Contemporary Business Environment: COVID-19 and Brexit in the UK

VerifiedAdded on 2023/06/11

|13

|3910

|113

Report

AI Summary

This report provides an overview of the contemporary business environment in the United Kingdom, focusing on the economic impacts of the COVID-19 pandemic and Brexit. It examines the effects of COVID-19 on various aspects of the UK economy, including public health, manufacturing, employment, and poverty levels. The report also discusses major economic responses from the UK government, such as the 'Eat Out to Help Out' scheme, Job Retention Scheme, Kickstart Scheme, and Furlough Scheme, along with their implications. Furthermore, it analyzes the responses of the Bank of England, including interest rate reductions, and their impact on the UK economy. Finally, the report explores the economic consequences of Brexit on the UK, covering trade, labor, and investment. The report concludes with recommendations based on the analysis. Desklib offers a variety of resources, including past papers and solved assignments, to aid students in their studies.

Contemporary

Business Environment

Business Environment

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive summary

The concept of contemporary business environment considers the fundamental and

applied aspects of environmental processes and impact of human on environment. It tales into

consideration of both internal and external factor which puts an significant impact on economy.

This factors of environment helps in identifying opportunities and threats for any business

organisation. It makes essential for the director to determine and evaluate the component along

with to manage such forces. In report the discussion is based on various economic impacts due to

Covid-19 and Brexit. Also, consider major consequence by Bank of England and UK’s

Government.

The concept of contemporary business environment considers the fundamental and

applied aspects of environmental processes and impact of human on environment. It tales into

consideration of both internal and external factor which puts an significant impact on economy.

This factors of environment helps in identifying opportunities and threats for any business

organisation. It makes essential for the director to determine and evaluate the component along

with to manage such forces. In report the discussion is based on various economic impacts due to

Covid-19 and Brexit. Also, consider major consequence by Bank of England and UK’s

Government.

Table of Contents

Executive summary .........................................................................................................................1

INTRODUCTION...........................................................................................................................1

DISCUSSION AND ANALYSIS...................................................................................................1

Impact of COVID-19 on the UK's Economy.........................................................................1

Major Economic Responses of the UK's Government and their implications.......................2

2.3 Major responses of the Bank of England and its implication to UK economy................4

2.4 Impacts of Brexit on the UK’s economy..........................................................................6

CONCLUSION................................................................................................................................8

Recommendations ...........................................................................................................................8

References:.......................................................................................................................................9

2

Executive summary .........................................................................................................................1

INTRODUCTION...........................................................................................................................1

DISCUSSION AND ANALYSIS...................................................................................................1

Impact of COVID-19 on the UK's Economy.........................................................................1

Major Economic Responses of the UK's Government and their implications.......................2

2.3 Major responses of the Bank of England and its implication to UK economy................4

2.4 Impacts of Brexit on the UK’s economy..........................................................................6

CONCLUSION................................................................................................................................8

Recommendations ...........................................................................................................................8

References:.......................................................................................................................................9

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Business environment involve all those factors which implies an affect on the business

operations. It is necessary for the business organisation to analyse all those factors in order to

avoid the challenges which the organisation will gonna face in future. Favourable business

environment make business operations easy and effective. Natural environment, political

environment, economic environment and cultural environment are consider as the several factors

of contemporary business environment. Changes in all these factors result in the changes in

business operations of an organisation. In order to maintain the business growth and success, the

evaluation of such factors is necessary. The economy of United Kingdom has been effected

several times such as Brexit and COVID-19 (Bagchi and et. al., 2020). This report include the

impact of COVID-19 on the economy of United Kingdom along with major economic responses

of government and Bank of England. Furthermore, it also deals with the impact of Brexit on the

economy of UK.

DISCUSSION AND ANALYSIS

Impact of COVID-19 on the UK's Economy

COVID-19 highly effect the health of general public which result in the global pandemic.

The entire world was battling with such a huge pandemic. Its impact has been also seen on the

economy and financial market of United Kingdom. Several of precautions have been also

adopted by the government of country in order to protect the general public from virus such as

social distancing. The circular flow of income is found as a model of economics which leads to

presenting the big exchange which include products & services, money and many more. This

model present the flow of money starts from manufacturers to labour in the form of wages and

then it reverse back to manufacturers as the payment which they receive from selling products.

Majorly, this model is applied for the purpose of analysing and understanding the flow of money

within the economy of a country (Bell, Gardiner and Tomlinson, 2020). The COVID-19

pandemic has presented several economic consequences on the country which include reduction

in the income of public, disruptions in the service of manufacturing industries and transportation,

increase in unemployment rate and many more. The earnings of people living in UK has been

directly affected because of premature deaths, work place absenteeism, reduction in productivity

and many more. Several of manufacturing companies stop working which result in the loss of

1

Business environment involve all those factors which implies an affect on the business

operations. It is necessary for the business organisation to analyse all those factors in order to

avoid the challenges which the organisation will gonna face in future. Favourable business

environment make business operations easy and effective. Natural environment, political

environment, economic environment and cultural environment are consider as the several factors

of contemporary business environment. Changes in all these factors result in the changes in

business operations of an organisation. In order to maintain the business growth and success, the

evaluation of such factors is necessary. The economy of United Kingdom has been effected

several times such as Brexit and COVID-19 (Bagchi and et. al., 2020). This report include the

impact of COVID-19 on the economy of United Kingdom along with major economic responses

of government and Bank of England. Furthermore, it also deals with the impact of Brexit on the

economy of UK.

DISCUSSION AND ANALYSIS

Impact of COVID-19 on the UK's Economy

COVID-19 highly effect the health of general public which result in the global pandemic.

The entire world was battling with such a huge pandemic. Its impact has been also seen on the

economy and financial market of United Kingdom. Several of precautions have been also

adopted by the government of country in order to protect the general public from virus such as

social distancing. The circular flow of income is found as a model of economics which leads to

presenting the big exchange which include products & services, money and many more. This

model present the flow of money starts from manufacturers to labour in the form of wages and

then it reverse back to manufacturers as the payment which they receive from selling products.

Majorly, this model is applied for the purpose of analysing and understanding the flow of money

within the economy of a country (Bell, Gardiner and Tomlinson, 2020). The COVID-19

pandemic has presented several economic consequences on the country which include reduction

in the income of public, disruptions in the service of manufacturing industries and transportation,

increase in unemployment rate and many more. The earnings of people living in UK has been

directly affected because of premature deaths, work place absenteeism, reduction in productivity

and many more. Several of manufacturing companies stop working which result in the loss of

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

jobs of people. Most of employees become jobless as they lost their jobs in pandemic. It also

reduce the requirements of industrial inputs and energy resources which cause shut down of

businesses which cause increase in poverty in nation. As a result of it, all the employers decided

to reduce the number of employees or their wages and salaries working in their business

organisation. At that stage, the businesses were not in condition to pay the full amount of salary

to their employees. Rate of unemployment was increasing constantly as the people getting

terminated by the employer. Lock down and absenteeism of workforce result in the decrease in

production of products which also leads to the decrease in profits as well. Minimization of profit

and production leads to the huge losses to the organisation and the employer shut down their

business.

The purchasing power of people get also minimised and people started investing only on the

essential requirements. Several non essential businesses also shut down because of impact of

COVID-19 as the sales of non essential businesses get decrease and the owner was not in the

situation of paying salary of employees, building rent, taxes and many more (Comunian and

England, 2020). Many employer used their personal property in order to pay their debts and rent

because of COVID-19 pandemic. The debts of government also increase because the customers

were not able to pay the interest on their loans.

Major Economic Responses of the UK's Government and their implications

Below mentioned are the several economic response of government of United Kingdom along

with their implications: Eat out to help out scheme: It is one of the best measure or response adopted by the

government of United Kingdom in against to COVID-19 pandemic. This scheme is

related to the reopening of organisation after lock down. It provide a huge support to the

hospitality sector and providing the job protection to the employees working in the same

industry. It encourage the people to eat out. This scheme has been introduced by

Chancellor on 8th July, 2020 (Eikhof, 2020). Under the scheme of Eat out to help out

scheme, government has announced a 50% discount on the food and non alcoholic drinks

at restaurants. This scheme was valid on every Monday to Wednesday from 3rd August to

21st August, 2020. This scheme was valid only on the dine in services. And such discount

is capped at a maximum of £10 per head. The major objective of this scheme was to

encourage a better return to the hospitality industry as they faced a lot during the

2

reduce the requirements of industrial inputs and energy resources which cause shut down of

businesses which cause increase in poverty in nation. As a result of it, all the employers decided

to reduce the number of employees or their wages and salaries working in their business

organisation. At that stage, the businesses were not in condition to pay the full amount of salary

to their employees. Rate of unemployment was increasing constantly as the people getting

terminated by the employer. Lock down and absenteeism of workforce result in the decrease in

production of products which also leads to the decrease in profits as well. Minimization of profit

and production leads to the huge losses to the organisation and the employer shut down their

business.

The purchasing power of people get also minimised and people started investing only on the

essential requirements. Several non essential businesses also shut down because of impact of

COVID-19 as the sales of non essential businesses get decrease and the owner was not in the

situation of paying salary of employees, building rent, taxes and many more (Comunian and

England, 2020). Many employer used their personal property in order to pay their debts and rent

because of COVID-19 pandemic. The debts of government also increase because the customers

were not able to pay the interest on their loans.

Major Economic Responses of the UK's Government and their implications

Below mentioned are the several economic response of government of United Kingdom along

with their implications: Eat out to help out scheme: It is one of the best measure or response adopted by the

government of United Kingdom in against to COVID-19 pandemic. This scheme is

related to the reopening of organisation after lock down. It provide a huge support to the

hospitality sector and providing the job protection to the employees working in the same

industry. It encourage the people to eat out. This scheme has been introduced by

Chancellor on 8th July, 2020 (Eikhof, 2020). Under the scheme of Eat out to help out

scheme, government has announced a 50% discount on the food and non alcoholic drinks

at restaurants. This scheme was valid on every Monday to Wednesday from 3rd August to

21st August, 2020. This scheme was valid only on the dine in services. And such discount

is capped at a maximum of £10 per head. The major objective of this scheme was to

encourage a better return to the hospitality industry as they faced a lot during the

2

COVID-19 pandemic. This scheme result in the increase in the demand of eating food

items in restaurant. As an outcome, almost 78116 outlets claimed £849 million. About

160 million individual meals were claimed during the period of this scheme and the

average claim of per meal is £5.24 (Eat Out to Help Out Scheme, 2020). Job Retention Scheme: The government of United Kingdom has develop the

Coronavirus Job Retention scheme for the purpose of helping the employers to maintain

their work force and employees even their operations are being effected due to the

COVID-19 pandemic. The major focus of this scheme was to support the employers of

nation. This scheme was announced by the government of United Kingdom on 20th

March, 2020. This scheme focus on brining improvement in the labour cost of business

organisation along with increasing the earning of employees in the situation of reduction

in business activities. The important aspect of this schemes is that it keep the employees

and employers even in the case of suspension of their employment (Fetzer, 2020). At the

initial phase of Covid-19 pandemic, the government of UK has supported the business

and workers deal with unforeseeable and abrupt decrease if not fulfil shutdown in

business functions resulting from the obligatory limitation by government to contain the

spread of disease. It provide the essential liquidity to the employers for the purpose of

holding their labour which also involve their skills, experiences and talent which also

allow them for ramping up the practices after the recovery of economic activity. They are

not required to perform the entire deep process of recruitment, selection and training for

new employees. It claimed almost 80% of the regular monthly labour cost and it present a

cap of £2,500 per worker and every month (The UK’s Job Retention Scheme, 2021). The

employers of UK also contribute towards the furlough labour costs which is being

provided under the scheme of Job Retention. Kickstart Scheme: The respective scheme has been developed for the purpose of creating

new placements for work for the people of 16 to 24 years old. Under this scheme, the

government of United Kingdom announced to provide a bonus of £1,500 for each new

vacancy. It leads to providing the appropriate jobs to the young generation people along

with providing them training in order to develop the skills. It result in the increase in

chances in getting the jobs top the people who just completed their academics. All these

employment opportunities are being provided by public, private and non profit business

3

items in restaurant. As an outcome, almost 78116 outlets claimed £849 million. About

160 million individual meals were claimed during the period of this scheme and the

average claim of per meal is £5.24 (Eat Out to Help Out Scheme, 2020). Job Retention Scheme: The government of United Kingdom has develop the

Coronavirus Job Retention scheme for the purpose of helping the employers to maintain

their work force and employees even their operations are being effected due to the

COVID-19 pandemic. The major focus of this scheme was to support the employers of

nation. This scheme was announced by the government of United Kingdom on 20th

March, 2020. This scheme focus on brining improvement in the labour cost of business

organisation along with increasing the earning of employees in the situation of reduction

in business activities. The important aspect of this schemes is that it keep the employees

and employers even in the case of suspension of their employment (Fetzer, 2020). At the

initial phase of Covid-19 pandemic, the government of UK has supported the business

and workers deal with unforeseeable and abrupt decrease if not fulfil shutdown in

business functions resulting from the obligatory limitation by government to contain the

spread of disease. It provide the essential liquidity to the employers for the purpose of

holding their labour which also involve their skills, experiences and talent which also

allow them for ramping up the practices after the recovery of economic activity. They are

not required to perform the entire deep process of recruitment, selection and training for

new employees. It claimed almost 80% of the regular monthly labour cost and it present a

cap of £2,500 per worker and every month (The UK’s Job Retention Scheme, 2021). The

employers of UK also contribute towards the furlough labour costs which is being

provided under the scheme of Job Retention. Kickstart Scheme: The respective scheme has been developed for the purpose of creating

new placements for work for the people of 16 to 24 years old. Under this scheme, the

government of United Kingdom announced to provide a bonus of £1,500 for each new

vacancy. It leads to providing the appropriate jobs to the young generation people along

with providing them training in order to develop the skills. It result in the increase in

chances in getting the jobs top the people who just completed their academics. All these

employment opportunities are being provided by public, private and non profit business

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

organisations. Under this scheme, it has been also listed that the new vacancy last for

minimum of next 6 months and a minimum of 25 hours a week. It has been found as

essential for employer to provide proper training to the people of age group of 16-24 in

order to improve their skills and get better opportunity in future.

Furlough Scheme: As per this scheme, the Premier declared the delay by saying that the

employers will be anticipated to impart their 10% towards the hours their employees do

not work. It bring several changes in the rules and regulations of lock down which left

millions of employees afraid and nonplussed regarding the time that when their next pay

cheque will be provided. This scheme of government of United Kingdom state that

anyone working as a full time employee can be furloughed. Basically, it involve all those

people whoa were working on flexible basis or on zero hour basis. It has been cleared by

HMRC that the employers can recall their employees for joining who were made excess

after 23rd September. This date is the qualified date for supporting the job scheme. The

government of United Kingdom was providing complete support to the employers but the

employees were not able to see much difference in their pay scale or salaries. Under this

scheme, employees were working in the same manner and getting their salary on the

same basis and they are also paying taxes. After completing the time period of furlough ,

employees get back to work with their previous employer (The UK’s coronavirus

furlough scheme, explained by experts, 2020).

2.3 Major responses of the Bank of England and its implication to UK economy.

The role of bank England is help UK business and households for managing an economic

shock as bank and society have great role in economy growth and most of company , peoples &

services rely on them. The series of supervisory and policy measure is being introduced by Bank

of England in UK to help organisation in development. The financial stability is measured by

maintaining design of regulatory measures along with ensures the soundness & firm safety by

making sure policy holders are safe (Ajimoko, O. J., 2018) . Following are some factors of Bank

of England and their implications on UK economy is been discussed-

Reduce interest rate- For supporting the cost of mortgages and loans for companies &

household there was reduced in interest rate of Bank of England. The banking service is

facilitated as this a UK's central bank to all the building societies and bank in UK. In the

Bank of England the accounts can be opened as well as money can be borrowed from

4

minimum of next 6 months and a minimum of 25 hours a week. It has been found as

essential for employer to provide proper training to the people of age group of 16-24 in

order to improve their skills and get better opportunity in future.

Furlough Scheme: As per this scheme, the Premier declared the delay by saying that the

employers will be anticipated to impart their 10% towards the hours their employees do

not work. It bring several changes in the rules and regulations of lock down which left

millions of employees afraid and nonplussed regarding the time that when their next pay

cheque will be provided. This scheme of government of United Kingdom state that

anyone working as a full time employee can be furloughed. Basically, it involve all those

people whoa were working on flexible basis or on zero hour basis. It has been cleared by

HMRC that the employers can recall their employees for joining who were made excess

after 23rd September. This date is the qualified date for supporting the job scheme. The

government of United Kingdom was providing complete support to the employers but the

employees were not able to see much difference in their pay scale or salaries. Under this

scheme, employees were working in the same manner and getting their salary on the

same basis and they are also paying taxes. After completing the time period of furlough ,

employees get back to work with their previous employer (The UK’s coronavirus

furlough scheme, explained by experts, 2020).

2.3 Major responses of the Bank of England and its implication to UK economy.

The role of bank England is help UK business and households for managing an economic

shock as bank and society have great role in economy growth and most of company , peoples &

services rely on them. The series of supervisory and policy measure is being introduced by Bank

of England in UK to help organisation in development. The financial stability is measured by

maintaining design of regulatory measures along with ensures the soundness & firm safety by

making sure policy holders are safe (Ajimoko, O. J., 2018) . Following are some factors of Bank

of England and their implications on UK economy is been discussed-

Reduce interest rate- For supporting the cost of mortgages and loans for companies &

household there was reduced in interest rate of Bank of England. The banking service is

facilitated as this a UK's central bank to all the building societies and bank in UK. In the

Bank of England the accounts can be opened as well as money can be borrowed from

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

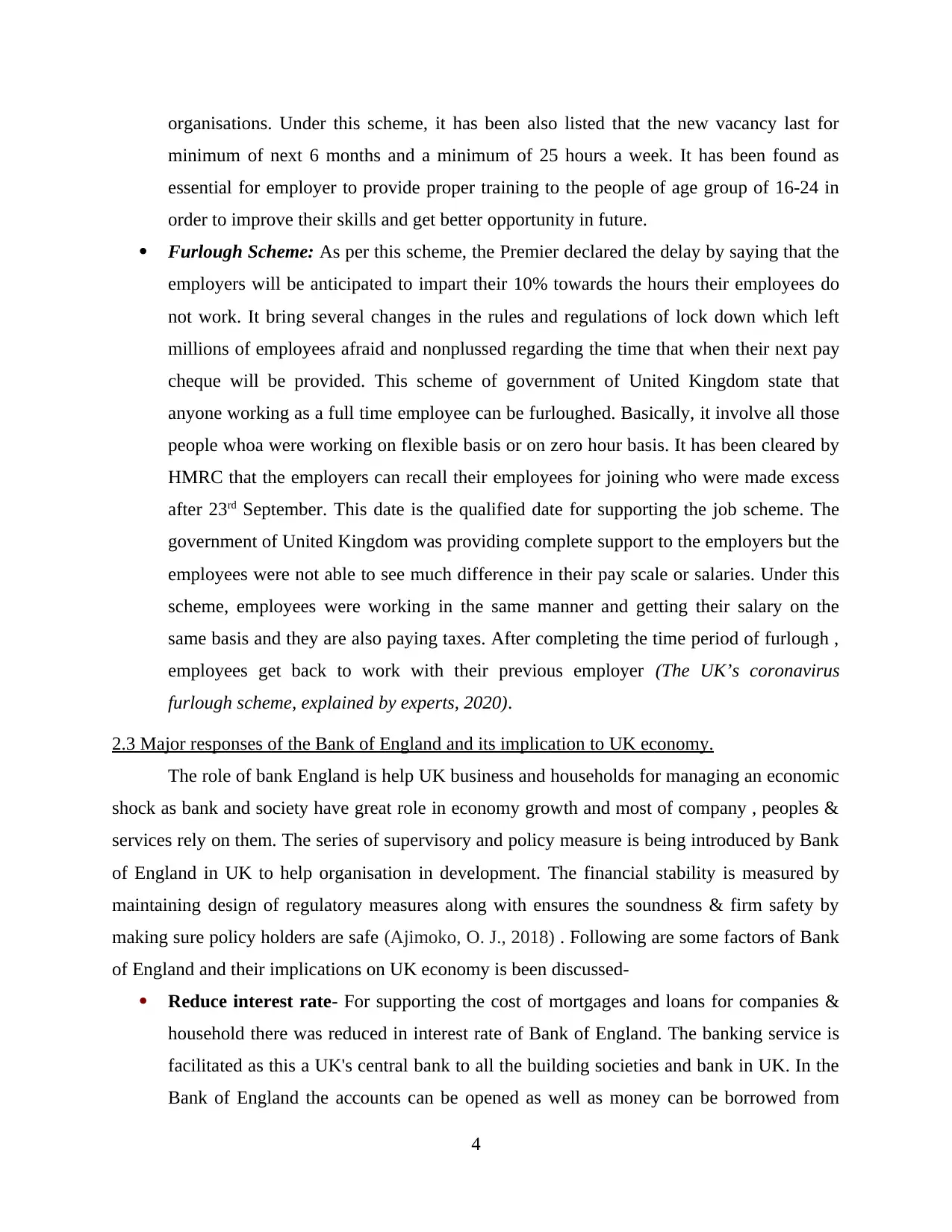

them for this they charge interest. The rate of interest was reduced by 0.1% by 2020

which is almost zero for facilitating support in overall UK economy. In UK, the support

is provided for increasing employment opportunities. With the change in bank rate there

is affect on the economy and people spending patterns also change and they spend by

knowing the cost of things (Anjum, and et.al., 2019). The change in bank rate affects the

prices and inflation. To keep inflation rate by 2% it is targeted by Bank of England. The

fall in payment of interest if someone is having loan or mortgage may get cheaper.

Hence, low interest rate tens to boost in expenditures and vice-versa. Also, this makes

essential in understanding in what way people save and spend their income in order to

identifying inflation target.

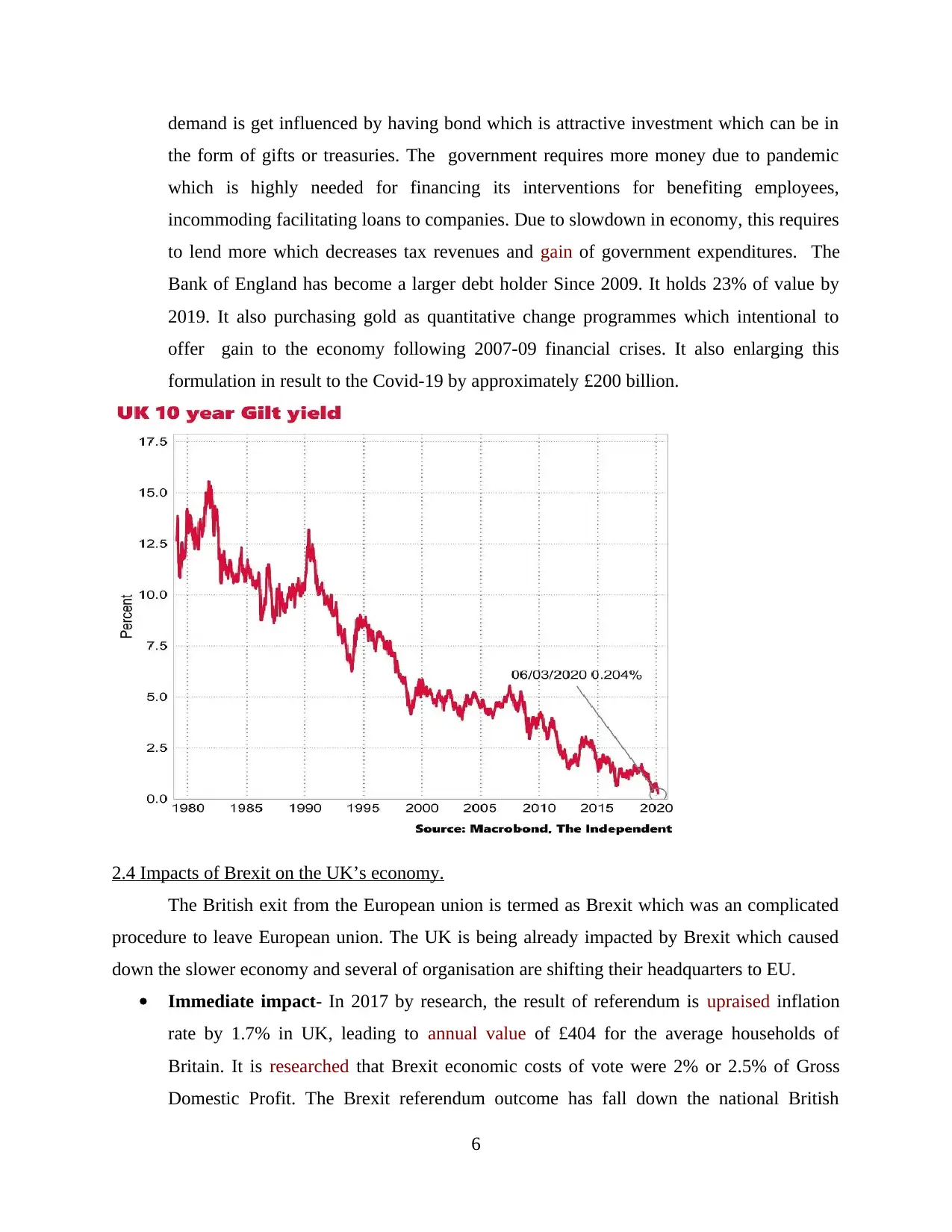

Sustenance of Government bonds- The Government bond is refereed as debt based

investing from which money is borrowed from government in return of agreed interest

rates. This funds can be utilised by government fir spending on infrastructures and

projects along with investor use for getting decided return paid at usual investments.

When their is purchase of government bond one contributes in government for the agreed

amount of time along with agreed amount (Dashper, K., 2019). In the way of fixed

interest rate it is return by government on regular basis which is known as coupon.

Therefore, government bond is defined as fixed income asset and on expiring of bond it is

back to regular investments. The demand and supply affects the government bonds, when

5

which is almost zero for facilitating support in overall UK economy. In UK, the support

is provided for increasing employment opportunities. With the change in bank rate there

is affect on the economy and people spending patterns also change and they spend by

knowing the cost of things (Anjum, and et.al., 2019). The change in bank rate affects the

prices and inflation. To keep inflation rate by 2% it is targeted by Bank of England. The

fall in payment of interest if someone is having loan or mortgage may get cheaper.

Hence, low interest rate tens to boost in expenditures and vice-versa. Also, this makes

essential in understanding in what way people save and spend their income in order to

identifying inflation target.

Sustenance of Government bonds- The Government bond is refereed as debt based

investing from which money is borrowed from government in return of agreed interest

rates. This funds can be utilised by government fir spending on infrastructures and

projects along with investor use for getting decided return paid at usual investments.

When their is purchase of government bond one contributes in government for the agreed

amount of time along with agreed amount (Dashper, K., 2019). In the way of fixed

interest rate it is return by government on regular basis which is known as coupon.

Therefore, government bond is defined as fixed income asset and on expiring of bond it is

back to regular investments. The demand and supply affects the government bonds, when

5

demand is get influenced by having bond which is attractive investment which can be in

the form of gifts or treasuries. The government requires more money due to pandemic

which is highly needed for financing its interventions for benefiting employees,

incommoding facilitating loans to companies. Due to slowdown in economy, this requires

to lend more which decreases tax revenues and gain of government expenditures. The

Bank of England has become a larger debt holder Since 2009. It holds 23% of value by

2019. It also purchasing gold as quantitative change programmes which intentional to

offer gain to the economy following 2007-09 financial crises. It also enlarging this

formulation in result to the Covid-19 by approximately £200 billion.

2.4 Impacts of Brexit on the UK’s economy.

The British exit from the European union is termed as Brexit which was an complicated

procedure to leave European union. The UK is being already impacted by Brexit which caused

down the slower economy and several of organisation are shifting their headquarters to EU.

Immediate impact- In 2017 by research, the result of referendum is upraised inflation

rate by 1.7% in UK, leading to annual value of £404 for the average households of

Britain. It is researched that Brexit economic costs of vote were 2% or 2.5% of Gross

Domestic Profit. The Brexit referendum outcome has fall down the national British

6

the form of gifts or treasuries. The government requires more money due to pandemic

which is highly needed for financing its interventions for benefiting employees,

incommoding facilitating loans to companies. Due to slowdown in economy, this requires

to lend more which decreases tax revenues and gain of government expenditures. The

Bank of England has become a larger debt holder Since 2009. It holds 23% of value by

2019. It also purchasing gold as quantitative change programmes which intentional to

offer gain to the economy following 2007-09 financial crises. It also enlarging this

formulation in result to the Covid-19 by approximately £200 billion.

2.4 Impacts of Brexit on the UK’s economy.

The British exit from the European union is termed as Brexit which was an complicated

procedure to leave European union. The UK is being already impacted by Brexit which caused

down the slower economy and several of organisation are shifting their headquarters to EU.

Immediate impact- In 2017 by research, the result of referendum is upraised inflation

rate by 1.7% in UK, leading to annual value of £404 for the average households of

Britain. It is researched that Brexit economic costs of vote were 2% or 2.5% of Gross

Domestic Profit. The Brexit referendum outcome has fall down the national British

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

income by 0.6% to 1.3% in December 2017 according to the study in financial times. It

has been researched that there are several studies that Brexit evoke uncertainties close to

future trade policy of UK declined British global trade (Delgado, and Calegari, 2020).

The British companies has started in 2019 their relocation processes to EU after

referendum. On the other side, EWU companies attending new investment in UK. The

bank of England after Brexit referendum and other banks forecasting short-term

macroeconomics which were pessimistic. The customer confidence in market and there

was creation of uncertainness which was predicted. By the end of transition period, the

agreement was based on trade negotiation among UK and EU that results in positive

which helps in solving several barriers that is associated with trade.

Future impact- In the medium and long term there is near-unanimous or overwhelming

agreement between scholars which is going away from the EU having negative impact on

economy of British in 2016. Fr9om several economist the agreement was surveyed the

weakened the real per capita level of income in UK. The survey of 2017 and 2019 of

present academic investigation measured the credible estimation which ranges between

GDP losses of 1.2 to 4.5% for UK and cost of between 1–10% income per capita of UK.

The disagreement is predict which depends whether there is Hard or Soft Brexit in UK

(Djukic, and Ilic, 2021). In January 2018, Brexit investigated by government of UK

describing that the economic improvement of UK would be inferior by 2-8% for minimal

15 years leading Brexit. The research has found that European Union on the basis of

Leave Scenario, the positive effect is delivered on trade by membership, resulting UK

trade that would be bad if it will be no longer part of EU. Under a hard Brexit, UK

returns to WTO rules, 1/4 would be look high trade barriers, 1/3 of UK’s export would be

tariff free to EU and other trade risk tariffs would be 1- 10%. This is also evaluated that

UK regions are much exposed to Brexit than other nation region. In 2017, economist find

which owed the economic impact of Brexit induced cut back in migration known that

there would be possible minimum affects on wage in the low-skill service sector with

significant negative effect on Gross Domestic Profit per capita in UK (Jabnoun, N.,

2019).

7

has been researched that there are several studies that Brexit evoke uncertainties close to

future trade policy of UK declined British global trade (Delgado, and Calegari, 2020).

The British companies has started in 2019 their relocation processes to EU after

referendum. On the other side, EWU companies attending new investment in UK. The

bank of England after Brexit referendum and other banks forecasting short-term

macroeconomics which were pessimistic. The customer confidence in market and there

was creation of uncertainness which was predicted. By the end of transition period, the

agreement was based on trade negotiation among UK and EU that results in positive

which helps in solving several barriers that is associated with trade.

Future impact- In the medium and long term there is near-unanimous or overwhelming

agreement between scholars which is going away from the EU having negative impact on

economy of British in 2016. Fr9om several economist the agreement was surveyed the

weakened the real per capita level of income in UK. The survey of 2017 and 2019 of

present academic investigation measured the credible estimation which ranges between

GDP losses of 1.2 to 4.5% for UK and cost of between 1–10% income per capita of UK.

The disagreement is predict which depends whether there is Hard or Soft Brexit in UK

(Djukic, and Ilic, 2021). In January 2018, Brexit investigated by government of UK

describing that the economic improvement of UK would be inferior by 2-8% for minimal

15 years leading Brexit. The research has found that European Union on the basis of

Leave Scenario, the positive effect is delivered on trade by membership, resulting UK

trade that would be bad if it will be no longer part of EU. Under a hard Brexit, UK

returns to WTO rules, 1/4 would be look high trade barriers, 1/3 of UK’s export would be

tariff free to EU and other trade risk tariffs would be 1- 10%. This is also evaluated that

UK regions are much exposed to Brexit than other nation region. In 2017, economist find

which owed the economic impact of Brexit induced cut back in migration known that

there would be possible minimum affects on wage in the low-skill service sector with

significant negative effect on Gross Domestic Profit per capita in UK (Jabnoun, N.,

2019).

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONCLUSION

From the above it is been concluded that business environment refers to collection of

several micro and macro factors by involving customer needs and preferences, employees,

management, supply& demand etc. The performance of business and sustainability is

influenced in the competitive market. In the report the discussion is on economic impact iof

Covid-19 in UK economy which rasied several factors like collapsing of business,

unemployment, increasing debts and many more. S3everal government economic responses of

UK is discussed which involves several schemes like job retention scheme, eat out to help out

scheme, kickstart scheme and furlough scheme and many more. Further, the major responses of

Bank of England is included in which implication of reduced interest rate and government bond

is described along with impact of Brexit on economy of UK resulting into trade barriers and

many more.

Recommendations

From above analysis, this can be suggested that the expenditure by government can be

increased or decreased on the infrastructure or new projects in order to increase the opportunity

of employment and to enhance growth of economy. The way in which organization operates

their business can be change by UK government wh9ich can influence economy either by

changing own taxes or spending patterns or through passing laws and regulations (Ko, and Kim,

2019). The example can be taken as such the extra expenditure by government results in up-

surging demand in economy which can lead to high employment & produc6tivituy. There can be

development of strategy or modification in existing by the government for people who are not

comfortable to take work from home or remote working. This encourages to return to work by

facilitating social distancing in organisation so as to keep health and safety. The government can

too increase their budget and modify plan of action for addressing Covid-19 pandemic situation.

8

From the above it is been concluded that business environment refers to collection of

several micro and macro factors by involving customer needs and preferences, employees,

management, supply& demand etc. The performance of business and sustainability is

influenced in the competitive market. In the report the discussion is on economic impact iof

Covid-19 in UK economy which rasied several factors like collapsing of business,

unemployment, increasing debts and many more. S3everal government economic responses of

UK is discussed which involves several schemes like job retention scheme, eat out to help out

scheme, kickstart scheme and furlough scheme and many more. Further, the major responses of

Bank of England is included in which implication of reduced interest rate and government bond

is described along with impact of Brexit on economy of UK resulting into trade barriers and

many more.

Recommendations

From above analysis, this can be suggested that the expenditure by government can be

increased or decreased on the infrastructure or new projects in order to increase the opportunity

of employment and to enhance growth of economy. The way in which organization operates

their business can be change by UK government wh9ich can influence economy either by

changing own taxes or spending patterns or through passing laws and regulations (Ko, and Kim,

2019). The example can be taken as such the extra expenditure by government results in up-

surging demand in economy which can lead to high employment & produc6tivituy. There can be

development of strategy or modification in existing by the government for people who are not

comfortable to take work from home or remote working. This encourages to return to work by

facilitating social distancing in organisation so as to keep health and safety. The government can

too increase their budget and modify plan of action for addressing Covid-19 pandemic situation.

8

References:

Books and Journals

Bagchi and et. al., 2020. Impact of COVID-19 on global economy. In Coronavirus Outbreak and

the Great Lockdown (pp. 15-26). Springer, Singapore.

Bell, T., Gardiner, L. and Tomlinson, D., 2020. Getting britain working (safely) again: The next

phase of the coronavirus job retention scheme. London: Resolution Foundation.

Comunian, R. and England, L., 2020. Creative and cultural work without filters: Covid-19 and

exposed precarity in the creative economy. Cultural Trends, 29(2), pp.112-128.

Eikhof, D.R., 2020. COVID-19, inclusion and workforce diversity in the cultural economy: what

now, what next?. Cultural Trends, 29(3), pp.234-250.

Fetzer, T., 2020. Subsidising the spread of COVID-19: Evidence from the UK’s Eat-Out-to-

Help-Out Scheme. Economic Journal (London, England).

Hijzen, A. and Salvatori, A., 2022. The impact of the COVID-19 crisis across different socio-

economic groups and the role of job retention schemes-The case of Switzerland.

Siu-Cheung, M.O.K. and Saigal, V.M., 2020. Using Solar Electric Cooking to Kickstart

Universal Energy Access in the Developing World. In 2020 IEEE Global Humanitarian

Technology Conference (GHTC) (pp. 1-4). IEEE.Letters, 9(12), pp.2143-2156.

Ajimoko, O. J., 2018. Considerations for the Adoption of Cloud-based Big Data Analytics in

Small Business Enterprises. Electronic Journal of Information Systems

Evaluation, 21(2), pp.pp63-79.

Anjum, and et.al., 2019. Antecedents of entrepreneurial intentions: A study of business students

from universities of Pakistan. International Journal of Business and Psychology, 1(2),

pp.72-88.

Dashper, K., 2019. Challenging the gendered rhetoric of success? The limitations of women‐only

mentoring for tackling gender inequality in the workplace. Gender, Work &

Organization, 26(4), pp.541-557.

Delgado, and Calegari, 2020, October. Towards a unified vision of business process and

organizational data. In 2020 XLVI Latin American Computing Conference (CLEI) (pp.

108-117). IEEE.

Djukic, and Ilic, 2021. Importance of Green Investment and Entrepreneurship for Economic

Development. In Contemporary Entrepreneurship Issues in International Business (pp.

195-220).

Jabnoun, N., 2019. A proposed model for sustainable business excellence. Management

Decision.

Ko, and Kim, 2019. The effects of maturity of project portfolio management and business

alignment on PMO efficiency. Sustainability, 11(1), p.238.

Online

Eat Out to Help Out Scheme, 2020. [Online] Available Through:

<https://commonslibrary.parliament.uk/research-briefings/cbp-8978/>

The UK’s Job Retention Scheme, 2021. [Online] Available Through:

<https://www.hoganlovells.com/en/publications/the-uks-job-retention-scheme>

9

Books and Journals

Bagchi and et. al., 2020. Impact of COVID-19 on global economy. In Coronavirus Outbreak and

the Great Lockdown (pp. 15-26). Springer, Singapore.

Bell, T., Gardiner, L. and Tomlinson, D., 2020. Getting britain working (safely) again: The next

phase of the coronavirus job retention scheme. London: Resolution Foundation.

Comunian, R. and England, L., 2020. Creative and cultural work without filters: Covid-19 and

exposed precarity in the creative economy. Cultural Trends, 29(2), pp.112-128.

Eikhof, D.R., 2020. COVID-19, inclusion and workforce diversity in the cultural economy: what

now, what next?. Cultural Trends, 29(3), pp.234-250.

Fetzer, T., 2020. Subsidising the spread of COVID-19: Evidence from the UK’s Eat-Out-to-

Help-Out Scheme. Economic Journal (London, England).

Hijzen, A. and Salvatori, A., 2022. The impact of the COVID-19 crisis across different socio-

economic groups and the role of job retention schemes-The case of Switzerland.

Siu-Cheung, M.O.K. and Saigal, V.M., 2020. Using Solar Electric Cooking to Kickstart

Universal Energy Access in the Developing World. In 2020 IEEE Global Humanitarian

Technology Conference (GHTC) (pp. 1-4). IEEE.Letters, 9(12), pp.2143-2156.

Ajimoko, O. J., 2018. Considerations for the Adoption of Cloud-based Big Data Analytics in

Small Business Enterprises. Electronic Journal of Information Systems

Evaluation, 21(2), pp.pp63-79.

Anjum, and et.al., 2019. Antecedents of entrepreneurial intentions: A study of business students

from universities of Pakistan. International Journal of Business and Psychology, 1(2),

pp.72-88.

Dashper, K., 2019. Challenging the gendered rhetoric of success? The limitations of women‐only

mentoring for tackling gender inequality in the workplace. Gender, Work &

Organization, 26(4), pp.541-557.

Delgado, and Calegari, 2020, October. Towards a unified vision of business process and

organizational data. In 2020 XLVI Latin American Computing Conference (CLEI) (pp.

108-117). IEEE.

Djukic, and Ilic, 2021. Importance of Green Investment and Entrepreneurship for Economic

Development. In Contemporary Entrepreneurship Issues in International Business (pp.

195-220).

Jabnoun, N., 2019. A proposed model for sustainable business excellence. Management

Decision.

Ko, and Kim, 2019. The effects of maturity of project portfolio management and business

alignment on PMO efficiency. Sustainability, 11(1), p.238.

Online

Eat Out to Help Out Scheme, 2020. [Online] Available Through:

<https://commonslibrary.parliament.uk/research-briefings/cbp-8978/>

The UK’s Job Retention Scheme, 2021. [Online] Available Through:

<https://www.hoganlovells.com/en/publications/the-uks-job-retention-scheme>

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.