Corporate Accounting: Comparative Analysis of JB Hi-Fi and Harvey Norman Holdings Limited

VerifiedAdded on 2023/06/05

|22

|3443

|251

AI Summary

This report provides a comparative analysis of the financial details of JB Hi-Fi and Harvey Norman Holdings Limited, two competing corporations in the retailing industry in Australia. It covers topics such as owners' equity, cash flow statement, and other comprehensive income statement.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

HI5020 Corporate Accounting

1

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

EXECUTIVE SUMMARY

Globalisation has brought all the organisations of the world on a common parlance.

There is a need to make the corporate reporting open and transparent. The current report is

based to highlight the same requirement. The two big competing corporations in the retailing

industry in Australia, JB Hi-Fi and Harvey Norman Holdings Limited are taken as the

reference companies for this assignment.

2

Globalisation has brought all the organisations of the world on a common parlance.

There is a need to make the corporate reporting open and transparent. The current report is

based to highlight the same requirement. The two big competing corporations in the retailing

industry in Australia, JB Hi-Fi and Harvey Norman Holdings Limited are taken as the

reference companies for this assignment.

2

Table of Contents

EXECUTIVE SUMMARY........................................................................................................2

INTRODUCTION......................................................................................................................3

JB HI-FI LIMITED....................................................................................................................4

HARVEY NORMAN LIMITED...............................................................................................4

OWNERS’ EQUITY..................................................................................................................4

QUESTION (i)...........................................................................................................................4

QUESTION (ii)..........................................................................................................................5

CASH FLOW STATEMENT....................................................................................................5

QUESTION (iii).........................................................................................................................5

QUESTION (iv).........................................................................................................................7

QUESTION (v)..........................................................................................................................8

OTHER COMPREHENSIVE INCOME STATEMENT..........................................................8

QUESTION (vi).........................................................................................................................8

QUESTION (vii)........................................................................................................................9

QUESTION (viii).......................................................................................................................9

QUESTION (ix).......................................................................................................................10

ACCOUNTING FOR CORPORATE INCOME TAX............................................................10

QUESTION (x)........................................................................................................................10

QUESTION (xi).......................................................................................................................10

3

EXECUTIVE SUMMARY........................................................................................................2

INTRODUCTION......................................................................................................................3

JB HI-FI LIMITED....................................................................................................................4

HARVEY NORMAN LIMITED...............................................................................................4

OWNERS’ EQUITY..................................................................................................................4

QUESTION (i)...........................................................................................................................4

QUESTION (ii)..........................................................................................................................5

CASH FLOW STATEMENT....................................................................................................5

QUESTION (iii).........................................................................................................................5

QUESTION (iv).........................................................................................................................7

QUESTION (v)..........................................................................................................................8

OTHER COMPREHENSIVE INCOME STATEMENT..........................................................8

QUESTION (vi).........................................................................................................................8

QUESTION (vii)........................................................................................................................9

QUESTION (viii).......................................................................................................................9

QUESTION (ix).......................................................................................................................10

ACCOUNTING FOR CORPORATE INCOME TAX............................................................10

QUESTION (x)........................................................................................................................10

QUESTION (xi).......................................................................................................................10

3

QUESTION (xii)......................................................................................................................10

QUESTION (xiii).....................................................................................................................11

QUESTION (xiv).....................................................................................................................11

QUESTION (xv)......................................................................................................................11

QUESTION (xvi).....................................................................................................................11

CONCLUSION........................................................................................................................12

REFERENCES.........................................................................................................................12

4

QUESTION (xiii).....................................................................................................................11

QUESTION (xiv).....................................................................................................................11

QUESTION (xv)......................................................................................................................11

QUESTION (xvi).....................................................................................................................11

CONCLUSION........................................................................................................................12

REFERENCES.........................................................................................................................12

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

With the ramified changes, every Organizaiton needs to use proper financial reporting in it

books of accounts. Before a discussion can be made regarding the things to be discussed in

the report, a brief understanding of the two companies is required. This report has been used

to make an assessment and gather an understanding of the major requirements that are

essential for the analysing the financial details of two company. Every detail has been carved

in a form of comparative analysis between both the companies.

JB HI-FI LIMITED

JB Hi-Fi is in the business of retailing and is listed on Australian Stock Exchange. The

company is a market leader when it comes to electronics and supersedes when it comes to the

sale of DVDs, CDs, mobile phones, video games, and etc. Melbourne marks the area where

the shopping centre of the company is located.

HARVEY NORMAN LIMITED

Working in the retailing industry at a multi-national level, Harvey Norman works in the

business of furniture, computers, bedding, communications, and certain electrical products

sold in the consumer market. The operation of the company is maintained in the franchisee

form. All the operators intended to the business are required to operate as a franchisee of the

company.

OWNERS’ EQUITY

QUESTION (i)

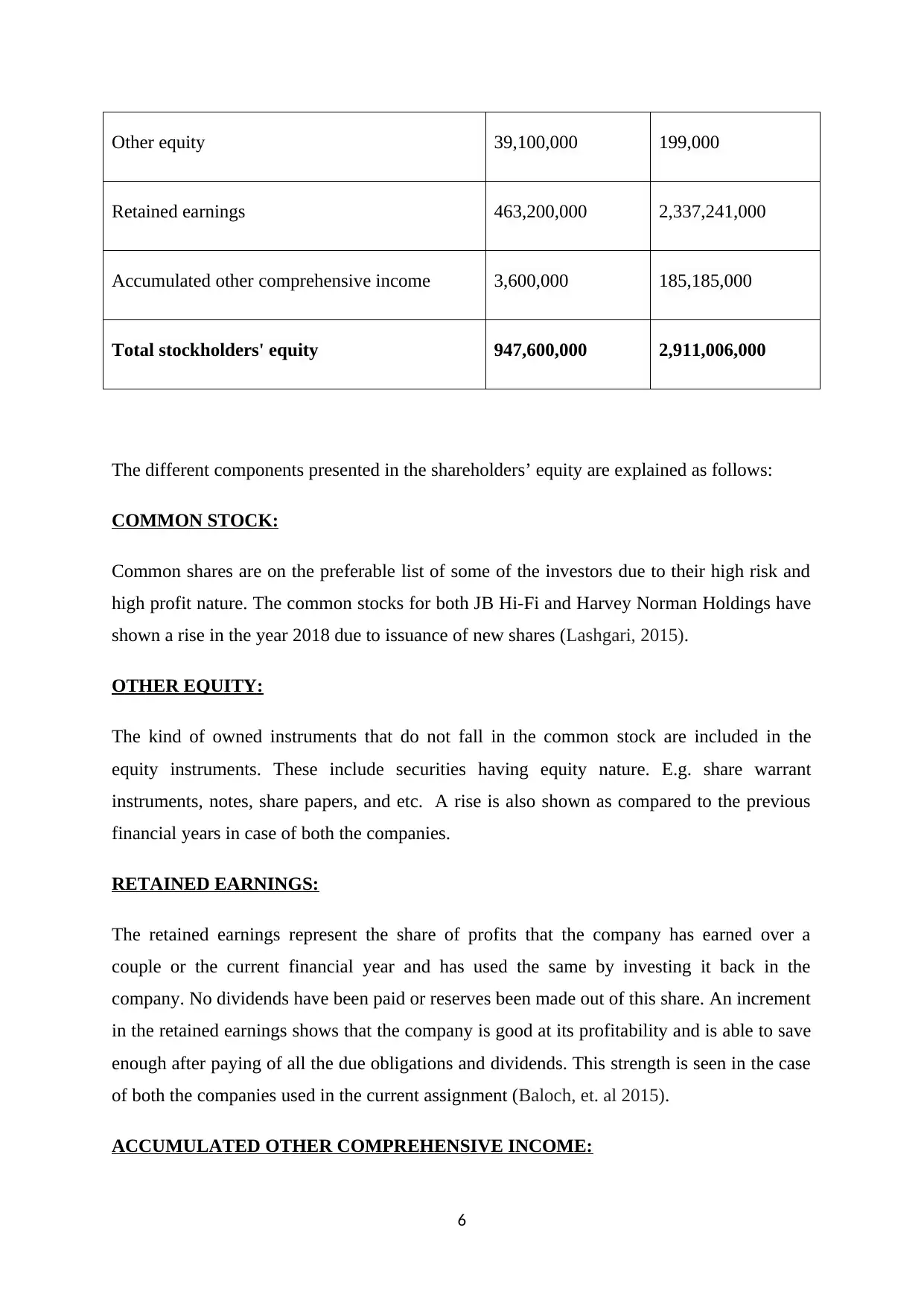

The table presented down gives a list of the individual items of each of the company’s equity:

SHAREHOLDERS’ EQUITY JB HI-FI LIMITED HARVEY

NORMAL

LIMITED

Common stock 441,700,000 388,381,000

5

With the ramified changes, every Organizaiton needs to use proper financial reporting in it

books of accounts. Before a discussion can be made regarding the things to be discussed in

the report, a brief understanding of the two companies is required. This report has been used

to make an assessment and gather an understanding of the major requirements that are

essential for the analysing the financial details of two company. Every detail has been carved

in a form of comparative analysis between both the companies.

JB HI-FI LIMITED

JB Hi-Fi is in the business of retailing and is listed on Australian Stock Exchange. The

company is a market leader when it comes to electronics and supersedes when it comes to the

sale of DVDs, CDs, mobile phones, video games, and etc. Melbourne marks the area where

the shopping centre of the company is located.

HARVEY NORMAN LIMITED

Working in the retailing industry at a multi-national level, Harvey Norman works in the

business of furniture, computers, bedding, communications, and certain electrical products

sold in the consumer market. The operation of the company is maintained in the franchisee

form. All the operators intended to the business are required to operate as a franchisee of the

company.

OWNERS’ EQUITY

QUESTION (i)

The table presented down gives a list of the individual items of each of the company’s equity:

SHAREHOLDERS’ EQUITY JB HI-FI LIMITED HARVEY

NORMAL

LIMITED

Common stock 441,700,000 388,381,000

5

Other equity 39,100,000 199,000

Retained earnings 463,200,000 2,337,241,000

Accumulated other comprehensive income 3,600,000 185,185,000

Total stockholders' equity 947,600,000 2,911,006,000

The different components presented in the shareholders’ equity are explained as follows:

COMMON STOCK:

Common shares are on the preferable list of some of the investors due to their high risk and

high profit nature. The common stocks for both JB Hi-Fi and Harvey Norman Holdings have

shown a rise in the year 2018 due to issuance of new shares (Lashgari, 2015).

OTHER EQUITY:

The kind of owned instruments that do not fall in the common stock are included in the

equity instruments. These include securities having equity nature. E.g. share warrant

instruments, notes, share papers, and etc. A rise is also shown as compared to the previous

financial years in case of both the companies.

RETAINED EARNINGS:

The retained earnings represent the share of profits that the company has earned over a

couple or the current financial year and has used the same by investing it back in the

company. No dividends have been paid or reserves been made out of this share. An increment

in the retained earnings shows that the company is good at its profitability and is able to save

enough after paying of all the due obligations and dividends. This strength is seen in the case

of both the companies used in the current assignment (Baloch, et. al 2015).

ACCUMULATED OTHER COMPREHENSIVE INCOME:

6

Retained earnings 463,200,000 2,337,241,000

Accumulated other comprehensive income 3,600,000 185,185,000

Total stockholders' equity 947,600,000 2,911,006,000

The different components presented in the shareholders’ equity are explained as follows:

COMMON STOCK:

Common shares are on the preferable list of some of the investors due to their high risk and

high profit nature. The common stocks for both JB Hi-Fi and Harvey Norman Holdings have

shown a rise in the year 2018 due to issuance of new shares (Lashgari, 2015).

OTHER EQUITY:

The kind of owned instruments that do not fall in the common stock are included in the

equity instruments. These include securities having equity nature. E.g. share warrant

instruments, notes, share papers, and etc. A rise is also shown as compared to the previous

financial years in case of both the companies.

RETAINED EARNINGS:

The retained earnings represent the share of profits that the company has earned over a

couple or the current financial year and has used the same by investing it back in the

company. No dividends have been paid or reserves been made out of this share. An increment

in the retained earnings shows that the company is good at its profitability and is able to save

enough after paying of all the due obligations and dividends. This strength is seen in the case

of both the companies used in the current assignment (Baloch, et. al 2015).

ACCUMULATED OTHER COMPREHENSIVE INCOME:

6

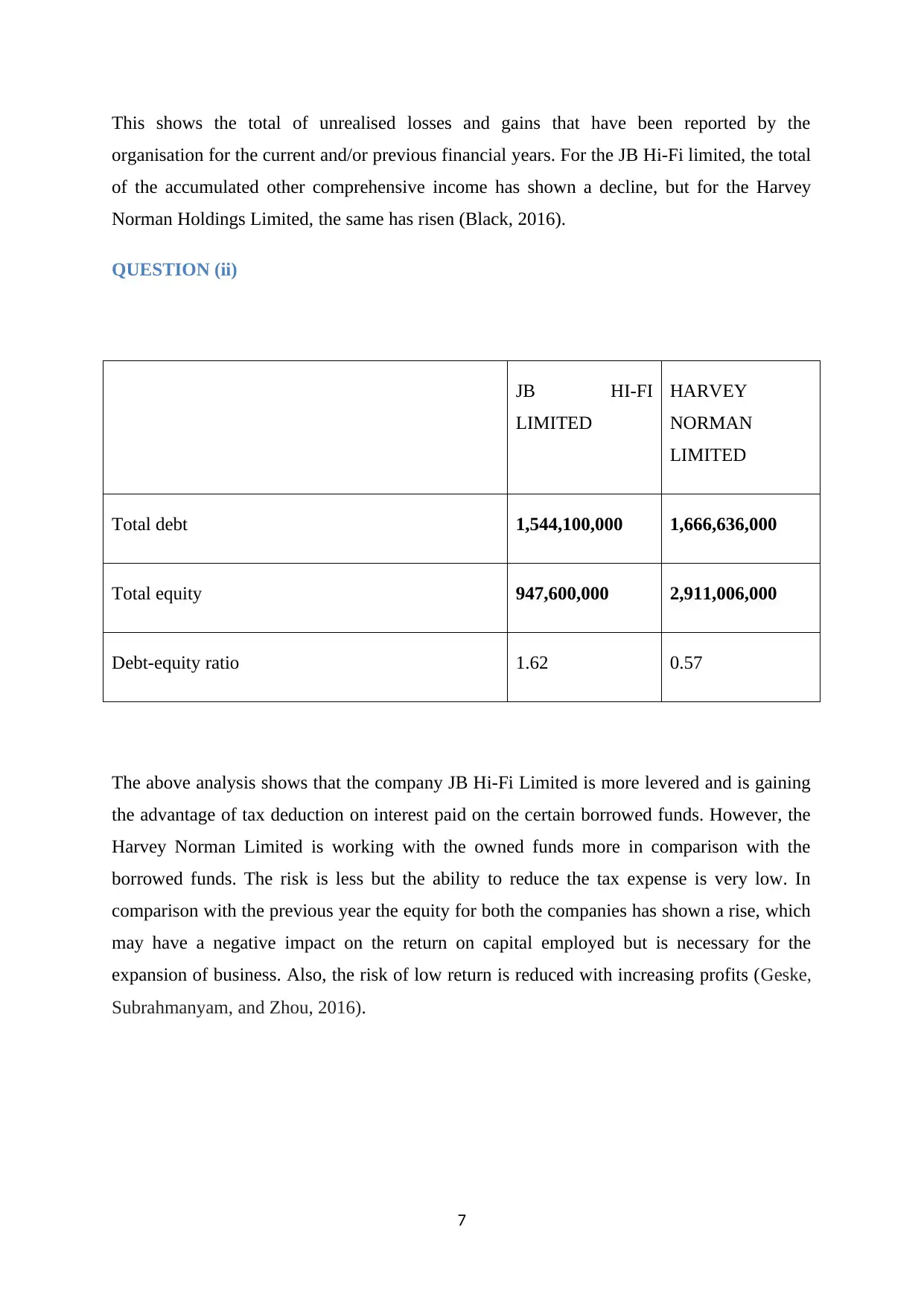

This shows the total of unrealised losses and gains that have been reported by the

organisation for the current and/or previous financial years. For the JB Hi-Fi limited, the total

of the accumulated other comprehensive income has shown a decline, but for the Harvey

Norman Holdings Limited, the same has risen (Black, 2016).

QUESTION (ii)

JB HI-FI

LIMITED

HARVEY

NORMAN

LIMITED

Total debt 1,544,100,000 1,666,636,000

Total equity 947,600,000 2,911,006,000

Debt-equity ratio 1.62 0.57

The above analysis shows that the company JB Hi-Fi Limited is more levered and is gaining

the advantage of tax deduction on interest paid on the certain borrowed funds. However, the

Harvey Norman Limited is working with the owned funds more in comparison with the

borrowed funds. The risk is less but the ability to reduce the tax expense is very low. In

comparison with the previous year the equity for both the companies has shown a rise, which

may have a negative impact on the return on capital employed but is necessary for the

expansion of business. Also, the risk of low return is reduced with increasing profits (Geske,

Subrahmanyam, and Zhou, 2016).

7

organisation for the current and/or previous financial years. For the JB Hi-Fi limited, the total

of the accumulated other comprehensive income has shown a decline, but for the Harvey

Norman Holdings Limited, the same has risen (Black, 2016).

QUESTION (ii)

JB HI-FI

LIMITED

HARVEY

NORMAN

LIMITED

Total debt 1,544,100,000 1,666,636,000

Total equity 947,600,000 2,911,006,000

Debt-equity ratio 1.62 0.57

The above analysis shows that the company JB Hi-Fi Limited is more levered and is gaining

the advantage of tax deduction on interest paid on the certain borrowed funds. However, the

Harvey Norman Limited is working with the owned funds more in comparison with the

borrowed funds. The risk is less but the ability to reduce the tax expense is very low. In

comparison with the previous year the equity for both the companies has shown a rise, which

may have a negative impact on the return on capital employed but is necessary for the

expansion of business. Also, the risk of low return is reduced with increasing profits (Geske,

Subrahmanyam, and Zhou, 2016).

7

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

CASH FLOW STATEMENT

QUESTION (iii)

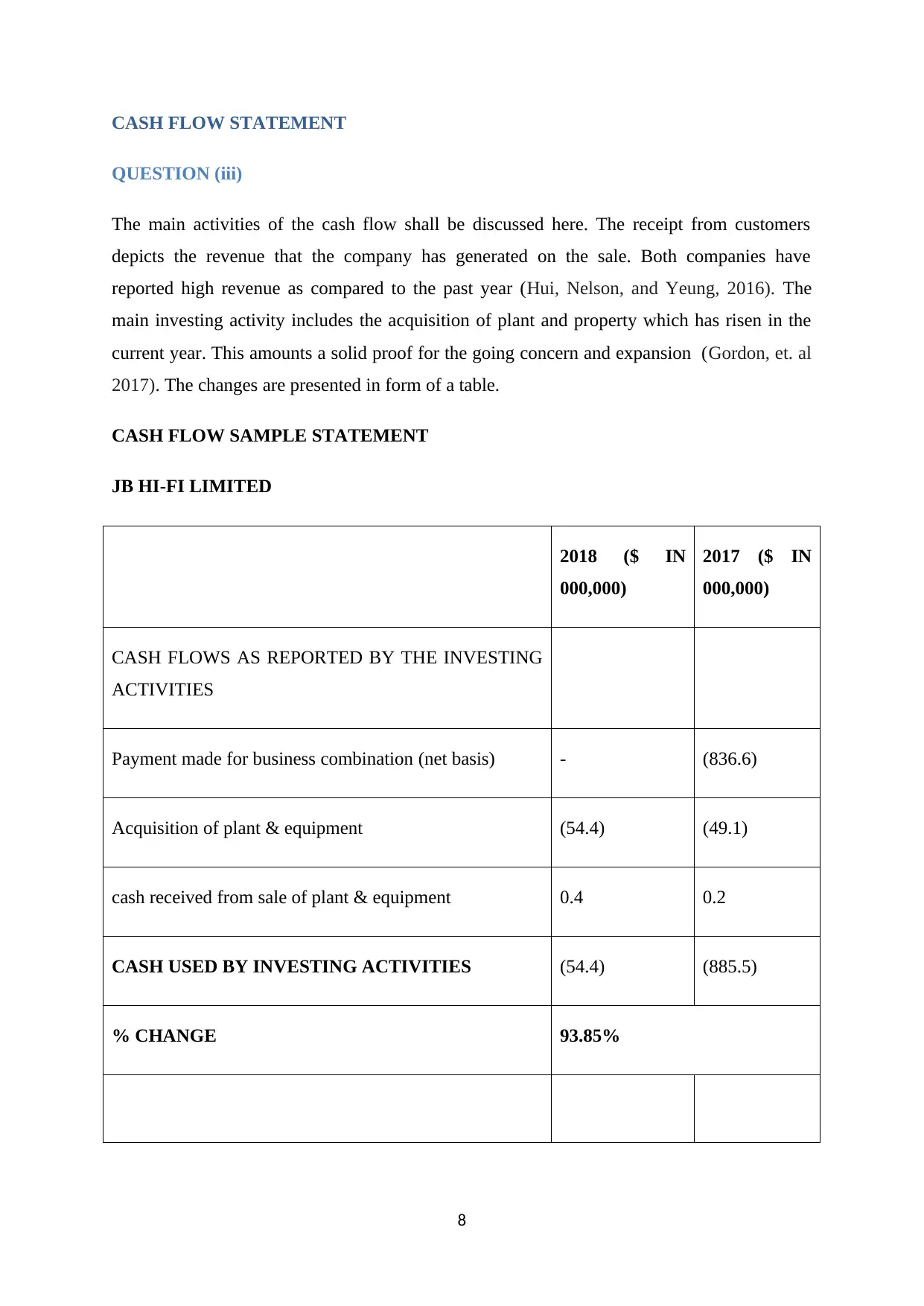

The main activities of the cash flow shall be discussed here. The receipt from customers

depicts the revenue that the company has generated on the sale. Both companies have

reported high revenue as compared to the past year (Hui, Nelson, and Yeung, 2016). The

main investing activity includes the acquisition of plant and property which has risen in the

current year. This amounts a solid proof for the going concern and expansion (Gordon, et. al

2017). The changes are presented in form of a table.

CASH FLOW SAMPLE STATEMENT

JB HI-FI LIMITED

2018 ($ IN

000,000)

2017 ($ IN

000,000)

CASH FLOWS AS REPORTED BY THE INVESTING

ACTIVITIES

Payment made for business combination (net basis) - (836.6)

Acquisition of plant & equipment (54.4) (49.1)

cash received from sale of plant & equipment 0.4 0.2

CASH USED BY INVESTING ACTIVITIES (54.4) (885.5)

% CHANGE 93.85%

8

QUESTION (iii)

The main activities of the cash flow shall be discussed here. The receipt from customers

depicts the revenue that the company has generated on the sale. Both companies have

reported high revenue as compared to the past year (Hui, Nelson, and Yeung, 2016). The

main investing activity includes the acquisition of plant and property which has risen in the

current year. This amounts a solid proof for the going concern and expansion (Gordon, et. al

2017). The changes are presented in form of a table.

CASH FLOW SAMPLE STATEMENT

JB HI-FI LIMITED

2018 ($ IN

000,000)

2017 ($ IN

000,000)

CASH FLOWS AS REPORTED BY THE INVESTING

ACTIVITIES

Payment made for business combination (net basis) - (836.6)

Acquisition of plant & equipment (54.4) (49.1)

cash received from sale of plant & equipment 0.4 0.2

CASH USED BY INVESTING ACTIVITIES (54.4) (885.5)

% CHANGE 93.85%

8

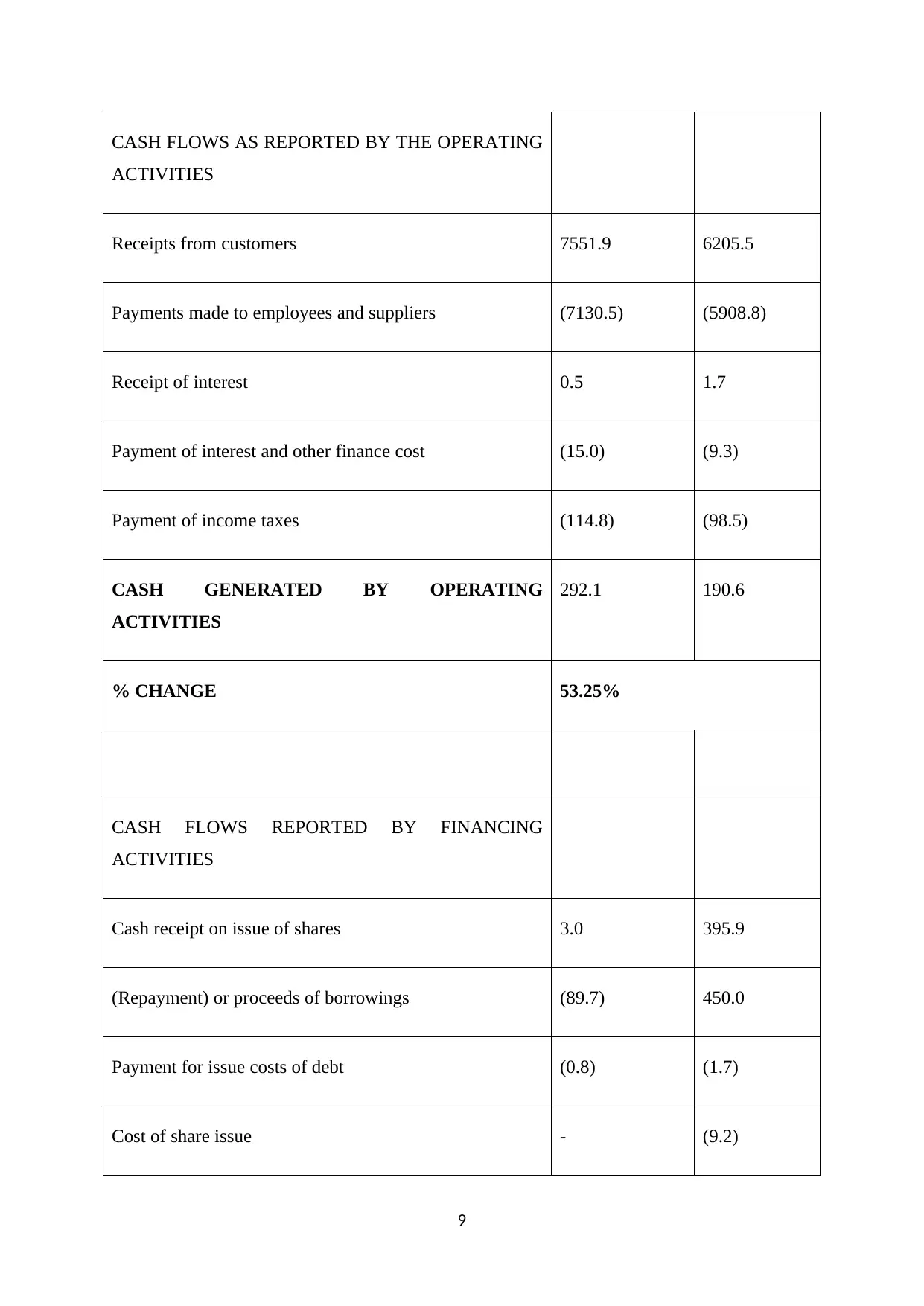

CASH FLOWS AS REPORTED BY THE OPERATING

ACTIVITIES

Receipts from customers 7551.9 6205.5

Payments made to employees and suppliers (7130.5) (5908.8)

Receipt of interest 0.5 1.7

Payment of interest and other finance cost (15.0) (9.3)

Payment of income taxes (114.8) (98.5)

CASH GENERATED BY OPERATING

ACTIVITIES

292.1 190.6

% CHANGE 53.25%

CASH FLOWS REPORTED BY FINANCING

ACTIVITIES

Cash receipt on issue of shares 3.0 395.9

(Repayment) or proceeds of borrowings (89.7) 450.0

Payment for issue costs of debt (0.8) (1.7)

Cost of share issue - (9.2)

9

ACTIVITIES

Receipts from customers 7551.9 6205.5

Payments made to employees and suppliers (7130.5) (5908.8)

Receipt of interest 0.5 1.7

Payment of interest and other finance cost (15.0) (9.3)

Payment of income taxes (114.8) (98.5)

CASH GENERATED BY OPERATING

ACTIVITIES

292.1 190.6

% CHANGE 53.25%

CASH FLOWS REPORTED BY FINANCING

ACTIVITIES

Cash receipt on issue of shares 3.0 395.9

(Repayment) or proceeds of borrowings (89.7) 450.0

Payment for issue costs of debt (0.8) (1.7)

Cost of share issue - (9.2)

9

Dividend payment made to the company’s owners (151.6) (119.1)

Cash (used) or generated by financing activities (239.1) 715.9

% CHANGE (133.40 %)

CASH FLOW SAMPLE STATEMENT

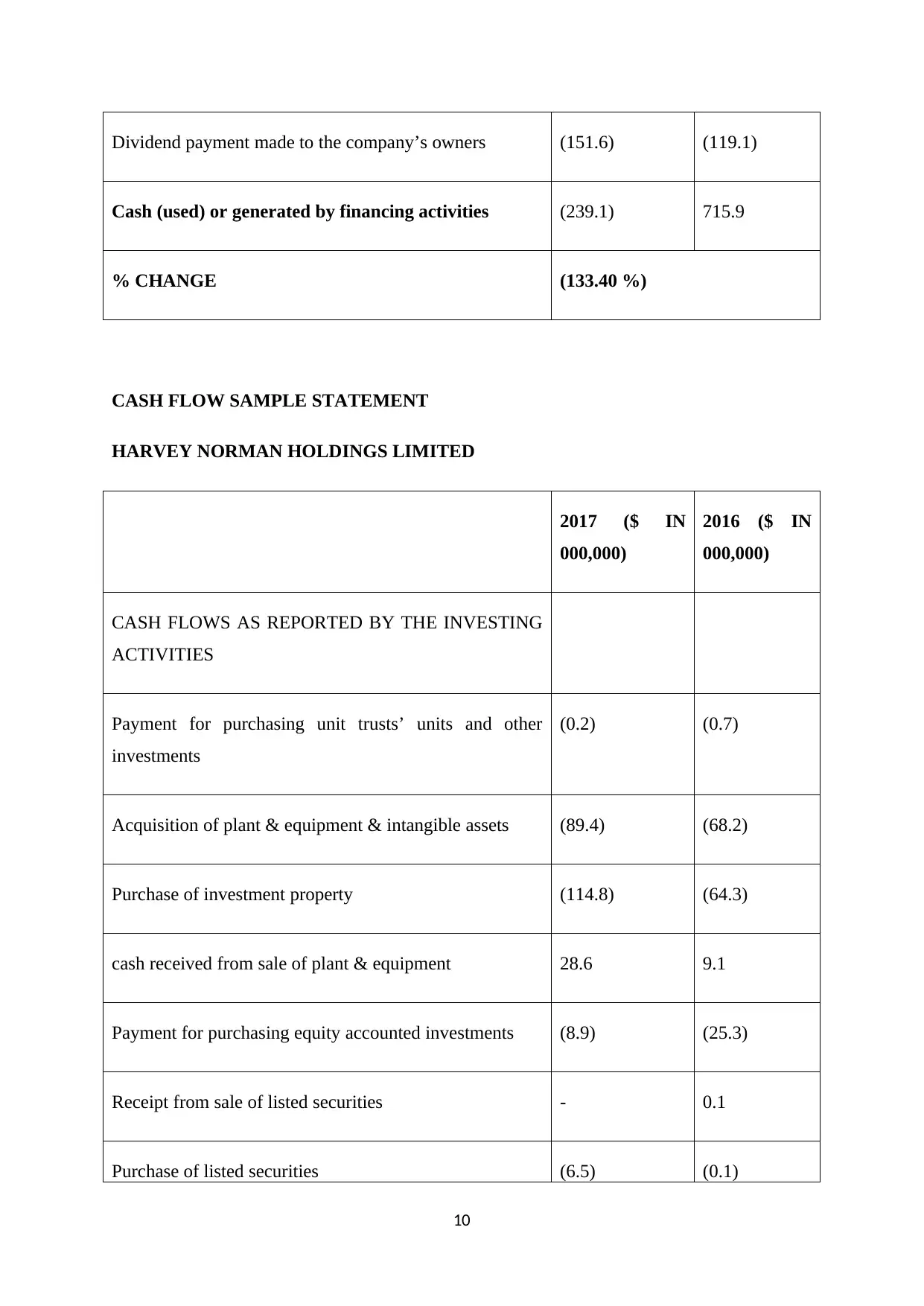

HARVEY NORMAN HOLDINGS LIMITED

2017 ($ IN

000,000)

2016 ($ IN

000,000)

CASH FLOWS AS REPORTED BY THE INVESTING

ACTIVITIES

Payment for purchasing unit trusts’ units and other

investments

(0.2) (0.7)

Acquisition of plant & equipment & intangible assets (89.4) (68.2)

Purchase of investment property (114.8) (64.3)

cash received from sale of plant & equipment 28.6 9.1

Payment for purchasing equity accounted investments (8.9) (25.3)

Receipt from sale of listed securities - 0.1

Purchase of listed securities (6.5) (0.1)

10

Cash (used) or generated by financing activities (239.1) 715.9

% CHANGE (133.40 %)

CASH FLOW SAMPLE STATEMENT

HARVEY NORMAN HOLDINGS LIMITED

2017 ($ IN

000,000)

2016 ($ IN

000,000)

CASH FLOWS AS REPORTED BY THE INVESTING

ACTIVITIES

Payment for purchasing unit trusts’ units and other

investments

(0.2) (0.7)

Acquisition of plant & equipment & intangible assets (89.4) (68.2)

Purchase of investment property (114.8) (64.3)

cash received from sale of plant & equipment 28.6 9.1

Payment for purchasing equity accounted investments (8.9) (25.3)

Receipt from sale of listed securities - 0.1

Purchase of listed securities (6.5) (0.1)

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

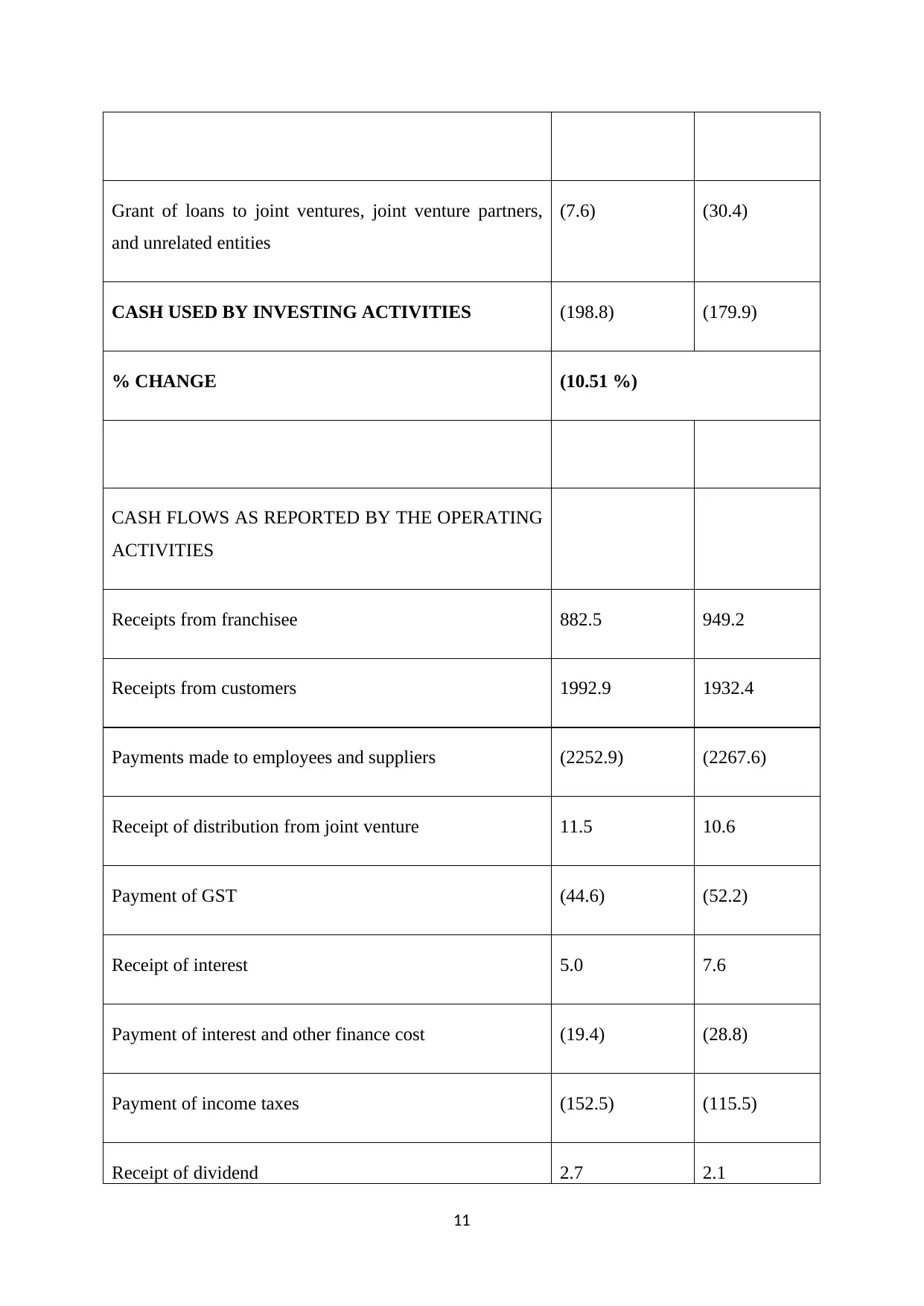

Grant of loans to joint ventures, joint venture partners,

and unrelated entities

(7.6) (30.4)

CASH USED BY INVESTING ACTIVITIES (198.8) (179.9)

% CHANGE (10.51 %)

CASH FLOWS AS REPORTED BY THE OPERATING

ACTIVITIES

Receipts from franchisee 882.5 949.2

Receipts from customers 1992.9 1932.4

Payments made to employees and suppliers (2252.9) (2267.6)

Receipt of distribution from joint venture 11.5 10.6

Payment of GST (44.6) (52.2)

Receipt of interest 5.0 7.6

Payment of interest and other finance cost (19.4) (28.8)

Payment of income taxes (152.5) (115.5)

Receipt of dividend 2.7 2.1

11

and unrelated entities

(7.6) (30.4)

CASH USED BY INVESTING ACTIVITIES (198.8) (179.9)

% CHANGE (10.51 %)

CASH FLOWS AS REPORTED BY THE OPERATING

ACTIVITIES

Receipts from franchisee 882.5 949.2

Receipts from customers 1992.9 1932.4

Payments made to employees and suppliers (2252.9) (2267.6)

Receipt of distribution from joint venture 11.5 10.6

Payment of GST (44.6) (52.2)

Receipt of interest 5.0 7.6

Payment of interest and other finance cost (19.4) (28.8)

Payment of income taxes (152.5) (115.5)

Receipt of dividend 2.7 2.1

11

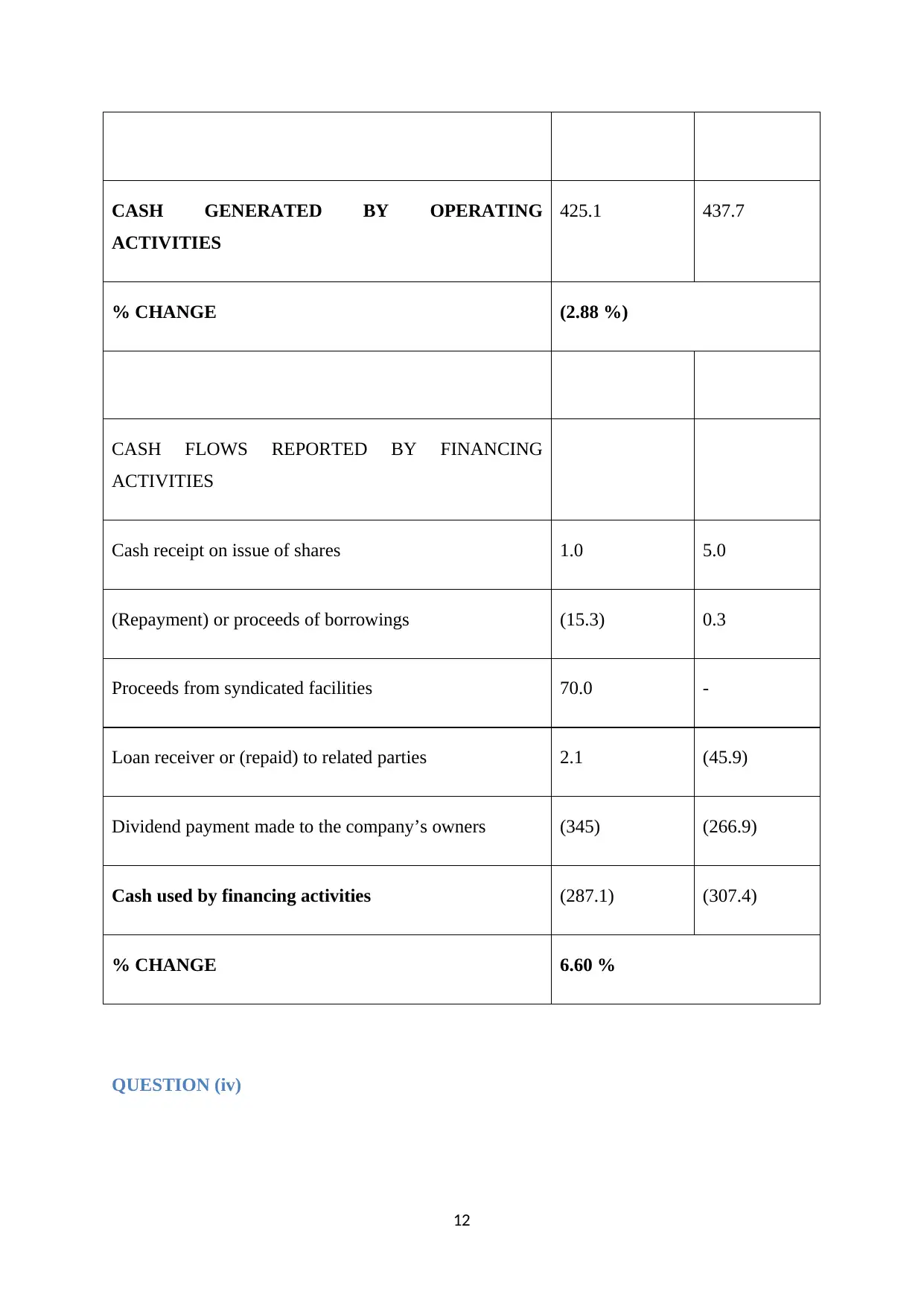

CASH GENERATED BY OPERATING

ACTIVITIES

425.1 437.7

% CHANGE (2.88 %)

CASH FLOWS REPORTED BY FINANCING

ACTIVITIES

Cash receipt on issue of shares 1.0 5.0

(Repayment) or proceeds of borrowings (15.3) 0.3

Proceeds from syndicated facilities 70.0 -

Loan receiver or (repaid) to related parties 2.1 (45.9)

Dividend payment made to the company’s owners (345) (266.9)

Cash used by financing activities (287.1) (307.4)

% CHANGE 6.60 %

QUESTION (iv)

12

ACTIVITIES

425.1 437.7

% CHANGE (2.88 %)

CASH FLOWS REPORTED BY FINANCING

ACTIVITIES

Cash receipt on issue of shares 1.0 5.0

(Repayment) or proceeds of borrowings (15.3) 0.3

Proceeds from syndicated facilities 70.0 -

Loan receiver or (repaid) to related parties 2.1 (45.9)

Dividend payment made to the company’s owners (345) (266.9)

Cash used by financing activities (287.1) (307.4)

% CHANGE 6.60 %

QUESTION (iv)

12

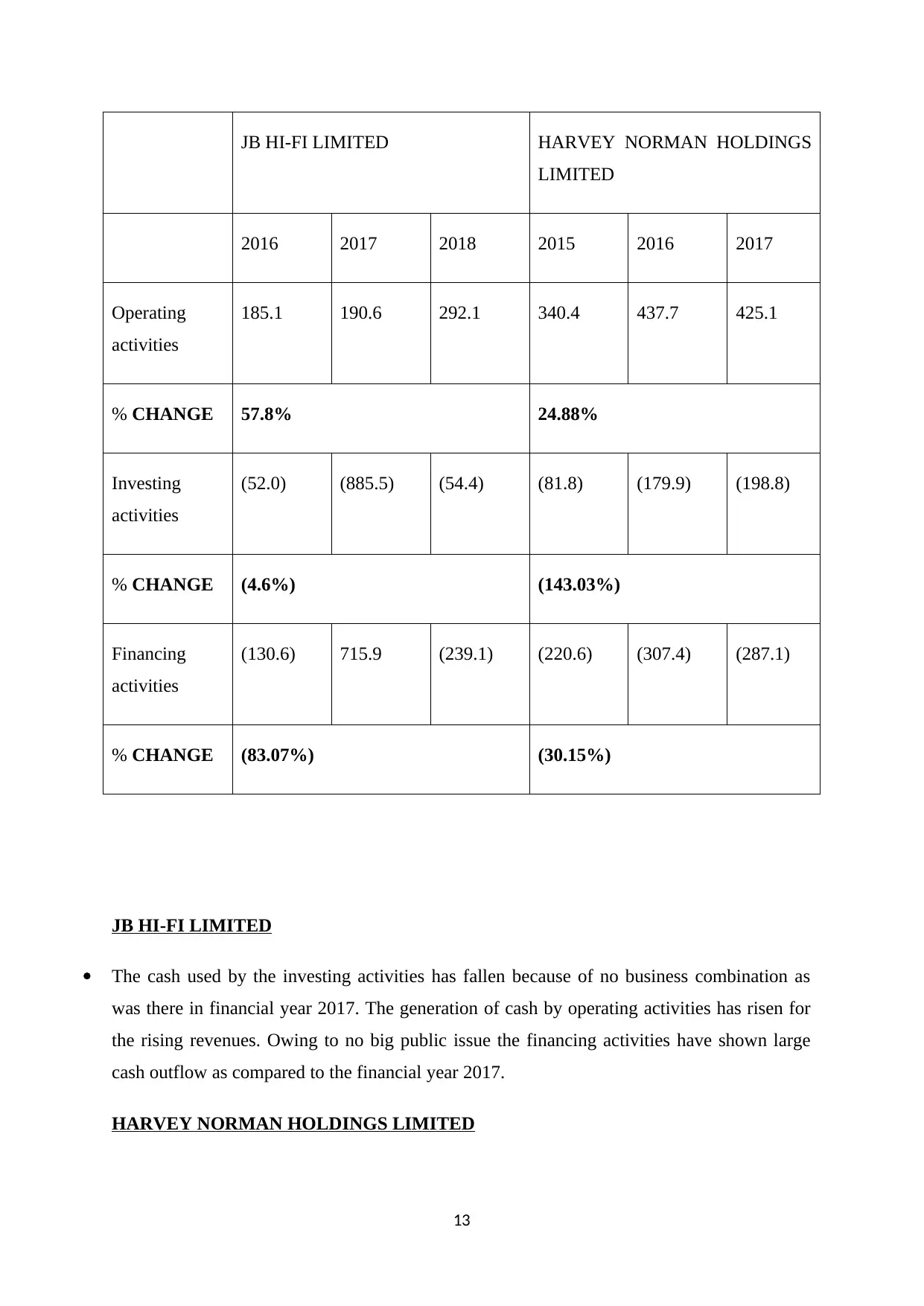

JB HI-FI LIMITED HARVEY NORMAN HOLDINGS

LIMITED

2016 2017 2018 2015 2016 2017

Operating

activities

185.1 190.6 292.1 340.4 437.7 425.1

% CHANGE 57.8% 24.88%

Investing

activities

(52.0) (885.5) (54.4) (81.8) (179.9) (198.8)

% CHANGE (4.6%) (143.03%)

Financing

activities

(130.6) 715.9 (239.1) (220.6) (307.4) (287.1)

% CHANGE (83.07%) (30.15%)

JB HI-FI LIMITED

The cash used by the investing activities has fallen because of no business combination as

was there in financial year 2017. The generation of cash by operating activities has risen for

the rising revenues. Owing to no big public issue the financing activities have shown large

cash outflow as compared to the financial year 2017.

HARVEY NORMAN HOLDINGS LIMITED

13

LIMITED

2016 2017 2018 2015 2016 2017

Operating

activities

185.1 190.6 292.1 340.4 437.7 425.1

% CHANGE 57.8% 24.88%

Investing

activities

(52.0) (885.5) (54.4) (81.8) (179.9) (198.8)

% CHANGE (4.6%) (143.03%)

Financing

activities

(130.6) 715.9 (239.1) (220.6) (307.4) (287.1)

% CHANGE (83.07%) (30.15%)

JB HI-FI LIMITED

The cash used by the investing activities has fallen because of no business combination as

was there in financial year 2017. The generation of cash by operating activities has risen for

the rising revenues. Owing to no big public issue the financing activities have shown large

cash outflow as compared to the financial year 2017.

HARVEY NORMAN HOLDINGS LIMITED

13

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

A large number of investments and properties have been purchased that has rose the cash

used by investing activities. Rest of the activities have not shown much change as compared

to financial year 2016.

QUESTION (v)

From the tables presented in the two parts above, the status van be compared for both the

companies. The investing activities’ cash flow position has improved highly in case of JB Hi-

Fi Limited if the figures are looked. Harvey Norman’s investing activities are generating high

cash outflows year by year, but the same is showing a declining trend in case of JB Hi-Fi.

The most obvious reason is no business combination in the current financial year in JB Hi-Fi.

As far as the operating activities are seen, although the cash inflow amount is high in case of

Harvey Norman, but the relative position is lacking as compared to JB Hi-Fi. When financing

activities are seen, JB Hi-Fi is depicting cash outflows way higher than Harvey Norman.

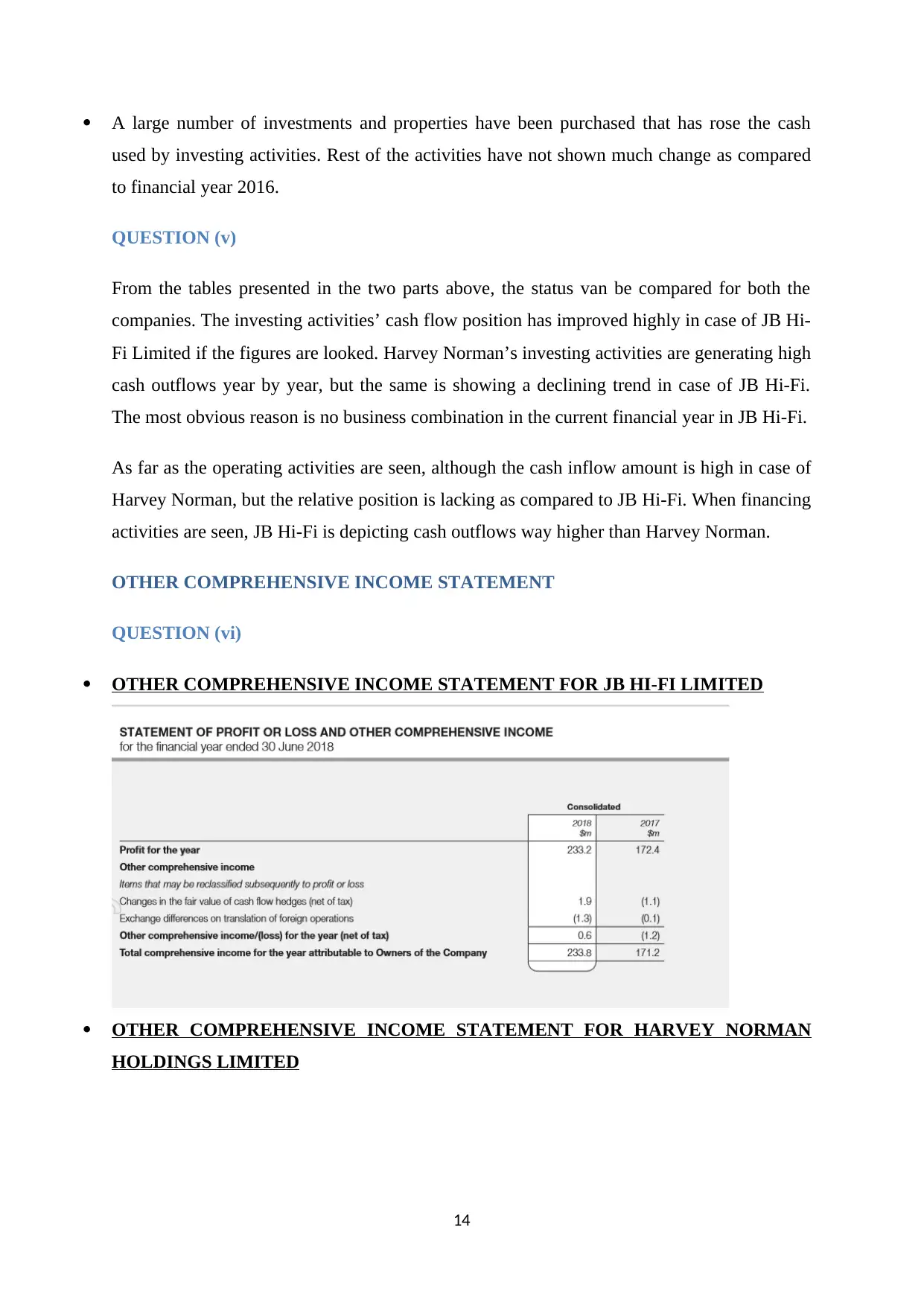

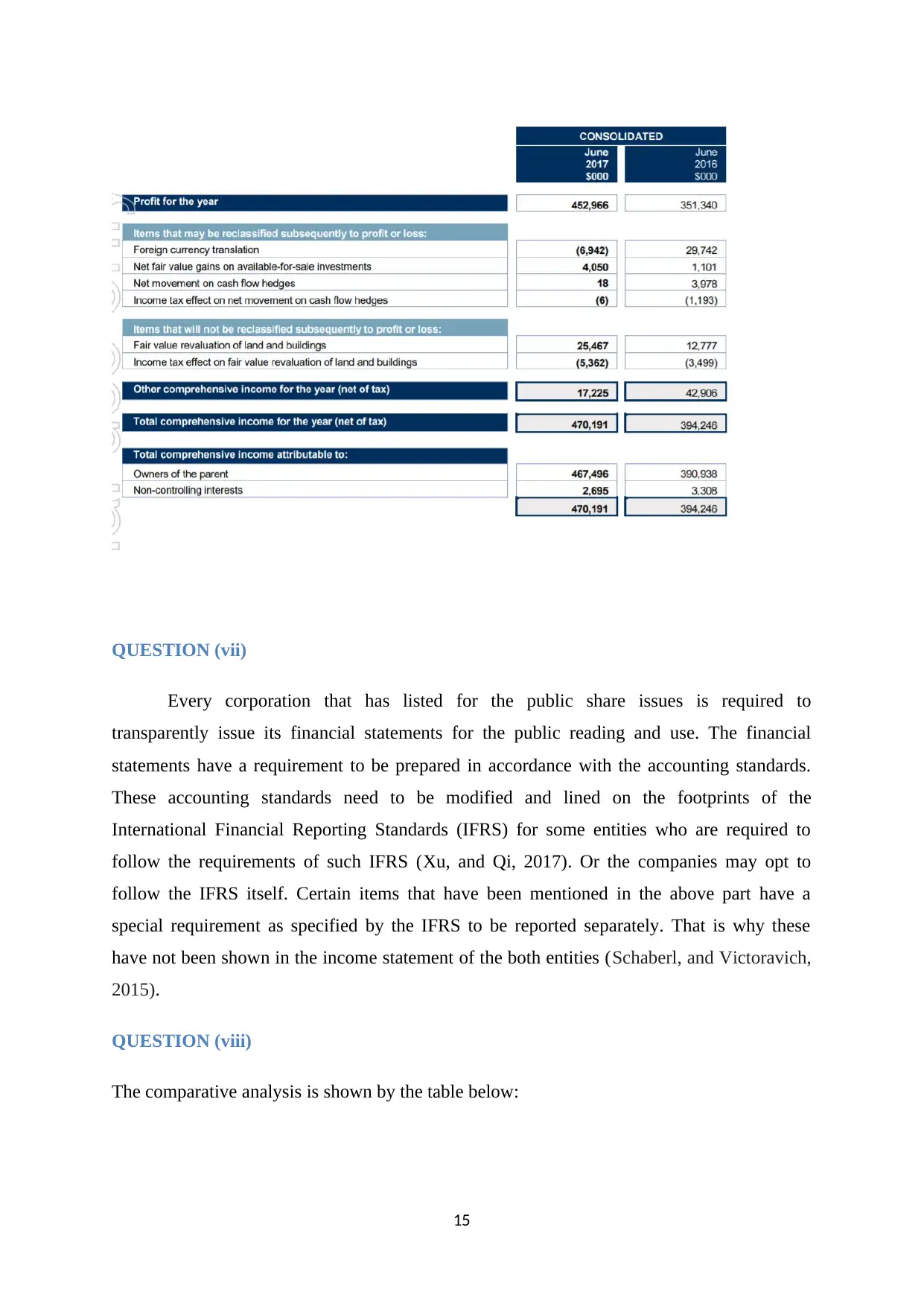

OTHER COMPREHENSIVE INCOME STATEMENT

QUESTION (vi)

OTHER COMPREHENSIVE INCOME STATEMENT FOR JB HI-FI LIMITED

OTHER COMPREHENSIVE INCOME STATEMENT FOR HARVEY NORMAN

HOLDINGS LIMITED

14

used by investing activities. Rest of the activities have not shown much change as compared

to financial year 2016.

QUESTION (v)

From the tables presented in the two parts above, the status van be compared for both the

companies. The investing activities’ cash flow position has improved highly in case of JB Hi-

Fi Limited if the figures are looked. Harvey Norman’s investing activities are generating high

cash outflows year by year, but the same is showing a declining trend in case of JB Hi-Fi.

The most obvious reason is no business combination in the current financial year in JB Hi-Fi.

As far as the operating activities are seen, although the cash inflow amount is high in case of

Harvey Norman, but the relative position is lacking as compared to JB Hi-Fi. When financing

activities are seen, JB Hi-Fi is depicting cash outflows way higher than Harvey Norman.

OTHER COMPREHENSIVE INCOME STATEMENT

QUESTION (vi)

OTHER COMPREHENSIVE INCOME STATEMENT FOR JB HI-FI LIMITED

OTHER COMPREHENSIVE INCOME STATEMENT FOR HARVEY NORMAN

HOLDINGS LIMITED

14

QUESTION (vii)

Every corporation that has listed for the public share issues is required to

transparently issue its financial statements for the public reading and use. The financial

statements have a requirement to be prepared in accordance with the accounting standards.

These accounting standards need to be modified and lined on the footprints of the

International Financial Reporting Standards (IFRS) for some entities who are required to

follow the requirements of such IFRS (Xu, and Qi, 2017). Or the companies may opt to

follow the IFRS itself. Certain items that have been mentioned in the above part have a

special requirement as specified by the IFRS to be reported separately. That is why these

have not been shown in the income statement of the both entities (Schaberl, and Victoravich,

2015).

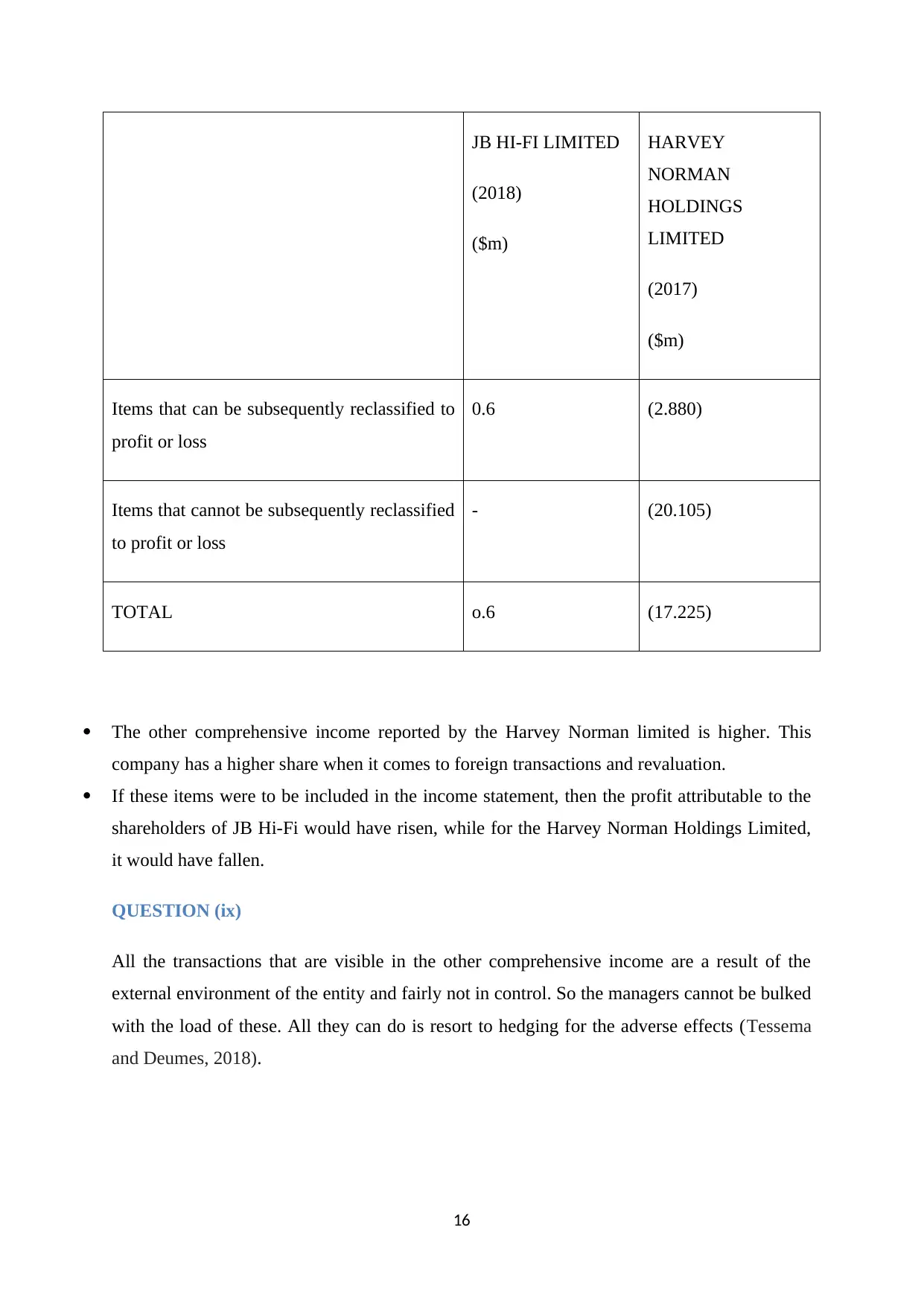

QUESTION (viii)

The comparative analysis is shown by the table below:

15

Every corporation that has listed for the public share issues is required to

transparently issue its financial statements for the public reading and use. The financial

statements have a requirement to be prepared in accordance with the accounting standards.

These accounting standards need to be modified and lined on the footprints of the

International Financial Reporting Standards (IFRS) for some entities who are required to

follow the requirements of such IFRS (Xu, and Qi, 2017). Or the companies may opt to

follow the IFRS itself. Certain items that have been mentioned in the above part have a

special requirement as specified by the IFRS to be reported separately. That is why these

have not been shown in the income statement of the both entities (Schaberl, and Victoravich,

2015).

QUESTION (viii)

The comparative analysis is shown by the table below:

15

JB HI-FI LIMITED

(2018)

($m)

HARVEY

NORMAN

HOLDINGS

LIMITED

(2017)

($m)

Items that can be subsequently reclassified to

profit or loss

0.6 (2.880)

Items that cannot be subsequently reclassified

to profit or loss

- (20.105)

TOTAL o.6 (17.225)

The other comprehensive income reported by the Harvey Norman limited is higher. This

company has a higher share when it comes to foreign transactions and revaluation.

If these items were to be included in the income statement, then the profit attributable to the

shareholders of JB Hi-Fi would have risen, while for the Harvey Norman Holdings Limited,

it would have fallen.

QUESTION (ix)

All the transactions that are visible in the other comprehensive income are a result of the

external environment of the entity and fairly not in control. So the managers cannot be bulked

with the load of these. All they can do is resort to hedging for the adverse effects (Tessema

and Deumes, 2018).

16

(2018)

($m)

HARVEY

NORMAN

HOLDINGS

LIMITED

(2017)

($m)

Items that can be subsequently reclassified to

profit or loss

0.6 (2.880)

Items that cannot be subsequently reclassified

to profit or loss

- (20.105)

TOTAL o.6 (17.225)

The other comprehensive income reported by the Harvey Norman limited is higher. This

company has a higher share when it comes to foreign transactions and revaluation.

If these items were to be included in the income statement, then the profit attributable to the

shareholders of JB Hi-Fi would have risen, while for the Harvey Norman Holdings Limited,

it would have fallen.

QUESTION (ix)

All the transactions that are visible in the other comprehensive income are a result of the

external environment of the entity and fairly not in control. So the managers cannot be bulked

with the load of these. All they can do is resort to hedging for the adverse effects (Tessema

and Deumes, 2018).

16

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

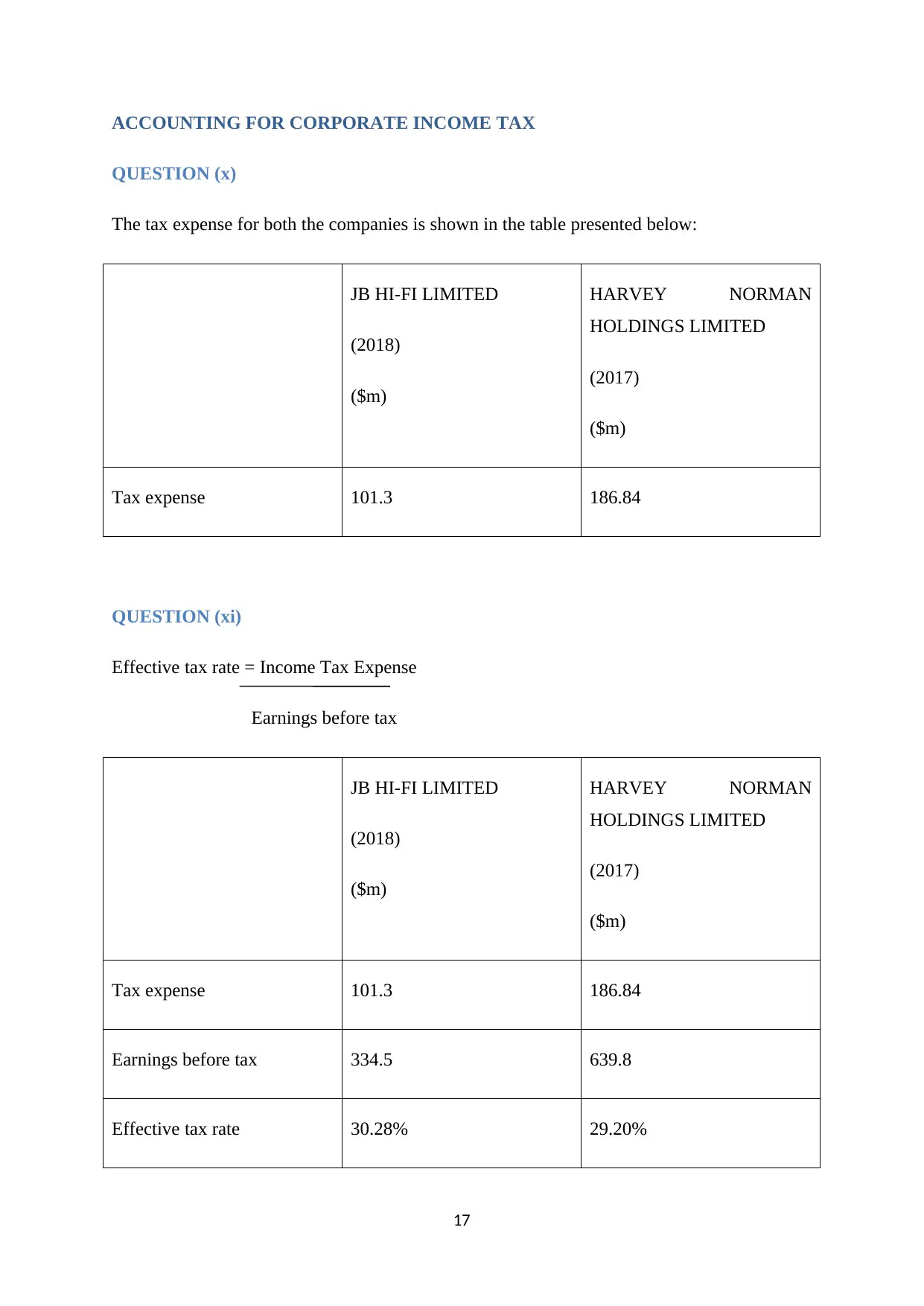

ACCOUNTING FOR CORPORATE INCOME TAX

QUESTION (x)

The tax expense for both the companies is shown in the table presented below:

JB HI-FI LIMITED

(2018)

($m)

HARVEY NORMAN

HOLDINGS LIMITED

(2017)

($m)

Tax expense 101.3 186.84

QUESTION (xi)

Effective tax rate = Income Tax Expense

Earnings before tax

JB HI-FI LIMITED

(2018)

($m)

HARVEY NORMAN

HOLDINGS LIMITED

(2017)

($m)

Tax expense 101.3 186.84

Earnings before tax 334.5 639.8

Effective tax rate 30.28% 29.20%

17

QUESTION (x)

The tax expense for both the companies is shown in the table presented below:

JB HI-FI LIMITED

(2018)

($m)

HARVEY NORMAN

HOLDINGS LIMITED

(2017)

($m)

Tax expense 101.3 186.84

QUESTION (xi)

Effective tax rate = Income Tax Expense

Earnings before tax

JB HI-FI LIMITED

(2018)

($m)

HARVEY NORMAN

HOLDINGS LIMITED

(2017)

($m)

Tax expense 101.3 186.84

Earnings before tax 334.5 639.8

Effective tax rate 30.28% 29.20%

17

JB Hi-Fi limited has a higher effective income tax rate.

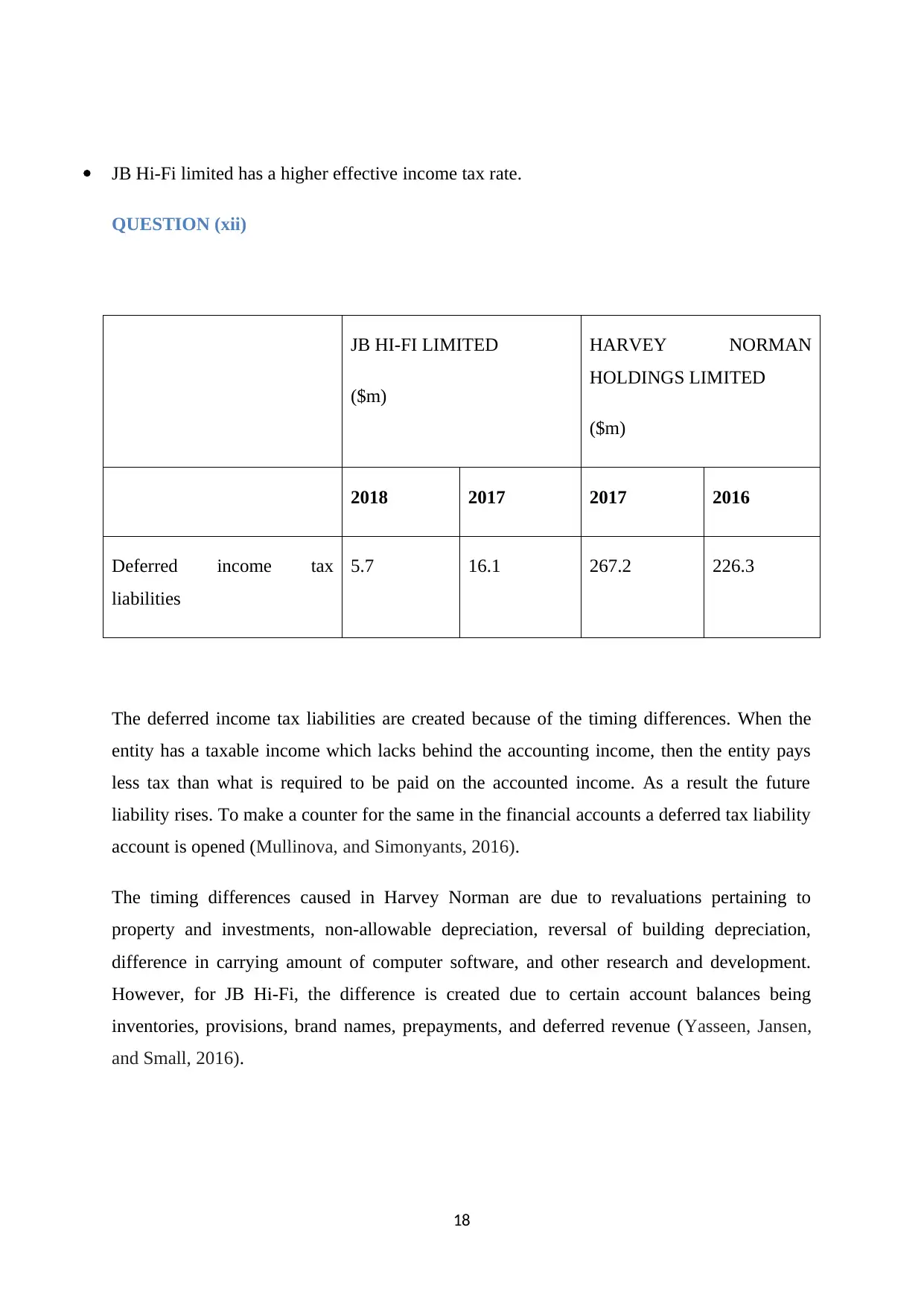

QUESTION (xii)

JB HI-FI LIMITED

($m)

HARVEY NORMAN

HOLDINGS LIMITED

($m)

2018 2017 2017 2016

Deferred income tax

liabilities

5.7 16.1 267.2 226.3

The deferred income tax liabilities are created because of the timing differences. When the

entity has a taxable income which lacks behind the accounting income, then the entity pays

less tax than what is required to be paid on the accounted income. As a result the future

liability rises. To make a counter for the same in the financial accounts a deferred tax liability

account is opened (Mullinova, and Simonyants, 2016).

The timing differences caused in Harvey Norman are due to revaluations pertaining to

property and investments, non-allowable depreciation, reversal of building depreciation,

difference in carrying amount of computer software, and other research and development.

However, for JB Hi-Fi, the difference is created due to certain account balances being

inventories, provisions, brand names, prepayments, and deferred revenue (Yasseen, Jansen,

and Small, 2016).

18

QUESTION (xii)

JB HI-FI LIMITED

($m)

HARVEY NORMAN

HOLDINGS LIMITED

($m)

2018 2017 2017 2016

Deferred income tax

liabilities

5.7 16.1 267.2 226.3

The deferred income tax liabilities are created because of the timing differences. When the

entity has a taxable income which lacks behind the accounting income, then the entity pays

less tax than what is required to be paid on the accounted income. As a result the future

liability rises. To make a counter for the same in the financial accounts a deferred tax liability

account is opened (Mullinova, and Simonyants, 2016).

The timing differences caused in Harvey Norman are due to revaluations pertaining to

property and investments, non-allowable depreciation, reversal of building depreciation,

difference in carrying amount of computer software, and other research and development.

However, for JB Hi-Fi, the difference is created due to certain account balances being

inventories, provisions, brand names, prepayments, and deferred revenue (Yasseen, Jansen,

and Small, 2016).

18

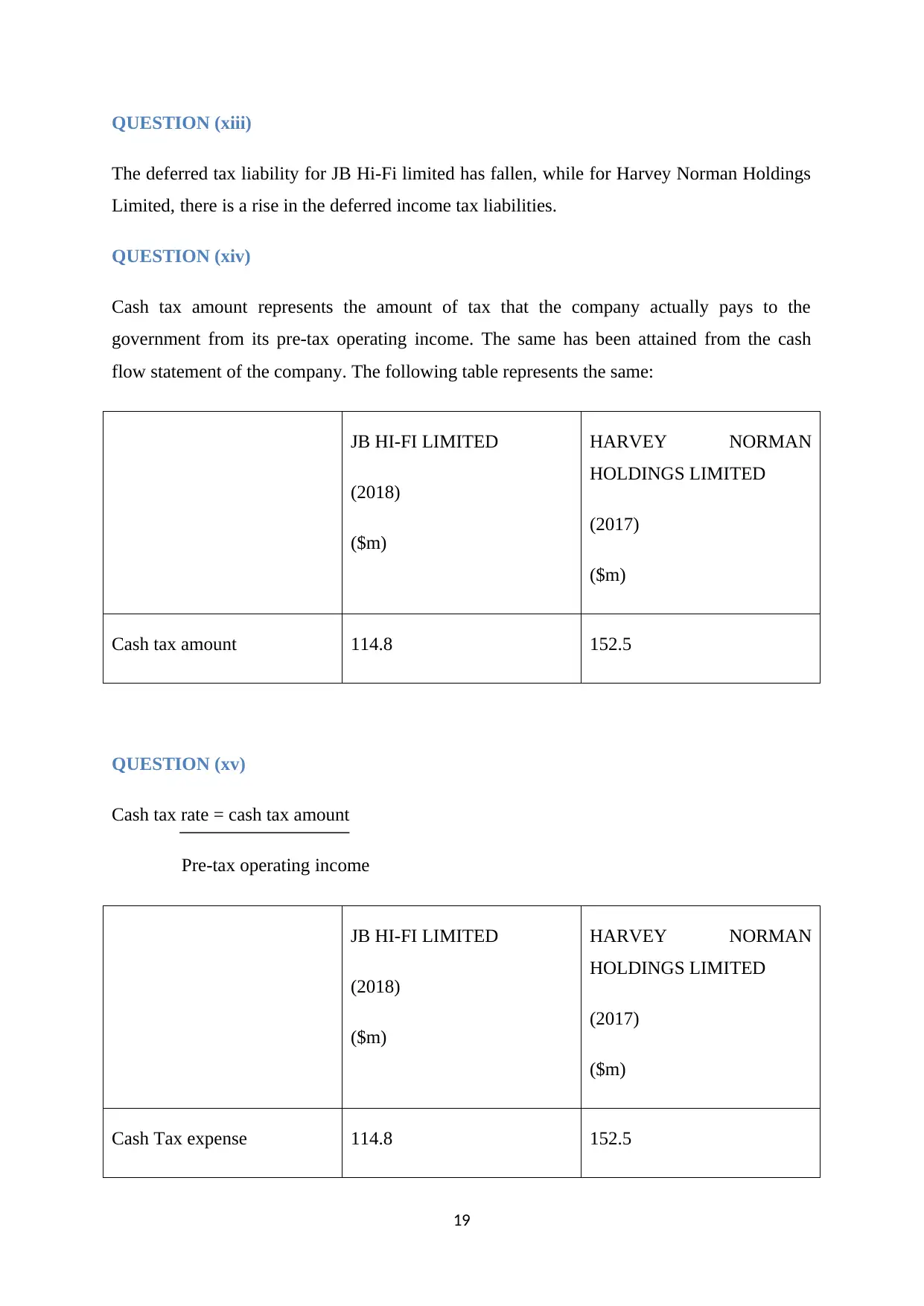

QUESTION (xiii)

The deferred tax liability for JB Hi-Fi limited has fallen, while for Harvey Norman Holdings

Limited, there is a rise in the deferred income tax liabilities.

QUESTION (xiv)

Cash tax amount represents the amount of tax that the company actually pays to the

government from its pre-tax operating income. The same has been attained from the cash

flow statement of the company. The following table represents the same:

JB HI-FI LIMITED

(2018)

($m)

HARVEY NORMAN

HOLDINGS LIMITED

(2017)

($m)

Cash tax amount 114.8 152.5

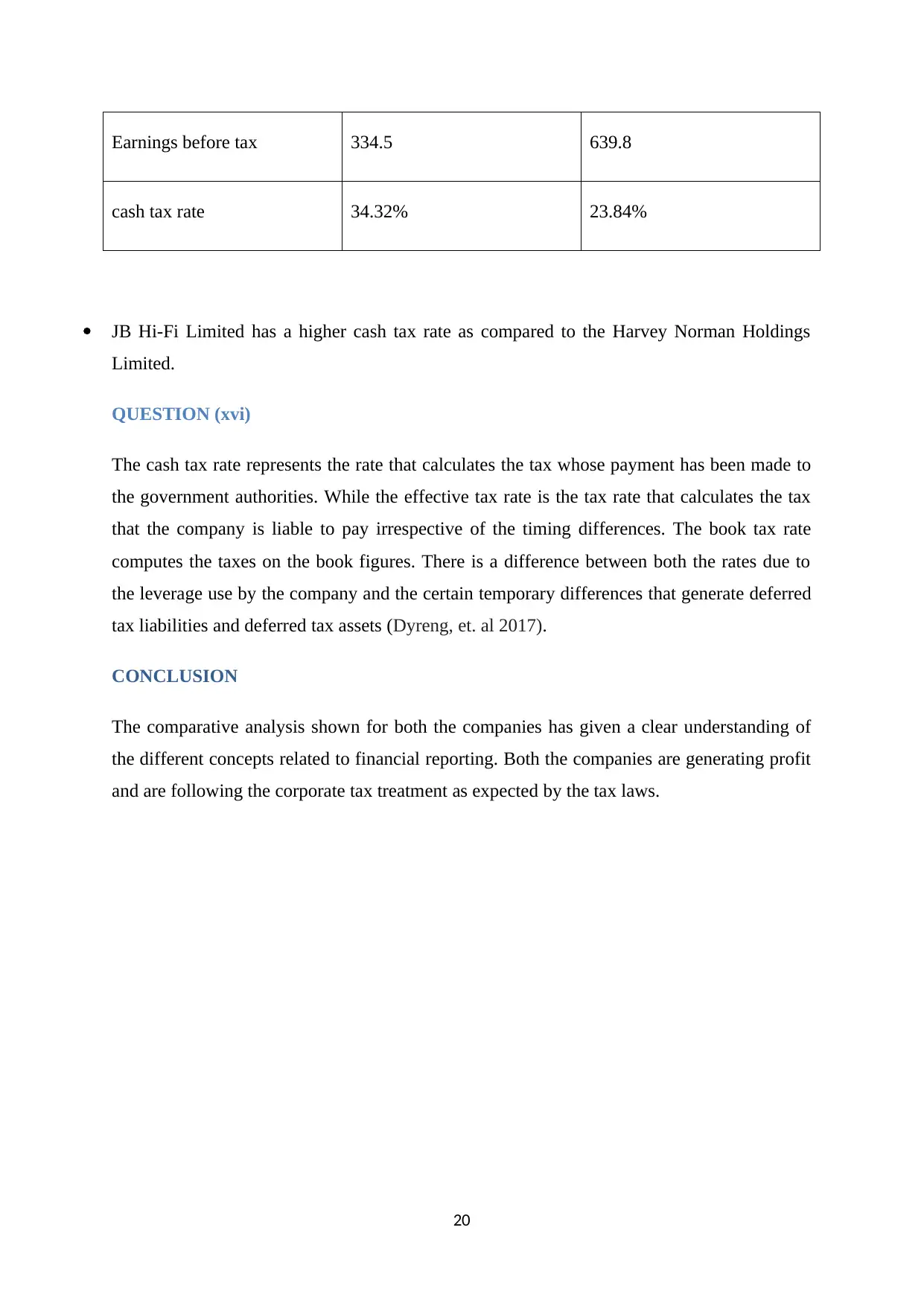

QUESTION (xv)

Cash tax rate = cash tax amount

Pre-tax operating income

JB HI-FI LIMITED

(2018)

($m)

HARVEY NORMAN

HOLDINGS LIMITED

(2017)

($m)

Cash Tax expense 114.8 152.5

19

The deferred tax liability for JB Hi-Fi limited has fallen, while for Harvey Norman Holdings

Limited, there is a rise in the deferred income tax liabilities.

QUESTION (xiv)

Cash tax amount represents the amount of tax that the company actually pays to the

government from its pre-tax operating income. The same has been attained from the cash

flow statement of the company. The following table represents the same:

JB HI-FI LIMITED

(2018)

($m)

HARVEY NORMAN

HOLDINGS LIMITED

(2017)

($m)

Cash tax amount 114.8 152.5

QUESTION (xv)

Cash tax rate = cash tax amount

Pre-tax operating income

JB HI-FI LIMITED

(2018)

($m)

HARVEY NORMAN

HOLDINGS LIMITED

(2017)

($m)

Cash Tax expense 114.8 152.5

19

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Earnings before tax 334.5 639.8

cash tax rate 34.32% 23.84%

JB Hi-Fi Limited has a higher cash tax rate as compared to the Harvey Norman Holdings

Limited.

QUESTION (xvi)

The cash tax rate represents the rate that calculates the tax whose payment has been made to

the government authorities. While the effective tax rate is the tax rate that calculates the tax

that the company is liable to pay irrespective of the timing differences. The book tax rate

computes the taxes on the book figures. There is a difference between both the rates due to

the leverage use by the company and the certain temporary differences that generate deferred

tax liabilities and deferred tax assets (Dyreng, et. al 2017).

CONCLUSION

The comparative analysis shown for both the companies has given a clear understanding of

the different concepts related to financial reporting. Both the companies are generating profit

and are following the corporate tax treatment as expected by the tax laws.

20

cash tax rate 34.32% 23.84%

JB Hi-Fi Limited has a higher cash tax rate as compared to the Harvey Norman Holdings

Limited.

QUESTION (xvi)

The cash tax rate represents the rate that calculates the tax whose payment has been made to

the government authorities. While the effective tax rate is the tax rate that calculates the tax

that the company is liable to pay irrespective of the timing differences. The book tax rate

computes the taxes on the book figures. There is a difference between both the rates due to

the leverage use by the company and the certain temporary differences that generate deferred

tax liabilities and deferred tax assets (Dyreng, et. al 2017).

CONCLUSION

The comparative analysis shown for both the companies has given a clear understanding of

the different concepts related to financial reporting. Both the companies are generating profit

and are following the corporate tax treatment as expected by the tax laws.

20

REFERENCES

Baloch, Q.B., Ihsan, A., Kakakhel, S.J. and Sethi, S., 2015. Impact of Firm Size, Asset

Tangibility and Retained Earnings on Financial Leverage: Evidence from Auto Sector,

Pakistan. Abasyn University Journal of Social Sciences, 8(1). 19-45

Black, D.E., 2016. Other comprehensive income: a review and directions for future

research. Accounting & Finance, 56(1), pp.9-45.

Dyreng, S.D., Hanlon, M., Maydew, E.L. and Thornock, J.R., 2017. Changes in corporate

effective tax rates over the past 25 years. Journal of Financial Economics, 124(3), pp.441-

463.

Geske, R., Subrahmanyam, A. and Zhou, Y., 2016. Capital structure effects on the prices of

equity call options. Journal of Financial Economics, 121(2), pp.231-253.

Gordon, E.A., Henry, E., Jorgensen, B.N. and Linthicum, C.L., 2017. Flexibility in cash-flow

classification under IFRS: determinants and consequences. Review of Accounting

Studies, 22(2), pp.839-872.

Hui, K.W., Nelson, K.K. and Yeung, P.E., 2016. On the persistence and pricing of industry-

wide and firm-specific earnings, cash flows, and accruals. Journal of Accounting and

Economics, 61(1), pp.185-202.

Lashgari, M., 2015, January. RETURN ON COMMON STOCK. In Allied Academies

International Conference. Academy of Accounting and Financial Studies. Proceedings(Vol.

20, No. 1, p. 19). Jordan Whitney Enterprises, Inc.

Mullinova, S. and Simonyants, N., 2016. Reflection of a deferred tax liability in the credit

union reporting according to IFRS (IAS) 12" Income taxes". Modern European Researches,

(1), pp.83-88.

Schaberl, P.D. and Victoravich, L.M., 2015. Reporting location and the value relevance of

accounting information: The case of other comprehensive income. Advances in

accounting, 31(2), pp.239-246.

21

Baloch, Q.B., Ihsan, A., Kakakhel, S.J. and Sethi, S., 2015. Impact of Firm Size, Asset

Tangibility and Retained Earnings on Financial Leverage: Evidence from Auto Sector,

Pakistan. Abasyn University Journal of Social Sciences, 8(1). 19-45

Black, D.E., 2016. Other comprehensive income: a review and directions for future

research. Accounting & Finance, 56(1), pp.9-45.

Dyreng, S.D., Hanlon, M., Maydew, E.L. and Thornock, J.R., 2017. Changes in corporate

effective tax rates over the past 25 years. Journal of Financial Economics, 124(3), pp.441-

463.

Geske, R., Subrahmanyam, A. and Zhou, Y., 2016. Capital structure effects on the prices of

equity call options. Journal of Financial Economics, 121(2), pp.231-253.

Gordon, E.A., Henry, E., Jorgensen, B.N. and Linthicum, C.L., 2017. Flexibility in cash-flow

classification under IFRS: determinants and consequences. Review of Accounting

Studies, 22(2), pp.839-872.

Hui, K.W., Nelson, K.K. and Yeung, P.E., 2016. On the persistence and pricing of industry-

wide and firm-specific earnings, cash flows, and accruals. Journal of Accounting and

Economics, 61(1), pp.185-202.

Lashgari, M., 2015, January. RETURN ON COMMON STOCK. In Allied Academies

International Conference. Academy of Accounting and Financial Studies. Proceedings(Vol.

20, No. 1, p. 19). Jordan Whitney Enterprises, Inc.

Mullinova, S. and Simonyants, N., 2016. Reflection of a deferred tax liability in the credit

union reporting according to IFRS (IAS) 12" Income taxes". Modern European Researches,

(1), pp.83-88.

Schaberl, P.D. and Victoravich, L.M., 2015. Reporting location and the value relevance of

accounting information: The case of other comprehensive income. Advances in

accounting, 31(2), pp.239-246.

21

Tessema, A. and Deumes, R., 2018. SFAS 133 and income smoothing via discretionary

accruals: The role of hedge effectiveness and market volatility. Journal of International

Financial Management & Accounting, 29(2), pp.105-130.

Xu, W. and Qi, M., 2017. Presentation Pattern and the Value Relevance of Comprehensive

Income---Evidence from China. International Journal of Economics and Finance, 9(6), p.31.

Yasseen, Y., Jansen, J. and Small, R., 2016. Accounting for deferred taxation: accounting

technical. Professional Accountant, 2016(27), pp.14-16.

22

accruals: The role of hedge effectiveness and market volatility. Journal of International

Financial Management & Accounting, 29(2), pp.105-130.

Xu, W. and Qi, M., 2017. Presentation Pattern and the Value Relevance of Comprehensive

Income---Evidence from China. International Journal of Economics and Finance, 9(6), p.31.

Yasseen, Y., Jansen, J. and Small, R., 2016. Accounting for deferred taxation: accounting

technical. Professional Accountant, 2016(27), pp.14-16.

22

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.