Company accounting - Assignment

VerifiedAdded on 2021/05/31

|16

|2806

|42

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: COMPANY ACCOUNTING

Company Accounting

Name of Student:

Name of University:

Author’s Note:

Company Accounting

Name of Student:

Name of University:

Author’s Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1COMPANY ACCOUNTING

Table of Contents

Introduction......................................................................................................................................2

Nature of the Company’s Activities................................................................................................2

Composition of The Company’s Equity..........................................................................................2

Share price for the company’s ordinary shares for the last day of the financial year......................4

Share price for the company’s ordinary shares one calendar month after the end of financial year

.........................................................................................................................................................5

Debt structure and the source of external financing........................................................................6

Provision for income tax figure, deferred tax assets/liabilities........................................................8

Key elements in the fixed assets categories...................................................................................10

Policy for recognising the impairment of intangible assets asset..................................................11

Summary of company’s financial operations during the financial year........................................13

Conclusion.....................................................................................................................................13

References......................................................................................................................................15

Table of Contents

Introduction......................................................................................................................................2

Nature of the Company’s Activities................................................................................................2

Composition of The Company’s Equity..........................................................................................2

Share price for the company’s ordinary shares for the last day of the financial year......................4

Share price for the company’s ordinary shares one calendar month after the end of financial year

.........................................................................................................................................................5

Debt structure and the source of external financing........................................................................6

Provision for income tax figure, deferred tax assets/liabilities........................................................8

Key elements in the fixed assets categories...................................................................................10

Policy for recognising the impairment of intangible assets asset..................................................11

Summary of company’s financial operations during the financial year........................................13

Conclusion.....................................................................................................................................13

References......................................................................................................................................15

2COMPANY ACCOUNTING

Introduction

The report aims to assess the QBE insurance’s financial statement. Some of the main

discourse of the study will comprise of the discussion on the activities performed by the

company. The various sections of the discussions will further evaluate the composition of equity

for QBE insurance. The third section of the study has been discussed with the various types of

the factors which are associated to the share price for the company’s ordinary shares for the last

day of the financial year. This section is followed with the various types of the discussions

pertaining to the company’s shares one calendar month after the end of financial year. The

important discussions on this aspect has been conducive in suggesting the difference in one

month for this period. The fifth section of the study has emphasized on the debt structure of the

company associated to the sourcing of the external debt. Some of the other section of the

discussions of the report has been able to consider the discussions associated to the discussions

in the key elements in the fixed assets categories. The last section has evaluated the policy for

impairment of the intangible assets made by the company (Titman, Keown & Martin, 2017).

Nature of the Company’s Activities

QBE Insurance headquartered in Sydney is recognised considered Australia’s one of the

largest insurer which provides the services across wide range of the countries including

“Australia, America, Europe and Asia Pacific region” (Martin, 2016). Originally QBE insurance

was better known as “North Queensland Insurance Co,” in 1886 situated in “Townsville, in

northern Queensland, Australia”. The company is seen to employ 14500 staff across 37 countries

worldwide. The total market capitalization of the company is discerned with A$ 17.81 billion

however the after-tax loss of the company has been reported as $ 1249 million in 2017. The

presentation currency of the company has been further depicted as AUD as the main accounting

framework is based AASB reporting standards (Renz & Herman, 2016).

Composition of The Company’s Equity

In the capital structure of the company equity comprises of the common preferred stock

along with the retained earnings which is considered as the total of shareholders equity (Finkler

et al., 2016). The main accounts for the QBE Insurance in the equity evaluation has been

Introduction

The report aims to assess the QBE insurance’s financial statement. Some of the main

discourse of the study will comprise of the discussion on the activities performed by the

company. The various sections of the discussions will further evaluate the composition of equity

for QBE insurance. The third section of the study has been discussed with the various types of

the factors which are associated to the share price for the company’s ordinary shares for the last

day of the financial year. This section is followed with the various types of the discussions

pertaining to the company’s shares one calendar month after the end of financial year. The

important discussions on this aspect has been conducive in suggesting the difference in one

month for this period. The fifth section of the study has emphasized on the debt structure of the

company associated to the sourcing of the external debt. Some of the other section of the

discussions of the report has been able to consider the discussions associated to the discussions

in the key elements in the fixed assets categories. The last section has evaluated the policy for

impairment of the intangible assets made by the company (Titman, Keown & Martin, 2017).

Nature of the Company’s Activities

QBE Insurance headquartered in Sydney is recognised considered Australia’s one of the

largest insurer which provides the services across wide range of the countries including

“Australia, America, Europe and Asia Pacific region” (Martin, 2016). Originally QBE insurance

was better known as “North Queensland Insurance Co,” in 1886 situated in “Townsville, in

northern Queensland, Australia”. The company is seen to employ 14500 staff across 37 countries

worldwide. The total market capitalization of the company is discerned with A$ 17.81 billion

however the after-tax loss of the company has been reported as $ 1249 million in 2017. The

presentation currency of the company has been further depicted as AUD as the main accounting

framework is based AASB reporting standards (Renz & Herman, 2016).

Composition of The Company’s Equity

In the capital structure of the company equity comprises of the common preferred stock

along with the retained earnings which is considered as the total of shareholders equity (Finkler

et al., 2016). The main accounts for the QBE Insurance in the equity evaluation has been

3COMPANY ACCOUNTING

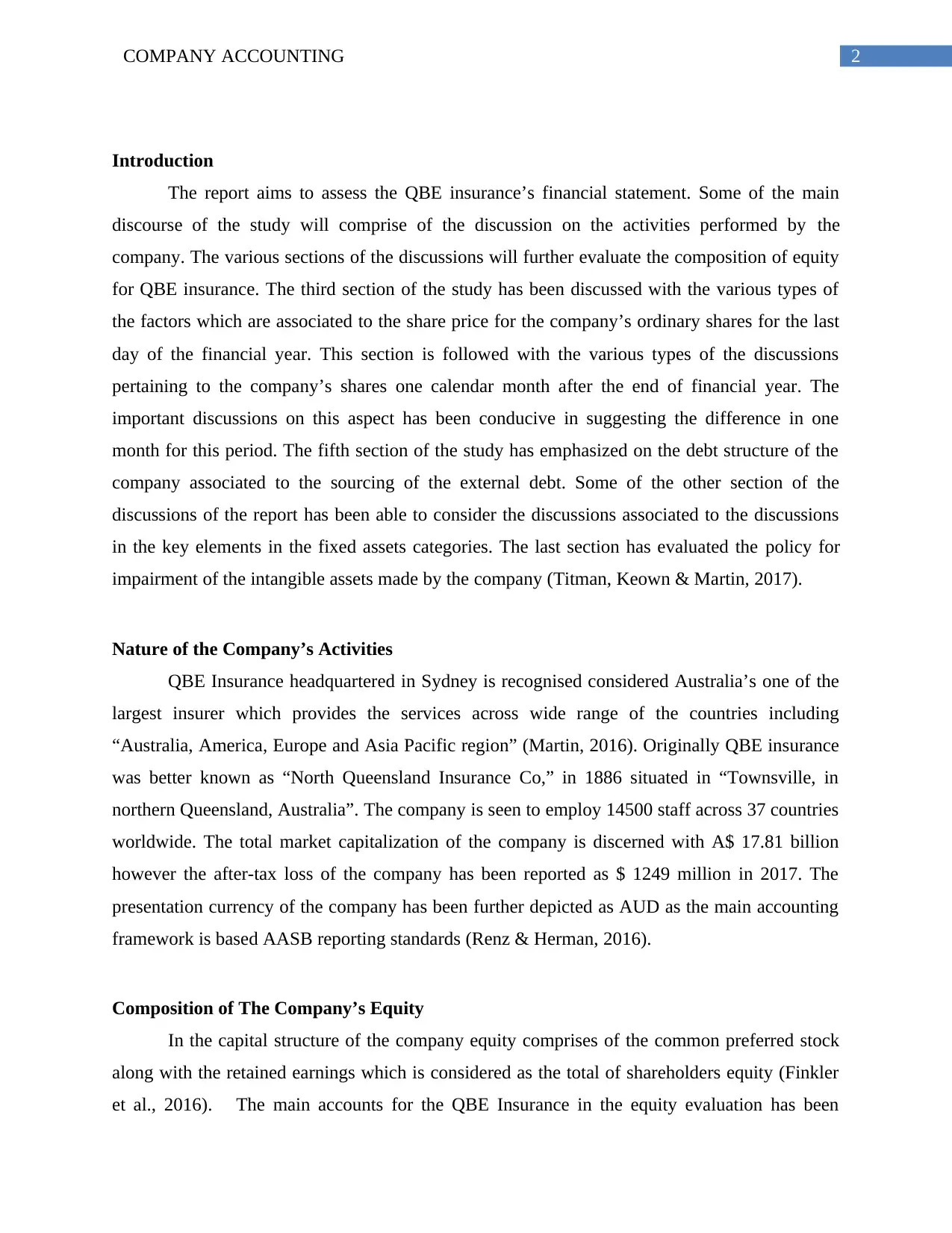

depicted with “share capital, treasury shares held in trust, reserves and retained profits”. In

addition to this, due to the presence of the noncontrolling interest amount of 42 million in 2017

and 50 million in 2016 the total equity of the company has been seen to be amounted to $ 8901

million in 2017 and $ 10334 in 2016. The total of the retained earnings figure of the company is

identified as $ 1763 million in 2017 and $ 3588 in 2016 (Barr, 2018). The depictions of the

values of the equity for the company has been depicted in the report as follows:

Figure: Equity amount of QBE insurance in 2017 and 2016

(Source: QBE.COM, 2018)

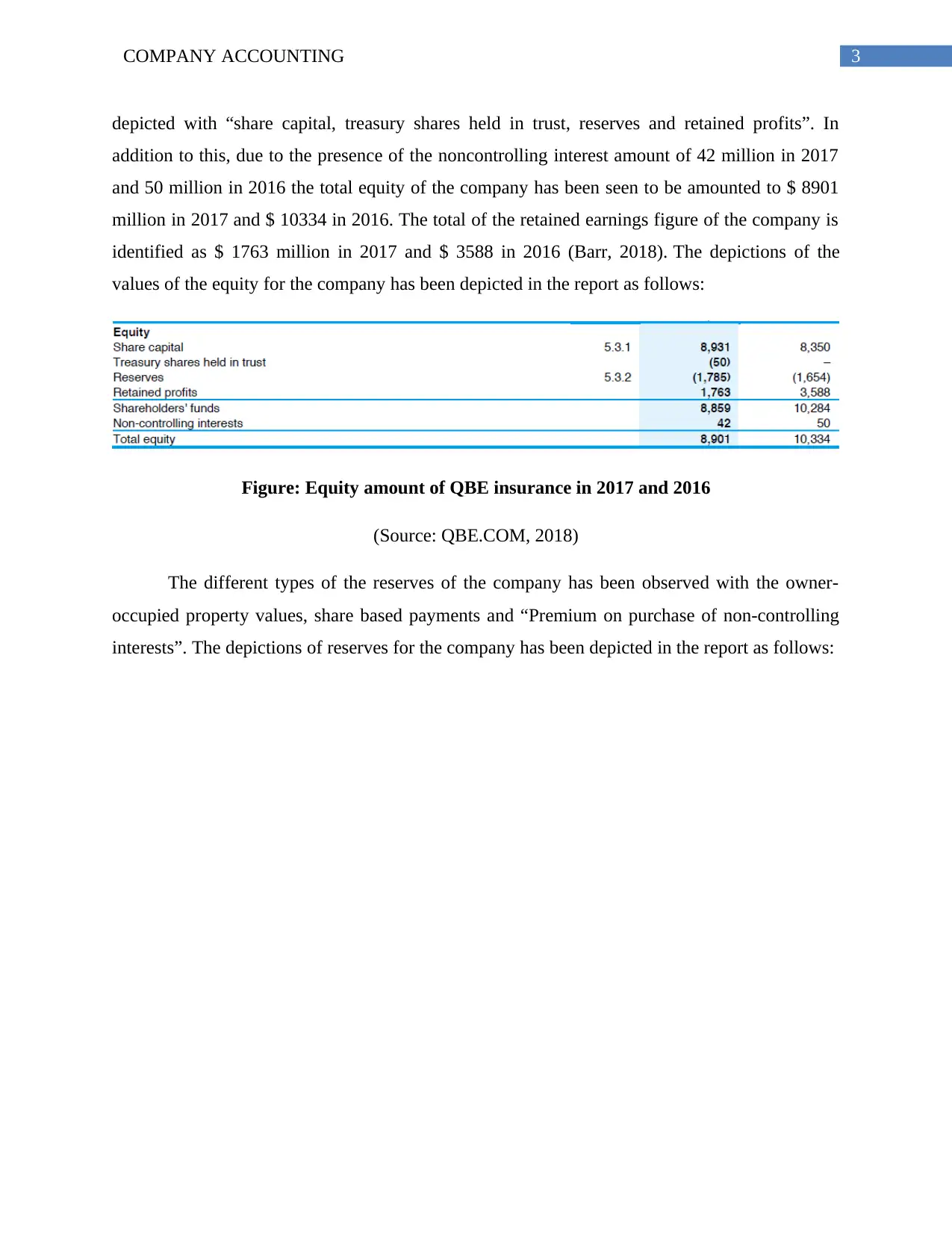

The different types of the reserves of the company has been observed with the owner-

occupied property values, share based payments and “Premium on purchase of non-controlling

interests”. The depictions of reserves for the company has been depicted in the report as follows:

depicted with “share capital, treasury shares held in trust, reserves and retained profits”. In

addition to this, due to the presence of the noncontrolling interest amount of 42 million in 2017

and 50 million in 2016 the total equity of the company has been seen to be amounted to $ 8901

million in 2017 and $ 10334 in 2016. The total of the retained earnings figure of the company is

identified as $ 1763 million in 2017 and $ 3588 in 2016 (Barr, 2018). The depictions of the

values of the equity for the company has been depicted in the report as follows:

Figure: Equity amount of QBE insurance in 2017 and 2016

(Source: QBE.COM, 2018)

The different types of the reserves of the company has been observed with the owner-

occupied property values, share based payments and “Premium on purchase of non-controlling

interests”. The depictions of reserves for the company has been depicted in the report as follows:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4COMPANY ACCOUNTING

Figure: Reserves of QBE insurance in 2017 and 2016

(Source: QBE.COM, 2018)

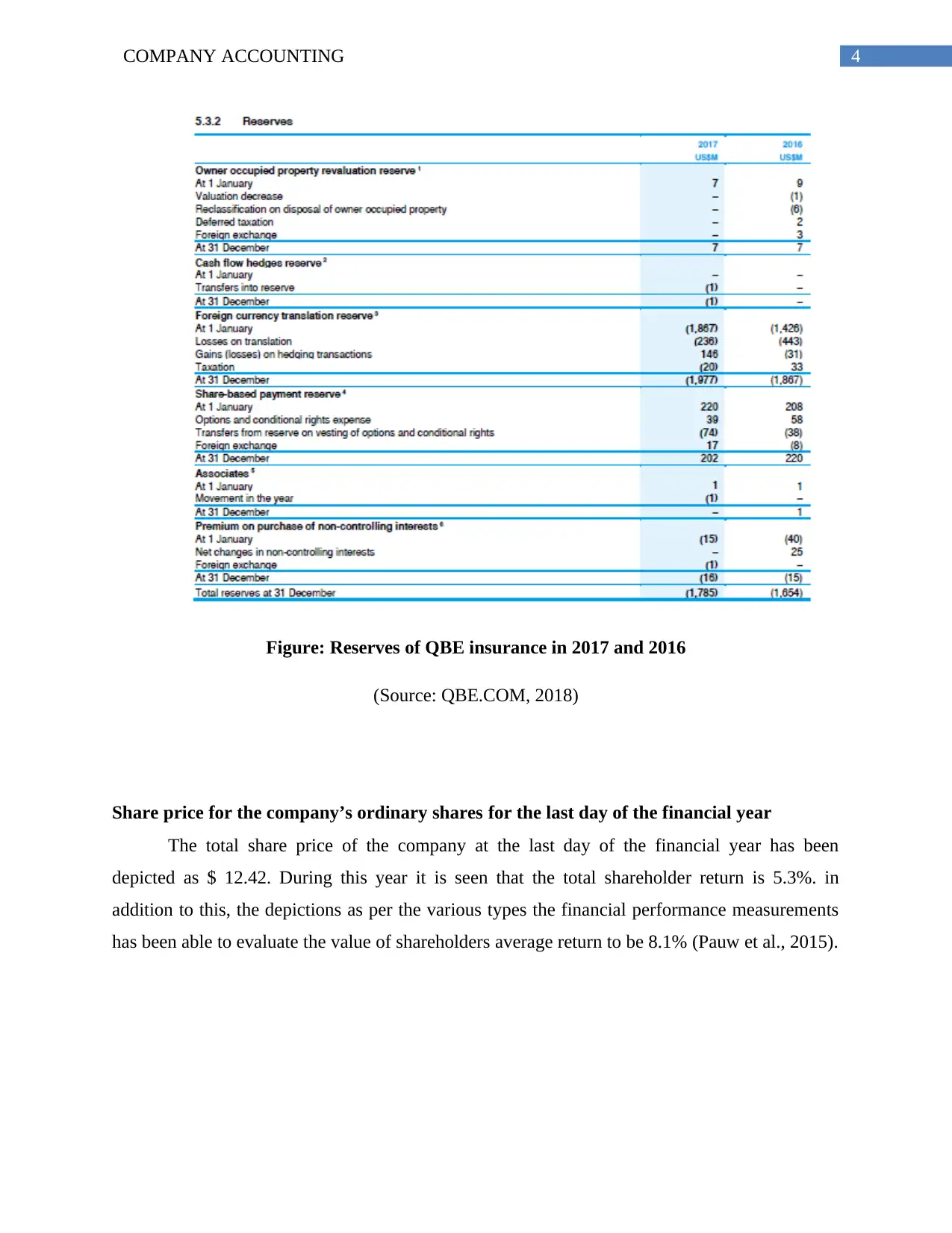

Share price for the company’s ordinary shares for the last day of the financial year

The total share price of the company at the last day of the financial year has been

depicted as $ 12.42. During this year it is seen that the total shareholder return is 5.3%. in

addition to this, the depictions as per the various types the financial performance measurements

has been able to evaluate the value of shareholders average return to be 8.1% (Pauw et al., 2015).

Figure: Reserves of QBE insurance in 2017 and 2016

(Source: QBE.COM, 2018)

Share price for the company’s ordinary shares for the last day of the financial year

The total share price of the company at the last day of the financial year has been

depicted as $ 12.42. During this year it is seen that the total shareholder return is 5.3%. in

addition to this, the depictions as per the various types the financial performance measurements

has been able to evaluate the value of shareholders average return to be 8.1% (Pauw et al., 2015).

5COMPANY ACCOUNTING

Figure: Share Price and share value relationship of QBE insurance in 2017 and 2016

(Source: QBE.COM, 2018)

Share price for the company’s ordinary shares one calendar month after the end of

financial year

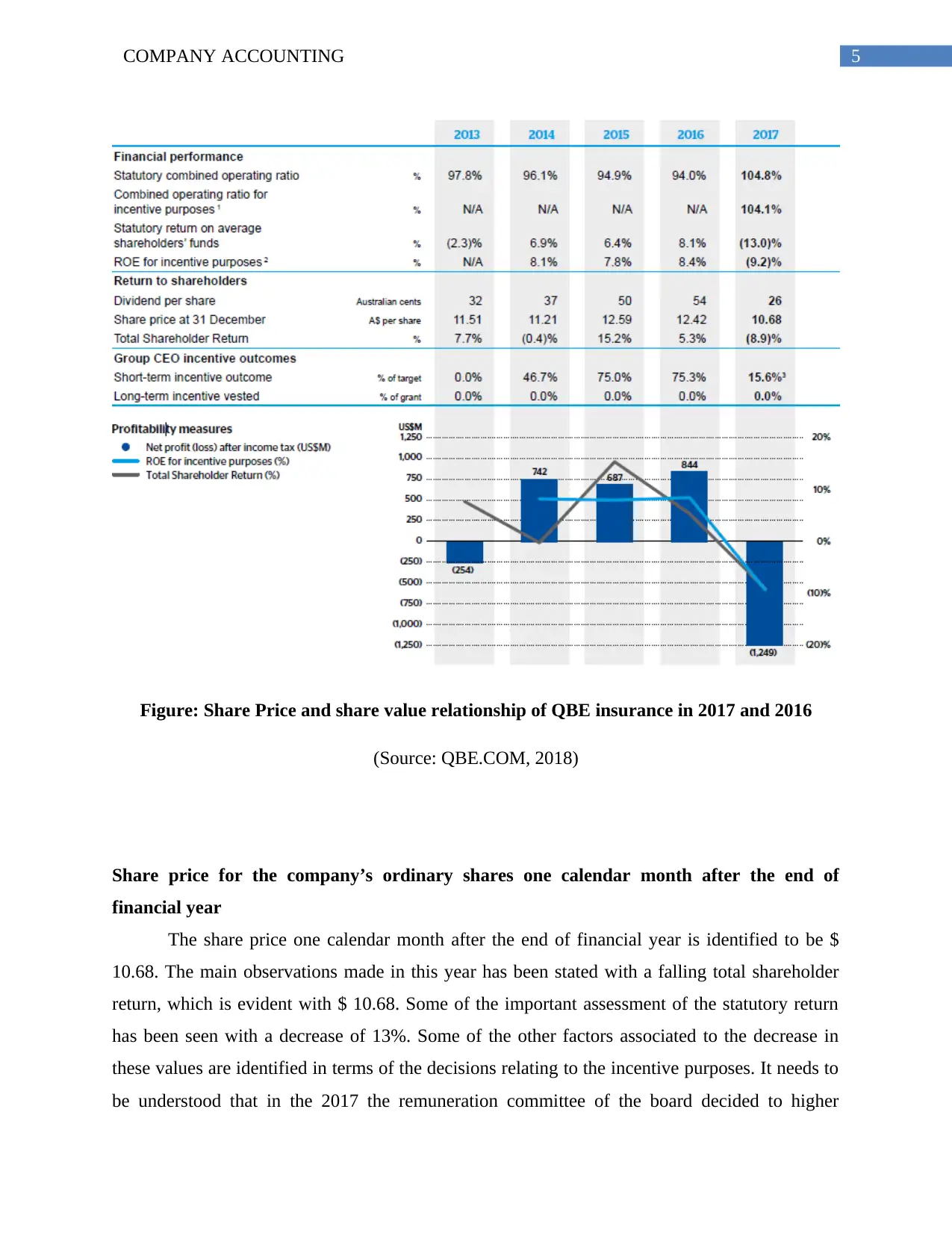

The share price one calendar month after the end of financial year is identified to be $

10.68. The main observations made in this year has been stated with a falling total shareholder

return, which is evident with $ 10.68. Some of the important assessment of the statutory return

has been seen with a decrease of 13%. Some of the other factors associated to the decrease in

these values are identified in terms of the decisions relating to the incentive purposes. It needs to

be understood that in the 2017 the remuneration committee of the board decided to higher

Figure: Share Price and share value relationship of QBE insurance in 2017 and 2016

(Source: QBE.COM, 2018)

Share price for the company’s ordinary shares one calendar month after the end of

financial year

The share price one calendar month after the end of financial year is identified to be $

10.68. The main observations made in this year has been stated with a falling total shareholder

return, which is evident with $ 10.68. Some of the important assessment of the statutory return

has been seen with a decrease of 13%. Some of the other factors associated to the decrease in

these values are identified in terms of the decisions relating to the incentive purposes. It needs to

be understood that in the 2017 the remuneration committee of the board decided to higher

6COMPANY ACCOUNTING

portion of the share capital toward the staff incentives .in addition this, it needs to be also

considered that the important consideration related to the dividend per share was also low in

nature (Zietlow et al., 2018).

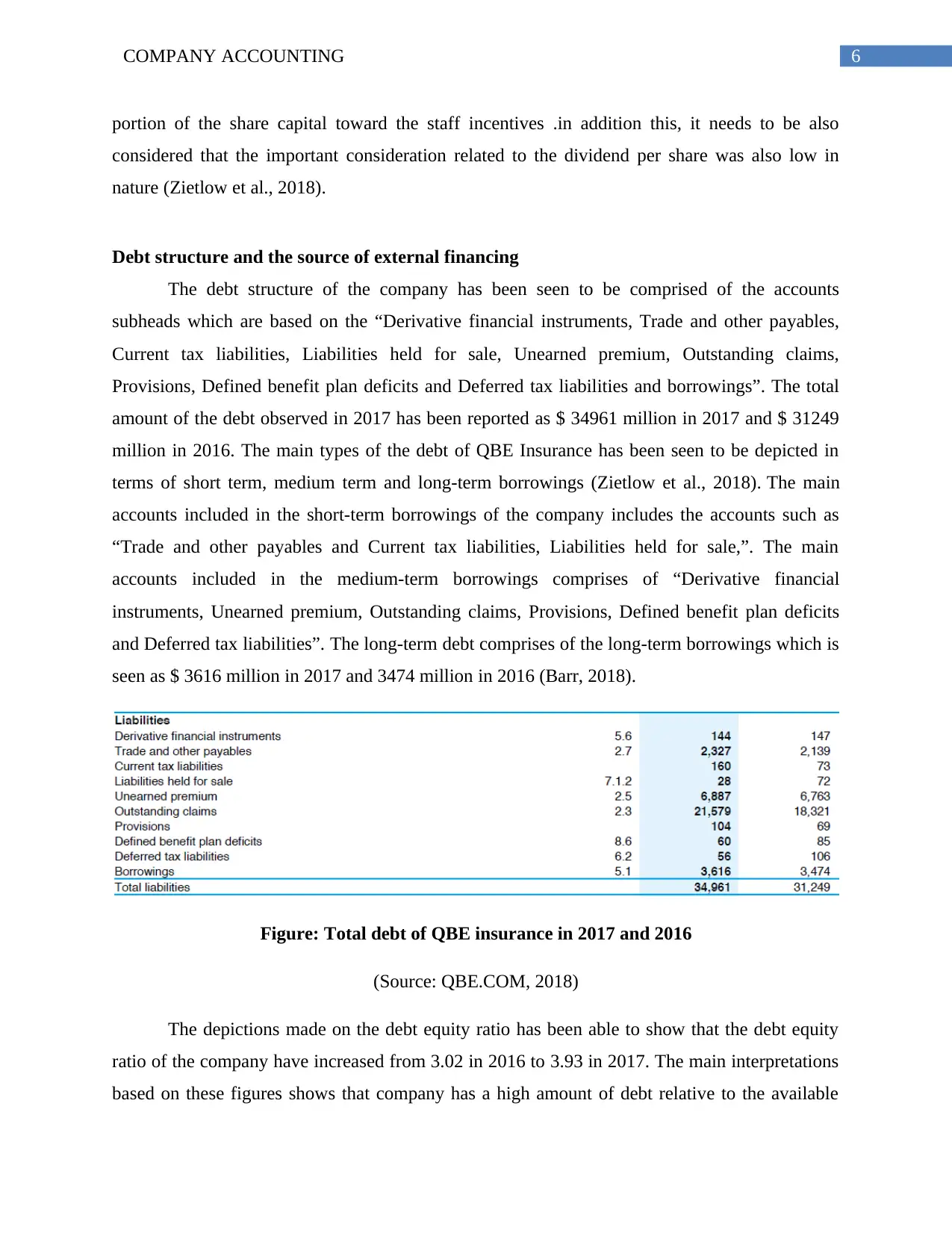

Debt structure and the source of external financing

The debt structure of the company has been seen to be comprised of the accounts

subheads which are based on the “Derivative financial instruments, Trade and other payables,

Current tax liabilities, Liabilities held for sale, Unearned premium, Outstanding claims,

Provisions, Defined benefit plan deficits and Deferred tax liabilities and borrowings”. The total

amount of the debt observed in 2017 has been reported as $ 34961 million in 2017 and $ 31249

million in 2016. The main types of the debt of QBE Insurance has been seen to be depicted in

terms of short term, medium term and long-term borrowings (Zietlow et al., 2018). The main

accounts included in the short-term borrowings of the company includes the accounts such as

“Trade and other payables and Current tax liabilities, Liabilities held for sale,”. The main

accounts included in the medium-term borrowings comprises of “Derivative financial

instruments, Unearned premium, Outstanding claims, Provisions, Defined benefit plan deficits

and Deferred tax liabilities”. The long-term debt comprises of the long-term borrowings which is

seen as $ 3616 million in 2017 and 3474 million in 2016 (Barr, 2018).

Figure: Total debt of QBE insurance in 2017 and 2016

(Source: QBE.COM, 2018)

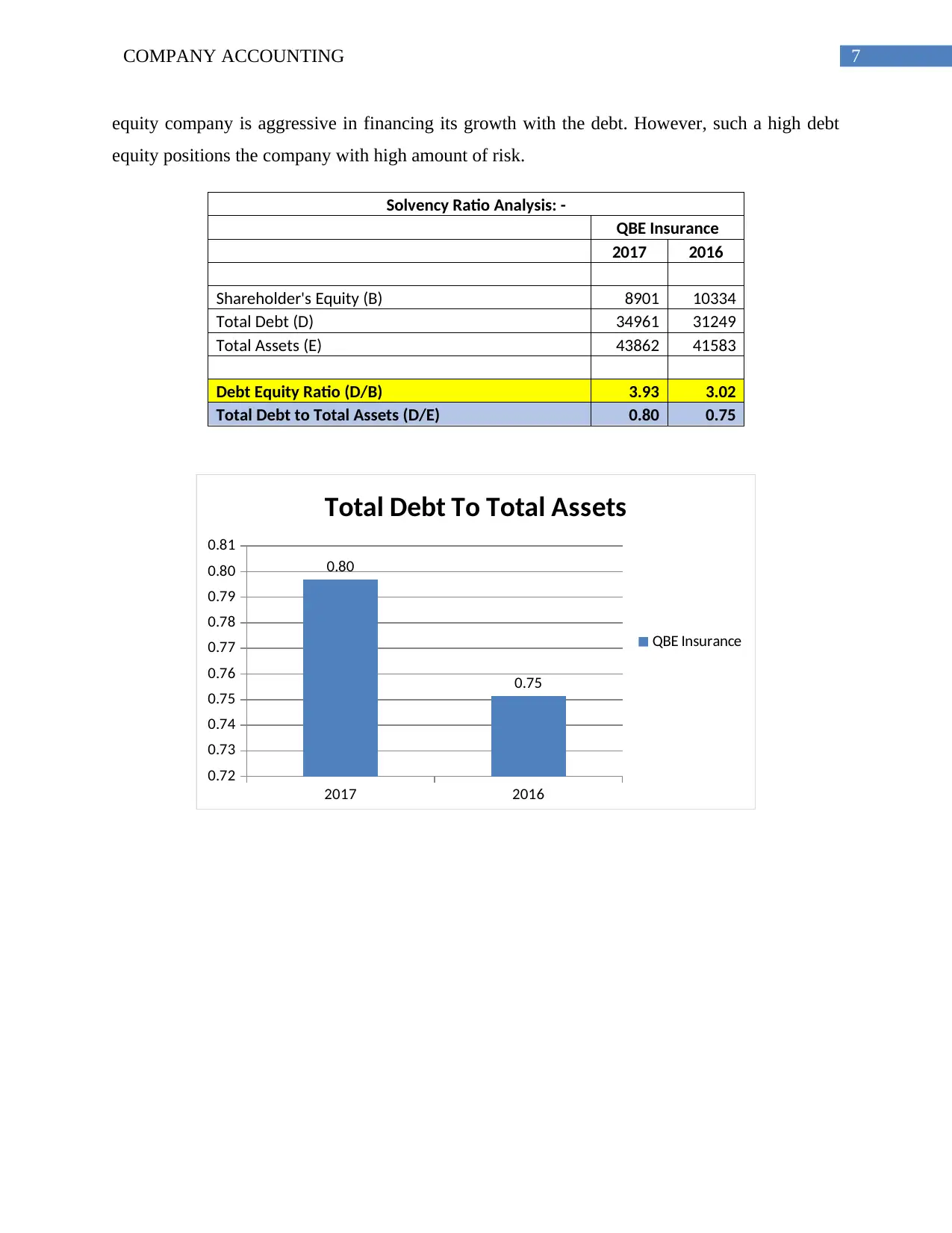

The depictions made on the debt equity ratio has been able to show that the debt equity

ratio of the company have increased from 3.02 in 2016 to 3.93 in 2017. The main interpretations

based on these figures shows that company has a high amount of debt relative to the available

portion of the share capital toward the staff incentives .in addition this, it needs to be also

considered that the important consideration related to the dividend per share was also low in

nature (Zietlow et al., 2018).

Debt structure and the source of external financing

The debt structure of the company has been seen to be comprised of the accounts

subheads which are based on the “Derivative financial instruments, Trade and other payables,

Current tax liabilities, Liabilities held for sale, Unearned premium, Outstanding claims,

Provisions, Defined benefit plan deficits and Deferred tax liabilities and borrowings”. The total

amount of the debt observed in 2017 has been reported as $ 34961 million in 2017 and $ 31249

million in 2016. The main types of the debt of QBE Insurance has been seen to be depicted in

terms of short term, medium term and long-term borrowings (Zietlow et al., 2018). The main

accounts included in the short-term borrowings of the company includes the accounts such as

“Trade and other payables and Current tax liabilities, Liabilities held for sale,”. The main

accounts included in the medium-term borrowings comprises of “Derivative financial

instruments, Unearned premium, Outstanding claims, Provisions, Defined benefit plan deficits

and Deferred tax liabilities”. The long-term debt comprises of the long-term borrowings which is

seen as $ 3616 million in 2017 and 3474 million in 2016 (Barr, 2018).

Figure: Total debt of QBE insurance in 2017 and 2016

(Source: QBE.COM, 2018)

The depictions made on the debt equity ratio has been able to show that the debt equity

ratio of the company have increased from 3.02 in 2016 to 3.93 in 2017. The main interpretations

based on these figures shows that company has a high amount of debt relative to the available

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7COMPANY ACCOUNTING

equity company is aggressive in financing its growth with the debt. However, such a high debt

equity positions the company with high amount of risk.

Solvency Ratio Analysis: -

QBE Insurance

2017 2016

Shareholder's Equity (B) 8901 10334

Total Debt (D) 34961 31249

Total Assets (E) 43862 41583

Debt Equity Ratio (D/B) 3.93 3.02

Total Debt to Total Assets (D/E) 0.80 0.75

2017 2016

0.72

0.73

0.74

0.75

0.76

0.77

0.78

0.79

0.80

0.81

0.80

0.75

Total Debt To Total Assets

QBE Insurance

equity company is aggressive in financing its growth with the debt. However, such a high debt

equity positions the company with high amount of risk.

Solvency Ratio Analysis: -

QBE Insurance

2017 2016

Shareholder's Equity (B) 8901 10334

Total Debt (D) 34961 31249

Total Assets (E) 43862 41583

Debt Equity Ratio (D/B) 3.93 3.02

Total Debt to Total Assets (D/E) 0.80 0.75

2017 2016

0.72

0.73

0.74

0.75

0.76

0.77

0.78

0.79

0.80

0.81

0.80

0.75

Total Debt To Total Assets

QBE Insurance

8COMPANY ACCOUNTING

2017 2016

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

3.93

3.02

Debt Equity Ratio

QBE Insurance

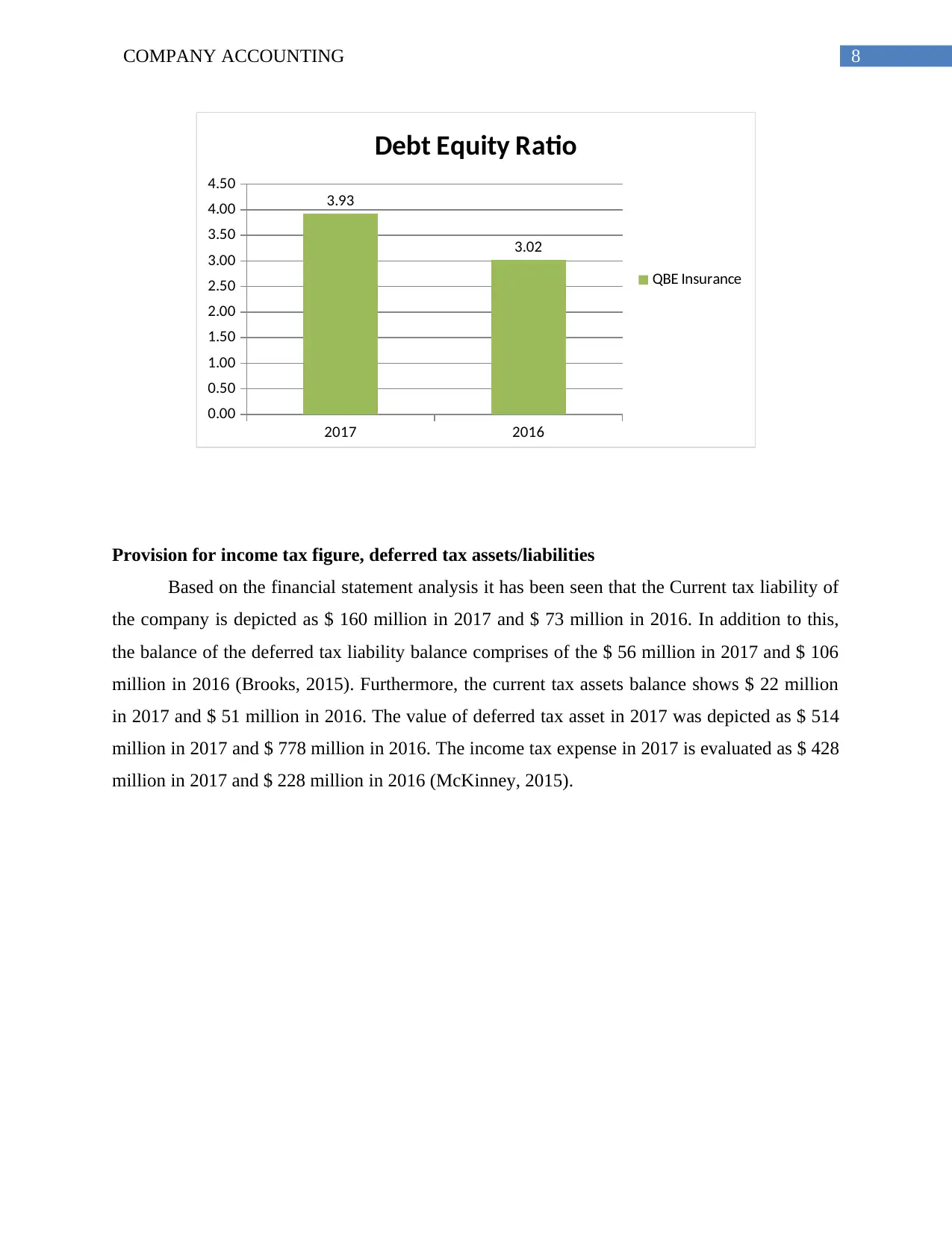

Provision for income tax figure, deferred tax assets/liabilities

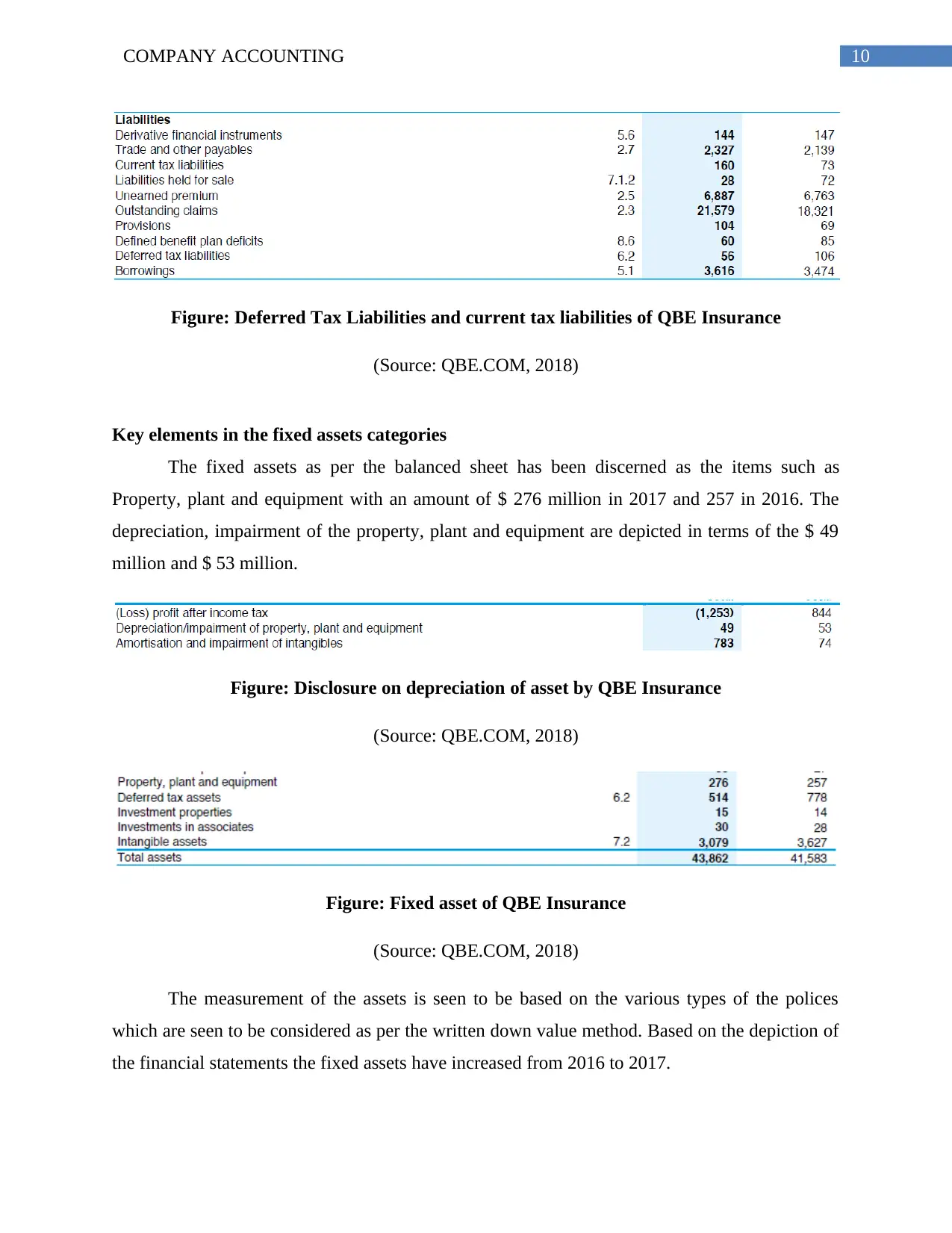

Based on the financial statement analysis it has been seen that the Current tax liability of

the company is depicted as $ 160 million in 2017 and $ 73 million in 2016. In addition to this,

the balance of the deferred tax liability balance comprises of the $ 56 million in 2017 and $ 106

million in 2016 (Brooks, 2015). Furthermore, the current tax assets balance shows $ 22 million

in 2017 and $ 51 million in 2016. The value of deferred tax asset in 2017 was depicted as $ 514

million in 2017 and $ 778 million in 2016. The income tax expense in 2017 is evaluated as $ 428

million in 2017 and $ 228 million in 2016 (McKinney, 2015).

2017 2016

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

3.93

3.02

Debt Equity Ratio

QBE Insurance

Provision for income tax figure, deferred tax assets/liabilities

Based on the financial statement analysis it has been seen that the Current tax liability of

the company is depicted as $ 160 million in 2017 and $ 73 million in 2016. In addition to this,

the balance of the deferred tax liability balance comprises of the $ 56 million in 2017 and $ 106

million in 2016 (Brooks, 2015). Furthermore, the current tax assets balance shows $ 22 million

in 2017 and $ 51 million in 2016. The value of deferred tax asset in 2017 was depicted as $ 514

million in 2017 and $ 778 million in 2016. The income tax expense in 2017 is evaluated as $ 428

million in 2017 and $ 228 million in 2016 (McKinney, 2015).

9COMPANY ACCOUNTING

Figure: Income tax expenses of QBE Insurance

(Source: QBE.COM, 2018)

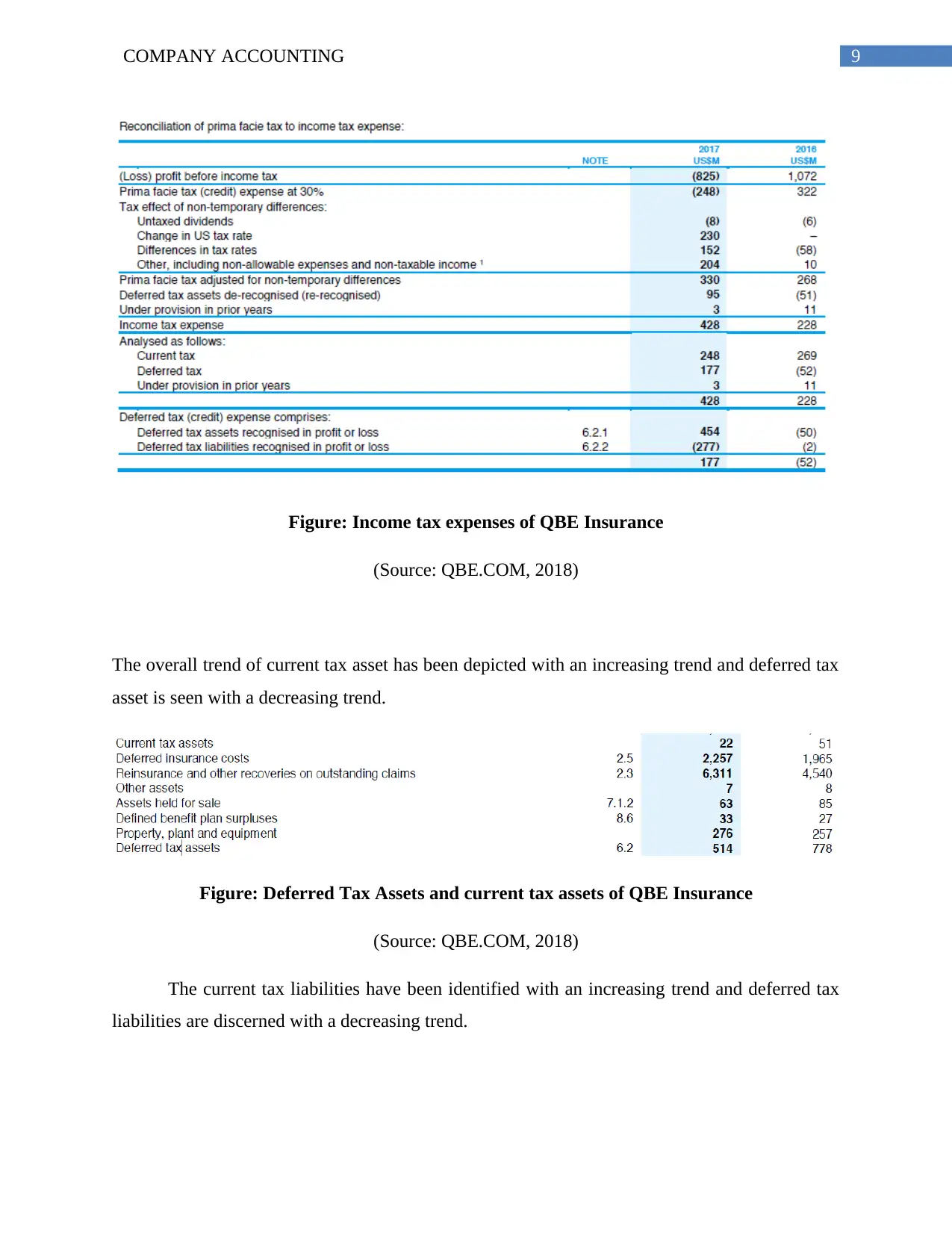

The overall trend of current tax asset has been depicted with an increasing trend and deferred tax

asset is seen with a decreasing trend.

Figure: Deferred Tax Assets and current tax assets of QBE Insurance

(Source: QBE.COM, 2018)

The current tax liabilities have been identified with an increasing trend and deferred tax

liabilities are discerned with a decreasing trend.

Figure: Income tax expenses of QBE Insurance

(Source: QBE.COM, 2018)

The overall trend of current tax asset has been depicted with an increasing trend and deferred tax

asset is seen with a decreasing trend.

Figure: Deferred Tax Assets and current tax assets of QBE Insurance

(Source: QBE.COM, 2018)

The current tax liabilities have been identified with an increasing trend and deferred tax

liabilities are discerned with a decreasing trend.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10COMPANY ACCOUNTING

Figure: Deferred Tax Liabilities and current tax liabilities of QBE Insurance

(Source: QBE.COM, 2018)

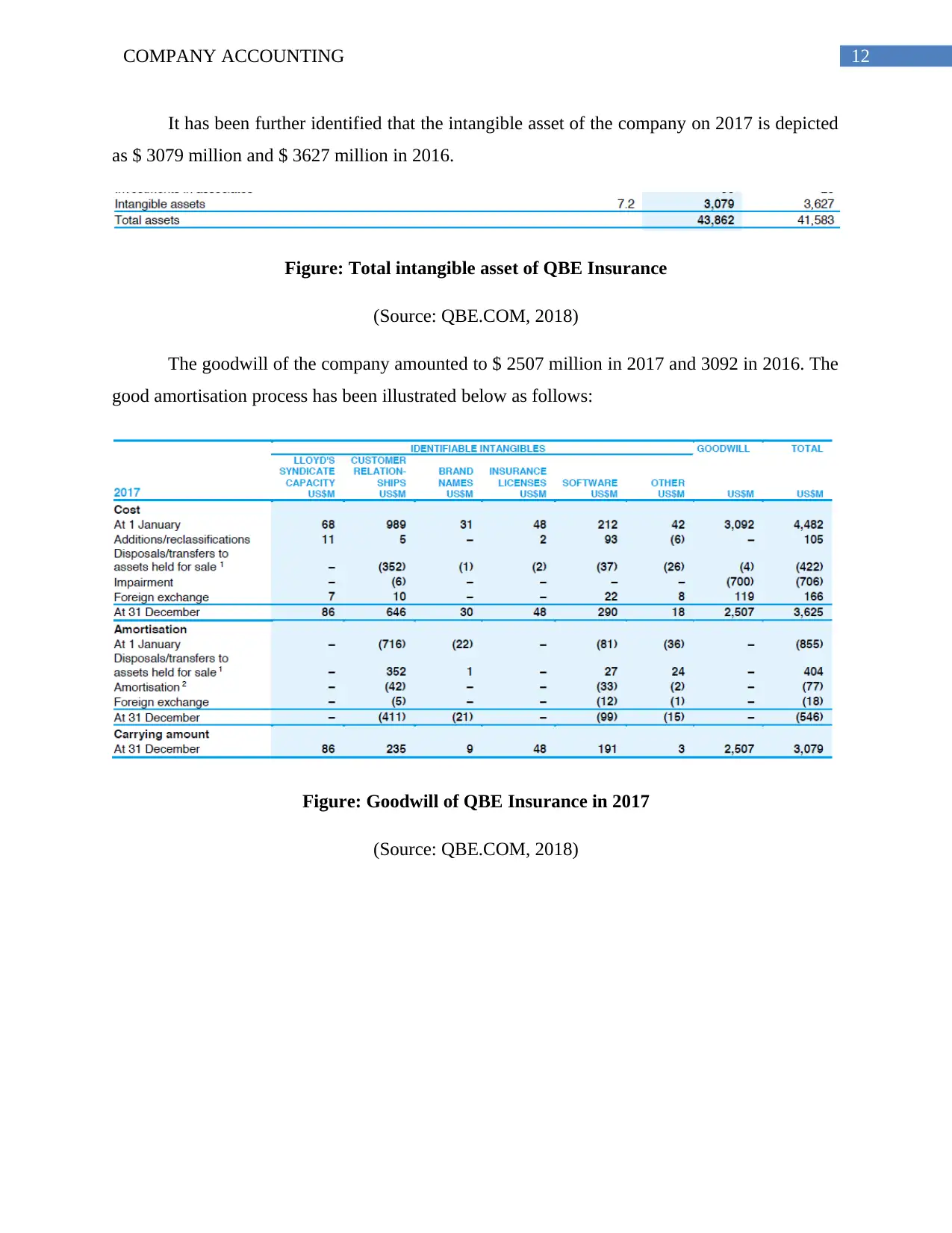

Key elements in the fixed assets categories

The fixed assets as per the balanced sheet has been discerned as the items such as

Property, plant and equipment with an amount of $ 276 million in 2017 and 257 in 2016. The

depreciation, impairment of the property, plant and equipment are depicted in terms of the $ 49

million and $ 53 million.

Figure: Disclosure on depreciation of asset by QBE Insurance

(Source: QBE.COM, 2018)

Figure: Fixed asset of QBE Insurance

(Source: QBE.COM, 2018)

The measurement of the assets is seen to be based on the various types of the polices

which are seen to be considered as per the written down value method. Based on the depiction of

the financial statements the fixed assets have increased from 2016 to 2017.

Figure: Deferred Tax Liabilities and current tax liabilities of QBE Insurance

(Source: QBE.COM, 2018)

Key elements in the fixed assets categories

The fixed assets as per the balanced sheet has been discerned as the items such as

Property, plant and equipment with an amount of $ 276 million in 2017 and 257 in 2016. The

depreciation, impairment of the property, plant and equipment are depicted in terms of the $ 49

million and $ 53 million.

Figure: Disclosure on depreciation of asset by QBE Insurance

(Source: QBE.COM, 2018)

Figure: Fixed asset of QBE Insurance

(Source: QBE.COM, 2018)

The measurement of the assets is seen to be based on the various types of the polices

which are seen to be considered as per the written down value method. Based on the depiction of

the financial statements the fixed assets have increased from 2016 to 2017.

11COMPANY ACCOUNTING

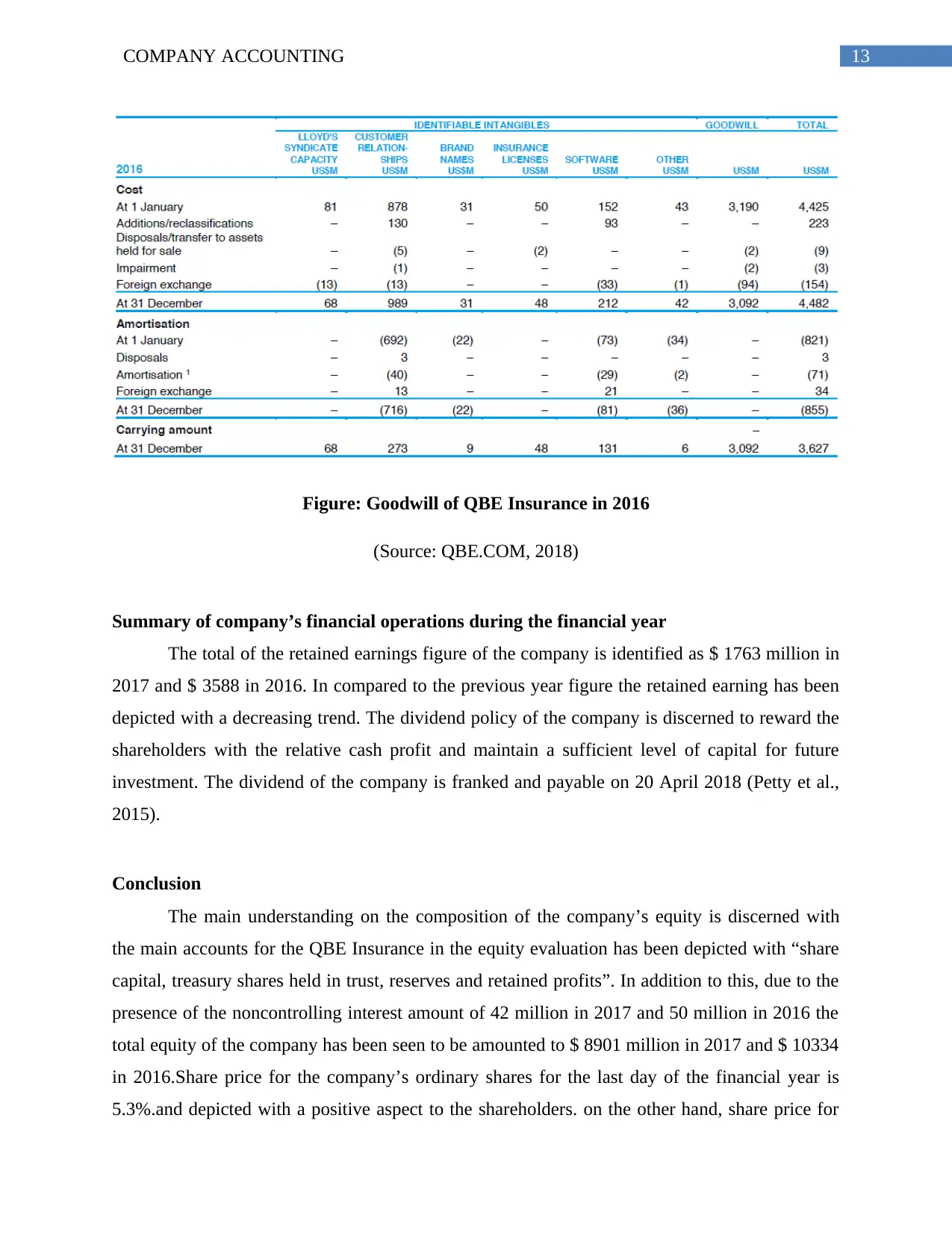

Policy for recognising the impairment of intangible assets asset

The overview of the intangible asset disclosure of the company are seen to be included

with the “Lloyds syndicate capacity, Customer relationships, Brand names, Insurance licences,

Software and Goodwill”. The carrying value of the intangibles have been seen as $ 3079 million

down from $ 3627 million at 31st December 2016. The carrying value during the year has been

depicted as reduction by $ 548 million (Moutinho & Vargas-Sanchez, 2018). This was primarily

done as $ 700 written down value method. The impairment testing of the intangible assets of the

company is done based on the “assets recoverable value is the greater of its value in use and its

fair value less cost to sell”.

Figure: Impairment testing of intangible assets

(Source: QBE.COM, 2018)

The amortisation of the impairment of the intangibles has been depicted as $ (752)

million in 2017 and $ (45) million in 2016.

Figure: Amortization and impairment of QBE Insurance

(Source: QBE.COM, 2018)

Policy for recognising the impairment of intangible assets asset

The overview of the intangible asset disclosure of the company are seen to be included

with the “Lloyds syndicate capacity, Customer relationships, Brand names, Insurance licences,

Software and Goodwill”. The carrying value of the intangibles have been seen as $ 3079 million

down from $ 3627 million at 31st December 2016. The carrying value during the year has been

depicted as reduction by $ 548 million (Moutinho & Vargas-Sanchez, 2018). This was primarily

done as $ 700 written down value method. The impairment testing of the intangible assets of the

company is done based on the “assets recoverable value is the greater of its value in use and its

fair value less cost to sell”.

Figure: Impairment testing of intangible assets

(Source: QBE.COM, 2018)

The amortisation of the impairment of the intangibles has been depicted as $ (752)

million in 2017 and $ (45) million in 2016.

Figure: Amortization and impairment of QBE Insurance

(Source: QBE.COM, 2018)

12COMPANY ACCOUNTING

It has been further identified that the intangible asset of the company on 2017 is depicted

as $ 3079 million and $ 3627 million in 2016.

Figure: Total intangible asset of QBE Insurance

(Source: QBE.COM, 2018)

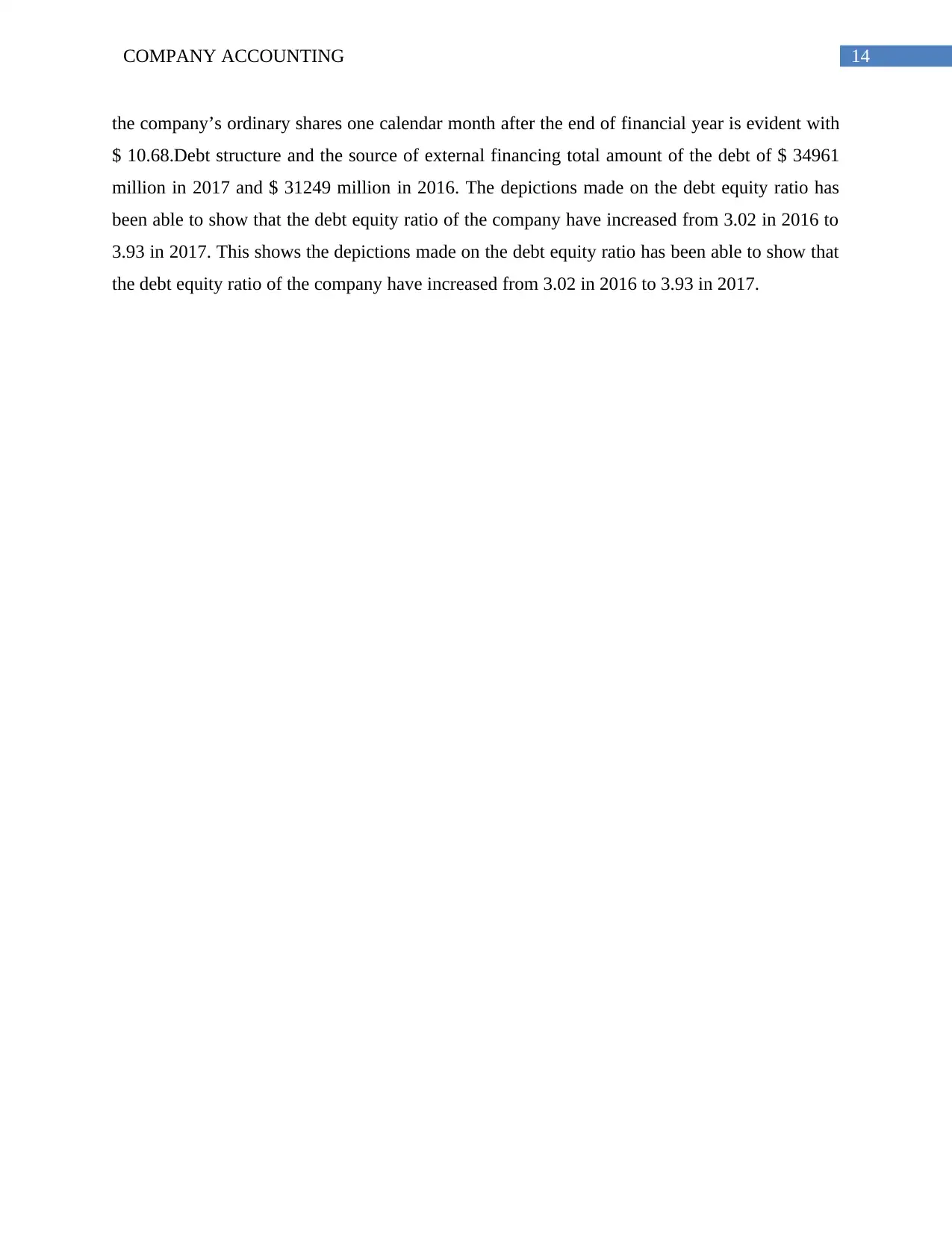

The goodwill of the company amounted to $ 2507 million in 2017 and 3092 in 2016. The

good amortisation process has been illustrated below as follows:

Figure: Goodwill of QBE Insurance in 2017

(Source: QBE.COM, 2018)

It has been further identified that the intangible asset of the company on 2017 is depicted

as $ 3079 million and $ 3627 million in 2016.

Figure: Total intangible asset of QBE Insurance

(Source: QBE.COM, 2018)

The goodwill of the company amounted to $ 2507 million in 2017 and 3092 in 2016. The

good amortisation process has been illustrated below as follows:

Figure: Goodwill of QBE Insurance in 2017

(Source: QBE.COM, 2018)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13COMPANY ACCOUNTING

Figure: Goodwill of QBE Insurance in 2016

(Source: QBE.COM, 2018)

Summary of company’s financial operations during the financial year

The total of the retained earnings figure of the company is identified as $ 1763 million in

2017 and $ 3588 in 2016. In compared to the previous year figure the retained earning has been

depicted with a decreasing trend. The dividend policy of the company is discerned to reward the

shareholders with the relative cash profit and maintain a sufficient level of capital for future

investment. The dividend of the company is franked and payable on 20 April 2018 (Petty et al.,

2015).

Conclusion

The main understanding on the composition of the company’s equity is discerned with

the main accounts for the QBE Insurance in the equity evaluation has been depicted with “share

capital, treasury shares held in trust, reserves and retained profits”. In addition to this, due to the

presence of the noncontrolling interest amount of 42 million in 2017 and 50 million in 2016 the

total equity of the company has been seen to be amounted to $ 8901 million in 2017 and $ 10334

in 2016.Share price for the company’s ordinary shares for the last day of the financial year is

5.3%.and depicted with a positive aspect to the shareholders. on the other hand, share price for

Figure: Goodwill of QBE Insurance in 2016

(Source: QBE.COM, 2018)

Summary of company’s financial operations during the financial year

The total of the retained earnings figure of the company is identified as $ 1763 million in

2017 and $ 3588 in 2016. In compared to the previous year figure the retained earning has been

depicted with a decreasing trend. The dividend policy of the company is discerned to reward the

shareholders with the relative cash profit and maintain a sufficient level of capital for future

investment. The dividend of the company is franked and payable on 20 April 2018 (Petty et al.,

2015).

Conclusion

The main understanding on the composition of the company’s equity is discerned with

the main accounts for the QBE Insurance in the equity evaluation has been depicted with “share

capital, treasury shares held in trust, reserves and retained profits”. In addition to this, due to the

presence of the noncontrolling interest amount of 42 million in 2017 and 50 million in 2016 the

total equity of the company has been seen to be amounted to $ 8901 million in 2017 and $ 10334

in 2016.Share price for the company’s ordinary shares for the last day of the financial year is

5.3%.and depicted with a positive aspect to the shareholders. on the other hand, share price for

14COMPANY ACCOUNTING

the company’s ordinary shares one calendar month after the end of financial year is evident with

$ 10.68.Debt structure and the source of external financing total amount of the debt of $ 34961

million in 2017 and $ 31249 million in 2016. The depictions made on the debt equity ratio has

been able to show that the debt equity ratio of the company have increased from 3.02 in 2016 to

3.93 in 2017. This shows the depictions made on the debt equity ratio has been able to show that

the debt equity ratio of the company have increased from 3.02 in 2016 to 3.93 in 2017.

the company’s ordinary shares one calendar month after the end of financial year is evident with

$ 10.68.Debt structure and the source of external financing total amount of the debt of $ 34961

million in 2017 and $ 31249 million in 2016. The depictions made on the debt equity ratio has

been able to show that the debt equity ratio of the company have increased from 3.02 in 2016 to

3.93 in 2017. This shows the depictions made on the debt equity ratio has been able to show that

the debt equity ratio of the company have increased from 3.02 in 2016 to 3.93 in 2017.

15COMPANY ACCOUNTING

References

Barr, M. J. (2018). Budgets and financial management in higher education. John Wiley & Sons.

Barr, M. J. (2018). Budgets and financial management in higher education. John Wiley & Sons.

Brooks, R. (2015). Financial management: core concepts. Pearson

Finkler, S. A., Smith, D. L., Calabrese, T. D., & Purtell, R. M. (2016). Financial management

for public, health, and not-for-profit organizations. CQ Press.

Martin, L. L. (2016). Financial management for human service administrators. Waveland Press.

McKinney, J. B. (2015). Effective financial management in public and nonprofit agencies. ABC-

CLIO.

Moutinho, L., & Vargas-Sanchez, A. (Eds.). (2018). Strategic Management in Tourism, CABI

Tourism Texts. Cabi.

Pauw, J. C., Van der Linde, G. J. A., Fourie, D. J., & Visser, C. B. (2015). Managing public

money. Pearson Holdings Southern Africa.

Petty, J. W., Titman, S., Keown, A. J., Martin, P., Martin, J. D., & Burrow, M. (2015). Financial

management: Principles and applications. Pearson Higher Education AU.

QBE.COM. (2018). 2017 Annual Report. Retrieved 11 May 2018, from

https://www.group.qbe.com/reportpresentation/2017-annual-report

Renz, D. O., & Herman, R. D. (Eds.). (2016). The Jossey-Bass handbook of nonprofit leadership

and management. John Wiley & Sons.

Titman, S., Keown, A. J., & Martin, J. D. (2017). Financial management: Principles and

applications. Pearson.

Zietlow, J., Hankin, J. A., Seidner, A., & O'Brien, T. (2018). Financial management for

nonprofit organizations: Policies and practices. John Wiley & Sons.

References

Barr, M. J. (2018). Budgets and financial management in higher education. John Wiley & Sons.

Barr, M. J. (2018). Budgets and financial management in higher education. John Wiley & Sons.

Brooks, R. (2015). Financial management: core concepts. Pearson

Finkler, S. A., Smith, D. L., Calabrese, T. D., & Purtell, R. M. (2016). Financial management

for public, health, and not-for-profit organizations. CQ Press.

Martin, L. L. (2016). Financial management for human service administrators. Waveland Press.

McKinney, J. B. (2015). Effective financial management in public and nonprofit agencies. ABC-

CLIO.

Moutinho, L., & Vargas-Sanchez, A. (Eds.). (2018). Strategic Management in Tourism, CABI

Tourism Texts. Cabi.

Pauw, J. C., Van der Linde, G. J. A., Fourie, D. J., & Visser, C. B. (2015). Managing public

money. Pearson Holdings Southern Africa.

Petty, J. W., Titman, S., Keown, A. J., Martin, P., Martin, J. D., & Burrow, M. (2015). Financial

management: Principles and applications. Pearson Higher Education AU.

QBE.COM. (2018). 2017 Annual Report. Retrieved 11 May 2018, from

https://www.group.qbe.com/reportpresentation/2017-annual-report

Renz, D. O., & Herman, R. D. (Eds.). (2016). The Jossey-Bass handbook of nonprofit leadership

and management. John Wiley & Sons.

Titman, S., Keown, A. J., & Martin, J. D. (2017). Financial management: Principles and

applications. Pearson.

Zietlow, J., Hankin, J. A., Seidner, A., & O'Brien, T. (2018). Financial management for

nonprofit organizations: Policies and practices. John Wiley & Sons.

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.