Project Proposal: Economics & Finance - Risk in Coal and Oil Markets

VerifiedAdded on 2023/06/12

|18

|4356

|216

Project

AI Summary

This project proposal explores the economic and financial risks and uncertainties within the Australian coal and oil markets. It identifies financial uncertainties and economic risks impacting both the coal and oil industries, aiming to reveal financial threats and evaluate economic risks that cause uncertainty. The research justifies its importance by highlighting its contribution to understanding complex oil and coal prices, supply and demand dynamics, and the co-movement of crude oil and coal prices. The conceptual framework outlines categories of risk, including financial and economic risks, and discusses the structure of risk management in the oil and coal market. The proposal includes a research methodology section detailing the research approach, data sources, data collection and analysis methods, research structure, budget, Gantt chart, and planned research activities. This document is available on Desklib, a platform offering a wide array of study tools and solved assignments for students.

Running head: ECONOMICS AND FINANCE RISK IN COAL AND OIL MARKETS

Economics and Finance-Risk and Uncertainty in Coal and Oil Markets

Name of the University:

Name of the Student:

Authors Note:

Economics and Finance-Risk and Uncertainty in Coal and Oil Markets

Name of the University:

Name of the Student:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMICS AND FINANCE RISK IN COAL AND OIL MARKETS

Table of Contents

1. Introduction......................................................................................................................2

2. Problem Statement...........................................................................................................2

3. Aim and Objectives of the Research...............................................................................3

4. Justification and Likely Research Outcome....................................................................4

5. Conceptual Framework and Hypotheses.........................................................................5

5.1. Categories of Risk and Uncertainties in Oil and Coal Market.................................5

5.2. Structure of Financial and Economic Risk Management in Oil and Coal Market...6

5.3. Research Hypotheses................................................................................................8

6. Research Methodology....................................................................................................8

6.1. Research Approach and Data Sources......................................................................8

6.2. Data Collection and Analysis...................................................................................9

6.3. Research Structure..................................................................................................10

6.4. Budget, Gantt Chart and Research Activities.........................................................11

References..........................................................................................................................14

Table of Contents

1. Introduction......................................................................................................................2

2. Problem Statement...........................................................................................................2

3. Aim and Objectives of the Research...............................................................................3

4. Justification and Likely Research Outcome....................................................................4

5. Conceptual Framework and Hypotheses.........................................................................5

5.1. Categories of Risk and Uncertainties in Oil and Coal Market.................................5

5.2. Structure of Financial and Economic Risk Management in Oil and Coal Market...6

5.3. Research Hypotheses................................................................................................8

6. Research Methodology....................................................................................................8

6.1. Research Approach and Data Sources......................................................................8

6.2. Data Collection and Analysis...................................................................................9

6.3. Research Structure..................................................................................................10

6.4. Budget, Gantt Chart and Research Activities.........................................................11

References..........................................................................................................................14

2ECONOMICS AND FINANCE RISK IN COAL AND OIL MARKETS

1. Introduction

Interest within the oil and coal-based investments and related financial risk management

has been developing for over the future financial years. Among the most vital energy

commodities is deemed to be the crude oil that is accompanied by increasingly uncertain and

volatile prices. Crude oil is deemed to be a vital aspect of the economic and the business

activities within any economy (Mack, 2014). For this reason, realizing the price movement is

deemed to be necessary for better business and economic decision making by managers within

the oil and coal industry of Australia. In addition, the crude oil, coal along with other energy

commodities has turned out to be among the highly active energy assets within Australia. From

the current publications represented by “International Renewable Energy Agency (IRENA)” it

has been gathered that the energy industry is dealing with the issues related with leaving more

than $10 trillion in the oil, gas and coal along with other associated assets (Mackey & Gass,

2015). Few other reports published by the Australian government revealed that the energy

industry operate on the precarious economic grounds that is experiencing new threats for the

organizations focused on oil, gas and coal fossil fuels.

2. Problem Statement

The major problem based on which the researcher has decided to carry out research on

this topic is focused issues raised by the previous literature. It was gathered that several risks and

uncertainties are faced by the oil and coal industry of Australia as per the report published by

“International Renewable Energy Agency (IRENA)”. Such issues have also been identified from

other publications as referred to declining of oil market in 2014. In addition, over the future years

oil company reserves is deemed to drop by at least $22 trillion that is observed to be equal to

1. Introduction

Interest within the oil and coal-based investments and related financial risk management

has been developing for over the future financial years. Among the most vital energy

commodities is deemed to be the crude oil that is accompanied by increasingly uncertain and

volatile prices. Crude oil is deemed to be a vital aspect of the economic and the business

activities within any economy (Mack, 2014). For this reason, realizing the price movement is

deemed to be necessary for better business and economic decision making by managers within

the oil and coal industry of Australia. In addition, the crude oil, coal along with other energy

commodities has turned out to be among the highly active energy assets within Australia. From

the current publications represented by “International Renewable Energy Agency (IRENA)” it

has been gathered that the energy industry is dealing with the issues related with leaving more

than $10 trillion in the oil, gas and coal along with other associated assets (Mackey & Gass,

2015). Few other reports published by the Australian government revealed that the energy

industry operate on the precarious economic grounds that is experiencing new threats for the

organizations focused on oil, gas and coal fossil fuels.

2. Problem Statement

The major problem based on which the researcher has decided to carry out research on

this topic is focused issues raised by the previous literature. It was gathered that several risks and

uncertainties are faced by the oil and coal industry of Australia as per the report published by

“International Renewable Energy Agency (IRENA)”. Such issues have also been identified from

other publications as referred to declining of oil market in 2014. In addition, over the future years

oil company reserves is deemed to drop by at least $22 trillion that is observed to be equal to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMICS AND FINANCE RISK IN COAL AND OIL MARKETS

twice the China’s GDP (Monasterolo et al., 2016). Declining local oil and coal industry is

another concern faced in the energy sector these days. Several government publications on

renewable and non-renewable energy indicated that in the year 2015, more than 94 organizations

operating in the energy sector collapsed and the other 41 energy-based organizations shut down

in the year 2016 (Slee, 2017). In some of the areas within United States it has been gathered that

unsubsidized Solar energy is observed to attain more consideration for the investors as well as

public concern regarding the climate risk requirements that must also be taken into account. Such

risks will also be able to associate the economic risks that are present within the oil and coal

market at the time of increasing investor along with public concern for the climate risk observed

within the fossil fuel industry. The current research is focused on offering vital implications

retarding the present understanding of risk management within crude oil and coal market. The

major scope of this research is to observe the finance and economic risks associated with process

of the crude oil and coal future contracts (Smith, 2017). It also offers analysis of the relationship

between the oil prices and the economic or financial variables. Another factor is persistence that

is present in data and economic oil prices transmission itself.

3. Aim and Objectives of the Research

The aim of the current research that is to be addressed after its completion is to recognize

the uncertainties those are present within the oil and coal industry of Australia along with

analyzing the related risks in finance and economy of the nation. The research objectives that are

to be met in the research are explained under:

To identify the financial uncertainties that results in increased risks within the coal

market

twice the China’s GDP (Monasterolo et al., 2016). Declining local oil and coal industry is

another concern faced in the energy sector these days. Several government publications on

renewable and non-renewable energy indicated that in the year 2015, more than 94 organizations

operating in the energy sector collapsed and the other 41 energy-based organizations shut down

in the year 2016 (Slee, 2017). In some of the areas within United States it has been gathered that

unsubsidized Solar energy is observed to attain more consideration for the investors as well as

public concern regarding the climate risk requirements that must also be taken into account. Such

risks will also be able to associate the economic risks that are present within the oil and coal

market at the time of increasing investor along with public concern for the climate risk observed

within the fossil fuel industry. The current research is focused on offering vital implications

retarding the present understanding of risk management within crude oil and coal market. The

major scope of this research is to observe the finance and economic risks associated with process

of the crude oil and coal future contracts (Smith, 2017). It also offers analysis of the relationship

between the oil prices and the economic or financial variables. Another factor is persistence that

is present in data and economic oil prices transmission itself.

3. Aim and Objectives of the Research

The aim of the current research that is to be addressed after its completion is to recognize

the uncertainties those are present within the oil and coal industry of Australia along with

analyzing the related risks in finance and economy of the nation. The research objectives that are

to be met in the research are explained under:

To identify the financial uncertainties that results in increased risks within the coal

market

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMICS AND FINANCE RISK IN COAL AND OIL MARKETS

To recognize the vital economic risks resulting in uncertainty to the coal industry

To reveal the financial threats for the organizations related with the oil industry

To evaluate the economic risks that can result in uncertainty within the oil industry

4. Justification and Likely Research Outcome

The current research is deemed to offer certain important research implications focused

on complex oil and coal prices. The research will also explain the demand and supply followed

by the inventories along with the storage that serves as the intermediary along with being a

market making process between the demand and supply (Soeder et al., 2014). The current

research will contribute to the literature regarding the co-movement of crude oil along with the

coal prices within the fossil fuel market. This will be revealed through investigating the co-

movement type employing the futures prices. The analysis carried out in this research will reveal

that the higher coal price volatility that ultimately decreases the value of the project. For this

reason, realizing the price movement is deemed to be necessary for better business and economic

decision making by managers within the oil and coal industry of Australia (Taylor, Bogdan &

DeVault, 2015). In addition, the crude oil, coal along with other energy commodities has turned

out to be among the highly active energy assets within Australia. It will also indicate that not just

the dynamics of oil and coal are important but also the co-movement nature of the process

related with gas and oil products in such research outcomes, an important factor that is to be

taken into consideration that valuation along with optimal operation. The valuation leads to

encompass a long-term relationship between the oil and coal market that can serve in taking a

crucial decision for valuing the project along with its suitable business operation. The research

findings are also deemed to reveal that ignoring such long-term relationship makes the optimal

policy highly sensitive to the dynamics of the coal and oil prices (Tulloch, Diaz-Rainey &

To recognize the vital economic risks resulting in uncertainty to the coal industry

To reveal the financial threats for the organizations related with the oil industry

To evaluate the economic risks that can result in uncertainty within the oil industry

4. Justification and Likely Research Outcome

The current research is deemed to offer certain important research implications focused

on complex oil and coal prices. The research will also explain the demand and supply followed

by the inventories along with the storage that serves as the intermediary along with being a

market making process between the demand and supply (Soeder et al., 2014). The current

research will contribute to the literature regarding the co-movement of crude oil along with the

coal prices within the fossil fuel market. This will be revealed through investigating the co-

movement type employing the futures prices. The analysis carried out in this research will reveal

that the higher coal price volatility that ultimately decreases the value of the project. For this

reason, realizing the price movement is deemed to be necessary for better business and economic

decision making by managers within the oil and coal industry of Australia (Taylor, Bogdan &

DeVault, 2015). In addition, the crude oil, coal along with other energy commodities has turned

out to be among the highly active energy assets within Australia. It will also indicate that not just

the dynamics of oil and coal are important but also the co-movement nature of the process

related with gas and oil products in such research outcomes, an important factor that is to be

taken into consideration that valuation along with optimal operation. The valuation leads to

encompass a long-term relationship between the oil and coal market that can serve in taking a

crucial decision for valuing the project along with its suitable business operation. The research

findings are also deemed to reveal that ignoring such long-term relationship makes the optimal

policy highly sensitive to the dynamics of the coal and oil prices (Tulloch, Diaz-Rainey &

5ECONOMICS AND FINANCE RISK IN COAL AND OIL MARKETS

Premachandra, 2016). It will also be gathered from the research results that the interest rate

premium, foreign exchange rate risks, return on the coal and oil price remains statistically

significant in determining a high return on the shares of coal and oil companies in Australia.

Several risk factors related with the coal and oil companies in Australia will also be revealed

through this research. Based on the financial and economic risks and uncertainties faced by the

companies the process to deal with these risks will be identified. This includes dealing with

market and industry risks that is a major part of financial and economic risk through proper use

of derivative market and active trading (Vaioleti, 2016).

5. Conceptual Framework and Hypotheses

5.1. Categories of Risk and Uncertainties in Oil and Coal Market

Bergmann, (2016) explained that financial risks experienced by the oil and coal market is

associated with the trading assets within the industry or the inability to trade specific assets. Such

risk describes the liquidity risk that is explained as the type of risk taking place from carrying out

transactions within the industry that has decreased liquidity. Berkey, (2016) explained that

operating in such economic marketplace can have negative implications on the company’s oil

and coal assets as well as its prices. It is also gathered that in the energy industry of Australia

making attempts to sell oil and coal assets might push prices lower and they will have to be sold

at prices below their normal value or in a timeframe longer than anticipated.

Within the macroeconomic envirinmet, the oil and coal companies are observed to the

major players and there are highly aware of the economic uncertainties faced by them by the

market and from fluctuations in the commodity prices. According to Bryan, (2016) the economic

risks are faced by the oil and coal companies in nations are because of the fluctuating global

Premachandra, 2016). It will also be gathered from the research results that the interest rate

premium, foreign exchange rate risks, return on the coal and oil price remains statistically

significant in determining a high return on the shares of coal and oil companies in Australia.

Several risk factors related with the coal and oil companies in Australia will also be revealed

through this research. Based on the financial and economic risks and uncertainties faced by the

companies the process to deal with these risks will be identified. This includes dealing with

market and industry risks that is a major part of financial and economic risk through proper use

of derivative market and active trading (Vaioleti, 2016).

5. Conceptual Framework and Hypotheses

5.1. Categories of Risk and Uncertainties in Oil and Coal Market

Bergmann, (2016) explained that financial risks experienced by the oil and coal market is

associated with the trading assets within the industry or the inability to trade specific assets. Such

risk describes the liquidity risk that is explained as the type of risk taking place from carrying out

transactions within the industry that has decreased liquidity. Berkey, (2016) explained that

operating in such economic marketplace can have negative implications on the company’s oil

and coal assets as well as its prices. It is also gathered that in the energy industry of Australia

making attempts to sell oil and coal assets might push prices lower and they will have to be sold

at prices below their normal value or in a timeframe longer than anticipated.

Within the macroeconomic envirinmet, the oil and coal companies are observed to the

major players and there are highly aware of the economic uncertainties faced by them by the

market and from fluctuations in the commodity prices. According to Bryan, (2016) the economic

risks are faced by the oil and coal companies in nations are because of the fluctuating global

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMICS AND FINANCE RISK IN COAL AND OIL MARKETS

prices of crude oil, coal and gas along with some by-product chemicals. There are also vital

implications of the buoyancy within the energy sector. It is also stated by these researchers that

oil and coal prices volatility take place from the economy’s decreased tolerance to the increased

oil prices. In contrast, Christophers, (2016) presented a view that there is a drive to constrain oil

and coal demand in the Australian energy market in order to prevent the climate change and

improve energy security that also threatens the profitability of the oil and coal companies as a

whole. Economic control over the uncertainties is deemed to include regulatory as well as

liability concerns focused on the regulations of crude oil trading along with the volatility of the

market. Cowell, (2017) indicated that the financial risks include the concerns focused on the

drilling and production of the crude oil and coal, the later uncertainty is associated with the

liquidity risk that is caused by certain implications that can have a drastic impact on capability of

oil and coal company’s ability to harvest as well as locate new sources. These reasechers also

indicated that another financial risk that is likely to be faced by the oil and coal market is the

credit risk. According to the views presented by Flick, (2015) it has been gathered that a change

in the credit quality in trading between two parties for crude oil and coal is deemed to negatively

affect the security value or that of the portfolio. Such risks can result in the oil and coal

companies to face the possibility of getting default and in this the counter party is to any more in

a position for the causes to address all the contractual obligations present within the energy

market.

5.2. Structure of Financial and Economic Risk Management in Oil and Coal Market

According to Roula, (2015) in the nature of financial and economic risk along with its

omnipresence on its mitigation, managing as well as supervising encompass the matters of the

financial nature which needs a discipline dedicated towards the end. Risks that are faced by the

prices of crude oil, coal and gas along with some by-product chemicals. There are also vital

implications of the buoyancy within the energy sector. It is also stated by these researchers that

oil and coal prices volatility take place from the economy’s decreased tolerance to the increased

oil prices. In contrast, Christophers, (2016) presented a view that there is a drive to constrain oil

and coal demand in the Australian energy market in order to prevent the climate change and

improve energy security that also threatens the profitability of the oil and coal companies as a

whole. Economic control over the uncertainties is deemed to include regulatory as well as

liability concerns focused on the regulations of crude oil trading along with the volatility of the

market. Cowell, (2017) indicated that the financial risks include the concerns focused on the

drilling and production of the crude oil and coal, the later uncertainty is associated with the

liquidity risk that is caused by certain implications that can have a drastic impact on capability of

oil and coal company’s ability to harvest as well as locate new sources. These reasechers also

indicated that another financial risk that is likely to be faced by the oil and coal market is the

credit risk. According to the views presented by Flick, (2015) it has been gathered that a change

in the credit quality in trading between two parties for crude oil and coal is deemed to negatively

affect the security value or that of the portfolio. Such risks can result in the oil and coal

companies to face the possibility of getting default and in this the counter party is to any more in

a position for the causes to address all the contractual obligations present within the energy

market.

5.2. Structure of Financial and Economic Risk Management in Oil and Coal Market

According to Roula, (2015) in the nature of financial and economic risk along with its

omnipresence on its mitigation, managing as well as supervising encompass the matters of the

financial nature which needs a discipline dedicated towards the end. Risks that are faced by the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS AND FINANCE RISK IN COAL AND OIL MARKETS

oil and coal companies are deemed to take place from certain environmental changes. Such

changes are associated with the factors related with the changes in the interest, market as well as

change rate risks. Frisari and Stadelmann, (2015) also stated that the financial risks that are

observed outside the company’s engagement or interaction takes place from the transactions with

the consumers, sellers and several other parties. Considering the same, the financial risk

management within the oil and coal market is observed to impact the internal as well as external

business operations of the related companies. Gary, (2018) explained economic risks

management to be a discipline to deal with the uncertainties that took place from the economic

market. Additional information is also provided that considers analyzing the economic risks

faced by the oil and coal market along with developing effective management strategies

consistent with internal policies present within the industry.

Hahnenstein, Köchling and Posch, (2018) indicated that management of the financial

risks happens to be a reliable platform in attaining a detailed understanding of the causes that are

causing it and it does not exclude the requirement to get involved in risky activities. For this

reason, the risks and its management that are considered are not deemed to be mutually

exclusive. These reasechers have also explained the economic and financial risks management

process that includes identifying risks, measuring exposure, performance, measure, estimation

and recognizing the techniques to mitigate them. Halland et al., (2014) evidenced that the

economic risk management process has developed another image of effective risk management.

Considering same, measurement of economic risk is followed by recognition of

instrument related with the trading risk. Such economic risk management process includes two

significant activities stream. Both of these models are considered to be a sequential process in

which the oil and coal companies get involved in certain interrelated activities which are

oil and coal companies are deemed to take place from certain environmental changes. Such

changes are associated with the factors related with the changes in the interest, market as well as

change rate risks. Frisari and Stadelmann, (2015) also stated that the financial risks that are

observed outside the company’s engagement or interaction takes place from the transactions with

the consumers, sellers and several other parties. Considering the same, the financial risk

management within the oil and coal market is observed to impact the internal as well as external

business operations of the related companies. Gary, (2018) explained economic risks

management to be a discipline to deal with the uncertainties that took place from the economic

market. Additional information is also provided that considers analyzing the economic risks

faced by the oil and coal market along with developing effective management strategies

consistent with internal policies present within the industry.

Hahnenstein, Köchling and Posch, (2018) indicated that management of the financial

risks happens to be a reliable platform in attaining a detailed understanding of the causes that are

causing it and it does not exclude the requirement to get involved in risky activities. For this

reason, the risks and its management that are considered are not deemed to be mutually

exclusive. These reasechers have also explained the economic and financial risks management

process that includes identifying risks, measuring exposure, performance, measure, estimation

and recognizing the techniques to mitigate them. Halland et al., (2014) evidenced that the

economic risk management process has developed another image of effective risk management.

Considering same, measurement of economic risk is followed by recognition of

instrument related with the trading risk. Such economic risk management process includes two

significant activities stream. Both of these models are considered to be a sequential process in

which the oil and coal companies get involved in certain interrelated activities which are

8ECONOMICS AND FINANCE RISK IN COAL AND OIL MARKETS

monitored as well as analyzed in this process. Hasan, (2016) explained the type of investments

that are made by the oil and coal companies to deal with the economic and financial risks that

further facilitates in maintaining stability if the volatility in the value of such organizations.

These reasechers have also recommended that among the advantages of economic risk

management within the companies operating in oil and coal market it is likely to increase

company value along with decreasing the financial distress possibility. Lewis, (2015) added that

the value of the energy sector companies is likely to experience fluctuations in the interest rates,

foreign exchange along with the commodity prices that includes oil and coal fossil fuels.

5.3. Research Hypotheses

The research hypotheses that are to be provided through accomplishment of the current

research are explained under:

Hypothesis 1: The financial uncertainties has positive impact on increasing increased

risks within the coal market

Hypothesis 2: The vital economic risks has positive impact on resulting in uncertainty to

the coal industry

Hypothesis 3: The financial threats for the organizations has positive impact on

increasing uncertainties within the oil industry

Hypothesis 4: The economic risks has positive impact on increasing uncertainty within

the oil industry

monitored as well as analyzed in this process. Hasan, (2016) explained the type of investments

that are made by the oil and coal companies to deal with the economic and financial risks that

further facilitates in maintaining stability if the volatility in the value of such organizations.

These reasechers have also recommended that among the advantages of economic risk

management within the companies operating in oil and coal market it is likely to increase

company value along with decreasing the financial distress possibility. Lewis, (2015) added that

the value of the energy sector companies is likely to experience fluctuations in the interest rates,

foreign exchange along with the commodity prices that includes oil and coal fossil fuels.

5.3. Research Hypotheses

The research hypotheses that are to be provided through accomplishment of the current

research are explained under:

Hypothesis 1: The financial uncertainties has positive impact on increasing increased

risks within the coal market

Hypothesis 2: The vital economic risks has positive impact on resulting in uncertainty to

the coal industry

Hypothesis 3: The financial threats for the organizations has positive impact on

increasing uncertainties within the oil industry

Hypothesis 4: The economic risks has positive impact on increasing uncertainty within

the oil industry

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMICS AND FINANCE RISK IN COAL AND OIL MARKETS

6. Research Methodology

6.1. Research Approach and Data Sources

The research survey that will be carried out in the research of financial and economical

risks faced by the oil and coal companies will include the respondents from both the coal along

with oil industries (Mackey & Gass, 2015). These respondents will be selected in a manner that

they are the suitable people those can identify the distinct type of financial as well as economic

issues that results to the uncertainties of the companies operating within the fossil fuels industry.

The respondents will be divided into two major divisions such as middle level employee’s as

well as the managers that works within the oil and coal industry in the Australian market. Mixed

research approach will be employed in the current research. Moreover, qualitative research

approach will be employed considering its benefit that it can support in using the semi-structured

and the unstructured techniques (Monasterolo et al., 2016). This research approach is also

focused on uncovering trends in the thoughts and viewpoints with offering detailed view within

the recognized research problem. Quantitative approach of reassert will be used that can indicate

the relevancy of the information that will be valuating in collection of important data that can

provide relevant research results.

The aim of the current research that is to be addressed after its completion is to recognize

the uncertainties those are present within the oil and coal industry of Australia along with

analyzing the related risks in finance and economy of the nation (Soeder et al., 2014). In

addition, as the current reassert focuses on analyzing the economic as well as financial risks

within the coal and oil markets through quantitative analysis, deductive research approach will

used employed in this study. This is due to the reason that the researcher has employed primary

6. Research Methodology

6.1. Research Approach and Data Sources

The research survey that will be carried out in the research of financial and economical

risks faced by the oil and coal companies will include the respondents from both the coal along

with oil industries (Mackey & Gass, 2015). These respondents will be selected in a manner that

they are the suitable people those can identify the distinct type of financial as well as economic

issues that results to the uncertainties of the companies operating within the fossil fuels industry.

The respondents will be divided into two major divisions such as middle level employee’s as

well as the managers that works within the oil and coal industry in the Australian market. Mixed

research approach will be employed in the current research. Moreover, qualitative research

approach will be employed considering its benefit that it can support in using the semi-structured

and the unstructured techniques (Monasterolo et al., 2016). This research approach is also

focused on uncovering trends in the thoughts and viewpoints with offering detailed view within

the recognized research problem. Quantitative approach of reassert will be used that can indicate

the relevancy of the information that will be valuating in collection of important data that can

provide relevant research results.

The aim of the current research that is to be addressed after its completion is to recognize

the uncertainties those are present within the oil and coal industry of Australia along with

analyzing the related risks in finance and economy of the nation (Soeder et al., 2014). In

addition, as the current reassert focuses on analyzing the economic as well as financial risks

within the coal and oil markets through quantitative analysis, deductive research approach will

used employed in this study. This is due to the reason that the researcher has employed primary

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMICS AND FINANCE RISK IN COAL AND OIL MARKETS

data collection method and deductive research approach is highly suitable in gathering relevant

research results on this subject.

6.2. Data Collection and Analysis

Collection of the qualitative as well as quantitative data that will be gathered in this

research will be relied on a particular time as the oil prices has began to decline in the year 2014

(Taylor, Bogdan & DeVault, 2015). At such period, the oil industry was observed to be selling

off at the auctions based on the prices of the bargain basement. The data collection of the

research that will be focused on this study on the increasing debts of the coal and oil industries

from the $1.1 trillion to $3 trillion from the year 2006 and the year 2014 (Mackey & Gass,

2015). Certain other sources of data collection that will be implied on the trend of the increasing

unemployment from the boom of coal mining in the year 1970s. Several other research articles

will be studied that is published by the “US Bureau of Labor Statistics”. The analysis is deemed

to be relied in such report that will signify the increase in the demand of the coal and oil because

of the resource depletion, technological changes as well as automation. In addition, the

secondary data that will be gathered is deemed to be from the authentic ad reliable journals, e-

books as well as previous research papers (Monasterolo et al., 2016). The data analysis will be

carried out relied on the indication of the vital reasons for the risks and the uncertainties with the

implementation of the measures of dispersion along with the descriptive statistics. The analysis

of the qualitative data will be carried out through following the observation method.

6.3. Research Structure

The first chapter in the research of likely economic and finance risks present in coal and

oil markets of Australia is focused on introducing this research topic. The second chapter of this

research proposal will explain the research problem based on which certain solutions are to be

data collection method and deductive research approach is highly suitable in gathering relevant

research results on this subject.

6.2. Data Collection and Analysis

Collection of the qualitative as well as quantitative data that will be gathered in this

research will be relied on a particular time as the oil prices has began to decline in the year 2014

(Taylor, Bogdan & DeVault, 2015). At such period, the oil industry was observed to be selling

off at the auctions based on the prices of the bargain basement. The data collection of the

research that will be focused on this study on the increasing debts of the coal and oil industries

from the $1.1 trillion to $3 trillion from the year 2006 and the year 2014 (Mackey & Gass,

2015). Certain other sources of data collection that will be implied on the trend of the increasing

unemployment from the boom of coal mining in the year 1970s. Several other research articles

will be studied that is published by the “US Bureau of Labor Statistics”. The analysis is deemed

to be relied in such report that will signify the increase in the demand of the coal and oil because

of the resource depletion, technological changes as well as automation. In addition, the

secondary data that will be gathered is deemed to be from the authentic ad reliable journals, e-

books as well as previous research papers (Monasterolo et al., 2016). The data analysis will be

carried out relied on the indication of the vital reasons for the risks and the uncertainties with the

implementation of the measures of dispersion along with the descriptive statistics. The analysis

of the qualitative data will be carried out through following the observation method.

6.3. Research Structure

The first chapter in the research of likely economic and finance risks present in coal and

oil markets of Australia is focused on introducing this research topic. The second chapter of this

research proposal will explain the research problem based on which certain solutions are to be

11ECONOMICS AND FINANCE RISK IN COAL AND OIL MARKETS

gathered after research completion. The third chapter of the research is to explain the aim and

objectives set in this particular research. The fourth chapter of this research proposal will provide

justifications for the possible research outcomes in this study. The fifth chapter will explain the

relevant literature that is present on the research subject based on which suitable research

hypotheses will be developed that will be further tested in the research. The sixth chapter will

explain the research methodology that will be employed in this study for explaining the suitable

approach, data collection process and budget set for the research.

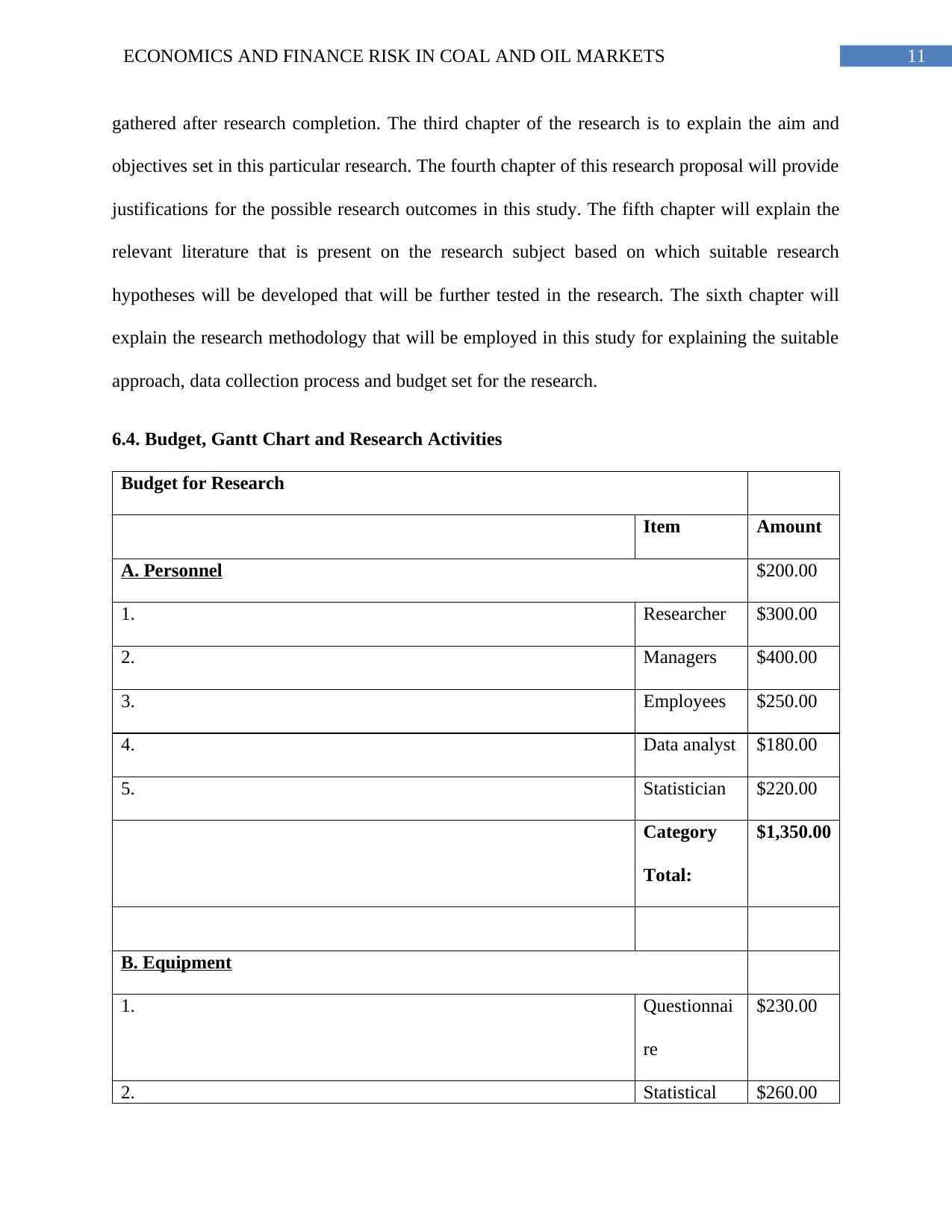

6.4. Budget, Gantt Chart and Research Activities

Budget for Research

Item Amount

A. Personnel $200.00

1. Researcher $300.00

2. Managers $400.00

3. Employees $250.00

4. Data analyst $180.00

5. Statistician $220.00

Category

Total:

$1,350.00

B. Equipment

1. Questionnai

re

$230.00

2. Statistical $260.00

gathered after research completion. The third chapter of the research is to explain the aim and

objectives set in this particular research. The fourth chapter of this research proposal will provide

justifications for the possible research outcomes in this study. The fifth chapter will explain the

relevant literature that is present on the research subject based on which suitable research

hypotheses will be developed that will be further tested in the research. The sixth chapter will

explain the research methodology that will be employed in this study for explaining the suitable

approach, data collection process and budget set for the research.

6.4. Budget, Gantt Chart and Research Activities

Budget for Research

Item Amount

A. Personnel $200.00

1. Researcher $300.00

2. Managers $400.00

3. Employees $250.00

4. Data analyst $180.00

5. Statistician $220.00

Category

Total:

$1,350.00

B. Equipment

1. Questionnai

re

$230.00

2. Statistical $260.00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.