Traditional Costing vs. ABC in Iran Tractor Forging Companies

VerifiedAdded on 2023/05/27

|10

|5886

|234

Literature Review

AI Summary

This literature review examines the adoption and implementation of Activity Based Costing (ABC) versus traditional cost accounting (TC) in Iranian forging companies of Iran Tractor manufacturing. The study analyzes archival data from 240 companies and interviews with engineers and industrial accounting experts, focusing on ten selected products. The research investigates whether there are significant differences in unit costs and gross profits between the two costing systems. The findings suggest no significant differences, leading to the rejection of sub-hypotheses related to cost and profit variations. The review also discusses the advantages and disadvantages of both ABC and traditional costing methods, highlighting the importance of considering factors such as cost, accuracy, and the specific needs of the organization when choosing a costing system. The paper concludes by referencing various studies that demonstrate the benefits of ABC/TC implementation across different industries, emphasizing the role of ABC in reengineering business processes and improving productivity and quality.

International Journal of Management Sciences and Business Research, Mar-2015 ISSN (2226-8235) Vol-4, Issue 3

http://www.ijmsbr.com Page 1

Comparative Study of Traditional and Activity-Based Costing in Forging

Companies of Iran Tractor.

Author’s Details:

(1)Dr. Mohammad Hassan Haddadi-Associated Professor, Department of Commercial

Management, Islamic Azad University, Julfa International Branch, Julfa, Azerbaijan

Sharqi, Iran.(2)Mir Javad Seyednezhad-Lecturer, Department of Accounting, Islamic

Azad University, Julfa International Branch, Julfa, Azerbaijan Sharqi, Iran.

Abstract:

The present study attempts to examine the impact/relationship between Activity Based Costing (ABC) adoption and

implementation versus Traditional Cost Accounting (TC) in Iranian forging companies of Iran tractor manufacturing.

Archival data were extracted from annual reports of 240 quoted companies in Iran for the year 2014. After conducting

an interviews with engineers and industrial accounting experts, all the products were classified according to weight

and by applying the sample method, only 10 kind of products were selected for the presented study. The results

showed that, (A) - there is no significant difference between cost of every unit according to TC and ABC system and

(B) - there is no significant difference between gross profit of every unit according to TC and ABC system. By

applying the statistical methods whit the help of Micro Soft Excel and SPSS software the results suggested that the

main hypothesis is confirmed and the sub-hypothesis Ha and Hb are rejected.

Keywords: Traditional Costing (TC), Activity Based Costing (ABC), Tractor Manufacturing, Forging Companies,

Management Accounting, Costing Systems.

Introduction

Activity Based Costing (ABC) adoption and

implementation versus traditional cost-accounting

have been widely researched in developed

countries. However, in developing countries like

I.R. of Iran, research regarding these issues in

general, and within the Iranian manufacturing of

forging company of Iran tractor in specific, is still

sadly limited. During the research we noticed that

at the end of 1960s and in early 1970s, some of

accounting researchers studied on the relationship

between activity and cost. But at the end of 1980s,

pursuant studies noticed that some factors like

profitability, competition at world level,

increasing customers’ satisfaction, emphasis on

products quality control and lowering costs were

taken as main Internal. The fact that costing

traditional systems not only cannot meet

managers’ needs but also using of the information

derived from these system in some cases causes

misleading and leads to making improper

decisions (Cooper and Slagmulder, 1997). By

following this trend, the increase of competitive

market that requires rational allocation of

production costs, a new system was introduced

under the title of activity based costing that was a

2-D system. Afterwards, it expressed costs

allocation from resources to activities and then

also from activities to cost objectives, that might

lead to presentation of useful information in order

to achieve corrected goals inside and outside the

organization. As a result, this technique may be

defined as follows (Szychta, 2010).

Kaplan and Johnson in a book titled Losses in

1987 introduced activity-based costing as an

alternative to traditional costing models. At that

time, traditional accounting models had failed to

provide information needed to calculate the cost

price of products and performance evaluation in

an environment with rapid technological changes,

intense competition, and information processing

revolution. Kaplan and Johnson's model was first

proposed in manufacturing companies to reduce

production costs. After the adoption of this model

by manufacturing companies, service industries

also took the model into account as an improved

method for calculating costs. The implementation of

the ABC and TC system has the following steps:

http://www.ijmsbr.com Page 1

Comparative Study of Traditional and Activity-Based Costing in Forging

Companies of Iran Tractor.

Author’s Details:

(1)Dr. Mohammad Hassan Haddadi-Associated Professor, Department of Commercial

Management, Islamic Azad University, Julfa International Branch, Julfa, Azerbaijan

Sharqi, Iran.(2)Mir Javad Seyednezhad-Lecturer, Department of Accounting, Islamic

Azad University, Julfa International Branch, Julfa, Azerbaijan Sharqi, Iran.

Abstract:

The present study attempts to examine the impact/relationship between Activity Based Costing (ABC) adoption and

implementation versus Traditional Cost Accounting (TC) in Iranian forging companies of Iran tractor manufacturing.

Archival data were extracted from annual reports of 240 quoted companies in Iran for the year 2014. After conducting

an interviews with engineers and industrial accounting experts, all the products were classified according to weight

and by applying the sample method, only 10 kind of products were selected for the presented study. The results

showed that, (A) - there is no significant difference between cost of every unit according to TC and ABC system and

(B) - there is no significant difference between gross profit of every unit according to TC and ABC system. By

applying the statistical methods whit the help of Micro Soft Excel and SPSS software the results suggested that the

main hypothesis is confirmed and the sub-hypothesis Ha and Hb are rejected.

Keywords: Traditional Costing (TC), Activity Based Costing (ABC), Tractor Manufacturing, Forging Companies,

Management Accounting, Costing Systems.

Introduction

Activity Based Costing (ABC) adoption and

implementation versus traditional cost-accounting

have been widely researched in developed

countries. However, in developing countries like

I.R. of Iran, research regarding these issues in

general, and within the Iranian manufacturing of

forging company of Iran tractor in specific, is still

sadly limited. During the research we noticed that

at the end of 1960s and in early 1970s, some of

accounting researchers studied on the relationship

between activity and cost. But at the end of 1980s,

pursuant studies noticed that some factors like

profitability, competition at world level,

increasing customers’ satisfaction, emphasis on

products quality control and lowering costs were

taken as main Internal. The fact that costing

traditional systems not only cannot meet

managers’ needs but also using of the information

derived from these system in some cases causes

misleading and leads to making improper

decisions (Cooper and Slagmulder, 1997). By

following this trend, the increase of competitive

market that requires rational allocation of

production costs, a new system was introduced

under the title of activity based costing that was a

2-D system. Afterwards, it expressed costs

allocation from resources to activities and then

also from activities to cost objectives, that might

lead to presentation of useful information in order

to achieve corrected goals inside and outside the

organization. As a result, this technique may be

defined as follows (Szychta, 2010).

Kaplan and Johnson in a book titled Losses in

1987 introduced activity-based costing as an

alternative to traditional costing models. At that

time, traditional accounting models had failed to

provide information needed to calculate the cost

price of products and performance evaluation in

an environment with rapid technological changes,

intense competition, and information processing

revolution. Kaplan and Johnson's model was first

proposed in manufacturing companies to reduce

production costs. After the adoption of this model

by manufacturing companies, service industries

also took the model into account as an improved

method for calculating costs. The implementation of

the ABC and TC system has the following steps:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

International Journal of Management Sciences and Business Research, Mar-2015 ISSN (2226-8235) Vol-4, Issue 3

http://www.ijmsbr.com Page 2

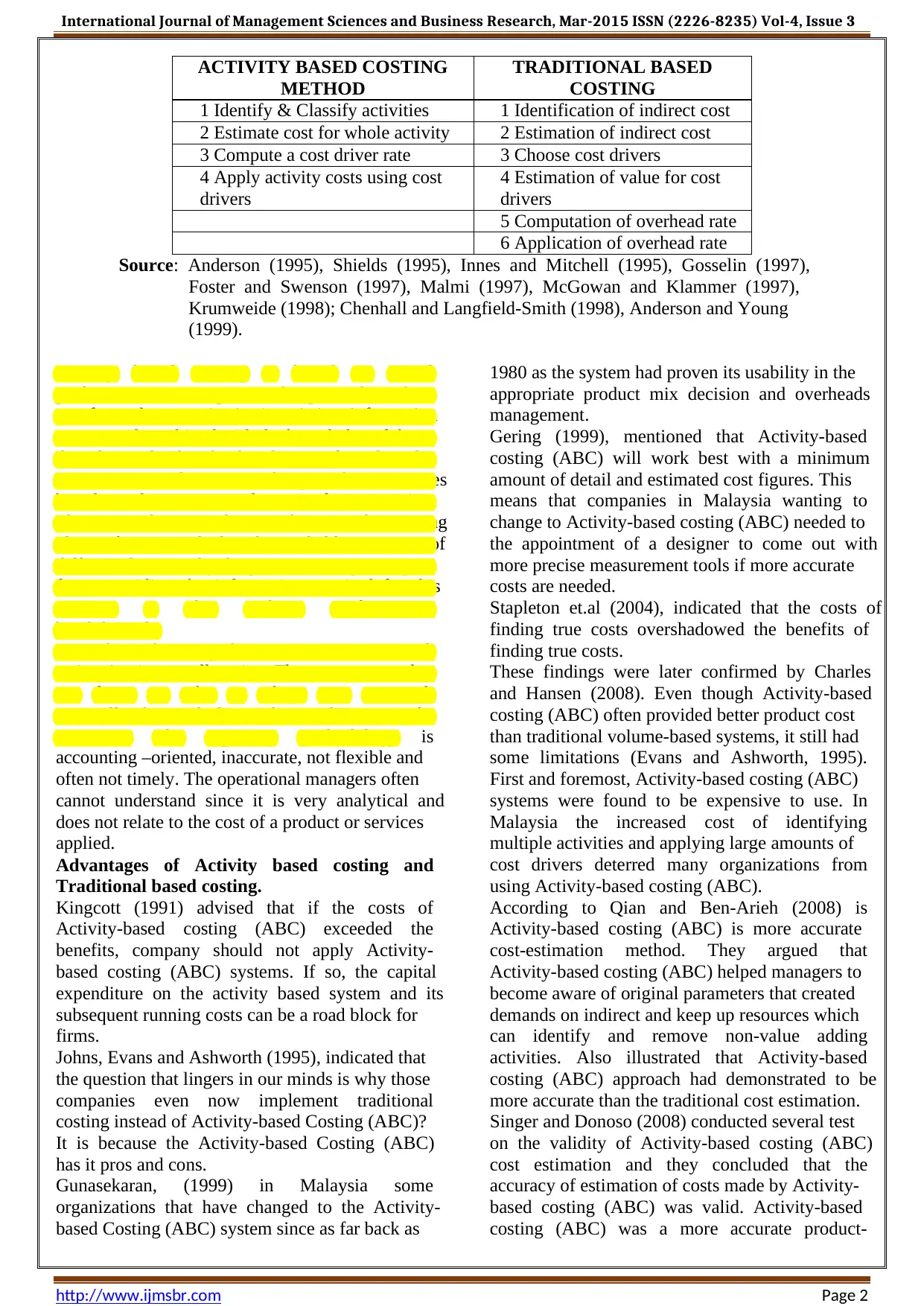

ACTIVITY BASED COSTING

METHOD

TRADITIONAL BASED

COSTING

1 Identify & Classify activities 1 Identification of indirect cost

2 Estimate cost for whole activity 2 Estimation of indirect cost

3 Compute a cost driver rate 3 Choose cost drivers

4 Apply activity costs using cost

drivers

4 Estimation of value for cost

drivers

5 Computation of overhead rate

6 Application of overhead rate

Source: Anderson (1995), Shields (1995), Innes and Mitchell (1995), Gosselin (1997),

Foster and Swenson (1997), Malmi (1997), McGowan and Klammer (1997),

Krumweide (1998); Chenhall and Langfield-Smith (1998), Anderson and Young

(1999).

Activity based costing is based on actual

performance, consumption and expense data taken

out from the organization‘s existing information

system and combined with the knowledge of those

directly involved in the distribution of goods and

services. Here the cost is designated to activities

based on the resources they use for processing.

The ABC also provides insights into the starting

place of costs and also the probable outcome of

different decisions by the process managers. Apart

from providing the information required for this

process, it also realizes performances

breakthrough.

In Traditional costing, there is a certain amount of

estimation in cost allocation. The cost systems do

not focus on why or where cost occurred.

Generally, there is little insight into the causes of

variances. The reporting methodology is

accounting –oriented, inaccurate, not flexible and

often not timely. The operational managers often

cannot understand since it is very analytical and

does not relate to the cost of a product or services

applied.

Advantages of Activity based costing and

Traditional based costing.

Kingcott (1991) advised that if the costs of

Activity-based costing (ABC) exceeded the

benefits, company should not apply Activity-

based costing (ABC) systems. If so, the capital

expenditure on the activity based system and its

subsequent running costs can be a road block for

firms.

Johns, Evans and Ashworth (1995), indicated that

the question that lingers in our minds is why those

companies even now implement traditional

costing instead of Activity-based Costing (ABC)?

It is because the Activity-based Costing (ABC)

has it pros and cons.

Gunasekaran, (1999) in Malaysia some

organizations that have changed to the Activity-

based Costing (ABC) system since as far back as

1980 as the system had proven its usability in the

appropriate product mix decision and overheads

management.

Gering (1999), mentioned that Activity-based

costing (ABC) will work best with a minimum

amount of detail and estimated cost figures. This

means that companies in Malaysia wanting to

change to Activity-based costing (ABC) needed to

the appointment of a designer to come out with

more precise measurement tools if more accurate

costs are needed.

Stapleton et.al (2004), indicated that the costs of

finding true costs overshadowed the benefits of

finding true costs.

These findings were later confirmed by Charles

and Hansen (2008). Even though Activity-based

costing (ABC) often provided better product cost

than traditional volume-based systems, it still had

some limitations (Evans and Ashworth, 1995).

First and foremost, Activity-based costing (ABC)

systems were found to be expensive to use. In

Malaysia the increased cost of identifying

multiple activities and applying large amounts of

cost drivers deterred many organizations from

using Activity-based costing (ABC).

According to Qian and Ben-Arieh (2008) is

Activity-based costing (ABC) is more accurate

cost-estimation method. They argued that

Activity-based costing (ABC) helped managers to

become aware of original parameters that created

demands on indirect and keep up resources which

can identify and remove non-value adding

activities. Also illustrated that Activity-based

costing (ABC) approach had demonstrated to be

more accurate than the traditional cost estimation.

Singer and Donoso (2008) conducted several test

on the validity of Activity-based costing (ABC)

cost estimation and they concluded that the

accuracy of estimation of costs made by Activity-

based costing (ABC) was valid. Activity-based

costing (ABC) was a more accurate product-

http://www.ijmsbr.com Page 2

ACTIVITY BASED COSTING

METHOD

TRADITIONAL BASED

COSTING

1 Identify & Classify activities 1 Identification of indirect cost

2 Estimate cost for whole activity 2 Estimation of indirect cost

3 Compute a cost driver rate 3 Choose cost drivers

4 Apply activity costs using cost

drivers

4 Estimation of value for cost

drivers

5 Computation of overhead rate

6 Application of overhead rate

Source: Anderson (1995), Shields (1995), Innes and Mitchell (1995), Gosselin (1997),

Foster and Swenson (1997), Malmi (1997), McGowan and Klammer (1997),

Krumweide (1998); Chenhall and Langfield-Smith (1998), Anderson and Young

(1999).

Activity based costing is based on actual

performance, consumption and expense data taken

out from the organization‘s existing information

system and combined with the knowledge of those

directly involved in the distribution of goods and

services. Here the cost is designated to activities

based on the resources they use for processing.

The ABC also provides insights into the starting

place of costs and also the probable outcome of

different decisions by the process managers. Apart

from providing the information required for this

process, it also realizes performances

breakthrough.

In Traditional costing, there is a certain amount of

estimation in cost allocation. The cost systems do

not focus on why or where cost occurred.

Generally, there is little insight into the causes of

variances. The reporting methodology is

accounting –oriented, inaccurate, not flexible and

often not timely. The operational managers often

cannot understand since it is very analytical and

does not relate to the cost of a product or services

applied.

Advantages of Activity based costing and

Traditional based costing.

Kingcott (1991) advised that if the costs of

Activity-based costing (ABC) exceeded the

benefits, company should not apply Activity-

based costing (ABC) systems. If so, the capital

expenditure on the activity based system and its

subsequent running costs can be a road block for

firms.

Johns, Evans and Ashworth (1995), indicated that

the question that lingers in our minds is why those

companies even now implement traditional

costing instead of Activity-based Costing (ABC)?

It is because the Activity-based Costing (ABC)

has it pros and cons.

Gunasekaran, (1999) in Malaysia some

organizations that have changed to the Activity-

based Costing (ABC) system since as far back as

1980 as the system had proven its usability in the

appropriate product mix decision and overheads

management.

Gering (1999), mentioned that Activity-based

costing (ABC) will work best with a minimum

amount of detail and estimated cost figures. This

means that companies in Malaysia wanting to

change to Activity-based costing (ABC) needed to

the appointment of a designer to come out with

more precise measurement tools if more accurate

costs are needed.

Stapleton et.al (2004), indicated that the costs of

finding true costs overshadowed the benefits of

finding true costs.

These findings were later confirmed by Charles

and Hansen (2008). Even though Activity-based

costing (ABC) often provided better product cost

than traditional volume-based systems, it still had

some limitations (Evans and Ashworth, 1995).

First and foremost, Activity-based costing (ABC)

systems were found to be expensive to use. In

Malaysia the increased cost of identifying

multiple activities and applying large amounts of

cost drivers deterred many organizations from

using Activity-based costing (ABC).

According to Qian and Ben-Arieh (2008) is

Activity-based costing (ABC) is more accurate

cost-estimation method. They argued that

Activity-based costing (ABC) helped managers to

become aware of original parameters that created

demands on indirect and keep up resources which

can identify and remove non-value adding

activities. Also illustrated that Activity-based

costing (ABC) approach had demonstrated to be

more accurate than the traditional cost estimation.

Singer and Donoso (2008) conducted several test

on the validity of Activity-based costing (ABC)

cost estimation and they concluded that the

accuracy of estimation of costs made by Activity-

based costing (ABC) was valid. Activity-based

costing (ABC) was a more accurate product-

International Journal of Management Sciences and Business Research, Mar-2015 ISSN (2226-8235) Vol-4, Issue 3

http://www.ijmsbr.com Page 3

costing system than traditional volume-based

costing systems especially when organizations

were facing higher product diversity.

Disadvantage of Activity Based costing and

Traditional Costing method

The disadvantage of traditional costing systems is

that they do not present nonfinancial information

about Small and Medium Enterprises (SMEs). The

traditional costing systems provided trivial

information regarding the factors that was

significant to the customers like quality and

service. A traditional based costing system

typically uses a single overhead pool that is a

single collection of costs that are not directly

peculiar as product part costs or as labor. This

would comprise of supply and maintenance

expenses, allotment of management salaries,

Depreciation, etc.

However, Cooper and Kaplan, (1991) Activity-

based costing (ABC) had emerged as a

tremendously useful guide to management action

that translated directly into higher profits.

Another disadvantage mentioned by Noreen

(1991) is that Activity based costing (ABC)

implementation provided beneficial results only

under specific conditions.

Datar and Gupta, (1994), indicated that the

disadvantage of Activity-based costing (ABC)

was that it increased the frequency of errors in

product cost measurement through increasing in

number of cost pools and improvement in

specification of cost bases.

Evan and Ashworth (1995) claimed that although

more overhead costs can be allocated straight to

products via ABC’s multiple activity cost pools,

but, some overhead cost remained to be dispensed

with the help of some arbitrary volume based cost

driver like machine or labor hours.

Carolfi (1996) claimed that Activity-based costing

(ABC) allowed managers to get rid of costs

related to non-value added activities and develop

the efficiencies of present development since

Activity-based costing (ABC) offered better

visibility into business development and their cost

drivers.

Another study conducted by McGowan and

Klammer (1997) suggested that many Activity-

based costing (ABC) adopters had abandoned

their implementations and this raised concerns on

the potential impact of Activity-based costing

(ABC) on performance.

Furthermore, Gunasekaran, Marri and Grieve,

(1999) traditional costing systems show that only

financial information while non-financial

information like defect rates and throughput rates

in each activity was beyond the capacity of

traditional costing systems. At first, managers

viewed Activity-based costing (ABC) approach as

a more accurate way of calculating product costs.

According to Dickinson and Lere (2003), one of

the most significant weaknesses of the traditional

costing method is that the cost of a sales

representative’s engaging in non-standard selling

activities is frequently excluded from his/her. Also

has mentioned that in order to comprehend the

potential power of Activity-based costing (ABC)

cost data in pricing, it is important to comprehend

how Activity-based costing (ABC) cost data is

different in contrast to the traditional method. The

attribute of Activity-based costing (ABC) is that it

does not vary with volume; however it may differ

with some other measure of activity. Activity-

based costing (ABC) recognizes that activities

cause cost.

Review of Literature

There are many studies that demonstrate the

benefits of ABC/TC implementation in different

manufacturing/service industries.

Keegan and Eiler, (1994) they stated that, the

increased knowledge of cost drivers has prompted

many companies to reengineer their business

processes by monitoring each of their processes

and then, eliminating (or improving) the processes

which are non-value added.

Evans and Ashworth, (1995), there are many

advantages and disadvantages of Activity-based

costing (ABC) as pointed out in the literature

review. The main disadvantages or limitations of

Activity-based costing (ABC) is that it is

expensive to use.

Andrade, Filho, Maia and Qassim (1997), found

that Activity-based costing (ABC) is being

extensively implemented as an alternative to

traditional costing.

Gunasekaran and Sarhadi (1998) discussed

different issues associated with the

implementation of ABC in manufacturing. They

explained that new productivity and quality

improvement strategies could increase in the

awareness of ABC in present day manufacturing

organizations and an appropriate framework for

the management of productivity and quality.

According to Ray H. Garrison and Eric W.

Noreen, (1999) there are six basic steps required

to implement an ABC system: (A). Identify and

define activities and activity pools, (B). Directly

trace costs to activities (to the extent feasible),

(C). Assign costs to activity cost pools, (D).

http://www.ijmsbr.com Page 3

costing system than traditional volume-based

costing systems especially when organizations

were facing higher product diversity.

Disadvantage of Activity Based costing and

Traditional Costing method

The disadvantage of traditional costing systems is

that they do not present nonfinancial information

about Small and Medium Enterprises (SMEs). The

traditional costing systems provided trivial

information regarding the factors that was

significant to the customers like quality and

service. A traditional based costing system

typically uses a single overhead pool that is a

single collection of costs that are not directly

peculiar as product part costs or as labor. This

would comprise of supply and maintenance

expenses, allotment of management salaries,

Depreciation, etc.

However, Cooper and Kaplan, (1991) Activity-

based costing (ABC) had emerged as a

tremendously useful guide to management action

that translated directly into higher profits.

Another disadvantage mentioned by Noreen

(1991) is that Activity based costing (ABC)

implementation provided beneficial results only

under specific conditions.

Datar and Gupta, (1994), indicated that the

disadvantage of Activity-based costing (ABC)

was that it increased the frequency of errors in

product cost measurement through increasing in

number of cost pools and improvement in

specification of cost bases.

Evan and Ashworth (1995) claimed that although

more overhead costs can be allocated straight to

products via ABC’s multiple activity cost pools,

but, some overhead cost remained to be dispensed

with the help of some arbitrary volume based cost

driver like machine or labor hours.

Carolfi (1996) claimed that Activity-based costing

(ABC) allowed managers to get rid of costs

related to non-value added activities and develop

the efficiencies of present development since

Activity-based costing (ABC) offered better

visibility into business development and their cost

drivers.

Another study conducted by McGowan and

Klammer (1997) suggested that many Activity-

based costing (ABC) adopters had abandoned

their implementations and this raised concerns on

the potential impact of Activity-based costing

(ABC) on performance.

Furthermore, Gunasekaran, Marri and Grieve,

(1999) traditional costing systems show that only

financial information while non-financial

information like defect rates and throughput rates

in each activity was beyond the capacity of

traditional costing systems. At first, managers

viewed Activity-based costing (ABC) approach as

a more accurate way of calculating product costs.

According to Dickinson and Lere (2003), one of

the most significant weaknesses of the traditional

costing method is that the cost of a sales

representative’s engaging in non-standard selling

activities is frequently excluded from his/her. Also

has mentioned that in order to comprehend the

potential power of Activity-based costing (ABC)

cost data in pricing, it is important to comprehend

how Activity-based costing (ABC) cost data is

different in contrast to the traditional method. The

attribute of Activity-based costing (ABC) is that it

does not vary with volume; however it may differ

with some other measure of activity. Activity-

based costing (ABC) recognizes that activities

cause cost.

Review of Literature

There are many studies that demonstrate the

benefits of ABC/TC implementation in different

manufacturing/service industries.

Keegan and Eiler, (1994) they stated that, the

increased knowledge of cost drivers has prompted

many companies to reengineer their business

processes by monitoring each of their processes

and then, eliminating (or improving) the processes

which are non-value added.

Evans and Ashworth, (1995), there are many

advantages and disadvantages of Activity-based

costing (ABC) as pointed out in the literature

review. The main disadvantages or limitations of

Activity-based costing (ABC) is that it is

expensive to use.

Andrade, Filho, Maia and Qassim (1997), found

that Activity-based costing (ABC) is being

extensively implemented as an alternative to

traditional costing.

Gunasekaran and Sarhadi (1998) discussed

different issues associated with the

implementation of ABC in manufacturing. They

explained that new productivity and quality

improvement strategies could increase in the

awareness of ABC in present day manufacturing

organizations and an appropriate framework for

the management of productivity and quality.

According to Ray H. Garrison and Eric W.

Noreen, (1999) there are six basic steps required

to implement an ABC system: (A). Identify and

define activities and activity pools, (B). Directly

trace costs to activities (to the extent feasible),

(C). Assign costs to activity cost pools, (D).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

International Journal of Management Sciences and Business Research, Mar-2015 ISSN (2226-8235) Vol-4, Issue 3

http://www.ijmsbr.com Page 4

Calculate activity rates, (E). Assign costs to cost

objects using the activity rates and activity

measures previously determined and (F). Prepare

and distribute management reports.

Gupta and Galloway (2003) introduced ABC/TC

as a supportive information system in operations

decision making processes such as, product

planning, product design, quality management,

process design, process improvement, inventory

management, and investment management.

Maliah, Nik Nazli and Norhayati, (2004),

mentioned that the cost allocation in traditional

costing was based on labour hours or machine

hours which are hard to reveal the actual cause

and effective relationship between indirect costs

and individual products.

Tsai and Kuo, (2004) studies shows in order to

address the problems of traditional cost systems,

companies reengineer their accounting systems by

incorporating their understanding of cost drivers

and applying these drivers to the cost of products

in proportion to the volume of activity that a

product consumes.

Hassanzadeh and Seyednejad (2007), in a study

entitled "A comparative analysis of traditional

costing and activity-based costing in Iran Tractor

Manufacturing Forging Company", explored two

concepts of traditional costing and activity-based

costing. The results of this study suggested that

there is no significant difference between the cost

prices calculated based on activity-based costing

and traditional costing.

Zanjirdar and Partani (2008), in a research entitled

"Analysis of the implementation of activity-based

costing systems in small and medium enterprises"

provided a background on activity-based costing

in small and medium enterprises and introduced a

framework in order to justify and implement

activity-based costing in in small and medium

enterprises.

Charles (2008) also pointed out that the approach of

Activity-based costing (ABC) is trying to allocate

overhead costs to cost objects more precise than

traditional cost systems or traditional costing.

Rezaie et al. (2008) used ABC approach together

with traditional costing (TC) for parts costing in

flexible manufacturing systems (FMS) with the

A(2) level of automation. They presented a new

model for the implementation of ABC based on

the product cost tree concept. In their work, they

first recorded the required resources and activities

for each part and then their expenses were

measured based on some scales. The model was

used in a forging industry. They reported that

ABC outputs were more reliable than the TC

outputs, and recommend using ABC approach.

Devinaga Rasiah, (2011) stated that, this is mainly

because no matter what costing method, all of

them do have their pros and cons. It’s important

for the organizations in Malaysia to know clearly

what they require prior to deciding on which

costing method to use. Organizations need to

study the pros and cons of each costing method to

know which one was more appropriate for their

organization. There is no such thing as the best

costing method; there is only the most suitable

costing method to use.

Devinaga, Rasiah, (2011), Why Activity Based

Costing (ABC) is still tagging behind the

traditional costing in Malaysia?, Journal of

Applied Finance & Banking, International

Scientific Press, vol.1, no.1, 83-106.

Batool Hasani and Younos Vakilalroaia (2013)

presented an empirical investigation to estimate

the cost of power station construction project

located in city of Zanjan, Iran based on the

implementation of both traditional as well as ABC

method. The project consisted of six components

namely the cost of purchasing equipment, buying

transformers, engineering services, construction,

laboratory services and purchase of land. The

results indicated that ABC method was able to

find better cost estimation compared with

traditional method. ABC method is generally

recommended when overhead costs are significant

compared with total cost. Therefore, they

recommend using ABC method only when the

cost of computation is negligible compared with

the results of ABC implementation.

The problem of the Research

In Islamic Republic of Iran, many companies are

still using the traditional based costing or using

some other methods of costing.

Objective of the study

The objectives of the research are as follows:

1. To compare the Activity-based costing (ABC)

with traditional costing.

2. To find out why activity based costing is still

lacking behind the traditional based costing in

Iran.

Research Question

The research question addressed in the present

study was as follows:

Does the implementation of activity-based costing

system versus Traditional Cost Accounting (TC)

in Iranian forging companies of Iran tractor

http://www.ijmsbr.com Page 4

Calculate activity rates, (E). Assign costs to cost

objects using the activity rates and activity

measures previously determined and (F). Prepare

and distribute management reports.

Gupta and Galloway (2003) introduced ABC/TC

as a supportive information system in operations

decision making processes such as, product

planning, product design, quality management,

process design, process improvement, inventory

management, and investment management.

Maliah, Nik Nazli and Norhayati, (2004),

mentioned that the cost allocation in traditional

costing was based on labour hours or machine

hours which are hard to reveal the actual cause

and effective relationship between indirect costs

and individual products.

Tsai and Kuo, (2004) studies shows in order to

address the problems of traditional cost systems,

companies reengineer their accounting systems by

incorporating their understanding of cost drivers

and applying these drivers to the cost of products

in proportion to the volume of activity that a

product consumes.

Hassanzadeh and Seyednejad (2007), in a study

entitled "A comparative analysis of traditional

costing and activity-based costing in Iran Tractor

Manufacturing Forging Company", explored two

concepts of traditional costing and activity-based

costing. The results of this study suggested that

there is no significant difference between the cost

prices calculated based on activity-based costing

and traditional costing.

Zanjirdar and Partani (2008), in a research entitled

"Analysis of the implementation of activity-based

costing systems in small and medium enterprises"

provided a background on activity-based costing

in small and medium enterprises and introduced a

framework in order to justify and implement

activity-based costing in in small and medium

enterprises.

Charles (2008) also pointed out that the approach of

Activity-based costing (ABC) is trying to allocate

overhead costs to cost objects more precise than

traditional cost systems or traditional costing.

Rezaie et al. (2008) used ABC approach together

with traditional costing (TC) for parts costing in

flexible manufacturing systems (FMS) with the

A(2) level of automation. They presented a new

model for the implementation of ABC based on

the product cost tree concept. In their work, they

first recorded the required resources and activities

for each part and then their expenses were

measured based on some scales. The model was

used in a forging industry. They reported that

ABC outputs were more reliable than the TC

outputs, and recommend using ABC approach.

Devinaga Rasiah, (2011) stated that, this is mainly

because no matter what costing method, all of

them do have their pros and cons. It’s important

for the organizations in Malaysia to know clearly

what they require prior to deciding on which

costing method to use. Organizations need to

study the pros and cons of each costing method to

know which one was more appropriate for their

organization. There is no such thing as the best

costing method; there is only the most suitable

costing method to use.

Devinaga, Rasiah, (2011), Why Activity Based

Costing (ABC) is still tagging behind the

traditional costing in Malaysia?, Journal of

Applied Finance & Banking, International

Scientific Press, vol.1, no.1, 83-106.

Batool Hasani and Younos Vakilalroaia (2013)

presented an empirical investigation to estimate

the cost of power station construction project

located in city of Zanjan, Iran based on the

implementation of both traditional as well as ABC

method. The project consisted of six components

namely the cost of purchasing equipment, buying

transformers, engineering services, construction,

laboratory services and purchase of land. The

results indicated that ABC method was able to

find better cost estimation compared with

traditional method. ABC method is generally

recommended when overhead costs are significant

compared with total cost. Therefore, they

recommend using ABC method only when the

cost of computation is negligible compared with

the results of ABC implementation.

The problem of the Research

In Islamic Republic of Iran, many companies are

still using the traditional based costing or using

some other methods of costing.

Objective of the study

The objectives of the research are as follows:

1. To compare the Activity-based costing (ABC)

with traditional costing.

2. To find out why activity based costing is still

lacking behind the traditional based costing in

Iran.

Research Question

The research question addressed in the present

study was as follows:

Does the implementation of activity-based costing

system versus Traditional Cost Accounting (TC)

in Iranian forging companies of Iran tractor

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

International Journal of Management Sciences and Business Research, Mar-2015 ISSN (2226-8235) Vol-4, Issue 3

http://www.ijmsbr.com Page 5

manufacturing improve the relevance and

usefulness of cost information for the managing

decision makers?

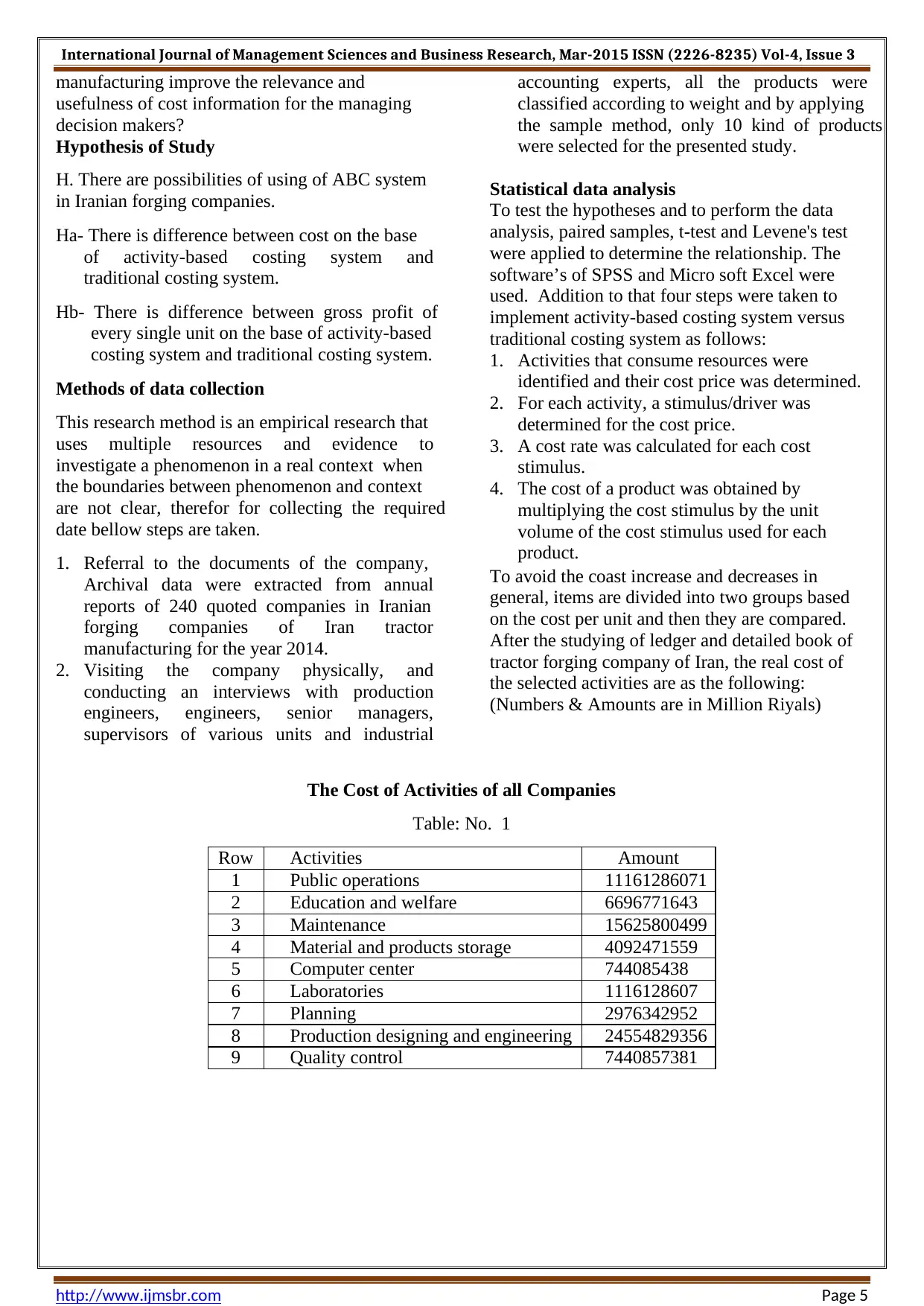

Hypothesis of Study

H. There are possibilities of using of ABC system

in Iranian forging companies.

Ha- There is difference between cost on the base

of activity-based costing system and

traditional costing system.

Hb- There is difference between gross profit of

every single unit on the base of activity-based

costing system and traditional costing system.

Methods of data collection

This research method is an empirical research that

uses multiple resources and evidence to

investigate a phenomenon in a real context when

the boundaries between phenomenon and context

are not clear, therefor for collecting the required

date bellow steps are taken.

1. Referral to the documents of the company,

Archival data were extracted from annual

reports of 240 quoted companies in Iranian

forging companies of Iran tractor

manufacturing for the year 2014.

2. Visiting the company physically, and

conducting an interviews with production

engineers, engineers, senior managers,

supervisors of various units and industrial

accounting experts, all the products were

classified according to weight and by applying

the sample method, only 10 kind of products

were selected for the presented study.

Statistical data analysis

To test the hypotheses and to perform the data

analysis, paired samples, t-test and Levene's test

were applied to determine the relationship. The

software’s of SPSS and Micro soft Excel were

used. Addition to that four steps were taken to

implement activity-based costing system versus

traditional costing system as follows:

1. Activities that consume resources were

identified and their cost price was determined.

2. For each activity, a stimulus/driver was

determined for the cost price.

3. A cost rate was calculated for each cost

stimulus.

4. The cost of a product was obtained by

multiplying the cost stimulus by the unit

volume of the cost stimulus used for each

product.

To avoid the coast increase and decreases in

general, items are divided into two groups based

on the cost per unit and then they are compared.

After the studying of ledger and detailed book of

tractor forging company of Iran, the real cost of

the selected activities are as the following:

(Numbers & Amounts are in Million Riyals)

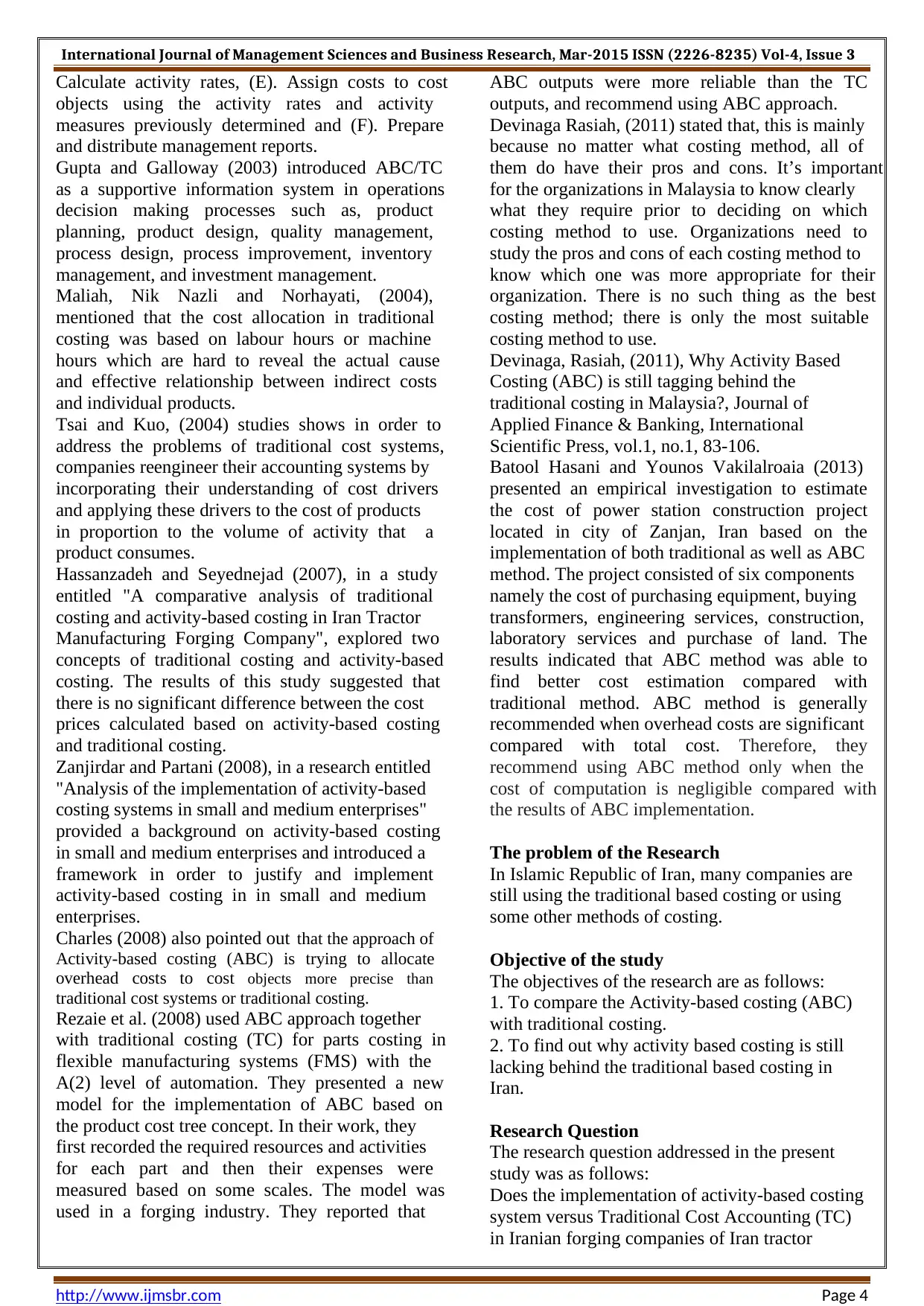

The Cost of Activities of all Companies

Table: No. 1

Row Activities Amount

1 Public operations 11161286071

2 Education and welfare 6696771643

3 Maintenance 15625800499

4 Material and products storage 4092471559

5 Computer center 744085438

6 Laboratories 1116128607

7 Planning 2976342952

8 Production designing and engineering 24554829356

9 Quality control 7440857381

http://www.ijmsbr.com Page 5

manufacturing improve the relevance and

usefulness of cost information for the managing

decision makers?

Hypothesis of Study

H. There are possibilities of using of ABC system

in Iranian forging companies.

Ha- There is difference between cost on the base

of activity-based costing system and

traditional costing system.

Hb- There is difference between gross profit of

every single unit on the base of activity-based

costing system and traditional costing system.

Methods of data collection

This research method is an empirical research that

uses multiple resources and evidence to

investigate a phenomenon in a real context when

the boundaries between phenomenon and context

are not clear, therefor for collecting the required

date bellow steps are taken.

1. Referral to the documents of the company,

Archival data were extracted from annual

reports of 240 quoted companies in Iranian

forging companies of Iran tractor

manufacturing for the year 2014.

2. Visiting the company physically, and

conducting an interviews with production

engineers, engineers, senior managers,

supervisors of various units and industrial

accounting experts, all the products were

classified according to weight and by applying

the sample method, only 10 kind of products

were selected for the presented study.

Statistical data analysis

To test the hypotheses and to perform the data

analysis, paired samples, t-test and Levene's test

were applied to determine the relationship. The

software’s of SPSS and Micro soft Excel were

used. Addition to that four steps were taken to

implement activity-based costing system versus

traditional costing system as follows:

1. Activities that consume resources were

identified and their cost price was determined.

2. For each activity, a stimulus/driver was

determined for the cost price.

3. A cost rate was calculated for each cost

stimulus.

4. The cost of a product was obtained by

multiplying the cost stimulus by the unit

volume of the cost stimulus used for each

product.

To avoid the coast increase and decreases in

general, items are divided into two groups based

on the cost per unit and then they are compared.

After the studying of ledger and detailed book of

tractor forging company of Iran, the real cost of

the selected activities are as the following:

(Numbers & Amounts are in Million Riyals)

The Cost of Activities of all Companies

Table: No. 1

Row Activities Amount

1 Public operations 11161286071

2 Education and welfare 6696771643

3 Maintenance 15625800499

4 Material and products storage 4092471559

5 Computer center 744085438

6 Laboratories 1116128607

7 Planning 2976342952

8 Production designing and engineering 24554829356

9 Quality control 7440857381

International Journal of Management Sciences and Business Research, Mar-2015 ISSN (2226-8235) Vol-4, Issue 3

http://www.ijmsbr.com Page 6

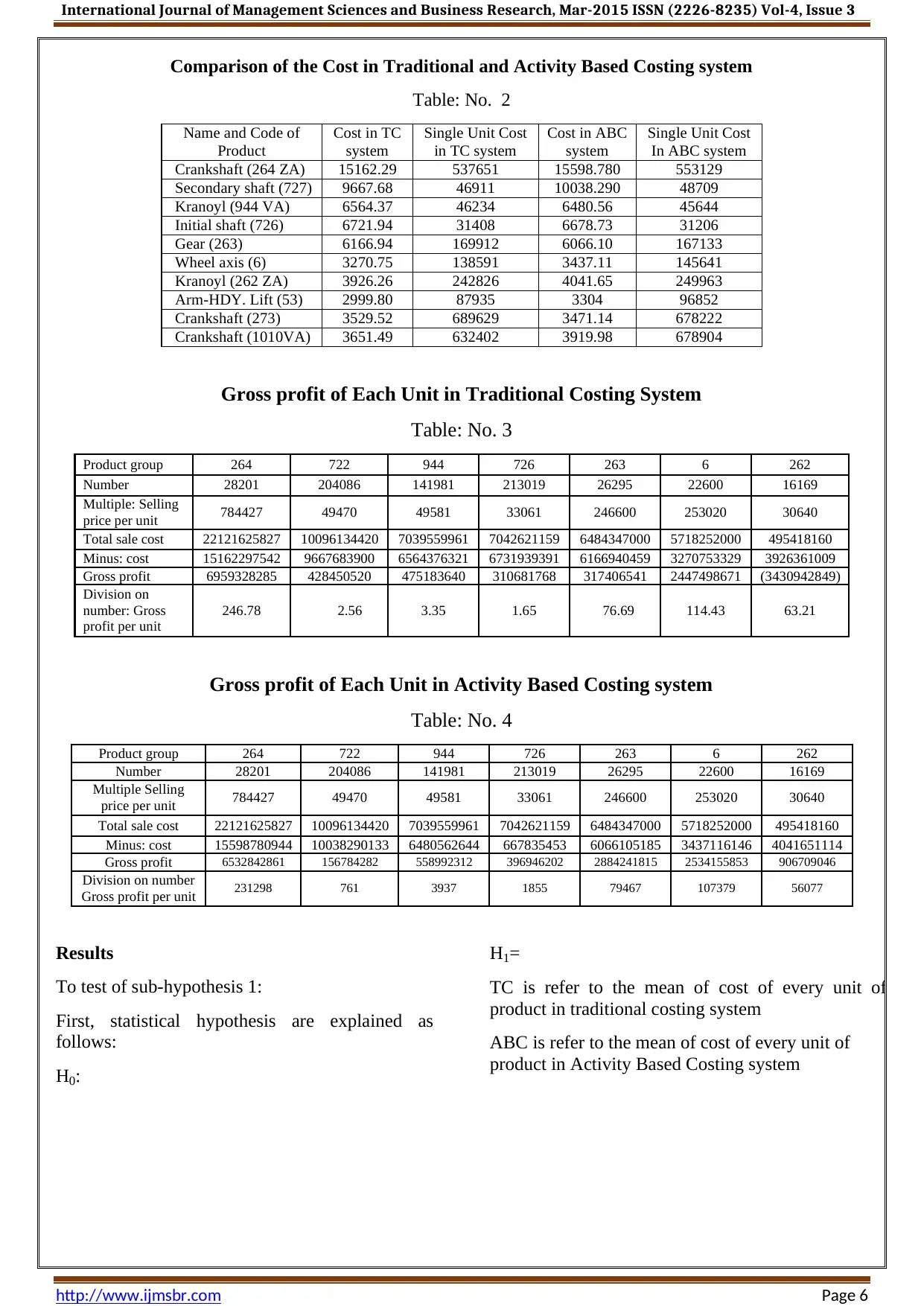

Comparison of the Cost in Traditional and Activity Based Costing system

Table: No. 2

Name and Code of

Product

Cost in TC

system

Single Unit Cost

in TC system

Cost in ABC

system

Single Unit Cost

In ABC system

Crankshaft (264 ZA) 15162.29 537651 15598.780 553129

Secondary shaft (727) 9667.68 46911 10038.290 48709

Kranoyl (944 VA) 6564.37 46234 6480.56 45644

Initial shaft (726) 6721.94 31408 6678.73 31206

Gear (263) 6166.94 169912 6066.10 167133

Wheel axis (6) 3270.75 138591 3437.11 145641

Kranoyl (262 ZA) 3926.26 242826 4041.65 249963

Arm-HDY. Lift (53) 2999.80 87935 3304 96852

Crankshaft (273) 3529.52 689629 3471.14 678222

Crankshaft (1010VA) 3651.49 632402 3919.98 678904

Gross profit of Each Unit in Traditional Costing System

Table: No. 3

Product group 264 722 944 726 263 6 262

Number 28201 204086 141981 213019 26295 22600 16169

Multiple: Selling

price per unit 784427 49470 49581 33061 246600 253020 30640

Total sale cost 22121625827 10096134420 7039559961 7042621159 6484347000 5718252000 495418160

Minus: cost 15162297542 9667683900 6564376321 6731939391 6166940459 3270753329 3926361009

Gross profit 6959328285 428450520 475183640 310681768 317406541 2447498671 (3430942849)

Division on

number: Gross

profit per unit

246.78 2.56 3.35 1.65 76.69 114.43 63.21

Gross profit of Each Unit in Activity Based Costing system

Table: No. 4

Product group 264 722 944 726 263 6 262

Number 28201 204086 141981 213019 26295 22600 16169

Multiple Selling

price per unit 784427 49470 49581 33061 246600 253020 30640

Total sale cost 22121625827 10096134420 7039559961 7042621159 6484347000 5718252000 495418160

Minus: cost 15598780944 10038290133 6480562644 667835453 6066105185 3437116146 4041651114

Gross profit 6532842861 156784282 558992312 396946202 2884241815 2534155853 906709046

Division on number

Gross profit per unit 231298 761 3937 1855 79467 107379 56077

Results

To test of sub-hypothesis 1:

First, statistical hypothesis are explained as

follows:

H0:

H1=

TC is refer to the mean of cost of every unit of

product in traditional costing system

ABC is refer to the mean of cost of every unit of

product in Activity Based Costing system

http://www.ijmsbr.com Page 6

Comparison of the Cost in Traditional and Activity Based Costing system

Table: No. 2

Name and Code of

Product

Cost in TC

system

Single Unit Cost

in TC system

Cost in ABC

system

Single Unit Cost

In ABC system

Crankshaft (264 ZA) 15162.29 537651 15598.780 553129

Secondary shaft (727) 9667.68 46911 10038.290 48709

Kranoyl (944 VA) 6564.37 46234 6480.56 45644

Initial shaft (726) 6721.94 31408 6678.73 31206

Gear (263) 6166.94 169912 6066.10 167133

Wheel axis (6) 3270.75 138591 3437.11 145641

Kranoyl (262 ZA) 3926.26 242826 4041.65 249963

Arm-HDY. Lift (53) 2999.80 87935 3304 96852

Crankshaft (273) 3529.52 689629 3471.14 678222

Crankshaft (1010VA) 3651.49 632402 3919.98 678904

Gross profit of Each Unit in Traditional Costing System

Table: No. 3

Product group 264 722 944 726 263 6 262

Number 28201 204086 141981 213019 26295 22600 16169

Multiple: Selling

price per unit 784427 49470 49581 33061 246600 253020 30640

Total sale cost 22121625827 10096134420 7039559961 7042621159 6484347000 5718252000 495418160

Minus: cost 15162297542 9667683900 6564376321 6731939391 6166940459 3270753329 3926361009

Gross profit 6959328285 428450520 475183640 310681768 317406541 2447498671 (3430942849)

Division on

number: Gross

profit per unit

246.78 2.56 3.35 1.65 76.69 114.43 63.21

Gross profit of Each Unit in Activity Based Costing system

Table: No. 4

Product group 264 722 944 726 263 6 262

Number 28201 204086 141981 213019 26295 22600 16169

Multiple Selling

price per unit 784427 49470 49581 33061 246600 253020 30640

Total sale cost 22121625827 10096134420 7039559961 7042621159 6484347000 5718252000 495418160

Minus: cost 15598780944 10038290133 6480562644 667835453 6066105185 3437116146 4041651114

Gross profit 6532842861 156784282 558992312 396946202 2884241815 2534155853 906709046

Division on number

Gross profit per unit 231298 761 3937 1855 79467 107379 56077

Results

To test of sub-hypothesis 1:

First, statistical hypothesis are explained as

follows:

H0:

H1=

TC is refer to the mean of cost of every unit of

product in traditional costing system

ABC is refer to the mean of cost of every unit of

product in Activity Based Costing system

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

International Journal of Management Sciences and Business Research, Mar-2015 ISSN (2226-8235) Vol-4, Issue 3

http://www.ijmsbr.com Page 7

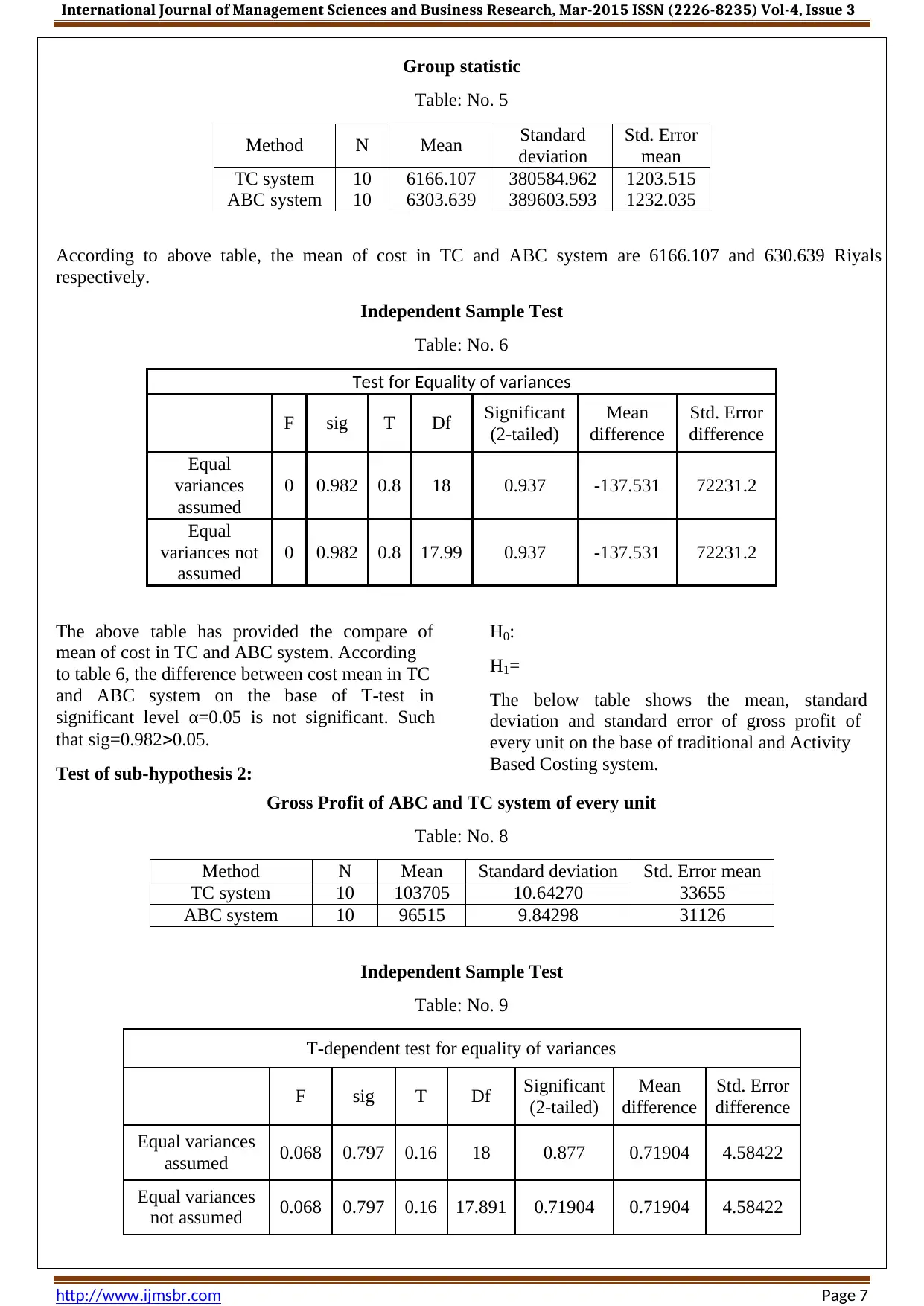

Group statistic

Table: No. 5

Method N Mean Standard

deviation

Std. Error

mean

TC system

ABC system

10

10

6166.107

6303.639

380584.962

389603.593

1203.515

1232.035

According to above table, the mean of cost in TC and ABC system are 6166.107 and 630.639 Riyals

respectively.

Independent Sample Test

Table: No. 6

Test for Equality of variances

F sig T Df Significant

(2-tailed)

Mean

difference

Std. Error

difference

Equal

variances

assumed

0 0.982 0.8 18 0.937 -137.531 72231.2

Equal

variances not

assumed

0 0.982 0.8 17.99 0.937 -137.531 72231.2

The above table has provided the compare of

mean of cost in TC and ABC system. According

to table 6, the difference between cost mean in TC

and ABC system on the base of T-test in

significant level α=0.05 is not significant. Such

that sig=0.9820.05.

Test of sub-hypothesis 2:

H0:

H1=

The below table shows the mean, standard

deviation and standard error of gross profit of

every unit on the base of traditional and Activity

Based Costing system.

Gross Profit of ABC and TC system of every unit

Table: No. 8

Method N Mean Standard deviation Std. Error mean

TC system 10 103705 10.64270 33655

ABC system 10 96515 9.84298 31126

Independent Sample Test

Table: No. 9

T-dependent test for equality of variances

F sig T Df Significant

(2-tailed)

Mean

difference

Std. Error

difference

Equal variances

assumed 0.068 0.797 0.16 18 0.877 0.71904 4.58422

Equal variances

not assumed 0.068 0.797 0.16 17.891 0.71904 0.71904 4.58422

http://www.ijmsbr.com Page 7

Group statistic

Table: No. 5

Method N Mean Standard

deviation

Std. Error

mean

TC system

ABC system

10

10

6166.107

6303.639

380584.962

389603.593

1203.515

1232.035

According to above table, the mean of cost in TC and ABC system are 6166.107 and 630.639 Riyals

respectively.

Independent Sample Test

Table: No. 6

Test for Equality of variances

F sig T Df Significant

(2-tailed)

Mean

difference

Std. Error

difference

Equal

variances

assumed

0 0.982 0.8 18 0.937 -137.531 72231.2

Equal

variances not

assumed

0 0.982 0.8 17.99 0.937 -137.531 72231.2

The above table has provided the compare of

mean of cost in TC and ABC system. According

to table 6, the difference between cost mean in TC

and ABC system on the base of T-test in

significant level α=0.05 is not significant. Such

that sig=0.9820.05.

Test of sub-hypothesis 2:

H0:

H1=

The below table shows the mean, standard

deviation and standard error of gross profit of

every unit on the base of traditional and Activity

Based Costing system.

Gross Profit of ABC and TC system of every unit

Table: No. 8

Method N Mean Standard deviation Std. Error mean

TC system 10 103705 10.64270 33655

ABC system 10 96515 9.84298 31126

Independent Sample Test

Table: No. 9

T-dependent test for equality of variances

F sig T Df Significant

(2-tailed)

Mean

difference

Std. Error

difference

Equal variances

assumed 0.068 0.797 0.16 18 0.877 0.71904 4.58422

Equal variances

not assumed 0.068 0.797 0.16 17.891 0.71904 0.71904 4.58422

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

International Journal of Management Sciences and Business Research, Mar-2015 ISSN (2226-8235) Vol-4, Issue 3

http://www.ijmsbr.com Page 8

Table 9 has provided the compare of gross profit

mean for every unit in TC and ABC system using

T-dependent test. The results indicates that, the

differences between gross profit in every unit of

TC and ABC system are not significant because

the value (sig= 0.7970.05) which has been

obtained is bigger than the, α=0.05.

The results of sub-hypothesis Ha test:

According to results, the P value is more than 5%

(P0.05), Null hypothesis in 95% confidence is

accepted and the opposite hypothesis is rejected. It

means that there is no significant difference

between cost of every unit according to TC and

ABC system.

The results of sub-hypothesis Hb test:

According to results, the P value is more than 5%

(P0.05), the Null hypothesis in 95% confidence

is accepted and the opposite hypothesis is

rejected. It means that there is no significant

difference between gross profit of every unit

according to TC and ABC system.

Conclusions

The aim of the present study was to explore the

possibility of implementing activity-based costing

system and calculating the cost of each product in

Iranian forging companies of Iran tractor

manufacturing. According to Iranian forging

companies the results of sub-hypothesis-1 and 2,

showed the companies can use of ABC system.

Therefore, the main hypotheses (H) is confirmed

and sub hypotheses (Ha&Hb) are rejected.

Therefor the results of the study indicated that the

use of activity-based costing system may enables

the Iranian forging companies to come up with a

better understanding of the profitability of their

products. Besides, this understanding we found

that Activity Based Costing System, in companies

that overhead cost consist the high percent of total

production costs, ABC system must be applied, in

particular, when operational staff and production

managers do not trust on current system about

costing the product. Finally this is important for

the organizations in I.R. Iran to know clearly what

they require prior to deciding on which costing

method to use. Organizations need to study the

pros and cons of each costing method to know

which one was more appropriate for their

organization. But there is no such thing as the best

costing method; there is only the most suitable

costing method to use.

References:

Anderson S. W. and Young S.M., (1999). The

impact of contextual and process factors on the

evaluation of activity based costing systems,

Accounting, Organizations and Society, 24, 525–

559.

Andrea, C., Filho P., Espozel M., Maia A. and

Quassim Y., (1999). Activity-based costing for

production learning, International Journal of

Production, Economics, 62(3), 175-180.

Batool, H., and Younos, V., (2013), An ABC

analysis for power generation project,

Management Science Letters, (3), 1943–1948.

Ben-Arieh, D., (2008). Qian L., Activity-based

cost management for design and development

stage, International Journal of Production

Economics, 83, 169–183.

Charles, S.L., Hansen, D.R., (2008), An

Evaluation of Activity-Based Costing and

Functional-Based Costing: a Game-theoretic

Approach, International Journal of Production

Economics, 113, 480–494.

Carolfi I.A., (1996), ABM can improve quality

and control costs, Cost and Management, (May),

12–16.

Cooper, R, Slagmulder R., (1997). Target costing

and value Portland:” Productivity press and

Montvale Management and its Determinants,

Journal of Management Accounting, 9, 109-41.

Cooper, R. and Kaplan R. S., (1991). Profit

priorities from activity based costing, Harvard

Business Review, 130–135.

Cooper, R. and Kaplan, R.S. (1991). The design

of cost management systems .Harvard business,

Jan- Feb 1991.

Cooper, R., (1988). The rise of activity based

costing-Part One: What is an activity based cost

system, Journal of Cost Management, 2 (2):45–

54.

Cooper, R., (1990). Cost classification in unit-

based and activity-based manufacturing cost

systems, Journal of Cost Management, 4(3), 4–14.

Datar, S. M. and Gupta M., (1994). Aggregation,

specification, and measurement, errors in product

http://www.ijmsbr.com Page 8

Table 9 has provided the compare of gross profit

mean for every unit in TC and ABC system using

T-dependent test. The results indicates that, the

differences between gross profit in every unit of

TC and ABC system are not significant because

the value (sig= 0.7970.05) which has been

obtained is bigger than the, α=0.05.

The results of sub-hypothesis Ha test:

According to results, the P value is more than 5%

(P0.05), Null hypothesis in 95% confidence is

accepted and the opposite hypothesis is rejected. It

means that there is no significant difference

between cost of every unit according to TC and

ABC system.

The results of sub-hypothesis Hb test:

According to results, the P value is more than 5%

(P0.05), the Null hypothesis in 95% confidence

is accepted and the opposite hypothesis is

rejected. It means that there is no significant

difference between gross profit of every unit

according to TC and ABC system.

Conclusions

The aim of the present study was to explore the

possibility of implementing activity-based costing

system and calculating the cost of each product in

Iranian forging companies of Iran tractor

manufacturing. According to Iranian forging

companies the results of sub-hypothesis-1 and 2,

showed the companies can use of ABC system.

Therefore, the main hypotheses (H) is confirmed

and sub hypotheses (Ha&Hb) are rejected.

Therefor the results of the study indicated that the

use of activity-based costing system may enables

the Iranian forging companies to come up with a

better understanding of the profitability of their

products. Besides, this understanding we found

that Activity Based Costing System, in companies

that overhead cost consist the high percent of total

production costs, ABC system must be applied, in

particular, when operational staff and production

managers do not trust on current system about

costing the product. Finally this is important for

the organizations in I.R. Iran to know clearly what

they require prior to deciding on which costing

method to use. Organizations need to study the

pros and cons of each costing method to know

which one was more appropriate for their

organization. But there is no such thing as the best

costing method; there is only the most suitable

costing method to use.

References:

Anderson S. W. and Young S.M., (1999). The

impact of contextual and process factors on the

evaluation of activity based costing systems,

Accounting, Organizations and Society, 24, 525–

559.

Andrea, C., Filho P., Espozel M., Maia A. and

Quassim Y., (1999). Activity-based costing for

production learning, International Journal of

Production, Economics, 62(3), 175-180.

Batool, H., and Younos, V., (2013), An ABC

analysis for power generation project,

Management Science Letters, (3), 1943–1948.

Ben-Arieh, D., (2008). Qian L., Activity-based

cost management for design and development

stage, International Journal of Production

Economics, 83, 169–183.

Charles, S.L., Hansen, D.R., (2008), An

Evaluation of Activity-Based Costing and

Functional-Based Costing: a Game-theoretic

Approach, International Journal of Production

Economics, 113, 480–494.

Carolfi I.A., (1996), ABM can improve quality

and control costs, Cost and Management, (May),

12–16.

Cooper, R, Slagmulder R., (1997). Target costing

and value Portland:” Productivity press and

Montvale Management and its Determinants,

Journal of Management Accounting, 9, 109-41.

Cooper, R. and Kaplan R. S., (1991). Profit

priorities from activity based costing, Harvard

Business Review, 130–135.

Cooper, R. and Kaplan, R.S. (1991). The design

of cost management systems .Harvard business,

Jan- Feb 1991.

Cooper, R., (1988). The rise of activity based

costing-Part One: What is an activity based cost

system, Journal of Cost Management, 2 (2):45–

54.

Cooper, R., (1990). Cost classification in unit-

based and activity-based manufacturing cost

systems, Journal of Cost Management, 4(3), 4–14.

Datar, S. M. and Gupta M., (1994). Aggregation,

specification, and measurement, errors in product

International Journal of Management Sciences and Business Research, Mar-2015 ISSN (2226-8235) Vol-4, Issue 3

http://www.ijmsbr.com Page 9

costing, The Accounting Review, (October, 567–

591.

Dickinson, V. and Lere J.C., (2003). Problems

evaluating sales representative performance? Try

activity-based costing, Industrial Marketing

Management, 32, 301– 307.

Evans, H. and Ashworth G., (1995) Activity-

Based Management: Moving Beyond,

Adolescence, Management Accounting-London,

(December, 26– 30.

Evans, H. and Ashworth G., (1995). Activity-

Based Management: Moving Beyond

Adolescence, Management Accounting-London,

(December, 26– 30.

Foster, G. and Swenson, D.W., (1997). Meaning

the success of activity- based cost management

and its determinants, Journal of Management

Accounting, 9, 109– 141.

Garrison, Ray H., and Eric W. Noreen. (1999).

Managerial Accounting. 9th ed. Boston: Irwin.

McGraw-Hill.

Gering, M., (1999). Activity-based costing lessons

learned implementing ABC, Management

Accounting, 26– 27.

Gunasekaran, A., Marri H.B. and Grieve R.J.,

(1999). Activity Based Costing in Small and

Medium Enterprises, Computers & Industrial

Engineering, 37, 407– 411.

Gunasekaran, A., & Sarhadi, M. (1998).

Implementation of activity-based costing in

manufacturing. International journal of

production economics, 56, 231-242.

Gupta, M., Galloway, K., (2003). Activity-based

costing/management and its implications for

operations management. Tec novation, 23(2):131-

138.

John, I. (1995), ABC: A follow-up survey of CIMA

members, Management Accounting, pp.50-1.

[Manual Request] [Infotrieve]. John, I., Mitchell,

F (1991).

Johnson, H., Kaplan, R., (1987). Relevance lost:

The rise and fall of management accounting.

Boston, MA: Harvard business school press.

Kaplan, S. Robert., (1986). Accounting Lag: The

Obsolescence of Cost Accounting Systems.

California Management Review, Vol. 28, No. 2,

pp. 174-199.

Keegan, DP. Eiler, RG., (1994). Reengineer cost

accounting: we need to synthesize the old with the

new, Journal of Management Accounting 76: 26–

31.

Kingcott, T., (1991). Opportunity-based

accounting: better than ABC, Management

Accounting, 36–37.

Maliah, Sulaiman, Nik Nazli Nik Ahmad and

Norhayati Mohmmadd Alwi, (2005), Is Standard

Costing Obsolete? Empirical Evidence from

Malaysia, Managerial, Auditing Journal, 20(2),

09–124.

McGowan, A., S. and Klammer, T. P., (1997).

Satisfaction with activity-based cost Management

implementation, Journal of Management

Accounting Research, 9, 217–237.

Mitchell, F., John, I., (1995). ABC: A follow-up

survey of CIMA members, Management

Accounting, pp.50-1.

Noreen, E., (1991). Conditions under which

activity-based cost systems provide relevant costs,

Journal of Management Accounting Research,

(Fall), 159–168.

Rezaie, K., Ostadi, B., Torabi, SA., (2008).

Activity-based costing in flexible manufacturing

systems with case study in a forging industry.

International Journal of Production Research,

46(4):1047-1069.

Singer M., Donoso, P., (2008). Strategic decision-

making at a steel manufacturer assisted by linear

programming. Journal of Business Research,

59(3):387-390.

Staptelon, D., Beach E. and Julmanichoti P.,

(2004). Activity-based costing for logistics and

marketing, Business Process Management

Journal, 10(5), 584–597.

Szychta, A., (2010). Time-Driven Activity-based

costing in service industries. Social

sciences/Socialiniai moslai, No 1(67), pp.49-60.

http://www.ijmsbr.com Page 9

costing, The Accounting Review, (October, 567–

591.

Dickinson, V. and Lere J.C., (2003). Problems

evaluating sales representative performance? Try

activity-based costing, Industrial Marketing

Management, 32, 301– 307.

Evans, H. and Ashworth G., (1995) Activity-

Based Management: Moving Beyond,

Adolescence, Management Accounting-London,

(December, 26– 30.

Evans, H. and Ashworth G., (1995). Activity-

Based Management: Moving Beyond

Adolescence, Management Accounting-London,

(December, 26– 30.

Foster, G. and Swenson, D.W., (1997). Meaning

the success of activity- based cost management

and its determinants, Journal of Management

Accounting, 9, 109– 141.

Garrison, Ray H., and Eric W. Noreen. (1999).

Managerial Accounting. 9th ed. Boston: Irwin.

McGraw-Hill.

Gering, M., (1999). Activity-based costing lessons

learned implementing ABC, Management

Accounting, 26– 27.

Gunasekaran, A., Marri H.B. and Grieve R.J.,

(1999). Activity Based Costing in Small and

Medium Enterprises, Computers & Industrial

Engineering, 37, 407– 411.

Gunasekaran, A., & Sarhadi, M. (1998).

Implementation of activity-based costing in

manufacturing. International journal of

production economics, 56, 231-242.

Gupta, M., Galloway, K., (2003). Activity-based

costing/management and its implications for

operations management. Tec novation, 23(2):131-

138.

John, I. (1995), ABC: A follow-up survey of CIMA

members, Management Accounting, pp.50-1.

[Manual Request] [Infotrieve]. John, I., Mitchell,

F (1991).

Johnson, H., Kaplan, R., (1987). Relevance lost:

The rise and fall of management accounting.

Boston, MA: Harvard business school press.

Kaplan, S. Robert., (1986). Accounting Lag: The

Obsolescence of Cost Accounting Systems.

California Management Review, Vol. 28, No. 2,

pp. 174-199.

Keegan, DP. Eiler, RG., (1994). Reengineer cost

accounting: we need to synthesize the old with the

new, Journal of Management Accounting 76: 26–

31.

Kingcott, T., (1991). Opportunity-based

accounting: better than ABC, Management

Accounting, 36–37.

Maliah, Sulaiman, Nik Nazli Nik Ahmad and

Norhayati Mohmmadd Alwi, (2005), Is Standard

Costing Obsolete? Empirical Evidence from

Malaysia, Managerial, Auditing Journal, 20(2),

09–124.

McGowan, A., S. and Klammer, T. P., (1997).

Satisfaction with activity-based cost Management

implementation, Journal of Management

Accounting Research, 9, 217–237.

Mitchell, F., John, I., (1995). ABC: A follow-up

survey of CIMA members, Management

Accounting, pp.50-1.

Noreen, E., (1991). Conditions under which

activity-based cost systems provide relevant costs,

Journal of Management Accounting Research,

(Fall), 159–168.

Rezaie, K., Ostadi, B., Torabi, SA., (2008).

Activity-based costing in flexible manufacturing

systems with case study in a forging industry.

International Journal of Production Research,

46(4):1047-1069.

Singer M., Donoso, P., (2008). Strategic decision-

making at a steel manufacturer assisted by linear

programming. Journal of Business Research,

59(3):387-390.

Staptelon, D., Beach E. and Julmanichoti P.,

(2004). Activity-based costing for logistics and

marketing, Business Process Management

Journal, 10(5), 584–597.

Szychta, A., (2010). Time-Driven Activity-based

costing in service industries. Social

sciences/Socialiniai moslai, No 1(67), pp.49-60.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

International Journal of Management Sciences and Business Research, Mar-2015 ISSN (2226-8235) Vol-4, Issue 3

http://www.ijmsbr.com Page 10

Tsai, WH, Kuo L., (2004). Operating costs and

capacity in the airline industry, Journal of Air

Transport Management, 10 (4): 269–275.

Zanjirdar, M. and Partani, (2008). Analysis of the

implementation of activity-based costing systems

in small and medium enterprises. Journal of

Mishagh -e- Modiran.

http://www.ijmsbr.com Page 10

Tsai, WH, Kuo L., (2004). Operating costs and

capacity in the airline industry, Journal of Air

Transport Management, 10 (4): 269–275.

Zanjirdar, M. and Partani, (2008). Analysis of the

implementation of activity-based costing systems

in small and medium enterprises. Journal of

Mishagh -e- Modiran.

1 out of 10

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.