Company Accounting Assignment Solution: Worksheet and Journal Entries

VerifiedAdded on 2020/05/01

|8

|792

|43

Homework Assignment

AI Summary

This assignment solution provides a detailed analysis of company accounting principles, focusing on worksheet entries, journal entries, and acquisition analysis. The solution covers the valuation of assets, including inventory, plant, and trademarks, and demonstrates the calculation of goodwill. It includes entries for business combinations, deferred tax liabilities, and payments to employees. The solution also provides journal entries in the books of EF Ltd, including investment and cash transactions related to the acquisition of GH Ltd. The analysis further explores the book value of shares, the amount paid, and the resulting goodwill calculation. Additionally, it addresses adjustments required for plant, property, and equipment in consolidated financial statements. References to relevant accounting literature are also provided.

Company accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Question...........................................................................................................................................3

Worksheet entries at 1 July 2013.................................................................................................3

Worksheet entries at 1 July 2016.................................................................................................3

Worksheet entries at 1 July 2017.................................................................................................3

Question 3.5.....................................................................................................................................5

Journal Entry in books of EF Ltd................................................................................................5

References........................................................................................................................................7

References........................................................................................................................................8

Question...........................................................................................................................................3

Worksheet entries at 1 July 2013.................................................................................................3

Worksheet entries at 1 July 2016.................................................................................................3

Worksheet entries at 1 July 2017.................................................................................................3

Question 3.5.....................................................................................................................................5

Journal Entry in books of EF Ltd................................................................................................5

References........................................................................................................................................7

References........................................................................................................................................8

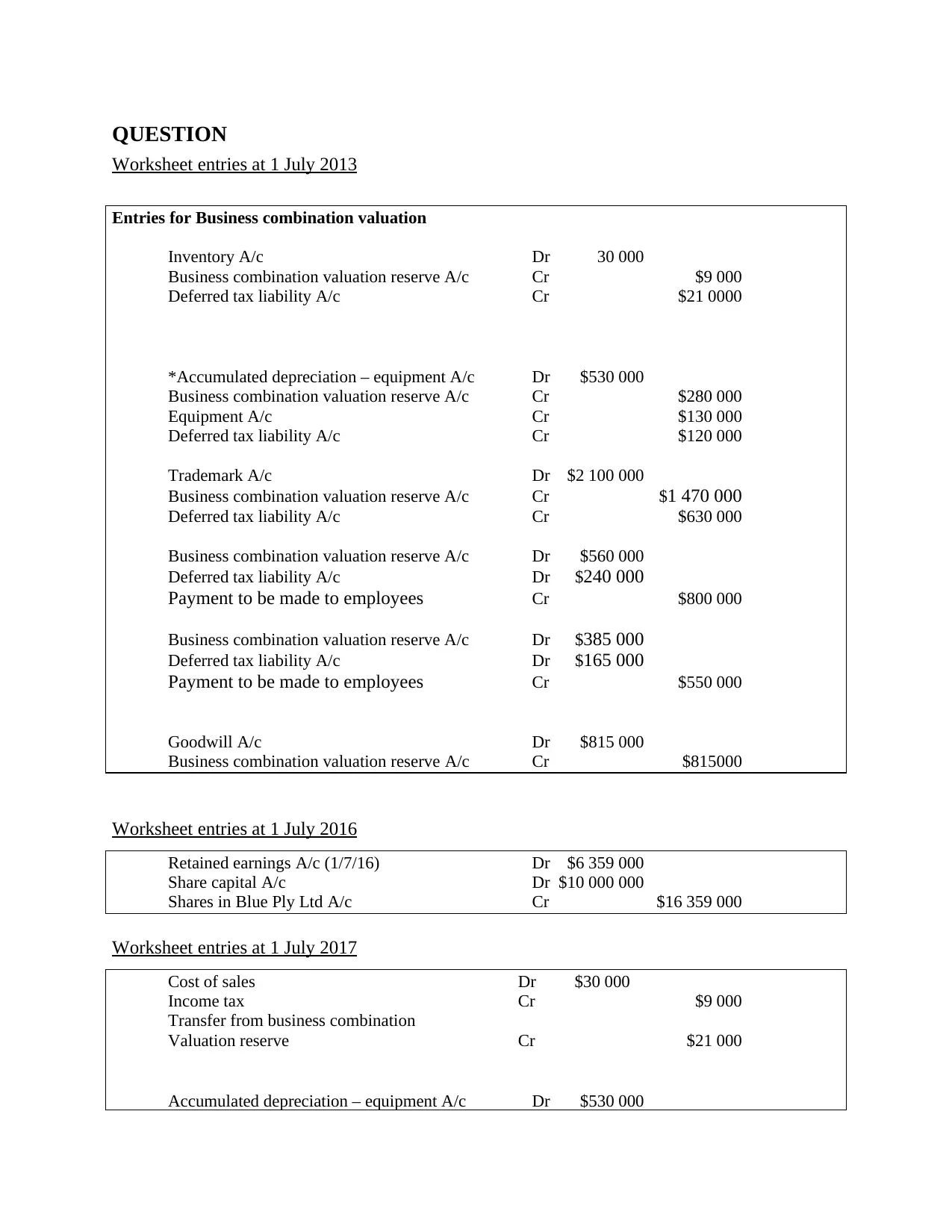

QUESTION

Worksheet entries at 1 July 2013

Entries for Business combination valuation

Inventory A/c Dr 30 000

Business combination valuation reserve A/c Cr $9 000

Deferred tax liability A/c Cr $21 0000

*Accumulated depreciation – equipment A/c Dr $530 000

Business combination valuation reserve A/c Cr $280 000

Equipment A/c Cr $130 000

Deferred tax liability A/c Cr $120 000

Trademark A/c Dr $2 100 000

Business combination valuation reserve A/c Cr $1 470 000

Deferred tax liability A/c Cr $630 000

Business combination valuation reserve A/c Dr $560 000

Deferred tax liability A/c Dr $240 000

Payment to be made to employees Cr $800 000

Business combination valuation reserve A/c Dr $385 000

Deferred tax liability A/c Dr $165 000

Payment to be made to employees Cr $550 000

Goodwill A/c Dr $815 000

Business combination valuation reserve A/c Cr $815000

Worksheet entries at 1 July 2016

Retained earnings A/c (1/7/16) Dr $6 359 000

Share capital A/c Dr $10 000 000

Shares in Blue Ply Ltd A/c Cr $16 359 000

Worksheet entries at 1 July 2017

Cost of sales Dr $30 000

Income tax Cr $9 000

Transfer from business combination

Valuation reserve Cr $21 000

Accumulated depreciation – equipment A/c Dr $530 000

Worksheet entries at 1 July 2013

Entries for Business combination valuation

Inventory A/c Dr 30 000

Business combination valuation reserve A/c Cr $9 000

Deferred tax liability A/c Cr $21 0000

*Accumulated depreciation – equipment A/c Dr $530 000

Business combination valuation reserve A/c Cr $280 000

Equipment A/c Cr $130 000

Deferred tax liability A/c Cr $120 000

Trademark A/c Dr $2 100 000

Business combination valuation reserve A/c Cr $1 470 000

Deferred tax liability A/c Cr $630 000

Business combination valuation reserve A/c Dr $560 000

Deferred tax liability A/c Dr $240 000

Payment to be made to employees Cr $800 000

Business combination valuation reserve A/c Dr $385 000

Deferred tax liability A/c Dr $165 000

Payment to be made to employees Cr $550 000

Goodwill A/c Dr $815 000

Business combination valuation reserve A/c Cr $815000

Worksheet entries at 1 July 2016

Retained earnings A/c (1/7/16) Dr $6 359 000

Share capital A/c Dr $10 000 000

Shares in Blue Ply Ltd A/c Cr $16 359 000

Worksheet entries at 1 July 2017

Cost of sales Dr $30 000

Income tax Cr $9 000

Transfer from business combination

Valuation reserve Cr $21 000

Accumulated depreciation – equipment A/c Dr $530 000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

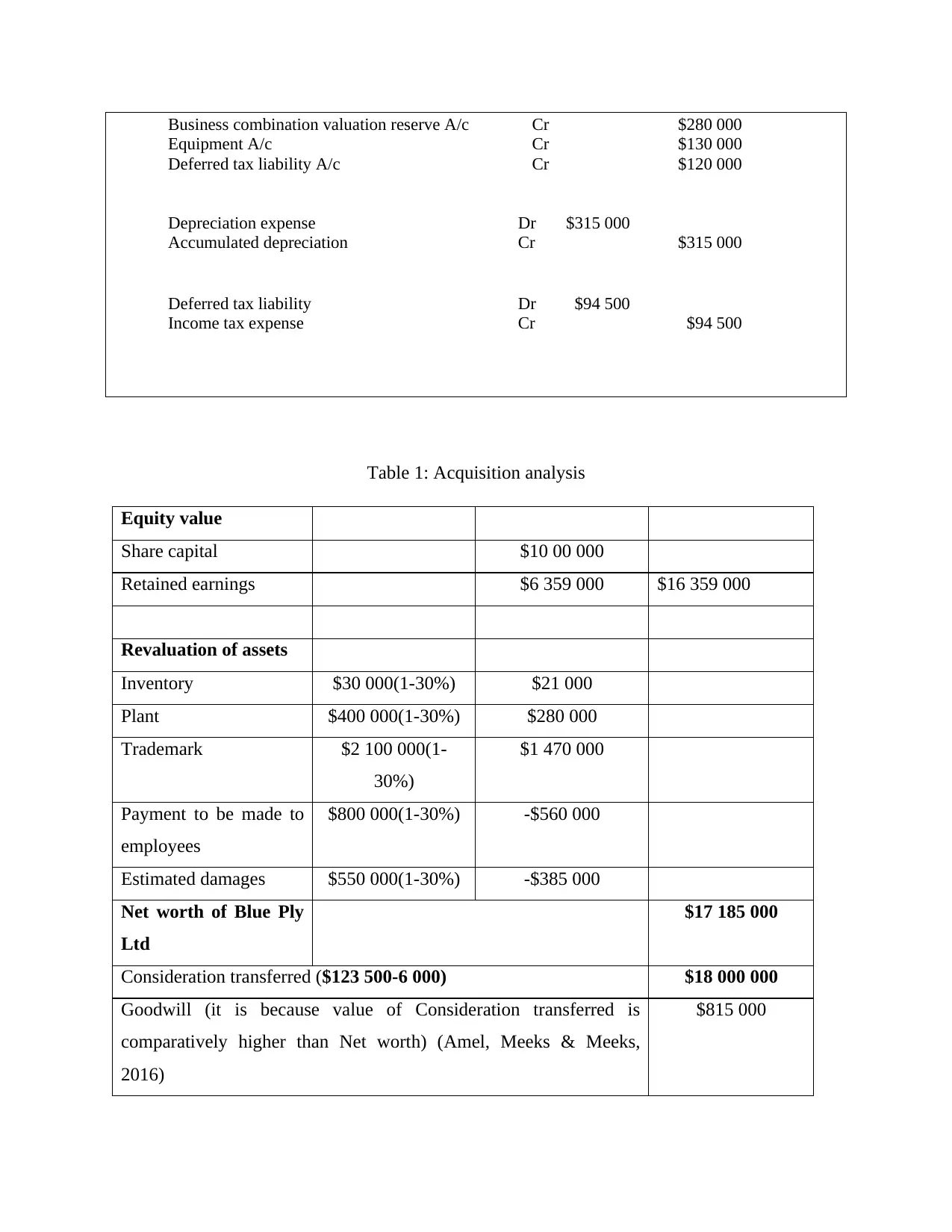

Business combination valuation reserve A/c Cr $280 000

Equipment A/c Cr $130 000

Deferred tax liability A/c Cr $120 000

Depreciation expense Dr $315 000

Accumulated depreciation Cr $315 000

Deferred tax liability Dr $94 500

Income tax expense Cr $94 500

Table 1: Acquisition analysis

Equity value

Share capital $10 00 000

Retained earnings $6 359 000 $16 359 000

Revaluation of assets

Inventory $30 000(1-30%) $21 000

Plant $400 000(1-30%) $280 000

Trademark $2 100 000(1-

30%)

$1 470 000

Payment to be made to

employees

$800 000(1-30%) -$560 000

Estimated damages $550 000(1-30%) -$385 000

Net worth of Blue Ply

Ltd

$17 185 000

Consideration transferred ($123 500-6 000) $18 000 000

Goodwill (it is because value of Consideration transferred is

comparatively higher than Net worth) (Amel, Meeks & Meeks,

2016)

$815 000

Equipment A/c Cr $130 000

Deferred tax liability A/c Cr $120 000

Depreciation expense Dr $315 000

Accumulated depreciation Cr $315 000

Deferred tax liability Dr $94 500

Income tax expense Cr $94 500

Table 1: Acquisition analysis

Equity value

Share capital $10 00 000

Retained earnings $6 359 000 $16 359 000

Revaluation of assets

Inventory $30 000(1-30%) $21 000

Plant $400 000(1-30%) $280 000

Trademark $2 100 000(1-

30%)

$1 470 000

Payment to be made to

employees

$800 000(1-30%) -$560 000

Estimated damages $550 000(1-30%) -$385 000

Net worth of Blue Ply

Ltd

$17 185 000

Consideration transferred ($123 500-6 000) $18 000 000

Goodwill (it is because value of Consideration transferred is

comparatively higher than Net worth) (Amel, Meeks & Meeks,

2016)

$815 000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

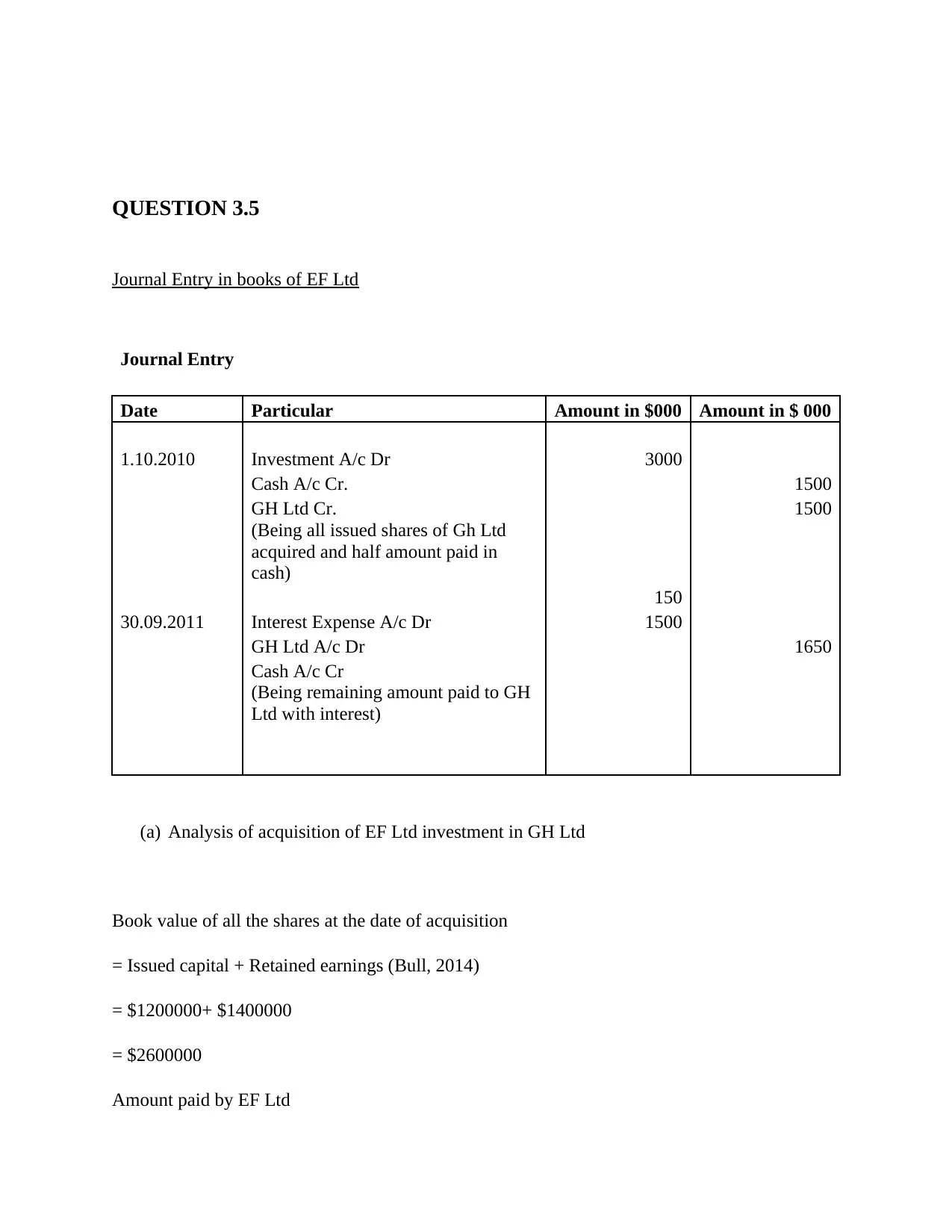

QUESTION 3.5

Journal Entry in books of EF Ltd

Journal Entry

Date Particular Amount in $000 Amount in $ 000

1.10.2010 Investment A/c Dr 3000

Cash A/c Cr. 1500

GH Ltd Cr. 1500

(Being all issued shares of Gh Ltd

acquired and half amount paid in

cash)

150

30.09.2011 Interest Expense A/c Dr 1500

GH Ltd A/c Dr 1650

Cash A/c Cr

(Being remaining amount paid to GH

Ltd with interest)

(a) Analysis of acquisition of EF Ltd investment in GH Ltd

Book value of all the shares at the date of acquisition

= Issued capital + Retained earnings (Bull, 2014)

= $1200000+ $1400000

= $2600000

Amount paid by EF Ltd

Journal Entry in books of EF Ltd

Journal Entry

Date Particular Amount in $000 Amount in $ 000

1.10.2010 Investment A/c Dr 3000

Cash A/c Cr. 1500

GH Ltd Cr. 1500

(Being all issued shares of Gh Ltd

acquired and half amount paid in

cash)

150

30.09.2011 Interest Expense A/c Dr 1500

GH Ltd A/c Dr 1650

Cash A/c Cr

(Being remaining amount paid to GH

Ltd with interest)

(a) Analysis of acquisition of EF Ltd investment in GH Ltd

Book value of all the shares at the date of acquisition

= Issued capital + Retained earnings (Bull, 2014)

= $1200000+ $1400000

= $2600000

Amount paid by EF Ltd

= $3000000

The difference between book value and the actual amount paid, i.e. $400000 ($3000000-

2600000) will be recorded as payment relating to goodwill of GH Ltd.

(b) Adjustment in PPE account

Consolidation adjustments will be required to be done in respect of GH Ltd’s plant and

equipment in case the consolidated financial statements are prepared for the year ended 30

September 20X0, as Plant, property and equipment are required to be recorded at replacement

cost (Amel-Zadeh, Meeks & Meeks, 2016); the adjustment in value of PPE will be made to

ascertain the appropriate amount of goodwill.

The difference between book value and the actual amount paid, i.e. $400000 ($3000000-

2600000) will be recorded as payment relating to goodwill of GH Ltd.

(b) Adjustment in PPE account

Consolidation adjustments will be required to be done in respect of GH Ltd’s plant and

equipment in case the consolidated financial statements are prepared for the year ended 30

September 20X0, as Plant, property and equipment are required to be recorded at replacement

cost (Amel-Zadeh, Meeks & Meeks, 2016); the adjustment in value of PPE will be made to

ascertain the appropriate amount of goodwill.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journal

Amel-Zadeh, A., Meeks, G., & Meeks, J. G. (2016). Historical perspectives on accounting for

M&A. Accounting and Business Research, 46(5), 501-524.

Bull, R. J. (2014). Accounting in business. Butterworth-Heinemann.

Weil, R. L., Schipper, K., & Francis, J. (2013). Financial accounting: an introduction to

concepts, methods and uses. Cengage Learning.

Books and Journal

Amel-Zadeh, A., Meeks, G., & Meeks, J. G. (2016). Historical perspectives on accounting for

M&A. Accounting and Business Research, 46(5), 501-524.

Bull, R. J. (2014). Accounting in business. Butterworth-Heinemann.

Weil, R. L., Schipper, K., & Francis, J. (2013). Financial accounting: an introduction to

concepts, methods and uses. Cengage Learning.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.