Case Study: Valuation of Telstra and Wesfarmers for FINA6000 Module

VerifiedAdded on 2023/05/29

|20

|3173

|322

Case Study

AI Summary

This case study undertakes a comprehensive financial analysis of two Australian companies, Telstra and Wesfarmers, focusing on their capital structures, valuation methods, and financial performance. The analysis includes an examination of each company's capital structure over a five-year period, considering factors like debt-to-equity ratios and industry benchmarks. The study then delves into the weighted average cost of capital (WACC) for both companies, highlighting the impact of tax rates on the cost of debt. Furthermore, the discounted cash flow (DCF) method is applied to estimate the fair value of each company's stock, considering growth rates and terminal values. The report also employs a relative valuation method using price-earnings, price-to-book, and price-to-sales ratios to assess the companies' valuations relative to their industry averages. The findings offer insights into the companies' financial health, investment potential, and the influence of various financial metrics on their market values.

RUNNING HEAD: MANAGING FINANCE

Company valuation

Company valuation

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Managing finance 2

Contents

Introduction.................................................................................................................................................3

Part-A..........................................................................................................................................................3

Part-B..........................................................................................................................................................6

Part-C..........................................................................................................................................................8

Part-C..........................................................................................................................................................9

Part-D..........................................................................................................................................................9

Computation of the discounted cash flow method.................................................................................9

Price Earnings Ratio...............................................................................................................................14

Part-E.........................................................................................................................................................16

Part-G........................................................................................................................................................17

Conclusion.................................................................................................................................................18

References.................................................................................................................................................19

Contents

Introduction.................................................................................................................................................3

Part-A..........................................................................................................................................................3

Part-B..........................................................................................................................................................6

Part-C..........................................................................................................................................................8

Part-C..........................................................................................................................................................9

Part-D..........................................................................................................................................................9

Computation of the discounted cash flow method.................................................................................9

Price Earnings Ratio...............................................................................................................................14

Part-E.........................................................................................................................................................16

Part-G........................................................................................................................................................17

Conclusion.................................................................................................................................................18

References.................................................................................................................................................19

Managing finance 3

Introduction

This report emphasizes upon the capital structure, market value and valuation methods

which could be used to analyze the market price of the shares of two companies. In this report,

two companies named, Telstra and Wesfarmers Company have been selected. Each and every

company needs to keep its financial leverage low and profitability high if it wants to survive in

long run. It will allow company to sustain its business in long run.

Part-A

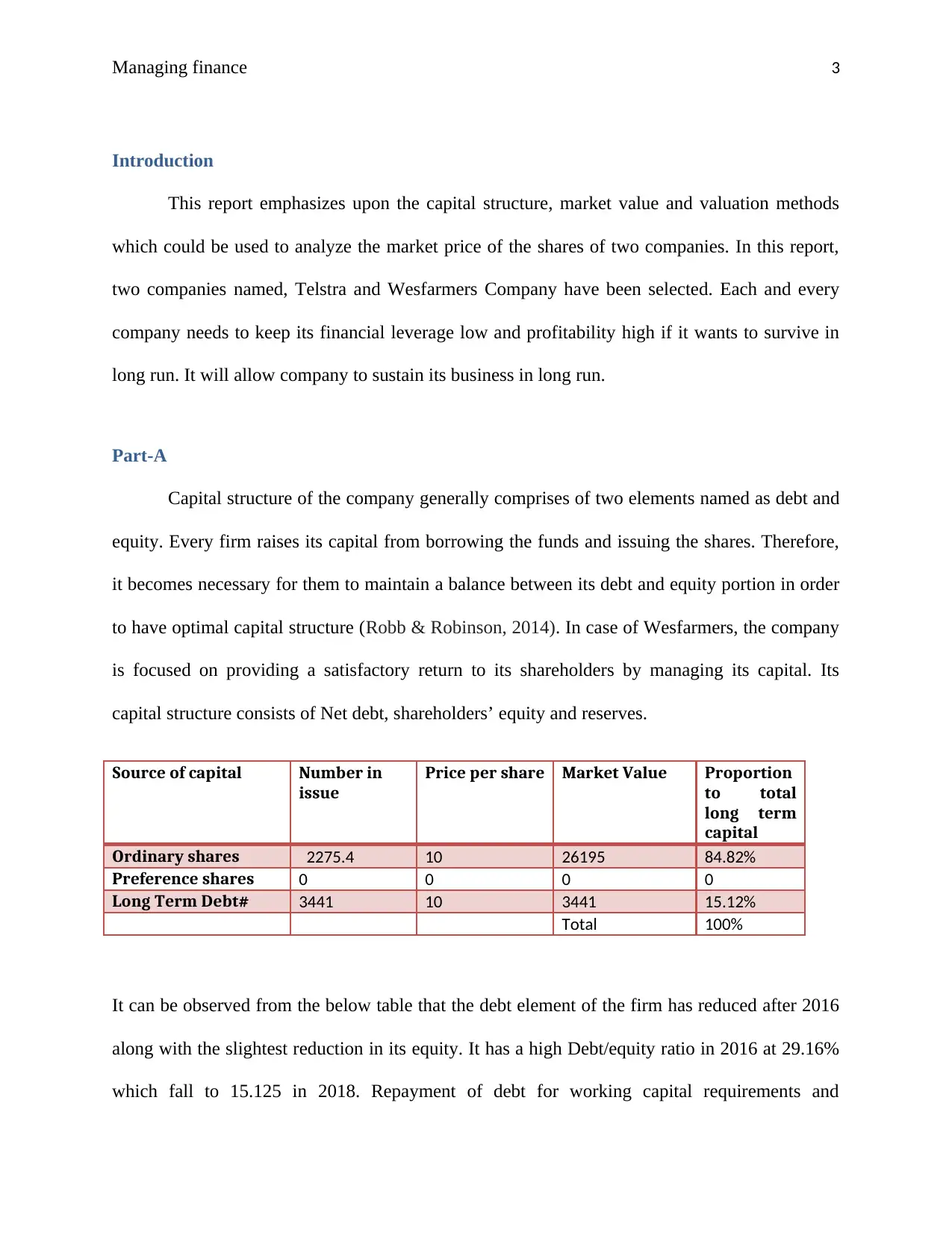

Capital structure of the company generally comprises of two elements named as debt and

equity. Every firm raises its capital from borrowing the funds and issuing the shares. Therefore,

it becomes necessary for them to maintain a balance between its debt and equity portion in order

to have optimal capital structure (Robb & Robinson, 2014). In case of Wesfarmers, the company

is focused on providing a satisfactory return to its shareholders by managing its capital. Its

capital structure consists of Net debt, shareholders’ equity and reserves.

Source of capital Number in

issue

Price per share Market Value Proportion

to total

long term

capital

Ordinary shares 2275.4 10 26195 84.82%

Preference shares 0 0 0 0

Long Term Debt# 3441 10 3441 15.12%

Total 100%

It can be observed from the below table that the debt element of the firm has reduced after 2016

along with the slightest reduction in its equity. It has a high Debt/equity ratio in 2016 at 29.16%

which fall to 15.125 in 2018. Repayment of debt for working capital requirements and

Introduction

This report emphasizes upon the capital structure, market value and valuation methods

which could be used to analyze the market price of the shares of two companies. In this report,

two companies named, Telstra and Wesfarmers Company have been selected. Each and every

company needs to keep its financial leverage low and profitability high if it wants to survive in

long run. It will allow company to sustain its business in long run.

Part-A

Capital structure of the company generally comprises of two elements named as debt and

equity. Every firm raises its capital from borrowing the funds and issuing the shares. Therefore,

it becomes necessary for them to maintain a balance between its debt and equity portion in order

to have optimal capital structure (Robb & Robinson, 2014). In case of Wesfarmers, the company

is focused on providing a satisfactory return to its shareholders by managing its capital. Its

capital structure consists of Net debt, shareholders’ equity and reserves.

Source of capital Number in

issue

Price per share Market Value Proportion

to total

long term

capital

Ordinary shares 2275.4 10 26195 84.82%

Preference shares 0 0 0 0

Long Term Debt# 3441 10 3441 15.12%

Total 100%

It can be observed from the below table that the debt element of the firm has reduced after 2016

along with the slightest reduction in its equity. It has a high Debt/equity ratio in 2016 at 29.16%

which fall to 15.125 in 2018. Repayment of debt for working capital requirements and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

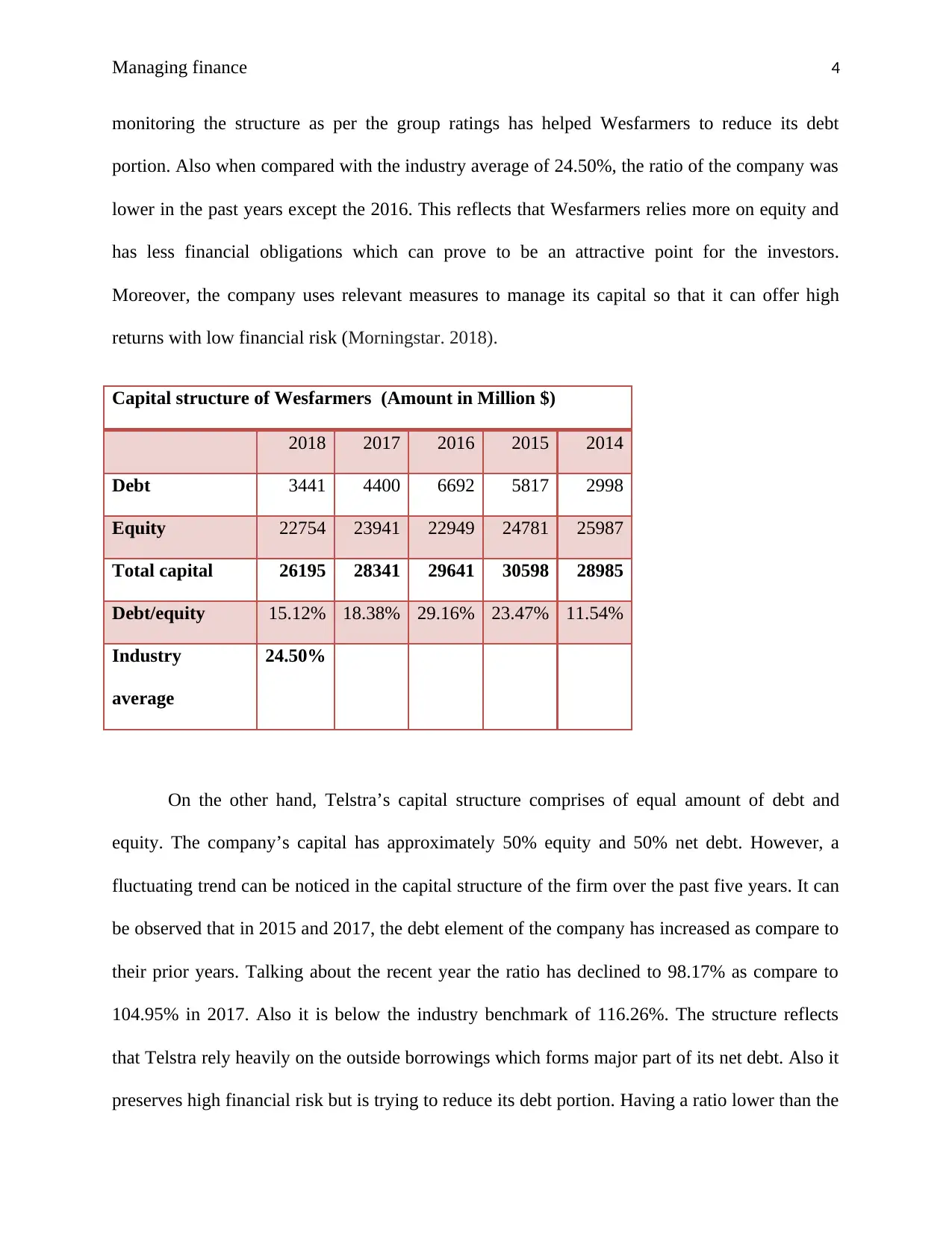

Managing finance 4

monitoring the structure as per the group ratings has helped Wesfarmers to reduce its debt

portion. Also when compared with the industry average of 24.50%, the ratio of the company was

lower in the past years except the 2016. This reflects that Wesfarmers relies more on equity and

has less financial obligations which can prove to be an attractive point for the investors.

Moreover, the company uses relevant measures to manage its capital so that it can offer high

returns with low financial risk (Morningstar. 2018).

Capital structure of Wesfarmers (Amount in Million $)

2018 2017 2016 2015 2014

Debt 3441 4400 6692 5817 2998

Equity 22754 23941 22949 24781 25987

Total capital 26195 28341 29641 30598 28985

Debt/equity 15.12% 18.38% 29.16% 23.47% 11.54%

Industry

average

24.50%

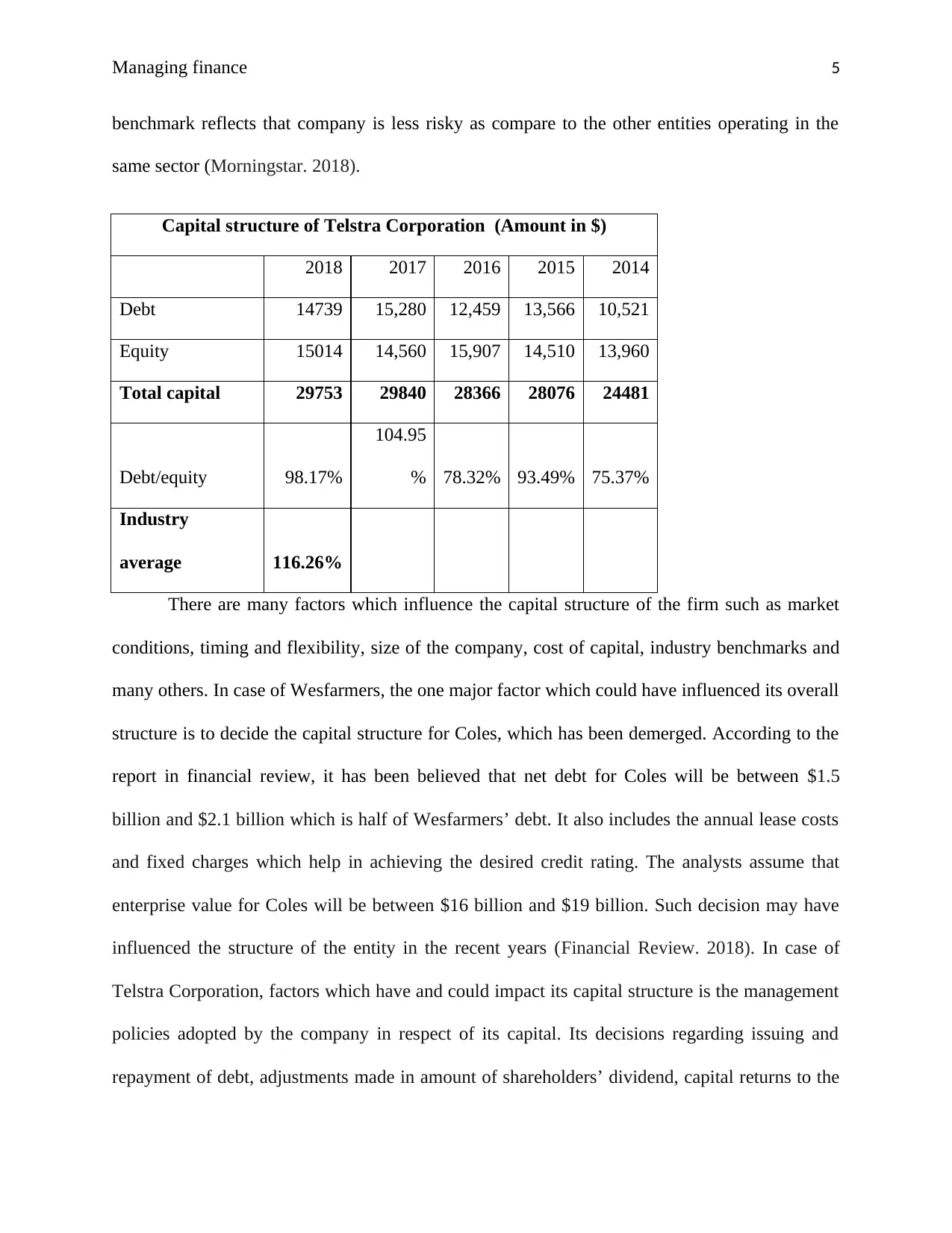

On the other hand, Telstra’s capital structure comprises of equal amount of debt and

equity. The company’s capital has approximately 50% equity and 50% net debt. However, a

fluctuating trend can be noticed in the capital structure of the firm over the past five years. It can

be observed that in 2015 and 2017, the debt element of the company has increased as compare to

their prior years. Talking about the recent year the ratio has declined to 98.17% as compare to

104.95% in 2017. Also it is below the industry benchmark of 116.26%. The structure reflects

that Telstra rely heavily on the outside borrowings which forms major part of its net debt. Also it

preserves high financial risk but is trying to reduce its debt portion. Having a ratio lower than the

monitoring the structure as per the group ratings has helped Wesfarmers to reduce its debt

portion. Also when compared with the industry average of 24.50%, the ratio of the company was

lower in the past years except the 2016. This reflects that Wesfarmers relies more on equity and

has less financial obligations which can prove to be an attractive point for the investors.

Moreover, the company uses relevant measures to manage its capital so that it can offer high

returns with low financial risk (Morningstar. 2018).

Capital structure of Wesfarmers (Amount in Million $)

2018 2017 2016 2015 2014

Debt 3441 4400 6692 5817 2998

Equity 22754 23941 22949 24781 25987

Total capital 26195 28341 29641 30598 28985

Debt/equity 15.12% 18.38% 29.16% 23.47% 11.54%

Industry

average

24.50%

On the other hand, Telstra’s capital structure comprises of equal amount of debt and

equity. The company’s capital has approximately 50% equity and 50% net debt. However, a

fluctuating trend can be noticed in the capital structure of the firm over the past five years. It can

be observed that in 2015 and 2017, the debt element of the company has increased as compare to

their prior years. Talking about the recent year the ratio has declined to 98.17% as compare to

104.95% in 2017. Also it is below the industry benchmark of 116.26%. The structure reflects

that Telstra rely heavily on the outside borrowings which forms major part of its net debt. Also it

preserves high financial risk but is trying to reduce its debt portion. Having a ratio lower than the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Managing finance 5

benchmark reflects that company is less risky as compare to the other entities operating in the

same sector (Morningstar. 2018).

Capital structure of Telstra Corporation (Amount in $)

2018 2017 2016 2015 2014

Debt 14739 15,280 12,459 13,566 10,521

Equity 15014 14,560 15,907 14,510 13,960

Total capital 29753 29840 28366 28076 24481

Debt/equity 98.17%

104.95

% 78.32% 93.49% 75.37%

Industry

average 116.26%

There are many factors which influence the capital structure of the firm such as market

conditions, timing and flexibility, size of the company, cost of capital, industry benchmarks and

many others. In case of Wesfarmers, the one major factor which could have influenced its overall

structure is to decide the capital structure for Coles, which has been demerged. According to the

report in financial review, it has been believed that net debt for Coles will be between $1.5

billion and $2.1 billion which is half of Wesfarmers’ debt. It also includes the annual lease costs

and fixed charges which help in achieving the desired credit rating. The analysts assume that

enterprise value for Coles will be between $16 billion and $19 billion. Such decision may have

influenced the structure of the entity in the recent years (Financial Review. 2018). In case of

Telstra Corporation, factors which have and could impact its capital structure is the management

policies adopted by the company in respect of its capital. Its decisions regarding issuing and

repayment of debt, adjustments made in amount of shareholders’ dividend, capital returns to the

benchmark reflects that company is less risky as compare to the other entities operating in the

same sector (Morningstar. 2018).

Capital structure of Telstra Corporation (Amount in $)

2018 2017 2016 2015 2014

Debt 14739 15,280 12,459 13,566 10,521

Equity 15014 14,560 15,907 14,510 13,960

Total capital 29753 29840 28366 28076 24481

Debt/equity 98.17%

104.95

% 78.32% 93.49% 75.37%

Industry

average 116.26%

There are many factors which influence the capital structure of the firm such as market

conditions, timing and flexibility, size of the company, cost of capital, industry benchmarks and

many others. In case of Wesfarmers, the one major factor which could have influenced its overall

structure is to decide the capital structure for Coles, which has been demerged. According to the

report in financial review, it has been believed that net debt for Coles will be between $1.5

billion and $2.1 billion which is half of Wesfarmers’ debt. It also includes the annual lease costs

and fixed charges which help in achieving the desired credit rating. The analysts assume that

enterprise value for Coles will be between $16 billion and $19 billion. Such decision may have

influenced the structure of the entity in the recent years (Financial Review. 2018). In case of

Telstra Corporation, factors which have and could impact its capital structure is the management

policies adopted by the company in respect of its capital. Its decisions regarding issuing and

repayment of debt, adjustments made in amount of shareholders’ dividend, capital returns to the

Managing finance 6

investors and issue of new shares are some factors which affect Telstra’s capital structure and

allow the company to maintain and adjust the same. Moreover, the changes in company’s

accounting policies also impact its capital structure (Telstra. 2018).

Capital Structure theories

Trade off theory

This theory reveals how company could set up optimum capital structure theory on the

basis of the cost and benefits associated with the same. It set ups relation between the financial

leverage and cost of capital of company.

Modigliani-miller approach

The theories of capital structure, one applicable to both the firms are the Modigliani-

miller approach stating the proposition II with the presence of taxes. It suggests that the value of

the firm can be enhanced by using more debt and reducing the cost of capital. In a way it

supports the net income approach where the increment in debt can bring an optimize capital

structure for the firm.

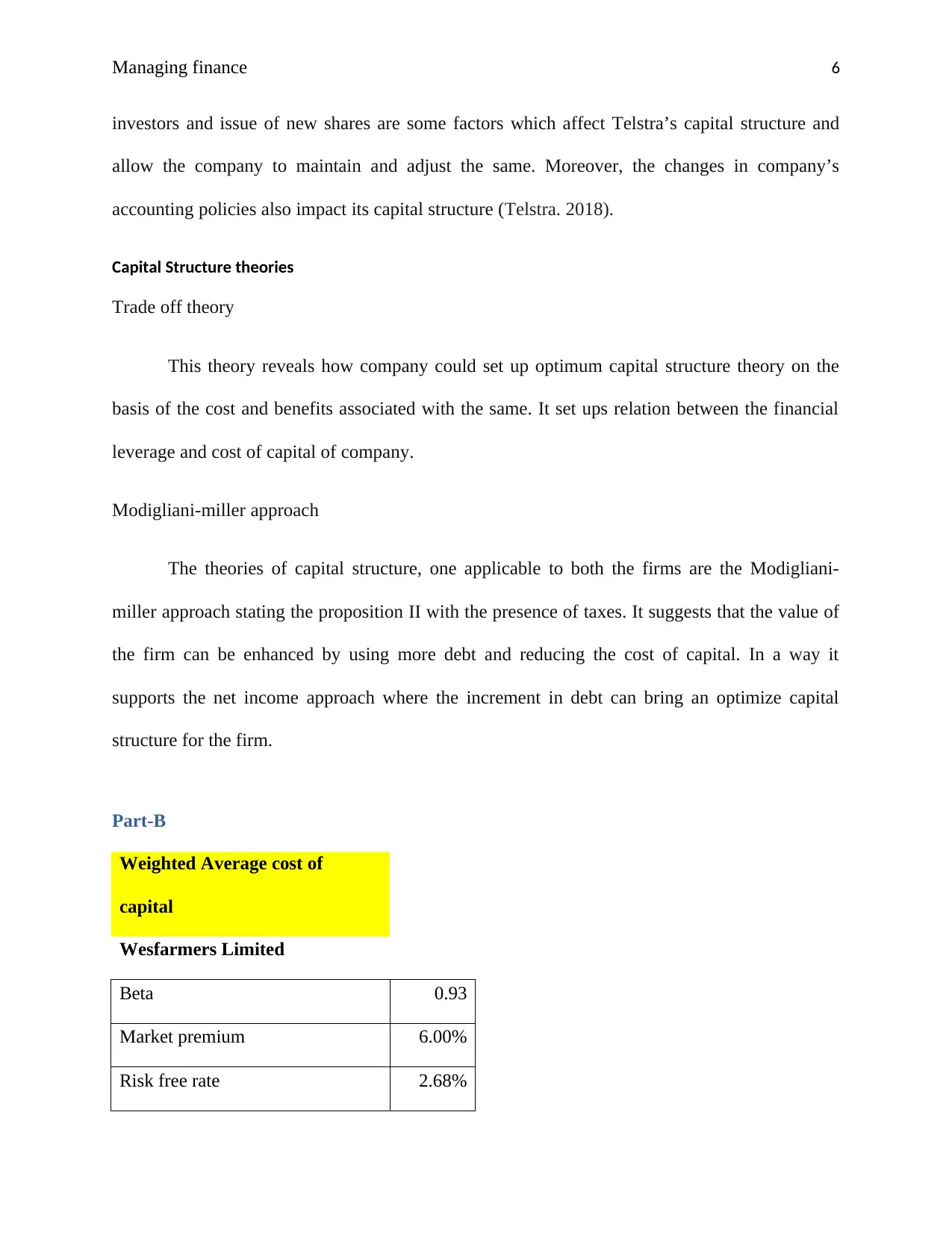

Part-B

Weighted Average cost of

capital

Wesfarmers Limited

Beta 0.93

Market premium 6.00%

Risk free rate 2.68%

investors and issue of new shares are some factors which affect Telstra’s capital structure and

allow the company to maintain and adjust the same. Moreover, the changes in company’s

accounting policies also impact its capital structure (Telstra. 2018).

Capital Structure theories

Trade off theory

This theory reveals how company could set up optimum capital structure theory on the

basis of the cost and benefits associated with the same. It set ups relation between the financial

leverage and cost of capital of company.

Modigliani-miller approach

The theories of capital structure, one applicable to both the firms are the Modigliani-

miller approach stating the proposition II with the presence of taxes. It suggests that the value of

the firm can be enhanced by using more debt and reducing the cost of capital. In a way it

supports the net income approach where the increment in debt can bring an optimize capital

structure for the firm.

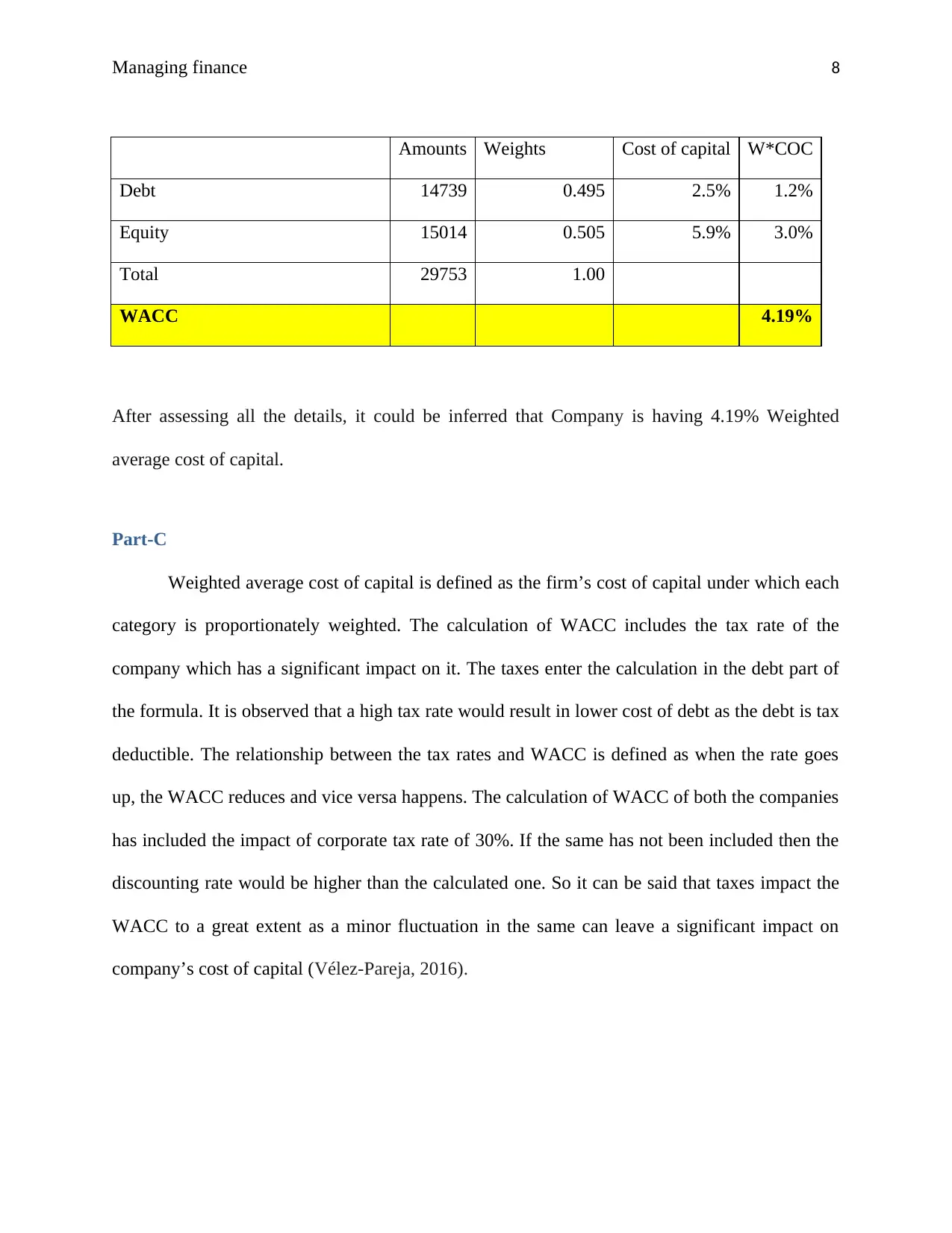

Part-B

Weighted Average cost of

capital

Wesfarmers Limited

Beta 0.93

Market premium 6.00%

Risk free rate 2.68%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Managing finance 7

Cost of equity 8%

Finance cost 211

Long term debt 2965

Cost of debt 7%

Tax rate 30%

After tax cost of debt 5%

Amounts Weights Cost of capital W*COC

Debt 3441 0.13 5.0% 0.7%

Equity 22754 0.87 8.3% 7.2%

Total 26195 1.00

WACC 7.83%

Telstra Corporation

Beta 0.53

Market premium 6.00%

Risk free rate 2.68%

Cost of equity 6%

Finance cost 549

Long term debt 15316

Cost of debt 4%

Tax rate 30.8%

After tax cost of debt 2.5%

Cost of equity 8%

Finance cost 211

Long term debt 2965

Cost of debt 7%

Tax rate 30%

After tax cost of debt 5%

Amounts Weights Cost of capital W*COC

Debt 3441 0.13 5.0% 0.7%

Equity 22754 0.87 8.3% 7.2%

Total 26195 1.00

WACC 7.83%

Telstra Corporation

Beta 0.53

Market premium 6.00%

Risk free rate 2.68%

Cost of equity 6%

Finance cost 549

Long term debt 15316

Cost of debt 4%

Tax rate 30.8%

After tax cost of debt 2.5%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Managing finance 8

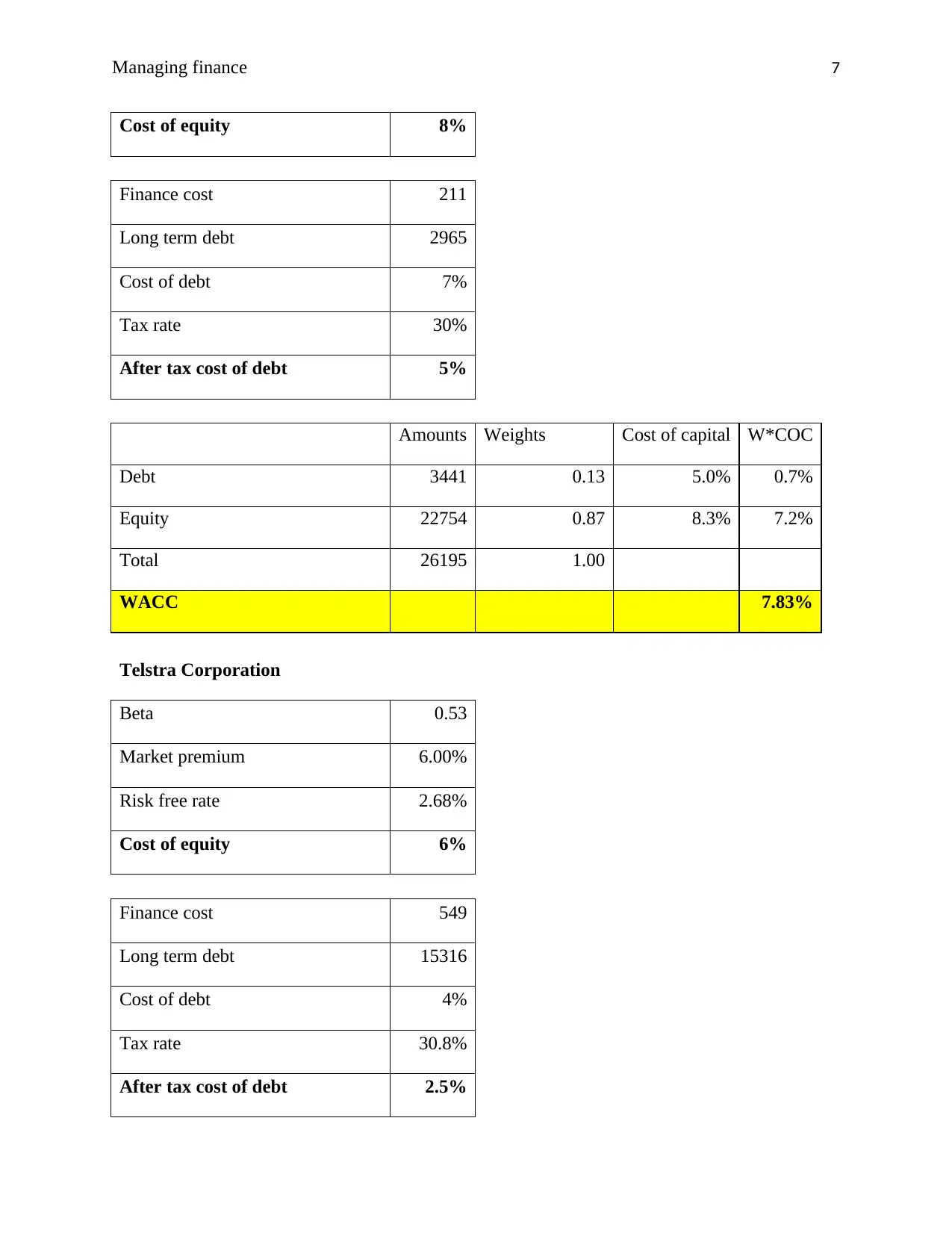

Amounts Weights Cost of capital W*COC

Debt 14739 0.495 2.5% 1.2%

Equity 15014 0.505 5.9% 3.0%

Total 29753 1.00

WACC 4.19%

After assessing all the details, it could be inferred that Company is having 4.19% Weighted

average cost of capital.

Part-C

Weighted average cost of capital is defined as the firm’s cost of capital under which each

category is proportionately weighted. The calculation of WACC includes the tax rate of the

company which has a significant impact on it. The taxes enter the calculation in the debt part of

the formula. It is observed that a high tax rate would result in lower cost of debt as the debt is tax

deductible. The relationship between the tax rates and WACC is defined as when the rate goes

up, the WACC reduces and vice versa happens. The calculation of WACC of both the companies

has included the impact of corporate tax rate of 30%. If the same has not been included then the

discounting rate would be higher than the calculated one. So it can be said that taxes impact the

WACC to a great extent as a minor fluctuation in the same can leave a significant impact on

company’s cost of capital (Vélez-Pareja, 2016).

Amounts Weights Cost of capital W*COC

Debt 14739 0.495 2.5% 1.2%

Equity 15014 0.505 5.9% 3.0%

Total 29753 1.00

WACC 4.19%

After assessing all the details, it could be inferred that Company is having 4.19% Weighted

average cost of capital.

Part-C

Weighted average cost of capital is defined as the firm’s cost of capital under which each

category is proportionately weighted. The calculation of WACC includes the tax rate of the

company which has a significant impact on it. The taxes enter the calculation in the debt part of

the formula. It is observed that a high tax rate would result in lower cost of debt as the debt is tax

deductible. The relationship between the tax rates and WACC is defined as when the rate goes

up, the WACC reduces and vice versa happens. The calculation of WACC of both the companies

has included the impact of corporate tax rate of 30%. If the same has not been included then the

discounting rate would be higher than the calculated one. So it can be said that taxes impact the

WACC to a great extent as a minor fluctuation in the same can leave a significant impact on

company’s cost of capital (Vélez-Pareja, 2016).

Managing finance 9

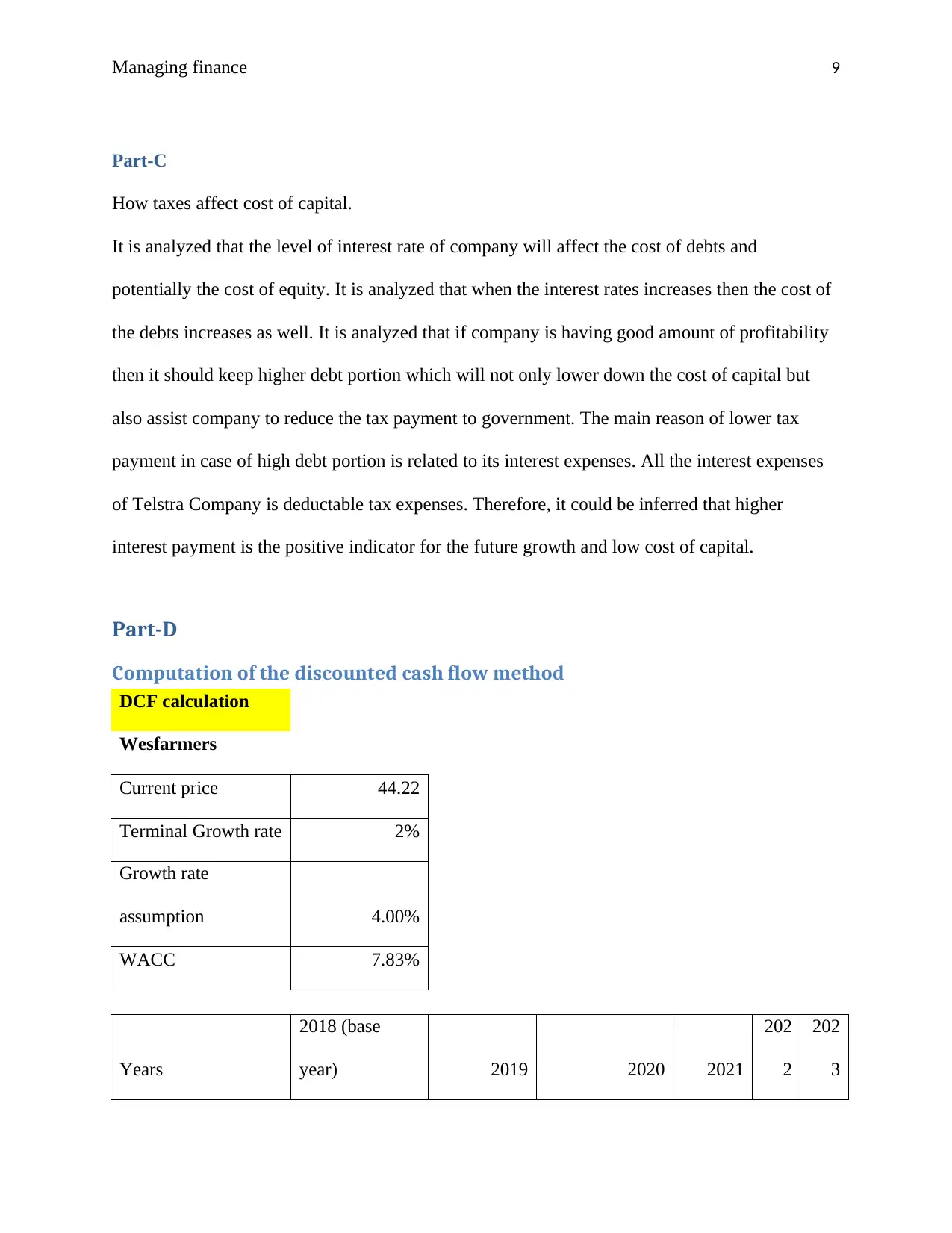

Part-C

How taxes affect cost of capital.

It is analyzed that the level of interest rate of company will affect the cost of debts and

potentially the cost of equity. It is analyzed that when the interest rates increases then the cost of

the debts increases as well. It is analyzed that if company is having good amount of profitability

then it should keep higher debt portion which will not only lower down the cost of capital but

also assist company to reduce the tax payment to government. The main reason of lower tax

payment in case of high debt portion is related to its interest expenses. All the interest expenses

of Telstra Company is deductable tax expenses. Therefore, it could be inferred that higher

interest payment is the positive indicator for the future growth and low cost of capital.

Part-D

Computation of the discounted cash flow method

DCF calculation

Wesfarmers

Current price 44.22

Terminal Growth rate 2%

Growth rate

assumption 4.00%

WACC 7.83%

Years

2018 (base

year) 2019 2020 2021

202

2

202

3

Part-C

How taxes affect cost of capital.

It is analyzed that the level of interest rate of company will affect the cost of debts and

potentially the cost of equity. It is analyzed that when the interest rates increases then the cost of

the debts increases as well. It is analyzed that if company is having good amount of profitability

then it should keep higher debt portion which will not only lower down the cost of capital but

also assist company to reduce the tax payment to government. The main reason of lower tax

payment in case of high debt portion is related to its interest expenses. All the interest expenses

of Telstra Company is deductable tax expenses. Therefore, it could be inferred that higher

interest payment is the positive indicator for the future growth and low cost of capital.

Part-D

Computation of the discounted cash flow method

DCF calculation

Wesfarmers

Current price 44.22

Terminal Growth rate 2%

Growth rate

assumption 4.00%

WACC 7.83%

Years

2018 (base

year) 2019 2020 2021

202

2

202

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Managing finance 10

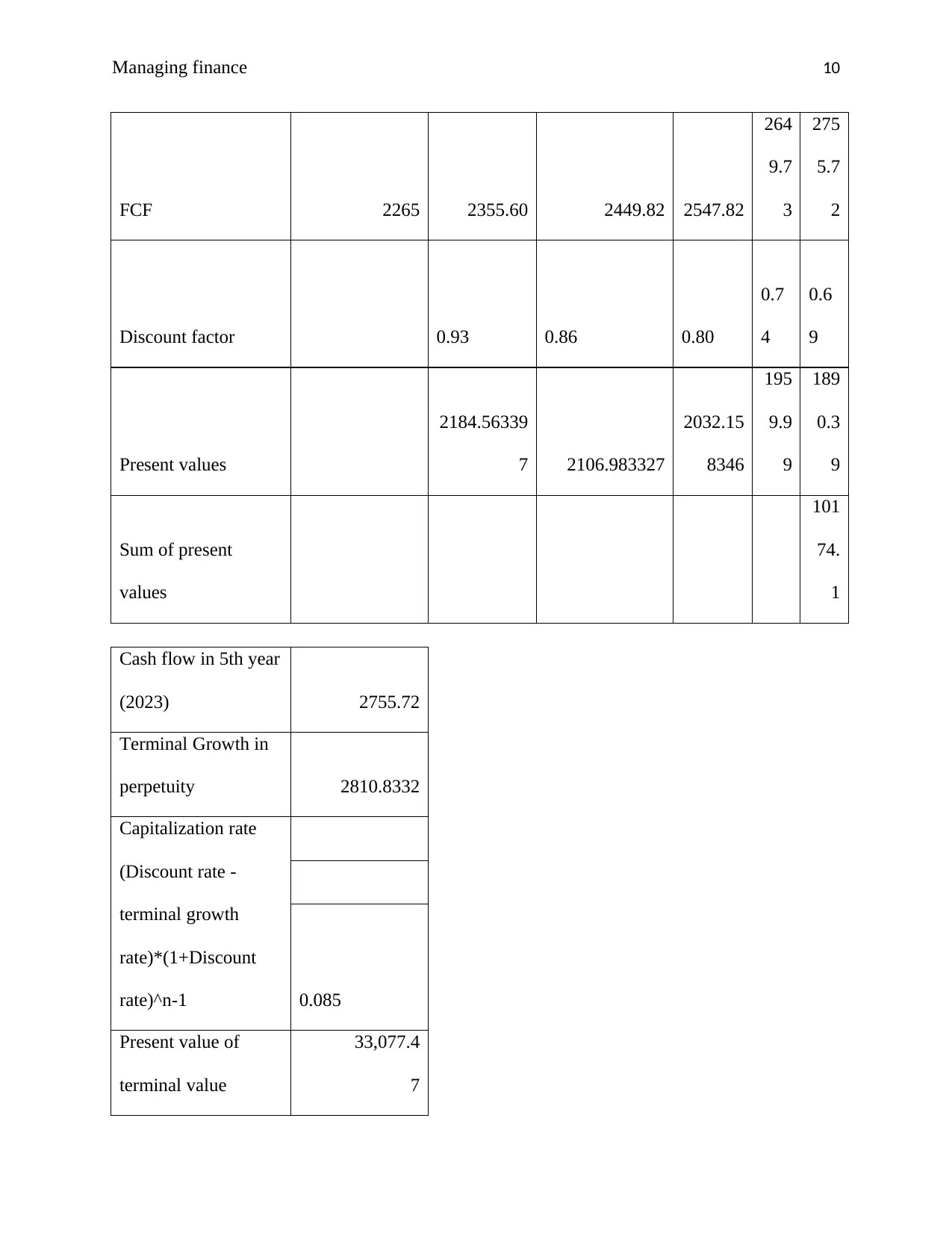

FCF 2265 2355.60 2449.82 2547.82

264

9.7

3

275

5.7

2

Discount factor 0.93 0.86 0.80

0.7

4

0.6

9

Present values

2184.56339

7 2106.983327

2032.15

8346

195

9.9

9

189

0.3

9

Sum of present

values

101

74.

1

Cash flow in 5th year

(2023) 2755.72

Terminal Growth in

perpetuity 2810.8332

Capitalization rate

(Discount rate -

terminal growth

rate)*(1+Discount

rate)^n-1 0.085

Present value of

terminal value

33,077.4

7

FCF 2265 2355.60 2449.82 2547.82

264

9.7

3

275

5.7

2

Discount factor 0.93 0.86 0.80

0.7

4

0.6

9

Present values

2184.56339

7 2106.983327

2032.15

8346

195

9.9

9

189

0.3

9

Sum of present

values

101

74.

1

Cash flow in 5th year

(2023) 2755.72

Terminal Growth in

perpetuity 2810.8332

Capitalization rate

(Discount rate -

terminal growth

rate)*(1+Discount

rate)^n-1 0.085

Present value of

terminal value

33,077.4

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Managing finance 11

Market Value (Sum

pf present cash flow

+ present value of

terminal value)

43,25

2

Number of Shares

outstanding

1,133.0

0

Fair value 38.17

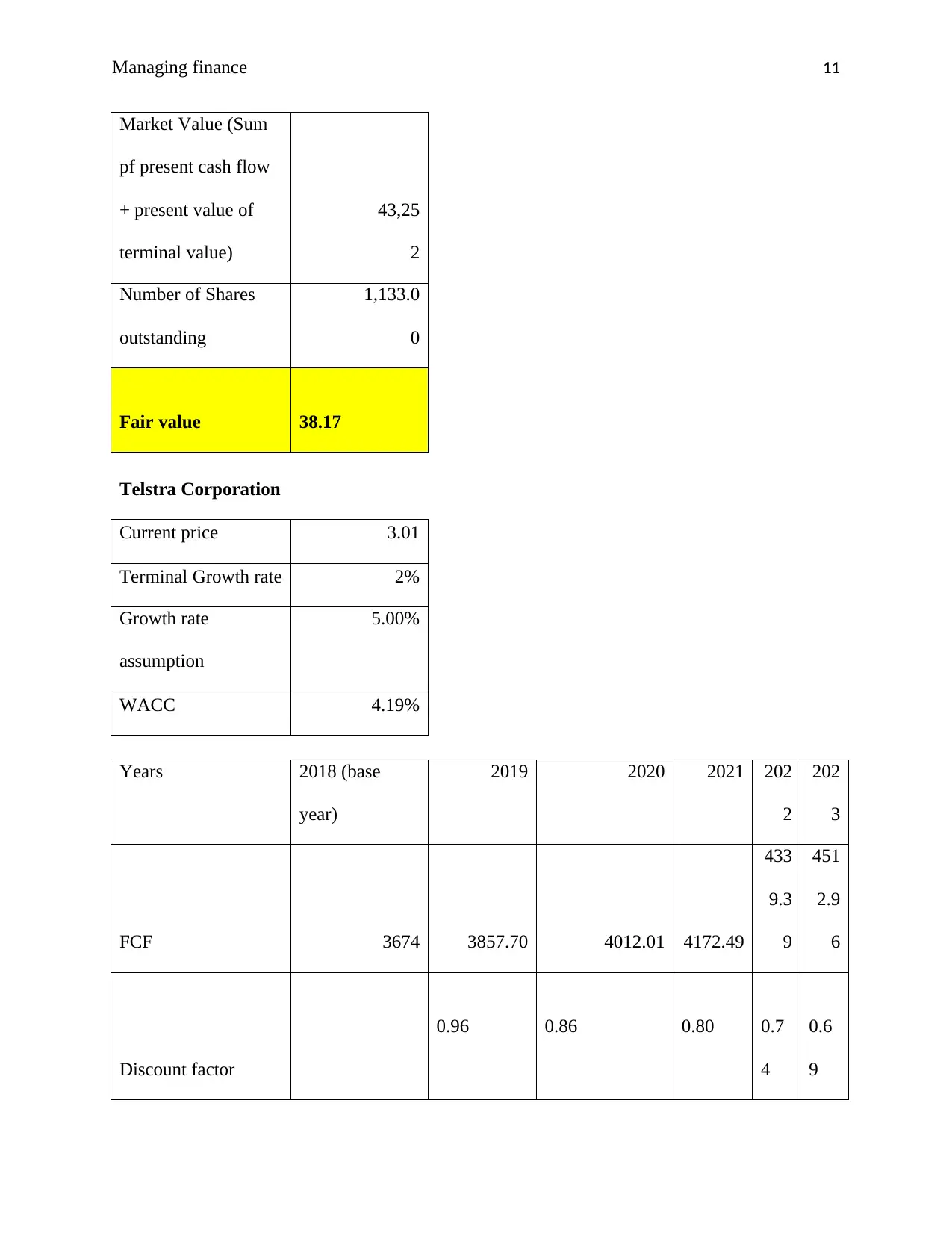

Telstra Corporation

Current price 3.01

Terminal Growth rate 2%

Growth rate

assumption

5.00%

WACC 4.19%

Years 2018 (base

year)

2019 2020 2021 202

2

202

3

FCF 3674 3857.70 4012.01 4172.49

433

9.3

9

451

2.9

6

Discount factor

0.96 0.86 0.80 0.7

4

0.6

9

Market Value (Sum

pf present cash flow

+ present value of

terminal value)

43,25

2

Number of Shares

outstanding

1,133.0

0

Fair value 38.17

Telstra Corporation

Current price 3.01

Terminal Growth rate 2%

Growth rate

assumption

5.00%

WACC 4.19%

Years 2018 (base

year)

2019 2020 2021 202

2

202

3

FCF 3674 3857.70 4012.01 4172.49

433

9.3

9

451

2.9

6

Discount factor

0.96 0.86 0.80 0.7

4

0.6

9

Managing finance 12

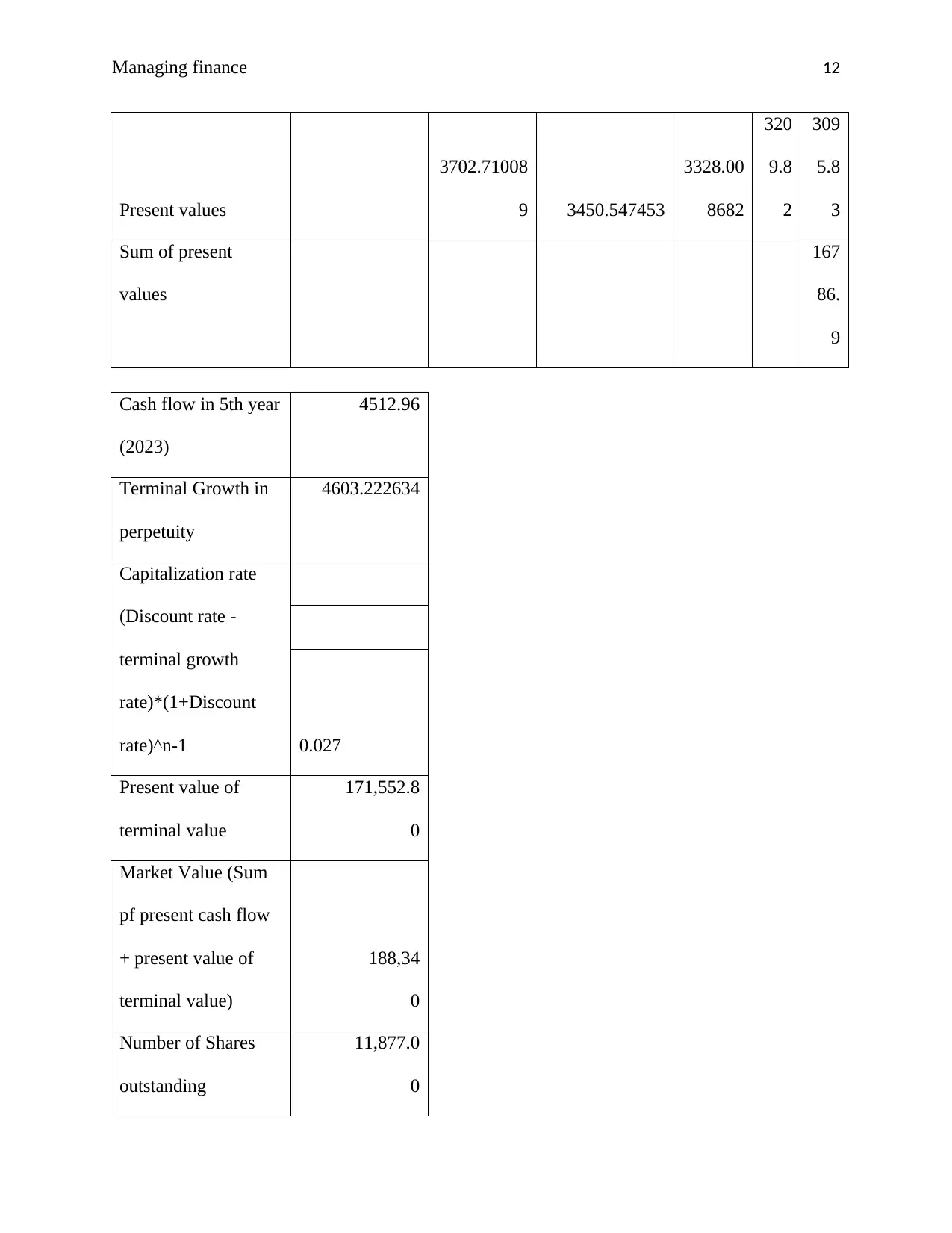

Present values

3702.71008

9 3450.547453

3328.00

8682

320

9.8

2

309

5.8

3

Sum of present

values

167

86.

9

Cash flow in 5th year

(2023)

4512.96

Terminal Growth in

perpetuity

4603.222634

Capitalization rate

(Discount rate -

terminal growth

rate)*(1+Discount

rate)^n-1 0.027

Present value of

terminal value

171,552.8

0

Market Value (Sum

pf present cash flow

+ present value of

terminal value)

188,34

0

Number of Shares

outstanding

11,877.0

0

Present values

3702.71008

9 3450.547453

3328.00

8682

320

9.8

2

309

5.8

3

Sum of present

values

167

86.

9

Cash flow in 5th year

(2023)

4512.96

Terminal Growth in

perpetuity

4603.222634

Capitalization rate

(Discount rate -

terminal growth

rate)*(1+Discount

rate)^n-1 0.027

Present value of

terminal value

171,552.8

0

Market Value (Sum

pf present cash flow

+ present value of

terminal value)

188,34

0

Number of Shares

outstanding

11,877.0

0

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.