Analysis of RCL LTD's Working Capital and Capital Budgeting Strategies

VerifiedAdded on 2020/06/03

|14

|3259

|37

Report

AI Summary

This report provides a comprehensive financial analysis of Root & Cook Ltd (RCL LTD), focusing on working capital management, capital budgeting, and investment appraisal. The report begins by defining key accounting terms like profit and cash flow, differentiating between them, and discussing their impact on business performance. It then delves into working capital, explaining its importance, calculation, and the factors affecting it. The report also examines the working capital cycle and its components. Part 2 explores capital budgeting, outlining the process and evaluating investment appraisal methods such as payback period and Net Present Value (NPV). The report calculates these methods for investment options and concludes with recommendations for selecting the best investment venture for RCL LTD. The report's analysis provides insights into financial planning, investment decisions, and the overall financial health of the company.

Root & Cook Ltd

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

Part 1................................................................................................................................................1

1. Different terms of accounting.............................................................................................1

2. Concepts that affect business financial results...................................................................2

3. Recommendations to improve the financial position by managing working capital.........3

Part 2................................................................................................................................................4

1. Explaining the term capital budgeting and process............................................................4

Merits and demerits of investment appraisal methods...........................................................5

2. Calculation of investment options......................................................................................7

3. Recommendation to select investment venture................................................................11

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................11

INTRODUCTION...........................................................................................................................1

Part 1................................................................................................................................................1

1. Different terms of accounting.............................................................................................1

2. Concepts that affect business financial results...................................................................2

3. Recommendations to improve the financial position by managing working capital.........3

Part 2................................................................................................................................................4

1. Explaining the term capital budgeting and process............................................................4

Merits and demerits of investment appraisal methods...........................................................5

2. Calculation of investment options......................................................................................7

3. Recommendation to select investment venture................................................................11

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................11

INTRODUCTION

Finance is required in every business so that it may be able to carry out day-to-day tasks

in effective way. Present report deals with RCL LTD which is engaged in producing garden

tractors and ride-on lawn movers. Report discusses importance of working capital and how it

should be managed to carry out tasks. Moreover, WCC is also explained with example. Apart

from this, capital budgeting process and techniques are discussed relevant for expansion purpose.

In relation to this, investment appraisal techniques such as payback period, IRR, NPV are

calculated for selecting best options available to company.

Part 1

1. Different terms of accounting

Profit: Profits are the surplus for firm in which all the expenses are deducted from the revenues

effectively. Profit is also a base for tac calculation which describe the overall picture of firm

efficiently. Profits such as net profit operating profit and gross profit. All of them in a positive

numerical form represents the performance of business operational activities and produce

information. The absence of profit affect the cash flow. In addition to this, business has incurred

expenditures more than income, then it is called net loss. This implies that organisation has to

initiate control over expenses to generate sufficient profits.

Cash flow: Cash flow refers to the inflow and outflow of money which will be done by Root and

Cook Ltd. Cash flow management is important for the business in order to manage and control

different operational activities such as operating cost, salary paid to workers, purchasing

inventories and taxes etc. Cash flow in positive manner defines the increasing liquid assets and

negative cash flow define decreasing liquid assets. On the other hand, cash outflow means

business makes payment to suppliers, rent for premises and all expenditures are allocated under

accounts payables.

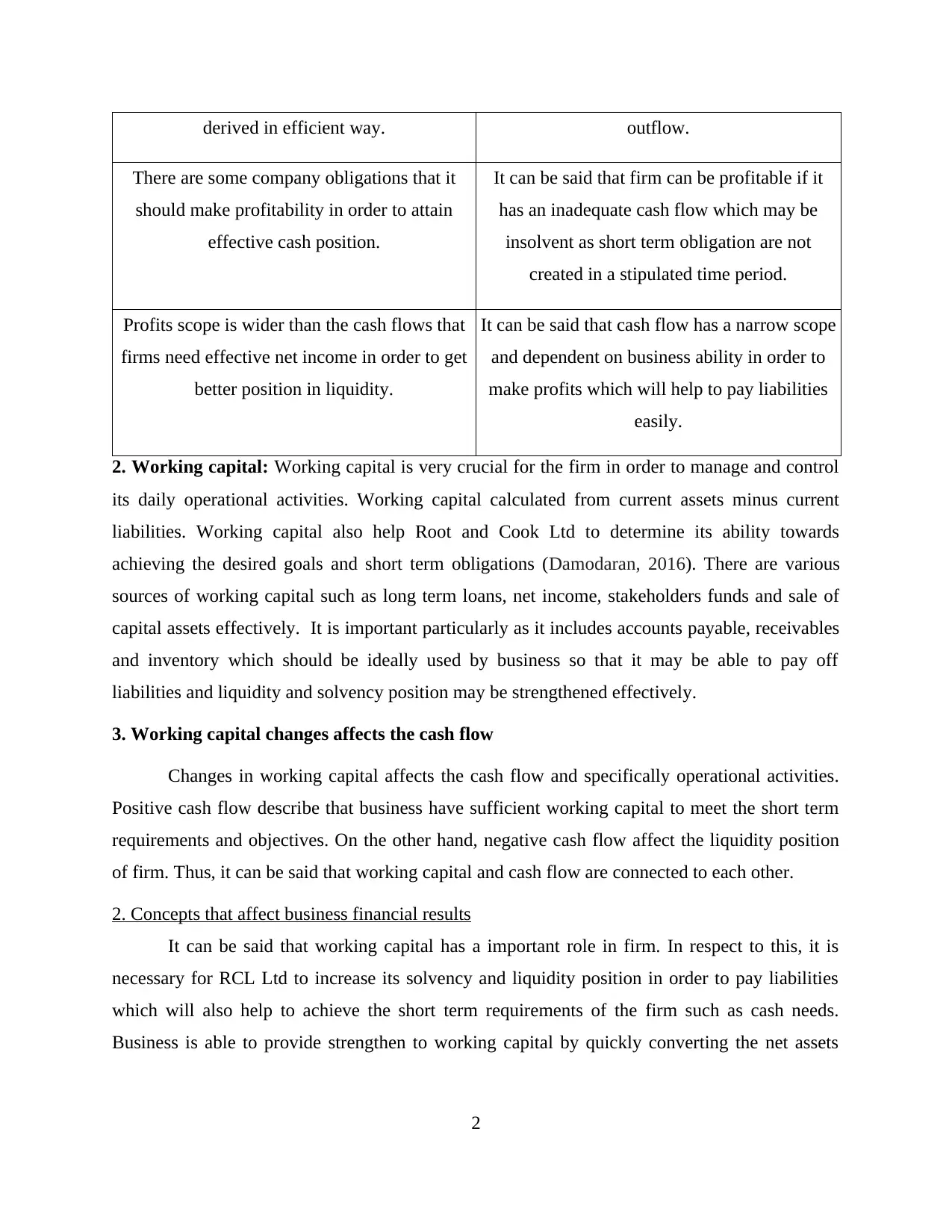

DIFFERENCE BETWEEN PROFIT AND CASH FLOW

Profit Cash flow

Profit is determined by deducting all the

variable and fixed expenses from revenue and

thus, the net income of Root and Cook Ltd is

Cash flow accounts are for a specific period in

order to derive it effectively. Cash flow

deduction are made from the cash inflow and

1

Finance is required in every business so that it may be able to carry out day-to-day tasks

in effective way. Present report deals with RCL LTD which is engaged in producing garden

tractors and ride-on lawn movers. Report discusses importance of working capital and how it

should be managed to carry out tasks. Moreover, WCC is also explained with example. Apart

from this, capital budgeting process and techniques are discussed relevant for expansion purpose.

In relation to this, investment appraisal techniques such as payback period, IRR, NPV are

calculated for selecting best options available to company.

Part 1

1. Different terms of accounting

Profit: Profits are the surplus for firm in which all the expenses are deducted from the revenues

effectively. Profit is also a base for tac calculation which describe the overall picture of firm

efficiently. Profits such as net profit operating profit and gross profit. All of them in a positive

numerical form represents the performance of business operational activities and produce

information. The absence of profit affect the cash flow. In addition to this, business has incurred

expenditures more than income, then it is called net loss. This implies that organisation has to

initiate control over expenses to generate sufficient profits.

Cash flow: Cash flow refers to the inflow and outflow of money which will be done by Root and

Cook Ltd. Cash flow management is important for the business in order to manage and control

different operational activities such as operating cost, salary paid to workers, purchasing

inventories and taxes etc. Cash flow in positive manner defines the increasing liquid assets and

negative cash flow define decreasing liquid assets. On the other hand, cash outflow means

business makes payment to suppliers, rent for premises and all expenditures are allocated under

accounts payables.

DIFFERENCE BETWEEN PROFIT AND CASH FLOW

Profit Cash flow

Profit is determined by deducting all the

variable and fixed expenses from revenue and

thus, the net income of Root and Cook Ltd is

Cash flow accounts are for a specific period in

order to derive it effectively. Cash flow

deduction are made from the cash inflow and

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

derived in efficient way. outflow.

There are some company obligations that it

should make profitability in order to attain

effective cash position.

It can be said that firm can be profitable if it

has an inadequate cash flow which may be

insolvent as short term obligation are not

created in a stipulated time period.

Profits scope is wider than the cash flows that

firms need effective net income in order to get

better position in liquidity.

It can be said that cash flow has a narrow scope

and dependent on business ability in order to

make profits which will help to pay liabilities

easily.

2. Working capital: Working capital is very crucial for the firm in order to manage and control

its daily operational activities. Working capital calculated from current assets minus current

liabilities. Working capital also help Root and Cook Ltd to determine its ability towards

achieving the desired goals and short term obligations (Damodaran, 2016). There are various

sources of working capital such as long term loans, net income, stakeholders funds and sale of

capital assets effectively. It is important particularly as it includes accounts payable, receivables

and inventory which should be ideally used by business so that it may be able to pay off

liabilities and liquidity and solvency position may be strengthened effectively.

3. Working capital changes affects the cash flow

Changes in working capital affects the cash flow and specifically operational activities.

Positive cash flow describe that business have sufficient working capital to meet the short term

requirements and objectives. On the other hand, negative cash flow affect the liquidity position

of firm. Thus, it can be said that working capital and cash flow are connected to each other.

2. Concepts that affect business financial results

It can be said that working capital has a important role in firm. In respect to this, it is

necessary for RCL Ltd to increase its solvency and liquidity position in order to pay liabilities

which will also help to achieve the short term requirements of the firm such as cash needs.

Business is able to provide strengthen to working capital by quickly converting the net assets

2

There are some company obligations that it

should make profitability in order to attain

effective cash position.

It can be said that firm can be profitable if it

has an inadequate cash flow which may be

insolvent as short term obligation are not

created in a stipulated time period.

Profits scope is wider than the cash flows that

firms need effective net income in order to get

better position in liquidity.

It can be said that cash flow has a narrow scope

and dependent on business ability in order to

make profits which will help to pay liabilities

easily.

2. Working capital: Working capital is very crucial for the firm in order to manage and control

its daily operational activities. Working capital calculated from current assets minus current

liabilities. Working capital also help Root and Cook Ltd to determine its ability towards

achieving the desired goals and short term obligations (Damodaran, 2016). There are various

sources of working capital such as long term loans, net income, stakeholders funds and sale of

capital assets effectively. It is important particularly as it includes accounts payable, receivables

and inventory which should be ideally used by business so that it may be able to pay off

liabilities and liquidity and solvency position may be strengthened effectively.

3. Working capital changes affects the cash flow

Changes in working capital affects the cash flow and specifically operational activities.

Positive cash flow describe that business have sufficient working capital to meet the short term

requirements and objectives. On the other hand, negative cash flow affect the liquidity position

of firm. Thus, it can be said that working capital and cash flow are connected to each other.

2. Concepts that affect business financial results

It can be said that working capital has a important role in firm. In respect to this, it is

necessary for RCL Ltd to increase its solvency and liquidity position in order to pay liabilities

which will also help to achieve the short term requirements of the firm such as cash needs.

Business is able to provide strengthen to working capital by quickly converting the net assets

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

into cash which will help to increase the liquidity aspects (Mathuva, 2015). The conversion cycle

is known a Working capital cycle.

The working capital cycle consists purchasing inventories from which firm utilise and

payments will be received from consumers in the market by selling finished products on the

credit basis. RCL Ltd has 30 days initial time to pay the amount of raw material purchased.

Average creditors' payment period calculated in such way:

Inventory on an average / sales of the concern 365

8000/22000*365 = 132 days

This defines that business will consider 132 days to sell inventories. Debtors collection

period assessment will be calculated in days that debtors outstanding are 20000 and the credit

sales is 80000. The formula to calculate debtors collection period will be:

Debtors/sales made on credit*365

20000/80000*36 = 91 days

It can be said that the above calculation will help to calculate the WCC effectively. It is

clear that creditor will be paid off within 30 days and stock will convert into sales within 132

days. Finally, the receivables will be converted into cash within 91 days time period effectively.

The calculation for WCC will be:

Stock turnover + Receivables turnover – credit period

132+91-30 = 193 days.

Thus, it can be justified that RCL Ltd will require 193 days in order to convert its net

assets into liquid cash successfully and effectively. The cash will be received by the firm within

193 days. Business should garner more capital which will help to enhance the solvency and

liquidity position efficiently. This will also help to manage the working capital successfully and

in effective manner.

3. Recommendations to improve the financial position by managing working capital

It can be said that the working capital has a vital role in the business. It will help to pay

liabilities and also carry the day to day operations. Working capital calculated from current

assets minus current liabilities. Working capital also help Root and Cook Ltd to determine its

3

is known a Working capital cycle.

The working capital cycle consists purchasing inventories from which firm utilise and

payments will be received from consumers in the market by selling finished products on the

credit basis. RCL Ltd has 30 days initial time to pay the amount of raw material purchased.

Average creditors' payment period calculated in such way:

Inventory on an average / sales of the concern 365

8000/22000*365 = 132 days

This defines that business will consider 132 days to sell inventories. Debtors collection

period assessment will be calculated in days that debtors outstanding are 20000 and the credit

sales is 80000. The formula to calculate debtors collection period will be:

Debtors/sales made on credit*365

20000/80000*36 = 91 days

It can be said that the above calculation will help to calculate the WCC effectively. It is

clear that creditor will be paid off within 30 days and stock will convert into sales within 132

days. Finally, the receivables will be converted into cash within 91 days time period effectively.

The calculation for WCC will be:

Stock turnover + Receivables turnover – credit period

132+91-30 = 193 days.

Thus, it can be justified that RCL Ltd will require 193 days in order to convert its net

assets into liquid cash successfully and effectively. The cash will be received by the firm within

193 days. Business should garner more capital which will help to enhance the solvency and

liquidity position efficiently. This will also help to manage the working capital successfully and

in effective manner.

3. Recommendations to improve the financial position by managing working capital

It can be said that the working capital has a vital role in the business. It will help to pay

liabilities and also carry the day to day operations. Working capital calculated from current

assets minus current liabilities. Working capital also help Root and Cook Ltd to determine its

3

ability towards achieving the desired goals and short term obligations. There are various sources

of working capital such as long term loans, net income, stakeholders funds and sale of capital

assets (de Almeida and Eid Jr, 2014). It is important particularly as it includes accounts payable,

receivables and inventory which should be ideally used by business so that it may be able to pay

off liabilities and liquidity and solvency position may be strengthened effectively.

Apart from this, business should purchase raw materials from suppliers in order to offer

discount on it. This will help firm to improve its liquidity and solvency position. Funds can be

also retained from better working capital management. The most important aspects to improve

the working capital is effective control over variable and fixed expenses which will help to

generate positive cash flow within business effectively and efficiently. Moreover, it is required

that business should examine interest obligations so that instalments can be reduced by making

early payments and also rate of interest can be analysed. Minimising these payments will add to

enlargement of working capital in effective manner (Ehrhardt and Brigham, 2016). Firm can also

eliminate extra and waste expenses in order to provide strengthen towards working capital

management. RCL Ltd is responsible for managing the payments received from customers in the

market. This will help to clear outstanding from customers.

Improve accounts receivables: Accounts receivables are outstanding and must be collected by

firm in a specific time manner in order to motivate customers in the market by offering them

incentives towards the payments effectively.

Improve accounts payables: The management of payment process should be evaluated by firm

in order to manage the cash flow. For an example, business is able to change the supplier if he is

unable to negotiate the price or better payment option towards the operational activities

effectively.

Thus, better working capital management will help business to operate their daily operational

activities effectively and in efficient manner. This will also help to increase the profitability

which leads towards achieving goals and objectives.

4

of working capital such as long term loans, net income, stakeholders funds and sale of capital

assets (de Almeida and Eid Jr, 2014). It is important particularly as it includes accounts payable,

receivables and inventory which should be ideally used by business so that it may be able to pay

off liabilities and liquidity and solvency position may be strengthened effectively.

Apart from this, business should purchase raw materials from suppliers in order to offer

discount on it. This will help firm to improve its liquidity and solvency position. Funds can be

also retained from better working capital management. The most important aspects to improve

the working capital is effective control over variable and fixed expenses which will help to

generate positive cash flow within business effectively and efficiently. Moreover, it is required

that business should examine interest obligations so that instalments can be reduced by making

early payments and also rate of interest can be analysed. Minimising these payments will add to

enlargement of working capital in effective manner (Ehrhardt and Brigham, 2016). Firm can also

eliminate extra and waste expenses in order to provide strengthen towards working capital

management. RCL Ltd is responsible for managing the payments received from customers in the

market. This will help to clear outstanding from customers.

Improve accounts receivables: Accounts receivables are outstanding and must be collected by

firm in a specific time manner in order to motivate customers in the market by offering them

incentives towards the payments effectively.

Improve accounts payables: The management of payment process should be evaluated by firm

in order to manage the cash flow. For an example, business is able to change the supplier if he is

unable to negotiate the price or better payment option towards the operational activities

effectively.

Thus, better working capital management will help business to operate their daily operational

activities effectively and in efficient manner. This will also help to increase the profitability

which leads towards achieving goals and objectives.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Part 2

1. Explaining the term capital budgeting and process

Capital budgeting is effective technique in the business for selecting adequate long term

assets so that organisation may be able to generate revenue with much ease. Capital budgeting is

used to effectively analyse investment options in terms of risk associated with it. Moreover, it is

also useful in assessing profitability aspect of new project so that adequate returns may be

produced and business may be benefited. Main purpose of this technique is to maximise

operation The process of capital budgeting is discussed below-

Identification

Identification is the first stage in capital budgeting process in which several proposals are

made and RCL Ltd can invest in the same for expansion purpose (Fokkema, Buijs and Vis,

2017).

Evaluation

This is the second stage which deals with evaluation of new project so that it may yield

benefits to RCL Ltd. Project is evaluated in terms of organisation's objective to earn revenue.

Selection

This is next stage in which proposals are scrutinised and effective project is selected. At

this stage, business finally selects that project yielding maximum benefit.

Implementation

This stage is second last stage which deals with implementation of selected project

yielding good returns. In this stage, various resources are initiated so that project may be

completed within timely manner.

Monitoring

This is the last stage which deals with monitoring of project implemented by RCL Ltd so

that budgeted results can be compared with actual one and corrective actions can be taken in the

event of shortcomings or variances.

Merits and demerits of investment appraisal methods

Payback period

5

1. Explaining the term capital budgeting and process

Capital budgeting is effective technique in the business for selecting adequate long term

assets so that organisation may be able to generate revenue with much ease. Capital budgeting is

used to effectively analyse investment options in terms of risk associated with it. Moreover, it is

also useful in assessing profitability aspect of new project so that adequate returns may be

produced and business may be benefited. Main purpose of this technique is to maximise

operation The process of capital budgeting is discussed below-

Identification

Identification is the first stage in capital budgeting process in which several proposals are

made and RCL Ltd can invest in the same for expansion purpose (Fokkema, Buijs and Vis,

2017).

Evaluation

This is the second stage which deals with evaluation of new project so that it may yield

benefits to RCL Ltd. Project is evaluated in terms of organisation's objective to earn revenue.

Selection

This is next stage in which proposals are scrutinised and effective project is selected. At

this stage, business finally selects that project yielding maximum benefit.

Implementation

This stage is second last stage which deals with implementation of selected project

yielding good returns. In this stage, various resources are initiated so that project may be

completed within timely manner.

Monitoring

This is the last stage which deals with monitoring of project implemented by RCL Ltd so

that budgeted results can be compared with actual one and corrective actions can be taken in the

event of shortcomings or variances.

Merits and demerits of investment appraisal methods

Payback period

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

This investment appraisal method is effective one for RCL Ltd as it clarifies to company

in how many years project will yield returns. This help company to select that project which

provide less time to yield results. It is recommended that less the payback period, company

should invest in the same (Drover and et.al, 2017).

Merits

1. It is easy to compute and interpret results quite effectively.

2. It is useful method which evaluates risk associated with the project and business is

benefited by it.

Demerits

1. Payback period is not suitable as it does not provide profitability aspect of new project

and clarifies only time period within which project will impart returns.

2. It ignores concept of time value of money and is the main disadvantage of this method.

NPV (Net Present Value)

NPV is quite useful investment appraisal method which provides clarity to RCL Ltd in

terms of profitability of project. More the NPV, better for company to invest in the same. Thus,

NPV is important method providing effectiveness of project.

Merits

1. It is quite useful for RCL Ltd as it provides information about profitability element

while assessing project.

2. NPV is useful as it considers time value of money quite effectually and correct

decisions can be made by the company.

Demerits

1. It is not suitable for the company as it considers cost of capital which is a rough

estimate and results may be inaccurate on concentrating on such basis.

2. It is not useful for comparison when two projects are mutually exclusive.

IRR (Internal Rate of Return)

6

in how many years project will yield returns. This help company to select that project which

provide less time to yield results. It is recommended that less the payback period, company

should invest in the same (Drover and et.al, 2017).

Merits

1. It is easy to compute and interpret results quite effectively.

2. It is useful method which evaluates risk associated with the project and business is

benefited by it.

Demerits

1. Payback period is not suitable as it does not provide profitability aspect of new project

and clarifies only time period within which project will impart returns.

2. It ignores concept of time value of money and is the main disadvantage of this method.

NPV (Net Present Value)

NPV is quite useful investment appraisal method which provides clarity to RCL Ltd in

terms of profitability of project. More the NPV, better for company to invest in the same. Thus,

NPV is important method providing effectiveness of project.

Merits

1. It is quite useful for RCL Ltd as it provides information about profitability element

while assessing project.

2. NPV is useful as it considers time value of money quite effectually and correct

decisions can be made by the company.

Demerits

1. It is not suitable for the company as it considers cost of capital which is a rough

estimate and results may be inaccurate on concentrating on such basis.

2. It is not useful for comparison when two projects are mutually exclusive.

IRR (Internal Rate of Return)

6

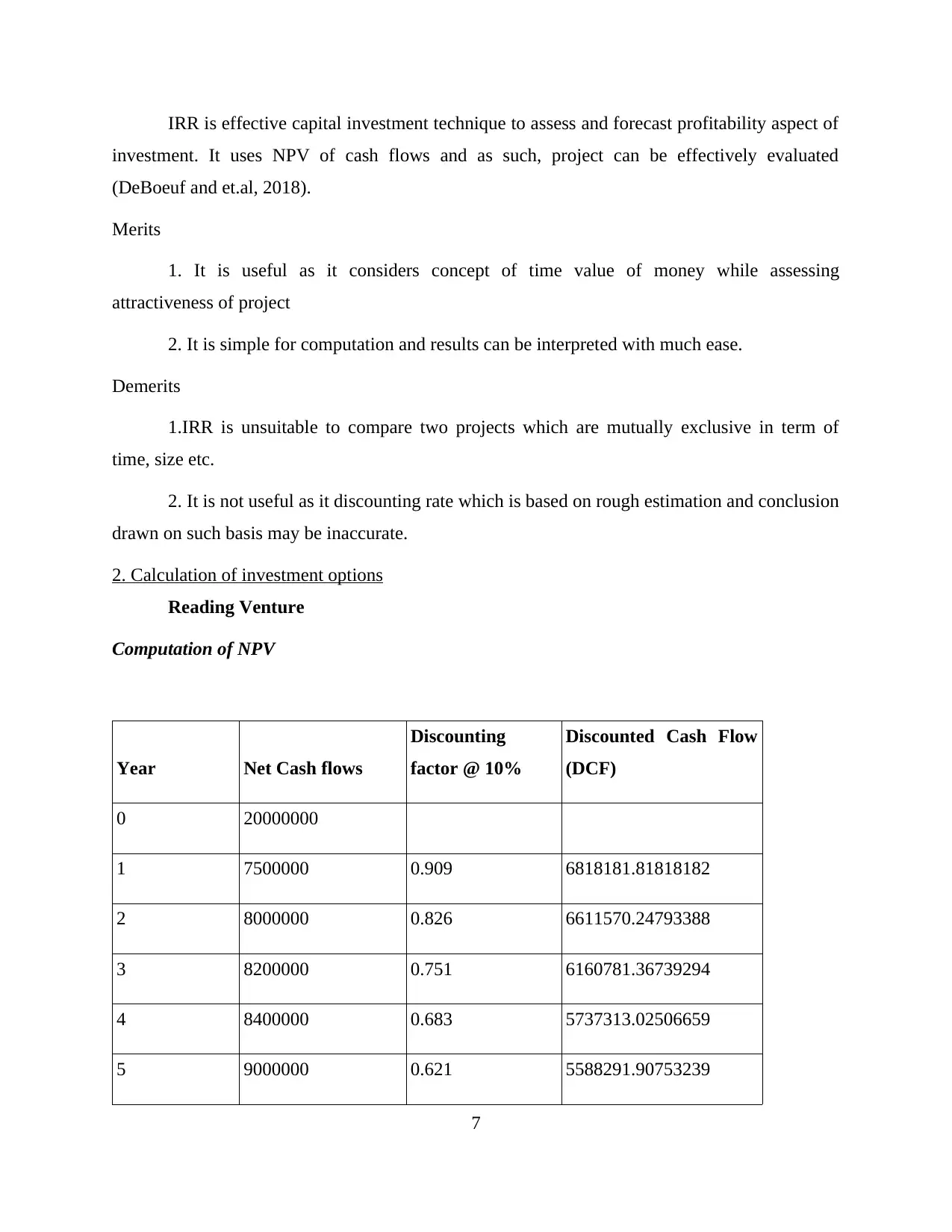

IRR is effective capital investment technique to assess and forecast profitability aspect of

investment. It uses NPV of cash flows and as such, project can be effectively evaluated

(DeBoeuf and et.al, 2018).

Merits

1. It is useful as it considers concept of time value of money while assessing

attractiveness of project

2. It is simple for computation and results can be interpreted with much ease.

Demerits

1.IRR is unsuitable to compare two projects which are mutually exclusive in term of

time, size etc.

2. It is not useful as it discounting rate which is based on rough estimation and conclusion

drawn on such basis may be inaccurate.

2. Calculation of investment options

Reading Venture

Computation of NPV

Year Net Cash flows

Discounting

factor @ 10%

Discounted Cash Flow

(DCF)

0 20000000

1 7500000 0.909 6818181.81818182

2 8000000 0.826 6611570.24793388

3 8200000 0.751 6160781.36739294

4 8400000 0.683 5737313.02506659

5 9000000 0.621 5588291.90753239

7

investment. It uses NPV of cash flows and as such, project can be effectively evaluated

(DeBoeuf and et.al, 2018).

Merits

1. It is useful as it considers concept of time value of money while assessing

attractiveness of project

2. It is simple for computation and results can be interpreted with much ease.

Demerits

1.IRR is unsuitable to compare two projects which are mutually exclusive in term of

time, size etc.

2. It is not useful as it discounting rate which is based on rough estimation and conclusion

drawn on such basis may be inaccurate.

2. Calculation of investment options

Reading Venture

Computation of NPV

Year Net Cash flows

Discounting

factor @ 10%

Discounted Cash Flow

(DCF)

0 20000000

1 7500000 0.909 6818181.81818182

2 8000000 0.826 6611570.24793388

3 8200000 0.751 6160781.36739294

4 8400000 0.683 5737313.02506659

5 9000000 0.621 5588291.90753239

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6 9200000 0.564 5193160.15649475

7 11000000 0.513 5644739.30053777

8 12000000 0.467 5598088.5625168

9 12500000 0.424 5301220.22965606

10 13000000 0.386 5012062.76258391

98800000 57665409.3778969

Initial Investment 20000000

NPV 37665409.3778969

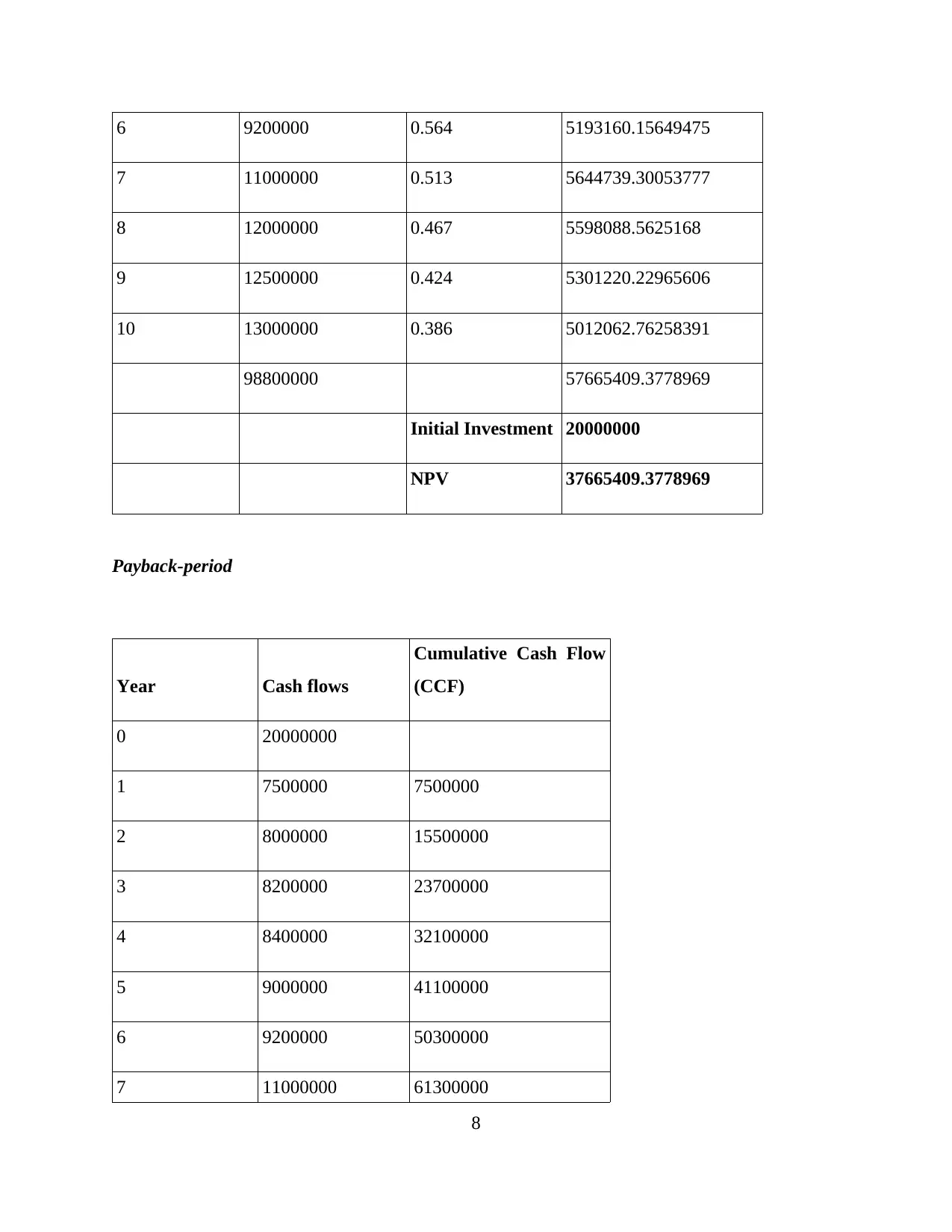

Payback-period

Year Cash flows

Cumulative Cash Flow

(CCF)

0 20000000

1 7500000 7500000

2 8000000 15500000

3 8200000 23700000

4 8400000 32100000

5 9000000 41100000

6 9200000 50300000

7 11000000 61300000

8

7 11000000 0.513 5644739.30053777

8 12000000 0.467 5598088.5625168

9 12500000 0.424 5301220.22965606

10 13000000 0.386 5012062.76258391

98800000 57665409.3778969

Initial Investment 20000000

NPV 37665409.3778969

Payback-period

Year Cash flows

Cumulative Cash Flow

(CCF)

0 20000000

1 7500000 7500000

2 8000000 15500000

3 8200000 23700000

4 8400000 32100000

5 9000000 41100000

6 9200000 50300000

7 11000000 61300000

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8 12000000 73300000

9 12500000 85800000

10 13000000 98800000

Total cash flows 98800000

Initial

investment 20000000

0.2024291498

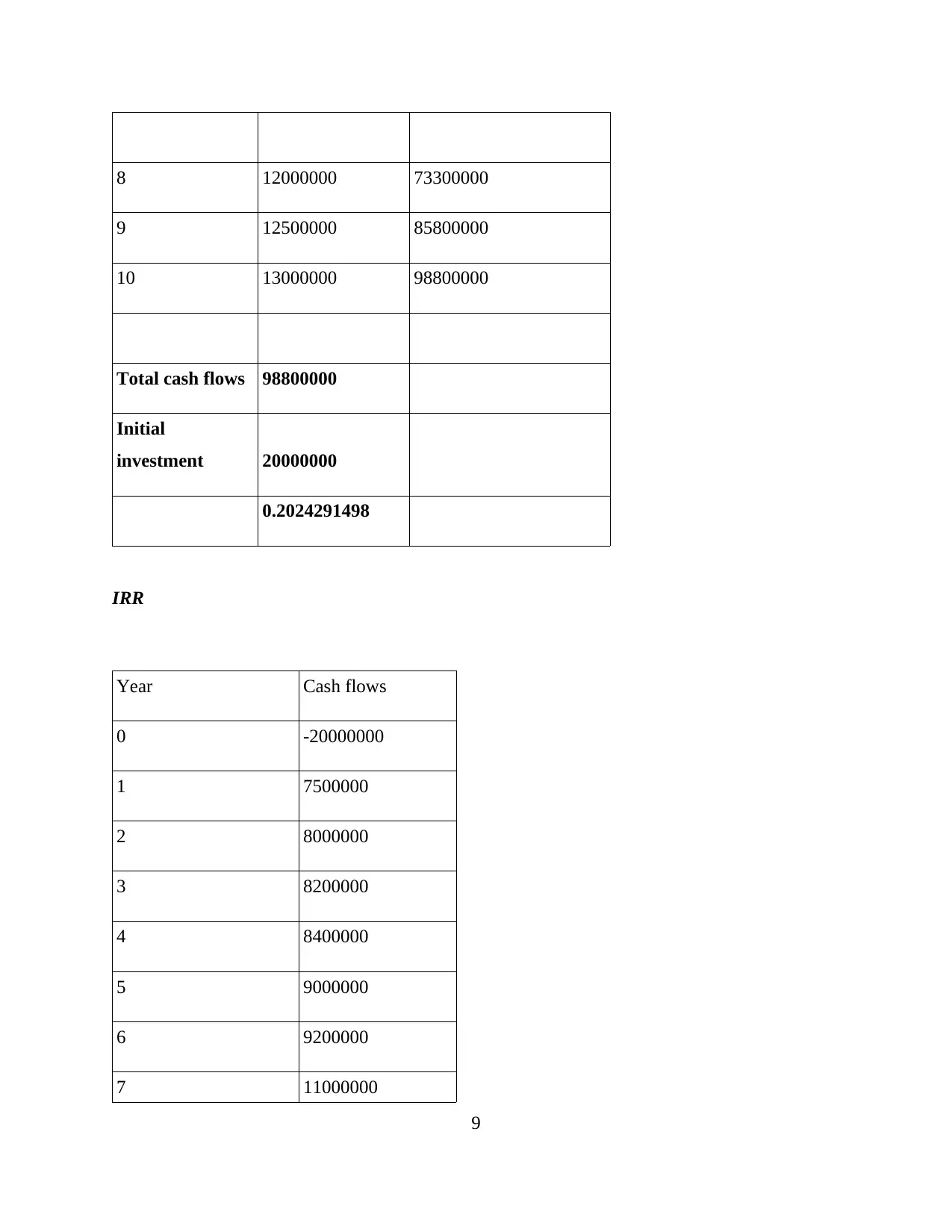

IRR

Year Cash flows

0 -20000000

1 7500000

2 8000000

3 8200000

4 8400000

5 9000000

6 9200000

7 11000000

9

9 12500000 85800000

10 13000000 98800000

Total cash flows 98800000

Initial

investment 20000000

0.2024291498

IRR

Year Cash flows

0 -20000000

1 7500000

2 8000000

3 8200000

4 8400000

5 9000000

6 9200000

7 11000000

9

8 12000000

9 12500000

10 13000000

IRR 40.85%

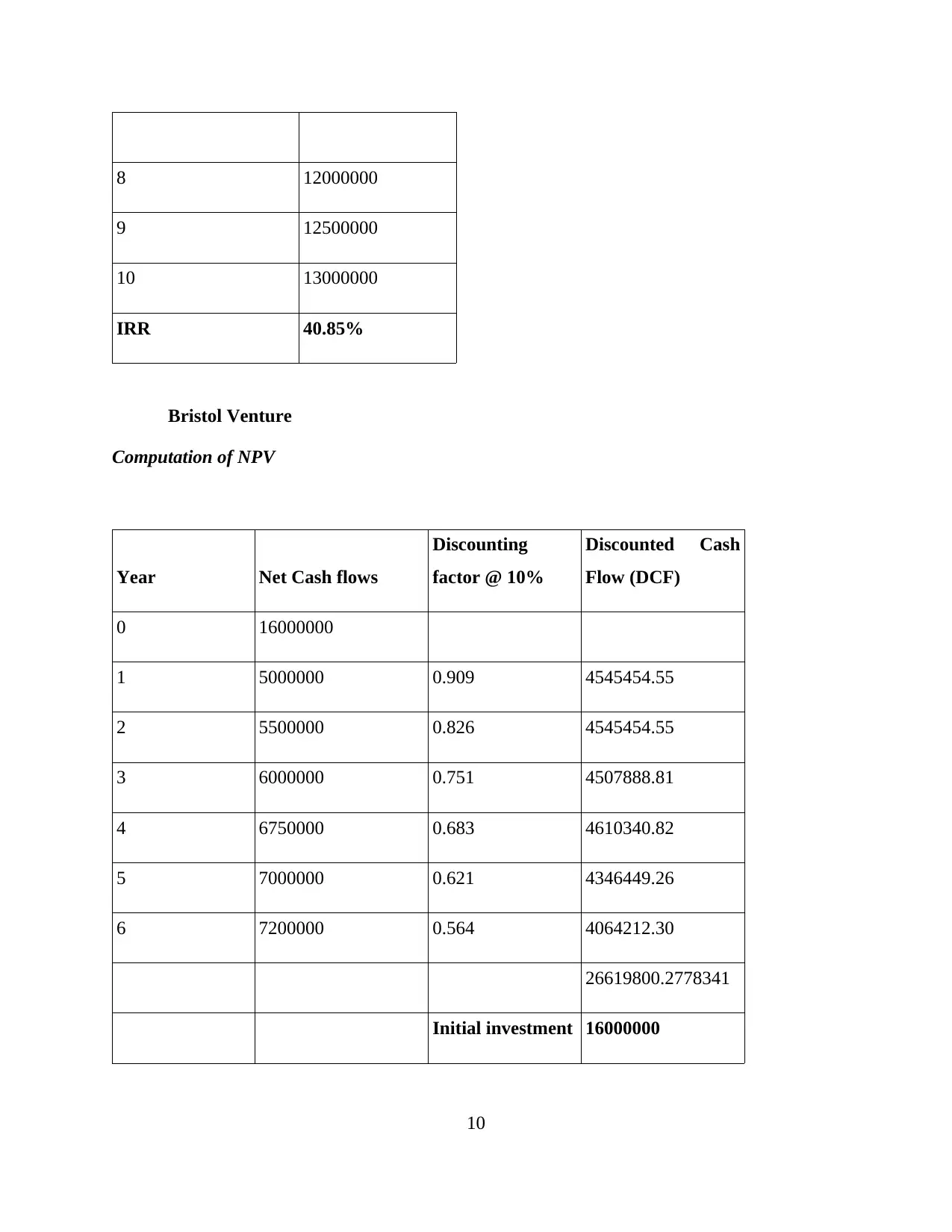

Bristol Venture

Computation of NPV

Year Net Cash flows

Discounting

factor @ 10%

Discounted Cash

Flow (DCF)

0 16000000

1 5000000 0.909 4545454.55

2 5500000 0.826 4545454.55

3 6000000 0.751 4507888.81

4 6750000 0.683 4610340.82

5 7000000 0.621 4346449.26

6 7200000 0.564 4064212.30

26619800.2778341

Initial investment 16000000

10

9 12500000

10 13000000

IRR 40.85%

Bristol Venture

Computation of NPV

Year Net Cash flows

Discounting

factor @ 10%

Discounted Cash

Flow (DCF)

0 16000000

1 5000000 0.909 4545454.55

2 5500000 0.826 4545454.55

3 6000000 0.751 4507888.81

4 6750000 0.683 4610340.82

5 7000000 0.621 4346449.26

6 7200000 0.564 4064212.30

26619800.2778341

Initial investment 16000000

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14