Finance and Funding in the Travel and Tourism Sector

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ...............................................................................................................................3

TASK 1.................................................................................................................................................3

1.1 Concepts of CVP analysis and its importance...........................................................................3

1.2 Analysis Of Pricing Methods in Tourism Industry....................................................................4

1.3 Factors influencing the profits...................................................................................................5

TASK 2 ................................................................................................................................................7

2.1 Types Of Management Accounting Information.......................................................................7

2.2 Use of Investment Appraisal Techniques 8

TASK 3 ................................................................................................................................................9

3.1 Financial Statement Analysis.....................................................................................................9

TASK 4...............................................................................................................................................11

4.1 Sources of Funds......................................................................................................................11

CONCLUSION .................................................................................................................................12

REFERENCES...................................................................................................................................13

Index of Tables

Table 1: Calculation of Break even point.............................................................................................5

Table 2: Calculation of profits at different levels of customers............................................................7

Table 3: Calculation of Payback period..............................................................................................10

Table 4: Calculation of NPV..............................................................................................................10

Table 5: Calculation of IRR................................................................................................................11

Table 6: Calculation of Profitability Ratios for Thomas Cook Group PLC.......................................11

Table 7: Calculation of Liquidity Ratios for Thomas Cook Group PLC............................................12

Table 8: Calculation of Investment ratios for Thomas Cook Group PLC..........................................12

Illustration Index

Illustration 1: Cost Volume Profit (CVP) analysis...............................................................................5

2

INTRODUCTION ...............................................................................................................................3

TASK 1.................................................................................................................................................3

1.1 Concepts of CVP analysis and its importance...........................................................................3

1.2 Analysis Of Pricing Methods in Tourism Industry....................................................................4

1.3 Factors influencing the profits...................................................................................................5

TASK 2 ................................................................................................................................................7

2.1 Types Of Management Accounting Information.......................................................................7

2.2 Use of Investment Appraisal Techniques 8

TASK 3 ................................................................................................................................................9

3.1 Financial Statement Analysis.....................................................................................................9

TASK 4...............................................................................................................................................11

4.1 Sources of Funds......................................................................................................................11

CONCLUSION .................................................................................................................................12

REFERENCES...................................................................................................................................13

Index of Tables

Table 1: Calculation of Break even point.............................................................................................5

Table 2: Calculation of profits at different levels of customers............................................................7

Table 3: Calculation of Payback period..............................................................................................10

Table 4: Calculation of NPV..............................................................................................................10

Table 5: Calculation of IRR................................................................................................................11

Table 6: Calculation of Profitability Ratios for Thomas Cook Group PLC.......................................11

Table 7: Calculation of Liquidity Ratios for Thomas Cook Group PLC............................................12

Table 8: Calculation of Investment ratios for Thomas Cook Group PLC..........................................12

Illustration Index

Illustration 1: Cost Volume Profit (CVP) analysis...............................................................................5

2

INTRODUCTION

Finance is of great importance in the business for the smooth functioning of business and to

support its major projects and expansion. Further, Carib Happy Tours Company (CHTC) engaged in

the tourism industry and conducts trip across the globe. This report conducts CVP analysis of the

CHTC and clarifies its importance. Moreover, this report reflects the pricing policies available to

the tourism industry. Later in this report, various investment appraisal techniques are demonstrated.

Thomas Cook is selected, and its financial performance is evaluated through ratio analysis.

TASK 1

1.1 Concepts of CVP analysis and its importance

CVP analysis

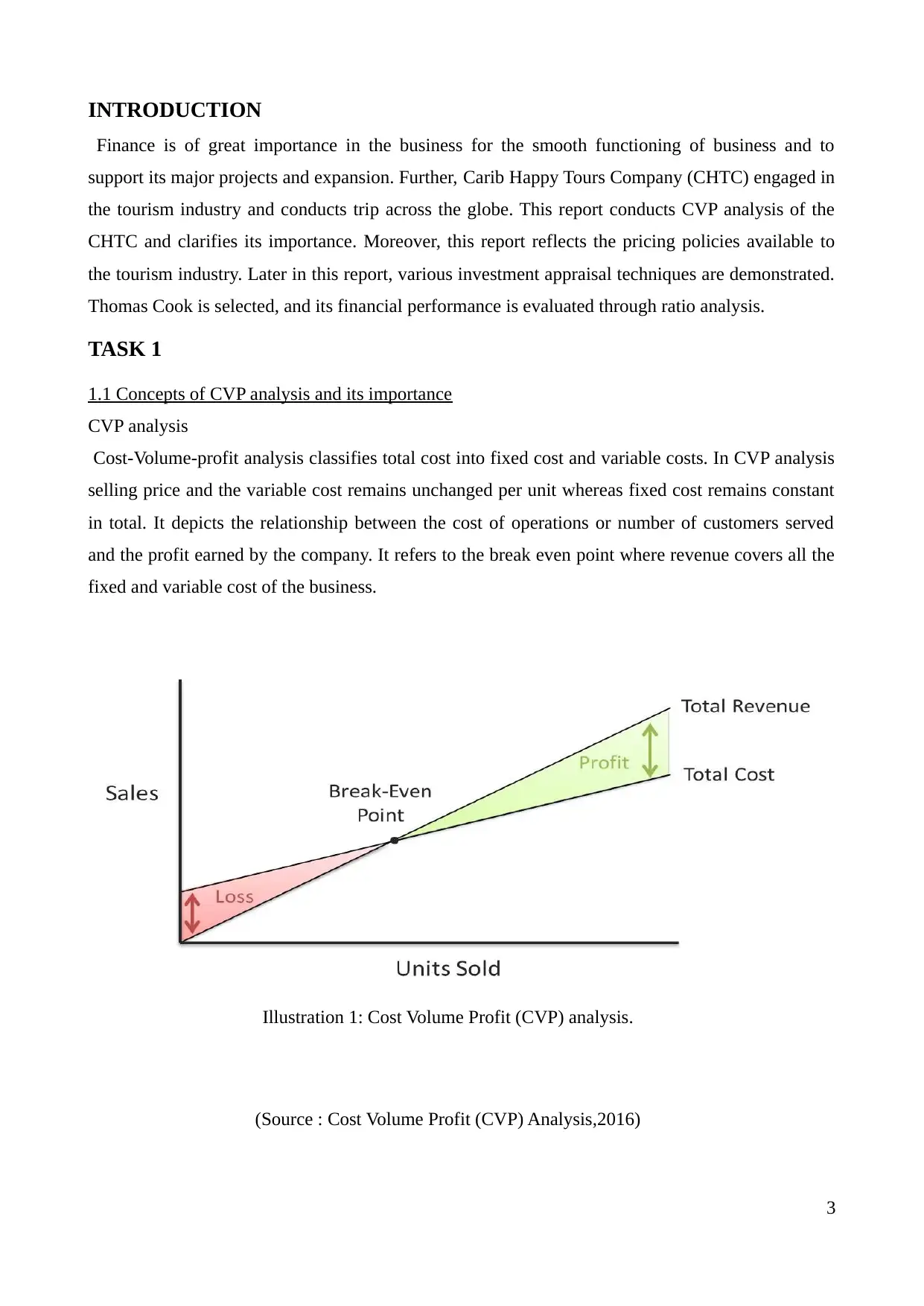

Cost-Volume-profit analysis classifies total cost into fixed cost and variable costs. In CVP analysis

selling price and the variable cost remains unchanged per unit whereas fixed cost remains constant

in total. It depicts the relationship between the cost of operations or number of customers served

and the profit earned by the company. It refers to the break even point where revenue covers all the

fixed and variable cost of the business.

3

Illustration 1: Cost Volume Profit (CVP) analysis.

(Source : Cost Volume Profit (CVP) Analysis,2016)

Finance is of great importance in the business for the smooth functioning of business and to

support its major projects and expansion. Further, Carib Happy Tours Company (CHTC) engaged in

the tourism industry and conducts trip across the globe. This report conducts CVP analysis of the

CHTC and clarifies its importance. Moreover, this report reflects the pricing policies available to

the tourism industry. Later in this report, various investment appraisal techniques are demonstrated.

Thomas Cook is selected, and its financial performance is evaluated through ratio analysis.

TASK 1

1.1 Concepts of CVP analysis and its importance

CVP analysis

Cost-Volume-profit analysis classifies total cost into fixed cost and variable costs. In CVP analysis

selling price and the variable cost remains unchanged per unit whereas fixed cost remains constant

in total. It depicts the relationship between the cost of operations or number of customers served

and the profit earned by the company. It refers to the break even point where revenue covers all the

fixed and variable cost of the business.

3

Illustration 1: Cost Volume Profit (CVP) analysis.

(Source : Cost Volume Profit (CVP) Analysis,2016)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

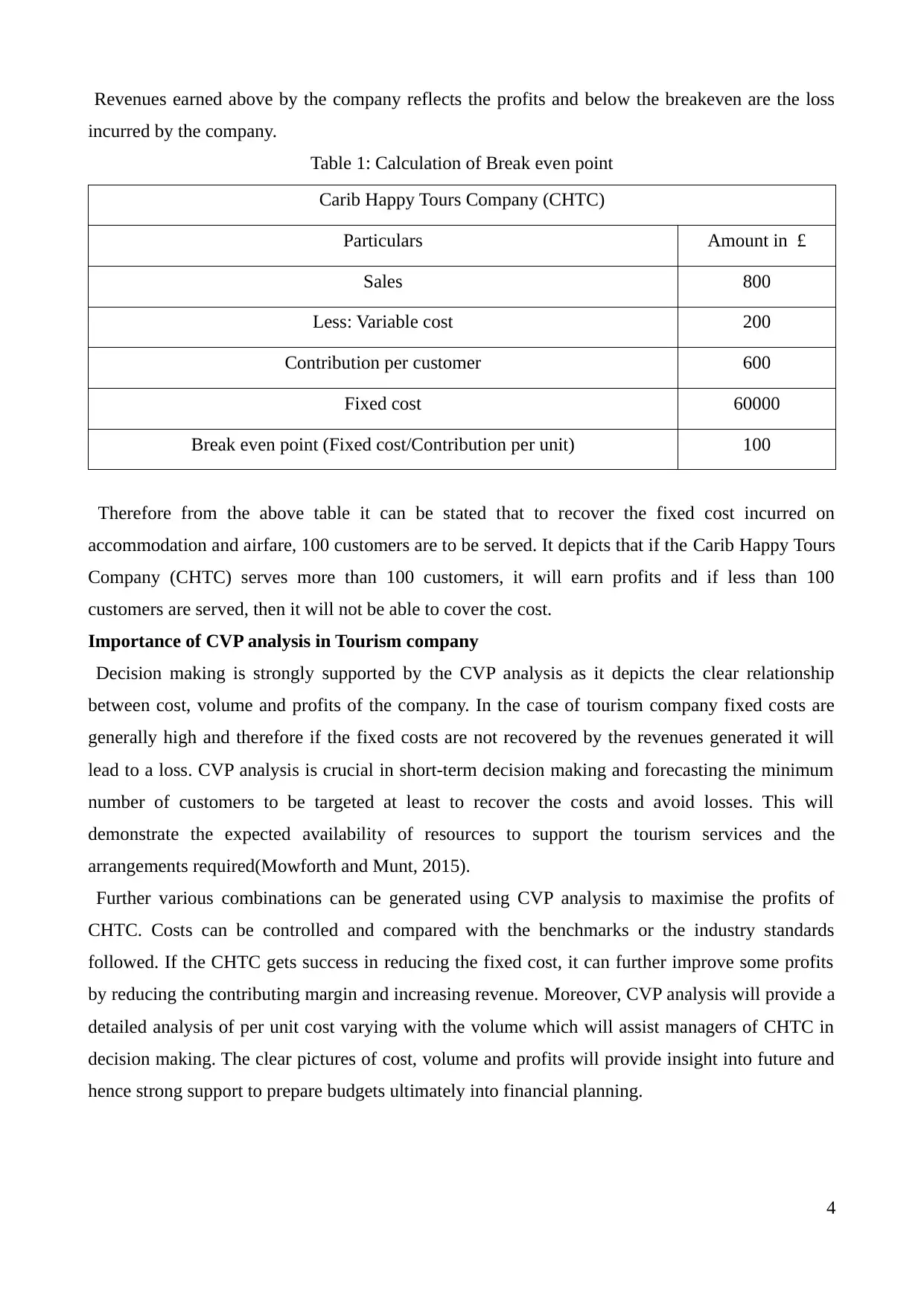

Revenues earned above by the company reflects the profits and below the breakeven are the loss

incurred by the company.

Table 1: Calculation of Break even point

Carib Happy Tours Company (CHTC)

Particulars Amount in £

Sales 800

Less: Variable cost 200

Contribution per customer 600

Fixed cost 60000

Break even point (Fixed cost/Contribution per unit) 100

Therefore from the above table it can be stated that to recover the fixed cost incurred on

accommodation and airfare, 100 customers are to be served. It depicts that if the Carib Happy Tours

Company (CHTC) serves more than 100 customers, it will earn profits and if less than 100

customers are served, then it will not be able to cover the cost.

Importance of CVP analysis in Tourism company

Decision making is strongly supported by the CVP analysis as it depicts the clear relationship

between cost, volume and profits of the company. In the case of tourism company fixed costs are

generally high and therefore if the fixed costs are not recovered by the revenues generated it will

lead to a loss. CVP analysis is crucial in short-term decision making and forecasting the minimum

number of customers to be targeted at least to recover the costs and avoid losses. This will

demonstrate the expected availability of resources to support the tourism services and the

arrangements required(Mowforth and Munt, 2015).

Further various combinations can be generated using CVP analysis to maximise the profits of

CHTC. Costs can be controlled and compared with the benchmarks or the industry standards

followed. If the CHTC gets success in reducing the fixed cost, it can further improve some profits

by reducing the contributing margin and increasing revenue. Moreover, CVP analysis will provide a

detailed analysis of per unit cost varying with the volume which will assist managers of CHTC in

decision making. The clear pictures of cost, volume and profits will provide insight into future and

hence strong support to prepare budgets ultimately into financial planning.

4

incurred by the company.

Table 1: Calculation of Break even point

Carib Happy Tours Company (CHTC)

Particulars Amount in £

Sales 800

Less: Variable cost 200

Contribution per customer 600

Fixed cost 60000

Break even point (Fixed cost/Contribution per unit) 100

Therefore from the above table it can be stated that to recover the fixed cost incurred on

accommodation and airfare, 100 customers are to be served. It depicts that if the Carib Happy Tours

Company (CHTC) serves more than 100 customers, it will earn profits and if less than 100

customers are served, then it will not be able to cover the cost.

Importance of CVP analysis in Tourism company

Decision making is strongly supported by the CVP analysis as it depicts the clear relationship

between cost, volume and profits of the company. In the case of tourism company fixed costs are

generally high and therefore if the fixed costs are not recovered by the revenues generated it will

lead to a loss. CVP analysis is crucial in short-term decision making and forecasting the minimum

number of customers to be targeted at least to recover the costs and avoid losses. This will

demonstrate the expected availability of resources to support the tourism services and the

arrangements required(Mowforth and Munt, 2015).

Further various combinations can be generated using CVP analysis to maximise the profits of

CHTC. Costs can be controlled and compared with the benchmarks or the industry standards

followed. If the CHTC gets success in reducing the fixed cost, it can further improve some profits

by reducing the contributing margin and increasing revenue. Moreover, CVP analysis will provide a

detailed analysis of per unit cost varying with the volume which will assist managers of CHTC in

decision making. The clear pictures of cost, volume and profits will provide insight into future and

hence strong support to prepare budgets ultimately into financial planning.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1.2 Analysis Of Pricing Methods in Tourism Industry

The pricing policy adopted by Tourism company is a blend of marketing strategy and analysis of

financial factors. Further various aspects are to be kept in mind while framing the policy such as

target customers, competitive market, unique services offered, market position of the company,

commission to agents, airfare and much more. Some of the pricing policy appropriate for tourism

industry are as follows:

Competitive Pricing: Travel and tourism sector is the highly competitive sector with many

new entrants trying to enter the market frequently and plenty of them already existing.

Competitive pricing refers to fixing the price at par with competitors or slightly above or

below as per the quality of services offered. To gain a competitive advantage in the market

CHTC should either fix the price below the competitor's price or fixing at par with a

competitor with improved or additional services. For Example: If the competitor is charging

£2500 per customer for same services and destination CHTC should charge around in the

range of £2000-£2800 to attract customers.

Cost Plus Method: This method is cost oriented. Pricing under this method is derived by

adding a predetermined margin to the cost incurred by the company to render the service. In

the case of CHTC, it should add the profit margin to the total cost incurred including

variable, fixed and semi-variable. This method ensures that at least the cost is covered in

addition to fixed percentage of profits. For Illustration: Cost per customer comes to £1000

then margin of 20% is to be added and price to be fixed at £1200.

Return on capital employed: Unlike Cost plus method, this is profit oriented. Prices are

fixed on the basis of profits desired as the result of return expected on the money invested

into the business. To earn the effective return on capital employed and expect the reasonable

profit on investment this method is adopted. For example: If the owner wishes the return of

20% and capital employed into business is £200,000. Then Pricing will be fixed to cover the

cost and profit required. Profit = £200,000*20% = £40,000. Therefore total profits desired

after deducting all the variable and fixed cost from the revenues are £40,000.

Penetration Pricing: In highly competitive markets when the customer demands are price

elastic best method to be adopted is penetration pricing. This pricing method promotes

setting the prices at low range initially to gain market share and gradually increasing. Once

the market popularity and confidence are achieved prices are increased. For example: When

CHTC launches any new tour package with innovative services to avoid competition, it can

set prices at reasonable lower rates to penetrate into the market.

5

The pricing policy adopted by Tourism company is a blend of marketing strategy and analysis of

financial factors. Further various aspects are to be kept in mind while framing the policy such as

target customers, competitive market, unique services offered, market position of the company,

commission to agents, airfare and much more. Some of the pricing policy appropriate for tourism

industry are as follows:

Competitive Pricing: Travel and tourism sector is the highly competitive sector with many

new entrants trying to enter the market frequently and plenty of them already existing.

Competitive pricing refers to fixing the price at par with competitors or slightly above or

below as per the quality of services offered. To gain a competitive advantage in the market

CHTC should either fix the price below the competitor's price or fixing at par with a

competitor with improved or additional services. For Example: If the competitor is charging

£2500 per customer for same services and destination CHTC should charge around in the

range of £2000-£2800 to attract customers.

Cost Plus Method: This method is cost oriented. Pricing under this method is derived by

adding a predetermined margin to the cost incurred by the company to render the service. In

the case of CHTC, it should add the profit margin to the total cost incurred including

variable, fixed and semi-variable. This method ensures that at least the cost is covered in

addition to fixed percentage of profits. For Illustration: Cost per customer comes to £1000

then margin of 20% is to be added and price to be fixed at £1200.

Return on capital employed: Unlike Cost plus method, this is profit oriented. Prices are

fixed on the basis of profits desired as the result of return expected on the money invested

into the business. To earn the effective return on capital employed and expect the reasonable

profit on investment this method is adopted. For example: If the owner wishes the return of

20% and capital employed into business is £200,000. Then Pricing will be fixed to cover the

cost and profit required. Profit = £200,000*20% = £40,000. Therefore total profits desired

after deducting all the variable and fixed cost from the revenues are £40,000.

Penetration Pricing: In highly competitive markets when the customer demands are price

elastic best method to be adopted is penetration pricing. This pricing method promotes

setting the prices at low range initially to gain market share and gradually increasing. Once

the market popularity and confidence are achieved prices are increased. For example: When

CHTC launches any new tour package with innovative services to avoid competition, it can

set prices at reasonable lower rates to penetrate into the market.

5

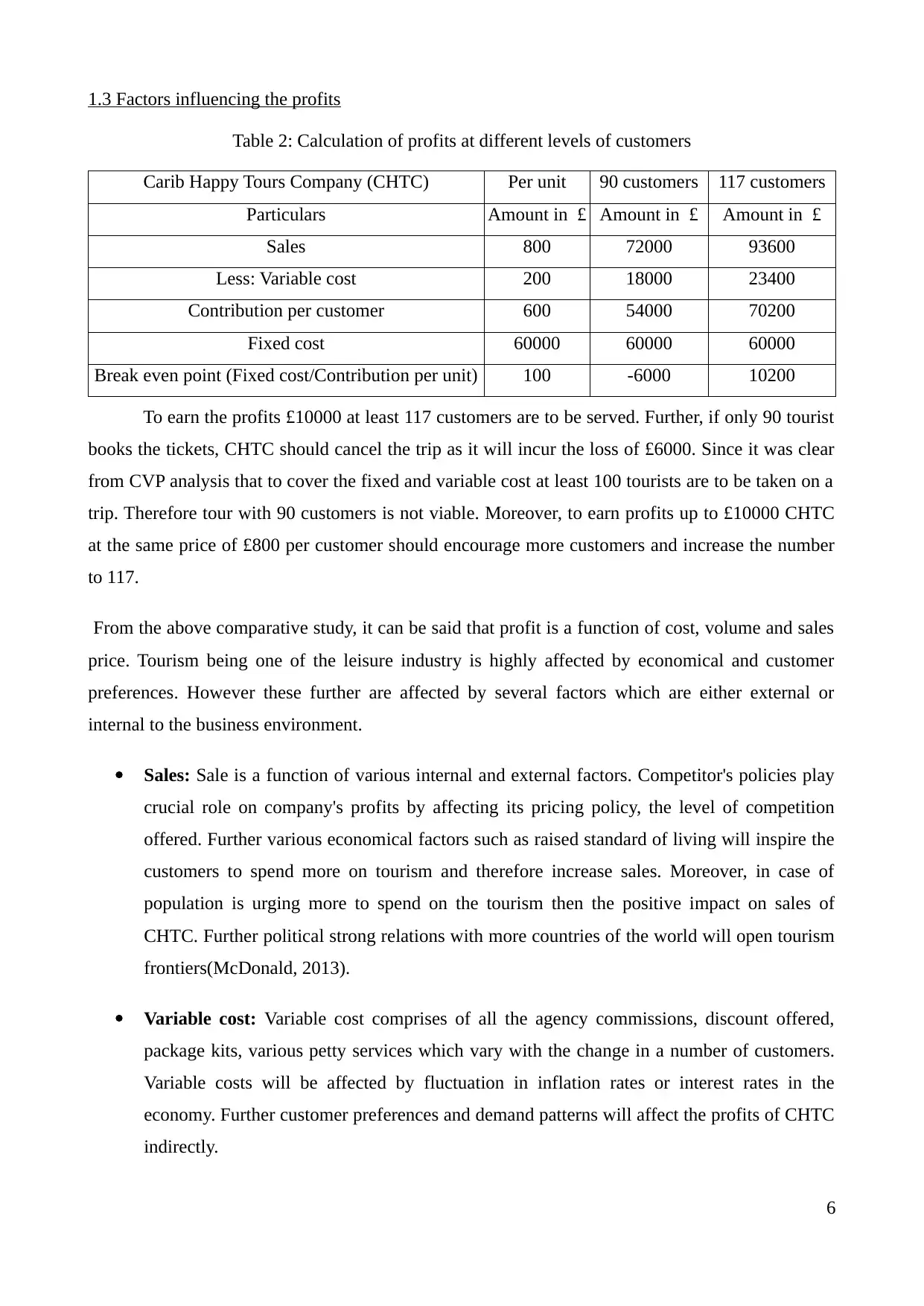

1.3 Factors influencing the profits

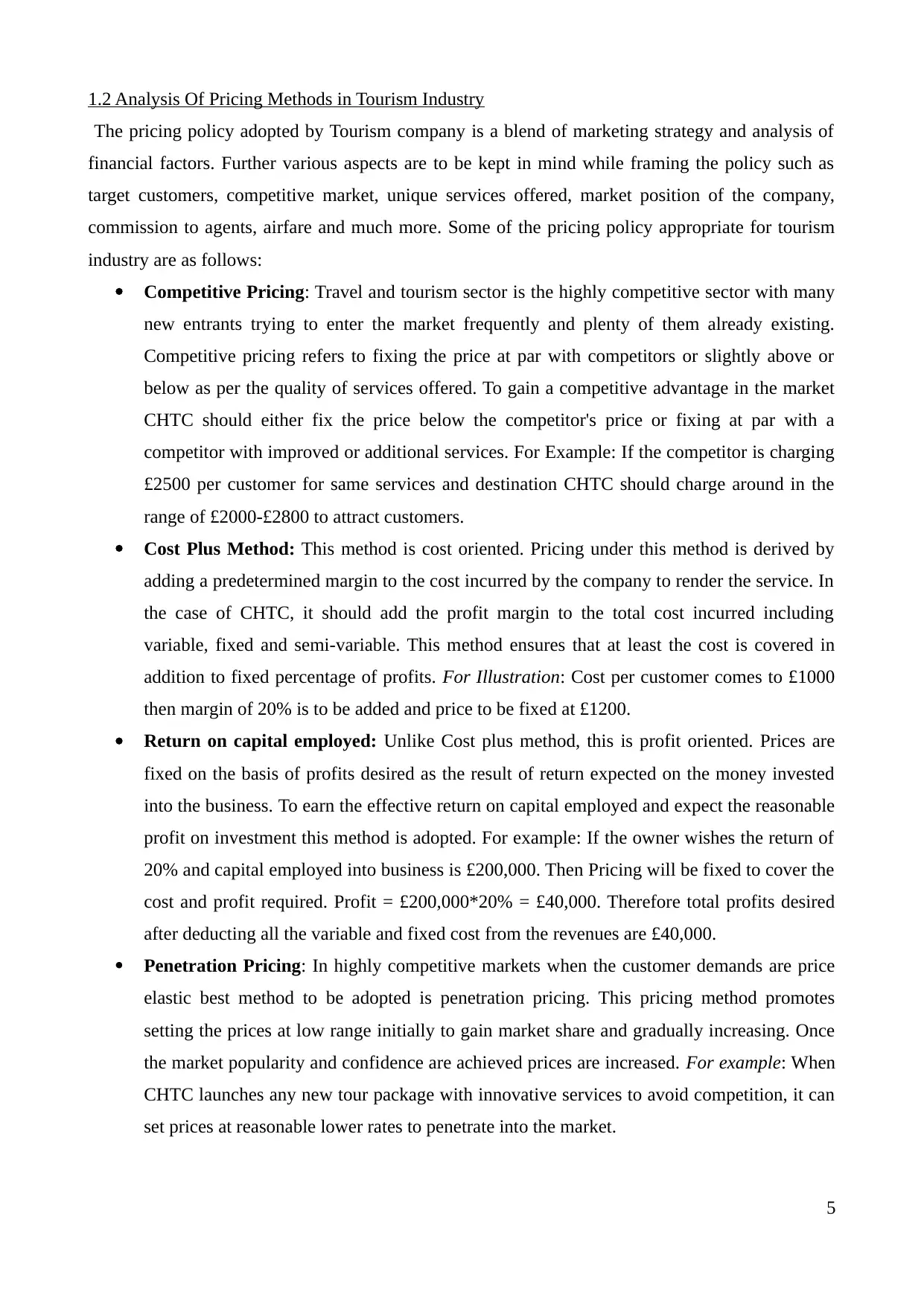

Table 2: Calculation of profits at different levels of customers

Carib Happy Tours Company (CHTC) Per unit 90 customers 117 customers

Particulars Amount in £ Amount in £ Amount in £

Sales 800 72000 93600

Less: Variable cost 200 18000 23400

Contribution per customer 600 54000 70200

Fixed cost 60000 60000 60000

Break even point (Fixed cost/Contribution per unit) 100 -6000 10200

To earn the profits £10000 at least 117 customers are to be served. Further, if only 90 tourist

books the tickets, CHTC should cancel the trip as it will incur the loss of £6000. Since it was clear

from CVP analysis that to cover the fixed and variable cost at least 100 tourists are to be taken on a

trip. Therefore tour with 90 customers is not viable. Moreover, to earn profits up to £10000 CHTC

at the same price of £800 per customer should encourage more customers and increase the number

to 117.

From the above comparative study, it can be said that profit is a function of cost, volume and sales

price. Tourism being one of the leisure industry is highly affected by economical and customer

preferences. However these further are affected by several factors which are either external or

internal to the business environment.

Sales: Sale is a function of various internal and external factors. Competitor's policies play

crucial role on company's profits by affecting its pricing policy, the level of competition

offered. Further various economical factors such as raised standard of living will inspire the

customers to spend more on tourism and therefore increase sales. Moreover, in case of

population is urging more to spend on the tourism then the positive impact on sales of

CHTC. Further political strong relations with more countries of the world will open tourism

frontiers(McDonald, 2013).

Variable cost: Variable cost comprises of all the agency commissions, discount offered,

package kits, various petty services which vary with the change in a number of customers.

Variable costs will be affected by fluctuation in inflation rates or interest rates in the

economy. Further customer preferences and demand patterns will affect the profits of CHTC

indirectly.

6

Table 2: Calculation of profits at different levels of customers

Carib Happy Tours Company (CHTC) Per unit 90 customers 117 customers

Particulars Amount in £ Amount in £ Amount in £

Sales 800 72000 93600

Less: Variable cost 200 18000 23400

Contribution per customer 600 54000 70200

Fixed cost 60000 60000 60000

Break even point (Fixed cost/Contribution per unit) 100 -6000 10200

To earn the profits £10000 at least 117 customers are to be served. Further, if only 90 tourist

books the tickets, CHTC should cancel the trip as it will incur the loss of £6000. Since it was clear

from CVP analysis that to cover the fixed and variable cost at least 100 tourists are to be taken on a

trip. Therefore tour with 90 customers is not viable. Moreover, to earn profits up to £10000 CHTC

at the same price of £800 per customer should encourage more customers and increase the number

to 117.

From the above comparative study, it can be said that profit is a function of cost, volume and sales

price. Tourism being one of the leisure industry is highly affected by economical and customer

preferences. However these further are affected by several factors which are either external or

internal to the business environment.

Sales: Sale is a function of various internal and external factors. Competitor's policies play

crucial role on company's profits by affecting its pricing policy, the level of competition

offered. Further various economical factors such as raised standard of living will inspire the

customers to spend more on tourism and therefore increase sales. Moreover, in case of

population is urging more to spend on the tourism then the positive impact on sales of

CHTC. Further political strong relations with more countries of the world will open tourism

frontiers(McDonald, 2013).

Variable cost: Variable cost comprises of all the agency commissions, discount offered,

package kits, various petty services which vary with the change in a number of customers.

Variable costs will be affected by fluctuation in inflation rates or interest rates in the

economy. Further customer preferences and demand patterns will affect the profits of CHTC

indirectly.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Fixed Cost: Fixed costs such as booking the whole floor or an exclusively chartered plane

by CHTC will affect the profits in the huge manner as it is a function of inflation and

competition in their respective fields. Moreover, this affects the profits closely and plays a

vital role in increase or decrease in profits. It has an inverse relationship with the profits of

the firm.

Volume: Volume refers to a number of customers served. If the number of customers

increases the profit will rise considerably as economies of scale works here as well. As bulk

booking by CHTC in hotels or flight will ensure the discounts which will reduce the costs

and improve profitability.

TASK 2

2.1 Types Of Management Accounting Information

As per the given scenario, Carib Happy Tours Company (CHTC) requires accepting modern

management tools and techniques for decision making. As it is beneficial for implementation and

evaluation of financial activities. It considers as an integration of all accounting system of the

organisation includes financial, tax project, social and governmental systems. Hence, analyses of

industry's performance as per past production and earning potential leads to create forecasting and

decision-making process for further activities(DRURY, 2013).

Financial Accounting: - Economic profile of CHTC is presented through financial

accounting. Presentation of balance sheet, profit and loss account structure including

production as well supplement quality is considered under this activity. On behalf of which,

travel and tourism make decision for future transaction action plans. It also involves rules

and regulations for preparation of further financial statements.

Tax accounting: - Adjustments of monetary transactions and tax payment performance is

able to forecast forward actions. During accounting year, payment of tax as per determined

tax rate by government policy is helpful to present economic position. It proceeds to the

decision-making process for CHCT. Hence, information generates an idea for travel and

tourism production and estimation of tax liability remains useful for the planning process.

Project accounting: - According to the occurrence of the issue, CHTC seeks to set a target

to reduce the problem. After that, travel and tourism seek manage projects and becomes

project oriented. Further, specific goals are determined to accomplish the project; it requires

7

by CHTC will affect the profits in the huge manner as it is a function of inflation and

competition in their respective fields. Moreover, this affects the profits closely and plays a

vital role in increase or decrease in profits. It has an inverse relationship with the profits of

the firm.

Volume: Volume refers to a number of customers served. If the number of customers

increases the profit will rise considerably as economies of scale works here as well. As bulk

booking by CHTC in hotels or flight will ensure the discounts which will reduce the costs

and improve profitability.

TASK 2

2.1 Types Of Management Accounting Information

As per the given scenario, Carib Happy Tours Company (CHTC) requires accepting modern

management tools and techniques for decision making. As it is beneficial for implementation and

evaluation of financial activities. It considers as an integration of all accounting system of the

organisation includes financial, tax project, social and governmental systems. Hence, analyses of

industry's performance as per past production and earning potential leads to create forecasting and

decision-making process for further activities(DRURY, 2013).

Financial Accounting: - Economic profile of CHTC is presented through financial

accounting. Presentation of balance sheet, profit and loss account structure including

production as well supplement quality is considered under this activity. On behalf of which,

travel and tourism make decision for future transaction action plans. It also involves rules

and regulations for preparation of further financial statements.

Tax accounting: - Adjustments of monetary transactions and tax payment performance is

able to forecast forward actions. During accounting year, payment of tax as per determined

tax rate by government policy is helpful to present economic position. It proceeds to the

decision-making process for CHCT. Hence, information generates an idea for travel and

tourism production and estimation of tax liability remains useful for the planning process.

Project accounting: - According to the occurrence of the issue, CHTC seeks to set a target

to reduce the problem. After that, travel and tourism seek manage projects and becomes

project oriented. Further, specific goals are determined to accomplish the project; it requires

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

strategic planning to reach out the objective in specifically decided time. It involves several

activities from setting goals to action plans and further its evaluation(Rajan, Datar and

Horngren, 2015). Furthermore, firm step forward to identify the activities, therefore, the

target can be achieved. Thus, the organization makes the decision for future implementation

by getting small targets.

Social Accounting: - Under this accounting system, annual reports of the company of last

years are recognised. Thus, through this information, generation of new techniques emerges

to concentrate on the effectiveness of the firm(Marik and Cavallazzi, 2013). Hence,

corporate responsibility reporting plays an essential role in the optimum allocation of travel

and tourism agency.

Thus, CHTC collection of all above mentioned accounting systems remains beneficial for setting

targets and action planning for further years. Proper idea is obtained to gain financial and non-

financial effectiveness of travel agency. It is a vital tool for setting targets as well determine

exchange activities for services systematically.

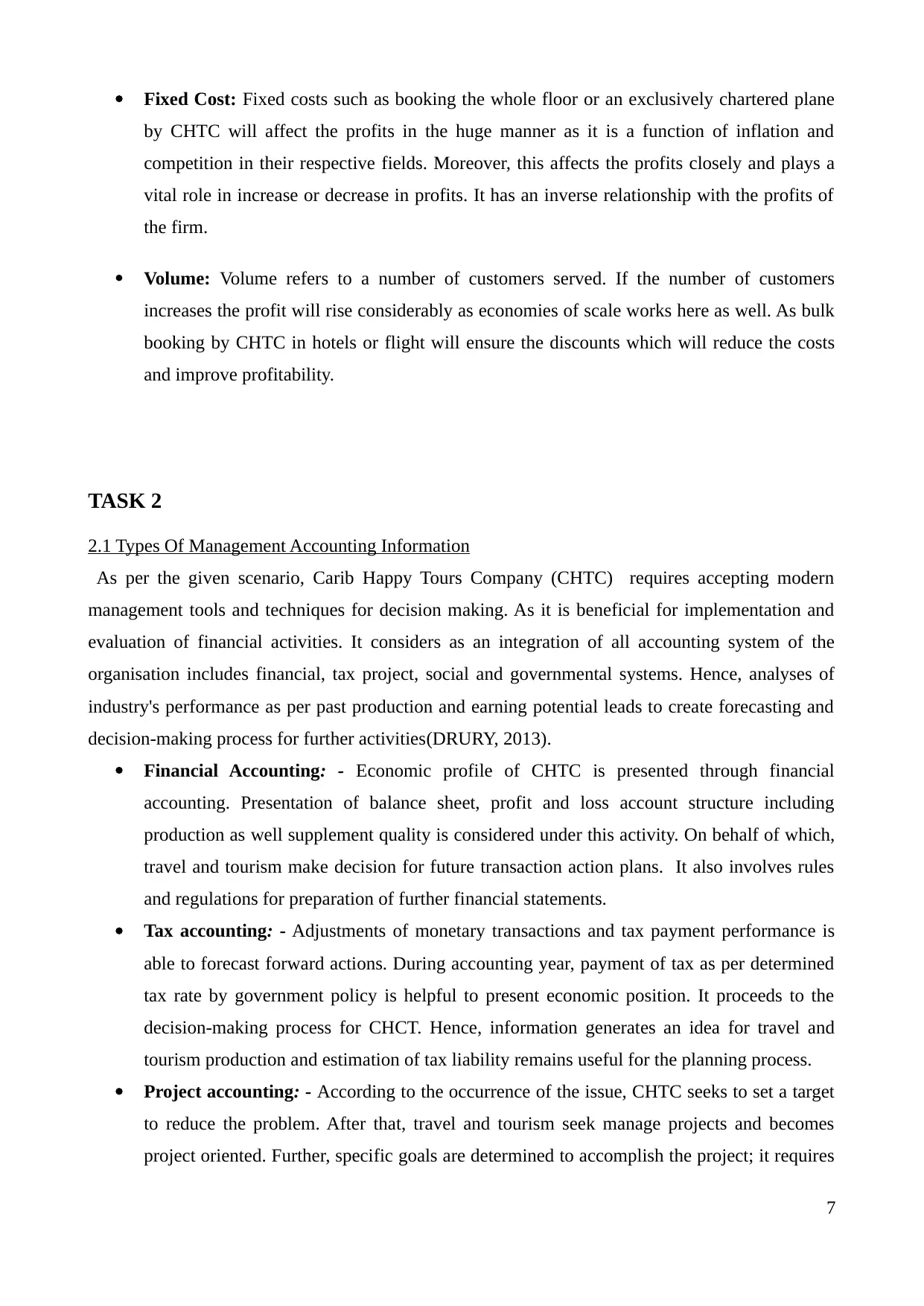

2.2 Use of Investment Appraisal Techniques

Investment appraisal techniques are tools of financial planning to support the decisions of

capital budgeting. These are applied to evaluate the profitability from the project or investment. It

supports decision making whether to accept the project or reject the same(Baum and Crosby, 2014).

Payback Period

Table 3: Calculation of Payback period

Project A

Amount in £ Amount in £

Initial investment0 -100000

1 10000 -90000

2 20000 -70000

3 35000 -35000

4 38000 3000

5 50000 53000

Payback period 3.92

Payback period is defined as the time limit within which the cash flows will be able to

recover the initial investment outflow. This method is useful for tourism companies to understand

better the viability of the project and decision making regarding accepting or rejecting the

8

activities from setting goals to action plans and further its evaluation(Rajan, Datar and

Horngren, 2015). Furthermore, firm step forward to identify the activities, therefore, the

target can be achieved. Thus, the organization makes the decision for future implementation

by getting small targets.

Social Accounting: - Under this accounting system, annual reports of the company of last

years are recognised. Thus, through this information, generation of new techniques emerges

to concentrate on the effectiveness of the firm(Marik and Cavallazzi, 2013). Hence,

corporate responsibility reporting plays an essential role in the optimum allocation of travel

and tourism agency.

Thus, CHTC collection of all above mentioned accounting systems remains beneficial for setting

targets and action planning for further years. Proper idea is obtained to gain financial and non-

financial effectiveness of travel agency. It is a vital tool for setting targets as well determine

exchange activities for services systematically.

2.2 Use of Investment Appraisal Techniques

Investment appraisal techniques are tools of financial planning to support the decisions of

capital budgeting. These are applied to evaluate the profitability from the project or investment. It

supports decision making whether to accept the project or reject the same(Baum and Crosby, 2014).

Payback Period

Table 3: Calculation of Payback period

Project A

Amount in £ Amount in £

Initial investment0 -100000

1 10000 -90000

2 20000 -70000

3 35000 -35000

4 38000 3000

5 50000 53000

Payback period 3.92

Payback period is defined as the time limit within which the cash flows will be able to

recover the initial investment outflow. This method is useful for tourism companies to understand

better the viability of the project and decision making regarding accepting or rejecting the

8

same(Aggarwal and Thakur, 2013). In the above example, it can be observed that payback period is

3.92 years which is reasonable good and the project is acceptable to CHTC.

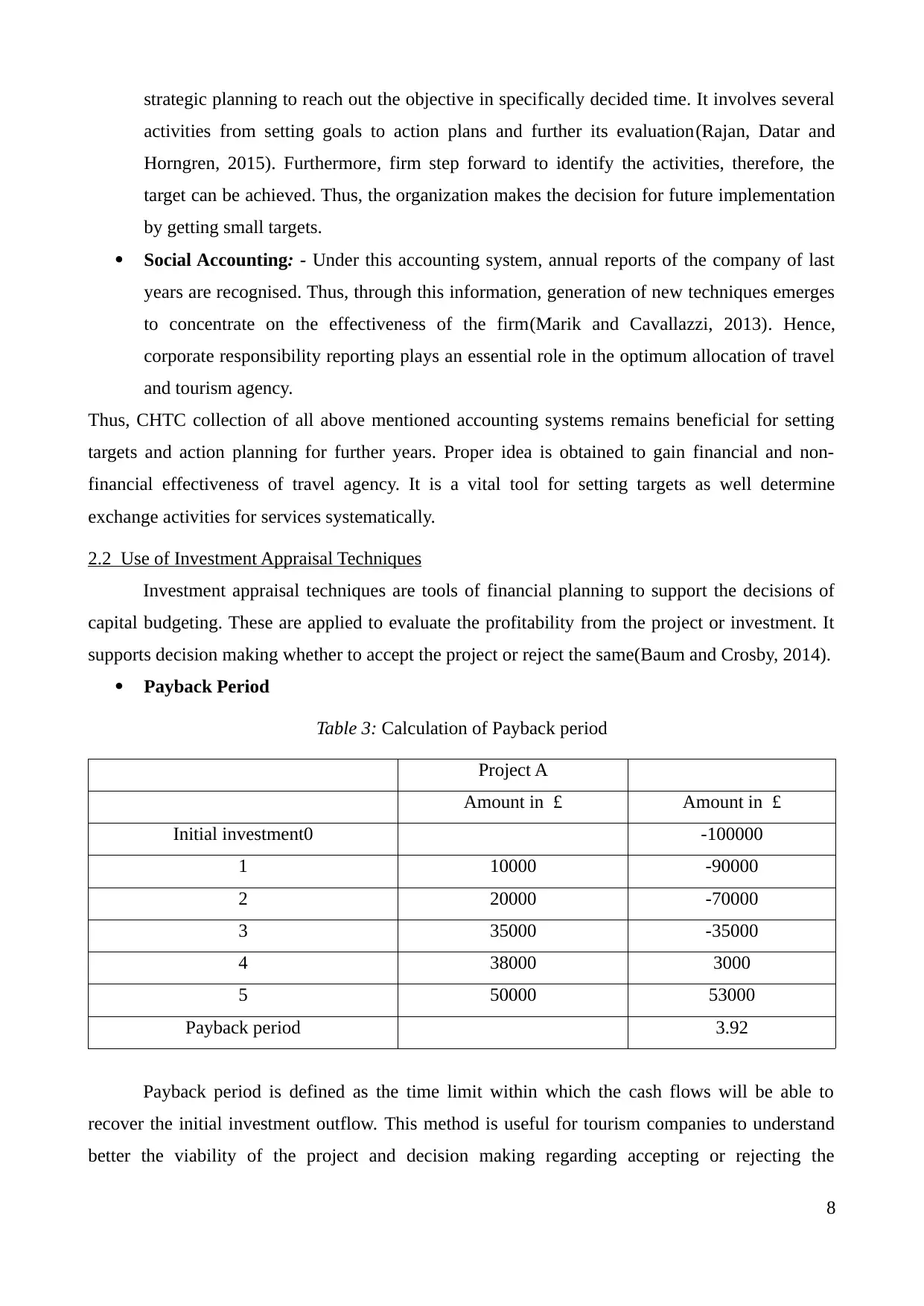

Net Present Value

Table 4: Calculation of NPV

Project A PV @ 10% Present value

Years Amount in £ Amount in £

Initial investment0 100000

1 10000 0.909 9091

2 20000 0.826 16529

3 35000 0.751 26296

4 38000 0.683 25955

5 50000 0.621 31046

Total 108916

NPV 8916

NPV refers to the net present value of the project. NPV is the difference between the present value

of all the cash inflows and the initial cash investment(Ling and Archer, 2012). Further, if NPV is

positive, it indicates that discounted inflows will be greater than the investment and therefore

project will be profitable. Tourism companies before launching any of the new product or packages

should prepare expected cash inflows and NPV and take the decision accordingly. However in the

example of CHTC NPV is positive which reflects that CHTC should launch the current package.

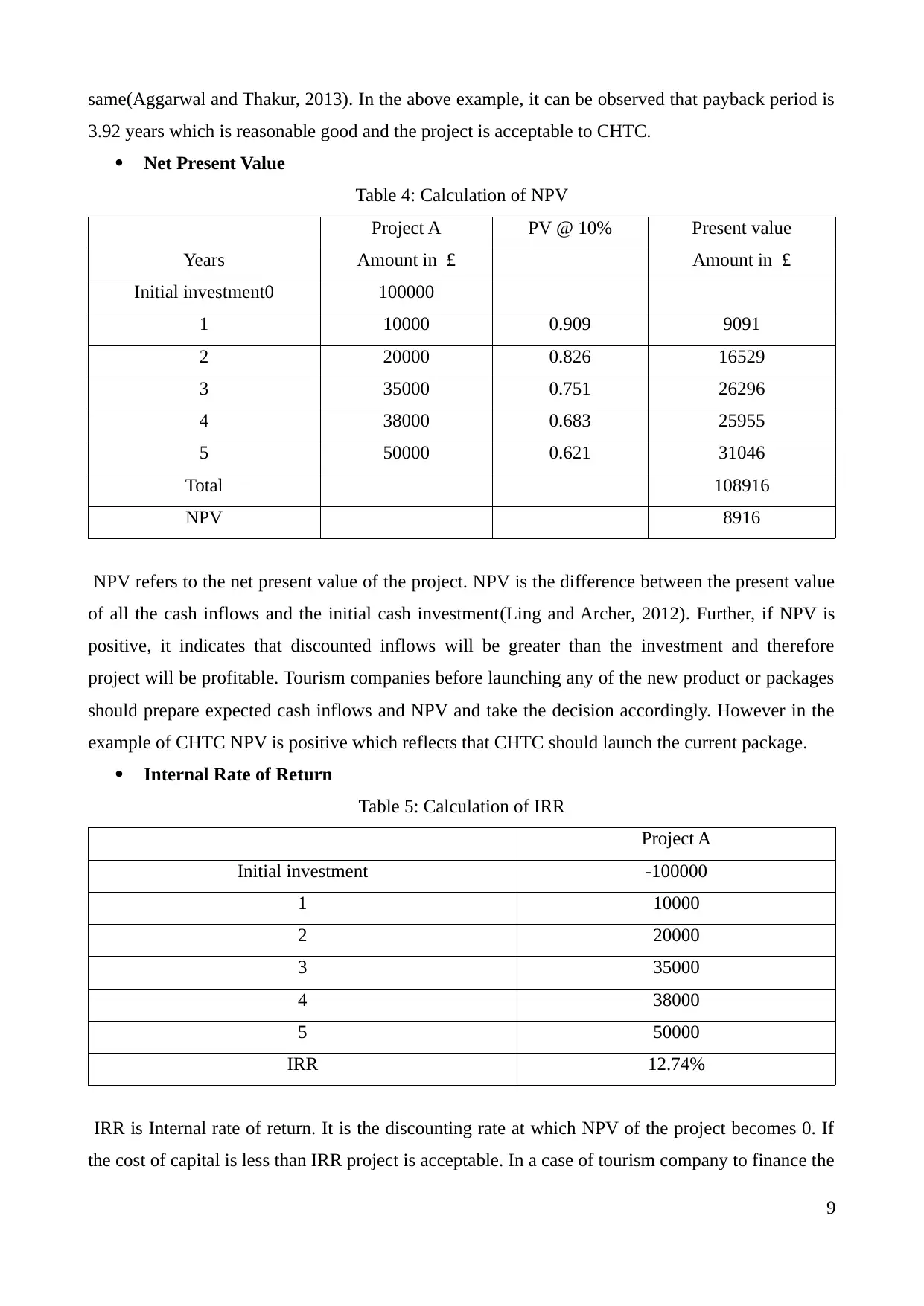

Internal Rate of Return

Table 5: Calculation of IRR

Project A

Initial investment -100000

1 10000

2 20000

3 35000

4 38000

5 50000

IRR 12.74%

IRR is Internal rate of return. It is the discounting rate at which NPV of the project becomes 0. If

the cost of capital is less than IRR project is acceptable. In a case of tourism company to finance the

9

3.92 years which is reasonable good and the project is acceptable to CHTC.

Net Present Value

Table 4: Calculation of NPV

Project A PV @ 10% Present value

Years Amount in £ Amount in £

Initial investment0 100000

1 10000 0.909 9091

2 20000 0.826 16529

3 35000 0.751 26296

4 38000 0.683 25955

5 50000 0.621 31046

Total 108916

NPV 8916

NPV refers to the net present value of the project. NPV is the difference between the present value

of all the cash inflows and the initial cash investment(Ling and Archer, 2012). Further, if NPV is

positive, it indicates that discounted inflows will be greater than the investment and therefore

project will be profitable. Tourism companies before launching any of the new product or packages

should prepare expected cash inflows and NPV and take the decision accordingly. However in the

example of CHTC NPV is positive which reflects that CHTC should launch the current package.

Internal Rate of Return

Table 5: Calculation of IRR

Project A

Initial investment -100000

1 10000

2 20000

3 35000

4 38000

5 50000

IRR 12.74%

IRR is Internal rate of return. It is the discounting rate at which NPV of the project becomes 0. If

the cost of capital is less than IRR project is acceptable. In a case of tourism company to finance the

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

project finance is acquired which is taken as discounting rate. In case cost of capital is lower than

IRR than the project should be accepted by CHTC. Since the above example illustrates the IRR of

12.74% in comparison to the cost of capital which is 10%. Therefore, the project should be

accepted.

TASK 3

3.1 Financial Statement Analysis

Ratio analysis is an effective tool for performance evaluation of the company. Thomas Cook

is selected for ratio analysis as it is one of the leading tourism company in the world.

Profitability Ratios

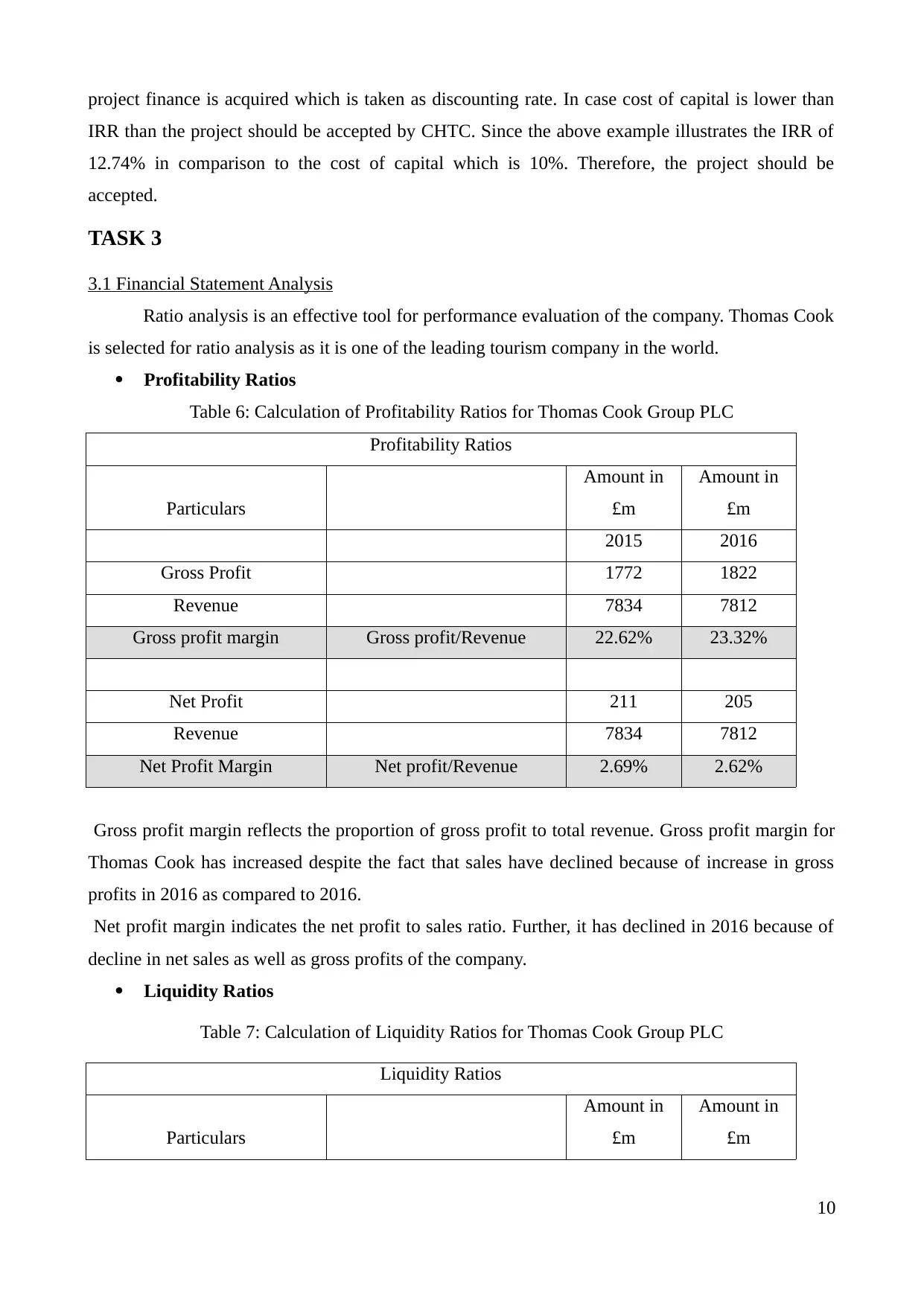

Table 6: Calculation of Profitability Ratios for Thomas Cook Group PLC

Profitability Ratios

Particulars

Amount in

£m

Amount in

£m

2015 2016

Gross Profit 1772 1822

Revenue 7834 7812

Gross profit margin Gross profit/Revenue 22.62% 23.32%

Net Profit 211 205

Revenue 7834 7812

Net Profit Margin Net profit/Revenue 2.69% 2.62%

Gross profit margin reflects the proportion of gross profit to total revenue. Gross profit margin for

Thomas Cook has increased despite the fact that sales have declined because of increase in gross

profits in 2016 as compared to 2016.

Net profit margin indicates the net profit to sales ratio. Further, it has declined in 2016 because of

decline in net sales as well as gross profits of the company.

Liquidity Ratios

Table 7: Calculation of Liquidity Ratios for Thomas Cook Group PLC

Liquidity Ratios

Particulars

Amount in

£m

Amount in

£m

10

IRR than the project should be accepted by CHTC. Since the above example illustrates the IRR of

12.74% in comparison to the cost of capital which is 10%. Therefore, the project should be

accepted.

TASK 3

3.1 Financial Statement Analysis

Ratio analysis is an effective tool for performance evaluation of the company. Thomas Cook

is selected for ratio analysis as it is one of the leading tourism company in the world.

Profitability Ratios

Table 6: Calculation of Profitability Ratios for Thomas Cook Group PLC

Profitability Ratios

Particulars

Amount in

£m

Amount in

£m

2015 2016

Gross Profit 1772 1822

Revenue 7834 7812

Gross profit margin Gross profit/Revenue 22.62% 23.32%

Net Profit 211 205

Revenue 7834 7812

Net Profit Margin Net profit/Revenue 2.69% 2.62%

Gross profit margin reflects the proportion of gross profit to total revenue. Gross profit margin for

Thomas Cook has increased despite the fact that sales have declined because of increase in gross

profits in 2016 as compared to 2016.

Net profit margin indicates the net profit to sales ratio. Further, it has declined in 2016 because of

decline in net sales as well as gross profits of the company.

Liquidity Ratios

Table 7: Calculation of Liquidity Ratios for Thomas Cook Group PLC

Liquidity Ratios

Particulars

Amount in

£m

Amount in

£m

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

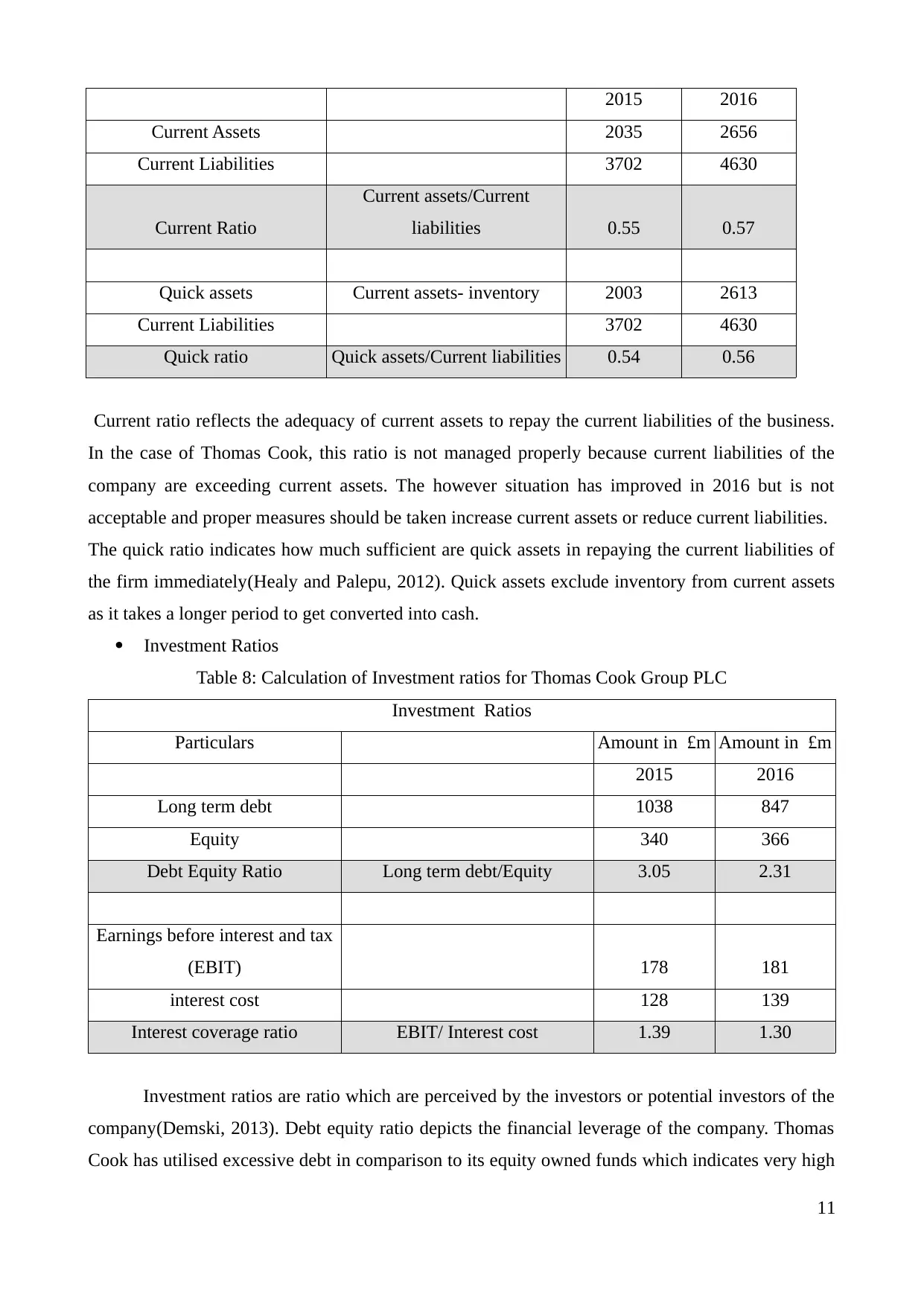

2015 2016

Current Assets 2035 2656

Current Liabilities 3702 4630

Current Ratio

Current assets/Current

liabilities 0.55 0.57

Quick assets Current assets- inventory 2003 2613

Current Liabilities 3702 4630

Quick ratio Quick assets/Current liabilities 0.54 0.56

Current ratio reflects the adequacy of current assets to repay the current liabilities of the business.

In the case of Thomas Cook, this ratio is not managed properly because current liabilities of the

company are exceeding current assets. The however situation has improved in 2016 but is not

acceptable and proper measures should be taken increase current assets or reduce current liabilities.

The quick ratio indicates how much sufficient are quick assets in repaying the current liabilities of

the firm immediately(Healy and Palepu, 2012). Quick assets exclude inventory from current assets

as it takes a longer period to get converted into cash.

Investment Ratios

Table 8: Calculation of Investment ratios for Thomas Cook Group PLC

Investment Ratios

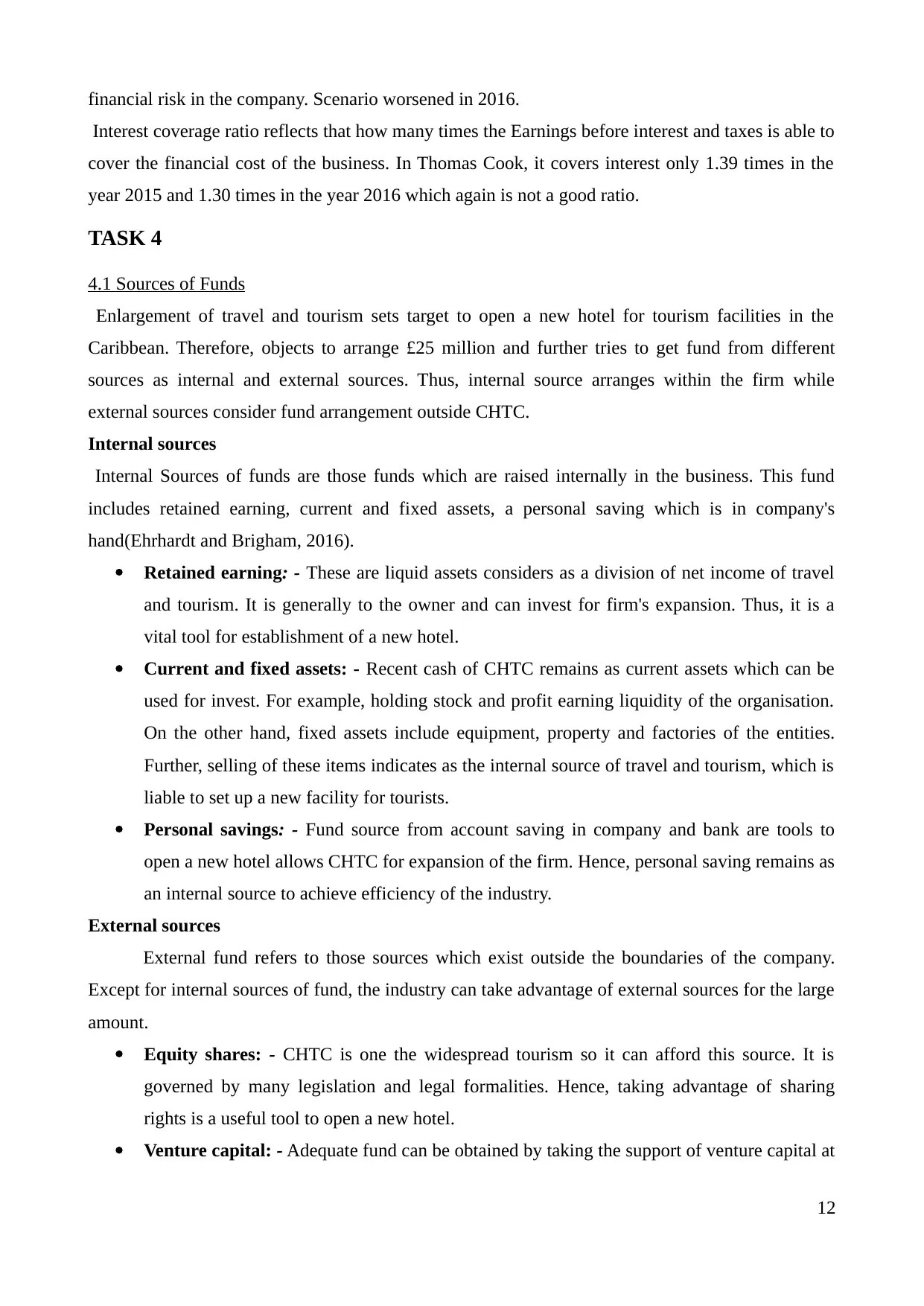

Particulars Amount in £m Amount in £m

2015 2016

Long term debt 1038 847

Equity 340 366

Debt Equity Ratio Long term debt/Equity 3.05 2.31

Earnings before interest and tax

(EBIT) 178 181

interest cost 128 139

Interest coverage ratio EBIT/ Interest cost 1.39 1.30

Investment ratios are ratio which are perceived by the investors or potential investors of the

company(Demski, 2013). Debt equity ratio depicts the financial leverage of the company. Thomas

Cook has utilised excessive debt in comparison to its equity owned funds which indicates very high

11

Current Assets 2035 2656

Current Liabilities 3702 4630

Current Ratio

Current assets/Current

liabilities 0.55 0.57

Quick assets Current assets- inventory 2003 2613

Current Liabilities 3702 4630

Quick ratio Quick assets/Current liabilities 0.54 0.56

Current ratio reflects the adequacy of current assets to repay the current liabilities of the business.

In the case of Thomas Cook, this ratio is not managed properly because current liabilities of the

company are exceeding current assets. The however situation has improved in 2016 but is not

acceptable and proper measures should be taken increase current assets or reduce current liabilities.

The quick ratio indicates how much sufficient are quick assets in repaying the current liabilities of

the firm immediately(Healy and Palepu, 2012). Quick assets exclude inventory from current assets

as it takes a longer period to get converted into cash.

Investment Ratios

Table 8: Calculation of Investment ratios for Thomas Cook Group PLC

Investment Ratios

Particulars Amount in £m Amount in £m

2015 2016

Long term debt 1038 847

Equity 340 366

Debt Equity Ratio Long term debt/Equity 3.05 2.31

Earnings before interest and tax

(EBIT) 178 181

interest cost 128 139

Interest coverage ratio EBIT/ Interest cost 1.39 1.30

Investment ratios are ratio which are perceived by the investors or potential investors of the

company(Demski, 2013). Debt equity ratio depicts the financial leverage of the company. Thomas

Cook has utilised excessive debt in comparison to its equity owned funds which indicates very high

11

financial risk in the company. Scenario worsened in 2016.

Interest coverage ratio reflects that how many times the Earnings before interest and taxes is able to

cover the financial cost of the business. In Thomas Cook, it covers interest only 1.39 times in the

year 2015 and 1.30 times in the year 2016 which again is not a good ratio.

TASK 4

4.1 Sources of Funds

Enlargement of travel and tourism sets target to open a new hotel for tourism facilities in the

Caribbean. Therefore, objects to arrange £25 million and further tries to get fund from different

sources as internal and external sources. Thus, internal source arranges within the firm while

external sources consider fund arrangement outside CHTC.

Internal sources

Internal Sources of funds are those funds which are raised internally in the business. This fund

includes retained earning, current and fixed assets, a personal saving which is in company's

hand(Ehrhardt and Brigham, 2016).

Retained earning: - These are liquid assets considers as a division of net income of travel

and tourism. It is generally to the owner and can invest for firm's expansion. Thus, it is a

vital tool for establishment of a new hotel.

Current and fixed assets: - Recent cash of CHTC remains as current assets which can be

used for invest. For example, holding stock and profit earning liquidity of the organisation.

On the other hand, fixed assets include equipment, property and factories of the entities.

Further, selling of these items indicates as the internal source of travel and tourism, which is

liable to set up a new facility for tourists.

Personal savings: - Fund source from account saving in company and bank are tools to

open a new hotel allows CHTC for expansion of the firm. Hence, personal saving remains as

an internal source to achieve efficiency of the industry.

External sources

External fund refers to those sources which exist outside the boundaries of the company.

Except for internal sources of fund, the industry can take advantage of external sources for the large

amount.

Equity shares: - CHTC is one the widespread tourism so it can afford this source. It is

governed by many legislation and legal formalities. Hence, taking advantage of sharing

rights is a useful tool to open a new hotel.

Venture capital: - Adequate fund can be obtained by taking the support of venture capital at

12

Interest coverage ratio reflects that how many times the Earnings before interest and taxes is able to

cover the financial cost of the business. In Thomas Cook, it covers interest only 1.39 times in the

year 2015 and 1.30 times in the year 2016 which again is not a good ratio.

TASK 4

4.1 Sources of Funds

Enlargement of travel and tourism sets target to open a new hotel for tourism facilities in the

Caribbean. Therefore, objects to arrange £25 million and further tries to get fund from different

sources as internal and external sources. Thus, internal source arranges within the firm while

external sources consider fund arrangement outside CHTC.

Internal sources

Internal Sources of funds are those funds which are raised internally in the business. This fund

includes retained earning, current and fixed assets, a personal saving which is in company's

hand(Ehrhardt and Brigham, 2016).

Retained earning: - These are liquid assets considers as a division of net income of travel

and tourism. It is generally to the owner and can invest for firm's expansion. Thus, it is a

vital tool for establishment of a new hotel.

Current and fixed assets: - Recent cash of CHTC remains as current assets which can be

used for invest. For example, holding stock and profit earning liquidity of the organisation.

On the other hand, fixed assets include equipment, property and factories of the entities.

Further, selling of these items indicates as the internal source of travel and tourism, which is

liable to set up a new facility for tourists.

Personal savings: - Fund source from account saving in company and bank are tools to

open a new hotel allows CHTC for expansion of the firm. Hence, personal saving remains as

an internal source to achieve efficiency of the industry.

External sources

External fund refers to those sources which exist outside the boundaries of the company.

Except for internal sources of fund, the industry can take advantage of external sources for the large

amount.

Equity shares: - CHTC is one the widespread tourism so it can afford this source. It is

governed by many legislation and legal formalities. Hence, taking advantage of sharing

rights is a useful tool to open a new hotel.

Venture capital: - Adequate fund can be obtained by taking the support of venture capital at

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

large scale. Development of business organisation is possible through this technique. Hence,

support of other entities for CHTC's expansion can achieve the target of establishment of the

new hotel.

Long term loan: - It is beneficial for a large amount of money as a source(Cummins and

Weiss, 2014). Therefore, taking advantage of long time loan facility at low rate plays a great

role to collect fund to set up a new hotel.

Hence, CHTC can take funds from these sources for business enlargement as the well large

quantity of service for tourists.

CONCLUSION

From the above analysis, it can be concluded that CVP analysis plays the major role in the

decision-making process of the company in addition to certain other environmental factors. Further,

there are many pricing policies available, but CTCH should go for competitive pricing to gain

market share and increase profitability. Moreover, capital budgeting techniques present a clear

picture of profitability of the project, especially NPV. However, it can be concluded from ratio

analysis of major competitor, Thomas Cook that its financial health is not managed properly.

13

support of other entities for CHTC's expansion can achieve the target of establishment of the

new hotel.

Long term loan: - It is beneficial for a large amount of money as a source(Cummins and

Weiss, 2014). Therefore, taking advantage of long time loan facility at low rate plays a great

role to collect fund to set up a new hotel.

Hence, CHTC can take funds from these sources for business enlargement as the well large

quantity of service for tourists.

CONCLUSION

From the above analysis, it can be concluded that CVP analysis plays the major role in the

decision-making process of the company in addition to certain other environmental factors. Further,

there are many pricing policies available, but CTCH should go for competitive pricing to gain

market share and increase profitability. Moreover, capital budgeting techniques present a clear

picture of profitability of the project, especially NPV. However, it can be concluded from ratio

analysis of major competitor, Thomas Cook that its financial health is not managed properly.

13

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.