Corporate Accounting Report: ASX Listed Company Analysis

VerifiedAdded on 2023/06/04

|17

|4368

|489

Report

AI Summary

This report provides a comprehensive analysis of the financial statements of Ausdrill Ltd and Rio Tinto Ltd, two companies operating in the mining industry. The analysis covers a three-year period, examining key components such as income tax expense, cash flow statements, owner's equity, and capital structure. The report delves into the income articulation of both organizations to understand their cash flows, leading to a comparative analysis of their cash flow statements. It also evaluates the effective tax rate, cash tax rate, and deferred tax assets and liabilities, along with an explanation of the tax structure and tax expenses. The report also includes an examination of owner's equity and capital structure, comparing the debt and equity capital employed by each company. The findings highlight the financial positions, cash flow patterns, and tax strategies of Ausdrill Ltd and Rio Tinto Ltd, offering insights into their financial performance and management approaches. The report is designed to provide a detailed overview of the financial aspects of the two companies and their comparative performance.

Running head: CORPORATE ACCOUNTING

Corporate Accounting

Name of the Student:

Name of the University:

Author’s Note:

Corporate Accounting

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

CORPORATE ACCOUNTING

Executive Summary

The primary reason for this evaluation is to investigate the financial statements of two

organizations for a time of three years. The organizations which are chosen for this

discussion are Ausdrill ltd and Rio Tinto Ltd. The assessment breaks down various

components which are disclosed in the yearly report, for example, the income tax expense.

The evaluation in dept analyses the income articulation of both the organizations keeping in

mind the end goal to under the cash flows of the business amid the year. The analysis leads to

a comparative analysis of the cash flow statement between Ausdrill ltd and Rio Tinto Ltd.

The evaluation of Effective tax rate and Cash and Book tax rates and furthermore a

clarification of the tax structure and tax expenses of both the organizations.

CORPORATE ACCOUNTING

Executive Summary

The primary reason for this evaluation is to investigate the financial statements of two

organizations for a time of three years. The organizations which are chosen for this

discussion are Ausdrill ltd and Rio Tinto Ltd. The assessment breaks down various

components which are disclosed in the yearly report, for example, the income tax expense.

The evaluation in dept analyses the income articulation of both the organizations keeping in

mind the end goal to under the cash flows of the business amid the year. The analysis leads to

a comparative analysis of the cash flow statement between Ausdrill ltd and Rio Tinto Ltd.

The evaluation of Effective tax rate and Cash and Book tax rates and furthermore a

clarification of the tax structure and tax expenses of both the organizations.

2

CORPORATE ACCOUNTING

Table of Contents

Introduction................................................................................................................................3

Discussion..................................................................................................................................4

Owner’s Equity......................................................................................................................4

Position of Capital Structure for both the organization.........................................................5

Analysis of Cash Flow Statement..........................................................................................6

Comparison of the three Components in the Cash Flow Statement.......................................8

Insight of Cash flow Statement..............................................................................................9

Other Comprehensive Income Statement Analysis................................................................9

Reporting of Comprehensive Items.....................................................................................10

Comparative Analysis of Comprehensive Items..................................................................10

Accounting for Income Tax.................................................................................................10

Effective Rate of Tax...........................................................................................................11

Deferred Tax Assets and Liabilities.....................................................................................11

Cash Tax Amount and Rate of Both Company....................................................................12

Difference between Book Tax Rate and Cash Tax Rate......................................................12

References................................................................................................................................12

CORPORATE ACCOUNTING

Table of Contents

Introduction................................................................................................................................3

Discussion..................................................................................................................................4

Owner’s Equity......................................................................................................................4

Position of Capital Structure for both the organization.........................................................5

Analysis of Cash Flow Statement..........................................................................................6

Comparison of the three Components in the Cash Flow Statement.......................................8

Insight of Cash flow Statement..............................................................................................9

Other Comprehensive Income Statement Analysis................................................................9

Reporting of Comprehensive Items.....................................................................................10

Comparative Analysis of Comprehensive Items..................................................................10

Accounting for Income Tax.................................................................................................10

Effective Rate of Tax...........................................................................................................11

Deferred Tax Assets and Liabilities.....................................................................................11

Cash Tax Amount and Rate of Both Company....................................................................12

Difference between Book Tax Rate and Cash Tax Rate......................................................12

References................................................................................................................................12

You're viewing a preview

Unlock full access by subscribing today!

3

CORPORATE ACCOUNTING

Introduction

The primary motivation behind this evaluation is to examine the financial statements

of two organizations that operates in similar industry and has comparable level of business

operations. The two organizations which are chosen for this analysis are Ausdrill Ltd and Rio

Tinto Ltd which are both engaged in extraction and mining and of mineral assets. For the

analysis the yearly reports of the two organizations are taken. The analysis includes the

various components of the financial statements and furthermore makes a comparison between

the two organizations and find out the better reporting components of the yearly reports.

The company Ausdrill Ltd is occupied with the operations of extricating minerals and

mining business in Australia. The primary operations of the organization are in Australia but

the business has additionally extended to specific zones of Africa and United Kingdom

(Ausdrill.com.au. 2018). The organization has some expertise in mining administrations,

review control and drill and blast investigation projects. The organization additionally utilizes

a critical number of representatives in the business and the incomes of the business are

continually improving.

On the other hand the Rio Tinto Ltd is viewed as one of the main organizations in

Mining industry and has its beginning as an Anglo-Australian organization which has a larger

part of its functions in Australia. The organization is known for its mining exercises and is a

main metals producer in Australia. The organization deals with iron ores, coal, copper,

uranium and precious stones. Additionally, the organization is additionally occupied with the

operations of refining bauxite and various different minerals (Riotinto.com. 2018).

The primary motive of the analysis will be to break down the yearly reports of both

the organizations for last three continuous years beginning from 2017. The evaluation

CORPORATE ACCOUNTING

Introduction

The primary motivation behind this evaluation is to examine the financial statements

of two organizations that operates in similar industry and has comparable level of business

operations. The two organizations which are chosen for this analysis are Ausdrill Ltd and Rio

Tinto Ltd which are both engaged in extraction and mining and of mineral assets. For the

analysis the yearly reports of the two organizations are taken. The analysis includes the

various components of the financial statements and furthermore makes a comparison between

the two organizations and find out the better reporting components of the yearly reports.

The company Ausdrill Ltd is occupied with the operations of extricating minerals and

mining business in Australia. The primary operations of the organization are in Australia but

the business has additionally extended to specific zones of Africa and United Kingdom

(Ausdrill.com.au. 2018). The organization has some expertise in mining administrations,

review control and drill and blast investigation projects. The organization additionally utilizes

a critical number of representatives in the business and the incomes of the business are

continually improving.

On the other hand the Rio Tinto Ltd is viewed as one of the main organizations in

Mining industry and has its beginning as an Anglo-Australian organization which has a larger

part of its functions in Australia. The organization is known for its mining exercises and is a

main metals producer in Australia. The organization deals with iron ores, coal, copper,

uranium and precious stones. Additionally, the organization is additionally occupied with the

operations of refining bauxite and various different minerals (Riotinto.com. 2018).

The primary motive of the analysis will be to break down the yearly reports of both

the organizations for last three continuous years beginning from 2017. The evaluation

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

CORPORATE ACCOUNTING

additionally demonstrates examination and investigation of the components that appear in the

yearly reports (Bryce, Ali and Mather 2015). The significant areas that are covered from the

annual reports the companies include equity capital, cash flow statements, disclosures and tax

treatments. Moreover, calculations regarding effective tax rate and other tax computations are

done in this report.

Discussion

Owner’s Equity

The owner equity represents the equity capital and businesses retained earnings which

are utilized for financing the operations. The yearly report of 2017 is considered for both the

organizations to analyze the equity of owners of the business. As per the yearly report of

2017 for the Ausdrill Ltd, in the balance sheet, the owners equity appears. The owner’s equity

contains retained earnings, other reserves and contributed equity. The contributed equity

identifies with the share capital which the organization has gathered by issuing to the people

in general. The owner’s equity of the business for the year 2017 is appeared to be $

546,447,000 which is same as the figure that appeared for past years. There have been no

adjustments in the figure of value according to earlier estimates (Saito 2016). The retained

earnings of the business refers to the profits which are kept aside either for reinvesting the

same in the business or meeting certain future commitments. The retained earnings of the

business for the year 2017 have essentially expanded in contrast with earlier year and the

same is appeared to be $ 121,444,000. The estimate which appeared for 2015 is $ 38,027,000

(Ausdrill.com.au. 2018). Hence, there is a general pattern which demonstrates the rise in the

profit of the business. This may occur because of the change in profit of the business and

because of changes in the working structure of the business. The reserves of the business are

CORPORATE ACCOUNTING

additionally demonstrates examination and investigation of the components that appear in the

yearly reports (Bryce, Ali and Mather 2015). The significant areas that are covered from the

annual reports the companies include equity capital, cash flow statements, disclosures and tax

treatments. Moreover, calculations regarding effective tax rate and other tax computations are

done in this report.

Discussion

Owner’s Equity

The owner equity represents the equity capital and businesses retained earnings which

are utilized for financing the operations. The yearly report of 2017 is considered for both the

organizations to analyze the equity of owners of the business. As per the yearly report of

2017 for the Ausdrill Ltd, in the balance sheet, the owners equity appears. The owner’s equity

contains retained earnings, other reserves and contributed equity. The contributed equity

identifies with the share capital which the organization has gathered by issuing to the people

in general. The owner’s equity of the business for the year 2017 is appeared to be $

546,447,000 which is same as the figure that appeared for past years. There have been no

adjustments in the figure of value according to earlier estimates (Saito 2016). The retained

earnings of the business refers to the profits which are kept aside either for reinvesting the

same in the business or meeting certain future commitments. The retained earnings of the

business for the year 2017 have essentially expanded in contrast with earlier year and the

same is appeared to be $ 121,444,000. The estimate which appeared for 2015 is $ 38,027,000

(Ausdrill.com.au. 2018). Hence, there is a general pattern which demonstrates the rise in the

profit of the business. This may occur because of the change in profit of the business and

because of changes in the working structure of the business. The reserves of the business are

5

CORPORATE ACCOUNTING

appeared is negative, this represents that the accumulated losses of the business which are

from earlier year.

Then again, the owners equity which is appearing in the yearly report of the business

for 2017 includes the share capital of the business, share premium, held income and stores.

The share capital for the business for 2017 contains owners equity Rio Tinto Limited (Suzuki

2015). The share capital speaks to the assets which are utilized by the business to meet the

commitments of the business. The share capital of the business is appeared to be US$ 4,140

million which has altogether enhanced in comparison with earlier year. This is because of the

way that the organization has issued certain number of offers amid the year with a specific

end goal to draw capital from the same. The held income of the business is appeared to be

US$ 23,761 million (Riotinto.com. 2018). The retained earnings of the business have

additionally expanded which is because of increase in the profit making capacity of the

business. The yearly report additionally demonstrates that the profit reserves of the business

are for meeting any future commitments of the business.

Position of Capital Structure for both the organization

The Ausdrill ltd’s capital structure of according to the balance sheet the business for

the year 2017 is appeared to be more depending on equity capital than the debt capital of the

business. The obligation capital is appeared to be $ 385,815,000 for the year 2017 and the

same was $ 395,019,000 of every 2016 as appeared to be determined sheet of the

organization for 2016 which demonstrates that the administration of organization repayed the

advance amid the present year. If there ids an occurrence of share capital, the business has

expanded the share capital of the business amid the year as appeared in the balance sheet of

the business. The borrowings of the business for the year 2015 are appeared to be $

407,307,000 which is higher than estimation of 2016 (Ausdrill.com.au. 2018). The

CORPORATE ACCOUNTING

appeared is negative, this represents that the accumulated losses of the business which are

from earlier year.

Then again, the owners equity which is appearing in the yearly report of the business

for 2017 includes the share capital of the business, share premium, held income and stores.

The share capital for the business for 2017 contains owners equity Rio Tinto Limited (Suzuki

2015). The share capital speaks to the assets which are utilized by the business to meet the

commitments of the business. The share capital of the business is appeared to be US$ 4,140

million which has altogether enhanced in comparison with earlier year. This is because of the

way that the organization has issued certain number of offers amid the year with a specific

end goal to draw capital from the same. The held income of the business is appeared to be

US$ 23,761 million (Riotinto.com. 2018). The retained earnings of the business have

additionally expanded which is because of increase in the profit making capacity of the

business. The yearly report additionally demonstrates that the profit reserves of the business

are for meeting any future commitments of the business.

Position of Capital Structure for both the organization

The Ausdrill ltd’s capital structure of according to the balance sheet the business for

the year 2017 is appeared to be more depending on equity capital than the debt capital of the

business. The obligation capital is appeared to be $ 385,815,000 for the year 2017 and the

same was $ 395,019,000 of every 2016 as appeared to be determined sheet of the

organization for 2016 which demonstrates that the administration of organization repayed the

advance amid the present year. If there ids an occurrence of share capital, the business has

expanded the share capital of the business amid the year as appeared in the balance sheet of

the business. The borrowings of the business for the year 2015 are appeared to be $

407,307,000 which is higher than estimation of 2016 (Ausdrill.com.au. 2018). The

You're viewing a preview

Unlock full access by subscribing today!

6

CORPORATE ACCOUNTING

examination for three years uncovers that the administration is systematically reducing the

debts of the business and accordingly concentrating on application of more equity capital.

On account of Rio Tinto Ltd, the balance sheet of the organization for the year 2017

demonstrates that the borrowings of the business are US$ 15,148 million which is lower than

the estimate which is appeared for the year 2016 which is US$ 17,470 million. The

borrowings of the business for the year 2015 are appeared to be US$ 21,140 million which is

more than debt capital which is appeared for 2016 (Bryce, Ali and Mather 2015). This

represents that the administration of the organization is required to pay off the debt capital of

the business on step by step basis. The organization has additionally equity capital which is

appeared in the yearly reports of the business amid the year that amounted to US$ 4,140

million for 2017 and the same was US$ 3,950 million of every 2015 which demonstrates that

the administration of the organization wanted to expand the equity capital in the business’s

capital structure (Riotinto.com. 2018). The administration of Rio Tinto Ltd is attempting to

expand the value capital of the business and is depending more on debt capital of the

business.

Hence, the examination of the equity and debt capital which is utilized by both the

organizations shows that Ausdrill ltd is more dependent on utilizing the debt capital for

financing the business activities while then again the administration of Rio Tinto ltd is

depending more on equity capital as the business is trying to pay off the debt capital which is

utilized by the business (Schaltegger and Burritt 2017). In any case, in current situation, the

administration of Rio Tinto ltd is utilizing more debt capital than the equity capital of the

business.

CORPORATE ACCOUNTING

examination for three years uncovers that the administration is systematically reducing the

debts of the business and accordingly concentrating on application of more equity capital.

On account of Rio Tinto Ltd, the balance sheet of the organization for the year 2017

demonstrates that the borrowings of the business are US$ 15,148 million which is lower than

the estimate which is appeared for the year 2016 which is US$ 17,470 million. The

borrowings of the business for the year 2015 are appeared to be US$ 21,140 million which is

more than debt capital which is appeared for 2016 (Bryce, Ali and Mather 2015). This

represents that the administration of the organization is required to pay off the debt capital of

the business on step by step basis. The organization has additionally equity capital which is

appeared in the yearly reports of the business amid the year that amounted to US$ 4,140

million for 2017 and the same was US$ 3,950 million of every 2015 which demonstrates that

the administration of the organization wanted to expand the equity capital in the business’s

capital structure (Riotinto.com. 2018). The administration of Rio Tinto Ltd is attempting to

expand the value capital of the business and is depending more on debt capital of the

business.

Hence, the examination of the equity and debt capital which is utilized by both the

organizations shows that Ausdrill ltd is more dependent on utilizing the debt capital for

financing the business activities while then again the administration of Rio Tinto ltd is

depending more on equity capital as the business is trying to pay off the debt capital which is

utilized by the business (Schaltegger and Burritt 2017). In any case, in current situation, the

administration of Rio Tinto ltd is utilizing more debt capital than the equity capital of the

business.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

CORPORATE ACCOUNTING

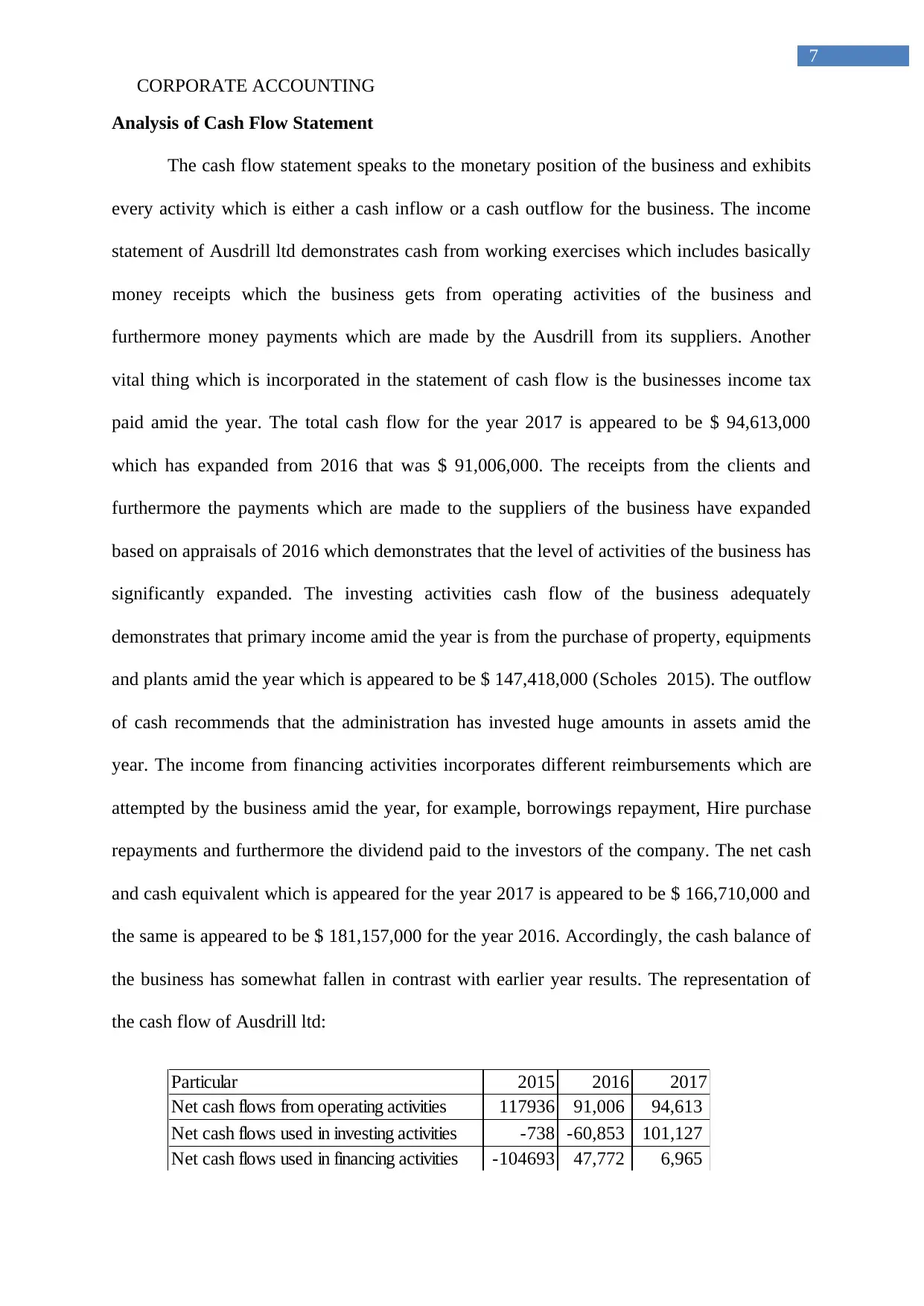

Analysis of Cash Flow Statement

The cash flow statement speaks to the monetary position of the business and exhibits

every activity which is either a cash inflow or a cash outflow for the business. The income

statement of Ausdrill ltd demonstrates cash from working exercises which includes basically

money receipts which the business gets from operating activities of the business and

furthermore money payments which are made by the Ausdrill from its suppliers. Another

vital thing which is incorporated in the statement of cash flow is the businesses income tax

paid amid the year. The total cash flow for the year 2017 is appeared to be $ 94,613,000

which has expanded from 2016 that was $ 91,006,000. The receipts from the clients and

furthermore the payments which are made to the suppliers of the business have expanded

based on appraisals of 2016 which demonstrates that the level of activities of the business has

significantly expanded. The investing activities cash flow of the business adequately

demonstrates that primary income amid the year is from the purchase of property, equipments

and plants amid the year which is appeared to be $ 147,418,000 (Scholes 2015). The outflow

of cash recommends that the administration has invested huge amounts in assets amid the

year. The income from financing activities incorporates different reimbursements which are

attempted by the business amid the year, for example, borrowings repayment, Hire purchase

repayments and furthermore the dividend paid to the investors of the company. The net cash

and cash equivalent which is appeared for the year 2017 is appeared to be $ 166,710,000 and

the same is appeared to be $ 181,157,000 for the year 2016. Accordingly, the cash balance of

the business has somewhat fallen in contrast with earlier year results. The representation of

the cash flow of Ausdrill ltd:

Particular 2015 2016 2017

Net cash flows from operating activities 117936 91,006 94,613

Net cash flows used in investing activities -738 -60,853 101,127

Net cash flows used in financing activities -104693 47,772 6,965

CORPORATE ACCOUNTING

Analysis of Cash Flow Statement

The cash flow statement speaks to the monetary position of the business and exhibits

every activity which is either a cash inflow or a cash outflow for the business. The income

statement of Ausdrill ltd demonstrates cash from working exercises which includes basically

money receipts which the business gets from operating activities of the business and

furthermore money payments which are made by the Ausdrill from its suppliers. Another

vital thing which is incorporated in the statement of cash flow is the businesses income tax

paid amid the year. The total cash flow for the year 2017 is appeared to be $ 94,613,000

which has expanded from 2016 that was $ 91,006,000. The receipts from the clients and

furthermore the payments which are made to the suppliers of the business have expanded

based on appraisals of 2016 which demonstrates that the level of activities of the business has

significantly expanded. The investing activities cash flow of the business adequately

demonstrates that primary income amid the year is from the purchase of property, equipments

and plants amid the year which is appeared to be $ 147,418,000 (Scholes 2015). The outflow

of cash recommends that the administration has invested huge amounts in assets amid the

year. The income from financing activities incorporates different reimbursements which are

attempted by the business amid the year, for example, borrowings repayment, Hire purchase

repayments and furthermore the dividend paid to the investors of the company. The net cash

and cash equivalent which is appeared for the year 2017 is appeared to be $ 166,710,000 and

the same is appeared to be $ 181,157,000 for the year 2016. Accordingly, the cash balance of

the business has somewhat fallen in contrast with earlier year results. The representation of

the cash flow of Ausdrill ltd:

Particular 2015 2016 2017

Net cash flows from operating activities 117936 91,006 94,613

Net cash flows used in investing activities -738 -60,853 101,127

Net cash flows used in financing activities -104693 47,772 6,965

8

CORPORATE ACCOUNTING

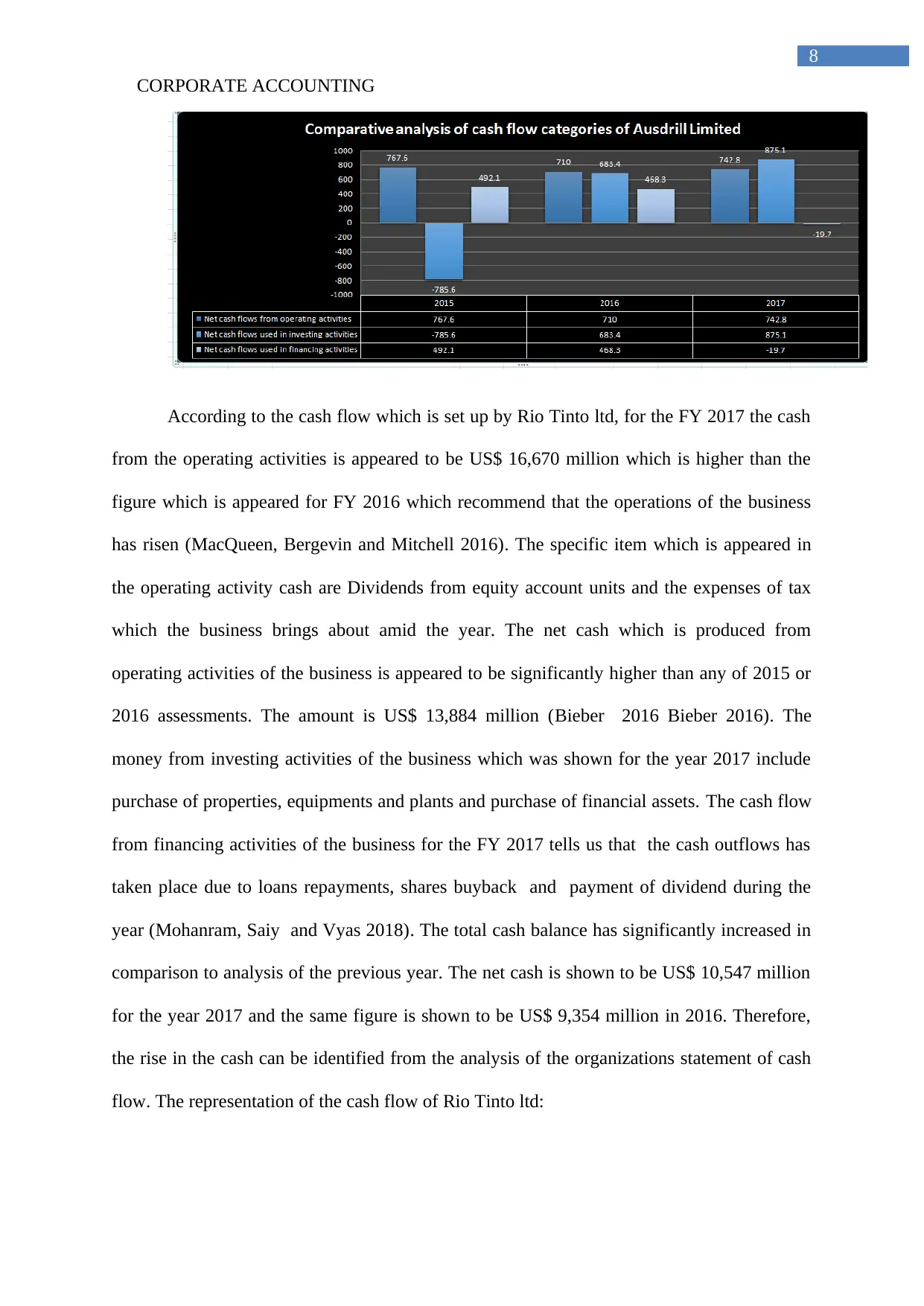

According to the cash flow which is set up by Rio Tinto ltd, for the FY 2017 the cash

from the operating activities is appeared to be US$ 16,670 million which is higher than the

figure which is appeared for FY 2016 which recommend that the operations of the business

has risen (MacQueen, Bergevin and Mitchell 2016). The specific item which is appeared in

the operating activity cash are Dividends from equity account units and the expenses of tax

which the business brings about amid the year. The net cash which is produced from

operating activities of the business is appeared to be significantly higher than any of 2015 or

2016 assessments. The amount is US$ 13,884 million (Bieber 2016 Bieber 2016). The

money from investing activities of the business which was shown for the year 2017 include

purchase of properties, equipments and plants and purchase of financial assets. The cash flow

from financing activities of the business for the FY 2017 tells us that the cash outflows has

taken place due to loans repayments, shares buyback and payment of dividend during the

year (Mohanram, Saiy and Vyas 2018). The total cash balance has significantly increased in

comparison to analysis of the previous year. The net cash is shown to be US$ 10,547 million

for the year 2017 and the same figure is shown to be US$ 9,354 million in 2016. Therefore,

the rise in the cash can be identified from the analysis of the organizations statement of cash

flow. The representation of the cash flow of Rio Tinto ltd:

CORPORATE ACCOUNTING

According to the cash flow which is set up by Rio Tinto ltd, for the FY 2017 the cash

from the operating activities is appeared to be US$ 16,670 million which is higher than the

figure which is appeared for FY 2016 which recommend that the operations of the business

has risen (MacQueen, Bergevin and Mitchell 2016). The specific item which is appeared in

the operating activity cash are Dividends from equity account units and the expenses of tax

which the business brings about amid the year. The net cash which is produced from

operating activities of the business is appeared to be significantly higher than any of 2015 or

2016 assessments. The amount is US$ 13,884 million (Bieber 2016 Bieber 2016). The

money from investing activities of the business which was shown for the year 2017 include

purchase of properties, equipments and plants and purchase of financial assets. The cash flow

from financing activities of the business for the FY 2017 tells us that the cash outflows has

taken place due to loans repayments, shares buyback and payment of dividend during the

year (Mohanram, Saiy and Vyas 2018). The total cash balance has significantly increased in

comparison to analysis of the previous year. The net cash is shown to be US$ 10,547 million

for the year 2017 and the same figure is shown to be US$ 9,354 million in 2016. Therefore,

the rise in the cash can be identified from the analysis of the organizations statement of cash

flow. The representation of the cash flow of Rio Tinto ltd:

You're viewing a preview

Unlock full access by subscribing today!

9

CORPORATE ACCOUNTING

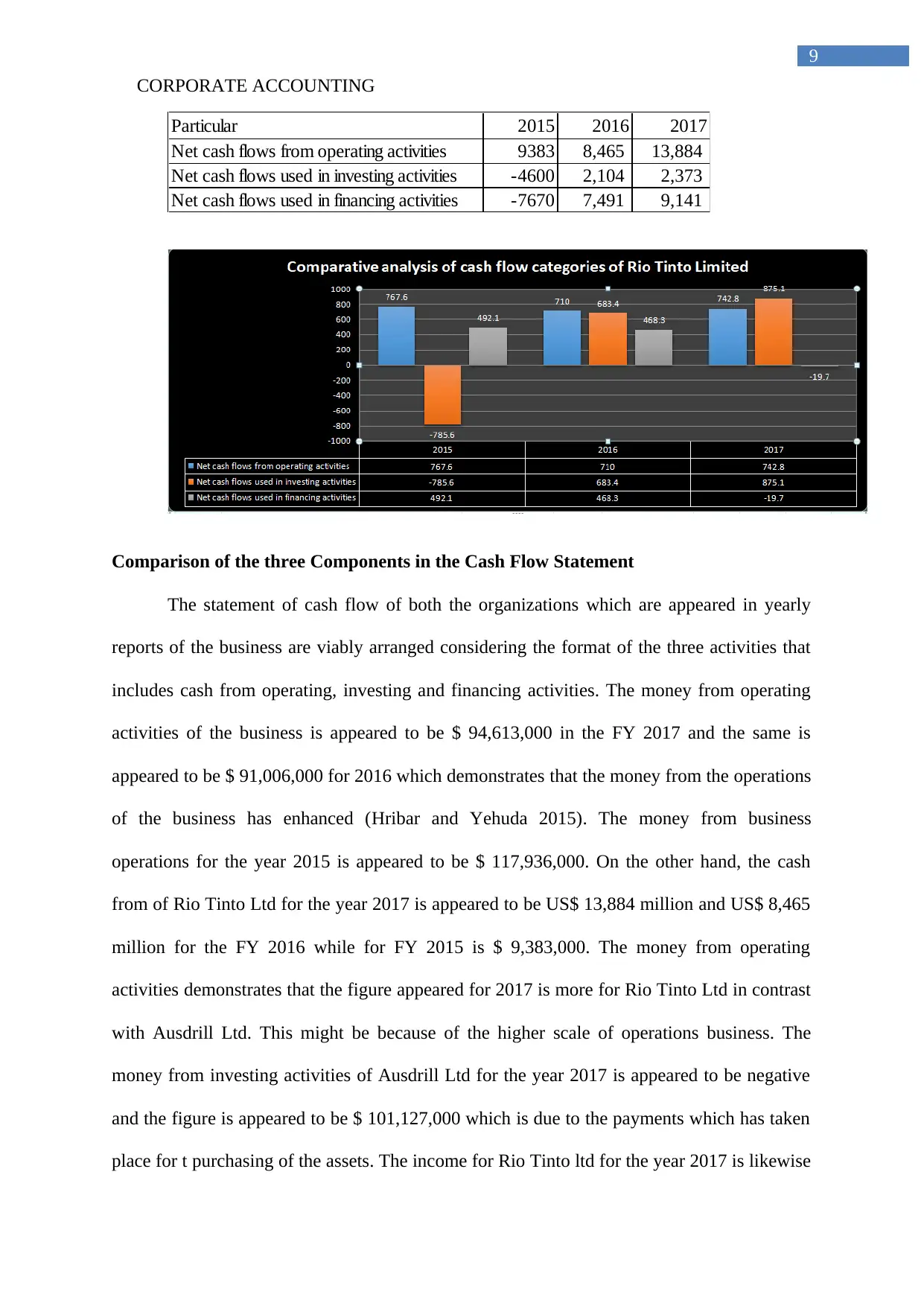

Particular 2015 2016 2017

Net cash flows from operating activities 9383 8,465 13,884

Net cash flows used in investing activities -4600 2,104 2,373

Net cash flows used in financing activities -7670 7,491 9,141

Comparison of the three Components in the Cash Flow Statement

The statement of cash flow of both the organizations which are appeared in yearly

reports of the business are viably arranged considering the format of the three activities that

includes cash from operating, investing and financing activities. The money from operating

activities of the business is appeared to be $ 94,613,000 in the FY 2017 and the same is

appeared to be $ 91,006,000 for 2016 which demonstrates that the money from the operations

of the business has enhanced (Hribar and Yehuda 2015). The money from business

operations for the year 2015 is appeared to be $ 117,936,000. On the other hand, the cash

from of Rio Tinto Ltd for the year 2017 is appeared to be US$ 13,884 million and US$ 8,465

million for the FY 2016 while for FY 2015 is $ 9,383,000. The money from operating

activities demonstrates that the figure appeared for 2017 is more for Rio Tinto Ltd in contrast

with Ausdrill Ltd. This might be because of the higher scale of operations business. The

money from investing activities of Ausdrill Ltd for the year 2017 is appeared to be negative

and the figure is appeared to be $ 101,127,000 which is due to the payments which has taken

place for t purchasing of the assets. The income for Rio Tinto ltd for the year 2017 is likewise

CORPORATE ACCOUNTING

Particular 2015 2016 2017

Net cash flows from operating activities 9383 8,465 13,884

Net cash flows used in investing activities -4600 2,104 2,373

Net cash flows used in financing activities -7670 7,491 9,141

Comparison of the three Components in the Cash Flow Statement

The statement of cash flow of both the organizations which are appeared in yearly

reports of the business are viably arranged considering the format of the three activities that

includes cash from operating, investing and financing activities. The money from operating

activities of the business is appeared to be $ 94,613,000 in the FY 2017 and the same is

appeared to be $ 91,006,000 for 2016 which demonstrates that the money from the operations

of the business has enhanced (Hribar and Yehuda 2015). The money from business

operations for the year 2015 is appeared to be $ 117,936,000. On the other hand, the cash

from of Rio Tinto Ltd for the year 2017 is appeared to be US$ 13,884 million and US$ 8,465

million for the FY 2016 while for FY 2015 is $ 9,383,000. The money from operating

activities demonstrates that the figure appeared for 2017 is more for Rio Tinto Ltd in contrast

with Ausdrill Ltd. This might be because of the higher scale of operations business. The

money from investing activities of Ausdrill Ltd for the year 2017 is appeared to be negative

and the figure is appeared to be $ 101,127,000 which is due to the payments which has taken

place for t purchasing of the assets. The income for Rio Tinto ltd for the year 2017 is likewise

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

CORPORATE ACCOUNTING

appeared to be negative which is additionally because of the expanding amount of payments

for business purchases. The cash from investing activities of the business is appeared to be

better in case of Ausdrill Ltd. The cash from financing activities of the business essentially

involve loans repayments higher purchase agreements (Epstein 2018). The income from

financing exercises is appeared to be in negative which is $ 6,965 million for the year and the

same has enhanced from the previous year. On account of Rio Tinto ltd, the financing money

from tasks is appeared to more which implies that the organization has made many cash

payments amid the FY.

Insight of Cash flow Statement

The cash generated from the operations of the two companies represents that there is a

rise in cash from operations that denotes an enhancement of the operational efficiency of the

business. However the cash which is generated from operations is more appropriate for Rio

Tinto ltd as compared to Ausdrill ltd after the analysis. The cash from investing activities are

same as both the companies has an essential amount of cash flows related to purchases of

property, plant and equipment and loans repayment. The net cash from investing activities for

both the companies is negative (Mohanram, Saiy and Vyas 2018). The cash from financing

activities includes loans and dividends. The total cash generated by the companies is more for

Rio Tinto Ltd as compared to Ausdrill Ltd.

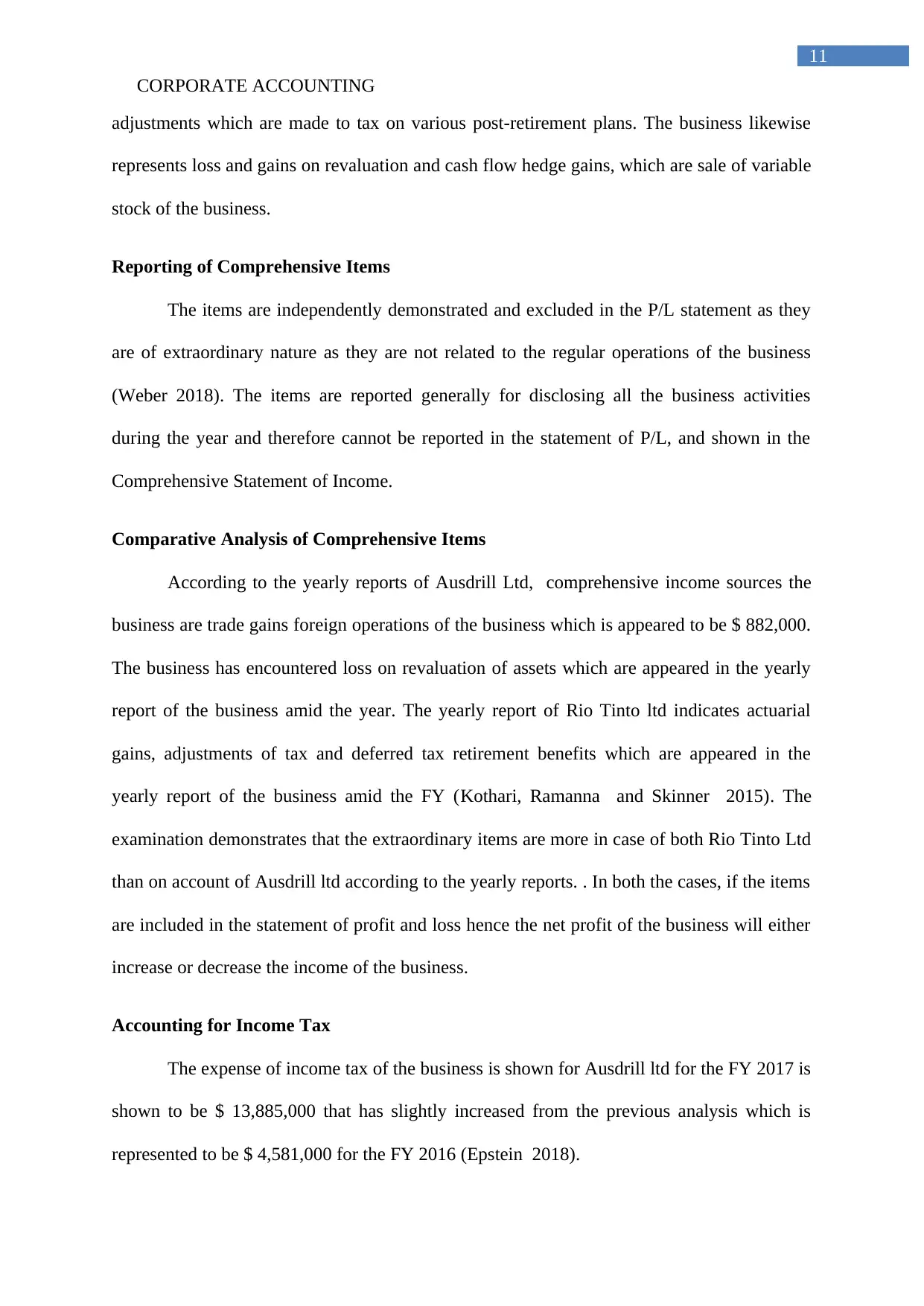

Other Comprehensive Income Statement Analysis

The comprehensive income statement involves the items which are not appearing in

the statement of profit or loss of the business. In case of Ausdrill ltd the items includes, trade

gains on exchange related to operations of foreign and is $ 882,000. There is additionally a

income which the business has obtained from joint ventures. Furthermore, gains on

revaluation on assets can also be identified (Wahlen, Baginski and Bradshaw 2014).

According to the yearly report of Rio Tinto for the year 2017 shows actuarial gains and

CORPORATE ACCOUNTING

appeared to be negative which is additionally because of the expanding amount of payments

for business purchases. The cash from investing activities of the business is appeared to be

better in case of Ausdrill Ltd. The cash from financing activities of the business essentially

involve loans repayments higher purchase agreements (Epstein 2018). The income from

financing exercises is appeared to be in negative which is $ 6,965 million for the year and the

same has enhanced from the previous year. On account of Rio Tinto ltd, the financing money

from tasks is appeared to more which implies that the organization has made many cash

payments amid the FY.

Insight of Cash flow Statement

The cash generated from the operations of the two companies represents that there is a

rise in cash from operations that denotes an enhancement of the operational efficiency of the

business. However the cash which is generated from operations is more appropriate for Rio

Tinto ltd as compared to Ausdrill ltd after the analysis. The cash from investing activities are

same as both the companies has an essential amount of cash flows related to purchases of

property, plant and equipment and loans repayment. The net cash from investing activities for

both the companies is negative (Mohanram, Saiy and Vyas 2018). The cash from financing

activities includes loans and dividends. The total cash generated by the companies is more for

Rio Tinto Ltd as compared to Ausdrill Ltd.

Other Comprehensive Income Statement Analysis

The comprehensive income statement involves the items which are not appearing in

the statement of profit or loss of the business. In case of Ausdrill ltd the items includes, trade

gains on exchange related to operations of foreign and is $ 882,000. There is additionally a

income which the business has obtained from joint ventures. Furthermore, gains on

revaluation on assets can also be identified (Wahlen, Baginski and Bradshaw 2014).

According to the yearly report of Rio Tinto for the year 2017 shows actuarial gains and

11

CORPORATE ACCOUNTING

adjustments which are made to tax on various post-retirement plans. The business likewise

represents loss and gains on revaluation and cash flow hedge gains, which are sale of variable

stock of the business.

Reporting of Comprehensive Items

The items are independently demonstrated and excluded in the P/L statement as they

are of extraordinary nature as they are not related to the regular operations of the business

(Weber 2018). The items are reported generally for disclosing all the business activities

during the year and therefore cannot be reported in the statement of P/L, and shown in the

Comprehensive Statement of Income.

Comparative Analysis of Comprehensive Items

According to the yearly reports of Ausdrill Ltd, comprehensive income sources the

business are trade gains foreign operations of the business which is appeared to be $ 882,000.

The business has encountered loss on revaluation of assets which are appeared in the yearly

report of the business amid the year. The yearly report of Rio Tinto ltd indicates actuarial

gains, adjustments of tax and deferred tax retirement benefits which are appeared in the

yearly report of the business amid the FY (Kothari, Ramanna and Skinner 2015). The

examination demonstrates that the extraordinary items are more in case of both Rio Tinto Ltd

than on account of Ausdrill ltd according to the yearly reports. . In both the cases, if the items

are included in the statement of profit and loss hence the net profit of the business will either

increase or decrease the income of the business.

Accounting for Income Tax

The expense of income tax of the business is shown for Ausdrill ltd for the FY 2017 is

shown to be $ 13,885,000 that has slightly increased from the previous analysis which is

represented to be $ 4,581,000 for the FY 2016 (Epstein 2018).

CORPORATE ACCOUNTING

adjustments which are made to tax on various post-retirement plans. The business likewise

represents loss and gains on revaluation and cash flow hedge gains, which are sale of variable

stock of the business.

Reporting of Comprehensive Items

The items are independently demonstrated and excluded in the P/L statement as they

are of extraordinary nature as they are not related to the regular operations of the business

(Weber 2018). The items are reported generally for disclosing all the business activities

during the year and therefore cannot be reported in the statement of P/L, and shown in the

Comprehensive Statement of Income.

Comparative Analysis of Comprehensive Items

According to the yearly reports of Ausdrill Ltd, comprehensive income sources the

business are trade gains foreign operations of the business which is appeared to be $ 882,000.

The business has encountered loss on revaluation of assets which are appeared in the yearly

report of the business amid the year. The yearly report of Rio Tinto ltd indicates actuarial

gains, adjustments of tax and deferred tax retirement benefits which are appeared in the

yearly report of the business amid the FY (Kothari, Ramanna and Skinner 2015). The

examination demonstrates that the extraordinary items are more in case of both Rio Tinto Ltd

than on account of Ausdrill ltd according to the yearly reports. . In both the cases, if the items

are included in the statement of profit and loss hence the net profit of the business will either

increase or decrease the income of the business.

Accounting for Income Tax

The expense of income tax of the business is shown for Ausdrill ltd for the FY 2017 is

shown to be $ 13,885,000 that has slightly increased from the previous analysis which is

represented to be $ 4,581,000 for the FY 2016 (Epstein 2018).

You're viewing a preview

Unlock full access by subscribing today!

12

CORPORATE ACCOUNTING

The expenses of income tax of Rio Tinto Ltd is represented in the annual report of the

business for the year 2017 which is $ 3,965 million and the same was shown to be $ 1,567

million for 2016.

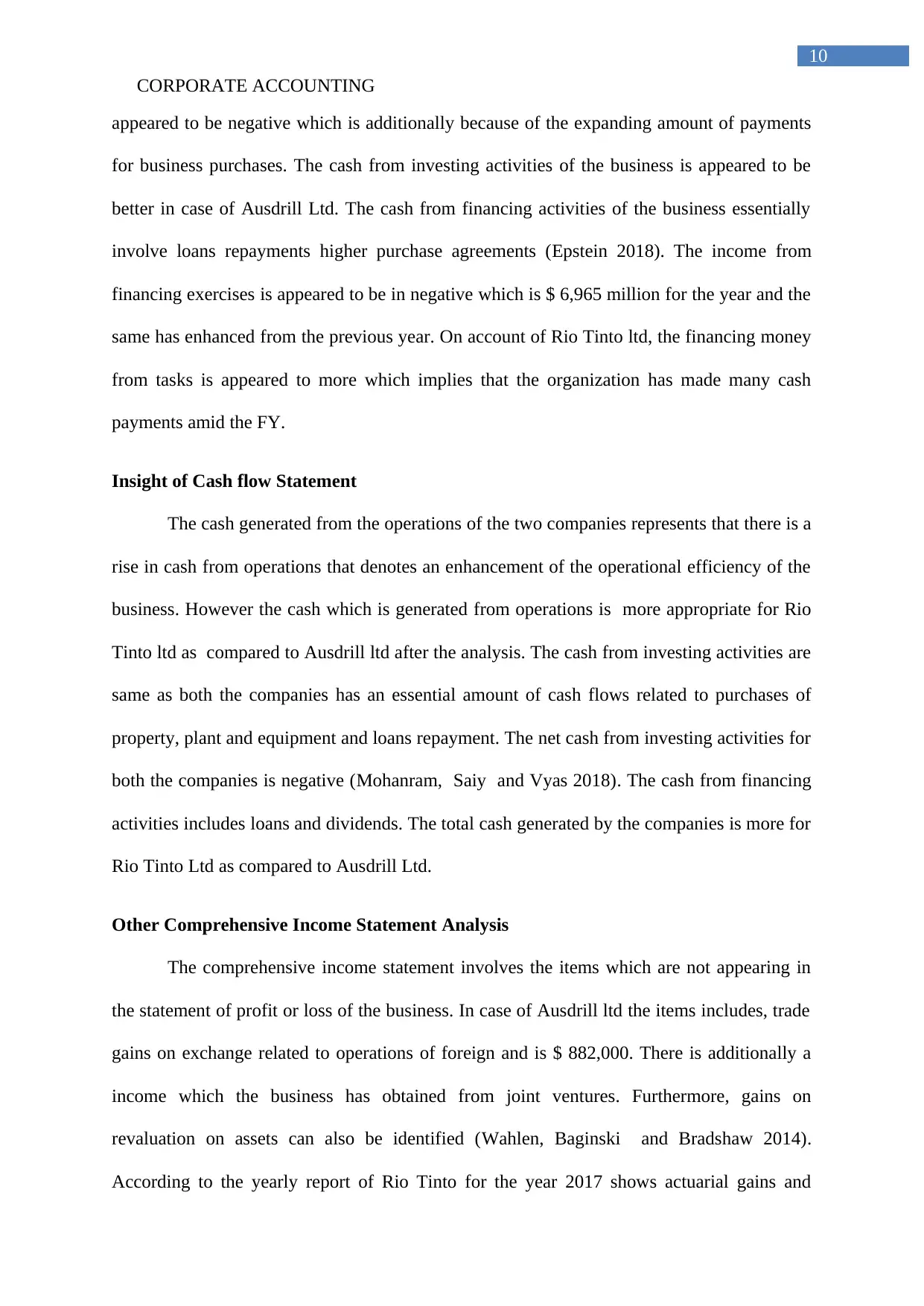

Effective Rate of Tax

Particulars Ausdrill Ltd Rio Tinto Ltd

Income Tax Expense 13,885,000 3,965,000,000

Earnings Before Tax 45,328,000 12,816,000,000

Effective Tax Rate 30.63% 30.94%

Computation of Effective Tax Rate

The effective rate of tax refers to the aggregate tax rate at which the business profits

are taxed and the computation of effective tax rate is shown in the figure above. The effective

rate of tax of Ausdrill ltd and Rio Tinto Ltd is represented in the above figure which is

30.63% and 30.94% ( Campbell 2015). Hence, it is clearly observed that the effective rate of

tax of Rio Tinto Ltd is improved than Ausdrill ltd and the same is higher.

Deferred Tax Assets and Liabilities

Deferred tax liabilities and assets shapes significant part of the financial statement of

the organization which is recorded at the year- end closing of accounts books and the same

has affects on the income tax which is appeared in the statement of Profit and loss. The

deferred tax of Ausdrill ltd is appeared to be 4 36,372,000 for the year 2017 and the same is

reduced in contrast with the previous year examination and the deferred tax liabilities of the

business is appeared to be $ 22,077,000 for the year 2017 which has additionally lessened in

contrast with the analysis of earlier year (Penman and Yehuda 2015).

In case of the deferred tax assets of Rio Tinto Ltd for the year 2017 is $ 3395 million

for the FY which has also decreased as compared to the analysis of previous year. The

CORPORATE ACCOUNTING

The expenses of income tax of Rio Tinto Ltd is represented in the annual report of the

business for the year 2017 which is $ 3,965 million and the same was shown to be $ 1,567

million for 2016.

Effective Rate of Tax

Particulars Ausdrill Ltd Rio Tinto Ltd

Income Tax Expense 13,885,000 3,965,000,000

Earnings Before Tax 45,328,000 12,816,000,000

Effective Tax Rate 30.63% 30.94%

Computation of Effective Tax Rate

The effective rate of tax refers to the aggregate tax rate at which the business profits

are taxed and the computation of effective tax rate is shown in the figure above. The effective

rate of tax of Ausdrill ltd and Rio Tinto Ltd is represented in the above figure which is

30.63% and 30.94% ( Campbell 2015). Hence, it is clearly observed that the effective rate of

tax of Rio Tinto Ltd is improved than Ausdrill ltd and the same is higher.

Deferred Tax Assets and Liabilities

Deferred tax liabilities and assets shapes significant part of the financial statement of

the organization which is recorded at the year- end closing of accounts books and the same

has affects on the income tax which is appeared in the statement of Profit and loss. The

deferred tax of Ausdrill ltd is appeared to be 4 36,372,000 for the year 2017 and the same is

reduced in contrast with the previous year examination and the deferred tax liabilities of the

business is appeared to be $ 22,077,000 for the year 2017 which has additionally lessened in

contrast with the analysis of earlier year (Penman and Yehuda 2015).

In case of the deferred tax assets of Rio Tinto Ltd for the year 2017 is $ 3395 million

for the FY which has also decreased as compared to the analysis of previous year. The

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13

CORPORATE ACCOUNTING

deferred tax liabilities for the FY 2017 are 3628 million and have increased from the

estimates of previous year.

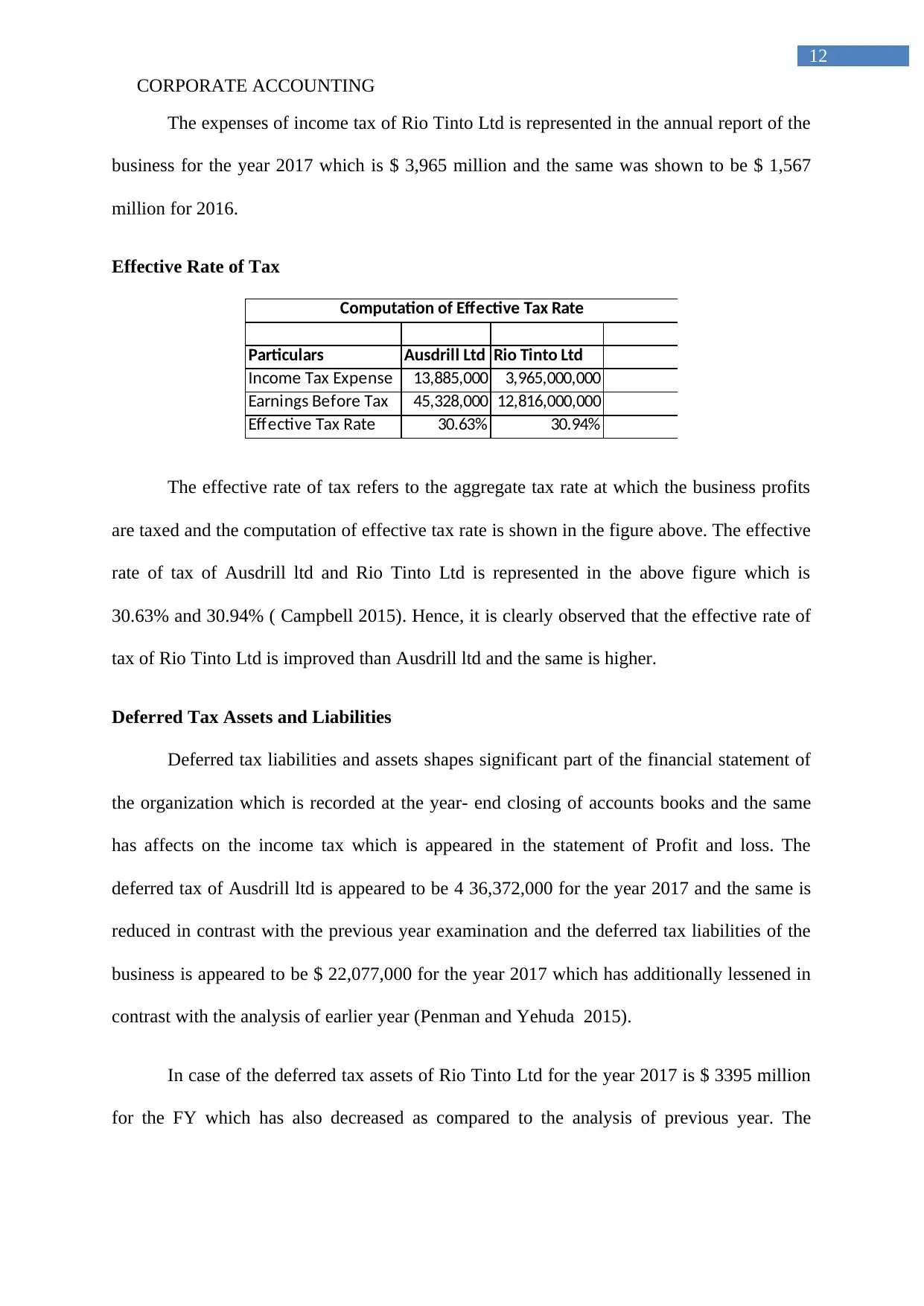

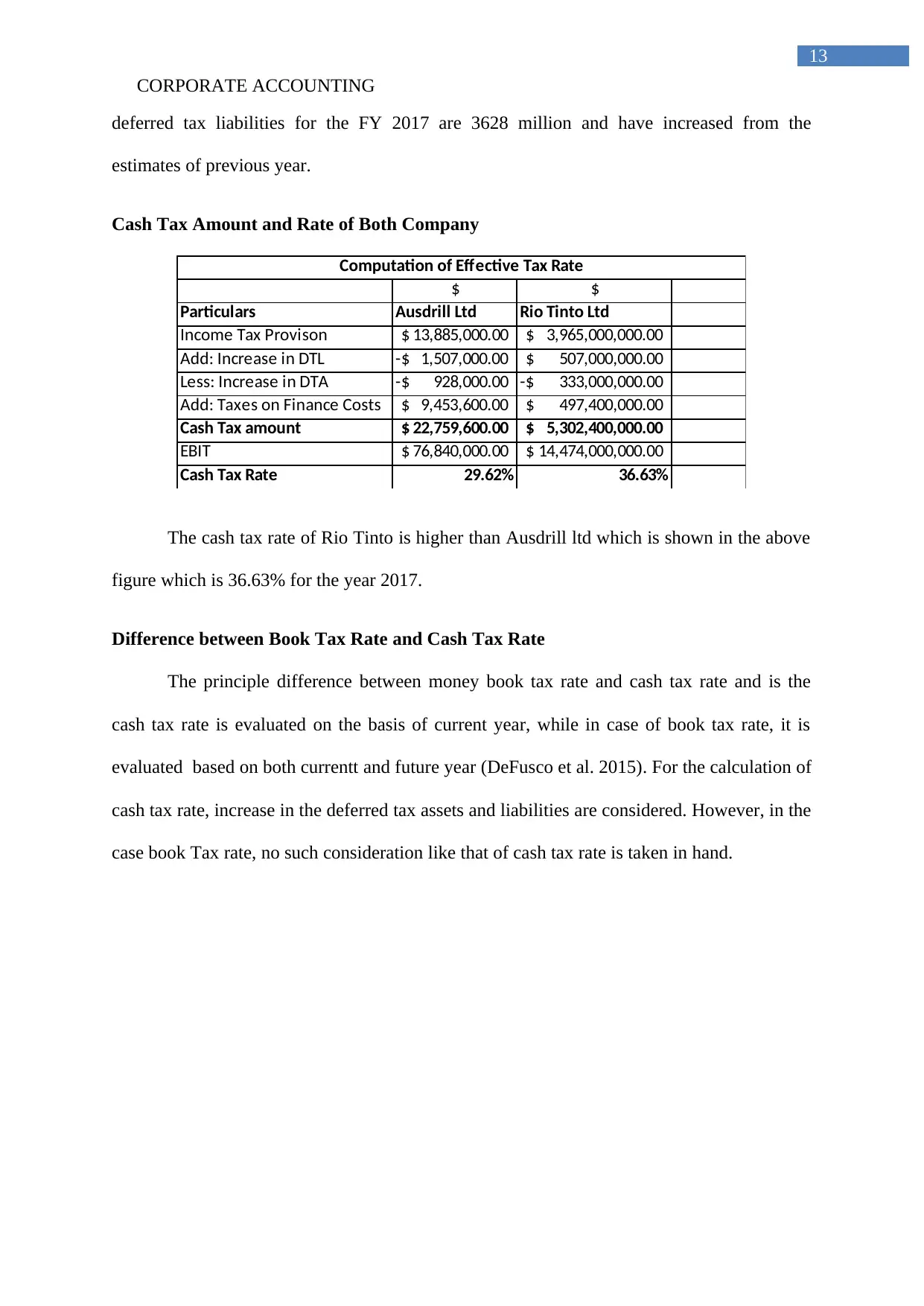

Cash Tax Amount and Rate of Both Company

$ $

Particulars Ausdrill Ltd Rio Tinto Ltd

Income Tax Provison 13,885,000.00$ 3,965,000,000.00$

Add: Increase in DTL 1,507,000.00-$ 507,000,000.00$

Less: Increase in DTA 928,000.00-$ 333,000,000.00-$

Add: Taxes on Finance Costs 9,453,600.00$ 497,400,000.00$

Cash Tax amount 22,759,600.00$ 5,302,400,000.00$

EBIT 76,840,000.00$ 14,474,000,000.00$

Cash Tax Rate 29.62% 36.63%

Computation of Effective Tax Rate

The cash tax rate of Rio Tinto is higher than Ausdrill ltd which is shown in the above

figure which is 36.63% for the year 2017.

Difference between Book Tax Rate and Cash Tax Rate

The principle difference between money book tax rate and cash tax rate and is the

cash tax rate is evaluated on the basis of current year, while in case of book tax rate, it is

evaluated based on both currentt and future year (DeFusco et al. 2015). For the calculation of

cash tax rate, increase in the deferred tax assets and liabilities are considered. However, in the

case book Tax rate, no such consideration like that of cash tax rate is taken in hand.

CORPORATE ACCOUNTING

deferred tax liabilities for the FY 2017 are 3628 million and have increased from the

estimates of previous year.

Cash Tax Amount and Rate of Both Company

$ $

Particulars Ausdrill Ltd Rio Tinto Ltd

Income Tax Provison 13,885,000.00$ 3,965,000,000.00$

Add: Increase in DTL 1,507,000.00-$ 507,000,000.00$

Less: Increase in DTA 928,000.00-$ 333,000,000.00-$

Add: Taxes on Finance Costs 9,453,600.00$ 497,400,000.00$

Cash Tax amount 22,759,600.00$ 5,302,400,000.00$

EBIT 76,840,000.00$ 14,474,000,000.00$

Cash Tax Rate 29.62% 36.63%

Computation of Effective Tax Rate

The cash tax rate of Rio Tinto is higher than Ausdrill ltd which is shown in the above

figure which is 36.63% for the year 2017.

Difference between Book Tax Rate and Cash Tax Rate

The principle difference between money book tax rate and cash tax rate and is the

cash tax rate is evaluated on the basis of current year, while in case of book tax rate, it is

evaluated based on both currentt and future year (DeFusco et al. 2015). For the calculation of

cash tax rate, increase in the deferred tax assets and liabilities are considered. However, in the

case book Tax rate, no such consideration like that of cash tax rate is taken in hand.

14

CORPORATE ACCOUNTING

References

Ausdrill.com.au. 2018. Annual Reports :Ausdrill. [online] Available at:

http://www.ausdrill.com.au/investors/annual-reports.html [Accessed 13 Sep. 2018].

Bieber, L., 2016. Financial Statement Analysis A Global Perspective. Perspective, 1, p.4.

Bryce, M., Ali, M.J. and Mather, P.R., 2015. Accounting quality in the pre-/post-IFRS

adoption periods and the impact on audit committee effectiveness—Evidence from

Australia. Pacific-Basin Finance Journal, 35, pp.163-181.

Campbell, J.L., 2015. The fair value of cash flow hedges, future profitability, and stock

returns. Contemporary Accounting Research, 32(1), pp.243-279.

DeFusco, R.A., McLeavey, D.W., Pinto, J.E., Anson, M.J. and Runkle, D.E.,

2015. Quantitative investment analysis. John Wiley & Sons.

Epstein, M.J., 2018. Making sustainability work: Best practices in managing and measuring

corporate social, environmental and economic impacts. Routledge.

Fazzini, M., 2018. Financial Statement Analysis. In Business Valuation (pp. 39-76). Palgrave

Macmillan, Cham.

Grant, R.M., 2016. Contemporary strategy analysis: Text and cases edition. John Wiley &

Sons.

Hribar, P. and Yehuda, N., 2015. The mispricing of cash flows and accruals at different life‐

cycle stages. Contemporary Accounting Research, 32(3), pp.1053-1072.

CORPORATE ACCOUNTING

References

Ausdrill.com.au. 2018. Annual Reports :Ausdrill. [online] Available at:

http://www.ausdrill.com.au/investors/annual-reports.html [Accessed 13 Sep. 2018].

Bieber, L., 2016. Financial Statement Analysis A Global Perspective. Perspective, 1, p.4.

Bryce, M., Ali, M.J. and Mather, P.R., 2015. Accounting quality in the pre-/post-IFRS

adoption periods and the impact on audit committee effectiveness—Evidence from

Australia. Pacific-Basin Finance Journal, 35, pp.163-181.

Campbell, J.L., 2015. The fair value of cash flow hedges, future profitability, and stock

returns. Contemporary Accounting Research, 32(1), pp.243-279.

DeFusco, R.A., McLeavey, D.W., Pinto, J.E., Anson, M.J. and Runkle, D.E.,

2015. Quantitative investment analysis. John Wiley & Sons.

Epstein, M.J., 2018. Making sustainability work: Best practices in managing and measuring

corporate social, environmental and economic impacts. Routledge.

Fazzini, M., 2018. Financial Statement Analysis. In Business Valuation (pp. 39-76). Palgrave

Macmillan, Cham.

Grant, R.M., 2016. Contemporary strategy analysis: Text and cases edition. John Wiley &

Sons.

Hribar, P. and Yehuda, N., 2015. The mispricing of cash flows and accruals at different life‐

cycle stages. Contemporary Accounting Research, 32(3), pp.1053-1072.

You're viewing a preview

Unlock full access by subscribing today!

15

CORPORATE ACCOUNTING

Kothari, S.P., Ramanna, K. and Skinner, D.J., 2015. Political Standards: Corporate Interest,

Ideology, and Leadership in the Shaping of Accounting Rules for the Market

Economy. Journal of Accounting & Economics, 45(20), pp.2-3.

MacQueen, M., Bergevin, P. and Mitchell, L., 2016. Financial Statement Analysis: Content

and Context.

Mohanram, P., Saiy, S. and Vyas, D., 2018. Fundamental analysis of banks: the use of

financial statement information to screen winners from losers. Review of Accounting

Studies, 23(1), pp.200-233.

Penman, S.H. and Yehuda, N., 2015. A matter of principle: Accounting reports convey both

cash-flow news and discount-rate news.

Riotinto.com. 2018. [online] Available at:

https://www.riotinto.com/documents/RT_2017_Annual_Report.pdf [Accessed 17 Sep. 2018].

Saito, S., 2016. Introduction to corporate accounting.

Schaltegger, S. and Burritt, R., 2017. Contemporary environmental accounting: issues,

concepts and practice. Routledge.

Scholes, M.S., 2015. Taxes and business strategy. Prentice Hall.

Suzuki, T., 2015. National Accounting, Corporate Accounting, and Global

Standardization. Wiley Encyclopedia of Management, pp.1-5.

Wahlen, J., Baginski, S. and Bradshaw, M., 2014. Financial reporting, financial statement

analysis and valuation. Nelson Education.

Wahlen, J., Baginski, S. and Bradshaw, M., 2014. Financial reporting, financial statement

analysis and valuation. Nelson Education.

CORPORATE ACCOUNTING

Kothari, S.P., Ramanna, K. and Skinner, D.J., 2015. Political Standards: Corporate Interest,

Ideology, and Leadership in the Shaping of Accounting Rules for the Market

Economy. Journal of Accounting & Economics, 45(20), pp.2-3.

MacQueen, M., Bergevin, P. and Mitchell, L., 2016. Financial Statement Analysis: Content

and Context.

Mohanram, P., Saiy, S. and Vyas, D., 2018. Fundamental analysis of banks: the use of

financial statement information to screen winners from losers. Review of Accounting

Studies, 23(1), pp.200-233.

Penman, S.H. and Yehuda, N., 2015. A matter of principle: Accounting reports convey both

cash-flow news and discount-rate news.

Riotinto.com. 2018. [online] Available at:

https://www.riotinto.com/documents/RT_2017_Annual_Report.pdf [Accessed 17 Sep. 2018].

Saito, S., 2016. Introduction to corporate accounting.

Schaltegger, S. and Burritt, R., 2017. Contemporary environmental accounting: issues,

concepts and practice. Routledge.

Scholes, M.S., 2015. Taxes and business strategy. Prentice Hall.

Suzuki, T., 2015. National Accounting, Corporate Accounting, and Global

Standardization. Wiley Encyclopedia of Management, pp.1-5.

Wahlen, J., Baginski, S. and Bradshaw, M., 2014. Financial reporting, financial statement

analysis and valuation. Nelson Education.

Wahlen, J., Baginski, S. and Bradshaw, M., 2014. Financial reporting, financial statement

analysis and valuation. Nelson Education.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

16

CORPORATE ACCOUNTING

Weber, M., 2018. Cash flow duration and the term structure of equity returns. Journal of

Financial Economics, 128(3), pp.486-503.

CORPORATE ACCOUNTING

Weber, M., 2018. Cash flow duration and the term structure of equity returns. Journal of

Financial Economics, 128(3), pp.486-503.

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.