Comparative Analysis: Exploring IFRS and GAAP Accounting Standards

VerifiedAdded on 2023/06/13

|6

|1352

|263

Report

AI Summary

This report provides a detailed comparison between International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP), focusing on their objectives, similarities, and areas of divergence. IFRS aims to establish a universal language for financial reporting, ensuring transparency and comparability across international companies, while GAAP provides specific guidelines for US-based companies. The report highlights differences in financial statement presentation, recognition of accounting elements, measurement of accounting elements (such as inventory valuation), and disclosures, including the treatment of extraordinary items. Despite these differences, both IFRS and GAAP serve as guiding principles for financial reporting, promoting reliability, transparency, and comparability. The report references several studies to support its analysis of the key distinctions and commonalities between these two major accounting standards. Desklib provides more resources for students.

INTRODUCTION TO

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

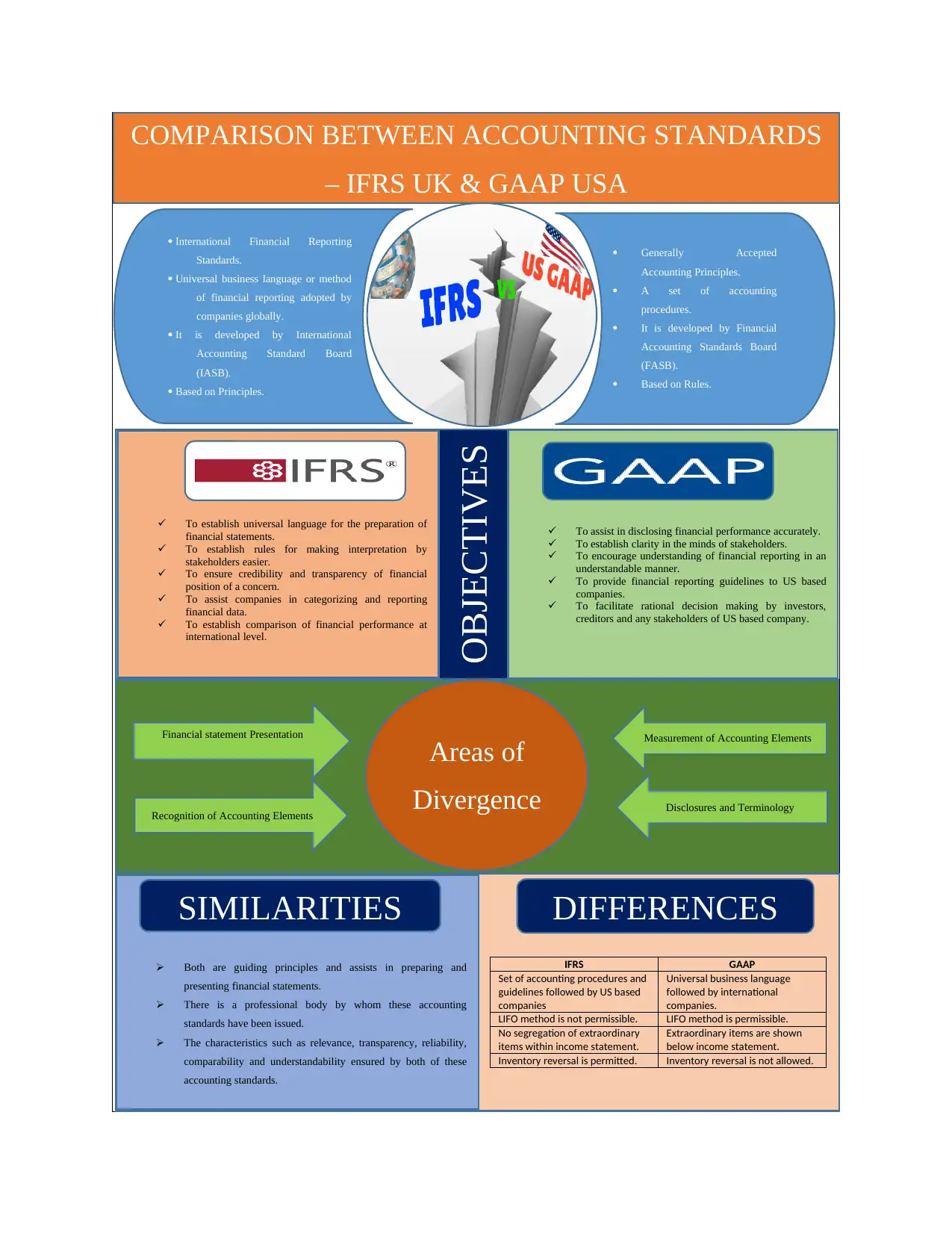

COMPARISON BETWEEN ACCOUNTING STANDARDS

– IFRS UK & GAAP USA

International Financial Reporting

Standards.

Universal business language or method

of financial reporting adopted by

companies globally.

It is developed by International

Accounting Standard Board

(IASB).

Based on Principles.

Generally Accepted

Accounting Principles.

A set of accounting

procedures.

It is developed by Financial

Accounting Standards Board

(FASB).

Based on Rules.

OBJECTIVES

To establish universal language for the preparation of

financial statements.

To establish rules for making interpretation by

stakeholders easier.

To ensure credibility and transparency of financial

position of a concern.

To assist companies in categorizing and reporting

financial data.

To establish comparison of financial performance at

international level.

To assist in disclosing financial performance accurately.

To establish clarity in the minds of stakeholders.

To encourage understanding of financial reporting in an

understandable manner.

To provide financial reporting guidelines to US based

companies.

To facilitate rational decision making by investors,

creditors and any stakeholders of US based company.

Areas of

Divergence

Financial statement Presentation

Recognition of Accounting Elements

Measurement of Accounting Elements

Disclosures and Terminology

Both are guiding principles and assists in preparing and

presenting financial statements.

There is a professional body by whom these accounting

standards have been issued.

The characteristics such as relevance, transparency, reliability,

comparability and understandability ensured by both of these

accounting standards.

IFRS GAAP

Set of accounting procedures and

guidelines followed by US based

companies

Universal business language

followed by international

companies.

LIFO method is not permissible. LIFO method is permissible.

No segregation of extraordinary

items within income statement.

Extraordinary items are shown

below income statement.

Inventory reversal is permitted. Inventory reversal is not allowed.

SIMILARITIES DIFFERENCES

– IFRS UK & GAAP USA

International Financial Reporting

Standards.

Universal business language or method

of financial reporting adopted by

companies globally.

It is developed by International

Accounting Standard Board

(IASB).

Based on Principles.

Generally Accepted

Accounting Principles.

A set of accounting

procedures.

It is developed by Financial

Accounting Standards Board

(FASB).

Based on Rules.

OBJECTIVES

To establish universal language for the preparation of

financial statements.

To establish rules for making interpretation by

stakeholders easier.

To ensure credibility and transparency of financial

position of a concern.

To assist companies in categorizing and reporting

financial data.

To establish comparison of financial performance at

international level.

To assist in disclosing financial performance accurately.

To establish clarity in the minds of stakeholders.

To encourage understanding of financial reporting in an

understandable manner.

To provide financial reporting guidelines to US based

companies.

To facilitate rational decision making by investors,

creditors and any stakeholders of US based company.

Areas of

Divergence

Financial statement Presentation

Recognition of Accounting Elements

Measurement of Accounting Elements

Disclosures and Terminology

Both are guiding principles and assists in preparing and

presenting financial statements.

There is a professional body by whom these accounting

standards have been issued.

The characteristics such as relevance, transparency, reliability,

comparability and understandability ensured by both of these

accounting standards.

IFRS GAAP

Set of accounting procedures and

guidelines followed by US based

companies

Universal business language

followed by international

companies.

LIFO method is not permissible. LIFO method is permissible.

No segregation of extraordinary

items within income statement.

Extraordinary items are shown

below income statement.

Inventory reversal is permitted. Inventory reversal is not allowed.

SIMILARITIES DIFFERENCES

Definition of IFRS: It stands for International Financial Reporting Standards which adopted at

global level and is issued by International Accounting Standard Board. It is a set of guidelines &

rules which is necessary for every firm to adopt in order to make sure that their financial

statements are able to satisfy consistency with the financial statements of other firms across the

globe (Anantharaman and Chuk, 2020).

Definition of GAAP: It stands for Generally Accepted Accounting Principles. It is a standard

framework, procedures and principles that is being adopted and used by US based companies for

the purpose of financial accounting. The principles have been issued by Financial Accounting

Standard Board (Kouki, 2018). The set of accounting standards within it provides rules and

standard ways for recording & reporting of company’s financial data.

Objectives of different accounting standards i.e., IFRS & GAAP

Objectives of IFRS

There are many purposes for which IFRS has been developed such as the following:

To introduce a common law that is to be adopted by all companies at global level to

ensure consistency and comparability within their financial statements, so that a universal

way of financial reporting can be established for all internationally operating business

(Cussatt, Huang and Pollard, 2018).

To assist stakeholders in carrying out analysis of financial performance of the company

along with correctly interpreting a concern’s financial position.

When IFRS is followed while preparing books of accounts, then the financial record

ensures reliability, accuracy, uniformity and appropriateness and thus there is an

availability of high quality financial data on the basis of which investors make informed

economic decisions.

Objectives of GAAP

The purpose for which GAAP has been developed are as follows:

To promote the understanding of how financial reporting can be done in transparent

manner (Kouki, 2018).

global level and is issued by International Accounting Standard Board. It is a set of guidelines &

rules which is necessary for every firm to adopt in order to make sure that their financial

statements are able to satisfy consistency with the financial statements of other firms across the

globe (Anantharaman and Chuk, 2020).

Definition of GAAP: It stands for Generally Accepted Accounting Principles. It is a standard

framework, procedures and principles that is being adopted and used by US based companies for

the purpose of financial accounting. The principles have been issued by Financial Accounting

Standard Board (Kouki, 2018). The set of accounting standards within it provides rules and

standard ways for recording & reporting of company’s financial data.

Objectives of different accounting standards i.e., IFRS & GAAP

Objectives of IFRS

There are many purposes for which IFRS has been developed such as the following:

To introduce a common law that is to be adopted by all companies at global level to

ensure consistency and comparability within their financial statements, so that a universal

way of financial reporting can be established for all internationally operating business

(Cussatt, Huang and Pollard, 2018).

To assist stakeholders in carrying out analysis of financial performance of the company

along with correctly interpreting a concern’s financial position.

When IFRS is followed while preparing books of accounts, then the financial record

ensures reliability, accuracy, uniformity and appropriateness and thus there is an

availability of high quality financial data on the basis of which investors make informed

economic decisions.

Objectives of GAAP

The purpose for which GAAP has been developed are as follows:

To promote the understanding of how financial reporting can be done in transparent

manner (Kouki, 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

To encourage accurate disclosure of financial information in order to ensure a

presentation of reliable financial performance and position among users of accounting

information through appropriate preparation of financial statements, so that users can

make informed decisions.

To make financial reporting uniform and transparent in order to reduce confusion among

stakeholders by providing standard guidelines to companies.

Areas of divergence between IFRS & GAAP

There are basically four areas at which IFRS & GAAP get diverge with reference to financial

reporting, which are as follows:

Financial Statement Presentation: Under GAAP, presentation for three periods have been done

as against IFRS where presentation for two periods are required while preparing income

statement. Also, assets are recorded in decreasing and increasing order of liquidity within GAAP

and IFRS respectively (Buesa, Población García and Tarancón, 2020).

Recognition of accounting elements: To determine whether an item is to be recognized as

expenses, revenue, asset or liability, there are different rules and principles for the same within

IFRS and GAAP. For instance, the term contingent liability is used with GAAP while the term

“provision” is being used within IFRS and also recognition is done at a threshold of >=75% and

>50% respectively.

Measurement of Accounting Elements: There is a difference in measuring accounting elements

with respect to IFRS and GAAP. For instance, within GAAP, both FIFO & LIFO method are

permissible whereas LIFO method is not permissible within IFRS. Also, valuation of fixed assets

is different as GAAP follows a tendency that value of fixed assets can only be reduced and

cannot increase in any circumstances. On the hand, IFRS employs fair value measurement while

reporting fixed assets where changes can be both positive and negative.

Disclosures & Terminology: The difference also lies in the inclusion of information within the

footnotes of the financial statements. For instance, extraordinary items are shown in income

statement within their footnotes in case of GAAP whereas there is no such segregate segment for

disclosing extraordinary items in case of IFRS (Turlington, Fafatas and Oliver, 2019). Also,

presentation of reliable financial performance and position among users of accounting

information through appropriate preparation of financial statements, so that users can

make informed decisions.

To make financial reporting uniform and transparent in order to reduce confusion among

stakeholders by providing standard guidelines to companies.

Areas of divergence between IFRS & GAAP

There are basically four areas at which IFRS & GAAP get diverge with reference to financial

reporting, which are as follows:

Financial Statement Presentation: Under GAAP, presentation for three periods have been done

as against IFRS where presentation for two periods are required while preparing income

statement. Also, assets are recorded in decreasing and increasing order of liquidity within GAAP

and IFRS respectively (Buesa, Población García and Tarancón, 2020).

Recognition of accounting elements: To determine whether an item is to be recognized as

expenses, revenue, asset or liability, there are different rules and principles for the same within

IFRS and GAAP. For instance, the term contingent liability is used with GAAP while the term

“provision” is being used within IFRS and also recognition is done at a threshold of >=75% and

>50% respectively.

Measurement of Accounting Elements: There is a difference in measuring accounting elements

with respect to IFRS and GAAP. For instance, within GAAP, both FIFO & LIFO method are

permissible whereas LIFO method is not permissible within IFRS. Also, valuation of fixed assets

is different as GAAP follows a tendency that value of fixed assets can only be reduced and

cannot increase in any circumstances. On the hand, IFRS employs fair value measurement while

reporting fixed assets where changes can be both positive and negative.

Disclosures & Terminology: The difference also lies in the inclusion of information within the

footnotes of the financial statements. For instance, extraordinary items are shown in income

statement within their footnotes in case of GAAP whereas there is no such segregate segment for

disclosing extraordinary items in case of IFRS (Turlington, Fafatas and Oliver, 2019). Also,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

terminology differs in both of these standards such as the term contingent liability is used in

GAAP while the term provision is used in IFRS.

The existence of these divergence within IFRS and GAAP leads to differences in these

accounting standards, whereas there are some similarities lies between these standards of

preparing presenting financial statements of the company, such as the following:

Both IFRS and GAAP act as a guiding principles and are issued by professional body that

assists in preparing financial statements and decision making by stakeholders.

Both of these accounting standards supports in ensuring reliability, transparency,

understandability and comparability of financial information.

GAAP while the term provision is used in IFRS.

The existence of these divergence within IFRS and GAAP leads to differences in these

accounting standards, whereas there are some similarities lies between these standards of

preparing presenting financial statements of the company, such as the following:

Both IFRS and GAAP act as a guiding principles and are issued by professional body that

assists in preparing financial statements and decision making by stakeholders.

Both of these accounting standards supports in ensuring reliability, transparency,

understandability and comparability of financial information.

REFERENCES

Turlington, J., Fafatas, S. and Oliver, E. G., 2019. Is it US GAAP or IFRS? Understanding how

R&D costs affect ratio analysis. Business Horizons, 62(4), pp.427-436.

Buesa, A., Población García, F. J. and Tarancón, J., 2020. Measuring the procyclicality of

impairment accounting regimes: a comparison between IFRS 9 and US GAAP.

Kouki, A., 2018. IFRS and value relevance: A comparison approach before and after IFRS

conversion in the European countries. Journal of Applied Accounting Research.

Cussatt, M., Huang, L. and Pollard, T. J., 2018. Accounting quality under US GAAP versus

IFRS: the case of Germany. Journal of International Accounting Research, 17(3), pp.21-

41.

Anantharaman, D. and Chuk, E., 2020. So Similar, yet So Different: Comparing the US GAAP

and IFRS Experience at Eliciting Greater Transparency on Pension Asset

Disclosures. Available at SSRN 3646842.

Turlington, J., Fafatas, S. and Oliver, E. G., 2019. Is it US GAAP or IFRS? Understanding how

R&D costs affect ratio analysis. Business Horizons, 62(4), pp.427-436.

Buesa, A., Población García, F. J. and Tarancón, J., 2020. Measuring the procyclicality of

impairment accounting regimes: a comparison between IFRS 9 and US GAAP.

Kouki, A., 2018. IFRS and value relevance: A comparison approach before and after IFRS

conversion in the European countries. Journal of Applied Accounting Research.

Cussatt, M., Huang, L. and Pollard, T. J., 2018. Accounting quality under US GAAP versus

IFRS: the case of Germany. Journal of International Accounting Research, 17(3), pp.21-

41.

Anantharaman, D. and Chuk, E., 2020. So Similar, yet So Different: Comparing the US GAAP

and IFRS Experience at Eliciting Greater Transparency on Pension Asset

Disclosures. Available at SSRN 3646842.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.