Company Accounting: Nature of Goodwill and Accounting Treatment

VerifiedAdded on 2023/01/16

|8

|848

|35

AI Summary

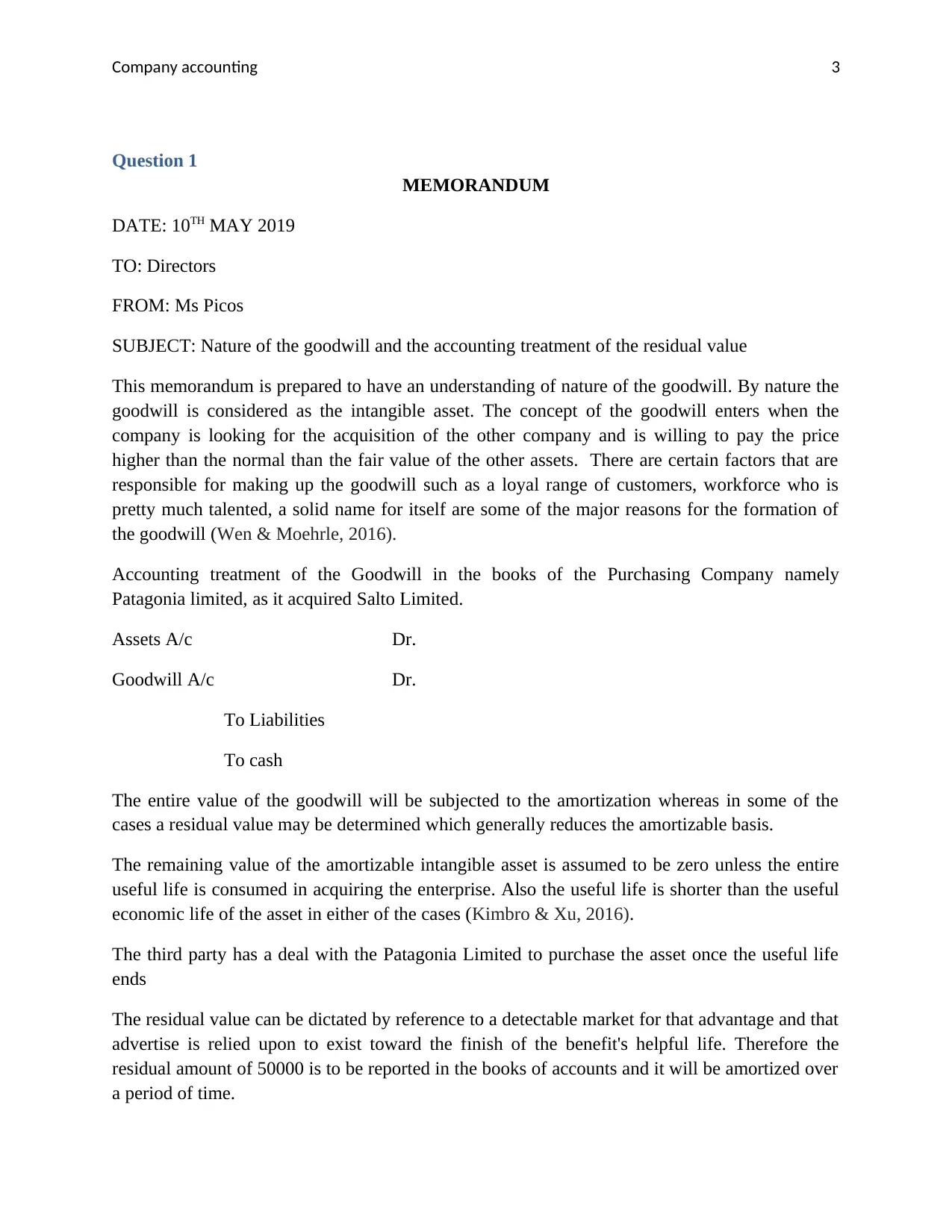

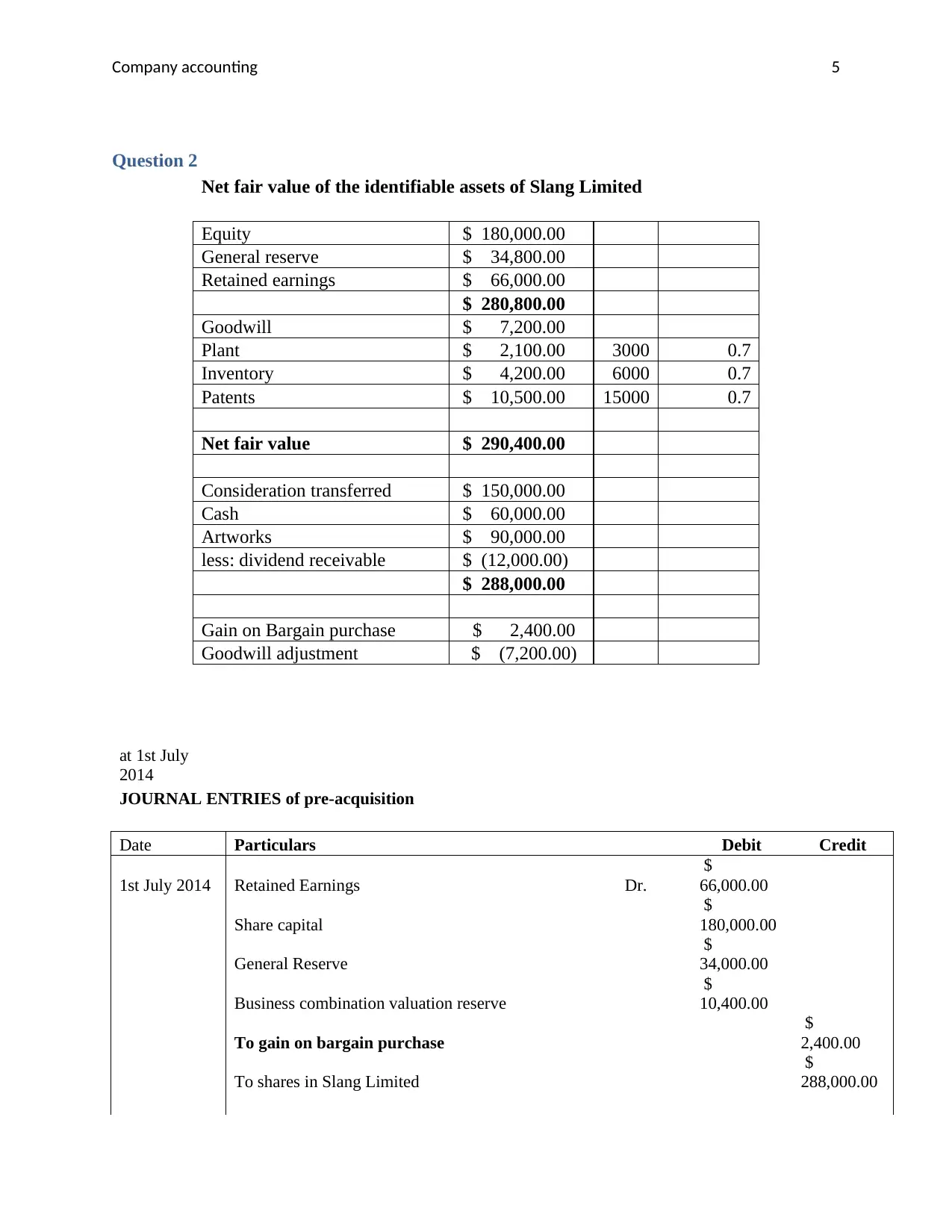

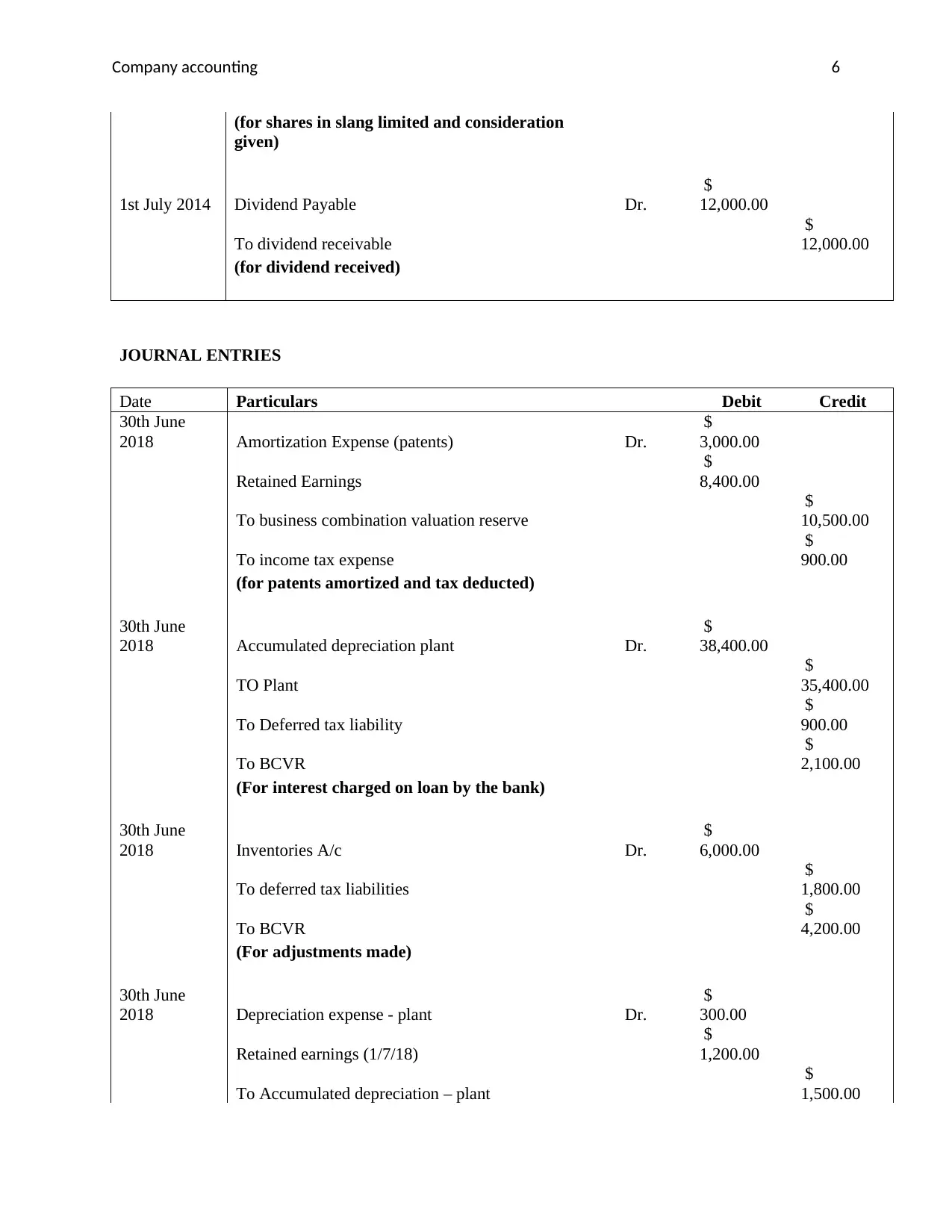

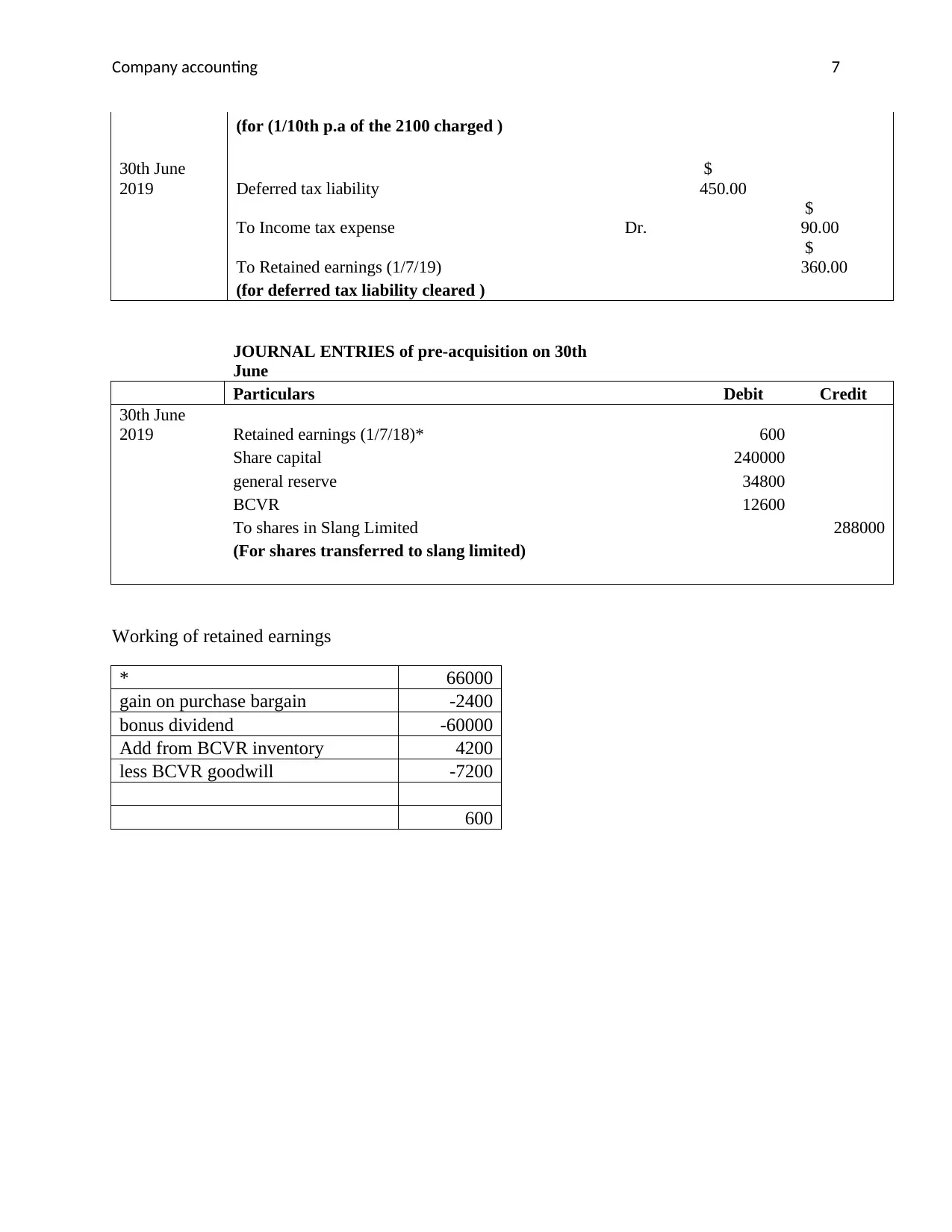

This document discusses the nature of goodwill and its accounting treatment in company acquisitions. It explains the factors that contribute to the formation of goodwill and the accounting entries involved. It also covers the concept of residual value and its impact on the amortization of intangible assets. The document includes examples and references for further reading.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1 out of 8

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)