Corporate Accounting: Acquisition Analysis, Consolidation Journal Entries, Income Statement and Balance Sheet

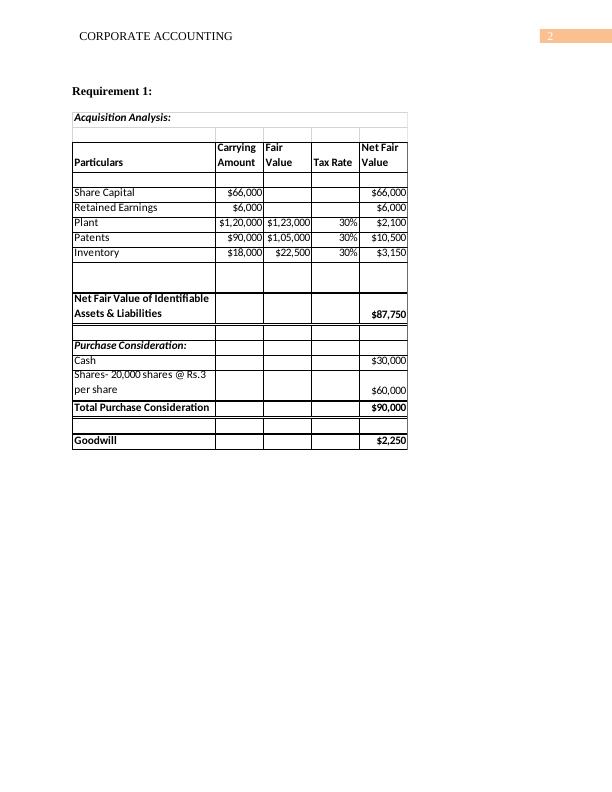

On 1 July 2015, Tuna Ltd acquired all the issued shares of Brim Ltd. Tuna Ltd paid $30 000 in cash and 20 000 shares in Tuna Ltd valued at $3 per share. At this date, the equity of Brim Ltd consisted of $66 000 share capital and $6000 retained earnings. At 1 July 2015, all the identifiable assets and liabilities of Brim Ltd were recorded at amounts equal to their fair values except for: Carrying amount Fair value Plant (cost $150 000) $120 000 $123 000 Patents 90 000 105 000 Inventory 18 000 22 500 The plant was considered to have a further 5-year life. The patents were sold for $120 000 to an external entity on 18 August 2015. The inventory was all sold by 30 June 2016. Additional information (a) Tuna Ltd sells certain raw materials to Brim Ltd to be used in its manufacturing process. At 1 July 2016, Brim Ltd held inventory sold to it by Tuna Ltd in the previous year at a profit of $600. During the 2016–17-year, Tuna Ltd sold inventory to Brim Ltd for $21 000. None of this was on hand at 30 June 2017. (b)

Added on 2023-06-12

About This Document

Corporate Accounting: Acquisition Analysis, Consolidation Journal Entries, Income Statement and Balance Sheet

On 1 July 2015, Tuna Ltd acquired all the issued shares of Brim Ltd. Tuna Ltd paid $30 000 in cash and 20 000 shares in Tuna Ltd valued at $3 per share. At this date, the equity of Brim Ltd consisted of $66 000 share capital and $6000 retained earnings. At 1 July 2015, all the identifiable assets and liabilities of Brim Ltd were recorded at amounts equal to their fair values except for: Carrying amount Fair value Plant (cost $150 000) $120 000 $123 000 Patents 90 000 105 000 Inventory 18 000 22 500 The plant was considered to have a further 5-year life. The patents were sold for $120 000 to an external entity on 18 August 2015. The inventory was all sold by 30 June 2016. Additional information (a) Tuna Ltd sells certain raw materials to Brim Ltd to be used in its manufacturing process. At 1 July 2016, Brim Ltd held inventory sold to it by Tuna Ltd in the previous year at a profit of $600. During the 2016–17-year, Tuna Ltd sold inventory to Brim Ltd for $21 000. None of this was on hand at 30 June 2017. (b)

Added on 2023-06-12

End of preview

Want to access all the pages? Upload your documents or become a member.