

management. This memo explains the periodic method and the perpetual method and Fist in

first out and the weighted average cost.

Periodic method is the method of the inventory management is which the only one

purchase entry is passed at the time of purchasing inventory. Further, in the end of the period

the combined entry passed in respect of cost of goods sold.

Perpetual method is another method of controlling the inventory of the firm. In this,

the cost of goods sold is passed along with the purchase entry at the time of purchasing

inventory.

The first in first out is the one of the system of recording the transaction of the

inventory in the firm. In this the transaction related to the inventory is recorded in the first in

first out basis means the earlier purchased goods will be sold first.

The Weighted average method is the another system of recording the inventory in the

books of account. In this, the transaction of the inventory is recorded by using the weighted

average method.

Answer to Question 1:-

MEMO

To: - Mr and Mrs Spot

From: - [Your Name]

Subject: - Inventory Management System

Date: - 14th May 2019

This memo is prepared to explain the different concept and method of the inventory

management. This memo explains the periodic method and the perpetual method and Fist in

first out and the weighted average cost.

Periodic method is the method of the inventory management is which the only one

purchase entry is passed at the time of purchasing inventory. Further, in the end of the period

the combined entry passed in respect of cost of goods sold.

Perpetual method is another method of controlling the inventory of the firm. In this,

the cost of goods sold is passed along with the purchase entry at the time of purchasing

inventory.

The first in first out is the one of the system of recording the transaction of the

inventory in the firm. In this the transaction related to the inventory is recorded in the first in

first out basis means the earlier purchased goods will be sold first.

The Weighted average method is the another system of recording the inventory in the

books of account. In this, the transaction of the inventory is recorded by using the weighted

average method.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CLOUD-BASED ACCOUNTING SYSTEM

The paper concludes that there is various method and system available for recording

the transactions related to the inventories. The company can use any of them as per there

requirements.

Answer to Question 2:-

Introduction

The report titled “CLOUD-BASED ACCOUNTING SYSTEM” is prepared to

explain the concept of the cloud based accounting systems to the Mr and Mrs Spot for their

company named Spotty Ltd. As the business of the Spotty Ltd is growing faster and the

company already increases its inventory line to twenty, hence the company is in the need of

the proper inventory system to manage and control the inventory of the firm properly. In this

regards, this report explains the concept of the cloud based accounting system as well as the

suitability of the Xero cloud based accounting system. Further, this report explains the

advantages and features of the Xero that can be beneficiary for the company.

Discussion

Cloud- based accounting system

The cloud based accounting systems are the accounting system that works based on

the online cloud server. These are totally based of the internet and the technology of the new

generation. By using, the latest technology this system provides ease of doing the accounting

entries and provide result that is more accurate based of the entry (Binde, 2017). This type of

the system provides the ease in preparing the accounting report in less time and with more

accuracy. The main advantages of this type of accounting system is that this system records

all the transaction in the online cloud, which is more secure and easily accessible from

anywhere and anytime. This system also provides the flexibility in the as the business

requirement as well as more security in the storing the data.

The paper concludes that there is various method and system available for recording

the transactions related to the inventories. The company can use any of them as per there

requirements.

Answer to Question 2:-

Introduction

The report titled “CLOUD-BASED ACCOUNTING SYSTEM” is prepared to

explain the concept of the cloud based accounting systems to the Mr and Mrs Spot for their

company named Spotty Ltd. As the business of the Spotty Ltd is growing faster and the

company already increases its inventory line to twenty, hence the company is in the need of

the proper inventory system to manage and control the inventory of the firm properly. In this

regards, this report explains the concept of the cloud based accounting system as well as the

suitability of the Xero cloud based accounting system. Further, this report explains the

advantages and features of the Xero that can be beneficiary for the company.

Discussion

Cloud- based accounting system

The cloud based accounting systems are the accounting system that works based on

the online cloud server. These are totally based of the internet and the technology of the new

generation. By using, the latest technology this system provides ease of doing the accounting

entries and provide result that is more accurate based of the entry (Binde, 2017). This type of

the system provides the ease in preparing the accounting report in less time and with more

accuracy. The main advantages of this type of accounting system is that this system records

all the transaction in the online cloud, which is more secure and easily accessible from

anywhere and anytime. This system also provides the flexibility in the as the business

requirement as well as more security in the storing the data.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CLOUD-BASED ACCOUNTING SYSTEM

Xero cloud based accounting information system

Xero is a cloud based accounting information system that assist the accountant to

prepare the various accounting report in much easier and accurate way. This is the online

server based accounting system and provides the flexibility to access the cloud from

anywhere and anytime (Brandas, Megan & Didraga, 2015). To enrol and use the system, the

company need to get the subscription of the Xero system and get enrol with it. To access the

system, it requires only the internet connectivity and the user id and password given after

purchasing the subscription of it. Once the company complete its registration with the Xero

then it can be accessible from anywhere and anytime. This is a fully automated accounting

system hence this itself creates all the relevant account in the initial stage in the basis of the

information provided by the company. The accountant only need to put the opening balance

of all the relevant account (Cleary & Quinn, 2016). After that, the accountant only need to

pass the entry of the transaction in daily basis and the system automatically performs all the

changes and effect of the transaction in the other accounts and gerent the various report in

just one click. This calculates the various report of accounts in less time and more accurately.

Features of Xero

The followings are the some important feature of the Xero that can be beneficial for

the Spotty Ltd. The first one is its inventory management solution. As the company is

growing and the inventory stocks of the company is also increasing hence the company needs

a proper accounting system for the inventory. The inventory management of the company can

be increase as the Xero provides the proper and efficient complete accounting to the Spotty

Ltd. The second one is the easiness and flexibility of the system (Flaherty, 2017). As the

Spotty Ltd is not a very big company and mainly handled by Mr and Mrs Spot. Hence, this

feature helps the directors of the company to understand the inventory management of the

Xero cloud based accounting information system

Xero is a cloud based accounting information system that assist the accountant to

prepare the various accounting report in much easier and accurate way. This is the online

server based accounting system and provides the flexibility to access the cloud from

anywhere and anytime (Brandas, Megan & Didraga, 2015). To enrol and use the system, the

company need to get the subscription of the Xero system and get enrol with it. To access the

system, it requires only the internet connectivity and the user id and password given after

purchasing the subscription of it. Once the company complete its registration with the Xero

then it can be accessible from anywhere and anytime. This is a fully automated accounting

system hence this itself creates all the relevant account in the initial stage in the basis of the

information provided by the company. The accountant only need to put the opening balance

of all the relevant account (Cleary & Quinn, 2016). After that, the accountant only need to

pass the entry of the transaction in daily basis and the system automatically performs all the

changes and effect of the transaction in the other accounts and gerent the various report in

just one click. This calculates the various report of accounts in less time and more accurately.

Features of Xero

The followings are the some important feature of the Xero that can be beneficial for

the Spotty Ltd. The first one is its inventory management solution. As the company is

growing and the inventory stocks of the company is also increasing hence the company needs

a proper accounting system for the inventory. The inventory management of the company can

be increase as the Xero provides the proper and efficient complete accounting to the Spotty

Ltd. The second one is the easiness and flexibility of the system (Flaherty, 2017). As the

Spotty Ltd is not a very big company and mainly handled by Mr and Mrs Spot. Hence, this

feature helps the directors of the company to understand the inventory management of the

5CLOUD-BASED ACCOUNTING SYSTEM

company easily. As the company is not so big, hence the expenses must be a concern for the

company. In this regards, Xero come up with the various packages as per the requirements of

the company. So, the company can opted for the small package in the initial stage and then

grow the package in the basis of growth of the firm and the requirement.

Advantages of Xero

The Xero the cloud based accounting system have the various advantages that can be

beneficial for the company. The Xero is a fully cloud based accounting system, which give

the access from the anywhere of the world in anytime to the accounting information of the

firm. This is fully automatic and easily calculates the various required accounting report in

just one click (Marshall & Lambert, 2018). This provides the ease in preparing or generating

the accounting report for the company. Easily accessible from anywhere in world though the

internet. This provides the detailed information of the each event and transaction as well as

the summarized information of the various transaction and event. The price of the

subscription and the easy process of registration is also beneficial for the firm.

Implication Process of Xero

The implication of the Xero in the business involves the very simple and few steps.

Firstly, the firm need to purchase the subscription of the Xero and then it get the login Id and

password to access the system. Then the company need to provide the opening balances of

the all accounts and it is completed. Additional, the company need a set up of the computer

and the internet connectivity.

Conclusion

As per the above discussion, this report concludes that the cloud based accounting

system are more developed and beneficial for the companies compared to the tradition

accounting system. The Xero cloud based accounting system has the various advantages and

company easily. As the company is not so big, hence the expenses must be a concern for the

company. In this regards, Xero come up with the various packages as per the requirements of

the company. So, the company can opted for the small package in the initial stage and then

grow the package in the basis of growth of the firm and the requirement.

Advantages of Xero

The Xero the cloud based accounting system have the various advantages that can be

beneficial for the company. The Xero is a fully cloud based accounting system, which give

the access from the anywhere of the world in anytime to the accounting information of the

firm. This is fully automatic and easily calculates the various required accounting report in

just one click (Marshall & Lambert, 2018). This provides the ease in preparing or generating

the accounting report for the company. Easily accessible from anywhere in world though the

internet. This provides the detailed information of the each event and transaction as well as

the summarized information of the various transaction and event. The price of the

subscription and the easy process of registration is also beneficial for the firm.

Implication Process of Xero

The implication of the Xero in the business involves the very simple and few steps.

Firstly, the firm need to purchase the subscription of the Xero and then it get the login Id and

password to access the system. Then the company need to provide the opening balances of

the all accounts and it is completed. Additional, the company need a set up of the computer

and the internet connectivity.

Conclusion

As per the above discussion, this report concludes that the cloud based accounting

system are more developed and beneficial for the companies compared to the tradition

accounting system. The Xero cloud based accounting system has the various advantages and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CLOUD-BASED ACCOUNTING SYSTEM

the features that can be beneficial for the company. Hence, this report recommends the Spotty

Ltd to adopt the Xero for performing there accounting activities.

Answer to Question 3:-

To,

The Directors

Spotty Ltd,

Australia

Date: - 14/05/2019

Sub: - Importance of internal control and employee fraud

Dear Sir,

This letter is to inform you about the importance of the internal control and the

employee fraud. As now a day, the employee fraud is increased and Australia witnesses the

various employee fraud. Hence, this letter prepared to aware you about the employee frauds

and the importance of the internal control in the business.

As the recent case observed that a Perth office worker who stolen the $ 1.2 million

from two small businesses in between the November 2009 and 2017. This type of cases are

increasing the Australian news. The employee fraud refers to such functions of the

employees, which economically effect the company like stealing the cash from the business

or the getting the reimbursements by presenting the manipulating bills (Newton, 2015). This

is suggested to the Spotty Ltd to observe and employees’ performance wisely to avoid such

frauds as this can be very harmful for the business.

The importance of the internal control increases the in the context of the employees

frauds. The internal control analyse the business performance internally and can save the

company from the employee’s fraud (Leitch, 2016). As the internal control of the business

the features that can be beneficial for the company. Hence, this report recommends the Spotty

Ltd to adopt the Xero for performing there accounting activities.

Answer to Question 3:-

To,

The Directors

Spotty Ltd,

Australia

Date: - 14/05/2019

Sub: - Importance of internal control and employee fraud

Dear Sir,

This letter is to inform you about the importance of the internal control and the

employee fraud. As now a day, the employee fraud is increased and Australia witnesses the

various employee fraud. Hence, this letter prepared to aware you about the employee frauds

and the importance of the internal control in the business.

As the recent case observed that a Perth office worker who stolen the $ 1.2 million

from two small businesses in between the November 2009 and 2017. This type of cases are

increasing the Australian news. The employee fraud refers to such functions of the

employees, which economically effect the company like stealing the cash from the business

or the getting the reimbursements by presenting the manipulating bills (Newton, 2015). This

is suggested to the Spotty Ltd to observe and employees’ performance wisely to avoid such

frauds as this can be very harmful for the business.

The importance of the internal control increases the in the context of the employees

frauds. The internal control analyse the business performance internally and can save the

company from the employee’s fraud (Leitch, 2016). As the internal control of the business

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CLOUD-BASED ACCOUNTING SYSTEM

analyse the each and every aspect of the business and highlights the suspicious activity in the

business that help the company to solve such activities. This also notifies the management

before any mishaps and give time to the management to fix it out.

Hence, this letter recommends the Spotty limited to properly perform the internal

control function of the management to avoid any type of employees’ fraud.

Thanking you.

With Regards,

[Name]

[Address]

[Contact details]

Answer to Question 4:-

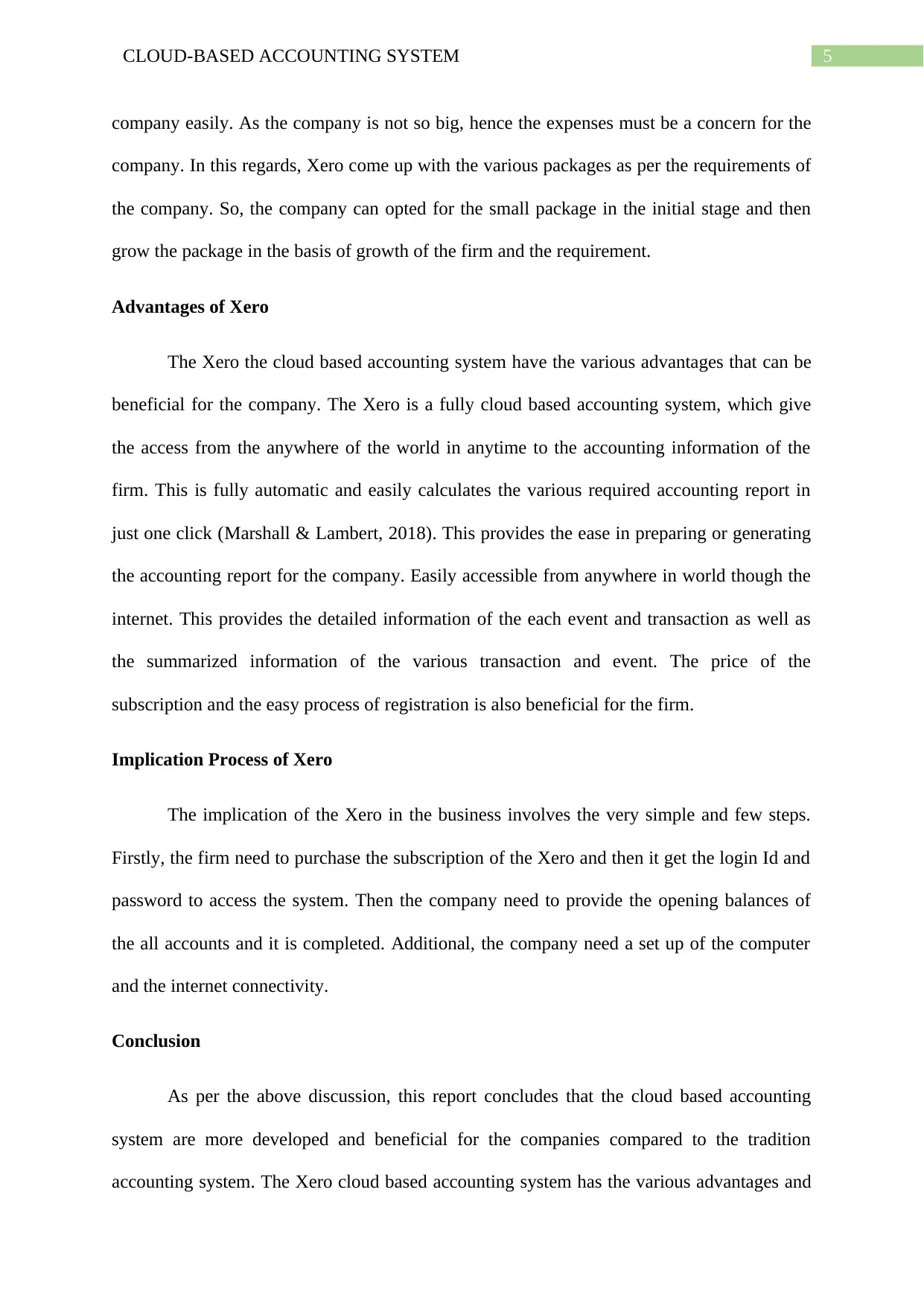

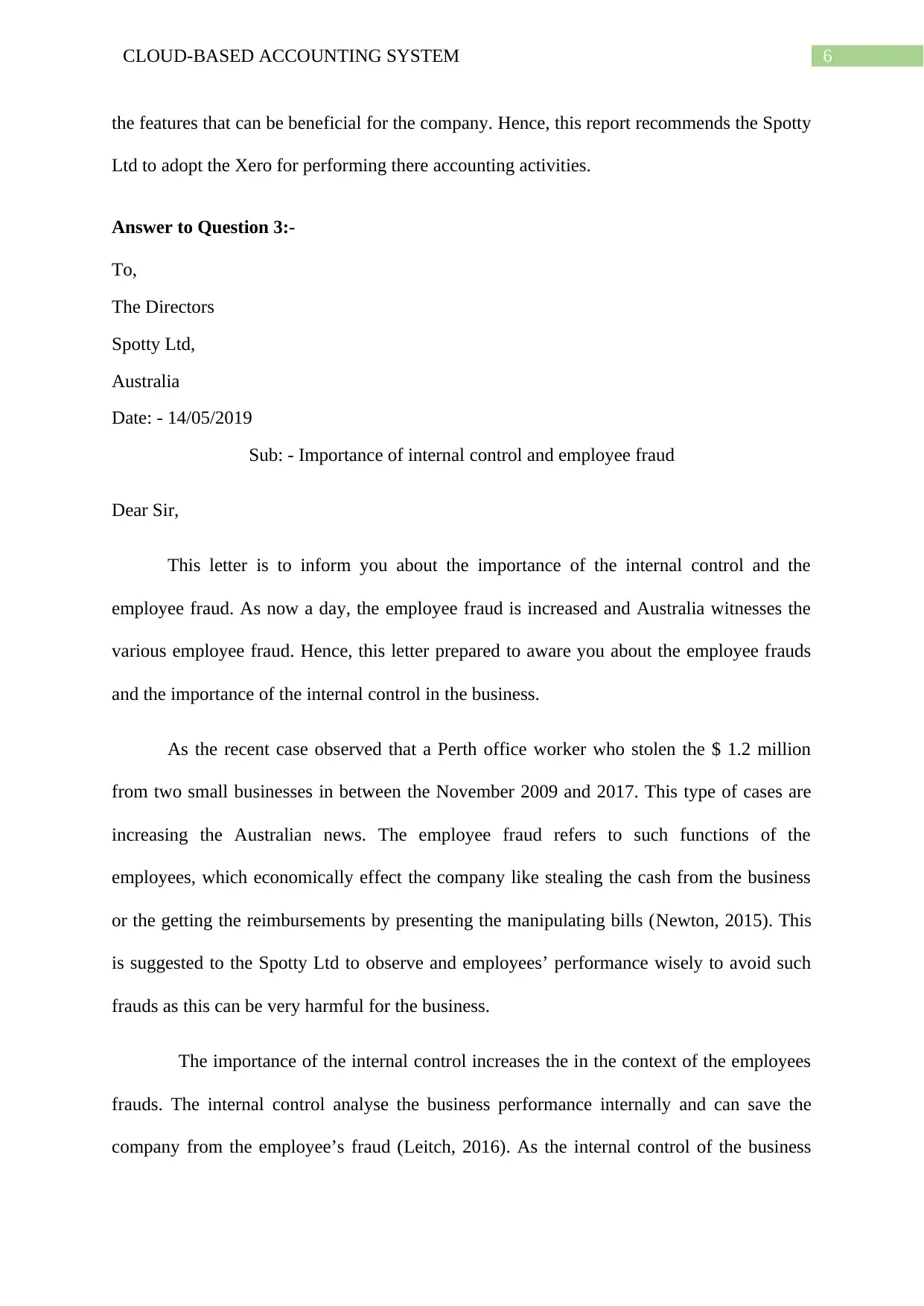

Requirement i:-

analyse the each and every aspect of the business and highlights the suspicious activity in the

business that help the company to solve such activities. This also notifies the management

before any mishaps and give time to the management to fix it out.

Hence, this letter recommends the Spotty limited to properly perform the internal

control function of the management to avoid any type of employees’ fraud.

Thanking you.

With Regards,

[Name]

[Address]

[Contact details]

Answer to Question 4:-

Requirement i:-

8CLOUD-BASED ACCOUNTING SYSTEM

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9CLOUD-BASED ACCOUNTING SYSTEM

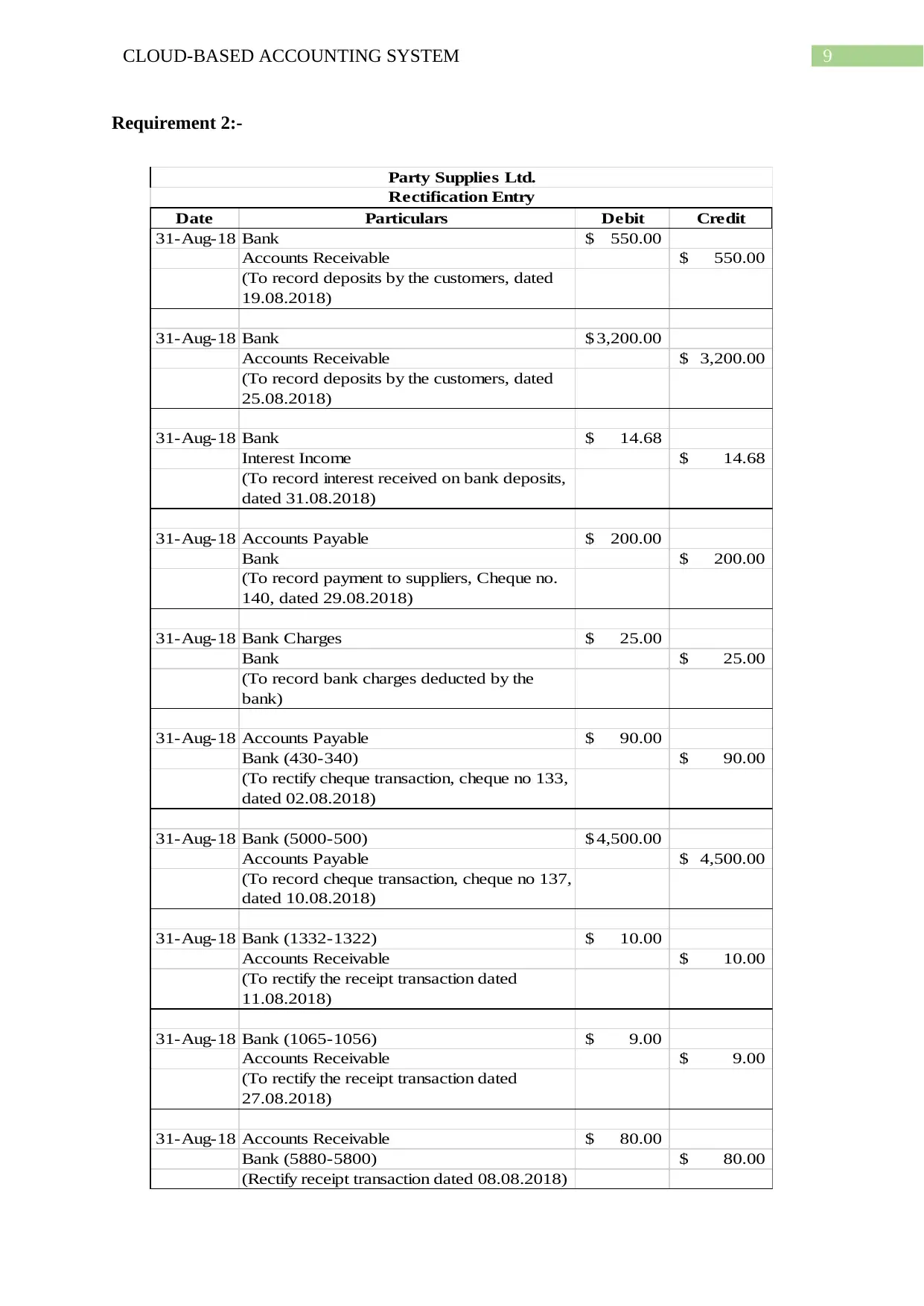

Requirement 2:-

Date Particulars Debit Credit

31-Aug-18 Bank 550.00$

Accounts Receivable 550.00$

(To record deposits by the customers, dated

19.08.2018)

31-Aug-18 Bank 3,200.00$

Accounts Receivable 3,200.00$

(To record deposits by the customers, dated

25.08.2018)

31-Aug-18 Bank 14.68$

Interest Income 14.68$

(To record interest received on bank deposits,

dated 31.08.2018)

31-Aug-18 Accounts Payable 200.00$

Bank 200.00$

(To record payment to suppliers, Cheque no.

140, dated 29.08.2018)

31-Aug-18 Bank Charges 25.00$

Bank 25.00$

(To record bank charges deducted by the

bank)

31-Aug-18 Accounts Payable 90.00$

Bank (430-340) 90.00$

(To rectify cheque transaction, cheque no 133,

dated 02.08.2018)

31-Aug-18 Bank (5000-500) 4,500.00$

Accounts Payable 4,500.00$

(To record cheque transaction, cheque no 137,

dated 10.08.2018)

31-Aug-18 Bank (1332-1322) 10.00$

Accounts Receivable 10.00$

(To rectify the receipt transaction dated

11.08.2018)

31-Aug-18 Bank (1065-1056) 9.00$

Accounts Receivable 9.00$

(To rectify the receipt transaction dated

27.08.2018)

31-Aug-18 Accounts Receivable 80.00$

Bank (5880-5800) 80.00$

(Rectify receipt transaction dated 08.08.2018)

Rectification Entry

Party Supplies Ltd.

Requirement 2:-

Date Particulars Debit Credit

31-Aug-18 Bank 550.00$

Accounts Receivable 550.00$

(To record deposits by the customers, dated

19.08.2018)

31-Aug-18 Bank 3,200.00$

Accounts Receivable 3,200.00$

(To record deposits by the customers, dated

25.08.2018)

31-Aug-18 Bank 14.68$

Interest Income 14.68$

(To record interest received on bank deposits,

dated 31.08.2018)

31-Aug-18 Accounts Payable 200.00$

Bank 200.00$

(To record payment to suppliers, Cheque no.

140, dated 29.08.2018)

31-Aug-18 Bank Charges 25.00$

Bank 25.00$

(To record bank charges deducted by the

bank)

31-Aug-18 Accounts Payable 90.00$

Bank (430-340) 90.00$

(To rectify cheque transaction, cheque no 133,

dated 02.08.2018)

31-Aug-18 Bank (5000-500) 4,500.00$

Accounts Payable 4,500.00$

(To record cheque transaction, cheque no 137,

dated 10.08.2018)

31-Aug-18 Bank (1332-1322) 10.00$

Accounts Receivable 10.00$

(To rectify the receipt transaction dated

11.08.2018)

31-Aug-18 Bank (1065-1056) 9.00$

Accounts Receivable 9.00$

(To rectify the receipt transaction dated

27.08.2018)

31-Aug-18 Accounts Receivable 80.00$

Bank (5880-5800) 80.00$

(Rectify receipt transaction dated 08.08.2018)

Rectification Entry

Party Supplies Ltd.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10CLOUD-BASED ACCOUNTING SYSTEM

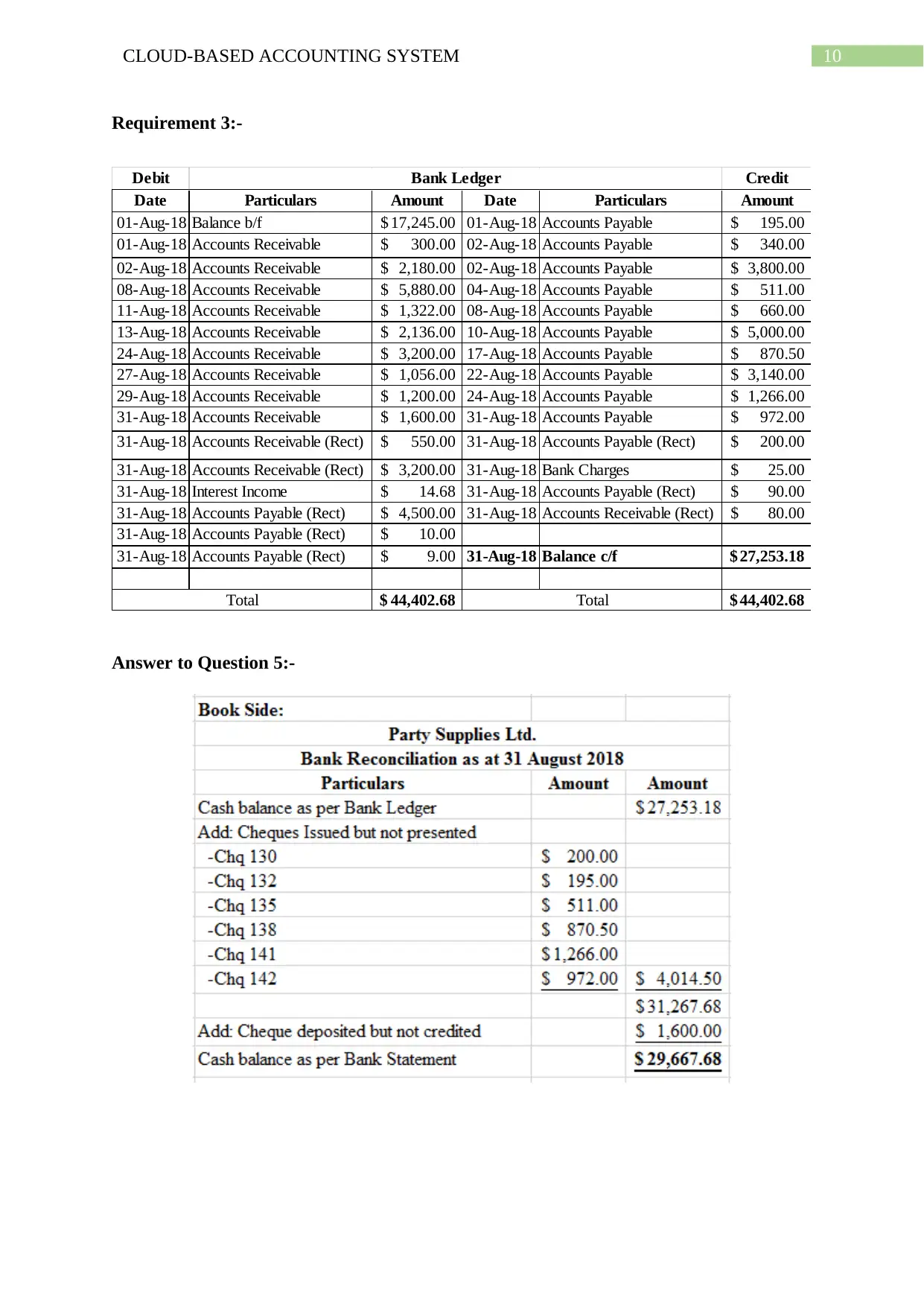

Requirement 3:-

Debit Credit

Date Particulars Amount Date Particulars Amount

01-Aug-18 Balance b/f 17,245.00$ 01-Aug-18 Accounts Payable 195.00$

01-Aug-18 Accounts Receivable 300.00$ 02-Aug-18 Accounts Payable 340.00$

02-Aug-18 Accounts Receivable 2,180.00$ 02-Aug-18 Accounts Payable 3,800.00$

08-Aug-18 Accounts Receivable 5,880.00$ 04-Aug-18 Accounts Payable 511.00$

11-Aug-18 Accounts Receivable 1,322.00$ 08-Aug-18 Accounts Payable 660.00$

13-Aug-18 Accounts Receivable 2,136.00$ 10-Aug-18 Accounts Payable 5,000.00$

24-Aug-18 Accounts Receivable 3,200.00$ 17-Aug-18 Accounts Payable 870.50$

27-Aug-18 Accounts Receivable 1,056.00$ 22-Aug-18 Accounts Payable 3,140.00$

29-Aug-18 Accounts Receivable 1,200.00$ 24-Aug-18 Accounts Payable 1,266.00$

31-Aug-18 Accounts Receivable 1,600.00$ 31-Aug-18 Accounts Payable 972.00$

31-Aug-18 Accounts Receivable (Rect) 550.00$ 31-Aug-18 Accounts Payable (Rect) 200.00$

31-Aug-18 Accounts Receivable (Rect) 3,200.00$ 31-Aug-18 Bank Charges 25.00$

31-Aug-18 Interest Income 14.68$ 31-Aug-18 Accounts Payable (Rect) 90.00$

31-Aug-18 Accounts Payable (Rect) 4,500.00$ 31-Aug-18 Accounts Receivable (Rect) 80.00$

31-Aug-18 Accounts Payable (Rect) 10.00$

31-Aug-18 Accounts Payable (Rect) 9.00$ 31-Aug-18 Balance c/f 27,253.18$

44,402.68$ 44,402.68$Total Total

Bank Ledger

Answer to Question 5:-

Requirement 3:-

Debit Credit

Date Particulars Amount Date Particulars Amount

01-Aug-18 Balance b/f 17,245.00$ 01-Aug-18 Accounts Payable 195.00$

01-Aug-18 Accounts Receivable 300.00$ 02-Aug-18 Accounts Payable 340.00$

02-Aug-18 Accounts Receivable 2,180.00$ 02-Aug-18 Accounts Payable 3,800.00$

08-Aug-18 Accounts Receivable 5,880.00$ 04-Aug-18 Accounts Payable 511.00$

11-Aug-18 Accounts Receivable 1,322.00$ 08-Aug-18 Accounts Payable 660.00$

13-Aug-18 Accounts Receivable 2,136.00$ 10-Aug-18 Accounts Payable 5,000.00$

24-Aug-18 Accounts Receivable 3,200.00$ 17-Aug-18 Accounts Payable 870.50$

27-Aug-18 Accounts Receivable 1,056.00$ 22-Aug-18 Accounts Payable 3,140.00$

29-Aug-18 Accounts Receivable 1,200.00$ 24-Aug-18 Accounts Payable 1,266.00$

31-Aug-18 Accounts Receivable 1,600.00$ 31-Aug-18 Accounts Payable 972.00$

31-Aug-18 Accounts Receivable (Rect) 550.00$ 31-Aug-18 Accounts Payable (Rect) 200.00$

31-Aug-18 Accounts Receivable (Rect) 3,200.00$ 31-Aug-18 Bank Charges 25.00$

31-Aug-18 Interest Income 14.68$ 31-Aug-18 Accounts Payable (Rect) 90.00$

31-Aug-18 Accounts Payable (Rect) 4,500.00$ 31-Aug-18 Accounts Receivable (Rect) 80.00$

31-Aug-18 Accounts Payable (Rect) 10.00$

31-Aug-18 Accounts Payable (Rect) 9.00$ 31-Aug-18 Balance c/f 27,253.18$

44,402.68$ 44,402.68$Total Total

Bank Ledger

Answer to Question 5:-

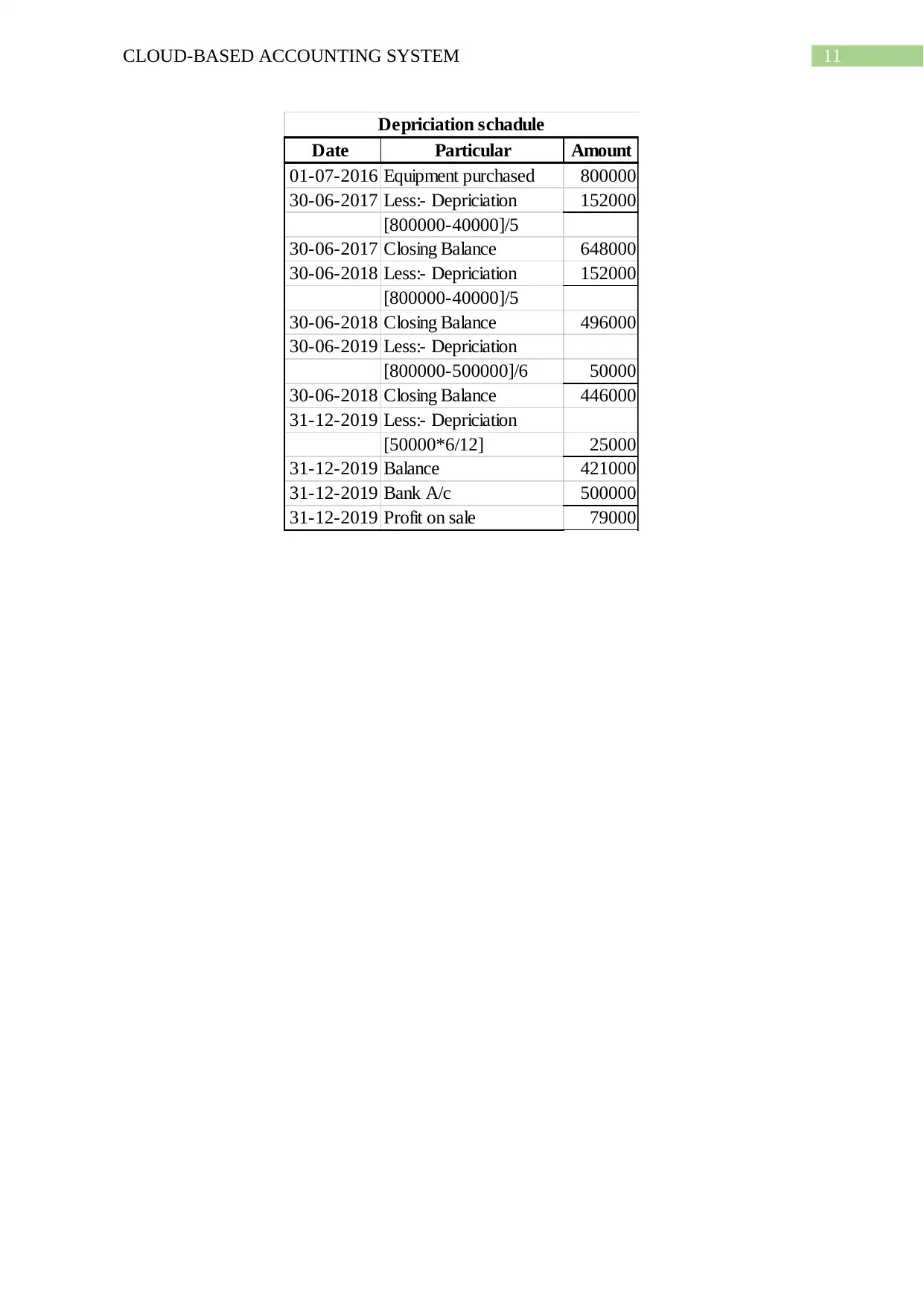

11CLOUD-BASED ACCOUNTING SYSTEM

Date Particular Amount

01-07-2016 Equipment purchased 800000

30-06-2017 Less:- Depriciation 152000

[800000-40000]/5

30-06-2017 Closing Balance 648000

30-06-2018 Less:- Depriciation 152000

[800000-40000]/5

30-06-2018 Closing Balance 496000

30-06-2019 Less:- Depriciation

[800000-500000]/6 50000

30-06-2018 Closing Balance 446000

31-12-2019 Less:- Depriciation

[50000*6/12] 25000

31-12-2019 Balance 421000

31-12-2019 Bank A/c 500000

31-12-2019 Profit on sale 79000

Depriciation schadule

Date Particular Amount

01-07-2016 Equipment purchased 800000

30-06-2017 Less:- Depriciation 152000

[800000-40000]/5

30-06-2017 Closing Balance 648000

30-06-2018 Less:- Depriciation 152000

[800000-40000]/5

30-06-2018 Closing Balance 496000

30-06-2019 Less:- Depriciation

[800000-500000]/6 50000

30-06-2018 Closing Balance 446000

31-12-2019 Less:- Depriciation

[50000*6/12] 25000

31-12-2019 Balance 421000

31-12-2019 Bank A/c 500000

31-12-2019 Profit on sale 79000

Depriciation schadule

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.