Pensonic vs. Panasonic Financial Analysis

VerifiedAdded on 2019/09/16

|10

|1495

|228

Report

AI Summary

This report provides a comprehensive financial analysis of Pensonic and Panasonic, two companies operating in the Malaysian market. The analysis covers several key areas, including average returns and standard deviation of stock prices, liquidity ratios (current ratio, quick ratio, cash ratio), leverage ratios (debt ratio, debt-to-equity ratio, interest coverage ratio), and profitability ratios (gross profit ratio, net profit ratio, operating profit ratio). The report also examines market preference based on market share data. The findings reveal that Panasonic demonstrates superior financial health compared to Pensonic across all analyzed metrics. Panasonic exhibits significantly higher liquidity, negligible debt, and substantially greater profitability. While Pensonic shows higher operating profit, its heavy reliance on debt and lower net profit significantly detract from its overall financial strength. The report concludes that Panasonic enjoys a stronger market preference, indicated by its considerably larger market share. The analysis is supported by data extracted from the annual reports of both companies and historical stock price data from Yahoo Finance.

Contents

Average Returns and Standard Deviation:.............................................................................................2

Financial Health analysis........................................................................................................................3

Liquidity:............................................................................................................................................3

Leverage:...........................................................................................................................................4

Profitability:.......................................................................................................................................5

Market Preference:...........................................................................................................................6

Appendix 1: Key financial inputs............................................................................................................7

Pensonic............................................................................................................................................7

Panasonic:.........................................................................................................................................8

References:............................................................................................................................................9

1

Average Returns and Standard Deviation:.............................................................................................2

Financial Health analysis........................................................................................................................3

Liquidity:............................................................................................................................................3

Leverage:...........................................................................................................................................4

Profitability:.......................................................................................................................................5

Market Preference:...........................................................................................................................6

Appendix 1: Key financial inputs............................................................................................................7

Pensonic............................................................................................................................................7

Panasonic:.........................................................................................................................................8

References:............................................................................................................................................9

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

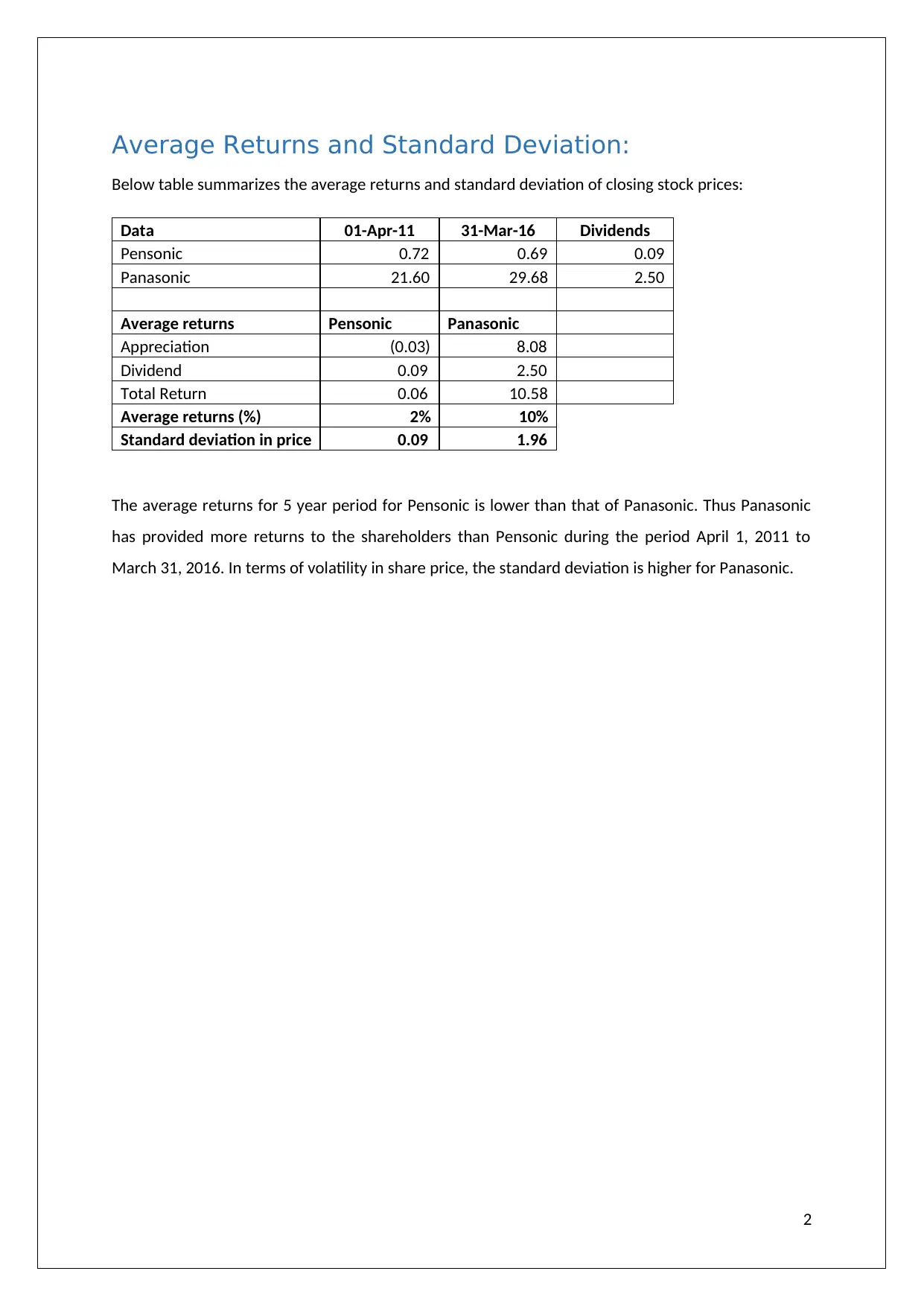

Average Returns and Standard Deviation:

Below table summarizes the average returns and standard deviation of closing stock prices:

Data 01-Apr-11 31-Mar-16 Dividends

Pensonic 0.72 0.69 0.09

Panasonic 21.60 29.68 2.50

Average returns Pensonic Panasonic

Appreciation (0.03) 8.08

Dividend 0.09 2.50

Total Return 0.06 10.58

Average returns (%) 2% 10%

Standard deviation in price 0.09 1.96

The average returns for 5 year period for Pensonic is lower than that of Panasonic. Thus Panasonic

has provided more returns to the shareholders than Pensonic during the period April 1, 2011 to

March 31, 2016. In terms of volatility in share price, the standard deviation is higher for Panasonic.

2

Below table summarizes the average returns and standard deviation of closing stock prices:

Data 01-Apr-11 31-Mar-16 Dividends

Pensonic 0.72 0.69 0.09

Panasonic 21.60 29.68 2.50

Average returns Pensonic Panasonic

Appreciation (0.03) 8.08

Dividend 0.09 2.50

Total Return 0.06 10.58

Average returns (%) 2% 10%

Standard deviation in price 0.09 1.96

The average returns for 5 year period for Pensonic is lower than that of Panasonic. Thus Panasonic

has provided more returns to the shareholders than Pensonic during the period April 1, 2011 to

March 31, 2016. In terms of volatility in share price, the standard deviation is higher for Panasonic.

2

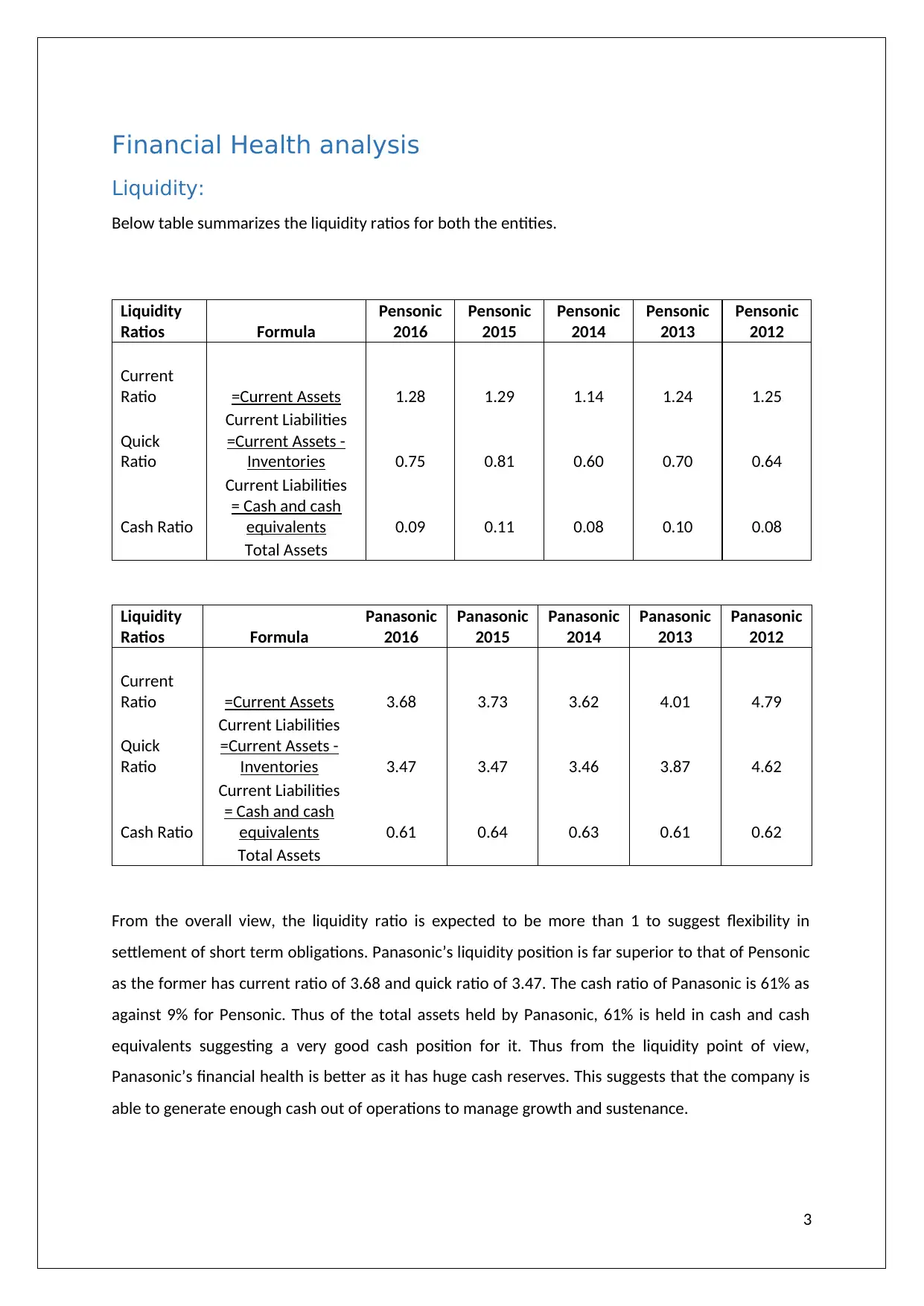

Financial Health analysis

Liquidity:

Below table summarizes the liquidity ratios for both the entities.

Liquidity

Ratios Formula

Pensonic

2016

Pensonic

2015

Pensonic

2014

Pensonic

2013

Pensonic

2012

Current

Ratio =Current Assets 1.28 1.29 1.14 1.24 1.25

Current Liabilities

Quick

Ratio

=Current Assets -

Inventories 0.75 0.81 0.60 0.70 0.64

Current Liabilities

Cash Ratio

= Cash and cash

equivalents 0.09 0.11 0.08 0.10 0.08

Total Assets

Liquidity

Ratios Formula

Panasonic

2016

Panasonic

2015

Panasonic

2014

Panasonic

2013

Panasonic

2012

Current

Ratio =Current Assets 3.68 3.73 3.62 4.01 4.79

Current Liabilities

Quick

Ratio

=Current Assets -

Inventories 3.47 3.47 3.46 3.87 4.62

Current Liabilities

Cash Ratio

= Cash and cash

equivalents 0.61 0.64 0.63 0.61 0.62

Total Assets

From the overall view, the liquidity ratio is expected to be more than 1 to suggest flexibility in

settlement of short term obligations. Panasonic’s liquidity position is far superior to that of Pensonic

as the former has current ratio of 3.68 and quick ratio of 3.47. The cash ratio of Panasonic is 61% as

against 9% for Pensonic. Thus of the total assets held by Panasonic, 61% is held in cash and cash

equivalents suggesting a very good cash position for it. Thus from the liquidity point of view,

Panasonic’s financial health is better as it has huge cash reserves. This suggests that the company is

able to generate enough cash out of operations to manage growth and sustenance.

3

Liquidity:

Below table summarizes the liquidity ratios for both the entities.

Liquidity

Ratios Formula

Pensonic

2016

Pensonic

2015

Pensonic

2014

Pensonic

2013

Pensonic

2012

Current

Ratio =Current Assets 1.28 1.29 1.14 1.24 1.25

Current Liabilities

Quick

Ratio

=Current Assets -

Inventories 0.75 0.81 0.60 0.70 0.64

Current Liabilities

Cash Ratio

= Cash and cash

equivalents 0.09 0.11 0.08 0.10 0.08

Total Assets

Liquidity

Ratios Formula

Panasonic

2016

Panasonic

2015

Panasonic

2014

Panasonic

2013

Panasonic

2012

Current

Ratio =Current Assets 3.68 3.73 3.62 4.01 4.79

Current Liabilities

Quick

Ratio

=Current Assets -

Inventories 3.47 3.47 3.46 3.87 4.62

Current Liabilities

Cash Ratio

= Cash and cash

equivalents 0.61 0.64 0.63 0.61 0.62

Total Assets

From the overall view, the liquidity ratio is expected to be more than 1 to suggest flexibility in

settlement of short term obligations. Panasonic’s liquidity position is far superior to that of Pensonic

as the former has current ratio of 3.68 and quick ratio of 3.47. The cash ratio of Panasonic is 61% as

against 9% for Pensonic. Thus of the total assets held by Panasonic, 61% is held in cash and cash

equivalents suggesting a very good cash position for it. Thus from the liquidity point of view,

Panasonic’s financial health is better as it has huge cash reserves. This suggests that the company is

able to generate enough cash out of operations to manage growth and sustenance.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

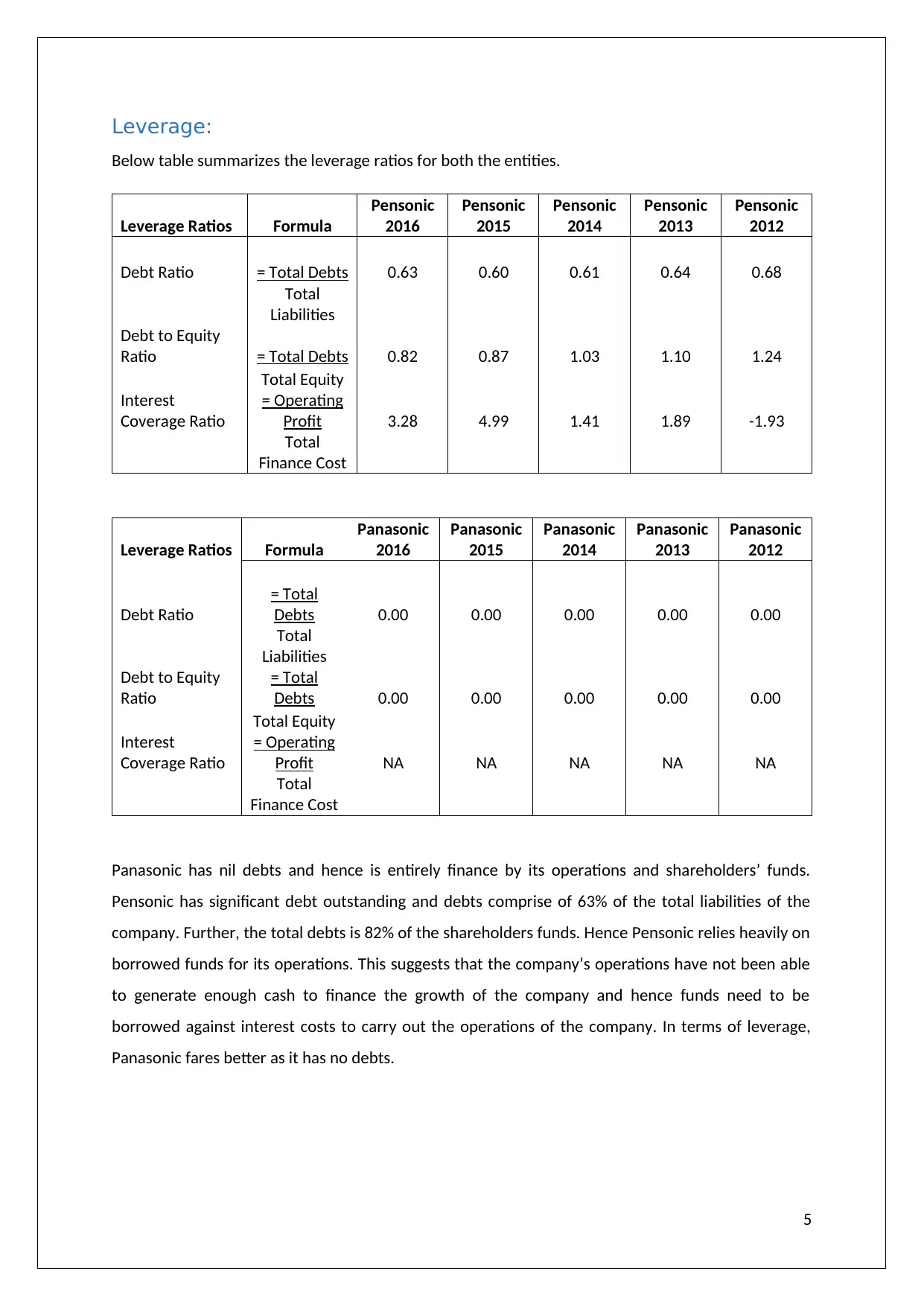

Leverage:

Below table summarizes the leverage ratios for both the entities.

Leverage Ratios Formula

Pensonic

2016

Pensonic

2015

Pensonic

2014

Pensonic

2013

Pensonic

2012

Debt Ratio = Total Debts 0.63 0.60 0.61 0.64 0.68

Total

Liabilities

Debt to Equity

Ratio = Total Debts 0.82 0.87 1.03 1.10 1.24

Total Equity

Interest

Coverage Ratio

= Operating

Profit 3.28 4.99 1.41 1.89 -1.93

Total

Finance Cost

Leverage Ratios Formula

Panasonic

2016

Panasonic

2015

Panasonic

2014

Panasonic

2013

Panasonic

2012

Debt Ratio

= Total

Debts 0.00 0.00 0.00 0.00 0.00

Total

Liabilities

Debt to Equity

Ratio

= Total

Debts 0.00 0.00 0.00 0.00 0.00

Total Equity

Interest

Coverage Ratio

= Operating

Profit NA NA NA NA NA

Total

Finance Cost

Panasonic has nil debts and hence is entirely finance by its operations and shareholders’ funds.

Pensonic has significant debt outstanding and debts comprise of 63% of the total liabilities of the

company. Further, the total debts is 82% of the shareholders funds. Hence Pensonic relies heavily on

borrowed funds for its operations. This suggests that the company’s operations have not been able

to generate enough cash to finance the growth of the company and hence funds need to be

borrowed against interest costs to carry out the operations of the company. In terms of leverage,

Panasonic fares better as it has no debts.

5

Below table summarizes the leverage ratios for both the entities.

Leverage Ratios Formula

Pensonic

2016

Pensonic

2015

Pensonic

2014

Pensonic

2013

Pensonic

2012

Debt Ratio = Total Debts 0.63 0.60 0.61 0.64 0.68

Total

Liabilities

Debt to Equity

Ratio = Total Debts 0.82 0.87 1.03 1.10 1.24

Total Equity

Interest

Coverage Ratio

= Operating

Profit 3.28 4.99 1.41 1.89 -1.93

Total

Finance Cost

Leverage Ratios Formula

Panasonic

2016

Panasonic

2015

Panasonic

2014

Panasonic

2013

Panasonic

2012

Debt Ratio

= Total

Debts 0.00 0.00 0.00 0.00 0.00

Total

Liabilities

Debt to Equity

Ratio

= Total

Debts 0.00 0.00 0.00 0.00 0.00

Total Equity

Interest

Coverage Ratio

= Operating

Profit NA NA NA NA NA

Total

Finance Cost

Panasonic has nil debts and hence is entirely finance by its operations and shareholders’ funds.

Pensonic has significant debt outstanding and debts comprise of 63% of the total liabilities of the

company. Further, the total debts is 82% of the shareholders funds. Hence Pensonic relies heavily on

borrowed funds for its operations. This suggests that the company’s operations have not been able

to generate enough cash to finance the growth of the company and hence funds need to be

borrowed against interest costs to carry out the operations of the company. In terms of leverage,

Panasonic fares better as it has no debts.

5

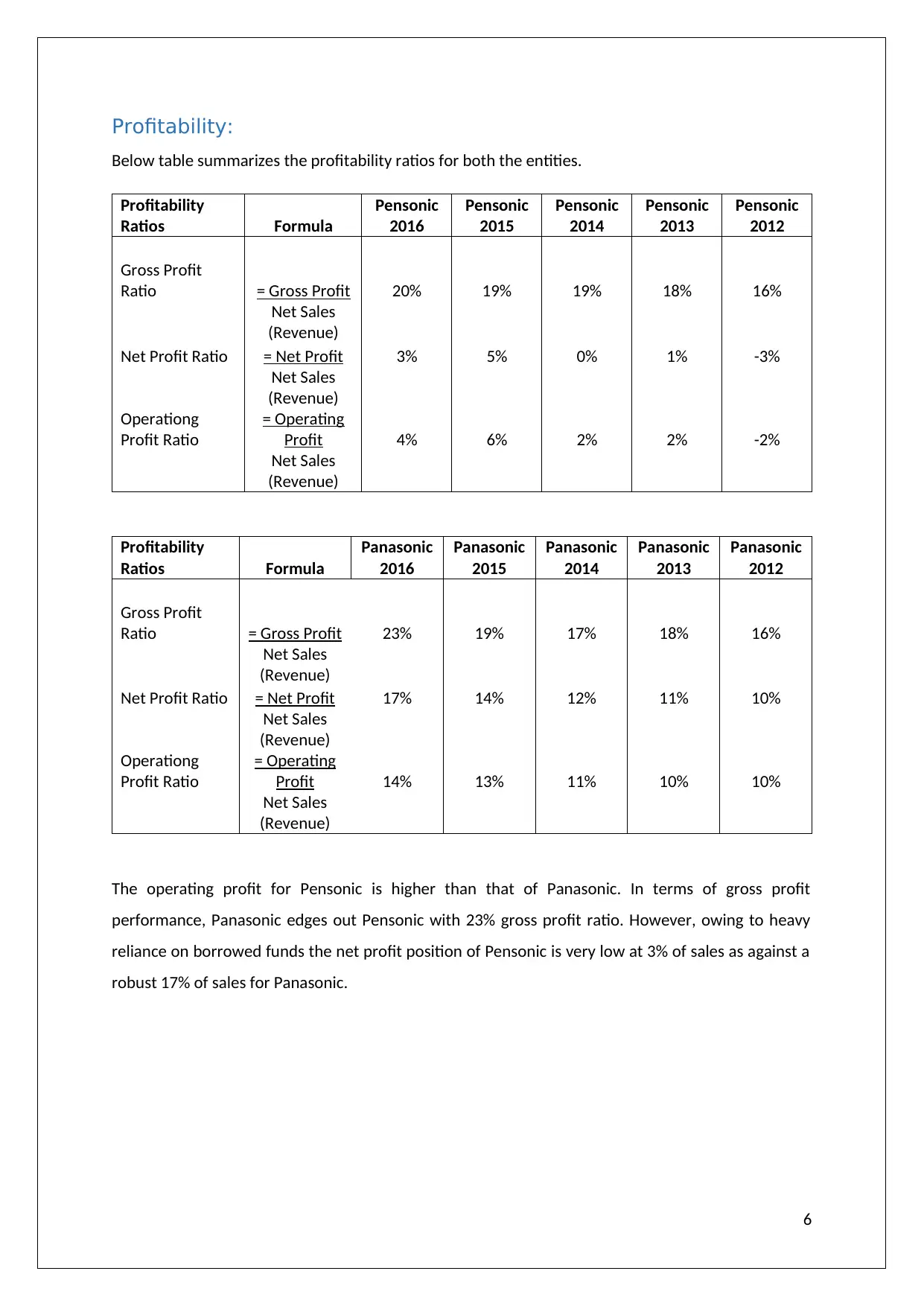

Profitability:

Below table summarizes the profitability ratios for both the entities.

Profitability

Ratios Formula

Pensonic

2016

Pensonic

2015

Pensonic

2014

Pensonic

2013

Pensonic

2012

Gross Profit

Ratio = Gross Profit 20% 19% 19% 18% 16%

Net Sales

(Revenue)

Net Profit Ratio = Net Profit 3% 5% 0% 1% -3%

Net Sales

(Revenue)

Operationg

Profit Ratio

= Operating

Profit 4% 6% 2% 2% -2%

Net Sales

(Revenue)

Profitability

Ratios Formula

Panasonic

2016

Panasonic

2015

Panasonic

2014

Panasonic

2013

Panasonic

2012

Gross Profit

Ratio = Gross Profit 23% 19% 17% 18% 16%

Net Sales

(Revenue)

Net Profit Ratio = Net Profit 17% 14% 12% 11% 10%

Net Sales

(Revenue)

Operationg

Profit Ratio

= Operating

Profit 14% 13% 11% 10% 10%

Net Sales

(Revenue)

The operating profit for Pensonic is higher than that of Panasonic. In terms of gross profit

performance, Panasonic edges out Pensonic with 23% gross profit ratio. However, owing to heavy

reliance on borrowed funds the net profit position of Pensonic is very low at 3% of sales as against a

robust 17% of sales for Panasonic.

6

Below table summarizes the profitability ratios for both the entities.

Profitability

Ratios Formula

Pensonic

2016

Pensonic

2015

Pensonic

2014

Pensonic

2013

Pensonic

2012

Gross Profit

Ratio = Gross Profit 20% 19% 19% 18% 16%

Net Sales

(Revenue)

Net Profit Ratio = Net Profit 3% 5% 0% 1% -3%

Net Sales

(Revenue)

Operationg

Profit Ratio

= Operating

Profit 4% 6% 2% 2% -2%

Net Sales

(Revenue)

Profitability

Ratios Formula

Panasonic

2016

Panasonic

2015

Panasonic

2014

Panasonic

2013

Panasonic

2012

Gross Profit

Ratio = Gross Profit 23% 19% 17% 18% 16%

Net Sales

(Revenue)

Net Profit Ratio = Net Profit 17% 14% 12% 11% 10%

Net Sales

(Revenue)

Operationg

Profit Ratio

= Operating

Profit 14% 13% 11% 10% 10%

Net Sales

(Revenue)

The operating profit for Pensonic is higher than that of Panasonic. In terms of gross profit

performance, Panasonic edges out Pensonic with 23% gross profit ratio. However, owing to heavy

reliance on borrowed funds the net profit position of Pensonic is very low at 3% of sales as against a

robust 17% of sales for Panasonic.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Market Preference:

Market share is a good determinant of market preference is it represents direct impact of consumer

choice and acceptability of a company’ products and services. Pensonic and Panasonic operates

within the Malaysian market in the same industry. The total sale of Panasonic is RM 1.09 billion as

against RM 0.39 billion for Pensonic as per financial inputs in Appendix 1. Thus Pensonic’s market

share represents 40% of total share enjoyed by Panasonic. Thus in terms of market preference,

Panasonic is better.

7

Market share is a good determinant of market preference is it represents direct impact of consumer

choice and acceptability of a company’ products and services. Pensonic and Panasonic operates

within the Malaysian market in the same industry. The total sale of Panasonic is RM 1.09 billion as

against RM 0.39 billion for Pensonic as per financial inputs in Appendix 1. Thus Pensonic’s market

share represents 40% of total share enjoyed by Panasonic. Thus in terms of market preference,

Panasonic is better.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

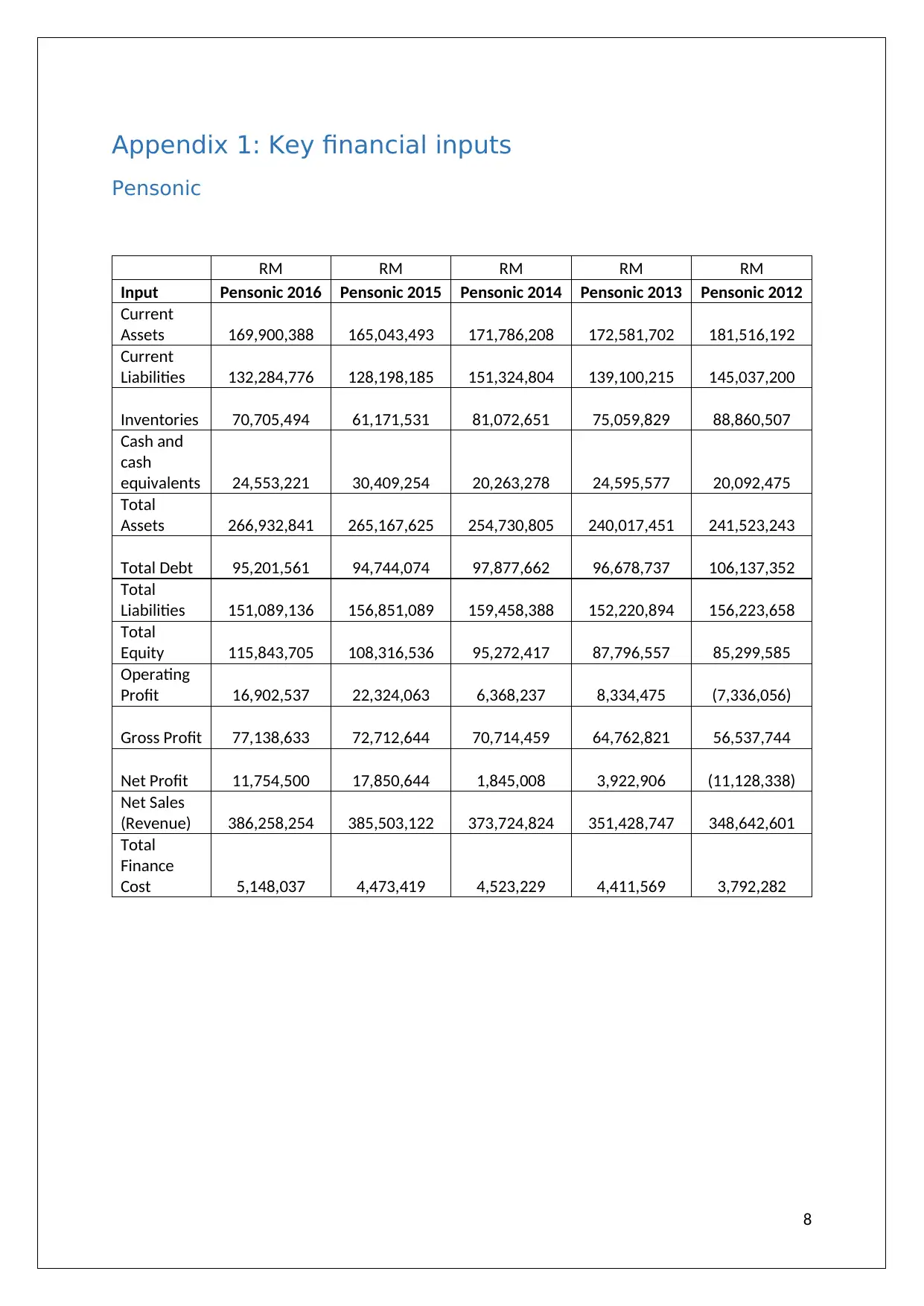

Appendix 1: Key financial inputs

Pensonic

RM RM RM RM RM

Input Pensonic 2016 Pensonic 2015 Pensonic 2014 Pensonic 2013 Pensonic 2012

Current

Assets 169,900,388 165,043,493 171,786,208 172,581,702 181,516,192

Current

Liabilities 132,284,776 128,198,185 151,324,804 139,100,215 145,037,200

Inventories 70,705,494 61,171,531 81,072,651 75,059,829 88,860,507

Cash and

cash

equivalents 24,553,221 30,409,254 20,263,278 24,595,577 20,092,475

Total

Assets 266,932,841 265,167,625 254,730,805 240,017,451 241,523,243

Total Debt 95,201,561 94,744,074 97,877,662 96,678,737 106,137,352

Total

Liabilities 151,089,136 156,851,089 159,458,388 152,220,894 156,223,658

Total

Equity 115,843,705 108,316,536 95,272,417 87,796,557 85,299,585

Operating

Profit 16,902,537 22,324,063 6,368,237 8,334,475 (7,336,056)

Gross Profit 77,138,633 72,712,644 70,714,459 64,762,821 56,537,744

Net Profit 11,754,500 17,850,644 1,845,008 3,922,906 (11,128,338)

Net Sales

(Revenue) 386,258,254 385,503,122 373,724,824 351,428,747 348,642,601

Total

Finance

Cost 5,148,037 4,473,419 4,523,229 4,411,569 3,792,282

8

Pensonic

RM RM RM RM RM

Input Pensonic 2016 Pensonic 2015 Pensonic 2014 Pensonic 2013 Pensonic 2012

Current

Assets 169,900,388 165,043,493 171,786,208 172,581,702 181,516,192

Current

Liabilities 132,284,776 128,198,185 151,324,804 139,100,215 145,037,200

Inventories 70,705,494 61,171,531 81,072,651 75,059,829 88,860,507

Cash and

cash

equivalents 24,553,221 30,409,254 20,263,278 24,595,577 20,092,475

Total

Assets 266,932,841 265,167,625 254,730,805 240,017,451 241,523,243

Total Debt 95,201,561 94,744,074 97,877,662 96,678,737 106,137,352

Total

Liabilities 151,089,136 156,851,089 159,458,388 152,220,894 156,223,658

Total

Equity 115,843,705 108,316,536 95,272,417 87,796,557 85,299,585

Operating

Profit 16,902,537 22,324,063 6,368,237 8,334,475 (7,336,056)

Gross Profit 77,138,633 72,712,644 70,714,459 64,762,821 56,537,744

Net Profit 11,754,500 17,850,644 1,845,008 3,922,906 (11,128,338)

Net Sales

(Revenue) 386,258,254 385,503,122 373,724,824 351,428,747 348,642,601

Total

Finance

Cost 5,148,037 4,473,419 4,523,229 4,411,569 3,792,282

8

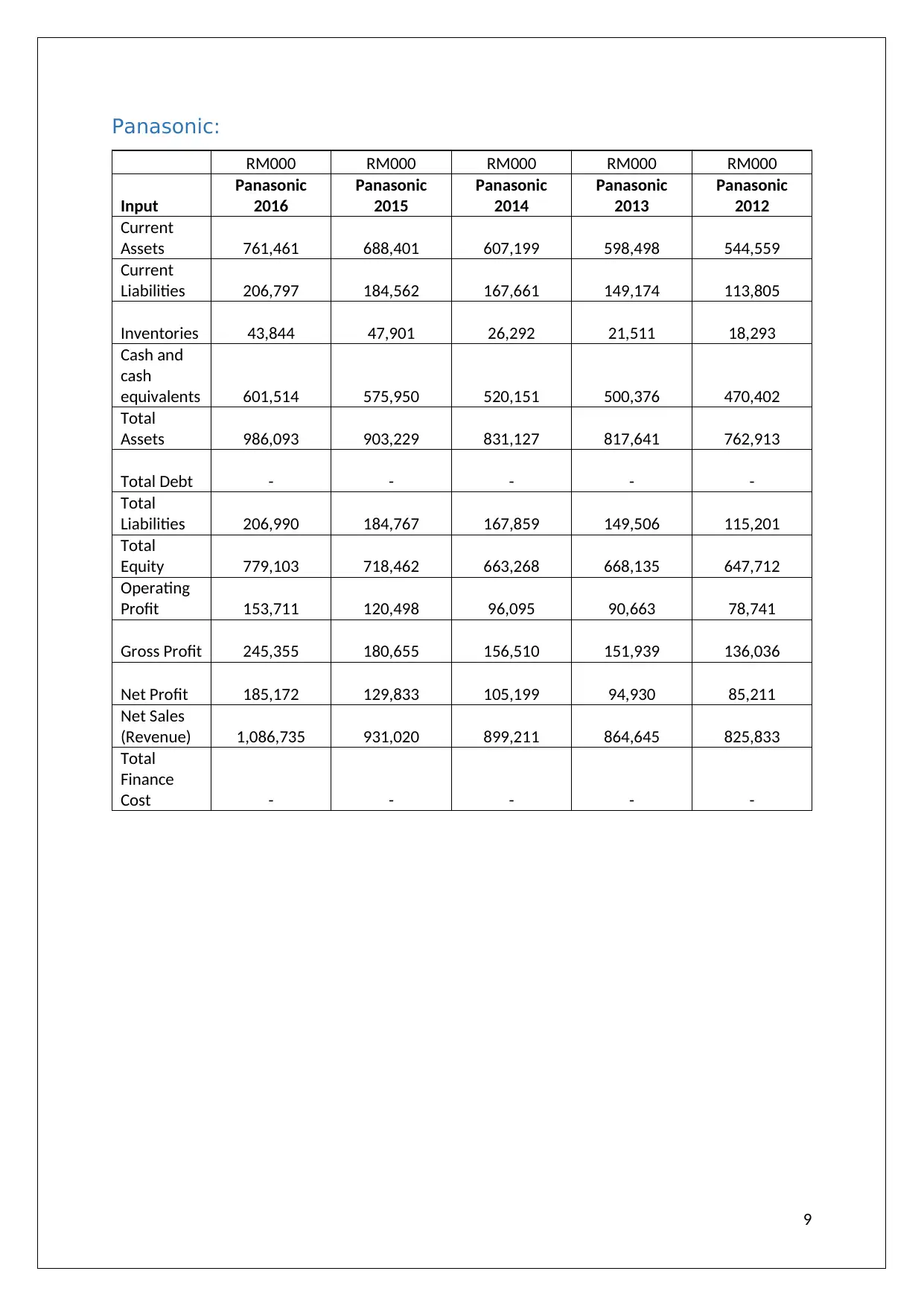

Panasonic:

RM000 RM000 RM000 RM000 RM000

Input

Panasonic

2016

Panasonic

2015

Panasonic

2014

Panasonic

2013

Panasonic

2012

Current

Assets 761,461 688,401 607,199 598,498 544,559

Current

Liabilities 206,797 184,562 167,661 149,174 113,805

Inventories 43,844 47,901 26,292 21,511 18,293

Cash and

cash

equivalents 601,514 575,950 520,151 500,376 470,402

Total

Assets 986,093 903,229 831,127 817,641 762,913

Total Debt - - - - -

Total

Liabilities 206,990 184,767 167,859 149,506 115,201

Total

Equity 779,103 718,462 663,268 668,135 647,712

Operating

Profit 153,711 120,498 96,095 90,663 78,741

Gross Profit 245,355 180,655 156,510 151,939 136,036

Net Profit 185,172 129,833 105,199 94,930 85,211

Net Sales

(Revenue) 1,086,735 931,020 899,211 864,645 825,833

Total

Finance

Cost - - - - -

9

RM000 RM000 RM000 RM000 RM000

Input

Panasonic

2016

Panasonic

2015

Panasonic

2014

Panasonic

2013

Panasonic

2012

Current

Assets 761,461 688,401 607,199 598,498 544,559

Current

Liabilities 206,797 184,562 167,661 149,174 113,805

Inventories 43,844 47,901 26,292 21,511 18,293

Cash and

cash

equivalents 601,514 575,950 520,151 500,376 470,402

Total

Assets 986,093 903,229 831,127 817,641 762,913

Total Debt - - - - -

Total

Liabilities 206,990 184,767 167,859 149,506 115,201

Total

Equity 779,103 718,462 663,268 668,135 647,712

Operating

Profit 153,711 120,498 96,095 90,663 78,741

Gross Profit 245,355 180,655 156,510 151,939 136,036

Net Profit 185,172 129,833 105,199 94,930 85,211

Net Sales

(Revenue) 1,086,735 931,020 899,211 864,645 825,833

Total

Finance

Cost - - - - -

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

References:

Pensonic.com, 2016, “The Annual Report 2016”, Retrieved from:

http://pensonic.com/index.php/finance/, Accessed date: November 7, 2016

Pensonic.com, 2015, “The Annual Report 2015”, Retrieved from:

http://pensonic.com/index.php/finance/, Accessed date: November 7, 2016

Pensonic.com, 2014, “The Annual Report 2014”, Retrieved from:

http://pensonic.com/index.php/finance/, Accessed date: November 7, 2016

Pensonic.com, 2013, “The Annual Report 2013”, Retrieved from:

http://pensonic.com/index.php/finance/, Accessed date: November 7, 2016

Pensonic.com, 2012, “The Annual Report 2012”, Retrieved from:

http://pensonic.com/index.php/finance/, Accessed date: November 7, 2016

Panasonic.com, 2016, “The Annual Report 2016”, Retrieved from:

http://pmma.panasonic.com.my/investor-relations/bursa-malaysia-requirements/, Accessed date:

November 7, 2016

Panasonic.com, 2015, “The Annual Report 2015”, Retrieved from:

http://pmma.panasonic.com.my/investor-relations/bursa-malaysia-requirements/, Accessed date:

November 7, 2016

Panasonic.com, 2014, “The Annual Report 2014”, Retrieved from:

http://pmma.panasonic.com.my/investor-relations/bursa-malaysia-requirements/, Accessed date:

November 7, 2016

Panasonic.com, 2013, “The Annual Report 2013”, Retrieved from:

http://pmma.panasonic.com.my/investor-relations/bursa-malaysia-requirements/, Accessed date:

November 7, 2016

Panasonic.com, 2012, “The Annual Report 2012”, Retrieved from:

http://pmma.panasonic.com.my/investor-relations/bursa-malaysia-requirements/, Accessed date:

November 7, 2016

Yahoofinance, n.d., “Historical data”, Retrieved from:

http://finance.yahoo.com/quote/3719.KL/history?

period1=1301596200&period2=1459362600&interval=div%7Csplit&filter=div&frequency=1wk,

Accessed date: November 7, 2016

10

Pensonic.com, 2016, “The Annual Report 2016”, Retrieved from:

http://pensonic.com/index.php/finance/, Accessed date: November 7, 2016

Pensonic.com, 2015, “The Annual Report 2015”, Retrieved from:

http://pensonic.com/index.php/finance/, Accessed date: November 7, 2016

Pensonic.com, 2014, “The Annual Report 2014”, Retrieved from:

http://pensonic.com/index.php/finance/, Accessed date: November 7, 2016

Pensonic.com, 2013, “The Annual Report 2013”, Retrieved from:

http://pensonic.com/index.php/finance/, Accessed date: November 7, 2016

Pensonic.com, 2012, “The Annual Report 2012”, Retrieved from:

http://pensonic.com/index.php/finance/, Accessed date: November 7, 2016

Panasonic.com, 2016, “The Annual Report 2016”, Retrieved from:

http://pmma.panasonic.com.my/investor-relations/bursa-malaysia-requirements/, Accessed date:

November 7, 2016

Panasonic.com, 2015, “The Annual Report 2015”, Retrieved from:

http://pmma.panasonic.com.my/investor-relations/bursa-malaysia-requirements/, Accessed date:

November 7, 2016

Panasonic.com, 2014, “The Annual Report 2014”, Retrieved from:

http://pmma.panasonic.com.my/investor-relations/bursa-malaysia-requirements/, Accessed date:

November 7, 2016

Panasonic.com, 2013, “The Annual Report 2013”, Retrieved from:

http://pmma.panasonic.com.my/investor-relations/bursa-malaysia-requirements/, Accessed date:

November 7, 2016

Panasonic.com, 2012, “The Annual Report 2012”, Retrieved from:

http://pmma.panasonic.com.my/investor-relations/bursa-malaysia-requirements/, Accessed date:

November 7, 2016

Yahoofinance, n.d., “Historical data”, Retrieved from:

http://finance.yahoo.com/quote/3719.KL/history?

period1=1301596200&period2=1459362600&interval=div%7Csplit&filter=div&frequency=1wk,

Accessed date: November 7, 2016

10

1 out of 10