HI5020 Corporate Accounting Assignment: Financial Analysis Report

VerifiedAdded on 2023/06/04

|25

|5150

|369

Report

AI Summary

This report provides a comprehensive analysis of the corporate accounting practices of Boral Limited and Adelaide Brighton Limited, both listed on the Australian Securities Exchange (ASX). The assignment focuses on several key areas, including owners' equity, cash flow statements (covering operating, investing, and financing activities), other comprehensive income statements, and the accounting for corporate income tax. A comparative analysis of the two companies' financial data from 2015 to 2017 is presented, with specific attention to items of equity, liabilities, and cash flow items. The report calculates and examines deferred tax liabilities and assets, along with cash tax rates and amounts. The introduction provides background information on both companies, highlighting their core business activities and key personnel. The body of the report includes detailed comparative tables and explanations of financial performance, along with calculations. The conclusion summarizes the findings and provides an overview of both companies financial positions. The report adheres to the guidelines of the HI5020 Corporate Accounting assessment, with proper formatting and references.

RUNNING HEAD: CORPORATE ACCOUNTING

[Document title]

[Document title]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CORPORATE ACCOUNTING 1

EXECUTIVE SUMMARY

The purpose of this assignment is to evaluate the complete understanding of owners’

equity, cash flow statement covering all the three activities, other comprehensive income

statement and the accounting for corporate income tax. In this assignment, companies

selected are Boral Limited and Adelaide Brighton limited. Both of these companies are

listed in Australian stock market and belongs to materials industry with ASX codes are BLD

and ABC respectively. Adelaide Brighton limited is a producer of lime and construction

materials in Australia. It produces and distributes lime, concrete, clinker, cement and concrete

products. Boral Limited also produces materials related to construction and building products

across world. For the complete understanding of the above topics, comparative analysis of

debt and equity portion, cash flow statement and the comprehensive income statement of both

selected companies for previous three years (2017, 2016 and 2015) are computed. Further

this task also reports deferred tax liabilities or assets given in the financial statements. In

addition to this, cash tax rate along with cash tax amount is also computed. At the end, this

report ends with stating conclusions about both companies and references.

EXECUTIVE SUMMARY

The purpose of this assignment is to evaluate the complete understanding of owners’

equity, cash flow statement covering all the three activities, other comprehensive income

statement and the accounting for corporate income tax. In this assignment, companies

selected are Boral Limited and Adelaide Brighton limited. Both of these companies are

listed in Australian stock market and belongs to materials industry with ASX codes are BLD

and ABC respectively. Adelaide Brighton limited is a producer of lime and construction

materials in Australia. It produces and distributes lime, concrete, clinker, cement and concrete

products. Boral Limited also produces materials related to construction and building products

across world. For the complete understanding of the above topics, comparative analysis of

debt and equity portion, cash flow statement and the comprehensive income statement of both

selected companies for previous three years (2017, 2016 and 2015) are computed. Further

this task also reports deferred tax liabilities or assets given in the financial statements. In

addition to this, cash tax rate along with cash tax amount is also computed. At the end, this

report ends with stating conclusions about both companies and references.

CORPORATE ACCOUNTING 2

Contents

INTRODUCTION.....................................................................................................................................3

Owners’ Equity..................................................................................................................................4

Cash Flow Statement:........................................................................................................................7

Other comprehensive income statement:.......................................................................................17

Accounting for corporate income tax:.............................................................................................20

CONCLUSION.......................................................................................................................................24

REFERENCES........................................................................................................................................25

Contents

INTRODUCTION.....................................................................................................................................3

Owners’ Equity..................................................................................................................................4

Cash Flow Statement:........................................................................................................................7

Other comprehensive income statement:.......................................................................................17

Accounting for corporate income tax:.............................................................................................20

CONCLUSION.......................................................................................................................................24

REFERENCES........................................................................................................................................25

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CORPORATE ACCOUNTING 3

INTRODUCTION

BORAL LIMITED

Boral Limited produces materials and products related to construction and related to

buildings in Australia. The Boral limited is listed in Australian Stock market and the ASX

code is ASX: BLD (AX, 2018). The core drive of the company is to produces and sells

supreme and finest eminence of products and materials across globe. It sells the materials and

products in Middle East, Asia, Australia and North America (Boral Limited, 2018). The

company encourages safe and friendly working environment for the employees. Also analyse

that the company has employed around 11499 people which includes 18% of women

workforce. The key people are Mike Kane is CEO whereas Dr Brian Clark is the chairman.

The foremost agenda of the company is to serve better value to the owners of the company.

ADELAIDE BRIGHTON LIMITED

Adelaide Brighton Limited is also a producer of construction materials. It mainly operates in

Australia. It is listed in Australian Stock market and the ASX code is ASX: ABC (ASX,

2018). The core business activities of a company are to produce, sells, imports distribute

concrete, clinker, construction, lime and cement. Further the company emboldens safe,

morals and welcoming working atmosphere for the employees. Also analyse that the

company has employed around 1600 people in Australia. Company’s main aim is to

maximise the shareholders’ value. Further in order to meet the customer’s satisfaction,

company offer turnkey results in all the business areas. The chief executive officer is Martin

Brydon (Adelaide Brighton limited; 2017, 2016).

In this task both entities “Boral Limited” and “Adelaide Brighton limited” are taken into

account. This report covers Complete understanding of each item of equity and cash flow

items. In addition to this, comparative analysis of debt and equity portion, cash flow

INTRODUCTION

BORAL LIMITED

Boral Limited produces materials and products related to construction and related to

buildings in Australia. The Boral limited is listed in Australian Stock market and the ASX

code is ASX: BLD (AX, 2018). The core drive of the company is to produces and sells

supreme and finest eminence of products and materials across globe. It sells the materials and

products in Middle East, Asia, Australia and North America (Boral Limited, 2018). The

company encourages safe and friendly working environment for the employees. Also analyse

that the company has employed around 11499 people which includes 18% of women

workforce. The key people are Mike Kane is CEO whereas Dr Brian Clark is the chairman.

The foremost agenda of the company is to serve better value to the owners of the company.

ADELAIDE BRIGHTON LIMITED

Adelaide Brighton Limited is also a producer of construction materials. It mainly operates in

Australia. It is listed in Australian Stock market and the ASX code is ASX: ABC (ASX,

2018). The core business activities of a company are to produce, sells, imports distribute

concrete, clinker, construction, lime and cement. Further the company emboldens safe,

morals and welcoming working atmosphere for the employees. Also analyse that the

company has employed around 1600 people in Australia. Company’s main aim is to

maximise the shareholders’ value. Further in order to meet the customer’s satisfaction,

company offer turnkey results in all the business areas. The chief executive officer is Martin

Brydon (Adelaide Brighton limited; 2017, 2016).

In this task both entities “Boral Limited” and “Adelaide Brighton limited” are taken into

account. This report covers Complete understanding of each item of equity and cash flow

items. In addition to this, comparative analysis of debt and equity portion, cash flow

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CORPORATE ACCOUNTING 4

statement comprising three types of cash flows (operating activities, investing activities and

financing activities) and other comprehensive income statement for three financial years that

is 2017, 2016 and 2015 are computed. Moreover, effective tax rate of both companies is

computed with the help of given tax expense in financial statements. Deferred tax

assets/liabilities are also recorded. Also cash tax rate is computed along with cash tax

amount. At last, this task is ended up with conclusions and references.

Owners’ Equity

i. Items of Equity:

Adelaide Brighton limited:

Adelaide Limited paid dividends for $ 156 million in financial year 2017

whereas in 2016 the dividends paid was $ 178.5 million. In other words, the

dividend was decreased by 12.60%.

Profit for the period was included in equity calculation. Thus, as per the

annual report, net profit reported by the company is $ 182.1 million in 2017

whereas in 2016 net profit was reported $ 186.2 million which means the

profit has declined by 2.2% because of increment in administration costs, cost

of sales and freight and distribution costs (Adelaide Brighton limited, 2017,

2016).

Other comprehensive income is also a part of statement of changes in equity.

The Adelaide limited has reported $ 183.8 million in FY 2017 whereas in FY

2016 the same was reported with an amount $ 187.4 million. The decrement is

due to less net profit in 2017 as compared to 2016 (Adelaide Brighton limited,

2017, 2016).

Boral Limited:

statement comprising three types of cash flows (operating activities, investing activities and

financing activities) and other comprehensive income statement for three financial years that

is 2017, 2016 and 2015 are computed. Moreover, effective tax rate of both companies is

computed with the help of given tax expense in financial statements. Deferred tax

assets/liabilities are also recorded. Also cash tax rate is computed along with cash tax

amount. At last, this task is ended up with conclusions and references.

Owners’ Equity

i. Items of Equity:

Adelaide Brighton limited:

Adelaide Limited paid dividends for $ 156 million in financial year 2017

whereas in 2016 the dividends paid was $ 178.5 million. In other words, the

dividend was decreased by 12.60%.

Profit for the period was included in equity calculation. Thus, as per the

annual report, net profit reported by the company is $ 182.1 million in 2017

whereas in 2016 net profit was reported $ 186.2 million which means the

profit has declined by 2.2% because of increment in administration costs, cost

of sales and freight and distribution costs (Adelaide Brighton limited, 2017,

2016).

Other comprehensive income is also a part of statement of changes in equity.

The Adelaide limited has reported $ 183.8 million in FY 2017 whereas in FY

2016 the same was reported with an amount $ 187.4 million. The decrement is

due to less net profit in 2017 as compared to 2016 (Adelaide Brighton limited,

2017, 2016).

Boral Limited:

CORPORATE ACCOUNTING 5

According to the annual report 2017, it was observed that Boral limited had

recognized $ 296.9 million as net profit whereas in financial year 2016, net

profit was recognized $ 256 million. The reason for such increment in net

profit in 2017 was due to increase in sales revenue by 7.92% in comparison to

2016.

Taken into consideration total comprehensive income for the period 2017 and

2016 it was observed that in 2017 the same was reported with $ 174.3 million

whereas in 2016 it was reported $ 251.7 million. This was resulted the

decrement by 44.40% from 2016. The main reason was due to negative

amount of translation of net assets of overseas entities (Boral Limited, 2017;

2016).

The dividend paid is included in the statement of changes in equity. From the

annual report, it is observed that dividend paid by the company in 2017 was $

226.2 million whereas in 2016 dividend paid was $ 154.2 million. The reason

was due to increment in net profit recognized by the company.

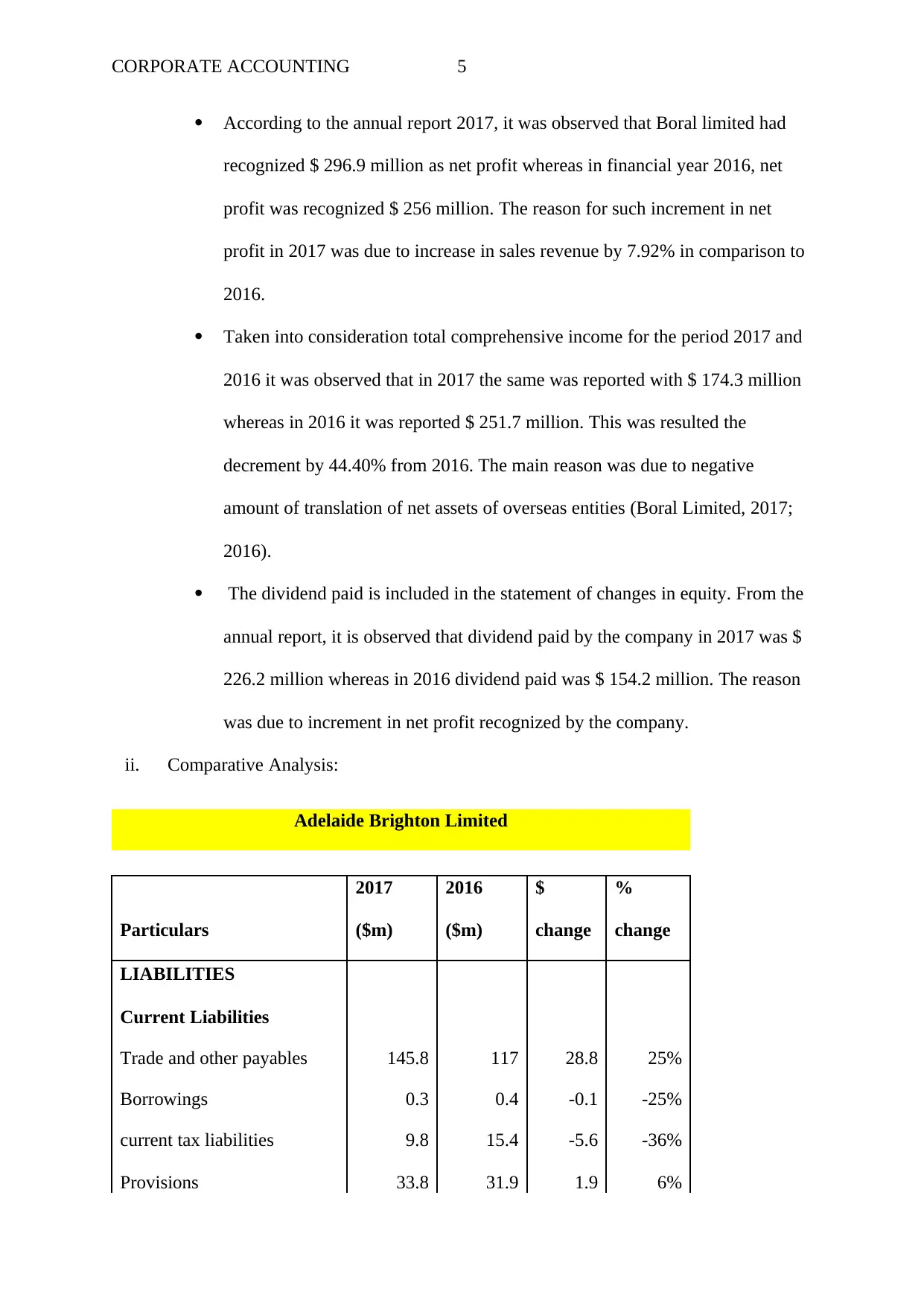

ii. Comparative Analysis:

Adelaide Brighton Limited

Particulars

2017

($m)

2016

($m)

$

change

%

change

LIABILITIES

Current Liabilities

Trade and other payables 145.8 117 28.8 25%

Borrowings 0.3 0.4 -0.1 -25%

current tax liabilities 9.8 15.4 -5.6 -36%

Provisions 33.8 31.9 1.9 6%

According to the annual report 2017, it was observed that Boral limited had

recognized $ 296.9 million as net profit whereas in financial year 2016, net

profit was recognized $ 256 million. The reason for such increment in net

profit in 2017 was due to increase in sales revenue by 7.92% in comparison to

2016.

Taken into consideration total comprehensive income for the period 2017 and

2016 it was observed that in 2017 the same was reported with $ 174.3 million

whereas in 2016 it was reported $ 251.7 million. This was resulted the

decrement by 44.40% from 2016. The main reason was due to negative

amount of translation of net assets of overseas entities (Boral Limited, 2017;

2016).

The dividend paid is included in the statement of changes in equity. From the

annual report, it is observed that dividend paid by the company in 2017 was $

226.2 million whereas in 2016 dividend paid was $ 154.2 million. The reason

was due to increment in net profit recognized by the company.

ii. Comparative Analysis:

Adelaide Brighton Limited

Particulars

2017

($m)

2016

($m)

$

change

%

change

LIABILITIES

Current Liabilities

Trade and other payables 145.8 117 28.8 25%

Borrowings 0.3 0.4 -0.1 -25%

current tax liabilities 9.8 15.4 -5.6 -36%

Provisions 33.8 31.9 1.9 6%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CORPORATE ACCOUNTING 6

Other liabilities 15.1 3.3 11.8 358%

Total current liabilities 204.8 168 36.8 22%

Non-current liabilities

Borrowings 428.9 309.6 119.3 39%

Deferred tax liabilities 86 89.9 -3.9 -4%

Provisions 45 39 6 15%

Other non-current liabilities 0.1 0.1 0 0%

Total non-current liabilities 560 438.6 121.4 28%

Total liabilities 764.8 606.6 158.2 26%

EQUITY

Share Capital 733.1 731.4 1.7 0%

Reserves 1.9 2.9 -1 -34%

Retained Earnings 510.6 483.3 27.3 6%

Total Equity 1245.6 1217.6 28 2%

(Adelaide Brighton Limited, 2017; 2016).

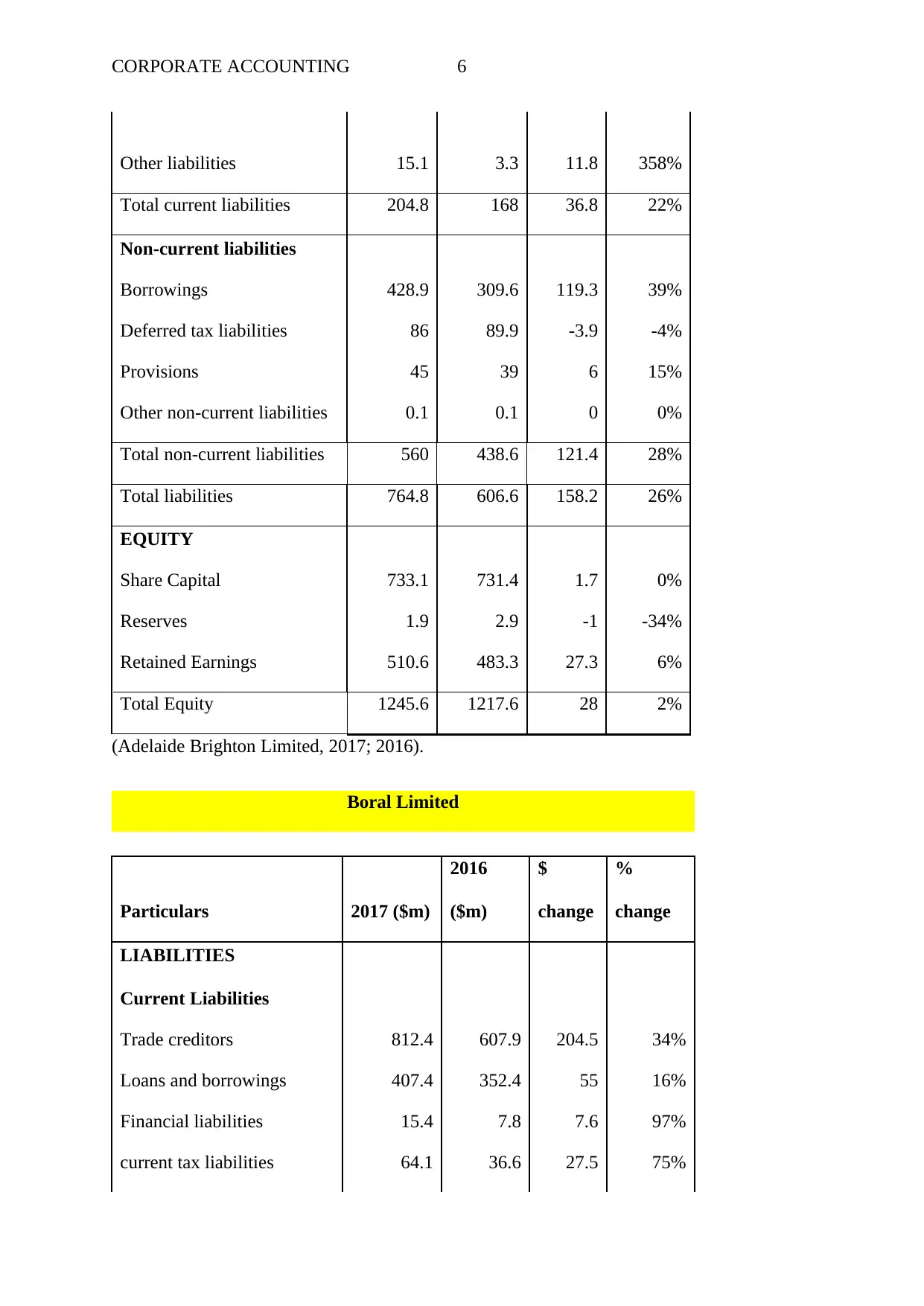

Boral Limited

Particulars 2017 ($m)

2016

($m)

$

change

%

change

LIABILITIES

Current Liabilities

Trade creditors 812.4 607.9 204.5 34%

Loans and borrowings 407.4 352.4 55 16%

Financial liabilities 15.4 7.8 7.6 97%

current tax liabilities 64.1 36.6 27.5 75%

Other liabilities 15.1 3.3 11.8 358%

Total current liabilities 204.8 168 36.8 22%

Non-current liabilities

Borrowings 428.9 309.6 119.3 39%

Deferred tax liabilities 86 89.9 -3.9 -4%

Provisions 45 39 6 15%

Other non-current liabilities 0.1 0.1 0 0%

Total non-current liabilities 560 438.6 121.4 28%

Total liabilities 764.8 606.6 158.2 26%

EQUITY

Share Capital 733.1 731.4 1.7 0%

Reserves 1.9 2.9 -1 -34%

Retained Earnings 510.6 483.3 27.3 6%

Total Equity 1245.6 1217.6 28 2%

(Adelaide Brighton Limited, 2017; 2016).

Boral Limited

Particulars 2017 ($m)

2016

($m)

$

change

%

change

LIABILITIES

Current Liabilities

Trade creditors 812.4 607.9 204.5 34%

Loans and borrowings 407.4 352.4 55 16%

Financial liabilities 15.4 7.8 7.6 97%

current tax liabilities 64.1 36.6 27.5 75%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CORPORATE ACCOUNTING 7

Employee benefit liabilities 115.5 118.8 -3.3 -3%

Provisions 53.5 58.2 -4.7 -8%

Total current liabilities 1468.3 1181.7 286.6 24%

Non-current liabilities

Loans and borrowings 2163.7 992.8 1170.9 118%

Financial liabilities 10.9 18.6 -7.7 -41%

Employee benefit liabilities 44.4 11.3 33.1 293%

Provisions 157.5 59 98.5 167%

Other liabilities 28.3 30.8 -2.5 -8%

Total non-current liabilities 2404.8 1112.5 1292.3 116%

Total liabilities 3873.1 2294.2 1578.9 69%

EQUITY

Issued capital 4265.1 2246.2 2018.9 90%

Reserves 19.3 162 -142.7 -88%

Retained Earnings 1156.1 1098.1 58 5%

Total Equity 5440.5 3506.3 1934.2 55%

(Boral Limited, 2017; 2016).

Cash Flow Statement:

iii. Items of Cash flow statement:

a. Cash flow from operating activities:

Adelaide Brighton Limited:

Receipts from customers and payments to suppliers and employees are

increased in 2017 from 2016. In other words, payments to suppliers and

employees are increased by 11.32% which is more than receipts from

Employee benefit liabilities 115.5 118.8 -3.3 -3%

Provisions 53.5 58.2 -4.7 -8%

Total current liabilities 1468.3 1181.7 286.6 24%

Non-current liabilities

Loans and borrowings 2163.7 992.8 1170.9 118%

Financial liabilities 10.9 18.6 -7.7 -41%

Employee benefit liabilities 44.4 11.3 33.1 293%

Provisions 157.5 59 98.5 167%

Other liabilities 28.3 30.8 -2.5 -8%

Total non-current liabilities 2404.8 1112.5 1292.3 116%

Total liabilities 3873.1 2294.2 1578.9 69%

EQUITY

Issued capital 4265.1 2246.2 2018.9 90%

Reserves 19.3 162 -142.7 -88%

Retained Earnings 1156.1 1098.1 58 5%

Total Equity 5440.5 3506.3 1934.2 55%

(Boral Limited, 2017; 2016).

Cash Flow Statement:

iii. Items of Cash flow statement:

a. Cash flow from operating activities:

Adelaide Brighton Limited:

Receipts from customers and payments to suppliers and employees are

increased in 2017 from 2016. In other words, payments to suppliers and

employees are increased by 11.32% which is more than receipts from

CORPORATE ACCOUNTING 8

customers which is 8.1% and there are chances of decrement of net profit in a

current FY (Adelaide Brighton limited, 2017; 2016).

Interest paid is covered under cash flows from operating activities because it is

considered as regular in nature. In this case, FY 2017 has reported $ 13 million

whereas in 2016 it was recognised as $ 12.1 million (ASX, 2018).

Cash flows from operating activities are also covered taxes paid for income.

he company has paid $ 81.3 million in 2017 whereas $ 67.2 million in 2016.

As a result, cash flow from operating activities are declined in 2017 from 2016 by 9.74%.

Boral Limited:

This company has reported net cash receipts from customers is $ 534.1 million

in 2017 which shows a decrement from last year by 5.67%. This is due to less

receipts from customers in current FY by $ 52.4 million.

Both dividend and interest received by the company are more in 2017 which is

a positive sign for the company (Boral Limited; 2017; 2016).

Restructure, acquisition and integration costs paid by the company is $ 116.9

million in 2017 whereas 2016 company has reported $34.5 million. The reason

is that company has purchased controlled entities and businesses (ASX, 2018).

As a result, cash flow from operating activities are declined in 2017 from 2016 by 13.44%.

b. Cash flow from investing activities:

Adelaide Brighton Limited:

In this category of cash flow, payments or proceeds related to fixed assets,

intangible assets and investments are recorded. Hence, the company had

reported payments for property, plant, equipment and intangibles and

customers which is 8.1% and there are chances of decrement of net profit in a

current FY (Adelaide Brighton limited, 2017; 2016).

Interest paid is covered under cash flows from operating activities because it is

considered as regular in nature. In this case, FY 2017 has reported $ 13 million

whereas in 2016 it was recognised as $ 12.1 million (ASX, 2018).

Cash flows from operating activities are also covered taxes paid for income.

he company has paid $ 81.3 million in 2017 whereas $ 67.2 million in 2016.

As a result, cash flow from operating activities are declined in 2017 from 2016 by 9.74%.

Boral Limited:

This company has reported net cash receipts from customers is $ 534.1 million

in 2017 which shows a decrement from last year by 5.67%. This is due to less

receipts from customers in current FY by $ 52.4 million.

Both dividend and interest received by the company are more in 2017 which is

a positive sign for the company (Boral Limited; 2017; 2016).

Restructure, acquisition and integration costs paid by the company is $ 116.9

million in 2017 whereas 2016 company has reported $34.5 million. The reason

is that company has purchased controlled entities and businesses (ASX, 2018).

As a result, cash flow from operating activities are declined in 2017 from 2016 by 13.44%.

b. Cash flow from investing activities:

Adelaide Brighton Limited:

In this category of cash flow, payments or proceeds related to fixed assets,

intangible assets and investments are recorded. Hence, the company had

reported payments for property, plant, equipment and intangibles and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CORPORATE ACCOUNTING 9

payments for acquisition of businesses is $ 89.1 million and $ 80.2 million in

2017 whereas in 2016 it was reported $ 86.5 million.

Proceeds from sale of property, plant, equipment is only $ 17.7 million

whereas in 2016 it was reported $ 23.2 million.

As a result, the company has reported Net cash outflow from investing activities is $ 154.1

million in 2017 which means the same was increased by $ 90 million.

Boral Limited:

In this category of cash flow, payments or proceeds related to fixed assets,

intangible assets and investments are recorded. Hence, the company had

reported payments for property, plant, equipment and intangibles and is $

340.1 million in 2017. Also given that the company has purchased controlled

entities and businesses for $ 3636.5 million in 2017.

The proceeds from disposal of purchased controlled entities and businesses for

$ 122.5 million in 2017. Hence the result would be cash outflow from

investing activities.

As a result, net cash used in investing activities is $ 3731.5 million which has increased by $

3471.8 million from past year.

c. Cash flow from financing activities:

Adelaide Brighton Limited:

Proceeds from issue of shares are included in cash flow from financing

activities where the company has reported $ 3.5 million.

The company has drawn down borrowings of $ 118.5million whereas in last

year company has repaid borrowings of $ 21 million.

payments for acquisition of businesses is $ 89.1 million and $ 80.2 million in

2017 whereas in 2016 it was reported $ 86.5 million.

Proceeds from sale of property, plant, equipment is only $ 17.7 million

whereas in 2016 it was reported $ 23.2 million.

As a result, the company has reported Net cash outflow from investing activities is $ 154.1

million in 2017 which means the same was increased by $ 90 million.

Boral Limited:

In this category of cash flow, payments or proceeds related to fixed assets,

intangible assets and investments are recorded. Hence, the company had

reported payments for property, plant, equipment and intangibles and is $

340.1 million in 2017. Also given that the company has purchased controlled

entities and businesses for $ 3636.5 million in 2017.

The proceeds from disposal of purchased controlled entities and businesses for

$ 122.5 million in 2017. Hence the result would be cash outflow from

investing activities.

As a result, net cash used in investing activities is $ 3731.5 million which has increased by $

3471.8 million from past year.

c. Cash flow from financing activities:

Adelaide Brighton Limited:

Proceeds from issue of shares are included in cash flow from financing

activities where the company has reported $ 3.5 million.

The company has drawn down borrowings of $ 118.5million whereas in last

year company has repaid borrowings of $ 21 million.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CORPORATE ACCOUNTING 10

Dividends paid are recognised in cash from financing activities. In this case, $

156 million and $ 178.5 million was reported in FY 2017 and 2016

respectively. This might due to less issue of shares in 2017.

As a result, net cash outflow from financing activities is $ 34 million which has decreased by

$ 161.5 million from past year (Adelaide Brighton Limited, 2017; 2016).

Boral Limited

Dividends paid are recognised in cash from financing activities. In this case, $

226.2 million and $ 154.2 million was reported in FY 2017 and 2016

respectively. This might due to more issue of shares in 2017.

Capital raising are included in cash flow from financing activities where the

company has reported $ 2018.9 million in 2017 (Boral limited, 2017; 2016).

Proceeds from borrowings are increased by 1801.4 million in 2017 from 2016

which is tremendous.

As a result, net cash provided by financing activities is $ 3107.5million which has increased

by $ 2833.6 million from past year.

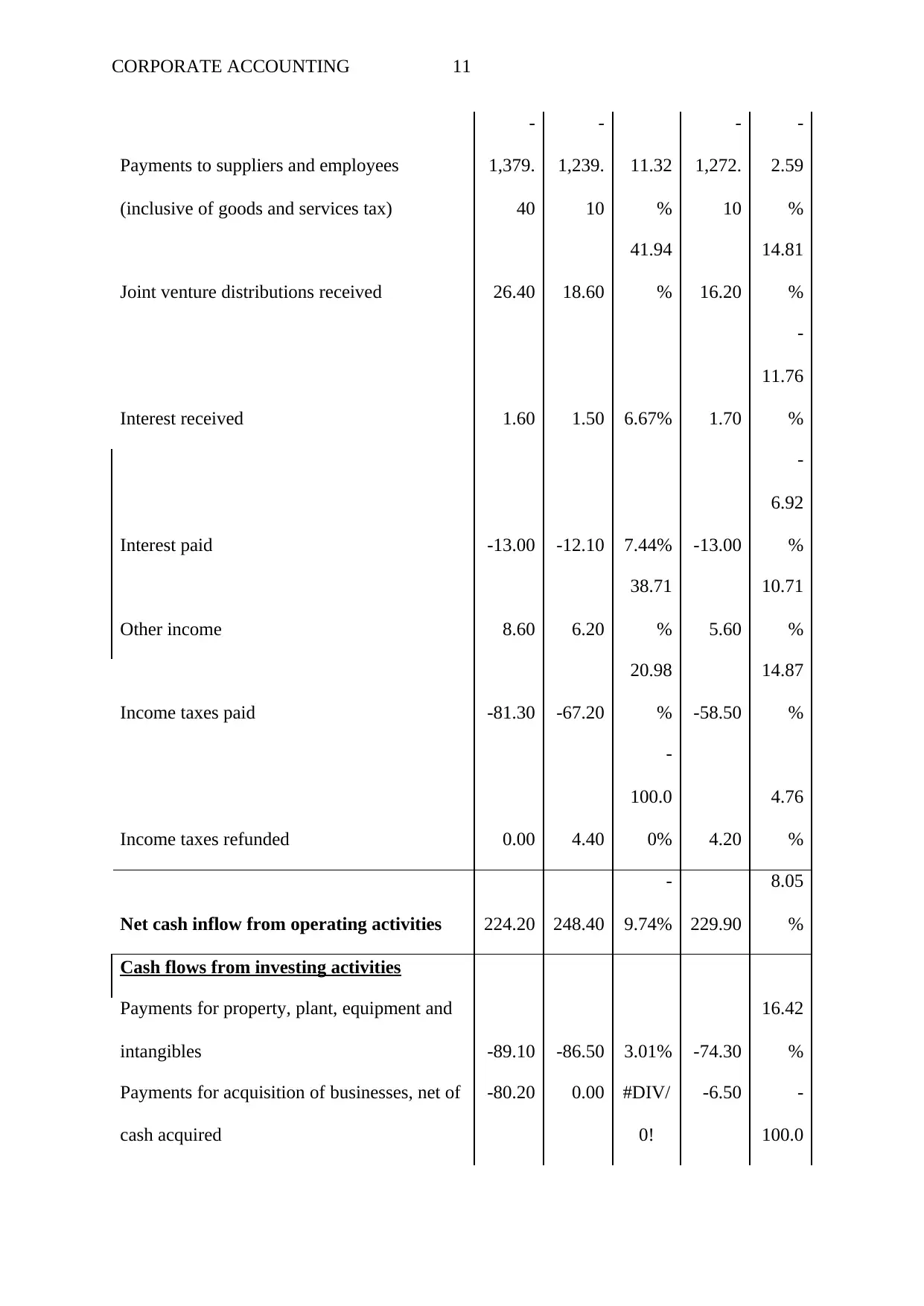

iv and v. Comparative analysis:

Adelaide Brighton limited

Particulars

2017

($'m)

2016

($'m)

2017

(%)

2015

($'m)

2016

(%)

cash flows from operating activities

Receipts from customers (inclusive of goods

and services tax)

1,661.

30

1,536.

10 8.15%

1,545.

80

-

0.63

%

Dividends paid are recognised in cash from financing activities. In this case, $

156 million and $ 178.5 million was reported in FY 2017 and 2016

respectively. This might due to less issue of shares in 2017.

As a result, net cash outflow from financing activities is $ 34 million which has decreased by

$ 161.5 million from past year (Adelaide Brighton Limited, 2017; 2016).

Boral Limited

Dividends paid are recognised in cash from financing activities. In this case, $

226.2 million and $ 154.2 million was reported in FY 2017 and 2016

respectively. This might due to more issue of shares in 2017.

Capital raising are included in cash flow from financing activities where the

company has reported $ 2018.9 million in 2017 (Boral limited, 2017; 2016).

Proceeds from borrowings are increased by 1801.4 million in 2017 from 2016

which is tremendous.

As a result, net cash provided by financing activities is $ 3107.5million which has increased

by $ 2833.6 million from past year.

iv and v. Comparative analysis:

Adelaide Brighton limited

Particulars

2017

($'m)

2016

($'m)

2017

(%)

2015

($'m)

2016

(%)

cash flows from operating activities

Receipts from customers (inclusive of goods

and services tax)

1,661.

30

1,536.

10 8.15%

1,545.

80

-

0.63

%

CORPORATE ACCOUNTING 11

Payments to suppliers and employees

(inclusive of goods and services tax)

-

1,379.

40

-

1,239.

10

11.32

%

-

1,272.

10

-

2.59

%

Joint venture distributions received 26.40 18.60

41.94

% 16.20

14.81

%

Interest received 1.60 1.50 6.67% 1.70

-

11.76

%

Interest paid -13.00 -12.10 7.44% -13.00

-

6.92

%

Other income 8.60 6.20

38.71

% 5.60

10.71

%

Income taxes paid -81.30 -67.20

20.98

% -58.50

14.87

%

Income taxes refunded 0.00 4.40

-

100.0

0% 4.20

4.76

%

Net cash inflow from operating activities 224.20 248.40

-

9.74% 229.90

8.05

%

Cash flows from investing activities

Payments for property, plant, equipment and

intangibles -89.10 -86.50 3.01% -74.30

16.42

%

Payments for acquisition of businesses, net of

cash acquired

-80.20 0.00 #DIV/

0!

-6.50 -

100.0

Payments to suppliers and employees

(inclusive of goods and services tax)

-

1,379.

40

-

1,239.

10

11.32

%

-

1,272.

10

-

2.59

%

Joint venture distributions received 26.40 18.60

41.94

% 16.20

14.81

%

Interest received 1.60 1.50 6.67% 1.70

-

11.76

%

Interest paid -13.00 -12.10 7.44% -13.00

-

6.92

%

Other income 8.60 6.20

38.71

% 5.60

10.71

%

Income taxes paid -81.30 -67.20

20.98

% -58.50

14.87

%

Income taxes refunded 0.00 4.40

-

100.0

0% 4.20

4.76

%

Net cash inflow from operating activities 224.20 248.40

-

9.74% 229.90

8.05

%

Cash flows from investing activities

Payments for property, plant, equipment and

intangibles -89.10 -86.50 3.01% -74.30

16.42

%

Payments for acquisition of businesses, net of

cash acquired

-80.20 0.00 #DIV/

0!

-6.50 -

100.0

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.