Corporate Accounting Report

VerifiedAdded on 2020/12/29

|18

|5018

|115

Report

AI Summary

This report analyzes the corporate accounting practices of Qantas Airways Limited and Alliance Aviation Services Limited, two Australian public limited companies. It examines key financial statements, including owner's equity, cash flow statements, other comprehensive income statements, and corporate income tax. The report provides a comparative analysis of both companies, highlighting their financial performance and capital structure.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

CORPORATE ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

EXECUTIVE SUMMARY

Corporate accounting can be termed as the major branch which directly deals with

organization's system, preparation of financial statements with its appropriate analysis and

interpretation of fiscal outcomes. The present report will discuss about two public limited

companies which are listed on Australian Securities Exchange as Qantas Airways Limited and

Alliance Aviation Services Limited. Further, it had been stated that, cash flow statement is

classified in three broad categories in which operating section plays major role for generating

cash. It could be elaborated that, actual profit could be attained through adjusting other

comprehensive income statement. Further, it could be summed by reflecting corporate income

tax which plays very efficient role for absorbing effective tax rate, cash tax rate and cash tax

amount.

Corporate accounting can be termed as the major branch which directly deals with

organization's system, preparation of financial statements with its appropriate analysis and

interpretation of fiscal outcomes. The present report will discuss about two public limited

companies which are listed on Australian Securities Exchange as Qantas Airways Limited and

Alliance Aviation Services Limited. Further, it had been stated that, cash flow statement is

classified in three broad categories in which operating section plays major role for generating

cash. It could be elaborated that, actual profit could be attained through adjusting other

comprehensive income statement. Further, it could be summed by reflecting corporate income

tax which plays very efficient role for absorbing effective tax rate, cash tax rate and cash tax

amount.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

OWNER'S EQUITY........................................................................................................................1

1. Discussing changes in each component of equity...................................................................1

2. Providing comparative analysis of debt and equity position of both the firms.......................2

CASH FLOW STATEMENT..........................................................................................................4

3. Discussing changes in cash flow items over the past years....................................................4

4. Comparative analysis of broad categories of cash flow statement.........................................5

5. Comparison of both companies from the above analysis........................................................7

OTHER COMPREHENSIVE INCOME STATEMENT................................................................7

6. Stating items of other comprehensive income statement of both organization......................7

7. Reason for not including items in Profit and Loss statement..................................................8

8. Comparative analysis of other comprehensive income statement..........................................8

9. Performance evaluation must be considered in other comprehensive income (OCI)...........10

ACCOUNTING FOR CORPORATE INCOME TAX..................................................................11

10. Stating tax expenses of both organization...........................................................................11

11. Calculation of effective tax rate..........................................................................................11

12. Comment on deferred tax asset and liabilities....................................................................11

13. Presenting changes in deferred tax asset and liabilities......................................................12

14. Calculating cash tax amount with book tax, deferred tax asset and liabilities....................13

15. Calculating cash tax rate.....................................................................................................13

16. Providing difference among book and cash tax rate...........................................................14

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................1

OWNER'S EQUITY........................................................................................................................1

1. Discussing changes in each component of equity...................................................................1

2. Providing comparative analysis of debt and equity position of both the firms.......................2

CASH FLOW STATEMENT..........................................................................................................4

3. Discussing changes in cash flow items over the past years....................................................4

4. Comparative analysis of broad categories of cash flow statement.........................................5

5. Comparison of both companies from the above analysis........................................................7

OTHER COMPREHENSIVE INCOME STATEMENT................................................................7

6. Stating items of other comprehensive income statement of both organization......................7

7. Reason for not including items in Profit and Loss statement..................................................8

8. Comparative analysis of other comprehensive income statement..........................................8

9. Performance evaluation must be considered in other comprehensive income (OCI)...........10

ACCOUNTING FOR CORPORATE INCOME TAX..................................................................11

10. Stating tax expenses of both organization...........................................................................11

11. Calculation of effective tax rate..........................................................................................11

12. Comment on deferred tax asset and liabilities....................................................................11

13. Presenting changes in deferred tax asset and liabilities......................................................12

14. Calculating cash tax amount with book tax, deferred tax asset and liabilities....................13

15. Calculating cash tax rate.....................................................................................................13

16. Providing difference among book and cash tax rate...........................................................14

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

Corporate accounting can be termed as the major branch which directly deals with

organization's system, preparation of financial statements with its appropriate analysis and

interpretation of fiscal outcomes. The present report will discuss about two public limited

companies which are listed on Australian Securities Exchange as Qantas Airways Limited and

Alliance Aviation Services Limited. Both these organizations are comprised in transportation

industry. This report will state financial statements in detailed aspect with reference to owner's

equity and various alteration from past three years. It will provide comparative analysis of

capital structure of both organization. It will also articulate about cash flow statements and

classification of its broad categories in past three years. In the similar aspect, it would state items

of other comprehensive income statement and reason for not considering it in profit and loss

statement. This report will also show various working on corporate income tax with the latest

financial statements of both companies. It ill calculate effective tax rate and amount by stating

reasons of creating deferred tax asset and liability. Last but not least, it will conclude by stating

variations among cash tax and book tax rate.

OWNER'S EQUITY

1. Discussing changes in each component of equity

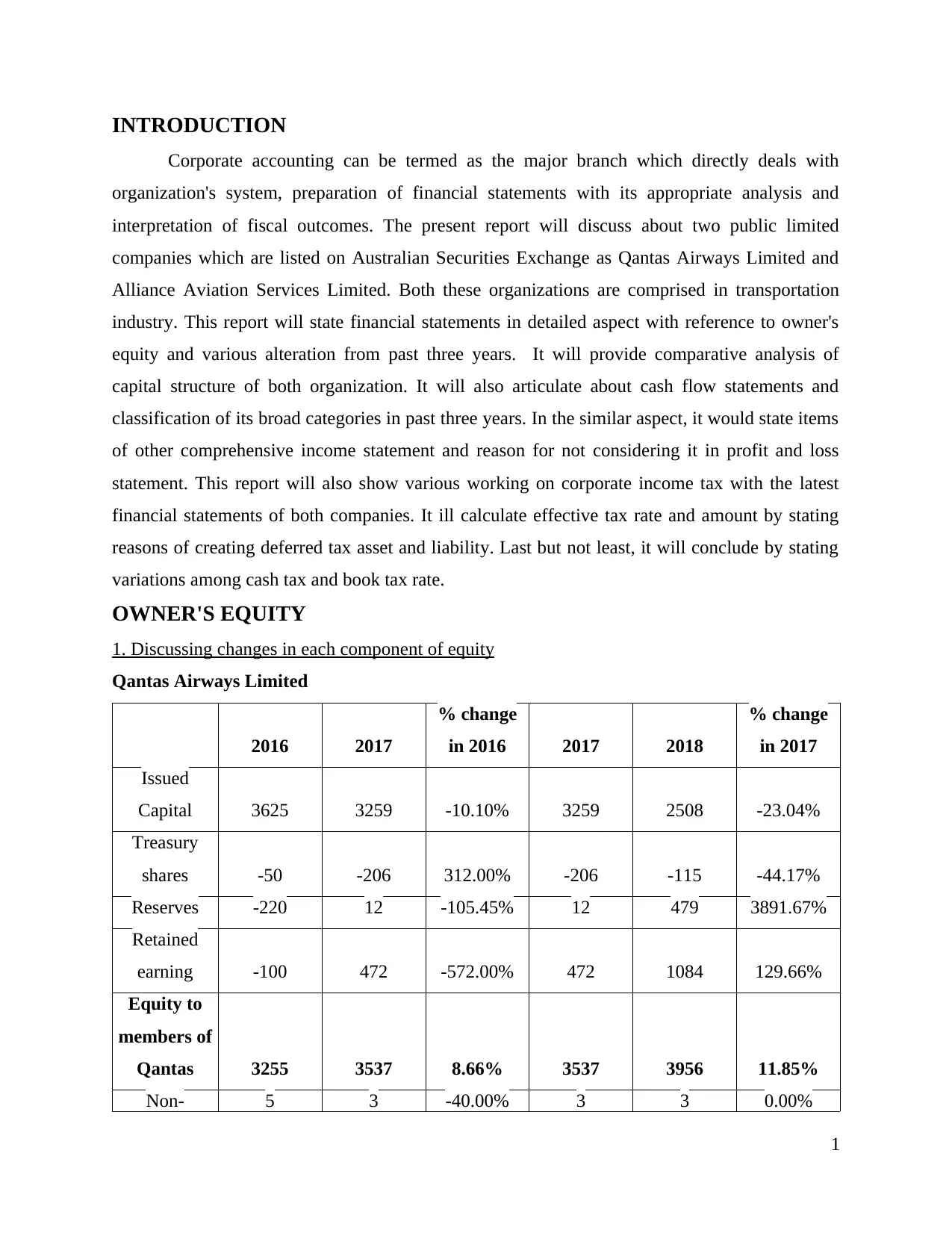

Qantas Airways Limited

2016 2017

% change

in 2016 2017 2018

% change

in 2017

Issued

Capital 3625 3259 -10.10% 3259 2508 -23.04%

Treasury

shares -50 -206 312.00% -206 -115 -44.17%

Reserves -220 12 -105.45% 12 479 3891.67%

Retained

earning -100 472 -572.00% 472 1084 129.66%

Equity to

members of

Qantas 3255 3537 8.66% 3537 3956 11.85%

Non- 5 3 -40.00% 3 3 0.00%

1

Corporate accounting can be termed as the major branch which directly deals with

organization's system, preparation of financial statements with its appropriate analysis and

interpretation of fiscal outcomes. The present report will discuss about two public limited

companies which are listed on Australian Securities Exchange as Qantas Airways Limited and

Alliance Aviation Services Limited. Both these organizations are comprised in transportation

industry. This report will state financial statements in detailed aspect with reference to owner's

equity and various alteration from past three years. It will provide comparative analysis of

capital structure of both organization. It will also articulate about cash flow statements and

classification of its broad categories in past three years. In the similar aspect, it would state items

of other comprehensive income statement and reason for not considering it in profit and loss

statement. This report will also show various working on corporate income tax with the latest

financial statements of both companies. It ill calculate effective tax rate and amount by stating

reasons of creating deferred tax asset and liability. Last but not least, it will conclude by stating

variations among cash tax and book tax rate.

OWNER'S EQUITY

1. Discussing changes in each component of equity

Qantas Airways Limited

2016 2017

% change

in 2016 2017 2018

% change

in 2017

Issued

Capital 3625 3259 -10.10% 3259 2508 -23.04%

Treasury

shares -50 -206 312.00% -206 -115 -44.17%

Reserves -220 12 -105.45% 12 479 3891.67%

Retained

earning -100 472 -572.00% 472 1084 129.66%

Equity to

members of

Qantas 3255 3537 8.66% 3537 3956 11.85%

Non- 5 3 -40.00% 3 3 0.00%

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

controlling

interest

Total Equity 3260 3540 8.59% 3540 3959 11.84%

Interpretation: The above table is depicting changes in owner's equity from year 2016 to

2018 of Qantas Airways limited. It comprises issued capital, treasury shares, retained earnings

and reserves. In the same series, it will exclude non controlling interest for getting outcome of

total equity. The capital which was issued was decreasing by 10.10% from year 2016 to 2017

and its reserves were moving towards positive aspect (Schaltegger, Etxeberria and Ortas, 2017).

By considering aggregate of total equity which is raising by 8.66% in this stated duration. In the

similar context, from year 2107 to 2018 its total equity is increasing by higher proportion of

11.84% as compared to previous year.

Alliance Aviation services Limited

2016 2017

% change

in 2016 2017 2018

% change

in 2017

Contributed

equity 180483 181035 0.31% 181035 183498 1.36%

Reserves -113031 -112333 -0.62% -112333 -112652 0.28%

Retained

earning 59533 75660 27.09% 75660 87016 15.01%

Total Equity 126985 144362 13.68% 144362 157862 9.35%

Interpretation: The above table is indicating each element of total equity of Alliance

Aviation Services Limited which are contributed equity, retained earnings and reserves. From

year 2016 to 2017 its contributed equity and retained earning is moving positively by 0.31% and

27.09% respectively. Aggregately, these elements of equity had given impact on total equity

which increased by 13.68% in year 2017. From year 2017 to 2018, it is increasing from 1.36% of

contributed equity and retained earnings with 15.01%. Hence, total equity is raising by 9.35% in

year 2018 which is lesser than 2017.

2. Providing comparative analysis of debt and equity position of both the firms

2

interest

Total Equity 3260 3540 8.59% 3540 3959 11.84%

Interpretation: The above table is depicting changes in owner's equity from year 2016 to

2018 of Qantas Airways limited. It comprises issued capital, treasury shares, retained earnings

and reserves. In the same series, it will exclude non controlling interest for getting outcome of

total equity. The capital which was issued was decreasing by 10.10% from year 2016 to 2017

and its reserves were moving towards positive aspect (Schaltegger, Etxeberria and Ortas, 2017).

By considering aggregate of total equity which is raising by 8.66% in this stated duration. In the

similar context, from year 2107 to 2018 its total equity is increasing by higher proportion of

11.84% as compared to previous year.

Alliance Aviation services Limited

2016 2017

% change

in 2016 2017 2018

% change

in 2017

Contributed

equity 180483 181035 0.31% 181035 183498 1.36%

Reserves -113031 -112333 -0.62% -112333 -112652 0.28%

Retained

earning 59533 75660 27.09% 75660 87016 15.01%

Total Equity 126985 144362 13.68% 144362 157862 9.35%

Interpretation: The above table is indicating each element of total equity of Alliance

Aviation Services Limited which are contributed equity, retained earnings and reserves. From

year 2016 to 2017 its contributed equity and retained earning is moving positively by 0.31% and

27.09% respectively. Aggregately, these elements of equity had given impact on total equity

which increased by 13.68% in year 2017. From year 2017 to 2018, it is increasing from 1.36% of

contributed equity and retained earnings with 15.01%. Hence, total equity is raising by 9.35% in

year 2018 which is lesser than 2017.

2. Providing comparative analysis of debt and equity position of both the firms

2

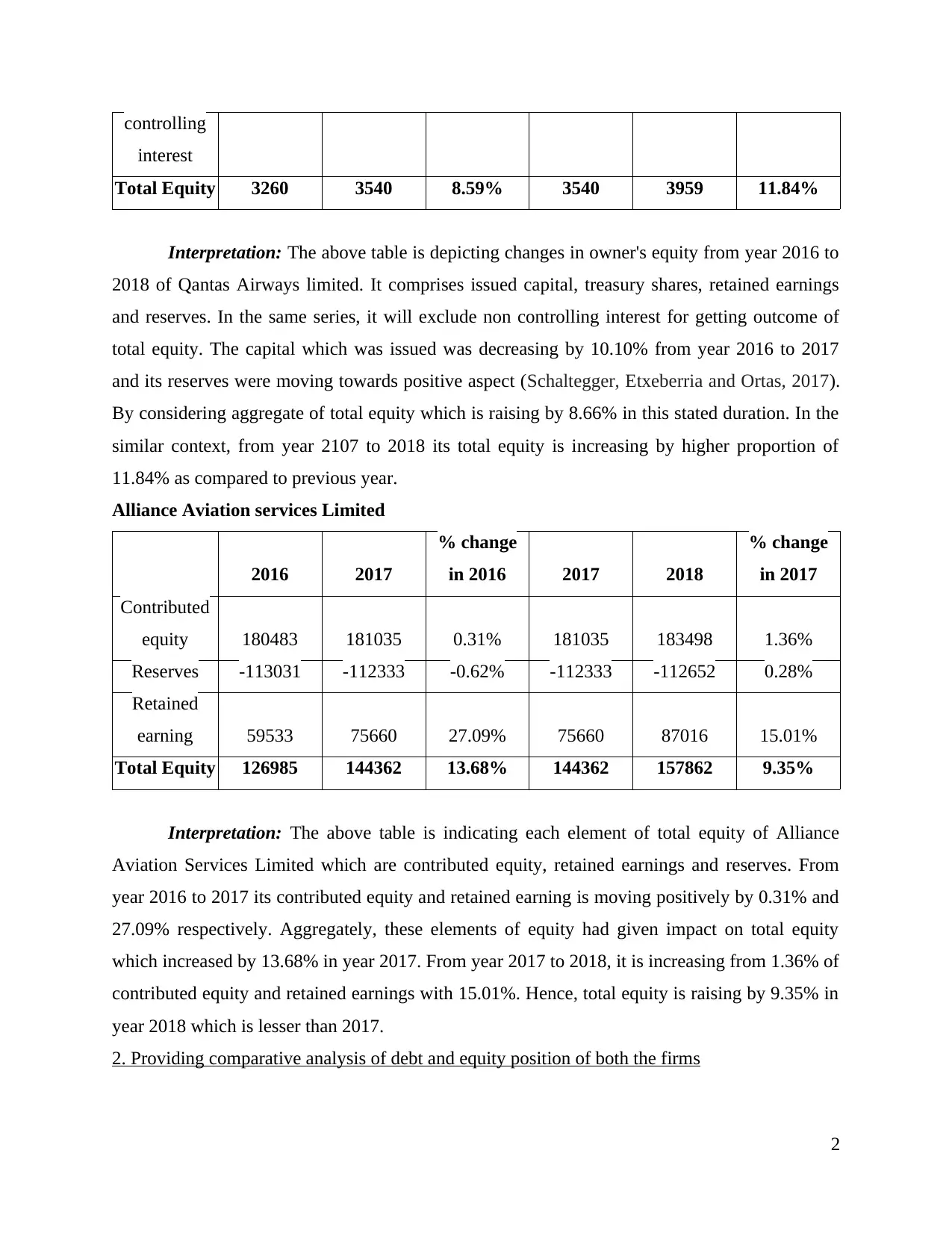

2018 (Million)

Qantas Airways

Limited 2018 (000)

Alliance Aviation

services Limited

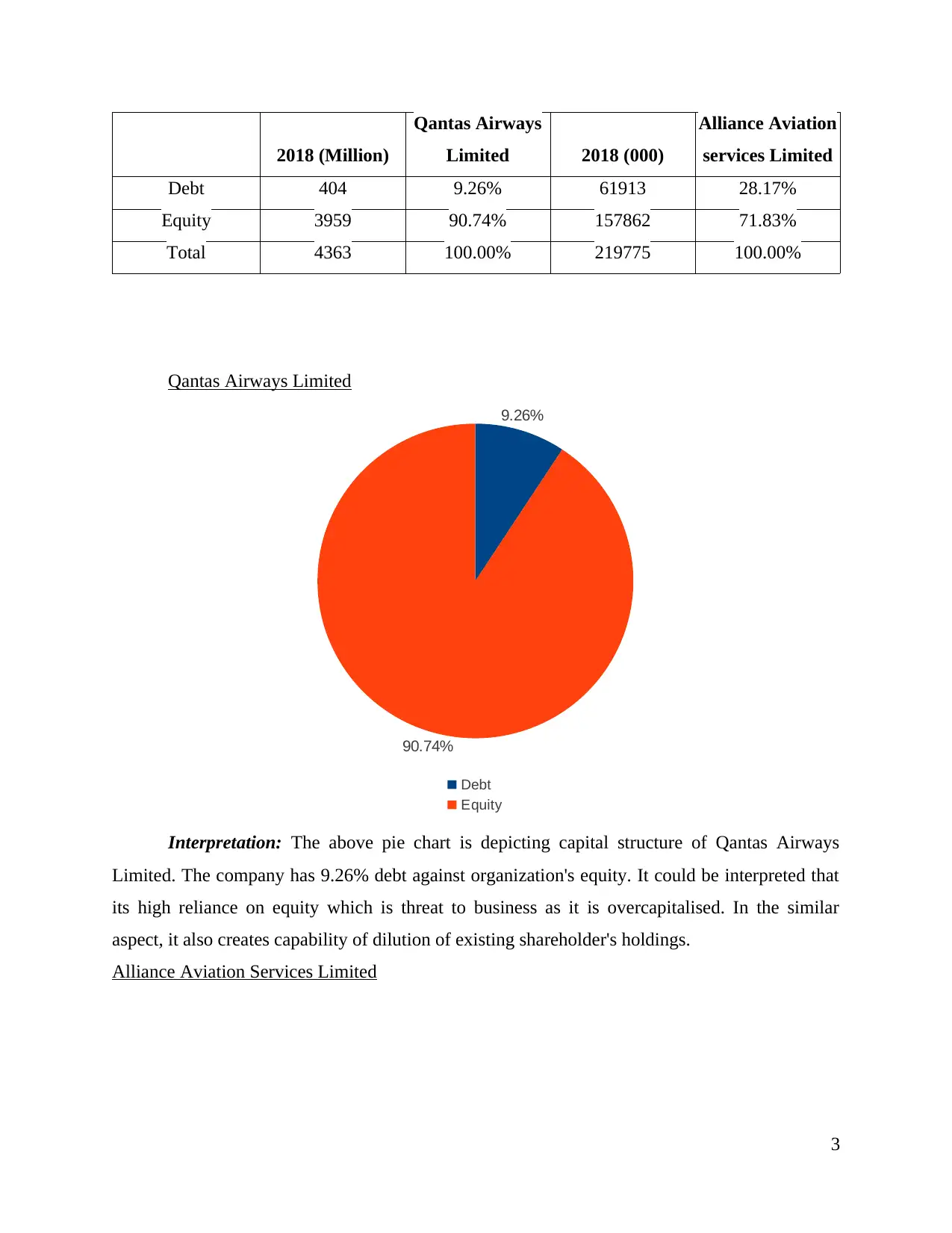

Debt 404 9.26% 61913 28.17%

Equity 3959 90.74% 157862 71.83%

Total 4363 100.00% 219775 100.00%

Qantas Airways Limited

9.26%

90.74%

Debt

Equity

Interpretation: The above pie chart is depicting capital structure of Qantas Airways

Limited. The company has 9.26% debt against organization's equity. It could be interpreted that

its high reliance on equity which is threat to business as it is overcapitalised. In the similar

aspect, it also creates capability of dilution of existing shareholder's holdings.

Alliance Aviation Services Limited

3

Qantas Airways

Limited 2018 (000)

Alliance Aviation

services Limited

Debt 404 9.26% 61913 28.17%

Equity 3959 90.74% 157862 71.83%

Total 4363 100.00% 219775 100.00%

Qantas Airways Limited

9.26%

90.74%

Debt

Equity

Interpretation: The above pie chart is depicting capital structure of Qantas Airways

Limited. The company has 9.26% debt against organization's equity. It could be interpreted that

its high reliance on equity which is threat to business as it is overcapitalised. In the similar

aspect, it also creates capability of dilution of existing shareholder's holdings.

Alliance Aviation Services Limited

3

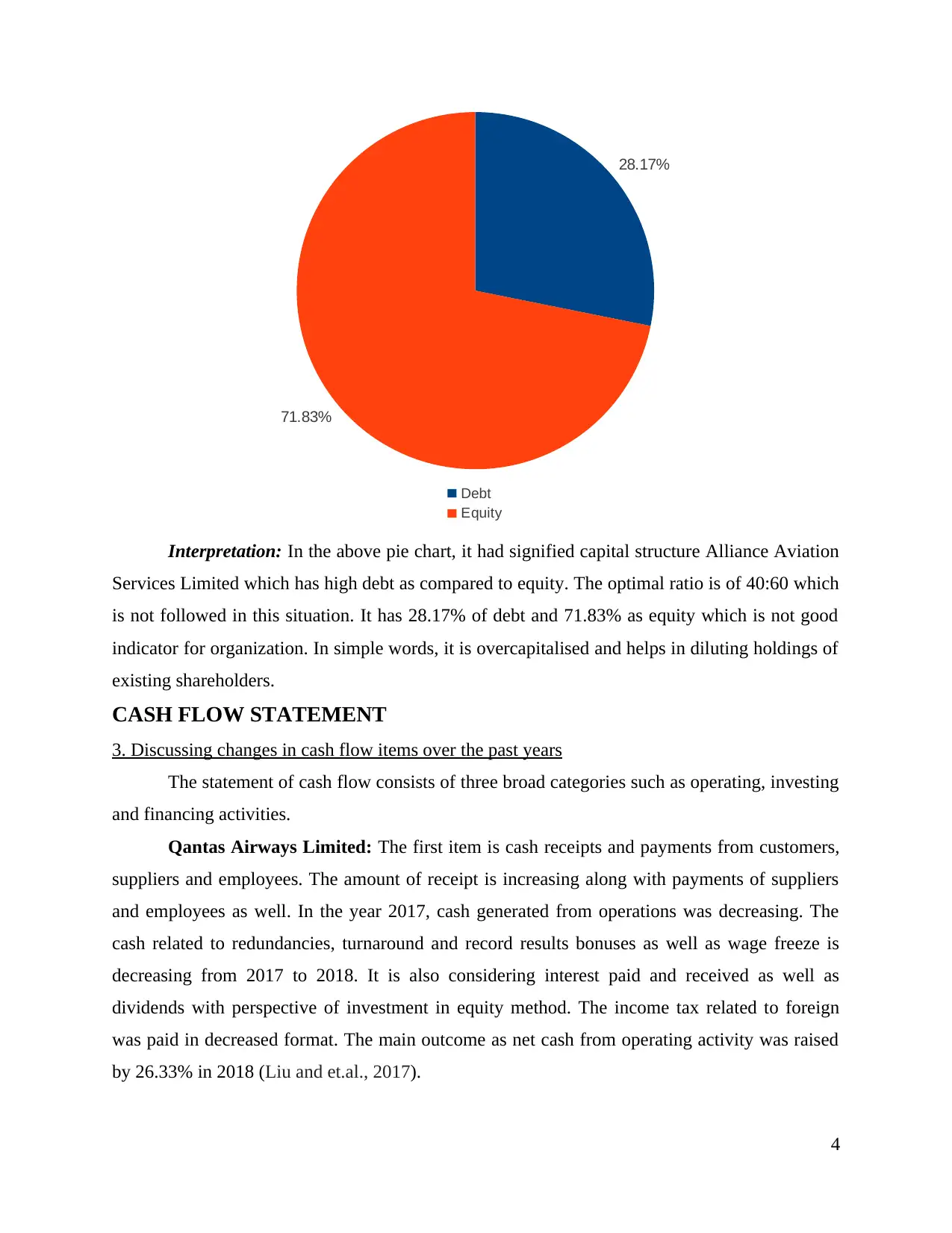

28.17%

71.83%

Debt

Equity

Interpretation: In the above pie chart, it had signified capital structure Alliance Aviation

Services Limited which has high debt as compared to equity. The optimal ratio is of 40:60 which

is not followed in this situation. It has 28.17% of debt and 71.83% as equity which is not good

indicator for organization. In simple words, it is overcapitalised and helps in diluting holdings of

existing shareholders.

CASH FLOW STATEMENT

3. Discussing changes in cash flow items over the past years

The statement of cash flow consists of three broad categories such as operating, investing

and financing activities.

Qantas Airways Limited: The first item is cash receipts and payments from customers,

suppliers and employees. The amount of receipt is increasing along with payments of suppliers

and employees as well. In the year 2017, cash generated from operations was decreasing. The

cash related to redundancies, turnaround and record results bonuses as well as wage freeze is

decreasing from 2017 to 2018. It is also considering interest paid and received as well as

dividends with perspective of investment in equity method. The income tax related to foreign

was paid in decreased format. The main outcome as net cash from operating activity was raised

by 26.33% in 2018 (Liu and et.al., 2017).

4

71.83%

Debt

Equity

Interpretation: In the above pie chart, it had signified capital structure Alliance Aviation

Services Limited which has high debt as compared to equity. The optimal ratio is of 40:60 which

is not followed in this situation. It has 28.17% of debt and 71.83% as equity which is not good

indicator for organization. In simple words, it is overcapitalised and helps in diluting holdings of

existing shareholders.

CASH FLOW STATEMENT

3. Discussing changes in cash flow items over the past years

The statement of cash flow consists of three broad categories such as operating, investing

and financing activities.

Qantas Airways Limited: The first item is cash receipts and payments from customers,

suppliers and employees. The amount of receipt is increasing along with payments of suppliers

and employees as well. In the year 2017, cash generated from operations was decreasing. The

cash related to redundancies, turnaround and record results bonuses as well as wage freeze is

decreasing from 2017 to 2018. It is also considering interest paid and received as well as

dividends with perspective of investment in equity method. The income tax related to foreign

was paid in decreased format. The main outcome as net cash from operating activity was raised

by 26.33% in 2018 (Liu and et.al., 2017).

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

In context of investing activity, it will consider payments for intangible assets, plant and

equipment which is raised by $591 million. Along with this, interest paid and capitalised with

qualifying asset is decreasing with 41 million. It has stated proceeds from disposal of controlled

entity, property, equipment and plant. As controlled entity was absence in 2017 and its disposal

is reduced directly by 50%. The payments for investment under equity method is reduced as it is

an aircraft company. It will exclude aircraft operating lease refinancing which is decreased by

301 million. Hence, net cash used for the purpose of investing activity is increased by 7.58%.

In the similar aspect, cash flow from financing activity is very important for Qantas

Airways Limited because it is increasing by more than 50%. It consists of payments for share

buyback and treasury shares which is increasing and decreasing respectively. It will also consider

proceeds and repayments of borrowing which are changing in a positive aspect. The net receipts

about aircraft security deposits and debt in context of hedge was absence in 2018 as it was $8

million in 2017. The dividends paid to shareholders are decreasing and to non-controlling

interest was nil in 2018 but in 2017, it was $3 million.

Alliance Aviation Services limited: The cash in context of operating activity is

increasing by 76.31%. It consists of receipts via customers and payments to suppliers which is

increasing by huge proportion. The amount of interest received and paid is considered as they

both have huge variation in which payment is decreased and receipt of interest is increased by

$73000. Further, it will also include payment of income tax which is approx. similar to that of

previous year (Annual Report of Alliance Airlines, 2017).

In the similar aspect, cash from investing activity considers payments via plant,

equipment and property is increased from previous year with absence of its proceeds. The cash

outflow from investing activity is increasing but with small proportion of 10.37% as compared to

both; operating and financing activities.

Alliance Aviation Services Limited has also presence of financing activity which is

increasing from huge percentage as 113.33%. It comprises proceeds and repayments of

borrowings along with the dividend paid as well.

4. Comparative analysis of broad categories of cash flow statement

Qantas

Airways

Limited

2016 (base

year) 2017 % 2017

2017 (base

year) 2018 % 2018

5

equipment which is raised by $591 million. Along with this, interest paid and capitalised with

qualifying asset is decreasing with 41 million. It has stated proceeds from disposal of controlled

entity, property, equipment and plant. As controlled entity was absence in 2017 and its disposal

is reduced directly by 50%. The payments for investment under equity method is reduced as it is

an aircraft company. It will exclude aircraft operating lease refinancing which is decreased by

301 million. Hence, net cash used for the purpose of investing activity is increased by 7.58%.

In the similar aspect, cash flow from financing activity is very important for Qantas

Airways Limited because it is increasing by more than 50%. It consists of payments for share

buyback and treasury shares which is increasing and decreasing respectively. It will also consider

proceeds and repayments of borrowing which are changing in a positive aspect. The net receipts

about aircraft security deposits and debt in context of hedge was absence in 2018 as it was $8

million in 2017. The dividends paid to shareholders are decreasing and to non-controlling

interest was nil in 2018 but in 2017, it was $3 million.

Alliance Aviation Services limited: The cash in context of operating activity is

increasing by 76.31%. It consists of receipts via customers and payments to suppliers which is

increasing by huge proportion. The amount of interest received and paid is considered as they

both have huge variation in which payment is decreased and receipt of interest is increased by

$73000. Further, it will also include payment of income tax which is approx. similar to that of

previous year (Annual Report of Alliance Airlines, 2017).

In the similar aspect, cash from investing activity considers payments via plant,

equipment and property is increased from previous year with absence of its proceeds. The cash

outflow from investing activity is increasing but with small proportion of 10.37% as compared to

both; operating and financing activities.

Alliance Aviation Services Limited has also presence of financing activity which is

increasing from huge percentage as 113.33%. It comprises proceeds and repayments of

borrowings along with the dividend paid as well.

4. Comparative analysis of broad categories of cash flow statement

Qantas

Airways

Limited

2016 (base

year) 2017 % 2017

2017 (base

year) 2018 % 2018

5

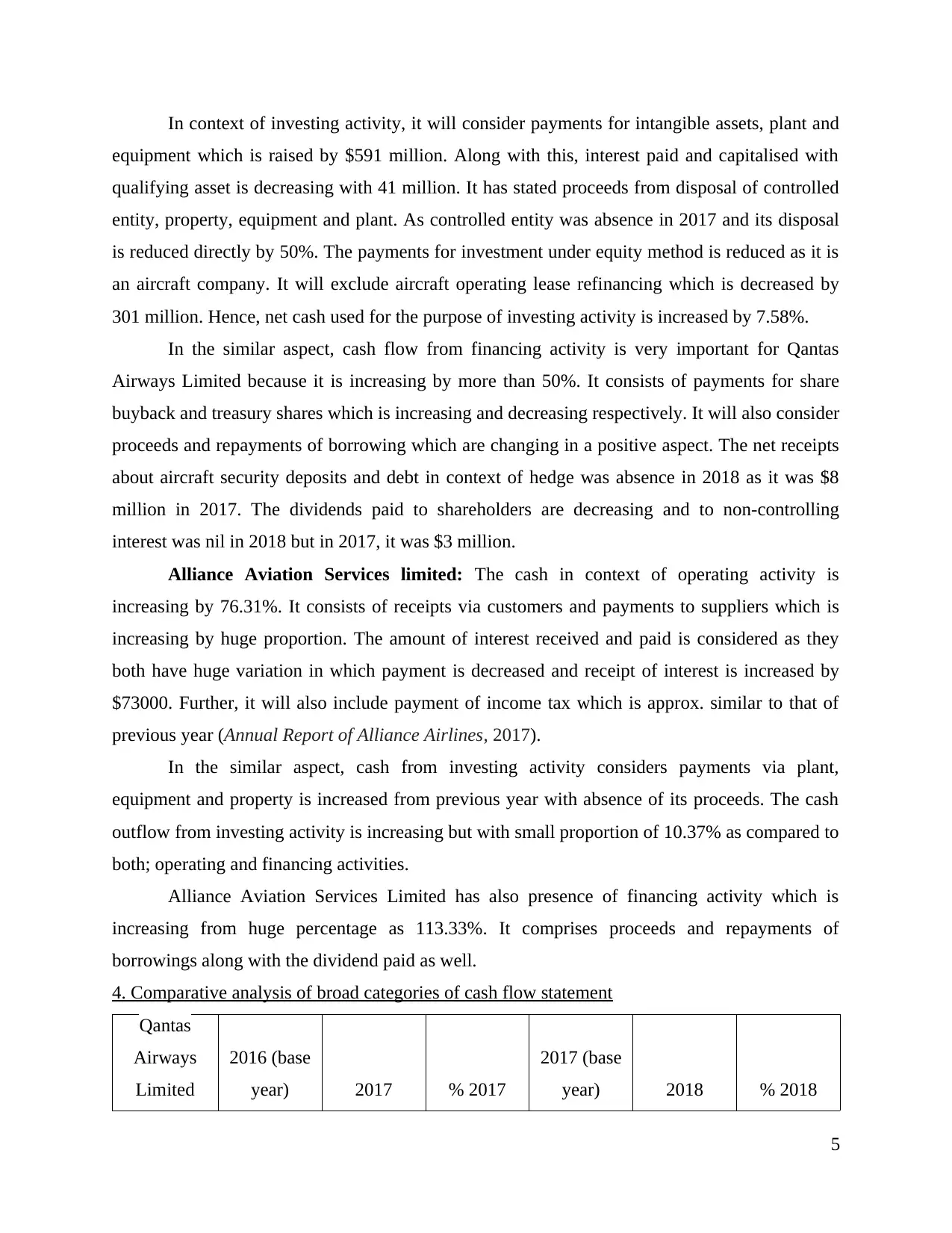

Net cash

from

operating

activity 2819 2704 -4.08% 2704 3416 26.33%

Net cash

from

investing

activity 1923 2046 6.40% 2046 2201 7.58%

Net cash

from

financing

activity 929 854 -8.07% 854 1296 51.76%

Alliance

aviation

Services

Limited 2016 2017 % 2017 2018 %

Net cash

from

operating

activity 25486 21702 -14.85% 21702 38263 76.31%

Net cash

from

investing

activity 18500 13463 -27.23% 13463 14859 10.37%

Net cash

from

financing

activity 5492 6917 25.95% 6917 14756 113.33%

6

from

operating

activity 2819 2704 -4.08% 2704 3416 26.33%

Net cash

from

investing

activity 1923 2046 6.40% 2046 2201 7.58%

Net cash

from

financing

activity 929 854 -8.07% 854 1296 51.76%

Alliance

aviation

Services

Limited 2016 2017 % 2017 2018 %

Net cash

from

operating

activity 25486 21702 -14.85% 21702 38263 76.31%

Net cash

from

investing

activity 18500 13463 -27.23% 13463 14859 10.37%

Net cash

from

financing

activity 5492 6917 25.95% 6917 14756 113.33%

6

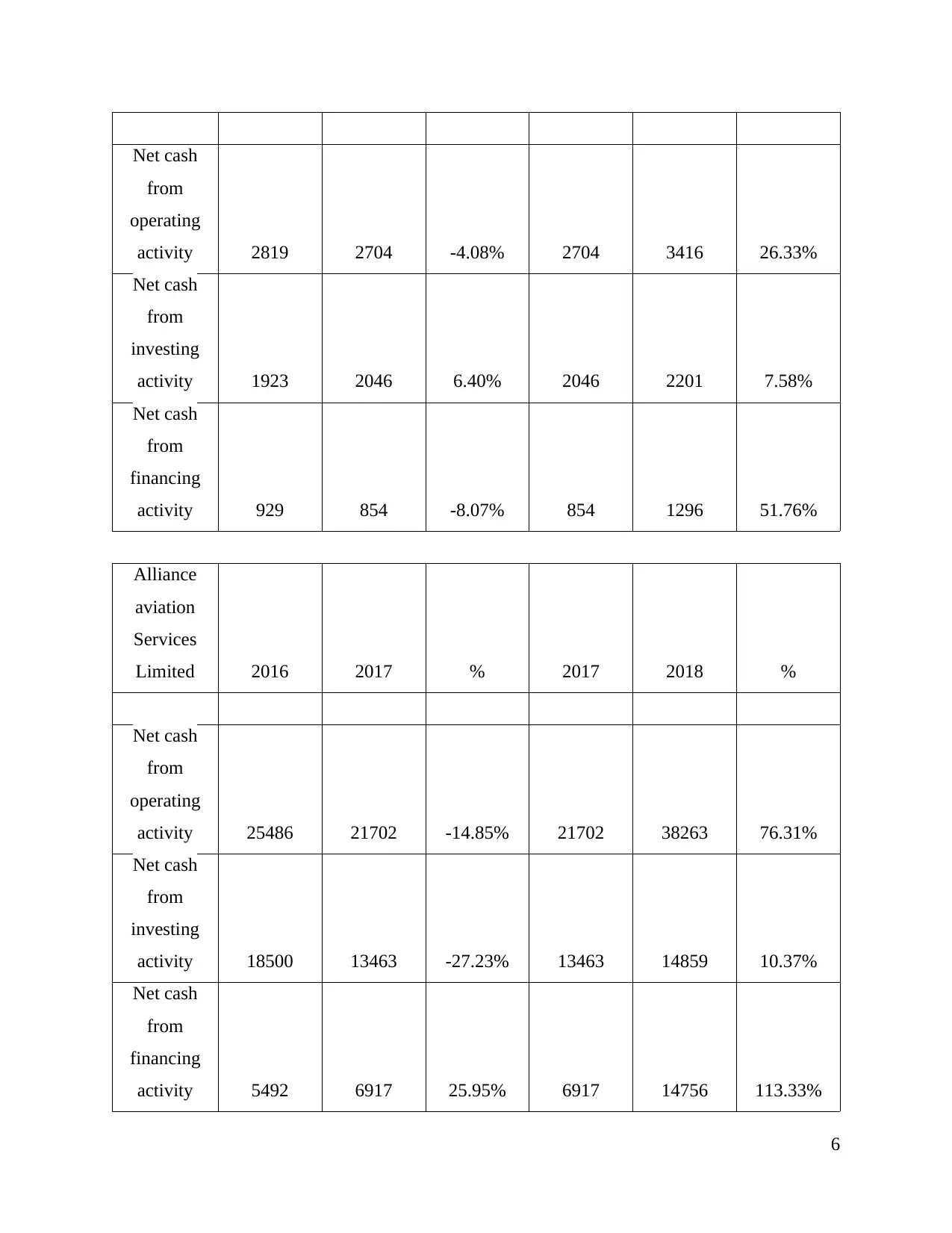

Interpretation: The above tables are signifying three broad categories of cash flow

statement on basis of both organization. It could be observed that, cash generated from operating

activities is higher than compared to both activities. While observing change, Qantas Airways

Limited had shown huge change in financing activity which is more than 50% and Alliance

Aviation services Limited with 113.33% in similar category.

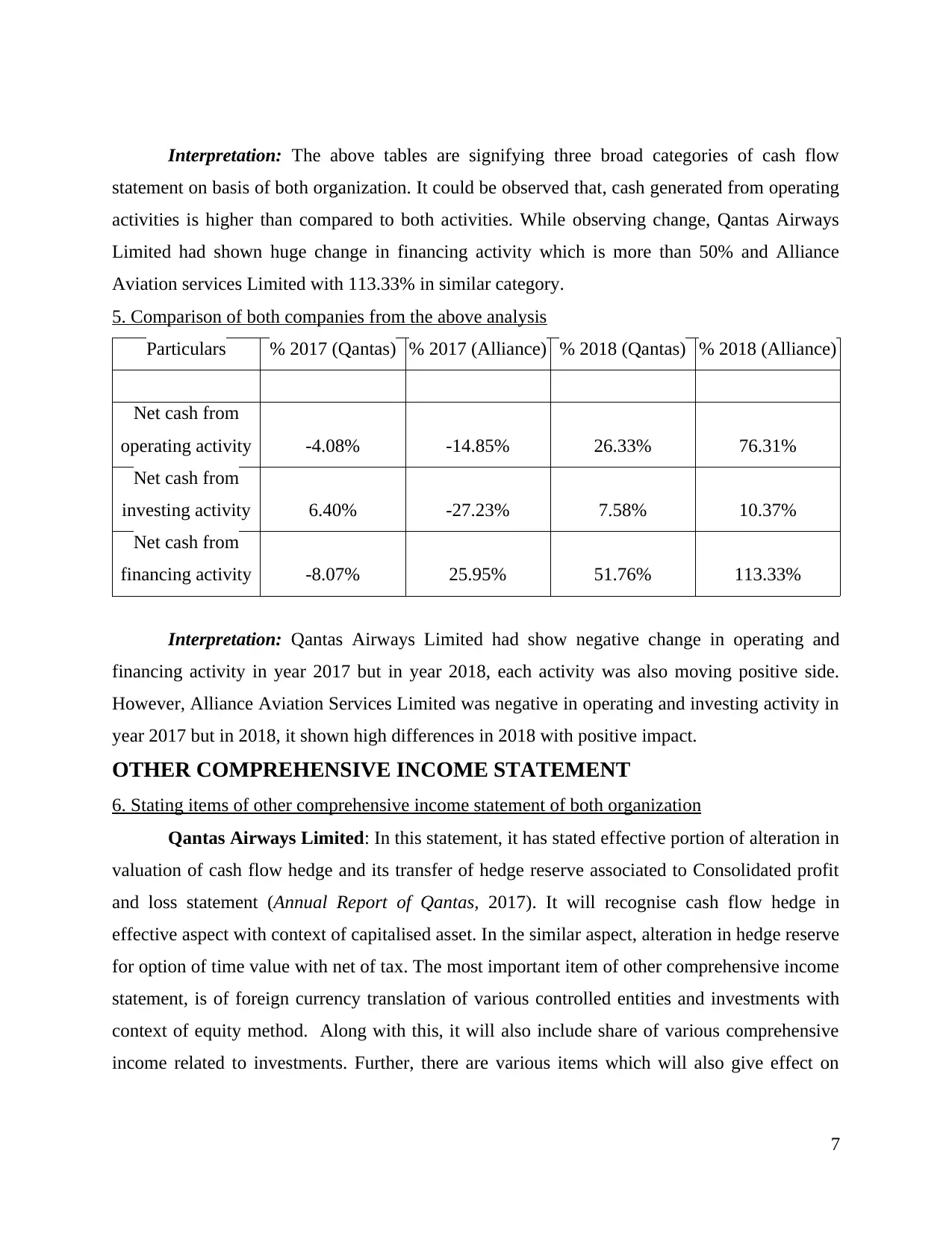

5. Comparison of both companies from the above analysis

Particulars % 2017 (Qantas) % 2017 (Alliance) % 2018 (Qantas) % 2018 (Alliance)

Net cash from

operating activity -4.08% -14.85% 26.33% 76.31%

Net cash from

investing activity 6.40% -27.23% 7.58% 10.37%

Net cash from

financing activity -8.07% 25.95% 51.76% 113.33%

Interpretation: Qantas Airways Limited had show negative change in operating and

financing activity in year 2017 but in year 2018, each activity was also moving positive side.

However, Alliance Aviation Services Limited was negative in operating and investing activity in

year 2017 but in 2018, it shown high differences in 2018 with positive impact.

OTHER COMPREHENSIVE INCOME STATEMENT

6. Stating items of other comprehensive income statement of both organization

Qantas Airways Limited: In this statement, it has stated effective portion of alteration in

valuation of cash flow hedge and its transfer of hedge reserve associated to Consolidated profit

and loss statement (Annual Report of Qantas, 2017). It will recognise cash flow hedge in

effective aspect with context of capitalised asset. In the similar aspect, alteration in hedge reserve

for option of time value with net of tax. The most important item of other comprehensive income

statement, is of foreign currency translation of various controlled entities and investments with

context of equity method. Along with this, it will also include share of various comprehensive

income related to investments. Further, there are various items which will also give effect on

7

statement on basis of both organization. It could be observed that, cash generated from operating

activities is higher than compared to both activities. While observing change, Qantas Airways

Limited had shown huge change in financing activity which is more than 50% and Alliance

Aviation services Limited with 113.33% in similar category.

5. Comparison of both companies from the above analysis

Particulars % 2017 (Qantas) % 2017 (Alliance) % 2018 (Qantas) % 2018 (Alliance)

Net cash from

operating activity -4.08% -14.85% 26.33% 76.31%

Net cash from

investing activity 6.40% -27.23% 7.58% 10.37%

Net cash from

financing activity -8.07% 25.95% 51.76% 113.33%

Interpretation: Qantas Airways Limited had show negative change in operating and

financing activity in year 2017 but in year 2018, each activity was also moving positive side.

However, Alliance Aviation Services Limited was negative in operating and investing activity in

year 2017 but in 2018, it shown high differences in 2018 with positive impact.

OTHER COMPREHENSIVE INCOME STATEMENT

6. Stating items of other comprehensive income statement of both organization

Qantas Airways Limited: In this statement, it has stated effective portion of alteration in

valuation of cash flow hedge and its transfer of hedge reserve associated to Consolidated profit

and loss statement (Annual Report of Qantas, 2017). It will recognise cash flow hedge in

effective aspect with context of capitalised asset. In the similar aspect, alteration in hedge reserve

for option of time value with net of tax. The most important item of other comprehensive income

statement, is of foreign currency translation of various controlled entities and investments with

context of equity method. Along with this, it will also include share of various comprehensive

income related to investments. Further, there are various items which will also give effect on

7

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

comprehensive income statement such as actuarial gains and fair value advantage on investment

as well.

Alliance Aviation Services Limited: It had considered cash flow hedge reserve which is

applicable for recording losses and gains with context of hedging instrument in cash flow. The

amount would be reclassified to loss or profit which is linked with hedge transaction which

impact both. In the similar aspect, it will also state expense of income tax relate to cash flow

hedge reserve (Annual Report of Alliance Airlines, 2018).

7. Reason for not including items in Profit and Loss statement

It is considered as very expansive view of net profit. In previous year, alterations in net

profit could be deemed outside with context of it core operations. It is volatile and allowed for

flowing towards shareholder's equity. It includes those expenses, losses, revenues and gains

which are not yet realized. Most common example is bond portfolio which is not yet sold so in

this context interim adjustments are considered in this other comprehensive income statement.

The items which changes business entity's equity without engaging investment of owner

or creation of its distribution. It does not affect net income and retained earning of organization

as well. The items of OCI of current year will impact alteration in accumulate other

comprehensive income which is replicated as other element of stockholder's equity.

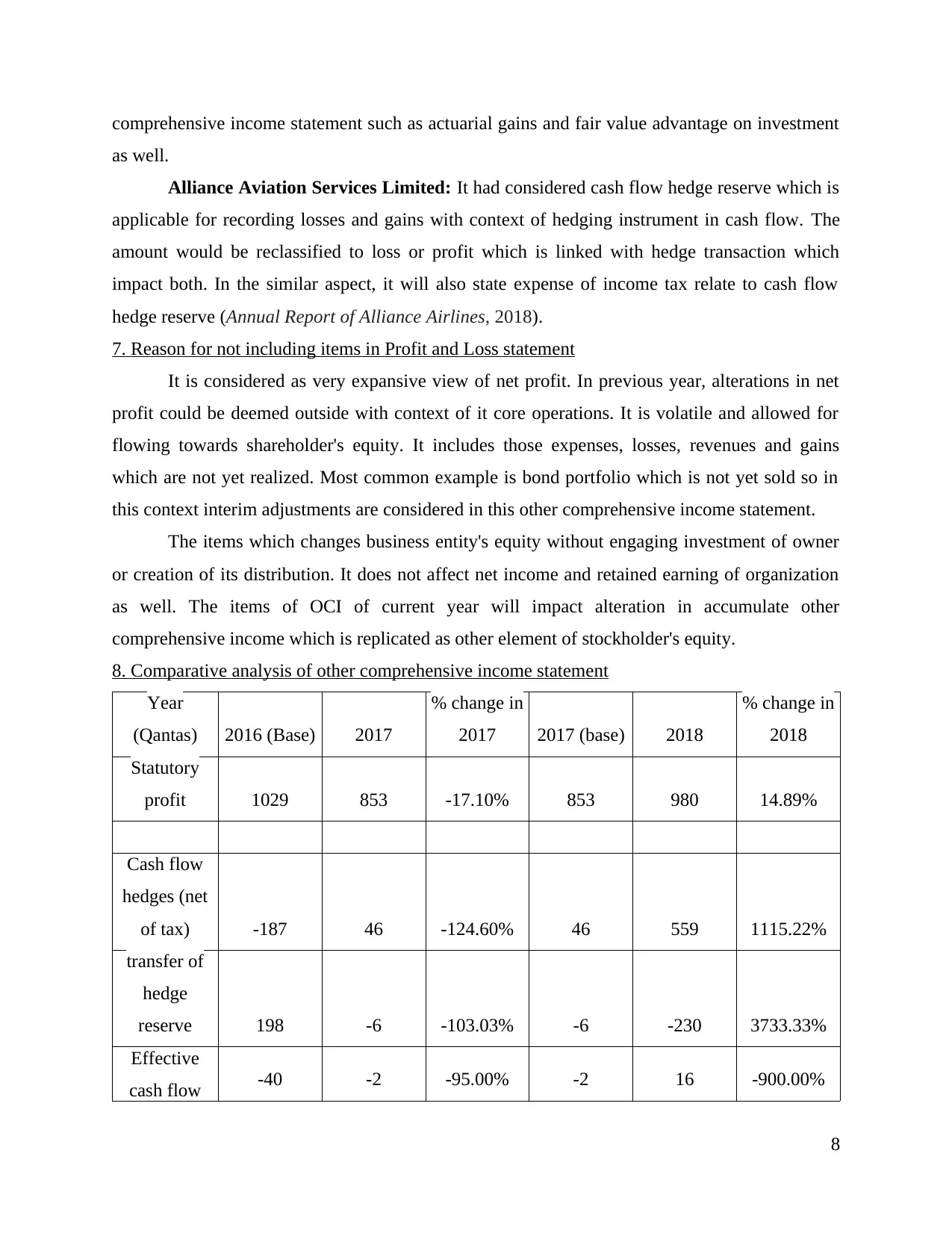

8. Comparative analysis of other comprehensive income statement

Year

(Qantas) 2016 (Base) 2017

% change in

2017 2017 (base) 2018

% change in

2018

Statutory

profit 1029 853 -17.10% 853 980 14.89%

Cash flow

hedges (net

of tax) -187 46 -124.60% 46 559 1115.22%

transfer of

hedge

reserve 198 -6 -103.03% -6 -230 3733.33%

Effective

cash flow -40 -2 -95.00% -2 16 -900.00%

8

as well.

Alliance Aviation Services Limited: It had considered cash flow hedge reserve which is

applicable for recording losses and gains with context of hedging instrument in cash flow. The

amount would be reclassified to loss or profit which is linked with hedge transaction which

impact both. In the similar aspect, it will also state expense of income tax relate to cash flow

hedge reserve (Annual Report of Alliance Airlines, 2018).

7. Reason for not including items in Profit and Loss statement

It is considered as very expansive view of net profit. In previous year, alterations in net

profit could be deemed outside with context of it core operations. It is volatile and allowed for

flowing towards shareholder's equity. It includes those expenses, losses, revenues and gains

which are not yet realized. Most common example is bond portfolio which is not yet sold so in

this context interim adjustments are considered in this other comprehensive income statement.

The items which changes business entity's equity without engaging investment of owner

or creation of its distribution. It does not affect net income and retained earning of organization

as well. The items of OCI of current year will impact alteration in accumulate other

comprehensive income which is replicated as other element of stockholder's equity.

8. Comparative analysis of other comprehensive income statement

Year

(Qantas) 2016 (Base) 2017

% change in

2017 2017 (base) 2018

% change in

2018

Statutory

profit 1029 853 -17.10% 853 980 14.89%

Cash flow

hedges (net

of tax) -187 46 -124.60% 46 559 1115.22%

transfer of

hedge

reserve 198 -6 -103.03% -6 -230 3733.33%

Effective

cash flow -40 -2 -95.00% -2 16 -900.00%

8

hedge

Changes in

hedge

reserve 35 -22 -162.86% -22 51 -331.82%

Foreign

currency

translation of

controlled

entities 2 -4 -300.00% -4 3 -175.00%

Foreign

currency

translation of

investments

under the

equity

method 24 -9 -137.50% -9 -3 -66.67%

Share of

other

comprehensi

ve

income/(loss)

of

investments -2 2 -200.00% 2 4 100.00%

Items that

will not

subsequently

be

reclassified

to profit or

loss

Benefit of -209 175 -183.73% 175 84 -52.00%

9

Changes in

hedge

reserve 35 -22 -162.86% -22 51 -331.82%

Foreign

currency

translation of

controlled

entities 2 -4 -300.00% -4 3 -175.00%

Foreign

currency

translation of

investments

under the

equity

method 24 -9 -137.50% -9 -3 -66.67%

Share of

other

comprehensi

ve

income/(loss)

of

investments -2 2 -200.00% 2 4 100.00%

Items that

will not

subsequently

be

reclassified

to profit or

loss

Benefit of -209 175 -183.73% 175 84 -52.00%

9

actuarial

gain(net tax)

Fair value

gains on

investment

(net tax) 0 0 0.00% 0 1 0.00%

Other

comprehensi

ve income -179 180 -200.56% 180 485 169.44%

Total

comprehensi

ve income 850 1033 21.53% 1033 1465 41.82%

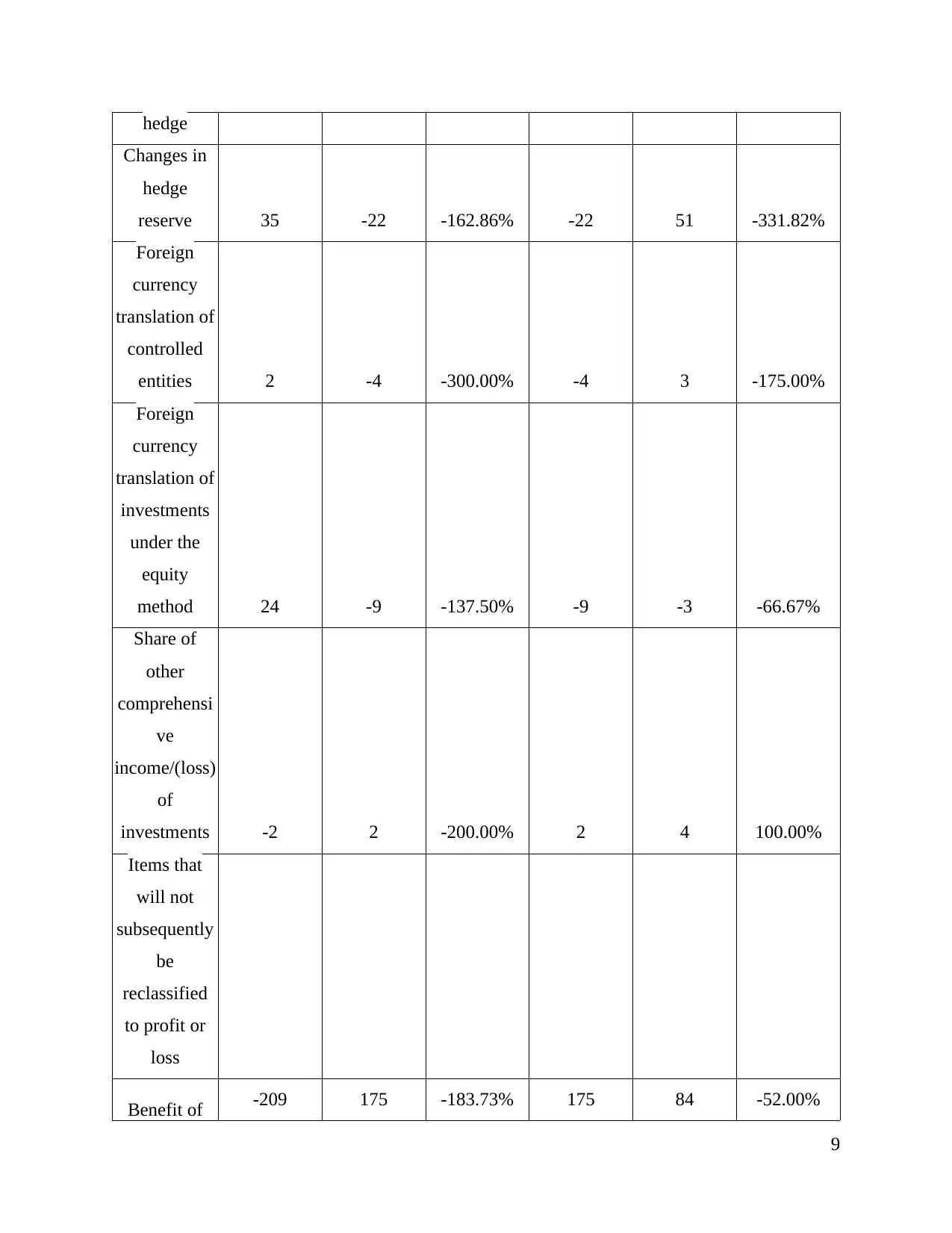

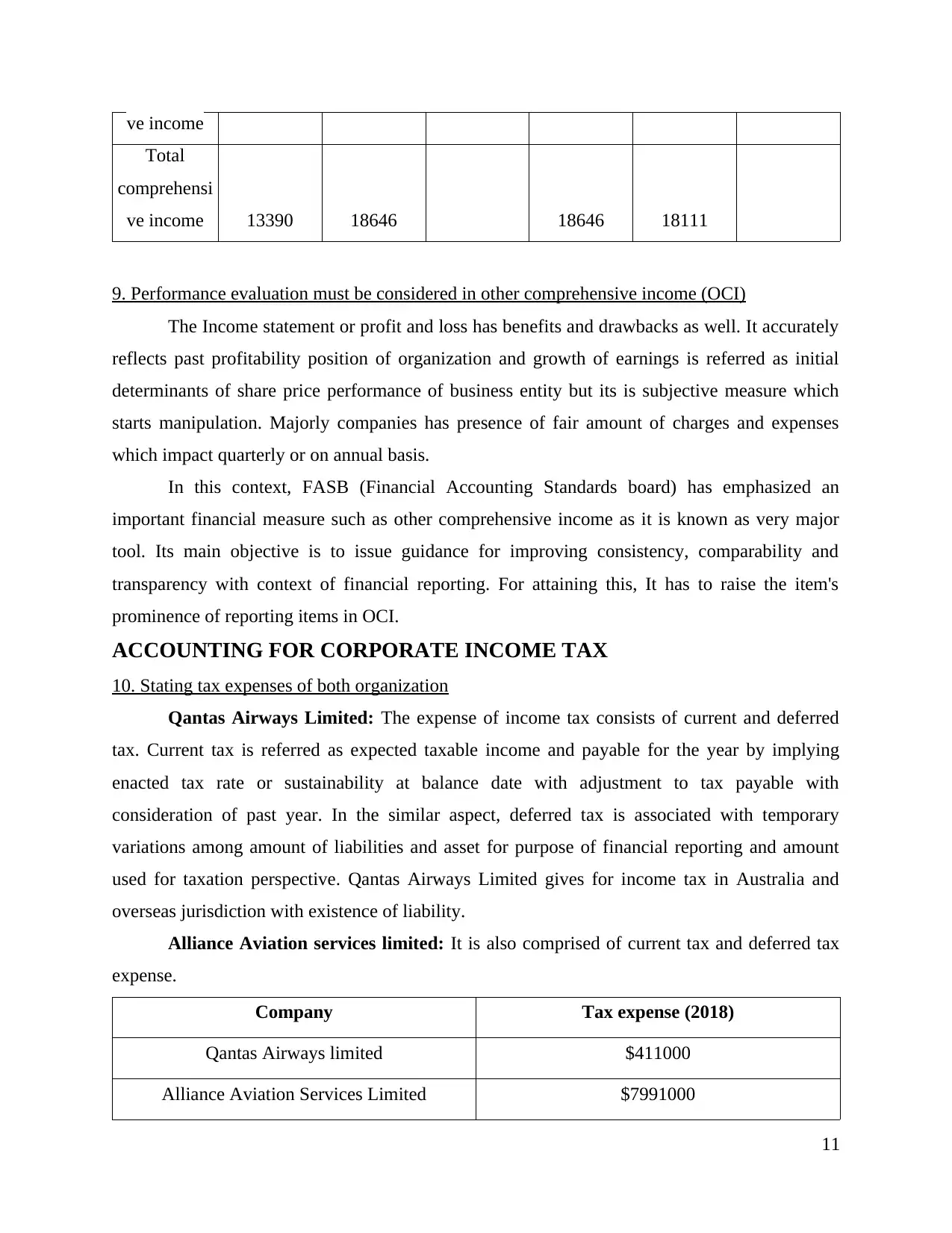

Alliance Aviation services Limited

Year

(Alliance) 2016 (Base) 2017

% change in

2017 2017 (base) 2018

% change in

2018

Profit 13489 18547 37.50% 18547 18111 -2.35%

Other

comprehensi

ve income

Items

classified in

loss or profit

Fair value of

cash flow

hedge

(change) -142 142 -200.00% 142 0 -100.00%

Income tax 43 -43 -200.00% -43 0

Other

comprehensi -99 99 -200.00% 99 0 -100.00%

10

gain(net tax)

Fair value

gains on

investment

(net tax) 0 0 0.00% 0 1 0.00%

Other

comprehensi

ve income -179 180 -200.56% 180 485 169.44%

Total

comprehensi

ve income 850 1033 21.53% 1033 1465 41.82%

Alliance Aviation services Limited

Year

(Alliance) 2016 (Base) 2017

% change in

2017 2017 (base) 2018

% change in

2018

Profit 13489 18547 37.50% 18547 18111 -2.35%

Other

comprehensi

ve income

Items

classified in

loss or profit

Fair value of

cash flow

hedge

(change) -142 142 -200.00% 142 0 -100.00%

Income tax 43 -43 -200.00% -43 0

Other

comprehensi -99 99 -200.00% 99 0 -100.00%

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ve income

Total

comprehensi

ve income 13390 18646 18646 18111

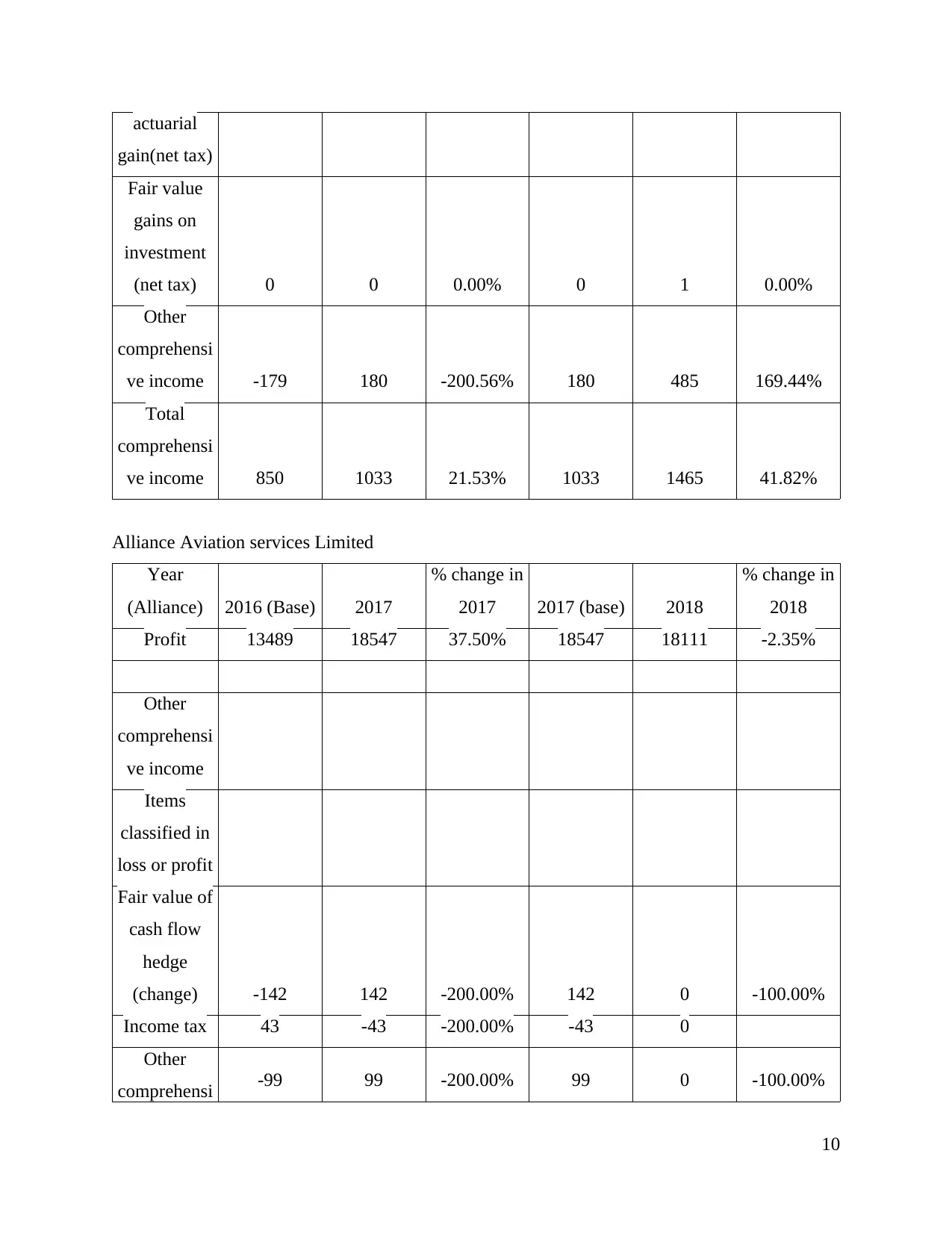

9. Performance evaluation must be considered in other comprehensive income (OCI)

The Income statement or profit and loss has benefits and drawbacks as well. It accurately

reflects past profitability position of organization and growth of earnings is referred as initial

determinants of share price performance of business entity but its is subjective measure which

starts manipulation. Majorly companies has presence of fair amount of charges and expenses

which impact quarterly or on annual basis.

In this context, FASB (Financial Accounting Standards board) has emphasized an

important financial measure such as other comprehensive income as it is known as very major

tool. Its main objective is to issue guidance for improving consistency, comparability and

transparency with context of financial reporting. For attaining this, It has to raise the item's

prominence of reporting items in OCI.

ACCOUNTING FOR CORPORATE INCOME TAX

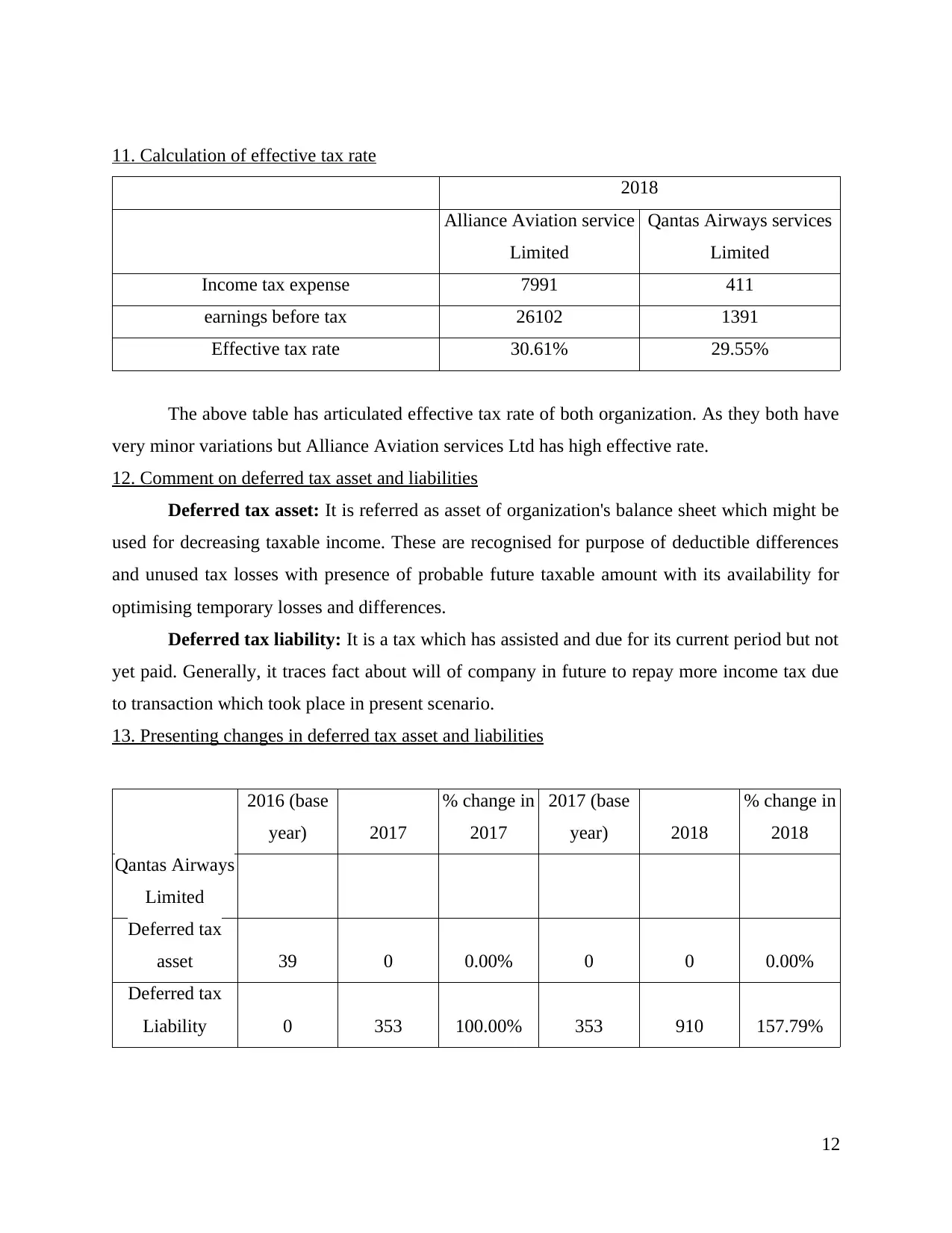

10. Stating tax expenses of both organization

Qantas Airways Limited: The expense of income tax consists of current and deferred

tax. Current tax is referred as expected taxable income and payable for the year by implying

enacted tax rate or sustainability at balance date with adjustment to tax payable with

consideration of past year. In the similar aspect, deferred tax is associated with temporary

variations among amount of liabilities and asset for purpose of financial reporting and amount

used for taxation perspective. Qantas Airways Limited gives for income tax in Australia and

overseas jurisdiction with existence of liability.

Alliance Aviation services limited: It is also comprised of current tax and deferred tax

expense.

Company Tax expense (2018)

Qantas Airways limited $411000

Alliance Aviation Services Limited $7991000

11

Total

comprehensi

ve income 13390 18646 18646 18111

9. Performance evaluation must be considered in other comprehensive income (OCI)

The Income statement or profit and loss has benefits and drawbacks as well. It accurately

reflects past profitability position of organization and growth of earnings is referred as initial

determinants of share price performance of business entity but its is subjective measure which

starts manipulation. Majorly companies has presence of fair amount of charges and expenses

which impact quarterly or on annual basis.

In this context, FASB (Financial Accounting Standards board) has emphasized an

important financial measure such as other comprehensive income as it is known as very major

tool. Its main objective is to issue guidance for improving consistency, comparability and

transparency with context of financial reporting. For attaining this, It has to raise the item's

prominence of reporting items in OCI.

ACCOUNTING FOR CORPORATE INCOME TAX

10. Stating tax expenses of both organization

Qantas Airways Limited: The expense of income tax consists of current and deferred

tax. Current tax is referred as expected taxable income and payable for the year by implying

enacted tax rate or sustainability at balance date with adjustment to tax payable with

consideration of past year. In the similar aspect, deferred tax is associated with temporary

variations among amount of liabilities and asset for purpose of financial reporting and amount

used for taxation perspective. Qantas Airways Limited gives for income tax in Australia and

overseas jurisdiction with existence of liability.

Alliance Aviation services limited: It is also comprised of current tax and deferred tax

expense.

Company Tax expense (2018)

Qantas Airways limited $411000

Alliance Aviation Services Limited $7991000

11

11. Calculation of effective tax rate

2018

Alliance Aviation service

Limited

Qantas Airways services

Limited

Income tax expense 7991 411

earnings before tax 26102 1391

Effective tax rate 30.61% 29.55%

The above table has articulated effective tax rate of both organization. As they both have

very minor variations but Alliance Aviation services Ltd has high effective rate.

12. Comment on deferred tax asset and liabilities

Deferred tax asset: It is referred as asset of organization's balance sheet which might be

used for decreasing taxable income. These are recognised for purpose of deductible differences

and unused tax losses with presence of probable future taxable amount with its availability for

optimising temporary losses and differences.

Deferred tax liability: It is a tax which has assisted and due for its current period but not

yet paid. Generally, it traces fact about will of company in future to repay more income tax due

to transaction which took place in present scenario.

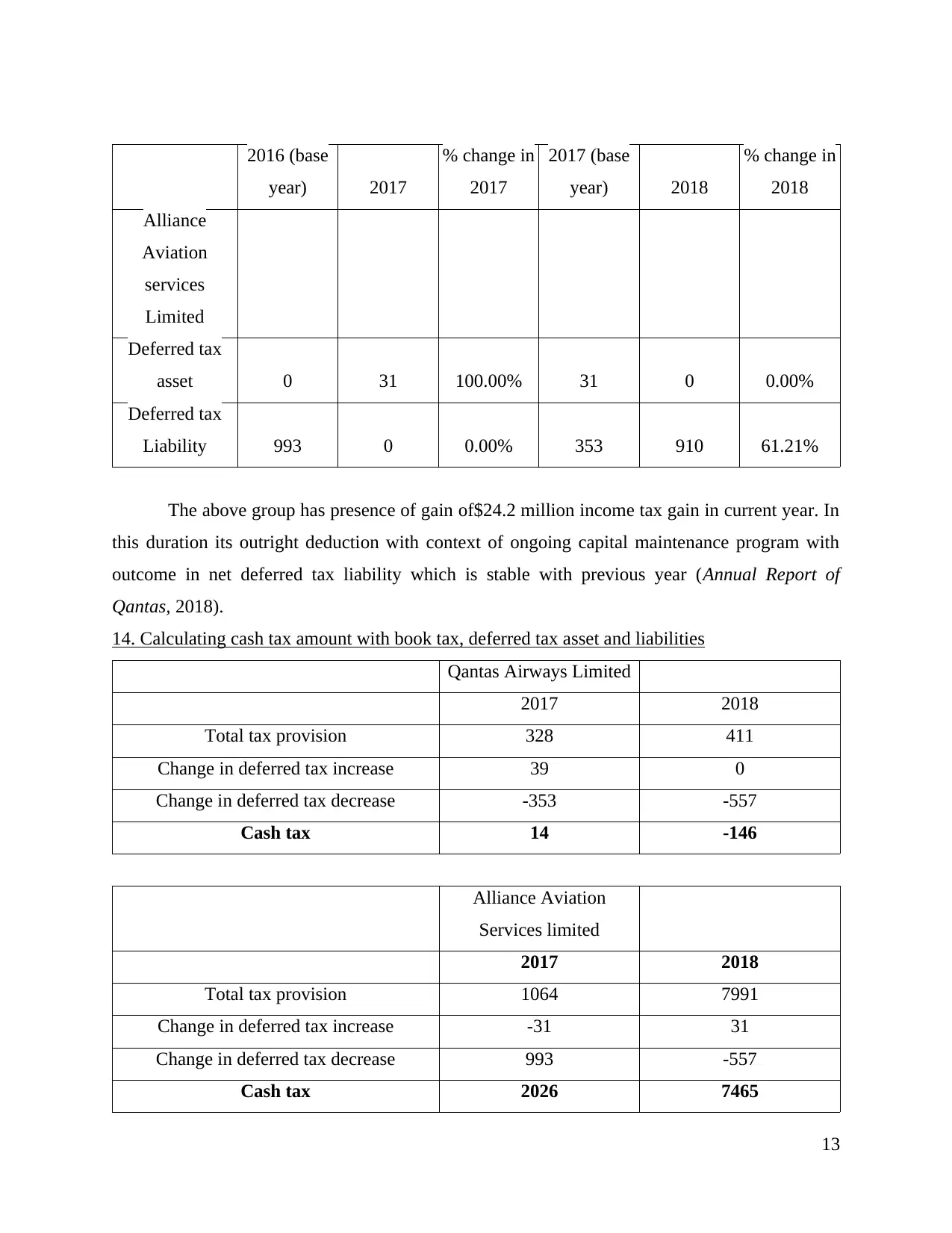

13. Presenting changes in deferred tax asset and liabilities

2016 (base

year) 2017

% change in

2017

2017 (base

year) 2018

% change in

2018

Qantas Airways

Limited

Deferred tax

asset 39 0 0.00% 0 0 0.00%

Deferred tax

Liability 0 353 100.00% 353 910 157.79%

12

2018

Alliance Aviation service

Limited

Qantas Airways services

Limited

Income tax expense 7991 411

earnings before tax 26102 1391

Effective tax rate 30.61% 29.55%

The above table has articulated effective tax rate of both organization. As they both have

very minor variations but Alliance Aviation services Ltd has high effective rate.

12. Comment on deferred tax asset and liabilities

Deferred tax asset: It is referred as asset of organization's balance sheet which might be

used for decreasing taxable income. These are recognised for purpose of deductible differences

and unused tax losses with presence of probable future taxable amount with its availability for

optimising temporary losses and differences.

Deferred tax liability: It is a tax which has assisted and due for its current period but not

yet paid. Generally, it traces fact about will of company in future to repay more income tax due

to transaction which took place in present scenario.

13. Presenting changes in deferred tax asset and liabilities

2016 (base

year) 2017

% change in

2017

2017 (base

year) 2018

% change in

2018

Qantas Airways

Limited

Deferred tax

asset 39 0 0.00% 0 0 0.00%

Deferred tax

Liability 0 353 100.00% 353 910 157.79%

12

2016 (base

year) 2017

% change in

2017

2017 (base

year) 2018

% change in

2018

Alliance

Aviation

services

Limited

Deferred tax

asset 0 31 100.00% 31 0 0.00%

Deferred tax

Liability 993 0 0.00% 353 910 61.21%

The above group has presence of gain of$24.2 million income tax gain in current year. In

this duration its outright deduction with context of ongoing capital maintenance program with

outcome in net deferred tax liability which is stable with previous year (Annual Report of

Qantas, 2018).

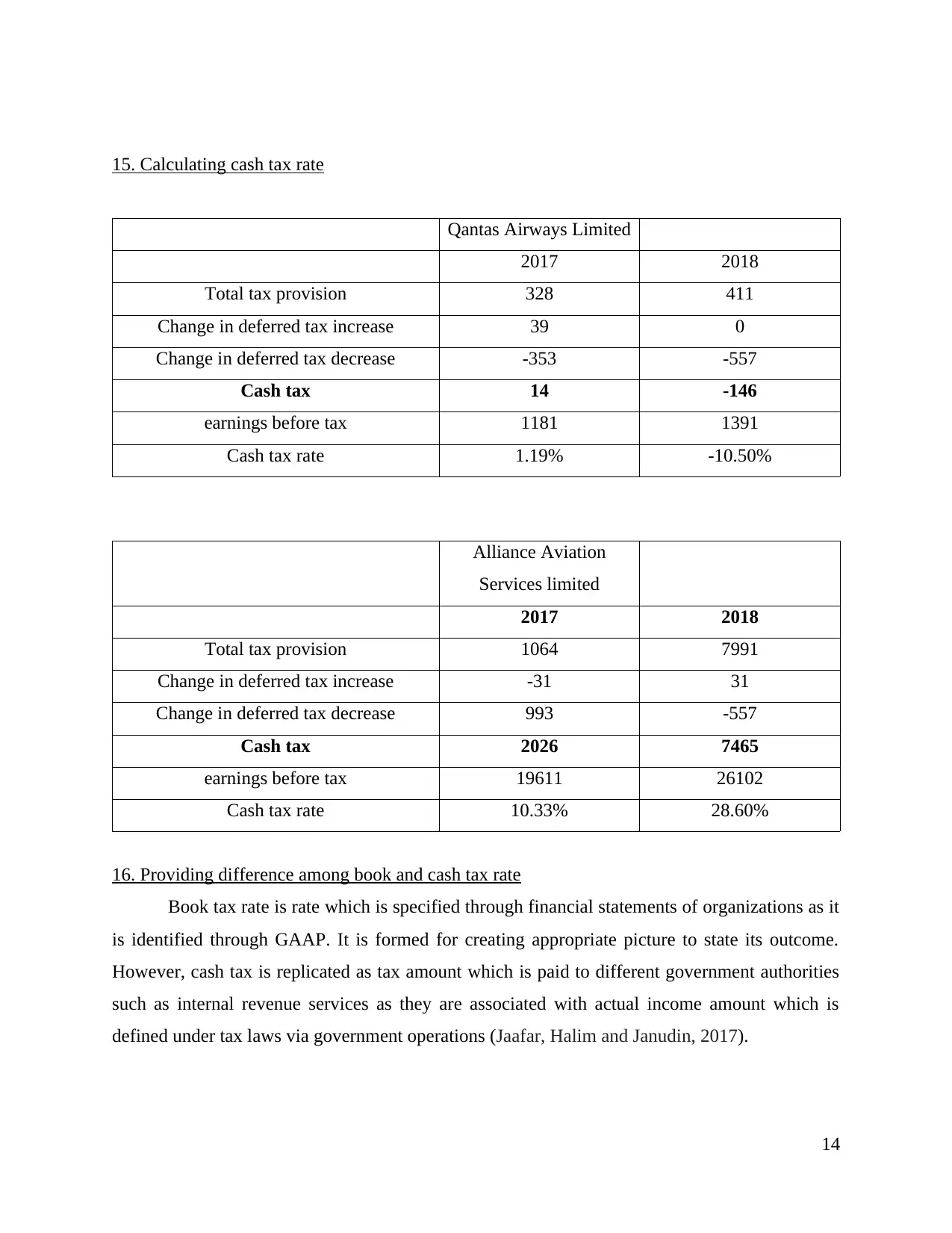

14. Calculating cash tax amount with book tax, deferred tax asset and liabilities

Qantas Airways Limited

2017 2018

Total tax provision 328 411

Change in deferred tax increase 39 0

Change in deferred tax decrease -353 -557

Cash tax 14 -146

Alliance Aviation

Services limited

2017 2018

Total tax provision 1064 7991

Change in deferred tax increase -31 31

Change in deferred tax decrease 993 -557

Cash tax 2026 7465

13

year) 2017

% change in

2017

2017 (base

year) 2018

% change in

2018

Alliance

Aviation

services

Limited

Deferred tax

asset 0 31 100.00% 31 0 0.00%

Deferred tax

Liability 993 0 0.00% 353 910 61.21%

The above group has presence of gain of$24.2 million income tax gain in current year. In

this duration its outright deduction with context of ongoing capital maintenance program with

outcome in net deferred tax liability which is stable with previous year (Annual Report of

Qantas, 2018).

14. Calculating cash tax amount with book tax, deferred tax asset and liabilities

Qantas Airways Limited

2017 2018

Total tax provision 328 411

Change in deferred tax increase 39 0

Change in deferred tax decrease -353 -557

Cash tax 14 -146

Alliance Aviation

Services limited

2017 2018

Total tax provision 1064 7991

Change in deferred tax increase -31 31

Change in deferred tax decrease 993 -557

Cash tax 2026 7465

13

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

15. Calculating cash tax rate

Qantas Airways Limited

2017 2018

Total tax provision 328 411

Change in deferred tax increase 39 0

Change in deferred tax decrease -353 -557

Cash tax 14 -146

earnings before tax 1181 1391

Cash tax rate 1.19% -10.50%

Alliance Aviation

Services limited

2017 2018

Total tax provision 1064 7991

Change in deferred tax increase -31 31

Change in deferred tax decrease 993 -557

Cash tax 2026 7465

earnings before tax 19611 26102

Cash tax rate 10.33% 28.60%

16. Providing difference among book and cash tax rate

Book tax rate is rate which is specified through financial statements of organizations as it

is identified through GAAP. It is formed for creating appropriate picture to state its outcome.

However, cash tax is replicated as tax amount which is paid to different government authorities

such as internal revenue services as they are associated with actual income amount which is

defined under tax laws via government operations (Jaafar, Halim and Janudin, 2017).

14

Qantas Airways Limited

2017 2018

Total tax provision 328 411

Change in deferred tax increase 39 0

Change in deferred tax decrease -353 -557

Cash tax 14 -146

earnings before tax 1181 1391

Cash tax rate 1.19% -10.50%

Alliance Aviation

Services limited

2017 2018

Total tax provision 1064 7991

Change in deferred tax increase -31 31

Change in deferred tax decrease 993 -557

Cash tax 2026 7465

earnings before tax 19611 26102

Cash tax rate 10.33% 28.60%

16. Providing difference among book and cash tax rate

Book tax rate is rate which is specified through financial statements of organizations as it

is identified through GAAP. It is formed for creating appropriate picture to state its outcome.

However, cash tax is replicated as tax amount which is paid to different government authorities

such as internal revenue services as they are associated with actual income amount which is

defined under tax laws via government operations (Jaafar, Halim and Janudin, 2017).

14

CONCLUSION

From the above study it had been concluded that, corporate accounting is very vital for

each business entity. It had shown its importance in this report on basis on Qantas Airways

Limited and Alliance Aviation services Limited. It is articulated that transportation industry has

major significance of corporate accounting for extracting its financial performance and wealth of

business entity. In the similar aspect, it had reflected capital structure of both organization and

risk associated with it. Further, it had been stated that, cash flow statement is classified in three

broad categories in which operating section plays major role for generating cash. It could be

elaborated that, actual profit could be attained through adjusting other comprehensive income

statement. Further, it could be summed by reflecting corporate income tax which plays very

efficient role for absorbing effective tax rate, cash tax rate and cash tax amount.

15

From the above study it had been concluded that, corporate accounting is very vital for

each business entity. It had shown its importance in this report on basis on Qantas Airways

Limited and Alliance Aviation services Limited. It is articulated that transportation industry has

major significance of corporate accounting for extracting its financial performance and wealth of

business entity. In the similar aspect, it had reflected capital structure of both organization and

risk associated with it. Further, it had been stated that, cash flow statement is classified in three

broad categories in which operating section plays major role for generating cash. It could be

elaborated that, actual profit could be attained through adjusting other comprehensive income

statement. Further, it could be summed by reflecting corporate income tax which plays very

efficient role for absorbing effective tax rate, cash tax rate and cash tax amount.

15

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.