HI5019 Strategic Info Systems: Commonwealth Bank of Australia Analysis

VerifiedAdded on 2023/06/04

|19

|5283

|180

Report

AI Summary

This report provides a strategic analysis of the Commonwealth Bank of Australia's (CBA) information systems. It identifies the bank's critical success factors, primary objectives, and formulates a mission statement. The report includes an organizational chart, an analysis of the current system, and specific control weaknesses. It proposes a new, improved system with primary features and relevant IT technologies, addressing potential security risks and accounting controls. The analysis aims to provide insights for informed decision-making regarding investment in information systems to enhance CBA's business operations and security.

Running head: STRATEGIC INFORMATION SYSTEMS OF COMMONWEALTH BANK OF AUSTRALIA

Strategic Information Systems of Commonwealth Bank of Australia

Name of the Student

Name of the University

Author’s note

Strategic Information Systems of Commonwealth Bank of Australia

Name of the Student

Name of the University

Author’s note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1STRATEGIC INFORMATION SYSTEMS OF COMMONWEALTH BANK OF AUSTRALIA

Table of Contents

1. Introduction..................................................................................................................................2

1.1 A Brief Introduction of Commonwealth Bank of Australia..................................................2

1.2 Primary Objectives and Critical Success Factors of CBA.....................................................2

1.3 Helpful Information for achieving the Objectives.................................................................3

1.4 Mission Statement for the Business.......................................................................................4

2. Organizational Chart of Commonwealth Bank of Australia.......................................................4

3. Brief Analysis of Commonwealth Bank of Australia..................................................................5

3.1 The Present System of Commonwealth Bank of Australia...................................................5

3.2 Identification of Specific Control Weaknesses within Commonwealth Bank of Australia. .6

4. New Improved System for the Commonwealth Bank of Australia.............................................8

4.1 Primary Features of New Improved System..........................................................................8

4.2 Relevance of the New Advanced IT Technologies.............................................................10

5. Other Necessary Requirements..................................................................................................11

5.1 Technological Platforms for the System..............................................................................11

5.2 Potential Security Risks for the Banking Sector of CBA....................................................12

5.3 Accounting Controls over the New Banking System..........................................................13

6. Conclusion.................................................................................................................................14

7. References..................................................................................................................................15

Table of Contents

1. Introduction..................................................................................................................................2

1.1 A Brief Introduction of Commonwealth Bank of Australia..................................................2

1.2 Primary Objectives and Critical Success Factors of CBA.....................................................2

1.3 Helpful Information for achieving the Objectives.................................................................3

1.4 Mission Statement for the Business.......................................................................................4

2. Organizational Chart of Commonwealth Bank of Australia.......................................................4

3. Brief Analysis of Commonwealth Bank of Australia..................................................................5

3.1 The Present System of Commonwealth Bank of Australia...................................................5

3.2 Identification of Specific Control Weaknesses within Commonwealth Bank of Australia. .6

4. New Improved System for the Commonwealth Bank of Australia.............................................8

4.1 Primary Features of New Improved System..........................................................................8

4.2 Relevance of the New Advanced IT Technologies.............................................................10

5. Other Necessary Requirements..................................................................................................11

5.1 Technological Platforms for the System..............................................................................11

5.2 Potential Security Risks for the Banking Sector of CBA....................................................12

5.3 Accounting Controls over the New Banking System..........................................................13

6. Conclusion.................................................................................................................................14

7. References..................................................................................................................................15

2STRATEGIC INFORMATION SYSTEMS OF COMMONWEALTH BANK OF AUSTRALIA

1. Introduction

1.1 A Brief Introduction of Commonwealth Bank of Australia

The use of Information Technology (IT) has formed a major part and focus within any

kind of organisation. The report is able to focus primarily on the various forms of changes that

are taking place on a daily basis within the IT sector. With the rise of technological aspects, there

have been several kind of reforms that have been taking place in the Commonwealth Bank of

Australia (CBA). The CBA is regarded as one of the large retail sector within the banking sector

and is primarily based in Australia. The CBA is the dominating banking sector and has a huge

base of customers (Weill and Woerner 2013). They provide various kinds of facilities such as

retail based deposits and various kinds of loans. The CBA has also made their immense presence

in various kinds of segments based within the area of the retail market.

1.2 Primary Objectives and Critical Success Factors of CBA

With the large forms of innovation that are taking place in the banking sector in day-to-

day life, there have been several forms of innovation of methods and strategies that have been

adopted by the CBA banking sector. The CBA has various kinds of stories of success in the

recent past history. Hence they have continued to improve their success paths and has brought

much innovations within the sector (Lovelock and Patterson 2015). The CBA is hence

considered as one of the largest storehouses of finance within the banking sector. They have

hence been accepted by the people who take the full form of advantage of the organisation.

Some of the primary objectives of CBA are:

1. Retaining of their lower structures of cost

1. Introduction

1.1 A Brief Introduction of Commonwealth Bank of Australia

The use of Information Technology (IT) has formed a major part and focus within any

kind of organisation. The report is able to focus primarily on the various forms of changes that

are taking place on a daily basis within the IT sector. With the rise of technological aspects, there

have been several kind of reforms that have been taking place in the Commonwealth Bank of

Australia (CBA). The CBA is regarded as one of the large retail sector within the banking sector

and is primarily based in Australia. The CBA is the dominating banking sector and has a huge

base of customers (Weill and Woerner 2013). They provide various kinds of facilities such as

retail based deposits and various kinds of loans. The CBA has also made their immense presence

in various kinds of segments based within the area of the retail market.

1.2 Primary Objectives and Critical Success Factors of CBA

With the large forms of innovation that are taking place in the banking sector in day-to-

day life, there have been several forms of innovation of methods and strategies that have been

adopted by the CBA banking sector. The CBA has various kinds of stories of success in the

recent past history. Hence they have continued to improve their success paths and has brought

much innovations within the sector (Lovelock and Patterson 2015). The CBA is hence

considered as one of the largest storehouses of finance within the banking sector. They have

hence been accepted by the people who take the full form of advantage of the organisation.

Some of the primary objectives of CBA are:

1. Retaining of their lower structures of cost

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3STRATEGIC INFORMATION SYSTEMS OF COMMONWEALTH BANK OF AUSTRALIA

2. Expanding the share of the customers within the market and would have high form of

leadership.

3. Implementing best forms of management practices among the people.

4. Providing the best form of financial services, which would help in meeting the high

expectation of customers.

The critical factors for CBA includes:

1. Provide a high level of training of the employees of the organisation and provide the

various forms of outcomes based on the sales structure of the organisation.

2. Maintain a clear expectation and thus be able to take various kinds of effective

measures based on the issues that have been faced by the organisation.

3. Provide different kinds of rewards and recognition, which would be highly linked with

the provided outcomes and services that would be based on sales (Osei-Kyei and Chan 2015).

4. There should be a passionate effort on the quality of leadership within the international

market.

1.3 Helpful Information for achieving the Objectives

The CBA would have the basic form of need for maintaining a high competitive gain

within the market. This would be extremely meaningful for maintain the huge base of customers

and thus be able to gain a competitive advantage within the market. Use of internet connected

products and mobile devices have shown a major growth of the business. There is a high level of

pressure in the highly competitive market. There have been different kinds of strategic advantage

2. Expanding the share of the customers within the market and would have high form of

leadership.

3. Implementing best forms of management practices among the people.

4. Providing the best form of financial services, which would help in meeting the high

expectation of customers.

The critical factors for CBA includes:

1. Provide a high level of training of the employees of the organisation and provide the

various forms of outcomes based on the sales structure of the organisation.

2. Maintain a clear expectation and thus be able to take various kinds of effective

measures based on the issues that have been faced by the organisation.

3. Provide different kinds of rewards and recognition, which would be highly linked with

the provided outcomes and services that would be based on sales (Osei-Kyei and Chan 2015).

4. There should be a passionate effort on the quality of leadership within the international

market.

1.3 Helpful Information for achieving the Objectives

The CBA would have the basic form of need for maintaining a high competitive gain

within the market. This would be extremely meaningful for maintain the huge base of customers

and thus be able to gain a competitive advantage within the market. Use of internet connected

products and mobile devices have shown a major growth of the business. There is a high level of

pressure in the highly competitive market. There have been different kinds of strategic advantage

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4STRATEGIC INFORMATION SYSTEMS OF COMMONWEALTH BANK OF AUSTRALIA

within the market. These kind of initiatives would be helpful for ensuring the maintenance of

quality and hence gain the advantage of the low cost structure (Murray et al. 2014).

1.4 Mission Statement for the Business

The mission statement based on the client business is – To provide high kind of services

for the customer, which would help in meeting the business requirements.

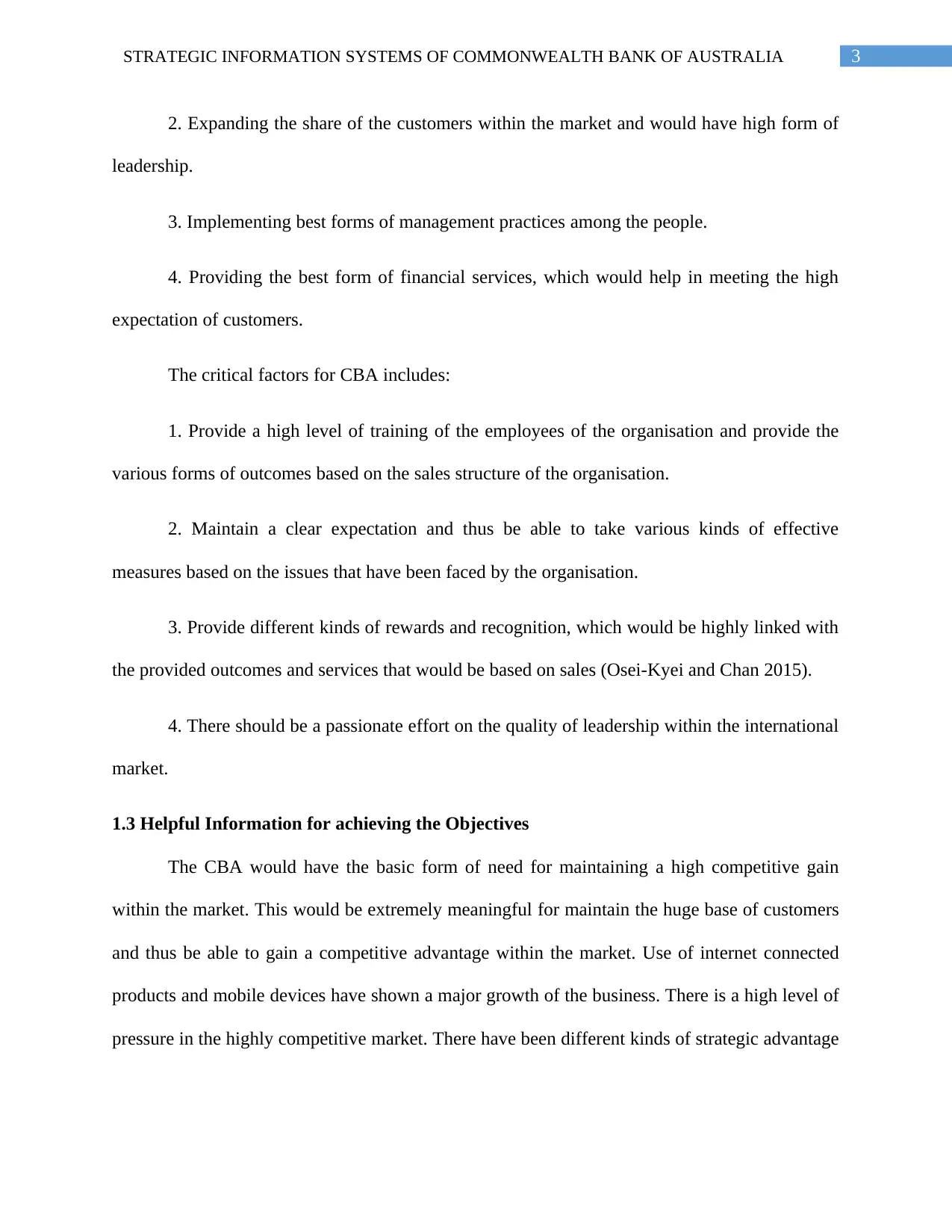

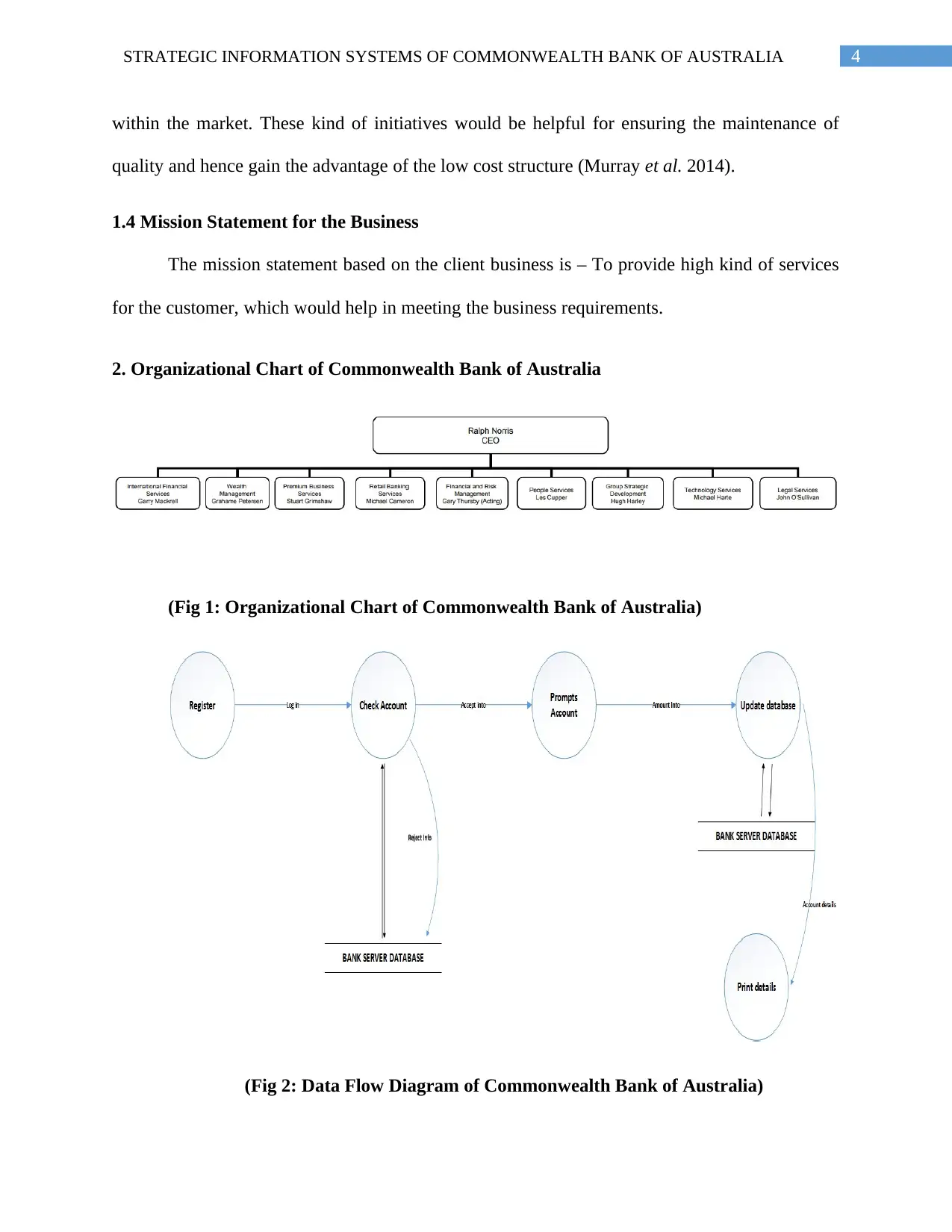

2. Organizational Chart of Commonwealth Bank of Australia

(Fig 1: Organizational Chart of Commonwealth Bank of Australia)

(Fig 2: Data Flow Diagram of Commonwealth Bank of Australia)

within the market. These kind of initiatives would be helpful for ensuring the maintenance of

quality and hence gain the advantage of the low cost structure (Murray et al. 2014).

1.4 Mission Statement for the Business

The mission statement based on the client business is – To provide high kind of services

for the customer, which would help in meeting the business requirements.

2. Organizational Chart of Commonwealth Bank of Australia

(Fig 1: Organizational Chart of Commonwealth Bank of Australia)

(Fig 2: Data Flow Diagram of Commonwealth Bank of Australia)

5STRATEGIC INFORMATION SYSTEMS OF COMMONWEALTH BANK OF AUSTRALIA

3. Brief Analysis of Commonwealth Bank of Australia

3.1 The Present System of Commonwealth Bank of Australia

The Commonwealth Bank of Australia is a public sector bank, which is primarily situated

in Australia. It is thus listed as one of the top quality banks by the Australian Securities

Exchange. CBA is one of the multinational bank based in Australia. The bank offers sever

services based within the financial sector and helps in assisting the business owners and other

clients (Tonts, Martinus and Plummer 2013). The banking structure of CBA is formed in a

vertical manner, which helps them within the operation of the network based structure. The

vision of the organization is to become one of the finest banking sectors within Australia and

thus maintain a fine strategic aspect within the business. The different kinds of strategies that

have been adopted by the banking sector is based on the improving the quality of banking

experience of the people and stakeholders.

The rise in the high form of technical aspects have majorly helped the CBA for the

purpose of integrating Information Systems within the various kinds of business processes of the

organization. With the various upcoming technologies within the sector, the bank has hence

improved their conditions within the various kinds of services within the sector. They have made

different kinds of technical changes within the use of computing systems and the use of systems

software by the employees (Schlagwein, Thorogood and Willcocks 2014.). These kind of

improved systems softwares and advanced functionalities within the banking website of CBA

would prove to be helpful for resolving the various kinds of issues of the customers. The use of

high form of technical systems is also a major critical aspect of the organization as the customers

would like to access the website of the bank from their personal mobile devices.

3. Brief Analysis of Commonwealth Bank of Australia

3.1 The Present System of Commonwealth Bank of Australia

The Commonwealth Bank of Australia is a public sector bank, which is primarily situated

in Australia. It is thus listed as one of the top quality banks by the Australian Securities

Exchange. CBA is one of the multinational bank based in Australia. The bank offers sever

services based within the financial sector and helps in assisting the business owners and other

clients (Tonts, Martinus and Plummer 2013). The banking structure of CBA is formed in a

vertical manner, which helps them within the operation of the network based structure. The

vision of the organization is to become one of the finest banking sectors within Australia and

thus maintain a fine strategic aspect within the business. The different kinds of strategies that

have been adopted by the banking sector is based on the improving the quality of banking

experience of the people and stakeholders.

The rise in the high form of technical aspects have majorly helped the CBA for the

purpose of integrating Information Systems within the various kinds of business processes of the

organization. With the various upcoming technologies within the sector, the bank has hence

improved their conditions within the various kinds of services within the sector. They have made

different kinds of technical changes within the use of computing systems and the use of systems

software by the employees (Schlagwein, Thorogood and Willcocks 2014.). These kind of

improved systems softwares and advanced functionalities within the banking website of CBA

would prove to be helpful for resolving the various kinds of issues of the customers. The use of

high form of technical systems is also a major critical aspect of the organization as the customers

would like to access the website of the bank from their personal mobile devices.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6STRATEGIC INFORMATION SYSTEMS OF COMMONWEALTH BANK OF AUSTRALIA

The general manager of CBA have hence declared the fact that the mobile banking

systems have been regarded as one of the secure form of systems within CBA. The CBA has

various kinds of secure methods within their website, which protects the security of the devices

and the accounts of the customer. The use of mobile banking systems would be helpful for

improving the conditions of the banking sector. The mobile devices have the inbuilt functionality

of SIM, which would be helpful for connecting with the database of the bank (Smith 2018). The

current systems of the mobile banking systems of the CBA would be helpful for securing the

customers from any form of hacking based systems. Banking systems are mainly prone to

various kinds of security attacks related to ransomware attacks, malware attacks and virus

systems, which are vulnerable for the banking systems. The high form of security systems within

the banking sector of CBA would help for availing the banking services in a highly secured

manner (Podger, Stanton and Whiteford 2014).

3.2 Identification of Specific Control Weaknesses within Commonwealth Bank of Australia

The rise of different kinds of systems based on mobile banking would be helpful for CBA

in order to maintain higher kinds of security aspects within the website of CBA. The website

should be able to meet the basic security standards that are previously set by the organisation.

The different banking systems of CBA and the various kinds of services that are provided by the

organisation help in maintaining the aspects of security within the organisation (Hasan and Xie

2013). The customers who would be availing the vast form of high technological systems of

banking systems would be heavily dependent on the mobility and the security aspects that have

been provided by the organisation. The use of the systems of mobile banking would help in

providing the vast form of services based on the transfer of money. The customers would also be

able to check their balance in their savings and current accounts, purchase items with the help of

The general manager of CBA have hence declared the fact that the mobile banking

systems have been regarded as one of the secure form of systems within CBA. The CBA has

various kinds of secure methods within their website, which protects the security of the devices

and the accounts of the customer. The use of mobile banking systems would be helpful for

improving the conditions of the banking sector. The mobile devices have the inbuilt functionality

of SIM, which would be helpful for connecting with the database of the bank (Smith 2018). The

current systems of the mobile banking systems of the CBA would be helpful for securing the

customers from any form of hacking based systems. Banking systems are mainly prone to

various kinds of security attacks related to ransomware attacks, malware attacks and virus

systems, which are vulnerable for the banking systems. The high form of security systems within

the banking sector of CBA would help for availing the banking services in a highly secured

manner (Podger, Stanton and Whiteford 2014).

3.2 Identification of Specific Control Weaknesses within Commonwealth Bank of Australia

The rise of different kinds of systems based on mobile banking would be helpful for CBA

in order to maintain higher kinds of security aspects within the website of CBA. The website

should be able to meet the basic security standards that are previously set by the organisation.

The different banking systems of CBA and the various kinds of services that are provided by the

organisation help in maintaining the aspects of security within the organisation (Hasan and Xie

2013). The customers who would be availing the vast form of high technological systems of

banking systems would be heavily dependent on the mobility and the security aspects that have

been provided by the organisation. The use of the systems of mobile banking would help in

providing the vast form of services based on the transfer of money. The customers would also be

able to check their balance in their savings and current accounts, purchase items with the help of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7STRATEGIC INFORMATION SYSTEMS OF COMMONWEALTH BANK OF AUSTRALIA

the internet banking methods and perform other kinds of banking based functions (Brown and

Davis 2015). There are also some kinds of situations in which the banking customers would not

wish to avail the banking services due to a short level of trust on the banking organization.

With the rise of high form of technological advancements within the sector, there have

been several forms of reports based on the cases of hacking and forgery, which leads to various

forms of vulnerability within the banking systems and services. With these kinds of arising

reports, this has been the leading factor of lowering of trust within the banking systems. The

cases of theft of banking services that are offered by CBA provide inconvenience on the user

based part (Hooper, Martini and Choo 2013). The various kinds of mechanisms based on security

aspects that are mainly been adopted by the organization help in securing the data of the clients

and employees within the banking environment. This form of systems of security should be the

utmost priority of the organization. As the organization has a huge base of customers, hence they

should provide higher forms of security mechanisms and encryption systems for the banking

services.

There are other kinds of weakness that have majorly been viewed by the banking systems

of CBA. The banking systems of CBA primarily outsource the various kinds of services based on

the architecture of third party organisation. The CBA also holds the responsibility of performing

and maintain secure kinds of transactions within the management systems of the organisation.

The different kinds of methods that have been adopted by the internal systems of the

organisation help in the mitigation of various kinds of issues related to the authentication

purposes. Trust is a major form of issue that is mainly breached within during cases of

exploitation by various forms of attacks. Some of the main issues that are faced by the

organisation based on the security aspects include the issues based on providing of services by

the internet banking methods and perform other kinds of banking based functions (Brown and

Davis 2015). There are also some kinds of situations in which the banking customers would not

wish to avail the banking services due to a short level of trust on the banking organization.

With the rise of high form of technological advancements within the sector, there have

been several forms of reports based on the cases of hacking and forgery, which leads to various

forms of vulnerability within the banking systems and services. With these kinds of arising

reports, this has been the leading factor of lowering of trust within the banking systems. The

cases of theft of banking services that are offered by CBA provide inconvenience on the user

based part (Hooper, Martini and Choo 2013). The various kinds of mechanisms based on security

aspects that are mainly been adopted by the organization help in securing the data of the clients

and employees within the banking environment. This form of systems of security should be the

utmost priority of the organization. As the organization has a huge base of customers, hence they

should provide higher forms of security mechanisms and encryption systems for the banking

services.

There are other kinds of weakness that have majorly been viewed by the banking systems

of CBA. The banking systems of CBA primarily outsource the various kinds of services based on

the architecture of third party organisation. The CBA also holds the responsibility of performing

and maintain secure kinds of transactions within the management systems of the organisation.

The different kinds of methods that have been adopted by the internal systems of the

organisation help in the mitigation of various kinds of issues related to the authentication

purposes. Trust is a major form of issue that is mainly breached within during cases of

exploitation by various forms of attacks. Some of the main issues that are faced by the

organisation based on the security aspects include the issues based on providing of services by

8STRATEGIC INFORMATION SYSTEMS OF COMMONWEALTH BANK OF AUSTRALIA

the third party services (Gitman, Juchau and Flanagan 2015). These include the control over the

security of the network, standardization of interoperability, controls over parental methods of

payment, liability, prevention of frauds based on authentication methods, privacy of the

employees and customers and permissions based on payment methods.

4. New Improved System for the Commonwealth Bank of Australia

4.1 Primary Features of New Improved System

The systems of mobile banking within CBA are considered to be highly secured within

the sector of banking. The technologies based on mobile banking are rising at a huge pace

besides the several kinds of banking based services. The rise of mobile banking technologies

have shown tremendous forms of improvements within the higher banking services (Brotchie et

al. 2017). These systems of banking have showed severe form of threats within CBA. There are

various forms of improved features within the systems of mobile banking, which mainly focus

on the use of biometric systems, high level of integration of PLS with HLS standards and thus

the upgrade of the mainframe systems based on a UNIX platform and DB2.

The use of biometric systems is a high form of method based on the security of the

mobile devices. The CBA would be able to adopt extreme form of levels of trust based on the

mobile based transactional systems. The biometric systems would be helpful for the purpose of

identification of the physical behavior of individual (Smith 2013). The biometric details are

unique for every individual and hence the detection of frauds based on these systems would be

very much helpful with the huge cases of forgery within the banking systems. As each person

have their own personal unique identity, hence the detection of frauds based on the systems

would be highly useful. The use of the mechanism of biometric based security would be helpful

for improving the systems within the banking sector. There are various kinds of mechanisms

the third party services (Gitman, Juchau and Flanagan 2015). These include the control over the

security of the network, standardization of interoperability, controls over parental methods of

payment, liability, prevention of frauds based on authentication methods, privacy of the

employees and customers and permissions based on payment methods.

4. New Improved System for the Commonwealth Bank of Australia

4.1 Primary Features of New Improved System

The systems of mobile banking within CBA are considered to be highly secured within

the sector of banking. The technologies based on mobile banking are rising at a huge pace

besides the several kinds of banking based services. The rise of mobile banking technologies

have shown tremendous forms of improvements within the higher banking services (Brotchie et

al. 2017). These systems of banking have showed severe form of threats within CBA. There are

various forms of improved features within the systems of mobile banking, which mainly focus

on the use of biometric systems, high level of integration of PLS with HLS standards and thus

the upgrade of the mainframe systems based on a UNIX platform and DB2.

The use of biometric systems is a high form of method based on the security of the

mobile devices. The CBA would be able to adopt extreme form of levels of trust based on the

mobile based transactional systems. The biometric systems would be helpful for the purpose of

identification of the physical behavior of individual (Smith 2013). The biometric details are

unique for every individual and hence the detection of frauds based on these systems would be

very much helpful with the huge cases of forgery within the banking systems. As each person

have their own personal unique identity, hence the detection of frauds based on the systems

would be highly useful. The use of the mechanism of biometric based security would be helpful

for improving the systems within the banking sector. There are various kinds of mechanisms

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9STRATEGIC INFORMATION SYSTEMS OF COMMONWEALTH BANK OF AUSTRALIA

based on biometric recognition and authentication of devices. The biological features of a person

vary from one person to another. Hence the biometric ways of authentication of the user would

be described as the most vital form of security measures. Some of the other kinds of features that

have been majorly been included within the banking systems of CBA include fingerprint

recognition, voice recognition and facial recognition (Moscardo et al. 2013). The different kinds

of research within the field of biometric based recognition are being widely developed by the

security aspects of the banking sector. New kinds of sensors are being developed by the experts

who are responsible for designing the security services.

With the integration of PLS with the HLS systems, it would be highly effective for

implementing the security perspectives within the banking sector. The user interface based

within the website of CBA would be mainly operated based on a no-supportable platform. In the

banking systems of CBA, the bank would have to enter the intrinsic form of details based on the

different forms of applications based on the internet systems (Wu-Bin et al. 2014). The banks

would have to optimize the functionality level and thus they would have to improve the

functionality of different parts within the system. These high form of functionalities would be

helpful for reducing the incurred costs and hence these kinds of systems should be integrated

within the banking features of CBA. With these forms of high forms of functionality integration

within the website systems of CBA, they would be able to excel in the field of customer service

and thus put satisfaction for the users. The high infrastructure of IT systems within CBA have a

major history of success. Hence the improved versions of implementation of IT systems that are

newly developed should be provided by the users in order to increase the effectiveness of

customer services (Erickson and Warren 2013). The implementation of high IT supported

systems would be helpful for managing the improvement of decisions, funding of new systems,

based on biometric recognition and authentication of devices. The biological features of a person

vary from one person to another. Hence the biometric ways of authentication of the user would

be described as the most vital form of security measures. Some of the other kinds of features that

have been majorly been included within the banking systems of CBA include fingerprint

recognition, voice recognition and facial recognition (Moscardo et al. 2013). The different kinds

of research within the field of biometric based recognition are being widely developed by the

security aspects of the banking sector. New kinds of sensors are being developed by the experts

who are responsible for designing the security services.

With the integration of PLS with the HLS systems, it would be highly effective for

implementing the security perspectives within the banking sector. The user interface based

within the website of CBA would be mainly operated based on a no-supportable platform. In the

banking systems of CBA, the bank would have to enter the intrinsic form of details based on the

different forms of applications based on the internet systems (Wu-Bin et al. 2014). The banks

would have to optimize the functionality level and thus they would have to improve the

functionality of different parts within the system. These high form of functionalities would be

helpful for reducing the incurred costs and hence these kinds of systems should be integrated

within the banking features of CBA. With these forms of high forms of functionality integration

within the website systems of CBA, they would be able to excel in the field of customer service

and thus put satisfaction for the users. The high infrastructure of IT systems within CBA have a

major history of success. Hence the improved versions of implementation of IT systems that are

newly developed should be provided by the users in order to increase the effectiveness of

customer services (Erickson and Warren 2013). The implementation of high IT supported

systems would be helpful for managing the improvement of decisions, funding of new systems,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10STRATEGIC INFORMATION SYSTEMS OF COMMONWEALTH BANK OF AUSTRALIA

inventing greater form of products, which would be highly useful for gaining high rates of

approval.

The CBA has a high form of IT based infrastructure and they are implementing new

kinds of IT based systems. They have partnered with high IT software based companies who are

responsible for dealing with the security aspects and maintenance of the websites. The IT

business partners help in upgrading the older and existing infrastructure systems of the

organisation. The previous versions of the IT systems based within CBA were much based on the

older versions of Windows Operating Systems (Gurran and Phibbs 2013). They should be highly

updated on a UNIX and DB2 systems. Although the updating of the existing systems to the new

structure would lead to improved form of functionalities, yet these might lead to the various

kinds of vulnerabilities within the systems. Hence the systems should be highly protected with

various forms of antivirus softwares and latest form of security patches within the existing

systems. The CBA should rethink the infrastructure of their existing systems, which would help

in increasing the level of efficiency of security within the systems. The CBA should implement

better automation systems within the organisation. This would be useful for the purpose of

increasing the levels of security, keeping monitor over the existing infrastructure systems and

thus be enable to increase the higher levels of speeds for the benefit of performing business

transactions.

4.2 Relevance of the New Advanced IT Technologies

The high IT implementation of software systems could be easily classified based on the

Electronic Data Interchange (EDI). The EDI systems based on electronic interchange of

information would be based on information, which would be available in relation within the

organization of business (Mossialos et al. 2016). The IT systems help in the processing of vital

inventing greater form of products, which would be highly useful for gaining high rates of

approval.

The CBA has a high form of IT based infrastructure and they are implementing new

kinds of IT based systems. They have partnered with high IT software based companies who are

responsible for dealing with the security aspects and maintenance of the websites. The IT

business partners help in upgrading the older and existing infrastructure systems of the

organisation. The previous versions of the IT systems based within CBA were much based on the

older versions of Windows Operating Systems (Gurran and Phibbs 2013). They should be highly

updated on a UNIX and DB2 systems. Although the updating of the existing systems to the new

structure would lead to improved form of functionalities, yet these might lead to the various

kinds of vulnerabilities within the systems. Hence the systems should be highly protected with

various forms of antivirus softwares and latest form of security patches within the existing

systems. The CBA should rethink the infrastructure of their existing systems, which would help

in increasing the level of efficiency of security within the systems. The CBA should implement

better automation systems within the organisation. This would be useful for the purpose of

increasing the levels of security, keeping monitor over the existing infrastructure systems and

thus be enable to increase the higher levels of speeds for the benefit of performing business

transactions.

4.2 Relevance of the New Advanced IT Technologies

The high IT implementation of software systems could be easily classified based on the

Electronic Data Interchange (EDI). The EDI systems based on electronic interchange of

information would be based on information, which would be available in relation within the

organization of business (Mossialos et al. 2016). The IT systems help in the processing of vital

11STRATEGIC INFORMATION SYSTEMS OF COMMONWEALTH BANK OF AUSTRALIA

information based within a standardized format. The use of EDI within the banking services of

CBA would prove to be extremely helpful for reducing the immense forms of risks within the

system. The CBA stores extremely valuable information that are in relation with the private and

confidential information of the clients and the customers. The EDI systems would help the

services of banking to be improved on a new format. These EDI systems would help the banking

services to avoid the loss of data from the organizations if the sector faces problems during the

transit of information. The EDI systems could easily track the different kinds of transactions that

are performed on a huge basis. Hence these transactions would be tracked on a real-time basis

and any kinds of arising disputes and fraud cases would be reported to the “smart” systems that

would be installed within the banking systems (Moradi-Motlagh and Babacan 2015).

The latest forms of designs of the EDI systems within the banking systems of CBA

would be helpful for supporting the efficiency of the banking sector. The workflow of the system

would also get improved with the implementation of the EDI system. This would help in

streamlining of the processes of workflow that would relate to processing of documents,

reduction of errors and saving of huge amount of time. They would also improve for the bringing

of accuracy of documents and enable faster business processes related to business transactions

(Jain, Keneley and Thomson 2015). The implementation of EDI systems would also be a cost

effective measure for the organization. Hence, with the implementation of EDI systems would

prove to be a very useful decision for the organization.

5. Other Necessary Requirements

5.1 Technological Platforms for the System

The mobile banking services are a much vital part of the organisation. These are a form

of services that are provided by any form of financial institution or the sector of banking. The use

information based within a standardized format. The use of EDI within the banking services of

CBA would prove to be extremely helpful for reducing the immense forms of risks within the

system. The CBA stores extremely valuable information that are in relation with the private and

confidential information of the clients and the customers. The EDI systems would help the

services of banking to be improved on a new format. These EDI systems would help the banking

services to avoid the loss of data from the organizations if the sector faces problems during the

transit of information. The EDI systems could easily track the different kinds of transactions that

are performed on a huge basis. Hence these transactions would be tracked on a real-time basis

and any kinds of arising disputes and fraud cases would be reported to the “smart” systems that

would be installed within the banking systems (Moradi-Motlagh and Babacan 2015).

The latest forms of designs of the EDI systems within the banking systems of CBA

would be helpful for supporting the efficiency of the banking sector. The workflow of the system

would also get improved with the implementation of the EDI system. This would help in

streamlining of the processes of workflow that would relate to processing of documents,

reduction of errors and saving of huge amount of time. They would also improve for the bringing

of accuracy of documents and enable faster business processes related to business transactions

(Jain, Keneley and Thomson 2015). The implementation of EDI systems would also be a cost

effective measure for the organization. Hence, with the implementation of EDI systems would

prove to be a very useful decision for the organization.

5. Other Necessary Requirements

5.1 Technological Platforms for the System

The mobile banking services are a much vital part of the organisation. These are a form

of services that are provided by any form of financial institution or the sector of banking. The use

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.