BYOD Security Risks and Mitigation Strategies

VerifiedAdded on 2020/04/01

|23

|5966

|42

AI Summary

This assignment delves into the potential security threats associated with Bring Your Own Device (BYOD) policies. It examines various risks, including data breaches, malware infections, and unauthorized access. Additionally, it analyzes different strategies for mitigating these risks, such as implementing strong passwords, utilizing mobile device management (MDM) solutions, and providing employee training on cybersecurity best practices.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Commonwealth Bank of Australia Risk Assessment- Employee Personal Devices

Name

Institutional Affiliation

Date

Name

Institutional Affiliation

Date

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

EXECUTIVE SUMMARY

As modern organizations continue to operate in the in the ever competitive environments, they

have been forced to come up with various strategies to meet current workplace demands. Among

the strategies that have been adopted by organizations is the use of technology in their

operations. The increase in the adoption of technology by organizations has come along with

associated risks touching on company’s data such as Data security risks. In Australia, for

example, data security has been an area of focus for many businesses especially due to the

significant rise in the cases of cyber crimes (Zahadat et al, 2015). Data security refers to all

digital privacy measures put in place to prohibit unauthorized persons to access computers

websites and databases. Data security which is also aimed at preventing data corruption has been

viewed as an essential component of all organizations using technology. Data security is also

referred to as IT security. Commonwealth Bank of Australia is a leading integrated financial

services provider that has branches in Europe, North America, New Zealand and Asia. The bank

offers some financial services, including share broking, funds management, business,

institutional, premium and retail banking, insurance and superannuation products and services

(Ballagas,et al,2014)

The Company among other guarantees provides its clients with 100% security guarantee about

their personal information and money. Among other strategies adopted by the company include

outsourcing for cyber security to reduce costs a move which has seen the Bank contemplate on

moving a number of its members of staff and functions related to its IT security to an offshore

location in India. In this, the company is focused on managing security assess by real-time

As modern organizations continue to operate in the in the ever competitive environments, they

have been forced to come up with various strategies to meet current workplace demands. Among

the strategies that have been adopted by organizations is the use of technology in their

operations. The increase in the adoption of technology by organizations has come along with

associated risks touching on company’s data such as Data security risks. In Australia, for

example, data security has been an area of focus for many businesses especially due to the

significant rise in the cases of cyber crimes (Zahadat et al, 2015). Data security refers to all

digital privacy measures put in place to prohibit unauthorized persons to access computers

websites and databases. Data security which is also aimed at preventing data corruption has been

viewed as an essential component of all organizations using technology. Data security is also

referred to as IT security. Commonwealth Bank of Australia is a leading integrated financial

services provider that has branches in Europe, North America, New Zealand and Asia. The bank

offers some financial services, including share broking, funds management, business,

institutional, premium and retail banking, insurance and superannuation products and services

(Ballagas,et al,2014)

The Company among other guarantees provides its clients with 100% security guarantee about

their personal information and money. Among other strategies adopted by the company include

outsourcing for cyber security to reduce costs a move which has seen the Bank contemplate on

moving a number of its members of staff and functions related to its IT security to an offshore

location in India. In this, the company is focused on managing security assess by real-time

monitoring the use of technology by staff as well as monitoring threats within and without the

bank (Smith, 2009).Bring your own device is a concept utilized in a situation where employees

are allowed to come in the workplace to go with personal devices such as computers, smart

phones, and tablets to be used in undertaking the daily activities. Allowing employees to bring

their own personal; devices at the workplace have been the cause of some of the challenges faced

by modern organizations with it has come some threats leading to the establishment of bringing

your own devices aimed at regulating access to organizational, technological resources using

their devices. Allowing employees to bring their devices might have a positive bearing on the

organization whose technology endowment is inadequate by enabling employees to come with

superior devices that can help in increasing efficiency and the overall productivity. On the other

hand, such a move can be detrimental to an organization’s health by making its data and

technologies prone to abuse from outside the organization (Chin, et al,2011)By deploying this

project, Commonwealth Bank of Australia will achieve both advantages and disadvantages.

Among the expected benefits is the flexibility that comes with the use of personal devices,

minimizing operational costs and increased efficiency due to technological familiarity. Problems

that will accrue to the organization as a result of this move include compromised security, device

disparities whereby employees use different devices and finally it might be an extra cost to

employees, especially those who might not be in possession of such devices.

bank (Smith, 2009).Bring your own device is a concept utilized in a situation where employees

are allowed to come in the workplace to go with personal devices such as computers, smart

phones, and tablets to be used in undertaking the daily activities. Allowing employees to bring

their own personal; devices at the workplace have been the cause of some of the challenges faced

by modern organizations with it has come some threats leading to the establishment of bringing

your own devices aimed at regulating access to organizational, technological resources using

their devices. Allowing employees to bring their devices might have a positive bearing on the

organization whose technology endowment is inadequate by enabling employees to come with

superior devices that can help in increasing efficiency and the overall productivity. On the other

hand, such a move can be detrimental to an organization’s health by making its data and

technologies prone to abuse from outside the organization (Chin, et al,2011)By deploying this

project, Commonwealth Bank of Australia will achieve both advantages and disadvantages.

Among the expected benefits is the flexibility that comes with the use of personal devices,

minimizing operational costs and increased efficiency due to technological familiarity. Problems

that will accrue to the organization as a result of this move include compromised security, device

disparities whereby employees use different devices and finally it might be an extra cost to

employees, especially those who might not be in possession of such devices.

Table of Contents

EXECUTIVE SUMMARY.................................................................................................................................2

REVIEW OF THE PROJECT............................................................................................................................5

SECURITY POSTURE.....................................................................................................................................6

THREATS, VULNERABILITIES, AND CONSEQUENCES....................................................................................9

DATA SECURITY RISKS................................................................................................................................14

CONCLUSION.............................................................................................................................................15

REFERENCES..............................................................................................................................................16

EXECUTIVE SUMMARY.................................................................................................................................2

REVIEW OF THE PROJECT............................................................................................................................5

SECURITY POSTURE.....................................................................................................................................6

THREATS, VULNERABILITIES, AND CONSEQUENCES....................................................................................9

DATA SECURITY RISKS................................................................................................................................14

CONCLUSION.............................................................................................................................................15

REFERENCES..............................................................................................................................................16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REVIEW OF THE PROJECT

Financial services refer to a range of financial services provided by various players in the

financial industry. They include services provided by banks, insurance companies, and

government-sponsored enterprises among others. In broad terms, institutions operating in the

financial sector are regarded as highly sensitive especially with regards to the security of their

systems. Financial service providers are virtually present all over the world even in remote areas

to satisfy the financial needs of individuals, groups, companies and other institutions (Gustav &

Kabanda,2016). The intermediary role played by financial service industry in Australia’s

economy is quite significant. Individuals, government agencies, businesses and nonprofit

organizations rely on this sector to either get funds when need be or dispose of excess cash

which is then lent out to those who need it, technologists play a significant role in facilitating this

transaction.

Clients .Clients are the most important asset to the Commonwealth Bank of Australia. The bank

is focused on establishing lasting cordial relationships with its various clients both depositors and

debtors. The bank's clients include retail clients, institutional investors, financial sponsors,

entrepreneurs, and corporations. Implementation of the project would mean that these client’s

needs attended to at any given time and with much efficiency (Felt,et al,2011)

Employees. Employees are an important shareholder and an important asset to the bank. The

company is focused on nurturing and developing the professional capability of their employees.

The project might be limiting to employees to employees without such devices and an

opportunity for those with the devices to enhance their professional prowess

Financial services refer to a range of financial services provided by various players in the

financial industry. They include services provided by banks, insurance companies, and

government-sponsored enterprises among others. In broad terms, institutions operating in the

financial sector are regarded as highly sensitive especially with regards to the security of their

systems. Financial service providers are virtually present all over the world even in remote areas

to satisfy the financial needs of individuals, groups, companies and other institutions (Gustav &

Kabanda,2016). The intermediary role played by financial service industry in Australia’s

economy is quite significant. Individuals, government agencies, businesses and nonprofit

organizations rely on this sector to either get funds when need be or dispose of excess cash

which is then lent out to those who need it, technologists play a significant role in facilitating this

transaction.

Clients .Clients are the most important asset to the Commonwealth Bank of Australia. The bank

is focused on establishing lasting cordial relationships with its various clients both depositors and

debtors. The bank's clients include retail clients, institutional investors, financial sponsors,

entrepreneurs, and corporations. Implementation of the project would mean that these client’s

needs attended to at any given time and with much efficiency (Felt,et al,2011)

Employees. Employees are an important shareholder and an important asset to the bank. The

company is focused on nurturing and developing the professional capability of their employees.

The project might be limiting to employees to employees without such devices and an

opportunity for those with the devices to enhance their professional prowess

There are some legislation that would determine the ability of Commonwealth Bank of Australia

to implement the project which includes Archives Act 1983, Privacy Act 1988 and Freedom of

Information Act 1982 which were established as a necessity as a result of the risks that emanate

from allowing employees to bring own devices at the workplace. If it can implement the project,

the Bank will, therefore, be required to put in place certain control measures to ensure that it

meets all legal obligations (Watkins, 2014). The bank would, therefore, be required to examine

the implications of the project to both the business and its overall security. As per best standards

requirements, commonwealth bank of Australia would be required to determine the implication

of the project by analyzing an already existing real example, identify the existing regulations and

legislation to facilitate compliance, put in place various support measures, both financial and

technical and finally roll out the project. The realization of this is solely dependent on the ICT

department or the technological department of the Bank. Financial institutions are affected by

many risks which can be categorized into.

Credit risks

Credit risks occur as a result of failure by debtors to pay what they owe a bank. Failure to pay

can be as a result of inability by the debtor or unwillingness to pay. Credit risks are likely to

affect Banks operations, its shareholders as well as its ability to issue fresh loans (Acharya, et

al,2017)

Legal risks

Legal risks occur as a result of violation of legal standards set by government institutions as well

as other regulatory bodies in which financial institutions are supposed to abide by. Legal risks

to implement the project which includes Archives Act 1983, Privacy Act 1988 and Freedom of

Information Act 1982 which were established as a necessity as a result of the risks that emanate

from allowing employees to bring own devices at the workplace. If it can implement the project,

the Bank will, therefore, be required to put in place certain control measures to ensure that it

meets all legal obligations (Watkins, 2014). The bank would, therefore, be required to examine

the implications of the project to both the business and its overall security. As per best standards

requirements, commonwealth bank of Australia would be required to determine the implication

of the project by analyzing an already existing real example, identify the existing regulations and

legislation to facilitate compliance, put in place various support measures, both financial and

technical and finally roll out the project. The realization of this is solely dependent on the ICT

department or the technological department of the Bank. Financial institutions are affected by

many risks which can be categorized into.

Credit risks

Credit risks occur as a result of failure by debtors to pay what they owe a bank. Failure to pay

can be as a result of inability by the debtor or unwillingness to pay. Credit risks are likely to

affect Banks operations, its shareholders as well as its ability to issue fresh loans (Acharya, et

al,2017)

Legal risks

Legal risks occur as a result of violation of legal standards set by government institutions as well

as other regulatory bodies in which financial institutions are supposed to abide by. Legal risks

affecting financial institutions include violation of security and fraud laws. Legal risks can have

adverse effect towards the operation and the reputation of a financial institution like the

Commonwealth Bank of Australia.

Systematic risks

Systematic risks occur as a result of changes in the value of an organization’s assets. Systematic

risks occur mostly a s a result of changes in the prevailing economic conditions such as changes

in interests rates, changes in foreign exchange among others. Systematic risks can also have a

significant impact on the operations of Bank (Acharya, et al,2017)

With the possibility the occurrence of many risks therefore, any Financial Institution is therefore

required to be aware of these risks among others so that it can put in place policies of identifying

and addressing the risks before they can have a significant impact on their operations.

SECURITY POSTURE

Modern organizations are faced with a myriad of challenges which continue to threaten their

survival. While challenges can present an opportunity for an organization to put in place

measures to avoid more devastating challenges, the emergence of serious challenges that can

lead to ultimate incapacitation of an organization. Of major concern is the financial service

sector whose data security is paramount especially due to the adverse effects that can result from

any serious threat through infringement of banks systems and databases. Such data these would

adversely affect not only the bank but also its various stakeholders who depend on the services

offered by the bank (Shim, et al,2013)The management of Commonwealth Bank of Australia

especially those in the IT department are tasked with the responsibility of ensuring that such

adverse effect towards the operation and the reputation of a financial institution like the

Commonwealth Bank of Australia.

Systematic risks

Systematic risks occur as a result of changes in the value of an organization’s assets. Systematic

risks occur mostly a s a result of changes in the prevailing economic conditions such as changes

in interests rates, changes in foreign exchange among others. Systematic risks can also have a

significant impact on the operations of Bank (Acharya, et al,2017)

With the possibility the occurrence of many risks therefore, any Financial Institution is therefore

required to be aware of these risks among others so that it can put in place policies of identifying

and addressing the risks before they can have a significant impact on their operations.

SECURITY POSTURE

Modern organizations are faced with a myriad of challenges which continue to threaten their

survival. While challenges can present an opportunity for an organization to put in place

measures to avoid more devastating challenges, the emergence of serious challenges that can

lead to ultimate incapacitation of an organization. Of major concern is the financial service

sector whose data security is paramount especially due to the adverse effects that can result from

any serious threat through infringement of banks systems and databases. Such data these would

adversely affect not only the bank but also its various stakeholders who depend on the services

offered by the bank (Shim, et al,2013)The management of Commonwealth Bank of Australia

especially those in the IT department are tasked with the responsibility of ensuring that such

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

threats are mitigated. It is their sole responsibility to protect the Banks systems, data and the

privacy of its clients by adequately managing the bank's financial information. Amid the

increasing level of competition in the Australian financial sector, the Bank has no option but

striving at providing the best data security measures in the industry. Commonwealth Bank of

Australia has been viewed to be way ahead of its main competitors in as far as information

security is concerned. With the many strategies undertaken by the Bank, implementation of the

project allowing employees to bring their devices to the workplace is likely to have huge

implications on its operations because employees might have unauthorized access to some of its

crucial information from their devices which might lead to loss, damage or manipulation of data.

While the project might have both positive and negative implications, it will be necessary for the

Bank to undertake sufficient research to find out whether the benefits surpass the negative

outcomes (Thomson,2012).

Monitoring is key in managing any sensitive data or information form an organization. By

allowing employees to bring their own devices this practice which is highly encouraged at the

Bank is likely to be affected. Among the implications of this project to the bank is the reduction

of system security assurance. The bank will also be able to monitor the working of their

employees because the use of personal devices makes it relatively hard for the management to

distinguish when employees are using the devices for personal undertakings or work-related

tasks. The project will also facilitate deviation from the banks secured use of sensitive

information to the unsecured use of such information. It is also possible that such devices might

be stolen thus risking the Bank’s sensitive information. The project also comes with an

additional budget for the company, implication on its human resources, compliance regulations

as well as legal obligations and liabilities. To regulate such implications, Commonwealth Bank

privacy of its clients by adequately managing the bank's financial information. Amid the

increasing level of competition in the Australian financial sector, the Bank has no option but

striving at providing the best data security measures in the industry. Commonwealth Bank of

Australia has been viewed to be way ahead of its main competitors in as far as information

security is concerned. With the many strategies undertaken by the Bank, implementation of the

project allowing employees to bring their devices to the workplace is likely to have huge

implications on its operations because employees might have unauthorized access to some of its

crucial information from their devices which might lead to loss, damage or manipulation of data.

While the project might have both positive and negative implications, it will be necessary for the

Bank to undertake sufficient research to find out whether the benefits surpass the negative

outcomes (Thomson,2012).

Monitoring is key in managing any sensitive data or information form an organization. By

allowing employees to bring their own devices this practice which is highly encouraged at the

Bank is likely to be affected. Among the implications of this project to the bank is the reduction

of system security assurance. The bank will also be able to monitor the working of their

employees because the use of personal devices makes it relatively hard for the management to

distinguish when employees are using the devices for personal undertakings or work-related

tasks. The project will also facilitate deviation from the banks secured use of sensitive

information to the unsecured use of such information. It is also possible that such devices might

be stolen thus risking the Bank’s sensitive information. The project also comes with an

additional budget for the company, implication on its human resources, compliance regulations

as well as legal obligations and liabilities. To regulate such implications, Commonwealth Bank

of Australia will need to put in place regulatory policies stipulating the terms of use of personal

devices (Miller,Voas & Hurlburt,2012).

Reasons for implementing a BYOD Policy

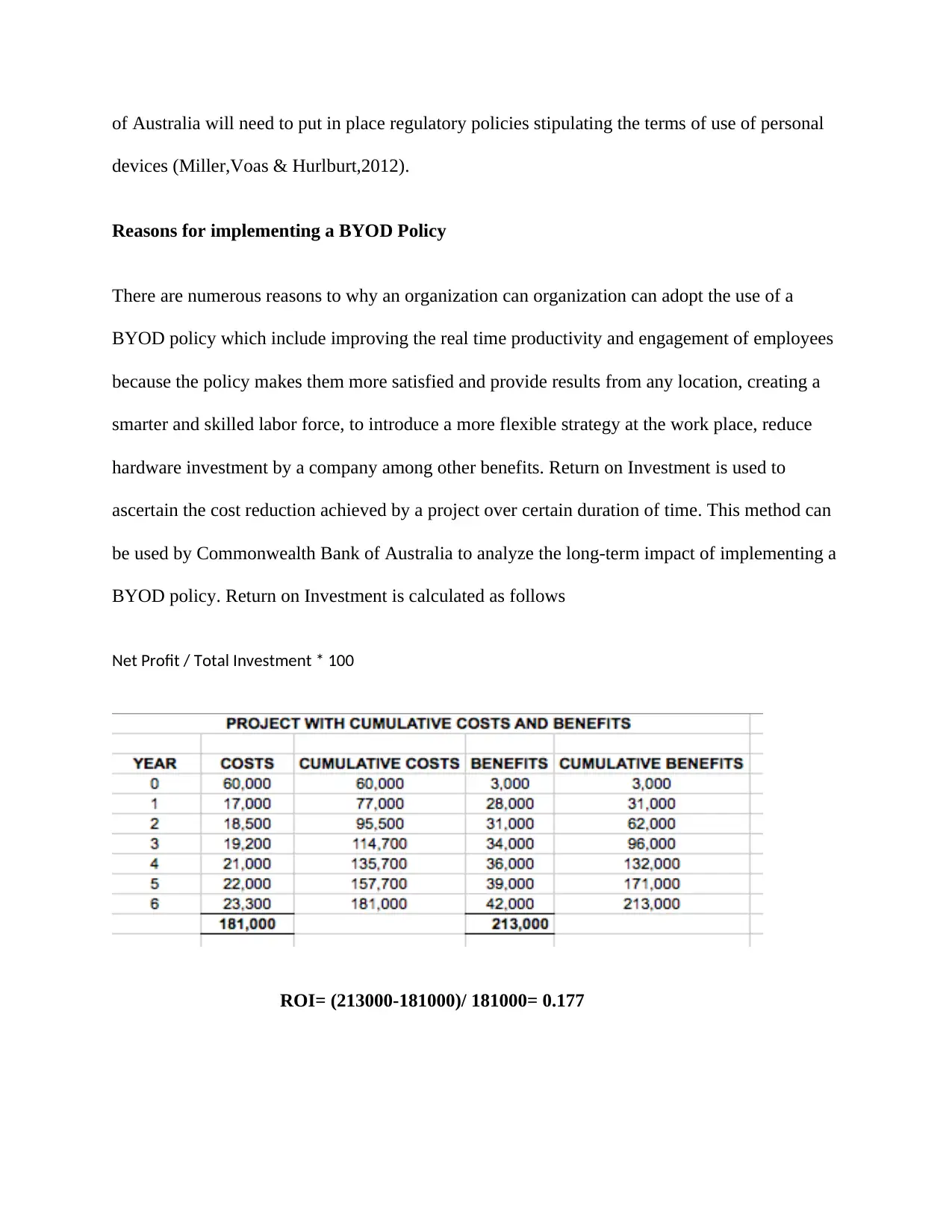

There are numerous reasons to why an organization can organization can adopt the use of a

BYOD policy which include improving the real time productivity and engagement of employees

because the policy makes them more satisfied and provide results from any location, creating a

smarter and skilled labor force, to introduce a more flexible strategy at the work place, reduce

hardware investment by a company among other benefits. Return on Investment is used to

ascertain the cost reduction achieved by a project over certain duration of time. This method can

be used by Commonwealth Bank of Australia to analyze the long-term impact of implementing a

BYOD policy. Return on Investment is calculated as follows

Net Profit / Total Investment * 100

ROI= (213000-181000)/ 181000= 0.177

devices (Miller,Voas & Hurlburt,2012).

Reasons for implementing a BYOD Policy

There are numerous reasons to why an organization can organization can adopt the use of a

BYOD policy which include improving the real time productivity and engagement of employees

because the policy makes them more satisfied and provide results from any location, creating a

smarter and skilled labor force, to introduce a more flexible strategy at the work place, reduce

hardware investment by a company among other benefits. Return on Investment is used to

ascertain the cost reduction achieved by a project over certain duration of time. This method can

be used by Commonwealth Bank of Australia to analyze the long-term impact of implementing a

BYOD policy. Return on Investment is calculated as follows

Net Profit / Total Investment * 100

ROI= (213000-181000)/ 181000= 0.177

Commonwealth Bank of Australia must, therefore, undertake an evaluation of the merits and

demerits of the project and its overall implications on the Banks' goals and mission. This will

then be followed by formulation of policies to regulate the use of personal devices and the

general security of the Banks systems. The Bank may also hire the services of solution providers

whose main responsibilities will be assessing the risks associated with the project, formulation of

different projects to govern the project as well as coming up with control measures to facilitate

implementation of these policies. Commonwealth Bank of Australia will, therefore, be required

to notify their employees on what to expect upon implementation of the project regarding the

privacy of their personal information which might need to be subjected to company monitoring

(Pillay,et al,2013)

Implementation of BYOD project will require the bank to consider its ability to remove the

banks information from employees devices upon their departure from the bank, clarify on what

devices, platforms, and networks that can be used in these devices including any associated

prohibitions to use such devices, avail a procedure to address possible theft of these devices in

order to protect Banks Information and clarifying on the consequences of any violations from

employees regarding the use of personal devices. The bank should also establish its ability to

access and have control over information belonging to it including the use of mobile device

management system as well as identify support limitations resulting from these devices to ensure

that they are addressed. Before implementing the Common program wealth Bank is also required

to analyze how the project is likely to affect the various stakeholders and the bank at large and

therefore it should solicit views from its employees, the finance department, its legal advisers

and finally its technological team (Ghosh, Gajar & Rai,2013).

demerits of the project and its overall implications on the Banks' goals and mission. This will

then be followed by formulation of policies to regulate the use of personal devices and the

general security of the Banks systems. The Bank may also hire the services of solution providers

whose main responsibilities will be assessing the risks associated with the project, formulation of

different projects to govern the project as well as coming up with control measures to facilitate

implementation of these policies. Commonwealth Bank of Australia will, therefore, be required

to notify their employees on what to expect upon implementation of the project regarding the

privacy of their personal information which might need to be subjected to company monitoring

(Pillay,et al,2013)

Implementation of BYOD project will require the bank to consider its ability to remove the

banks information from employees devices upon their departure from the bank, clarify on what

devices, platforms, and networks that can be used in these devices including any associated

prohibitions to use such devices, avail a procedure to address possible theft of these devices in

order to protect Banks Information and clarifying on the consequences of any violations from

employees regarding the use of personal devices. The bank should also establish its ability to

access and have control over information belonging to it including the use of mobile device

management system as well as identify support limitations resulting from these devices to ensure

that they are addressed. Before implementing the Common program wealth Bank is also required

to analyze how the project is likely to affect the various stakeholders and the bank at large and

therefore it should solicit views from its employees, the finance department, its legal advisers

and finally its technological team (Ghosh, Gajar & Rai,2013).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

The solution lies in the Bank’s ability to use smart policies and compliance; such policies would

include an adoption of a formal mobile policy that stipulates consequences of violation,

sufficient security measures use of training programs to solve mobile liabilities. A mobile policy

would include ensuring that each device that is being used by an employee is remote wipe

enabled. Although the process might require much time and resources, it will save the Bank a

significant amount of resources that it might incur in an instance where these devices are used to

break the law (Moyer,2013).

THREATS, VULNERABILITIES, AND CONSEQUENCES

Although highly considered for their useful functionality and high efficiency at the workplace,

technological devices such as iPads, mobile phones, laptops, and ipads have come with

numerous challenges that continue to affect not only employees but also their employers. Recent

studies have shown an increase in the usage of usage of own smart phones and tablets for

business with the number expected to keep rising (Morrow,2012). The number of Companies

allowing employees to make use of their devices for business has also continued to rise with a

recent research predicting that at least 38% of global companies will have implemented Bring

Your Device into their operations. This is also a trend that has been witnessed 2017 which has

recorded a significant increase in the level of usage of personal devices by employees at the

workplace. This is to signify perhaps the Importance that some employers attach to the use of

personal devices for business. However, adoption of BYOD Policy requires employers to shift

their focus to remain updated on changes in technology as well as being mindful of data security

and privacy issues (Lebek, Degirmenci & Breitner, 2013).

include an adoption of a formal mobile policy that stipulates consequences of violation,

sufficient security measures use of training programs to solve mobile liabilities. A mobile policy

would include ensuring that each device that is being used by an employee is remote wipe

enabled. Although the process might require much time and resources, it will save the Bank a

significant amount of resources that it might incur in an instance where these devices are used to

break the law (Moyer,2013).

THREATS, VULNERABILITIES, AND CONSEQUENCES

Although highly considered for their useful functionality and high efficiency at the workplace,

technological devices such as iPads, mobile phones, laptops, and ipads have come with

numerous challenges that continue to affect not only employees but also their employers. Recent

studies have shown an increase in the usage of usage of own smart phones and tablets for

business with the number expected to keep rising (Morrow,2012). The number of Companies

allowing employees to make use of their devices for business has also continued to rise with a

recent research predicting that at least 38% of global companies will have implemented Bring

Your Device into their operations. This is also a trend that has been witnessed 2017 which has

recorded a significant increase in the level of usage of personal devices by employees at the

workplace. This is to signify perhaps the Importance that some employers attach to the use of

personal devices for business. However, adoption of BYOD Policy requires employers to shift

their focus to remain updated on changes in technology as well as being mindful of data security

and privacy issues (Lebek, Degirmenci & Breitner, 2013).

For the Commonwealth Bank of Australia, the implementation of the project allowing employees

to use their devices for business will, therefore, come with threats, vulnerabilities, and

consequences for both the Bank and its Employees. As such, the Bank will find it necessary to

focus on changes in technology and regularly address security and privacy issues arising a result

of the project (Garba,et al,2015)

There are various risks associated with the implementation of the project. By allowing its

employees to use personal devices for official purposes, the Bank will commit itself to any

violations committed by their employees through the use of personal devices, For any offense

broken by their employees, Commonwealth Bank of Australia will be held responsible (Ghosh,

Gajar & Rai, 2013). A good example of such risks would be where a driver of the bank causes an

accident because of using a cell phone while driving as it was the case of the COCA-COLA

Company driver who hit a woman while on the phone in 2016. The cases of Employers being

sued for employee use of personal devices have been on the rise in the recent past ( Bzur,

2013).There, therefore, some risks that Commonwealth Bank of Australia will be faced with as a

result of implementing this project.

Abstracted driving

Distracted driving is one of the most common risks that result from the use of personal devices at

work. The impact of this can be quite huge for a company. The use of mobile phones by drivers

while driving can result in unwarranted legal battles as well as penalties due to injuries or deaths

of road users. Risks associated with distracted driving is, therefore, one of the risks that

Commonwealth Bank of Australia is likely to be faced with as a result of allowing employees to

use their devices at work (French, Guo & Shim,2014).

to use their devices for business will, therefore, come with threats, vulnerabilities, and

consequences for both the Bank and its Employees. As such, the Bank will find it necessary to

focus on changes in technology and regularly address security and privacy issues arising a result

of the project (Garba,et al,2015)

There are various risks associated with the implementation of the project. By allowing its

employees to use personal devices for official purposes, the Bank will commit itself to any

violations committed by their employees through the use of personal devices, For any offense

broken by their employees, Commonwealth Bank of Australia will be held responsible (Ghosh,

Gajar & Rai, 2013). A good example of such risks would be where a driver of the bank causes an

accident because of using a cell phone while driving as it was the case of the COCA-COLA

Company driver who hit a woman while on the phone in 2016. The cases of Employers being

sued for employee use of personal devices have been on the rise in the recent past ( Bzur,

2013).There, therefore, some risks that Commonwealth Bank of Australia will be faced with as a

result of implementing this project.

Abstracted driving

Distracted driving is one of the most common risks that result from the use of personal devices at

work. The impact of this can be quite huge for a company. The use of mobile phones by drivers

while driving can result in unwarranted legal battles as well as penalties due to injuries or deaths

of road users. Risks associated with distracted driving is, therefore, one of the risks that

Commonwealth Bank of Australia is likely to be faced with as a result of allowing employees to

use their devices at work (French, Guo & Shim,2014).

Loss of devices with unsecured data

Lost devices can pose risks not only for Companies but also for individuals. Due to the

sensitivity of information handled by monetary institutions, loss of personal devices such as

phones or tablets used by employees in their daily duties may lead to leaking out of secrets and

sensitive information about the Bank’s Clients and employees. Such information may end up

being used against the company in legal suits (Burt,2011).

Sexual Harassment

Sexual harassment at the workplace is one of the major risks of allowing employees to bring

their devices. Sexting is the most common form of sexual harassment used by adults. It is the

process where someone sends another person sexually explicit messages or photographs through

mobile phones. Sexting is classified together with speaking inappropriately to a colleague at the

workplace (French, Guo & Shim,2014). However, unlike the use of inappropriate language at

the workplace done orally, Sexting using personal devices at the workplace presents concrete

evidence that can be used against the Bank.

Content posted on social media

The final risk that the Bank is faced with has to do with the content posted on social media using

employee’s devices. It is a common practice by some companies that social media sites be

blocked from the company’s network; however, with the adoption of this project, it might be

difficult to regulate what is posted on social media by employees. Some of the risks associated

with social media might include racist comments posted on Facebook by an employee using a

BYOD device or an inappropriate photo such as that of an employee trespass (Guan, 2012). All

Lost devices can pose risks not only for Companies but also for individuals. Due to the

sensitivity of information handled by monetary institutions, loss of personal devices such as

phones or tablets used by employees in their daily duties may lead to leaking out of secrets and

sensitive information about the Bank’s Clients and employees. Such information may end up

being used against the company in legal suits (Burt,2011).

Sexual Harassment

Sexual harassment at the workplace is one of the major risks of allowing employees to bring

their devices. Sexting is the most common form of sexual harassment used by adults. It is the

process where someone sends another person sexually explicit messages or photographs through

mobile phones. Sexting is classified together with speaking inappropriately to a colleague at the

workplace (French, Guo & Shim,2014). However, unlike the use of inappropriate language at

the workplace done orally, Sexting using personal devices at the workplace presents concrete

evidence that can be used against the Bank.

Content posted on social media

The final risk that the Bank is faced with has to do with the content posted on social media using

employee’s devices. It is a common practice by some companies that social media sites be

blocked from the company’s network; however, with the adoption of this project, it might be

difficult to regulate what is posted on social media by employees. Some of the risks associated

with social media might include racist comments posted on Facebook by an employee using a

BYOD device or an inappropriate photo such as that of an employee trespass (Guan, 2012). All

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

these can be used against the Bank in legal suits and therefore making the Bank liable for

violation of the Law.

Companies cannot afford to ignore the increasing rates of adopting BYOD that has been caused

by the rise in the use of technology. By implementing the project, Commonwealth Bank of

Australia will allow usage of employee’s devices such as smart phones, laptops, and tablets for

official duties instead of company-provided devices. Among the information stored in such

devices might include inventory, mobile schedules, photos and training videos among others to

facilitate easy access of data. While the practice of allowing employees to bring their own

devices at eth workplace is becoming a norm, there are many consequences that Commonwealth

Bank of Australia might be subjecting itself to by implementation of the project (Mansfield-

Devine,2012).

Resentment by employees

By implementing the project, the Bank will force its employees to incur extra costs to acquire the

requisite devices for those who might not be having them. Requesting employees to purchase

new devices for work purposes might, therefore, leave them unhappy. Additionally, the costs of

usage and transportation are also likely to be pegged on employees (Scarfo,2012) It is likely that

employees will be unwilling to shoulder this cost. Too much usage of personal devices for work-

related tasks also makes them depreciate within a short period. Among the considerations that

The Bank might be considered before implementation of the project will be determining who

will be responsible for any repairs on the personal devices. Additionally, the issue of costs

associated with the loss of the device while at work can also lead to resentment on the part of

employees

violation of the Law.

Companies cannot afford to ignore the increasing rates of adopting BYOD that has been caused

by the rise in the use of technology. By implementing the project, Commonwealth Bank of

Australia will allow usage of employee’s devices such as smart phones, laptops, and tablets for

official duties instead of company-provided devices. Among the information stored in such

devices might include inventory, mobile schedules, photos and training videos among others to

facilitate easy access of data. While the practice of allowing employees to bring their own

devices at eth workplace is becoming a norm, there are many consequences that Commonwealth

Bank of Australia might be subjecting itself to by implementation of the project (Mansfield-

Devine,2012).

Resentment by employees

By implementing the project, the Bank will force its employees to incur extra costs to acquire the

requisite devices for those who might not be having them. Requesting employees to purchase

new devices for work purposes might, therefore, leave them unhappy. Additionally, the costs of

usage and transportation are also likely to be pegged on employees (Scarfo,2012) It is likely that

employees will be unwilling to shoulder this cost. Too much usage of personal devices for work-

related tasks also makes them depreciate within a short period. Among the considerations that

The Bank might be considered before implementation of the project will be determining who

will be responsible for any repairs on the personal devices. Additionally, the issue of costs

associated with the loss of the device while at work can also lead to resentment on the part of

employees

(Zahadat,et all,2015)

Reduced productivity

Another consequence of the use of personal devices by employees can be associated with their

distractive nature. By using their devices at the workplace, employees are more likely to spend a

considerable amount of their productive hours on social sites such as Whatsapp, Facebook

Instagram, and Twitter. While the Bank desires to maximize profits, the implementation of the

project will result in a distraction of employees from their primary duties which will directly

affect their productivity. The small amount of time spent by one employee to send a text message

to a friend or surf the web can collectively lead to wastage of so much time which will reduce the

overall productivity of the Bank (Mitrovic,et al,2015)

Little Control over the Device

By allowing the use of personal devices, the bank will also have little control over them.

Although the Bank might result in restrictions on the files that can be activated by the device

there some employees as a result of their technological prowess might jailbreak such restrictions

and gain access to restricted content (Wiech,2013).

DATA SECURITY RISKS

Increased entry points for hackers

The use of personal devices in the workplace increases the chances of hacking of an

organization’s systems. While hacking in a situation where all the Banks desktops are within its

premises might be relatively difficult, having employees work from their mobile phones or

Reduced productivity

Another consequence of the use of personal devices by employees can be associated with their

distractive nature. By using their devices at the workplace, employees are more likely to spend a

considerable amount of their productive hours on social sites such as Whatsapp, Facebook

Instagram, and Twitter. While the Bank desires to maximize profits, the implementation of the

project will result in a distraction of employees from their primary duties which will directly

affect their productivity. The small amount of time spent by one employee to send a text message

to a friend or surf the web can collectively lead to wastage of so much time which will reduce the

overall productivity of the Bank (Mitrovic,et al,2015)

Little Control over the Device

By allowing the use of personal devices, the bank will also have little control over them.

Although the Bank might result in restrictions on the files that can be activated by the device

there some employees as a result of their technological prowess might jailbreak such restrictions

and gain access to restricted content (Wiech,2013).

DATA SECURITY RISKS

Increased entry points for hackers

The use of personal devices in the workplace increases the chances of hacking of an

organization’s systems. While hacking in a situation where all the Banks desktops are within its

premises might be relatively difficult, having employees work from their mobile phones or

laptops makes it possible to hack from multiple points thus making it easier for hackers to get

hold of sensitive information from the bank (Downer & Bhattacharya, 2015)

Access to Unsecured Wi-Fi

Accessing of unsecured Wi-Fi can be quite risky to the bank's data. Allowing use of personal

devices would mean that employees will use the same devices that they use to access unsecured

Wi-Fi Connections at restaurants, their homes or even at the Airport. Such unsecured networks

can facilitate easy hacking of the Bank’s systems (Suby,2013).

Discoverability of data

This can be the case where there is a loss of the devices. Any loss resulting from theft or

employee’s carelessness puts the employer’s data which is stored on the device at risk.

Additionally, the project also means that the privacy of employees will also be at stake. For

example, in the case of any legal proceedings, personal devices being used by an employee

might b explored by the employer or a third party if need be. Some of the personal information

that could be explored includes information contained in social media accounts, geographical

location or even private photos. This could be against the wishes of the employee (Song, 2014).

People leaving the Bank

Sometimes employees might leave a company abruptly without prior notice. In such a situation

where employees leave the Bank without notice, the management might not have time to remove

the bank's information and passwords which might facilitate unauthorized access to the Banks

systems by former employees (Vijayan & Hardy,2015).

hold of sensitive information from the bank (Downer & Bhattacharya, 2015)

Access to Unsecured Wi-Fi

Accessing of unsecured Wi-Fi can be quite risky to the bank's data. Allowing use of personal

devices would mean that employees will use the same devices that they use to access unsecured

Wi-Fi Connections at restaurants, their homes or even at the Airport. Such unsecured networks

can facilitate easy hacking of the Bank’s systems (Suby,2013).

Discoverability of data

This can be the case where there is a loss of the devices. Any loss resulting from theft or

employee’s carelessness puts the employer’s data which is stored on the device at risk.

Additionally, the project also means that the privacy of employees will also be at stake. For

example, in the case of any legal proceedings, personal devices being used by an employee

might b explored by the employer or a third party if need be. Some of the personal information

that could be explored includes information contained in social media accounts, geographical

location or even private photos. This could be against the wishes of the employee (Song, 2014).

People leaving the Bank

Sometimes employees might leave a company abruptly without prior notice. In such a situation

where employees leave the Bank without notice, the management might not have time to remove

the bank's information and passwords which might facilitate unauthorized access to the Banks

systems by former employees (Vijayan & Hardy,2015).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

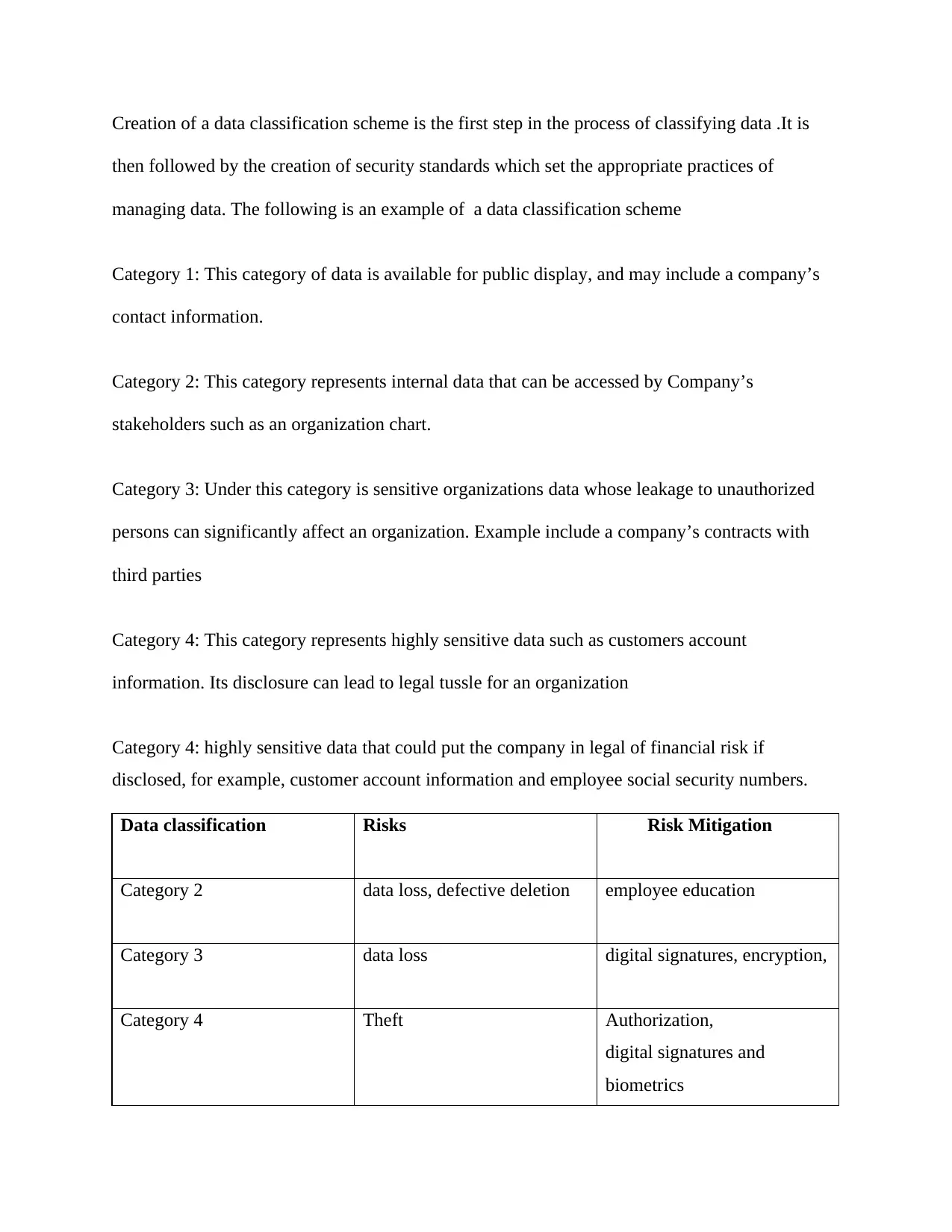

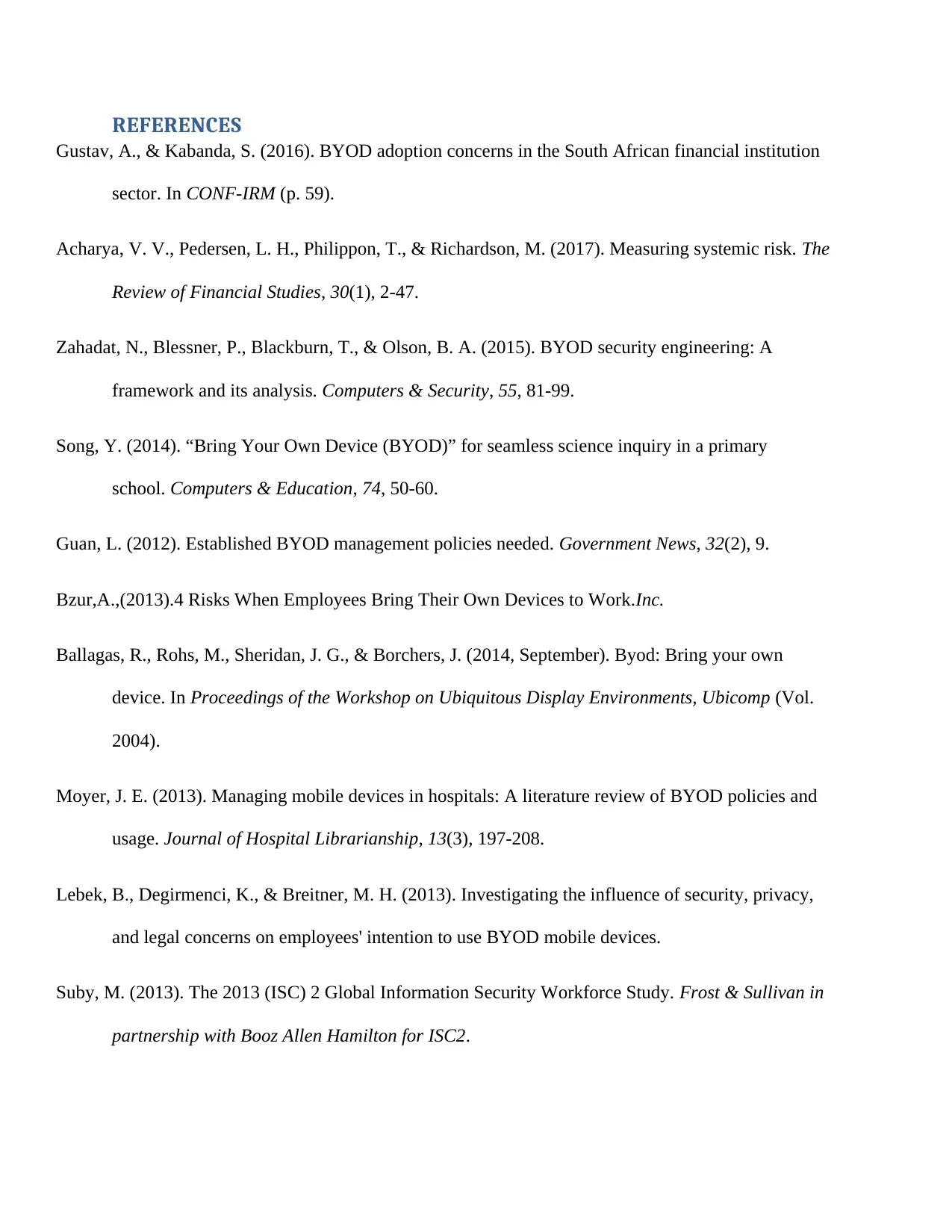

Creation of a data classification scheme is the first step in the process of classifying data .It is

then followed by the creation of security standards which set the appropriate practices of

managing data. The following is an example of a data classification scheme

Category 1: This category of data is available for public display, and may include a company’s

contact information.

Category 2: This category represents internal data that can be accessed by Company’s

stakeholders such as an organization chart.

Category 3: Under this category is sensitive organizations data whose leakage to unauthorized

persons can significantly affect an organization. Example include a company’s contracts with

third parties

Category 4: This category represents highly sensitive data such as customers account

information. Its disclosure can lead to legal tussle for an organization

Category 4: highly sensitive data that could put the company in legal of financial risk if

disclosed, for example, customer account information and employee social security numbers.

Data classification Risks Risk Mitigation

Category 2 data loss, defective deletion employee education

Category 3 data loss digital signatures, encryption,

Category 4 Theft Authorization,

digital signatures and

biometrics

then followed by the creation of security standards which set the appropriate practices of

managing data. The following is an example of a data classification scheme

Category 1: This category of data is available for public display, and may include a company’s

contact information.

Category 2: This category represents internal data that can be accessed by Company’s

stakeholders such as an organization chart.

Category 3: Under this category is sensitive organizations data whose leakage to unauthorized

persons can significantly affect an organization. Example include a company’s contracts with

third parties

Category 4: This category represents highly sensitive data such as customers account

information. Its disclosure can lead to legal tussle for an organization

Category 4: highly sensitive data that could put the company in legal of financial risk if

disclosed, for example, customer account information and employee social security numbers.

Data classification Risks Risk Mitigation

Category 2 data loss, defective deletion employee education

Category 3 data loss digital signatures, encryption,

Category 4 Theft Authorization,

digital signatures and

biometrics

Risks and Risk Mitigation for various data categories

CONCLUSION

In conclusion, BYOD Policy is a concept that has gained momentum in the recent past as per the

recent statistics of the number of organizations that are embracing it. Commonwealth Bank of

Australia intends to join the list of companies that use this policy by implementing its project that

will require their employees to use personal devices to be used as the main devices for

performing their work tasks. However, successful implementation of the program will depend

upon an analysis of numerous factors as well as the inclusion of various shareholders within the

Organization. Commonwealth Bank of Australia will, therefore, be required to conduct a cost-

benefit analysis of the proposed project before its implementation as well as the various

considerations and measures that will be laid out to facilitate successful implementation of the

project. Among the considerations that the Bank will need to look at are the various laws

governing the use of personal devices at the workplace by employees to facilitate co0mpliance

by both the employees and the management. However, the implementation of the project will

come with many challenges that the company will be required to mitigate. The associated threats,

vulnerabilities, and consequences will affect both employees and the management. Among the

risks that the Bank will be faced with are legal liabilities in case of violation of the exciting laws

regarding the use of personal devices by the employees, abstracted driving, increases of sexual

harassment among employees, associated risks of social media content ,possibility of loss of

devices with unsecured data resentment by employees, loss of productivity for employees and

the bank and Management’s loss of control over devices used by employees in performing their

work tasks. The Bank will also be faced with many data security risks including the risk of its

CONCLUSION

In conclusion, BYOD Policy is a concept that has gained momentum in the recent past as per the

recent statistics of the number of organizations that are embracing it. Commonwealth Bank of

Australia intends to join the list of companies that use this policy by implementing its project that

will require their employees to use personal devices to be used as the main devices for

performing their work tasks. However, successful implementation of the program will depend

upon an analysis of numerous factors as well as the inclusion of various shareholders within the

Organization. Commonwealth Bank of Australia will, therefore, be required to conduct a cost-

benefit analysis of the proposed project before its implementation as well as the various

considerations and measures that will be laid out to facilitate successful implementation of the

project. Among the considerations that the Bank will need to look at are the various laws

governing the use of personal devices at the workplace by employees to facilitate co0mpliance

by both the employees and the management. However, the implementation of the project will

come with many challenges that the company will be required to mitigate. The associated threats,

vulnerabilities, and consequences will affect both employees and the management. Among the

risks that the Bank will be faced with are legal liabilities in case of violation of the exciting laws

regarding the use of personal devices by the employees, abstracted driving, increases of sexual

harassment among employees, associated risks of social media content ,possibility of loss of

devices with unsecured data resentment by employees, loss of productivity for employees and

the bank and Management’s loss of control over devices used by employees in performing their

work tasks. The Bank will also be faced with many data security risks including the risk of its

systems being hacked from multiple points, the risk of former employees of the bank being able

to access the Bank’s confidential information and the risk of discoverability of data.

to access the Bank’s confidential information and the risk of discoverability of data.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Gustav, A., & Kabanda, S. (2016). BYOD adoption concerns in the South African financial institution

sector. In CONF-IRM (p. 59).

Acharya, V. V., Pedersen, L. H., Philippon, T., & Richardson, M. (2017). Measuring systemic risk. The

Review of Financial Studies, 30(1), 2-47.

Zahadat, N., Blessner, P., Blackburn, T., & Olson, B. A. (2015). BYOD security engineering: A

framework and its analysis. Computers & Security, 55, 81-99.

Song, Y. (2014). “Bring Your Own Device (BYOD)” for seamless science inquiry in a primary

school. Computers & Education, 74, 50-60.

Guan, L. (2012). Established BYOD management policies needed. Government News, 32(2), 9.

Bzur,A.,(2013).4 Risks When Employees Bring Their Own Devices to Work.Inc.

Ballagas, R., Rohs, M., Sheridan, J. G., & Borchers, J. (2014, September). Byod: Bring your own

device. In Proceedings of the Workshop on Ubiquitous Display Environments, Ubicomp (Vol.

2004).

Moyer, J. E. (2013). Managing mobile devices in hospitals: A literature review of BYOD policies and

usage. Journal of Hospital Librarianship, 13(3), 197-208.

Lebek, B., Degirmenci, K., & Breitner, M. H. (2013). Investigating the influence of security, privacy,

and legal concerns on employees' intention to use BYOD mobile devices.

Suby, M. (2013). The 2013 (ISC) 2 Global Information Security Workforce Study. Frost & Sullivan in

partnership with Booz Allen Hamilton for ISC2.

Gustav, A., & Kabanda, S. (2016). BYOD adoption concerns in the South African financial institution

sector. In CONF-IRM (p. 59).

Acharya, V. V., Pedersen, L. H., Philippon, T., & Richardson, M. (2017). Measuring systemic risk. The

Review of Financial Studies, 30(1), 2-47.

Zahadat, N., Blessner, P., Blackburn, T., & Olson, B. A. (2015). BYOD security engineering: A

framework and its analysis. Computers & Security, 55, 81-99.

Song, Y. (2014). “Bring Your Own Device (BYOD)” for seamless science inquiry in a primary

school. Computers & Education, 74, 50-60.

Guan, L. (2012). Established BYOD management policies needed. Government News, 32(2), 9.

Bzur,A.,(2013).4 Risks When Employees Bring Their Own Devices to Work.Inc.

Ballagas, R., Rohs, M., Sheridan, J. G., & Borchers, J. (2014, September). Byod: Bring your own

device. In Proceedings of the Workshop on Ubiquitous Display Environments, Ubicomp (Vol.

2004).

Moyer, J. E. (2013). Managing mobile devices in hospitals: A literature review of BYOD policies and

usage. Journal of Hospital Librarianship, 13(3), 197-208.

Lebek, B., Degirmenci, K., & Breitner, M. H. (2013). Investigating the influence of security, privacy,

and legal concerns on employees' intention to use BYOD mobile devices.

Suby, M. (2013). The 2013 (ISC) 2 Global Information Security Workforce Study. Frost & Sullivan in

partnership with Booz Allen Hamilton for ISC2.

Mitrovic, Z., Veljkovic, I., Whyte, G., & Thompson, K. (2014, November). Introducing BYOD in an

organisation: the risk and customer services view points. In The 1st Namibia Customer Service

Awards & Conference (pp. 1-26).

Burt, J. (2011). BYOD trend pressures corporate networks. eweek, 28(14), 30-31.

Shim, J. P., Mittleman, D., Welke, R., French, A. M., & Guo, J. C. (2013). Bring your own device

(BYOD): Current status, issues, and future directions.

Smith, A. D. (2009). Internet retail banking: A competitive analysis in an increasingly financially

troubled environment. Information Management & Computer Security, 17(2), 127-150.

Ghosh, A., Gajar, P. K., & Rai, S. (2013). Bring your own device (BYOD): Security risks and mitigating

strategies. Journal of Global Research in Computer Science, 4(4), 62-70.

French, A. M., Guo, C., & Shim, J. P. (2014). Current Status, Issues, and Future of Bring Your Own

Device (BYOD). CAIS, 35, 10.

Garba, A. B., Armarego, J., Murray, D., & Kenworthy, W. (2015). Review of the information security

and privacy challenges in Bring Your Own Device (BYOD) environments. Journal of

Information privacy and security, 11(1), 38-54.

Zahadat, N., Blessner, P., Blackburn, T., & Olson, B. A. (2015). BYOD security engineering: A

framework and its analysis. Computers & Security, 55, 81-99.

Watkins, B. (2014). The impact of cyber attacks on the private sector. Briefing Paper, Association for

International Affair, 12.

organisation: the risk and customer services view points. In The 1st Namibia Customer Service

Awards & Conference (pp. 1-26).

Burt, J. (2011). BYOD trend pressures corporate networks. eweek, 28(14), 30-31.

Shim, J. P., Mittleman, D., Welke, R., French, A. M., & Guo, J. C. (2013). Bring your own device

(BYOD): Current status, issues, and future directions.

Smith, A. D. (2009). Internet retail banking: A competitive analysis in an increasingly financially

troubled environment. Information Management & Computer Security, 17(2), 127-150.

Ghosh, A., Gajar, P. K., & Rai, S. (2013). Bring your own device (BYOD): Security risks and mitigating

strategies. Journal of Global Research in Computer Science, 4(4), 62-70.

French, A. M., Guo, C., & Shim, J. P. (2014). Current Status, Issues, and Future of Bring Your Own

Device (BYOD). CAIS, 35, 10.

Garba, A. B., Armarego, J., Murray, D., & Kenworthy, W. (2015). Review of the information security

and privacy challenges in Bring Your Own Device (BYOD) environments. Journal of

Information privacy and security, 11(1), 38-54.

Zahadat, N., Blessner, P., Blackburn, T., & Olson, B. A. (2015). BYOD security engineering: A

framework and its analysis. Computers & Security, 55, 81-99.

Watkins, B. (2014). The impact of cyber attacks on the private sector. Briefing Paper, Association for

International Affair, 12.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Ghosh, A., Gajar, P. K., & Rai, S. (2013). Bring your own device (BYOD): Security risks and mitigating

strategies. Journal of Global Research in Computer Science, 4(4), 62-70.

Downer, K., & Bhattacharya, M. (2015, December). BYOD security: A new business challenge.

In Smart City/SocialCom/SustainCom (SmartCity), 2015 IEEE International Conference on (pp.

1128-1133). IEEE.

Vijayan, J., & Hardy, G. M. (2015). Security Spending and Preparedness in the Financial Sector: A

SANS Survey.

Morrow, B. (2012). BYOD security challenges: control and protect your most sensitive data. Network

Security, 2012(12), 5-8.

Chin, E., Felt, A. P., Greenwood, K., & Wagner, D. (2011, June). Analyzing inter-application

communication in Android. In Proceedings of the 9th international conference on Mobile

systems, applications, and services (pp. 239-252). ACM.

French, A. M., Guo, C., & Shim, J. P. (2014). Current Status, Issues, and Future of Bring Your Own

Device (BYOD). CAIS, 35, 10.

Mansfield-Devine, S. (2012). Interview: BYOD and the enterprise network. Computer fraud &

security, 2012(4), 14-17.

Thomson, G. (2012). BYOD: enabling the chaos. Network Security, 2012(2), 5-8.

Felt, A. P., Chin, E., Hanna, S., Song, D., & Wagner, D. (2011, October). Android permissions

demystified. In Proceedings of the 18th ACM conference on Computer and communications

security(pp. 627-638). ACM.

Wiech, D. (2013). The benefits and risks of BYOD. Manufacturing Business Technology.

strategies. Journal of Global Research in Computer Science, 4(4), 62-70.

Downer, K., & Bhattacharya, M. (2015, December). BYOD security: A new business challenge.

In Smart City/SocialCom/SustainCom (SmartCity), 2015 IEEE International Conference on (pp.

1128-1133). IEEE.

Vijayan, J., & Hardy, G. M. (2015). Security Spending and Preparedness in the Financial Sector: A

SANS Survey.

Morrow, B. (2012). BYOD security challenges: control and protect your most sensitive data. Network

Security, 2012(12), 5-8.

Chin, E., Felt, A. P., Greenwood, K., & Wagner, D. (2011, June). Analyzing inter-application

communication in Android. In Proceedings of the 9th international conference on Mobile

systems, applications, and services (pp. 239-252). ACM.

French, A. M., Guo, C., & Shim, J. P. (2014). Current Status, Issues, and Future of Bring Your Own

Device (BYOD). CAIS, 35, 10.

Mansfield-Devine, S. (2012). Interview: BYOD and the enterprise network. Computer fraud &

security, 2012(4), 14-17.

Thomson, G. (2012). BYOD: enabling the chaos. Network Security, 2012(2), 5-8.

Felt, A. P., Chin, E., Hanna, S., Song, D., & Wagner, D. (2011, October). Android permissions

demystified. In Proceedings of the 18th ACM conference on Computer and communications

security(pp. 627-638). ACM.

Wiech, D. (2013). The benefits and risks of BYOD. Manufacturing Business Technology.

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.