BUACC 2613 Semester 2: Activity Based Costing Implementation

VerifiedAdded on 2023/06/04

|12

|3026

|434

Report

AI Summary

This report provides a comparative evaluation of traditional costing and activity-based costing (ABC) systems, focusing on a case scenario involving Essendon Electronics. It details the computation of profitability using ABC, highlighting the differences in profit amounts compared to traditional methods. The report discusses the benefits and limitations of ABC, including its accuracy in determining product costs and its complexity in implementation. It also addresses the ethical considerations for the accountant facing pressure to alter costing methods. The analysis concludes with a recommendation for the company to adopt ABC for more precise cost allocation and improved decision-making, despite the higher implementation costs. Desklib provides access to similar reports and study tools for students.

BUACC 2613

Semester 2, 2018

Group Assignment

Semester 2, 2018

Group Assignment

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Part A...............................................................................................................................................3

Part B...............................................................................................................................................4

Part C...............................................................................................................................................4

Part D...............................................................................................................................................4

Benefits........................................................................................................................................4

Limitations...................................................................................................................................5

Cost..............................................................................................................................................6

References........................................................................................................................................7

Part A...............................................................................................................................................3

Part B...............................................................................................................................................4

Part C...............................................................................................................................................4

Part D...............................................................................................................................................4

Benefits........................................................................................................................................4

Limitations...................................................................................................................................5

Cost..............................................................................................................................................6

References........................................................................................................................................7

LIST OF TABLES

Table 1: Statement showing computation of profitability is done as be activity based costing

system..............................................................................................................................................4

Table 1: Statement showing computation of profitability is done as be activity based costing

system..............................................................................................................................................4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Cost accounting is considered to be the significant part of any business. It is considered by the

managerial authorities of the business as an accounting strategy which deals with ascertaining

the cost of the product to make various decisions related to the sale of products in the market.

There are various methods that can be used for the allocation of the overhead to the product

(Shields, 2015). Moreover, determination of the method for allocation of the overhead depends

on the circumstances of the business. It is a very typical task to ascertain the method of costing

adopted in the organization. Activity based costing is a costing method of that identifies the

connection between overhead activities, costs and manufactured products, and with the help of

this connection, it assigns the indirect costs to products less randomly as compare to traditional

methods. Apart from this accountant should also follow all the rules, regulations, principles

which are prescribed under the code of ethics standard and the decision of the accountant should

not be influenced by any other person. By considering these factors the present study focus on

the comparative evaluation traditional system of costing and the activity based system of the

costing.

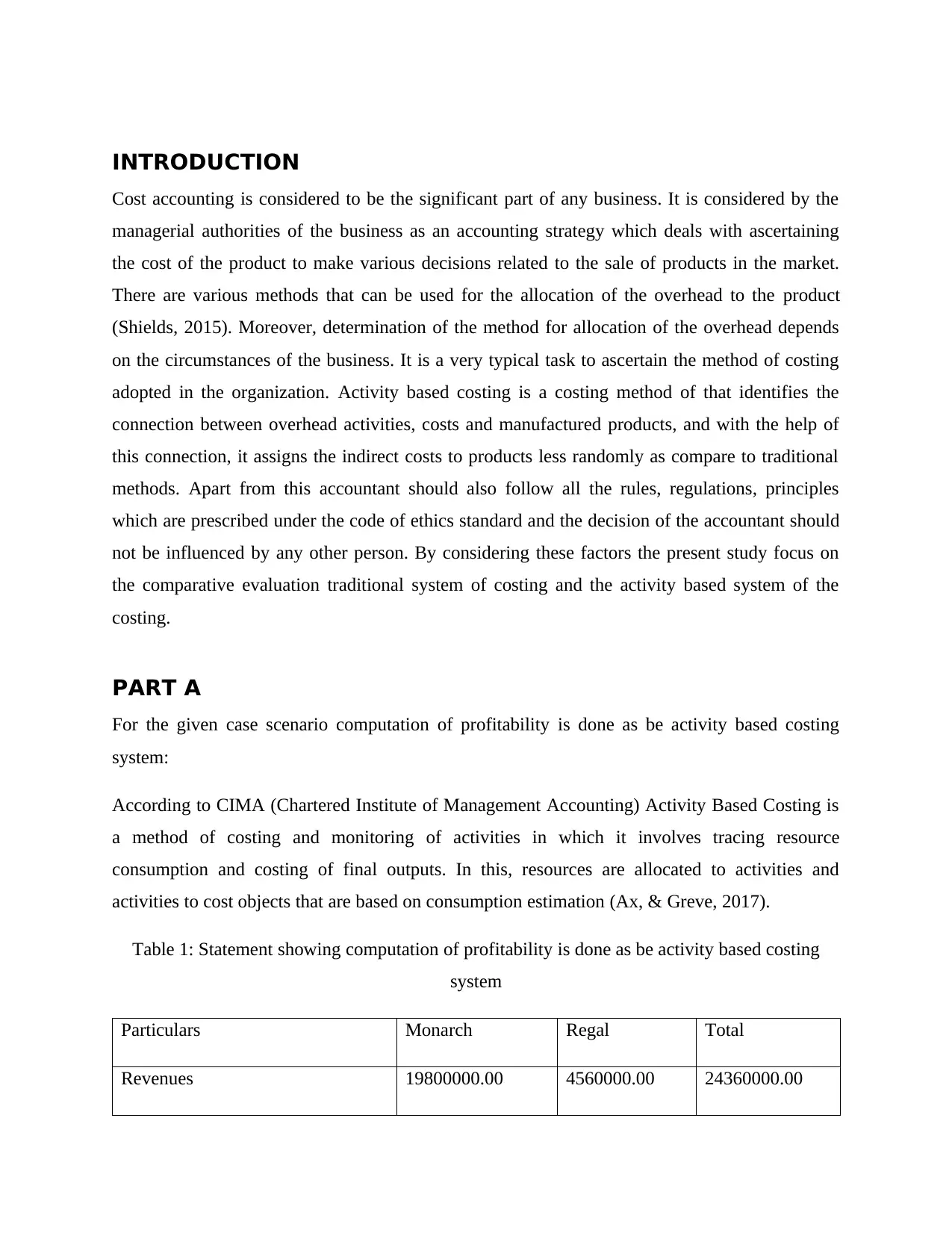

PART A

For the given case scenario computation of profitability is done as be activity based costing

system:

According to CIMA (Chartered Institute of Management Accounting) Activity Based Costing is

a method of costing and monitoring of activities in which it involves tracing resource

consumption and costing of final outputs. In this, resources are allocated to activities and

activities to cost objects that are based on consumption estimation (Ax, & Greve, 2017).

Table 1: Statement showing computation of profitability is done as be activity based costing

system

Particulars Monarch Regal Total

Revenues 19800000.00 4560000.00 24360000.00

Cost accounting is considered to be the significant part of any business. It is considered by the

managerial authorities of the business as an accounting strategy which deals with ascertaining

the cost of the product to make various decisions related to the sale of products in the market.

There are various methods that can be used for the allocation of the overhead to the product

(Shields, 2015). Moreover, determination of the method for allocation of the overhead depends

on the circumstances of the business. It is a very typical task to ascertain the method of costing

adopted in the organization. Activity based costing is a costing method of that identifies the

connection between overhead activities, costs and manufactured products, and with the help of

this connection, it assigns the indirect costs to products less randomly as compare to traditional

methods. Apart from this accountant should also follow all the rules, regulations, principles

which are prescribed under the code of ethics standard and the decision of the accountant should

not be influenced by any other person. By considering these factors the present study focus on

the comparative evaluation traditional system of costing and the activity based system of the

costing.

PART A

For the given case scenario computation of profitability is done as be activity based costing

system:

According to CIMA (Chartered Institute of Management Accounting) Activity Based Costing is

a method of costing and monitoring of activities in which it involves tracing resource

consumption and costing of final outputs. In this, resources are allocated to activities and

activities to cost objects that are based on consumption estimation (Ax, & Greve, 2017).

Table 1: Statement showing computation of profitability is done as be activity based costing

system

Particulars Monarch Regal Total

Revenues 19800000.00 4560000.00 24360000.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

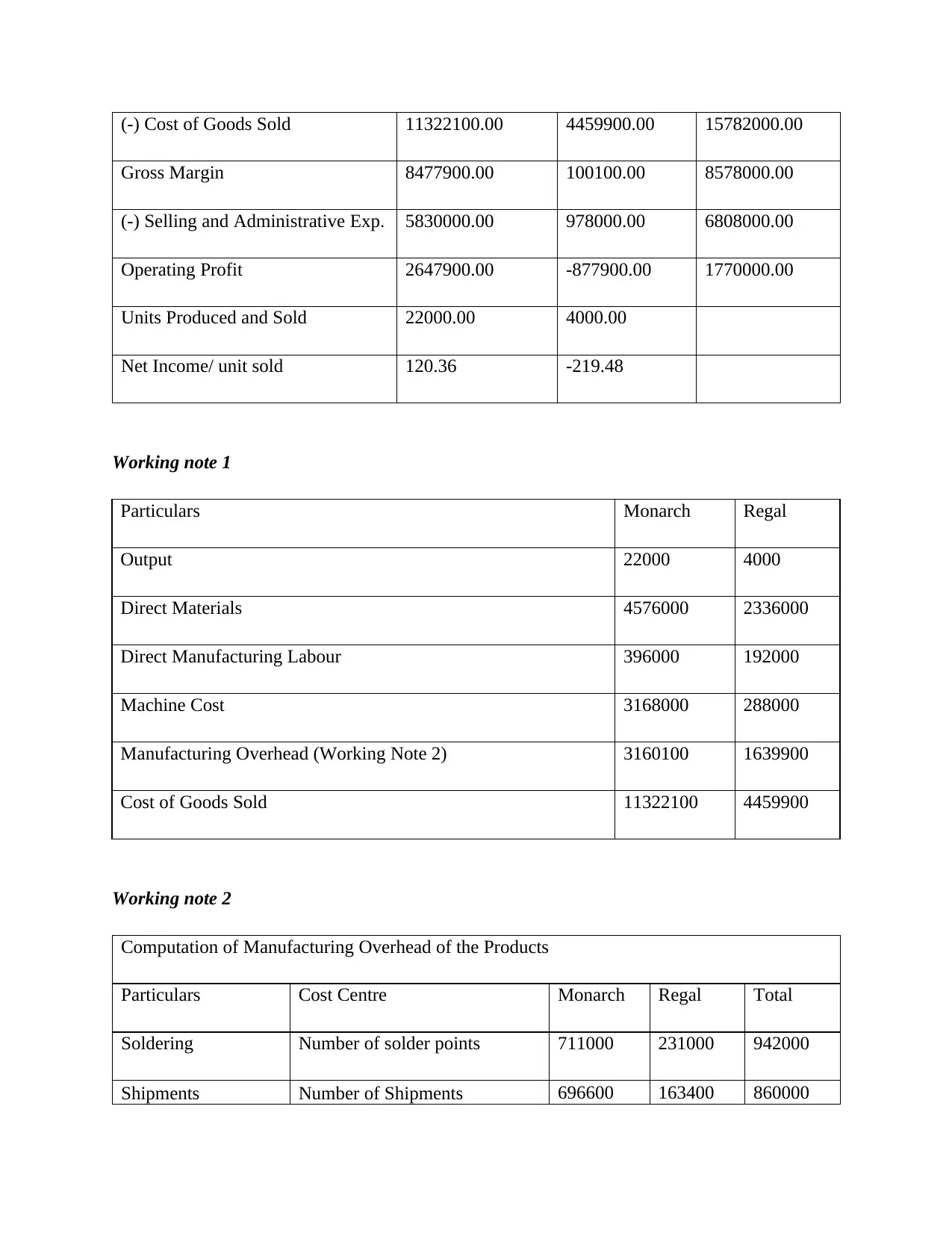

(-) Cost of Goods Sold 11322100.00 4459900.00 15782000.00

Gross Margin 8477900.00 100100.00 8578000.00

(-) Selling and Administrative Exp. 5830000.00 978000.00 6808000.00

Operating Profit 2647900.00 -877900.00 1770000.00

Units Produced and Sold 22000.00 4000.00

Net Income/ unit sold 120.36 -219.48

Working note 1

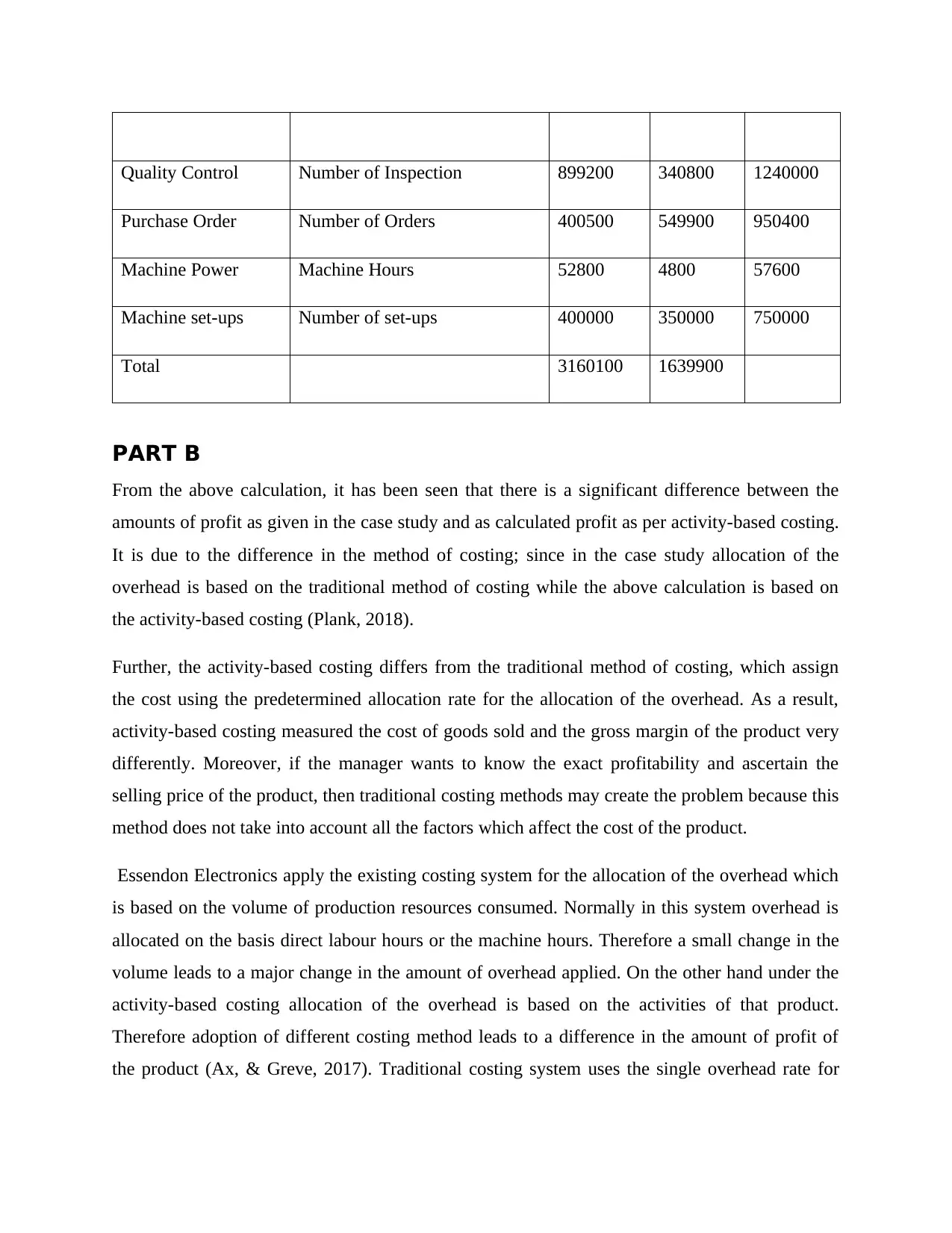

Particulars Monarch Regal

Output 22000 4000

Direct Materials 4576000 2336000

Direct Manufacturing Labour 396000 192000

Machine Cost 3168000 288000

Manufacturing Overhead (Working Note 2) 3160100 1639900

Cost of Goods Sold 11322100 4459900

Working note 2

Computation of Manufacturing Overhead of the Products

Particulars Cost Centre Monarch Regal Total

Soldering Number of solder points 711000 231000 942000

Shipments Number of Shipments 696600 163400 860000

Gross Margin 8477900.00 100100.00 8578000.00

(-) Selling and Administrative Exp. 5830000.00 978000.00 6808000.00

Operating Profit 2647900.00 -877900.00 1770000.00

Units Produced and Sold 22000.00 4000.00

Net Income/ unit sold 120.36 -219.48

Working note 1

Particulars Monarch Regal

Output 22000 4000

Direct Materials 4576000 2336000

Direct Manufacturing Labour 396000 192000

Machine Cost 3168000 288000

Manufacturing Overhead (Working Note 2) 3160100 1639900

Cost of Goods Sold 11322100 4459900

Working note 2

Computation of Manufacturing Overhead of the Products

Particulars Cost Centre Monarch Regal Total

Soldering Number of solder points 711000 231000 942000

Shipments Number of Shipments 696600 163400 860000

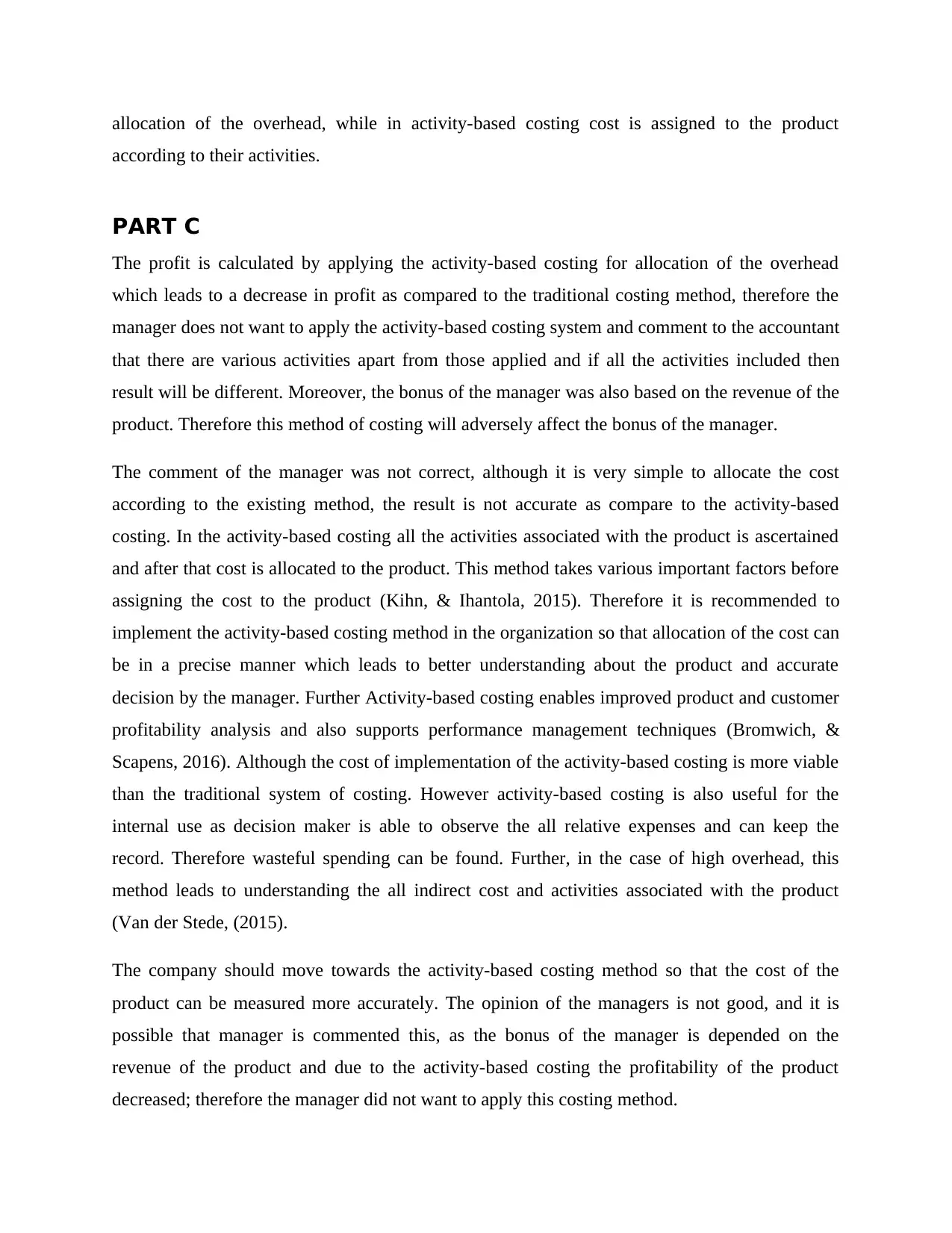

Quality Control Number of Inspection 899200 340800 1240000

Purchase Order Number of Orders 400500 549900 950400

Machine Power Machine Hours 52800 4800 57600

Machine set-ups Number of set-ups 400000 350000 750000

Total 3160100 1639900

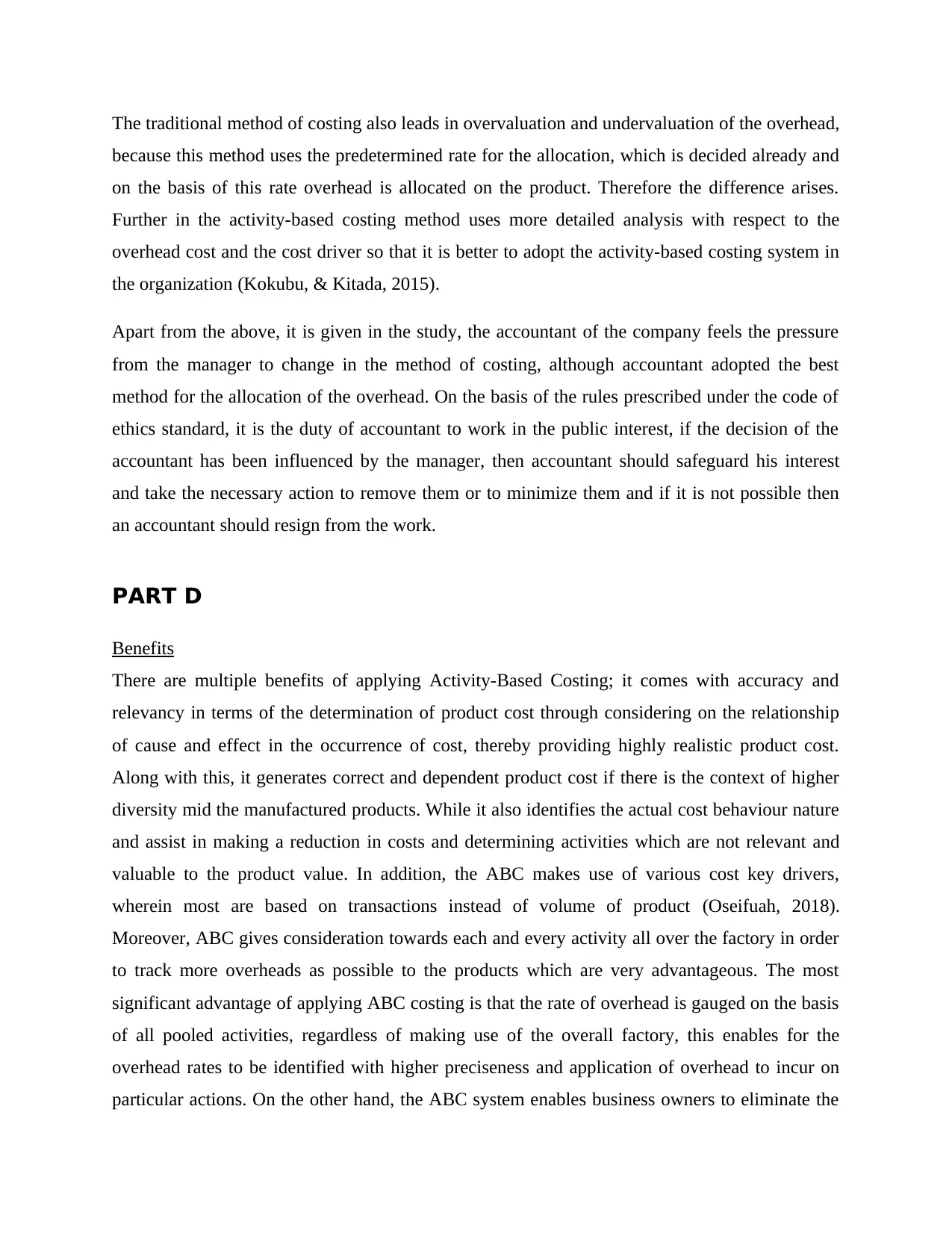

PART B

From the above calculation, it has been seen that there is a significant difference between the

amounts of profit as given in the case study and as calculated profit as per activity-based costing.

It is due to the difference in the method of costing; since in the case study allocation of the

overhead is based on the traditional method of costing while the above calculation is based on

the activity-based costing (Plank, 2018).

Further, the activity-based costing differs from the traditional method of costing, which assign

the cost using the predetermined allocation rate for the allocation of the overhead. As a result,

activity-based costing measured the cost of goods sold and the gross margin of the product very

differently. Moreover, if the manager wants to know the exact profitability and ascertain the

selling price of the product, then traditional costing methods may create the problem because this

method does not take into account all the factors which affect the cost of the product.

Essendon Electronics apply the existing costing system for the allocation of the overhead which

is based on the volume of production resources consumed. Normally in this system overhead is

allocated on the basis direct labour hours or the machine hours. Therefore a small change in the

volume leads to a major change in the amount of overhead applied. On the other hand under the

activity-based costing allocation of the overhead is based on the activities of that product.

Therefore adoption of different costing method leads to a difference in the amount of profit of

the product (Ax, & Greve, 2017). Traditional costing system uses the single overhead rate for

Purchase Order Number of Orders 400500 549900 950400

Machine Power Machine Hours 52800 4800 57600

Machine set-ups Number of set-ups 400000 350000 750000

Total 3160100 1639900

PART B

From the above calculation, it has been seen that there is a significant difference between the

amounts of profit as given in the case study and as calculated profit as per activity-based costing.

It is due to the difference in the method of costing; since in the case study allocation of the

overhead is based on the traditional method of costing while the above calculation is based on

the activity-based costing (Plank, 2018).

Further, the activity-based costing differs from the traditional method of costing, which assign

the cost using the predetermined allocation rate for the allocation of the overhead. As a result,

activity-based costing measured the cost of goods sold and the gross margin of the product very

differently. Moreover, if the manager wants to know the exact profitability and ascertain the

selling price of the product, then traditional costing methods may create the problem because this

method does not take into account all the factors which affect the cost of the product.

Essendon Electronics apply the existing costing system for the allocation of the overhead which

is based on the volume of production resources consumed. Normally in this system overhead is

allocated on the basis direct labour hours or the machine hours. Therefore a small change in the

volume leads to a major change in the amount of overhead applied. On the other hand under the

activity-based costing allocation of the overhead is based on the activities of that product.

Therefore adoption of different costing method leads to a difference in the amount of profit of

the product (Ax, & Greve, 2017). Traditional costing system uses the single overhead rate for

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

allocation of the overhead, while in activity-based costing cost is assigned to the product

according to their activities.

PART C

The profit is calculated by applying the activity-based costing for allocation of the overhead

which leads to a decrease in profit as compared to the traditional costing method, therefore the

manager does not want to apply the activity-based costing system and comment to the accountant

that there are various activities apart from those applied and if all the activities included then

result will be different. Moreover, the bonus of the manager was also based on the revenue of the

product. Therefore this method of costing will adversely affect the bonus of the manager.

The comment of the manager was not correct, although it is very simple to allocate the cost

according to the existing method, the result is not accurate as compare to the activity-based

costing. In the activity-based costing all the activities associated with the product is ascertained

and after that cost is allocated to the product. This method takes various important factors before

assigning the cost to the product (Kihn, & Ihantola, 2015). Therefore it is recommended to

implement the activity-based costing method in the organization so that allocation of the cost can

be in a precise manner which leads to better understanding about the product and accurate

decision by the manager. Further Activity-based costing enables improved product and customer

profitability analysis and also supports performance management techniques (Bromwich, &

Scapens, 2016). Although the cost of implementation of the activity-based costing is more viable

than the traditional system of costing. However activity-based costing is also useful for the

internal use as decision maker is able to observe the all relative expenses and can keep the

record. Therefore wasteful spending can be found. Further, in the case of high overhead, this

method leads to understanding the all indirect cost and activities associated with the product

(Van der Stede, (2015).

The company should move towards the activity-based costing method so that the cost of the

product can be measured more accurately. The opinion of the managers is not good, and it is

possible that manager is commented this, as the bonus of the manager is depended on the

revenue of the product and due to the activity-based costing the profitability of the product

decreased; therefore the manager did not want to apply this costing method.

according to their activities.

PART C

The profit is calculated by applying the activity-based costing for allocation of the overhead

which leads to a decrease in profit as compared to the traditional costing method, therefore the

manager does not want to apply the activity-based costing system and comment to the accountant

that there are various activities apart from those applied and if all the activities included then

result will be different. Moreover, the bonus of the manager was also based on the revenue of the

product. Therefore this method of costing will adversely affect the bonus of the manager.

The comment of the manager was not correct, although it is very simple to allocate the cost

according to the existing method, the result is not accurate as compare to the activity-based

costing. In the activity-based costing all the activities associated with the product is ascertained

and after that cost is allocated to the product. This method takes various important factors before

assigning the cost to the product (Kihn, & Ihantola, 2015). Therefore it is recommended to

implement the activity-based costing method in the organization so that allocation of the cost can

be in a precise manner which leads to better understanding about the product and accurate

decision by the manager. Further Activity-based costing enables improved product and customer

profitability analysis and also supports performance management techniques (Bromwich, &

Scapens, 2016). Although the cost of implementation of the activity-based costing is more viable

than the traditional system of costing. However activity-based costing is also useful for the

internal use as decision maker is able to observe the all relative expenses and can keep the

record. Therefore wasteful spending can be found. Further, in the case of high overhead, this

method leads to understanding the all indirect cost and activities associated with the product

(Van der Stede, (2015).

The company should move towards the activity-based costing method so that the cost of the

product can be measured more accurately. The opinion of the managers is not good, and it is

possible that manager is commented this, as the bonus of the manager is depended on the

revenue of the product and due to the activity-based costing the profitability of the product

decreased; therefore the manager did not want to apply this costing method.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The traditional method of costing also leads in overvaluation and undervaluation of the overhead,

because this method uses the predetermined rate for the allocation, which is decided already and

on the basis of this rate overhead is allocated on the product. Therefore the difference arises.

Further in the activity-based costing method uses more detailed analysis with respect to the

overhead cost and the cost driver so that it is better to adopt the activity-based costing system in

the organization (Kokubu, & Kitada, 2015).

Apart from the above, it is given in the study, the accountant of the company feels the pressure

from the manager to change in the method of costing, although accountant adopted the best

method for the allocation of the overhead. On the basis of the rules prescribed under the code of

ethics standard, it is the duty of accountant to work in the public interest, if the decision of the

accountant has been influenced by the manager, then accountant should safeguard his interest

and take the necessary action to remove them or to minimize them and if it is not possible then

an accountant should resign from the work.

PART D

Benefits

There are multiple benefits of applying Activity-Based Costing; it comes with accuracy and

relevancy in terms of the determination of product cost through considering on the relationship

of cause and effect in the occurrence of cost, thereby providing highly realistic product cost.

Along with this, it generates correct and dependent product cost if there is the context of higher

diversity mid the manufactured products. While it also identifies the actual cost behaviour nature

and assist in making a reduction in costs and determining activities which are not relevant and

valuable to the product value. In addition, the ABC makes use of various cost key drivers,

wherein most are based on transactions instead of volume of product (Oseifuah, 2018).

Moreover, ABC gives consideration towards each and every activity all over the factory in order

to track more overheads as possible to the products which are very advantageous. The most

significant advantage of applying ABC costing is that the rate of overhead is gauged on the basis

of all pooled activities, regardless of making use of the overall factory, this enables for the

overhead rates to be identified with higher preciseness and application of overhead to incur on

particular actions. On the other hand, the ABC system enables business owners to eliminate the

because this method uses the predetermined rate for the allocation, which is decided already and

on the basis of this rate overhead is allocated on the product. Therefore the difference arises.

Further in the activity-based costing method uses more detailed analysis with respect to the

overhead cost and the cost driver so that it is better to adopt the activity-based costing system in

the organization (Kokubu, & Kitada, 2015).

Apart from the above, it is given in the study, the accountant of the company feels the pressure

from the manager to change in the method of costing, although accountant adopted the best

method for the allocation of the overhead. On the basis of the rules prescribed under the code of

ethics standard, it is the duty of accountant to work in the public interest, if the decision of the

accountant has been influenced by the manager, then accountant should safeguard his interest

and take the necessary action to remove them or to minimize them and if it is not possible then

an accountant should resign from the work.

PART D

Benefits

There are multiple benefits of applying Activity-Based Costing; it comes with accuracy and

relevancy in terms of the determination of product cost through considering on the relationship

of cause and effect in the occurrence of cost, thereby providing highly realistic product cost.

Along with this, it generates correct and dependent product cost if there is the context of higher

diversity mid the manufactured products. While it also identifies the actual cost behaviour nature

and assist in making a reduction in costs and determining activities which are not relevant and

valuable to the product value. In addition, the ABC makes use of various cost key drivers,

wherein most are based on transactions instead of volume of product (Oseifuah, 2018).

Moreover, ABC gives consideration towards each and every activity all over the factory in order

to track more overheads as possible to the products which are very advantageous. The most

significant advantage of applying ABC costing is that the rate of overhead is gauged on the basis

of all pooled activities, regardless of making use of the overall factory, this enables for the

overhead rates to be identified with higher preciseness and application of overhead to incur on

particular actions. On the other hand, the ABC system enables business owners to eliminate the

costs that can affect decision making or are irrelevant. ABC system benefits from tracking

overhead costs and traces costs to management responsibility, procedures, and consumers away

from the cost of products. It also allows better decision making for managerial pursuits, which

are useful in setting product price. ABC offers cost key drivers rate as well as information in the

volume of the transaction which is beneficial in managing the cost management and

responsibility of performance appraisal (Arjmand, Shah, Edward Reece MD, Hollier Jr, Faryan

Jalalabadi BBA, Hoxworth & Milewicz, 2018). Additionally, the rate of cost drivers can be

highly advantageous for the new product design as they are capable of indicating overhead costs

that are expected to be implied in the product costing.

Limitations

Activity-based costing has various cost pools and numerous cost drivers, and thus it can create

much of complexity and is evidenced to be costly to be maintained and managed. The integrated

accuracy of the ABC system is only applicable in a situation where the business owner is likely

to manage the time for analysing the manufacturing procedures with adequate details to identify

the manner by which there is the occurrence of overhead costs (Al-Sayed & Dugdale, 2016).

Because of this among of complexity, most of the small business does not provide preference to

this method and consider it as less worthy. There is another limitation that, the managerial

authorities which are willing to apply this method require an intense amount of experience in the

same field.

There is also a limitation in that it requires a vast amount and application of information

technology; it is not possible to perfectly apply ABC system in the absence of information

technology (Woodruff, 2018). It necessities a higher amount of data to be collected, clarified and

converted into real-time information, with the critical analyses of the same to find out rationales

of the applications of specified decisions (Lavia López, & Hiebl, 2014). Generally, most of the

small firms do not consider the benefits of the ABC system to be more important than the costs.

Certain complexities take place while the ABC system is being adopted as the selection of the

key costs drivers, allocation of the general costs and differing rates of costs drivers.

Some of the limitations are inclusive of difficulty identifying the entire activities that create an

impact on costs. Unease selection of the best suitable costs drivers, complexity in evaluating the

cost based on activities and non-reliability for the concerns of small manufacturers.

overhead costs and traces costs to management responsibility, procedures, and consumers away

from the cost of products. It also allows better decision making for managerial pursuits, which

are useful in setting product price. ABC offers cost key drivers rate as well as information in the

volume of the transaction which is beneficial in managing the cost management and

responsibility of performance appraisal (Arjmand, Shah, Edward Reece MD, Hollier Jr, Faryan

Jalalabadi BBA, Hoxworth & Milewicz, 2018). Additionally, the rate of cost drivers can be

highly advantageous for the new product design as they are capable of indicating overhead costs

that are expected to be implied in the product costing.

Limitations

Activity-based costing has various cost pools and numerous cost drivers, and thus it can create

much of complexity and is evidenced to be costly to be maintained and managed. The integrated

accuracy of the ABC system is only applicable in a situation where the business owner is likely

to manage the time for analysing the manufacturing procedures with adequate details to identify

the manner by which there is the occurrence of overhead costs (Al-Sayed & Dugdale, 2016).

Because of this among of complexity, most of the small business does not provide preference to

this method and consider it as less worthy. There is another limitation that, the managerial

authorities which are willing to apply this method require an intense amount of experience in the

same field.

There is also a limitation in that it requires a vast amount and application of information

technology; it is not possible to perfectly apply ABC system in the absence of information

technology (Woodruff, 2018). It necessities a higher amount of data to be collected, clarified and

converted into real-time information, with the critical analyses of the same to find out rationales

of the applications of specified decisions (Lavia López, & Hiebl, 2014). Generally, most of the

small firms do not consider the benefits of the ABC system to be more important than the costs.

Certain complexities take place while the ABC system is being adopted as the selection of the

key costs drivers, allocation of the general costs and differing rates of costs drivers.

Some of the limitations are inclusive of difficulty identifying the entire activities that create an

impact on costs. Unease selection of the best suitable costs drivers, complexity in evaluating the

cost based on activities and non-reliability for the concerns of small manufacturers.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cost

The major cost and drawback of the application of activity-based costing are stated as the

measurements which are required to adopt it. It is considered that the ABC system highly

demands management to predict and calculate the activity pools cost while to determine and

estimate the key cost drivers to deliver on the basis of cost allocation. In the case of fundamental

ABC system also, there is a need for major calculations to identify the actual costs of related

products or services (Van der Stede, 2016). It is proved that the whole process of measurement

and application of ABC system are expensive also its limits in regular updating of the rate of

activity costs (Schmidt, 2018). Furthermore, the ABC systems are not able to eradicate the

traditional costing system, due to the design, implement and maintenance which is highly cost

incremental as compared to the traditional system of the company. However, this makes the

application of the ABC system more costly, specifically for the small-size business. However,

contradictory and vague estimates of costs can create problem while the management urge to

consider precisely whether the products are profitable or are incurring losses.

CONCLUSION

On the basis of the above study, it has been concluded that in the traditional method of costing

the allocation is based on the single overhead rate, which is generally calculated by the direct

labour hours or the machine hours. On the other hand, activity-based costing uses the cost driver

for allocation of the overhead as per the activity associated with the product. Moreover, different

costing method results in different cost and profit analysis of the product. In the present study,

the company should implement the activity-based costing system in the organization, which

leads to more accurate and precise result so that management can take the right decisions. Along

with this accountant should follow the basic principles which are prescribed under the code of

ethics standard, so that the public can get informed about the true picture of the company.

The major cost and drawback of the application of activity-based costing are stated as the

measurements which are required to adopt it. It is considered that the ABC system highly

demands management to predict and calculate the activity pools cost while to determine and

estimate the key cost drivers to deliver on the basis of cost allocation. In the case of fundamental

ABC system also, there is a need for major calculations to identify the actual costs of related

products or services (Van der Stede, 2016). It is proved that the whole process of measurement

and application of ABC system are expensive also its limits in regular updating of the rate of

activity costs (Schmidt, 2018). Furthermore, the ABC systems are not able to eradicate the

traditional costing system, due to the design, implement and maintenance which is highly cost

incremental as compared to the traditional system of the company. However, this makes the

application of the ABC system more costly, specifically for the small-size business. However,

contradictory and vague estimates of costs can create problem while the management urge to

consider precisely whether the products are profitable or are incurring losses.

CONCLUSION

On the basis of the above study, it has been concluded that in the traditional method of costing

the allocation is based on the single overhead rate, which is generally calculated by the direct

labour hours or the machine hours. On the other hand, activity-based costing uses the cost driver

for allocation of the overhead as per the activity associated with the product. Moreover, different

costing method results in different cost and profit analysis of the product. In the present study,

the company should implement the activity-based costing system in the organization, which

leads to more accurate and precise result so that management can take the right decisions. Along

with this accountant should follow the basic principles which are prescribed under the code of

ethics standard, so that the public can get informed about the true picture of the company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Oseifuah, E. K. (2018). Activity-based costing (ABC) in the public sector: benefits and

challenges. Management, 12, 4-2.

Arjmand, E. M., Shah, S. R., Edward Reece MD, E. M. B. A., Hollier Jr, L. H., Faryan Jalalabadi

BBA, M. D., Hoxworth, R. E., & Milewicz, A. L. (2018). COST ALLOCATION CAN

BE AS SIMPLE AS ABC. Physician Leadership Journal, 5(4), 34-38.

Al-Sayed, M., & Dugdale, D. (2016). Activity-based innovations in the UK manufacturing

sector: Extent, adoption process patterns and contingency factors. The British Accounting

Review, 48(1), 38-58.

Woodruff, J., (2018). The Disadvantages & Advantages of Activity-Based Costing [online].

Available through < https://smallbusiness.chron.com/disadvantages-advantages-activity-

based-costing-45096.html > [Accessed on 12 September 2018]

Schmidt, M., (2018). Activity-Based Costing and ABC Management [online]. Available through

< https://www.business-case-analysis.com/activity-based-costing.html> [Accessed on 12

September 2018]

Plank, P. (2018). Introduction. In Price and Product-Mix Decisions Under Different Cost

Systems (pp. 1-5). Springer Gabler, Wiesbaden.

Ax, C., & Greve, J. (2017). Adoption of management accounting innovations: Organizational

culture compatibility and perceived outcomes. Management Accounting Research, 34,

59-74.

Kihn, L. A., & Ihantola, E. M. (2015). Approaches to validation and evaluation in qualitative

studies of management accounting. Qualitative Research in Accounting &

Management, 12(3), 230-255.

Bromwich, M., & Scapens, R. W. (2016). Management accounting research: 25 years

on. Management Accounting Research, 31, 1-9.

Oseifuah, E. K. (2018). Activity-based costing (ABC) in the public sector: benefits and

challenges. Management, 12, 4-2.

Arjmand, E. M., Shah, S. R., Edward Reece MD, E. M. B. A., Hollier Jr, L. H., Faryan Jalalabadi

BBA, M. D., Hoxworth, R. E., & Milewicz, A. L. (2018). COST ALLOCATION CAN

BE AS SIMPLE AS ABC. Physician Leadership Journal, 5(4), 34-38.

Al-Sayed, M., & Dugdale, D. (2016). Activity-based innovations in the UK manufacturing

sector: Extent, adoption process patterns and contingency factors. The British Accounting

Review, 48(1), 38-58.

Woodruff, J., (2018). The Disadvantages & Advantages of Activity-Based Costing [online].

Available through < https://smallbusiness.chron.com/disadvantages-advantages-activity-

based-costing-45096.html > [Accessed on 12 September 2018]

Schmidt, M., (2018). Activity-Based Costing and ABC Management [online]. Available through

< https://www.business-case-analysis.com/activity-based-costing.html> [Accessed on 12

September 2018]

Plank, P. (2018). Introduction. In Price and Product-Mix Decisions Under Different Cost

Systems (pp. 1-5). Springer Gabler, Wiesbaden.

Ax, C., & Greve, J. (2017). Adoption of management accounting innovations: Organizational

culture compatibility and perceived outcomes. Management Accounting Research, 34,

59-74.

Kihn, L. A., & Ihantola, E. M. (2015). Approaches to validation and evaluation in qualitative

studies of management accounting. Qualitative Research in Accounting &

Management, 12(3), 230-255.

Bromwich, M., & Scapens, R. W. (2016). Management accounting research: 25 years

on. Management Accounting Research, 31, 1-9.

Lavia López, O., & Hiebl, M. R. (2014). Management accounting in small and medium-sized

enterprises: current knowledge and avenues for further research. Journal of Management

Accounting Research, 27(1), 81-119.

Van der Stede, W. A. (2016). Management accounting in context: Industry, regulation and

informatics. Management Accounting Research, 31, 100-102.

Shields, M. D. (2015). Established management accounting knowledge. Journal of Management

Accounting Research, 27(1), 123-132.

Kokubu, K., & Kitada, H. (2015). Material flow cost accounting and existing management

perspectives. Journal of Cleaner Production, 108, 1279-1288.

Van der Stede, W. A. (2015). Management accounting: Where from, where now, where

to?. Journal of Management Accounting Research, 27(1), 171-176.

enterprises: current knowledge and avenues for further research. Journal of Management

Accounting Research, 27(1), 81-119.

Van der Stede, W. A. (2016). Management accounting in context: Industry, regulation and

informatics. Management Accounting Research, 31, 100-102.

Shields, M. D. (2015). Established management accounting knowledge. Journal of Management

Accounting Research, 27(1), 123-132.

Kokubu, K., & Kitada, H. (2015). Material flow cost accounting and existing management

perspectives. Journal of Cleaner Production, 108, 1279-1288.

Van der Stede, W. A. (2015). Management accounting: Where from, where now, where

to?. Journal of Management Accounting Research, 27(1), 171-176.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.