Corporate Accounting: Detailed Financial Statement Analysis Report

VerifiedAdded on 2024/06/03

|11

|2861

|415

Report

AI Summary

This corporate accounting assignment provides a detailed analysis of financial statements, focusing on cash flow, comparative statements, and comprehensive income. It examines items within comprehensive statements, reasons for their exclusion from the profit and loss account, and tax expenses of the company. The analysis covers deferred tax assets and liabilities, current tax assets, and discrepancies between income tax expense and income tax paid. The report also highlights interesting accounting policies and their impact on financial reporting, offering a thorough understanding of corporate financial practices. Desklib provides this and many other solved assignments to aid students in their studies.

Corporate accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

1: Cash flow statement:...............................................................................................................3

2: Comparative statement of 2017, 2016 and 2015:....................................................................5

3: Statement of Comprehensive income:.....................................................................................7

4: Description of items of comprehensive statements:................................................................7

5: why comprehensive items not included in profit and loss account:........................................8

6: Tax expenses of company:......................................................................................................8

7: Is this figure the same as the company tax rate times your firm’s accounting income?

Explain why this is, or is not, the case for your firm...................................................................9

8: Comment on deferred tax assets/liabilities that are reported on the balance sheet articulating

the possible reasons why they have been recorded.....................................................................9

9: Is there any current tax assets or income tax payable recorded by your company? Why is the

income tax payable not the same as income tax expense?..........................................................9

10: Is the income tax expense shown in the income statement same as the income tax paid

shown in the cash flow statement? If not why is the difference?..............................................10

11: Interesting fact of accounting policy...................................................................................10

1: Cash flow statement:...............................................................................................................3

2: Comparative statement of 2017, 2016 and 2015:....................................................................5

3: Statement of Comprehensive income:.....................................................................................7

4: Description of items of comprehensive statements:................................................................7

5: why comprehensive items not included in profit and loss account:........................................8

6: Tax expenses of company:......................................................................................................8

7: Is this figure the same as the company tax rate times your firm’s accounting income?

Explain why this is, or is not, the case for your firm...................................................................9

8: Comment on deferred tax assets/liabilities that are reported on the balance sheet articulating

the possible reasons why they have been recorded.....................................................................9

9: Is there any current tax assets or income tax payable recorded by your company? Why is the

income tax payable not the same as income tax expense?..........................................................9

10: Is the income tax expense shown in the income statement same as the income tax paid

shown in the cash flow statement? If not why is the difference?..............................................10

11: Interesting fact of accounting policy...................................................................................10

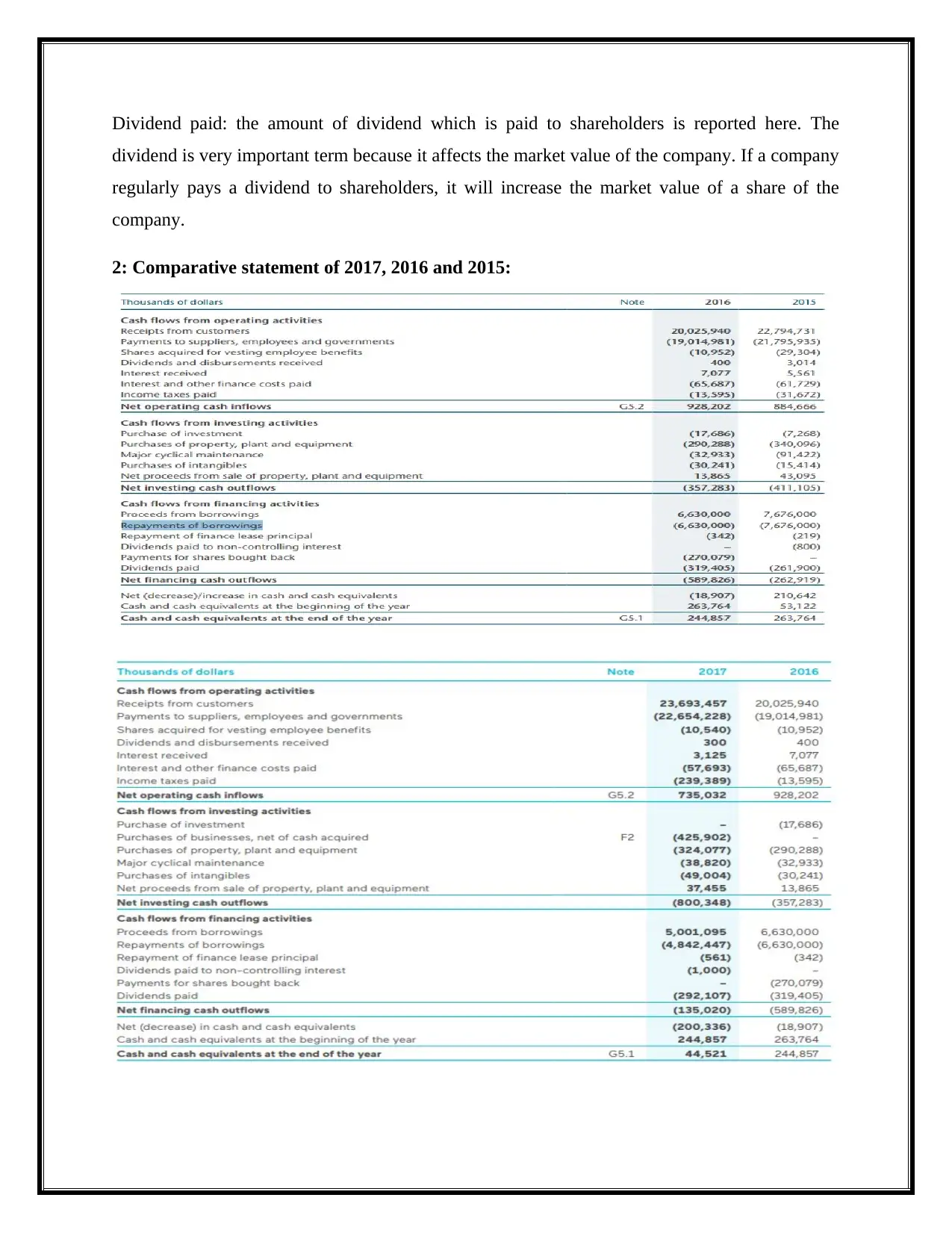

1: Cash flow statement:

Cash flow from operating activities:

Customers Receipts: Receipts from customer denotes the amount which is received against the

credit sales or as advance payment form the debtors of the company. The receipt from customers

is more than 2016 in 2017 which denotes the soundness of credit policy of the company.

Payments made to supplier, employee and government: the amount which is paid to the creditors

for their supply of goods, company staff for their services and governing authority for different

reasons is included in this section. This amount is also more than the previous year.

Shares acquired for vesting employee benefits: This term states the amount which is paid by the

company for purchasing the shares under employee stock benefit scheme. Under ESOP plan, the

company provides an option to its employees to purchase company shares at low prices after the

completion of a certain time of service (Madineh, et. al., 2017).

Interest received: Interest received stands for the amount which is received against the loans

provided by the company to external parties. It is an income for the company and contributes to

improving the liquidity.

Finance costs and Interest paid: interest is payable on those loans which are borrowed by the

company from the external market. It is a cost for the company and should be paid without

considering the profitability of the company. The company paid fewer amounts in 2017 in the

comparison with 2016 which denotes that some funds are repaid by the company during the year.

Income Tax Paid: Income tax is a liability for the company and should be paid timely to avoid

the legal penalties. It is an expense and a legal obligation to the company and such obligation

generates an outflow of funds. Tax paid in 2016 and tax paid in 2017 has the high difference and

the same can be arising due to deferred tax assets or sales.

Cash flows from investing activities:

Purchase of investment: When a company purchase investments to gain some profits from its

extra funds, this out arises. Company purchase some investments in 2016 and but no investment

is purchased during 2017.

Cash flow from operating activities:

Customers Receipts: Receipts from customer denotes the amount which is received against the

credit sales or as advance payment form the debtors of the company. The receipt from customers

is more than 2016 in 2017 which denotes the soundness of credit policy of the company.

Payments made to supplier, employee and government: the amount which is paid to the creditors

for their supply of goods, company staff for their services and governing authority for different

reasons is included in this section. This amount is also more than the previous year.

Shares acquired for vesting employee benefits: This term states the amount which is paid by the

company for purchasing the shares under employee stock benefit scheme. Under ESOP plan, the

company provides an option to its employees to purchase company shares at low prices after the

completion of a certain time of service (Madineh, et. al., 2017).

Interest received: Interest received stands for the amount which is received against the loans

provided by the company to external parties. It is an income for the company and contributes to

improving the liquidity.

Finance costs and Interest paid: interest is payable on those loans which are borrowed by the

company from the external market. It is a cost for the company and should be paid without

considering the profitability of the company. The company paid fewer amounts in 2017 in the

comparison with 2016 which denotes that some funds are repaid by the company during the year.

Income Tax Paid: Income tax is a liability for the company and should be paid timely to avoid

the legal penalties. It is an expense and a legal obligation to the company and such obligation

generates an outflow of funds. Tax paid in 2016 and tax paid in 2017 has the high difference and

the same can be arising due to deferred tax assets or sales.

Cash flows from investing activities:

Purchase of investment: When a company purchase investments to gain some profits from its

extra funds, this out arises. Company purchase some investments in 2016 and but no investment

is purchased during 2017.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Purchases of businesses: This term stands for the amount which paid the company for purchasing

a business. This can be done through the merger, amalgamation or business purchase

combination. The amount to acquire the business, which is paid by the company as a cash

payment is included here.

Purchases of property, Equipment and plant: This term represents the amount which is paid by

the company to acquire the fix assets. Equipment and plant are purchased to support the

production process and property can be purchased for investment and business use purpose.

Major payment cyclical maintenance: this term marks the amount which is paid for the timely

maintenance of assets and plants. It is an expense for the company and generates outflow of

funds (Gazzola and Amelio, 2014).

Purchases of intangibles: intangibles are those assets which are used in business but they do not

have any physical existence and the amount paid by those assets is included in this term.

Net proceeds from the sale of equipment property and plant: the amount which is received

against the sales of old property and plant is denoted by this term. Some assets which are not

more useful for the business can be solved by the company and the amount which is received for

the same is included here.

Cash flow financing activities

Proceeds from borrowings: This figure marks that amount which is borrowed by the company

from market to finance its business activities. It is a liability which should be paid along with

interest. Fund borrowing is normal business activity and generates fix costs for the business.

Repayments of borrowings: this term denotes the amount which is repaid by the company to its

lenders. It is also noted that the amount which is borrowed by the company is same as the

amount paid and it proves that the borrowing was a short-term borrowing (Madineh, et. al.,

2017).

Payment for share buyback: the amount which is paid by the company to purchase its own shares

is reported here.

a business. This can be done through the merger, amalgamation or business purchase

combination. The amount to acquire the business, which is paid by the company as a cash

payment is included here.

Purchases of property, Equipment and plant: This term represents the amount which is paid by

the company to acquire the fix assets. Equipment and plant are purchased to support the

production process and property can be purchased for investment and business use purpose.

Major payment cyclical maintenance: this term marks the amount which is paid for the timely

maintenance of assets and plants. It is an expense for the company and generates outflow of

funds (Gazzola and Amelio, 2014).

Purchases of intangibles: intangibles are those assets which are used in business but they do not

have any physical existence and the amount paid by those assets is included in this term.

Net proceeds from the sale of equipment property and plant: the amount which is received

against the sales of old property and plant is denoted by this term. Some assets which are not

more useful for the business can be solved by the company and the amount which is received for

the same is included here.

Cash flow financing activities

Proceeds from borrowings: This figure marks that amount which is borrowed by the company

from market to finance its business activities. It is a liability which should be paid along with

interest. Fund borrowing is normal business activity and generates fix costs for the business.

Repayments of borrowings: this term denotes the amount which is repaid by the company to its

lenders. It is also noted that the amount which is borrowed by the company is same as the

amount paid and it proves that the borrowing was a short-term borrowing (Madineh, et. al.,

2017).

Payment for share buyback: the amount which is paid by the company to purchase its own shares

is reported here.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Dividend paid: the amount of dividend which is paid to shareholders is reported here. The

dividend is very important term because it affects the market value of the company. If a company

regularly pays a dividend to shareholders, it will increase the market value of a share of the

company.

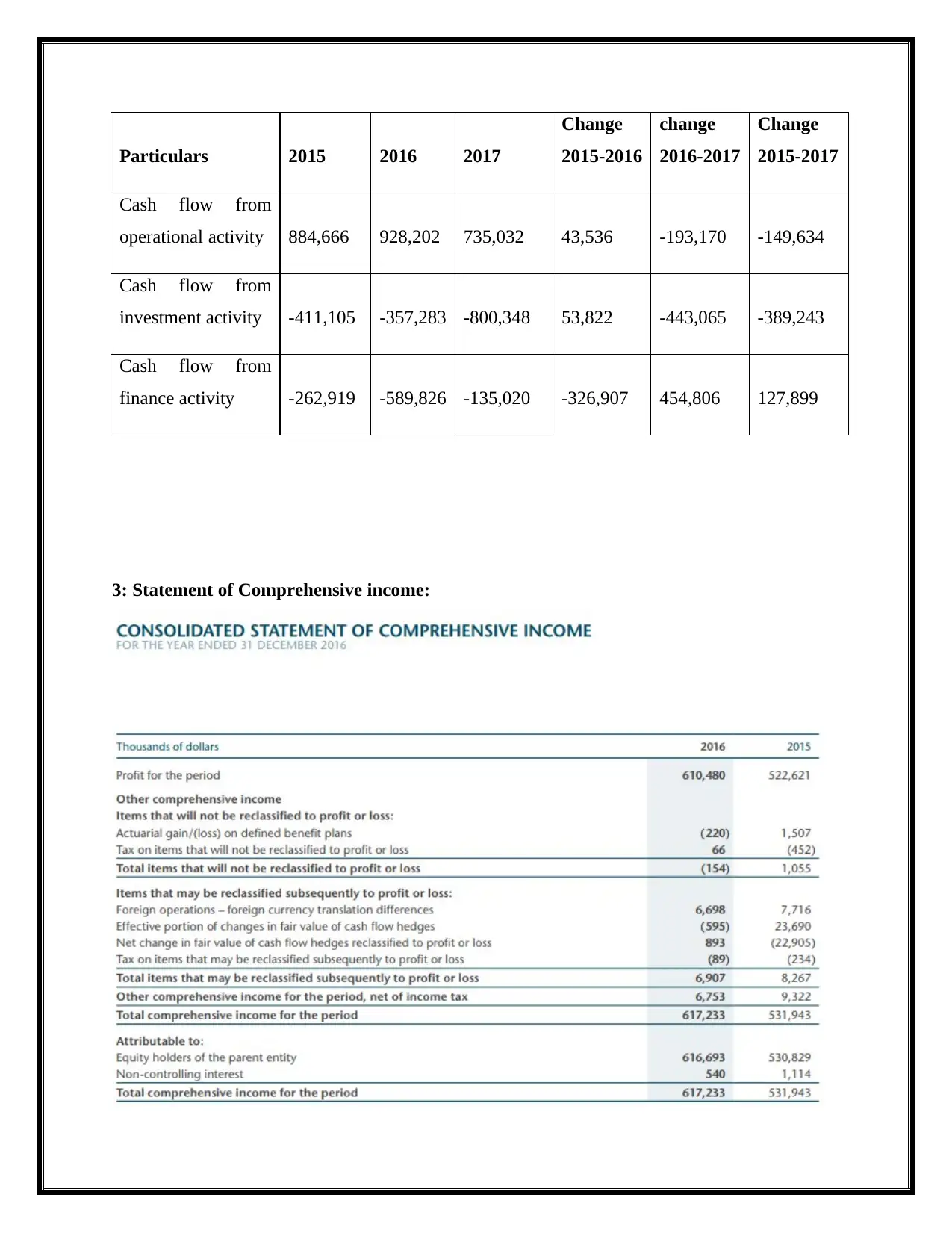

2: Comparative statement of 2017, 2016 and 2015:

dividend is very important term because it affects the market value of the company. If a company

regularly pays a dividend to shareholders, it will increase the market value of a share of the

company.

2: Comparative statement of 2017, 2016 and 2015:

Particulars 2015 2016 2017

Change

2015-2016

change

2016-2017

Change

2015-2017

Cash flow from

operational activity 884,666 928,202 735,032 43,536 -193,170 -149,634

Cash flow from

investment activity -411,105 -357,283 -800,348 53,822 -443,065 -389,243

Cash flow from

finance activity -262,919 -589,826 -135,020 -326,907 454,806 127,899

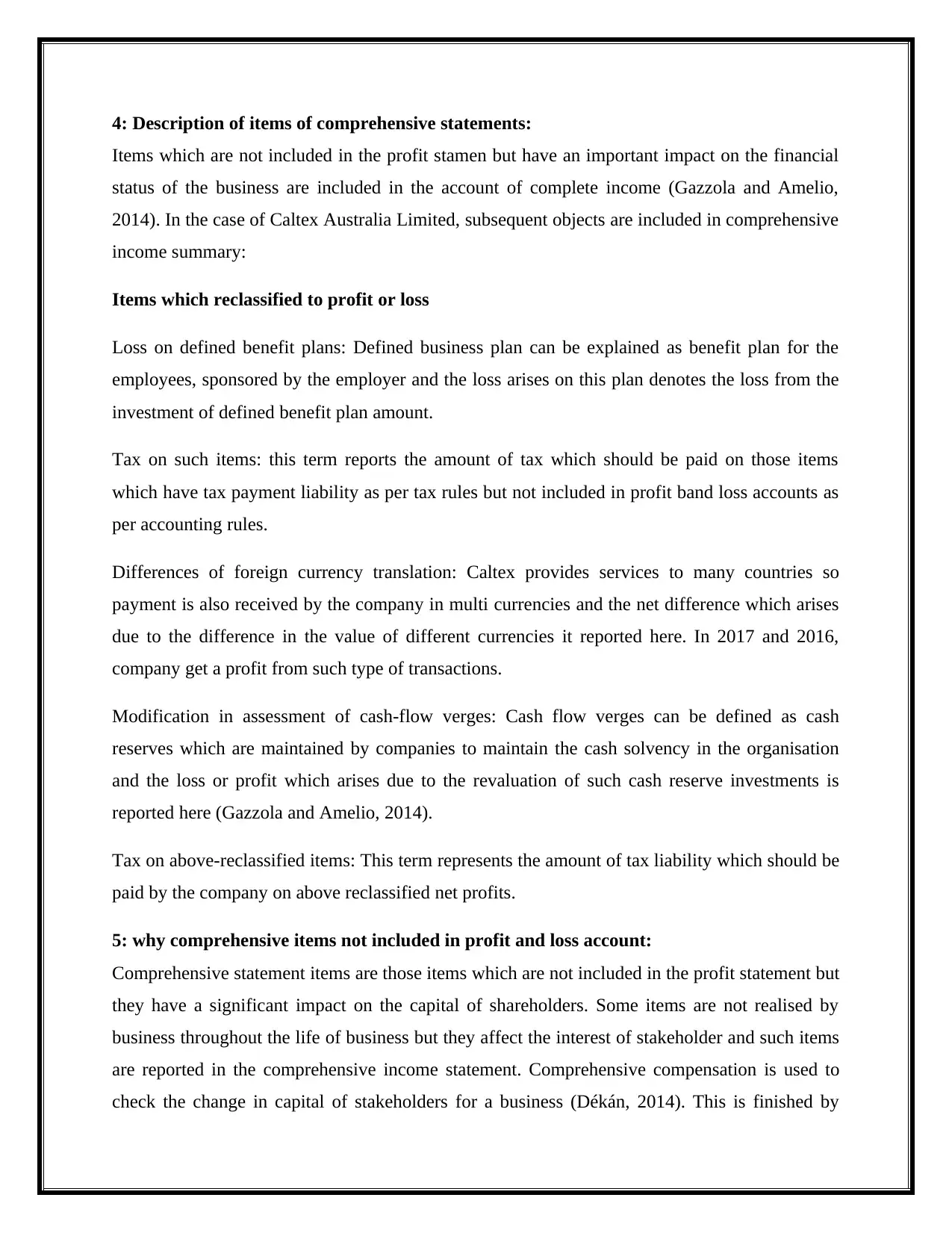

3: Statement of Comprehensive income:

Change

2015-2016

change

2016-2017

Change

2015-2017

Cash flow from

operational activity 884,666 928,202 735,032 43,536 -193,170 -149,634

Cash flow from

investment activity -411,105 -357,283 -800,348 53,822 -443,065 -389,243

Cash flow from

finance activity -262,919 -589,826 -135,020 -326,907 454,806 127,899

3: Statement of Comprehensive income:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4: Description of items of comprehensive statements:

Items which are not included in the profit stamen but have an important impact on the financial

status of the business are included in the account of complete income (Gazzola and Amelio,

2014). In the case of Caltex Australia Limited, subsequent objects are included in comprehensive

income summary:

Items which reclassified to profit or loss

Loss on defined benefit plans: Defined business plan can be explained as benefit plan for the

employees, sponsored by the employer and the loss arises on this plan denotes the loss from the

investment of defined benefit plan amount.

Tax on such items: this term reports the amount of tax which should be paid on those items

which have tax payment liability as per tax rules but not included in profit band loss accounts as

per accounting rules.

Differences of foreign currency translation: Caltex provides services to many countries so

payment is also received by the company in multi currencies and the net difference which arises

due to the difference in the value of different currencies it reported here. In 2017 and 2016,

company get a profit from such type of transactions.

Modification in assessment of cash-flow verges: Cash flow verges can be defined as cash

reserves which are maintained by companies to maintain the cash solvency in the organisation

and the loss or profit which arises due to the revaluation of such cash reserve investments is

reported here (Gazzola and Amelio, 2014).

Tax on above-reclassified items: This term represents the amount of tax liability which should be

paid by the company on above reclassified net profits.

5: why comprehensive items not included in profit and loss account:

Comprehensive statement items are those items which are not included in the profit statement but

they have a significant impact on the capital of shareholders. Some items are not realised by

business throughout the life of business but they affect the interest of stakeholder and such items

are reported in the comprehensive income statement. Comprehensive compensation is used to

check the change in capital of stakeholders for a business (Dékán, 2014). This is finished by

Items which are not included in the profit stamen but have an important impact on the financial

status of the business are included in the account of complete income (Gazzola and Amelio,

2014). In the case of Caltex Australia Limited, subsequent objects are included in comprehensive

income summary:

Items which reclassified to profit or loss

Loss on defined benefit plans: Defined business plan can be explained as benefit plan for the

employees, sponsored by the employer and the loss arises on this plan denotes the loss from the

investment of defined benefit plan amount.

Tax on such items: this term reports the amount of tax which should be paid on those items

which have tax payment liability as per tax rules but not included in profit band loss accounts as

per accounting rules.

Differences of foreign currency translation: Caltex provides services to many countries so

payment is also received by the company in multi currencies and the net difference which arises

due to the difference in the value of different currencies it reported here. In 2017 and 2016,

company get a profit from such type of transactions.

Modification in assessment of cash-flow verges: Cash flow verges can be defined as cash

reserves which are maintained by companies to maintain the cash solvency in the organisation

and the loss or profit which arises due to the revaluation of such cash reserve investments is

reported here (Gazzola and Amelio, 2014).

Tax on above-reclassified items: This term represents the amount of tax liability which should be

paid by the company on above reclassified net profits.

5: why comprehensive items not included in profit and loss account:

Comprehensive statement items are those items which are not included in the profit statement but

they have a significant impact on the capital of shareholders. Some items are not realised by

business throughout the life of business but they affect the interest of stakeholder and such items

are reported in the comprehensive income statement. Comprehensive compensation is used to

check the change in capital of stakeholders for a business (Dékán, 2014). This is finished by

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

diagramming the change in an association's assets from non-owner resources, along with all

profits and expenses that in most cases keep away from the reimbursement explanation for the

reason that they have not yet been made the experience of it. Comprehensive profit is frequently

recorded in a surprising declaration in comparison to paying, which incorporates modifications

in stakeholder capital.

6: Tax expenses of the company:

Tax obligations are measured on the basis of profits and should be paid to the governing

authorities. If a loss is faced by the company in any financial year, the tax benefit of the same is

also available. In the case of Caltex Australia limited, company earn a profit of $ 620752 in 2017

and $ 610480 in 2016. It is also noted that the deduction of loss is also available and can be set

off with future profits and for this purpose; it can be involved in the company balance sheet with

the name of deferred tax asset. Identification of correct profit is also an important matter and it

should be done by following AASB and IFRS rules and GAAP.

7: Is this figure the same as the company tax rate times your firm’s accounting income?

Explain why this is, or is not, the case for your firm.

No, the amount of tax reported by the profit and loss account and the tax as per tax rate is not

same due to the difference in tax and accounting rules. The tax rate which is applicable on Caltex

Australia is 30% but the profit reported by the company statement is not 30% of profits because

tax amounts are measured as per tax rules and accounting profits are calculated as per Generally

Accepted Accounting Principles and accounting standards (AASB). Some items which are

deductible as per accounting rules for profit calculation are not deductible as income tax rules

and the same difference creates the difference in tax amounts (Madineh, et. al., 2017).

8: Comment on deferred tax assets/liabilities that are reported on the balance sheet

articulating the possible reasons why they have been recorded.

Deferred tax Asset can be defined as a provision for the future tax liability. When a company

faced the situation of loss then the deduction of the same is available in coming years when

company generate the profit and to make the suitable adjustment of the same deductions,

deferred tax assets are recorded in financial statements (Sözbilir, 2015). A Deferred tax Asset is

a salaried force made through a passing on a measure of net difficulty or price credit, which is at

last lower back to the association and secured the company’s accounting report as leeway.

profits and expenses that in most cases keep away from the reimbursement explanation for the

reason that they have not yet been made the experience of it. Comprehensive profit is frequently

recorded in a surprising declaration in comparison to paying, which incorporates modifications

in stakeholder capital.

6: Tax expenses of the company:

Tax obligations are measured on the basis of profits and should be paid to the governing

authorities. If a loss is faced by the company in any financial year, the tax benefit of the same is

also available. In the case of Caltex Australia limited, company earn a profit of $ 620752 in 2017

and $ 610480 in 2016. It is also noted that the deduction of loss is also available and can be set

off with future profits and for this purpose; it can be involved in the company balance sheet with

the name of deferred tax asset. Identification of correct profit is also an important matter and it

should be done by following AASB and IFRS rules and GAAP.

7: Is this figure the same as the company tax rate times your firm’s accounting income?

Explain why this is, or is not, the case for your firm.

No, the amount of tax reported by the profit and loss account and the tax as per tax rate is not

same due to the difference in tax and accounting rules. The tax rate which is applicable on Caltex

Australia is 30% but the profit reported by the company statement is not 30% of profits because

tax amounts are measured as per tax rules and accounting profits are calculated as per Generally

Accepted Accounting Principles and accounting standards (AASB). Some items which are

deductible as per accounting rules for profit calculation are not deductible as income tax rules

and the same difference creates the difference in tax amounts (Madineh, et. al., 2017).

8: Comment on deferred tax assets/liabilities that are reported on the balance sheet

articulating the possible reasons why they have been recorded.

Deferred tax Asset can be defined as a provision for the future tax liability. When a company

faced the situation of loss then the deduction of the same is available in coming years when

company generate the profit and to make the suitable adjustment of the same deductions,

deferred tax assets are recorded in financial statements (Sözbilir, 2015). A Deferred tax Asset is

a salaried force made through a passing on a measure of net difficulty or price credit, which is at

last lower back to the association and secured the company’s accounting report as leeway.

Associations use to run after deferrals to bring the compensation force fees of the coming

accounting time span, given that next duty duration will create positive wage. In The case of

Caltex, a deferred tax asset of $ 244073 is recorded by the company in 2017 and 237083 in 2016

(Wang, et. al., 2015).

9: Is there any current tax assets or income tax payable recorded by your company? Why

is the income tax payable not the same as income tax expense?

The income tax payable is a liability for a company and should be paid when it became payable.

There is no current tax asset or income tax payable recorded in 2017 but a current tax asset of $

9524 is recorded in 2016 (Scott, D., 2017). This amount stands for that advance payment which

is adjustable with future tax liability so included as an asset in the financial statements. The

income payable and the income tax expenses of the current year are not same because several

adjustments also required after the determination of tax liability on current profits. For example,

if a company have current year tax liability of $ 100, income tax payable will be calculated by

adjusting the deferred tax assets and current tax asset which will create the difference in these

two terms.

10: Is the income tax expense shown in the income statement same as the income tax paid

shown in the cash flow statement? If not why is the difference?

The income tax on net profit reported by the financial statement of Caltex is 242694 in 2017 and

253283 in 2016 but the income tax paid by the company is 239389 in 2017 and 13595 in 2016.

The amounts have huge differences and the same is arising due to adjustments which are

required to ascertain the correct tax liability (Bragg, 2018). The other adjustments like advance

Tax paid, deferred tax asset or liability and difference in GAAP and income tax rules are

responsible for this difference.

11: the Interesting fact of accounting policy.

There are various terms which have more than one treatment under tax and accounting rules.

Valuation of inventory, revaluation of employee benefit plan is some items which have various

treatments. In the case of Caltex Australia, company yearly revalued its investments which are

purchased form employee benefit plan fund and the difference of revaluation is charged to

another comprehensive statement. According to the AASB, it can be charged from profit and

accounting time span, given that next duty duration will create positive wage. In The case of

Caltex, a deferred tax asset of $ 244073 is recorded by the company in 2017 and 237083 in 2016

(Wang, et. al., 2015).

9: Is there any current tax assets or income tax payable recorded by your company? Why

is the income tax payable not the same as income tax expense?

The income tax payable is a liability for a company and should be paid when it became payable.

There is no current tax asset or income tax payable recorded in 2017 but a current tax asset of $

9524 is recorded in 2016 (Scott, D., 2017). This amount stands for that advance payment which

is adjustable with future tax liability so included as an asset in the financial statements. The

income payable and the income tax expenses of the current year are not same because several

adjustments also required after the determination of tax liability on current profits. For example,

if a company have current year tax liability of $ 100, income tax payable will be calculated by

adjusting the deferred tax assets and current tax asset which will create the difference in these

two terms.

10: Is the income tax expense shown in the income statement same as the income tax paid

shown in the cash flow statement? If not why is the difference?

The income tax on net profit reported by the financial statement of Caltex is 242694 in 2017 and

253283 in 2016 but the income tax paid by the company is 239389 in 2017 and 13595 in 2016.

The amounts have huge differences and the same is arising due to adjustments which are

required to ascertain the correct tax liability (Bragg, 2018). The other adjustments like advance

Tax paid, deferred tax asset or liability and difference in GAAP and income tax rules are

responsible for this difference.

11: the Interesting fact of accounting policy.

There are various terms which have more than one treatment under tax and accounting rules.

Valuation of inventory, revaluation of employee benefit plan is some items which have various

treatments. In the case of Caltex Australia, company yearly revalued its investments which are

purchased form employee benefit plan fund and the difference of revaluation is charged to

another comprehensive statement. According to the AASB, it can be charged from profit and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

loss also but company assumes that this amount does not arise from business activity but affects

the financial position so it is recorded in the comprehensive income statement.

References:

1. Sözbilir, H., Kula, V. and Baykut, L.E., 2015. A Research on Deferred Taxes: A Case

Study of BIST Listed Banks in Turkey. European Journal of Business and

Management, 7(2), pp.1-10.

2. Wang, Y., Butterfield, S. and Campbell, M., 2016. Deferred tax items as earnings

management indicators. International Management Review, 12(2), p.37.

3. Madineh, S.M., Sohrabi, A.R., Mohammadi, A. and Veismoradi, A., 2017. Prediction of

Financial Distress by Using Criteria for Cash Flow Statement in Companies Listed on

the Tehran Stock Exchange. Journal of Administrative Management, Education and

Training, 13(2), pp.180-190.

4. Ciconte, W., Donohoe, M., Lisowsky, P. and Mayberry, M., 2016. Predictable

uncertainty: The relation between unrecognized tax benefits and future income tax cash

outflows.

5. Bragg, S., 2018. Income tax payable. [online] AccountingTools. Available

at: https://www.accountingtools.com/articles/2017/5/12/income-tax-payable [Accessed

25 May 2018].

the financial position so it is recorded in the comprehensive income statement.

References:

1. Sözbilir, H., Kula, V. and Baykut, L.E., 2015. A Research on Deferred Taxes: A Case

Study of BIST Listed Banks in Turkey. European Journal of Business and

Management, 7(2), pp.1-10.

2. Wang, Y., Butterfield, S. and Campbell, M., 2016. Deferred tax items as earnings

management indicators. International Management Review, 12(2), p.37.

3. Madineh, S.M., Sohrabi, A.R., Mohammadi, A. and Veismoradi, A., 2017. Prediction of

Financial Distress by Using Criteria for Cash Flow Statement in Companies Listed on

the Tehran Stock Exchange. Journal of Administrative Management, Education and

Training, 13(2), pp.180-190.

4. Ciconte, W., Donohoe, M., Lisowsky, P. and Mayberry, M., 2016. Predictable

uncertainty: The relation between unrecognized tax benefits and future income tax cash

outflows.

5. Bragg, S., 2018. Income tax payable. [online] AccountingTools. Available

at: https://www.accountingtools.com/articles/2017/5/12/income-tax-payable [Accessed

25 May 2018].

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

6. Scott, D., 2017. The Difference Between Income Tax Expense & Income Tax Payable.

[online] Bizfluent. Available at: https://bizfluent.com/info-12002322-difference-

between-income-tax-expense-income-tax-payable.html [Accessed 25 May 2018].

7. V.T., Peters, S.J., Schacht, K.N. and Lu, S., 2015. Analyzing Bank Performance: Role

of Comprehensive Income: The Need to Increase Investor Attention on Other

Comprehensive Income Statement Items. Codes, Standards, and Position

Papers, 2015(3), pp.1-91.

8. Gobetti, S. W., & Orair, R. O. (2017). Taxation and distribution of income in Brazil: new

evidence from personal income tax data. Revista de Economia Política, 37(2), 267-286.

9. Gazzola, P. and Amelio, S., 2014. The impact of comprehensive income on the financial

ratios in a period of crises. Procedia Economics and Finance, 12, pp.174-183.

10. Dékán, I.O.M.T., 2014. ROLE AND SIGNIFICANCE OF STATEMENT OF OTHER

COMPREHENSIVE INCOME–IN RESPECT OF REPORTING

COMPANIES’PERFORMANCE. THE ANNALS OF THE UNIVERSITY OF

ORADEA, p.647.

11.

[online] Bizfluent. Available at: https://bizfluent.com/info-12002322-difference-

between-income-tax-expense-income-tax-payable.html [Accessed 25 May 2018].

7. V.T., Peters, S.J., Schacht, K.N. and Lu, S., 2015. Analyzing Bank Performance: Role

of Comprehensive Income: The Need to Increase Investor Attention on Other

Comprehensive Income Statement Items. Codes, Standards, and Position

Papers, 2015(3), pp.1-91.

8. Gobetti, S. W., & Orair, R. O. (2017). Taxation and distribution of income in Brazil: new

evidence from personal income tax data. Revista de Economia Política, 37(2), 267-286.

9. Gazzola, P. and Amelio, S., 2014. The impact of comprehensive income on the financial

ratios in a period of crises. Procedia Economics and Finance, 12, pp.174-183.

10. Dékán, I.O.M.T., 2014. ROLE AND SIGNIFICANCE OF STATEMENT OF OTHER

COMPREHENSIVE INCOME–IN RESPECT OF REPORTING

COMPANIES’PERFORMANCE. THE ANNALS OF THE UNIVERSITY OF

ORADEA, p.647.

11.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.