Corporate Accounting: Analysis of Financial Statements of Rio Tinto and Ausdrill Limited

VerifiedAdded on 2023/06/04

|21

|5204

|122

AI Summary

The report is prepared for analysing the financial statements of two organisations operating in the same sector having similar kinds of operations. Therefore, the organisations selected for this paper include Rio Tinto and Ausdrill Limited, as they are associated with extracting and mining mineral resources. It has been found that Rio Tinto has focused on equity capital, while Ausdrill Limited has concentrated on raising more funds through debt. In terms of cash flow statement, the position is deemed to be favourable for Rio Tinto as well. Finally, it has been found that Rio Tinto has incurred more cash tax compared to Ausdrill Limited because of more revenue generated over the years.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: CORPORATE ACCOUNTING

Corporate Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Corporate Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1CORPORATE ACCOUNTING

Executive Summary:

The report is prepared for analysing the financial statements of two organisations operating in

the same sector having similar kinds of operations. Therefore, the organisations selected for

this paper include Rio Tinto and Ausdrill Limited, as they are associated with extracting and

mining mineral resources. It has been found that Rio Tinto has focused on equity capital,

while Ausdrill Limited has concentrated on raising more funds through debt. In terms of cash

flow statement, the position is deemed to be favourable for Rio Tinto as well. Finally, it has

been found that Rio Tinto has incurred more cash tax compared to Ausdrill Limited because

of more revenue generated over the years.

Executive Summary:

The report is prepared for analysing the financial statements of two organisations operating in

the same sector having similar kinds of operations. Therefore, the organisations selected for

this paper include Rio Tinto and Ausdrill Limited, as they are associated with extracting and

mining mineral resources. It has been found that Rio Tinto has focused on equity capital,

while Ausdrill Limited has concentrated on raising more funds through debt. In terms of cash

flow statement, the position is deemed to be favourable for Rio Tinto as well. Finally, it has

been found that Rio Tinto has incurred more cash tax compared to Ausdrill Limited because

of more revenue generated over the years.

2CORPORATE ACCOUNTING

Table of Contents

Introduction:...............................................................................................................................4

Owners’ equity:..........................................................................................................................5

Part (i):...................................................................................................................................5

Part (ii):..................................................................................................................................6

Cash flow statement:..................................................................................................................8

Part (iii):.................................................................................................................................8

Part (iv):...............................................................................................................................11

Part (v):.................................................................................................................................12

Other comprehensive income statement:.................................................................................13

Part (vi):...............................................................................................................................13

Part (vii):..............................................................................................................................13

Part (viii):.............................................................................................................................13

Part (ix):...............................................................................................................................14

Accounting for corporate income tax:......................................................................................14

Part (x):.................................................................................................................................14

Part (xi):...............................................................................................................................15

Part (xii):..............................................................................................................................15

Part (xiii):.............................................................................................................................15

Part (xiv):.............................................................................................................................16

Part (xv):...............................................................................................................................16

Table of Contents

Introduction:...............................................................................................................................4

Owners’ equity:..........................................................................................................................5

Part (i):...................................................................................................................................5

Part (ii):..................................................................................................................................6

Cash flow statement:..................................................................................................................8

Part (iii):.................................................................................................................................8

Part (iv):...............................................................................................................................11

Part (v):.................................................................................................................................12

Other comprehensive income statement:.................................................................................13

Part (vi):...............................................................................................................................13

Part (vii):..............................................................................................................................13

Part (viii):.............................................................................................................................13

Part (ix):...............................................................................................................................14

Accounting for corporate income tax:......................................................................................14

Part (x):.................................................................................................................................14

Part (xi):...............................................................................................................................15

Part (xii):..............................................................................................................................15

Part (xiii):.............................................................................................................................15

Part (xiv):.............................................................................................................................16

Part (xv):...............................................................................................................................16

3CORPORATE ACCOUNTING

Part (xvi):.............................................................................................................................16

Conclusion:..............................................................................................................................17

References:...............................................................................................................................18

Part (xvi):.............................................................................................................................16

Conclusion:..............................................................................................................................17

References:...............................................................................................................................18

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4CORPORATE ACCOUNTING

Introduction:

The report is prepared for analysing the financial statements of two organisations

operating in the same sector having similar kinds of operations. Therefore, the organisations

selected for this paper include Rio Tinto and Ausdrill Limited, as they are associated with

extracting and mining mineral resources. The paper takes into account the annual reports of

the two organisations in order to evaluate several components of the financial statements

along with conducting comparative assessment between them for evaluating better reporting

of the different elements of the financial statements.

The primary operations of Ausdrill Limited include extraction of minerals and mining

other metals in Australia. The organisation has global presence in Africa and United

Kingdom as well. The specialisation of the firm is in mining services, drill and blast

exploration projects along with grade control1. Moreover, the organisation has experienced

increase in revenue throughout the years due to which it has recruited additional employees

for maintaining its business operations.

Rio Tinto is considered as the leading organisation in the Australian mining sector

and it is an Anglo-Australian firm having maximum operations in Australia. The organisation

is popular for its mining operations and it is one of the largest producers of metals in

Australia2. It is involved in producing iron ore, coal, copper, uranium and diamond.

Moreover, the organisation is involved in refining business for products such as bauxite as

well as other minerals.

1 "Annual Reports: Ausdrill", 2018, <http://www.ausdrill.com.au/investors/annual-reports.html> [accessed 26

September 2018].

2 “Results & reports”, 2018, <http://www.riotinto.com/investors/results-and-reports-2146.aspx> [accessed 26

September 2018].

Introduction:

The report is prepared for analysing the financial statements of two organisations

operating in the same sector having similar kinds of operations. Therefore, the organisations

selected for this paper include Rio Tinto and Ausdrill Limited, as they are associated with

extracting and mining mineral resources. The paper takes into account the annual reports of

the two organisations in order to evaluate several components of the financial statements

along with conducting comparative assessment between them for evaluating better reporting

of the different elements of the financial statements.

The primary operations of Ausdrill Limited include extraction of minerals and mining

other metals in Australia. The organisation has global presence in Africa and United

Kingdom as well. The specialisation of the firm is in mining services, drill and blast

exploration projects along with grade control1. Moreover, the organisation has experienced

increase in revenue throughout the years due to which it has recruited additional employees

for maintaining its business operations.

Rio Tinto is considered as the leading organisation in the Australian mining sector

and it is an Anglo-Australian firm having maximum operations in Australia. The organisation

is popular for its mining operations and it is one of the largest producers of metals in

Australia2. It is involved in producing iron ore, coal, copper, uranium and diamond.

Moreover, the organisation is involved in refining business for products such as bauxite as

well as other minerals.

1 "Annual Reports: Ausdrill", 2018, <http://www.ausdrill.com.au/investors/annual-reports.html> [accessed 26

September 2018].

2 “Results & reports”, 2018, <http://www.riotinto.com/investors/results-and-reports-2146.aspx> [accessed 26

September 2018].

5CORPORATE ACCOUNTING

The report focuses on assessing the annual reports of the two-above mentioned

organisations for three years starting from 2015 and ending with 2017. It covers comparative

assessment of the components mentioned in the annual reports of the organisations. Some of

the few important areas taken into consideration in their annual reports constitute of equity

capital, cash flow statement, tax treatment as well as disclosures. Moreover, the report would

shed light on the effective tax rate, cash tax rate and book tax rate of the two selected

organisations.

Owners’ equity:

Part (i):

The owners’ equity depicts the issued capital and retained earnings, which are utilised

for funding the business activities3. The annual reports of 2015, 2016 and 2017 are taken into

account for both the organisations so that their owners’ equity could be evaluated

accordingly. This is found mainly in the balance sheet statements of the two organisations, as

per their annual reports. As per the annual reports of Ausdrill Limited, contributed equity,

retained earnings and other reserves are the main items. The contributed equity is related to

share capital obtained by an organisation through issuance of shares to the public. The

contributed equity of the organisation has been $546,447,000 in 2017 and this item value has

been same as that of the previous two years.

The retained earnings of the organisation denote a portion of the profits, which are set

apart for reinvestment in business or fulfilling different future dues of the organisation4.

Significant rise in retained earnings could be observed in the year 2017 compared to the

3 P. Bick, Orlova. S, and Sun. L, "Fair value accounting and corporate cash holdings", Advances in Accounting,

vol. 40, no. 3, 2018, p.102

4 P. Binkow, "The Impact of Self-Service Applications on Corporate Accounting and Its Customers", Journal of

Corporate Accounting & Finance, vol. 26, 2015, p.91.

The report focuses on assessing the annual reports of the two-above mentioned

organisations for three years starting from 2015 and ending with 2017. It covers comparative

assessment of the components mentioned in the annual reports of the organisations. Some of

the few important areas taken into consideration in their annual reports constitute of equity

capital, cash flow statement, tax treatment as well as disclosures. Moreover, the report would

shed light on the effective tax rate, cash tax rate and book tax rate of the two selected

organisations.

Owners’ equity:

Part (i):

The owners’ equity depicts the issued capital and retained earnings, which are utilised

for funding the business activities3. The annual reports of 2015, 2016 and 2017 are taken into

account for both the organisations so that their owners’ equity could be evaluated

accordingly. This is found mainly in the balance sheet statements of the two organisations, as

per their annual reports. As per the annual reports of Ausdrill Limited, contributed equity,

retained earnings and other reserves are the main items. The contributed equity is related to

share capital obtained by an organisation through issuance of shares to the public. The

contributed equity of the organisation has been $546,447,000 in 2017 and this item value has

been same as that of the previous two years.

The retained earnings of the organisation denote a portion of the profits, which are set

apart for reinvestment in business or fulfilling different future dues of the organisation4.

Significant rise in retained earnings could be observed in the year 2017 compared to the

3 P. Bick, Orlova. S, and Sun. L, "Fair value accounting and corporate cash holdings", Advances in Accounting,

vol. 40, no. 3, 2018, p.102

4 P. Binkow, "The Impact of Self-Service Applications on Corporate Accounting and Its Customers", Journal of

Corporate Accounting & Finance, vol. 26, 2015, p.91.

6CORPORATE ACCOUNTING

previous year and retained earnings amounted to $121,444,000. In 2015, the amount of

retained earnings has been $38,027,000. This trend reflects rise in retained earnings of the

organisation. This is because of rise in profit level of the business and enhancement in its

business structure5. The business reserves are represented in negative numbers due to

accumulated losses from the past years.

For Rio Tinto, the main equity items reflected in the balance sheet statement of the

organisation include share capital, reserves, share premium and retained earnings. The share

capital has been obtained from Rio Tinto Limited and Rio Tinto Plc over the years. The

equity capital denotes the funds that a firm accumulates to fulfil the business obligations. The

reserves are shown in positive numbers, which signify that the organisation has accumulated

earnings that could be used by the management for any future business activities6. The share

capital of the organisation has been $4,140 million and improvements could be seen from the

previous year. This is because Rio Tinto has issued additional shares in the market for

drawing adequate funds in order to finance its business operations. The retained earnings of

the organisation have been $23,761 million and this increase is inevitable due to increase in

profit generation capacity of the business. Moreover, it is apparent from the annual report that

the profit reserves of the organisation are adequate for fulfilling future business obligations.

Part (ii):

In accordance with the annual reports of Ausdrill Limited, the capital structure of the

organisation is observed to place adequate dependence on equity capital rather than debt

funding. The debt capital has declined from $395,019,000 in 2016 to $385,815,000 in 2017,

which implies that the management has managed to repay a portion of its loan in the current

5 C. Warren, M. Reeve James and Duchac. J, Corporate financial accounting, Mason, OH, South-Western

Cengage Learning, 2014.

6 M. Bojańczyk, Corporate accounting in the unstable world, Warszawa, Akademia Finansów i Biznesu Vistula,

2017.

previous year and retained earnings amounted to $121,444,000. In 2015, the amount of

retained earnings has been $38,027,000. This trend reflects rise in retained earnings of the

organisation. This is because of rise in profit level of the business and enhancement in its

business structure5. The business reserves are represented in negative numbers due to

accumulated losses from the past years.

For Rio Tinto, the main equity items reflected in the balance sheet statement of the

organisation include share capital, reserves, share premium and retained earnings. The share

capital has been obtained from Rio Tinto Limited and Rio Tinto Plc over the years. The

equity capital denotes the funds that a firm accumulates to fulfil the business obligations. The

reserves are shown in positive numbers, which signify that the organisation has accumulated

earnings that could be used by the management for any future business activities6. The share

capital of the organisation has been $4,140 million and improvements could be seen from the

previous year. This is because Rio Tinto has issued additional shares in the market for

drawing adequate funds in order to finance its business operations. The retained earnings of

the organisation have been $23,761 million and this increase is inevitable due to increase in

profit generation capacity of the business. Moreover, it is apparent from the annual report that

the profit reserves of the organisation are adequate for fulfilling future business obligations.

Part (ii):

In accordance with the annual reports of Ausdrill Limited, the capital structure of the

organisation is observed to place adequate dependence on equity capital rather than debt

funding. The debt capital has declined from $395,019,000 in 2016 to $385,815,000 in 2017,

which implies that the management has managed to repay a portion of its loan in the current

5 C. Warren, M. Reeve James and Duchac. J, Corporate financial accounting, Mason, OH, South-Western

Cengage Learning, 2014.

6 M. Bojańczyk, Corporate accounting in the unstable world, Warszawa, Akademia Finansów i Biznesu Vistula,

2017.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CORPORATE ACCOUNTING

year for minimising its overall debt burden. For equity share capital, increase in equity capital

of the organisation could be observed during the year evident from the balance sheet

statement. The business borrowings are identified as $407,307,000, which is more than the

estimate of 2016. The three-year analysis states that the management is minimising the debt

burden of the business in a systematic manner and thus, focus is kept on applying additional

equity capital of the business7.

For Rio Tinto, the balance sheet statement of the organisation in 2017 states that the

business borrowings have been $15,148 million and this amount is deemed to be lower than

the estimate represented in the year 2016, which is observed to be $17,470 million. In 2015,

the overall business borrowings of Rio Tinto have been $21,140 million, which is higher

compared to debt capital shown in 2016. This clearly sheds light on the fact that the

management of the organisation is attempting to minimise the debt capital over the years8.

The equity capital of the organisation reflected in its annual reports is found to be $4,140

million in 2017 and the same has been $3,950 million in 2016. This indicates that the

management of the organisation is attempting to raise the equity funding in its business

capital structure. Moreover, the management is making efforts to maintain optimality in its

capital structure by raising funds from debt as well9.

Hence, the evaluation of debt and equity capital utilised by both of the organisations

reveals that Ausdrill Limited is focusing more on raising funds through debt for financing its

business activities. On the other hand, Rio Tinto has focused on raising more funds through

debt rather than depending on equity capital, as the investors are unwilling to invest in

7 Carl. W, Corporate Financial Accounting, Cengage Learning, 2016.

8 J. Choi, Choi, W, and Lee. E, "Corporate Life Cycle and Earnings Benchmarks", Australian Accounting

Review, vol. 26, no. 4, 2016, p.412.

9 A. Uyar, "Evolution of Corporate Reporting and Emerging Trends", Journal of Corporate Accounting &

Finance, vol. 27, no. 4, 2016, p.29.

year for minimising its overall debt burden. For equity share capital, increase in equity capital

of the organisation could be observed during the year evident from the balance sheet

statement. The business borrowings are identified as $407,307,000, which is more than the

estimate of 2016. The three-year analysis states that the management is minimising the debt

burden of the business in a systematic manner and thus, focus is kept on applying additional

equity capital of the business7.

For Rio Tinto, the balance sheet statement of the organisation in 2017 states that the

business borrowings have been $15,148 million and this amount is deemed to be lower than

the estimate represented in the year 2016, which is observed to be $17,470 million. In 2015,

the overall business borrowings of Rio Tinto have been $21,140 million, which is higher

compared to debt capital shown in 2016. This clearly sheds light on the fact that the

management of the organisation is attempting to minimise the debt capital over the years8.

The equity capital of the organisation reflected in its annual reports is found to be $4,140

million in 2017 and the same has been $3,950 million in 2016. This indicates that the

management of the organisation is attempting to raise the equity funding in its business

capital structure. Moreover, the management is making efforts to maintain optimality in its

capital structure by raising funds from debt as well9.

Hence, the evaluation of debt and equity capital utilised by both of the organisations

reveals that Ausdrill Limited is focusing more on raising funds through debt for financing its

business activities. On the other hand, Rio Tinto has focused on raising more funds through

debt rather than depending on equity capital, as the investors are unwilling to invest in

7 Carl. W, Corporate Financial Accounting, Cengage Learning, 2016.

8 J. Choi, Choi, W, and Lee. E, "Corporate Life Cycle and Earnings Benchmarks", Australian Accounting

Review, vol. 26, no. 4, 2016, p.412.

9 A. Uyar, "Evolution of Corporate Reporting and Emerging Trends", Journal of Corporate Accounting &

Finance, vol. 27, no. 4, 2016, p.29.

8CORPORATE ACCOUNTING

business operations. Therefore, in terms of capital structure, Ausdrill Limited is placed in a

favourable position in the Australian mining industry.

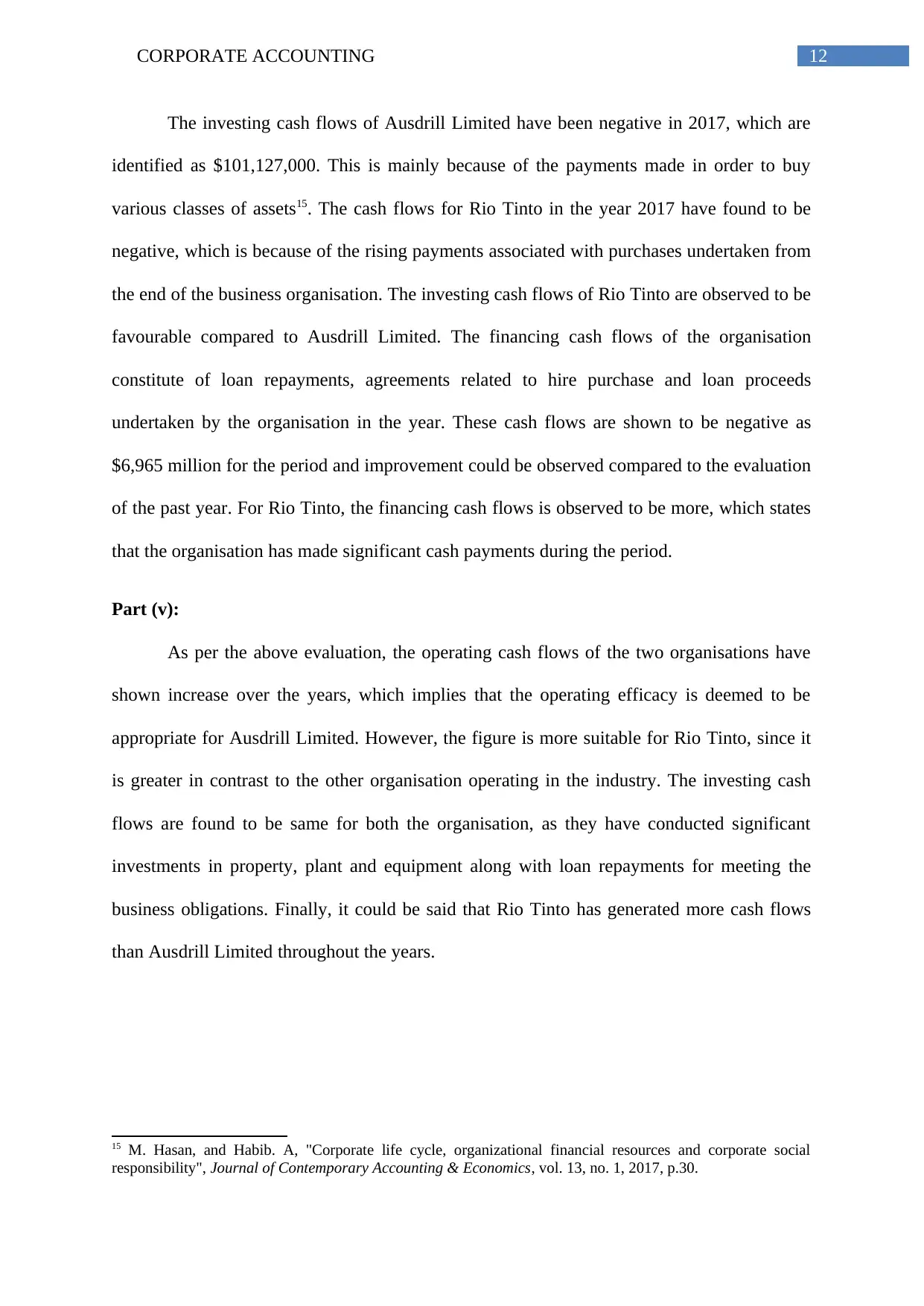

Cash flow statement:

Part (iii):

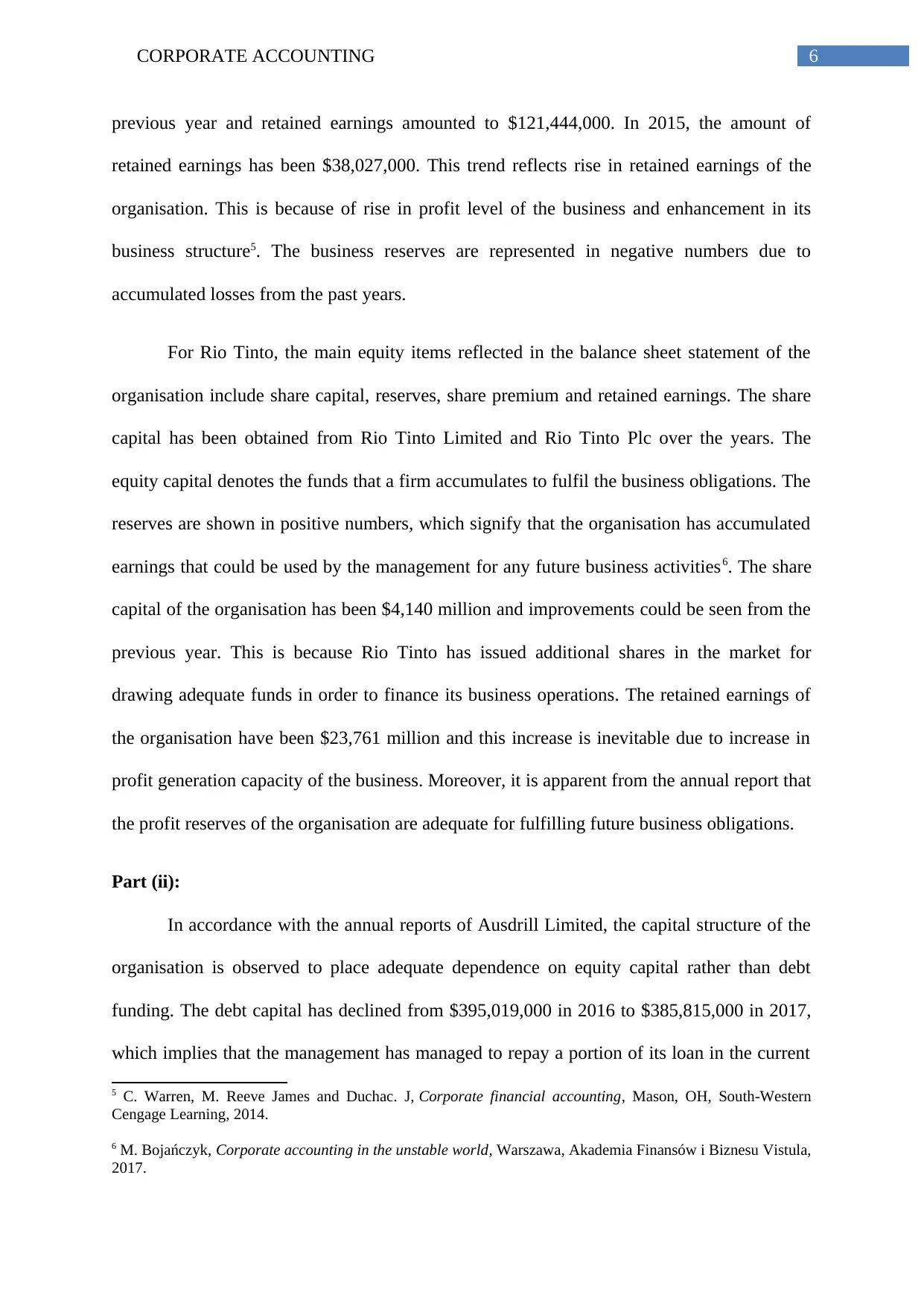

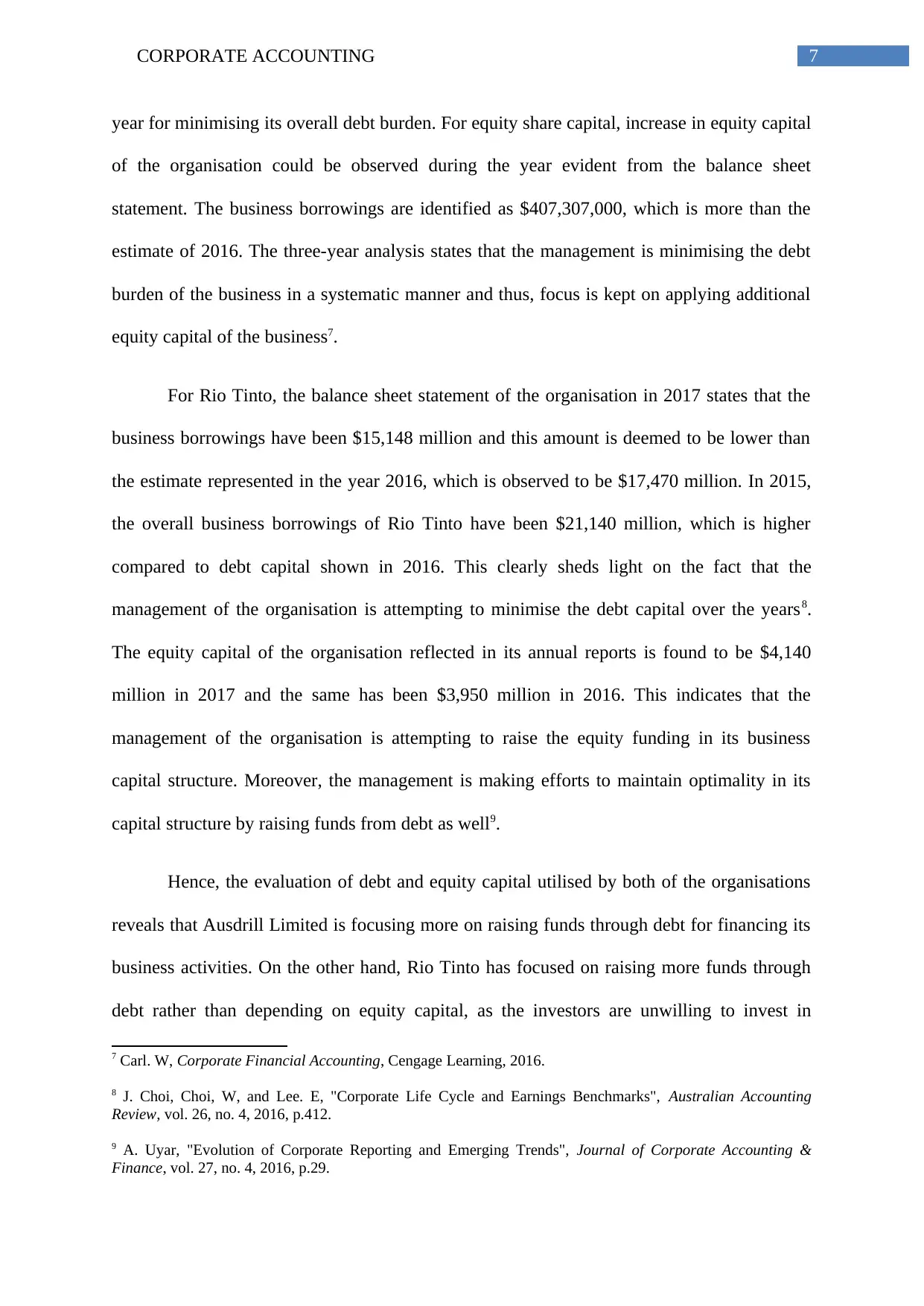

The cash flow statement signifies the cash position of an organisation and it denotes

each activity that represents cash inflows and cash outflows. As per the cash flow statement

of Ausdrill Limited, the operating cash flows primarily include receipts from the customers

for conducting sales and cash payments to suppliers for purchase of raw materials as well as

other products. Another important item is taken into consideration in the cash flow statement,

which is the income tax payment made by the organisation in an accounting year10. The net

cash flow has increased from $91,006,000 in 2016 to $94,613,000 in 2017. The amount

collected from the customers and the payments made to the suppliers have risen based on the

estimates of the year 2016, which state that the operational level of the organisation has risen

considerably.

The investing cash flows of the organisation state that the organisation has invested

large amount of cash in order to purchase property, plant and equipment observed to be

$147,418,000 in 2017. The financing cash flows take into account different repayments,

which the organisation has undertaken over the year like borrowing repayment, hire purchase

repayment and dividend payment to the shareholders of the organisation11. As per the cash

flow statement, the cash and cash equivalents have been $166,710,000 in 2017 compared to

$181,157,000 in 2016. Thus, the cash balance of the organisation has declined slightly in

contrast to the outcomes of the past year.

10 J. Ciesielski, and Weirich. T, "Current Accounting Issues Facing Chief Accounting and Chief Financial

Officers", Journal of Corporate Accounting & Finance, vol. 26, 2015, p.68.

11 A. Corelli, Analytical Corporate Finance, Cham, Springer International Publishing, 2016.

business operations. Therefore, in terms of capital structure, Ausdrill Limited is placed in a

favourable position in the Australian mining industry.

Cash flow statement:

Part (iii):

The cash flow statement signifies the cash position of an organisation and it denotes

each activity that represents cash inflows and cash outflows. As per the cash flow statement

of Ausdrill Limited, the operating cash flows primarily include receipts from the customers

for conducting sales and cash payments to suppliers for purchase of raw materials as well as

other products. Another important item is taken into consideration in the cash flow statement,

which is the income tax payment made by the organisation in an accounting year10. The net

cash flow has increased from $91,006,000 in 2016 to $94,613,000 in 2017. The amount

collected from the customers and the payments made to the suppliers have risen based on the

estimates of the year 2016, which state that the operational level of the organisation has risen

considerably.

The investing cash flows of the organisation state that the organisation has invested

large amount of cash in order to purchase property, plant and equipment observed to be

$147,418,000 in 2017. The financing cash flows take into account different repayments,

which the organisation has undertaken over the year like borrowing repayment, hire purchase

repayment and dividend payment to the shareholders of the organisation11. As per the cash

flow statement, the cash and cash equivalents have been $166,710,000 in 2017 compared to

$181,157,000 in 2016. Thus, the cash balance of the organisation has declined slightly in

contrast to the outcomes of the past year.

10 J. Ciesielski, and Weirich. T, "Current Accounting Issues Facing Chief Accounting and Chief Financial

Officers", Journal of Corporate Accounting & Finance, vol. 26, 2015, p.68.

11 A. Corelli, Analytical Corporate Finance, Cham, Springer International Publishing, 2016.

9CORPORATE ACCOUNTING

Particulars 2015 2016 2017

Net cash flows from operating activities $ 1,17,936.00 $ 91,006.00 $ 94,613.00

Net cash flows used in investing

activities $ -738.00 $ -60,853.00 $ 1,01,127.00

Net cash flows used in financing

activities $ -1,04,693.00 $ 47,772.00 $ 6,965.00

2015 2016 2017

-1000

-800

-600

-400

-200

0

200

400

600

800

1000

767.6 710 742.8

-785.6

683.4

875.1

492.1 468.3

-19.6999999999999

Comparative analysis of cash flow categories of

Ausdrill Limited

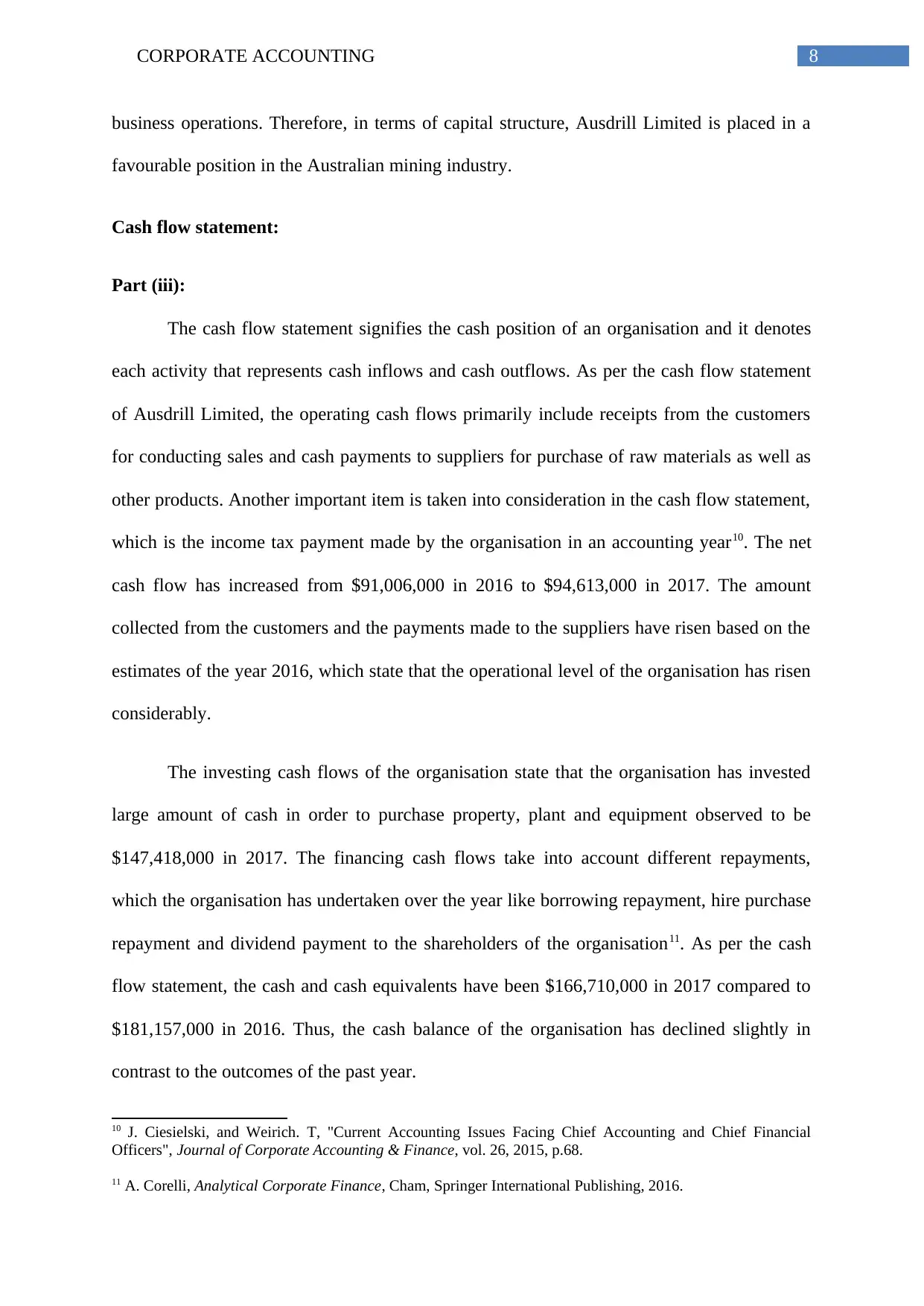

According to the cash flow statement of Rio Tinto in 2017, the operating cash flows

are observed as $16,670 million, which is more than the amount of the year 2016. This

implies increase in overall business operations of the organisation. The items reflected in the

operating cash flows primarily constitute of dividends from the units of equity account as

well as tax expenses incurred by the organisation in the year12. The cash generated from

12 E. Ferran, and Ho. L, Principles of corporate finance law. Oxford, Oxford University Press, 2014.

Particulars 2015 2016 2017

Net cash flows from operating activities $ 1,17,936.00 $ 91,006.00 $ 94,613.00

Net cash flows used in investing

activities $ -738.00 $ -60,853.00 $ 1,01,127.00

Net cash flows used in financing

activities $ -1,04,693.00 $ 47,772.00 $ 6,965.00

2015 2016 2017

-1000

-800

-600

-400

-200

0

200

400

600

800

1000

767.6 710 742.8

-785.6

683.4

875.1

492.1 468.3

-19.6999999999999

Comparative analysis of cash flow categories of

Ausdrill Limited

According to the cash flow statement of Rio Tinto in 2017, the operating cash flows

are observed as $16,670 million, which is more than the amount of the year 2016. This

implies increase in overall business operations of the organisation. The items reflected in the

operating cash flows primarily constitute of dividends from the units of equity account as

well as tax expenses incurred by the organisation in the year12. The cash generated from

12 E. Ferran, and Ho. L, Principles of corporate finance law. Oxford, Oxford University Press, 2014.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10CORPORATE ACCOUNTING

operations is observed to be greater compared to the estimates of 2015 and 2016 and it is

found to be $13,884 million.

The investing cash flows for the year 2017 constitute of purchase of property, plant

and equipment, purchase and sale of financial assets. In addition, it has been observed that the

organisation has different subsidiaries held in the year. The investing cash flows are found to

be negative in comparison to the cash inflows. The financing cash flows depict increased

outflows of cash because of loan repayments, share buyback and dividend incurred by the

organisation in the year. As a result, this has lead to increase in overall cash balance of the

organisation in contrast to the analysis of the past year. The net cash is found as $10,547

million in 2017, which has been $9,354 million in 2016. Hence, cash balance has increased

considerably over the years after critical comparative evaluation of the cash flow statements

of Rio Tinto over the years.

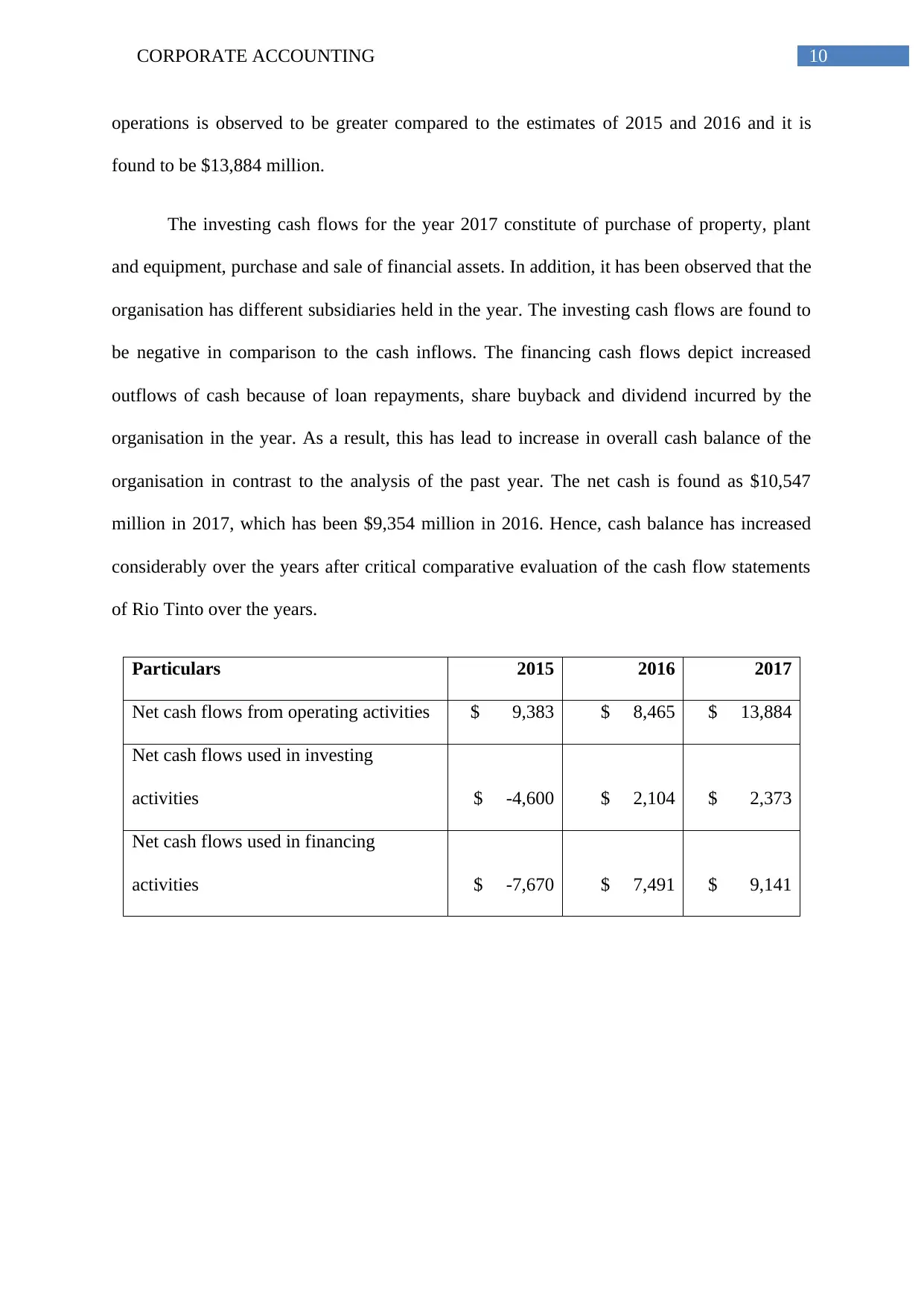

Particulars 2015 2016 2017

Net cash flows from operating activities $ 9,383 $ 8,465 $ 13,884

Net cash flows used in investing

activities $ -4,600 $ 2,104 $ 2,373

Net cash flows used in financing

activities $ -7,670 $ 7,491 $ 9,141

operations is observed to be greater compared to the estimates of 2015 and 2016 and it is

found to be $13,884 million.

The investing cash flows for the year 2017 constitute of purchase of property, plant

and equipment, purchase and sale of financial assets. In addition, it has been observed that the

organisation has different subsidiaries held in the year. The investing cash flows are found to

be negative in comparison to the cash inflows. The financing cash flows depict increased

outflows of cash because of loan repayments, share buyback and dividend incurred by the

organisation in the year. As a result, this has lead to increase in overall cash balance of the

organisation in contrast to the analysis of the past year. The net cash is found as $10,547

million in 2017, which has been $9,354 million in 2016. Hence, cash balance has increased

considerably over the years after critical comparative evaluation of the cash flow statements

of Rio Tinto over the years.

Particulars 2015 2016 2017

Net cash flows from operating activities $ 9,383 $ 8,465 $ 13,884

Net cash flows used in investing

activities $ -4,600 $ 2,104 $ 2,373

Net cash flows used in financing

activities $ -7,670 $ 7,491 $ 9,141

11CORPORATE ACCOUNTING

2015 2016 2017

-1000

-800

-600

-400

-200

0

200

400

600

800

1000

767.6 710 742.8

-785.6

683.4

875.1

492.1 468.3

-19.6999999999999

Comparative analysis of cash flow categories of Rio

Tinto Limited

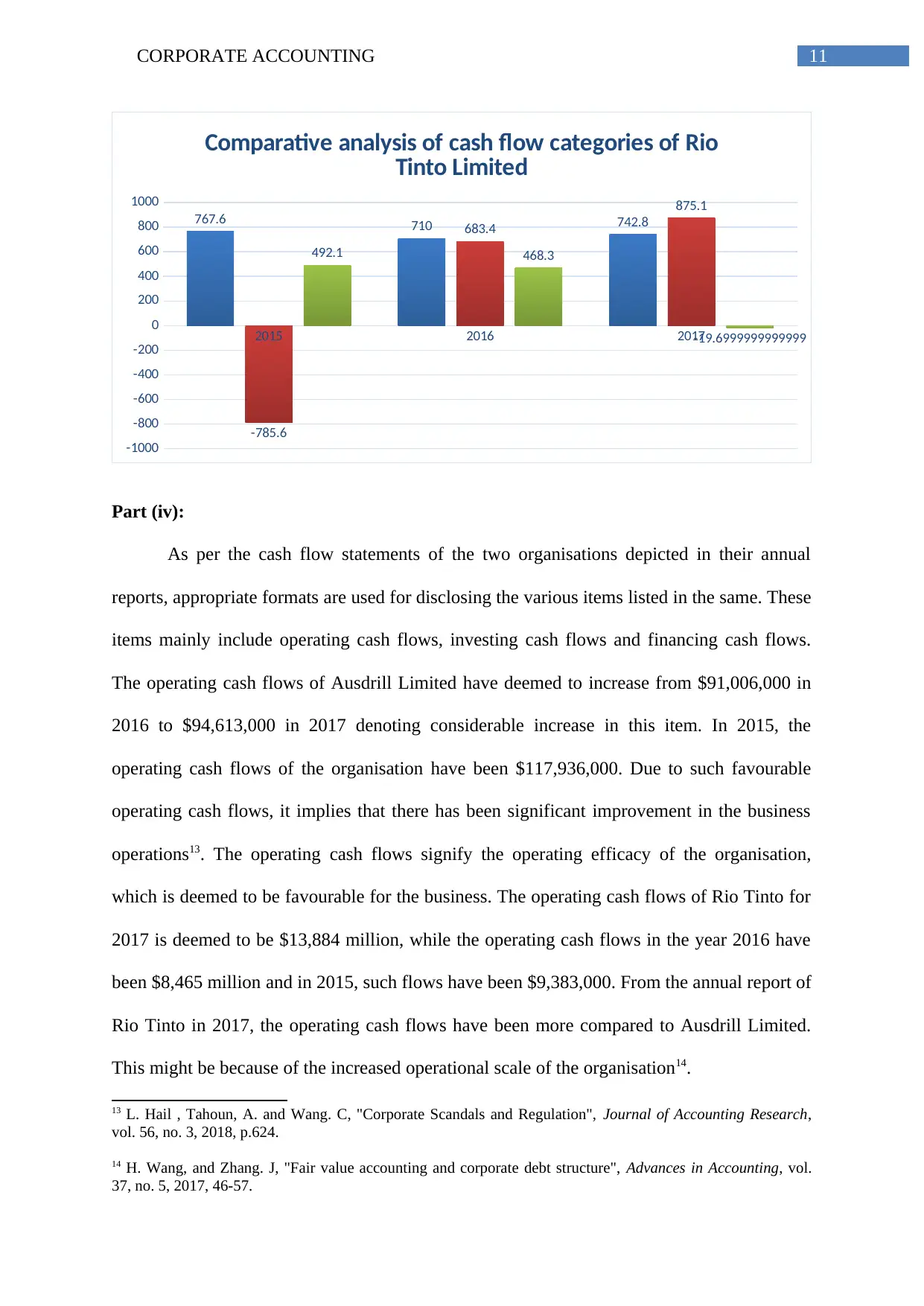

Part (iv):

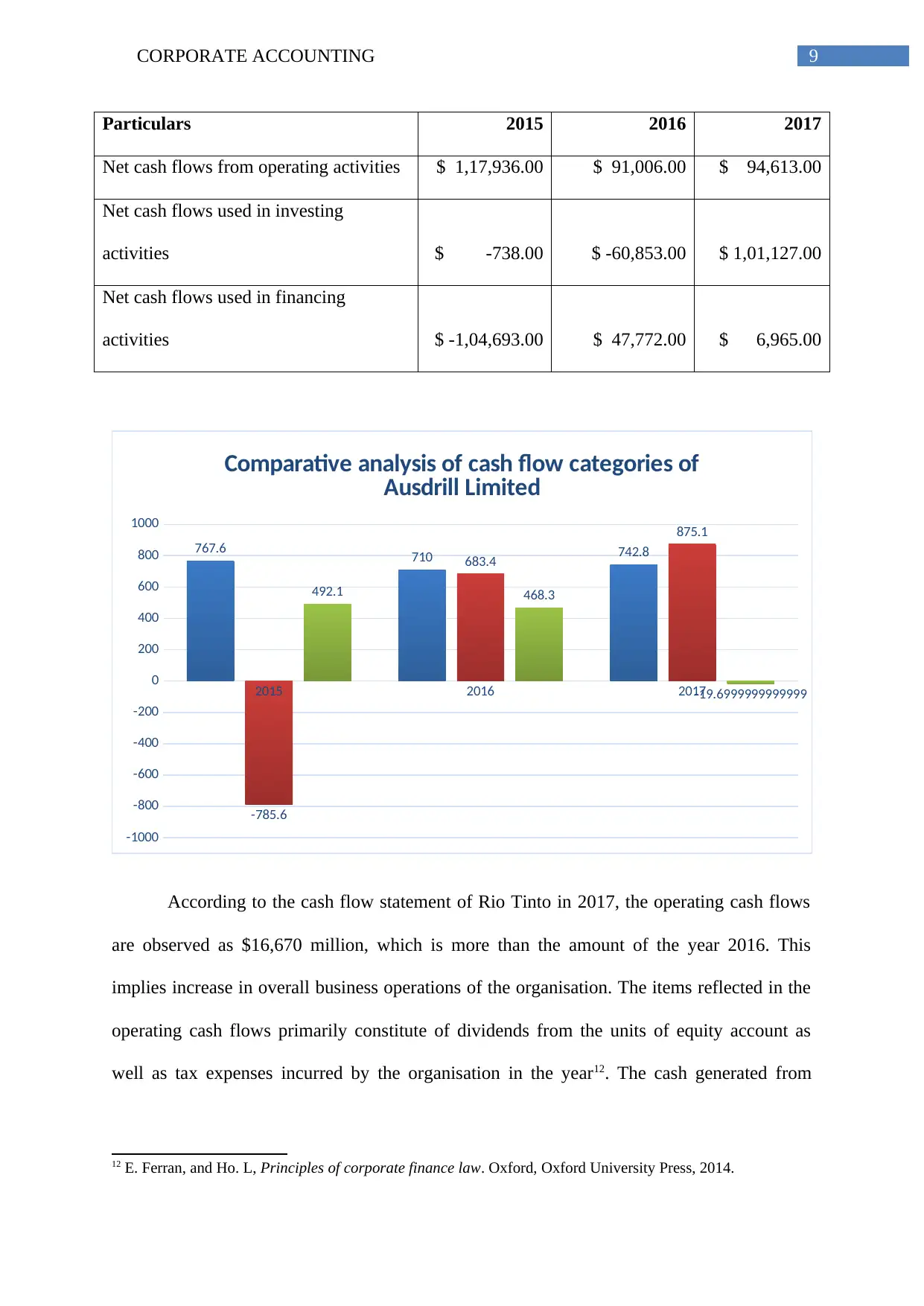

As per the cash flow statements of the two organisations depicted in their annual

reports, appropriate formats are used for disclosing the various items listed in the same. These

items mainly include operating cash flows, investing cash flows and financing cash flows.

The operating cash flows of Ausdrill Limited have deemed to increase from $91,006,000 in

2016 to $94,613,000 in 2017 denoting considerable increase in this item. In 2015, the

operating cash flows of the organisation have been $117,936,000. Due to such favourable

operating cash flows, it implies that there has been significant improvement in the business

operations13. The operating cash flows signify the operating efficacy of the organisation,

which is deemed to be favourable for the business. The operating cash flows of Rio Tinto for

2017 is deemed to be $13,884 million, while the operating cash flows in the year 2016 have

been $8,465 million and in 2015, such flows have been $9,383,000. From the annual report of

Rio Tinto in 2017, the operating cash flows have been more compared to Ausdrill Limited.

This might be because of the increased operational scale of the organisation14.

13 L. Hail , Tahoun, A. and Wang. C, "Corporate Scandals and Regulation", Journal of Accounting Research,

vol. 56, no. 3, 2018, p.624.

14 H. Wang, and Zhang. J, "Fair value accounting and corporate debt structure", Advances in Accounting, vol.

37, no. 5, 2017, 46-57.

2015 2016 2017

-1000

-800

-600

-400

-200

0

200

400

600

800

1000

767.6 710 742.8

-785.6

683.4

875.1

492.1 468.3

-19.6999999999999

Comparative analysis of cash flow categories of Rio

Tinto Limited

Part (iv):

As per the cash flow statements of the two organisations depicted in their annual

reports, appropriate formats are used for disclosing the various items listed in the same. These

items mainly include operating cash flows, investing cash flows and financing cash flows.

The operating cash flows of Ausdrill Limited have deemed to increase from $91,006,000 in

2016 to $94,613,000 in 2017 denoting considerable increase in this item. In 2015, the

operating cash flows of the organisation have been $117,936,000. Due to such favourable

operating cash flows, it implies that there has been significant improvement in the business

operations13. The operating cash flows signify the operating efficacy of the organisation,

which is deemed to be favourable for the business. The operating cash flows of Rio Tinto for

2017 is deemed to be $13,884 million, while the operating cash flows in the year 2016 have

been $8,465 million and in 2015, such flows have been $9,383,000. From the annual report of

Rio Tinto in 2017, the operating cash flows have been more compared to Ausdrill Limited.

This might be because of the increased operational scale of the organisation14.

13 L. Hail , Tahoun, A. and Wang. C, "Corporate Scandals and Regulation", Journal of Accounting Research,

vol. 56, no. 3, 2018, p.624.

14 H. Wang, and Zhang. J, "Fair value accounting and corporate debt structure", Advances in Accounting, vol.

37, no. 5, 2017, 46-57.

12CORPORATE ACCOUNTING

The investing cash flows of Ausdrill Limited have been negative in 2017, which are

identified as $101,127,000. This is mainly because of the payments made in order to buy

various classes of assets15. The cash flows for Rio Tinto in the year 2017 have found to be

negative, which is because of the rising payments associated with purchases undertaken from

the end of the business organisation. The investing cash flows of Rio Tinto are observed to be

favourable compared to Ausdrill Limited. The financing cash flows of the organisation

constitute of loan repayments, agreements related to hire purchase and loan proceeds

undertaken by the organisation in the year. These cash flows are shown to be negative as

$6,965 million for the period and improvement could be observed compared to the evaluation

of the past year. For Rio Tinto, the financing cash flows is observed to be more, which states

that the organisation has made significant cash payments during the period.

Part (v):

As per the above evaluation, the operating cash flows of the two organisations have

shown increase over the years, which implies that the operating efficacy is deemed to be

appropriate for Ausdrill Limited. However, the figure is more suitable for Rio Tinto, since it

is greater in contrast to the other organisation operating in the industry. The investing cash

flows are found to be same for both the organisation, as they have conducted significant

investments in property, plant and equipment along with loan repayments for meeting the

business obligations. Finally, it could be said that Rio Tinto has generated more cash flows

than Ausdrill Limited throughout the years.

15 M. Hasan, and Habib. A, "Corporate life cycle, organizational financial resources and corporate social

responsibility", Journal of Contemporary Accounting & Economics, vol. 13, no. 1, 2017, p.30.

The investing cash flows of Ausdrill Limited have been negative in 2017, which are

identified as $101,127,000. This is mainly because of the payments made in order to buy

various classes of assets15. The cash flows for Rio Tinto in the year 2017 have found to be

negative, which is because of the rising payments associated with purchases undertaken from

the end of the business organisation. The investing cash flows of Rio Tinto are observed to be

favourable compared to Ausdrill Limited. The financing cash flows of the organisation

constitute of loan repayments, agreements related to hire purchase and loan proceeds

undertaken by the organisation in the year. These cash flows are shown to be negative as

$6,965 million for the period and improvement could be observed compared to the evaluation

of the past year. For Rio Tinto, the financing cash flows is observed to be more, which states

that the organisation has made significant cash payments during the period.

Part (v):

As per the above evaluation, the operating cash flows of the two organisations have

shown increase over the years, which implies that the operating efficacy is deemed to be

appropriate for Ausdrill Limited. However, the figure is more suitable for Rio Tinto, since it

is greater in contrast to the other organisation operating in the industry. The investing cash

flows are found to be same for both the organisation, as they have conducted significant

investments in property, plant and equipment along with loan repayments for meeting the

business obligations. Finally, it could be said that Rio Tinto has generated more cash flows

than Ausdrill Limited throughout the years.

15 M. Hasan, and Habib. A, "Corporate life cycle, organizational financial resources and corporate social

responsibility", Journal of Contemporary Accounting & Economics, vol. 13, no. 1, 2017, p.30.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13CORPORATE ACCOUNTING

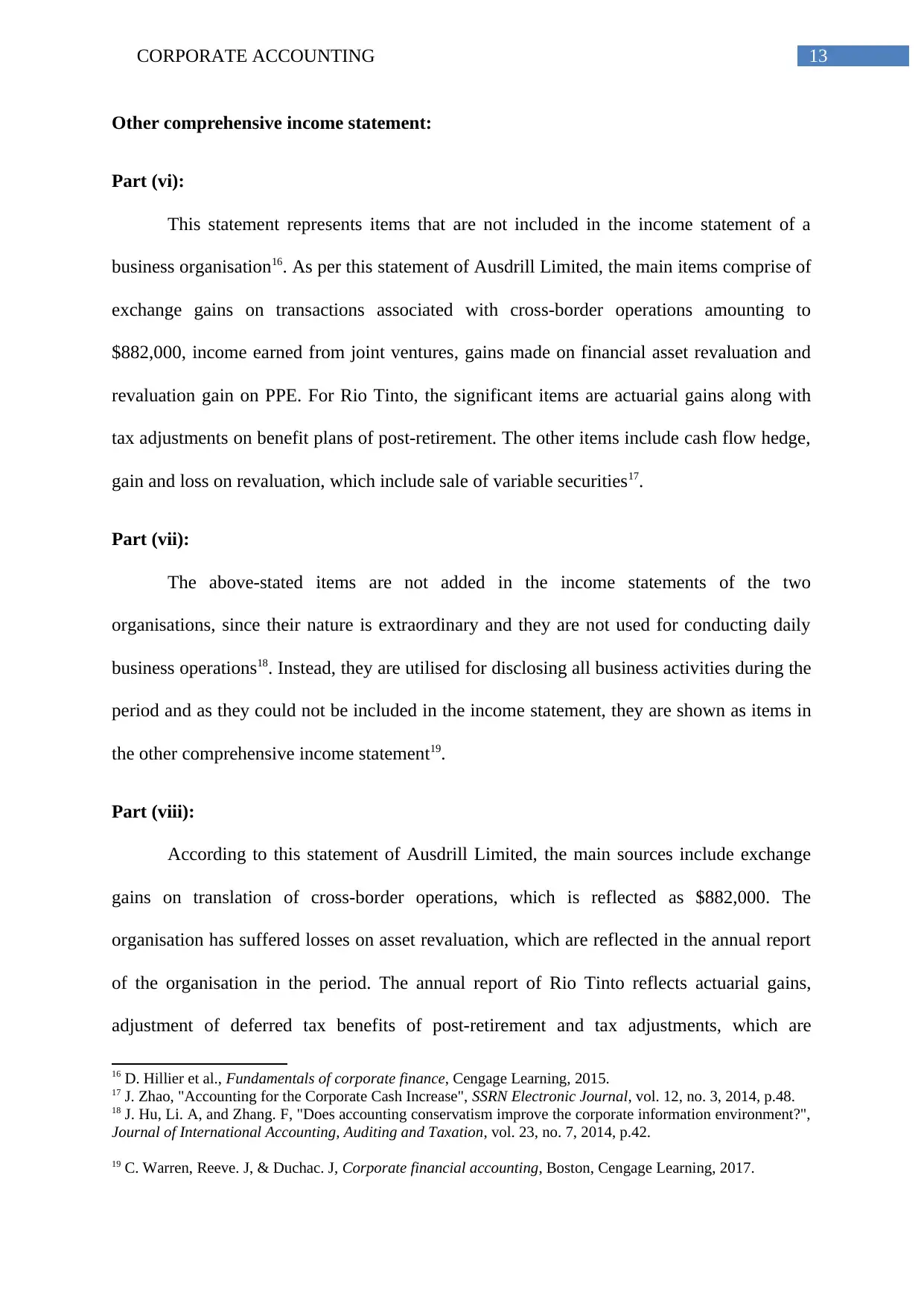

Other comprehensive income statement:

Part (vi):

This statement represents items that are not included in the income statement of a

business organisation16. As per this statement of Ausdrill Limited, the main items comprise of

exchange gains on transactions associated with cross-border operations amounting to

$882,000, income earned from joint ventures, gains made on financial asset revaluation and

revaluation gain on PPE. For Rio Tinto, the significant items are actuarial gains along with

tax adjustments on benefit plans of post-retirement. The other items include cash flow hedge,

gain and loss on revaluation, which include sale of variable securities17.

Part (vii):

The above-stated items are not added in the income statements of the two

organisations, since their nature is extraordinary and they are not used for conducting daily

business operations18. Instead, they are utilised for disclosing all business activities during the

period and as they could not be included in the income statement, they are shown as items in

the other comprehensive income statement19.

Part (viii):

According to this statement of Ausdrill Limited, the main sources include exchange

gains on translation of cross-border operations, which is reflected as $882,000. The

organisation has suffered losses on asset revaluation, which are reflected in the annual report

of the organisation in the period. The annual report of Rio Tinto reflects actuarial gains,

adjustment of deferred tax benefits of post-retirement and tax adjustments, which are

16 D. Hillier et al., Fundamentals of corporate finance, Cengage Learning, 2015.

17 J. Zhao, "Accounting for the Corporate Cash Increase", SSRN Electronic Journal, vol. 12, no. 3, 2014, p.48.

18 J. Hu, Li. A, and Zhang. F, "Does accounting conservatism improve the corporate information environment?",

Journal of International Accounting, Auditing and Taxation, vol. 23, no. 7, 2014, p.42.

19 C. Warren, Reeve. J, & Duchac. J, Corporate financial accounting, Boston, Cengage Learning, 2017.

Other comprehensive income statement:

Part (vi):

This statement represents items that are not included in the income statement of a

business organisation16. As per this statement of Ausdrill Limited, the main items comprise of

exchange gains on transactions associated with cross-border operations amounting to

$882,000, income earned from joint ventures, gains made on financial asset revaluation and

revaluation gain on PPE. For Rio Tinto, the significant items are actuarial gains along with

tax adjustments on benefit plans of post-retirement. The other items include cash flow hedge,

gain and loss on revaluation, which include sale of variable securities17.

Part (vii):

The above-stated items are not added in the income statements of the two

organisations, since their nature is extraordinary and they are not used for conducting daily

business operations18. Instead, they are utilised for disclosing all business activities during the

period and as they could not be included in the income statement, they are shown as items in

the other comprehensive income statement19.

Part (viii):

According to this statement of Ausdrill Limited, the main sources include exchange

gains on translation of cross-border operations, which is reflected as $882,000. The

organisation has suffered losses on asset revaluation, which are reflected in the annual report

of the organisation in the period. The annual report of Rio Tinto reflects actuarial gains,

adjustment of deferred tax benefits of post-retirement and tax adjustments, which are

16 D. Hillier et al., Fundamentals of corporate finance, Cengage Learning, 2015.

17 J. Zhao, "Accounting for the Corporate Cash Increase", SSRN Electronic Journal, vol. 12, no. 3, 2014, p.48.

18 J. Hu, Li. A, and Zhang. F, "Does accounting conservatism improve the corporate information environment?",

Journal of International Accounting, Auditing and Taxation, vol. 23, no. 7, 2014, p.42.

19 C. Warren, Reeve. J, & Duchac. J, Corporate financial accounting, Boston, Cengage Learning, 2017.

14CORPORATE ACCOUNTING

reflected in the annual report of the organisation during the period20. The comprehensive

income statement developed reflects cash flow hedge gains as well as revaluation gains of

available securities of sales.

The evaluation denotes that the extraordinary items are greater for Rio Tinto

compared to those of Ausdrill Limited, according to the annual reports. In the two cases, if

these items are considered in the income statement, the net income of the organisation would

either increase or minimise the income of the organisation. For Ausdrill Limited, the net

income would decrease if the comprehensive items are reflected in the income statement. On

the other hand, the profit of Rio Tinto would rise, if the profits are considered in the income

statement of the organisation.

Part (ix):

The performance of the organisation need not be dependent on comprehensive items

that are reflected distinctively in the annual reports of the organisations, since the nature of

these items is extraordinary and they might not be recurring in nature. The items reflected in

the other comprehensive income statement are primarily of extraordinary nature. Hence, the

items need not be included while undertaking business decisions.

Accounting for corporate income tax:

Part (x):

The income tax expense for Ausdrill Limited in 2017 is represented as $13,885,000

and this amount has risen from $4,581,000 in 2016. In case of Rio Tinto, the income tax

expense of the organisation has been $3,965 million in 2017 and $1,567 million in 2016.

20 J. Thanopoulos, Global Business and Corporate Governance, New York, Business Expert Press, 2014.

reflected in the annual report of the organisation during the period20. The comprehensive

income statement developed reflects cash flow hedge gains as well as revaluation gains of

available securities of sales.

The evaluation denotes that the extraordinary items are greater for Rio Tinto

compared to those of Ausdrill Limited, according to the annual reports. In the two cases, if

these items are considered in the income statement, the net income of the organisation would

either increase or minimise the income of the organisation. For Ausdrill Limited, the net

income would decrease if the comprehensive items are reflected in the income statement. On

the other hand, the profit of Rio Tinto would rise, if the profits are considered in the income

statement of the organisation.

Part (ix):

The performance of the organisation need not be dependent on comprehensive items

that are reflected distinctively in the annual reports of the organisations, since the nature of

these items is extraordinary and they might not be recurring in nature. The items reflected in

the other comprehensive income statement are primarily of extraordinary nature. Hence, the

items need not be included while undertaking business decisions.

Accounting for corporate income tax:

Part (x):

The income tax expense for Ausdrill Limited in 2017 is represented as $13,885,000

and this amount has risen from $4,581,000 in 2016. In case of Rio Tinto, the income tax

expense of the organisation has been $3,965 million in 2017 and $1,567 million in 2016.

20 J. Thanopoulos, Global Business and Corporate Governance, New York, Business Expert Press, 2014.

15CORPORATE ACCOUNTING

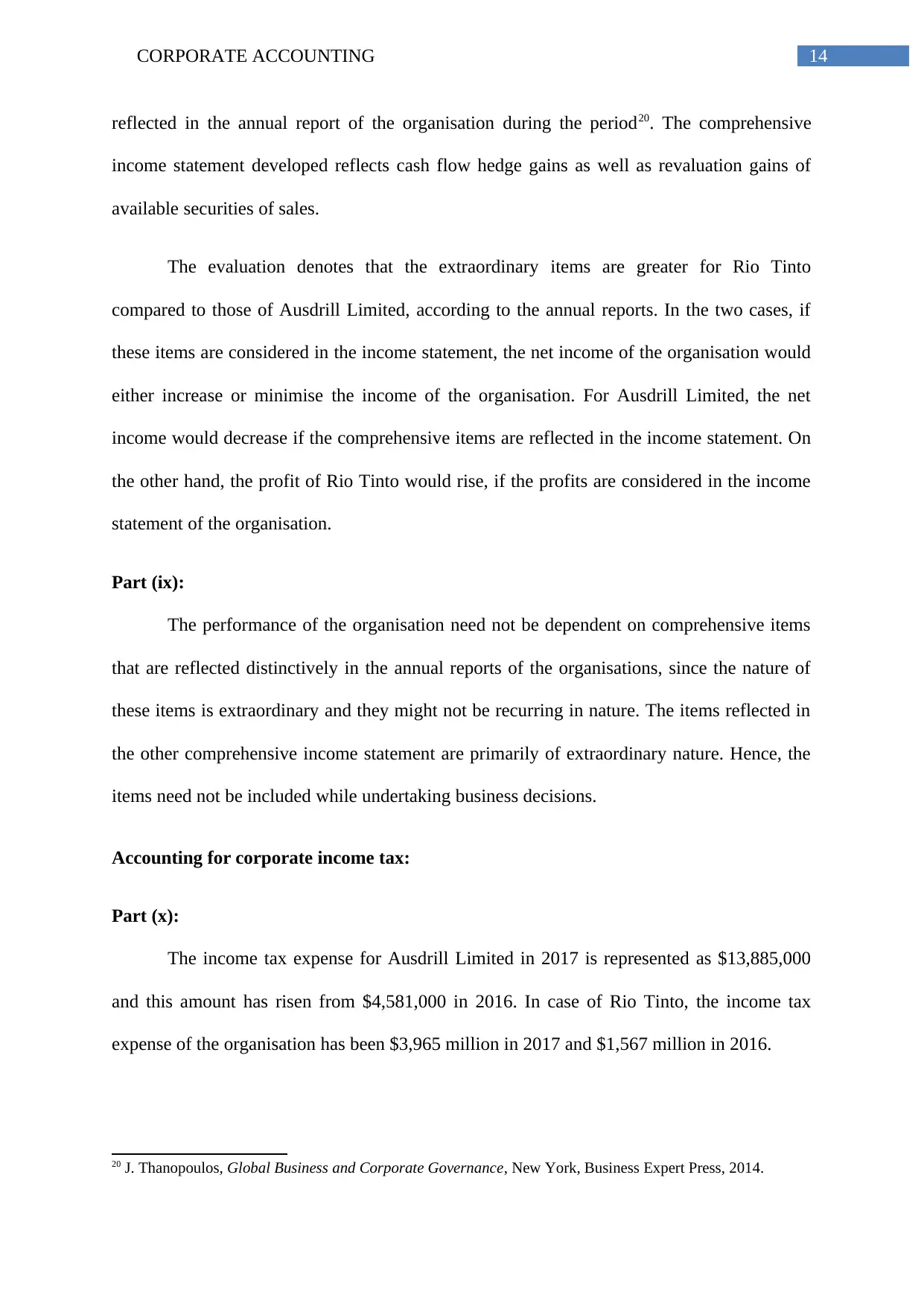

Part (xi):

The effective tax rate denotes the average rate of tax, in which the business profits are

taxed and the computation of effective tax rate is depicted in the above figure. It is apparent

from the above figure that Rio Tinto has higher tax rate compared to Ausdrill Limited.

Part (xii):

Deferred tax assets as well as deferred tax liabilities are important components of the

financial statements of the organisation, which are recorded at the end of the period and the

same has effect on income tax reflected in the income statement21. The cause due to which

deferred tax assets and liabilities are recognised is the temporary variation and permanent

variation between tax profit and accounting profit22. Another cause could the tax liabilities or

tax assets brought forward from the past year.

Part (xiii):

Ausdrill Limited has deferred tax assets of $36,372,000 in 2017 and they have fallen

compared to the previous year. On the other hand, deferred tax liabilities of the organisation

have been $22,077,000 in 2017 and this amount has been minimised compared to the analysis

of the past year. The deferred tax assets of Rio Tinto have followed similar trend like that of

Ausdrill Limited; however, increase in deferred tax liabilities could be observed over the

year.

21 M, Pozzoli, and Paolone. F, Corporate financial distress, Cham, Springer Verlag, 2017.

22 M. Lim, How. J, and Verhoeven. P, "Corporate ownership, corporate governance reform and timeliness of

earnings: Malaysian evidence", Journal of Contemporary Accounting & Economics, vol. 10, 2014, p.37.

Part (xi):

The effective tax rate denotes the average rate of tax, in which the business profits are

taxed and the computation of effective tax rate is depicted in the above figure. It is apparent

from the above figure that Rio Tinto has higher tax rate compared to Ausdrill Limited.

Part (xii):

Deferred tax assets as well as deferred tax liabilities are important components of the

financial statements of the organisation, which are recorded at the end of the period and the

same has effect on income tax reflected in the income statement21. The cause due to which

deferred tax assets and liabilities are recognised is the temporary variation and permanent

variation between tax profit and accounting profit22. Another cause could the tax liabilities or

tax assets brought forward from the past year.

Part (xiii):

Ausdrill Limited has deferred tax assets of $36,372,000 in 2017 and they have fallen

compared to the previous year. On the other hand, deferred tax liabilities of the organisation

have been $22,077,000 in 2017 and this amount has been minimised compared to the analysis

of the past year. The deferred tax assets of Rio Tinto have followed similar trend like that of

Ausdrill Limited; however, increase in deferred tax liabilities could be observed over the

year.

21 M, Pozzoli, and Paolone. F, Corporate financial distress, Cham, Springer Verlag, 2017.

22 M. Lim, How. J, and Verhoeven. P, "Corporate ownership, corporate governance reform and timeliness of

earnings: Malaysian evidence", Journal of Contemporary Accounting & Economics, vol. 10, 2014, p.37.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16CORPORATE ACCOUNTING

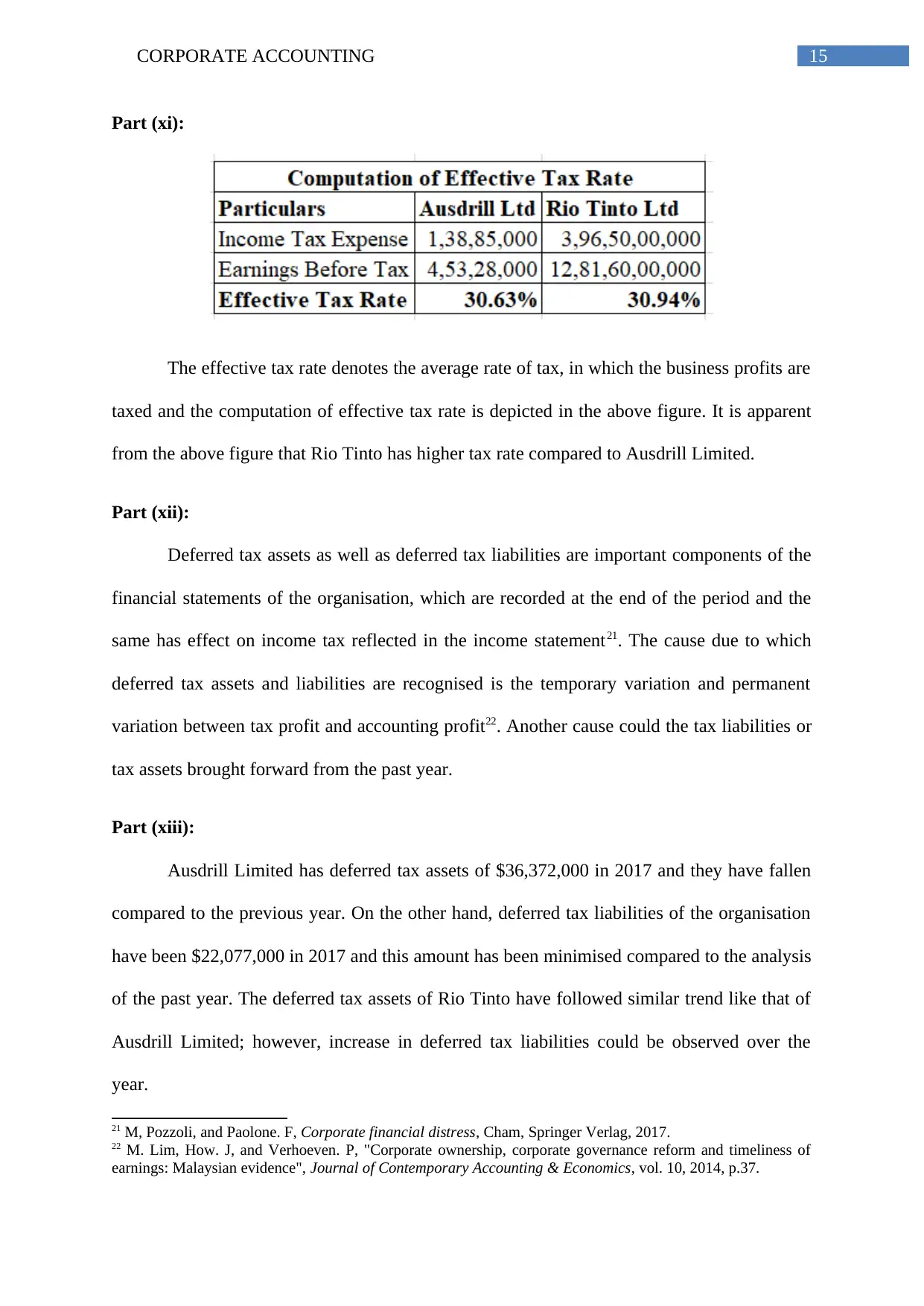

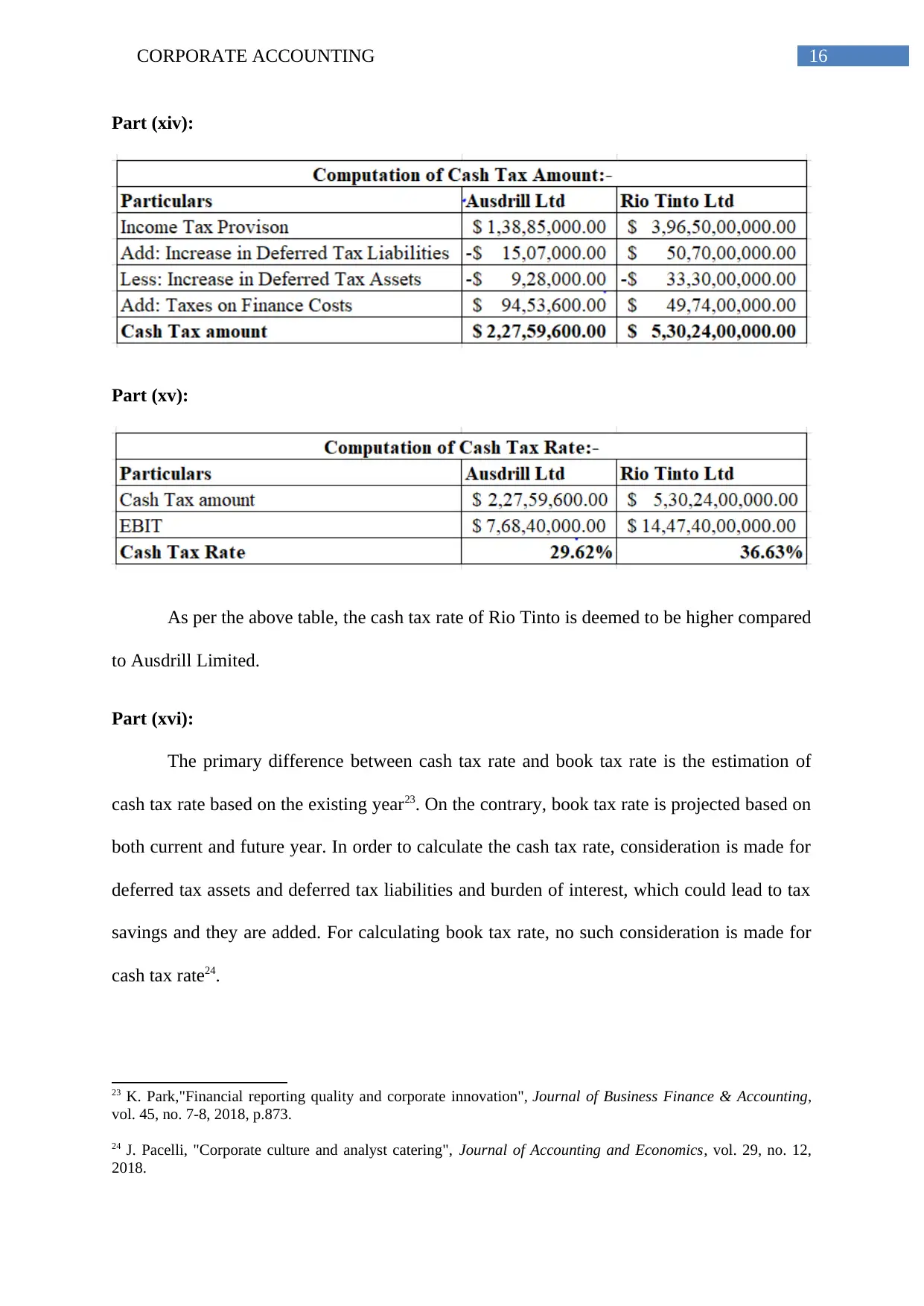

Part (xiv):

Part (xv):

As per the above table, the cash tax rate of Rio Tinto is deemed to be higher compared

to Ausdrill Limited.

Part (xvi):

The primary difference between cash tax rate and book tax rate is the estimation of

cash tax rate based on the existing year23. On the contrary, book tax rate is projected based on

both current and future year. In order to calculate the cash tax rate, consideration is made for

deferred tax assets and deferred tax liabilities and burden of interest, which could lead to tax

savings and they are added. For calculating book tax rate, no such consideration is made for

cash tax rate24.

23 K. Park,"Financial reporting quality and corporate innovation", Journal of Business Finance & Accounting,

vol. 45, no. 7-8, 2018, p.873.

24 J. Pacelli, "Corporate culture and analyst catering", Journal of Accounting and Economics, vol. 29, no. 12,

2018.

Part (xiv):

Part (xv):

As per the above table, the cash tax rate of Rio Tinto is deemed to be higher compared

to Ausdrill Limited.

Part (xvi):

The primary difference between cash tax rate and book tax rate is the estimation of

cash tax rate based on the existing year23. On the contrary, book tax rate is projected based on

both current and future year. In order to calculate the cash tax rate, consideration is made for

deferred tax assets and deferred tax liabilities and burden of interest, which could lead to tax

savings and they are added. For calculating book tax rate, no such consideration is made for

cash tax rate24.

23 K. Park,"Financial reporting quality and corporate innovation", Journal of Business Finance & Accounting,

vol. 45, no. 7-8, 2018, p.873.

24 J. Pacelli, "Corporate culture and analyst catering", Journal of Accounting and Economics, vol. 29, no. 12,

2018.

17CORPORATE ACCOUNTING

Conclusion:

It is prominent from the above discussion that both Rio Tinto and Ausdrill Limited

have made adequate disclosures regarding the various financial aspects. It has been found that

Rio Tinto has focused on equity capital, while Ausdrill Limited has concentrated on raising

more funds through debt. In terms of cash flow statement, the position is deemed to be

favourable for Rio Tinto as well. Finally, it has been found that Rio Tinto has incurred more

cash tax compared to Ausdrill Limited because of more revenue generated over the years.

Conclusion:

It is prominent from the above discussion that both Rio Tinto and Ausdrill Limited

have made adequate disclosures regarding the various financial aspects. It has been found that

Rio Tinto has focused on equity capital, while Ausdrill Limited has concentrated on raising

more funds through debt. In terms of cash flow statement, the position is deemed to be

favourable for Rio Tinto as well. Finally, it has been found that Rio Tinto has incurred more

cash tax compared to Ausdrill Limited because of more revenue generated over the years.

18CORPORATE ACCOUNTING

References:

"Annual Reports: Ausdrill", 2018, <http://www.ausdrill.com.au/investors/annual-

reports.html> [accessed 26 September 2018].

Bick, P, S Orlova, and L Sun, "Fair value accounting and corporate cash holdings", Advances

in Accounting, vol. 40, no. 3, 2018, 98-110.

Binkow, P, "The Impact of Self-Service Applications on Corporate Accounting and Its

Customers", Journal of Corporate Accounting & Finance, vol. 26, 2015, 81-85.

Bojańczyk, M, Corporate accounting in the unstable world, Warszawa, Akademia Finansów

i Biznesu Vistula, 2017.

Carl, W, Corporate Financial Accounting, Cengage Learning, 2016.

Choi, J, W Choi, and E Lee, "Corporate Life Cycle and Earnings Benchmarks", Australian

Accounting Review, vol. 26, no. 4, 2016, 415-428.

Ciesielski, J, and T Weirich, "Current Accounting Issues Facing Chief Accounting and Chief

Financial Officers", Journal of Corporate Accounting & Finance, vol. 26, 2015, 63-72.

Corelli, A, Analytical Corporate Finance, Cham, Springer International Publishing, 2016.

Ferran, E, and L Ho, Principles of corporate finance law. Oxford, Oxford University Press,

2014.

Hail, L, A Tahoun, and C Wang, "Corporate Scandals and Regulation", Journal of

Accounting Research, vol. 56, no. 3, 2018, 617-671.

References:

"Annual Reports: Ausdrill", 2018, <http://www.ausdrill.com.au/investors/annual-

reports.html> [accessed 26 September 2018].

Bick, P, S Orlova, and L Sun, "Fair value accounting and corporate cash holdings", Advances

in Accounting, vol. 40, no. 3, 2018, 98-110.

Binkow, P, "The Impact of Self-Service Applications on Corporate Accounting and Its

Customers", Journal of Corporate Accounting & Finance, vol. 26, 2015, 81-85.

Bojańczyk, M, Corporate accounting in the unstable world, Warszawa, Akademia Finansów

i Biznesu Vistula, 2017.

Carl, W, Corporate Financial Accounting, Cengage Learning, 2016.

Choi, J, W Choi, and E Lee, "Corporate Life Cycle and Earnings Benchmarks", Australian

Accounting Review, vol. 26, no. 4, 2016, 415-428.

Ciesielski, J, and T Weirich, "Current Accounting Issues Facing Chief Accounting and Chief

Financial Officers", Journal of Corporate Accounting & Finance, vol. 26, 2015, 63-72.

Corelli, A, Analytical Corporate Finance, Cham, Springer International Publishing, 2016.

Ferran, E, and L Ho, Principles of corporate finance law. Oxford, Oxford University Press,

2014.

Hail, L, A Tahoun, and C Wang, "Corporate Scandals and Regulation", Journal of

Accounting Research, vol. 56, no. 3, 2018, 617-671.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

19CORPORATE ACCOUNTING

Hasan, M, and A Habib, "Corporate life cycle, organizational financial resources and

corporate social responsibility", Journal of Contemporary Accounting & Economics, vol. 13,

no. 1, 2017, 20-36.

Hillier, D. et al., Fundamentals of corporate finance, Cengage Learning, 2015.

Hu, J, A Li, and F Zhang, "Does accounting conservatism improve the corporate information

environment?", Journal of International Accounting, Auditing and Taxation, vol. 23, no. 7,

2014, 32-43.

Lim, M, J How, and P Verhoeven, "Corporate ownership, corporate governance reform and

timeliness of earnings: Malaysian evidence", Journal of Contemporary Accounting &

Economics, vol. 10, 2014, 32-45.

Pacelli, J, "Corporate culture and analyst catering", Journal of Accounting and Economics,

vol. 29, no. 12, 2018.

Park, K, "Financial reporting quality and corporate innovation", Journal of Business Finance

& Accounting, vol. 45, no. 7-8, 2018, 871-894.

Pozzoli, M, and F Paolone, Corporate financial distress, Cham, Springer Verlag, 2017.

“Results & reports”, 2018, <http://www.riotinto.com/investors/results-and-reports-

2146.aspx> [accessed 26 September 2018].

Thanopoulos, J, Global Business and Corporate Governance, New York, Business Expert

Press, 2014.

Uyar, A, "Evolution of Corporate Reporting and Emerging Trends", Journal of Corporate

Accounting & Finance, vol. 27, no. 4, 2016, 27-30.

Hasan, M, and A Habib, "Corporate life cycle, organizational financial resources and

corporate social responsibility", Journal of Contemporary Accounting & Economics, vol. 13,

no. 1, 2017, 20-36.

Hillier, D. et al., Fundamentals of corporate finance, Cengage Learning, 2015.

Hu, J, A Li, and F Zhang, "Does accounting conservatism improve the corporate information

environment?", Journal of International Accounting, Auditing and Taxation, vol. 23, no. 7,

2014, 32-43.

Lim, M, J How, and P Verhoeven, "Corporate ownership, corporate governance reform and

timeliness of earnings: Malaysian evidence", Journal of Contemporary Accounting &

Economics, vol. 10, 2014, 32-45.

Pacelli, J, "Corporate culture and analyst catering", Journal of Accounting and Economics,

vol. 29, no. 12, 2018.

Park, K, "Financial reporting quality and corporate innovation", Journal of Business Finance

& Accounting, vol. 45, no. 7-8, 2018, 871-894.

Pozzoli, M, and F Paolone, Corporate financial distress, Cham, Springer Verlag, 2017.

“Results & reports”, 2018, <http://www.riotinto.com/investors/results-and-reports-

2146.aspx> [accessed 26 September 2018].

Thanopoulos, J, Global Business and Corporate Governance, New York, Business Expert

Press, 2014.

Uyar, A, "Evolution of Corporate Reporting and Emerging Trends", Journal of Corporate

Accounting & Finance, vol. 27, no. 4, 2016, 27-30.

20CORPORATE ACCOUNTING

Wang, H, and J Zhang, "Fair value accounting and corporate debt structure", Advances in

Accounting, vol. 37, no. 5, 2017, 46-57.

Warren, C, J Reeve, and J Duchac, Corporate financial accounting, Boston, Cengage

Learning, 2017.

Warren, C, Reeve James M., and J Duchac, Corporate financial accounting, Mason, OH,

South-Western Cengage Learning, 2014.

Zhao, J, "Accounting for the Corporate Cash Increase", SSRN Electronic Journal, vol. 12, no.

3, 2014, 45-68.

Wang, H, and J Zhang, "Fair value accounting and corporate debt structure", Advances in

Accounting, vol. 37, no. 5, 2017, 46-57.

Warren, C, J Reeve, and J Duchac, Corporate financial accounting, Boston, Cengage

Learning, 2017.

Warren, C, Reeve James M., and J Duchac, Corporate financial accounting, Mason, OH,

South-Western Cengage Learning, 2014.

Zhao, J, "Accounting for the Corporate Cash Increase", SSRN Electronic Journal, vol. 12, no.

3, 2014, 45-68.

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.