Corporate Accounting: Tax, Goodwill, and Non-Controlling Interests

VerifiedAdded on 2023/01/06

|16

|1943

|94

Homework Assignment

AI Summary

This homework assignment delves into various aspects of corporate accounting, providing detailed solutions to complex problems. It begins with the calculation of taxable profit and deferred tax liabilities, including the preparation of necessary journal entries. The assignment further explores topics such as recording acquisitions, determining goodwill, and preparing consolidation entries. It examines intra-group transactions, evaluating the portion needing elimination and the impact on non-controlling interests. The document outlines the steps to calculate total non-controlling interest and addresses inter-firm transfers, including adjustments for tax implications. The assignment concludes with calculations of goodwill and the preparation of journal entries for subsequent years, offering a comprehensive understanding of corporate accounting principles. The solution references key concepts like consolidation, non-controlling interests, and intra-group transactions, providing a thorough analysis of financial reporting and accounting practices.

Corporate Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION.......................................................................................................................................3

MAIN BODY..............................................................................................................................................3

Question 1...................................................................................................................................................3

Question 2...................................................................................................................................................5

Question 3...................................................................................................................................................7

Question 4...................................................................................................................................................9

Question 5.................................................................................................................................................12

Question 6.................................................................................................................................................13

CONCLUSION.........................................................................................................................................15

REFERENCES..........................................................................................................................................16

INTRODUCTION.......................................................................................................................................3

MAIN BODY..............................................................................................................................................3

Question 1...................................................................................................................................................3

Question 2...................................................................................................................................................5

Question 3...................................................................................................................................................7

Question 4...................................................................................................................................................9

Question 5.................................................................................................................................................12

Question 6.................................................................................................................................................13

CONCLUSION.........................................................................................................................................15

REFERENCES..........................................................................................................................................16

INTRODUCTION

Corporate accounting is a special accounting method for companies that identify

corporate accounts and file final estimates and a report on cash flow (Habib and Hasan, 2019). It

also helps to track and calculate company financial reports and to account for particular

incidents, such as financial statements merger, merger and filing. Additional corporate

accounting allows management, by multiple financial reporting, to make successful or

productive decisions that encourage more prospective customers to spend and to reveal their

financial status. This measure is based on many kinds of queries, all of which apply to purchase,

division of securities, taxable income measurement, journal entry reports of various transactions.

Moreover, it also provides a description of non-controlling rights, such as how intra-group

transfers can be measured, reported or influenced. This evaluation also contains the consolidated

worksheet with it.

MAIN BODY

Question 1

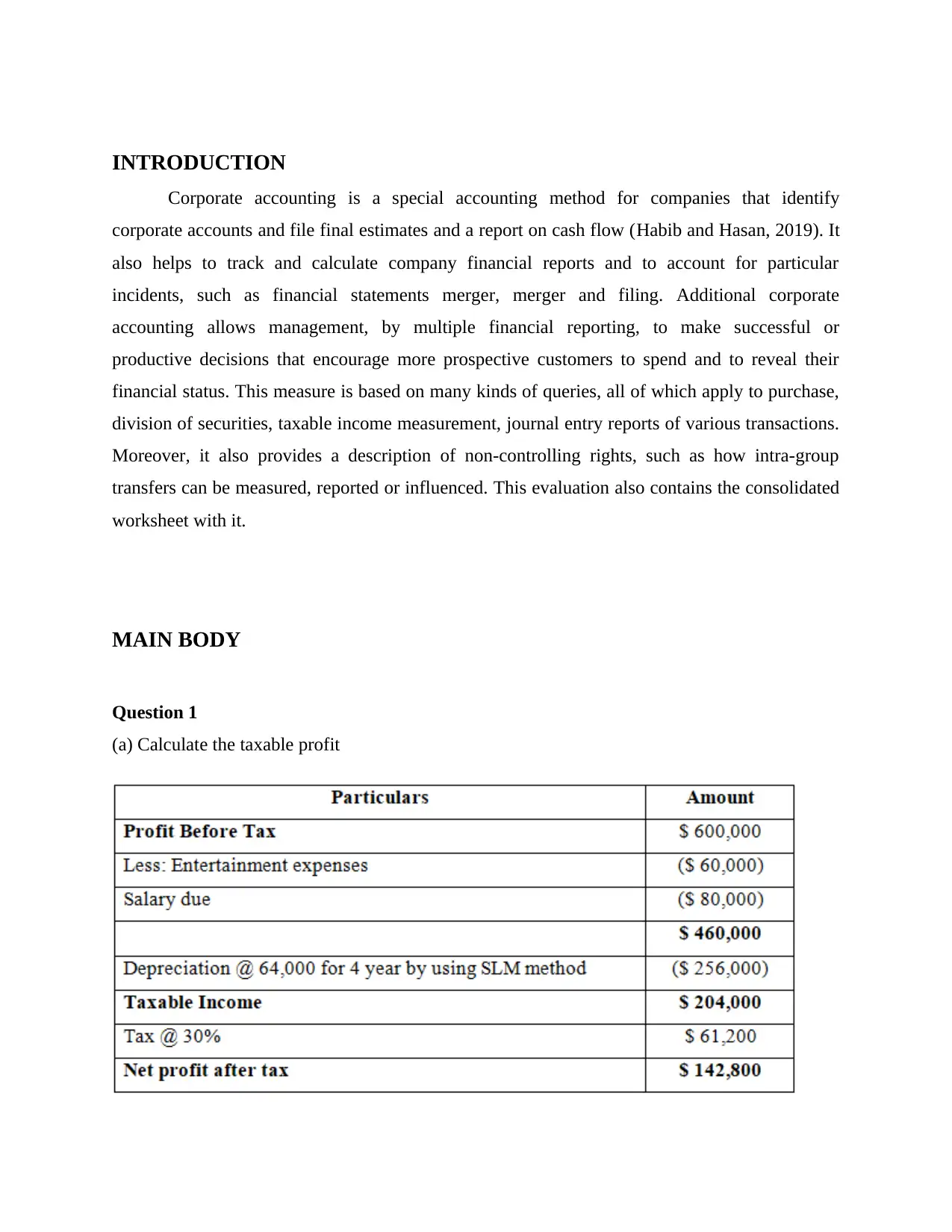

(a) Calculate the taxable profit

Corporate accounting is a special accounting method for companies that identify

corporate accounts and file final estimates and a report on cash flow (Habib and Hasan, 2019). It

also helps to track and calculate company financial reports and to account for particular

incidents, such as financial statements merger, merger and filing. Additional corporate

accounting allows management, by multiple financial reporting, to make successful or

productive decisions that encourage more prospective customers to spend and to reveal their

financial status. This measure is based on many kinds of queries, all of which apply to purchase,

division of securities, taxable income measurement, journal entry reports of various transactions.

Moreover, it also provides a description of non-controlling rights, such as how intra-group

transfers can be measured, reported or influenced. This evaluation also contains the consolidated

worksheet with it.

MAIN BODY

Question 1

(a) Calculate the taxable profit

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Jaguar Ltd’s taxes benefit for the 2017 year is $204,000 and the gross rate of income due is

$61,200. Profit after tax is $142,800 received in the 2017 period by the firm.

(b) Determine the deferred tax liability or deferred tax asset that will result.

Deferred tax assets- It is a balance sheet item arising from the additional imposition of

dividends or actually received. That is the equivalent of the depreciation expense, which will be

the tax owed on profits.

Deferred tax liability- It normally happens as fixed investments are dropped in value, profits

and inventory levels are remembered and priced (Skouloudis, Malesios and Dimitrakopoulos,

2019). For instance, once the payment is actually made, the money due on the current credit

balance cannot be paid, but the payment must be reported during the present timeframe.

$61,200. Profit after tax is $142,800 received in the 2017 period by the firm.

(b) Determine the deferred tax liability or deferred tax asset that will result.

Deferred tax assets- It is a balance sheet item arising from the additional imposition of

dividends or actually received. That is the equivalent of the depreciation expense, which will be

the tax owed on profits.

Deferred tax liability- It normally happens as fixed investments are dropped in value, profits

and inventory levels are remembered and priced (Skouloudis, Malesios and Dimitrakopoulos,

2019). For instance, once the payment is actually made, the money due on the current credit

balance cannot be paid, but the payment must be reported during the present timeframe.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

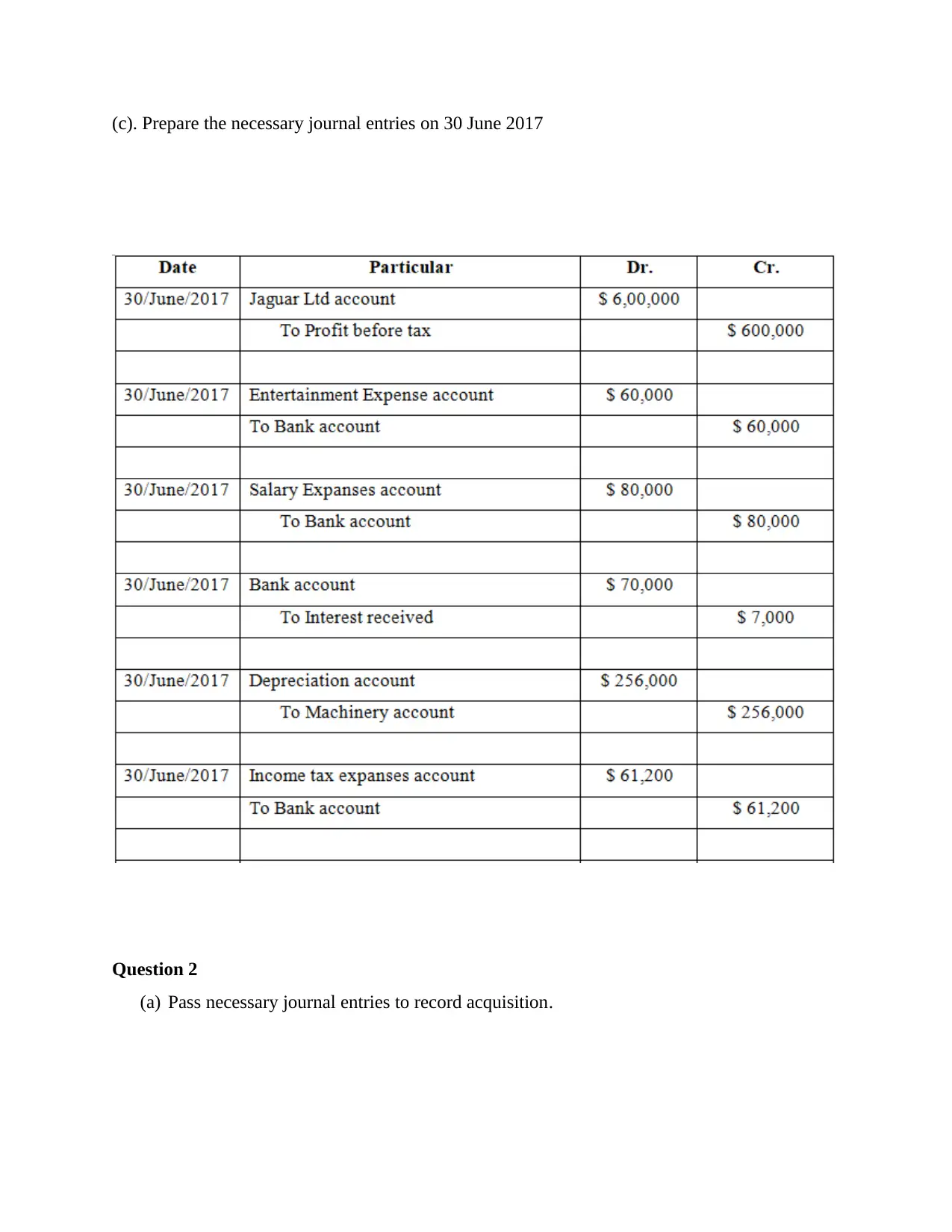

(c). Prepare the necessary journal entries on 30 June 2017

Question 2

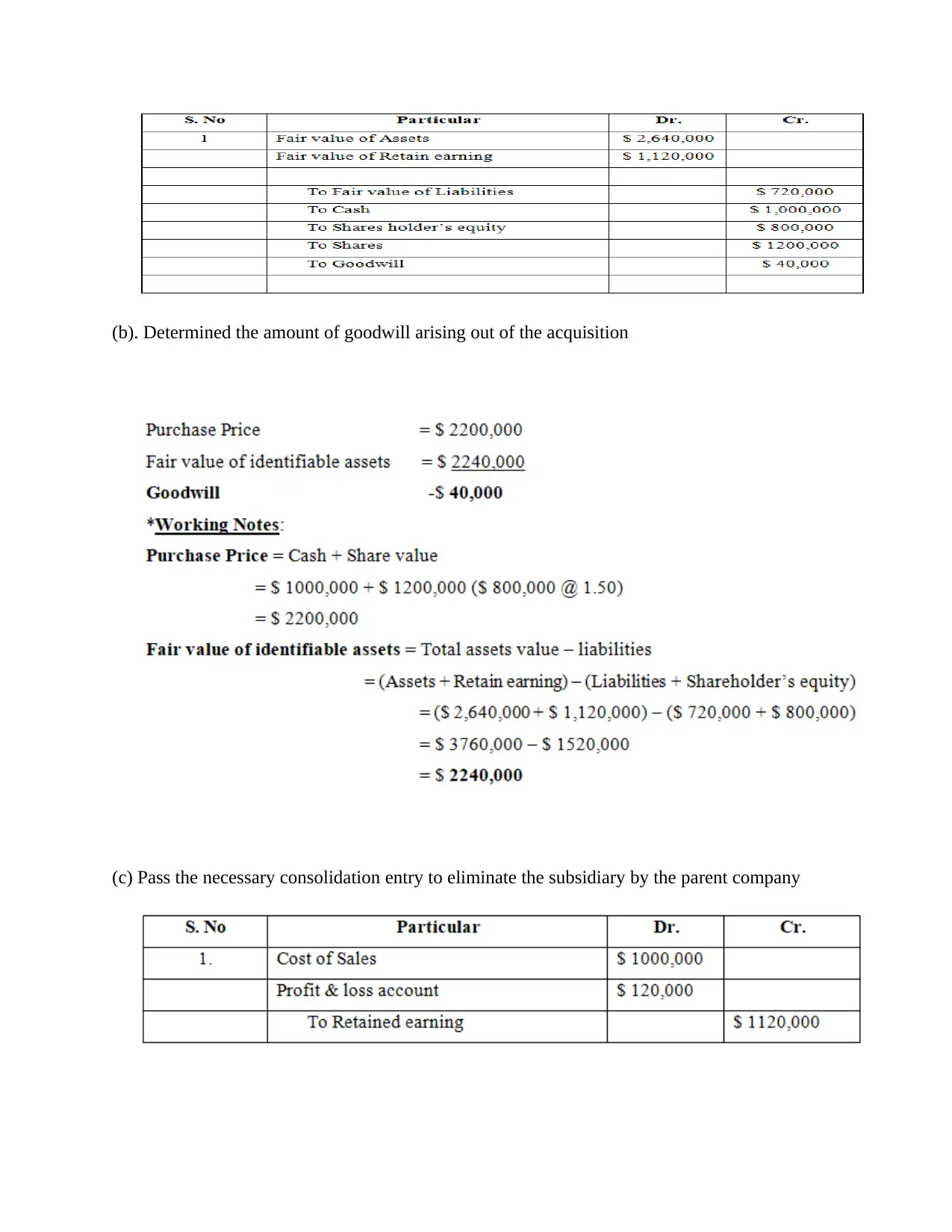

(a) Pass necessary journal entries to record acquisition.

Question 2

(a) Pass necessary journal entries to record acquisition.

(b). Determined the amount of goodwill arising out of the acquisition

(c) Pass the necessary consolidation entry to eliminate the subsidiary by the parent company

(c) Pass the necessary consolidation entry to eliminate the subsidiary by the parent company

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

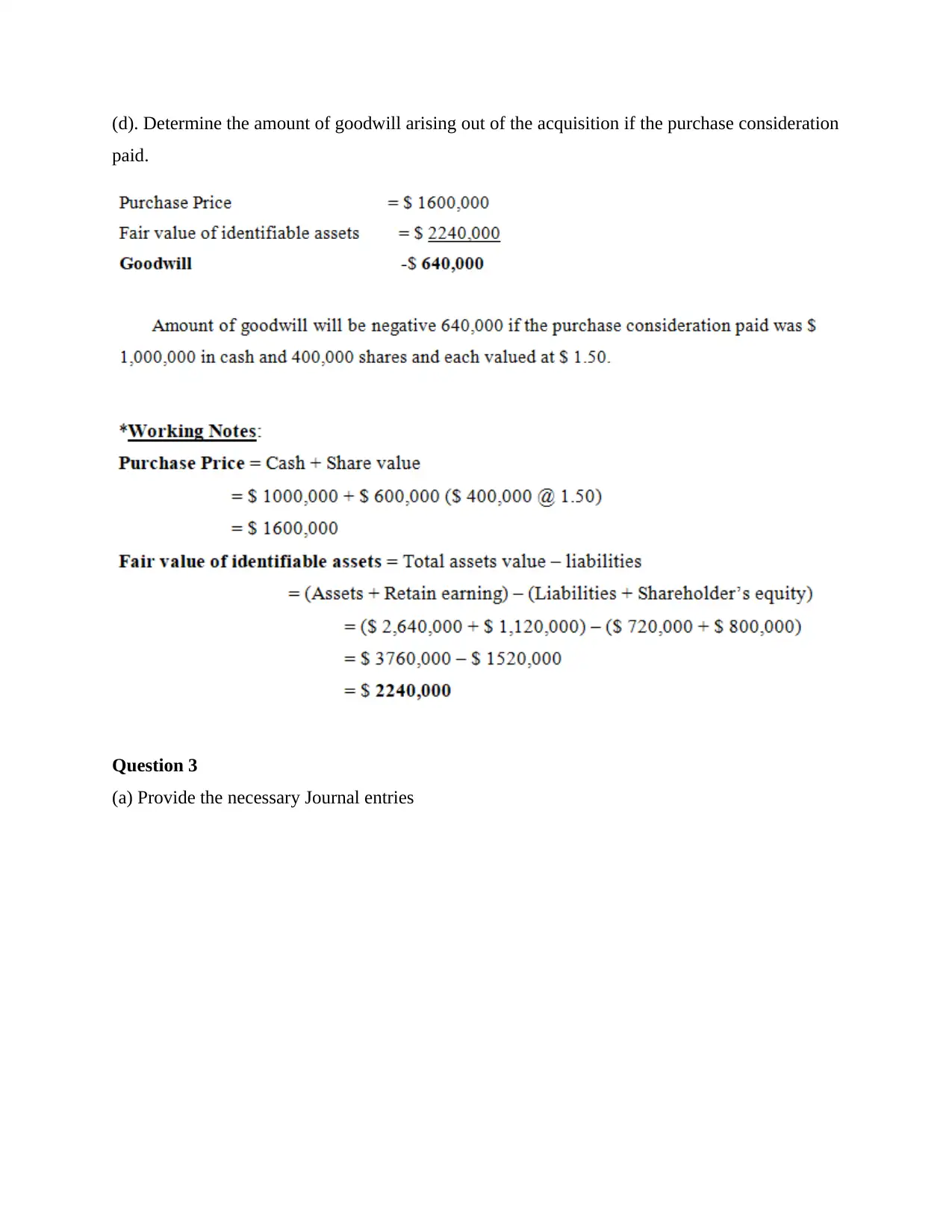

(d). Determine the amount of goodwill arising out of the acquisition if the purchase consideration

paid.

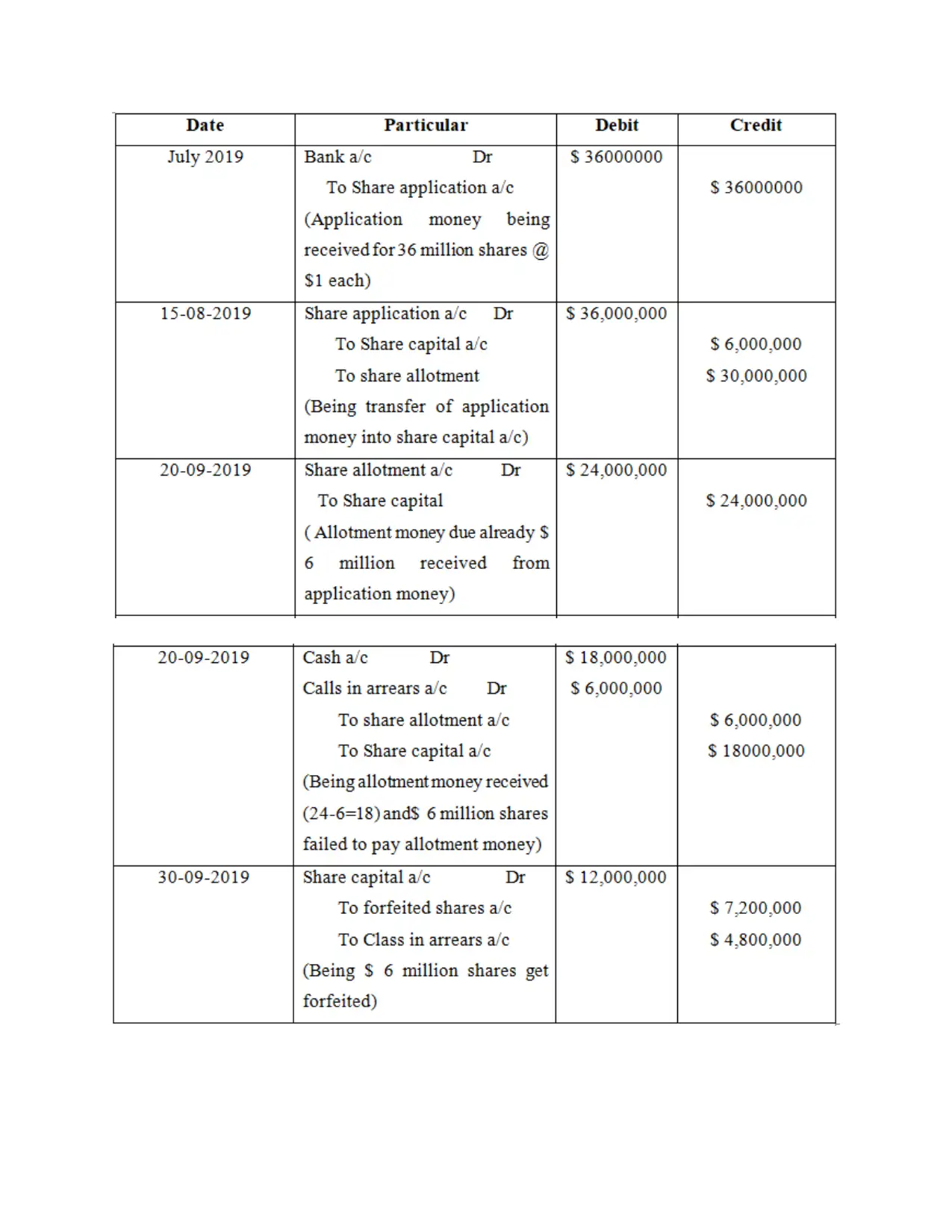

Question 3

(a) Provide the necessary Journal entries

paid.

Question 3

(a) Provide the necessary Journal entries

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 4

(a) Evaluate the portion of the intra-group transactions between the parent entity and the

subsidiary entity will need to be eliminated on consolidation.

If the main company holds less than 100 shares of its subsidiaries, the combined balance sheet

may have a special group covering non-controlling resources, that, of comparison to the parent

organization, refers to the owners ’ equity preferences (Hajawiyah, Wahyudin and Pahala, 2020).

For instance, if a business acquires 90% of a subsidiaries at a book valuation of $450,000, the

controlling shareholder interests is 10% or $50,000 [$450,000*(10/90)]. The aggregate balance

sheet offers a summary of expenditure in affiliate funds of $450,000 and a non-controlling value

of $50,000 in this case. Financial reports must also represent a shareholders’ interest change. The

shareholders element must be deducted from the net benefit or expense if the investor doesn't

own 100 percent of the company.

Non-controlling interest is often regarded as a small stake that assumes an equity role wherein

the parent owns or less 50% of the shares outstanding and has no authority to make decisions.

Non-controlling interests is measured by the company's net asset valuation and thus does not

represent potential right to vote.

Today, the majority of public sector owners would be classified as possessing shareholders’

interests, with a 5 % to 10% share capital perceived to be a large stakeholder in a single business.

A controlling shareholder position in a company where the investor retains the voting rights and

can thus have an impact on the vision of the company can be contrasted with an equity share or a

voting position. In reality, companies can only declare overall non-controlling interests in the

primary statements. Nevertheless, no financial specifics are contained in this transparency clause

to enable investors to measure the value and uncertainties inherent in those non - current

liabilities. Non-Controlling Interests is generally separated from the parent's capital in the

accounting equation of the parent's financial statements of the business, instead of in the

mezzanine between shareholder equity.

Consolidation is a compilation of annual disclosures which, under one financial statement,

consolidate the financial information of several entities (Lev, 2019). As that of the main

shareholder, a division of an inherited entity, and a non-controlling ownership business, they

(a) Evaluate the portion of the intra-group transactions between the parent entity and the

subsidiary entity will need to be eliminated on consolidation.

If the main company holds less than 100 shares of its subsidiaries, the combined balance sheet

may have a special group covering non-controlling resources, that, of comparison to the parent

organization, refers to the owners ’ equity preferences (Hajawiyah, Wahyudin and Pahala, 2020).

For instance, if a business acquires 90% of a subsidiaries at a book valuation of $450,000, the

controlling shareholder interests is 10% or $50,000 [$450,000*(10/90)]. The aggregate balance

sheet offers a summary of expenditure in affiliate funds of $450,000 and a non-controlling value

of $50,000 in this case. Financial reports must also represent a shareholders’ interest change. The

shareholders element must be deducted from the net benefit or expense if the investor doesn't

own 100 percent of the company.

Non-controlling interest is often regarded as a small stake that assumes an equity role wherein

the parent owns or less 50% of the shares outstanding and has no authority to make decisions.

Non-controlling interests is measured by the company's net asset valuation and thus does not

represent potential right to vote.

Today, the majority of public sector owners would be classified as possessing shareholders’

interests, with a 5 % to 10% share capital perceived to be a large stakeholder in a single business.

A controlling shareholder position in a company where the investor retains the voting rights and

can thus have an impact on the vision of the company can be contrasted with an equity share or a

voting position. In reality, companies can only declare overall non-controlling interests in the

primary statements. Nevertheless, no financial specifics are contained in this transparency clause

to enable investors to measure the value and uncertainties inherent in those non - current

liabilities. Non-Controlling Interests is generally separated from the parent's capital in the

accounting equation of the parent's financial statements of the business, instead of in the

mezzanine between shareholder equity.

Consolidation is a compilation of annual disclosures which, under one financial statement,

consolidate the financial information of several entities (Lev, 2019). As that of the main

shareholder, a division of an inherited entity, and a non-controlling ownership business, they

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

usually include a holding company. Centralized monetary capacity causes the three separate

entities to be treated by owners, shareholders and business management as if the three

organizations are one. Consolidation also implies that the securities of a company have been

acquired jointly by a company as well as a no controlling ownership company. Any contracts

between the parent corporation and the affiliate business or between the parent corporation and

the non controlling interests business shall be withdrawn before the balance sheet and income

statement are drawn up.

(c) Evaluate the non-controlling interests affected by intra-group transactions.

The Non-Controlling Interest (NCI) does not really influence improvements in

restructuring for inter - firm deals as the cumulative restructuring effect of the intra - group

contract is changed. The funds are put together through full (100%) and the removal round /

changes are made in whole (100%) in the complete consolidation. However, if the customer

provides wholly held branch documents that are unfulfilled, this impacts the NCI's calculation.

Consolidation also implies that the securities of a company have been acquired jointly by a

company as well as a non-controlling ownership company. Any contracts between the parent

organization and the affiliate business and between the parent corporation and the non-

controlling interests business shall be withdrawn before the balance sheet and income statement

are drawn up (Roychowdhury, Shroff and Verdi, 2019).

That really is the proportion of the stated invested capital in Phase 2 & Step 3 estimates of the

NCI part of the invested capital. When adjustments for inter - firm payments are implemented, in

which these payments reflect the change for unfulfilled affiliate gain, an adjustment is often

made to the revenue share of a Non-Controlling Interest. The net consequence is that a portion of

the real capital of the parent business is collected by the NCI. There have been some instances of

payments influencing the non-controlling value measure, as follows:

entities to be treated by owners, shareholders and business management as if the three

organizations are one. Consolidation also implies that the securities of a company have been

acquired jointly by a company as well as a no controlling ownership company. Any contracts

between the parent corporation and the affiliate business or between the parent corporation and

the non controlling interests business shall be withdrawn before the balance sheet and income

statement are drawn up.

(c) Evaluate the non-controlling interests affected by intra-group transactions.

The Non-Controlling Interest (NCI) does not really influence improvements in

restructuring for inter - firm deals as the cumulative restructuring effect of the intra - group

contract is changed. The funds are put together through full (100%) and the removal round /

changes are made in whole (100%) in the complete consolidation. However, if the customer

provides wholly held branch documents that are unfulfilled, this impacts the NCI's calculation.

Consolidation also implies that the securities of a company have been acquired jointly by a

company as well as a non-controlling ownership company. Any contracts between the parent

organization and the affiliate business and between the parent corporation and the non-

controlling interests business shall be withdrawn before the balance sheet and income statement

are drawn up (Roychowdhury, Shroff and Verdi, 2019).

That really is the proportion of the stated invested capital in Phase 2 & Step 3 estimates of the

NCI part of the invested capital. When adjustments for inter - firm payments are implemented, in

which these payments reflect the change for unfulfilled affiliate gain, an adjustment is often

made to the revenue share of a Non-Controlling Interest. The net consequence is that a portion of

the real capital of the parent business is collected by the NCI. There have been some instances of

payments influencing the non-controlling value measure, as follows:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(d) Identify the three steps which company use to calculate total non-controlling interest.

There's many three key steps needed to determine the total cost of the non-controlling interest,

but these are described below-

The valuation of the non-controlling interest (investments fair value) is originally determined.

This is the value business who will intend equally to offer the holding on the shelf (Alshbili,

Elamer and Beddewela, 2019). For instance, unless the fair value of shareholders stock is 10

million, the corporation would like to add $1 million for reputation and all other adjustments in

fair market value, totaling $11 million. Add pro-rated income due to stock shares that are not

regulated. Then at the point of purchase will the anti-rated portion of NCI sales be 20% of $5

million = $1 million if the organization had a revenue of $5 million. Adjust this income to a

reasonable valuation of 11 million dollars + 1 million dollars = 12 million dollars.

There's many three key steps needed to determine the total cost of the non-controlling interest,

but these are described below-

The valuation of the non-controlling interest (investments fair value) is originally determined.

This is the value business who will intend equally to offer the holding on the shelf (Alshbili,

Elamer and Beddewela, 2019). For instance, unless the fair value of shareholders stock is 10

million, the corporation would like to add $1 million for reputation and all other adjustments in

fair market value, totaling $11 million. Add pro-rated income due to stock shares that are not

regulated. Then at the point of purchase will the anti-rated portion of NCI sales be 20% of $5

million = $1 million if the organization had a revenue of $5 million. Adjust this income to a

reasonable valuation of 11 million dollars + 1 million dollars = 12 million dollars.

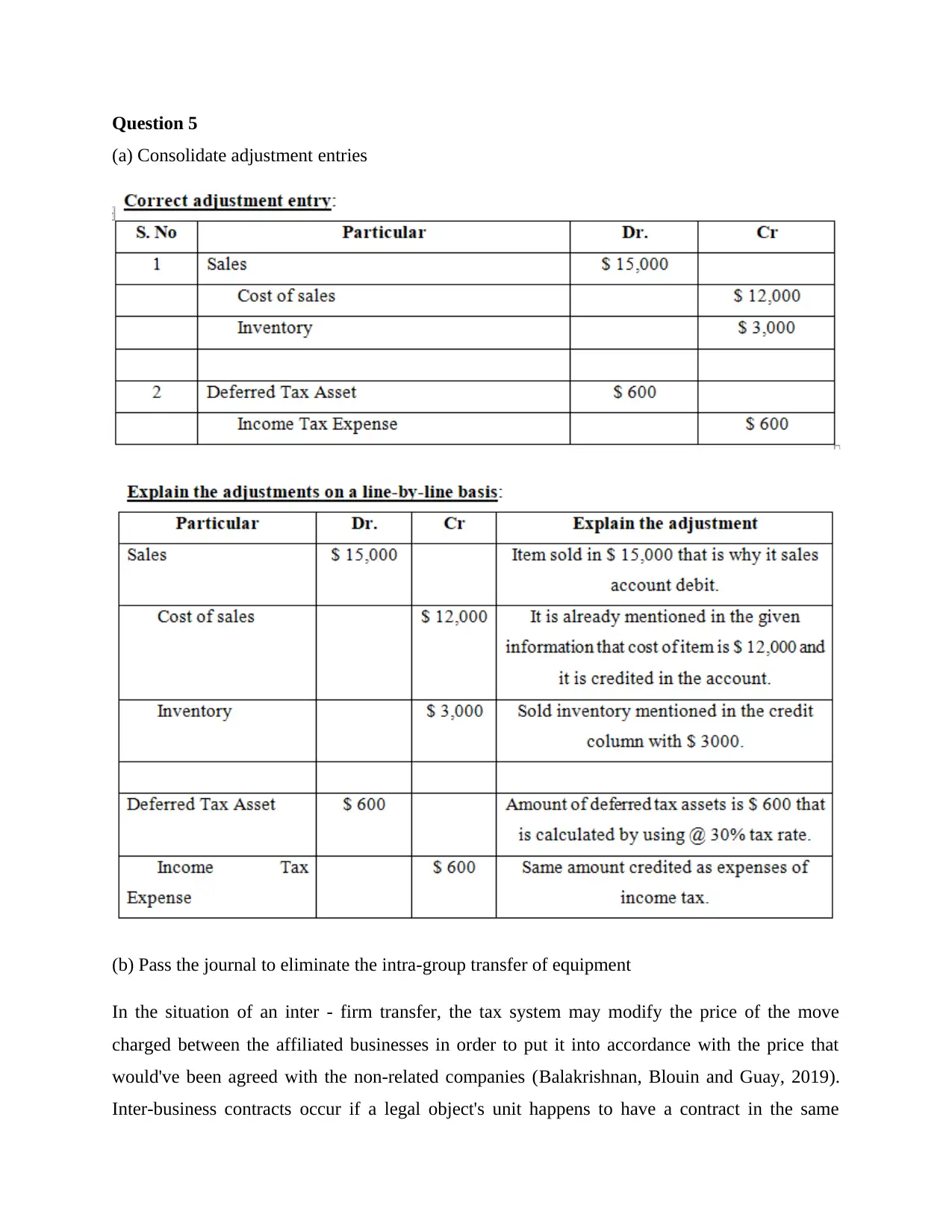

Question 5

(a) Consolidate adjustment entries

(b) Pass the journal to eliminate the intra-group transfer of equipment

In the situation of an inter - firm transfer, the tax system may modify the price of the move

charged between the affiliated businesses in order to put it into accordance with the price that

would've been agreed with the non-related companies (Balakrishnan, Blouin and Guay, 2019).

Inter-business contracts occur if a legal object's unit happens to have a contract in the same

(a) Consolidate adjustment entries

(b) Pass the journal to eliminate the intra-group transfer of equipment

In the situation of an inter - firm transfer, the tax system may modify the price of the move

charged between the affiliated businesses in order to put it into accordance with the price that

would've been agreed with the non-related companies (Balakrishnan, Blouin and Guay, 2019).

Inter-business contracts occur if a legal object's unit happens to have a contract in the same

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.