Strategic Analysis and Recommendations for Wesfarmers

VerifiedAdded on 2020/05/04

|20

|3912

|162

AI Summary

The assignment requires an in-depth analysis of Wesfarmers' corporate strategy, focusing on evaluating their current performance and market position. Students will conduct a SWOT analysis to uncover internal strengths and weaknesses as well as external opportunities and threats. This task involves examining the company's organizational structure, strategic objectives, competitive landscape, and financial health. Based on these insights, students are expected to develop strategic recommendations aimed at enhancing Wesfarmers' overall performance and achieving long-term business goals. The assignment will culminate in a comprehensive report that synthesizes research findings and presents well-founded strategies for future growth and success.

Running head: PART A

Contemporary Business Issues: Part A

Name of the Student:

Name of the University:

Author’s Note:

Contemporary Business Issues: Part A

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1PART A

Part A

Executive Summary

Strategic management cycle examines the strategic issues of an organization and suggests

improved strategies for gaining high level of competitive advantage. It is an ongoing process of

creating, implementing and evaluating business decisions, which enables an organization

towards achieving organizational goals. The study has analyzed the strategic marketing

management of Wesfarmers. Wesfarmers is an Australian conglomerate providing services like

retail, coal mining, industrial and safety products, chemicals and fertilizers. As per the survey of

2016, Wesfarmers has become the largest Australian company based on its revenue with

AU$65.98 billion revenue.

The stakeholder analysis matrix has demonstrated that shareholders, customers, suppliers and

employees are the most important stakeholders of the organization. The study has analyzed its

external market though PESTLE and Porter’s Five Forces model. From this analysis, it has been

found that economic development and stable political condition of Australia has boosted the

business development of Wesfarmers. However, the organization faces tough competitive

pressure from Woolworths and Washington H. Soul Pattinson. From the competitor analysis, it

has been found that Wesfarmers has wide products and service ranges as compared to

Woolworths and Washington H. Soul Pattinson. The study has also assessed its internal market

though VRIO and SWOT analysis. From the internal analysis, it has been found that strong

brand image and worldwide distribution network has built sustained competitive advantage for

Wesfarmers. The study had analyzed the strategic options for Wesfarmers through Porter’s

Generic Model and Ansoff Matrix. From such analysis, it has been found that Wesfarmers

follows cost leadership strategy. The organization has high potential for wide geographical

expansion in international markets.

Part A

Executive Summary

Strategic management cycle examines the strategic issues of an organization and suggests

improved strategies for gaining high level of competitive advantage. It is an ongoing process of

creating, implementing and evaluating business decisions, which enables an organization

towards achieving organizational goals. The study has analyzed the strategic marketing

management of Wesfarmers. Wesfarmers is an Australian conglomerate providing services like

retail, coal mining, industrial and safety products, chemicals and fertilizers. As per the survey of

2016, Wesfarmers has become the largest Australian company based on its revenue with

AU$65.98 billion revenue.

The stakeholder analysis matrix has demonstrated that shareholders, customers, suppliers and

employees are the most important stakeholders of the organization. The study has analyzed its

external market though PESTLE and Porter’s Five Forces model. From this analysis, it has been

found that economic development and stable political condition of Australia has boosted the

business development of Wesfarmers. However, the organization faces tough competitive

pressure from Woolworths and Washington H. Soul Pattinson. From the competitor analysis, it

has been found that Wesfarmers has wide products and service ranges as compared to

Woolworths and Washington H. Soul Pattinson. The study has also assessed its internal market

though VRIO and SWOT analysis. From the internal analysis, it has been found that strong

brand image and worldwide distribution network has built sustained competitive advantage for

Wesfarmers. The study had analyzed the strategic options for Wesfarmers through Porter’s

Generic Model and Ansoff Matrix. From such analysis, it has been found that Wesfarmers

follows cost leadership strategy. The organization has high potential for wide geographical

expansion in international markets.

2PART A

Table of Contents

1.0 Introduction................................................................................................................................4

2.0 Sustainability.............................................................................................................................4

2.1 Stakeholder Analysis.............................................................................................................4

2.2 PESTEL Analysis..................................................................................................................6

3.0 Governance................................................................................................................................7

4.0 Strategy......................................................................................................................................7

4.1 External analysis....................................................................................................................7

4.1.1 Porters 5 Forces Analysis...............................................................................................7

4.1.2 Competitor and Customer/Market Analysis...................................................................9

4.2 Internal analysis...................................................................................................................10

4.2.1 Capabilities (VRIO)......................................................................................................10

4.3 SWOT Analysis...................................................................................................................11

4.4 Porters’ generic strategic choices for competitive advantage..............................................11

4.4.1 Cost Leadership............................................................................................................11

4.4.2 Differentiation...............................................................................................................12

4.4.3 Focus.............................................................................................................................12

4.5 Ansoff Matrix......................................................................................................................14

4.5.1 Market Penetration........................................................................................................14

4.5.2 Market Development....................................................................................................14

4.5.3 Product Development...................................................................................................14

4.5.4 Diversification..............................................................................................................14

5.0 Operations................................................................................................................................15

5.1 Recommendations................................................................................................................15

Table of Contents

1.0 Introduction................................................................................................................................4

2.0 Sustainability.............................................................................................................................4

2.1 Stakeholder Analysis.............................................................................................................4

2.2 PESTEL Analysis..................................................................................................................6

3.0 Governance................................................................................................................................7

4.0 Strategy......................................................................................................................................7

4.1 External analysis....................................................................................................................7

4.1.1 Porters 5 Forces Analysis...............................................................................................7

4.1.2 Competitor and Customer/Market Analysis...................................................................9

4.2 Internal analysis...................................................................................................................10

4.2.1 Capabilities (VRIO)......................................................................................................10

4.3 SWOT Analysis...................................................................................................................11

4.4 Porters’ generic strategic choices for competitive advantage..............................................11

4.4.1 Cost Leadership............................................................................................................11

4.4.2 Differentiation...............................................................................................................12

4.4.3 Focus.............................................................................................................................12

4.5 Ansoff Matrix......................................................................................................................14

4.5.1 Market Penetration........................................................................................................14

4.5.2 Market Development....................................................................................................14

4.5.3 Product Development...................................................................................................14

4.5.4 Diversification..............................................................................................................14

5.0 Operations................................................................................................................................15

5.1 Recommendations................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3PART A

5.2 Proposal of Recommendations through McKinsey 7S Framework....................................15

6.0 Conclusion...............................................................................................................................16

Reference List................................................................................................................................17

5.2 Proposal of Recommendations through McKinsey 7S Framework....................................15

6.0 Conclusion...............................................................................................................................16

Reference List................................................................................................................................17

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4PART A

1.0 Introduction

Strategic marketing defines the way in which an organization differentiates itself from its

competitors though capitalizing its strengths towards providing unique value to the customers

consistently. This study will assess the strategic marketing management of Wesfarmers.

Wesfarmers is an Australian conglomerate with interest of retail, fertilizers, chemicals, industrial

and safety products and coal mining (Wesfarmers.com.au 2017). The study will the stakeholders

of the organization though stakeholder-mapping analysis. The study will also analyze its external

market through PESTLE, Porter’s Five Force analysis and competitor analysis. The internal

market of the organization will be assessed through VRIO and SWOT analysis. Apart from that,

the study will also evaluate some strategic options to the organization through Porter’s Generic

Strategy and Ansoff matrix. Based on the strategic analysis, the study will also provide some

recommendation to Wesfarmers for fulfilling the expectation of the stakeholders. Furthermore,

the study will also apply McKinsey 7S Framework for implementing the suggested strategies.

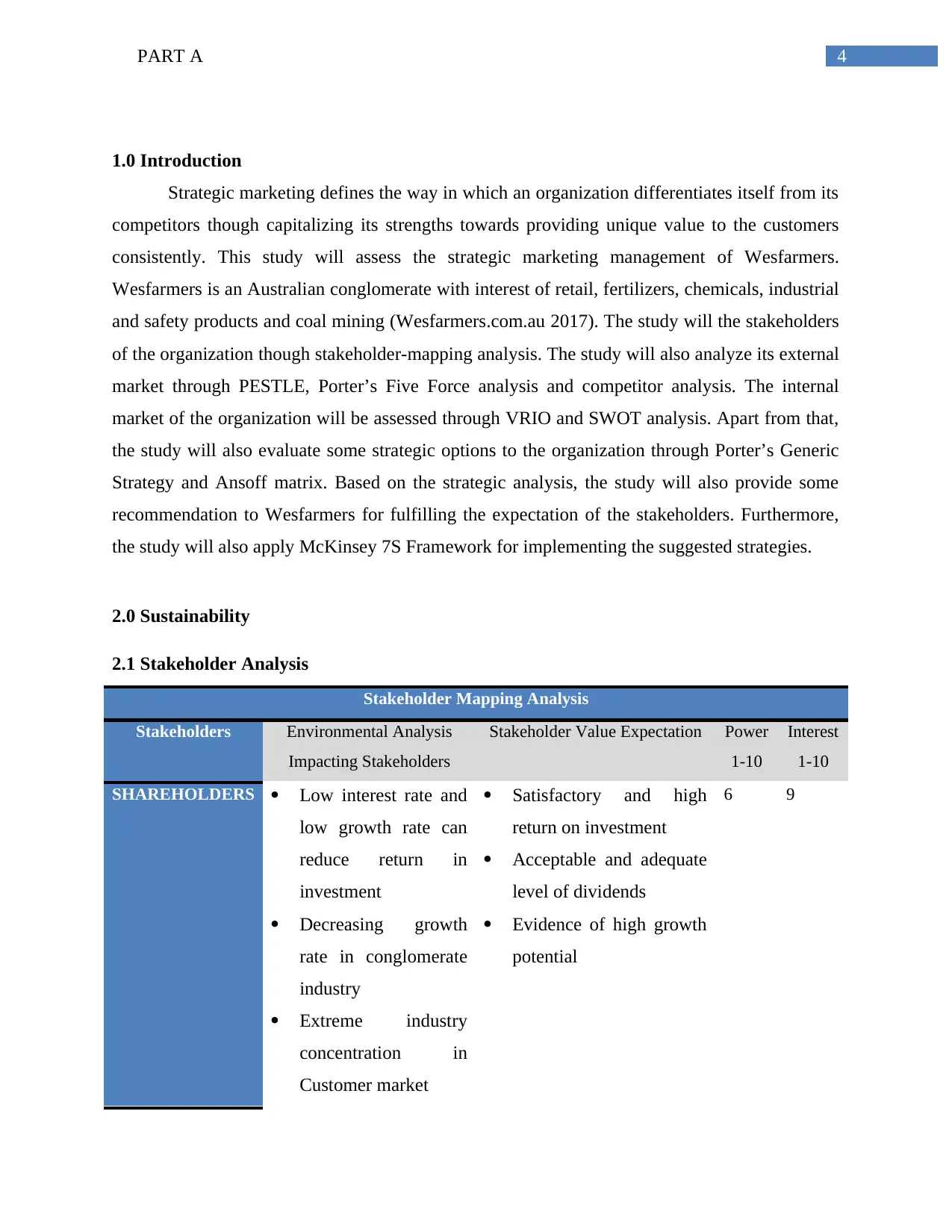

2.0 Sustainability

2.1 Stakeholder Analysis

Stakeholder Mapping Analysis

Stakeholders Environmental Analysis

Impacting Stakeholders

Stakeholder Value Expectation Power

1-10

Interest

1-10

SHAREHOLDERS Low interest rate and

low growth rate can

reduce return in

investment

Decreasing growth

rate in conglomerate

industry

Extreme industry

concentration in

Customer market

Satisfactory and high

return on investment

Acceptable and adequate

level of dividends

Evidence of high growth

potential

6 9

1.0 Introduction

Strategic marketing defines the way in which an organization differentiates itself from its

competitors though capitalizing its strengths towards providing unique value to the customers

consistently. This study will assess the strategic marketing management of Wesfarmers.

Wesfarmers is an Australian conglomerate with interest of retail, fertilizers, chemicals, industrial

and safety products and coal mining (Wesfarmers.com.au 2017). The study will the stakeholders

of the organization though stakeholder-mapping analysis. The study will also analyze its external

market through PESTLE, Porter’s Five Force analysis and competitor analysis. The internal

market of the organization will be assessed through VRIO and SWOT analysis. Apart from that,

the study will also evaluate some strategic options to the organization through Porter’s Generic

Strategy and Ansoff matrix. Based on the strategic analysis, the study will also provide some

recommendation to Wesfarmers for fulfilling the expectation of the stakeholders. Furthermore,

the study will also apply McKinsey 7S Framework for implementing the suggested strategies.

2.0 Sustainability

2.1 Stakeholder Analysis

Stakeholder Mapping Analysis

Stakeholders Environmental Analysis

Impacting Stakeholders

Stakeholder Value Expectation Power

1-10

Interest

1-10

SHAREHOLDERS Low interest rate and

low growth rate can

reduce return in

investment

Decreasing growth

rate in conglomerate

industry

Extreme industry

concentration in

Customer market

Satisfactory and high

return on investment

Acceptable and adequate

level of dividends

Evidence of high growth

potential

6 9

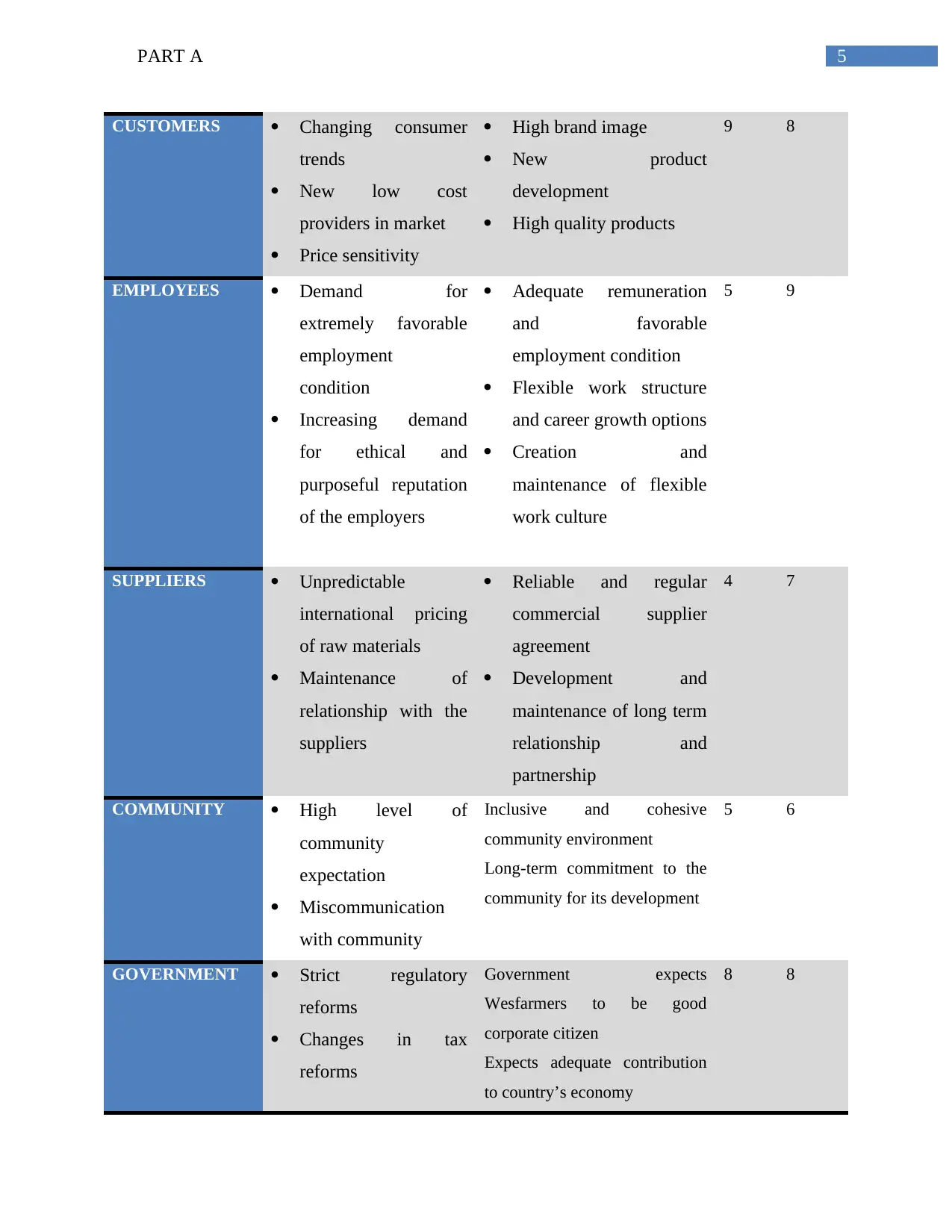

5PART A

CUSTOMERS Changing consumer

trends

New low cost

providers in market

Price sensitivity

High brand image

New product

development

High quality products

9 8

EMPLOYEES Demand for

extremely favorable

employment

condition

Increasing demand

for ethical and

purposeful reputation

of the employers

Adequate remuneration

and favorable

employment condition

Flexible work structure

and career growth options

Creation and

maintenance of flexible

work culture

5 9

SUPPLIERS Unpredictable

international pricing

of raw materials

Maintenance of

relationship with the

suppliers

Reliable and regular

commercial supplier

agreement

Development and

maintenance of long term

relationship and

partnership

4 7

COMMUNITY High level of

community

expectation

Miscommunication

with community

Inclusive and cohesive

community environment

Long-term commitment to the

community for its development

5 6

GOVERNMENT Strict regulatory

reforms

Changes in tax

reforms

Government expects

Wesfarmers to be good

corporate citizen

Expects adequate contribution

to country’s economy

8 8

CUSTOMERS Changing consumer

trends

New low cost

providers in market

Price sensitivity

High brand image

New product

development

High quality products

9 8

EMPLOYEES Demand for

extremely favorable

employment

condition

Increasing demand

for ethical and

purposeful reputation

of the employers

Adequate remuneration

and favorable

employment condition

Flexible work structure

and career growth options

Creation and

maintenance of flexible

work culture

5 9

SUPPLIERS Unpredictable

international pricing

of raw materials

Maintenance of

relationship with the

suppliers

Reliable and regular

commercial supplier

agreement

Development and

maintenance of long term

relationship and

partnership

4 7

COMMUNITY High level of

community

expectation

Miscommunication

with community

Inclusive and cohesive

community environment

Long-term commitment to the

community for its development

5 6

GOVERNMENT Strict regulatory

reforms

Changes in tax

reforms

Government expects

Wesfarmers to be good

corporate citizen

Expects adequate contribution

to country’s economy

8 8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6PART A

Table 1: Stakeholder Analysis of Wesfarmers

(Source: Missonier and Loufrani-Fedida 2014)

Table 1: Stakeholder Analysis of Wesfarmers

(Source: Missonier and Loufrani-Fedida 2014)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7PART A

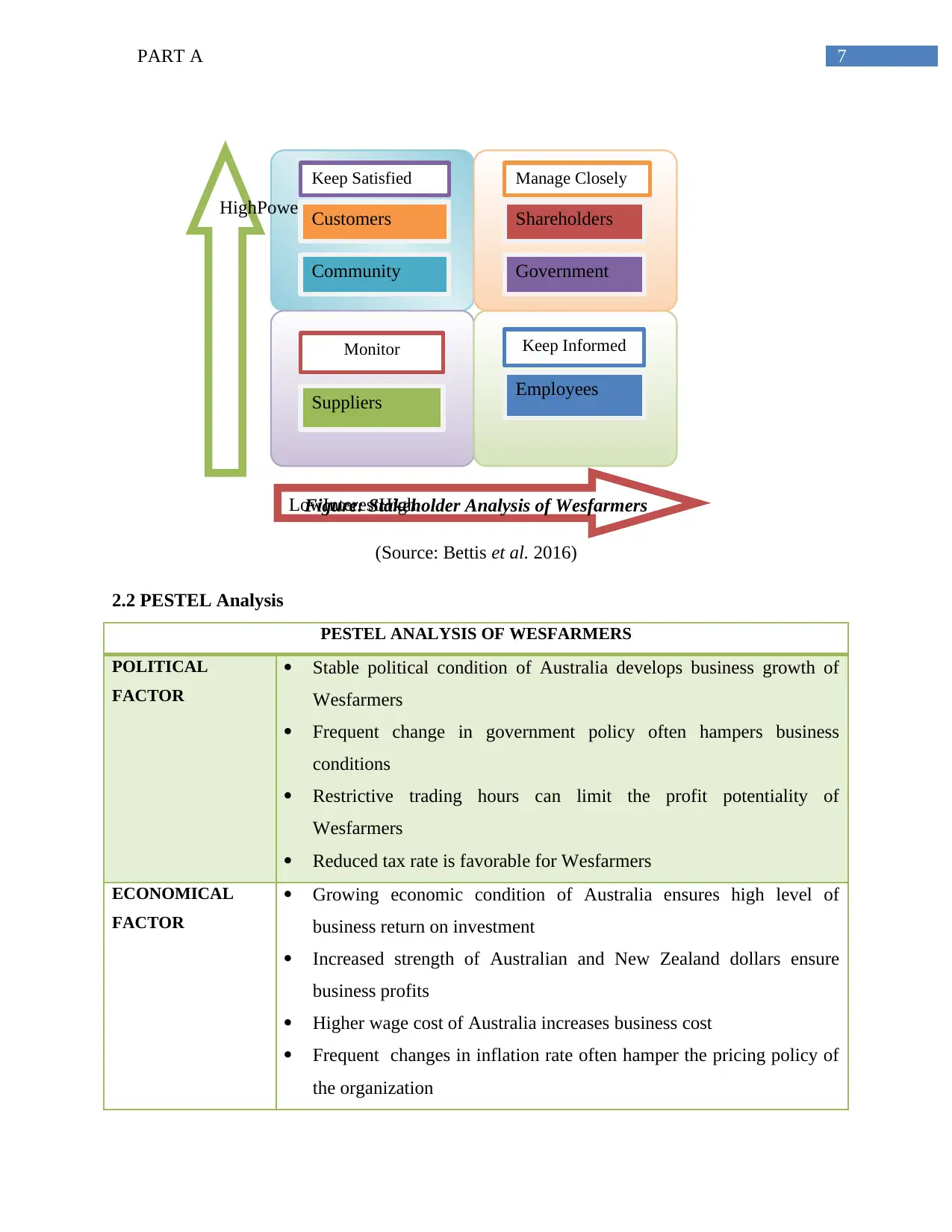

LowInterestHigh

HighPowerLow Shareholders

Government

Customers

Community

Suppliers Employees

Keep Satisfied Manage Closely

Monitor Keep Informed

Figure: Stakeholder Analysis of Wesfarmers

(Source: Bettis et al. 2016)

2.2 PESTEL Analysis

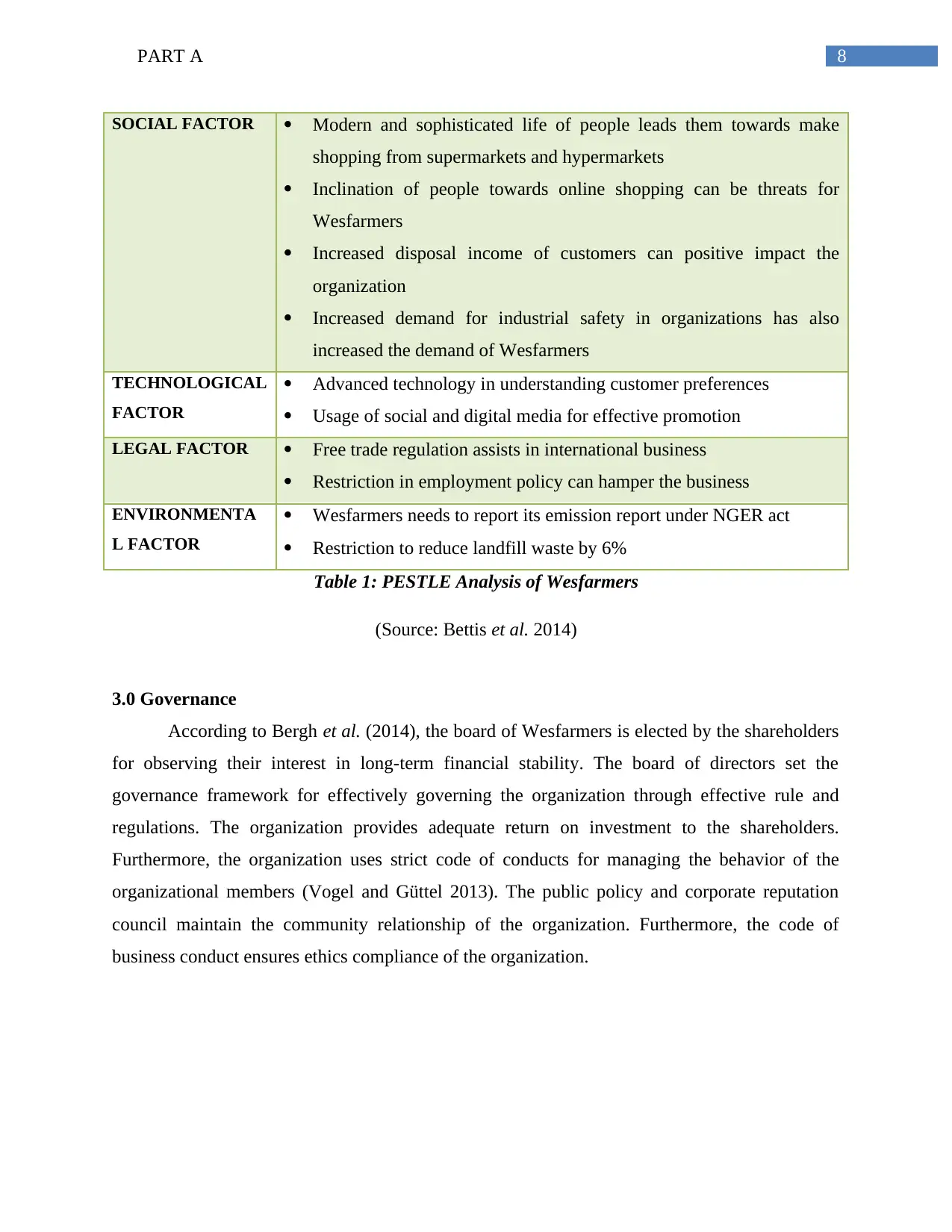

PESTEL ANALYSIS OF WESFARMERS

POLITICAL

FACTOR

Stable political condition of Australia develops business growth of

Wesfarmers

Frequent change in government policy often hampers business

conditions

Restrictive trading hours can limit the profit potentiality of

Wesfarmers

Reduced tax rate is favorable for Wesfarmers

ECONOMICAL

FACTOR

Growing economic condition of Australia ensures high level of

business return on investment

Increased strength of Australian and New Zealand dollars ensure

business profits

Higher wage cost of Australia increases business cost

Frequent changes in inflation rate often hamper the pricing policy of

the organization

LowInterestHigh

HighPowerLow Shareholders

Government

Customers

Community

Suppliers Employees

Keep Satisfied Manage Closely

Monitor Keep Informed

Figure: Stakeholder Analysis of Wesfarmers

(Source: Bettis et al. 2016)

2.2 PESTEL Analysis

PESTEL ANALYSIS OF WESFARMERS

POLITICAL

FACTOR

Stable political condition of Australia develops business growth of

Wesfarmers

Frequent change in government policy often hampers business

conditions

Restrictive trading hours can limit the profit potentiality of

Wesfarmers

Reduced tax rate is favorable for Wesfarmers

ECONOMICAL

FACTOR

Growing economic condition of Australia ensures high level of

business return on investment

Increased strength of Australian and New Zealand dollars ensure

business profits

Higher wage cost of Australia increases business cost

Frequent changes in inflation rate often hamper the pricing policy of

the organization

8PART A

SOCIAL FACTOR Modern and sophisticated life of people leads them towards make

shopping from supermarkets and hypermarkets

Inclination of people towards online shopping can be threats for

Wesfarmers

Increased disposal income of customers can positive impact the

organization

Increased demand for industrial safety in organizations has also

increased the demand of Wesfarmers

TECHNOLOGICAL

FACTOR

Advanced technology in understanding customer preferences

Usage of social and digital media for effective promotion

LEGAL FACTOR Free trade regulation assists in international business

Restriction in employment policy can hamper the business

ENVIRONMENTA

L FACTOR

Wesfarmers needs to report its emission report under NGER act

Restriction to reduce landfill waste by 6%

Table 1: PESTLE Analysis of Wesfarmers

(Source: Bettis et al. 2014)

3.0 Governance

According to Bergh et al. (2014), the board of Wesfarmers is elected by the shareholders

for observing their interest in long-term financial stability. The board of directors set the

governance framework for effectively governing the organization through effective rule and

regulations. The organization provides adequate return on investment to the shareholders.

Furthermore, the organization uses strict code of conducts for managing the behavior of the

organizational members (Vogel and Güttel 2013). The public policy and corporate reputation

council maintain the community relationship of the organization. Furthermore, the code of

business conduct ensures ethics compliance of the organization.

SOCIAL FACTOR Modern and sophisticated life of people leads them towards make

shopping from supermarkets and hypermarkets

Inclination of people towards online shopping can be threats for

Wesfarmers

Increased disposal income of customers can positive impact the

organization

Increased demand for industrial safety in organizations has also

increased the demand of Wesfarmers

TECHNOLOGICAL

FACTOR

Advanced technology in understanding customer preferences

Usage of social and digital media for effective promotion

LEGAL FACTOR Free trade regulation assists in international business

Restriction in employment policy can hamper the business

ENVIRONMENTA

L FACTOR

Wesfarmers needs to report its emission report under NGER act

Restriction to reduce landfill waste by 6%

Table 1: PESTLE Analysis of Wesfarmers

(Source: Bettis et al. 2014)

3.0 Governance

According to Bergh et al. (2014), the board of Wesfarmers is elected by the shareholders

for observing their interest in long-term financial stability. The board of directors set the

governance framework for effectively governing the organization through effective rule and

regulations. The organization provides adequate return on investment to the shareholders.

Furthermore, the organization uses strict code of conducts for managing the behavior of the

organizational members (Vogel and Güttel 2013). The public policy and corporate reputation

council maintain the community relationship of the organization. Furthermore, the code of

business conduct ensures ethics compliance of the organization.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9PART A

4.0 Strategy

4.1 External analysis

4.1.1 Porters 5 Forces Analysis

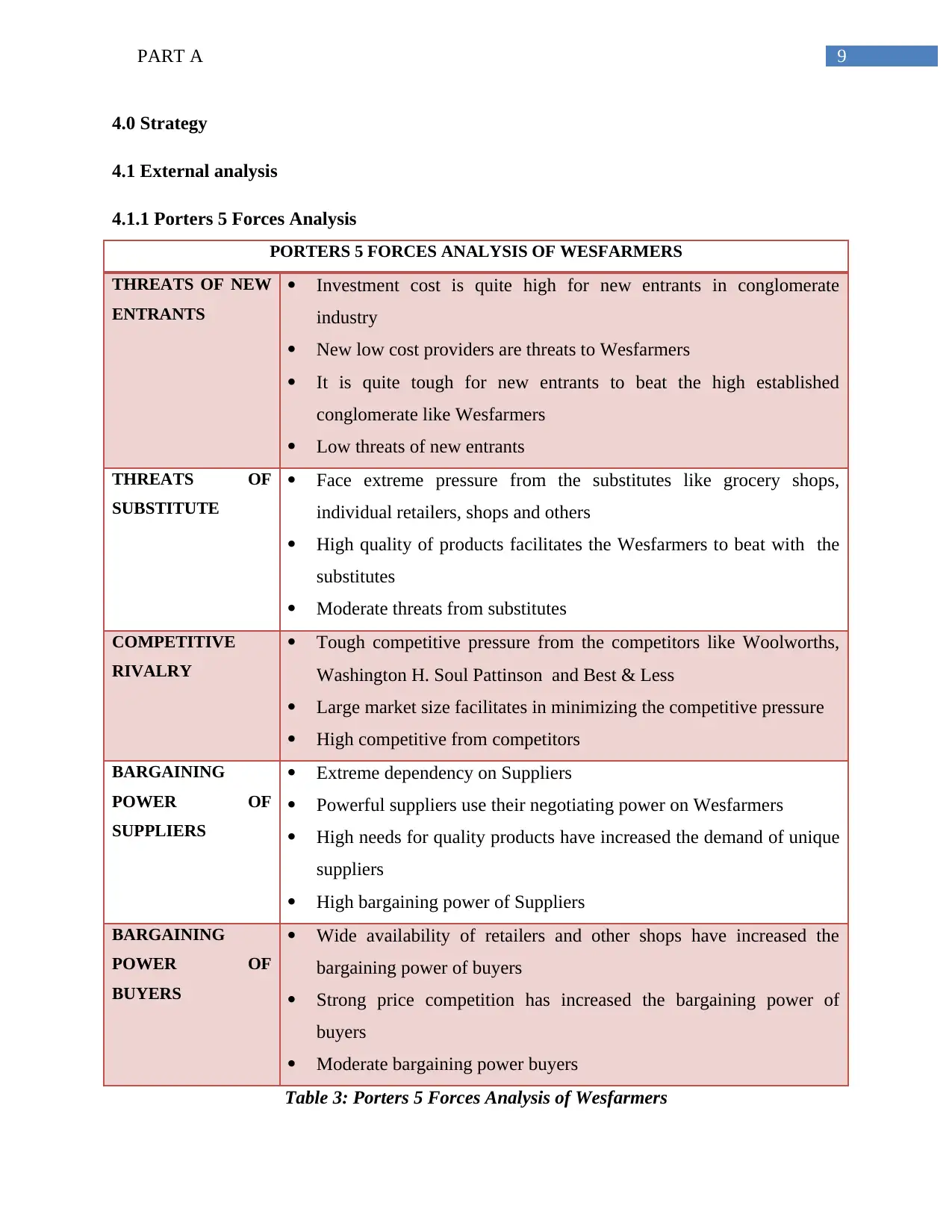

PORTERS 5 FORCES ANALYSIS OF WESFARMERS

THREATS OF NEW

ENTRANTS

Investment cost is quite high for new entrants in conglomerate

industry

New low cost providers are threats to Wesfarmers

It is quite tough for new entrants to beat the high established

conglomerate like Wesfarmers

Low threats of new entrants

THREATS OF

SUBSTITUTE

Face extreme pressure from the substitutes like grocery shops,

individual retailers, shops and others

High quality of products facilitates the Wesfarmers to beat with the

substitutes

Moderate threats from substitutes

COMPETITIVE

RIVALRY

Tough competitive pressure from the competitors like Woolworths,

Washington H. Soul Pattinson and Best & Less

Large market size facilitates in minimizing the competitive pressure

High competitive from competitors

BARGAINING

POWER OF

SUPPLIERS

Extreme dependency on Suppliers

Powerful suppliers use their negotiating power on Wesfarmers

High needs for quality products have increased the demand of unique

suppliers

High bargaining power of Suppliers

BARGAINING

POWER OF

BUYERS

Wide availability of retailers and other shops have increased the

bargaining power of buyers

Strong price competition has increased the bargaining power of

buyers

Moderate bargaining power buyers

Table 3: Porters 5 Forces Analysis of Wesfarmers

4.0 Strategy

4.1 External analysis

4.1.1 Porters 5 Forces Analysis

PORTERS 5 FORCES ANALYSIS OF WESFARMERS

THREATS OF NEW

ENTRANTS

Investment cost is quite high for new entrants in conglomerate

industry

New low cost providers are threats to Wesfarmers

It is quite tough for new entrants to beat the high established

conglomerate like Wesfarmers

Low threats of new entrants

THREATS OF

SUBSTITUTE

Face extreme pressure from the substitutes like grocery shops,

individual retailers, shops and others

High quality of products facilitates the Wesfarmers to beat with the

substitutes

Moderate threats from substitutes

COMPETITIVE

RIVALRY

Tough competitive pressure from the competitors like Woolworths,

Washington H. Soul Pattinson and Best & Less

Large market size facilitates in minimizing the competitive pressure

High competitive from competitors

BARGAINING

POWER OF

SUPPLIERS

Extreme dependency on Suppliers

Powerful suppliers use their negotiating power on Wesfarmers

High needs for quality products have increased the demand of unique

suppliers

High bargaining power of Suppliers

BARGAINING

POWER OF

BUYERS

Wide availability of retailers and other shops have increased the

bargaining power of buyers

Strong price competition has increased the bargaining power of

buyers

Moderate bargaining power buyers

Table 3: Porters 5 Forces Analysis of Wesfarmers

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10PART A

(Source: Simon, Fischbach and Schoder 2014)

Figure 2: Porters 5 Forces Analysis of Wesfarmers

(Source: Gans and Ryall 2017)

(Source: Simon, Fischbach and Schoder 2014)

Figure 2: Porters 5 Forces Analysis of Wesfarmers

(Source: Gans and Ryall 2017)

11PART A

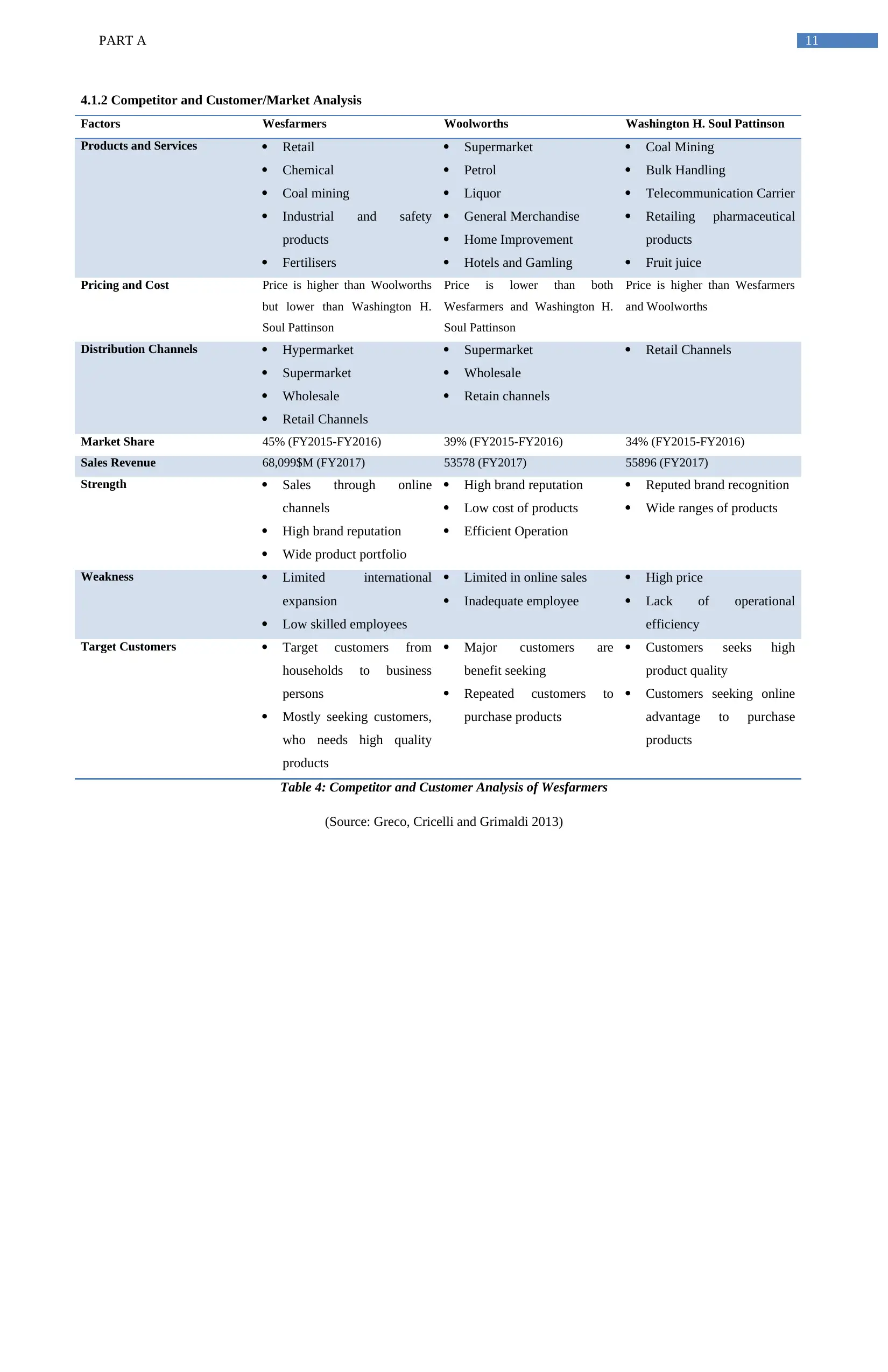

4.1.2 Competitor and Customer/Market Analysis

Factors Wesfarmers Woolworths Washington H. Soul Pattinson

Products and Services Retail

Chemical

Coal mining

Industrial and safety

products

Fertilisers

Supermarket

Petrol

Liquor

General Merchandise

Home Improvement

Hotels and Gamling

Coal Mining

Bulk Handling

Telecommunication Carrier

Retailing pharmaceutical

products

Fruit juice

Pricing and Cost Price is higher than Woolworths

but lower than Washington H.

Soul Pattinson

Price is lower than both

Wesfarmers and Washington H.

Soul Pattinson

Price is higher than Wesfarmers

and Woolworths

Distribution Channels Hypermarket

Supermarket

Wholesale

Retail Channels

Supermarket

Wholesale

Retain channels

Retail Channels

Market Share 45% (FY2015-FY2016) 39% (FY2015-FY2016) 34% (FY2015-FY2016)

Sales Revenue 68,099$M (FY2017) 53578 (FY2017) 55896 (FY2017)

Strength Sales through online

channels

High brand reputation

Wide product portfolio

High brand reputation

Low cost of products

Efficient Operation

Reputed brand recognition

Wide ranges of products

Weakness Limited international

expansion

Low skilled employees

Limited in online sales

Inadequate employee

High price

Lack of operational

efficiency

Target Customers Target customers from

households to business

persons

Mostly seeking customers,

who needs high quality

products

Major customers are

benefit seeking

Repeated customers to

purchase products

Customers seeks high

product quality

Customers seeking online

advantage to purchase

products

Table 4: Competitor and Customer Analysis of Wesfarmers

(Source: Greco, Cricelli and Grimaldi 2013)

4.1.2 Competitor and Customer/Market Analysis

Factors Wesfarmers Woolworths Washington H. Soul Pattinson

Products and Services Retail

Chemical

Coal mining

Industrial and safety

products

Fertilisers

Supermarket

Petrol

Liquor

General Merchandise

Home Improvement

Hotels and Gamling

Coal Mining

Bulk Handling

Telecommunication Carrier

Retailing pharmaceutical

products

Fruit juice

Pricing and Cost Price is higher than Woolworths

but lower than Washington H.

Soul Pattinson

Price is lower than both

Wesfarmers and Washington H.

Soul Pattinson

Price is higher than Wesfarmers

and Woolworths

Distribution Channels Hypermarket

Supermarket

Wholesale

Retail Channels

Supermarket

Wholesale

Retain channels

Retail Channels

Market Share 45% (FY2015-FY2016) 39% (FY2015-FY2016) 34% (FY2015-FY2016)

Sales Revenue 68,099$M (FY2017) 53578 (FY2017) 55896 (FY2017)

Strength Sales through online

channels

High brand reputation

Wide product portfolio

High brand reputation

Low cost of products

Efficient Operation

Reputed brand recognition

Wide ranges of products

Weakness Limited international

expansion

Low skilled employees

Limited in online sales

Inadequate employee

High price

Lack of operational

efficiency

Target Customers Target customers from

households to business

persons

Mostly seeking customers,

who needs high quality

products

Major customers are

benefit seeking

Repeated customers to

purchase products

Customers seeks high

product quality

Customers seeking online

advantage to purchase

products

Table 4: Competitor and Customer Analysis of Wesfarmers

(Source: Greco, Cricelli and Grimaldi 2013)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.