Corporate Accounting: AASB 10 Application on Investments

VerifiedAdded on 2023/06/05

|11

|1834

|294

Report

AI Summary

This report provides a detailed analysis of corporate accounting principles, focusing on the application of AASB 10 concerning consolidated financial statements and investment decisions. It examines various investment scenarios, including loan conversions to equity, direct loan provisions, shared subsidiary ownership, and majority stake holdings, advising on whether these investments should be included in consolidated financial statements based on the control criteria outlined in AASB 10. The report covers journal entries, acquisition analysis, and creditor rankings in liquidation scenarios, offering a comprehensive overview of the accounting treatments required for different investment types and business structures. It concludes by summarizing the implications of AASB 10 for investment reporting and consolidation.

Running head: CORPORATE ACCOUNTING

Corporate Accounting

Name of the Student:

Name of the University:

Author’s Note

Corporate Accounting

Name of the Student:

Name of the University:

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

CORPORATE ACCOUNTING

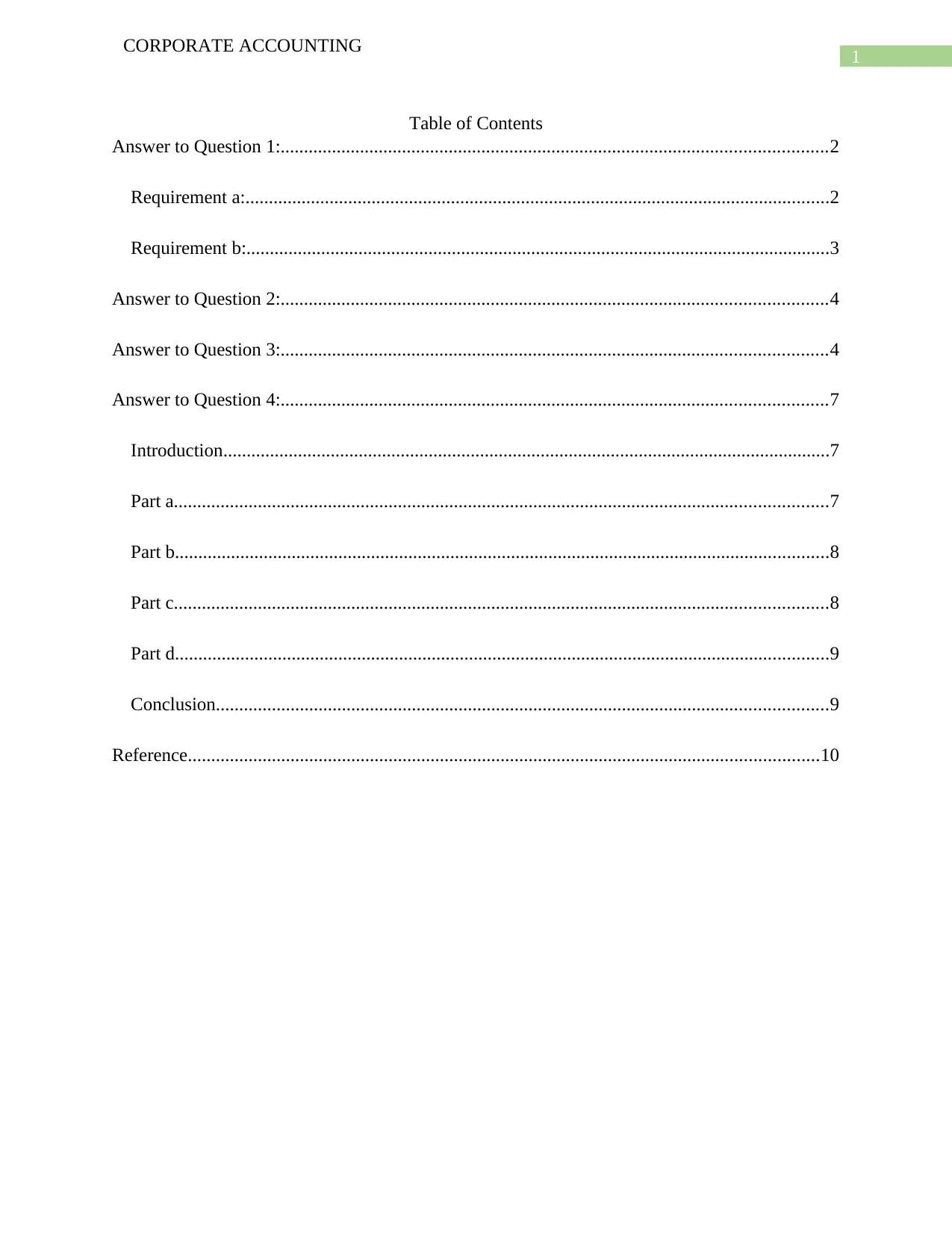

Table of Contents

Answer to Question 1:.....................................................................................................................2

Requirement a:.............................................................................................................................2

Requirement b:.............................................................................................................................3

Answer to Question 2:.....................................................................................................................4

Answer to Question 3:.....................................................................................................................4

Answer to Question 4:.....................................................................................................................7

Introduction..................................................................................................................................7

Part a............................................................................................................................................7

Part b............................................................................................................................................8

Part c............................................................................................................................................8

Part d............................................................................................................................................9

Conclusion...................................................................................................................................9

Reference.......................................................................................................................................10

CORPORATE ACCOUNTING

Table of Contents

Answer to Question 1:.....................................................................................................................2

Requirement a:.............................................................................................................................2

Requirement b:.............................................................................................................................3

Answer to Question 2:.....................................................................................................................4

Answer to Question 3:.....................................................................................................................4

Answer to Question 4:.....................................................................................................................7

Introduction..................................................................................................................................7

Part a............................................................................................................................................7

Part b............................................................................................................................................8

Part c............................................................................................................................................8

Part d............................................................................................................................................9

Conclusion...................................................................................................................................9

Reference.......................................................................................................................................10

2

CORPORATE ACCOUNTING

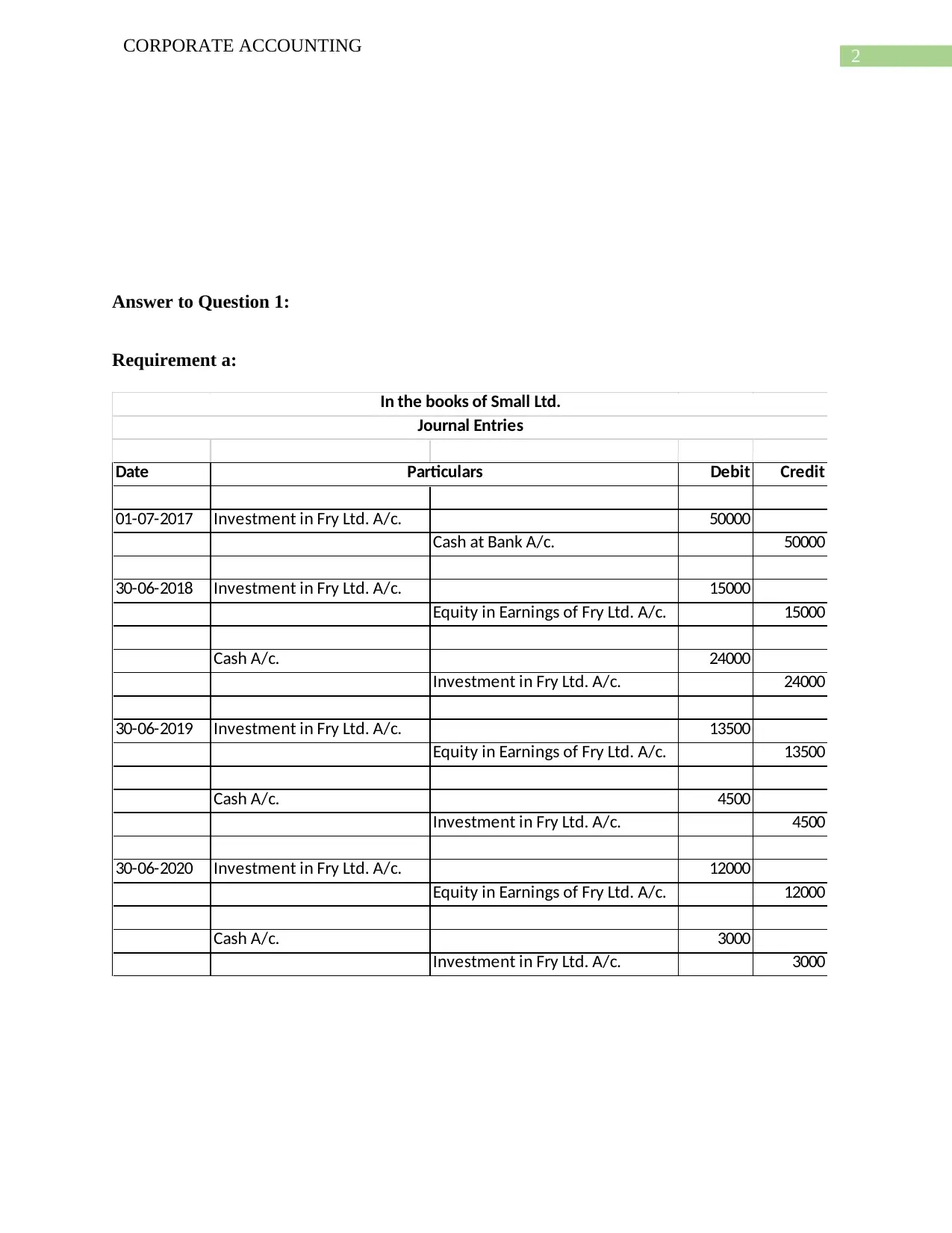

Answer to Question 1:

Requirement a:

Date Debit Credit

01-07-2017 Investment in Fry Ltd. A/c. 50000

Cash at Bank A/c. 50000

30-06-2018 Investment in Fry Ltd. A/c. 15000

Equity in Earnings of Fry Ltd. A/c. 15000

Cash A/c. 24000

Investment in Fry Ltd. A/c. 24000

30-06-2019 Investment in Fry Ltd. A/c. 13500

Equity in Earnings of Fry Ltd. A/c. 13500

Cash A/c. 4500

Investment in Fry Ltd. A/c. 4500

30-06-2020 Investment in Fry Ltd. A/c. 12000

Equity in Earnings of Fry Ltd. A/c. 12000

Cash A/c. 3000

Investment in Fry Ltd. A/c. 3000

Particulars

In the books of Small Ltd.

Journal Entries

CORPORATE ACCOUNTING

Answer to Question 1:

Requirement a:

Date Debit Credit

01-07-2017 Investment in Fry Ltd. A/c. 50000

Cash at Bank A/c. 50000

30-06-2018 Investment in Fry Ltd. A/c. 15000

Equity in Earnings of Fry Ltd. A/c. 15000

Cash A/c. 24000

Investment in Fry Ltd. A/c. 24000

30-06-2019 Investment in Fry Ltd. A/c. 13500

Equity in Earnings of Fry Ltd. A/c. 13500

Cash A/c. 4500

Investment in Fry Ltd. A/c. 4500

30-06-2020 Investment in Fry Ltd. A/c. 12000

Equity in Earnings of Fry Ltd. A/c. 12000

Cash A/c. 3000

Investment in Fry Ltd. A/c. 3000

Particulars

In the books of Small Ltd.

Journal Entries

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

CORPORATE ACCOUNTING

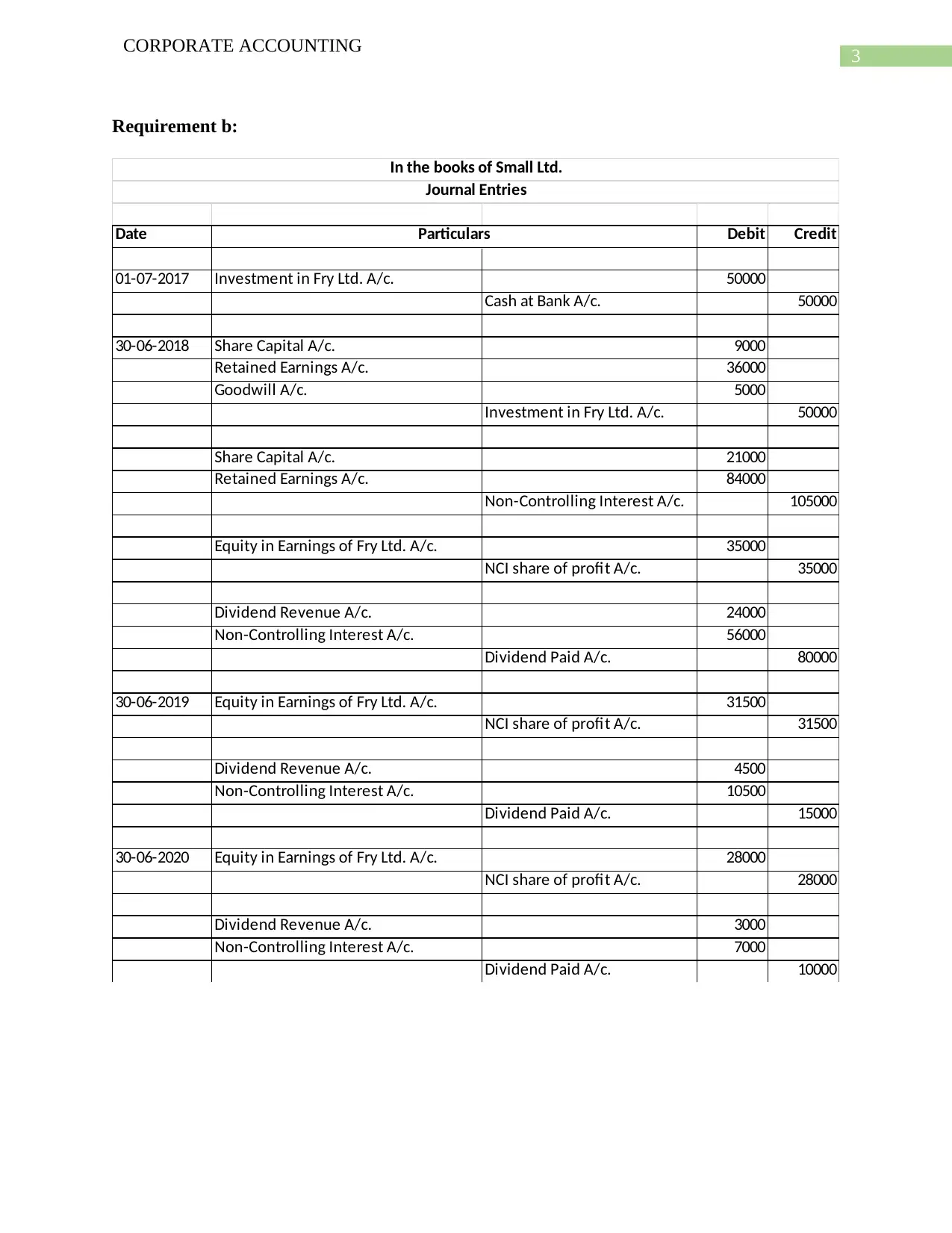

Requirement b:

Date Debit Credit

01-07-2017 Investment in Fry Ltd. A/c. 50000

Cash at Bank A/c. 50000

30-06-2018 Share Capital A/c. 9000

Retained Earnings A/c. 36000

Goodwill A/c. 5000

Investment in Fry Ltd. A/c. 50000

Share Capital A/c. 21000

Retained Earnings A/c. 84000

Non-Controlling Interest A/c. 105000

Equity in Earnings of Fry Ltd. A/c. 35000

NCI share of profit A/c. 35000

Dividend Revenue A/c. 24000

Non-Controlling Interest A/c. 56000

Dividend Paid A/c. 80000

30-06-2019 Equity in Earnings of Fry Ltd. A/c. 31500

NCI share of profit A/c. 31500

Dividend Revenue A/c. 4500

Non-Controlling Interest A/c. 10500

Dividend Paid A/c. 15000

30-06-2020 Equity in Earnings of Fry Ltd. A/c. 28000

NCI share of profit A/c. 28000

Dividend Revenue A/c. 3000

Non-Controlling Interest A/c. 7000

Dividend Paid A/c. 10000

In the books of Small Ltd.

Journal Entries

Particulars

CORPORATE ACCOUNTING

Requirement b:

Date Debit Credit

01-07-2017 Investment in Fry Ltd. A/c. 50000

Cash at Bank A/c. 50000

30-06-2018 Share Capital A/c. 9000

Retained Earnings A/c. 36000

Goodwill A/c. 5000

Investment in Fry Ltd. A/c. 50000

Share Capital A/c. 21000

Retained Earnings A/c. 84000

Non-Controlling Interest A/c. 105000

Equity in Earnings of Fry Ltd. A/c. 35000

NCI share of profit A/c. 35000

Dividend Revenue A/c. 24000

Non-Controlling Interest A/c. 56000

Dividend Paid A/c. 80000

30-06-2019 Equity in Earnings of Fry Ltd. A/c. 31500

NCI share of profit A/c. 31500

Dividend Revenue A/c. 4500

Non-Controlling Interest A/c. 10500

Dividend Paid A/c. 15000

30-06-2020 Equity in Earnings of Fry Ltd. A/c. 28000

NCI share of profit A/c. 28000

Dividend Revenue A/c. 3000

Non-Controlling Interest A/c. 7000

Dividend Paid A/c. 10000

In the books of Small Ltd.

Journal Entries

Particulars

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

CORPORATE ACCOUNTING

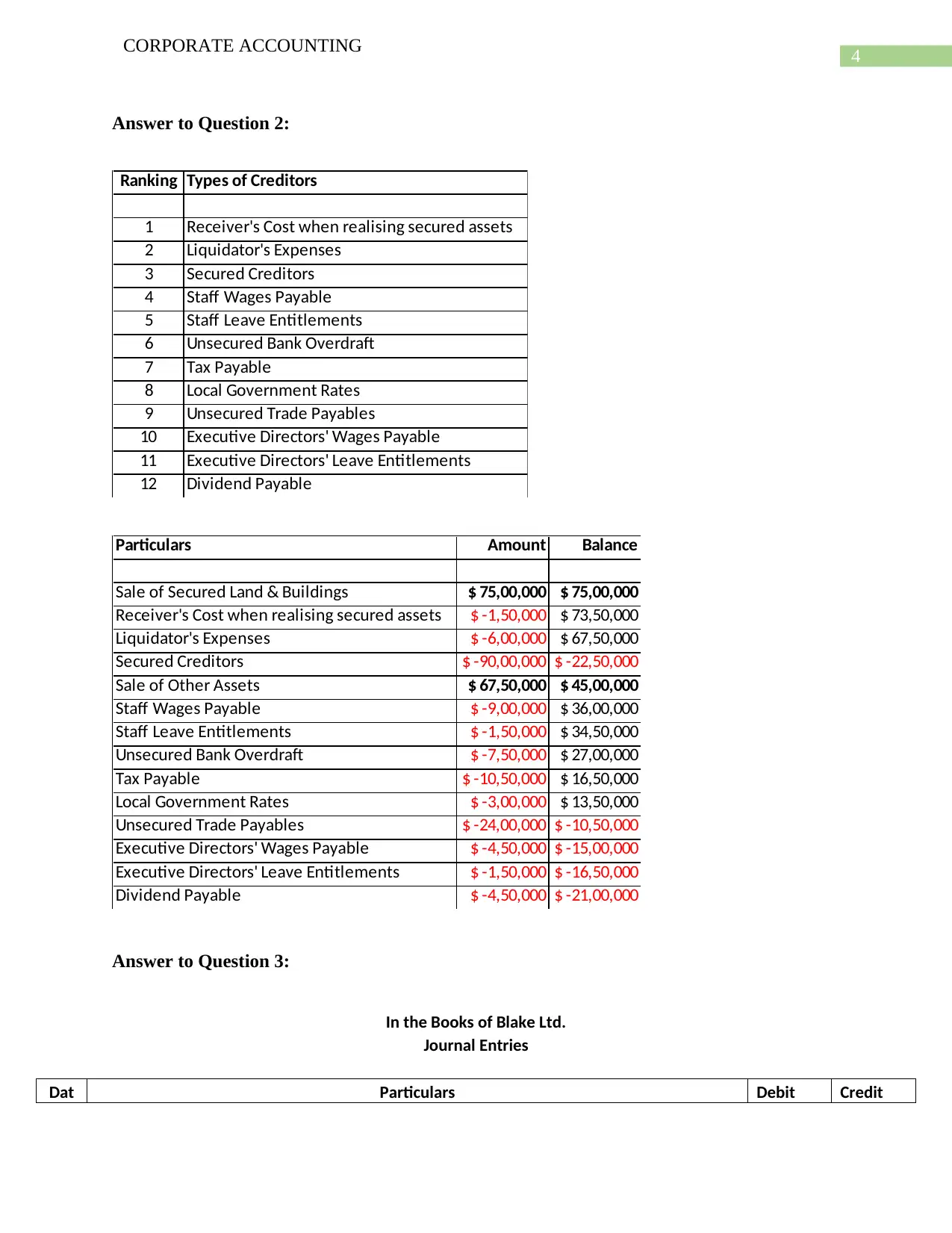

Answer to Question 2:

Ranking Types of Creditors

1 Receiver's Cost when realising secured assets

2 Liquidator's Expenses

3 Secured Creditors

4 Staff Wages Payable

5 Staff Leave Entitlements

6 Unsecured Bank Overdraft

7 Tax Payable

8 Local Government Rates

9 Unsecured Trade Payables

10 Executive Directors' Wages Payable

11 Executive Directors' Leave Entitlements

12 Dividend Payable

Particulars Amount Balance

Sale of Secured Land & Buildings $ 75,00,000 $ 75,00,000

Receiver's Cost when realising secured assets $ -1,50,000 $ 73,50,000

Liquidator's Expenses $ -6,00,000 $ 67,50,000

Secured Creditors $ -90,00,000 $ -22,50,000

Sale of Other Assets $ 67,50,000 $ 45,00,000

Staff Wages Payable $ -9,00,000 $ 36,00,000

Staff Leave Entitlements $ -1,50,000 $ 34,50,000

Unsecured Bank Overdraft $ -7,50,000 $ 27,00,000

Tax Payable $ -10,50,000 $ 16,50,000

Local Government Rates $ -3,00,000 $ 13,50,000

Unsecured Trade Payables $ -24,00,000 $ -10,50,000

Executive Directors' Wages Payable $ -4,50,000 $ -15,00,000

Executive Directors' Leave Entitlements $ -1,50,000 $ -16,50,000

Dividend Payable $ -4,50,000 $ -21,00,000

Answer to Question 3:

In the Books of Blake Ltd.

Journal Entries

Dat Particulars Debit Credit

CORPORATE ACCOUNTING

Answer to Question 2:

Ranking Types of Creditors

1 Receiver's Cost when realising secured assets

2 Liquidator's Expenses

3 Secured Creditors

4 Staff Wages Payable

5 Staff Leave Entitlements

6 Unsecured Bank Overdraft

7 Tax Payable

8 Local Government Rates

9 Unsecured Trade Payables

10 Executive Directors' Wages Payable

11 Executive Directors' Leave Entitlements

12 Dividend Payable

Particulars Amount Balance

Sale of Secured Land & Buildings $ 75,00,000 $ 75,00,000

Receiver's Cost when realising secured assets $ -1,50,000 $ 73,50,000

Liquidator's Expenses $ -6,00,000 $ 67,50,000

Secured Creditors $ -90,00,000 $ -22,50,000

Sale of Other Assets $ 67,50,000 $ 45,00,000

Staff Wages Payable $ -9,00,000 $ 36,00,000

Staff Leave Entitlements $ -1,50,000 $ 34,50,000

Unsecured Bank Overdraft $ -7,50,000 $ 27,00,000

Tax Payable $ -10,50,000 $ 16,50,000

Local Government Rates $ -3,00,000 $ 13,50,000

Unsecured Trade Payables $ -24,00,000 $ -10,50,000

Executive Directors' Wages Payable $ -4,50,000 $ -15,00,000

Executive Directors' Leave Entitlements $ -1,50,000 $ -16,50,000

Dividend Payable $ -4,50,000 $ -21,00,000

Answer to Question 3:

In the Books of Blake Ltd.

Journal Entries

Dat Particulars Debit Credit

5

CORPORATE ACCOUNTING

e

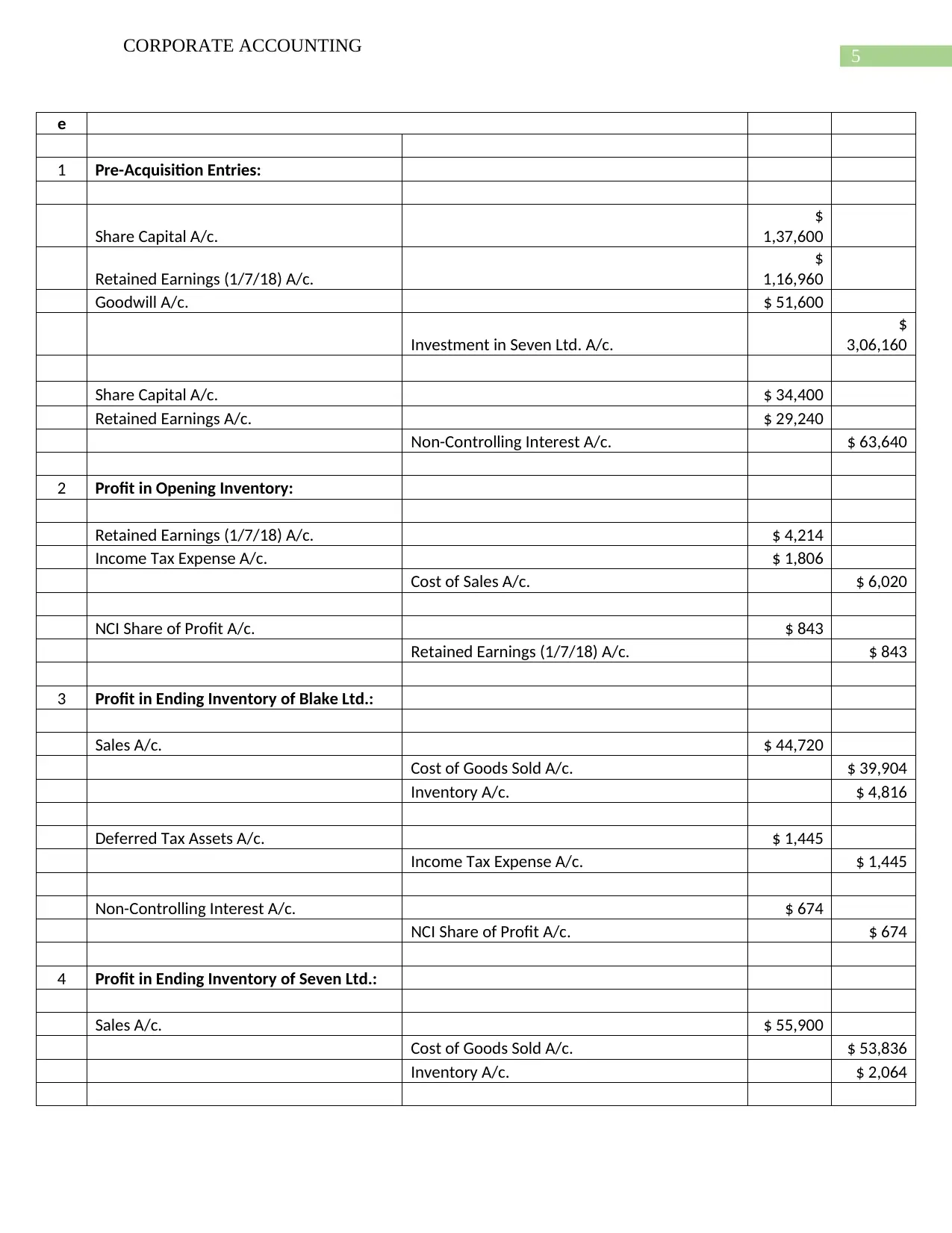

1 Pre-Acquisition Entries:

Share Capital A/c.

$

1,37,600

Retained Earnings (1/7/18) A/c.

$

1,16,960

Goodwill A/c. $ 51,600

Investment in Seven Ltd. A/c.

$

3,06,160

Share Capital A/c. $ 34,400

Retained Earnings A/c. $ 29,240

Non-Controlling Interest A/c. $ 63,640

2 Profit in Opening Inventory:

Retained Earnings (1/7/18) A/c. $ 4,214

Income Tax Expense A/c. $ 1,806

Cost of Sales A/c. $ 6,020

NCI Share of Profit A/c. $ 843

Retained Earnings (1/7/18) A/c. $ 843

3 Profit in Ending Inventory of Blake Ltd.:

Sales A/c. $ 44,720

Cost of Goods Sold A/c. $ 39,904

Inventory A/c. $ 4,816

Deferred Tax Assets A/c. $ 1,445

Income Tax Expense A/c. $ 1,445

Non-Controlling Interest A/c. $ 674

NCI Share of Profit A/c. $ 674

4 Profit in Ending Inventory of Seven Ltd.:

Sales A/c. $ 55,900

Cost of Goods Sold A/c. $ 53,836

Inventory A/c. $ 2,064

CORPORATE ACCOUNTING

e

1 Pre-Acquisition Entries:

Share Capital A/c.

$

1,37,600

Retained Earnings (1/7/18) A/c.

$

1,16,960

Goodwill A/c. $ 51,600

Investment in Seven Ltd. A/c.

$

3,06,160

Share Capital A/c. $ 34,400

Retained Earnings A/c. $ 29,240

Non-Controlling Interest A/c. $ 63,640

2 Profit in Opening Inventory:

Retained Earnings (1/7/18) A/c. $ 4,214

Income Tax Expense A/c. $ 1,806

Cost of Sales A/c. $ 6,020

NCI Share of Profit A/c. $ 843

Retained Earnings (1/7/18) A/c. $ 843

3 Profit in Ending Inventory of Blake Ltd.:

Sales A/c. $ 44,720

Cost of Goods Sold A/c. $ 39,904

Inventory A/c. $ 4,816

Deferred Tax Assets A/c. $ 1,445

Income Tax Expense A/c. $ 1,445

Non-Controlling Interest A/c. $ 674

NCI Share of Profit A/c. $ 674

4 Profit in Ending Inventory of Seven Ltd.:

Sales A/c. $ 55,900

Cost of Goods Sold A/c. $ 53,836

Inventory A/c. $ 2,064

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

CORPORATE ACCOUNTING

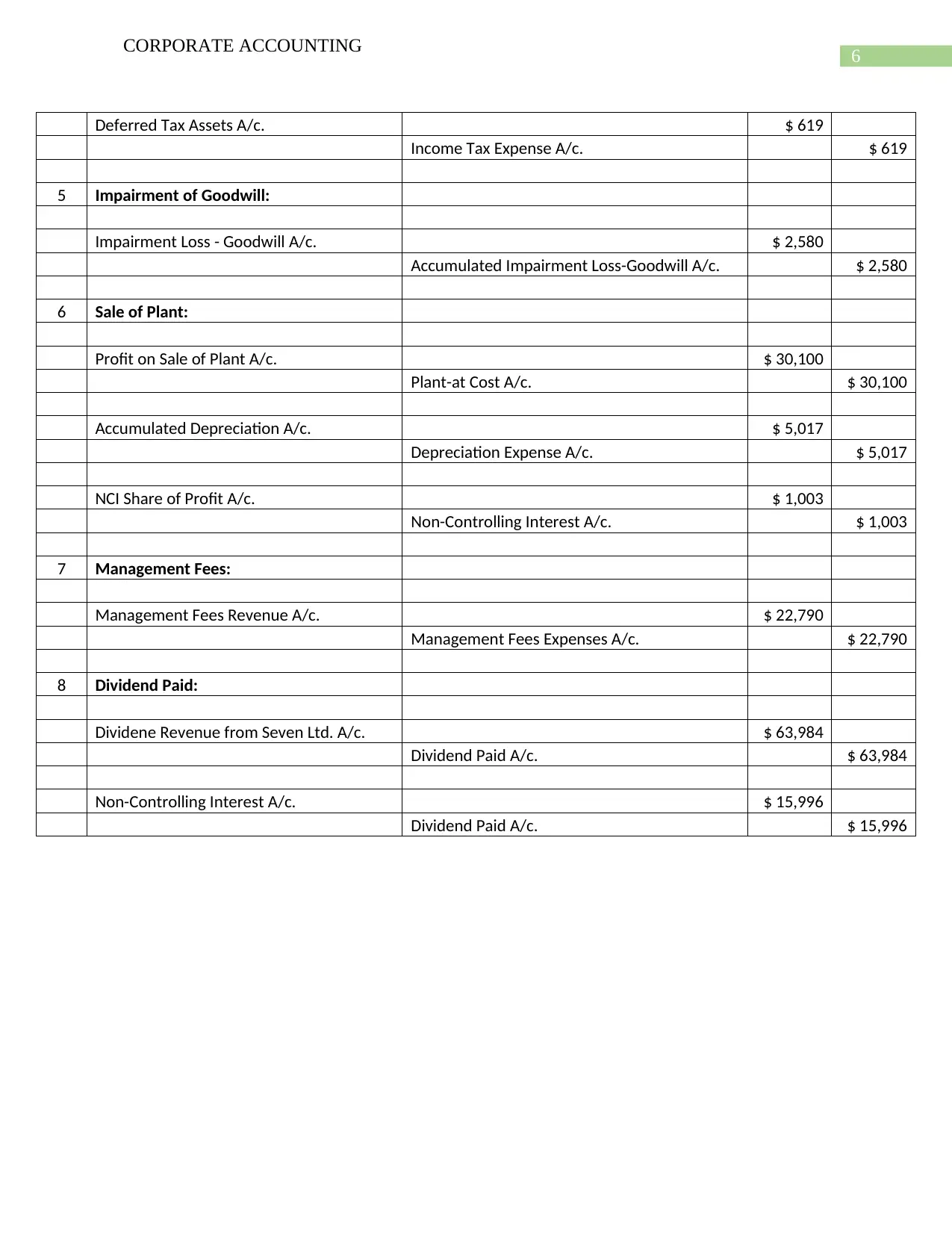

Deferred Tax Assets A/c. $ 619

Income Tax Expense A/c. $ 619

5 Impairment of Goodwill:

Impairment Loss - Goodwill A/c. $ 2,580

Accumulated Impairment Loss-Goodwill A/c. $ 2,580

6 Sale of Plant:

Profit on Sale of Plant A/c. $ 30,100

Plant-at Cost A/c. $ 30,100

Accumulated Depreciation A/c. $ 5,017

Depreciation Expense A/c. $ 5,017

NCI Share of Profit A/c. $ 1,003

Non-Controlling Interest A/c. $ 1,003

7 Management Fees:

Management Fees Revenue A/c. $ 22,790

Management Fees Expenses A/c. $ 22,790

8 Dividend Paid:

Dividene Revenue from Seven Ltd. A/c. $ 63,984

Dividend Paid A/c. $ 63,984

Non-Controlling Interest A/c. $ 15,996

Dividend Paid A/c. $ 15,996

CORPORATE ACCOUNTING

Deferred Tax Assets A/c. $ 619

Income Tax Expense A/c. $ 619

5 Impairment of Goodwill:

Impairment Loss - Goodwill A/c. $ 2,580

Accumulated Impairment Loss-Goodwill A/c. $ 2,580

6 Sale of Plant:

Profit on Sale of Plant A/c. $ 30,100

Plant-at Cost A/c. $ 30,100

Accumulated Depreciation A/c. $ 5,017

Depreciation Expense A/c. $ 5,017

NCI Share of Profit A/c. $ 1,003

Non-Controlling Interest A/c. $ 1,003

7 Management Fees:

Management Fees Revenue A/c. $ 22,790

Management Fees Expenses A/c. $ 22,790

8 Dividend Paid:

Dividene Revenue from Seven Ltd. A/c. $ 63,984

Dividend Paid A/c. $ 63,984

Non-Controlling Interest A/c. $ 15,996

Dividend Paid A/c. $ 15,996

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

CORPORATE ACCOUNTING

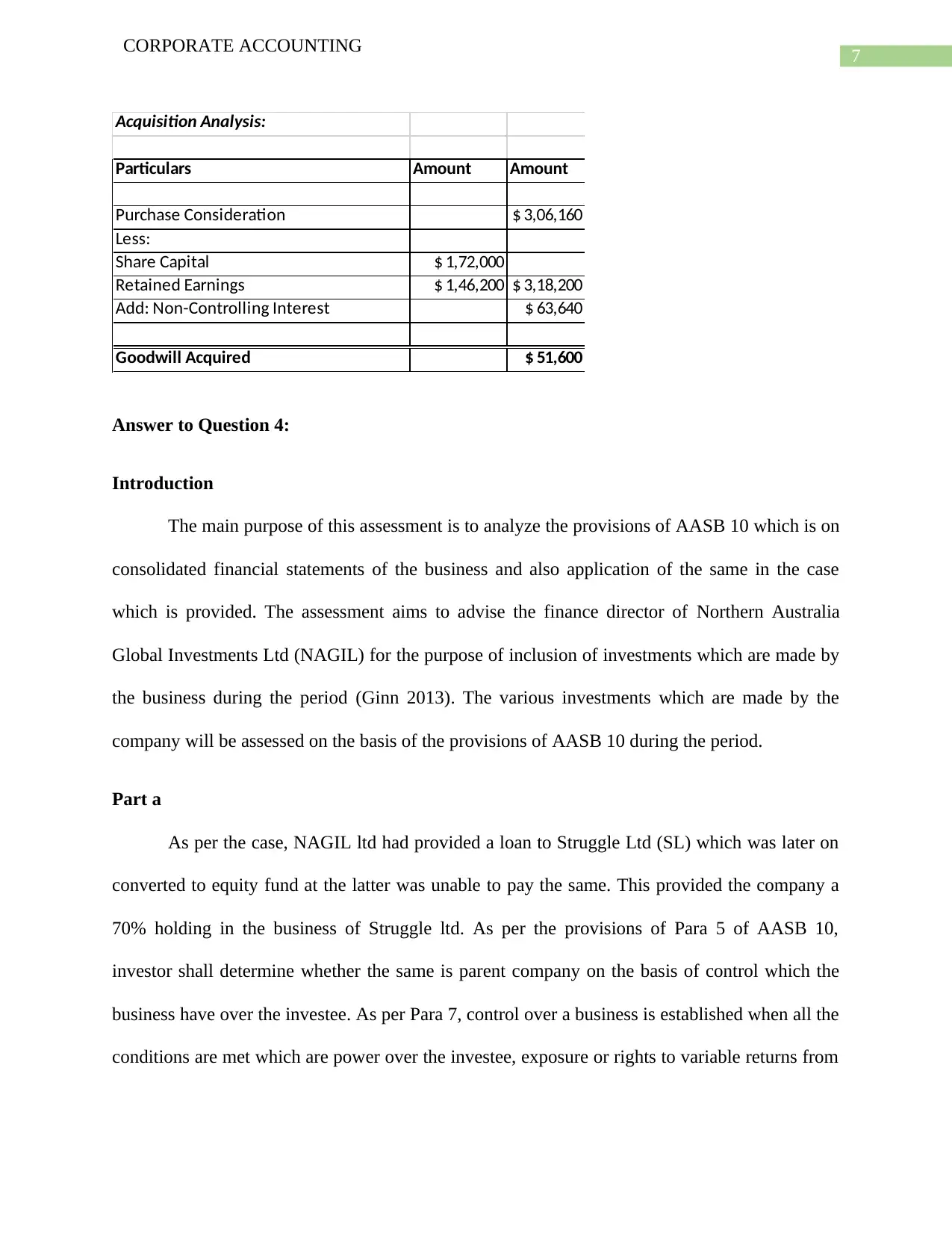

Acquisition Analysis:

Particulars Amount Amount

Purchase Consideration $ 3,06,160

Less:

Share Capital $ 1,72,000

Retained Earnings $ 1,46,200 $ 3,18,200

Add: Non-Controlling Interest $ 63,640

Goodwill Acquired $ 51,600

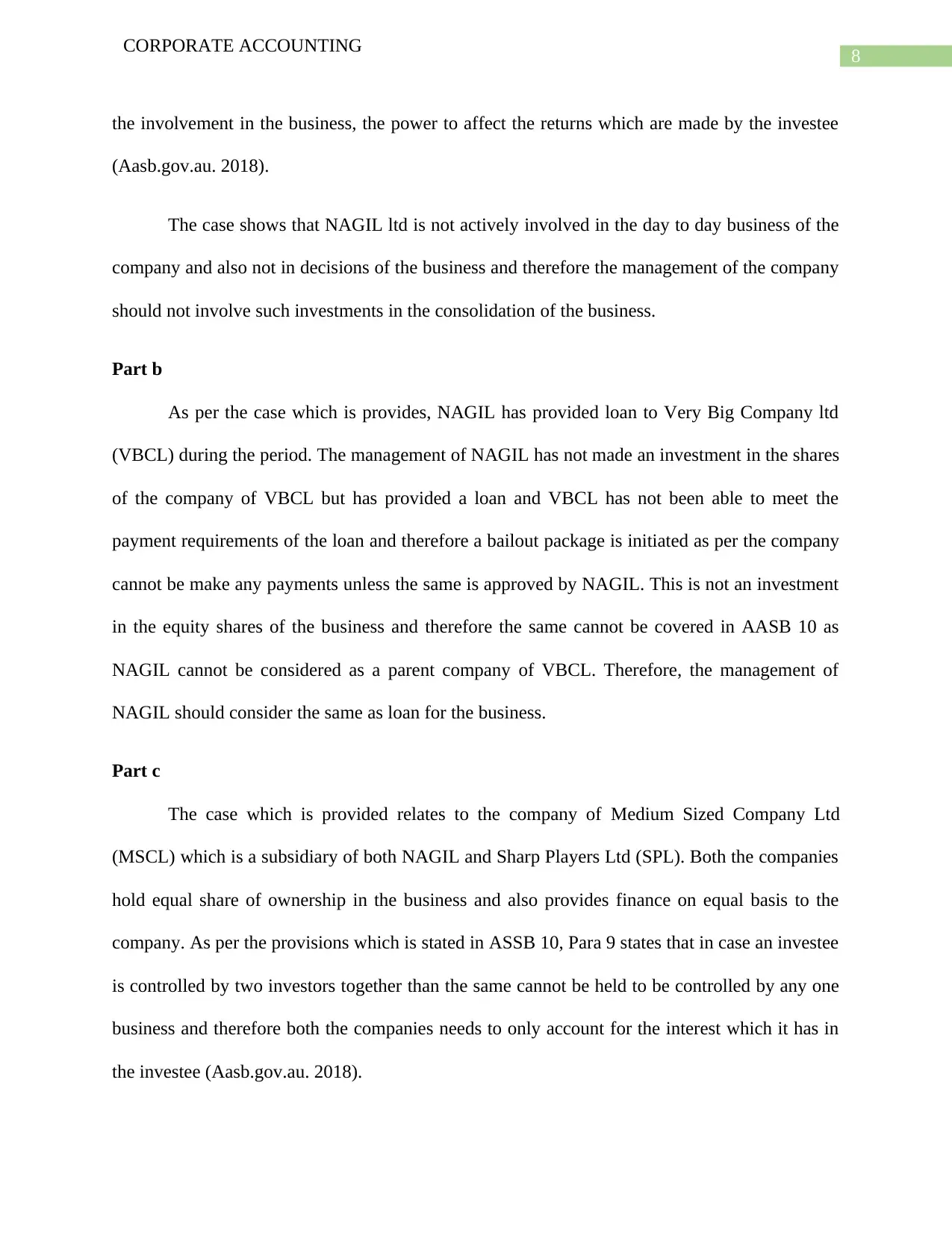

Answer to Question 4:

Introduction

The main purpose of this assessment is to analyze the provisions of AASB 10 which is on

consolidated financial statements of the business and also application of the same in the case

which is provided. The assessment aims to advise the finance director of Northern Australia

Global Investments Ltd (NAGIL) for the purpose of inclusion of investments which are made by

the business during the period (Ginn 2013). The various investments which are made by the

company will be assessed on the basis of the provisions of AASB 10 during the period.

Part a

As per the case, NAGIL ltd had provided a loan to Struggle Ltd (SL) which was later on

converted to equity fund at the latter was unable to pay the same. This provided the company a

70% holding in the business of Struggle ltd. As per the provisions of Para 5 of AASB 10,

investor shall determine whether the same is parent company on the basis of control which the

business have over the investee. As per Para 7, control over a business is established when all the

conditions are met which are power over the investee, exposure or rights to variable returns from

CORPORATE ACCOUNTING

Acquisition Analysis:

Particulars Amount Amount

Purchase Consideration $ 3,06,160

Less:

Share Capital $ 1,72,000

Retained Earnings $ 1,46,200 $ 3,18,200

Add: Non-Controlling Interest $ 63,640

Goodwill Acquired $ 51,600

Answer to Question 4:

Introduction

The main purpose of this assessment is to analyze the provisions of AASB 10 which is on

consolidated financial statements of the business and also application of the same in the case

which is provided. The assessment aims to advise the finance director of Northern Australia

Global Investments Ltd (NAGIL) for the purpose of inclusion of investments which are made by

the business during the period (Ginn 2013). The various investments which are made by the

company will be assessed on the basis of the provisions of AASB 10 during the period.

Part a

As per the case, NAGIL ltd had provided a loan to Struggle Ltd (SL) which was later on

converted to equity fund at the latter was unable to pay the same. This provided the company a

70% holding in the business of Struggle ltd. As per the provisions of Para 5 of AASB 10,

investor shall determine whether the same is parent company on the basis of control which the

business have over the investee. As per Para 7, control over a business is established when all the

conditions are met which are power over the investee, exposure or rights to variable returns from

8

CORPORATE ACCOUNTING

the involvement in the business, the power to affect the returns which are made by the investee

(Aasb.gov.au. 2018).

The case shows that NAGIL ltd is not actively involved in the day to day business of the

company and also not in decisions of the business and therefore the management of the company

should not involve such investments in the consolidation of the business.

Part b

As per the case which is provides, NAGIL has provided loan to Very Big Company ltd

(VBCL) during the period. The management of NAGIL has not made an investment in the shares

of the company of VBCL but has provided a loan and VBCL has not been able to meet the

payment requirements of the loan and therefore a bailout package is initiated as per the company

cannot be make any payments unless the same is approved by NAGIL. This is not an investment

in the equity shares of the business and therefore the same cannot be covered in AASB 10 as

NAGIL cannot be considered as a parent company of VBCL. Therefore, the management of

NAGIL should consider the same as loan for the business.

Part c

The case which is provided relates to the company of Medium Sized Company Ltd

(MSCL) which is a subsidiary of both NAGIL and Sharp Players Ltd (SPL). Both the companies

hold equal share of ownership in the business and also provides finance on equal basis to the

company. As per the provisions which is stated in ASSB 10, Para 9 states that in case an investee

is controlled by two investors together than the same cannot be held to be controlled by any one

business and therefore both the companies needs to only account for the interest which it has in

the investee (Aasb.gov.au. 2018).

CORPORATE ACCOUNTING

the involvement in the business, the power to affect the returns which are made by the investee

(Aasb.gov.au. 2018).

The case shows that NAGIL ltd is not actively involved in the day to day business of the

company and also not in decisions of the business and therefore the management of the company

should not involve such investments in the consolidation of the business.

Part b

As per the case which is provides, NAGIL has provided loan to Very Big Company ltd

(VBCL) during the period. The management of NAGIL has not made an investment in the shares

of the company of VBCL but has provided a loan and VBCL has not been able to meet the

payment requirements of the loan and therefore a bailout package is initiated as per the company

cannot be make any payments unless the same is approved by NAGIL. This is not an investment

in the equity shares of the business and therefore the same cannot be covered in AASB 10 as

NAGIL cannot be considered as a parent company of VBCL. Therefore, the management of

NAGIL should consider the same as loan for the business.

Part c

The case which is provided relates to the company of Medium Sized Company Ltd

(MSCL) which is a subsidiary of both NAGIL and Sharp Players Ltd (SPL). Both the companies

hold equal share of ownership in the business and also provides finance on equal basis to the

company. As per the provisions which is stated in ASSB 10, Para 9 states that in case an investee

is controlled by two investors together than the same cannot be held to be controlled by any one

business and therefore both the companies needs to only account for the interest which it has in

the investee (Aasb.gov.au. 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

CORPORATE ACCOUNTING

In the case of MSCL, the management NAGIL needs to only consider the interest on

loans and the management fees which is to be paid in case the company is able to generate

profits for the period. In case of losses, the management of MSCL only needs to incur interest

expenses and not the management fees to the business.

Part d

The case which is provided in the assessment shows that the management of NAGIL ltd

holds around 40% of holdings in the business of CrocsRUs and the other 60% is held by the

owners. The case provides that the management of the company is handled by NAGIL and also

all major decisions are taken by them as well. As per the provisions of ASSB 10, Para 7 provides

that in order for a business to be in control of the investee, the business should possess a power

over the investee, should have variable rights on returns of the business which is for active rile in

the business. and also, the ability to use the power over the investee in order to affect the returns

of the business. All three conditions need to satisfy for the business to have control.

In the case of CrocsRUs, the management of NAGIL have the control over the business

and also takes the major decisions and therefore they need to consolidate the investments in the

balance sheet.

Conclusion

The above discussion shows the various investments and loans which are provided to

different businesses during the period. The assessment shows the application of the provisions of

AASB 10 in order to determine whether the finance director should incorporate the transaction in

the consolidated financial statement of the business. The assessment effectively deals with the

reporting requirement of investments made in other businesses.

CORPORATE ACCOUNTING

In the case of MSCL, the management NAGIL needs to only consider the interest on

loans and the management fees which is to be paid in case the company is able to generate

profits for the period. In case of losses, the management of MSCL only needs to incur interest

expenses and not the management fees to the business.

Part d

The case which is provided in the assessment shows that the management of NAGIL ltd

holds around 40% of holdings in the business of CrocsRUs and the other 60% is held by the

owners. The case provides that the management of the company is handled by NAGIL and also

all major decisions are taken by them as well. As per the provisions of ASSB 10, Para 7 provides

that in order for a business to be in control of the investee, the business should possess a power

over the investee, should have variable rights on returns of the business which is for active rile in

the business. and also, the ability to use the power over the investee in order to affect the returns

of the business. All three conditions need to satisfy for the business to have control.

In the case of CrocsRUs, the management of NAGIL have the control over the business

and also takes the major decisions and therefore they need to consolidate the investments in the

balance sheet.

Conclusion

The above discussion shows the various investments and loans which are provided to

different businesses during the period. The assessment shows the application of the provisions of

AASB 10 in order to determine whether the finance director should incorporate the transaction in

the consolidated financial statement of the business. The assessment effectively deals with the

reporting requirement of investments made in other businesses.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

CORPORATE ACCOUNTING

Reference

Aasb.gov.au. 2018. [online] Available at:

https://www.aasb.gov.au/admin/file/content105/c9/AASB10_08-11.pdf [Accessed 25 Sep.

2018].

Ginn, W., 2013. Investing in nature: case studies of land conservation in collaboration with

business. Island Press.

CORPORATE ACCOUNTING

Reference

Aasb.gov.au. 2018. [online] Available at:

https://www.aasb.gov.au/admin/file/content105/c9/AASB10_08-11.pdf [Accessed 25 Sep.

2018].

Ginn, W., 2013. Investing in nature: case studies of land conservation in collaboration with

business. Island Press.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.