Corporate Accounting: Analysis of Financial Statements of Wesfarmers and Woolworths

VerifiedAdded on 2023/06/05

|27

|5012

|116

AI Summary

This report provides an analysis of the financial statements of Wesfarmers and Woolworths, including owner's equity, cash flow, comprehensive income statement, and tax treatment. It also includes a comparative analysis of the two companies over a three-year period.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: CORPORATE ACCOUNTING 0

Executive Summary

Wesfarmers and the Woolworths are two giant retailers of the Australia which are engaged in the

business of the channelizing the supermarkets and providing the products under one channel so that

it’s convenient for the customers. The analysis of the of the each item of the major financial

statements such as the owner’s equity, cash flow, comprehensive income statement and the

treatment of the tax component is what has been discussed under this report to give an

understanding of the entire scenario of each firm over the period of the three years.

Executive Summary

Wesfarmers and the Woolworths are two giant retailers of the Australia which are engaged in the

business of the channelizing the supermarkets and providing the products under one channel so that

it’s convenient for the customers. The analysis of the of the each item of the major financial

statements such as the owner’s equity, cash flow, comprehensive income statement and the

treatment of the tax component is what has been discussed under this report to give an

understanding of the entire scenario of each firm over the period of the three years.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Running Head: CORPORATE ACCOUNTING

Corporate Accounting

Corporate Accounting

Running Head: CORPORATE ACCOUNTING

Table of Contents

Owners’ Equity..........................................................................................................................2

Ordinary Share capital............................................................................................................2

Reserves..................................................................................................................................3

Retained profits......................................................................................................................3

Comparative Analysis................................................................................................................3

Cash flow statements..................................................................................................................4

Operating Activities................................................................................................................4

Investing Activities.................................................................................................................5

Financing Activities................................................................................................................6

Net Change in Cash................................................................................................................7

Free Cash Flow.......................................................................................................................7

Comprehensive Income statement...........................................................................................17

Accounting for Corporate Income Tax....................................................................................20

References................................................................................................................................23

Table of Contents

Owners’ Equity..........................................................................................................................2

Ordinary Share capital............................................................................................................2

Reserves..................................................................................................................................3

Retained profits......................................................................................................................3

Comparative Analysis................................................................................................................3

Cash flow statements..................................................................................................................4

Operating Activities................................................................................................................4

Investing Activities.................................................................................................................5

Financing Activities................................................................................................................6

Net Change in Cash................................................................................................................7

Free Cash Flow.......................................................................................................................7

Comprehensive Income statement...........................................................................................17

Accounting for Corporate Income Tax....................................................................................20

References................................................................................................................................23

Running Head: CORPORATE ACCOUNTING

Introduction

Corporate accounting is a branch of the accounting which deals with the preparation of the final

accounts and the cash flow statements. The corporate accounting also deals with the analysis and

the interpretation of the companies and the financial results and the accounting treatment of the

events like the amalgamation. The companies like Wesfarmers and the Woolworths are of large

volume and therefore it is necessary to observe the financial statements.

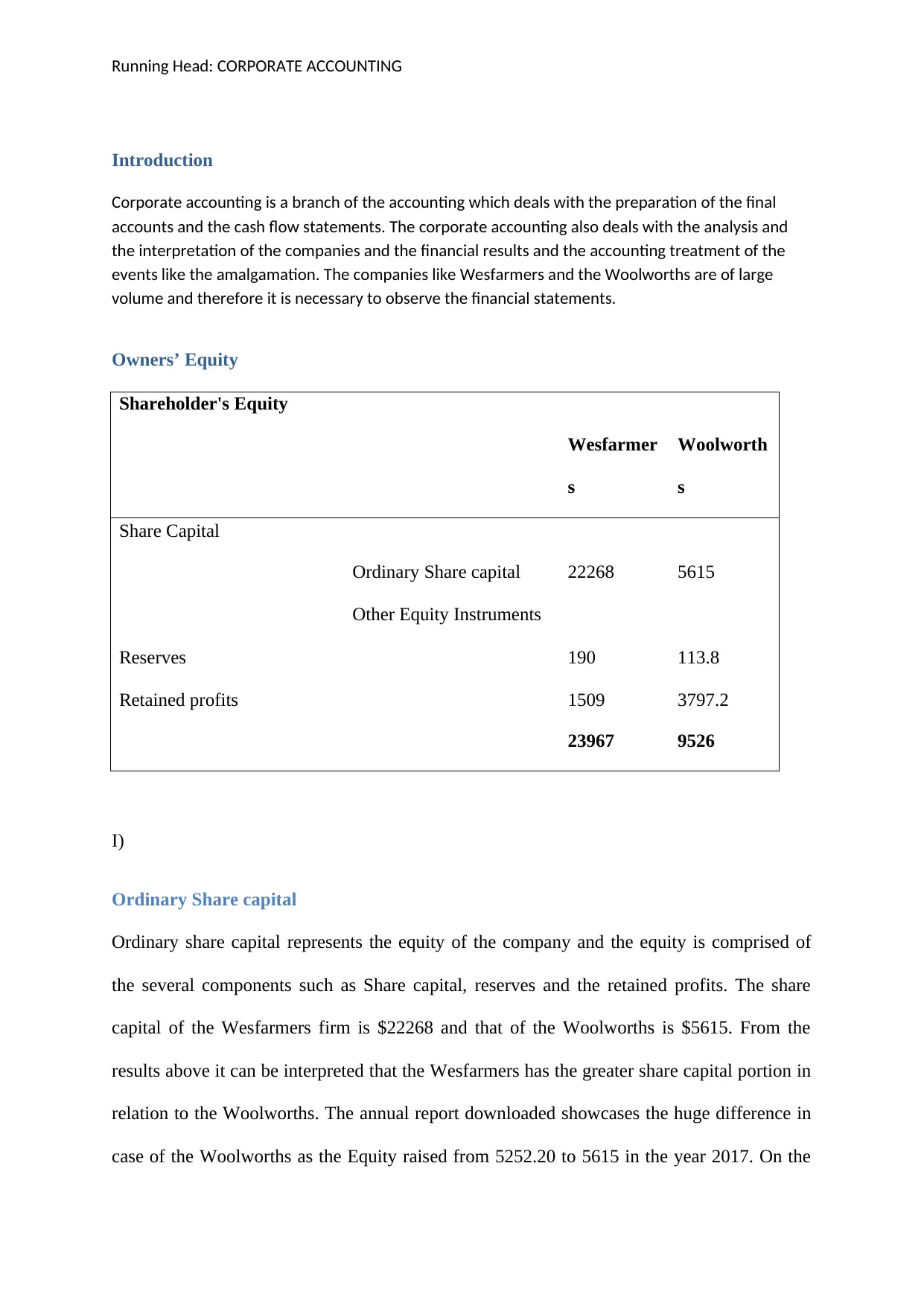

Owners’ Equity

Shareholder's Equity

Wesfarmer

s

Woolworth

s

Share Capital

Ordinary Share capital 22268 5615

Other Equity Instruments

Reserves 190 113.8

Retained profits 1509 3797.2

23967 9526

I)

Ordinary Share capital

Ordinary share capital represents the equity of the company and the equity is comprised of

the several components such as Share capital, reserves and the retained profits. The share

capital of the Wesfarmers firm is $22268 and that of the Woolworths is $5615. From the

results above it can be interpreted that the Wesfarmers has the greater share capital portion in

relation to the Woolworths. The annual report downloaded showcases the huge difference in

case of the Woolworths as the Equity raised from 5252.20 to 5615 in the year 2017. On the

Introduction

Corporate accounting is a branch of the accounting which deals with the preparation of the final

accounts and the cash flow statements. The corporate accounting also deals with the analysis and

the interpretation of the companies and the financial results and the accounting treatment of the

events like the amalgamation. The companies like Wesfarmers and the Woolworths are of large

volume and therefore it is necessary to observe the financial statements.

Owners’ Equity

Shareholder's Equity

Wesfarmer

s

Woolworth

s

Share Capital

Ordinary Share capital 22268 5615

Other Equity Instruments

Reserves 190 113.8

Retained profits 1509 3797.2

23967 9526

I)

Ordinary Share capital

Ordinary share capital represents the equity of the company and the equity is comprised of

the several components such as Share capital, reserves and the retained profits. The share

capital of the Wesfarmers firm is $22268 and that of the Woolworths is $5615. From the

results above it can be interpreted that the Wesfarmers has the greater share capital portion in

relation to the Woolworths. The annual report downloaded showcases the huge difference in

case of the Woolworths as the Equity raised from 5252.20 to 5615 in the year 2017. On the

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Running Head: CORPORATE ACCOUNTING

other hand the ordinary share capital of the Wesfarmers accelerated from 21937 to 22268

(Wesfarmers, 2018).The possible reasons are the increase in the interest of the investors

towards the share price of the company. Moreover in comparison to the market the sales

growth have been 7.2% more in comparison to the previous year. Due to turnaround potential

in case of the Woolworths the investors are investing more in the largest retailer company of

the Australia.

Reserves

Reserves which are also known as the retained earnings are the portions set aside by the

company in the anticipation of the fact that it can strengthen the position of the company. The

reserves are generally are used for the purpose of the purchasing of the fixed assets to repay

the debts or it funds the bonus and the expansion and the payment of the dividend. The

reserves of the Wesfarmers are 190 and that of the Woolworths are 113.8, and in both the

case the reserves have been increased (Woolworths, 2017).

Retained profits

Retained profits are the amount which has been earned till date less any dividends or the

other amount of the distributions paid to investors. Undistributed profits generally club

themselves in the company’s equity which is owned by the investors and the shareholders.

There are different names for the same terms as the retained profits are also known as the

accumulated or undivided profits. The major reason for the increase in the retained earnings

is the increase in the amount of the revenue more than the ones that are expensed out and

when the income is readily steady. The Retained profits of the Wesfarmers are $1509 and

$3797 in case of the Woolworths (Wesfarmers, 2017).

II)

other hand the ordinary share capital of the Wesfarmers accelerated from 21937 to 22268

(Wesfarmers, 2018).The possible reasons are the increase in the interest of the investors

towards the share price of the company. Moreover in comparison to the market the sales

growth have been 7.2% more in comparison to the previous year. Due to turnaround potential

in case of the Woolworths the investors are investing more in the largest retailer company of

the Australia.

Reserves

Reserves which are also known as the retained earnings are the portions set aside by the

company in the anticipation of the fact that it can strengthen the position of the company. The

reserves are generally are used for the purpose of the purchasing of the fixed assets to repay

the debts or it funds the bonus and the expansion and the payment of the dividend. The

reserves of the Wesfarmers are 190 and that of the Woolworths are 113.8, and in both the

case the reserves have been increased (Woolworths, 2017).

Retained profits

Retained profits are the amount which has been earned till date less any dividends or the

other amount of the distributions paid to investors. Undistributed profits generally club

themselves in the company’s equity which is owned by the investors and the shareholders.

There are different names for the same terms as the retained profits are also known as the

accumulated or undivided profits. The major reason for the increase in the retained earnings

is the increase in the amount of the revenue more than the ones that are expensed out and

when the income is readily steady. The Retained profits of the Wesfarmers are $1509 and

$3797 in case of the Woolworths (Wesfarmers, 2017).

II)

Running Head: CORPORATE ACCOUNTING

Comparative Analysis

The comparative analysis of the shareholder equity will eventually give the company an

analysis of the fact that how much portion of the share and the debt for the part of the capital

structure and the funds which are invested by the investors and the shareholders (Campbell,

2015). The data presented in the report id of the past three years and in case of the

Wesfarmers and the Woolworths the share capital of both the companies has increased

overall from $22949 to $23941 and $8781.9 to $9876.21 respectively (Wesfarmers, 2018).

Cash flow statements

Operating Activities

Operating activities fall under the category of the direct activities which have been a part of

the business right from the start. In simpler words the ordinary activities are basically those

activities which are associated with the supply of the goods and services to the market. The

core activities such as procurement of the raw materials and the distribution and marketing

are certain examples of the operating activities (McInnis, Yu and Yust, 2018).

III)

Funds from operations

In the cash flow statement the amount form the funds from the operations the are used by the

real estate investment trusts mainly represent the cash flow from the different and variety of

the areas. The FFO is calculated by subtracting the profit on sale and the addition of the

depreciation value (Talebnia, Jaberzadeh and Salehi, 2015).

Changes in the Working Capital

The working capital is basically the difference between the assets and the liabilities of the

current nature. A change in the figure of the working capital reflects the decision making

Comparative Analysis

The comparative analysis of the shareholder equity will eventually give the company an

analysis of the fact that how much portion of the share and the debt for the part of the capital

structure and the funds which are invested by the investors and the shareholders (Campbell,

2015). The data presented in the report id of the past three years and in case of the

Wesfarmers and the Woolworths the share capital of both the companies has increased

overall from $22949 to $23941 and $8781.9 to $9876.21 respectively (Wesfarmers, 2018).

Cash flow statements

Operating Activities

Operating activities fall under the category of the direct activities which have been a part of

the business right from the start. In simpler words the ordinary activities are basically those

activities which are associated with the supply of the goods and services to the market. The

core activities such as procurement of the raw materials and the distribution and marketing

are certain examples of the operating activities (McInnis, Yu and Yust, 2018).

III)

Funds from operations

In the cash flow statement the amount form the funds from the operations the are used by the

real estate investment trusts mainly represent the cash flow from the different and variety of

the areas. The FFO is calculated by subtracting the profit on sale and the addition of the

depreciation value (Talebnia, Jaberzadeh and Salehi, 2015).

Changes in the Working Capital

The working capital is basically the difference between the assets and the liabilities of the

current nature. A change in the figure of the working capital reflects the decision making

Running Head: CORPORATE ACCOUNTING

capacity of the investors and therefore it is very important to analyse the cash flow statements

(Suzuki, 2015).

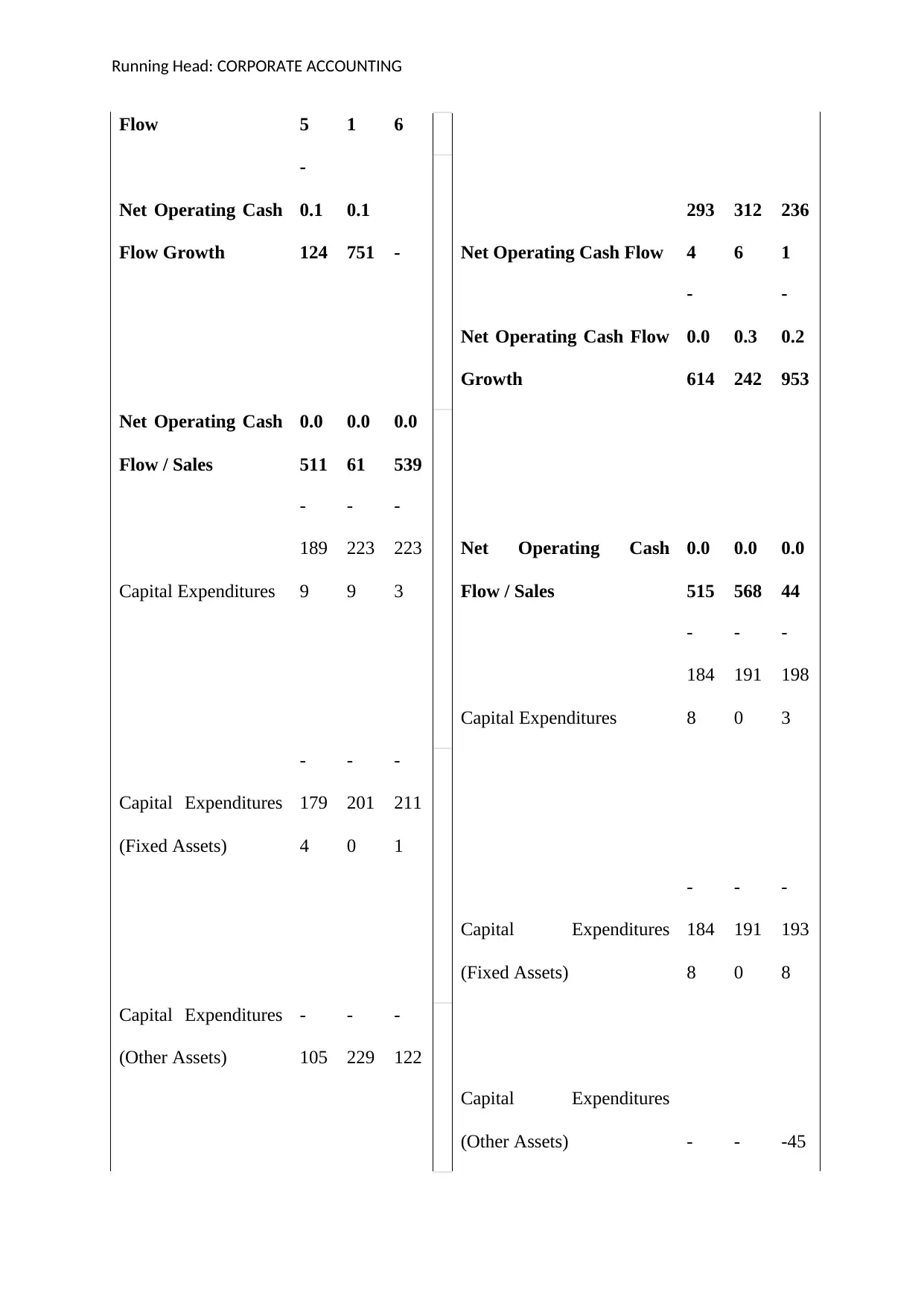

Net Operating Cash Flow

The net operating cash flow is the cash amount generated by the company to perform the

normal activities of the business. The operating cash flow indicates whether the company is

having the sufficient amount of the cash to maintain and grow its operations which may also

be required for the purpose of the external expansion (Weber, 2018).

Investing Activities

The investing activities are basically those activities which are represented in the cash flow

statement and report the aggregate change in the cash position of the company. The factors

that help in determining the same are purchase of the machinery of the equipment, the gain or

loss from the purchase of the investments and reflects the changes in the amount spent by the

owners (Agrawal and Cooper, 2017).

Capital Expenditures

The capital expenditure of the company are the expenditures that will provide the long term

benefits to the company and the benefits can be monetary as well as the non-monetary. The

capital expenditure of the Wesfarmers have increased from -229 to -105 whereas in case of

the Woolworths the same has been improved from -1910 to -1848 (Watson, 2015).

Net Assets from Acquisitions

The net assets from the acquisition is the basically the amount of the assets which have been

purchased by the company instead of the stock. The net assets will assist the investors and the

shareholders with the information of the net assets so that they can determine the amount of

the assets and utilise the same instead of the inventory (Manova, Wei and Zhang 2015).

capacity of the investors and therefore it is very important to analyse the cash flow statements

(Suzuki, 2015).

Net Operating Cash Flow

The net operating cash flow is the cash amount generated by the company to perform the

normal activities of the business. The operating cash flow indicates whether the company is

having the sufficient amount of the cash to maintain and grow its operations which may also

be required for the purpose of the external expansion (Weber, 2018).

Investing Activities

The investing activities are basically those activities which are represented in the cash flow

statement and report the aggregate change in the cash position of the company. The factors

that help in determining the same are purchase of the machinery of the equipment, the gain or

loss from the purchase of the investments and reflects the changes in the amount spent by the

owners (Agrawal and Cooper, 2017).

Capital Expenditures

The capital expenditure of the company are the expenditures that will provide the long term

benefits to the company and the benefits can be monetary as well as the non-monetary. The

capital expenditure of the Wesfarmers have increased from -229 to -105 whereas in case of

the Woolworths the same has been improved from -1910 to -1848 (Watson, 2015).

Net Assets from Acquisitions

The net assets from the acquisition is the basically the amount of the assets which have been

purchased by the company instead of the stock. The net assets will assist the investors and the

shareholders with the information of the net assets so that they can determine the amount of

the assets and utilise the same instead of the inventory (Manova, Wei and Zhang 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running Head: CORPORATE ACCOUNTING

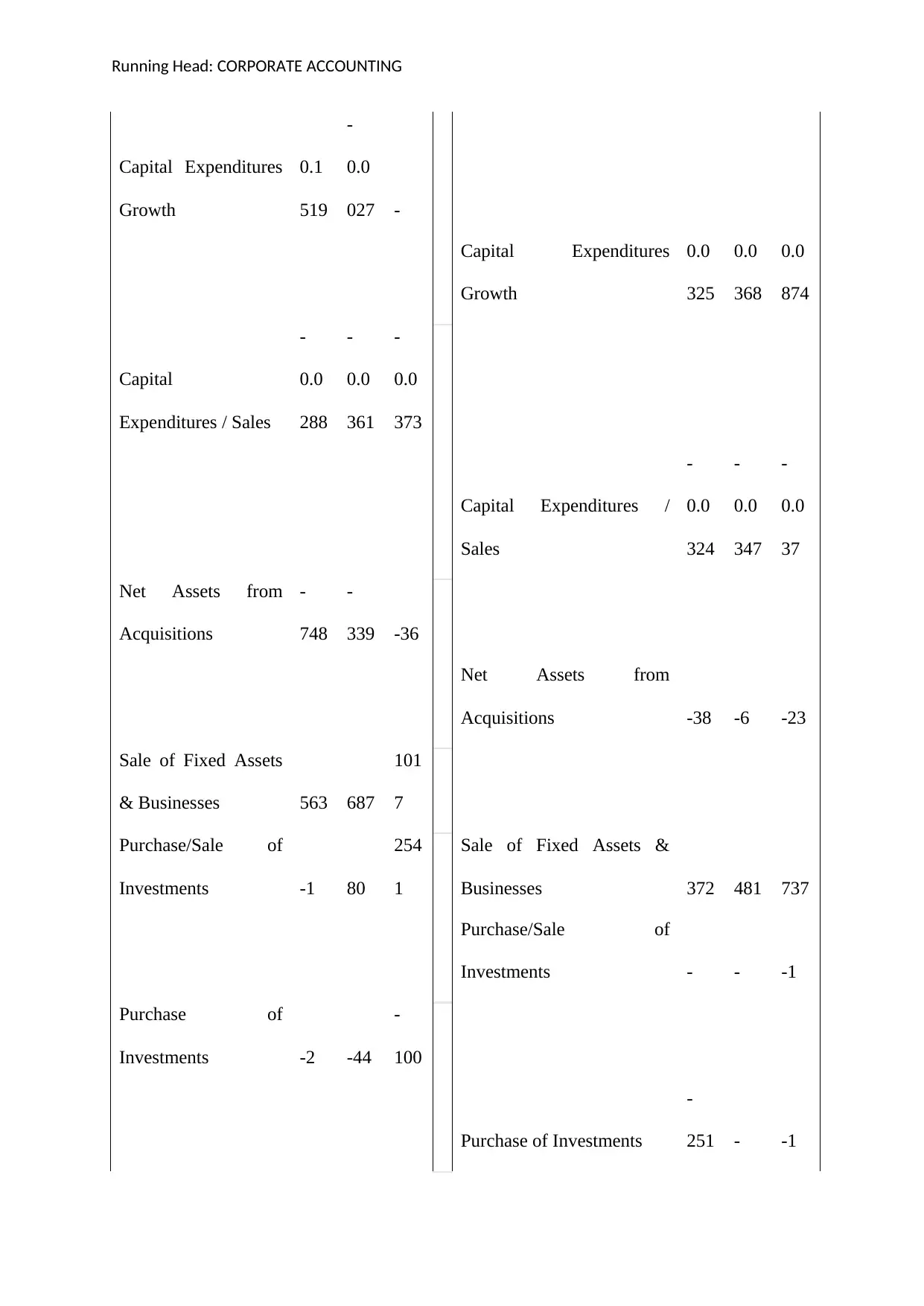

Sale of Fixed Assets & Businesses

The sale of the fixed assets is necessary and this is an item of the investing activity. The

amount received from the sale of the fixed assets is a kind of an income for the company.

Under the sale of the fixed assets it also involves the transfer of the business and the

possession of the asset to another party (Ehrhardt and Brigham, 2016).

Purchase/Sale of Investments

Any change in the amount of the cash which is occurring due to the change in the purchase

and sale of investments fall under the category of the investing activities. The investments are

an assets which are taken for the purpose of securing the company if the company goes

cashless. The right market price will fetch the right amount of the revenue in return (Borio

and Disyatat, 2015).

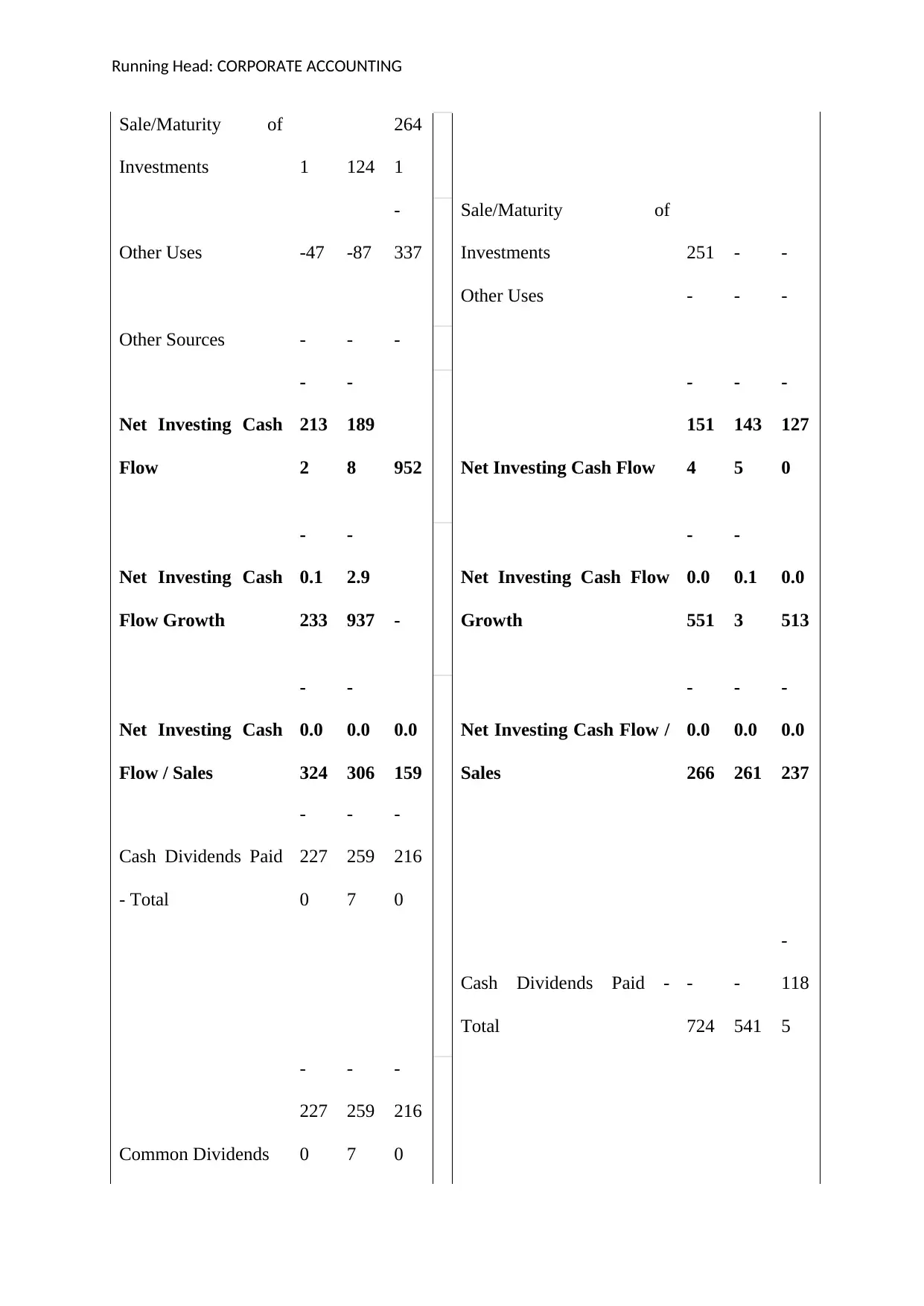

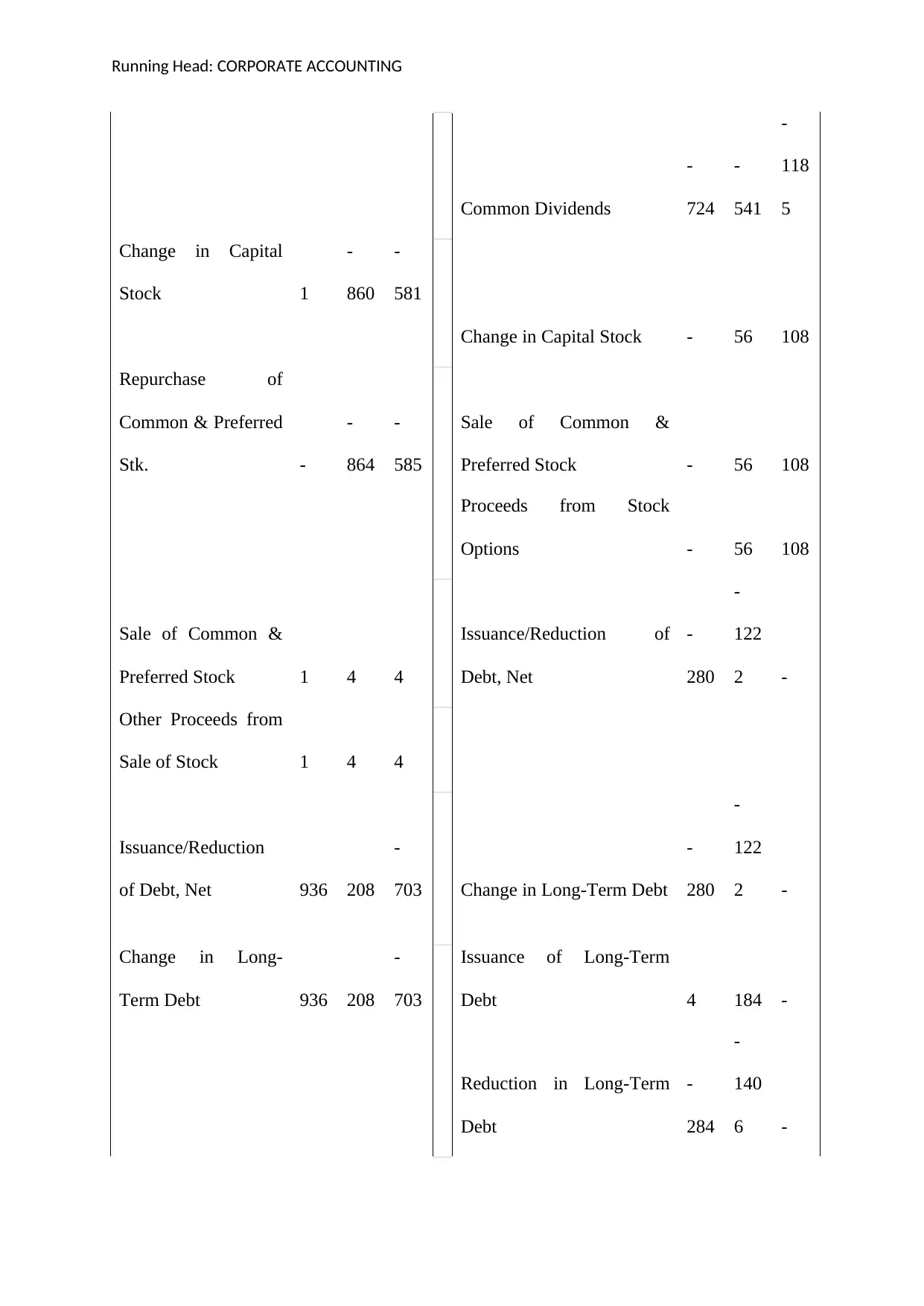

Financing Activities

Financing activities are those activities which can be found in the cash flow statements that

typically accounts for the external activities. It enables the firm to raise the capital. In

addition to the raising of the capital the financing activities also involve in the process of the

repaying the investors, issuance of more stock, and the addition and disbursement of loans are

also some of the examples that fall under the umbrella of the financing activities.

Cash Dividends

Cash dividend is the amount which is paid to the stockholders, normally from the current

earnings or the accumulated profits of the company. Not all companies are in favour of

payment of the dividend. The decision of the dividend is taken by the board of the directors in

lieu of whether the dividend is necessary or not (Firth, Gao, Shen and Zhang, 2016).

Common Dividend

Sale of Fixed Assets & Businesses

The sale of the fixed assets is necessary and this is an item of the investing activity. The

amount received from the sale of the fixed assets is a kind of an income for the company.

Under the sale of the fixed assets it also involves the transfer of the business and the

possession of the asset to another party (Ehrhardt and Brigham, 2016).

Purchase/Sale of Investments

Any change in the amount of the cash which is occurring due to the change in the purchase

and sale of investments fall under the category of the investing activities. The investments are

an assets which are taken for the purpose of securing the company if the company goes

cashless. The right market price will fetch the right amount of the revenue in return (Borio

and Disyatat, 2015).

Financing Activities

Financing activities are those activities which can be found in the cash flow statements that

typically accounts for the external activities. It enables the firm to raise the capital. In

addition to the raising of the capital the financing activities also involve in the process of the

repaying the investors, issuance of more stock, and the addition and disbursement of loans are

also some of the examples that fall under the umbrella of the financing activities.

Cash Dividends

Cash dividend is the amount which is paid to the stockholders, normally from the current

earnings or the accumulated profits of the company. Not all companies are in favour of

payment of the dividend. The decision of the dividend is taken by the board of the directors in

lieu of whether the dividend is necessary or not (Firth, Gao, Shen and Zhang, 2016).

Common Dividend

Running Head: CORPORATE ACCOUNTING

A common stock dividend is the dividend is the amount paid to the common shareholders and

the stockholders out of the normal profits incurred by the company. Under the scenario of the

common dividends the method of the payment is either in the form of cash or stock. The

dividend decides the reward associated with it. The higher the dividend, higher will be the

reward. Therefore it can be inferred that there is a direct relationship between the dividend

and the reward (Amess, Stiebale and Wright, 2016).

A common stock dividend is the dividend is the amount paid to the common shareholders and

the stockholders out of the normal profits incurred by the company. Under the scenario of the

common dividends the method of the payment is either in the form of cash or stock. The

dividend decides the reward associated with it. The higher the dividend, higher will be the

reward. Therefore it can be inferred that there is a direct relationship between the dividend

and the reward (Amess, Stiebale and Wright, 2016).

Running Head: CORPORATE ACCOUNTING

Long term debt

Having too much of the debt reduces the flexibility of the operations and reducing the long

run can help a business proceed it in a long run. Long term is cumulatively inclusive of the

borrowings and the payments. The prospective analysts are also interested in the debt

component to gain an understanding the debt position of the company and whether it is able

to pay back its debts on time utilising the income and assets.

Net Change in Cash

The net change in cash determines the rise and fall of the cash and the cash equivalents in the

period of one financial year. the net change is calculated on the basis of all the adjustments

made in the cash flow from different activities such as ordinary, investing and the financing.

Free Cash Flow

The free cash flow is a kind of a metric that depicts the ability of the company to generate the

cash after paying off all the capital expense such as the buildings or the equipment. Once the

cash is generated it can be sued for the various purposes such as the expansion, reduction of

the debt by repayment and for other purposes as well such as tax payment (Free cash flow,

2017).

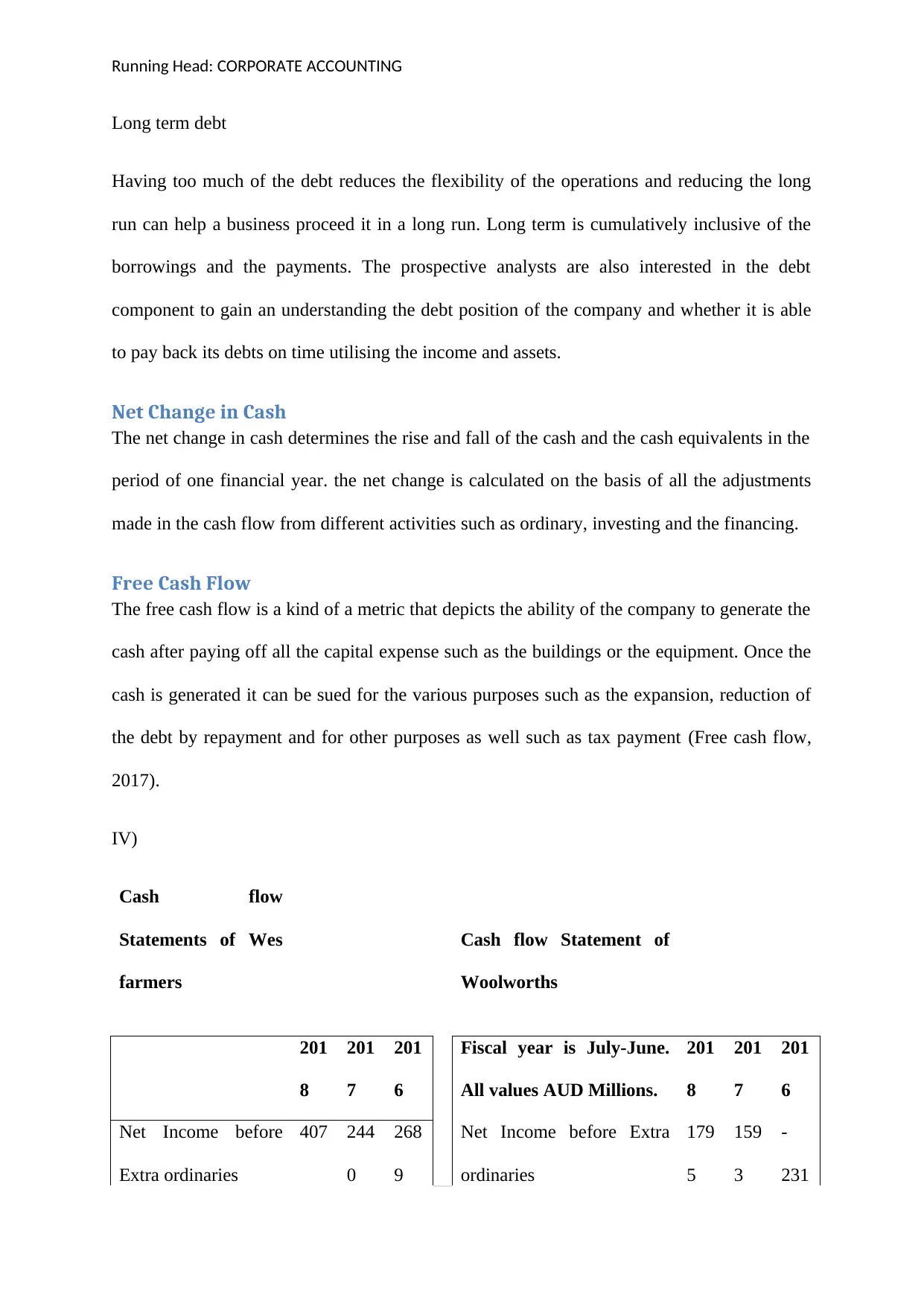

IV)

Cash flow

Statements of Wes

farmers

Cash flow Statement of

Woolworths

201

8

201

7

201

6

Fiscal year is July-June.

All values AUD Millions.

201

8

201

7

201

6

Net Income before

Extra ordinaries

407 244

0

268

9

Net Income before Extra

ordinaries

179

5

159

3

-

231

Long term debt

Having too much of the debt reduces the flexibility of the operations and reducing the long

run can help a business proceed it in a long run. Long term is cumulatively inclusive of the

borrowings and the payments. The prospective analysts are also interested in the debt

component to gain an understanding the debt position of the company and whether it is able

to pay back its debts on time utilising the income and assets.

Net Change in Cash

The net change in cash determines the rise and fall of the cash and the cash equivalents in the

period of one financial year. the net change is calculated on the basis of all the adjustments

made in the cash flow from different activities such as ordinary, investing and the financing.

Free Cash Flow

The free cash flow is a kind of a metric that depicts the ability of the company to generate the

cash after paying off all the capital expense such as the buildings or the equipment. Once the

cash is generated it can be sued for the various purposes such as the expansion, reduction of

the debt by repayment and for other purposes as well such as tax payment (Free cash flow,

2017).

IV)

Cash flow

Statements of Wes

farmers

Cash flow Statement of

Woolworths

201

8

201

7

201

6

Fiscal year is July-June.

All values AUD Millions.

201

8

201

7

201

6

Net Income before

Extra ordinaries

407 244

0

268

9

Net Income before Extra

ordinaries

179

5

159

3

-

231

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Running Head: CORPORATE ACCOUNTING

1

Net Income Growth

-

0.8

332

-

0.0

926 -

Net Income Growth

0.1

268

1.6

892

-

2.0

814

Depreciation,

Depletion &

Amortization

129

6

121

9

112

3

Depreciation and

Depletion

116

2

110

1

103

3

Depreciation, Depletion &

Amortization

110

3

106

1

107

6

Amortization of

Intangible Assets 134 118 90 Depreciation and Depletion

108

5

104

3

105

3

Deferred Taxes &

Investment Tax

Credit

-

347 6 -40

Amortization of Intangible

Assets 18 18 23

Deferred Taxes &

Investment Tax Credit 98 122

-

362

Deferred Taxes

-

347 6 -40

Deferred Taxes 98 122

-

362

Other Funds

217

9 11

-

350

1

Net Income Growth

-

0.8

332

-

0.0

926 -

Net Income Growth

0.1

268

1.6

892

-

2.0

814

Depreciation,

Depletion &

Amortization

129

6

121

9

112

3

Depreciation and

Depletion

116

2

110

1

103

3

Depreciation, Depletion &

Amortization

110

3

106

1

107

6

Amortization of

Intangible Assets 134 118 90 Depreciation and Depletion

108

5

104

3

105

3

Deferred Taxes &

Investment Tax

Credit

-

347 6 -40

Amortization of Intangible

Assets 18 18 23

Deferred Taxes &

Investment Tax Credit 98 122

-

362

Deferred Taxes

-

347 6 -40

Deferred Taxes 98 122

-

362

Other Funds

217

9 11

-

350

Running Head: CORPORATE ACCOUNTING

Other Funds -52 362

207

5

Funds from

Operations

353

5

367

6

342

2

Changes in Working

Capital

-

170 115

-

196 Funds from Operations

294

4

313

8 477

Changes in Working

Capital -10 -12

188

4

Receivables -12 17 54

Receivables

-

142 3 29

Inventories

-

444

-

128

-

266

Inventories -60 305 204

Accounts Payable 259 219 -91

Accounts Payable 129 323

-

172

Income Taxes

Payable -31

-

106 -35

Income Taxes Payable 28 45 -60

Other

Assets/Liabilities 58 113 142

Other Assets/Liabilities 35

-

688

188

2

Net Operating Cash 336 379 322

Other Funds -52 362

207

5

Funds from

Operations

353

5

367

6

342

2

Changes in Working

Capital

-

170 115

-

196 Funds from Operations

294

4

313

8 477

Changes in Working

Capital -10 -12

188

4

Receivables -12 17 54

Receivables

-

142 3 29

Inventories

-

444

-

128

-

266

Inventories -60 305 204

Accounts Payable 259 219 -91

Accounts Payable 129 323

-

172

Income Taxes

Payable -31

-

106 -35

Income Taxes Payable 28 45 -60

Other

Assets/Liabilities 58 113 142

Other Assets/Liabilities 35

-

688

188

2

Net Operating Cash 336 379 322

Running Head: CORPORATE ACCOUNTING

Flow 5 1 6

Net Operating Cash

Flow Growth

-

0.1

124

0.1

751 - Net Operating Cash Flow

293

4

312

6

236

1

Net Operating Cash Flow

Growth

-

0.0

614

0.3

242

-

0.2

953

Net Operating Cash

Flow / Sales

0.0

511

0.0

61

0.0

539

Capital Expenditures

-

189

9

-

223

9

-

223

3

Net Operating Cash

Flow / Sales

0.0

515

0.0

568

0.0

44

Capital Expenditures

-

184

8

-

191

0

-

198

3

Capital Expenditures

(Fixed Assets)

-

179

4

-

201

0

-

211

1

Capital Expenditures

(Fixed Assets)

-

184

8

-

191

0

-

193

8

Capital Expenditures

(Other Assets)

-

105

-

229

-

122

Capital Expenditures

(Other Assets) - - -45

Flow 5 1 6

Net Operating Cash

Flow Growth

-

0.1

124

0.1

751 - Net Operating Cash Flow

293

4

312

6

236

1

Net Operating Cash Flow

Growth

-

0.0

614

0.3

242

-

0.2

953

Net Operating Cash

Flow / Sales

0.0

511

0.0

61

0.0

539

Capital Expenditures

-

189

9

-

223

9

-

223

3

Net Operating Cash

Flow / Sales

0.0

515

0.0

568

0.0

44

Capital Expenditures

-

184

8

-

191

0

-

198

3

Capital Expenditures

(Fixed Assets)

-

179

4

-

201

0

-

211

1

Capital Expenditures

(Fixed Assets)

-

184

8

-

191

0

-

193

8

Capital Expenditures

(Other Assets)

-

105

-

229

-

122

Capital Expenditures

(Other Assets) - - -45

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running Head: CORPORATE ACCOUNTING

Capital Expenditures

Growth

0.1

519

-

0.0

027 -

Capital Expenditures

Growth

0.0

325

0.0

368

0.0

874

Capital

Expenditures / Sales

-

0.0

288

-

0.0

361

-

0.0

373

Capital Expenditures /

Sales

-

0.0

324

-

0.0

347

-

0.0

37

Net Assets from

Acquisitions

-

748

-

339 -36

Net Assets from

Acquisitions -38 -6 -23

Sale of Fixed Assets

& Businesses 563 687

101

7

Purchase/Sale of

Investments -1 80

254

1

Sale of Fixed Assets &

Businesses 372 481 737

Purchase/Sale of

Investments - - -1

Purchase of

Investments -2 -44

-

100

Purchase of Investments

-

251 - -1

Capital Expenditures

Growth

0.1

519

-

0.0

027 -

Capital Expenditures

Growth

0.0

325

0.0

368

0.0

874

Capital

Expenditures / Sales

-

0.0

288

-

0.0

361

-

0.0

373

Capital Expenditures /

Sales

-

0.0

324

-

0.0

347

-

0.0

37

Net Assets from

Acquisitions

-

748

-

339 -36

Net Assets from

Acquisitions -38 -6 -23

Sale of Fixed Assets

& Businesses 563 687

101

7

Purchase/Sale of

Investments -1 80

254

1

Sale of Fixed Assets &

Businesses 372 481 737

Purchase/Sale of

Investments - - -1

Purchase of

Investments -2 -44

-

100

Purchase of Investments

-

251 - -1

Running Head: CORPORATE ACCOUNTING

Sale/Maturity of

Investments 1 124

264

1

Other Uses -47 -87

-

337

Sale/Maturity of

Investments 251 - -

Other Uses - - -

Other Sources - - -

Net Investing Cash

Flow

-

213

2

-

189

8 952 Net Investing Cash Flow

-

151

4

-

143

5

-

127

0

Net Investing Cash

Flow Growth

-

0.1

233

-

2.9

937 -

Net Investing Cash Flow

Growth

-

0.0

551

-

0.1

3

0.0

513

Net Investing Cash

Flow / Sales

-

0.0

324

-

0.0

306

0.0

159

Net Investing Cash Flow /

Sales

-

0.0

266

-

0.0

261

-

0.0

237

Cash Dividends Paid

- Total

-

227

0

-

259

7

-

216

0

Cash Dividends Paid -

Total

-

724

-

541

-

118

5

Common Dividends

-

227

0

-

259

7

-

216

0

Sale/Maturity of

Investments 1 124

264

1

Other Uses -47 -87

-

337

Sale/Maturity of

Investments 251 - -

Other Uses - - -

Other Sources - - -

Net Investing Cash

Flow

-

213

2

-

189

8 952 Net Investing Cash Flow

-

151

4

-

143

5

-

127

0

Net Investing Cash

Flow Growth

-

0.1

233

-

2.9

937 -

Net Investing Cash Flow

Growth

-

0.0

551

-

0.1

3

0.0

513

Net Investing Cash

Flow / Sales

-

0.0

324

-

0.0

306

0.0

159

Net Investing Cash Flow /

Sales

-

0.0

266

-

0.0

261

-

0.0

237

Cash Dividends Paid

- Total

-

227

0

-

259

7

-

216

0

Cash Dividends Paid -

Total

-

724

-

541

-

118

5

Common Dividends

-

227

0

-

259

7

-

216

0

Running Head: CORPORATE ACCOUNTING

Common Dividends

-

724

-

541

-

118

5

Change in Capital

Stock 1

-

860

-

581

Change in Capital Stock - 56 108

Repurchase of

Common & Preferred

Stk. -

-

864

-

585

Sale of Common &

Preferred Stock - 56 108

Proceeds from Stock

Options - 56 108

Sale of Common &

Preferred Stock 1 4 4

Issuance/Reduction of

Debt, Net

-

280

-

122

2 -

Other Proceeds from

Sale of Stock 1 4 4

Issuance/Reduction

of Debt, Net 936 208

-

703 Change in Long-Term Debt

-

280

-

122

2 -

Change in Long-

Term Debt 936 208

-

703

Issuance of Long-Term

Debt 4 184 -

Reduction in Long-Term

Debt

-

284

-

140

6 -

Common Dividends

-

724

-

541

-

118

5

Change in Capital

Stock 1

-

860

-

581

Change in Capital Stock - 56 108

Repurchase of

Common & Preferred

Stk. -

-

864

-

585

Sale of Common &

Preferred Stock - 56 108

Proceeds from Stock

Options - 56 108

Sale of Common &

Preferred Stock 1 4 4

Issuance/Reduction of

Debt, Net

-

280

-

122

2 -

Other Proceeds from

Sale of Stock 1 4 4

Issuance/Reduction

of Debt, Net 936 208

-

703 Change in Long-Term Debt

-

280

-

122

2 -

Change in Long-

Term Debt 936 208

-

703

Issuance of Long-Term

Debt 4 184 -

Reduction in Long-Term

Debt

-

284

-

140

6 -

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Running Head: CORPORATE ACCOUNTING

Issuance of Long-

Term Debt

236

0 930 888

Reduction in Long-

Term Debt

-

142

4

-

722

-

159

1 Other Funds -56 -22 -32

Other Funds - - - Other Uses -56 -22 -32

Other Uses - - - Net Financing Cash Flow

-

106

0

-

172

9

-

147

5

Net Financing Cash

Flow

-

133

3

-

324

9

-

344

4

Net Financing Cash Flow

Growth

0.3

869

-

0.1

723

0.0

844

Net Financing Cash

Flow Growth

0.5

897

0.0

566 -

Net Financing Cash

Flow / Sales

-

0.0

186

-

0.0

314

-

0.0

275

Net Financing Cash

Flow / Sales

-

0.0

202

-

0.0

523

-

0.0

575 Exchange Rate Effect - -1 7

Net Change in Cash

-

100

-

135

6 734 Net Change in Cash 360 -39

-

377

Issuance of Long-

Term Debt

236

0 930 888

Reduction in Long-

Term Debt

-

142

4

-

722

-

159

1 Other Funds -56 -22 -32

Other Funds - - - Other Uses -56 -22 -32

Other Uses - - - Net Financing Cash Flow

-

106

0

-

172

9

-

147

5

Net Financing Cash

Flow

-

133

3

-

324

9

-

344

4

Net Financing Cash Flow

Growth

0.3

869

-

0.1

723

0.0

844

Net Financing Cash

Flow Growth

0.5

897

0.0

566 -

Net Financing Cash

Flow / Sales

-

0.0

186

-

0.0

314

-

0.0

275

Net Financing Cash

Flow / Sales

-

0.0

202

-

0.0

523

-

0.0

575 Exchange Rate Effect - -1 7

Net Change in Cash

-

100

-

135

6 734 Net Change in Cash 360 -39

-

377

Running Head: CORPORATE ACCOUNTING

Free Cash Flow

157

1

178

1

111

5 Free Cash Flow

108

6

121

6 422

Free Cash Flow

Growth

-

0.1

179

0.5

973 - Free Cash Flow Growth

-

0.1

069

1.8

788

-

0.6

534

Free Cash Flow

Yield - - - Free Cash Flow Yield

0.0

093 - -

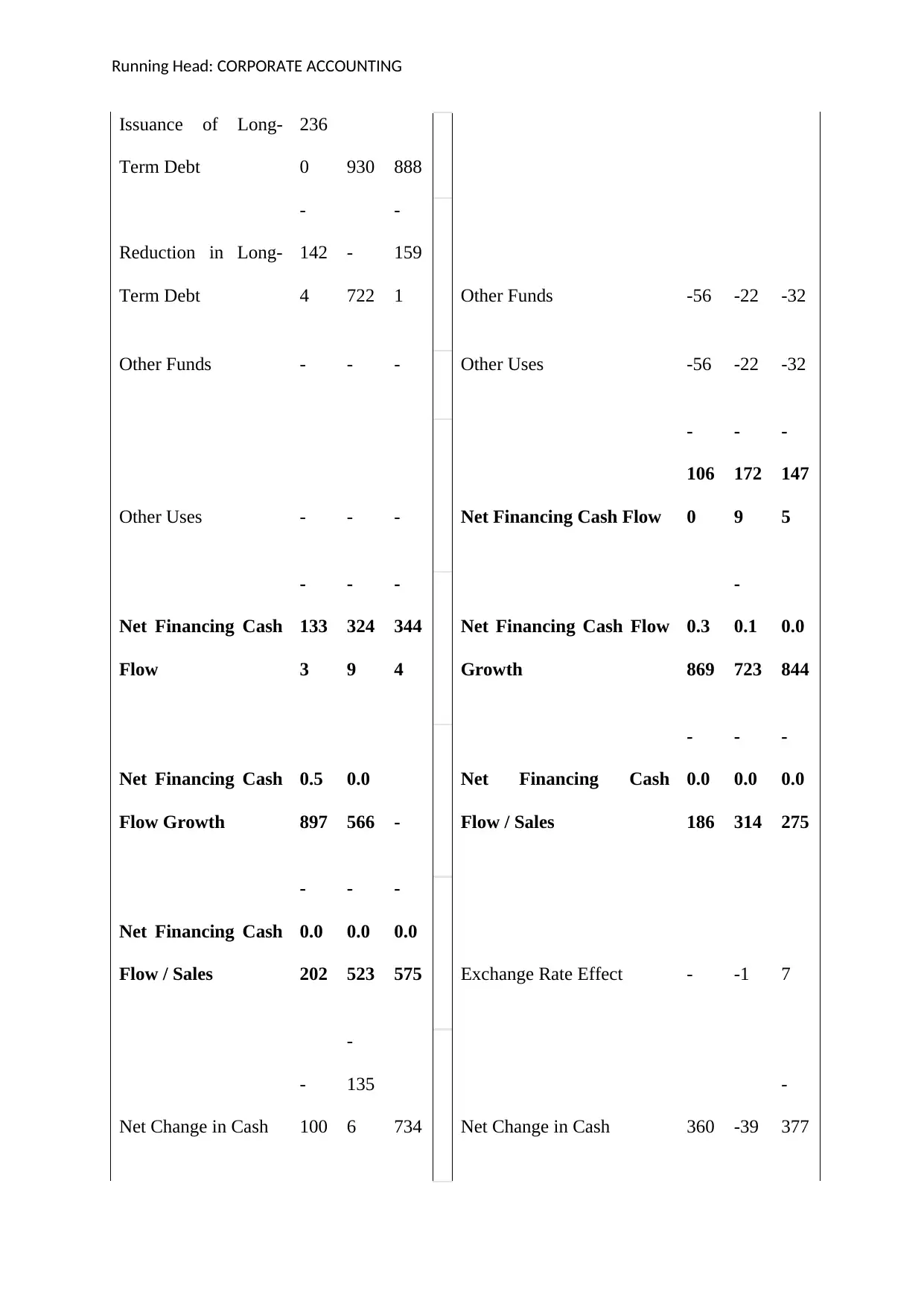

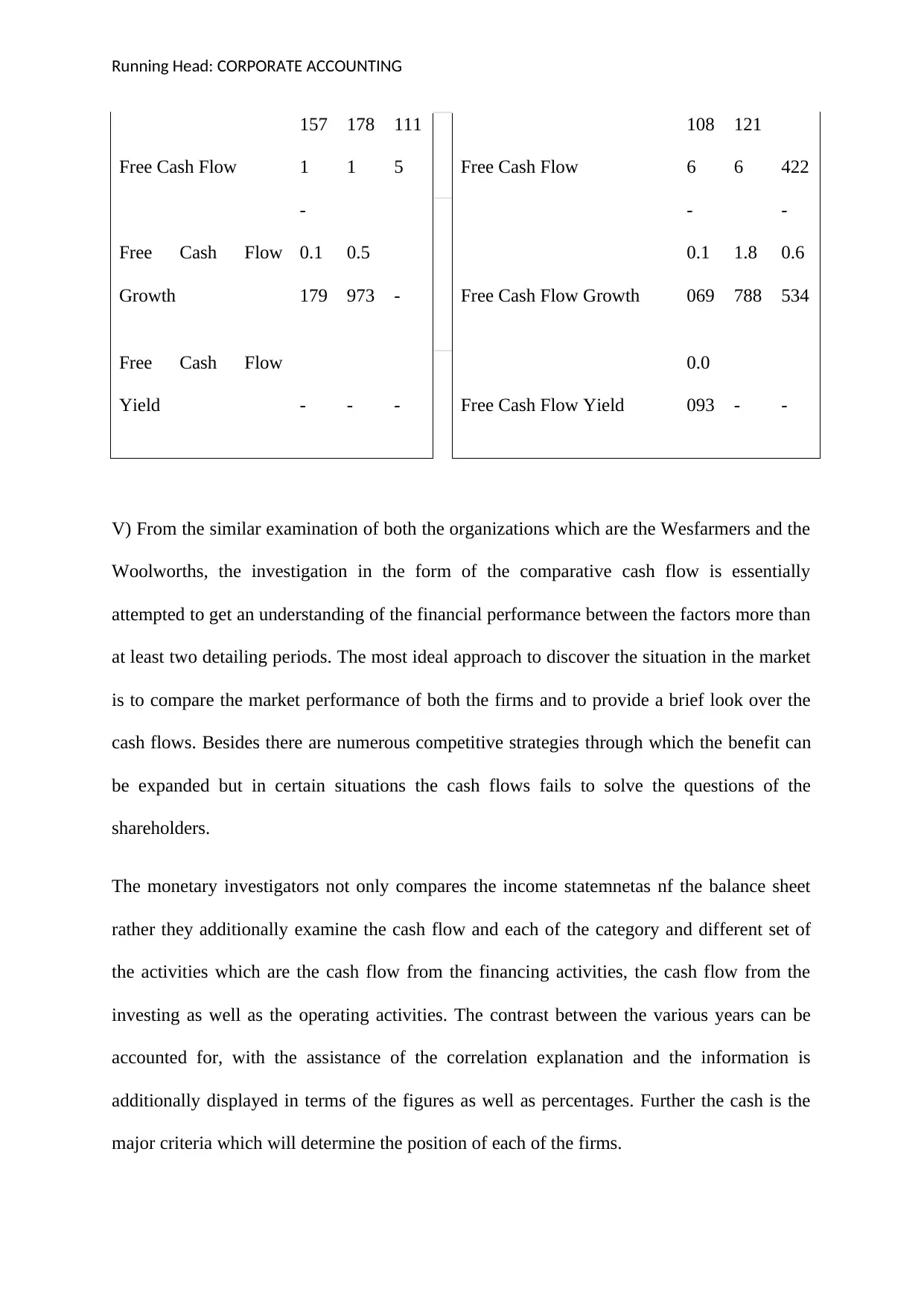

V) From the similar examination of both the organizations which are the Wesfarmers and the

Woolworths, the investigation in the form of the comparative cash flow is essentially

attempted to get an understanding of the financial performance between the factors more than

at least two detailing periods. The most ideal approach to discover the situation in the market

is to compare the market performance of both the firms and to provide a brief look over the

cash flows. Besides there are numerous competitive strategies through which the benefit can

be expanded but in certain situations the cash flows fails to solve the questions of the

shareholders.

The monetary investigators not only compares the income statemnetas nf the balance sheet

rather they additionally examine the cash flow and each of the category and different set of

the activities which are the cash flow from the financing activities, the cash flow from the

investing as well as the operating activities. The contrast between the various years can be

accounted for, with the assistance of the correlation explanation and the information is

additionally displayed in terms of the figures as well as percentages. Further the cash is the

major criteria which will determine the position of each of the firms.

Free Cash Flow

157

1

178

1

111

5 Free Cash Flow

108

6

121

6 422

Free Cash Flow

Growth

-

0.1

179

0.5

973 - Free Cash Flow Growth

-

0.1

069

1.8

788

-

0.6

534

Free Cash Flow

Yield - - - Free Cash Flow Yield

0.0

093 - -

V) From the similar examination of both the organizations which are the Wesfarmers and the

Woolworths, the investigation in the form of the comparative cash flow is essentially

attempted to get an understanding of the financial performance between the factors more than

at least two detailing periods. The most ideal approach to discover the situation in the market

is to compare the market performance of both the firms and to provide a brief look over the

cash flows. Besides there are numerous competitive strategies through which the benefit can

be expanded but in certain situations the cash flows fails to solve the questions of the

shareholders.

The monetary investigators not only compares the income statemnetas nf the balance sheet

rather they additionally examine the cash flow and each of the category and different set of

the activities which are the cash flow from the financing activities, the cash flow from the

investing as well as the operating activities. The contrast between the various years can be

accounted for, with the assistance of the correlation explanation and the information is

additionally displayed in terms of the figures as well as percentages. Further the cash is the

major criteria which will determine the position of each of the firms.

Running Head: CORPORATE ACCOUNTING

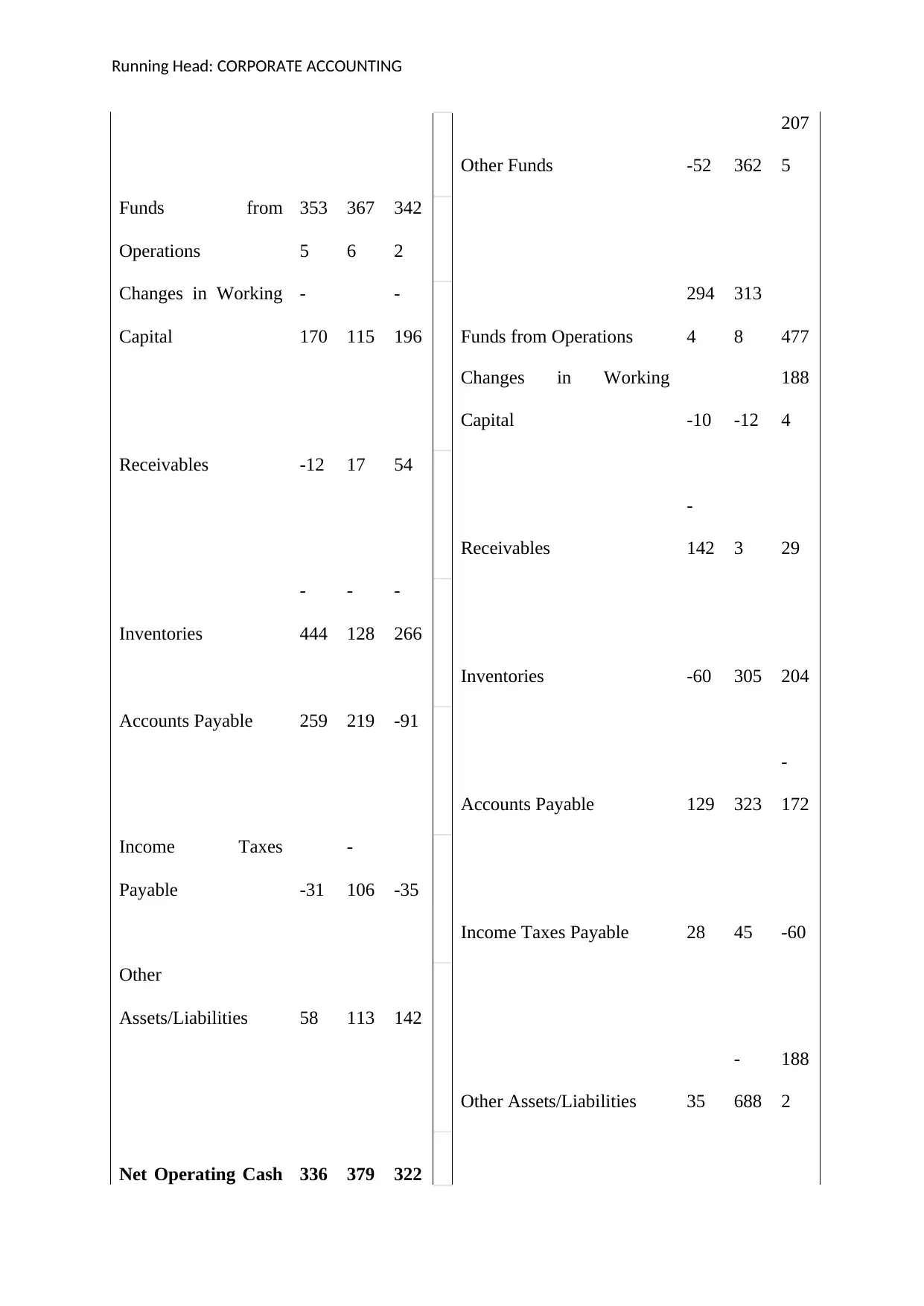

From the above comparison it can be stated that the cash flow statements of both the Wes

farmers and the Woolworths are reported for the period of the three years and it can be

interpreted that in case of the net cash the Woolworths have performed better but the firm is

not having enough free cash flows left and the situation is vice versa in case of the

Wesfarmers.

The net cash flows from the operating activities in case of the Wesfarmers is 3365 and that of

the Woolworths 2934. The net cash from the investing activities is negative in case of the

Wesfarmers which is -2132 and in case of the competitive bank the same has been -1514

which is less risky (Wesfarmers, 2018). Lastly from the financing activities the amount

achieved is -1333 in case of the Wesfarmers and that of the Woolworths is -1060.

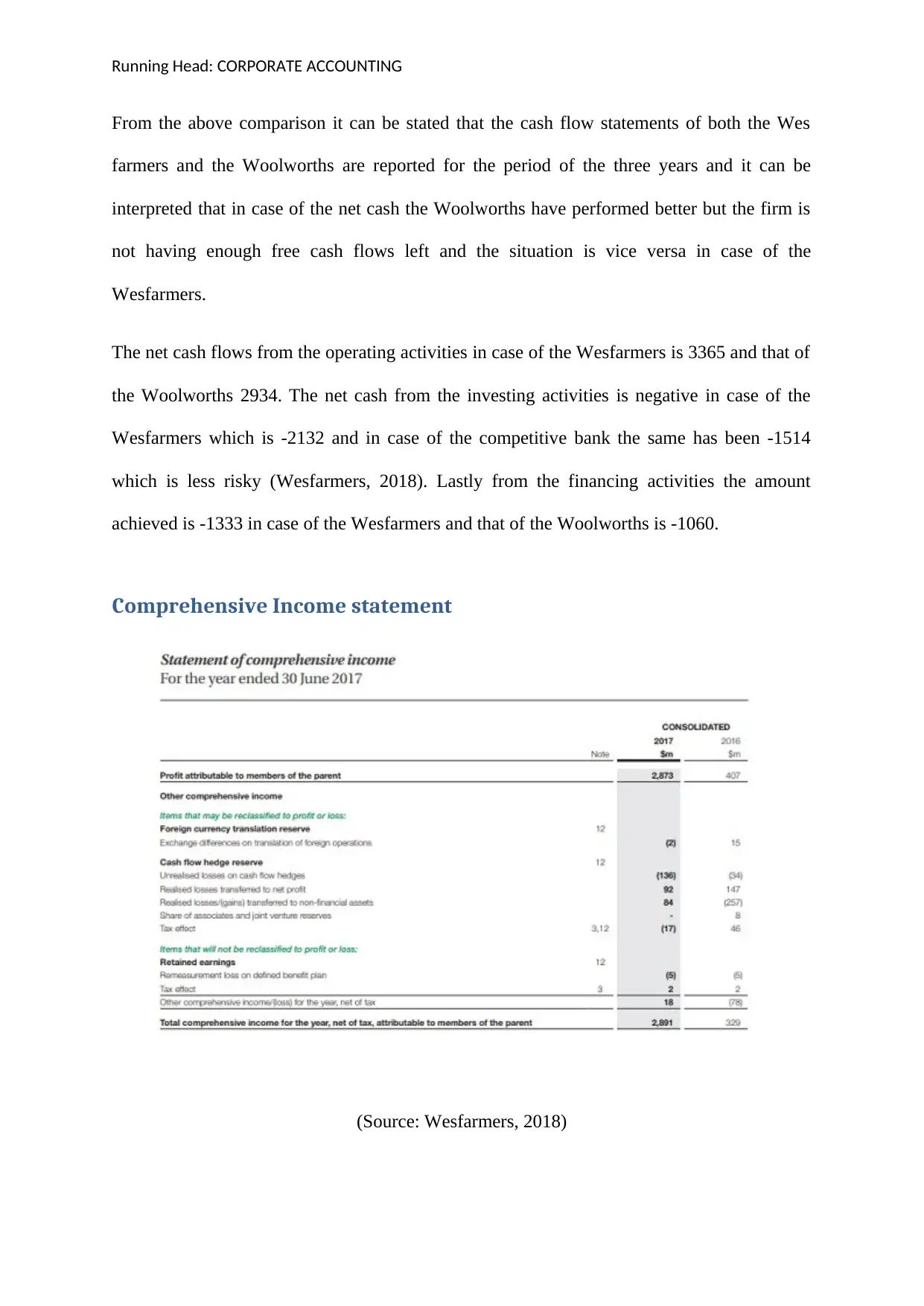

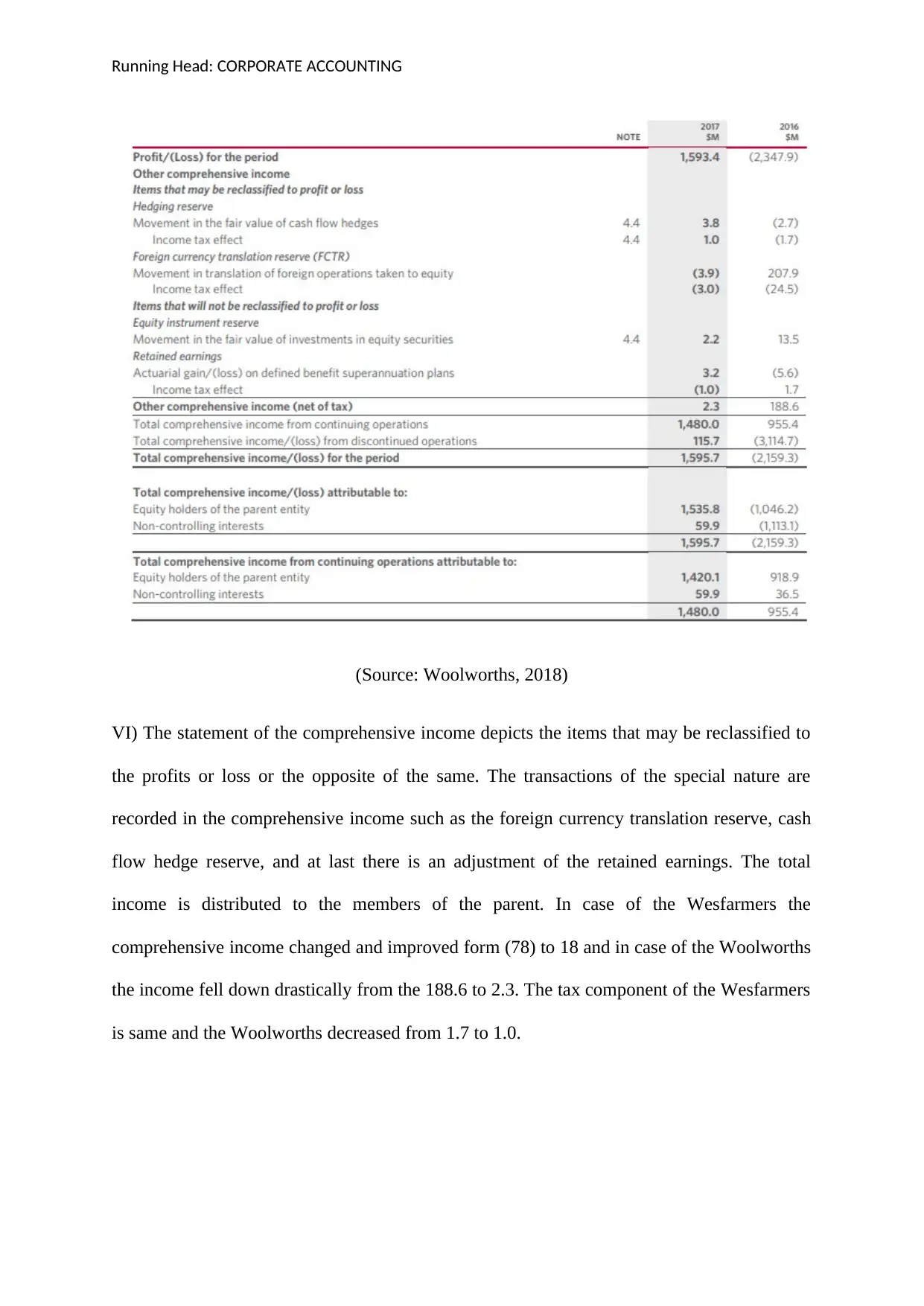

Comprehensive Income statement

(Source: Wesfarmers, 2018)

From the above comparison it can be stated that the cash flow statements of both the Wes

farmers and the Woolworths are reported for the period of the three years and it can be

interpreted that in case of the net cash the Woolworths have performed better but the firm is

not having enough free cash flows left and the situation is vice versa in case of the

Wesfarmers.

The net cash flows from the operating activities in case of the Wesfarmers is 3365 and that of

the Woolworths 2934. The net cash from the investing activities is negative in case of the

Wesfarmers which is -2132 and in case of the competitive bank the same has been -1514

which is less risky (Wesfarmers, 2018). Lastly from the financing activities the amount

achieved is -1333 in case of the Wesfarmers and that of the Woolworths is -1060.

Comprehensive Income statement

(Source: Wesfarmers, 2018)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running Head: CORPORATE ACCOUNTING

(Source: Woolworths, 2018)

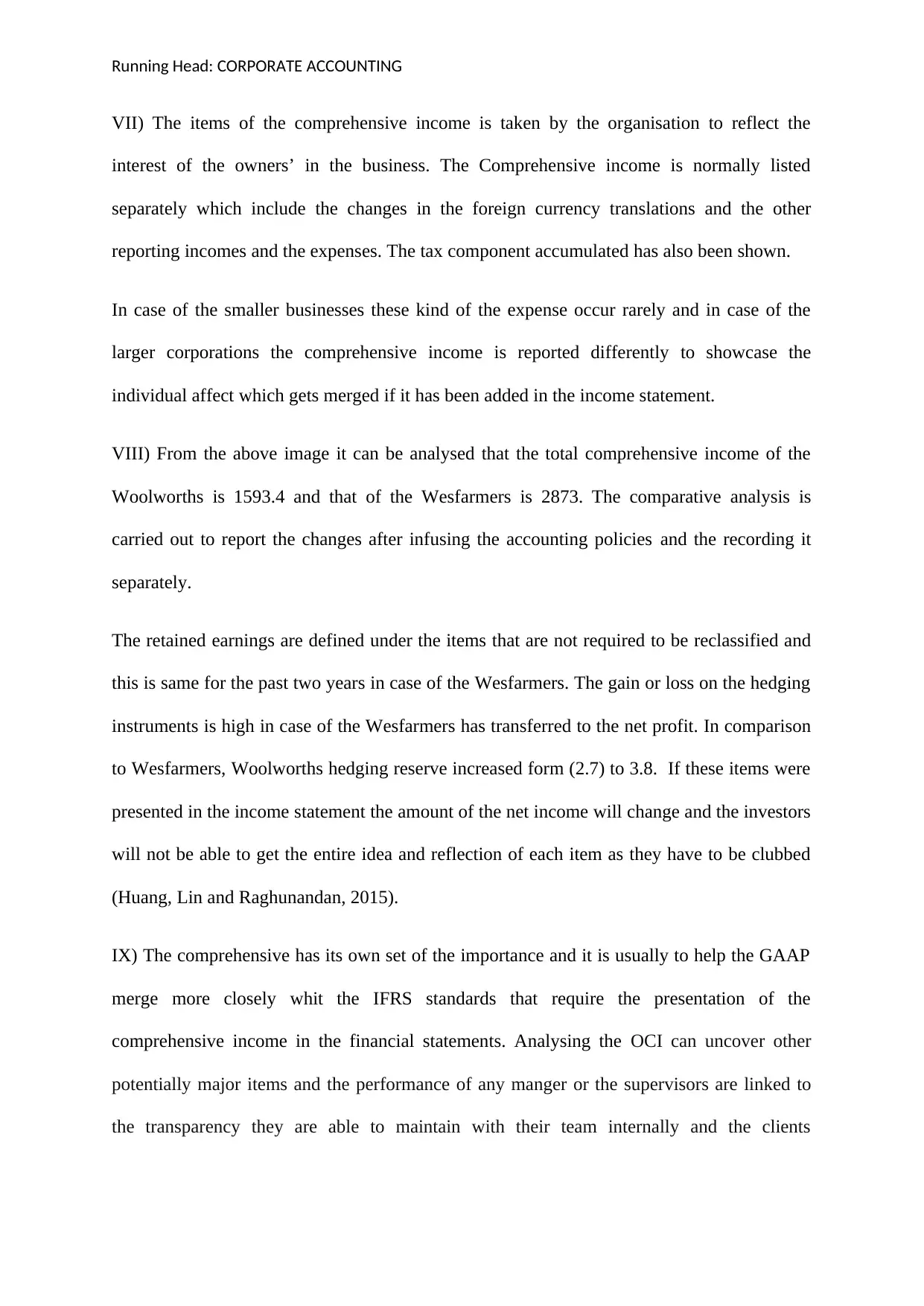

VI) The statement of the comprehensive income depicts the items that may be reclassified to

the profits or loss or the opposite of the same. The transactions of the special nature are

recorded in the comprehensive income such as the foreign currency translation reserve, cash

flow hedge reserve, and at last there is an adjustment of the retained earnings. The total

income is distributed to the members of the parent. In case of the Wesfarmers the

comprehensive income changed and improved form (78) to 18 and in case of the Woolworths

the income fell down drastically from the 188.6 to 2.3. The tax component of the Wesfarmers

is same and the Woolworths decreased from 1.7 to 1.0.

(Source: Woolworths, 2018)

VI) The statement of the comprehensive income depicts the items that may be reclassified to

the profits or loss or the opposite of the same. The transactions of the special nature are

recorded in the comprehensive income such as the foreign currency translation reserve, cash

flow hedge reserve, and at last there is an adjustment of the retained earnings. The total

income is distributed to the members of the parent. In case of the Wesfarmers the

comprehensive income changed and improved form (78) to 18 and in case of the Woolworths

the income fell down drastically from the 188.6 to 2.3. The tax component of the Wesfarmers

is same and the Woolworths decreased from 1.7 to 1.0.

Running Head: CORPORATE ACCOUNTING

VII) The items of the comprehensive income is taken by the organisation to reflect the

interest of the owners’ in the business. The Comprehensive income is normally listed

separately which include the changes in the foreign currency translations and the other

reporting incomes and the expenses. The tax component accumulated has also been shown.

In case of the smaller businesses these kind of the expense occur rarely and in case of the

larger corporations the comprehensive income is reported differently to showcase the

individual affect which gets merged if it has been added in the income statement.

VIII) From the above image it can be analysed that the total comprehensive income of the

Woolworths is 1593.4 and that of the Wesfarmers is 2873. The comparative analysis is

carried out to report the changes after infusing the accounting policies and the recording it

separately.

The retained earnings are defined under the items that are not required to be reclassified and

this is same for the past two years in case of the Wesfarmers. The gain or loss on the hedging

instruments is high in case of the Wesfarmers has transferred to the net profit. In comparison

to Wesfarmers, Woolworths hedging reserve increased form (2.7) to 3.8. If these items were

presented in the income statement the amount of the net income will change and the investors

will not be able to get the entire idea and reflection of each item as they have to be clubbed

(Huang, Lin and Raghunandan, 2015).

IX) The comprehensive has its own set of the importance and it is usually to help the GAAP

merge more closely whit the IFRS standards that require the presentation of the

comprehensive income in the financial statements. Analysing the OCI can uncover other

potentially major items and the performance of any manger or the supervisors are linked to

the transparency they are able to maintain with their team internally and the clients

VII) The items of the comprehensive income is taken by the organisation to reflect the

interest of the owners’ in the business. The Comprehensive income is normally listed

separately which include the changes in the foreign currency translations and the other

reporting incomes and the expenses. The tax component accumulated has also been shown.

In case of the smaller businesses these kind of the expense occur rarely and in case of the

larger corporations the comprehensive income is reported differently to showcase the

individual affect which gets merged if it has been added in the income statement.

VIII) From the above image it can be analysed that the total comprehensive income of the

Woolworths is 1593.4 and that of the Wesfarmers is 2873. The comparative analysis is

carried out to report the changes after infusing the accounting policies and the recording it

separately.

The retained earnings are defined under the items that are not required to be reclassified and

this is same for the past two years in case of the Wesfarmers. The gain or loss on the hedging

instruments is high in case of the Wesfarmers has transferred to the net profit. In comparison

to Wesfarmers, Woolworths hedging reserve increased form (2.7) to 3.8. If these items were

presented in the income statement the amount of the net income will change and the investors

will not be able to get the entire idea and reflection of each item as they have to be clubbed

(Huang, Lin and Raghunandan, 2015).

IX) The comprehensive has its own set of the importance and it is usually to help the GAAP

merge more closely whit the IFRS standards that require the presentation of the

comprehensive income in the financial statements. Analysing the OCI can uncover other

potentially major items and the performance of any manger or the supervisors are linked to

the transparency they are able to maintain with their team internally and the clients

Running Head: CORPORATE ACCOUNTING

externally. There is an indirect relation of the employee’s performance and henceforth, it is

important to recognise the OCI (Graham and Lin, 2018).

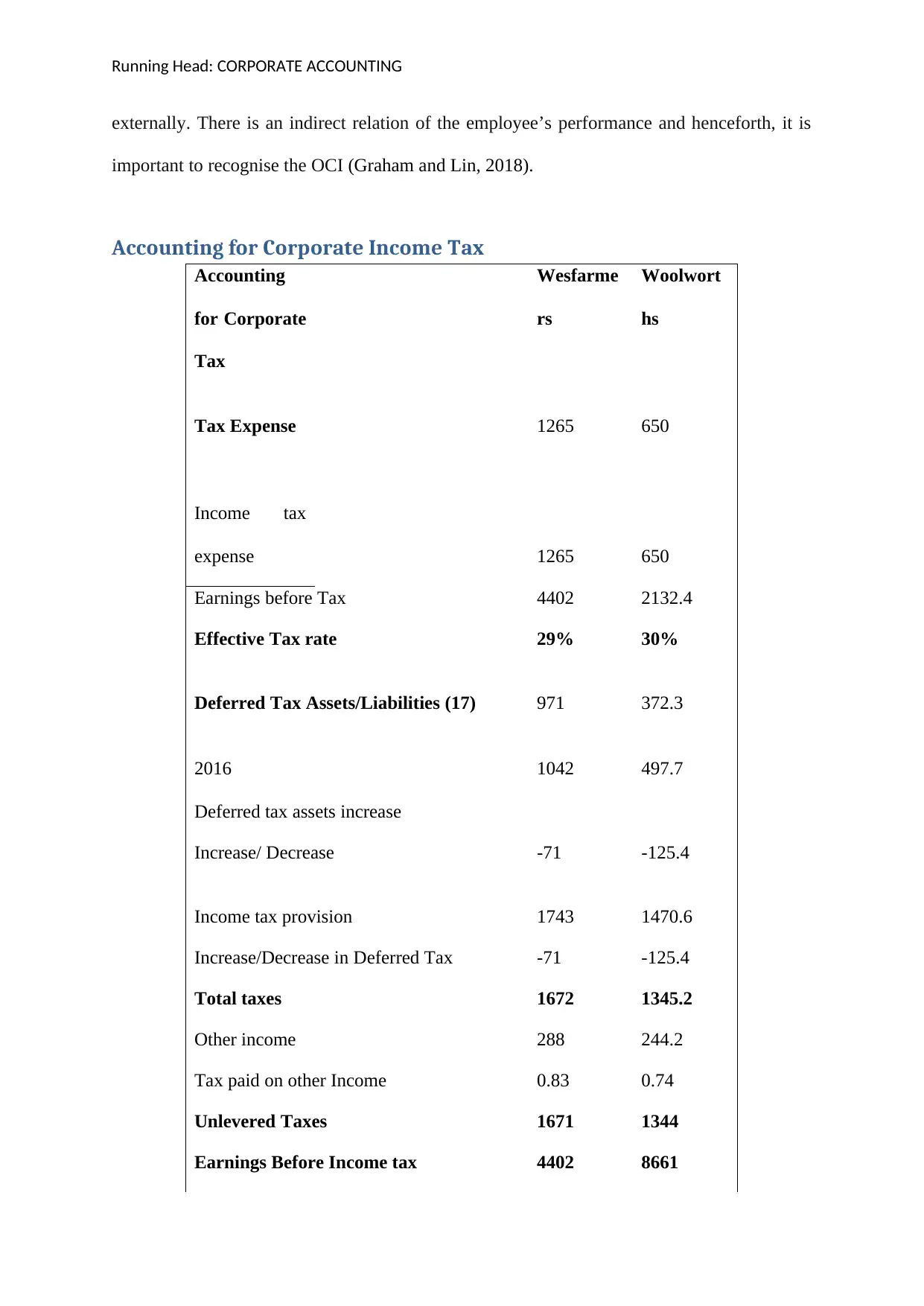

Accounting for Corporate Income Tax

Accounting

for Corporate

Tax

Wesfarme

rs

Woolwort

hs

Tax Expense 1265 650

Income tax

expense 1265 650

Earnings before Tax 4402 2132.4

Effective Tax rate 29% 30%

Deferred Tax Assets/Liabilities (17) 971 372.3

2016 1042 497.7

Deferred tax assets increase

Increase/ Decrease -71 -125.4

Income tax provision 1743 1470.6

Increase/Decrease in Deferred Tax -71 -125.4

Total taxes 1672 1345.2

Other income 288 244.2

Tax paid on other Income 0.83 0.74

Unlevered Taxes 1671 1344

Earnings Before Income tax 4402 8661

externally. There is an indirect relation of the employee’s performance and henceforth, it is

important to recognise the OCI (Graham and Lin, 2018).

Accounting for Corporate Income Tax

Accounting

for Corporate

Tax

Wesfarme

rs

Woolwort

hs

Tax Expense 1265 650

Income tax

expense 1265 650

Earnings before Tax 4402 2132.4

Effective Tax rate 29% 30%

Deferred Tax Assets/Liabilities (17) 971 372.3

2016 1042 497.7

Deferred tax assets increase

Increase/ Decrease -71 -125.4

Income tax provision 1743 1470.6

Increase/Decrease in Deferred Tax -71 -125.4

Total taxes 1672 1345.2

Other income 288 244.2

Tax paid on other Income 0.83 0.74

Unlevered Taxes 1671 1344

Earnings Before Income tax 4402 8661

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Running Head: CORPORATE ACCOUNTING

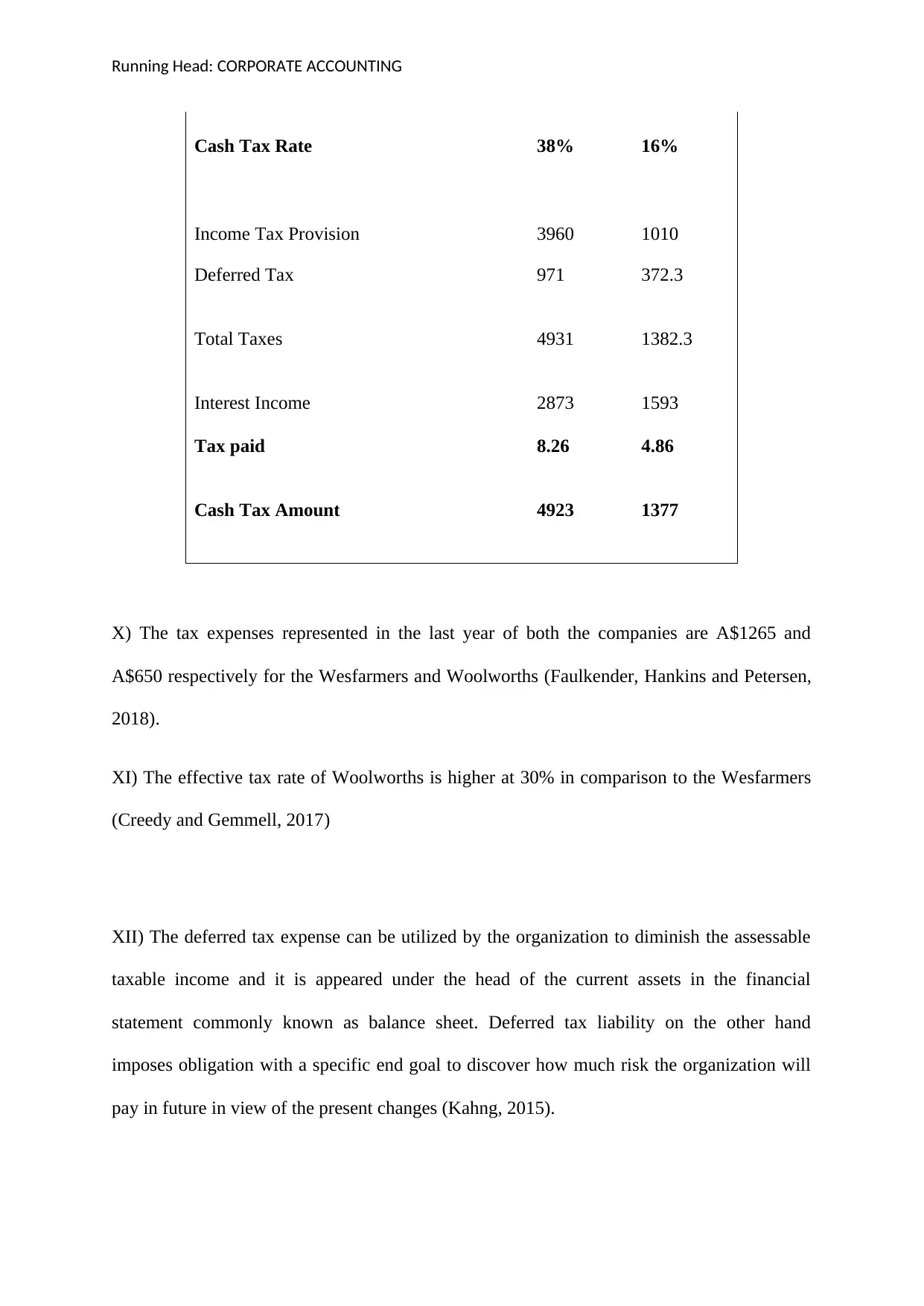

Cash Tax Rate 38% 16%

Income Tax Provision 3960 1010

Deferred Tax 971 372.3

Total Taxes 4931 1382.3

Interest Income 2873 1593

Tax paid 8.26 4.86

Cash Tax Amount 4923 1377

X) The tax expenses represented in the last year of both the companies are A$1265 and

A$650 respectively for the Wesfarmers and Woolworths (Faulkender, Hankins and Petersen,

2018).

XI) The effective tax rate of Woolworths is higher at 30% in comparison to the Wesfarmers

(Creedy and Gemmell, 2017)

XII) The deferred tax expense can be utilized by the organization to diminish the assessable

taxable income and it is appeared under the head of the current assets in the financial

statement commonly known as balance sheet. Deferred tax liability on the other hand

imposes obligation with a specific end goal to discover how much risk the organization will

pay in future in view of the present changes (Kahng, 2015).

Cash Tax Rate 38% 16%

Income Tax Provision 3960 1010

Deferred Tax 971 372.3

Total Taxes 4931 1382.3

Interest Income 2873 1593

Tax paid 8.26 4.86

Cash Tax Amount 4923 1377

X) The tax expenses represented in the last year of both the companies are A$1265 and

A$650 respectively for the Wesfarmers and Woolworths (Faulkender, Hankins and Petersen,

2018).

XI) The effective tax rate of Woolworths is higher at 30% in comparison to the Wesfarmers

(Creedy and Gemmell, 2017)

XII) The deferred tax expense can be utilized by the organization to diminish the assessable

taxable income and it is appeared under the head of the current assets in the financial

statement commonly known as balance sheet. Deferred tax liability on the other hand

imposes obligation with a specific end goal to discover how much risk the organization will

pay in future in view of the present changes (Kahng, 2015).

Running Head: CORPORATE ACCOUNTING

XIII) The deferred tax asset/liabilities of the Wesfarmers decreased by A$71 and the

liabilities decreased by A$125.4 in case of the Woolworths.

XIV) The cash tax amount for the Wesfarmers is A$4923 and that of the Woolworths is

A$1377 (Wesfarmers, 2018).

XV) The cash tax rate of the Wesfarmers is higher in comparison to the Woolworths at 38%

(Wesfarmers, 2018). The cash tax rate of the Woolworths is 16%.

XVI) There are the temporary and the long term differences which occurred due to the

practice adopted by the IRS of not equating the pre-tax and the pre taxable income in the

books of accounts. Therefore there is a difference in the numbers. Short term difference

results into the deferred tax whereas the permanent changes results in the effective tax rate.

Conclusion

From the above analysis it can be concluded that the financial statements and the cash flow

analysis is necessary to get the overview of the entire position of the company and with the

assistance of the accounting and the corporate practice helps the investors to make the nice

decisions before making the investment.

XIII) The deferred tax asset/liabilities of the Wesfarmers decreased by A$71 and the

liabilities decreased by A$125.4 in case of the Woolworths.

XIV) The cash tax amount for the Wesfarmers is A$4923 and that of the Woolworths is

A$1377 (Wesfarmers, 2018).

XV) The cash tax rate of the Wesfarmers is higher in comparison to the Woolworths at 38%

(Wesfarmers, 2018). The cash tax rate of the Woolworths is 16%.

XVI) There are the temporary and the long term differences which occurred due to the

practice adopted by the IRS of not equating the pre-tax and the pre taxable income in the

books of accounts. Therefore there is a difference in the numbers. Short term difference

results into the deferred tax whereas the permanent changes results in the effective tax rate.

Conclusion

From the above analysis it can be concluded that the financial statements and the cash flow

analysis is necessary to get the overview of the entire position of the company and with the

assistance of the accounting and the corporate practice helps the investors to make the nice

decisions before making the investment.

Running Head: CORPORATE ACCOUNTING

References

Agrawal, A. and Cooper, T., (2017) Corporate governance consequences of accounting

scandals: Evidence from top management, CFO and auditor turnover. Quarterly Journal of

Finance, 7(01), p.1650014.

Amess, K., Stiebale, J. and Wright, M., (2016) The impact of private equity on firms׳

patenting activity. European Economic Review, 86, pp.147-160.

Borio, C.E. and Disyatat, P., (2015) Capital flows and the current account: Taking financing

(more) seriously. New York: Springer.

Campbell, J.L., (2015) The fair value of cash flow hedges, future profitability, and stock

returns. Contemporary Accounting Research, 32(1), pp.243-279.

Creedy, J. and Gemmell, N., (2017) Effective tax rates and the user cost of capital when

interest rates are low. Economics Letters, 156, pp.82-87.

Ehrhardt, M.C. and Brigham, E.F., (2016) Corporate finance: A focused approach. Boston:

Cengage learning.

Faulkender, M.W., Hankins, K.W. and Petersen, M.A., (2018) Understanding the Rise in

Corporate Cash: Precautionary Savings or Foreign Taxes. United States: John Wiley & Sons

Firth, M., Gao, J., Shen, J. and Zhang, Y., (2016) Institutional stock ownership and firms’

cash dividend policies: Evidence from China. Journal of Banking & Finance, 65, pp.91-107.

Free cash flow, (2017) what is the free cash flow? [online] Available from

https://corporatefinanceinstitute.com/resources/knowledge/valuation/fcf-formula-free-cash-

flow/ [Accessed on 24th September 2018]

References

Agrawal, A. and Cooper, T., (2017) Corporate governance consequences of accounting

scandals: Evidence from top management, CFO and auditor turnover. Quarterly Journal of

Finance, 7(01), p.1650014.

Amess, K., Stiebale, J. and Wright, M., (2016) The impact of private equity on firms׳

patenting activity. European Economic Review, 86, pp.147-160.

Borio, C.E. and Disyatat, P., (2015) Capital flows and the current account: Taking financing

(more) seriously. New York: Springer.

Campbell, J.L., (2015) The fair value of cash flow hedges, future profitability, and stock

returns. Contemporary Accounting Research, 32(1), pp.243-279.

Creedy, J. and Gemmell, N., (2017) Effective tax rates and the user cost of capital when

interest rates are low. Economics Letters, 156, pp.82-87.

Ehrhardt, M.C. and Brigham, E.F., (2016) Corporate finance: A focused approach. Boston:

Cengage learning.

Faulkender, M.W., Hankins, K.W. and Petersen, M.A., (2018) Understanding the Rise in

Corporate Cash: Precautionary Savings or Foreign Taxes. United States: John Wiley & Sons

Firth, M., Gao, J., Shen, J. and Zhang, Y., (2016) Institutional stock ownership and firms’

cash dividend policies: Evidence from China. Journal of Banking & Finance, 65, pp.91-107.

Free cash flow, (2017) what is the free cash flow? [online] Available from

https://corporatefinanceinstitute.com/resources/knowledge/valuation/fcf-formula-free-cash-

flow/ [Accessed on 24th September 2018]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running Head: CORPORATE ACCOUNTING

Graham, R.C. and Lin, K.C., (2018) The influence of other comprehensive income on

discretionary expenditures. Journal of Business Finance & Accounting, 45(1-2), pp.72-91.

Huang, H.W., Lin, S. and Raghunandan, K., (2015) The volatility of other comprehensive

income and audit fees. Accounting Horizons, 30(2), pp.195-210.

Kahng, L., (2015). Perspectives on the Relationship between Tax and Financial Accounting.

New York: Springer

Manova, K., Wei, S.J. and Zhang, Z., (2015) Firm exports and multinational activity under

credit constraints. Review of Economics and Statistics, 97(3), pp.574-588.

McInnis, J.M., Yu, Y. and Yust, C.G., (2018) Does Fair Value Accounting Provide More

Useful Financial Statements Than Current GAAP For Banks?. The Accounting Review.

Suzuki, T., (2015) National Accounting, Corporate Accounting, and Global

Standardization. Wiley Encyclopedia of Management, pp.1-5.

Talebnia, G., Jaberzadeh, F. and Salehi, M., (2015) Study Information Content of

Comprehensive income by Focusing on Firm Size. Asian Journal of Research in Banking and

Finance, 5(1), pp.111-118.

Watson, L., (2015) Corporate social responsibility research in accounting. Journal of

Accounting Literature, 34, pp.1-16.)

Weber, M., (2018) Cash flow duration and the term structure of equity returns. Journal of

Financial Economics, 128(3), pp.486-503.

Wesfarmers, (2018) Annual Report [online] Available from

https://www.wesfarmers.com.au/docs/default-source/default-document-library/2017-annual-

report.pdf?sfvrsn=0[Accessed on 24th September 2018]

Graham, R.C. and Lin, K.C., (2018) The influence of other comprehensive income on

discretionary expenditures. Journal of Business Finance & Accounting, 45(1-2), pp.72-91.

Huang, H.W., Lin, S. and Raghunandan, K., (2015) The volatility of other comprehensive

income and audit fees. Accounting Horizons, 30(2), pp.195-210.

Kahng, L., (2015). Perspectives on the Relationship between Tax and Financial Accounting.

New York: Springer

Manova, K., Wei, S.J. and Zhang, Z., (2015) Firm exports and multinational activity under

credit constraints. Review of Economics and Statistics, 97(3), pp.574-588.

McInnis, J.M., Yu, Y. and Yust, C.G., (2018) Does Fair Value Accounting Provide More

Useful Financial Statements Than Current GAAP For Banks?. The Accounting Review.

Suzuki, T., (2015) National Accounting, Corporate Accounting, and Global

Standardization. Wiley Encyclopedia of Management, pp.1-5.

Talebnia, G., Jaberzadeh, F. and Salehi, M., (2015) Study Information Content of

Comprehensive income by Focusing on Firm Size. Asian Journal of Research in Banking and

Finance, 5(1), pp.111-118.

Watson, L., (2015) Corporate social responsibility research in accounting. Journal of

Accounting Literature, 34, pp.1-16.)

Weber, M., (2018) Cash flow duration and the term structure of equity returns. Journal of

Financial Economics, 128(3), pp.486-503.

Wesfarmers, (2018) Annual Report [online] Available from

https://www.wesfarmers.com.au/docs/default-source/default-document-library/2017-annual-

report.pdf?sfvrsn=0[Accessed on 24th September 2018]

Running Head: CORPORATE ACCOUNTING

Woolworths, (2017) Annual Report [online] Available from

https://www.woolworthsgroup.com.au/icms_docs/188795_annual-report-2017.pdf [Accessed

on 24th September 2018]

Woolworths, (2017) Annual Report [online] Available from

https://www.woolworthsgroup.com.au/icms_docs/188795_annual-report-2017.pdf [Accessed

on 24th September 2018]

1 out of 27

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.