CORPORATE ACCOUNTING AND REPORTING

VerifiedAdded on 2022/08/20

|9

|754

|9

AI Summary

.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

unning ead C T CC T TR H : ORPORA E A OUN ING AND REPOR ING

CORPORATE ACCOUNTING AND REPORTING

CORPORATE ACCOUNTING AND REPORTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

unning ead C T CC T TR H : ORPORA E A OUN ING AND REPOR ING

Table of Contents

Step 1: Acquisition Analysis.......................................................................................................................3

Step 2: Pre-Acquisition analysis..................................................................................................................3

Step 3: NCI entry.........................................................................................................................................4

Step 4: Business Combination entries..........................................................................................................5

Step 5: Partial Goodwill method to full goodwill Method...........................................................................6

References...................................................................................................................................................8

Table of Contents

Step 1: Acquisition Analysis.......................................................................................................................3

Step 2: Pre-Acquisition analysis..................................................................................................................3

Step 3: NCI entry.........................................................................................................................................4

Step 4: Business Combination entries..........................................................................................................5

Step 5: Partial Goodwill method to full goodwill Method...........................................................................6

References...................................................................................................................................................8

unning ead C T CC T TR H : ORPORA E A OUN ING AND REPOR ING

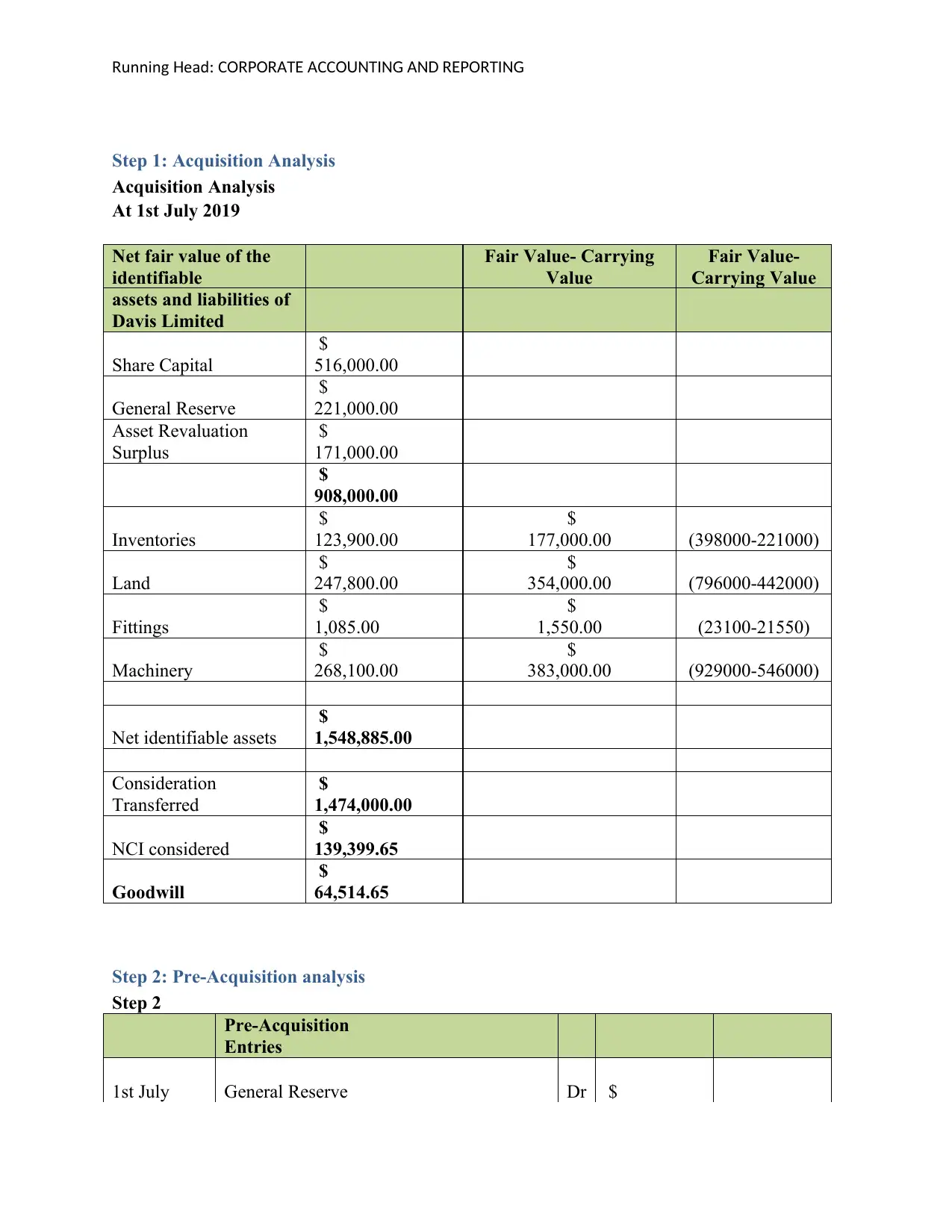

Step 1: Acquisition Analysis

Acquisition Analysis

At 1st July 2019

Net fair value of the

identifiable

Fair Value- Carrying

Value

Fair Value-

Carrying Value

assets and liabilities of

Davis Limited

Share Capital

$

516,000.00

General Reserve

$

221,000.00

Asset Revaluation

Surplus

$

171,000.00

$

908,000.00

Inventories

$

123,900.00

$

177,000.00 (398000-221000)

Land

$

247,800.00

$

354,000.00 (796000-442000)

Fittings

$

1,085.00

$

1,550.00 (23100-21550)

Machinery

$

268,100.00

$

383,000.00 (929000-546000)

Net identifiable assets

$

1,548,885.00

Consideration

Transferred

$

1,474,000.00

NCI considered

$

139,399.65

Goodwill

$

64,514.65

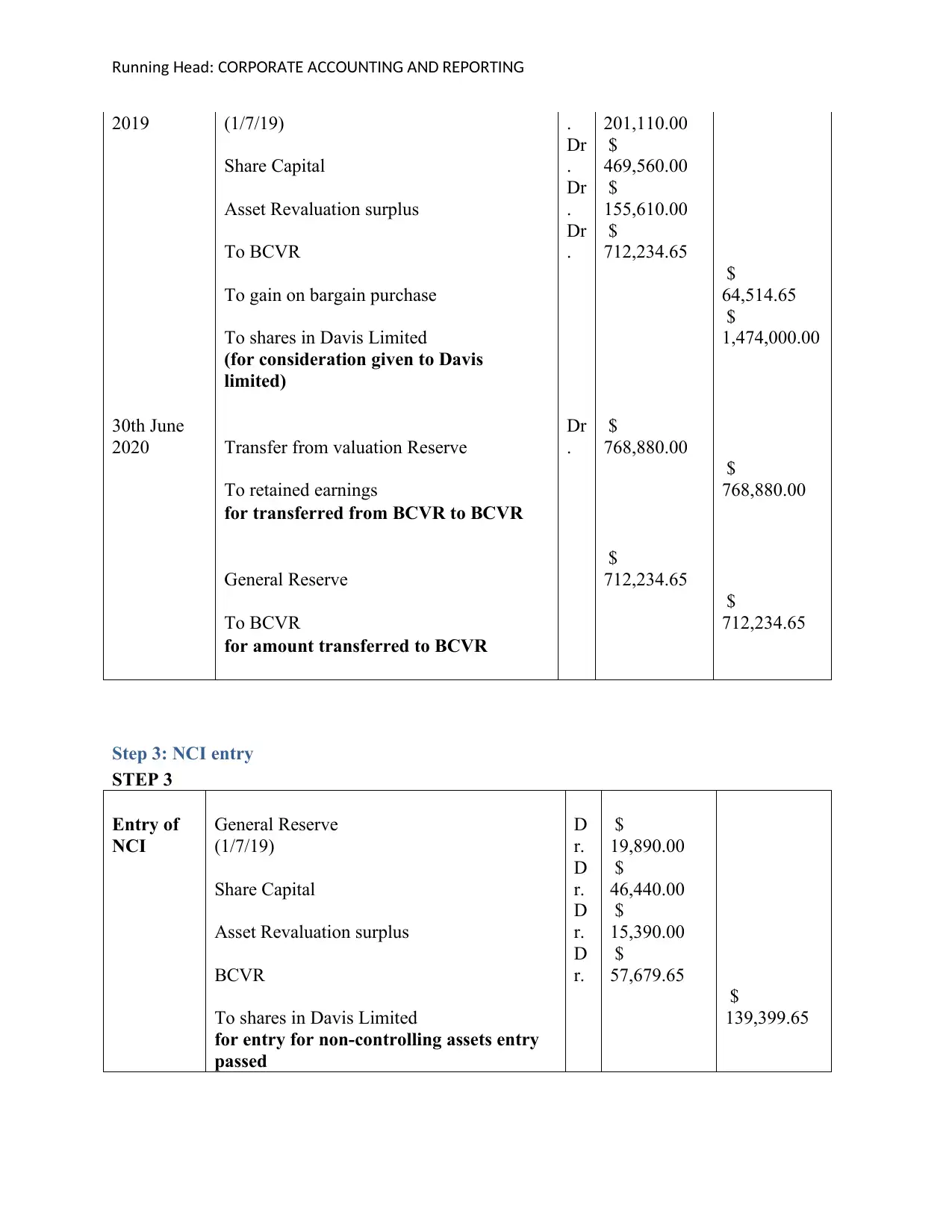

Step 2: Pre-Acquisition analysis

Step 2

Pre-Acquisition

Entries

1st July General Reserve Dr $

Step 1: Acquisition Analysis

Acquisition Analysis

At 1st July 2019

Net fair value of the

identifiable

Fair Value- Carrying

Value

Fair Value-

Carrying Value

assets and liabilities of

Davis Limited

Share Capital

$

516,000.00

General Reserve

$

221,000.00

Asset Revaluation

Surplus

$

171,000.00

$

908,000.00

Inventories

$

123,900.00

$

177,000.00 (398000-221000)

Land

$

247,800.00

$

354,000.00 (796000-442000)

Fittings

$

1,085.00

$

1,550.00 (23100-21550)

Machinery

$

268,100.00

$

383,000.00 (929000-546000)

Net identifiable assets

$

1,548,885.00

Consideration

Transferred

$

1,474,000.00

NCI considered

$

139,399.65

Goodwill

$

64,514.65

Step 2: Pre-Acquisition analysis

Step 2

Pre-Acquisition

Entries

1st July General Reserve Dr $

unning ead C T CC T TR H : ORPORA E A OUN ING AND REPOR ING

2019 (1/7/19) . 201,110.00

Share Capital

Dr

.

$

469,560.00

Asset Revaluation surplus

Dr

.

$

155,610.00

To BCVR

Dr

.

$

712,234.65

To gain on bargain purchase

$

64,514.65

To shares in Davis Limited

$

1,474,000.00

(for consideration given to Davis

limited)

30th June

2020 Transfer from valuation Reserve

Dr

.

$

768,880.00

To retained earnings

$

768,880.00

for transferred from BCVR to BCVR

General Reserve

$

712,234.65

To BCVR

$

712,234.65

for amount transferred to BCVR

Step 3: NCI entry

STEP 3

Entry of

NCI

General Reserve

(1/7/19)

D

r.

$

19,890.00

Share Capital

D

r.

$

46,440.00

Asset Revaluation surplus

D

r.

$

15,390.00

BCVR

D

r.

$

57,679.65

To shares in Davis Limited

$

139,399.65

for entry for non-controlling assets entry

passed

2019 (1/7/19) . 201,110.00

Share Capital

Dr

.

$

469,560.00

Asset Revaluation surplus

Dr

.

$

155,610.00

To BCVR

Dr

.

$

712,234.65

To gain on bargain purchase

$

64,514.65

To shares in Davis Limited

$

1,474,000.00

(for consideration given to Davis

limited)

30th June

2020 Transfer from valuation Reserve

Dr

.

$

768,880.00

To retained earnings

$

768,880.00

for transferred from BCVR to BCVR

General Reserve

$

712,234.65

To BCVR

$

712,234.65

for amount transferred to BCVR

Step 3: NCI entry

STEP 3

Entry of

NCI

General Reserve

(1/7/19)

D

r.

$

19,890.00

Share Capital

D

r.

$

46,440.00

Asset Revaluation surplus

D

r.

$

15,390.00

BCVR

D

r.

$

57,679.65

To shares in Davis Limited

$

139,399.65

for entry for non-controlling assets entry

passed

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

unning ead C T CC T TR H : ORPORA E A OUN ING AND REPOR ING

unning ead C T CC T TR H : ORPORA E A OUN ING AND REPOR ING

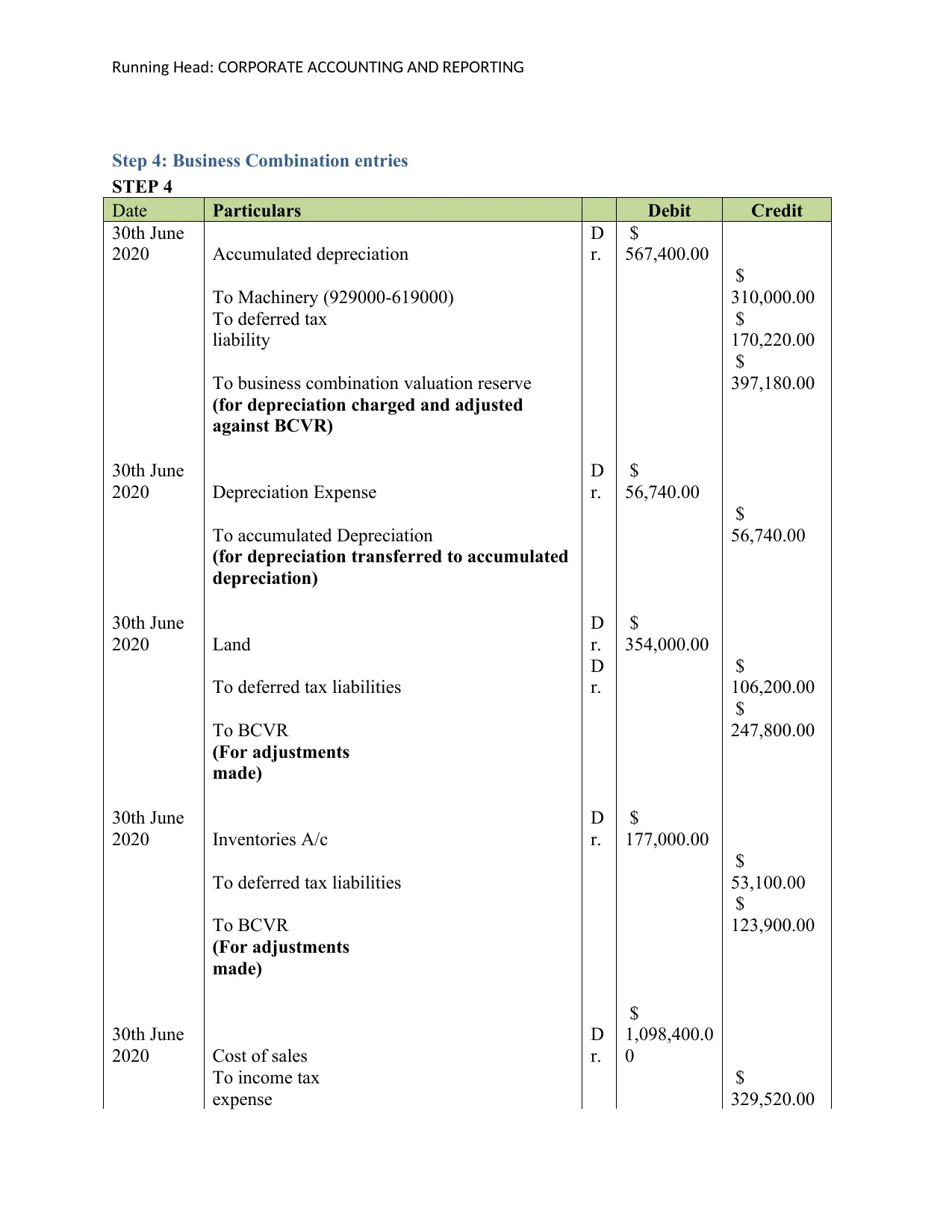

Step 4: Business Combination entries

STEP 4

Date Particulars Debit Credit

30th June

2020 Accumulated depreciation

D

r.

$

567,400.00

To Machinery (929000-619000)

$

310,000.00

To deferred tax

liability

$

170,220.00

To business combination valuation reserve

$

397,180.00

(for depreciation charged and adjusted

against BCVR)

30th June

2020 Depreciation Expense

D

r.

$

56,740.00

To accumulated Depreciation

$

56,740.00

(for depreciation transferred to accumulated

depreciation)

30th June

2020 Land

D

r.

$

354,000.00

To deferred tax liabilities

D

r.

$

106,200.00

To BCVR

$

247,800.00

(For adjustments

made)

30th June

2020 Inventories A/c

D

r.

$

177,000.00

To deferred tax liabilities

$

53,100.00

To BCVR

$

123,900.00

(For adjustments

made)

30th June

2020 Cost of sales

D

r.

$

1,098,400.0

0

To income tax

expense

$

329,520.00

Step 4: Business Combination entries

STEP 4

Date Particulars Debit Credit

30th June

2020 Accumulated depreciation

D

r.

$

567,400.00

To Machinery (929000-619000)

$

310,000.00

To deferred tax

liability

$

170,220.00

To business combination valuation reserve

$

397,180.00

(for depreciation charged and adjusted

against BCVR)

30th June

2020 Depreciation Expense

D

r.

$

56,740.00

To accumulated Depreciation

$

56,740.00

(for depreciation transferred to accumulated

depreciation)

30th June

2020 Land

D

r.

$

354,000.00

To deferred tax liabilities

D

r.

$

106,200.00

To BCVR

$

247,800.00

(For adjustments

made)

30th June

2020 Inventories A/c

D

r.

$

177,000.00

To deferred tax liabilities

$

53,100.00

To BCVR

$

123,900.00

(For adjustments

made)

30th June

2020 Cost of sales

D

r.

$

1,098,400.0

0

To income tax

expense

$

329,520.00

unning ead C T CC T TR H : ORPORA E A OUN ING AND REPOR ING

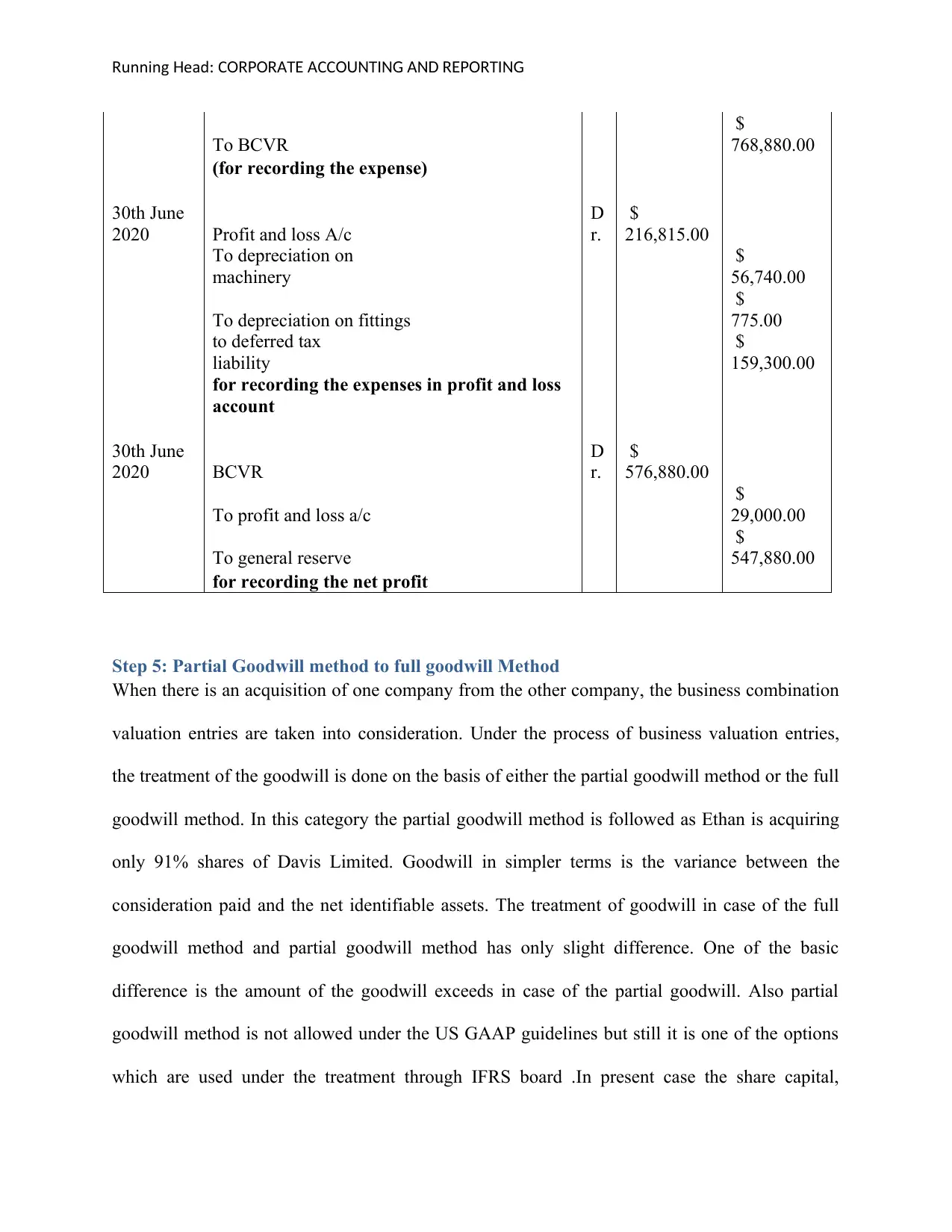

To BCVR

$

768,880.00

(for recording the expense)

30th June

2020 Profit and loss A/c

D

r.

$

216,815.00

To depreciation on

machinery

$

56,740.00

To depreciation on fittings

$

775.00

to deferred tax

liability

$

159,300.00

for recording the expenses in profit and loss

account

30th June

2020 BCVR

D

r.

$

576,880.00

To profit and loss a/c

$

29,000.00

To general reserve

$

547,880.00

for recording the net profit

Step 5: Partial Goodwill method to full goodwill Method

When there is an acquisition of one company from the other company, the business combination

valuation entries are taken into consideration. Under the process of business valuation entries,

the treatment of the goodwill is done on the basis of either the partial goodwill method or the full

goodwill method. In this category the partial goodwill method is followed as Ethan is acquiring

only 91% shares of Davis Limited. Goodwill in simpler terms is the variance between the

consideration paid and the net identifiable assets. The treatment of goodwill in case of the full

goodwill method and partial goodwill method has only slight difference. One of the basic

difference is the amount of the goodwill exceeds in case of the partial goodwill. Also partial

goodwill method is not allowed under the US GAAP guidelines but still it is one of the options

which are used under the treatment through IFRS board .In present case the share capital,

To BCVR

$

768,880.00

(for recording the expense)

30th June

2020 Profit and loss A/c

D

r.

$

216,815.00

To depreciation on

machinery

$

56,740.00

To depreciation on fittings

$

775.00

to deferred tax

liability

$

159,300.00

for recording the expenses in profit and loss

account

30th June

2020 BCVR

D

r.

$

576,880.00

To profit and loss a/c

$

29,000.00

To general reserve

$

547,880.00

for recording the net profit

Step 5: Partial Goodwill method to full goodwill Method

When there is an acquisition of one company from the other company, the business combination

valuation entries are taken into consideration. Under the process of business valuation entries,

the treatment of the goodwill is done on the basis of either the partial goodwill method or the full

goodwill method. In this category the partial goodwill method is followed as Ethan is acquiring

only 91% shares of Davis Limited. Goodwill in simpler terms is the variance between the

consideration paid and the net identifiable assets. The treatment of goodwill in case of the full

goodwill method and partial goodwill method has only slight difference. One of the basic

difference is the amount of the goodwill exceeds in case of the partial goodwill. Also partial

goodwill method is not allowed under the US GAAP guidelines but still it is one of the options

which are used under the treatment through IFRS board .In present case the share capital,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

unning ead C T CC T TR H : ORPORA E A OUN ING AND REPOR ING

reserves and the asset valuation are measured at 91% whereas in full consideration the value is

taken at 100% (ACCA, 2018). The profit also seems to be $29000 therefore; if the non-

controlling interest is inclusive it means the full goodwill method is applied in the business.

reserves and the asset valuation are measured at 91% whereas in full consideration the value is

taken at 100% (ACCA, 2018). The profit also seems to be $29000 therefore; if the non-

controlling interest is inclusive it means the full goodwill method is applied in the business.

unning ead C T CC T TR H : ORPORA E A OUN ING AND REPOR ING

References

ACCA, (2018) IFRS 3 will create significant changes in accounting for business combinations,

explains Graham Holt [online] Available from

https://www.accaglobal.com/gb/en/member/discover/cpd-articles/corporate-reporting/ifrs3-

combinations.html [Accessed on 17th September 2019]

References

ACCA, (2018) IFRS 3 will create significant changes in accounting for business combinations,

explains Graham Holt [online] Available from

https://www.accaglobal.com/gb/en/member/discover/cpd-articles/corporate-reporting/ifrs3-

combinations.html [Accessed on 17th September 2019]

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.