Comprehensive Corporate Accounting Report: PWR Holdings Limited

VerifiedAdded on 2023/06/05

|16

|3722

|340

Report

AI Summary

This report delves into the realm of corporate accounting, providing a comprehensive analysis of key concepts such as accounting profit, taxable profit, temporary differences (both taxable and deductible), and deferred tax assets and liabilities. Using PWR Holdings Limited, an Australian company, as a case study, the report examines the company's financial statements to evaluate tax expenses, current assets and liabilities, and the reasons behind discrepancies between accounting and taxable profits. The report also explores the recognition criteria for deferred tax items, the relationship between income tax expense and income tax paid, and the distinctions between temporary and permanent differences. The analysis includes a step-by-step guide to calculating and recording deferred tax, along with an examination of the tax expense components for PWR Holdings Limited. The report concludes with insights into the practical application of corporate accounting principles within a real-world context.

Corporate Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Abstract............................................................................................................................................3

INTRODUCTION ..........................................................................................................................4

TASK...............................................................................................................................................4

1.Meaning of accounting and taxable profit, temporary, taxable temporary, deductible

temporary difference, deferred tax assets and liability...........................................................4

2. The recognition criteria of deferred tax assets and liabilities.............................................6

3.The tax expense of the PWR Holdings Limited .................................................................7

4.Identify the reason, if it is or not the company tax rate hows the same figure the firm's

accounting income..................................................................................................................8

5.Identify the deferred tax assets and liabilities of PWR Holdings........................................8

6.Identify the reasons the current tax assets or income tax payable recorded by company...9

7.Justify with reason the income tax expense shown in the income statement same as the

income tax paid shown in the cash flow statement................................................................9

8.Explain the concepts of temporary difference and permanent difference ........................10

9.The interesting, confusing, surprising or difficult to understand about the treatment of tax 10

CONCLUSION .............................................................................................................................11

REFERENCES..............................................................................................................................12

Appendix........................................................................................................................................13

Abstract............................................................................................................................................3

INTRODUCTION ..........................................................................................................................4

TASK...............................................................................................................................................4

1.Meaning of accounting and taxable profit, temporary, taxable temporary, deductible

temporary difference, deferred tax assets and liability...........................................................4

2. The recognition criteria of deferred tax assets and liabilities.............................................6

3.The tax expense of the PWR Holdings Limited .................................................................7

4.Identify the reason, if it is or not the company tax rate hows the same figure the firm's

accounting income..................................................................................................................8

5.Identify the deferred tax assets and liabilities of PWR Holdings........................................8

6.Identify the reasons the current tax assets or income tax payable recorded by company...9

7.Justify with reason the income tax expense shown in the income statement same as the

income tax paid shown in the cash flow statement................................................................9

8.Explain the concepts of temporary difference and permanent difference ........................10

9.The interesting, confusing, surprising or difficult to understand about the treatment of tax 10

CONCLUSION .............................................................................................................................11

REFERENCES..............................................................................................................................12

Appendix........................................................................................................................................13

Abstract

This report includes the concept of corporate accounting and other accounting term.

Corporate accounting is a very important term in the industry. It is different from simple

accounting. This report also includes the concept of accounting profit, taxation profit, short-lived

variation, assets related with deferred and liabilities (deferred) of the PWH holding. It is an

Australian company that are listed in the ASE. The company applies rules and regulation to

determine the accounting profit. The taxable profit is different from accounting profit because

some incomes and expenses that do not allowed in tax. So this report will analysis how the tax

profit is different from accounting profit.

This report includes the concept of corporate accounting and other accounting term.

Corporate accounting is a very important term in the industry. It is different from simple

accounting. This report also includes the concept of accounting profit, taxation profit, short-lived

variation, assets related with deferred and liabilities (deferred) of the PWH holding. It is an

Australian company that are listed in the ASE. The company applies rules and regulation to

determine the accounting profit. The taxable profit is different from accounting profit because

some incomes and expenses that do not allowed in tax. So this report will analysis how the tax

profit is different from accounting profit.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Corporate accounting is an extension tool of accounting that engage with the corporate

accounting, preparation of annual statements such as statement of assets and liabilities, income

statement and cash received or payment during the year. Company can be classified into the two

parts such as public company and private company. Public company means those company that

is registered under the security exchange for sale of the share and bonds to the market. Private

company means those company that sale of the share its relative. The public accountant is

different for corporate accountant because it works in the specialized industry as an accountant.

It works as a Chief financial officer to the industry. It performs various activities in the company

such as preparing budget, evaluate finances and prepare detailed report (Abernathy and et.al,

2019). This report, includes the critical analysis of the selected company is PWR Holdings

Limited that is registered under the Australian securities exchange. It is deal in the production

and development of cooling parts in the motor sport firms. Furthermore this report includes the

analysis of financial statements of last two years and evaluate the tax expenses, accounting profit

and current assets and liabilities of the company.

TASK

1.

Accounting profit- It refers company profit, that is calculate on the basis of general

accepted accounting principles. It means the firm's profit obtained after deduct total cost from

total earnings. It is calculate in according of accounting standard and evaluate of current

accounting year. It aims to evaluate the performance and profitability of the organisation. It is

used when company wants to known the liquidity and solvency. It shows the future performance

of the company. It examines the resources are distributed of the accurate person.

For example- if person starts its business with the $50000 and generated the profit of

$60000, it means $10000 is recorded as a accounting profit (Chu, Liu and Qiu, 2019).

Taxable profit- It means the business earning that is taxable as per the Australian

Income tax. The tax is calculated of the previous year income. Taxable profit shows under the

head of income from business and profession. The tax return is submitted to the income tax

department. It evaluates to known the actual taxable profit and actual tax paid by the company to

Corporate accounting is an extension tool of accounting that engage with the corporate

accounting, preparation of annual statements such as statement of assets and liabilities, income

statement and cash received or payment during the year. Company can be classified into the two

parts such as public company and private company. Public company means those company that

is registered under the security exchange for sale of the share and bonds to the market. Private

company means those company that sale of the share its relative. The public accountant is

different for corporate accountant because it works in the specialized industry as an accountant.

It works as a Chief financial officer to the industry. It performs various activities in the company

such as preparing budget, evaluate finances and prepare detailed report (Abernathy and et.al,

2019). This report, includes the critical analysis of the selected company is PWR Holdings

Limited that is registered under the Australian securities exchange. It is deal in the production

and development of cooling parts in the motor sport firms. Furthermore this report includes the

analysis of financial statements of last two years and evaluate the tax expenses, accounting profit

and current assets and liabilities of the company.

TASK

1.

Accounting profit- It refers company profit, that is calculate on the basis of general

accepted accounting principles. It means the firm's profit obtained after deduct total cost from

total earnings. It is calculate in according of accounting standard and evaluate of current

accounting year. It aims to evaluate the performance and profitability of the organisation. It is

used when company wants to known the liquidity and solvency. It shows the future performance

of the company. It examines the resources are distributed of the accurate person.

For example- if person starts its business with the $50000 and generated the profit of

$60000, it means $10000 is recorded as a accounting profit (Chu, Liu and Qiu, 2019).

Taxable profit- It means the business earning that is taxable as per the Australian

Income tax. The tax is calculated of the previous year income. Taxable profit shows under the

head of income from business and profession. The tax return is submitted to the income tax

department. It evaluates to known the actual taxable profit and actual tax paid by the company to

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the tax department. The various taxation rates apply to different type of taxable profit. It is based

on the company profit after the adjustments of tax rules and regulations.

example-If a person starts their business with the 200000 and earned income of 250000

and tax rate is @10% then taxable profit is 50000*90%=45000.

Temporary difference- It means the distinguish among carrying value of assets and

liabilities and amount is determined of the basis of tax. The rent income is an example of

temporary difference because if rent received in advance then it is included while determine the

taxable profit but it is excluded while calculating the accounting income (Dang and et.al, 2019).

The difference which is arise between the tax profit and accounting profit of the rent income is

known as temporary difference. It is calculated on the basis of different ways:

Deductible- it means the amount will receive after the deduction while calculating taxable loss

and profit.

Taxable- it means the taxable amount will receive in the future while calculating taxable profit

and loss.

For example- if an organisation purchase of assets $20000 and useful life of 4 years. The

deprecation amount is $5000 every year, if company calculated deprecation in according to tax

the amount is received $7500 then the difference amount of $2500 will be adjusted after the year

ended of the each financial period.

Temporary difference taxable- It means the amount of tax will pay in the future when

settled of assets and liabilities. It can be saving and deduction in tax amount while assets and

liabilities are settled.

Example- if land and building is purchased $100000 and after 2 years it revalued

120000. The difference of 20000 is revaluation of land and building and it is treated as taxable

temporary difference.

Deductible temporary difference-It means the saving and deduction in the future of tax

when assets and liabilities is paid. The internation accounting standard requires that liabilities of

tax deferred are included in respect of all local differences which is present at the year ended

(Gruszczyński, 2018).

Example- if assets are recorded in the balance sheet $ 120000 but in according to tax is

recorded as 140000. the difference is raised $20000 is treated as deductible temporary difference.

on the company profit after the adjustments of tax rules and regulations.

example-If a person starts their business with the 200000 and earned income of 250000

and tax rate is @10% then taxable profit is 50000*90%=45000.

Temporary difference- It means the distinguish among carrying value of assets and

liabilities and amount is determined of the basis of tax. The rent income is an example of

temporary difference because if rent received in advance then it is included while determine the

taxable profit but it is excluded while calculating the accounting income (Dang and et.al, 2019).

The difference which is arise between the tax profit and accounting profit of the rent income is

known as temporary difference. It is calculated on the basis of different ways:

Deductible- it means the amount will receive after the deduction while calculating taxable loss

and profit.

Taxable- it means the taxable amount will receive in the future while calculating taxable profit

and loss.

For example- if an organisation purchase of assets $20000 and useful life of 4 years. The

deprecation amount is $5000 every year, if company calculated deprecation in according to tax

the amount is received $7500 then the difference amount of $2500 will be adjusted after the year

ended of the each financial period.

Temporary difference taxable- It means the amount of tax will pay in the future when

settled of assets and liabilities. It can be saving and deduction in tax amount while assets and

liabilities are settled.

Example- if land and building is purchased $100000 and after 2 years it revalued

120000. The difference of 20000 is revaluation of land and building and it is treated as taxable

temporary difference.

Deductible temporary difference-It means the saving and deduction in the future of tax

when assets and liabilities is paid. The internation accounting standard requires that liabilities of

tax deferred are included in respect of all local differences which is present at the year ended

(Gruszczyński, 2018).

Example- if assets are recorded in the balance sheet $ 120000 but in according to tax is

recorded as 140000. the difference is raised $20000 is treated as deductible temporary difference.

Deferred tax assets- It decreases the taxable income in the future accounting period. It

shows in the company balance sheet as an assets side. when the company pays its taxes excess

to the actual tax , then it is carry forward to the years ahead, is known as deferred tax assets.

This amount of deferment later on back to the company's books.. This deferment is adjusted by

the amount in the reserve, unabsorbed taxes of the years. This adjustment is done in the profit

and loss account after adjusting depreciation (Habib and Costa, 2021).

Example- If the company total earning is $3000 and warranty cost is $60 then taxable income is

$2940 and tax authorities do not allow these expense so that the taxable amount is 3000. The

difference amount is $60 and the applicable rate of tax @30% it means the tax amount is $18 and

it is recorded as the assets( deferred tax).

Liabilities of deferred tax- In simple words the postponement of the taxes liability which

the company has to pay tax is called deferred tax liability. But these due taxes are not paid till its

due date but is to be paid in the future. Deferred tax is an adjustment made by the organization

in the commercial enterprise statements at the year end and delayed impose possession are

occurred to the differences in the time. Company makes provision of the taxes as per the

Company act. later on the taxes are paid and adjusted according to the provisions. This affects

the income tax of the current year as well the coming years (Hassan, Florio and Abbas, 2022).

Example- if company earns 2000 and prepaid expenses 300 but this amount is not considered

when calculating accounting profit but when calculate taxable profit then amount is $1700. The

difference amount $300 and the tax rate is 30% then $90is treated as deferred tax liabilities and it

is recorded in assets side of balance sheet.

2.

While recorded of assets it means deferred tax and liabilities relate to deferred tax, the

following steps should be followed:

Step-1 calculated the carrying value- company is recorded the fair value of statement of the

assets and liabilities in the financial statement after adjustment of deprecation and revaluation.

Step-2 compute tax base- The company calculates the basic of tax assets or a liabilities on the

basis of: tax base of an assets, tax base of a liability. Items with a tax base but no fair value and

items of assets and liabilities where tax base is not apparent.

Step-3 calculate of temporary differences-It means the distinguish arise among the fair value of

assets and liabilities in the annual statement and on the basis of tax.

shows in the company balance sheet as an assets side. when the company pays its taxes excess

to the actual tax , then it is carry forward to the years ahead, is known as deferred tax assets.

This amount of deferment later on back to the company's books.. This deferment is adjusted by

the amount in the reserve, unabsorbed taxes of the years. This adjustment is done in the profit

and loss account after adjusting depreciation (Habib and Costa, 2021).

Example- If the company total earning is $3000 and warranty cost is $60 then taxable income is

$2940 and tax authorities do not allow these expense so that the taxable amount is 3000. The

difference amount is $60 and the applicable rate of tax @30% it means the tax amount is $18 and

it is recorded as the assets( deferred tax).

Liabilities of deferred tax- In simple words the postponement of the taxes liability which

the company has to pay tax is called deferred tax liability. But these due taxes are not paid till its

due date but is to be paid in the future. Deferred tax is an adjustment made by the organization

in the commercial enterprise statements at the year end and delayed impose possession are

occurred to the differences in the time. Company makes provision of the taxes as per the

Company act. later on the taxes are paid and adjusted according to the provisions. This affects

the income tax of the current year as well the coming years (Hassan, Florio and Abbas, 2022).

Example- if company earns 2000 and prepaid expenses 300 but this amount is not considered

when calculating accounting profit but when calculate taxable profit then amount is $1700. The

difference amount $300 and the tax rate is 30% then $90is treated as deferred tax liabilities and it

is recorded in assets side of balance sheet.

2.

While recorded of assets it means deferred tax and liabilities relate to deferred tax, the

following steps should be followed:

Step-1 calculated the carrying value- company is recorded the fair value of statement of the

assets and liabilities in the financial statement after adjustment of deprecation and revaluation.

Step-2 compute tax base- The company calculates the basic of tax assets or a liabilities on the

basis of: tax base of an assets, tax base of a liability. Items with a tax base but no fair value and

items of assets and liabilities where tax base is not apparent.

Step-3 calculate of temporary differences-It means the distinguish arise among the fair value of

assets and liabilities in the annual statement and on the basis of tax.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Step-4 Classification of temporary difference- It can be divided into the two parts. Taxable

temporary difference means the tax will levied in the upcoming year. It will raised the tax

liabilities. It can be arise when the recorded value of asset increases its tax base or tax base of a

liability exceeds its carrying amount. And deductible temporary differences means the amount

are deductible when evaluate the taxable gain or loss of the future period (Hörisch, Schaltegger

and Freeman, 2020).

Step-5 Evaluate the exceptions- The recognition method of intangible assets in the case of

business combination. The second exception is the recognition criteria of an assets or liabilities

at the time of the transaction, affects neither accounting profit nor taxable profit.

Step-6 Evaluate deductible tax losses, tax credits and deductible temporary difference.

Step-7 It decreases the taxable profits of the upcoming years. It refers the tax payment of the

future period will be smaller by a particular amount. The economic benefit will received in the

future due to lower tax liability if the future profit are given.

Step-7 Determine the tax rate- The company is created the tax amount of deferred tax assets and

liabilities.

Step-8 Calculate and recorded deferred tax- the tax rate is multiple with the taxable temporary

differences and results will lead to deferred tax liabilities. Deductible temporary differences is

multiple with tax rates will leads to deferred tax assets (Izzo, Fasan and Tiscini, 2021).

Step-9 It is affected of the transaction of an event is consistent with the accounting for that

transaction.

Step-10 Offsetting of deferred tax assets and liabilities-The company shall offset assets and

liabilities only when: the organisation has a legally enforceable right to set off current assets

against current tax liabilities.

3.The tax expense of the PWR Holdings Limited

Tax expense mean those expense that is charged by the government on the profit earned

by company. The current year tax expenses shows in the current year financial statement.

As per the financial statements of PWR Holdings Limited the tax expenses of the year

2021 is $5750 which is showed in the profit and loss account. But if company classifies the tax

expense :

The current period tax expenses = $5921

Over provision is included in the prior period= $(536)

temporary difference means the tax will levied in the upcoming year. It will raised the tax

liabilities. It can be arise when the recorded value of asset increases its tax base or tax base of a

liability exceeds its carrying amount. And deductible temporary differences means the amount

are deductible when evaluate the taxable gain or loss of the future period (Hörisch, Schaltegger

and Freeman, 2020).

Step-5 Evaluate the exceptions- The recognition method of intangible assets in the case of

business combination. The second exception is the recognition criteria of an assets or liabilities

at the time of the transaction, affects neither accounting profit nor taxable profit.

Step-6 Evaluate deductible tax losses, tax credits and deductible temporary difference.

Step-7 It decreases the taxable profits of the upcoming years. It refers the tax payment of the

future period will be smaller by a particular amount. The economic benefit will received in the

future due to lower tax liability if the future profit are given.

Step-7 Determine the tax rate- The company is created the tax amount of deferred tax assets and

liabilities.

Step-8 Calculate and recorded deferred tax- the tax rate is multiple with the taxable temporary

differences and results will lead to deferred tax liabilities. Deductible temporary differences is

multiple with tax rates will leads to deferred tax assets (Izzo, Fasan and Tiscini, 2021).

Step-9 It is affected of the transaction of an event is consistent with the accounting for that

transaction.

Step-10 Offsetting of deferred tax assets and liabilities-The company shall offset assets and

liabilities only when: the organisation has a legally enforceable right to set off current assets

against current tax liabilities.

3.The tax expense of the PWR Holdings Limited

Tax expense mean those expense that is charged by the government on the profit earned

by company. The current year tax expenses shows in the current year financial statement.

As per the financial statements of PWR Holdings Limited the tax expenses of the year

2021 is $5750 which is showed in the profit and loss account. But if company classifies the tax

expense :

The current period tax expenses = $5921

Over provision is included in the prior period= $(536)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Reversal of temporary difference = $365

Total tax expenses charged by Profit and loss account =$5750

4.

The profit as per the financial statements are rarely match with the profit as per the tax. If

any difference arise between the two profits due to the timing differences and permanent

differences. Timing differences is arised due to the reversal, if company is levied deprecation in

according to SLM but in tax the WDV method is allowed. The difference arise between the two

methods, it is known as timing difference. If any expense that are allowed in accounts but the tax

authorities do not allow those expenses, so that the difference arise between the two profits, it is

known as permanent difference (Marrone and et.al, 2020).

In the given financial statement of PWR Holdings the accounting profit is different for

taxable profit because company charges the deprecation in SLM method but tax is allowed only

WDV method, the timing difference is arised but permanent difference is not arised. When

company is calculated the tax expense, the company is deduct the over provision of tax and

determines the tax liabilities in according to tax authorities.

5.

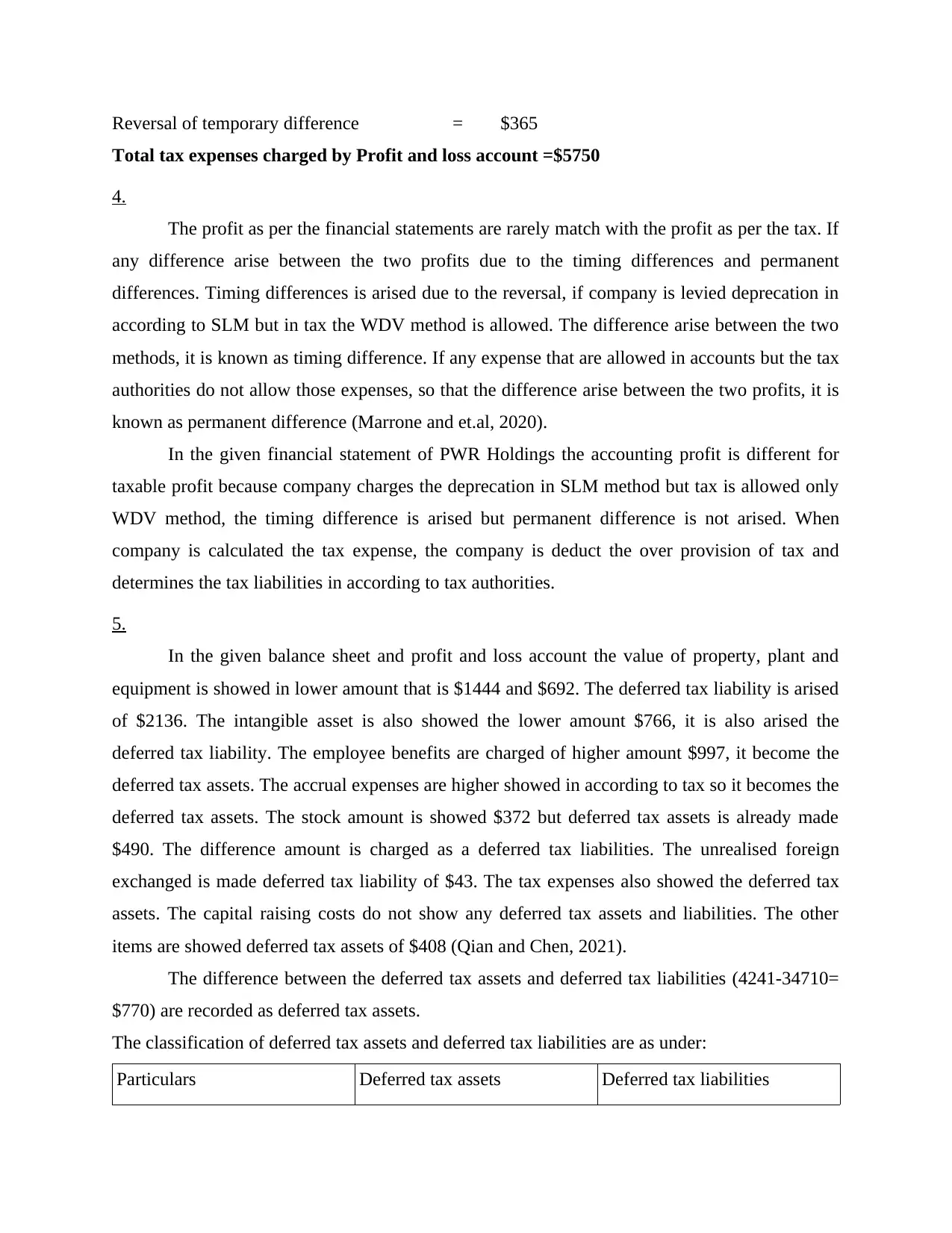

In the given balance sheet and profit and loss account the value of property, plant and

equipment is showed in lower amount that is $1444 and $692. The deferred tax liability is arised

of $2136. The intangible asset is also showed the lower amount $766, it is also arised the

deferred tax liability. The employee benefits are charged of higher amount $997, it become the

deferred tax assets. The accrual expenses are higher showed in according to tax so it becomes the

deferred tax assets. The stock amount is showed $372 but deferred tax assets is already made

$490. The difference amount is charged as a deferred tax liabilities. The unrealised foreign

exchanged is made deferred tax liability of $43. The tax expenses also showed the deferred tax

assets. The capital raising costs do not show any deferred tax assets and liabilities. The other

items are showed deferred tax assets of $408 (Qian and Chen, 2021).

The difference between the deferred tax assets and deferred tax liabilities (4241-34710=

$770) are recorded as deferred tax assets.

The classification of deferred tax assets and deferred tax liabilities are as under:

Particulars Deferred tax assets Deferred tax liabilities

Total tax expenses charged by Profit and loss account =$5750

4.

The profit as per the financial statements are rarely match with the profit as per the tax. If

any difference arise between the two profits due to the timing differences and permanent

differences. Timing differences is arised due to the reversal, if company is levied deprecation in

according to SLM but in tax the WDV method is allowed. The difference arise between the two

methods, it is known as timing difference. If any expense that are allowed in accounts but the tax

authorities do not allow those expenses, so that the difference arise between the two profits, it is

known as permanent difference (Marrone and et.al, 2020).

In the given financial statement of PWR Holdings the accounting profit is different for

taxable profit because company charges the deprecation in SLM method but tax is allowed only

WDV method, the timing difference is arised but permanent difference is not arised. When

company is calculated the tax expense, the company is deduct the over provision of tax and

determines the tax liabilities in according to tax authorities.

5.

In the given balance sheet and profit and loss account the value of property, plant and

equipment is showed in lower amount that is $1444 and $692. The deferred tax liability is arised

of $2136. The intangible asset is also showed the lower amount $766, it is also arised the

deferred tax liability. The employee benefits are charged of higher amount $997, it become the

deferred tax assets. The accrual expenses are higher showed in according to tax so it becomes the

deferred tax assets. The stock amount is showed $372 but deferred tax assets is already made

$490. The difference amount is charged as a deferred tax liabilities. The unrealised foreign

exchanged is made deferred tax liability of $43. The tax expenses also showed the deferred tax

assets. The capital raising costs do not show any deferred tax assets and liabilities. The other

items are showed deferred tax assets of $408 (Qian and Chen, 2021).

The difference between the deferred tax assets and deferred tax liabilities (4241-34710=

$770) are recorded as deferred tax assets.

The classification of deferred tax assets and deferred tax liabilities are as under:

Particulars Deferred tax assets Deferred tax liabilities

Property, plant and equipment -2136

Intangible assets -766

Employee benefits 997

accruals 52

Inventories 490 -118

Unrealised foreign exchange 1 -43

Tax looses 1364

Capital raising costs

Other items 1337 -408

4241 -3471

6.

In the given balance sheet, there is no any current tax assets but given balance shows the

current tax liabilities $2001. And the current tax expenses that are charged in Profit and loss

account $5750. Tax expenses for the latest financial year and deferred tax should be considered

in the income statement. Income on taxes are assumed as expense incurred by the company in

generated income and accrual in the same time duration, when the expenses and income are

generated. The timing differences of tax effects are considered as tax expenses in the income

statement and as a current tax assets (Türegün, 2019).

But the given statements the company has no any current tax assets. So the current tax

liability of the company remains same because there has no any adjustment of current tax assets.

7.

The income statement and profit and loss account both are component of financial

statements. Cash flow statement determines the sources of cash and uses of cash while the

income statement shows the income, expenses, profit and loss of the specific period. The cash

flow statement shows the income tax in the operating activities. The actual cash amount is paid

by the company of the tax authorities are showed in the cash flow statement. If cash flow is

prepared by indirect method then the provision of the income tax is added in the profit and loss

account and actual cash paid is included in the operating statement (Türegün, 2020). In profit and

Intangible assets -766

Employee benefits 997

accruals 52

Inventories 490 -118

Unrealised foreign exchange 1 -43

Tax looses 1364

Capital raising costs

Other items 1337 -408

4241 -3471

6.

In the given balance sheet, there is no any current tax assets but given balance shows the

current tax liabilities $2001. And the current tax expenses that are charged in Profit and loss

account $5750. Tax expenses for the latest financial year and deferred tax should be considered

in the income statement. Income on taxes are assumed as expense incurred by the company in

generated income and accrual in the same time duration, when the expenses and income are

generated. The timing differences of tax effects are considered as tax expenses in the income

statement and as a current tax assets (Türegün, 2019).

But the given statements the company has no any current tax assets. So the current tax

liability of the company remains same because there has no any adjustment of current tax assets.

7.

The income statement and profit and loss account both are component of financial

statements. Cash flow statement determines the sources of cash and uses of cash while the

income statement shows the income, expenses, profit and loss of the specific period. The cash

flow statement shows the income tax in the operating activities. The actual cash amount is paid

by the company of the tax authorities are showed in the cash flow statement. If cash flow is

prepared by indirect method then the provision of the income tax is added in the profit and loss

account and actual cash paid is included in the operating statement (Türegün, 2020). In profit and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

loss account shows those tax expense that are related of the current period whether it is paid in

cash or not.

In the given statement the cash flow from operating activities the tax expenses are

showed of $4619 while income statement is showed $5750.

8.

Temporary difference means those difference that is arised among the fair value of assets

and liabilities in the annual statement ad amount determine as per tax. It can be classified into the

two types:

1. Assessable impermanent difference- it is the temporary differences which will effect

amount that are charged in evaluating assessable income statement of the upcoming year

when carrying amount of money of assets and liabilities are recovered (Wszelaki and

Tkocz-Wolny, 2019).

2. Deductible temporary difference- It is another type of local difference which will result in

value which are lee in evaluating taxable profit and loss of upcoming periods when the

carrying value of the assets and liabilities is settled.

Permanent difference- It is the difference between the tax payable and tax expense by an

item which do not reverse over time. The difference is arised between the accounting and tax

accounting.

In the given financial statements there are no any permanent and temporary difference. In

PWH Holdings limited can not arise any permanent and temporary difference because financial

profit and tax profit are same so there is no need to make any tax provision.

9.

The most important thing of the financial evidence and income statement is tax expenses.

The tax is calculated on the basis of income earned by the company in according to tax

authorities but accounting profit is calculated in according to Accounting standard. So the

difference is arised between the accounting profit and tax profit is recognised in various types.

So that, the calculation of tax is very interest and conflict part of the financial statements (Yang,

and Lee, 2020)(Zeng, 2019).

cash or not.

In the given statement the cash flow from operating activities the tax expenses are

showed of $4619 while income statement is showed $5750.

8.

Temporary difference means those difference that is arised among the fair value of assets

and liabilities in the annual statement ad amount determine as per tax. It can be classified into the

two types:

1. Assessable impermanent difference- it is the temporary differences which will effect

amount that are charged in evaluating assessable income statement of the upcoming year

when carrying amount of money of assets and liabilities are recovered (Wszelaki and

Tkocz-Wolny, 2019).

2. Deductible temporary difference- It is another type of local difference which will result in

value which are lee in evaluating taxable profit and loss of upcoming periods when the

carrying value of the assets and liabilities is settled.

Permanent difference- It is the difference between the tax payable and tax expense by an

item which do not reverse over time. The difference is arised between the accounting and tax

accounting.

In the given financial statements there are no any permanent and temporary difference. In

PWH Holdings limited can not arise any permanent and temporary difference because financial

profit and tax profit are same so there is no need to make any tax provision.

9.

The most important thing of the financial evidence and income statement is tax expenses.

The tax is calculated on the basis of income earned by the company in according to tax

authorities but accounting profit is calculated in according to Accounting standard. So the

difference is arised between the accounting profit and tax profit is recognised in various types.

So that, the calculation of tax is very interest and conflict part of the financial statements (Yang,

and Lee, 2020)(Zeng, 2019).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONCLUSION

From the above report, it is concluded that in every company is needed of accounting.

Because every organisation prepares the financial statements of each year and analysed every

components of the financial statement. This report is analysed various accounting terms. Further

this report includes, the reasons due to which the tax profit is differ from accounting profit.

From the above report, it is concluded that in every company is needed of accounting.

Because every organisation prepares the financial statements of each year and analysed every

components of the financial statement. This report is analysed various accounting terms. Further

this report includes, the reasons due to which the tax profit is differ from accounting profit.

REFERENCES

Books and Journals

Abernathy and et.al, 2019. Financial statement footnote readability and corporate audit

outcomes. Auditing: A Journal of Practice & Theory, 38(2). pp.1-26.

Chu, Y., Liu, S. and Qiu, M., 2019. Unemployment Risk and Accounting

Conservatism. Available at SSRN 3500288.

Dang and et.al, 2019. Study the impact of growth, firm size, capital structure, and profitability on

enterprise value: Evidence of enterprises in Vietnam. Journal of Corporate Accounting &

Finance, 30(1). pp.144-160.

Gruszczyński, M., 2018. Financial microeconometrics as research methodology in corporate

finance and accounting. In Efficiency in Business and Economics (pp. 71-80). Springer,

Cham.

Habib, A. and Costa, M.D., 2021. Debt maturity structure and cost stickiness. Journal of

Corporate Accounting & Finance, 32(1). pp.78-89.

Hassan, M.K., Florio, C. and Abbas, B.A., 2022. Corporate governance, transparency and

performance: empirical evidence from UAE. Afro-Asian Journal of Finance and

Accounting, 12(3). pp.312-344.

Hörisch, J., Schaltegger, S. and Freeman, R.E., 2020. Integrating stakeholder theory and

sustainability accounting: A conceptual synthesis. Journal of Cleaner Production, 275.

p.124097.

Izzo, M.F., Fasan, M. and Tiscini, R., 2021. The role of digital transformation in enabling

continuous accounting and the effects on intellectual capital: the case of Oracle. Meditari

Accountancy Research.

Marrone and et.al, 2020. Trends in environmental accounting research within and outside of the

accounting discipline. Accounting, Auditing & Accountability Journal.

Qian, W. and Chen, X., 2021. Corporate environmental disclosure and political connection in

regulatory and leadership changes: The case of China. The British Accounting

Review, 53(1). p.100935.

Türegün, N., 2019. Impact of technology in financial reporting: The case of Amazon Go. Journal

of Corporate Accounting & Finance, 30(3). pp.90-95.

Türegün, N., 2020. Does financial crisis impact earnings management? Evidence from

Turkey. Journal of Corporate Accounting & Finance, 31(1). pp.64-71.

Wszelaki, A. and Tkocz-Wolny, K., 2019. Implementation of the provisions of directive

2014/95/EU on disclosures in the field of corporate social responsibility in the enterprise's

accounting practice on the example of a selected listed entity. International

Multidisciplinary Scientific GeoConference: SGEM, 19(5.4). pp.483-491.

Yang, C.H. and Lee, K.C., 2020. Developing a strategy map for forensic accounting with fraud

risk management: An integrated balanced scorecard-based decision model. Evaluation and

Program Planning, 80. p.101780.

Zeng, T., 2019. Country-level governance, accounting standards, and tax avoidance: a cross-

country study. Asian Review of Accounting.

Books and Journals

Abernathy and et.al, 2019. Financial statement footnote readability and corporate audit

outcomes. Auditing: A Journal of Practice & Theory, 38(2). pp.1-26.

Chu, Y., Liu, S. and Qiu, M., 2019. Unemployment Risk and Accounting

Conservatism. Available at SSRN 3500288.

Dang and et.al, 2019. Study the impact of growth, firm size, capital structure, and profitability on

enterprise value: Evidence of enterprises in Vietnam. Journal of Corporate Accounting &

Finance, 30(1). pp.144-160.

Gruszczyński, M., 2018. Financial microeconometrics as research methodology in corporate

finance and accounting. In Efficiency in Business and Economics (pp. 71-80). Springer,

Cham.

Habib, A. and Costa, M.D., 2021. Debt maturity structure and cost stickiness. Journal of

Corporate Accounting & Finance, 32(1). pp.78-89.

Hassan, M.K., Florio, C. and Abbas, B.A., 2022. Corporate governance, transparency and

performance: empirical evidence from UAE. Afro-Asian Journal of Finance and

Accounting, 12(3). pp.312-344.

Hörisch, J., Schaltegger, S. and Freeman, R.E., 2020. Integrating stakeholder theory and

sustainability accounting: A conceptual synthesis. Journal of Cleaner Production, 275.

p.124097.

Izzo, M.F., Fasan, M. and Tiscini, R., 2021. The role of digital transformation in enabling

continuous accounting and the effects on intellectual capital: the case of Oracle. Meditari

Accountancy Research.

Marrone and et.al, 2020. Trends in environmental accounting research within and outside of the

accounting discipline. Accounting, Auditing & Accountability Journal.

Qian, W. and Chen, X., 2021. Corporate environmental disclosure and political connection in

regulatory and leadership changes: The case of China. The British Accounting

Review, 53(1). p.100935.

Türegün, N., 2019. Impact of technology in financial reporting: The case of Amazon Go. Journal

of Corporate Accounting & Finance, 30(3). pp.90-95.

Türegün, N., 2020. Does financial crisis impact earnings management? Evidence from

Turkey. Journal of Corporate Accounting & Finance, 31(1). pp.64-71.

Wszelaki, A. and Tkocz-Wolny, K., 2019. Implementation of the provisions of directive

2014/95/EU on disclosures in the field of corporate social responsibility in the enterprise's

accounting practice on the example of a selected listed entity. International

Multidisciplinary Scientific GeoConference: SGEM, 19(5.4). pp.483-491.

Yang, C.H. and Lee, K.C., 2020. Developing a strategy map for forensic accounting with fraud

risk management: An integrated balanced scorecard-based decision model. Evaluation and

Program Planning, 80. p.101780.

Zeng, T., 2019. Country-level governance, accounting standards, and tax avoidance: a cross-

country study. Asian Review of Accounting.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.