THE CORPORATE ACCOUNTING

VerifiedAdded on 2022/08/20

|9

|765

|15

AI Summary

.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

CORPORATE ACCOUNTING 1

CORPORATE ACCOUNTING

CORPORATE ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

CORPORATE ACCOUNTING

Table of Contents

Acquisition Analysis........................................................................................................................3

Combination Entries........................................................................................................................4

Non-Controlling Entries..................................................................................................................5

Worksheet Entries............................................................................................................................6

Full Goodwill Method.....................................................................................................................7

References........................................................................................................................................8

Table of Contents

Acquisition Analysis........................................................................................................................3

Combination Entries........................................................................................................................4

Non-Controlling Entries..................................................................................................................5

Worksheet Entries............................................................................................................................6

Full Goodwill Method.....................................................................................................................7

References........................................................................................................................................8

CORPORATE ACCOUNTING

Corporate accounting is a special branch of accounting that deals with accounting procedures of

companies, preparation of their final accounts and the overall cash flow statement,

amalgamation, absorption and preparation of the consolidated statements. In this report a five

step treatment is undertaken to understand the acquisition process of Davis Limited by Ethan

Limited for 92% of the shares (Albersmann, 2017).

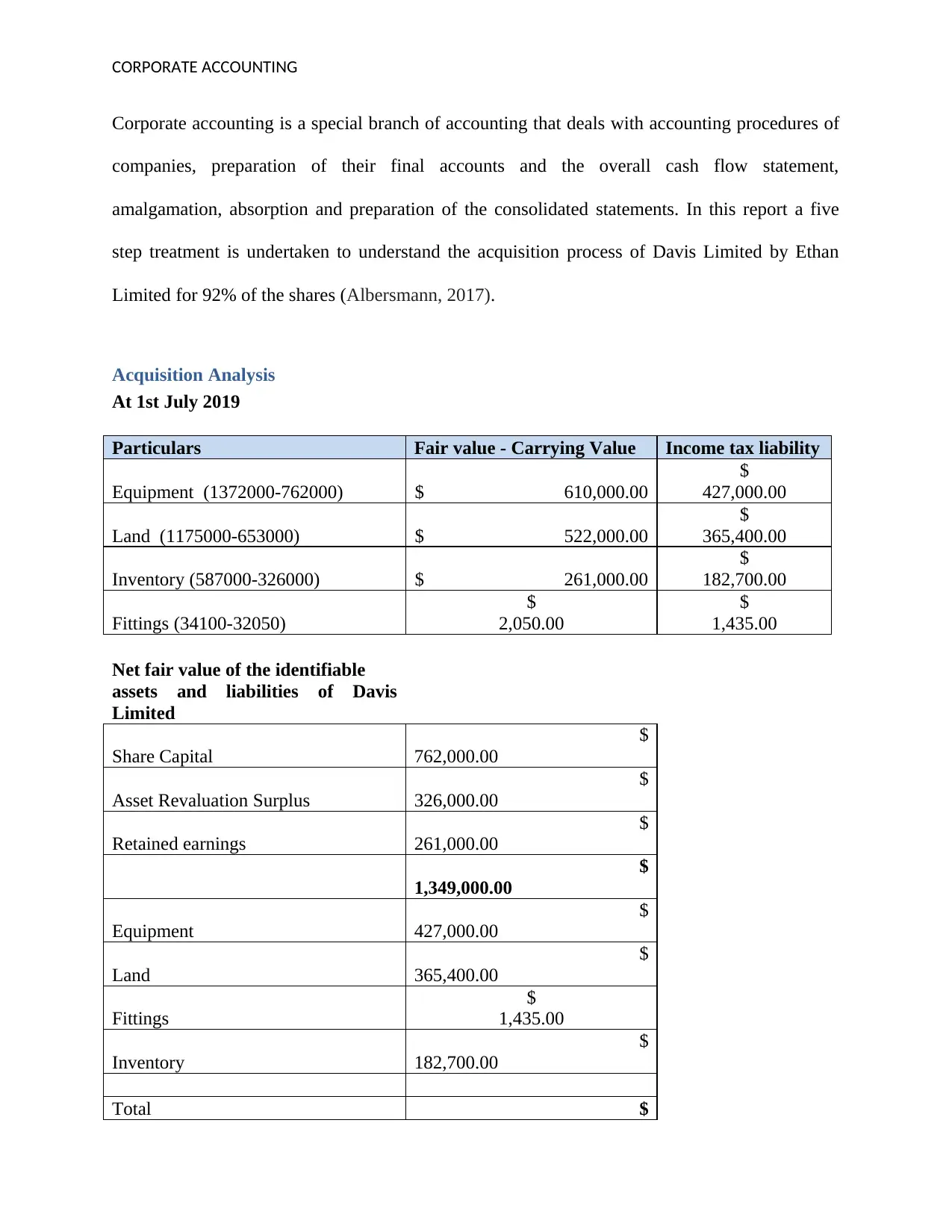

Acquisition Analysis

At 1st July 2019

Particulars Fair value - Carrying Value Income tax liability

Equipment (1372000-762000) $ 610,000.00

$

427,000.00

Land (1175000-653000) $ 522,000.00

$

365,400.00

Inventory (587000-326000) $ 261,000.00

$

182,700.00

Fittings (34100-32050)

$

2,050.00

$

1,435.00

Net fair value of the identifiable

assets and liabilities of Davis

Limited

Share Capital

$

762,000.00

Asset Revaluation Surplus

$

326,000.00

Retained earnings

$

261,000.00

$

1,349,000.00

Equipment

$

427,000.00

Land

$

365,400.00

Fittings

$

1,435.00

Inventory

$

182,700.00

Total $

Corporate accounting is a special branch of accounting that deals with accounting procedures of

companies, preparation of their final accounts and the overall cash flow statement,

amalgamation, absorption and preparation of the consolidated statements. In this report a five

step treatment is undertaken to understand the acquisition process of Davis Limited by Ethan

Limited for 92% of the shares (Albersmann, 2017).

Acquisition Analysis

At 1st July 2019

Particulars Fair value - Carrying Value Income tax liability

Equipment (1372000-762000) $ 610,000.00

$

427,000.00

Land (1175000-653000) $ 522,000.00

$

365,400.00

Inventory (587000-326000) $ 261,000.00

$

182,700.00

Fittings (34100-32050)

$

2,050.00

$

1,435.00

Net fair value of the identifiable

assets and liabilities of Davis

Limited

Share Capital

$

762,000.00

Asset Revaluation Surplus

$

326,000.00

Retained earnings

$

261,000.00

$

1,349,000.00

Equipment

$

427,000.00

Land

$

365,400.00

Fittings

$

1,435.00

Inventory

$

182,700.00

Total $

CORPORATE ACCOUNTING

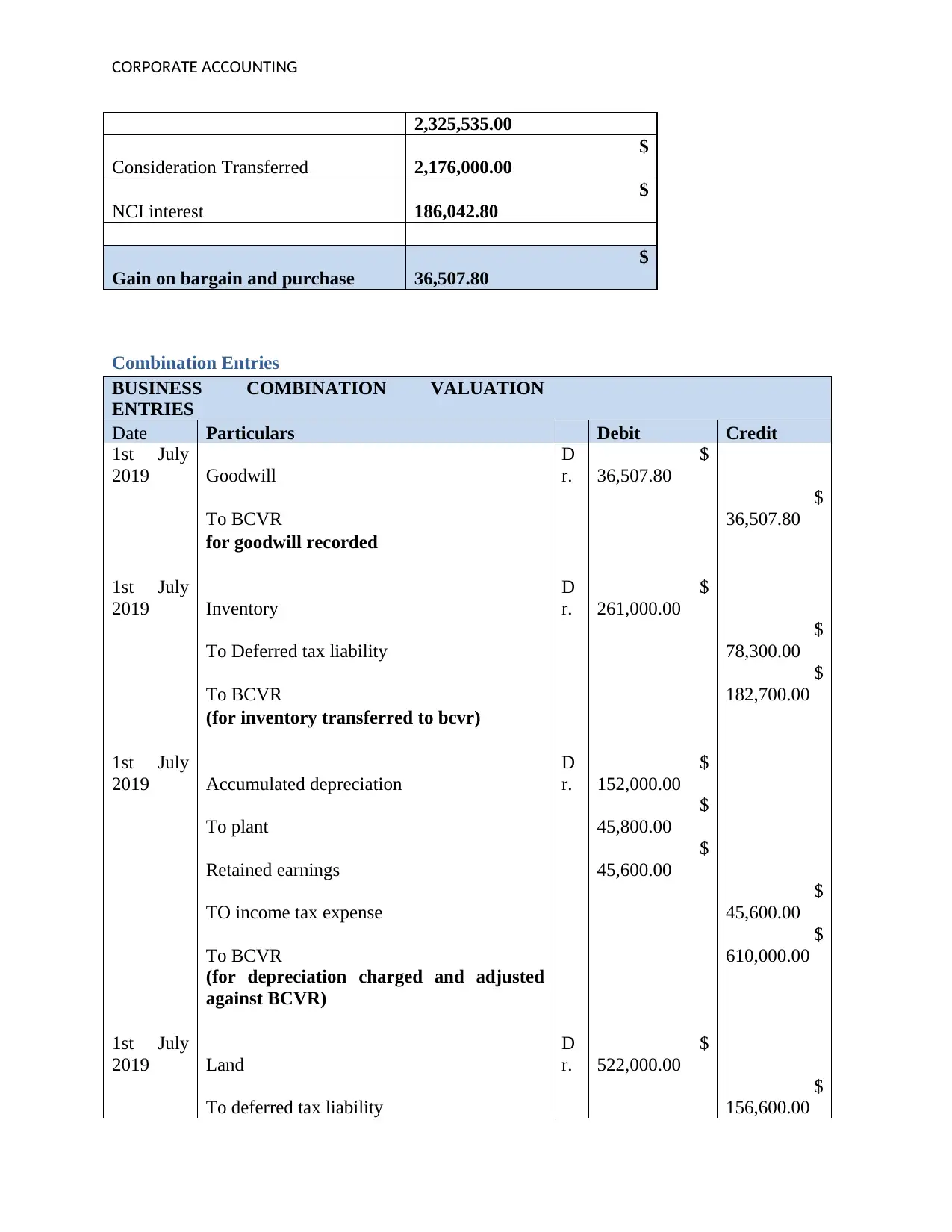

2,325,535.00

Consideration Transferred

$

2,176,000.00

NCI interest

$

186,042.80

Gain on bargain and purchase

$

36,507.80

Combination Entries

BUSINESS COMBINATION VALUATION

ENTRIES

Date Particulars Debit Credit

1st July

2019 Goodwill

D

r.

$

36,507.80

To BCVR

$

36,507.80

for goodwill recorded

1st July

2019 Inventory

D

r.

$

261,000.00

To Deferred tax liability

$

78,300.00

To BCVR

$

182,700.00

(for inventory transferred to bcvr)

1st July

2019 Accumulated depreciation

D

r.

$

152,000.00

To plant

$

45,800.00

Retained earnings

$

45,600.00

TO income tax expense

$

45,600.00

To BCVR

$

610,000.00

(for depreciation charged and adjusted

against BCVR)

1st July

2019 Land

D

r.

$

522,000.00

To deferred tax liability

$

156,600.00

2,325,535.00

Consideration Transferred

$

2,176,000.00

NCI interest

$

186,042.80

Gain on bargain and purchase

$

36,507.80

Combination Entries

BUSINESS COMBINATION VALUATION

ENTRIES

Date Particulars Debit Credit

1st July

2019 Goodwill

D

r.

$

36,507.80

To BCVR

$

36,507.80

for goodwill recorded

1st July

2019 Inventory

D

r.

$

261,000.00

To Deferred tax liability

$

78,300.00

To BCVR

$

182,700.00

(for inventory transferred to bcvr)

1st July

2019 Accumulated depreciation

D

r.

$

152,000.00

To plant

$

45,800.00

Retained earnings

$

45,600.00

TO income tax expense

$

45,600.00

To BCVR

$

610,000.00

(for depreciation charged and adjusted

against BCVR)

1st July

2019 Land

D

r.

$

522,000.00

To deferred tax liability

$

156,600.00

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

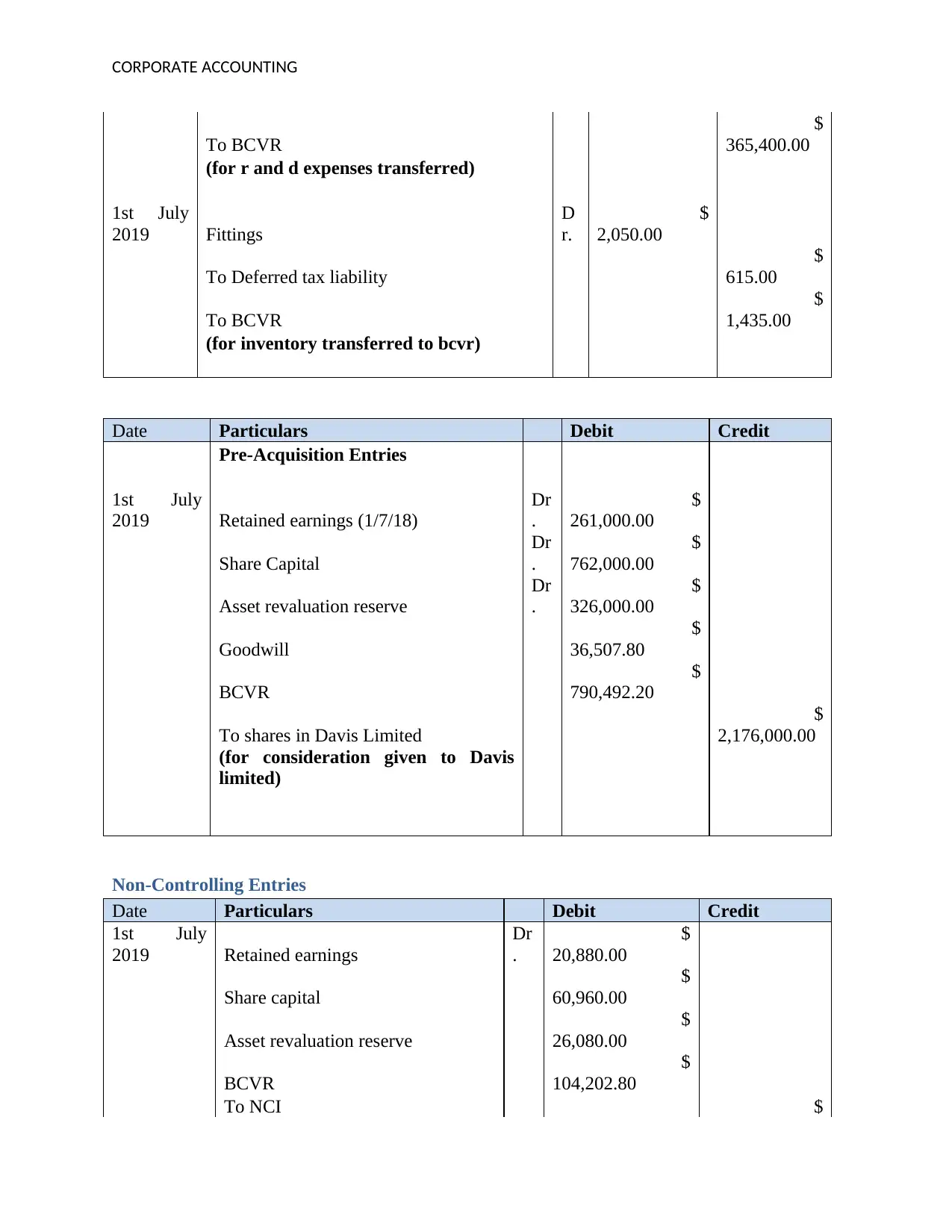

CORPORATE ACCOUNTING

To BCVR

$

365,400.00

(for r and d expenses transferred)

1st July

2019 Fittings

D

r.

$

2,050.00

To Deferred tax liability

$

615.00

To BCVR

$

1,435.00

(for inventory transferred to bcvr)

Date Particulars Debit Credit

Pre-Acquisition Entries

1st July

2019 Retained earnings (1/7/18)

Dr

.

$

261,000.00

Share Capital

Dr

.

$

762,000.00

Asset revaluation reserve

Dr

.

$

326,000.00

Goodwill

$

36,507.80

BCVR

$

790,492.20

To shares in Davis Limited

$

2,176,000.00

(for consideration given to Davis

limited)

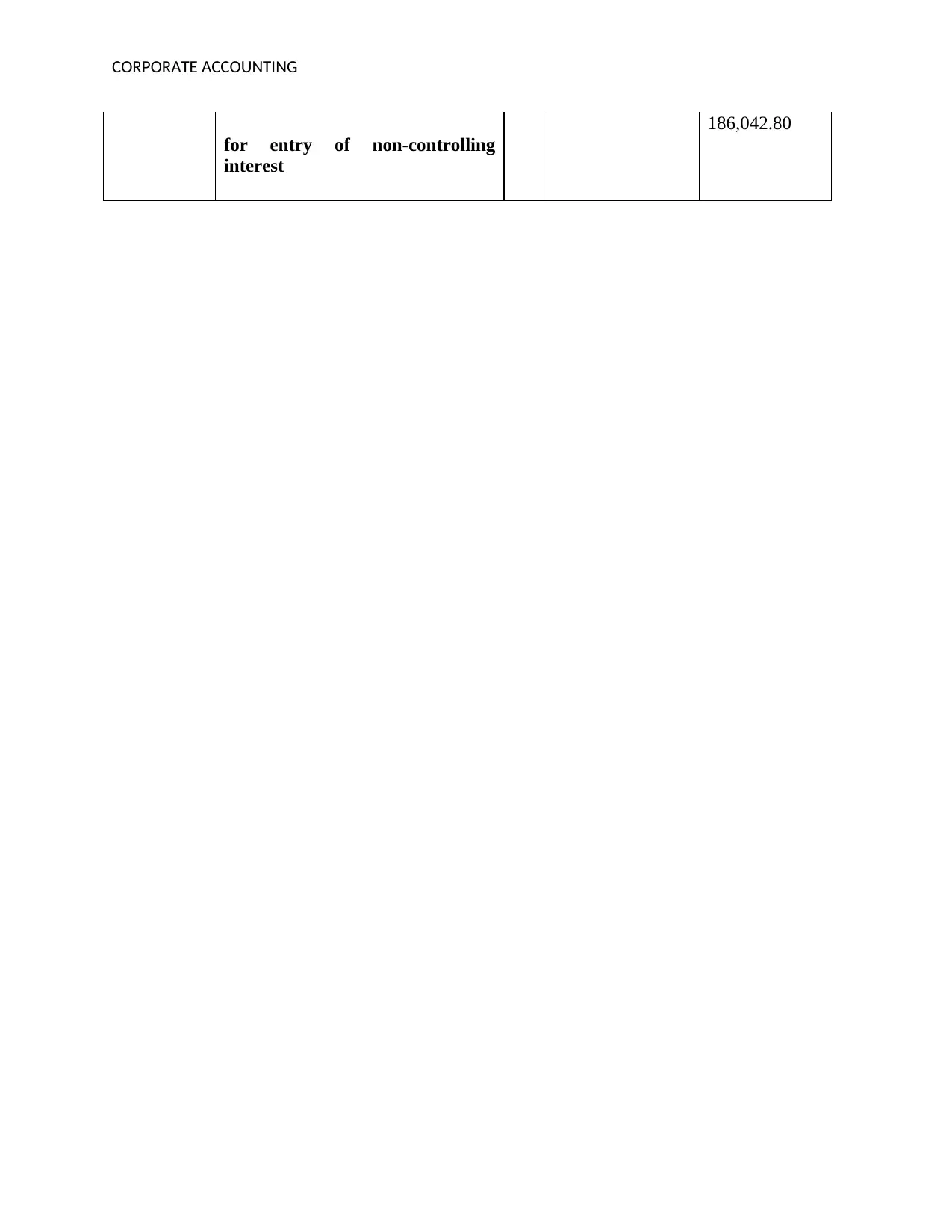

Non-Controlling Entries

Date Particulars Debit Credit

1st July

2019 Retained earnings

Dr

.

$

20,880.00

Share capital

$

60,960.00

Asset revaluation reserve

$

26,080.00

BCVR

$

104,202.80

To NCI $

To BCVR

$

365,400.00

(for r and d expenses transferred)

1st July

2019 Fittings

D

r.

$

2,050.00

To Deferred tax liability

$

615.00

To BCVR

$

1,435.00

(for inventory transferred to bcvr)

Date Particulars Debit Credit

Pre-Acquisition Entries

1st July

2019 Retained earnings (1/7/18)

Dr

.

$

261,000.00

Share Capital

Dr

.

$

762,000.00

Asset revaluation reserve

Dr

.

$

326,000.00

Goodwill

$

36,507.80

BCVR

$

790,492.20

To shares in Davis Limited

$

2,176,000.00

(for consideration given to Davis

limited)

Non-Controlling Entries

Date Particulars Debit Credit

1st July

2019 Retained earnings

Dr

.

$

20,880.00

Share capital

$

60,960.00

Asset revaluation reserve

$

26,080.00

BCVR

$

104,202.80

To NCI $

CORPORATE ACCOUNTING

186,042.80

for entry of non-controlling

interest

186,042.80

for entry of non-controlling

interest

CORPORATE ACCOUNTING

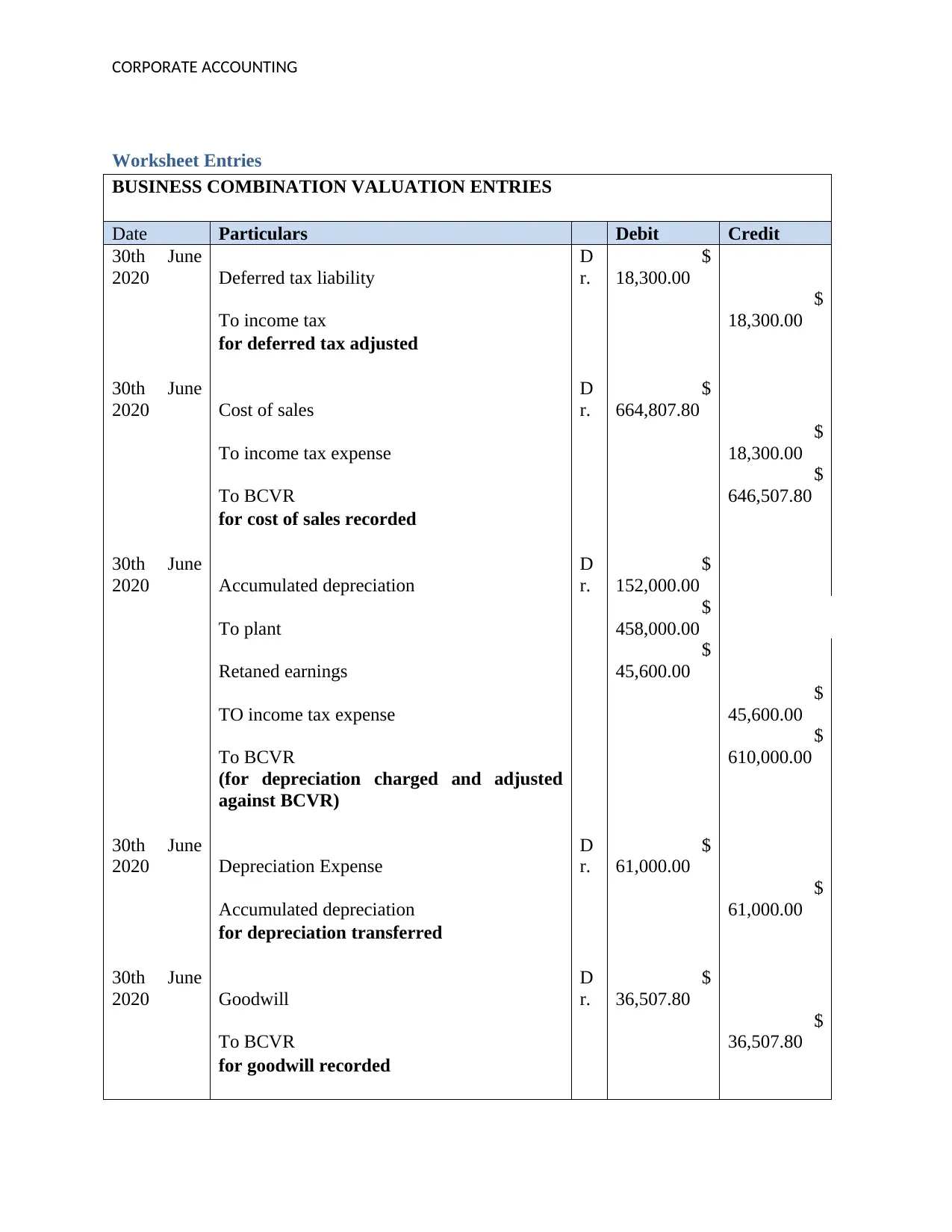

Worksheet Entries

BUSINESS COMBINATION VALUATION ENTRIES

Date Particulars Debit Credit

30th June

2020 Deferred tax liability

D

r.

$

18,300.00

To income tax

$

18,300.00

for deferred tax adjusted

30th June

2020 Cost of sales

D

r.

$

664,807.80

To income tax expense

$

18,300.00

To BCVR

$

646,507.80

for cost of sales recorded

30th June

2020 Accumulated depreciation

D

r.

$

152,000.00

To plant

$

458,000.00

Retaned earnings

$

45,600.00

TO income tax expense

$

45,600.00

To BCVR

$

610,000.00

(for depreciation charged and adjusted

against BCVR)

30th June

2020 Depreciation Expense

D

r.

$

61,000.00

Accumulated depreciation

$

61,000.00

for depreciation transferred

30th June

2020 Goodwill

D

r.

$

36,507.80

To BCVR

$

36,507.80

for goodwill recorded

Worksheet Entries

BUSINESS COMBINATION VALUATION ENTRIES

Date Particulars Debit Credit

30th June

2020 Deferred tax liability

D

r.

$

18,300.00

To income tax

$

18,300.00

for deferred tax adjusted

30th June

2020 Cost of sales

D

r.

$

664,807.80

To income tax expense

$

18,300.00

To BCVR

$

646,507.80

for cost of sales recorded

30th June

2020 Accumulated depreciation

D

r.

$

152,000.00

To plant

$

458,000.00

Retaned earnings

$

45,600.00

TO income tax expense

$

45,600.00

To BCVR

$

610,000.00

(for depreciation charged and adjusted

against BCVR)

30th June

2020 Depreciation Expense

D

r.

$

61,000.00

Accumulated depreciation

$

61,000.00

for depreciation transferred

30th June

2020 Goodwill

D

r.

$

36,507.80

To BCVR

$

36,507.80

for goodwill recorded

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CORPORATE ACCOUNTING

Full Goodwill Method

Goodwill is a brand value of nay business, and if one plans to acquire the business there are two

major ways to do so. One is the partial goodwill and the other is full goodwill method. Under the

partial goodwill when there is a measurement of the assets and liabilities but recognition of the

goodwill amount which is associated with the non-controlling interest. In case of the full

goodwill method, the non-controlling interest is inclusive of the goodwill. Since the partial

goodwill method is followed in this case, the goodwill is recognized only for Ethan’s portion,

worth $36507.80, whereas in case of the treatment of the full goodwill method, full value of NCI

is taken into consideration than the net identifiable assets are deducted from the same. At times it

becomes cumbersome to evaluate the fair value of NCI (Grathwohl & Voeller, 2016).

Full Goodwill Method

Goodwill is a brand value of nay business, and if one plans to acquire the business there are two

major ways to do so. One is the partial goodwill and the other is full goodwill method. Under the

partial goodwill when there is a measurement of the assets and liabilities but recognition of the

goodwill amount which is associated with the non-controlling interest. In case of the full

goodwill method, the non-controlling interest is inclusive of the goodwill. Since the partial

goodwill method is followed in this case, the goodwill is recognized only for Ethan’s portion,

worth $36507.80, whereas in case of the treatment of the full goodwill method, full value of NCI

is taken into consideration than the net identifiable assets are deducted from the same. At times it

becomes cumbersome to evaluate the fair value of NCI (Grathwohl & Voeller, 2016).

CORPORATE ACCOUNTING

References

Albersmann, B. T. (2017). IFRS Goodwill Impairment Test-Audit Approach, Earnings

Management, and Capital Market Perception (Doctoral dissertation, Technische

Universität).

Grathwohl, J., & Voeller, D. (2016). Full or partial goodwill recognition: An analytical

comparison/Full-Goodwill-oder Partial-Goodwill-Bilanzierung: Ein analytischer

Vergleich. Die Betriebswirtschaft, 76(2), 147.

References

Albersmann, B. T. (2017). IFRS Goodwill Impairment Test-Audit Approach, Earnings

Management, and Capital Market Perception (Doctoral dissertation, Technische

Universität).

Grathwohl, J., & Voeller, D. (2016). Full or partial goodwill recognition: An analytical

comparison/Full-Goodwill-oder Partial-Goodwill-Bilanzierung: Ein analytischer

Vergleich. Die Betriebswirtschaft, 76(2), 147.

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.