HI5020 Corporate Accounting: Financial Statement Analysis Report

VerifiedAdded on 2023/06/07

|17

|3745

|351

Report

AI Summary

This report provides a comprehensive analysis of the financial statements of Bega Cheese Ltd and Bellamy’s Australia Ltd, both listed on the Australian Securities Exchange (ASX). The assessment delves into the companies' annual reports over a three-year period, focusing on key financial elements. It includes a comparative study of owner's equity, examining share capital, reserves, and retained earnings for each company. The report also conducts a thorough cash flow analysis, comparing the operating, investing, and financing activities of both businesses and providing a graphical representation of their cash positions. Furthermore, the assessment addresses corporate taxation, calculating the effective tax rate, and comparing cash and book tax rates. The report aims to highlight the financial performance and strategic decisions of both companies, offering insights into their capital structures and overall financial health. The analysis includes details on the capital structure, and debt levels. The report concludes with a comparative analysis of the two companies based on the financial data presented. The aim of the report is to gain insights into their financial performance and strategic decisions.

Running head: CORPORATE ACCOUNTING

Corporate Accounting

Name of the Student:

Name of the University:

Author’s Note

Corporate Accounting

Name of the Student:

Name of the University:

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

CORPORATE ACCOUNTING

Executive Summary

The main purpose of this assessment is to analyze the financial statement of the Bega Cheese Ltd

and Bellamy’s Australia Ltd. The assessment contains analysis of the cash flow statement and

also owner’s equity which are shown in the annual reports of the business for a period of three

years. The reporting of taxation and calculation for effective tax rate and cash and book tax rate

is also shown in the assessment. The report aims to bring about a comparative study of the items

which are included in the financial statements of both the companies.

CORPORATE ACCOUNTING

Executive Summary

The main purpose of this assessment is to analyze the financial statement of the Bega Cheese Ltd

and Bellamy’s Australia Ltd. The assessment contains analysis of the cash flow statement and

also owner’s equity which are shown in the annual reports of the business for a period of three

years. The reporting of taxation and calculation for effective tax rate and cash and book tax rate

is also shown in the assessment. The report aims to bring about a comparative study of the items

which are included in the financial statements of both the companies.

2

CORPORATE ACCOUNTING

Table of Contents

Introduction......................................................................................................................................4

Discussions......................................................................................................................................5

Owner’s Equity............................................................................................................................5

Corporate Structure Analysis.......................................................................................................6

Cash Flow Analysis.....................................................................................................................7

Comparative Analysis of Cash Flow statement of Both Companies...........................................8

Insights of Cash flow Statement................................................................................................12

Accounting for Comprehensive Items.......................................................................................12

Reporting of Comprehensive Items...........................................................................................12

Comparative Analysis of Comprehensive items........................................................................12

Accounting for Taxation............................................................................................................13

Effective Tax Rate.....................................................................................................................13

Deferred Tax Assets and Liabilities..........................................................................................14

Calculation of Cash Tax Rate and Book Tax Rate....................................................................14

Cash Tax Rate and Book Tax Rate............................................................................................14

Conclusion.....................................................................................................................................14

Reference.......................................................................................................................................16

CORPORATE ACCOUNTING

Table of Contents

Introduction......................................................................................................................................4

Discussions......................................................................................................................................5

Owner’s Equity............................................................................................................................5

Corporate Structure Analysis.......................................................................................................6

Cash Flow Analysis.....................................................................................................................7

Comparative Analysis of Cash Flow statement of Both Companies...........................................8

Insights of Cash flow Statement................................................................................................12

Accounting for Comprehensive Items.......................................................................................12

Reporting of Comprehensive Items...........................................................................................12

Comparative Analysis of Comprehensive items........................................................................12

Accounting for Taxation............................................................................................................13

Effective Tax Rate.....................................................................................................................13

Deferred Tax Assets and Liabilities..........................................................................................14

Calculation of Cash Tax Rate and Book Tax Rate....................................................................14

Cash Tax Rate and Book Tax Rate............................................................................................14

Conclusion.....................................................................................................................................14

Reference.......................................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

CORPORATE ACCOUNTING

Introduction

The focus of this assessment lies in analysis of the financial statements of two companies

which are engaged in same industry. The company which are considered for this assessment are

Bega Cheese Ltd and Bellamy’s Australia Ltd which are both engaged in providing the

customers with consumer staple food products. The assessment systematically shows

comparative study of the financial elements which are shown in the annual report of the

companies for a period of 3 years. The assessment shows increase or decrease in different

aspects of the business during the three years frame.

Bega Cheese Ltd is engaged in dairy business and predominantly engages in its business

operations in New South Wales of Australia. The company was initially founded as dairy

supplying business or as an agriculture cooperative in Australia. The company is regarded to be

the leading brand which produces cheese in the country. It is estimated that half of the revenues

of the company is generated with the different varieties of cheese products which is offered by

the business (Bega Cheese Ltd. 2018). The company in 2017 has acquired the business

of Mondelez International which has extensive grocery and dairy business both in Australia and

New Zealand. The company has therefore added the popular products such as Vegemite and

Bonox thus providing the business more scope for profitability.

Bellamy’s Australia Ltd is one of the largest Australia food and beverage company and

the company is regarded to be the best and largest in organic infant formula production which are

in high demand among the consumers. The company has its headquarters in Australia and has

operational sites in about 8 other places (Bellamy's Australia Ltd 2018). The company has an

CORPORATE ACCOUNTING

Introduction

The focus of this assessment lies in analysis of the financial statements of two companies

which are engaged in same industry. The company which are considered for this assessment are

Bega Cheese Ltd and Bellamy’s Australia Ltd which are both engaged in providing the

customers with consumer staple food products. The assessment systematically shows

comparative study of the financial elements which are shown in the annual report of the

companies for a period of 3 years. The assessment shows increase or decrease in different

aspects of the business during the three years frame.

Bega Cheese Ltd is engaged in dairy business and predominantly engages in its business

operations in New South Wales of Australia. The company was initially founded as dairy

supplying business or as an agriculture cooperative in Australia. The company is regarded to be

the leading brand which produces cheese in the country. It is estimated that half of the revenues

of the company is generated with the different varieties of cheese products which is offered by

the business (Bega Cheese Ltd. 2018). The company in 2017 has acquired the business

of Mondelez International which has extensive grocery and dairy business both in Australia and

New Zealand. The company has therefore added the popular products such as Vegemite and

Bonox thus providing the business more scope for profitability.

Bellamy’s Australia Ltd is one of the largest Australia food and beverage company and

the company is regarded to be the best and largest in organic infant formula production which are

in high demand among the consumers. The company has its headquarters in Australia and has

operational sites in about 8 other places (Bellamy's Australia Ltd 2018). The company has an

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

CORPORATE ACCOUNTING

excellent distribution system which it utilizes effectively for distributing its products across

stores, pharmacy and direct customer through online sales.

The assessment goes into details regarding the equity position of the business and any

changes in the same during the three years period (Brochet, Jagolinzer and Riedl 2013). The

report also looks into the cash flow statement which is prepared by the businesses and also

accounting for taxes for the current year.

Discussions

Owner’s Equity

The owner’s equity represents the equity capital which is utilized by the business for

managing the day to day operations which is associated with the business. The owner’s equity of

a business is represented in the balance sheet of the business. The analysis is to be conducted for

both the companies on the basis of the information which is shown in the annual reports of the

business for the last three years. As per the annual reports of Bega Cheese ltd for 2017, the three

elements which are shown in the owner’s equity section are share capital, reserves and retained

earnings (Vismara 2016). The share capital of the business shows the capital which the business

is able to accumulated by issues of shares and securities of the business. As per the annual report

of 2015, the share capital of the business is shown to be $ 103.942,000 which is shown to be $

224,692,000 for the year 2017. The increase in the share capital of the business suggest that the

business has issued new shares and the same has been issued in 2017 itself. The increase in share

capital also indicates that the liquidity position of the business has improved significantly during

the period. The reserve and retained earning balance which is shown in the balance sheet

represent a part of the profits which the company retains for the purpose of meeting any

CORPORATE ACCOUNTING

excellent distribution system which it utilizes effectively for distributing its products across

stores, pharmacy and direct customer through online sales.

The assessment goes into details regarding the equity position of the business and any

changes in the same during the three years period (Brochet, Jagolinzer and Riedl 2013). The

report also looks into the cash flow statement which is prepared by the businesses and also

accounting for taxes for the current year.

Discussions

Owner’s Equity

The owner’s equity represents the equity capital which is utilized by the business for

managing the day to day operations which is associated with the business. The owner’s equity of

a business is represented in the balance sheet of the business. The analysis is to be conducted for

both the companies on the basis of the information which is shown in the annual reports of the

business for the last three years. As per the annual reports of Bega Cheese ltd for 2017, the three

elements which are shown in the owner’s equity section are share capital, reserves and retained

earnings (Vismara 2016). The share capital of the business shows the capital which the business

is able to accumulated by issues of shares and securities of the business. As per the annual report

of 2015, the share capital of the business is shown to be $ 103.942,000 which is shown to be $

224,692,000 for the year 2017. The increase in the share capital of the business suggest that the

business has issued new shares and the same has been issued in 2017 itself. The increase in share

capital also indicates that the liquidity position of the business has improved significantly during

the period. The reserve and retained earning balance which is shown in the balance sheet

represent a part of the profits which the company retains for the purpose of meeting any

5

CORPORATE ACCOUNTING

emergency or even financing the fund requirements of the business (Thirumalaisamy 2013). The

reserve balance and the retained earnings balance of the business is shown to have increased

significantly during the year 2017. The increase in reserves and retained earnings of the business

can be considered to be a positive sign for the business as this suggest that the profitability of the

business has increased significantly over the years.

The annual report of Bellamy’s Australia Ltd shows that the business has share capital,

reserves and retained earnings as shown in the annual report of the business. The share capital of

the company for the year 2015 is shown to be $ 39,655,000 and the equity share capital is shown

to have increased significantly during the year 2017 and the same is shown to be $ 53,795,000.

This shows that the business has issued new shares during the year and the rise in share capital is

consistent on year to year basis which shows that the management of the company relies more on

equity capital for the purpose of meeting the financial requirements of the business (Tandon and

Malhotra 2013). The reserves and retained earnings figure of the business has also increased

significantly as per 2017 analysis which is clear indicator that the business of Bellamy’s

Australia ltd is performing efficiently while meeting the expectations of the shareholders of the

company.

Corporate Structure Analysis

The capital structure of the business is an important consideration for formulating the

strategies of the business. The capital structure of a business is made of equity capitals and debt

capital. The mixture of equity and debt capital differs from company to company. The capital

structure of Bega Cheese ltd shows that the business has the policy of using both equity and debt

capital in meeting the financial requirements of the business (Serfling 2016). The debt capital of

the business for the year 2017 is shown to be $ 215,280,000 which was just $ 47,500,000 in

CORPORATE ACCOUNTING

emergency or even financing the fund requirements of the business (Thirumalaisamy 2013). The

reserve balance and the retained earnings balance of the business is shown to have increased

significantly during the year 2017. The increase in reserves and retained earnings of the business

can be considered to be a positive sign for the business as this suggest that the profitability of the

business has increased significantly over the years.

The annual report of Bellamy’s Australia Ltd shows that the business has share capital,

reserves and retained earnings as shown in the annual report of the business. The share capital of

the company for the year 2015 is shown to be $ 39,655,000 and the equity share capital is shown

to have increased significantly during the year 2017 and the same is shown to be $ 53,795,000.

This shows that the business has issued new shares during the year and the rise in share capital is

consistent on year to year basis which shows that the management of the company relies more on

equity capital for the purpose of meeting the financial requirements of the business (Tandon and

Malhotra 2013). The reserves and retained earnings figure of the business has also increased

significantly as per 2017 analysis which is clear indicator that the business of Bellamy’s

Australia ltd is performing efficiently while meeting the expectations of the shareholders of the

company.

Corporate Structure Analysis

The capital structure of the business is an important consideration for formulating the

strategies of the business. The capital structure of a business is made of equity capitals and debt

capital. The mixture of equity and debt capital differs from company to company. The capital

structure of Bega Cheese ltd shows that the business has the policy of using both equity and debt

capital in meeting the financial requirements of the business (Serfling 2016). The debt capital of

the business for the year 2017 is shown to be $ 215,280,000 which was just $ 47,500,000 in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

CORPORATE ACCOUNTING

2016. The debt capital of the business has increased during the year and so has the equity capital

which is used by the business (Antão and Bonfim 2014). The capital structure mix for the

company shows that the managements wants a balanced capital structure which is made of oth

equity and debt caapit.

On the other hand, Bellamy’s Australia Ltd shows a capital structure which signifies that

the management of the company utilizes both equity and debt capital (Jõeveer 2013). The

borrowings of the business for the year 2016 is shown to be $ 130,000 and the same is shown to

have increased significantly to $ 25,264,000 for the year 2017. The increase in debts of the

business is done to meet the expenses of the business and the profit and loss statement also

shows that the business has incurred significant amount of losses in current year. The capital

structure of the business is dominated by equity share capital and a minor portion is contributed

by debt capital.

On the basis of the discussion which is provided above, a comparative analysis can be

conducted. The management of Bega Cheese ltd prefers more of a balanced capital structure

whereas the business of Bellamy’s Australia Ltd relies more on utilization of equity capital in

order to meet the financial requirements of the business.

Cash Flow Analysis

The cash flow statement which is prepared by the business are mainly prepared by

businesses for the purpose of analyzing the cash position of the business and also identify the

cash inflows and outflows of the business. The cash flow statement of Bega Cheese ltd for the

year 2017 comprise of cash from operating activities, cash from investing activities and cash

from financial activities (Barth 2013). The cash flow statement of the business shows favorable

CORPORATE ACCOUNTING

2016. The debt capital of the business has increased during the year and so has the equity capital

which is used by the business (Antão and Bonfim 2014). The capital structure mix for the

company shows that the managements wants a balanced capital structure which is made of oth

equity and debt caapit.

On the other hand, Bellamy’s Australia Ltd shows a capital structure which signifies that

the management of the company utilizes both equity and debt capital (Jõeveer 2013). The

borrowings of the business for the year 2016 is shown to be $ 130,000 and the same is shown to

have increased significantly to $ 25,264,000 for the year 2017. The increase in debts of the

business is done to meet the expenses of the business and the profit and loss statement also

shows that the business has incurred significant amount of losses in current year. The capital

structure of the business is dominated by equity share capital and a minor portion is contributed

by debt capital.

On the basis of the discussion which is provided above, a comparative analysis can be

conducted. The management of Bega Cheese ltd prefers more of a balanced capital structure

whereas the business of Bellamy’s Australia Ltd relies more on utilization of equity capital in

order to meet the financial requirements of the business.

Cash Flow Analysis

The cash flow statement which is prepared by the business are mainly prepared by

businesses for the purpose of analyzing the cash position of the business and also identify the

cash inflows and outflows of the business. The cash flow statement of Bega Cheese ltd for the

year 2017 comprise of cash from operating activities, cash from investing activities and cash

from financial activities (Barth 2013). The cash flow statement of the business shows favorable

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

CORPORATE ACCOUNTING

conditions. The cash flow statement of Bellamy’s Australia ltd is not showing a favorable

position as the cash and cash equivalent balance is shown to have decreased from the previous

year and the same suggest that the liquidity of the business has decreased.

Both the companies show that the main receipts from operating activities of the business

is through sale of the products to customers and the main cash outflow is shown to be related to

the payments which is made to the suppliers and employees of the business. The cash from

investing activities of the business mainly comprise of purchases and sales of assets which are

undertaken by the business during the year (Balsari and Varan 2014). The cash flow from

financing activities of the business for both the companies shows the shares which the

management of the company has undertaken during the year and also the borrowings which is

taken by the business during the year. The cash flow statement of both the companies are

prepared following the conceptual framework which are commonly followed by most of the

businesses.

Comparative Analysis of Cash Flow statement of Both Companies

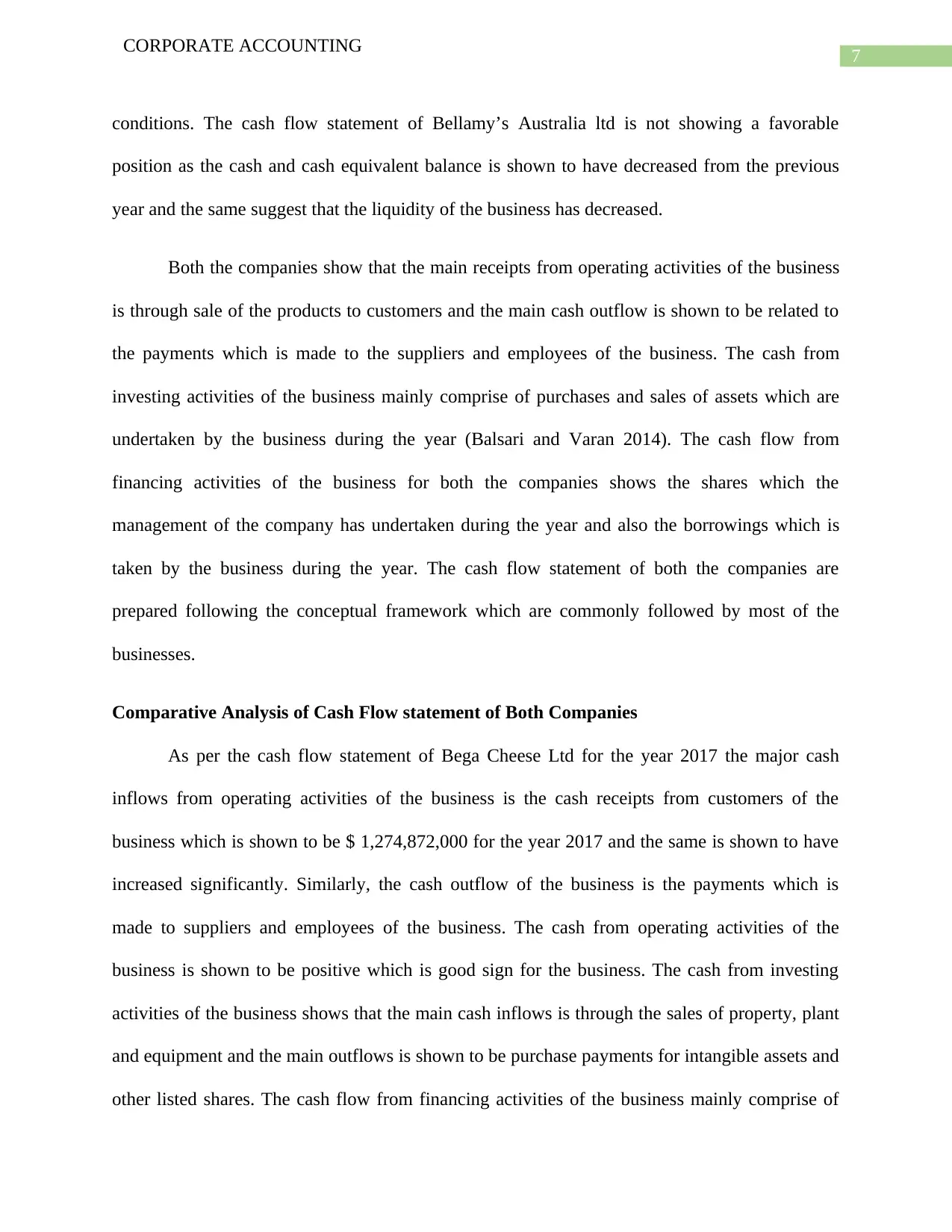

As per the cash flow statement of Bega Cheese Ltd for the year 2017 the major cash

inflows from operating activities of the business is the cash receipts from customers of the

business which is shown to be $ 1,274,872,000 for the year 2017 and the same is shown to have

increased significantly. Similarly, the cash outflow of the business is the payments which is

made to suppliers and employees of the business. The cash from operating activities of the

business is shown to be positive which is good sign for the business. The cash from investing

activities of the business shows that the main cash inflows is through the sales of property, plant

and equipment and the main outflows is shown to be purchase payments for intangible assets and

other listed shares. The cash flow from financing activities of the business mainly comprise of

CORPORATE ACCOUNTING

conditions. The cash flow statement of Bellamy’s Australia ltd is not showing a favorable

position as the cash and cash equivalent balance is shown to have decreased from the previous

year and the same suggest that the liquidity of the business has decreased.

Both the companies show that the main receipts from operating activities of the business

is through sale of the products to customers and the main cash outflow is shown to be related to

the payments which is made to the suppliers and employees of the business. The cash from

investing activities of the business mainly comprise of purchases and sales of assets which are

undertaken by the business during the year (Balsari and Varan 2014). The cash flow from

financing activities of the business for both the companies shows the shares which the

management of the company has undertaken during the year and also the borrowings which is

taken by the business during the year. The cash flow statement of both the companies are

prepared following the conceptual framework which are commonly followed by most of the

businesses.

Comparative Analysis of Cash Flow statement of Both Companies

As per the cash flow statement of Bega Cheese Ltd for the year 2017 the major cash

inflows from operating activities of the business is the cash receipts from customers of the

business which is shown to be $ 1,274,872,000 for the year 2017 and the same is shown to have

increased significantly. Similarly, the cash outflow of the business is the payments which is

made to suppliers and employees of the business. The cash from operating activities of the

business is shown to be positive which is good sign for the business. The cash from investing

activities of the business shows that the main cash inflows is through the sales of property, plant

and equipment and the main outflows is shown to be purchase payments for intangible assets and

other listed shares. The cash flow from financing activities of the business mainly comprise of

8

CORPORATE ACCOUNTING

loans proceeds which is taken by the business and the new equity shares which is issued by the

business. A graph is presented below which shows the cash flows of the business:

Particular 2015 2016 2017

Net cash flows from operating activities -$ 17,345.00 $ 58,980.00 $ 57,074.00

Net cash flows used in investing activities -$ 36,416.00 -$ 39,634.00 $ 151,257.00

Net cash flows used in financing activities $ 35,415.00 -$ 19,972.00 $ 257,544.00

2015 2016 2017

$(100,000.00)

$(50,000.00)

$-

$50,000.00

$100,000.00

$150,000.00

$200,000.00

$250,000.00

$300,000.00

$(17,345.00)

$58,980.00 $57,074.00

$(36,416.00) $(39,634.00)

$151,257.00

$35,415.00

$(19,972.00)

$257,544.00

Comparati ve analysis of cash fl ow categories of Bega

Cheese Limited

The above graph effectively shows the cash position of the business for the three years

period. In 2017, the bar graphs are shown to be positive which is a favorable sign for the

CORPORATE ACCOUNTING

loans proceeds which is taken by the business and the new equity shares which is issued by the

business. A graph is presented below which shows the cash flows of the business:

Particular 2015 2016 2017

Net cash flows from operating activities -$ 17,345.00 $ 58,980.00 $ 57,074.00

Net cash flows used in investing activities -$ 36,416.00 -$ 39,634.00 $ 151,257.00

Net cash flows used in financing activities $ 35,415.00 -$ 19,972.00 $ 257,544.00

2015 2016 2017

$(100,000.00)

$(50,000.00)

$-

$50,000.00

$100,000.00

$150,000.00

$200,000.00

$250,000.00

$300,000.00

$(17,345.00)

$58,980.00 $57,074.00

$(36,416.00) $(39,634.00)

$151,257.00

$35,415.00

$(19,972.00)

$257,544.00

Comparati ve analysis of cash fl ow categories of Bega

Cheese Limited

The above graph effectively shows the cash position of the business for the three years

period. In 2017, the bar graphs are shown to be positive which is a favorable sign for the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

CORPORATE ACCOUNTING

business. The comparison also shows that the business has significantly improved from the

position it was in 2015 and 2016.

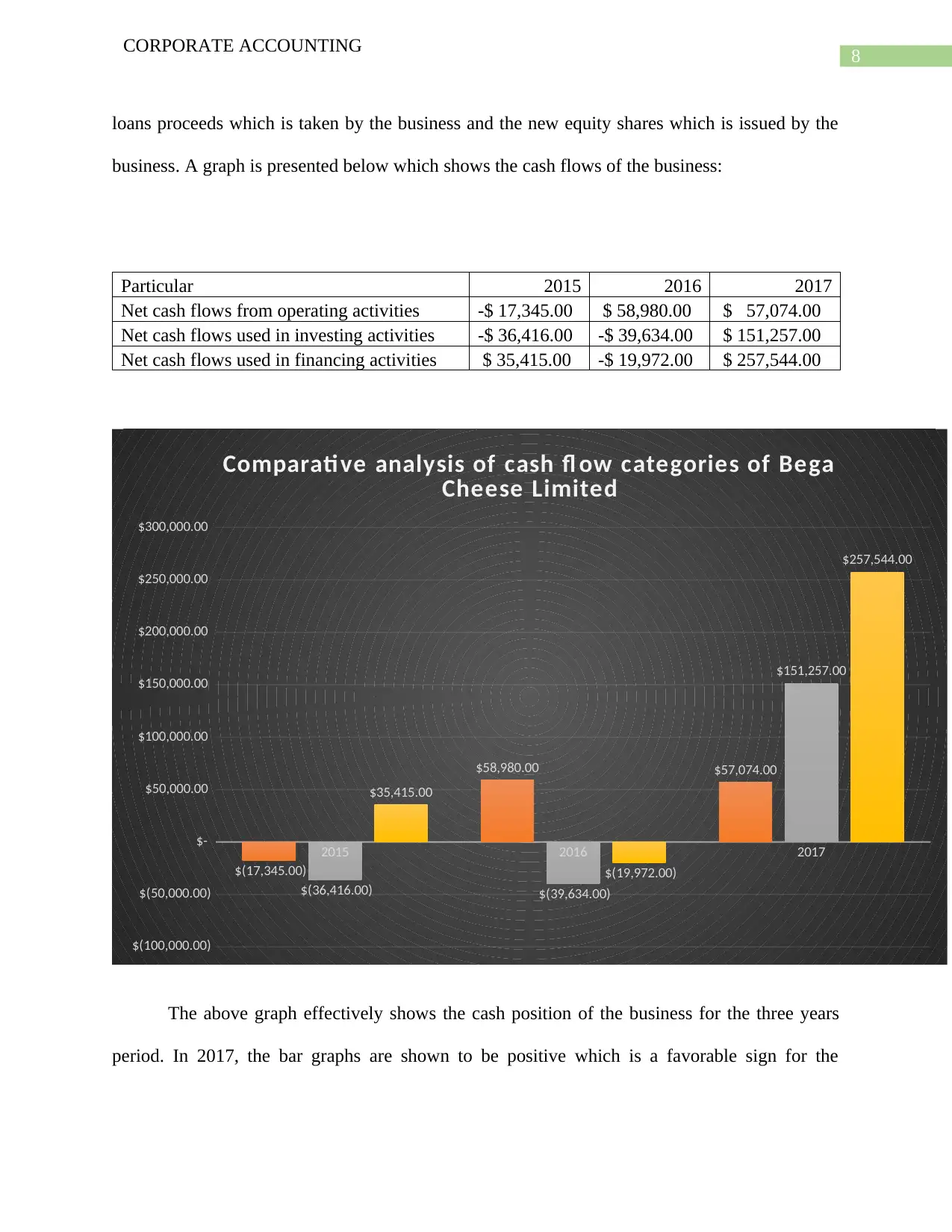

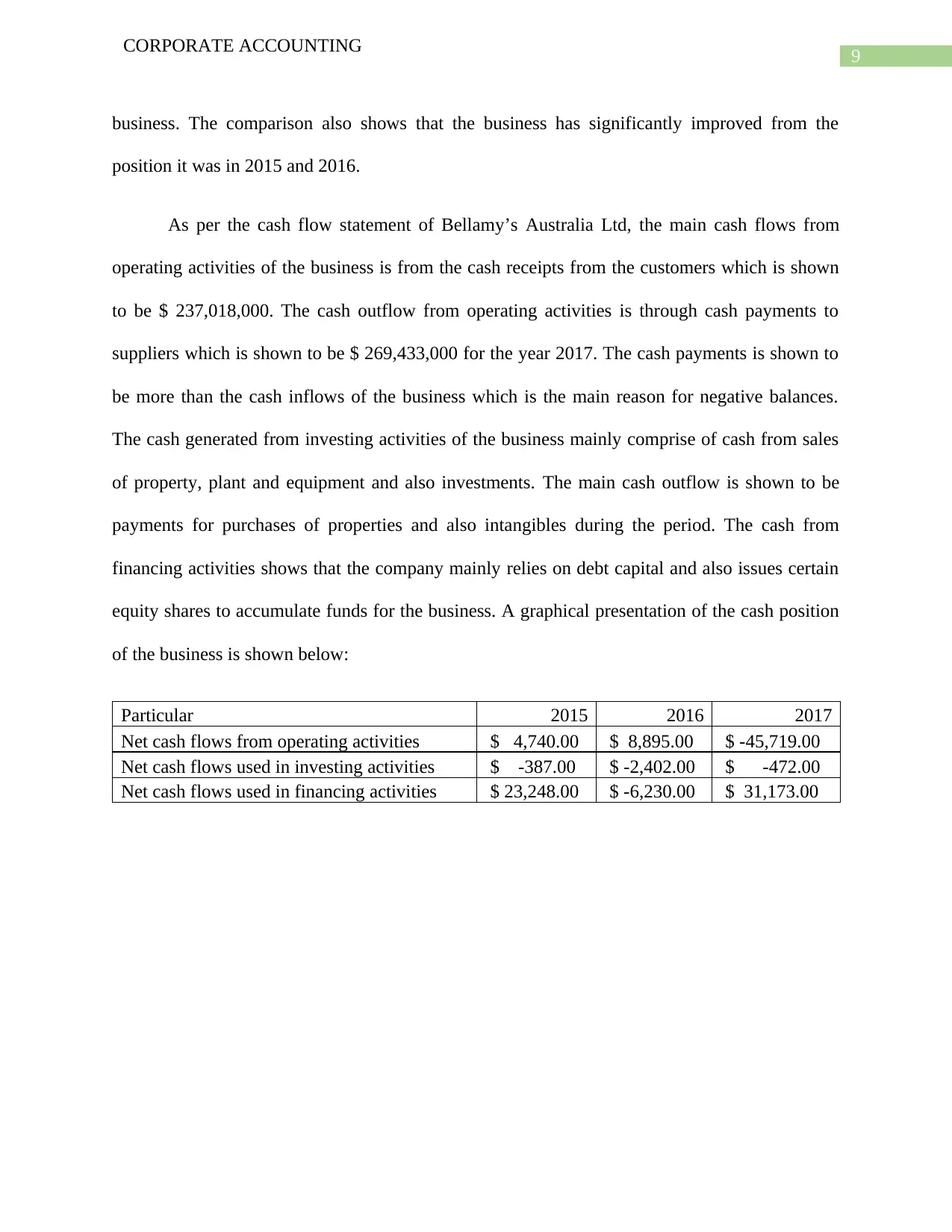

As per the cash flow statement of Bellamy’s Australia Ltd, the main cash flows from

operating activities of the business is from the cash receipts from the customers which is shown

to be $ 237,018,000. The cash outflow from operating activities is through cash payments to

suppliers which is shown to be $ 269,433,000 for the year 2017. The cash payments is shown to

be more than the cash inflows of the business which is the main reason for negative balances.

The cash generated from investing activities of the business mainly comprise of cash from sales

of property, plant and equipment and also investments. The main cash outflow is shown to be

payments for purchases of properties and also intangibles during the period. The cash from

financing activities shows that the company mainly relies on debt capital and also issues certain

equity shares to accumulate funds for the business. A graphical presentation of the cash position

of the business is shown below:

Particular 2015 2016 2017

Net cash flows from operating activities $ 4,740.00 $ 8,895.00 $ -45,719.00

Net cash flows used in investing activities $ -387.00 $ -2,402.00 $ -472.00

Net cash flows used in financing activities $ 23,248.00 $ -6,230.00 $ 31,173.00

CORPORATE ACCOUNTING

business. The comparison also shows that the business has significantly improved from the

position it was in 2015 and 2016.

As per the cash flow statement of Bellamy’s Australia Ltd, the main cash flows from

operating activities of the business is from the cash receipts from the customers which is shown

to be $ 237,018,000. The cash outflow from operating activities is through cash payments to

suppliers which is shown to be $ 269,433,000 for the year 2017. The cash payments is shown to

be more than the cash inflows of the business which is the main reason for negative balances.

The cash generated from investing activities of the business mainly comprise of cash from sales

of property, plant and equipment and also investments. The main cash outflow is shown to be

payments for purchases of properties and also intangibles during the period. The cash from

financing activities shows that the company mainly relies on debt capital and also issues certain

equity shares to accumulate funds for the business. A graphical presentation of the cash position

of the business is shown below:

Particular 2015 2016 2017

Net cash flows from operating activities $ 4,740.00 $ 8,895.00 $ -45,719.00

Net cash flows used in investing activities $ -387.00 $ -2,402.00 $ -472.00

Net cash flows used in financing activities $ 23,248.00 $ -6,230.00 $ 31,173.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

CORPORATE ACCOUNTING

2015 2016 2017

$-50,000.00

$-40,000.00

$-30,000.00

$-20,000.00

$-10,000.00

$-

$10,000.00

$20,000.00

$30,000.00

$40,000.00

$4,740.00

$8,895.00

$-45,719.00

$-387.00 $-2,402.00 $-472.00

$23,248.00

$-6,230.00

$31,173.00

Comparati ve analysis of cash fl ow categories of

Bellamy's Australia Ltd

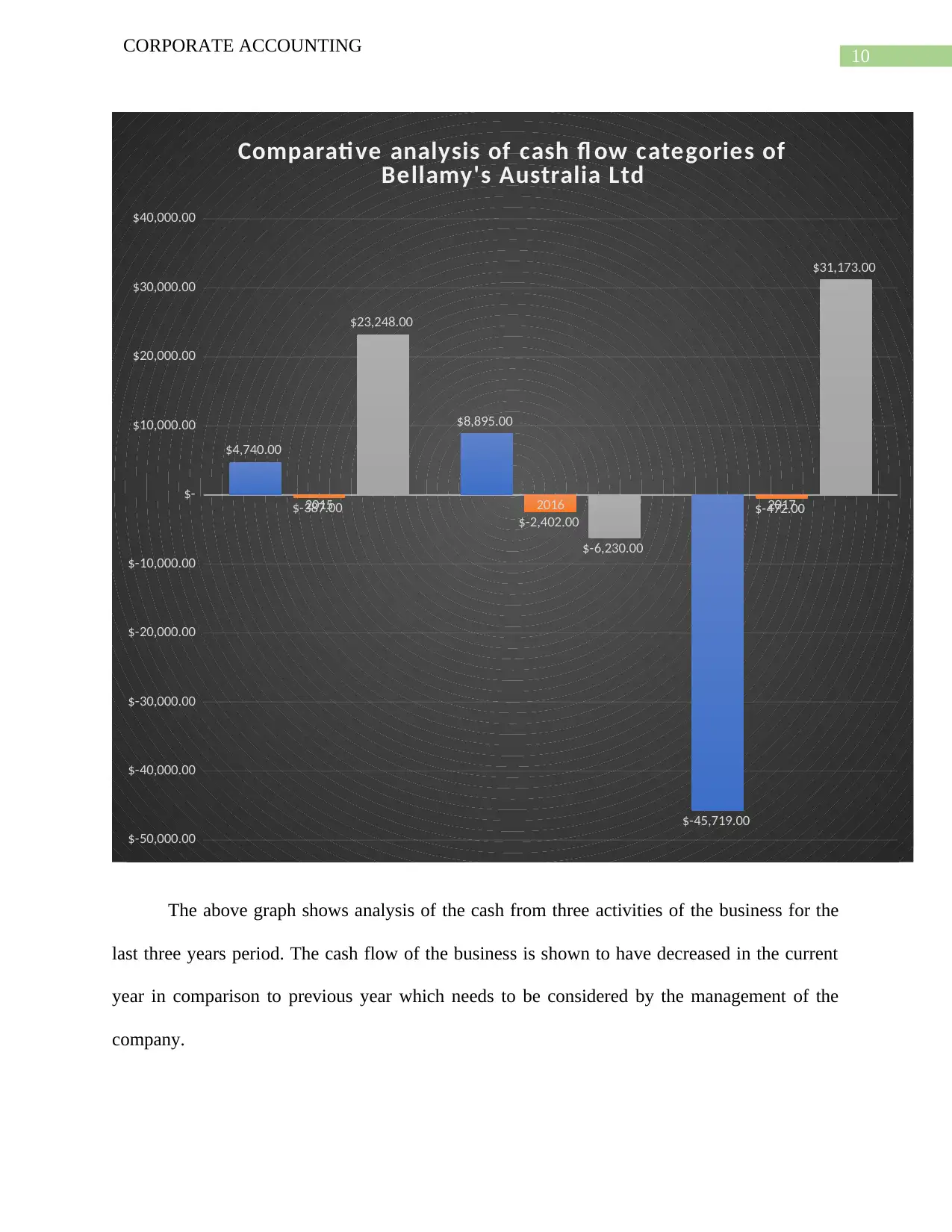

The above graph shows analysis of the cash from three activities of the business for the

last three years period. The cash flow of the business is shown to have decreased in the current

year in comparison to previous year which needs to be considered by the management of the

company.

CORPORATE ACCOUNTING

2015 2016 2017

$-50,000.00

$-40,000.00

$-30,000.00

$-20,000.00

$-10,000.00

$-

$10,000.00

$20,000.00

$30,000.00

$40,000.00

$4,740.00

$8,895.00

$-45,719.00

$-387.00 $-2,402.00 $-472.00

$23,248.00

$-6,230.00

$31,173.00

Comparati ve analysis of cash fl ow categories of

Bellamy's Australia Ltd

The above graph shows analysis of the cash from three activities of the business for the

last three years period. The cash flow of the business is shown to have decreased in the current

year in comparison to previous year which needs to be considered by the management of the

company.

11

CORPORATE ACCOUNTING

Insights of Cash flow Statement

The cash flow statement of both the companies which is presented above shows that Bega

Cheese ltd has a favorable cash position as all the activities of the business is able to generate

cash inflows for the business which is a positive for the business. The capital structure which is

utilized by the business is also shown to be appropriate. On the other hand, the cash flow

statement of Bellamy shows in appropriate cash flows during the period. The cash from

operating activity is shown to be negative which shows operational weakness of the business and

also shows that the management is struggling to keep the liquidity of the business.

Accounting for Comprehensive Items

The comprehensive items which are shown in the profit and loss statement of Bega

Cheese ltd for the year 2017 consist of hedge cash flows and change in values of financial assets

of the business. On the other hand, the items which are included in the profit and loss statement

of Bellamy’s Australia Ltd are hedge cash flow items and exchange difference which arises from

translation of fully owned foreign entities.

Reporting of Comprehensive Items

The comprehensive items of a business are shown separately as they are of extraordinary

nature and does not form part of the ordinary business transactions of the business (Duran and

Lozano-Vivas 2013). These items are separately shown either in income statement or in a

separate statement.

Comparative Analysis of Comprehensive items

The comprehensive items show that the both the companies have made investments in

hedge contracts in order to avoid the risk of fluctuations in foreign exchanges (Firescu 2015).

CORPORATE ACCOUNTING

Insights of Cash flow Statement

The cash flow statement of both the companies which is presented above shows that Bega

Cheese ltd has a favorable cash position as all the activities of the business is able to generate

cash inflows for the business which is a positive for the business. The capital structure which is

utilized by the business is also shown to be appropriate. On the other hand, the cash flow

statement of Bellamy shows in appropriate cash flows during the period. The cash from

operating activity is shown to be negative which shows operational weakness of the business and

also shows that the management is struggling to keep the liquidity of the business.

Accounting for Comprehensive Items

The comprehensive items which are shown in the profit and loss statement of Bega

Cheese ltd for the year 2017 consist of hedge cash flows and change in values of financial assets

of the business. On the other hand, the items which are included in the profit and loss statement

of Bellamy’s Australia Ltd are hedge cash flow items and exchange difference which arises from

translation of fully owned foreign entities.

Reporting of Comprehensive Items

The comprehensive items of a business are shown separately as they are of extraordinary

nature and does not form part of the ordinary business transactions of the business (Duran and

Lozano-Vivas 2013). These items are separately shown either in income statement or in a

separate statement.

Comparative Analysis of Comprehensive items

The comprehensive items show that the both the companies have made investments in

hedge contracts in order to avoid the risk of fluctuations in foreign exchanges (Firescu 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.