Consolidation Statements and Financial Analysis of ABC & XYZ Ltd

VerifiedAdded on 2023/06/11

|12

|1556

|89

Case Study

AI Summary

This assignment presents a detailed case study involving the consolidation of financial statements for ABC Ltd and XYZ Ltd following a takeover bid. It includes an acquisition analysis, journal entries, and the preparation of consolidated financial statements. The analysis covers key aspects such as consideration transferred, fair value adjustments, goodwill calculation, and non-controlling interest. The document also discusses the partial and full goodwill methods, highlighting their advantages and disadvantages under both IFRS and US GAAP frameworks. The assignment concludes with consolidated income statements and balance sheets, providing a comprehensive view of the post-acquisition financial position. Desklib offers similar solved assignments and past papers for students.

Running head: CONSOLIDATION STATEMENTS

Consolidation Statements

Name of the Student:

Name of the University

Author’s Note

Consolidation Statements

Name of the Student:

Name of the University

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

CONSOLIDATION STATEMENT

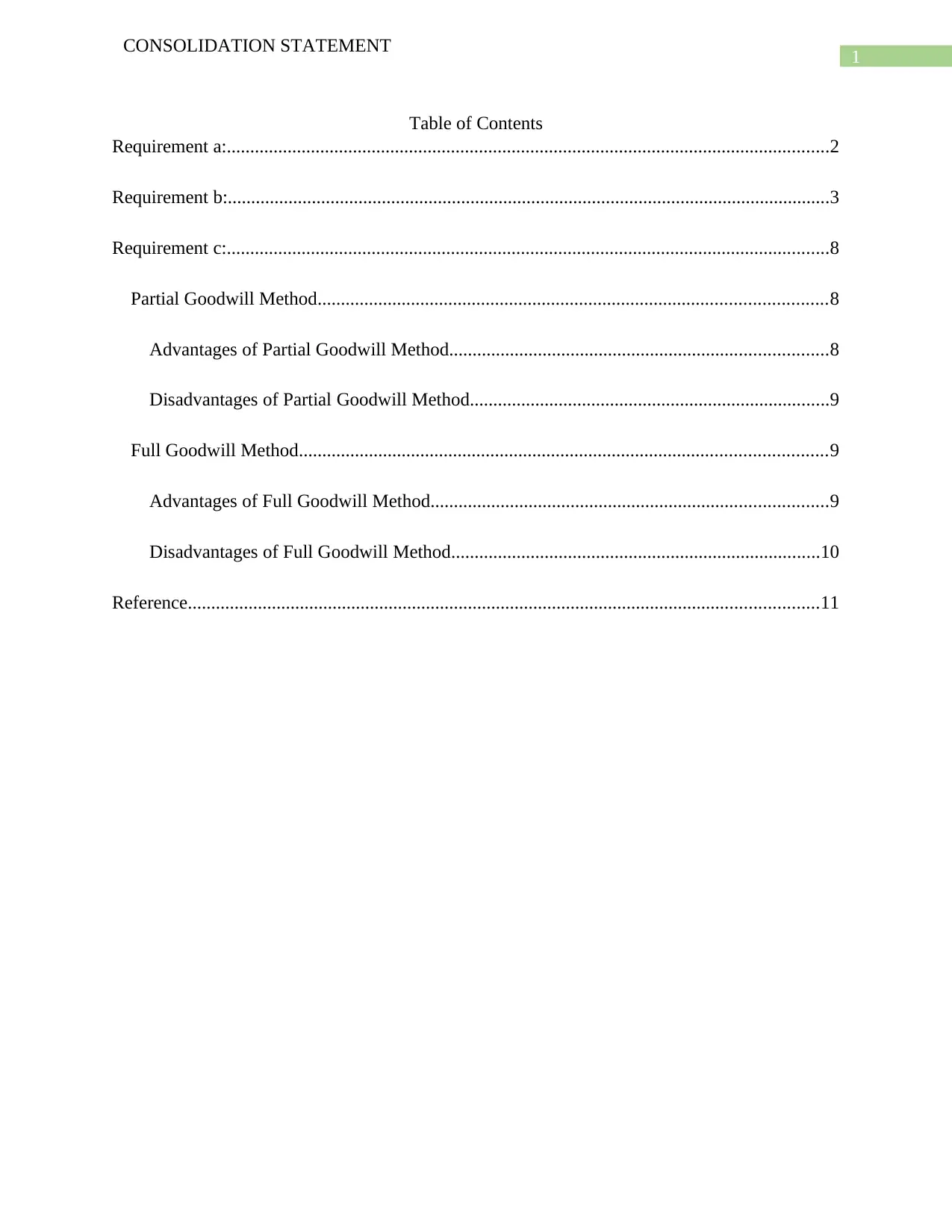

Table of Contents

Requirement a:.................................................................................................................................2

Requirement b:.................................................................................................................................3

Requirement c:.................................................................................................................................8

Partial Goodwill Method.............................................................................................................8

Advantages of Partial Goodwill Method.................................................................................8

Disadvantages of Partial Goodwill Method.............................................................................9

Full Goodwill Method.................................................................................................................9

Advantages of Full Goodwill Method.....................................................................................9

Disadvantages of Full Goodwill Method...............................................................................10

Reference.......................................................................................................................................11

CONSOLIDATION STATEMENT

Table of Contents

Requirement a:.................................................................................................................................2

Requirement b:.................................................................................................................................3

Requirement c:.................................................................................................................................8

Partial Goodwill Method.............................................................................................................8

Advantages of Partial Goodwill Method.................................................................................8

Disadvantages of Partial Goodwill Method.............................................................................9

Full Goodwill Method.................................................................................................................9

Advantages of Full Goodwill Method.....................................................................................9

Disadvantages of Full Goodwill Method...............................................................................10

Reference.......................................................................................................................................11

2

CONSOLIDATION STATEMENT

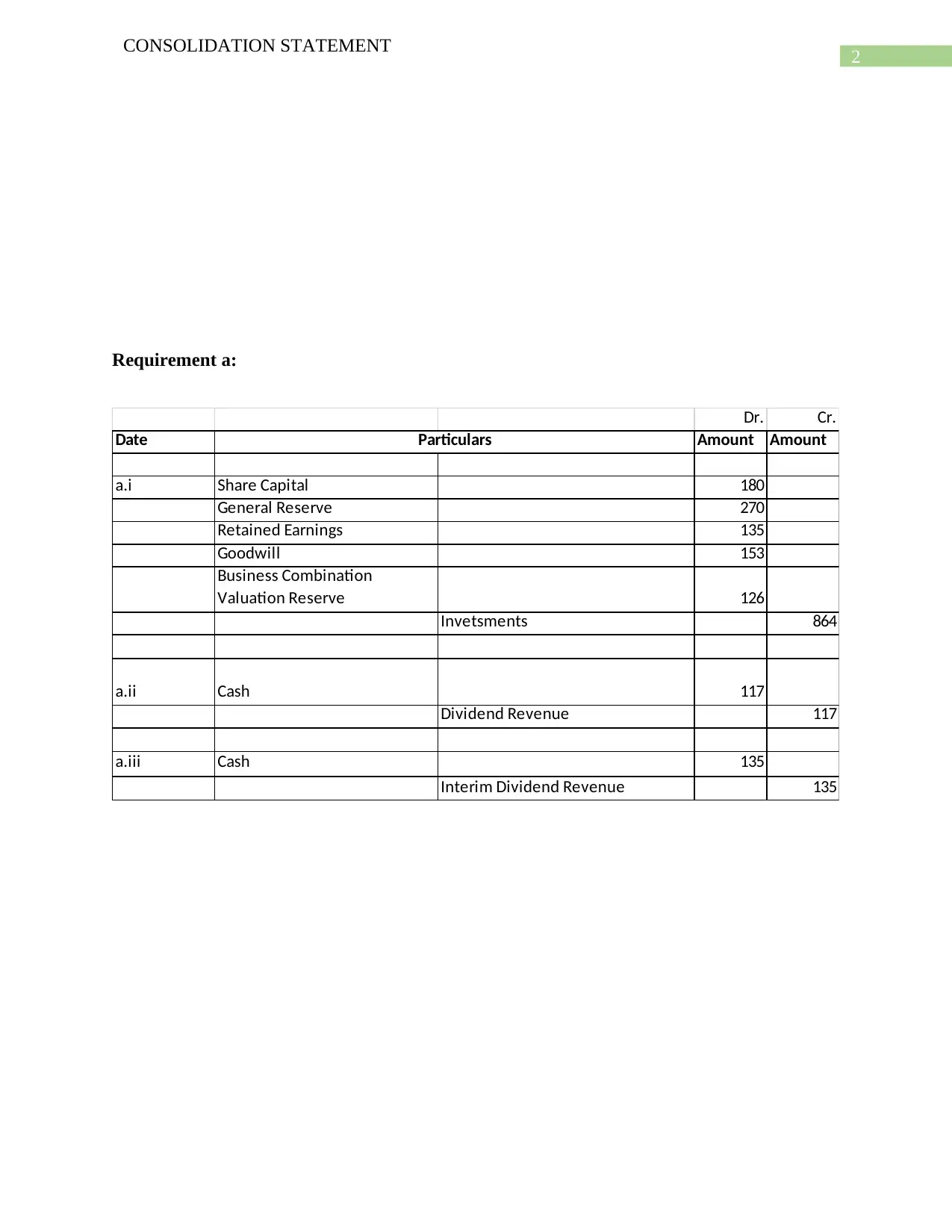

Requirement a:

Dr. Cr.

Date Amount Amount

a.i Share Capital 180

General Reserve 270

Retained Earnings 135

Goodwill 153

Business Combination

Valuation Reserve 126

Invetsments 864

a.ii Cash 117

Dividend Revenue 117

a.iii Cash 135

Interim Dividend Revenue 135

Particulars

CONSOLIDATION STATEMENT

Requirement a:

Dr. Cr.

Date Amount Amount

a.i Share Capital 180

General Reserve 270

Retained Earnings 135

Goodwill 153

Business Combination

Valuation Reserve 126

Invetsments 864

a.ii Cash 117

Dividend Revenue 117

a.iii Cash 135

Interim Dividend Revenue 135

Particulars

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

CONSOLIDATION STATEMENT

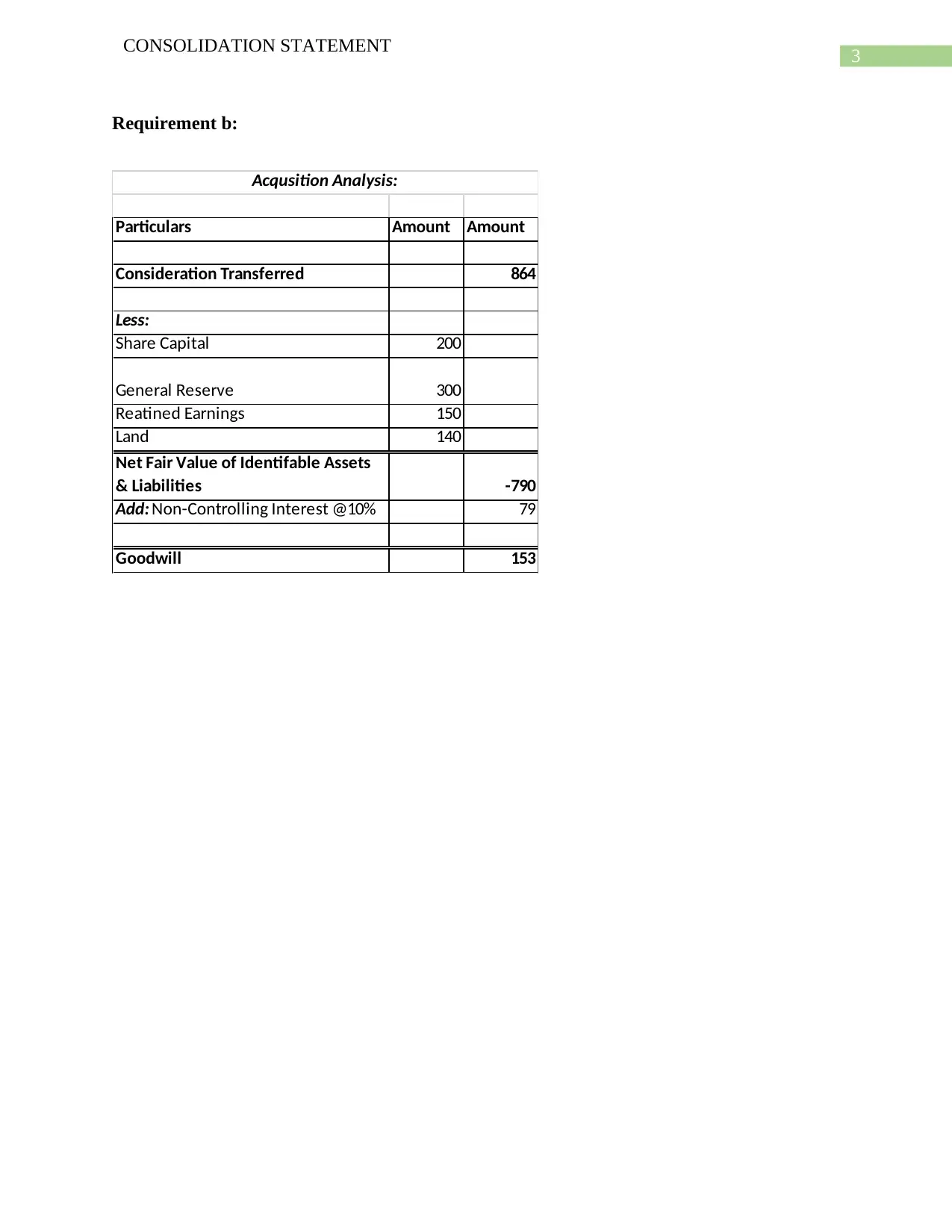

Requirement b:

Particulars Amount Amount

Consideration Transferred 864

Less:

Share Capital 200

General Reserve 300

Reatined Earnings 150

Land 140

Net Fair Value of Identifable Assets

& Liabilities -790

Add: Non-Controlling Interest @10% 79

Goodwill 153

Acqusition Analysis:

CONSOLIDATION STATEMENT

Requirement b:

Particulars Amount Amount

Consideration Transferred 864

Less:

Share Capital 200

General Reserve 300

Reatined Earnings 150

Land 140

Net Fair Value of Identifable Assets

& Liabilities -790

Add: Non-Controlling Interest @10% 79

Goodwill 153

Acqusition Analysis:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

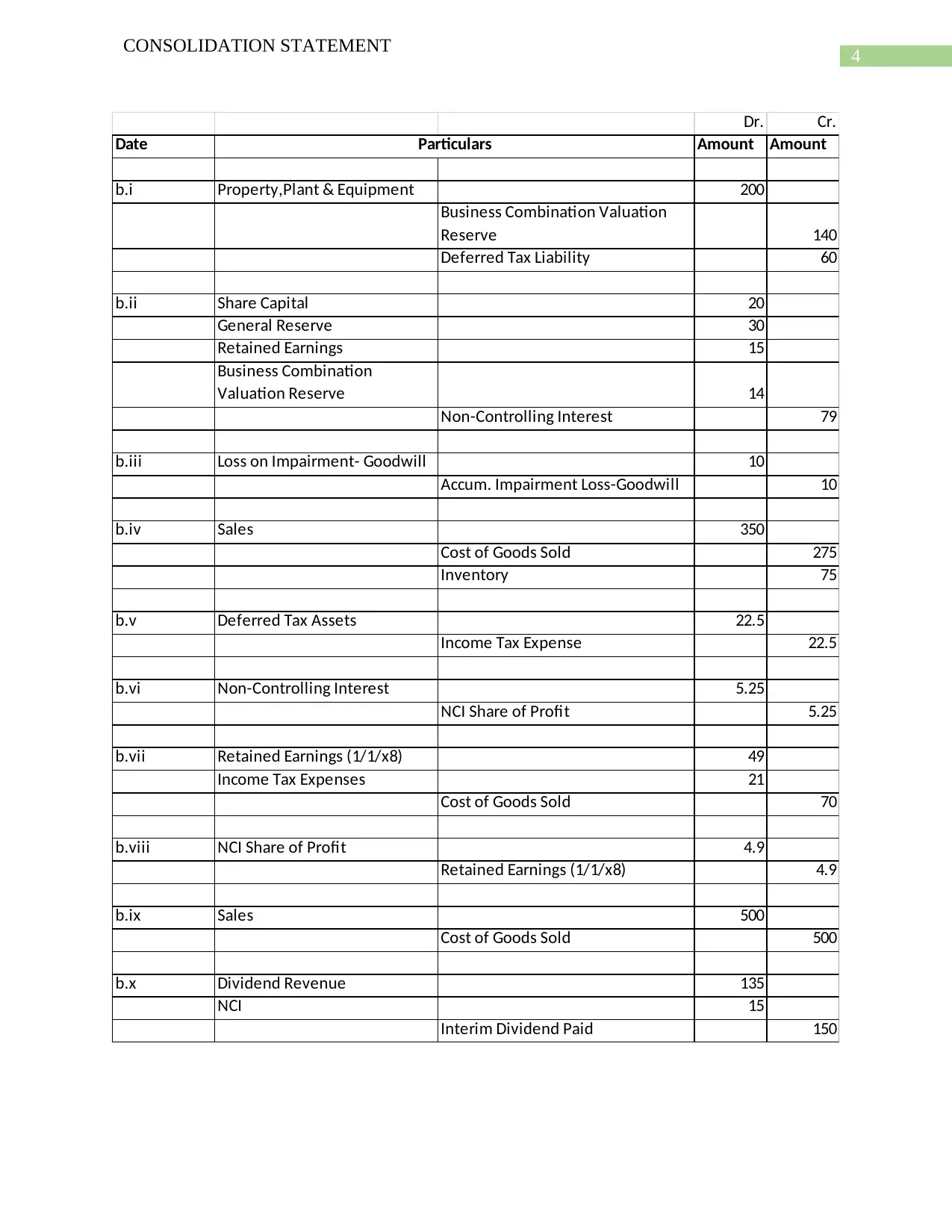

CONSOLIDATION STATEMENT

Dr. Cr.

Date Amount Amount

b.i Property,Plant & Equipment 200

Business Combination Valuation

Reserve 140

Deferred Tax Liability 60

b.ii Share Capital 20

General Reserve 30

Retained Earnings 15

Business Combination

Valuation Reserve 14

Non-Controlling Interest 79

b.iii Loss on Impairment- Goodwill 10

Accum. Impairment Loss-Goodwill 10

b.iv Sales 350

Cost of Goods Sold 275

Inventory 75

b.v Deferred Tax Assets 22.5

Income Tax Expense 22.5

b.vi Non-Controlling Interest 5.25

NCI Share of Profit 5.25

b.vii Retained Earnings (1/1/x8) 49

Income Tax Expenses 21

Cost of Goods Sold 70

b.viii NCI Share of Profit 4.9

Retained Earnings (1/1/x8) 4.9

b.ix Sales 500

Cost of Goods Sold 500

b.x Dividend Revenue 135

NCI 15

Interim Dividend Paid 150

Particulars

CONSOLIDATION STATEMENT

Dr. Cr.

Date Amount Amount

b.i Property,Plant & Equipment 200

Business Combination Valuation

Reserve 140

Deferred Tax Liability 60

b.ii Share Capital 20

General Reserve 30

Retained Earnings 15

Business Combination

Valuation Reserve 14

Non-Controlling Interest 79

b.iii Loss on Impairment- Goodwill 10

Accum. Impairment Loss-Goodwill 10

b.iv Sales 350

Cost of Goods Sold 275

Inventory 75

b.v Deferred Tax Assets 22.5

Income Tax Expense 22.5

b.vi Non-Controlling Interest 5.25

NCI Share of Profit 5.25

b.vii Retained Earnings (1/1/x8) 49

Income Tax Expenses 21

Cost of Goods Sold 70

b.viii NCI Share of Profit 4.9

Retained Earnings (1/1/x8) 4.9

b.ix Sales 500

Cost of Goods Sold 500

b.x Dividend Revenue 135

NCI 15

Interim Dividend Paid 150

Particulars

5

CONSOLIDATION STATEMENT

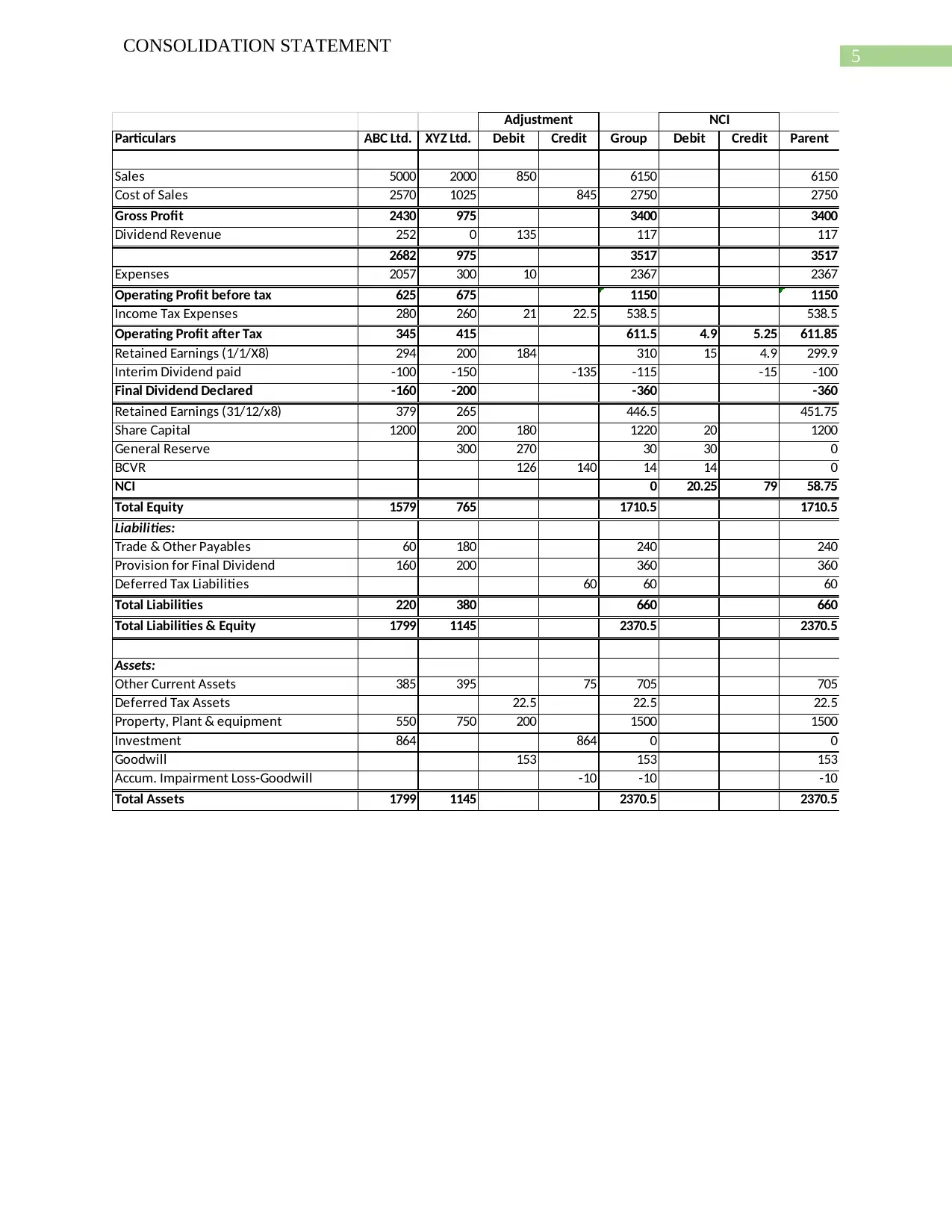

Particulars ABC Ltd. XYZ Ltd. Debit Credit Group Debit Credit Parent

Sales 5000 2000 850 6150 6150

Cost of Sales 2570 1025 845 2750 2750

Gross Profit 2430 975 3400 3400

Dividend Revenue 252 0 135 117 117

2682 975 3517 3517

Expenses 2057 300 10 2367 2367

Operating Profit before tax 625 675 1150 1150

Income Tax Expenses 280 260 21 22.5 538.5 538.5

Operating Profit after Tax 345 415 611.5 4.9 5.25 611.85

Retained Earnings (1/1/X8) 294 200 184 310 15 4.9 299.9

Interim Dividend paid -100 -150 -135 -115 -15 -100

Final Dividend Declared -160 -200 -360 -360

Retained Earnings (31/12/x8) 379 265 446.5 451.75

Share Capital 1200 200 180 1220 20 1200

General Reserve 300 270 30 30 0

BCVR 126 140 14 14 0

NCI 0 20.25 79 58.75

Total Equity 1579 765 1710.5 1710.5

Liabilities:

Trade & Other Payables 60 180 240 240

Provision for Final Dividend 160 200 360 360

Deferred Tax Liabilities 60 60 60

Total Liabilities 220 380 660 660

Total Liabilities & Equity 1799 1145 2370.5 2370.5

Assets:

Other Current Assets 385 395 75 705 705

Deferred Tax Assets 22.5 22.5 22.5

Property, Plant & equipment 550 750 200 1500 1500

Investment 864 864 0 0

Goodwill 153 153 153

Accum. Impairment Loss-Goodwill -10 -10 -10

Total Assets 1799 1145 2370.5 2370.5

Adjustment NCI

CONSOLIDATION STATEMENT

Particulars ABC Ltd. XYZ Ltd. Debit Credit Group Debit Credit Parent

Sales 5000 2000 850 6150 6150

Cost of Sales 2570 1025 845 2750 2750

Gross Profit 2430 975 3400 3400

Dividend Revenue 252 0 135 117 117

2682 975 3517 3517

Expenses 2057 300 10 2367 2367

Operating Profit before tax 625 675 1150 1150

Income Tax Expenses 280 260 21 22.5 538.5 538.5

Operating Profit after Tax 345 415 611.5 4.9 5.25 611.85

Retained Earnings (1/1/X8) 294 200 184 310 15 4.9 299.9

Interim Dividend paid -100 -150 -135 -115 -15 -100

Final Dividend Declared -160 -200 -360 -360

Retained Earnings (31/12/x8) 379 265 446.5 451.75

Share Capital 1200 200 180 1220 20 1200

General Reserve 300 270 30 30 0

BCVR 126 140 14 14 0

NCI 0 20.25 79 58.75

Total Equity 1579 765 1710.5 1710.5

Liabilities:

Trade & Other Payables 60 180 240 240

Provision for Final Dividend 160 200 360 360

Deferred Tax Liabilities 60 60 60

Total Liabilities 220 380 660 660

Total Liabilities & Equity 1799 1145 2370.5 2370.5

Assets:

Other Current Assets 385 395 75 705 705

Deferred Tax Assets 22.5 22.5 22.5

Property, Plant & equipment 550 750 200 1500 1500

Investment 864 864 0 0

Goodwill 153 153 153

Accum. Impairment Loss-Goodwill -10 -10 -10

Total Assets 1799 1145 2370.5 2370.5

Adjustment NCI

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

CONSOLIDATION STATEMENT

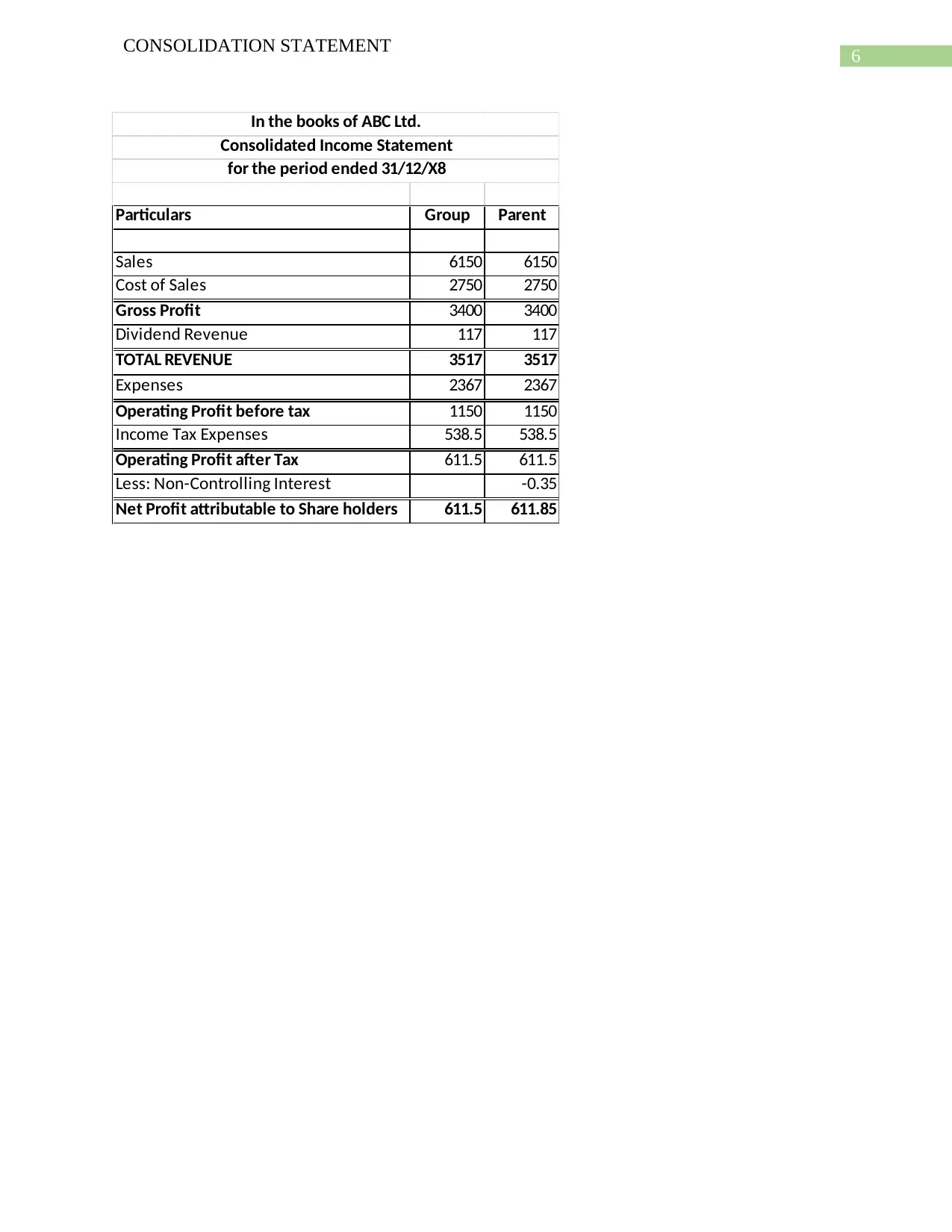

Particulars Group Parent

Sales 6150 6150

Cost of Sales 2750 2750

Gross Profit 3400 3400

Dividend Revenue 117 117

TOTAL REVENUE 3517 3517

Expenses 2367 2367

Operating Profit before tax 1150 1150

Income Tax Expenses 538.5 538.5

Operating Profit after Tax 611.5 611.5

Less: Non-Controlling Interest -0.35

Net Profit attributable to Share holders 611.5 611.85

In the books of ABC Ltd.

Consolidated Income Statement

for the period ended 31/12/X8

CONSOLIDATION STATEMENT

Particulars Group Parent

Sales 6150 6150

Cost of Sales 2750 2750

Gross Profit 3400 3400

Dividend Revenue 117 117

TOTAL REVENUE 3517 3517

Expenses 2367 2367

Operating Profit before tax 1150 1150

Income Tax Expenses 538.5 538.5

Operating Profit after Tax 611.5 611.5

Less: Non-Controlling Interest -0.35

Net Profit attributable to Share holders 611.5 611.85

In the books of ABC Ltd.

Consolidated Income Statement

for the period ended 31/12/X8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

CONSOLIDATION STATEMENT

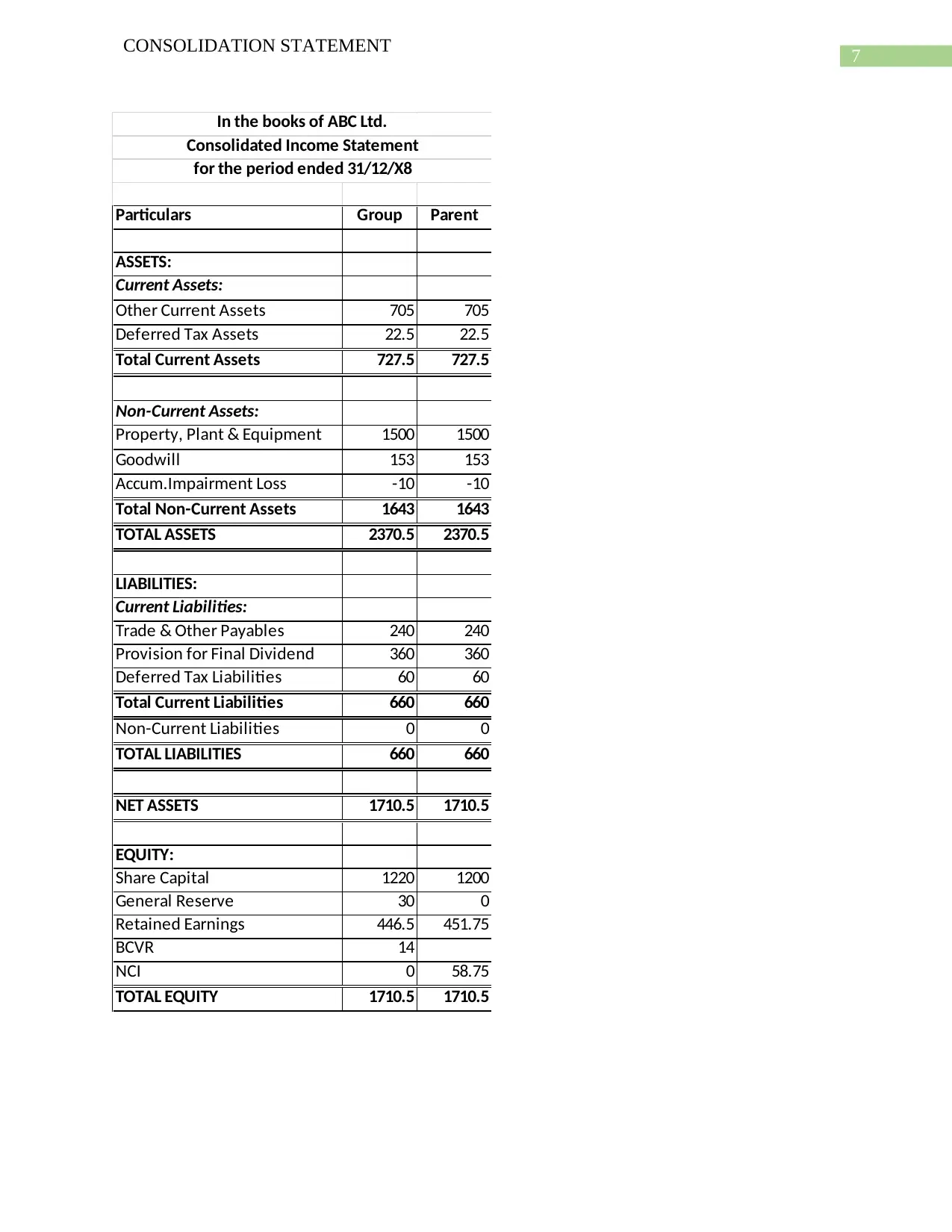

Particulars Group Parent

ASSETS:

Current Assets:

Other Current Assets 705 705

Deferred Tax Assets 22.5 22.5

Total Current Assets 727.5 727.5

Non-Current Assets:

Property, Plant & Equipment 1500 1500

Goodwill 153 153

Accum.Impairment Loss -10 -10

Total Non-Current Assets 1643 1643

TOTAL ASSETS 2370.5 2370.5

LIABILITIES:

Current Liabilities:

Trade & Other Payables 240 240

Provision for Final Dividend 360 360

Deferred Tax Liabilities 60 60

Total Current Liabilities 660 660

Non-Current Liabilities 0 0

TOTAL LIABILITIES 660 660

NET ASSETS 1710.5 1710.5

EQUITY:

Share Capital 1220 1200

General Reserve 30 0

Retained Earnings 446.5 451.75

BCVR 14

NCI 0 58.75

TOTAL EQUITY 1710.5 1710.5

In the books of ABC Ltd.

Consolidated Income Statement

for the period ended 31/12/X8

CONSOLIDATION STATEMENT

Particulars Group Parent

ASSETS:

Current Assets:

Other Current Assets 705 705

Deferred Tax Assets 22.5 22.5

Total Current Assets 727.5 727.5

Non-Current Assets:

Property, Plant & Equipment 1500 1500

Goodwill 153 153

Accum.Impairment Loss -10 -10

Total Non-Current Assets 1643 1643

TOTAL ASSETS 2370.5 2370.5

LIABILITIES:

Current Liabilities:

Trade & Other Payables 240 240

Provision for Final Dividend 360 360

Deferred Tax Liabilities 60 60

Total Current Liabilities 660 660

Non-Current Liabilities 0 0

TOTAL LIABILITIES 660 660

NET ASSETS 1710.5 1710.5

EQUITY:

Share Capital 1220 1200

General Reserve 30 0

Retained Earnings 446.5 451.75

BCVR 14

NCI 0 58.75

TOTAL EQUITY 1710.5 1710.5

In the books of ABC Ltd.

Consolidated Income Statement

for the period ended 31/12/X8

8

CONSOLIDATION STATEMENT

Requirement c:

Partial Goodwill Method

Partial Goodwill method can be defined as the process in which the calculation of

goodwill is done by considering the difference between the purchase consideration which is paid

and the acquirer’s share of fair value of net identifiable asset of the business. In case of partial

goodwill method, the shares of goodwill which the acquirer has is recognized as a part of

goodwill (Whiting, Hansen and Sen 2017). It is to be understood that partial goodwill method is

not allowable under US GAAP but the same is allowed as a method of calculating goodwill

under the IFRS structure. Another important thing about partial goodwill method is that the

method differs from the full goodwill method only in certain situations where the investment by

the acquirer is less than 100%. Partial Goodwill method is used by companies which follow the

IFRS framework for the purpose of reporting for accounting transactions.

Advantages of Partial Goodwill Method

The advantages which is associated with partial goodwill method can be discussed as

shown below:

The partial goodwill method allows the businesses to measure the assets and liabilities of

the business.

The method recognizes only the goodwill which is associated with the controlling interest

in the opinion.

The method is allowed by IFRS standards which are to be followed by the companies for

the purpose of measuring the goodwill of the business.

CONSOLIDATION STATEMENT

Requirement c:

Partial Goodwill Method

Partial Goodwill method can be defined as the process in which the calculation of

goodwill is done by considering the difference between the purchase consideration which is paid

and the acquirer’s share of fair value of net identifiable asset of the business. In case of partial

goodwill method, the shares of goodwill which the acquirer has is recognized as a part of

goodwill (Whiting, Hansen and Sen 2017). It is to be understood that partial goodwill method is

not allowable under US GAAP but the same is allowed as a method of calculating goodwill

under the IFRS structure. Another important thing about partial goodwill method is that the

method differs from the full goodwill method only in certain situations where the investment by

the acquirer is less than 100%. Partial Goodwill method is used by companies which follow the

IFRS framework for the purpose of reporting for accounting transactions.

Advantages of Partial Goodwill Method

The advantages which is associated with partial goodwill method can be discussed as

shown below:

The partial goodwill method allows the businesses to measure the assets and liabilities of

the business.

The method recognizes only the goodwill which is associated with the controlling interest

in the opinion.

The method is allowed by IFRS standards which are to be followed by the companies for

the purpose of measuring the goodwill of the business.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

CONSOLIDATION STATEMENT

Disadvantages of Partial Goodwill Method

The disadvantages of using partial Goodwill method for the purpose of measuring

goodwill are given below:

The method does not recognize the non-controlling interest of the business in

computation of Goodwill.

The method is not allowable under the US GAAP framework therefore the method is not

universally applicable by all companies.

Full Goodwill Method

In case of Full goodwill method, the calculation for goodwill is done by considering the

difference between the total fair value of the targeted company and the fair value of the

company’s net identifiable assets (Boennen and Glaum 2014). The method considers the non-

controlling interest of a goodwill which is not the case in partial goodwill method. The

accounting structure of US GAAP mandatorily requires businesses to follow the full goodwill

method for the purpose of measuring the goodwill of the company (Gardini and Grossi 2014).

On the other hand, the accounting structure which is provided by the IFRS framework requires

companies to follow any of the two options available which are partial goodwill method or full

goodwill method.

Using the framework which is provided by full goodwill method, businesses are able to

measure the entire assets and liabilities which the business possess along with the controlling and

non-controlling interest which is included in the goodwill.

CONSOLIDATION STATEMENT

Disadvantages of Partial Goodwill Method

The disadvantages of using partial Goodwill method for the purpose of measuring

goodwill are given below:

The method does not recognize the non-controlling interest of the business in

computation of Goodwill.

The method is not allowable under the US GAAP framework therefore the method is not

universally applicable by all companies.

Full Goodwill Method

In case of Full goodwill method, the calculation for goodwill is done by considering the

difference between the total fair value of the targeted company and the fair value of the

company’s net identifiable assets (Boennen and Glaum 2014). The method considers the non-

controlling interest of a goodwill which is not the case in partial goodwill method. The

accounting structure of US GAAP mandatorily requires businesses to follow the full goodwill

method for the purpose of measuring the goodwill of the company (Gardini and Grossi 2014).

On the other hand, the accounting structure which is provided by the IFRS framework requires

companies to follow any of the two options available which are partial goodwill method or full

goodwill method.

Using the framework which is provided by full goodwill method, businesses are able to

measure the entire assets and liabilities which the business possess along with the controlling and

non-controlling interest which is included in the goodwill.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

CONSOLIDATION STATEMENT

Advantages of Full Goodwill Method

The advantages which are associated with the application of full goodwill method can be

explained in the point form below:

The full goodwill method of measuring the goodwill considers the non-controlling

interest and controlling interest of the business in case of goodwill measurement.

The full goodwill method is allowed by both US GAAP and IFRS framework and

therefore the method can be universally applied by most of the companies for the purpose

of measuring the goodwill of the business (Welc 2015).

This method allows the companies to consider and measure all the assets and liabilities of

the business for the purpose of measuring the goodwill of the business.

Disadvantages of Full Goodwill Method

The disadvantages which are associated with the full goodwill method are listed below in

details:

The computation and measurement of Goodwill is complex under this method as the

method considers both controlling and non-controlling interest of the business.

Full Goodwill method can be manipulated easily and therefore may sacrifice the

reliability, comparability and transparency of the financial statements of the company.

CONSOLIDATION STATEMENT

Advantages of Full Goodwill Method

The advantages which are associated with the application of full goodwill method can be

explained in the point form below:

The full goodwill method of measuring the goodwill considers the non-controlling

interest and controlling interest of the business in case of goodwill measurement.

The full goodwill method is allowed by both US GAAP and IFRS framework and

therefore the method can be universally applied by most of the companies for the purpose

of measuring the goodwill of the business (Welc 2015).

This method allows the companies to consider and measure all the assets and liabilities of

the business for the purpose of measuring the goodwill of the business.

Disadvantages of Full Goodwill Method

The disadvantages which are associated with the full goodwill method are listed below in

details:

The computation and measurement of Goodwill is complex under this method as the

method considers both controlling and non-controlling interest of the business.

Full Goodwill method can be manipulated easily and therefore may sacrifice the

reliability, comparability and transparency of the financial statements of the company.

11

CONSOLIDATION STATEMENT

Reference

Boennen, S. and Glaum, M., 2014. Goodwill accounting: A review of the literature.

Gardini, S. and Grossi, G., 2014. Voluntary adoption of the consolidated financial statement and

fair value accounting by Italian local governments. Journal of Public Budgeting, Accounting &

Financial Management, 26(2), pp.313-344.

Welc, J., 2015. Full-Goodwill Method of Accounting for Business Combinations and Quality of

Financial Statements.

Whiting, R.H., Hansen, P. and Sen, A., 2017. A tool for measuring SMEs’ reputation,

engagement and goodwill: A New Zealand exploratory study. Journal of Intellectual

Capital, 18(1), pp.170-188.

CONSOLIDATION STATEMENT

Reference

Boennen, S. and Glaum, M., 2014. Goodwill accounting: A review of the literature.

Gardini, S. and Grossi, G., 2014. Voluntary adoption of the consolidated financial statement and

fair value accounting by Italian local governments. Journal of Public Budgeting, Accounting &

Financial Management, 26(2), pp.313-344.

Welc, J., 2015. Full-Goodwill Method of Accounting for Business Combinations and Quality of

Financial Statements.

Whiting, R.H., Hansen, P. and Sen, A., 2017. A tool for measuring SMEs’ reputation,

engagement and goodwill: A New Zealand exploratory study. Journal of Intellectual

Capital, 18(1), pp.170-188.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.