Analyzing Security & Privacy Issues in Cloud Computing for Finance

VerifiedAdded on 2023/06/14

|16

|3933

|310

Report

AI Summary

This report examines the security and privacy challenges posed by cloud computing within the financial sector, highlighting the opportunities and flaws associated with its adoption. It reviews existing literature, identifying strengths and shortcomings of previous research, and points out gaps in current solutions. The core objective is to identify security and privacy challenges and propose potential measures to create a more secure financial environment. The paper emphasizes the criticality of addressing these issues due to the financial sector's significant impact on national GDP and growth, advocating for solutions that can adapt to the evolving nature of cloud technology, potentially through the integration of machine learning. The report utilizes a detailed methodology for data collection and analysis, culminating in a scheduled timeframe for the proposed research work.

Running head: CLOUD COMPUTING IN FINANCIAL SECTOR: CURRENT SECURITY, PRIVACY ISSUES AND ITS SOLUTIONS

CLOUD COMPUTING IN FINANCIAL SECTOR: CURRENT SECURITY, PRIVACY

ISSUES AND ITS SOLUTIONS

Name of the Student

Name of the University

Author Note

CLOUD COMPUTING IN FINANCIAL SECTOR: CURRENT SECURITY, PRIVACY

ISSUES AND ITS SOLUTIONS

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CLOUD COMPUTING IN FINANCIAL SECTOR: CURRENT SECURITY, PRIVACY ISSUES AND ITS SOLUTIONS

Abstract:

Cloud computing is offering major challenges to the security & privacy and the proposed

paper will evaluate the significance and potential solution of the same in the finance sector.

The paper will introduce, the research topic and the objectives. Additionally, the devised

report will offer an insight into the steps and measures that will be taken to achieve the

proposed research work along with relevant literature review to earn an insight in the subject.

Finally, the paper has offered a scheduled time frame of the proposed work to conclude the

proposal.

Abstract:

Cloud computing is offering major challenges to the security & privacy and the proposed

paper will evaluate the significance and potential solution of the same in the finance sector.

The paper will introduce, the research topic and the objectives. Additionally, the devised

report will offer an insight into the steps and measures that will be taken to achieve the

proposed research work along with relevant literature review to earn an insight in the subject.

Finally, the paper has offered a scheduled time frame of the proposed work to conclude the

proposal.

2CLOUD COMPUTING IN FINANCIAL SECTOR: CURRENT SECURITY, PRIVACY ISSUES AND ITS SOLUTIONS

Table of Contents

Background:...............................................................................................................................3

Aims & Objectives:....................................................................................................................3

Literature review:.......................................................................................................................4

Paper under review:................................................................................................................4

Justification over selection of papers:....................................................................................5

Strength:.................................................................................................................................6

Shortcomings:........................................................................................................................7

Methodology:.............................................................................................................................8

Data Collection...................................................................................................................9

Schedule:..................................................................................................................................14

Bibliography:............................................................................................................................16

Table of Contents

Background:...............................................................................................................................3

Aims & Objectives:....................................................................................................................3

Literature review:.......................................................................................................................4

Paper under review:................................................................................................................4

Justification over selection of papers:....................................................................................5

Strength:.................................................................................................................................6

Shortcomings:........................................................................................................................7

Methodology:.............................................................................................................................8

Data Collection...................................................................................................................9

Schedule:..................................................................................................................................14

Bibliography:............................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CLOUD COMPUTING IN FINANCIAL SECTOR: CURRENT SECURITY, PRIVACY ISSUES AND ITS SOLUTIONS

Background:

Cloud computing (CC) has opened up different opportunities in different sectors and

one of such industry is financial industry. The discussed industry has greatly been benefited

by the introduction especially for the customers as they can now access different options

offered by the organisation while seating at their favourite location. The benefits enjoyed by

the customers is not the limited for CC’s benefit in the financial sector. The subject (financial

industry) are enjoying the benefits of proper utilisation of resources along with fast and less

effort consuming operation. However, the benefits do not come without it flaws and the

recent financial debacles due to CC are acting as evidence to the flaws. The flaws are

associated with security and privacy which is a major concern for the industry. The proposed

paper will attempt at citing some light on to the discussed challenges offered by the CC to the

subject and in the process contribute to the literary work on CC. The proposed paper will also

offer potential solutions to the identified challenges. The section following offers the aim and

objective that the proposed paper will pursue.

Literature review:

Reviewing the literary work of the past enables the author of the proposed research

work to earn a critical insight into the paper and also develops a platform for the research

work. The articles reviewed for the proposed paper will offer an insight into the Cloud

services and their role in financial industry which will further assist in the proposed research.

The critical literature review has been discussed in the following subsections:

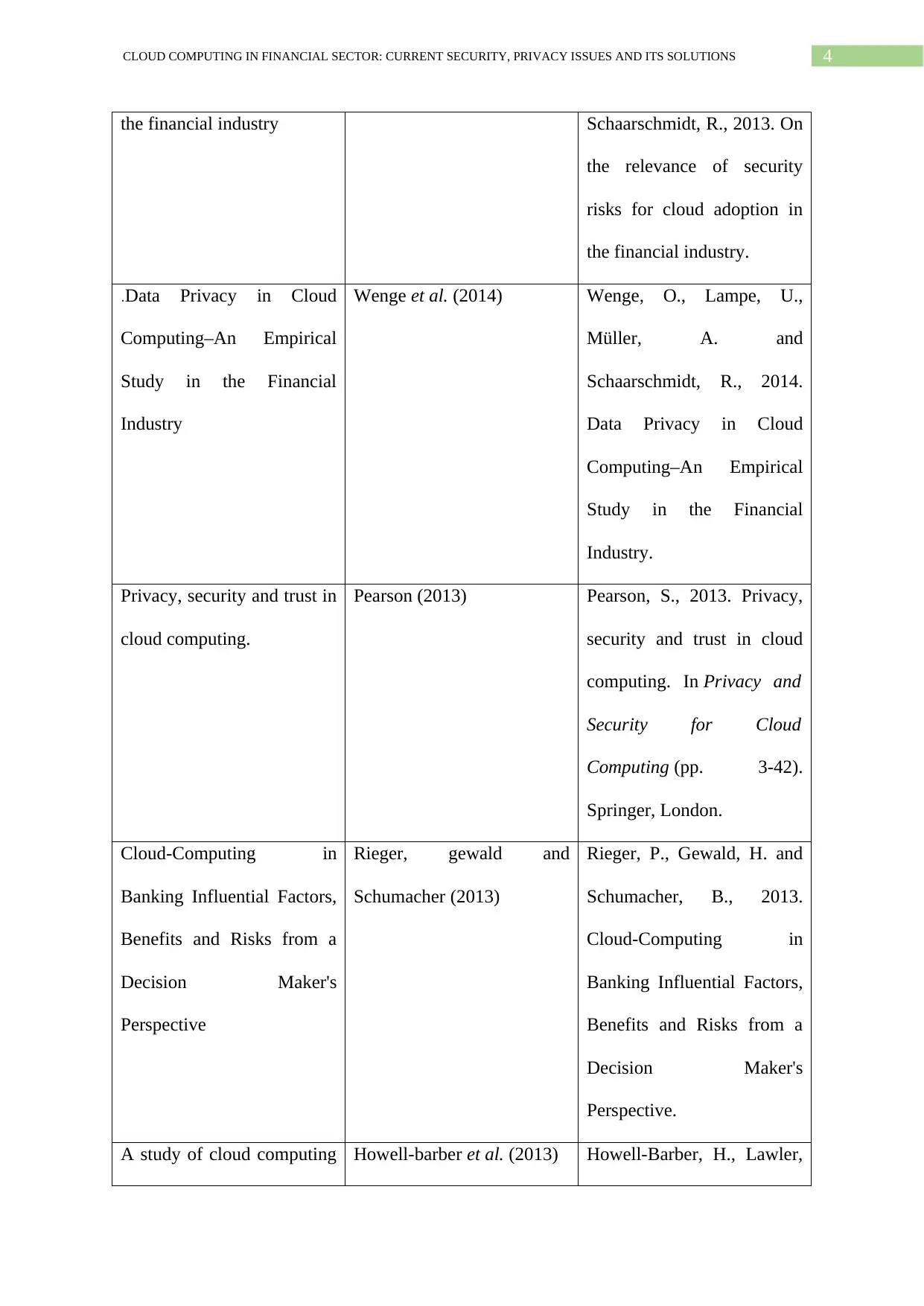

Paper under review:

Article Author in-text link

On the relevance of security

risks for cloud adoption in

Lampe et al. (2013) Lampe, U., Wenge, O.,

Müller, A. and

Background:

Cloud computing (CC) has opened up different opportunities in different sectors and

one of such industry is financial industry. The discussed industry has greatly been benefited

by the introduction especially for the customers as they can now access different options

offered by the organisation while seating at their favourite location. The benefits enjoyed by

the customers is not the limited for CC’s benefit in the financial sector. The subject (financial

industry) are enjoying the benefits of proper utilisation of resources along with fast and less

effort consuming operation. However, the benefits do not come without it flaws and the

recent financial debacles due to CC are acting as evidence to the flaws. The flaws are

associated with security and privacy which is a major concern for the industry. The proposed

paper will attempt at citing some light on to the discussed challenges offered by the CC to the

subject and in the process contribute to the literary work on CC. The proposed paper will also

offer potential solutions to the identified challenges. The section following offers the aim and

objective that the proposed paper will pursue.

Literature review:

Reviewing the literary work of the past enables the author of the proposed research

work to earn a critical insight into the paper and also develops a platform for the research

work. The articles reviewed for the proposed paper will offer an insight into the Cloud

services and their role in financial industry which will further assist in the proposed research.

The critical literature review has been discussed in the following subsections:

Paper under review:

Article Author in-text link

On the relevance of security

risks for cloud adoption in

Lampe et al. (2013) Lampe, U., Wenge, O.,

Müller, A. and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CLOUD COMPUTING IN FINANCIAL SECTOR: CURRENT SECURITY, PRIVACY ISSUES AND ITS SOLUTIONS

the financial industry Schaarschmidt, R., 2013. On

the relevance of security

risks for cloud adoption in

the financial industry.

.Data Privacy in Cloud

Computing–An Empirical

Study in the Financial

Industry

Wenge et al. (2014) Wenge, O., Lampe, U.,

Müller, A. and

Schaarschmidt, R., 2014.

Data Privacy in Cloud

Computing–An Empirical

Study in the Financial

Industry.

Privacy, security and trust in

cloud computing.

Pearson (2013) Pearson, S., 2013. Privacy,

security and trust in cloud

computing. In Privacy and

Security for Cloud

Computing (pp. 3-42).

Springer, London.

Cloud-Computing in

Banking Influential Factors,

Benefits and Risks from a

Decision Maker's

Perspective

Rieger, gewald and

Schumacher (2013)

Rieger, P., Gewald, H. and

Schumacher, B., 2013.

Cloud-Computing in

Banking Influential Factors,

Benefits and Risks from a

Decision Maker's

Perspective.

A study of cloud computing Howell-barber et al. (2013) Howell-Barber, H., Lawler,

the financial industry Schaarschmidt, R., 2013. On

the relevance of security

risks for cloud adoption in

the financial industry.

.Data Privacy in Cloud

Computing–An Empirical

Study in the Financial

Industry

Wenge et al. (2014) Wenge, O., Lampe, U.,

Müller, A. and

Schaarschmidt, R., 2014.

Data Privacy in Cloud

Computing–An Empirical

Study in the Financial

Industry.

Privacy, security and trust in

cloud computing.

Pearson (2013) Pearson, S., 2013. Privacy,

security and trust in cloud

computing. In Privacy and

Security for Cloud

Computing (pp. 3-42).

Springer, London.

Cloud-Computing in

Banking Influential Factors,

Benefits and Risks from a

Decision Maker's

Perspective

Rieger, gewald and

Schumacher (2013)

Rieger, P., Gewald, H. and

Schumacher, B., 2013.

Cloud-Computing in

Banking Influential Factors,

Benefits and Risks from a

Decision Maker's

Perspective.

A study of cloud computing Howell-barber et al. (2013) Howell-Barber, H., Lawler,

5CLOUD COMPUTING IN FINANCIAL SECTOR: CURRENT SECURITY, PRIVACY ISSUES AND ITS SOLUTIONS

software-as-a-service (SaaS)

in financial firms

J., Desai, S. and Joseph, A.,

2013. A study of cloud

computing software-as-a-

service (SaaS) in financial

firms. Journal of

Information Systems

Applied Research, 6(3).

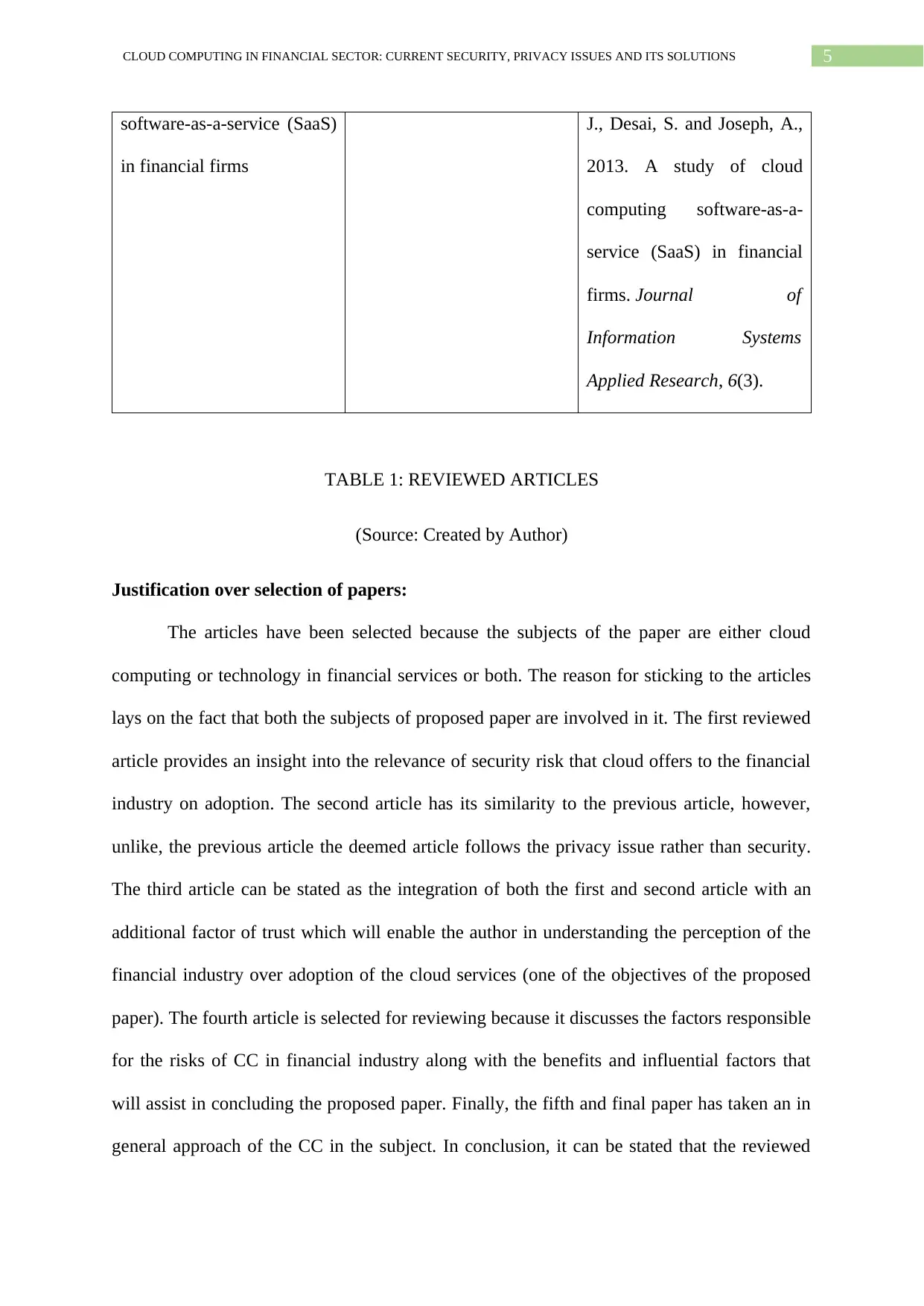

TABLE 1: REVIEWED ARTICLES

(Source: Created by Author)

Justification over selection of papers:

The articles have been selected because the subjects of the paper are either cloud

computing or technology in financial services or both. The reason for sticking to the articles

lays on the fact that both the subjects of proposed paper are involved in it. The first reviewed

article provides an insight into the relevance of security risk that cloud offers to the financial

industry on adoption. The second article has its similarity to the previous article, however,

unlike, the previous article the deemed article follows the privacy issue rather than security.

The third article can be stated as the integration of both the first and second article with an

additional factor of trust which will enable the author in understanding the perception of the

financial industry over adoption of the cloud services (one of the objectives of the proposed

paper). The fourth article is selected for reviewing because it discusses the factors responsible

for the risks of CC in financial industry along with the benefits and influential factors that

will assist in concluding the proposed paper. Finally, the fifth and final paper has taken an in

general approach of the CC in the subject. In conclusion, it can be stated that the reviewed

software-as-a-service (SaaS)

in financial firms

J., Desai, S. and Joseph, A.,

2013. A study of cloud

computing software-as-a-

service (SaaS) in financial

firms. Journal of

Information Systems

Applied Research, 6(3).

TABLE 1: REVIEWED ARTICLES

(Source: Created by Author)

Justification over selection of papers:

The articles have been selected because the subjects of the paper are either cloud

computing or technology in financial services or both. The reason for sticking to the articles

lays on the fact that both the subjects of proposed paper are involved in it. The first reviewed

article provides an insight into the relevance of security risk that cloud offers to the financial

industry on adoption. The second article has its similarity to the previous article, however,

unlike, the previous article the deemed article follows the privacy issue rather than security.

The third article can be stated as the integration of both the first and second article with an

additional factor of trust which will enable the author in understanding the perception of the

financial industry over adoption of the cloud services (one of the objectives of the proposed

paper). The fourth article is selected for reviewing because it discusses the factors responsible

for the risks of CC in financial industry along with the benefits and influential factors that

will assist in concluding the proposed paper. Finally, the fifth and final paper has taken an in

general approach of the CC in the subject. In conclusion, it can be stated that the reviewed

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CLOUD COMPUTING IN FINANCIAL SECTOR: CURRENT SECURITY, PRIVACY ISSUES AND ITS SOLUTIONS

articles are relevant to the proposed work and will assist in achieving the objectives and the

selection is justified.

Strength:

The strength of a reviewed article can be associated with anything from its offered

details to the structuring or the way it had paved for future researches. In case of the first

article, the strength of the article lays on the detailed nut, concussed information it has

offered. The detailing of the security threats offered by the article is vital and can be used to

derive the remedial measures for the same. Additionally, the paper is also good with

theoretical representation along with lack of practicality makes it easy to understand even for

the non-technical readers and is even capable of developing critical thinking about security

risks in the subject.

The second paper has its strength laying in the offering made by it. The paper has

offered a detail review over the privacy concerns that may arise post-adoption of the

discussed technology. The argument presented by the authors that financial sector should

focus more on the privacy issues rather than others because loss of private data will not only

threat the financial institution but also the enormous amount of customers associated with

them is a key strength of the paper.

The strength of the third article as well as the fourth article lays on the fact that they

have taken consideration of most of the factors that are relevant to the CC and the financial

services. Doing so, enables the readers to earn a collective idea about the subjects and can

even gather interest in them to pursue further researches on the subjects. Finally, the fifth

paper has its strength laying in the appropriate referencing and crediting that it has offered to

the sources of data collection along with choosing a much needed research topic which

enhances the reliability along with scope of the article.

articles are relevant to the proposed work and will assist in achieving the objectives and the

selection is justified.

Strength:

The strength of a reviewed article can be associated with anything from its offered

details to the structuring or the way it had paved for future researches. In case of the first

article, the strength of the article lays on the detailed nut, concussed information it has

offered. The detailing of the security threats offered by the article is vital and can be used to

derive the remedial measures for the same. Additionally, the paper is also good with

theoretical representation along with lack of practicality makes it easy to understand even for

the non-technical readers and is even capable of developing critical thinking about security

risks in the subject.

The second paper has its strength laying in the offering made by it. The paper has

offered a detail review over the privacy concerns that may arise post-adoption of the

discussed technology. The argument presented by the authors that financial sector should

focus more on the privacy issues rather than others because loss of private data will not only

threat the financial institution but also the enormous amount of customers associated with

them is a key strength of the paper.

The strength of the third article as well as the fourth article lays on the fact that they

have taken consideration of most of the factors that are relevant to the CC and the financial

services. Doing so, enables the readers to earn a collective idea about the subjects and can

even gather interest in them to pursue further researches on the subjects. Finally, the fifth

paper has its strength laying in the appropriate referencing and crediting that it has offered to

the sources of data collection along with choosing a much needed research topic which

enhances the reliability along with scope of the article.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CLOUD COMPUTING IN FINANCIAL SECTOR: CURRENT SECURITY, PRIVACY ISSUES AND ITS SOLUTIONS

Shortcomings:

Though, the first paper has offered some prominent detail relevant to the security

threats offered by the cloud services in the financial industry, they seem less feasible because

the offered is more theoretical in nature than practical. The second paper is an interesting and

viable readable resource for the readers of cloud services however, the paper has been

developed on the secondary data that scholars have collected during their era. Additionally, it

is also known that cloud is a disruptive technology and is continuously changing, hence,

working on the secondary data does not seem feasible as the issues that were in past could

have been omitted in the current scenario or even the issues that were not associated with CC

in the past must have made their way in the current scenario. Hence, the reliability of the

reviewed article is in doubts.

No potential shortcoming has been identified in the third article because it is well-

structured and also offers detailed and knowledgeable facts that the readers need to know.

The fourth article has its shortcoming laying in the limited size of the collected data. The

collected data for the paper were only from two banking industry of Germany. Additionally,

lack of literature review means that the paper has not collected secondary data which raises

the question over viability of the paper. The only identified drawback of the final reviewed

paper is its improper language.

Gaps in literature:

The review above cites that the CC in the financial industry has been researched at

times and by many scholars. However, the research questions of the proposed paper are still

unanswered and another potential gap that had been identified by reviewing the literary work

of the past on the subject of the paper is lack of adequate solution for CC in financial sector.

The reason for lack of adequate solution of the challenges that CC offers in the financial

sector is still in existence because cloud is a disruptive technology and is in its adolescence

Shortcomings:

Though, the first paper has offered some prominent detail relevant to the security

threats offered by the cloud services in the financial industry, they seem less feasible because

the offered is more theoretical in nature than practical. The second paper is an interesting and

viable readable resource for the readers of cloud services however, the paper has been

developed on the secondary data that scholars have collected during their era. Additionally, it

is also known that cloud is a disruptive technology and is continuously changing, hence,

working on the secondary data does not seem feasible as the issues that were in past could

have been omitted in the current scenario or even the issues that were not associated with CC

in the past must have made their way in the current scenario. Hence, the reliability of the

reviewed article is in doubts.

No potential shortcoming has been identified in the third article because it is well-

structured and also offers detailed and knowledgeable facts that the readers need to know.

The fourth article has its shortcoming laying in the limited size of the collected data. The

collected data for the paper were only from two banking industry of Germany. Additionally,

lack of literature review means that the paper has not collected secondary data which raises

the question over viability of the paper. The only identified drawback of the final reviewed

paper is its improper language.

Gaps in literature:

The review above cites that the CC in the financial industry has been researched at

times and by many scholars. However, the research questions of the proposed paper are still

unanswered and another potential gap that had been identified by reviewing the literary work

of the past on the subject of the paper is lack of adequate solution for CC in financial sector.

The reason for lack of adequate solution of the challenges that CC offers in the financial

sector is still in existence because cloud is a disruptive technology and is in its adolescence

8CLOUD COMPUTING IN FINANCIAL SECTOR: CURRENT SECURITY, PRIVACY ISSUES AND ITS SOLUTIONS

stage which is witnessing major changes. Hence, an adequate solution for the discussed

challenges can only be that solution which is capable of upgrading itself with the upgrading

technology. One of the way to establish the deemed method is to induce machine learning in

CC. The deemed approach is one area which has not been explored and needs attention. The

proposed research may formulate path for further research on machine learning capabilities of

Cloud computing.

Statement of Problem:

The discussion above cites the vitality of the CC in the financial industry and have

also cited witness to the challenges that it offers. The problem becomes more significant

because financial sector is one of the most promising industry of a country’s GDP & growth

and if it remains at threat then the threats can be considered a threat for the nation and hence

they need to be mitigated. Hence, the deemed problem can be considered as one of the most

crucial problem and needs to be addressed in the minimum possible time.

Aims & Objectives:

Cloud services is one of the most discussed subject in today’s world of technology.

The benefits of the deemed subject have invited debate and so have the challenges. Hence,

inspired by the huge attention over the discussion over the author of the proposed paper was

motivated to pursue the deemed research work. Additionally, financial sector is a sector

which most of the individuals can relate to and are influenced if the former is suffering from

any challenges. Hence, the author attempted to research on the challenges of the financial

sector and attempts to mitigate them.

The core objective of the paper is to identify the security & privacy challenge offered

by the discussed technology to the subject. The problem statement above can be taken in

consideration to understand the vitality of the aim. The aim of the paper will act as a

stage which is witnessing major changes. Hence, an adequate solution for the discussed

challenges can only be that solution which is capable of upgrading itself with the upgrading

technology. One of the way to establish the deemed method is to induce machine learning in

CC. The deemed approach is one area which has not been explored and needs attention. The

proposed research may formulate path for further research on machine learning capabilities of

Cloud computing.

Statement of Problem:

The discussion above cites the vitality of the CC in the financial industry and have

also cited witness to the challenges that it offers. The problem becomes more significant

because financial sector is one of the most promising industry of a country’s GDP & growth

and if it remains at threat then the threats can be considered a threat for the nation and hence

they need to be mitigated. Hence, the deemed problem can be considered as one of the most

crucial problem and needs to be addressed in the minimum possible time.

Aims & Objectives:

Cloud services is one of the most discussed subject in today’s world of technology.

The benefits of the deemed subject have invited debate and so have the challenges. Hence,

inspired by the huge attention over the discussion over the author of the proposed paper was

motivated to pursue the deemed research work. Additionally, financial sector is a sector

which most of the individuals can relate to and are influenced if the former is suffering from

any challenges. Hence, the author attempted to research on the challenges of the financial

sector and attempts to mitigate them.

The core objective of the paper is to identify the security & privacy challenge offered

by the discussed technology to the subject. The problem statement above can be taken in

consideration to understand the vitality of the aim. The aim of the paper will act as a

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9CLOUD COMPUTING IN FINANCIAL SECTOR: CURRENT SECURITY, PRIVACY ISSUES AND ITS SOLUTIONS

milestone in mitigating the discussed problem and offering a stability to CC based Financial

sector. The identification of the security & privacy challenge will ensure that a solution for

the problem that is capable of mitigating the discussed challenge.

The co-objective that the paper will pursue is identification of the potential measures that

can assist in tackling the identified challenges and in the process make a secure financial

environment. Identification of a problem is not sufficient as it may attract theoretical

solutions for the identified challenges. However, the feasibility of the solutions will stay

unclear unless they are researched over. The research will determine the limitation and

benefits of the proposed solution which the readers can adopt in real-world scenario

leveraging the research effort invested by the author(s). Hence, depending on the literature

review and the problem statement, the following research questions will be addressed by the

proposed research work.

What are the different types of uses of Cloud Computing in the business

organizations in Financial Sector?

What are the potential challenges of using Cloud Computing in Financial Sector?

What are the efficient strategies for mitigating the challenges of using Cloud

Computing in Financial Sector?

Can machine learning prove to be adequate solution for the security & privacy threat

for the CC based financial industries?

Methodology:

DATA COLLECTION

The proposed paper has adopted mixed methodology which will collect both the

primary and secondary data. It is also notable that the primary data will be quantitative data.

The secondary data will be from reviewing the literary work that had been done in the past

milestone in mitigating the discussed problem and offering a stability to CC based Financial

sector. The identification of the security & privacy challenge will ensure that a solution for

the problem that is capable of mitigating the discussed challenge.

The co-objective that the paper will pursue is identification of the potential measures that

can assist in tackling the identified challenges and in the process make a secure financial

environment. Identification of a problem is not sufficient as it may attract theoretical

solutions for the identified challenges. However, the feasibility of the solutions will stay

unclear unless they are researched over. The research will determine the limitation and

benefits of the proposed solution which the readers can adopt in real-world scenario

leveraging the research effort invested by the author(s). Hence, depending on the literature

review and the problem statement, the following research questions will be addressed by the

proposed research work.

What are the different types of uses of Cloud Computing in the business

organizations in Financial Sector?

What are the potential challenges of using Cloud Computing in Financial Sector?

What are the efficient strategies for mitigating the challenges of using Cloud

Computing in Financial Sector?

Can machine learning prove to be adequate solution for the security & privacy threat

for the CC based financial industries?

Methodology:

DATA COLLECTION

The proposed paper has adopted mixed methodology which will collect both the

primary and secondary data. It is also notable that the primary data will be quantitative data.

The secondary data will be from reviewing the literary work that had been done in the past

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10CLOUD COMPUTING IN FINANCIAL SECTOR: CURRENT SECURITY, PRIVACY ISSUES AND ITS SOLUTIONS

over the subject. While primary data will be collected by distributing a survey questionnaire

to the professionals who can associate themselves with the CC and financial industry as well.

The secondary data will be collected to develop platform for the research. It will assist in

justifying the findings that had been analysed from the primary data analysis. The primary

quantitative data will be collected to increase the size of the of the data.

Researches have been conducted in the past over the same topic and hence, reviewing

them would enable the author of proposed paper to understand the subject more appropriately

and based on the enhance understanding the questionnaire will be developed with

consideration of the research questions.

The reason for selecting primary quantitative data is based on the fact that CC is a

disruptive technology which is changing with time and hence, based on the previous statistics

new evaluation cannot be done. Additionally, the quantitative data is selected to increase the

size of data collected and take a global perception on the subject.

PHILOSOPHY

Interpretivism is the research philosophy that takes consideration of the factual data.

The factual data are those collected from scientific or other scholarly procedure and has been

selected as the research philosophy of the paper. The selection is based on the fact that CC is

a technological achievement and social factor does not have much in much in context for the

objective and hence, instead of positivism philosophy interpretivism has been adopted.

APPROACH

Inductive and deductive are the most commonly known approach. While inductive

approach is used for scholarly work where a new tool or technique is inducted to counter a

situation, deductive approach are used when there is need of deducing some facts from a

scenario. However, there is a third approach known as remedial approach which deduces and

over the subject. While primary data will be collected by distributing a survey questionnaire

to the professionals who can associate themselves with the CC and financial industry as well.

The secondary data will be collected to develop platform for the research. It will assist in

justifying the findings that had been analysed from the primary data analysis. The primary

quantitative data will be collected to increase the size of the of the data.

Researches have been conducted in the past over the same topic and hence, reviewing

them would enable the author of proposed paper to understand the subject more appropriately

and based on the enhance understanding the questionnaire will be developed with

consideration of the research questions.

The reason for selecting primary quantitative data is based on the fact that CC is a

disruptive technology which is changing with time and hence, based on the previous statistics

new evaluation cannot be done. Additionally, the quantitative data is selected to increase the

size of data collected and take a global perception on the subject.

PHILOSOPHY

Interpretivism is the research philosophy that takes consideration of the factual data.

The factual data are those collected from scientific or other scholarly procedure and has been

selected as the research philosophy of the paper. The selection is based on the fact that CC is

a technological achievement and social factor does not have much in much in context for the

objective and hence, instead of positivism philosophy interpretivism has been adopted.

APPROACH

Inductive and deductive are the most commonly known approach. While inductive

approach is used for scholarly work where a new tool or technique is inducted to counter a

situation, deductive approach are used when there is need of deducing some facts from a

scenario. However, there is a third approach known as remedial approach which deduces and

11CLOUD COMPUTING IN FINANCIAL SECTOR: CURRENT SECURITY, PRIVACY ISSUES AND ITS SOLUTIONS

incudes both at the same time. It identifies the issues and offers remedial tools and techniques

at the same time.

The objective of the paper is to identify security & privacy issues due to CC in

financial sector which needs deductive objective. Another demand of the proposed paper is to

recommend potential measures for tackling the identified challenges which calls for inductive

approach. Hence, remedial approach is selected which takes account of both deduction and

induction at a particular instance.

DESIGN

Three types of research design are generally equipped and they are descriptive,

exploratory and explanatory. The proposed paper will equip the exploratory and explanatory

research design. Descriptive research design is used when there is need to describe a scenario

while explanatory design assists in explaining a scenario. Finally, the exploratory design is

equipped when there is need for exploring a scenario and explore remedial procedures.

The objective of the proposed paper demands the need of explaining the security &

privacy issues offered by CC in the financial sector and hence explanatory design will be

adopted. Additionally, the objective also raises the need for exploring the measures and tools

that can assist in tackling the identified security & privacy issues and hence, exploratory

design will be a part of the proposed research work. So, the research design of the paper is an

integrated form of explanatory and exploratory research design.

SAMPLING

Critical thinking and sampling tool (MS-Excel) will be the associated tools &

techniques which will assist in data sampling. Critical thinking will be equipped for the

secondary data while statistical tool will be used to evaluate and conclude on the collected

incudes both at the same time. It identifies the issues and offers remedial tools and techniques

at the same time.

The objective of the paper is to identify security & privacy issues due to CC in

financial sector which needs deductive objective. Another demand of the proposed paper is to

recommend potential measures for tackling the identified challenges which calls for inductive

approach. Hence, remedial approach is selected which takes account of both deduction and

induction at a particular instance.

DESIGN

Three types of research design are generally equipped and they are descriptive,

exploratory and explanatory. The proposed paper will equip the exploratory and explanatory

research design. Descriptive research design is used when there is need to describe a scenario

while explanatory design assists in explaining a scenario. Finally, the exploratory design is

equipped when there is need for exploring a scenario and explore remedial procedures.

The objective of the proposed paper demands the need of explaining the security &

privacy issues offered by CC in the financial sector and hence explanatory design will be

adopted. Additionally, the objective also raises the need for exploring the measures and tools

that can assist in tackling the identified security & privacy issues and hence, exploratory

design will be a part of the proposed research work. So, the research design of the paper is an

integrated form of explanatory and exploratory research design.

SAMPLING

Critical thinking and sampling tool (MS-Excel) will be the associated tools &

techniques which will assist in data sampling. Critical thinking will be equipped for the

secondary data while statistical tool will be used to evaluate and conclude on the collected

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.