Comparative Analysis of Competitive Strategies: Xero and Carsales

VerifiedAdded on 2023/06/04

|12

|2593

|295

Report

AI Summary

This report presents a comparative analysis of the competitive strategies employed by Xero Accounting Ltd and Carsales.com. It begins with a description of each company's operations and comparative advantages, highlighting Xero's cloud-based accounting software and Carsales' online automotive platform. The analysis then delves into a detailed examination of performance ratios, including liquidity, profitability, and capital structure, comparing the financial health of both companies. The report further investigates the movements of monthly share prices for both companies, identifying factors influencing these fluctuations. Beta values and expected rates of return are calculated using the CAPM model, and the dividend policies of each company are discussed. Finally, a recommendation letter is provided, offering investment advice based on the analysis. The report utilizes financial data, market trends, and company-specific information to provide a comprehensive assessment of the competitive landscape and strategic positioning of Xero and Carsales.

Competitive Strategy 1

Competitive Strategy

Competitive Strategy

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Competitive Strategy 2

1. Description of operation and comparative advantages of the two chosen companies

carsales.com Ltd company is a company that provides online platform to its customers to deal in

purchase and sale of automotives, marine classified and motorcycle. This company is considered

as an online destination for buying and selling of motorbikes, boats, trucks, caravans, cars and

machinery equipment. The different segments of the business include online advertising

offerings, data and research services and the operations in overseas countries (Reuters, 2018).

Xero Accounting Ltd is an online accounting firm established in the year 2006 in New Zealand.

Xero is considered as one of the fastest growing software which includes cloud based accounting

software that are being offered to different clients in different countries such as New Zealand and

UK. Apart from this, the company employs 2000 people and has around 1.38 million subscribers

(Xero Limited, 2018).

The comparative advantage of Xero Accounting Ltd is that it is able to provide cloud based

accounting software to carsales.com ltd in a cost effective manner which in turn helps them to

carry out the accounting and book keeping operations in an effective manner. This can be

provided in efficient manner because Xero has a technological and knowledge expertise in

creation of the cloud based software which can be used in online platforms. This company has a

comparative advantage over other players that offers accounting services to the customers as the

company has an advantage to provide high quality and cost effect solutions to the customers to

gain an advantage over other players in the market (Costinot, Donaldson Vogel and Werning,

2015).

In a similar manner, carsales.com ltd company also has a comparative advantage over other

players in the automotive industry as it uses the digital platform by becoming a one stop shop to

the customers to buy and sell used and new automobiles especially cars by the customers and

1. Description of operation and comparative advantages of the two chosen companies

carsales.com Ltd company is a company that provides online platform to its customers to deal in

purchase and sale of automotives, marine classified and motorcycle. This company is considered

as an online destination for buying and selling of motorbikes, boats, trucks, caravans, cars and

machinery equipment. The different segments of the business include online advertising

offerings, data and research services and the operations in overseas countries (Reuters, 2018).

Xero Accounting Ltd is an online accounting firm established in the year 2006 in New Zealand.

Xero is considered as one of the fastest growing software which includes cloud based accounting

software that are being offered to different clients in different countries such as New Zealand and

UK. Apart from this, the company employs 2000 people and has around 1.38 million subscribers

(Xero Limited, 2018).

The comparative advantage of Xero Accounting Ltd is that it is able to provide cloud based

accounting software to carsales.com ltd in a cost effective manner which in turn helps them to

carry out the accounting and book keeping operations in an effective manner. This can be

provided in efficient manner because Xero has a technological and knowledge expertise in

creation of the cloud based software which can be used in online platforms. This company has a

comparative advantage over other players that offers accounting services to the customers as the

company has an advantage to provide high quality and cost effect solutions to the customers to

gain an advantage over other players in the market (Costinot, Donaldson Vogel and Werning,

2015).

In a similar manner, carsales.com ltd company also has a comparative advantage over other

players in the automotive industry as it uses the digital platform by becoming a one stop shop to

the customers to buy and sell used and new automobiles especially cars by the customers and

Competitive Strategy 3

provide them the opportunity to compare the different parameters of the used and new cars to

customers in a convenient manner to make buying decision such as price and features of the cars

offered by different players through an online platform (Costinot, et.al, 2015).

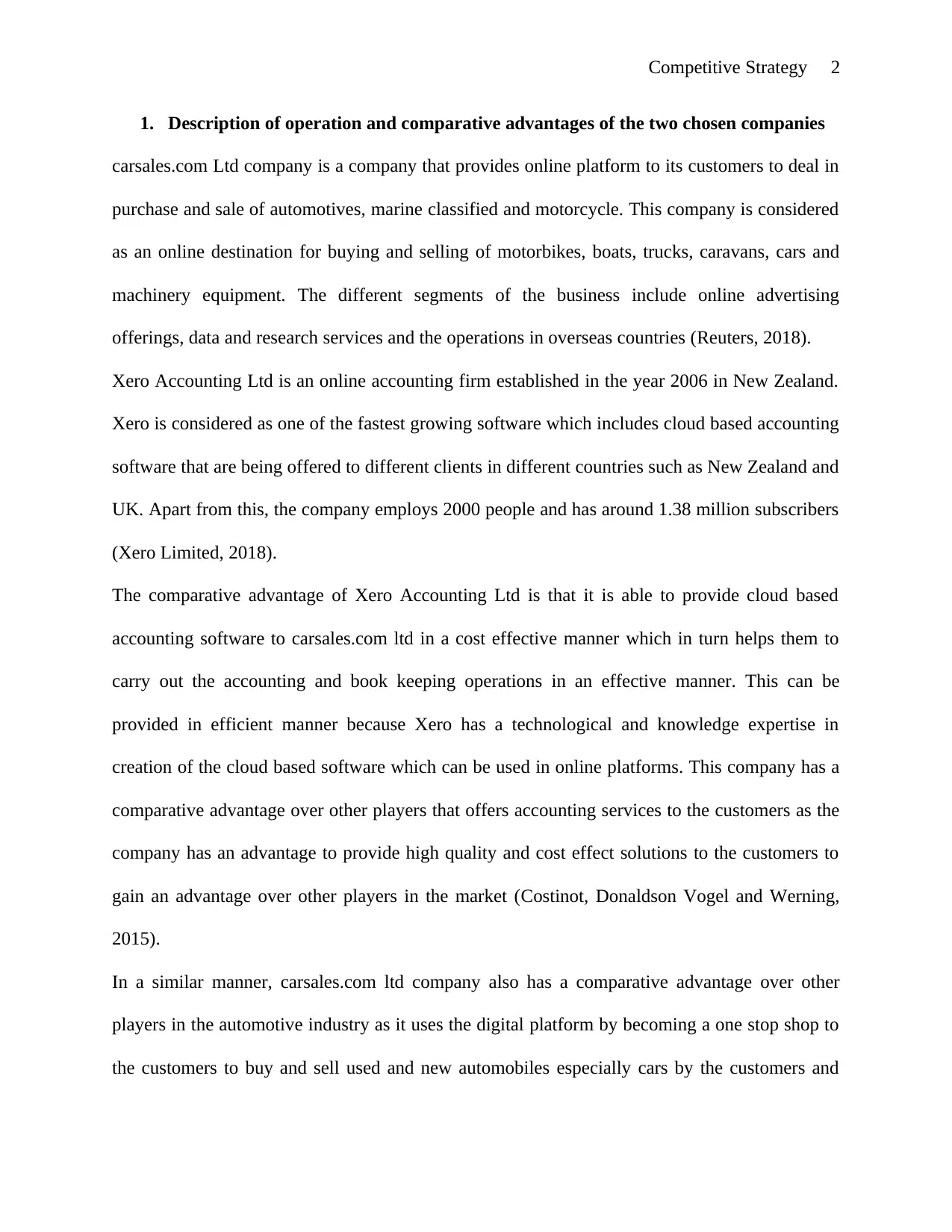

2. Calculation and comparison of performance ratios

Xero Accounting Ltd Carsales.com Ltd

Particulars 2015 2016 2017 2015 2016 2017

Current Assets 293516 211480 147710 67869 74543 89032

Current

Liabilities 30351 46774 65656 49017 57512 66492

Current Ratio

9.670719

251

4.521315

261

2.249756

306

1.384601

261

1.296129

503

1.338988

149

Gross Profit 87312 157179 226004 154338 170310 176497

Sales 124020 270060 295389 311756 344010 372114

Gross profit

ratio

0.704015

481

0.582015

108

0.765106

351

0.495060

239

0.495072

818

0.474308

948

Debt 2394 2238 3444 213658 227892 195540

Equity 345653 279089 224510 229513 260370 277160

Debt to equity

ratio

0.006926

021

0.008018

947

0.015340

074

0.930918

946

0.875262

127

0.705513

061

Liquidity Ratios

Liquidity ratios reflect the liquidity position of the company. It refers to the ability of the firm to

attain the current assets to meet out their day to day activities and obligations in an effective

manner. This can be reflected by the use of evaluation of the current ratio. Current ratio provides

the information related to the availability of the current assets held to meet out its current

obligations. It is indicated that the current ratio of Xero Accounting Ltd is declining over the

years from 9.67 in the year 2015 to 2.24 in the year 2017. In a similar manner, the current ratio

of carsales.com.au has also declined from 1.38 in the year 2015 to 1.33 in the year 2017

(Carsales.com.au, 2017). From the comparison it is found out that the liquidity position of Xero

provide them the opportunity to compare the different parameters of the used and new cars to

customers in a convenient manner to make buying decision such as price and features of the cars

offered by different players through an online platform (Costinot, et.al, 2015).

2. Calculation and comparison of performance ratios

Xero Accounting Ltd Carsales.com Ltd

Particulars 2015 2016 2017 2015 2016 2017

Current Assets 293516 211480 147710 67869 74543 89032

Current

Liabilities 30351 46774 65656 49017 57512 66492

Current Ratio

9.670719

251

4.521315

261

2.249756

306

1.384601

261

1.296129

503

1.338988

149

Gross Profit 87312 157179 226004 154338 170310 176497

Sales 124020 270060 295389 311756 344010 372114

Gross profit

ratio

0.704015

481

0.582015

108

0.765106

351

0.495060

239

0.495072

818

0.474308

948

Debt 2394 2238 3444 213658 227892 195540

Equity 345653 279089 224510 229513 260370 277160

Debt to equity

ratio

0.006926

021

0.008018

947

0.015340

074

0.930918

946

0.875262

127

0.705513

061

Liquidity Ratios

Liquidity ratios reflect the liquidity position of the company. It refers to the ability of the firm to

attain the current assets to meet out their day to day activities and obligations in an effective

manner. This can be reflected by the use of evaluation of the current ratio. Current ratio provides

the information related to the availability of the current assets held to meet out its current

obligations. It is indicated that the current ratio of Xero Accounting Ltd is declining over the

years from 9.67 in the year 2015 to 2.24 in the year 2017. In a similar manner, the current ratio

of carsales.com.au has also declined from 1.38 in the year 2015 to 1.33 in the year 2017

(Carsales.com.au, 2017). From the comparison it is found out that the liquidity position of Xero

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Competitive Strategy 4

Accounting Ltd is strong in comparison to carsales.com.au because its current ratio is higher than

carsales.com.au in past three years.

Profitability Ratio

The main aim of the company is to earn maximum profit. These ratios help in evaluation of the

profitability position of the companies in the market. The profitability position of the companies

has been evaluated by the help of gross profit ratio. Gross profit ratio helps in gaining

information related to the profit earned by the company as a percentage of sales. The gross profit

ratio of Xero Accounting Ltd has increased from 70.4% in the year 2015 to 76.5% in the year

2017 which indicates that the profitability position of the company has improved over the years

(Xero Limited, 2017). In a similar manner, the gross profit ratio of carsales.com.au has declined

from 49.5% in the year 2015 to 47.4% in the year 2017. The analysis indicates that the

profitability position of Xero Accounting Ltd is stronger than carsales.com.au.

Capital Structure (Leverage) Ratios

Capital structure or leverage ratios help in the analysis of the level of the debt and equity used by

the companies to finance its assets. It can be evaluated by estimating the debt to equity ratio. The

debt to equity ratio of Xero Accounting Ltd is increased from 0.006 in the year 2015 to 0.015 in

the year 2017. This shows that the company emphasizes more on utilizing the equity funds to

finance its assets in comparison to debt (Xero Limited, 2017). Besides this, the debt to equity

ratio of carsales.com.au has declined from 0.93 in the year 2015 to 0.70 in the year 2017 which

indicates that the company focuses on the utilization of increased amount of debt to finance its

assets in comparison to equity.

3. Analysis of monthly share prices movements

Accounting Ltd is strong in comparison to carsales.com.au because its current ratio is higher than

carsales.com.au in past three years.

Profitability Ratio

The main aim of the company is to earn maximum profit. These ratios help in evaluation of the

profitability position of the companies in the market. The profitability position of the companies

has been evaluated by the help of gross profit ratio. Gross profit ratio helps in gaining

information related to the profit earned by the company as a percentage of sales. The gross profit

ratio of Xero Accounting Ltd has increased from 70.4% in the year 2015 to 76.5% in the year

2017 which indicates that the profitability position of the company has improved over the years

(Xero Limited, 2017). In a similar manner, the gross profit ratio of carsales.com.au has declined

from 49.5% in the year 2015 to 47.4% in the year 2017. The analysis indicates that the

profitability position of Xero Accounting Ltd is stronger than carsales.com.au.

Capital Structure (Leverage) Ratios

Capital structure or leverage ratios help in the analysis of the level of the debt and equity used by

the companies to finance its assets. It can be evaluated by estimating the debt to equity ratio. The

debt to equity ratio of Xero Accounting Ltd is increased from 0.006 in the year 2015 to 0.015 in

the year 2017. This shows that the company emphasizes more on utilizing the equity funds to

finance its assets in comparison to debt (Xero Limited, 2017). Besides this, the debt to equity

ratio of carsales.com.au has declined from 0.93 in the year 2015 to 0.70 in the year 2017 which

indicates that the company focuses on the utilization of increased amount of debt to finance its

assets in comparison to equity.

3. Analysis of monthly share prices movements

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Competitive Strategy 5

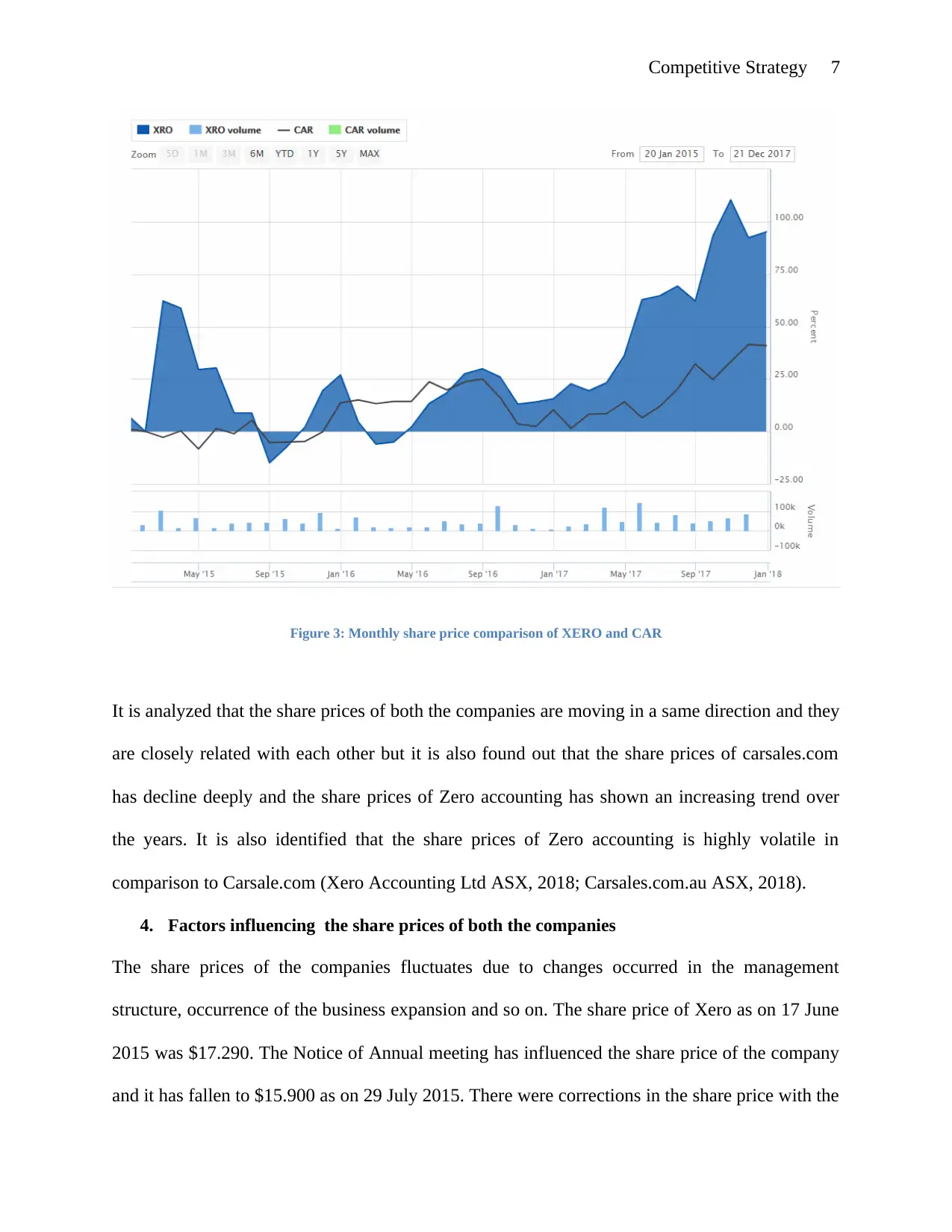

Figure 1: XERO Comparison with All Ordinaries

The share price of Xero limited was $14.690 as on 30 January 2015 which has increased to

$23.820 on Feb 27 2015 but again later in the year as on 30 April 2015 the share price was

declined to $19.020. Again, as on 31 July 2015 the share price of Xero was declined to 15.980.

The volume of shares traded as on date were 45363. The share price continuous to fall ad

reached an all time low of the assessment period to $12.500 as on 31 August 2015. There after

the company share show some recovery and there were several corrections in the share prices

which lead the share price to reach 19.080 as on 31 August 2016. The share price of the company

again increases to 23.920 as on 31 May 2017. There is sharp recovery in the share price of

XERO and it lead to $30.900 as on 31 October 2017 (Xero Accounting Ltd ASX, 2018).

Figure 1: XERO Comparison with All Ordinaries

The share price of Xero limited was $14.690 as on 30 January 2015 which has increased to

$23.820 on Feb 27 2015 but again later in the year as on 30 April 2015 the share price was

declined to $19.020. Again, as on 31 July 2015 the share price of Xero was declined to 15.980.

The volume of shares traded as on date were 45363. The share price continuous to fall ad

reached an all time low of the assessment period to $12.500 as on 31 August 2015. There after

the company share show some recovery and there were several corrections in the share prices

which lead the share price to reach 19.080 as on 31 August 2016. The share price of the company

again increases to 23.920 as on 31 May 2017. There is sharp recovery in the share price of

XERO and it lead to $30.900 as on 31 October 2017 (Xero Accounting Ltd ASX, 2018).

Competitive Strategy 6

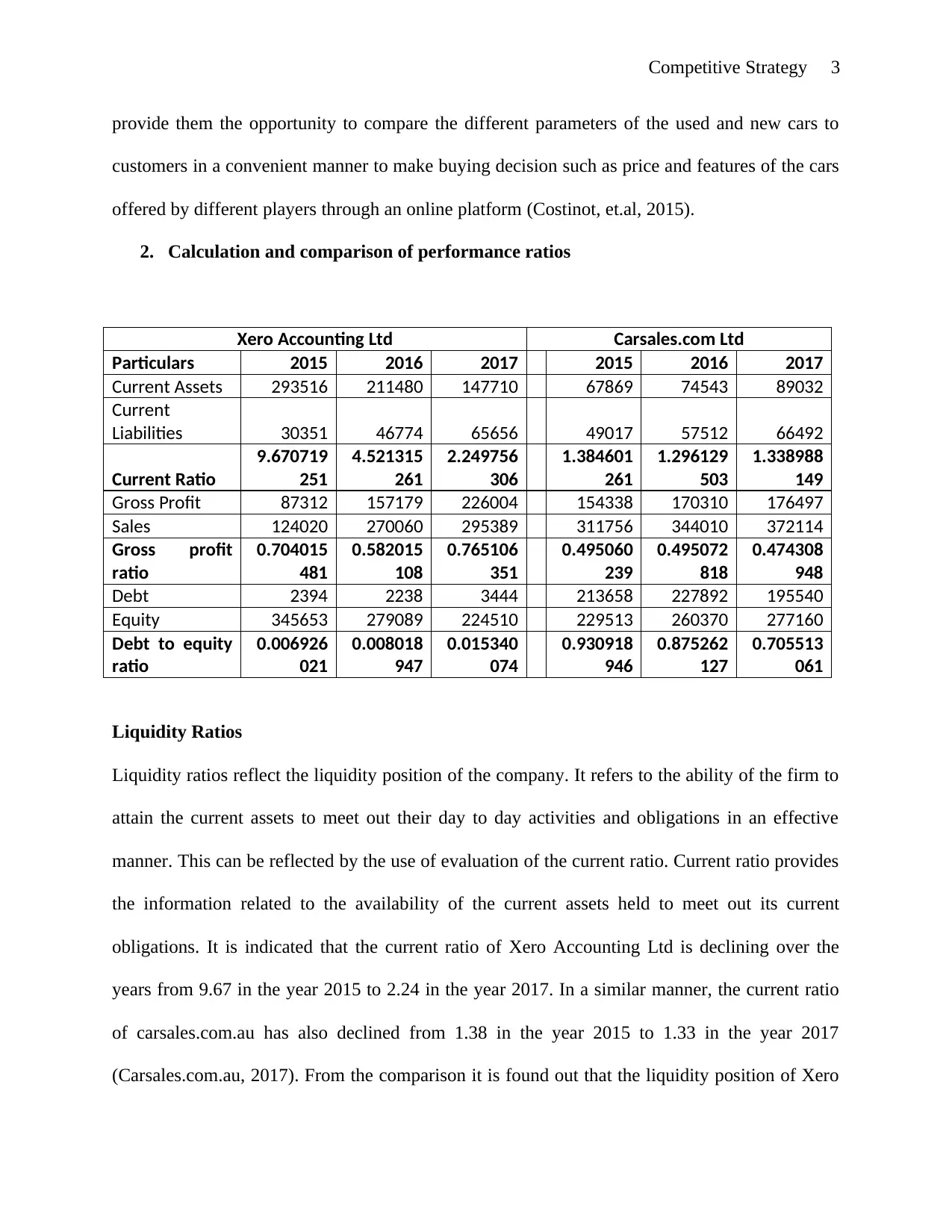

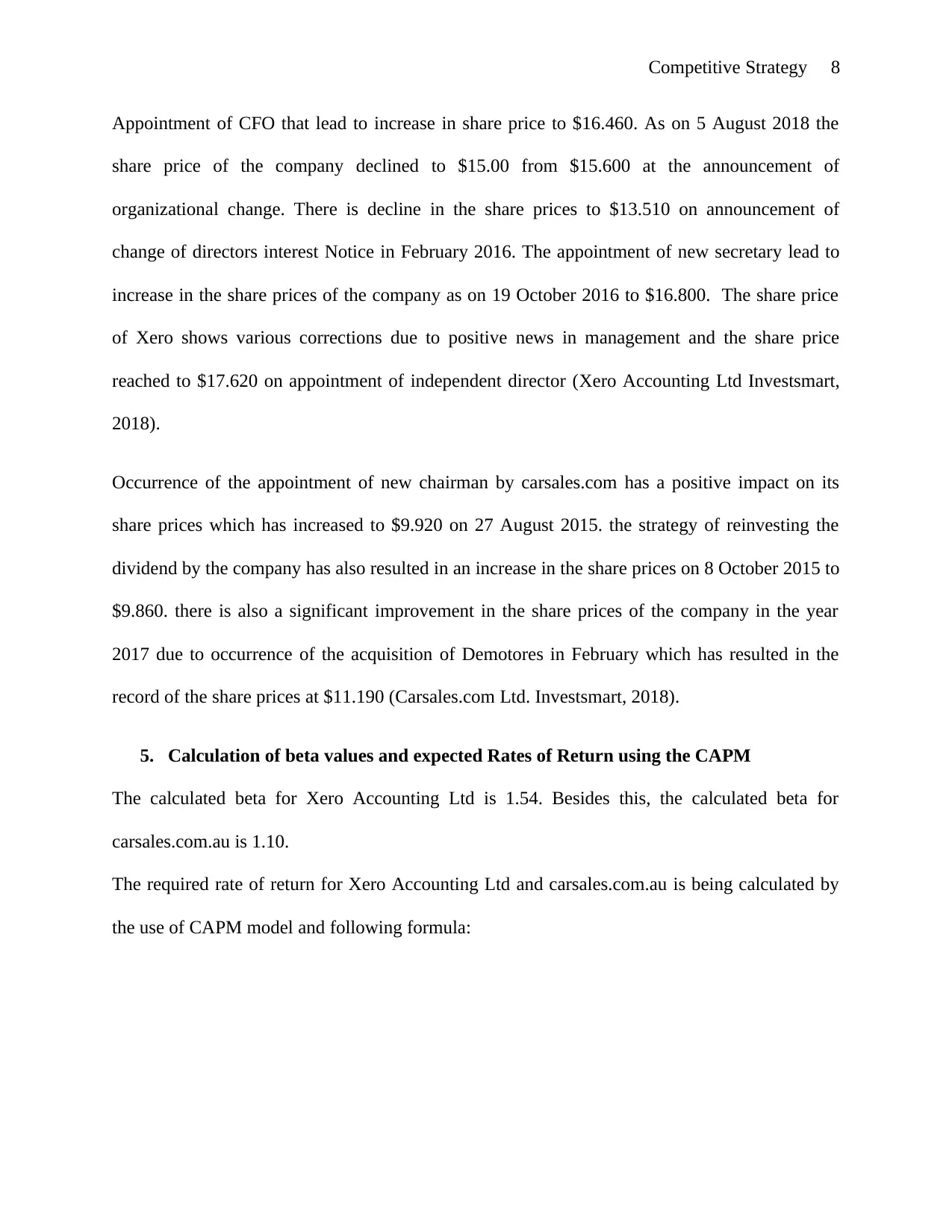

Figure 2: CAR share price for year 2015, 2016 and 2017 (ASX, 2018)

The share price of Carsales.com.au was 10.285 as on January 30 2015 which has declined to

9.426 on 30 April 2015. There after there were several fluctuations in the share prices and the

share price recovered and reaches to 11.680 on 31 December 2015. Later in the year the share

prices shows correction and reached to 12.860 on 31 August 2016 but there was decline in the

share price in the next few months and the share price of the company fall to 10.440 on 31

January 2017 (Carsales.com.au ASX, 2018).

Figure 2: CAR share price for year 2015, 2016 and 2017 (ASX, 2018)

The share price of Carsales.com.au was 10.285 as on January 30 2015 which has declined to

9.426 on 30 April 2015. There after there were several fluctuations in the share prices and the

share price recovered and reaches to 11.680 on 31 December 2015. Later in the year the share

prices shows correction and reached to 12.860 on 31 August 2016 but there was decline in the

share price in the next few months and the share price of the company fall to 10.440 on 31

January 2017 (Carsales.com.au ASX, 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Competitive Strategy 7

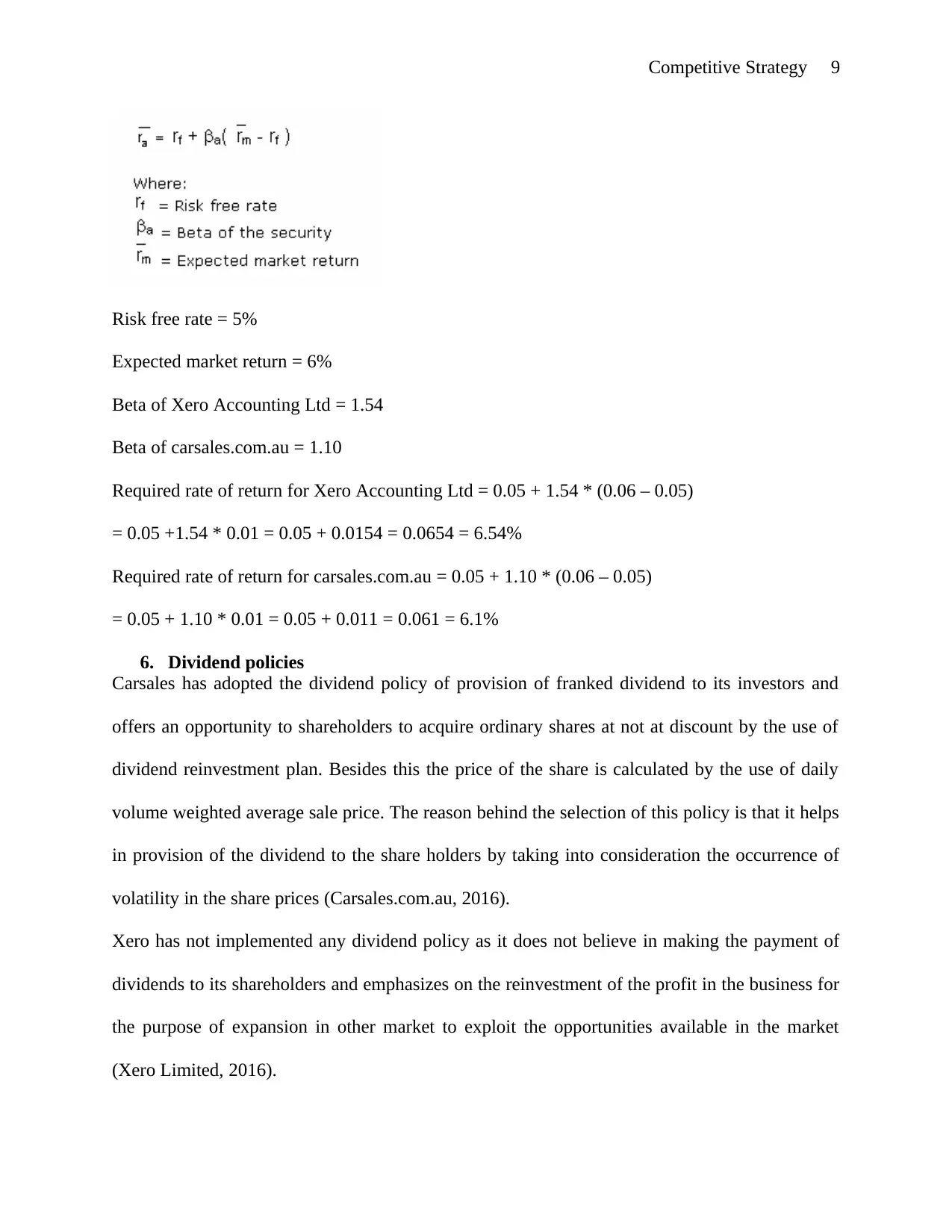

Figure 3: Monthly share price comparison of XERO and CAR

It is analyzed that the share prices of both the companies are moving in a same direction and they

are closely related with each other but it is also found out that the share prices of carsales.com

has decline deeply and the share prices of Zero accounting has shown an increasing trend over

the years. It is also identified that the share prices of Zero accounting is highly volatile in

comparison to Carsale.com (Xero Accounting Ltd ASX, 2018; Carsales.com.au ASX, 2018).

4. Factors influencing the share prices of both the companies

The share prices of the companies fluctuates due to changes occurred in the management

structure, occurrence of the business expansion and so on. The share price of Xero as on 17 June

2015 was $17.290. The Notice of Annual meeting has influenced the share price of the company

and it has fallen to $15.900 as on 29 July 2015. There were corrections in the share price with the

Figure 3: Monthly share price comparison of XERO and CAR

It is analyzed that the share prices of both the companies are moving in a same direction and they

are closely related with each other but it is also found out that the share prices of carsales.com

has decline deeply and the share prices of Zero accounting has shown an increasing trend over

the years. It is also identified that the share prices of Zero accounting is highly volatile in

comparison to Carsale.com (Xero Accounting Ltd ASX, 2018; Carsales.com.au ASX, 2018).

4. Factors influencing the share prices of both the companies

The share prices of the companies fluctuates due to changes occurred in the management

structure, occurrence of the business expansion and so on. The share price of Xero as on 17 June

2015 was $17.290. The Notice of Annual meeting has influenced the share price of the company

and it has fallen to $15.900 as on 29 July 2015. There were corrections in the share price with the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Competitive Strategy 8

Appointment of CFO that lead to increase in share price to $16.460. As on 5 August 2018 the

share price of the company declined to $15.00 from $15.600 at the announcement of

organizational change. There is decline in the share prices to $13.510 on announcement of

change of directors interest Notice in February 2016. The appointment of new secretary lead to

increase in the share prices of the company as on 19 October 2016 to $16.800. The share price

of Xero shows various corrections due to positive news in management and the share price

reached to $17.620 on appointment of independent director (Xero Accounting Ltd Investsmart,

2018).

Occurrence of the appointment of new chairman by carsales.com has a positive impact on its

share prices which has increased to $9.920 on 27 August 2015. the strategy of reinvesting the

dividend by the company has also resulted in an increase in the share prices on 8 October 2015 to

$9.860. there is also a significant improvement in the share prices of the company in the year

2017 due to occurrence of the acquisition of Demotores in February which has resulted in the

record of the share prices at $11.190 (Carsales.com Ltd. Investsmart, 2018).

5. Calculation of beta values and expected Rates of Return using the CAPM

The calculated beta for Xero Accounting Ltd is 1.54. Besides this, the calculated beta for

carsales.com.au is 1.10.

The required rate of return for Xero Accounting Ltd and carsales.com.au is being calculated by

the use of CAPM model and following formula:

Appointment of CFO that lead to increase in share price to $16.460. As on 5 August 2018 the

share price of the company declined to $15.00 from $15.600 at the announcement of

organizational change. There is decline in the share prices to $13.510 on announcement of

change of directors interest Notice in February 2016. The appointment of new secretary lead to

increase in the share prices of the company as on 19 October 2016 to $16.800. The share price

of Xero shows various corrections due to positive news in management and the share price

reached to $17.620 on appointment of independent director (Xero Accounting Ltd Investsmart,

2018).

Occurrence of the appointment of new chairman by carsales.com has a positive impact on its

share prices which has increased to $9.920 on 27 August 2015. the strategy of reinvesting the

dividend by the company has also resulted in an increase in the share prices on 8 October 2015 to

$9.860. there is also a significant improvement in the share prices of the company in the year

2017 due to occurrence of the acquisition of Demotores in February which has resulted in the

record of the share prices at $11.190 (Carsales.com Ltd. Investsmart, 2018).

5. Calculation of beta values and expected Rates of Return using the CAPM

The calculated beta for Xero Accounting Ltd is 1.54. Besides this, the calculated beta for

carsales.com.au is 1.10.

The required rate of return for Xero Accounting Ltd and carsales.com.au is being calculated by

the use of CAPM model and following formula:

Competitive Strategy 9

Risk free rate = 5%

Expected market return = 6%

Beta of Xero Accounting Ltd = 1.54

Beta of carsales.com.au = 1.10

Required rate of return for Xero Accounting Ltd = 0.05 + 1.54 * (0.06 – 0.05)

= 0.05 +1.54 * 0.01 = 0.05 + 0.0154 = 0.0654 = 6.54%

Required rate of return for carsales.com.au = 0.05 + 1.10 * (0.06 – 0.05)

= 0.05 + 1.10 * 0.01 = 0.05 + 0.011 = 0.061 = 6.1%

6. Dividend policies

Carsales has adopted the dividend policy of provision of franked dividend to its investors and

offers an opportunity to shareholders to acquire ordinary shares at not at discount by the use of

dividend reinvestment plan. Besides this the price of the share is calculated by the use of daily

volume weighted average sale price. The reason behind the selection of this policy is that it helps

in provision of the dividend to the share holders by taking into consideration the occurrence of

volatility in the share prices (Carsales.com.au, 2016).

Xero has not implemented any dividend policy as it does not believe in making the payment of

dividends to its shareholders and emphasizes on the reinvestment of the profit in the business for

the purpose of expansion in other market to exploit the opportunities available in the market

(Xero Limited, 2016).

Risk free rate = 5%

Expected market return = 6%

Beta of Xero Accounting Ltd = 1.54

Beta of carsales.com.au = 1.10

Required rate of return for Xero Accounting Ltd = 0.05 + 1.54 * (0.06 – 0.05)

= 0.05 +1.54 * 0.01 = 0.05 + 0.0154 = 0.0654 = 6.54%

Required rate of return for carsales.com.au = 0.05 + 1.10 * (0.06 – 0.05)

= 0.05 + 1.10 * 0.01 = 0.05 + 0.011 = 0.061 = 6.1%

6. Dividend policies

Carsales has adopted the dividend policy of provision of franked dividend to its investors and

offers an opportunity to shareholders to acquire ordinary shares at not at discount by the use of

dividend reinvestment plan. Besides this the price of the share is calculated by the use of daily

volume weighted average sale price. The reason behind the selection of this policy is that it helps

in provision of the dividend to the share holders by taking into consideration the occurrence of

volatility in the share prices (Carsales.com.au, 2016).

Xero has not implemented any dividend policy as it does not believe in making the payment of

dividends to its shareholders and emphasizes on the reinvestment of the profit in the business for

the purpose of expansion in other market to exploit the opportunities available in the market

(Xero Limited, 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Competitive Strategy 10

7. Recommendation letter

To,

Richard

From the above analysis, it is found out that Xero Accounting Ltd is a company that has a better

financial position and performance in comparison to carsales.com.au. This indicates that the

investor should make investment in Xero Accounting Ltd as it has better profitability and

liquidity position. However, the other factor from the perspective of dividend policy, the

investors should make an investment in carsales.com.au as the company is paying the dividend to

its shareholders. It is also found out that the company has also made acquisitions with different

companies that help in the exploitation of the available opportunities in the market

(Carsales.com.au, 2016). Although the share prices of both the companies are moving in the

same direction from past three years, but there is a possibility in the growth and development of

the carsales.com.au in comparison to Xero Accounting Ltd in an effective manner. However, the

required rate of return of Xero Accounting Ltd is higher than that of carsales.com.au, which

shows that the investor should make an investment in Xero Accounting Ltd (Xero Limited,

2017).

Thanks and Regards

Charlie

Thaumas consultants Limited

7. Recommendation letter

To,

Richard

From the above analysis, it is found out that Xero Accounting Ltd is a company that has a better

financial position and performance in comparison to carsales.com.au. This indicates that the

investor should make investment in Xero Accounting Ltd as it has better profitability and

liquidity position. However, the other factor from the perspective of dividend policy, the

investors should make an investment in carsales.com.au as the company is paying the dividend to

its shareholders. It is also found out that the company has also made acquisitions with different

companies that help in the exploitation of the available opportunities in the market

(Carsales.com.au, 2016). Although the share prices of both the companies are moving in the

same direction from past three years, but there is a possibility in the growth and development of

the carsales.com.au in comparison to Xero Accounting Ltd in an effective manner. However, the

required rate of return of Xero Accounting Ltd is higher than that of carsales.com.au, which

shows that the investor should make an investment in Xero Accounting Ltd (Xero Limited,

2017).

Thanks and Regards

Charlie

Thaumas consultants Limited

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Competitive Strategy 11

References

Carsales.com Ltd. Investsmart. (2018) Company Announcements. [Online]. Available at:

Carsales.com.au ASX. (2018) Charting. [Online]. Available at:

https://www.asx.com.au/prices/charting/?code=CAR&compareCode=ALL

%20ORDIANRIES&chartType=COMMONBASE&priceMovingAverage1=&priceMovingAver

age2=&volumeIndicator=BAR&volumeMovingAverage=&timeframe=monthly [Accessed on:

28 September 2018].

Carsales.com.au. (2016) Annual Report. [Online]. Available at:

http://shareholder.carsales.com.au/FormBuilder/_Resource/_module/NwbnH0pKFk-

uPGxM7cmTrw/docs/reports/annual/Annual_Report_2016.pdf [Accessed on: 28 September

2018].

Carsales.com.au. (2017) Annual Report. [Online]. Available at:

http://shareholder.carsales.com.au/FormBuilder/_Resource/_module/NwbnH0pKFk-

uPGxM7cmTrw/docs/reports/annual/Annual_Report_June_2017.pdf [Accessed on: 28

September 2018].

Costinot, A., Donaldson, D., Vogel, J. and Werning, I. (2015) Comparative advantage and

optimal trade policy. The Quarterly Journal of Economics, 130(2), pp.659-702.

https://www.investsmart.com.au/shares/asx-car/carssales-limited/announcements?page=4

[Accessed on: 28 September 2018].

Reuters. (2018) Carsales.com.au. [Online]. Available at:

https://www.reuters.com/finance/stocks/overview/CAR.AX [Accessed on: 28 September 2018].

References

Carsales.com Ltd. Investsmart. (2018) Company Announcements. [Online]. Available at:

Carsales.com.au ASX. (2018) Charting. [Online]. Available at:

https://www.asx.com.au/prices/charting/?code=CAR&compareCode=ALL

%20ORDIANRIES&chartType=COMMONBASE&priceMovingAverage1=&priceMovingAver

age2=&volumeIndicator=BAR&volumeMovingAverage=&timeframe=monthly [Accessed on:

28 September 2018].

Carsales.com.au. (2016) Annual Report. [Online]. Available at:

http://shareholder.carsales.com.au/FormBuilder/_Resource/_module/NwbnH0pKFk-

uPGxM7cmTrw/docs/reports/annual/Annual_Report_2016.pdf [Accessed on: 28 September

2018].

Carsales.com.au. (2017) Annual Report. [Online]. Available at:

http://shareholder.carsales.com.au/FormBuilder/_Resource/_module/NwbnH0pKFk-

uPGxM7cmTrw/docs/reports/annual/Annual_Report_June_2017.pdf [Accessed on: 28

September 2018].

Costinot, A., Donaldson, D., Vogel, J. and Werning, I. (2015) Comparative advantage and

optimal trade policy. The Quarterly Journal of Economics, 130(2), pp.659-702.

https://www.investsmart.com.au/shares/asx-car/carssales-limited/announcements?page=4

[Accessed on: 28 September 2018].

Reuters. (2018) Carsales.com.au. [Online]. Available at:

https://www.reuters.com/finance/stocks/overview/CAR.AX [Accessed on: 28 September 2018].

Competitive Strategy 12

Xero Accounting Ltd ASX. (2018) Charting. [Online]. Available at:

https://www.asx.com.au/prices/charting/?

code=XRO&compareCode=CAR&chartType=COMMONBASE&priceMovingAverage1=&pric

eMovingAverage2=&volumeIndicator=BAR&volumeMovingAverage=&timeframe=monthly

[Accessed on: 28 September 2018].

Xero Accounting Ltd Investsmart. (2018) Company Announcements. [Online]. Available at:

https://www.investsmart.com.au/shares/asx-xro/xero-limited/announcements?page=9 [Accessed

on: 28 September 2018].

Xero Limited. (2016) Annual Report. [Online]. Available at:

https://www.xero.com/media/9883890/xro_2016_annual_report.pdf [Accessed on: 28 September

2018].

Xero Limited. (2017) Annual Report. [Online]. Available at:

https://www.xero.com/content/dam/xero/pdf/Xero%20Annual%20Report%20FY17.pdf

[Accessed on: 28 September 2018].

Xero Limited. (2018) About us. [Online]. Available at: https://www.xero.com/au/about/

[Accessed on: 28 September 2018].

Xero Accounting Ltd ASX. (2018) Charting. [Online]. Available at:

https://www.asx.com.au/prices/charting/?

code=XRO&compareCode=CAR&chartType=COMMONBASE&priceMovingAverage1=&pric

eMovingAverage2=&volumeIndicator=BAR&volumeMovingAverage=&timeframe=monthly

[Accessed on: 28 September 2018].

Xero Accounting Ltd Investsmart. (2018) Company Announcements. [Online]. Available at:

https://www.investsmart.com.au/shares/asx-xro/xero-limited/announcements?page=9 [Accessed

on: 28 September 2018].

Xero Limited. (2016) Annual Report. [Online]. Available at:

https://www.xero.com/media/9883890/xro_2016_annual_report.pdf [Accessed on: 28 September

2018].

Xero Limited. (2017) Annual Report. [Online]. Available at:

https://www.xero.com/content/dam/xero/pdf/Xero%20Annual%20Report%20FY17.pdf

[Accessed on: 28 September 2018].

Xero Limited. (2018) About us. [Online]. Available at: https://www.xero.com/au/about/

[Accessed on: 28 September 2018].

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.